As filed with the Securities and Exchange Commission on May 5, 2017

File No. _-_____, ___-_____

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

( ) Pre-Effective Amendment No.

( ) Post-Effective Amendment No.

GREAT-WEST FUNDS, INC.

(Exact Name of Registrant as Specified in Charter)

8515 E. Orchard Road

Greenwood Village, Colorado 80111

Registrant’s Telephone Number, including Area Code (866) 831-7129

David L. Musto

President and Chief Executive Officer

Great-West Funds, Inc.

8515 E. Orchard Road

Greenwood Village, Colorado 80111

(Address of Principal Executive Offices)

Copy to:

Renee M. Hardt, Esq.

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

TITLE OF SECURITIES BEING REGISTERED: Shares of Common Stock (par value $0.10 per share) of the Registrant.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Dear Shareholder,

We wish to provide you with some important information concerning your investment in one or more of the “Target Funds” listed in the table below. The Board of Directors of Great-West Funds, Inc. has approved reorganizations of each Target Fund, a series of Great-West Funds, Inc. (“Great-West Funds”), into the corresponding “Acquiring Fund” listed in the table below (collectively referred to as “this reorganization”).

| | |

| Target Fund (collectively the “Target Funds”) | | Acquiring Fund (collectively the “Acquiring Funds”) |

Great-West Aggressive Profile I Fund | | Great-West Aggressive Profile II Fund |

Great-West Conservative Profile I Fund | | Great-West Conservative Profile II Fund |

Great-West Moderate Profile I Fund | | Great-West Moderate Profile II Fund |

Great-West Moderately Aggressive Profile I Fund | | Great-West Moderately Aggressive Profile II Fund |

Great-West Moderately Conservative Profile I Fund | | Great-West Moderately Conservative Profile II Fund |

As a result, effective on or about July 14, 2017, shareholders of a Target Fund will become shareholders of the corresponding Acquiring Fund.

The Target Funds and the Acquiring Funds share a common investment adviser, Great-West Capital Management, LLC. Each Target Fund and its corresponding Acquiring Fund have identical investment objectives, principal investment strategies, and principal investment risks.

Each Acquiring Fund has a lower total expense ratio than the corresponding Target Fund. Generally, each class of each Target Fund and its corresponding Acquiring Fund has identical 12b-1 fees, shareholder services fees, and acquired fund fees and expenses. Management fees are calculated at the annual rate of 0.25% for the Target Funds and at the annual rate of 0.10% for the Acquiring Funds. Once this reorganization is effective, shareholders of the Target Funds will pay a lower management fee and thus, lower total expenses.

This reorganization is intended to be a tax-free transaction for federal income tax purposes, and the closing of this reorganization will be conditioned upon, among other things, receiving an opinion of counsel to the effect that this reorganization will qualify as a tax-free reorganization for federal income tax purposes. As a result, it is anticipated that shareholders will not recognize any gain or loss as a direct result of this reorganization.

Detailed information about the Agreement and Plan of Reorganization, including reasons why it was approved, are contained in the enclosed materials.

NO ACTION ON YOUR PART IS REQUIRED TO EFFECT THIS REORGANIZATION. You will automatically receive shares of the Acquiring Funds in exchange for your shares of the Target Funds on or about July 14, 2017. If you have any questions, please contact us at (866) 831-7129.

If you have any questions after considering the enclosed materials, please call.

|

Sincerely, |

|

|

|

David Musto |

President & Chief Executive Officer |

Great-West Funds, Inc. |

Important Information for

Great-West Conservative Profile I, Great-West Moderately Conservative Profile I, Great-West Moderate

Profile I, Great-West Moderately Aggressive Profile I, and Great-West Aggressive Profile I Fund

Shareholders

The enclosed Information Statement/Prospectus describes the contemplated reorganization of each “Target Fund” listed in the table below into the corresponding “Acquiring Fund” listed in the table below. For the sake of simplicity, the reorganizations are collectively referred to as “this reorganization.”

| | |

| Target Fund (collectively the “Target Funds”) | | Acquiring Fund (collectively the “Acquiring Funds”) |

Great-West Aggressive Profile I Fund | | Great-West Aggressive Profile II Fund |

Great-West Conservative Profile I Fund | | Great-West Conservative Profile II Fund |

Great-West Moderate Profile I Fund | | Great-West Moderate Profile II Fund |

Great-West Moderately Aggressive Profile I Fund | | Great-West Moderately Aggressive Profile II Fund |

Great-West Moderately Conservative Profile I Fund | | Great-West Moderately Conservative Profile II Fund |

Although we recommend that you read the complete Information Statement/Prospectus, for your convenience, we have provided the following brief overview of this reorganization. Please refer to the more complete information about this reorganization contained elsewhere in the Information Statement/Prospectus.

NO ACTION ON YOUR PART IS REQUIRED TO EFFECT THIS REORGANIZATION.

| Q. | Why am I receiving this Information Statement/Prospectus? |

| A. | On February 23, 2017, the Board of Directors of Great-West Funds (the “Board”) approved the reorganization of each Target Fund into the corresponding Acquiring Fund (listed in the table above). As of the close of business on the effective date of this reorganization, investments in the Investor Class shares1 of each Target Fund will automatically become investments in the Investor Class shares of the corresponding Acquiring Fund with an equal total net asset value. You will not incur any fees or charges or any tax liability as a direct result of this reorganization. It is currently anticipated that this reorganization will close on or about July 14, 2017. |

| Q. | Why has this reorganization been proposed for the Target Funds? |

| A. | Based on the recommendation by Great-West Capital Management, LLC (“GWCM”), each Fund’s investment adviser, as part of an overall product rationalization strategy, the Board has concluded that the reorganization of each Target Fund into the corresponding Acquiring Fund is in the best interest of each Target Fund and its shareholders, and that each Target Fund’s existing shareholders will not be diluted as a result of the reorganization. In reaching this conclusion, the Board considered a number of factors, which are summarized below and are discussed in greater detail in the enclosed materials. |

| | The Board believes that this reorganization will benefit each Target Fund and its shareholders by, among other things, allowing Target Fund shareholders to remain invested in a fund with identical investment objectives, principal investment strategies, and principal investment risks to those of the Target Funds, while benefitting from lower management fees. |

| 1 | Effective May 1, 2017, “Initial Class shares” have been renamed to “Investor Class shares.” |

| Q. | How do the fees and expenses compare? |

| A. | Each Acquiring Fund has a lower total expense ratio than its corresponding Target Fund. Management fees are calculated at the annual rate of 0.25% for the Target Funds and at the annual rate of 0.10% for the Acquiring Funds. Each share class of each Target Fund and its corresponding Acquiring Fund has identical 12b-1 fees and shareholder services fees. For details on fees and expenses, please see the section entitled “Fees and Expenses” of the Information Statement/Prospectus. |

| Q. | Will Target Fund shareholders receive new shares in exchange for their current shares? |

| A. | Yes. Once this reorganization is completed, each Target Fund shareholder will receive shares of the corresponding Acquiring Fund in an amount equal in total value to the total value of the Target Fund shares surrendered by such shareholder, in each case as of the close of trading on the closing date of this reorganization. |

| Q. | Will I have to pay federal income taxes as a result of this reorganization? |

| A. | No. This reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. It is expected that investors in the Target Funds will recognize no gain or loss for federal income tax purposes as a direct result of this reorganization. The section entitled “The Proposed Reorganization—Material Federal Income Tax Consequences” of the Information Statement/Prospectus provides additional information regarding the federal income tax consequences of this reorganization. |

| Q. | Who will bear the costs of this reorganization? |

| A. | GWCM will bear all expenses of this reorganization even if this reorganization is not completed, including legal costs, audit fees, and printing and mailing expenses. GWCM estimates the costs of this reorganization to be $63,250. |

| Q. | What is the timetable for this reorganization? |

| A. | This reorganization is expected to occur at the close of business on July 14, 2017. |

| Q. | Whom do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding this reorganization, please call (866) 831-7129. |

