UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-3327

MFS SERIES TRUST XIII

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617)954-5000

Date of fiscal year end: February 28*

Date of reporting period: August 31, 2019

| * | This FormN-CSR pertains only to the following series of the Registrant: MFS Diversified Income Fund, MFS Government Securities Fund and MFS New Discovery Value Fund. The remaining series of the Registrant has a fiscal year end other than February 28. |

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Semiannual Report

August 31, 2019

MFS® Diversified Income Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the complete reports will be made available on the fund’s Web site (funds.mfs.com), and you will be notified by mail each time a report is posted and provided with a Web site link to access the report.

If you are already signed up to receive shareholder reports by email, you will not be affected by this change and you need not take any action. You may sign up to receive shareholder reports and other communications from the fund by email by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly with the fund, by calling 1-800-225-2606 or by logging on to MFS Access at mfs.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. Contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you can call 1-800-225-2606 or send an email request to orderliterature@mfs.com to let the fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the MFS fund complex if you invest directly.

DIF-SEM

MFS® Diversified Income Fund

CONTENTS

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED• MAY LOSE VALUE• NO BANK GUARANTEE

LETTER FROM THE EXECUTIVE CHAIRMAN

Dear Shareholders:

Slowing global growth, low inflation, and increasing trade friction between the United States and China have been hallmarks of the past 12 months. After experiencing an

uptick in market volatility in late 2018, markets steadied during the first half of 2019, thanks in large measure to the adoption of a dovish policy stance on the part of global central banks, focused on supporting economic growth. The U.S. and China have raised tariffs on each other, heightening tensions and uncertainty. Despite repeated declarations by British Prime Minister Boris Johnson that the United Kingdom will leave the European Union on October 31, 2019, with or without a deal, apprehension over the possibility of a no-deal Brexit has eased somewhat, with Parliament having taken steps to block such an outcome.

Markets expect that the longest economic expansion in U.S. history will continue for the time being, albeit at a slower pace. In an effort to prolong the expansion, the U.S. Federal Reserve lowered interest rates for the first time in more than a decade in July and again in September. Similarly, the European Central Bank loosened policy in September. While markets have grown more risk averse, the accommodative monetary environment has helped push global interest rates toward record-low levels and has been somewhat supportive of risk assets despite the unsettled economic and geopolitical backdrop.

Since launching the first U.S. open-end mutual fund in 1924, MFS® has been committed to a single purpose: to create value by allocating capital responsibly for clients. Through our powerful global investment platform, we combine collective expertise, thoughtful risk management, and long-term discipline to uncover what we believe are the best investment opportunities in the market.

Respectfully,

Robert J. Manning

Executive Chairman

MFS Investment Management

October 17, 2019

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

PORTFOLIO COMPOSITION

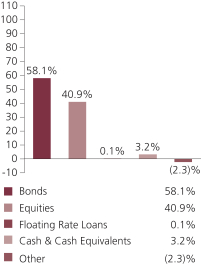

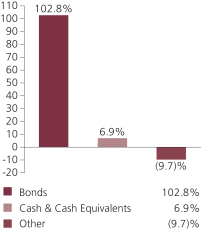

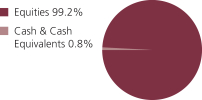

Portfolio structure (i)

| | | | |

| Top ten holdings (i) | | | | |

| U.S. Treasury Notes, 1.75%, 11/30/2021 | | | 2.0% | |

| Public Storage, Inc., REIT | | | 2.0% | |

| U.S. Treasury Note 10 yr Future - DEC 2019 | | | 1.8% | |

| Fannie Mae, 3.5%, 30 Years | | | 1.5% | |

| Prologis, Inc., REIT | | | 1.4% | |

| Welltower, Inc., REIT | | | 1.4% | |

| STORE Capital Corp., REIT | | | 1.3% | |

| AvalonBay Communities, Inc., REIT | | | 1.3% | |

| Alexandria Real Estate Equities, Inc., REIT | | | 1.3% | |

| Mid-America Apartment Communities, Inc., REIT | | | 1.2% | |

| | | | |

| GICS equity sectors (g)(i) | | | | |

| Real Estate | | | 24.2% | |

| Health Care | | | 3.0% | |

| Financials | | | 2.6% | |

| Consumer Staples | | | 2.0% | |

| Consumer Discretionary | | | 1.7% | |

| Energy | | | 1.6% | |

| Information Technology | | | 1.5% | |

| Industrials | | | 1.4% | |

| Communication Services | | | 1.3% | |

| Utilities | | | 1.2% | |

| Materials | | | 0.4% | |

| |

| Fixed income sectors (i) | | | | |

| Emerging Markets Bonds | | | 18.9% | |

| High Yield Corporates | | | 15.1% | |

| Mortgage-Backed Securities | | | 11.2% | |

| U.S. Treasury Securities | | | 9.4% | |

| Investment Grade Corporates | | | 1.0% | |

| U.S. Government Agencies | | | 1.0% | |

| Commercial Mortgage-Backed Securities | | | 0.5% | |

| Collateralized Debt Obligations | | | 0.4% | |

| Municipal Bonds | | | 0.3% | |

| Asset-Backed Securities | | | 0.2% | |

| Floating Rate Loans | | | 0.1% | |

| Non-U.S. Government Bonds (o) | | | 0.0% | |

2

Portfolio Composition – continued

| | | | |

| Composition including fixed income credit quality (a)(i) | | | | |

| AAA | | | 0.9% | |

| AA | | | 1.1% | |

| A | | | 1.5% | |

| BBB | | | 8.2% | |

| BB | | | 12.1% | |

| B | | | 10.8% | |

| CCC | | | 1.9% | |

| CC (o) | | | 0.0% | |

| D (o) | | | 0.0% | |

| U.S. Government | | | 7.1% | |

| Federal Agencies | | | 12.2% | |

| Not Rated | | | 2.4% | |

| Non-Fixed Income | | | 40.9% | |

| Cash & Cash Equivalents | | | 3.2% | |

| Other | | | (2.3)% | |

| | | | |

| Issuer country weightings (i)(x) | |

| United States | | | 67.5% | |

| Canada | | | 2.5% | |

| Switzerland | | | 1.9% | |

| United Kingdom | | | 1.5% | |

| France | | | 1.4% | |

| Chile | | | 1.1% | |

| France | | | 1.1% | |

| China | | | 1.1% | |

| India | | | 1.0% | |

| Other Countries | | | 20.9% | |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Federal Agencies includes rated and unrated U.S. Agency fixed-income securities, U.S. Agency mortgage-backed securities, and collateralized mortgage obligations of U.S. Agency mortgage-backed securities. Not Rated includes fixed income securities and fixed income derivatives, which have not been rated by any rating agency.Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and/or commodity-linked derivatives. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (g) | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and S&P Global Market Intelligence Inc. (“S&P Global Market Intelligence”). GICS is a service mark of MSCI and S&P Global Market Intelligence and has been licensed for use by MFS. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

3

Portfolio Composition – continued

| (x) | Represents the portfolio’s exposure to issuer countries as a percentage of the portfolio’s net assets. For purposes of this presentation, United States includes Cash & Cash Equivalents and Other. |

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

The fund invests a portion of its assets in the MFS High Yield Pooled Portfolio. Percentages include the indirect exposure to the underlying holdings, including investments in money market funds and Other, of the MFS High Yield Pooled Portfolio and not the direct exposure from investing in the MFS High Yield Pooled Portfolio itself.

Cash & Cash Equivalents includes any direct exposure to cash, direct and indirect exposure to investments in money market funds, cash equivalents, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s direct cash position and other assets and liabilities.

Other includes the direct and indirect equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative.

Percentages are based on net assets as of August 31, 2019.

The portfolio is actively managed and current holdings may be different.

4

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, March 1, 2019 through August 31, 2019

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service(12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the MFS High Yield Pooled Portfolio, an underlying MFS Pooled Portfolio in which the fund invests. MFS Pooled Portfolios are mutual funds advised by MFS that do not pay management fees to MFS but do incur investment and operating costs. If these transactional and indirect costs were included, your costs would have been higher.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period March 1, 2019 through August 31, 2019.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

5

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | | Beginning

Account Value

3/01/19 | | | Ending

Account Value

8/31/19 | | | Expenses

Paid During

Period (p)

3/01/19-8/31/19 | |

| A | | Actual | | | 0.97% | | | | $1,000.00 | | | | $1,064.54 | | | | $5.03 | |

| | Hypothetical (h) | | | 0.97% | | | | $1,000.00 | | | | $1,020.26 | | | | $4.93 | |

| C | | Actual | | | 1.72% | | | | $1,000.00 | | | | $1,059.79 | | | | $8.91 | |

| | Hypothetical (h) | | | 1.72% | | | | $1,000.00 | | | | $1,016.49 | | | | $8.72 | |

| I | | Actual | | | 0.72% | | | | $1,000.00 | | | | $1,065.86 | | | | $3.74 | |

| | Hypothetical (h) | | | 0.72% | | | | $1,000.00 | | | | $1,021.52 | | | | $3.66 | |

| R1 | | Actual | | | 1.72% | | | | $1,000.00 | | | | $1,059.83 | | | | $8.91 | |

| | Hypothetical (h) | | | 1.72% | | | | $1,000.00 | | | | $1,016.49 | | | | $8.72 | |

| R2 | | Actual | | | 1.23% | | | | $1,000.00 | | | | $1,062.41 | | | | $6.38 | |

| | Hypothetical (h) | | | 1.23% | | | | $1,000.00 | | | | $1,018.95 | | | | $6.24 | |

| R3 | | Actual | | | 0.97% | | | | $1,000.00 | | | | $1,063.69 | | | | $5.03 | |

| | Hypothetical (h) | | | 0.97% | | | | $1,000.00 | | | | $1,020.26 | | | | $4.93 | |

| R4 | | Actual | | | 0.72% | | | | $1,000.00 | | | | $1,065.00 | | | | $3.74 | |

| | Hypothetical (h) | | | 0.72% | | | | $1,000.00 | | | | $1,021.52 | | | | $3.66 | |

| R6 | | Actual | | | 0.64% | | | | $1,000.00 | | | | $1,066.31 | | | | $3.32 | |

| | Hypothetical (h) | | | 0.64% | | | | $1,000.00 | | | | $1,021.92 | | | | $3.25 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/366 (to reflect theone-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