Information Statement/Prospectus

Dated May [__], 2017

Relating to the Acquisition of the Assets and Liabilities of

GREAT-WEST CONSERVATIVE PROFILE I, MODERATELY CONSERVATIVE PROFILE I,

MODERATE PROFILE I, MODERATELY AGGRESSIVE PROFILE I, AND AGGRESSIVE PROFILE I

FUNDS

by GREAT-WEST CONSERVATIVE PROFILE II, MODERATELY CONSERVATIVE PROFILE II,

MODERATE PROFILE II, MODERATELY AGGRESSIVE PROFILE II, AND AGGRESSIVE PROFILE

II FUNDS, respectively

This Information Statement/Prospectus is being furnished to shareholders of the Great-West Conservative Profile I, Great-West Moderately Conservative Profile I, Great-West Moderate Profile I, Great-West Moderately Aggressive Profile I, and Great-West Aggressive Profile I Funds (each a “Target Fund” and, collectively, the “Target Funds,”), series of Great-West Funds, Inc. (“Great-West Funds”), a Maryland corporation and an open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act). This Information Statement/Prospectus is provided in connection with this reorganization of each Target Fund into the corresponding Great-West Conservative Profile II, Great-West Moderately Conservative Profile II, Great-West Moderate Profile II, Great-West Moderately Aggressive Profile II, and Great-West Aggressive Profile II Funds as provided in the chart below (each an “Acquiring Fund” and, collectively, the “Acquiring Funds”), each a series of Great-West Funds. The Target Funds and the Acquiring Funds are referred to herein collectively as the “Funds” and individually as a “Fund.” Upon completion of this reorganization, holders of Investor Class shares of each Target Fund will receive Investor Class shares of the corresponding Acquiring Fund, with the same total value as the total value of the Target Fund shares surrendered by such shareholders, as of the close of trading on the closing date of this reorganization. The Board has determined that this reorganization is in the best interests of the Target Funds. The address, principal executive office and telephone number of Great-West Funds is 8515 East Orchard Road, Greenwood Village, Colorado 80111 and (866) 831-7129.

| | |

| Target Fund | | Acquiring Fund |

Great-West Aggressive Profile I Fund | | Great-West Aggressive Profile II Fund |

Great-West Conservative Profile I Fund | | Great-West Conservative Profile II Fund |

Great-West Moderate Profile I Fund | | Great-West Moderate Profile II Fund |

Great-West Moderately Aggressive Profile I Fund | | Great-West Moderately Aggressive Profile II Fund |

Great-West Moderately Conservative Profile I Fund | | Great-West Moderately Conservative Profile II Fund |

The Securities and Exchange Commission has not approved or disapproved these securities or determined

whether the information in this Information Statement/Prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

This Information Statement/Prospectus concisely sets forth the information shareholders of the Target Funds should know about this reorganization (in effect, investing in Investor Class shares of the Acquiring Funds) and constitutes an offering of Investor Class shares of common stock, par value $0.10 per share, of the Acquiring Funds. Please read it carefully and retain it for future reference.

SHAREHOLDER APPROVAL IS NOT REQUIRED TO EFFECT THIS REORGANIZATION. YOU ARE NOT ASKED TO RETURN A PROXY OR TO TAKE ANY OTHER ACTION AT THIS TIME.

The following document has been filed with the Securities and Exchange Commission (“SEC”) and is incorporated into this Information Statement/Prospectus by reference and also accompanies this Information Statement/Prospectus:

| | (i) | the Acquiring Funds’ prospectus, dated May 1, 2017, as supplemented through the date of this Information Statement/Prospectus. |

The following documents contain additional information about the Funds, have been filed with the SEC and are incorporated into this Information Statement/Prospectus by reference:

| | (i) | the Funds’ prospectus, dated May 1, 2017, as supplemented through the date of this Information Statement/Prospectus, only insofar as it relates to the Target Funds; |

| | (ii) | the audited financial statements contained in the Funds’ annual report for the fiscal year ended December 31, 2016; |

| | (iii) | the statement of additional information relating to the proposed Reorganization, dated May [ ], 2017 (the “Reorganization SAI”); and |

| | (iv) | the Funds’ statement of additional information dated May 1, 2017, as supplemented through the date of this Information Statement/Prospectus, only insofar as it relates to the Funds. |

No other parts of the documents referenced above are incorporated by reference herein.

Copies of the foregoing may be obtained without charge by calling (866) 831-7129 or writing the Funds at 8515 East Orchard Road, Greenwood Village, Colorado 80111. If you wish to request this reorganization SAI, please ask for the “Reorganization SAI.”

Great-West Funds is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and in accordance therewith files reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by Great-West Funds (including the registration statement relating to the Acquiring Funds on Form N-14 of which this Information Statement/Prospectus is a part) may be inspected without charge and copied (for a duplication fee at prescribed rates) at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may call the SEC at (202) 551-8090 for information about the operation of the Public Reference Room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

TABLE OF CONTENTS

SUMMARY

The following is a summary of, and is qualified by reference to, the more complete information contained in this Information Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the Agreement and Plan of Reorganization. Once this reorganization is completed, shareholders of each Target Fund will become shareholders of the corresponding Acquiring Fund, and will cease to be shareholders of any Target Fund.

Shareholders should read the entire Information Statement/Prospectus carefully together with the Acquiring Funds’ Prospectus that accompanies this Information Statement/Prospectus, which is incorporated herein by reference. This Information Statement/Prospectus constitutes an offering of Investor Class shares of the Acquiring Funds only.

Background

The Target Funds were launched on September 11, 1997. Three of the five Acquiring Funds – (i) Great-West Aggressive Profile II Fund, (ii) Great-West Moderately Aggressive Profile II Fund, and (iii) Great-West Moderate Profile II Fund – were launched on September 16, 1999. The other two Acquiring Funds – (i) Great-West Moderately Conservative Profile II Fund, and (ii) Great-West Conservative Profile II Fund – were launched on September 27, 1999, and September 30, 1999, respectively. The Target Funds and the Acquiring Funds were created for and originally offered in two different markets, and invested in different underlying funds. The Target Funds and Acquiring Funds have the same investment objectives, principal investment strategies, principal investment risks, and currently have the same respective underlying funds.

Each Acquiring Fund has a lower total operating expense ratio than its corresponding Target Fund. Management fees are calculated at the annual rate of 0.25% for the Target Funds and at the annual rate of 0.10% for the Acquiring Funds. Each share class of each Target Fund and its corresponding Acquiring Fund has identical shareholder services fees. The Acquired Fund Fees and Expenses (“AFFE”) are identical for each Target Fund and its corresponding Acquiring Fund, with the exception of the Great-West Aggressive Profile I and II Funds, the Great-West Moderately Aggressive Profile I and II Funds, and the Great-West Conservative Profile I and II Funds, which differ by 0.01% due to the timing of cash flows. However, since the Target Funds and Acquiring Funds invest in the same underlying funds in the same proportions, their AFFEs are typically the same. For more details of fees and expenses, please see “Fees and Expenses” below.