6

PORTFOLIO OF INVESTMENTS

8/31/19 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Common Stocks - 40.5% | | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Airlines - 0.4% | | | | | | | | |

| Aena S.A. | | | 17,653 | | | $ | 3,181,851 | |

| Air Canada (a) | | | 398,205 | | | | 13,384,162 | |

| | | | | | | | |

| | | | | | | $ | 16,566,013 | |

| Alcoholic Beverages - 0.1% | | | | | | | | |

| Molson Coors Brewing Co. | | | 76,265 | | | $ | 3,916,970 | |

| | |

| Automotive - 0.5% | | | | | | | | |

| Bridgestone Corp. | | | 83,900 | | | $ | 3,200,891 | |

| Magna International, Inc. | | | 308,646 | | | | 15,453,164 | |

| | | | | | | | |

| | | | | | | $ | 18,654,055 | |

| Biotechnology - 0.1% | | | | | | | | |

| Biogen, Inc. (a) | | | 23,697 | | | $ | 5,207,416 | |

| | |

| Broadcasting - 0.1% | | | | | | | | |

| Publicis Groupe | | | 108,294 | | | $ | 5,191,675 | |

| | |

| Brokerage & Asset Managers - 0.1% | | | | | | | | |

| Invesco Ltd. | | | 196,132 | | | $ | 3,079,272 | |

| | |

| Business Services - 1.3% | | | | | | | | |

| DXC Technology Co. | | | 120,657 | | | $ | 4,008,226 | |

| Equinix, Inc., REIT | | | 80,151 | | | | 44,586,398 | |

| | | | | | | | |

| | | | | | | $ | 48,594,624 | |

| Computer Software - 0.2% | | | | | | | | |

| Adobe Systems, Inc. (a) | | | 20,517 | | | $ | 5,837,292 | |

| | |

| Computer Software - Systems - 0.3% | | | | | | | | |

| Hitachi Ltd. | | | 307,700 | | | $ | 10,511,068 | |

| Panasonic Corp. | | | 376,800 | | | | 2,908,775 | |

| | | | | | | | |

| | | | | | | $ | 13,419,843 | |

| Construction - 3.7% | | | | | | | | |

| American Homes 4 Rent, “A”, REIT | | | 1,408,142 | | | $ | 36,020,272 | |

| AvalonBay Communities, Inc., REIT | | | 234,643 | | | | 49,875,716 | |

| ICA Tenedora S.A. de C.V. (a) | | | 560,019 | | | | 939,525 | |

| Mid-America Apartment Communities, Inc., REIT | | | 372,390 | | | | 47,174,365 | |

7

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Construction - continued | | | | | | | | |

| Toll Brothers, Inc. | | | 227,921 | | | $ | 8,248,461 | |

| | | | | | | | |

| | | | | | | $ | 142,258,339 | |

| Consumer Products - 0.6% | | | | | | | | |

| Kimberly-Clark Corp. | | | 163,184 | | | $ | 23,026,894 | |

| | |

| Electrical Equipment - 0.5% | | | | | | | | |

| Schneider Electric SE | | | 235,924 | | | $ | 19,747,699 | |

| | |

| Electronics - 0.8% | | | | | | | | |

| Samsung Electronics Co. Ltd. | | | 127,268 | | | $ | 4,623,151 | |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | | 589,989 | | | | 25,151,231 | |

| | | | | | | | |

| | | | | | | $ | 29,774,382 | |

| Energy - Independent - 0.4% | | | | | | | | |

| Frontera Energy Corp. | | | 72,682 | | | $ | 701,490 | |

| Marathon Petroleum Corp. | | | 79,126 | | | | 3,893,791 | |

| Phillips 66 | | | 93,056 | | | | 9,178,113 | |

| | | | | | | | |

| | | | | | | $ | 13,773,394 | |

| Energy - Integrated - 1.1% | | | | | | | | |

| BP PLC | | | 829,436 | | | $ | 5,048,307 | |

| China Petroleum & Chemical Corp. | | | 16,184,000 | | | | 9,474,588 | |

| Eni S.p.A. | | | 705,454 | | | | 10,606,503 | |

| Exxon Mobil Corp. | | | 79,060 | | | | 5,414,029 | |

| Galp Energia SGPS S.A. | | | 408,289 | | | | 5,860,414 | |

| LUKOIL PJSC, ADR | | | 85,273 | | | | 6,850,833 | |

| | | | | | | | |

| | | | | | | $ | 43,254,674 | |

| Food & Beverages - 0.4% | | | | | | | | |

| General Mills, Inc. | | | 98,195 | | | $ | 5,282,891 | |

| J.M. Smucker Co. | | | 60,133 | | | | 6,323,586 | |

| Mowi A.S.A. | | | 110,641 | | | | 2,646,972 | |

| | | | | | | | |

| | | | | | | $ | 14,253,449 | |

| Food & Drug Stores - 0.2% | | | | | | | | |

| Wesfarmers Ltd. | | | 222,699 | | | $ | 5,864,087 | |

| | |

| Insurance - 1.2% | | | | | | | | |

| AXA S.A. | | | 203,786 | | | $ | 4,674,275 | |

| Manulife Financial Corp. | | | 314,065 | | | | 5,210,827 | |

| MetLife, Inc. | | | 181,788 | | | | 8,053,208 | |

| Prudential Financial, Inc. | | | 69,152 | | | | 5,538,384 | |

| Samsung Fire & Marine Insurance Co. Ltd. | | | 14,120 | | | | 2,669,540 | |

8

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Insurance - continued | | | | | | | | |

| Zurich Insurance Group AG | | | 54,652 | | | $ | 19,447,774 | |

| | | | | | | | |

| | | | | | | $ | 45,594,008 | |

| Machinery & Tools - 0.5% | | | | | | | | |

| AGCO Corp. | | | 37,270 | | | $ | 2,576,102 | |

| Eaton Corp. PLC | | | 175,675 | | | | 14,180,486 | |

| PT United Tractors Tbk | | | 438,800 | | | | 647,296 | |

| | | | | | | | |

| | | | | | | $ | 17,403,884 | |

| Major Banks - 0.6% | | | | | | | | |

| ABSA Group Ltd. | | | 652,435 | | | $ | 6,610,481 | |

| China Construction Bank | | | 14,649,000 | | | | 10,874,085 | |

| Royal Bank of Canada | | | 74,531 | | | | 5,571,938 | |

| | | | | | | | |

| | | | | | | $ | 23,056,504 | |

| Medical & Health Technology & Services - 0.3% | | | | | | | | |

| HCA Healthcare, Inc. | | | 108,252 | | | $ | 13,011,891 | |

| | |

| Metals & Mining - 0.1% | | | | | | | | |

| POSCO | | | 9,713 | | | $ | 1,692,007 | |

| Rio Tinto PLC | | | 62,650 | | | | 3,163,268 | |

| | | | | | | | |

| | | | | | | $ | 4,855,275 | |

| Natural Gas - Pipeline - 0.1% | | | | | | | | |

| Enterprise Products Partners LP | | | 169,459 | | | $ | 4,831,276 | |

| | |

| Network & Telecom - 0.2% | | | | | | | | |

| Cisco Systems, Inc. | | | 164,120 | | | $ | 7,682,457 | |

| | |

| Other Banks & Diversified Financials - 0.7% | | | | | | | | |

| Citigroup, Inc. | | | 203,461 | | | $ | 13,092,715 | |

| DBS Group Holdings Ltd. | | | 520,200 | | | | 9,195,104 | |

| Komercni Banka A.S. | | | 23,338 | | | | 828,460 | |

| ORIX Corp. | | | 165,000 | | | | 2,436,909 | |

| Sberbank of Russia, ADR | | | 117,961 | | | | 1,616,656 | |

| | | | | | | | |

| | | | | | | $ | 27,169,844 | |

| Pharmaceuticals - 2.5% | | | | | | | | |

| AbbVie, Inc. | | | 40,157 | | | $ | 2,639,921 | |

| Bayer AG | | | 144,355 | | | | 10,683,717 | |

| Bristol-Myers Squibb Co. | | | 193,399 | | | | 9,296,690 | |

| Eli Lilly & Co. | | | 121,579 | | | | 13,734,780 | |

| Novartis AG | | | 246,923 | | | | 22,206,230 | |

| Pfizer, Inc. | | | 292,671 | | | | 10,404,454 | |

9

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Pharmaceuticals - continued | | | | | | | | |

| Roche Holding AG | | | 98,895 | | | $ | 27,038,128 | |

| | | | | | | | |

| | | | | | | $ | 96,003,920 | |

| Real Estate - 19.0% | | | | | | | | |

| Alexandria Real Estate Equities, Inc., REIT | | | 329,371 | | | $ | 49,352,951 | |

| Boardwalk, REIT | | | 711,952 | | | | 23,630,133 | |

| Boston Properties, Inc., REIT | | | 191,431 | | | | 24,583,569 | |

| Brixmor Property Group, Inc., REIT | | | 1,927,099 | | | | 35,516,435 | |

| Daiwa House Industry Co. Ltd. | | | 108,900 | | | | 3,415,586 | |

| Equity Lifestyle Properties, Inc., REIT | | | 315,033 | | | | 42,441,246 | |

| Extra Space Storage, Inc., REIT | | | 161,040 | | | | 19,633,997 | |

| Farmland Partners, Inc., REIT | | | 655,730 | | | | 3,954,052 | |

| Industrial Logistics Properties Trust, REIT | | | 621,483 | | | | 13,293,521 | |

| Longfor Properties Co. Ltd. | | | 531,500 | | | | 1,894,728 | |

| Medical Properties Trust, Inc., REIT | | | 1,298,152 | | | | 24,132,646 | |

| Prologis, Inc., REIT | | | 657,867 | | | | 55,010,838 | |

| Public Storage, Inc., REIT | | | 282,507 | | | | 74,790,903 | |

| Rexford Industrial Realty, Inc., REIT | | | 466,131 | | | | 20,598,329 | |

| RPT Realty, REIT | | | 1,921,468 | | | | 22,865,469 | |

| Simon Property Group, Inc., REIT | | | 297,186 | | | | 44,262,883 | |

| STAG Industrial, Inc., REIT | | | 873,393 | | | | 25,398,268 | |

| STORE Capital Corp., REIT | | | 1,329,706 | | | | 50,209,699 | |

| Sun Communities, Inc., REIT | | | 287,761 | | | | 42,531,076 | |

| Unibail-Rodamco-Westfield, REIT | | | 21,980 | | | | 2,877,113 | |

| Urban Edge Properties, REIT | | | 1,824,732 | | | | 31,951,057 | |

| VICI Properties, Inc., REIT | | | 1,424,468 | | | | 31,566,211 | |

| W.P. Carey, Inc., REIT | | | 312,297 | | | | 28,044,271 | |

| Welltower, Inc., REIT | | | 602,976 | | | | 54,002,530 | |

| | | | | | | | |

| | | | | | | $ | 725,957,511 | |

| Restaurants - 0.5% | | | | | | | | |

| Greggs PLC | | | 190,320 | | | $ | 4,895,630 | |

| Starbucks Corp. | | | 134,762 | | | | 13,012,619 | |

| | | | | | | | |

| | | | | | | $ | 17,908,249 | |

| Specialty Chemicals - 0.3% | | | | | | | | |

| PTT Global Chemical PLC | | | 5,565,700 | | | $ | 9,648,609 | |

| | |

| Specialty Stores - 0.2% | | | | | | | | |

| Target Corp. | | | 77,704 | | | $ | 8,317,436 | |

| | |

| Telecommunications - Wireless - 1.3% | | | | | | | | |

| American Tower Corp., REIT | | | 96,509 | | | $ | 22,215,407 | |

| KDDI Corp. | | | 640,900 | | | | 17,103,135 | |

10

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Common Stocks - continued | | | | | | | | |