The Reorganization

This Information Statement/Prospectus is being furnished to shareholders of the Target Funds in connection with the combination of the Target Funds with and into the corresponding Acquiring Funds pursuant to the terms and conditions of the Agreement and Plan of Reorganization entered into by Great-West Funds, on behalf of the Funds, and GWCM (the “Agreement”). The Agreement provides for (i) the transfer of all the assets of each Target Fund to the corresponding Acquiring Fund in exchange solely for Investor Class shares of common stock, par value $0.10 per share, of the corresponding Acquiring Fund and the assumption by the corresponding Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution by each Target Fund of Investor Class shares of the corresponding Acquiring Fund to the holders of Investor Class shares of the Target Fund in complete liquidation and termination of each Target Fund. The Board unanimously approved this reorganization and the Agreement at a meeting held on February 23, 2017. Once this reorganization is completed, each Target Fund shareholder will become a shareholder of the corresponding Acquiring Fund.

It is anticipated that the closing of this reorganization (the “Closing”) will occur at the close of business on or about July 14, 2017 (the “Closing Date”), but it may be at a different time as described herein. For a more detailed discussion about this reorganization, please see “The Proposed Reorganization” below.

Reasons for the Proposed Reorganization

The Board believes that the proposed reorganization would be in the best interests of each Target Fund and the corresponding Acquiring Fund. For a more detailed discussion of the Board’s considerations regarding the approval of this reorganization, see “The Board’s Approval of the Reorganization” below.

1

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

The Funds have identical procedures for purchasing, exchanging and redeeming shares for each share class. The Funds offer three classes of shares: (1) Institutional Class, (2) Investor Class, and (3) Class L. The corresponding classes of each Fund have the same investment eligibility criteria. Each Fund normally declares and pays dividends from net investment income, if any, semi-annually. For each Fund, any capital gains are normally distributed at least once a year. See “Comparison of the Funds— Purchase and Sale of Fund Shares” below for a more detailed discussion.

Material Federal Income Tax Consequences of the Reorganization

It is expected that none of the Funds or their respective investors will recognize gain or loss for federal income tax purposes as a direct result of this reorganization. For a more detailed discussion of the federal income tax consequences of this reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

COMPARISON OF THE FUNDS

Investment Objectives

Each Target Fund and its respective Acquiring Fund have identical investment objectives. The investment objectives of the Great-West Conservative Profile I & II Funds are to seek capital preservation primarily through investments in other mutual funds managed by GWCM or its affiliates, and in a fixed interest contract issued and guaranteed by GWL&A (the “Underlying Funds”) that emphasize fixed income investments; the investment objectives of the Great-West Moderately Conservative Profile I & II Funds are to seek income and capital appreciation primarily through investments in Underlying Funds that emphasize fixed income investments and, to a lesser degree, in Underlying Funds that emphasize equity investments; the investment objectives of the Great-West Moderate Profile I & II Funds are to seek long-term capital appreciation primarily through investments in Underlying Funds with a relatively equal emphasis on equity and fixed income investments; the investment objectives of the Great-West Moderately Aggressive Profile I & II Funds are to seek long-term capital appreciation primarily through investments in Underlying Funds that emphasize equity investments and, to a lesser degree, in Underlying Funds that emphasize fixed income investments; and the investment objectives of the Great-West Aggressive Profile I & II Funds are to seek long-term capital appreciation primarily through investments in Underlying Funds that emphasize equity investments.

Investment Strategies

Each Target Fund and the corresponding Acquiring Fund have identical principal investment strategies. The Funds seek to achieve their objective by investing in a mix of Underlying Funds.

The following table describes each Fund’s emphasis on income and growth of capital:

| | | | |

| | | |

Target and Acquiring Funds | | Income | | Growth of Capital |

| | | |

Conservative | | Primary | | Secondary |

| | | |

Moderately Conservative | | Primary | | Secondary |

| | | |

Moderate | | Primary | | Primary |

| | | |

Moderately Aggressive | | Secondary | | Primary |

| | | |

Aggressive | | Secondary | | Primary |

2

GWCM uses asset allocation strategies to allocate assets among different broad asset classes and the Underlying Funds. The asset allocation strategies are the same for each Target Fund and its corresponding Acquiring Fund.

The following table describes the asset allocation ranges for each Target Fund and Acquiring Fund:

| | | | | | | | | | | | |

Asset Class | | Conservative | | Moderately Conservative | | Moderate | | Moderately Aggressive | | Aggressive |

| | | | | | | |

EQUITY | | International | | 0-15% | | 0-30% | | 0-30% | | 5-35% | | 10-40% |

| | Small Cap | | 0-15% | | 0-15% | | 0-25% | | 0-25% | | 5-35% |

| | Mid Cap | | 0-15% | | 0-25% | | 0-30% | | 5-35% | | 15-45% |

| | Large Cap | | 5-25% | | 10-40% | | 15-45% | | 20-50% | | 30-50% |

| | Real Estate | | 0-10% | | 0-10% | | 0-10% | | 0-10% | | 0-10% |

| | | | | | | |

FIXED INCOME | | Bond | | 30-50% | | 20-40% | | 10-30% | | 5-25% | | 0-10% |

| | Short-Term Bond | | 20-40% | | 10-30% | | 5-25% | | 0-15% | | 0-10% |

Each Underlying Fund has its own investment objectives and strategies and may hold a wide range of securities and other instruments in its portfolio, including, without limitation, U.S. and foreign equity securities (including those from emerging markets), real estate instruments, U.S. and foreign fixed income securities (including those rated below investment grade), derivatives, and short-term investments. The Funds may also invest in a fixed interest contract issued and guaranteed by Great-West Life & Annuity Insurance Company (the “GWL&A Contract”).

The Funds will rebalance their holdings of the Underlying Funds on a periodic basis to maintain the appropriate asset allocations. GWCM reviews asset class allocations, Underlying Fund allocations, and the Underlying Funds themselves on a quarterly basis, or more frequently as deemed necessary. GWCM may add or delete asset classes, add or delete Underlying Funds, or change the asset allocations at any time and without shareholder notice or approval.

In evaluating this reorganization, each Target Fund shareholder should consider the risks of investing in the corresponding Acquiring Fund, which are the same as those of the Target Fund. The principal investment risks of investing in the Acquiring Funds are described in the section below entitled “Principal Investment Risks.”

Temporary Investment Strategies

Each Acquiring Fund, like the corresponding Target Fund, may hold cash or cash equivalents and may invest up to 100% of its assets in money market instruments, as deemed appropriate by GWCM, for temporary defensive purposes to respond to adverse market, economic or political conditions. Should the Acquiring Fund take this action, it may be inconsistent with the Acquiring Fund’s principal investment strategies and the Acquiring Fund may not achieve its investment objective.

Money market instruments include a variety of short-term fixed income securities, usually with a maturity of less than 13 months. Some common types of money market instruments include Treasury bills and notes, which are securities issued by the U.S. Government, commercial paper, which is a promissory note issued by a company, bankers’ acceptances, which are credit instruments guaranteed by a bank, and negotiable certificates of deposit, which are issued by banks in large denominations.