| Telecommunications - Wireless - continued | | | | | | | | |

| Vodafone Group PLC | | | 6,268,563 | | | $ | 11,841,066 | |

| | | | | | | | |

| | | | | | | $ | 51,159,608 | |

| Telephone Services - 0.3% | | | | | | | | |

| Koninklijke KPN N.V. | | | 1,018,405 | | | $ | 3,223,521 | |

| TELUS Corp. | | | 181,978 | | | | 6,592,158 | |

| TELUS Corp. | | | 63,992 | | | | 2,320,350 | |

| | | | | | | | |

| | | | | | | $ | 12,136,029 | |

| Tobacco - 0.9% | | | | | | | | |

| Imperial Brands PLC | | | 248,720 | | | $ | 6,429,640 | |

| Japan Tobacco, Inc. | | | 723,900 | | | | 15,335,218 | |

| Philip Morris International, Inc. | | | 176,874 | | | | 12,750,847 | |

| | | | | | | | |

| | | | | | | $ | 34,515,705 | |

| Utilities - Electric Power - 1.0% | | | | | | | | |

| E.ON SE | | | 295,228 | | | $ | 2,743,397 | |

| Exelon Corp. | | | 370,356 | | | | 17,503,024 | |

| SSE PLC | | | 880,493 | | | | 12,331,628 | |

| Xcel Energy, Inc. | | | 107,630 | | | | 6,911,999 | |

| | | | | | | | |

| | | | | | | $ | 39,490,048 | |

| Total Common Stocks (Identified Cost, $1,283,843,394) | | | $ | 1,551,162,332 | |

| | |

| Bonds - 39.8% | | | | | | | | |

| Asset-Backed & Securitized - 1.1% | | | | | | | | |

| ALM Loan Funding, CLO,2015-12A, “A1R2”, FLR, 3.212% (LIBOR - 3mo. + 0.89%), 4/16/2027 (n) | | $ | 1,638,165 | | | $ | 1,636,575 | |

| Chesapeake Funding II LLC,2018-1A, “A1”, 3.04%, 4/15/2030 (n) | | | 1,429,096 | | | | 1,450,084 | |

| Chesapeake Funding II LLC,2018-3A, “A1”, 3.39%, 1/15/2031 (n) | | | 2,655,828 | | | | 2,705,660 | |

| Citigroup Commercial Mortgage Trust, 2015-GC27, “A5”, 3.137%, 2/10/2048 | | | 2,850,000 | | | | 3,003,024 | |

| Commercial Mortgage Trust,2015-DC1, “A5”, 3.35%, 2/10/2048 | | | 2,574,000 | | | | 2,731,088 | |

| Commercial Mortgage Trust,2015-PC1, “A5”, 3.902%, 7/10/2050 | | | 1,800,000 | | | | 1,966,541 | |

| CSAIL Commercial Mortgage Trust,2015-C2, “A4”, 3.504%, 6/15/2057 | | | 58,835 | | | | 63,024 | |

| DLL Securitization Trust,2019-DA1, “A2”, 2.79%, 11/22/2021 (n) | | | 2,770,000 | | | | 2,780,329 | |

| Dryden Senior Loan Fund,2018-55A, “A1”, CLO, FLR, 3.323% (LIBOR - 3mo. + 1.02%), 4/15/2031 (n) | | | 2,267,245 | | | | 2,249,334 | |

11

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Asset-Backed & Securitized - continued | | | | | | | | |

| GS Mortgage Securities Trust, 2015-GC30, “A4”, 3.382%, 5/10/2050 | | $ | 1,750,000 | | | $ | 1,868,285 | |

| JPMBB Commercial Mortgage Securities Trust,2014-C26, 3.494%, 1/15/2048 | | | 1,888,516 | | | | 2,020,654 | |

| Loomis, Sayles & Co., CLO, “A2”, FLR, 3.703% (LIBOR - 3mo. + 1.4%), 4/15/2028 (n) | | | 2,261,785 | | | | 2,245,260 | |

| Madison Park Funding Ltd.,2014-13A, “BR2”, FLR, 3.803% (LIBOR - 3mo. + 1.5%), 4/19/2030 (n) | | | 2,390,920 | | | | 2,368,584 | |

| Morgan Stanley Bank of America Merrill Lynch Trust,2017-C34, “A4”, 3.536%, 11/15/2052 | | | 700,873 | | | | 767,666 | |

| Morgan Stanley Capital I Trust,2018-H4, “XA”, 1.035%, 12/15/2051 (i) | | | 10,091,532 | | | | 669,452 | |

| Symphony CLO Ltd.,2016-17A, “BR”, FLR, 3.503% (LIBOR - 3mo. + 1.2%), 4/15/2028 (n) | | | 2,026,203 | | | | 2,017,488 | |

| TICP CLO Ltd., FLR, 3.117% (LIBOR - 3mo. + 0.8%), 4/20/2028 (n) | | | 3,317,451 | | | | 3,296,684 | |

| UBS Commercial Mortgage Trust,2017-C1, “A4”, 3.544%, 11/15/2050 | | | 1,505,000 | | | | 1,651,617 | |

| Wells Fargo Commercial Mortgage Trust,2015-C28, “A4”, 3.54%, 5/15/2048 | | | 1,516,848 | | | | 1,632,015 | |

| Wells Fargo Commercial Mortgage Trust, 2015-NXS1, “A5”, 3.148%, 5/15/2048 | | | 1,258,254 | | | | 1,327,068 | |

| Wells Fargo Commercial Mortgage Trust, 2016-LC25, “A4”, 3.64%, 12/15/2059 | | | 2,500,000 | | | | 2,737,481 | |

| Wells Fargo Commercial Mortgage Trust,2018-C48, “XA”, 1.126%, 1/15/2052 (i)(n) | | | 5,955,576 | | | | 435,545 | |

| | | | | | | | |

| | | | | | | $ | 41,623,458 | |

| Cable TV - 0.1% | | | | | | | | |

| VTR Finance B.V., 6.875%, 1/15/2024 (n) | | $ | 3,818,000 | | | $ | 3,946,857 | |

| | |

| Chemicals - 0.1% | | | | | | | | |

| Consolidated Energy Finance S.A., 6.875%, 6/15/2025 (n) | | $ | 680,000 | | | $ | 693,600 | |

| Consolidated Energy Finance S.A., 6.875%, 6/15/2025 | | | 1,855,000 | | | | 1,892,100 | |

| Sherwin Williams Co., 2.75%, 6/01/2022 | | | 704,000 | | | | 714,888 | |

| Sociedad Quimica y Minera de Chile S.A., 4.25%, 5/07/2029 (n) | | | 2,014,000 | | | | 2,180,155 | |

| | | | | | | | |

| | | | | | | $ | 5,480,743 | |

| Conglomerates - 0.2% | | | | | | | | |

| Grupo KUO S.A.B. de C.V., 5.75%, 7/07/2027 (n) | | $ | 5,300,000 | | | $ | 5,333,178 | |

| United Technologies Corp., 3.95%, 8/16/2025 | | | 1,000,000 | | | | 1,098,336 | |

| | | | | | | | |

| | | | | | | $ | 6,431,514 | |

12

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Construction - 0.0% | | | | | | | | |

| Sunac China Holdings Ltd., 7.95%, 10/11/2023 | | $ | 1,721,000 | | | $ | 1,647,995 | |

| | |

| Consumer Products - 0.1% | | | | | | | | |

| Reckitt Benckiser Treasury Services PLC, 2.75%, 6/26/2024 (n) | | $ | 1,734,000 | | | $ | 1,763,966 | |

| | |

| Consumer Services - 0.1% | | | | | | | | |

| Alibaba Group Holding Ltd., 3.4%, 12/06/2027 | | $ | 3,224,000 | | | $ | 3,385,128 | |

| GEMS Menasa Cayman Ltd./GEMS Education | | | | | | | | |

| Delaware LLC, 7.125%, 7/31/2026 (z) | | | 1,470,000 | | | | 1,497,930 | |

| | | | | | | | |

| | | | | | | $ | 4,883,058 | |

| Containers - 0.1% | | | | | | | | |

| San Miguel Industrias PET S.A., 4.5%, 9/18/2022 (n) | | $ | 2,724,000 | | | $ | 2,761,455 | |

| San Miguel Industrias PET S.A., 4.5%, 9/18/2022 | | | 1,606,000 | | | | 1,628,082 | |

| | | | | | | | |

| | | | | | | $ | 4,389,537 | |

| Emerging Market Quasi-Sovereign - 4.4% | | | | | | | | |

| Abu Dhabi Crude Oil Pipeline, 3.65%, 11/02/2029 (n) | | $ | 802,000 | | | $ | 896,588 | |

| Abu Dhabi Crude Oil Pipeline, 3.65%, 11/02/2029 | | | 2,045,000 | | | | 2,286,187 | |

| Abu Dhabi Crude Oil Pipeline, 4.6%, 11/02/2047 (n) | | | 3,245,000 | | | | 4,015,687 | |

| Abu Dhabi Crude Oil Pipeline, 4.6%, 11/02/2047 | | | 2,593,000 | | | | 3,208,838 | |

| Aeropuerto Internacional de Tocumen S.A., 6%, 11/18/2048 (n) | | | 2,833,000 | | | | 3,640,405 | |

| Aeropuerto Internacional de Tocumen S.A., 6%, 11/18/2048 | | | 800,000 | | | | 1,028,000 | |

| Autoridad del Canal de Panama, 4.95%, 7/29/2035 (n) | | | 281,000 | | | | 320,694 | |

| Autoridad del Canal de Panama, 4.95%, 7/29/2035 | | | 1,220,000 | | | | 1,392,337 | |

| Banco de Reservas de la Republica Dominicana, 7%, 2/01/2023 | | | 1,500,000 | | | | 1,566,000 | |

| Banco do Brasil S.A. (Cayman Branch), 9.25%, 4/15/2023 | | | 433,000 | | | | 482,795 | |

| Banco do Brasil S.A. (Cayman Branch), 4.625%, 1/15/2025 | | | 2,728,000 | | | | 2,847,759 | |

| Corporacion Nacional del Cobre de Chile, 4.375%, 2/05/2049 (n) | | | 2,000,000 | | | | 2,313,900 | |

| Development Bank of Kazakhstan, 4.125%, 12/10/2022 | | | 1,663,000 | | | | 1,725,010 | |

| Empresa de Transmision Electrica S.A., 5.125%, 5/02/2049 (n) | | | 1,694,000 | | | | 1,965,057 | |

| Empresa Nacional del Petroleo, 4.375%, 10/30/2024 (n) | | | 2,469,000 | | | | 2,638,864 | |

| Empresa Nacional del Petroleo, 5.25%, 11/06/2029 (n) | | | 1,233,000 | | | | 1,429,330 | |

| Empresa Nacional del Petroleo, 5.25%, 11/06/2029 | | | 1,271,000 | | | | 1,473,381 | |

| Empresas Publicas de Medellin, 4.25%, 7/18/2029 (n) | | | 1,537,000 | | | | 1,614,926 | |

| Equate Petrochemical B.V., 4.25%, 11/03/2026 | | | 3,292,000 | | | | 3,570,543 | |

| Eskom Holdings SOC Ltd., 6.35%, 8/10/2028 (n) | | | 2,885,000 | | | | 3,121,195 | |

| Eskom Holdings SOC Ltd., 8.45%, 8/10/2028 | | | 1,926,000 | | | | 2,114,555 | |

| Export-Import Bank of India, 3.875%, 2/01/2028 (n) | | | 10,026,000 | | | | 10,697,220 | |

13

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Emerging Market Quasi-Sovereign - continued | | | | | | | | |

| Kazakhstan Temir Zholy Finance B.V., 4.85%, 11/17/2027 (n) | | $ | 6,560,000 | | | $ | 7,319,714 | |

| KazMunayGas National Co., JSC, 5.375%, 4/24/2030 (n) | | | 6,669,000 | | | | 7,734,039 | |

| KazMunayGas National Co., JSC, 5.375%, 4/24/2030 | | | 3,453,000 | | | | 4,004,444 | |

| KazMunayGas National Co., JSC, 6.375%, 10/24/2048 | | | 3,652,000 | | | | 4,607,948 | |

| KazTransGas JSC, 4.375%, 9/26/2027 | | | 1,707,000 | | | | 1,799,963 | |

| Magyar Export-Import Bank PLC, 4%, 1/30/2020 | | | 2,518,000 | | | | 2,532,312 | |

| NTPC Ltd., 7.375%, 8/10/2021 | | INR | 120,000,000 | | | | 1,674,127 | |

| NTPC Ltd., 7.25%, 5/03/2022 | | | 90,000,000 | | | | 1,260,687 | |

| NTPC Ltd., 4.375%, 11/26/2024 | | $ | 5,157,000 | | | | 5,501,668 | |

| OCP S.A., 6.875%, 4/25/2044 | | | 2,448,000 | | | | 3,043,520 | |

| Office Cherifien des Phosphates, 6.875%, 4/25/2044 (n) | | | 2,519,000 | | | | 3,131,792 | |

| Petroamazonas, 4.625%, 11/06/2020 (n) | | | 302,000 | | | | 298,376 | |

| Petrobras Global Finance B.V., 5.75%, 2/01/2029 | | | 4,747,000 | | | | 5,141,001 | |

| Petrobras Global Finance B.V., 6.9%, 3/19/2049 | | | 3,680,000 | | | | 4,178,640 | |

| Petroleos del Peru S.A., 4.75%, 6/19/2032 (n) | | | 4,117,000 | | | | 4,641,917 | |

| Petroleos del Peru S.A., 5.625%, 6/19/2047 (n) | | | 379,000 | | | | 463,441 | |

| Petroleos del Peru S.A., 5.625%, 6/19/2047 | | | 4,758,000 | | | | 5,818,082 | |

| Petroleos Mexicanos, 6.75%, 9/21/2047 | | | 2,660,000 | | | | 2,533,650 | |

| PJSC State Savings Bank of Ukraine, 9.375%, 3/10/2023 | | | 2,357,600 | | | | 2,456,714 | |

| PJSC State Savings Bank of Ukraine, 9.625%, 3/20/2025 | | | 1,013,000 | | | | 1,058,666 | |

| PT Indonesia Asahan Aluminium (Persero), 5.71%, 11/15/2023 (n) | | | 1,120,000 | | | | 1,241,638 | |

| PT Perusahaan Listrik Negara, 6.15%, 5/21/2048 (n) | | | 1,317,000 | | | | 1,702,865 | |

| REC Ltd., 3.875%, 7/07/2027 | | | 5,697,000 | | | | 5,729,025 | |

| Saudi Arabian Oil Co., 4.25%, 4/16/2039 (n) | | | 1,887,000 | | | | 2,138,059 | |

| Saudi Arabian Oil Co., 4.25%, 4/16/2039 | | | 1,685,000 | | | | 1,909,184 | |

| Southern Gas Corridor CJSC, 6.875%, 3/24/2026 (n) | | | 7,385,000 | | | | 8,711,036 | |

| State Bank of India (London), 4.375%, 1/24/2024 | | | 1,646,000 | | | | 1,748,505 | |

| State Grid Overseas Investment (2016) Ltd., 3.5%, 5/04/2027 (n) | | | 3,774,000 | | | | 4,037,810 | |

| State Grid Overseas Investment (2016) Ltd., 3.5%, 5/04/2027 | | | 7,145,000 | | | | 7,644,449 | |

| State Oil Company of the Azerbaijan Republic, 4.75%, 3/13/2023 | | | 3,933,000 | | | | 4,111,637 | |

| State Oil Company of the Azerbaijan Republic, 6.95%, 3/18/2030 | | | 2,267,000 | | | | 2,731,735 | |

| Ukreximbank Via Biz Finance PLC, 9.75%, 1/22/2025 | | | 1,026,000 | | | | 1,082,943 | |

| YPF Energia Electrica S.A., 10%, 7/25/2026 (z) | | | 1,452,000 | | | | 842,175 | |

| | | | | | | | |

| | | | | | | $ | 167,181,033 | |

14

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Emerging Market Sovereign - 10.2% | | | | | | | | |

| Arab Republic of Egypt, 6.125%, 1/31/2022 (n) | | $ | 2,754,000 | | | $ | 2,858,322 | |

| Arab Republic of Egypt, 6.125%, 1/31/2022 | | | 8,324,000 | | | | 8,639,313 | |

| Arab Republic of Egypt, 5.577%, 2/21/2023 (n) | | | 3,045,000 | | | | 3,139,017 | |

| Arab Republic of Egypt, 5.875%, 6/11/2025 | | | 2,005,000 | | | | 2,067,656 | |

| Arab Republic of Egypt, 7.5%, 1/31/2027 | | | 1,900,000 | | | | 2,060,413 | |

| Arab Republic of Egypt, 6.588%, 2/21/2028 (n) | | | 4,360,000 | | | | 4,463,550 | |

| Arab Republic of Egypt, 6.588%, 2/21/2028 | | | 1,753,000 | | | | 1,794,634 | |

| Arab Republic of Egypt, 7.6%, 3/01/2029 (n) | | | 2,792,000 | | | | 3,011,982 | |

| Arab Republic of Egypt, 7.6%, 3/01/2029 | | | 670,000 | | | | 722,789 | |

| Arab Republic of Egypt, 8.5%, 1/31/2047 | | | 1,601,000 | | | | 1,737,661 | |

| Arab Republic of Egypt, 8.7%, 3/01/2049 (n) | | | 3,353,000 | | | | 3,671,535 | |

| Dominican Republic, 6.875%, 1/29/2026 | | | 5,450,000 | | | | 6,219,867 | |

| Dominican Republic, 5.95%, 1/25/2027 | | | 3,057,000 | | | | 3,351,267 | |

| Dominican Republic, 6%, 7/19/2028 (n) | | | 5,087,000 | | | | 5,614,827 | |

| Dominican Republic, 6.5%, 2/15/2048 (n) | | | 4,694,000 | | | | 5,175,182 | |

| Dominican Republic, 6.4%, 6/05/2049 (n) | | | 3,344,000 | | | | 3,665,893 | |

| Emirate of Abu Dhabi, 3.125%, 10/11/2027 (n) | | | 443,000 | | | | 479,548 | |

| Emirate of Abu Dhabi, 4.125%, 10/11/2047 (n) | | | 590,000 | | | | 733,075 | |

| Federal Republic of Nigeria, 7.625%, 11/21/2025 (n) | | | 1,927,000 | | | | 2,110,373 | |

| Federal Republic of Nigeria, 6.5%, 11/28/2027 (n) | | | 2,571,000 | | | | 2,563,004 | |

| Federal Republic of Nigeria, 7.143%, 2/23/2030 (n) | | | 1,113,000 | | | | 1,118,024 | |

| Federal Republic of Nigeria, 7.696%, 2/23/2038 | | | 1,937,000 | | | | 1,932,138 | |

| Federal Republic of Nigeria, 9.248%, 1/21/2049 | | | 1,543,000 | | | | 1,696,670 | |

| Federative Republic of Brazil, 5.625%, 2/21/2047 | | | 3,582,000 | | | | 4,096,948 | |

| Government of Benin, 5.75%, 3/26/2026 | | EUR | 1,645,000 | | | | 1,846,717 | |

| Government of Jamaica, 8%, 3/15/2039 | | $ | 5,375,000 | | | | 6,940,522 | |

| Government of Jamaica, 7.875%, 7/28/2045 | | | 4,402,000 | | | | 5,685,183 | |

| Government of Malaysia, 4.921%, 7/06/2048 | | MYR | 8,917,000 | | | | 2,538,679 | |

| Government of Oman, 6%, 8/01/2029 (n) | | $ | 1,175,000 | | | | 1,168,538 | |

| Government of Romania, 2%, 12/08/2026 (n) | | EUR | 1,099,000 | | | | 1,297,769 | |

| Government of Romania, 2.124%, 7/16/2031 (n) | | | 1,608,000 | | | | 1,827,271 | |

| Government of Romania, 4.625%, 4/03/2049 (n) | | | 1,889,000 | | | | 2,657,623 | |

| Government of Ukraine, 7.75%, 9/01/2024 (n) | | $ | 2,600,000 | | | | 2,779,015 | |

| Government of Ukraine, 7.75%, 9/01/2024 | | | 304,000 | | | | 324,931 | |

| Government of Ukraine, 7.75%, 9/01/2025 (n) | | | 2,600,000 | | | | 2,760,238 | |

| Government of Ukraine, 7.75%, 9/01/2025 | | | 6,940,000 | | | | 7,367,712 | |

| Government of Ukraine, 6.75%, 6/20/2026 (n) | | EUR | 2,513,000 | | | | 3,003,978 | |

| Government of Ukraine, 7.75%, 9/01/2026 | | $ | 3,434,000 | | | | 3,639,278 | |

| Government of Ukraine, 7.75%, 9/01/2027 | | | 1,819,000 | | | | 1,924,975 | |

| Government of Ukraine, 7.375%, 9/25/2032 | | | 6,022,000 | | | | 6,189,062 | |

| Government of Ukraine, 0%, 5/31/2040 | | | 4,912,000 | | | | 4,292,106 | |

| Islamic Republic of Pakistan, 7.875%, 3/31/2036 | | | 1,717,000 | | | | 1,725,928 | |

| Ivory Coast, 5.75%, 12/31/2032 | | | 3,540,240 | | | | 3,505,262 | |

15

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Emerging Market Sovereign - continued | | | | | | | | |

| Kingdom of Saudi Arabia, 4.375%, 4/16/2029 (n) | | $ | 2,632,000 | | | $ | 3,034,106 | |

| Kingdom of Saudi Arabia, 4.5%, 4/17/2030 | | | 3,255,000 | | | | 3,795,929 | |

| Kingdom of Saudi Arabia, 4.625%, 10/04/2047 | | | 939,000 | | | | 1,108,240 | |

| Oriental Republic of Uruguay, 4.375%, 1/23/2031 | | | 1,415,000 | | | | 1,602,488 | |

| Oriental Republic of Uruguay, 4.125%, 11/20/2045 | | | 1,312,000 | | | | 1,454,365 | |