U.S. Government securities are obligations of and, in certain cases, guaranteed by, the U.S. Government, its agencies or instrumentalities. However, the U.S. Government does not guarantee the net asset value of Acquiring Funds shares. Also, with respect to securities supported only by the credit of the issuing agency or instrumentality,

3

there is no guarantee that the U.S. Government will provide support to such agencies or instrumentalities and such securities may involve risk of loss of principal and interest.

Fees and Expenses

The tables below provide information about the fees and expenses attributable to Investor Class shares of the Funds, and the pro forma fees and expenses of the combined fund. Shareholder fees reflect the fees currently in effect for the Funds as of its fiscal year ended December 31, 2016. The pro forma fees and expenses are based on the amounts shown in the table for each Fund, assuming this reorganization occurred as of December 31, 2016.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | |

| Investor Class | | Great-West

Conservative

Profile I Fund 12/31/2016 | | Great-West

Conservative

Profile II Fund 12/31/2016 | | Combined Fund Pro Forma 12/31/2016 |

Management Fees | | 0.25% | | 0.10% | | 0.10% |

Distribution and Service (12b-1) Fees | | 0.00% | | 0.00% | | 0.00% |

Total Other Expenses | | 0.35% | | 0.35% | | 0.35% |

Shareholder Services Fee | | 0.35% | | 0.35% | | 0.35% |

Acquired Fund Fees and Expenses | | 0.46% | | 0.46% | | 0.46% |

Total Annual Fund Operating Expenses1 | | 1.06% | | 0.91% | | 0.91% |

Expense Reimbursements2 | | 0.08% | | 0.08% | | 0.08% |

| Total Annual Fund Operating Expenses After Reimbursements | | 0.98% | | 0.83% | | 0.83% |

| | | | | | |

| Investor Class | | Great-West

Moderately

Conservative

Profile I Fund 12/31/2016 | | Great-West

Moderately

Conservative

Profile II Fund 12/31/2016 | | Combined Fund Pro Forma 12/31/2016 |

Management Fees | | 0.25% | | 0.10% | | 0.10% |

Distribution and Service (12b-1) Fees | | 0.00% | | 0.00% | | 0.00% |

Total Other Expenses | | 0.35% | | 0.35% | | 0.35% |

Shareholder Services Fee | | 0.35% | | �� 0.35% | | 0.35% |

Acquired Fund Fees and Expenses | | 0.50% | | 0.52% | | 0.52% |

Total Annual Fund Operating Expenses1 | | 1.10% | | 0.97% | | 0.97% |

Expense Reimbursements2 | | 0.08% | | 0.08% | | 0.08% |

| Total Annual Fund Operating Expenses After Reimbursements | | 1.02% | | 0.89% | | 0.89% |

| | | | | | |

| Investor Class | | Great-West Moderate Profile I Fund 12/31/2016 | | Great-West Moderate Profile II Fund 12/31/2016 | | Combined Fund Pro Forma 12/31/2016 |

Management Fees | | 0.25% | | 0.10% | | 0.10% |

Distribution and Service (12b-1) Fees | | 0.00% | | 0.00% | | 0.00% |

Total Other Expenses | | 0.35% | | 0.35% | | 0.35% |

Shareholder Services Fee | | 0.35% | | 0.35% | | 0.35% |

4

| | | | | | |

Acquired Fund Fees and Expenses | | 0.56% | | 0.59% | | 0.59% |

Total Annual Fund Operating Expenses1 | | 1.16% | | 1.01% | | 1.01% |

Expense Reimbursements2 | | 0.06% | | 0.06% | | 0.06% |

Total Annual Fund Operating Expenses After Reimbursements | | 1.10% | | 0.98% | | 0.98% |

| | | | | | |

| Investor Class | | Great-West

Moderately

Aggressive

Profile I Fund 12/31/2016 | | Great-West

Moderately

Aggressive

Profile II Fund 12/31/2016 | | Combined Fund Pro Forma 12/31/2016 |

Management Fees | | 0.25% | | 0.10% | | 0.10% |

Distribution and Service (12b-1) Fees | | 0.00% | | 0.00% | | 0.00% |

Total Other Expenses | | 0.35% | | 0.35% | | 0.35% |

Shareholder Services Fee | | 0.35% | | 0.35% | | 0.35% |

Acquired Fund Fees and Expenses | | 0.62% | | 0.64% | | 0.64% |

Total Annual Fund Operating Expenses1 | | 1.22% | | 1.06% | | 1.06% |

Expense Reimbursements2 | | 0.03% | | 0.03% | | 0.03% |

Total Annual Fund Operating Expenses After Reimbursements | | 1.19% | | 1.06% | | 1.06% |

| | | | | | |

| Investor Class | | Great-West

Aggressive

Profile I Fund 12/31/2016 | | Great-West

Aggressive

Profile II Fund 12/31/2016 | | Combined Fund Pro Forma 12/31/2016 |

Management Fees | | 0.25% | | 0.10% | | 0.10% |

Distribution and Service (12b-1) Fees | | 0.00% | | 0.00% | | 0.00% |

Total Other Expenses | | 0.35% | | 0.35% | | 0.35% |

Shareholder Services Fee | | 0.35% | | 0.35% | | 0.35% |

Acquired Fund Fees and Expenses | | 0.72% | | 0.76% | | 0.76% |

Total Annual Fund Operating Expenses1 | | 1.32% | | 1.21% | | 1.21% |

| 1 | The Total Annual Fund Operating Expenses may not correlate to the ratio of expenses to average net assets provided in the Fund’s Financial Highlights, which reflects the operating expenses of the Fund and does not include Acquired Fund (Underlying Fund) Fees and Expenses. |

| 2 | GWCM has contractually agreed to reduce its management fee by 0.35% of the amount such Fund is allocated to a GWL&A Contract. The agreement’s current term ends on April 30, 2018. The agreement automatically renews for one-year terms unless it is terminated by Great-West Funds or GWCM upon written notice within 90 days of the end of the current term or upon termination of the advisory agreement. |

Example

The Examples below are intended to help you compare the cost of investing in each Fund and the pro forma cost of investing in the combined fund. The Examples do not reflect the fees and expenses of any insurance company separate accounts for certain variable annuity contracts and variable life insurance policies (“variable contracts”), individual retirement account, qualified retirement plans, or college savings programs (collectively, “Permitted Accounts”). If reflected, the expenses in the Examples would be higher.

The Examples assume that you invest $10,000 in a Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Examples also assume that the expense reimbursement for the Funds is in place for all periods, your investment has a 5% return each year, that all dividends and capital gains are reinvested,

5

and that each Fund’s operating expenses are the amount shown in the fee table and remain the same for the years shown. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | |

| Investor Class | | Great-West Conservative Profile I Fund | | Great-West Conservative Profile II Fund | | Combined Fund Pro Forma |

1 Year | | $101 | | $85 | | $85 |

3 Years | | $332 | | $282 | | $282 |

5 Years | | $582 | | $496 | | $496 |

10 Years | | $1298 | | $1112 | | $1112 |

| | | | | | |

| Investor Class | | Great-West Moderately Conservative Profile I Fund | | Great-West Moderately Conservative Profile II Fund | | Combined Fund Pro Forma |

1 Year | | $106 | | $91 | | $91 |

3 Years | | $348 | | $301 | | $301 |

5 Years | | $609 | | $529 | | $529 |

10 Years | | $1356 | | $1182 | | $1182 |

| | | | | | |

| Investor Class | | Great-West Moderate Profile I Fund | | Great-West Moderate Profile II Fund | | Combined Fund Pro Forma |

1 Year | | $115 | | $100 | | $100 |

3 Years | | $372 | | $325 | | $325 |

5 Years | | $649 | | $568 | | $568 |

10 Years | | $1438 | | $1266 | | $1266 |

| | | | | | |

| Investor Class | | Great-West Moderately Aggressive Profile I Fund | | Great-West Moderately Aggressive Profile II Fund | | Combined Fund Pro Forma |

1 Year | | $124 | | $108 | | $108 |

3 Years | | $394 | | $344 | | $344 |

5 Years | | $683 | | $598 | | $598 |

10 Years | | $1509 | | $1326 | | $1326 |

| | | | | | |

| Investor Class | | Great-West Aggressive Profile I Fund | | Great-West Aggressive Profile II Fund | | Combined Fund Pro Forma |

1 Year | | $138 | | $123 | | $123 |

3 Years | | $431 | | $384 | | $384 |

5 Years | | $745 | | $665 | | $665 |

10 Years | | $1635 | | $1466 | | $1466 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Funds’ performance. During the most recent fiscal year, the Target Funds’ and the Acquiring Funds’ turnover rates of the average value of their portfolios are as follows:

6

| | |

| Fund | | Turnover Rate |

Great-West Conservative Profile I Fund | | 15% |

Great-West Moderately Conservative Profile I Fund | | 28% |

Great-West Moderate Profile I Fund | | 15% |

Great-West Moderately Aggressive Profile I Fund | | 18% |

Great-West Aggressive Profile I Fund | | 18% |

Great-West Conservative Profile II Fund | | 21% |

Great-West Moderately Conservative Profile II Fund | | 25% |

Great-West Moderate Profile II Fund | | 26% |

Great-West Moderately Aggressive Profile II Fund | | 30% |

Great-West Aggressive Profile II Fund | | 30% |

Principal Investment Risks

Each Target Fund and its respective Acquiring Fund have identical principal investment risks identified below.

Fund-of-Funds Structure Risk

| | • | | Since the Fund invests directly in the Underlying Funds, all risks associated with the eligible Underlying Funds apply to the Fund. To the extent the Fund invests more of its assets in one Underlying Fund than another, the Fund will have greater exposure to the risks of that Underlying Fund. |

| | • | | Since the Fund invests in Underlying Funds, you will bear your proportionate share of expenses of the Fund and indirectly of the Underlying Funds, resulting in an additional layer of expenses. |

| | • | | The Fund is classified as non-diversified under the Investment Company Act of 1940, as amended (the “1940 Act”), which means a relatively high percentage of its assets may be invested in securities of a limited number of Underlying Funds. As a result, the Fund’s securities may be more susceptible to any single economic, political or regulatory event than that experienced by a similarly structured diversified fund. |

Single Issuer Risk - The GWL&A Contract in which the Fund invests has a stable principal value and pays a fixed rate of interest to the Fund. Both the principal and a minimum rate of interest are guaranteed by GWL&A. However, if GWL&A becomes unable to meet this guarantee, the Fund may lose money from unpaid principal or unpaid or reduced interest.

The following are risks associated with Underlying Fund investments that may indirectly result in a loss of your investment in a Fund. There can be no assurance that an Underlying Fund will achieve its investment objective.

Currency Exchange Rate Risk - Adverse fluctuations in exchange rates between the U.S. Dollar and other currencies may cause an Underlying Fund to lose money on investments denominated in foreign currencies. Currency risk is especially high in emerging markets.

Derivatives Risk - Underlying Funds may invest in derivative instruments such as futures, swaps, and structured securities. Using derivatives can disproportionately increase losses and reduce opportunities for gains when stock prices, currency rates or interest rates are changing. An Underlying Fund may not fully benefit from or may lose money on derivatives if changes in their value do not correspond accurately to changes in the value of the Underlying Fund’s holdings. The other parties to certain derivative contracts present the same types of credit risk as issuers of fixed income securities. Derivatives can also make a fund less liquid and harder to value, especially in declining markets.

Equity Securities Risk - The value of the stocks and other securities owned by the Underlying Funds will fluctuate depending on the performance of the companies that issued them, general market and economic conditions, and investor confidence.

7

Fixed Income Securities Risk - Investments in fixed income securities will be subject to interest rate risk (the chance that bond prices will decline because of rising interest rates), income risk (the chance that the Underlying Fund’s income will decline because of falling interest rates), credit risk (the chance that a bond issuer will fail to pay interest and principal in a timely manner, or that market perception of the issuer will cause the price of a bond to decline), and call/prepayment risk (the chance that bond issuers will redeem bonds prior to their maturity dates). Fixed income securities rated below investment grade (junk bonds) are highly speculative securities that are usually issued by smaller, less creditworthy, and/or highly leveraged (indebted) companies and their issuers are less likely to make payments of interest and repay principal.

Foreign Securities Risk - Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, currency valuation or economic developments. In addition, emerging markets may be more volatile and less liquid than the markets of more mature economies, and the securities of emerging markets issuers often are subject to rapid and large changes in price.

Geographic Concentration Risk - Geographic concentration risk is the risk that economic, political and social conditions in the countries or regions in which an Underlying Fund invests will have a significant impact on the performance of the Underlying Fund.

Investment Style Risk - Because the Fund invests in Underlying Funds with both growth and value characteristics, its share price may be negatively affected if either investing approach falls out of favor.

Liquidity Risk - Underlying Funds may invest in securities that cannot be sold, or cannot be sold quickly, at an acceptable price. When there is little or no active trading market for specific types of securities, it can become more difficult to sell the securities at or near their perceived value. In such a market, the value of such securities and the Fund’s share price may fall dramatically. Extraordinary and sudden changes in interest rates could disrupt the market for fixed-income securities and result in fluctuations in the Underlying Fund’s net asset value. Increased redemptions due to a rise in interest rates may require the Underlying Fund to liquidate its holdings at an unfavorable time and/or under adverse or disadvantageous conditions which may negatively affect the Underlying Fund. Investments in many, but not all, foreign securities tend to have greater exposure to liquidity risk than domestic securities.

Management Risk - A strategy used by the portfolio managers may fail to produce the intended results.

Market Risk - Markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market or economic developments in the U.S. and in other countries. Market risk may affect a single company, industry sector of the economy or the market as a whole.

Mortgage-Backed and Asset-Backed Securities Risk - Mortgage-backed and asset-backed securities represent interests in “pools” of mortgages and other assets, including consumer loans or receivables held in trust. Mortgage-backed and asset-backed securities are subject to interest rate risk and credit risk. These securities are also subject to the risk that borrowers will prepay the principal on their loans more quickly than expected (prepayment risk) or more slowly than expected (extension risk), which will affect the yield, average life and price of the securities. In addition, faster than expected prepayments may cause the Underlying Fund to invest the prepaid principal in lower yielding securities, and slower than expected prepayments may reduce the potential for the Underlying Fund to invest in higher yielding securities.

Real Estate Investment Trust (REIT) / Real Estate Risk - Investments in real estate related instruments may be affected by economic, legal, cultural, environmental or technological factors that affect property values, rents or occupancies of real estate.

Small, Medium and Large Size Company Securities Risk - The stocks of small and medium size companies often involve more risk and volatility than those of larger companies. Among other things, small and medium size companies are often dependent on a small number of products and have limited financial resources, and there is generally less publicly available information about them. Securities of small and medium size companies have lower trading volume and are less liquid than securities of large, more established companies. Companies with large

8

market capitalizations go in and out of favor based on market and economic conditions, and could underperform returns of smaller companies.