| Oriental Republic of Uruguay, 4.975%, 4/20/2055 | | | 3,778,000 | | | | 4,632,810 | |

| Republic of Angola, 8.25%, 5/09/2028 (n) | | | 3,237,000 | | | | 3,338,286 | |

| Republic of Argentina, 6.625%, 7/06/2028 | | | 1,222,000 | | | | 455,195 | |

| Republic of Argentina, 3.75%, 12/31/2038 | | | 14,413,000 | | | | 5,116,615 | |

| Republic of Azerbaijan, 3.5%, 9/01/2032 | | | 3,490,000 | | | | 3,429,525 | |

| Republic of Belarus, 7.625%, 6/29/2027 | | | 609,000 | | | | 689,954 | |

| Republic of Colombia, 3.875%, 4/25/2027 | | | 1,350,000 | | | | 1,458,689 | |

| Republic of Colombia, 6.125%, 1/18/2041 | | | 2,582,000 | | | | 3,443,768 | |

| Republic of Colombia, 5%, 6/15/2045 | | | 6,402,000 | | | | 7,730,415 | |

| Republic of Cote d’Ivoire, 5.25%, 3/22/2030 (n) | | EUR | 2,432,000 | | | | 2,709,813 | |

| Republic of Cote d’Ivoire, 6.125%, 6/15/2033 | | $ | 2,730,000 | | | | 2,576,984 | |

| Republic of Croatia, 5.5%, 4/04/2023 | | | 3,155,000 | | | | 3,503,817 | |

| Republic of Ecuador, 7.95%, 6/20/2024 | | | 4,731,000 | | | | 4,760,616 | |

| Republic of Ecuador, 9.625%, 6/02/2027 | | | 1,350,000 | | | | 1,383,750 | |

| Republic of Ecuador, 7.875%, 1/23/2028 | | | 3,833,000 | | | | 3,581,939 | |

| Republic of Ecuador, 10.75%, 1/31/2029 (n) | | | 1,323,000 | | | | 1,424,210 | |

| Republic of El Salvador, 7.375%, 12/01/2019 | | | 3,276,000 | | | | 3,292,413 | |

| Republic of El Salvador, 7.125%, 1/20/2050 (z) | | | 1,293,000 | | | | 1,320,153 | |

| Republic of Gabon, 6.95%, 6/16/2025 | | | 1,742,000 | | | | 1,687,963 | |

| Republic of Ghana, 8.125%, 3/26/2032 (n) | | | 4,739,000 | | | | 4,632,373 | |

| Republic of Guatemala, 4.9%, 6/01/2030 (n) | | | 1,887,000 | | | | 2,027,015 | |

| Republic of Guatemala, 4.9%, 6/01/2030 | | | 1,385,000 | | | | 1,487,767 | |

| Republic of Guatemala, 6.125%, 6/01/2050 (n) | | | 1,700,000 | | | | 2,025,142 | |

| Republic of Guatemala, 6.125%, 6/01/2050 | | | 1,325,000 | | | | 1,578,420 | |

| Republic of Hungary, 5.75%, 11/22/2023 | | | 2,734,000 | | | | 3,108,924 | |

| Republic of Hungary, 5.375%, 3/25/2024 | | | 8,784,000 | | | | 9,953,431 | |

| Republic of Indonesia, 4.75%, 1/08/2026 (n) | | | 4,918,000 | | | | 5,484,375 | |

| Republic of Indonesia, 4.35%, 1/08/2027 | | | 7,986,000 | | | | 8,788,939 | |

| Republic of Indonesia, 3.5%, 1/11/2028 | | | 1,066,000 | | | | 1,120,476 | |

| Republic of Indonesia, 8.375%, 3/15/2034 | | IDR | 72,039,000,000 | | | | 5,357,345 | |

| Republic of Indonesia, 7.5%, 5/15/2038 | | | 52,848,000,000 | | | | 3,622,426 | |

| Republic of Indonesia, 4.625%, 4/15/2043 | | $ | 1,624,000 | | | | 1,863,004 | |

| Republic of Kenya, 7%, 5/22/2027 (n) | | | 1,709,000 | | | | 1,801,201 | |

| Republic of Kenya, 8%, 5/22/2032 (n) | | | 2,010,000 | | | | 2,125,756 | |

| Republic of Kenya, 8.25%, 2/28/2048 (n) | | | 1,974,000 | | | | 2,037,875 | |

| Republic of Mongolia, 5.625%, 5/01/2023 | | | 1,683,000 | | | | 1,690,754 | |

| Republic of Namibia, 5.25%, 10/29/2025 | | | 1,385,000 | | | | 1,390,238 | |

| Republic of Panama, 3.75%, 4/17/2026 | | | 1,641,000 | | | | 1,748,502 | |

16

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Emerging Market Sovereign - continued | | | | | | | | |

| Republic of Panama, 3.875%, 3/17/2028 | | $ | 2,654,000 | | | $ | 2,939,332 | |

| Republic of Panama, 3.16%, 1/23/2030 | | | 2,587,000 | | | | 2,744,807 | |

| Republic of Panama, 4.5%, 4/16/2050 | | | 1,283,000 | | | | 1,592,537 | |

| Republic of Paraguay, 6.1%, 8/11/2044 | | | 4,048,000 | | | | 5,076,192 | |

| Republic of Paraguay, 5.6%, 3/13/2048 (n) | | | 1,194,000 | | | | 1,436,382 | |

| Republic of Paraguay, 5.6%, 3/13/2048 | | | 2,452,000 | | | | 2,949,756 | |

| Republic of Paraguay, 5.4%, 3/30/2050 (n) | | | 1,369,000 | | | | 1,608,575 | |

| Republic of Peru, 6.9%, 8/12/2037 | | PEN | 4,901,000 | | | | 1,782,258 | |

| Republic of Rwanda, 6.625%, 5/02/2023 | | $ | 1,257,000 | | | | 1,352,768 | |

| Republic of Senegal, 4.75%, 3/13/2028 (n) | | EUR | 1,883,000 | | | | 2,151,414 | |

| Republic of Senegal, 4.75%, 3/13/2028 | | | 1,153,000 | | | | 1,317,356 | |

| Republic of Senegal, 6.25%, 5/23/2033 | | $ | 3,517,000 | | | | 3,479,002 | |

| Republic of Senegal, 6.75%, 3/13/2048 | | | 1,061,000 | | | | 1,012,393 | |

| Republic of South Africa, 4.85%, 9/27/2027 | | | 1,734,000 | | | | 1,804,185 | |

| Republic of Sri Lanka, 5.75%, 4/18/2023 (n) | | | 810,000 | | | | 801,951 | |

| Republic of Sri Lanka, 6.85%, 3/14/2024 (n) | | | 1,955,000 | | | | 1,988,322 | |

| Republic of Sri Lanka, 6.125%, 6/03/2025 | | | 9,785,000 | | | | 9,468,509 | |

| Republic of Sri Lanka, 7.55%, 3/28/2030 (n) | | | 1,213,000 | | | | 1,205,830 | |

| Republic of Turkey, 3.25%, 3/23/2023 | | | 2,486,000 | | | | 2,265,228 | |

| Republic of Turkey, 7.25%, 12/23/2023 | | | 1,967,000 | | | | 2,033,386 | |

| Republic of Turkey, 5.75%, 3/22/2024 | | | 3,216,000 | | | | 3,130,564 | |

| Republic of Turkey, 6.35%, 8/10/2024 | | | 1,635,000 | | | | 1,624,471 | |

| Republic of Turkey, 6%, 3/25/2027 | | | 7,500,000 | | | | 7,124,595 | |

| Republic of Turkey, 6.125%, 10/24/2028 | | | 2,629,000 | | | | 2,473,626 | |

| Republic of Turkey, 6.875%, 3/17/2036 | | | 3,197,000 | | | | 3,061,716 | |

| Russian Federation, 4.75%, 5/27/2026 | | | 5,400,000 | | | | 5,899,500 | |

| Russian Federation, 4.25%, 6/23/2027 | | | 5,600,000 | | | | 5,957,750 | |

| Russian Federation, 4.375%, 3/21/2029 (n) | | | 7,800,000 | | | | 8,385,047 | |

| Russian Federation, 4.375%, 3/21/2029 | | | 3,200,000 | | | | 3,440,019 | |

| Russian Federation, 7.7%, 3/23/2033 | | RUB | 111,335,000 | | | | 1,741,723 | |

| Russian Federation, 5.1%, 3/28/2035 (n) | | $ | 3,400,000 | | | | 3,842,000 | |

| Russian Federation, 5.25%, 6/23/2047 | | | 600,000 | | | | 713,706 | |

| Socialist Republic of Vietnam, 4.8%, 11/19/2024 | | | 2,602,000 | | | | 2,828,161 | |

| State of Qatar, 4%, 3/14/2029 (n) | | | 6,099,000 | | | | 6,960,484 | |

| State of Qatar, 5.103%, 4/23/2048 (n) | | | 5,813,000 | | | | 7,745,009 | |

| State of Qatar, 5.103%, 4/23/2048 | | | 898,000 | | | | 1,196,459 | |

| State of Qatar, 4.817%, 3/14/2049 (n) | | | 2,471,000 | | | | 3,179,362 | |

| State of Qatar, 4.817%, 3/14/2049 | | | 840,000 | | | | 1,080,803 | |

| United Mexican States, 3.75%, 1/11/2028 | | | 4,427,000 | | | | 4,628,473 | |

| United Mexican States, 8.5%, 5/31/2029 | | MXN | 32,400,000 | | | | 1,787,202 | |

| United Mexican States, 4.6%, 2/10/2048 | | $ | 1,371,000 | | | | 1,497,831 | |

| | | | | | | | |

| | | | | | | $ | 391,083,165 | |

17

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Energy - Independent - 0.1% | | | | | | | | |

| Afren PLC, 11.5%, 2/01/2020 (a)(d)(z) | | $ | 200,000 | | | $ | 164 | |

| Tengizchevroil Finance Co. International Ltd., 4%, 8/15/2026 (n) | | | 2,119,000 | | | | 2,190,737 | |

| Ultrapar International S.A., 5.25%, 6/06/2029 (n) | | | 453,000 | | | | 474,970 | |

| | | | | | | | |

| | | | | | | $ | 2,665,871 | |

| Energy - Integrated - 0.0% | | | | | | | | |

| Inkia Energy Ltd., 5.875%, 11/09/2027 (n) | | $ | 901,000 | | | $ | 935,923 | |

| | |

| Financial Institutions - 0.0% | | | | | | | | |

| InterCorp Peru Ltd., 3.875%, 8/15/2029 (n) | | $ | 647,000 | | | $ | 651,853 | |

| | |

| Food & Beverages - 0.2% | | | | | | | | |

| Central American Bottling Corp., 5.75%, 1/31/2027 (n) | | $ | 800,000 | | | $ | 846,000 | |

| Corporacion Lindley S.A., 6.75%, 11/23/2021 (n) | | | 1,145,000 | | | | 1,210,837 | |

| Corporacion Lindley S.A., 6.75%, 11/23/2021 | | | 1,010,000 | | | | 1,068,075 | |