Sovereign Debt Securities Risk - Sovereign debt securities are subject to various risks in addition to those relating to debt securities and foreign securities generally, including, but not limited to, the risk that a governmental entity may be unwilling or unable to pay interest and repay principal on its sovereign debt, or otherwise meet its obligations when due because of cash flow problems, insufficient foreign reserves, the relative size of the debt service burden to the economy as a whole, the government’s policy towards principal international lenders such as the International Monetary Fund, or the political situations to which the government may be subject. If a sovereign debtor defaults (or threatens to default) on its sovereign debt obligations, the indebtedness may be restructured. Some sovereign debtors in the past have been able to restructure their debt payments without the approval of some or all debt holders or to declare moritoria on payments. In the event of a default on sovereign debt, the Underlying Fund may also have limited legal recourse against the defaulting government entity.

An investment in the Fund or Underlying Funds is not a deposit with a bank, is not insured, endorsed or guaranteed by the FDIC or any government agency, and is subject to the possible loss of your original investment.

Fundamental Investment Restrictions

The Funds have identical fundamental investment restrictions that cannot be changed without shareholder approval.

Performance Information

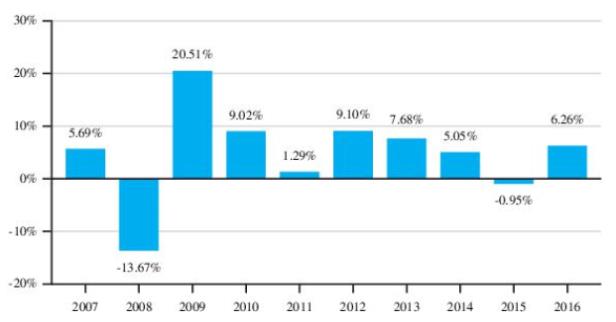

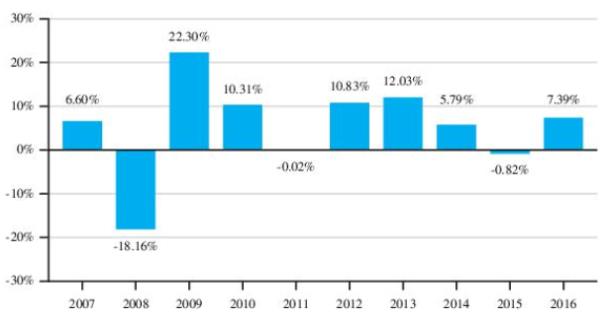

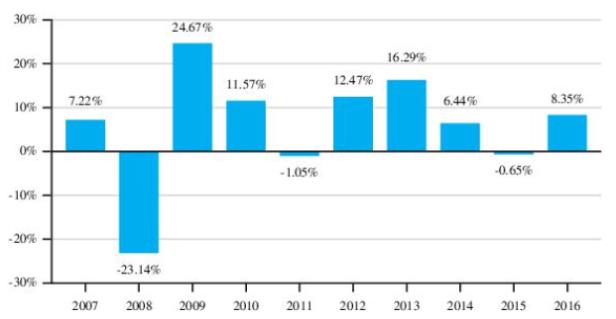

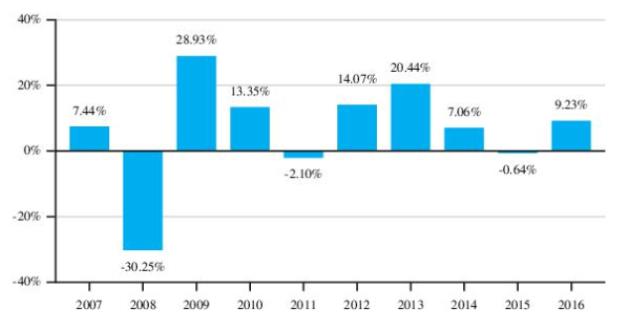

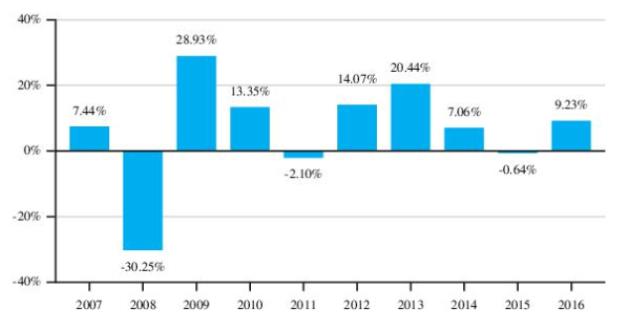

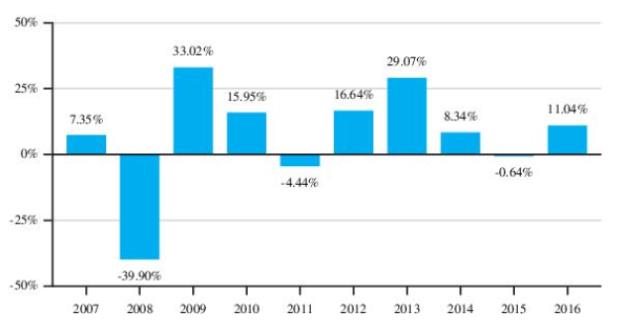

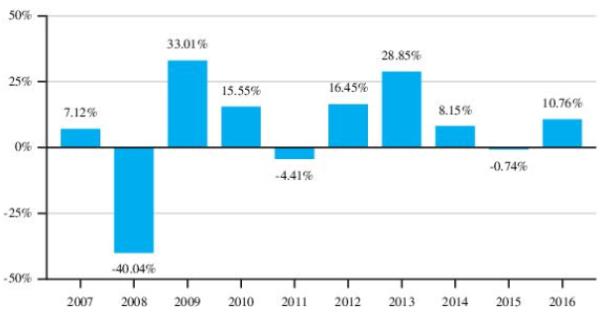

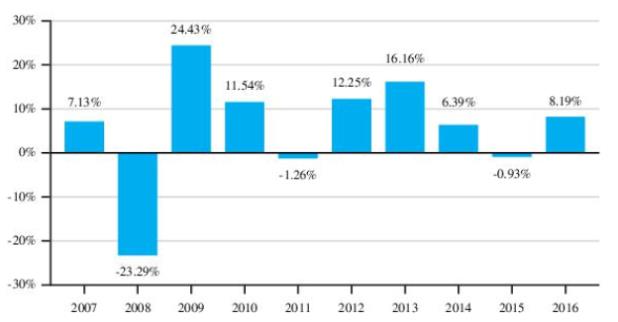

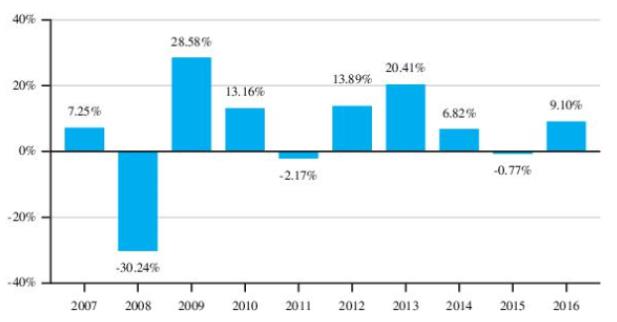

The bar charts and tables below provide an indication of the risk of investment in the Funds by showing changes in the performance of the Funds’ Investor Class shares for the last ten calendar years and comparing their average annual total return to the performance of a broad-based securities market index, a secondary index, and a composite index. The returns shown below for the Funds are historical and are not an indication of future performance. Total return figures assume reinvestment of dividends and capital gains distributions and include the effect of the Funds’ recurring expenses, but do not include fees and expenses of any Permitted Account. If those fees and expenses were reflected, the Funds’ performance shown would have been lower.