| JBS Investments II GmbH, 5.75%, 1/15/2028 (n) | | | 1,796,000 | | | | 1,885,800 | |

| JBS USA Lux S.A./JBS USA Finance, Inc., 6.5%, 4/15/2029 (n) | | | 1,304,000 | | | | 1,444,180 | |

| NBM U.S. Holdings, Inc., 7%, 5/14/2026 (n) | | | 1,391,000 | | | | 1,420,434 | |

| | | | | | | | |

| | | | | | | $ | 7,875,326 | |

| Forest & Paper Products - 0.1% | | | | | | | | |

| Suzano Austria GmbH, 6%, 1/15/2029 | | $ | 1,631,000 | | | $ | 1,808,290 | |

| Suzano Austria GmbH, 5%, 1/15/2030 | | | 1,274,000 | | | | 1,312,220 | |

| | | | | | | | |

| | | | | | | $ | 3,120,510 | |

| Gaming & Lodging - 0.1% | | | | | | | | |

| Sands China Ltd., 5.4%, 8/08/2028 | | $ | 2,871,000 | | | $ | 3,313,442 | |

| | |

| Industrial - 0.1% | | | | | | | | |

| GOHL Capital Ltd., 4.25%, 1/24/2027 | | $ | 2,052,000 | | | $ | 2,168,867 | |

| | |

| International Market Sovereign - 0.1% | | | | | | | | |

| Government of Bermuda, 4.75%, 2/15/2029 (n) | | $ | 2,534,000 | | | $ | 2,920,435 | |

| | |

| Local Authorities - 0.1% | | | | | | | | |

| Province of Santa Fe, 6.9%, 11/01/2027 | | $ | 2,012,000 | | | $ | 1,086,480 | |

| Provincia de Cordoba, 7.125%, 6/10/2021 | | | 7,306,000 | | | | 3,653,000 | |

| | | | | | | | |

| | | | | | | $ | 4,739,480 | |

| Major Banks - 0.0% | | | | | | | | |

| UBS Group Funding (Switzerland) AG, 3.491%, 5/23/2023 (n) | | $ | 829,000 | | | $ | 854,110 | |

18

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Medical & Health Technology & Services - 0.2% | | | | | | | | |

| CommonSpirit Health, 2.76%, 10/01/2024 | | $ | 1,608,000 | | | $ | 1,634,667 | |

| Montefiore Obligated Group, 5.246%, 11/01/2048 | | | 3,192,000 | | | | 4,072,791 | |

| | | | | | | | |

| | | | | | | $ | 5,707,458 | |

| Metals & Mining - 0.1% | | | | | | | | |

| First Quantum Minerals Ltd., 7.25%, 4/01/2023 | | $ | 683,000 | | | $ | 642,020 | |

| First Quantum Minerals Ltd., 6.5%, 3/01/2024 | | | 1,072,000 | | | | 972,840 | |

| Petra Diamonds U.S. Treasury PLC, 7.25%, 5/01/2022 (n) | | | 682,000 | | | | 593,340 | |

| Petra Diamonds U.S. Treasury PLC, 7.25%, 5/01/2022 | | | 2,699,000 | | | | 2,348,130 | |

| | | | | | | | |

| | | | | | | $ | 4,556,330 | |

| Midstream - 0.1% | | | | | | | | |

| Cosan Ltd., 5.5%, 9/20/2029 (n) | | $ | 2,427,000 | | | $ | 2,467,555 | |

| | |

| Mortgage-Backed - 11.2% | | | | | | | | |

| Fannie Mae, 5%, 9/01/2019 - 3/01/2042 | | $ | 6,342,462 | | | $ | 6,962,423 | |

| Fannie Mae, 5.5%, 10/01/2019 - 4/01/2040 | | | 5,915,730 | | | | 6,673,414 | |

| Fannie Mae, 4.14%, 8/01/2020 | | | 37,576 | | | | 37,905 | |

| Fannie Mae, 5.19%, 9/01/2020 | | | 79,741 | | | | 80,816 | |

| Fannie Mae, 3.416%, 10/01/2020 | | | 257,097 | | | | 261,078 | |

| Fannie Mae, 4.58%, 1/01/2021 | | | 243,297 | | | | 245,792 | |

| Fannie Mae, 3.99%, 7/01/2021 | | | 357,113 | | | | 367,762 | |

| Fannie Mae, 6%, 7/01/2021 - 6/01/2038 | | | 312,183 | | | | 354,698 | |

| Fannie Mae, 4.5%, 1/01/2023 - 8/01/2046 | | | 24,865,209 | | | | 26,906,635 | |

| Fannie Mae, 2.152%, 1/25/2023 | | | 1,212,602 | | | | 1,222,988 | |

| Fannie Mae, 2.41%, 5/01/2023 | | | 222,597 | | | | 227,202 | |

| Fannie Mae, 2.55%, 5/01/2023 | | | 191,941 | | | | 196,825 | |

| Fannie Mae, 2.62%, 5/01/2023 | | | 263,794 | | | | 271,133 | |

| Fannie Mae, 3.65%, 9/01/2023 | | | 779,374 | | | | 832,891 | |

| Fannie Mae, 3.78%, 10/01/2023 | | | 458,086 | | | | 493,097 | |

| Fannie Mae, 3.92%, 10/01/2023 | | | 987,000 | | | | 1,071,619 | |

| Fannie Mae, 3.5%, 5/25/2025 - 8/01/2047 | | | 59,543,490 | | | | 62,124,112 | |

| Fannie Mae, 2.7%, 7/01/2025 | | | 680,000 | | | | 710,071 | |

| Fannie Mae, 3.59%, 9/01/2026 | | | 359,974 | | | | 396,990 | |

| Fannie Mae, 2.672%, 12/25/2026 | | | 3,827,000 | | | | 3,979,301 | |

| Fannie Mae, 3.144%, 3/25/2028 | | | 2,027,000 | | | | 2,179,247 | |

| Fannie Mae, 4%, 3/25/2028 - 9/01/2047 | | | 41,724,106 | | | | 44,237,620 | |

| Fannie Mae, 3%, 11/01/2028 - 11/01/2046 | | | 27,082,870 | | | | 27,932,994 | |

| Fannie Mae, 4.01%, 1/01/2029 | | | 686,029 | | | | 787,116 | |

| Fannie Mae, 4.96%, 6/01/2030 | | | 1,071,301 | | | | 1,266,741 | |

| Fannie Mae, 6.5%, 1/01/2033 - 10/01/2037 | | | 92,239 | | | | 104,999 | |

| Fannie Mae, 2%, 10/25/2040 - 4/25/2046 | | | 2,841,989 | | | | 2,840,717 | |

| Fannie Mae, TBA, 2.5%, 9/01/2034 - 10/01/2034 | | | 1,375,000 | | | | 1,393,087 | |

| Fannie Mae, TBA, 3%, 9/01/2034 - 9/01/2049 | | | 12,064,000 | | | | 12,356,636 | |

19

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Mortgage-Backed - continued | | | | | | | | |

| Fannie Mae, TBA, 3.5%, 9/01/2034 - 11/01/2034 | | $ | 4,475,000 | | | $ | 4,637,414 | |

| Fannie Mae, TBA, 4%, 9/01/2049 | | | 7,250,000 | | | | 7,526,973 | |

| Freddie Mac, 4.251%, 1/25/2020 | | | 315,112 | | | | 315,701 | |

| Freddie Mac, 4.224%, 3/25/2020 | | | 304,843 | | | | 305,816 | |

| Freddie Mac, 5%, 5/01/2020 - 6/01/2040 | | | 677,864 | | | | 755,937 | |

| Freddie Mac, 3.808%, 8/25/2020 | | | 787,416 | | | | 795,171 | |

| Freddie Mac, 3.034%, 10/25/2020 | | | 494,366 | | | | 497,509 | |

| Freddie Mac, 6%, 5/01/2021 - 10/01/2038 | | | 370,837 | | | | 423,737 | |

| Freddie Mac, 2.51%, 11/25/2022 | | | 2,731,000 | | | | 2,787,054 | |

| Freddie Mac, 2.637%, 1/25/2023 | | | 1,000,000 | | | | 1,025,524 | |

| Freddie Mac, 3.32%, 2/25/2023 | | | 1,277,000 | | | | 1,337,383 | |

| Freddie Mac, 3.25%, 4/25/2023 | | | 1,700,000 | | | | 1,779,356 | |

| Freddie Mac, 3.3%, 4/25/2023 - 10/25/2026 | | | 4,285,940 | | | | 4,592,738 | |

| Freddie Mac, 3.06%, 7/25/2023 | | | 886,000 | | | | 923,445 | |

| Freddie Mac, 3.458%, 8/25/2023 | | | 675,000 | | | | 713,684 | |

| Freddie Mac, 1.016%, 4/25/2024 (i) | | | 21,175,438 | | | | 699,063 | |

| Freddie Mac, 0.736%, 7/25/2024 (i) | | | 24,626,786 | | | | 616,581 | |

| Freddie Mac, 3.303%, 7/25/2024 | | | 5,037,000 | | | | 5,365,428 | |

| Freddie Mac, 3.064%, 8/25/2024 | | | 2,626,852 | | | | 2,761,855 | |

| Freddie Mac, 4.5%, 9/01/2024 - 5/01/2042 | | | 2,421,618 | | | | 2,623,771 | |

| Freddie Mac, 2.67%, 12/25/2024 | | | 2,555,000 | | | | 2,657,509 | |

| Freddie Mac, 2.811%, 1/25/2025 | | | 2,125,000 | | | | 2,223,038 | |

| Freddie Mac, 3.023%, 1/25/2025 | | | 1,000,000 | | | | 1,057,277 | |

| Freddie Mac, 3.329%, 5/25/2025 | | | 5,166,000 | | | | 5,573,141 | |

| Freddie Mac, 3.284%, 6/25/2025 | | | 5,000,000 | | | | 5,383,797 | |

| Freddie Mac, 4%, 7/01/2025 - 4/01/2044 | | | 2,661,328 | | | | 2,820,883 | |

| Freddie Mac, 3.01%, 7/25/2025 | | | 1,775,000 | | | | 1,888,145 | |

| Freddie Mac, 2.745%, 1/25/2026 | | | 3,263,000 | | | | 3,432,347 | |

| Freddie Mac, 2.673%, 3/25/2026 | | | 2,368,000 | | | | 2,484,025 | |

| Freddie Mac, 3.224%, 3/25/2027 | | | 3,227,000 | | | | 3,507,580 | |

| Freddie Mac, 3.243%, 4/25/2027 | | | 3,546,000 | | | | 3,862,123 | |

| Freddie Mac, 0.713%, 7/25/2027 (i) | | | 45,698,565 | | | | 1,885,783 | |

| Freddie Mac, 0.567%, 8/25/2027 (i) | | | 35,028,100 | | | | 1,092,898 | |

| Freddie Mac, 0.427%, 1/25/2028 (i) | | | 64,140,634 | | | | 1,571,728 | |

| Freddie Mac, 0.434%, 1/25/2028 (i) | | | 26,439,695 | | | | 662,653 | |

| Freddie Mac, 0.27%, 2/25/2028 (i) | | | 79,119,414 | | | | 1,022,049 | |

| Freddie Mac, 2.5%, 3/15/2028 | | | 354,095 | | | | 362,684 | |

| Freddie Mac, 0.263%, 4/25/2028 (i) | | | 50,741,117 | | | | 613,409 | |

| Freddie Mac, 3%, 6/15/2028 - 3/01/2047 | | | 28,005,576 | | | | 28,932,325 | |

| Freddie Mac, 3.5%, 6/15/2028 - 10/25/2058 | | | 33,249,810 | | | | 34,866,668 | |