Updated performance information may be obtained at www.greatwestfunds.com (the web site does not form a part of this Prospectus).

9

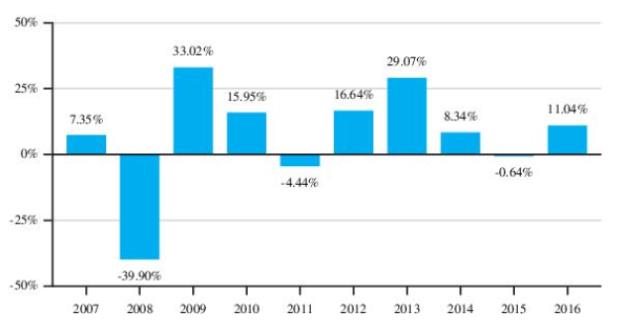

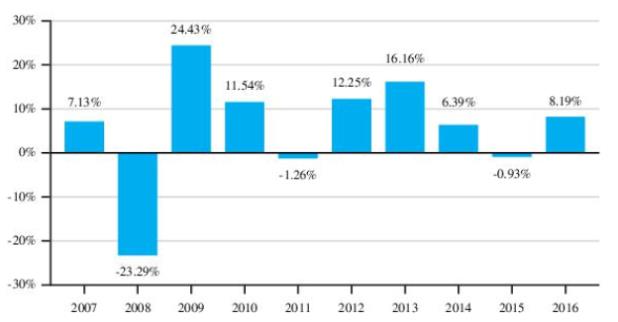

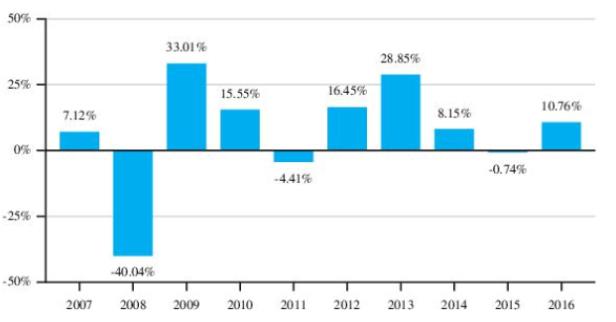

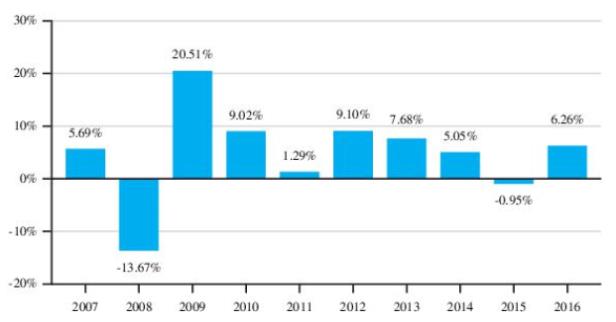

Acquiring Fund Calendar Year Total Returns

Great-West Conservative Profile II Fund

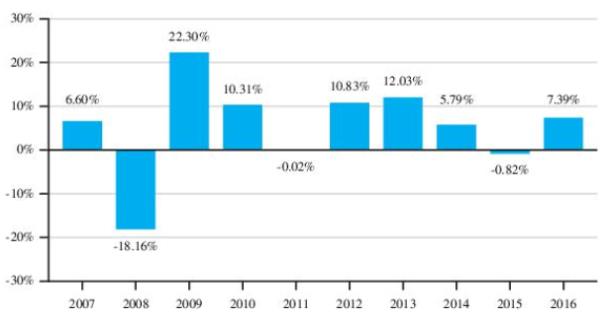

Great-West Moderately Conservative Profile II Fund

10

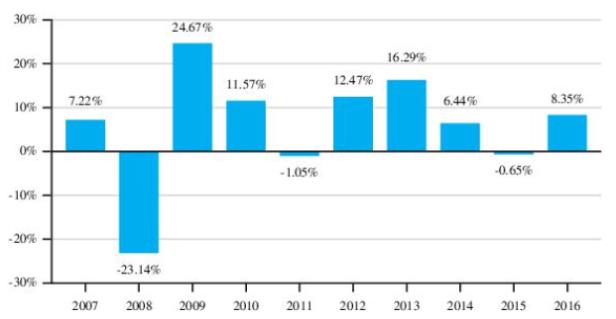

Great-West Moderate Profile II Fund

Great-West Moderately Aggressive Profile II Fund

11

Great-West Aggressive Profile II Fund

| | | | |

| | | |

Conservative Profile II | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 10.50% |

| | | |

Worst Quarter | | December 2008 | | -6.97% |

| | | |

Moderately Conservative Profile II | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 12.07% |

| | | |

Worst Quarter | | December 2008 | | -9.41% |

| | | |

Moderate Profile II | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 14.21% |

| | | |

Worst Quarter | | December 2008 | | -11.88 |

| | | |

Moderately Aggressive Profile II | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 17.16% |

| | | |

Worst Quarter | | December 2008 | | -16.71% |

| | | |

Aggressive Profile II | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 20.52% |

| | | |

Worst Quarter | | December 2008 | | -24.00% |

12

Acquiring Funds Average Annual Total Returns for the Periods Ended December 31, 2016

| | | | | | |

Conservative Profile II | | One Year | | Five Years | | Ten Years |

Investor Class | | 6.26% | | 5.37% | | 4.66% |

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | 2.65% | | 2.23% | | 4.34% |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| Composite Index* (reflects no deduction for fees, expenses or taxes) | | 4.68% | | 5.24% | | 4.46% |

| Moderately Conservative Profile II | | One Year | | Five Years | | Ten Years |

Investor Class | | 7.39% | | 6.95% | | 5.11% |

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | 2.65% | | 2.23% | | 4.34% |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| Composite Index* (reflects no deduction for fees, expenses or taxes) | | 5.87% | | 6.84% | | 4.72% |

| Moderate Profile II | | One Year | | Five Years | | Ten Years |

Investor Class | | 8.35% | | 8.43% | | 5.45% |

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | 2.65% | | 2.23% | | 4.34% |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| Composite Index* (reflects no deduction for fees, expenses or taxes) | | 7.03% | | 8.41% | | 4.97% |

| Moderately Aggressive Profile II | | One Year | | Five Years | | Ten Years |

Investor Class | | 9.23% | | 9.80% | | 5.25% |

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | 2.65% | | 2.23% | | 4.34% |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| Composite Index* (reflects no deduction for fees, expenses or taxes) | | 8.03% | | 9.79% | | 5.14% |

| Aggressive Profile II | | One Year | | Five Years | | Ten Years |

Investor Class | | 11.04% | | 12.47% | | 5.52% |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| Composite Index* (reflects no deduction for fees, expenses or taxes) | | 10.02% | | 12.58% | | 5.51% |

* The Composite Index is derived by applying each Fund’s target asset allocation among the applicable asset classes over time to the results of the following indices: the Wilshire 5000 Index (U.S. equities); the MSCI EAFE® Index (international equities); the Dow Jones U.S. Select REIT Index (real estate); the Barclays U.S. Aggregate Bond Index (bonds); and the Barclays 1-3 Yr Credit Bond Index (short-term bonds).