| Freddie Mac, 5.5%, 6/01/2030 - 6/01/2041 | | | 668,899 | | | | 754,652 | |

| Freddie Mac, 6.5%, 5/01/2037 | | | 13,512 | | | | 15,469 | |

| Ginnie Mae, 2.5%, 7/20/2032 - 6/20/2042 | | | 1,045,000 | | | | 1,059,054 | |

| Ginnie Mae, 5.5%, 5/15/2033 - 1/20/2042 | | | 278,978 | | | | 315,314 | |

20

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Mortgage-Backed - continued | | | | | | | | |

| Ginnie Mae, 4.5%, 7/20/2033 - 9/20/2041 | | $ | 5,200,174 | | | $ | 5,618,684 | |

| Ginnie Mae, 4%, 5/16/2039 - 7/20/2049 | | | 20,099,720 | | | | 21,075,153 | |

| Ginnie Mae, 3.5%, 12/15/2041 - 6/20/2049 | | | 10,950,831 | | | | 11,535,612 | |

| Ginnie Mae, 3%, 4/20/2045 - 10/20/2048 | | | 16,590,288 | | | | 17,148,792 | |

| Ginnie Mae, 5%, 1/20/2049 | | | 1,999,999 | | | | 2,102,958 | |

| Ginnie Mae, 5.87%, 4/20/2058 | | | 1,568 | | | | 1,787 | |

| Ginnie Mae, 0.661%, 2/16/2059 (i) | | | 3,081,077 | | | | 181,232 | |

| Ginnie Mae, TBA, 3.5%, 9/01/2049 - 10/01/2049 | | | 6,300,000 | | | | 6,543,141 | |

| Ginnie Mae, TBA, 4%, 9/01/2049 - 10/01/2049 | | | 5,650,000 | | | | 5,887,477 | |

| Ginnie Mae, TBA, 3%, 10/01/2049 | | | 3,375,000 | | | | 3,475,129 | |

| | | | | | | | |

| | | | | | | $ | 428,614,565 | |

| Municipals - 0.3% | | | | | | | | |

| New Jersey Economic Development Authority State | | | | | | | | |

| Pension Funding Rev., Capital Appreciation, “B”, AGM, 0%, 2/15/2023 | | $ | 6,363,000 | | | $ | 5,896,274 | |

| Philadelphia, PA, School District, “A”, AGM, 5.995%, 9/01/2030 | | | 1,210,000 | | | | 1,573,157 | |

| State of California (Build America Bonds), 7.6%, 11/01/2040 | | | 2,320,000 | | | | 3,999,657 | |

| University of California Rev. (Build America Bonds), 5.77%, 5/15/2043 | | | 60,000 | | | | 85,478 | |

| | | | | | | | |

| | | | | | | $ | 11,554,566 | |

| Natural Gas - Distribution - 0.2% | | | | | | | | |

| GNL Quintero S.A., 4.634%, 7/31/2029 (n) | | $ | 4,778,000 | | | $ | 5,124,453 | |

| Infraestructura Energética Nova S.A.B. de C.V, 4.875%, 1/14/2048 (n) | | | 4,200,000 | | | | 3,927,000 | |

| | | | | | | | |

| | | | | | | $ | 9,051,453 | |

| Natural Gas - Pipeline - 0.1% | | | | | | | | |

| Peru LNG, 5.375%, 3/22/2030 (n) | | $ | 3,644,000 | | | $ | 3,926,447 | |

| Peru LNG, 5.375%, 3/22/2030 | | | 1,542,000 | | | | 1,661,520 | |

| | | | | | | | |

| | | | | | | $ | 5,587,967 | |

| Network & Telecom - 0.3% | | | | | | | | |

| C&W Senior Financing Designated Activity, 7.5%, 10/15/2026 (n) | | $ | 1,212,000 | | | $ | 1,314,778 | |

| Empresa Nacional de Telecomunicaciones S.A., 4.75%, 8/01/2026 | | | 5,020,000 | | | | 5,306,721 | |

| Telefónica Celular del Paraguay S.A., 5.875%, 4/15/2027 (n) | | | 1,846,000 | | | | 1,959,068 | |

| WTT Investment Ltd., 5.5%, 11/21/2022 (n) | | | 3,420,000 | | | | 3,513,744 | |

| | | | | | | | |

| | | | | | | $ | 12,094,311 | |

| Oils - 0.0% | | | | | | | | |

| Thaioil Treasury Center Co. Ltd., 5.375%, 11/20/2048 (n) | | $ | 543,000 | | | $ | 734,090 | |

21

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Other Banks & Diversified Financials - 0.3% | | | | | | | | |

| Bangkok Bank (Hong Kong), 4.05%, 3/19/2024 (n) | | $ | 4,000,000 | | | $ | 4,286,285 | |

| ING Groep N.V., 3.15%, 3/29/2022 | | | 1,585,000 | | | | 1,624,841 | |

| Kazkommertsbank JSC, 5.5%, 12/21/2022 | | | 5,860,998 | | | | 5,904,956 | |

| | | | | | | | |

| | | | | | | $ | 11,816,082 | |

| Pollution Control - 0.1% | | | | | | | | |

| Aegea Finance S.à r.l., 5.75%, 10/10/2024 (n) | | $ | 1,617,000 | | | $ | 1,683,718 | |

| Aegea Finance S.à r.l., 5.75%, 10/10/2024 | | | 1,716,000 | | | | 1,786,802 | |

| | | | | | | | |

| | | | | | | $ | 3,470,520 | |

| Railroad & Shipping - 0.2% | | | | | | | | |

| Lima Metro Line 2 Finance Ltd., 5.875%, 7/05/2034 | | $ | 4,620,000 | | | $ | 5,041,621 | |

| Lima Metro Line 2 Finance Ltd., 4.35%, 4/05/2036 (n) | | | 975,000 | | | | 1,033,988 | |

| | | | | | | | |

| | | | | | | $ | 6,075,609 | |

| Restaurants - 0.1% | | | | | | | | |

| Starbucks Corp., 3.8%, 8/15/2025 | | $ | 2,396,000 | | | $ | 2,598,019 | |

| | |

| Retailers - 0.1% | | | | | | | | |

| S.A.C.I. Falabella, 3.75%, 4/30/2023 | | $ | 1,764,000 | | | $ | 1,812,578 | |

| | |

| Supermarkets - 0.1% | | | | | | | | |

| Eurotorg LLC Via Bonitron DAC, 8.75%, 10/30/2022 (n) | | $ | 1,028,000 | | | $ | 1,091,222 | |

| Eurotorg LLC Via Bonitron DAC, 8.75%, 10/30/2022 | | | 1,552,000 | | | | 1,647,448 | |

| | | | | | | | |

| | | | | | | $ | 2,738,670 | |

| Supranational - 0.0% | | | | | | | | |

| Inter-American Development Bank, 4.375%, 1/24/2044 | | $ | 511,000 | | | $ | 725,898 | |

| | |

| Tobacco - 0.0% | | | | | | | | |

| B.A.T Capital Corp., 2.764%, 8/15/2022 | | $ | 1,508,000 | | | $ | 1,526,657 | |

| | |

| Transportation - Services - 0.2% | | | | | | | | |

| Adani Ports & Special Economic Zone Ltd., 4.375%, 7/03/2029 (n) | | $ | 1,052,000 | | | $ | 1,101,343 | |

| Aeropuertos Dominicanos Siglo XXI S.A., 6.75%, 3/30/2029 | | | 1,200,000 | | | | 1,260,000 | |

| Delhi International Airport Ltd., 6.45%, 6/04/2029 (n) | | | 1,600,000 | | | | 1,681,824 | |

| Rumo Luxembourg S.à r.l., 7.375%, 2/09/2024 | | | 2,508,000 | | | | 2,707,812 | |

| Rumo Luxembourg S.à r.l., 5.875%, 1/18/2025 (n) | | | 334,000 | | | | 350,074 | |

| Rumo Luxembourg S.à r.l., “A”, 7.375%, 2/09/2024 (n) | | | 632,000 | | | | 682,352 | |

| Topaz Marine S.A., 9.125%, 7/26/2022 | | | 670,000 | | | | 697,814 | |

| | | | | | | | |

| | | | | | | $ | 8,481,219 | |

22

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| U.S. Government Agencies and Equivalents - 1.0% | | | | | |

| AID-Tunisia, 2.452%, 7/24/2021 | | $ | 728,000 | | | $ | 735,287 | |

| AID-Ukraine, 1.847%, 5/29/2020 | | | 8,820,000 | | | | 8,845,731 | |

| Fannie Mae, 1.75%, 11/26/2019 | | | 4,750,000 | | | | 4,746,729 | |

| Fannie Mae, 1.625%, 1/21/2020 | | | 7,500,000 | | | | 7,490,766 | |

| Federal Home Loan Bank, 1.5%, 10/21/2019 | | | 9,000,000 | | | | 8,992,955 | |

| Hashemite Kingdom of Jordan, 2.503%, 10/30/2020 | | | 1,108,000 | | | | 1,116,896 | |

| Private Export Funding Corp., 2.25%, 3/15/2020 | | | 419,000 | | | | 419,584 | |

| Private Export Funding Corp., 2.3%, 9/15/2020 | | | 2,000,000 | | | | 2,006,495 | |

| Small Business Administration, 6.34%, 5/01/2021 | | | 8,909 | | | | 9,072 | |

| Small Business Administration, 6.07%, 3/01/2022 | | | 7,681 | | | | 7,878 | |

| Small Business Administration, 5.16%, 2/01/2028 | | | 46,026 | | | | 49,858 | |

| Small Business Administration, 2.21%, 2/01/2033 | | | 209,890 | | | | 212,394 | |

| Small Business Administration, 2.22%, 3/01/2033 | | | 367,379 | | | | 372,330 | |

| Small Business Administration, 3.15%, 7/01/2033 | | | 442,951 | | | | 465,941 | |

| Small Business Administration, 3.16%, 8/01/2033 | | | 478,750 | | | | 504,078 | |

| Small Business Administration, 3.62%, 9/01/2033 | | | 414,579 | | | | 445,894 | |

| | | | | | | | |

| | | | | | | $ | 36,421,888 | |

| U.S. Treasury Obligations - 7.0% | | | | | | | | |

| U.S. Treasury Bonds, 6.375%, 8/15/2027 | | $ | 106,000 | | | $ | 144,938 | |

| U.S. Treasury Bonds, 5.25%, 2/15/2029 | | | 2,965,000 | | | | 3,944,956 | |

| U.S. Treasury Bonds, 4.375%, 2/15/2038 | | | 1,349,000 | | | | 1,910,574 | |

| U.S. Treasury Bonds, 4.5%, 8/15/2039 | | | 401,000 | | | | 583,126 | |

| U.S. Treasury Bonds, 3.125%, 2/15/2043 | | | 9,137,900 | | | | 11,201,066 | |

| U.S. Treasury Bonds, 2.875%, 5/15/2043 | | | 17,378,300 | | | | 20,489,423 | |

| U.S. Treasury Bonds, 2.5%, 2/15/2045 (f) | | | 33,851,000 | | | | 37,549,486 | |

| U.S. Treasury Bonds, 2.875%, 11/15/2046 | | | 11,828,000 | | | | 14,109,048 | |

| U.S. Treasury Notes, 3.125%, 5/15/2021 | | | 3,748,000 | | | | 3,843,750 | |

| U.S. Treasury Notes, 1.75%, 11/30/2021 | | | 75,932,000 | | | | 76,359,117 | |

| U.S. Treasury Notes, 1.75%, 5/15/2022 | | | 3,949,000 | | | | 3,979,852 | |

| U.S. Treasury Notes, 2.5%, 8/15/2023 | | | 29,025,000 | | | | 30,223,415 | |

| U.S. Treasury Notes, 2.75%, 2/15/2024 | | | 7,855,000 | | | | 8,304,515 | |

| U.S. Treasury Notes, 2.5%, 5/15/2024 | | | 4,680,000 | | | | 4,909,978 | |

| U.S. Treasury Notes, 2.875%, 7/31/2025 | | | 1,948,000 | | | | 2,104,905 | |

| U.S. Treasury Notes, 2.625%, 12/31/2025 | | | 13,800,000 | | | | 14,772,469 | |

| U.S. Treasury Notes, 2%, 11/15/2026 | | | 15,400,000 | | | | 15,972,086 | |

| U.S. Treasury Notes, 2.25%, 8/15/2027 | | | 8,936,000 | | | | 9,455,754 | |

| U.S. Treasury Notes, 2.375%, 5/15/2029 | | | 8,149,500 | | | | 8,782,678 | |

| | | | | | | | |

| | | | | | | $ | 268,641,136 | |

| Utilities - Electric Power - 1.0% | | | | | | | | |

| Adani Green Energy (UP) Ltd./Prayatna Developers Private Ltd., 6.25%, 12/10/2024 (n) | | $ | 3,526,000 | | | $ | 3,614,150 | |

| Azure Power Energy Ltd., 5.5%, 11/03/2022 (n) | | | 3,114,000 | | | | 3,123,465 | |

23

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Utilities - Electric Power - continued | | | | | | | | |

| Cerro del Aguila S.A., 4.125%, 8/16/2027 (n) | | $ | 1,409,000 | | | $ | 1,463,613 | |

| China Southern Power Grid International Finance Co. Ltd., 3.5%, 5/08/2027 | | | 998,000 | | | | 1,067,854 | |

| Consorcio Transmantaro S.A., 4.7%, 4/16/2034 (n) | | | 636,000 | | | | 694,035 | |

| Enel Finance International N.V., 2.875%, 5/25/2022 (n) | | | 2,073,000 | | �� | | 2,097,868 | |

| Engie Energia Chile S.A., 5.625%, 1/15/2021 | | | 2,177,000 | | | | 2,267,532 | |

| Engie Energia Chile S.A., 4.5%, 1/29/2025 (n) | | | 2,824,000 | | | | 3,033,875 | |

| Genneia S.A., 8.75%, 1/20/2022 (n) | | | 1,250,000 | | | | 638,137 | |

| Greenko Dutch B.V., 5.25%, 7/24/2024 (n) | | | 3,065,000 | | | | 3,066,532 | |

| LLPL Capital Pte. Ltd., 6.875%, 2/04/2039 (n) | | | 1,146,312 | | | | 1,359,135 | |

| Mong Duong Finance Holdings B.V., 5.125%, 5/07/2029 (n) | | | 2,190,000 | | | | 2,224,351 | |

| TerraForm Global Operating LLC, 6.125%, 3/01/2026 (n) | | | 1,536,000 | | | | 1,578,240 | |

| Transelec S.A., 4.25%, 1/14/2025 (n) | | | 2,631,000 | | | | 2,788,860 | |

| Transelec S.A., 4.25%, 1/14/2025 | | | 2,603,000 | | | | 2,759,180 | |

| Transelec S.A., 3.875%, 1/12/2029 (n) | | | 3,854,000 | | | | 3,945,571 | |

| Transelec S.A., 3.875%, 1/12/2029 | | | 392,000 | | | | 401,314 | |

| Virginia Electric & Power Co., 3.5%, 3/15/2027 | | | 813,000 | | | | 876,241 | |

| | | | | | | | |

| | | | | | | $ | 36,999,953 | |

| Utilities - Gas - 0.0% | | | | | | | | |

| Gas Natural de Lima y Callao S.A., 4.375%, 4/01/2023 | | $ | 1,259,000 | | | $ | 1,310,946 | |

| Total Bonds (Identified Cost, $1,454,903,596) | | | | | | $ | 1,520,664,613 | |

| | |

| Convertible Preferred Stocks - 0.2% | | | | | | | | |

| Medical Equipment - 0.0% | | | | | | | | |

| Danaher Corp., 4.75% | | | 857 | | | $ | 977,811 | |

| | |

| Utilities - Electric Power - 0.2% | | | | | | | | |

| CenterPoint Energy, Inc., 7% | | | 67,302 | | | $ | 3,328,084 | |

| NextEra Energy, Inc., 6.123% | | | 27,684 | | | | 1,913,795 | |

| | | | | | | | |

| | | | | | | $ | 5,241,879 | |

Total Convertible Preferred Stocks

(Identified Cost, $5,872,254) | | | $ | 6,219,690 | |

| | |

| Preferred Stocks - 0.1% | | | | | | | | |

| Telephone Services - 0.1% | | | | | | | | |

| Telefonica Brasil S.A. (Identified Cost, $3,306,558) | | | 242,100 | | | $ | 3,137,771 | |

| | |

| Investment Companies (h) - 19.8% | | | | | | | | |

| Bond Funds - 16.6% | | | | | | | | |

| MFS High Yield Pooled Portfolio (v) | | | 68,882,259 | | | $ | 637,160,890 | |

24

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| Investment Companies (h) - continued | | | | | | | | |

| Money Market Funds - 3.2% | | | | | | | | |

| MFS Institutional Money Market Portfolio, 2.17% (v) | | | 121,238,881 | | | $ | 121,251,005 | |

Total Investment Companies

(Identified Cost, $740,764,032) | | | $ | 758,411,895 | |

| | |

| Other Assets, Less Liabilities - (0.4)% | | | | | | | (15,434,608 | ) |

| Net Assets - 100.0% | | | | | | $ | 3,824,161,693 | |

| (a) | Non-income producing security. |

| (f) | All or a portion of the security has been segregated as collateral for open futures contracts. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $758,411,895 and $3,081,184,406, respectively. |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $315,916,990, representing 8.3% of net assets. |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualizedseven-day yield of the fund at period end. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| | | | | | | | | | |

| Restricted Securities | | Acquisition

Date | | Cost | | | Value | |

| Afren PLC, 11.5%, 2/01/2020 | | 11/20/15 | | | $194,048 | | | | $164 | |

| GEMS Menasa Cayman Ltd./GEMS Education Delaware LLC, 7.125%, 7/31/2026 | | 7/30/19 | | | 1,470,000 | | | | 1,497,930 | |

| Republic of El Salvador, 7.125%, 1/20/2050 | | 7/30/19 | | | 1,293,000 | | | | 1,320,153 | |

| YPF Energia Electrica S.A., 10%, 7/25/2026 | | 7/18/19 | | | 1,434,351 | | | | 842,175 | |

| Total Restricted Securities | | | | | | | | | $3,660,422 | |

| % of Net assets | | | | | | | | | 0.1% | |

The following abbreviations are used in this report and are defined:

| ADR | | American Depositary Receipt |

| AGM | | Assured Guaranty Municipal |

| CLO | | Collateralized Loan Obligation |

| FLR | | Floating Rate. Interest rate resets periodically based on the parenthetically disclosed reference rate plus a spread (if any). Theperiod-end rate reported may not be the current rate. All reference rates are USD unless otherwise noted. |

25

Portfolio of Investments (unaudited) – continued

| LIBOR | | London Interbank Offered Rate |

| REIT | | Real Estate Investment Trust |

Abbreviations indicate amounts shown in currencies other than the U.S. dollar. All amounts are stated in U.S. dollars unless otherwise indicated. A list of abbreviations is shown below:

Derivative Contracts at 8/31/19

Forward Foreign Currency Exchange Contracts

| | | | | | | | | | | | | | | | | | |

Currency

Purchased | | | Currency

Sold | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| Asset Derivatives | | | | | | | | | | | | |

| INR | | | 26,780,000 | | | USD | | 372,617 | | JPMorgan Chase Bank N.A. | | | 10/21/2019 | | | | $392 | |

| TRY | | | 20,369,000 | | | USD | | 3,417,250 | | Merrill Lynch International | | | 10/11/2019 | | | | 26,799 | |

| USD | | | 5,193,400 | | | BRL | | 20,233,000 | | JPMorgan Chase Bank N.A. | | | 10/02/2019 | | | | 316,582 | |

| USD | | | 20,537,928 | | | EUR | | 18,197,911 | | Deutsche Bank AG | | | 10/11/2019 | | | | 478,809 | |

| USD | | | 414,998 | | | EUR | | 366,000 | | State Street Bank Corp. | | | 10/11/2019 | | | | 11,565 | |

| USD | | | 2,991,278 | | | EUR | | 2,650,000 | | UBS AG | | | 10/11/2019 | | | | 70,246 | |

| USD | | | 3,602,079 | | | KRW | | 4,338,344,000 | | JPMorgan Chase Bank N.A. | | | 9/06/2019 | | | | 20,212 | |

| USD | | | 1,824,903 | | | MXN | | 36,801,000 | | Morgan Stanley Capital Services, Inc. | | | 10/11/2019 | | | | 391 | |

| USD | | | 1,783,097 | | | PHP | | 91,669,000 | | JPMorgan Chase Bank N.A. | | | 9/09/2019 | | | | 22,722 | |

| USD | | | 1,033,508 | | | PLN | | 4,073,000 | | BNP Paribas S.A. | | | 10/11/2019 | | | | 9,705 | |

| USD | | | 1,049,194 | | | PLN | | 4,136,000 | | Deutsche Bank AG | | | 10/11/2019 | | | | 9,554 | |

| USD | | | 1,747,365 | | | RUB | | 116,087,099 | | JPMorgan Chase Bank N.A. | | | 10/28/2019 | | | | 20,206 | |

| USD | | | 4,885,408 | | | ZAR | | 70,001,721 | | JPMorgan Chase Bank N.A. | | | 10/11/2019 | | | | 292,990 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | $1,280,173 | |