13

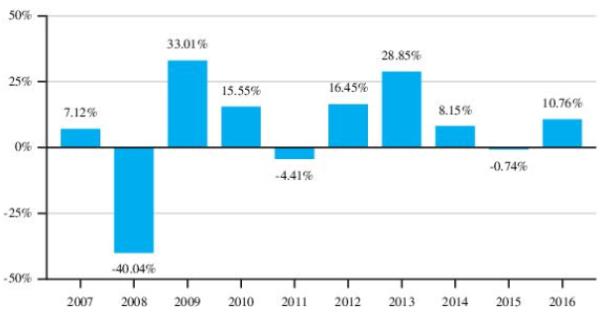

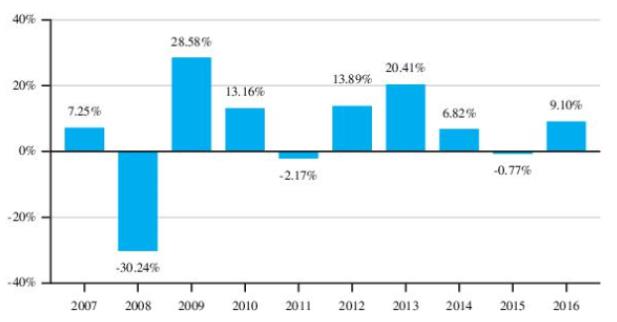

Target Funds Calendar Year Total Returns

Great-West Conservative Profile I Fund

Great-West Moderately Conservative Profile I Fund

14

Great-West Moderate Profile I Fund

Great-West Moderately Aggressive Profile I Fund

15

Great-West Aggressive Profile I Fund

| | | | |

| | | |

Conservative Profile I | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 10.44% |

| | | |

Worst Quarter | | December 2008 | | -7.00% |

| | | |

Moderately Conservative Profile I | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 12.15% |

| | | |

Worst Quarter | | December 2008 | | -9.19% |

| | | |

Moderate Profile I | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 14.12% |

| | | |

Worst Quarter | | December 2008 | | -11.92% |

| | | |

Moderately Aggressive Profile I | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 17.04% |

| | | |

Worst Quarter | | December 2008 | | -16.65% |

| | | |

Aggressive Profile I | | Quarter Ended | | Total Return |

| | | |

Best Quarter | | June 2009 | | 20.56% |

| | | |

Worst Quarter | | December 2008 | | -24.09% |

Target Funds Average Annual Total Returns for the Periods Ended December 31, 2016

| | | | | | |

| | | | |

| Conservative Profile I | | One Year | | Five Years | | Ten Years |

| | | | |

Investor Class | | 6.14% | | 5.25% | | 4.52% |

| | | | |

Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | 2.65% | | 2.23% | | 4.34% |

16

| | | | | | |

(reflects no deduction for fees, expenses or taxes) | | | | | | |

| | | | |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| | | | |

Composite Index* (reflects no deduction for fees, expenses or taxes) | | 4.68% | | 5.24% | | 4.46% |

| | | | |

| Moderately Conservative Profile I | | One Year | | Five Years | | Ten Years |

| | | | |

Investor Class | | 7.18% | | 6.76% | | 4.96% |

| | | | |

Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | 2.65% | | 2.23% | | 4.34% |

| | | | |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| | | | |

Composite Index* (reflects no deduction for fees, expenses or taxes) | | 5.87% | | 6.84% | | 4.72% |

| | | | |

| Moderate Profile I | | One Year | | Five Years | | Ten Years |

| | | | |

Investor Class | | 8.19% | | 8.26% | | 5.29% |

| | | | |

Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | 2.65% | | 2.23% | | 4.34% |

| | | | |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| | | | |

Composite Index* (reflects no deduction for fees, expenses or taxes) | | 7.03% | | 8.41% | | 4.97% |

| | | | |

| Moderately Aggressive Profile I | | One Year | | Five Years | | Ten Years |

| | | | |

Investor Class | | 9.10% | | 9.66% | | 5.38% |

| | | | |

Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | 2.65% | | 2.23% | | 4.34% |

| | | | |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| | | | |

Composite Index* (reflects no deduction for fees, expenses or taxes) | | 8.03% | | 9.79% | | 5.14% |

| | | | |

| Aggressive Profile I | | One Year | | Five Years | | Ten Years |

| | | | |

Investor Class | | 10.76% | | 12.27% | | 5.35% |

| | | | |

Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | | 2.65% | | 2.23% | | 4.34% |

| | | | |

| Wilshire 5000 Index (reflects no deduction for fees, expenses or taxes) | | 13.37% | | 14.71% | | 7.17% |

| | | | |

Composite Index* (reflects no deduction for fees, expenses or taxes) | | 10.02% | | 12.58% | | 5.51% |

* The Composite Index is derived by applying each Fund’s target asset allocation among the applicable asset classes over time to the results of the following indices: the Wilshire 5000 Index (U.S. equities); the MSCI EAFE® Index (international equities); the Dow Jones U.S. Select REIT Index (real estate); the Barclays U.S. Aggregate Bond Index (bonds); and the Barclays 1-3 Yr Credit Bond Index (short-term bonds).

Investment Adviser

GWCM, a wholly owned subsidiary of Great-West Life & Annuity Insurance Company (“GWL&A”), serves as investment adviser to each of the Funds. GWCM provides investment advisory, fund operations, and accounting services to Great-West Funds. GWCM is registered as an investment adviser under the Investment Advisers Act of 1940. GWCM’s address is 8515 East Orchard Road, Greenwood Village, Colorado 80111. As of December 31,

17

2016, GWCM provides investment management services for mutual funds and other investment portfolios representing assets of $28.3 billion. GWCM and its affiliates have been providing investment management services since 1969.

The Funds are managed by an Asset Allocation Committee of GWCM comprised of Catherine Tocher, Jonathan Kreider, Jack Brown and Andrew Corwin.

Catherine Tocher, CFA, Senior Vice President and Chief Investment Officer, is the Chairperson of the Asset Allocation Committee. She has managed the Funds since 2014. In addition to the Funds, Ms. Tocher manages the Great-West Bond Index Fund, Great-West Government Money Market Fund, Great-West Short Duration Bond Fund, Great-West U.S. Government Mortgage Securities Fund, Great-West Lifetime Funds, Great-West SecureFoundation Funds, collective investment trusts managed by GWCM, stable value funds managed by GWCM and GWL&A, certain fixed income separate accounts of GWL&A, and the residential and commercial mortgage-backed securities portfolio of GWL&A’s general account. Ms. Tocher joined GWL&A in 1987. Ms. Tocher received a Bachelor of Commerce in finance, with honors, from the University of Manitoba.

Jonathan Kreider, CFA, Portfolio Manager, has managed the Funds since 2014. In addition to the Funds, Mr. Kreider manages the Great-West Lifetime Funds, Great-West SecureFoundation Funds, and collective investment trusts managed by GWCM. Mr. Kreider was previously a Management Consulting Associate at JDL Consultants, LLC from 2010-2012, and a Senior Research Analyst at Lipper, Inc. from 2005-2010. Mr. Kreider received a B.S. in finance and an M.B.A. from the University of Colorado.

Jack Brown, CFA, Portfolio Manager, has managed the Funds since 2016. In addition to the Funds, Mr. Brown manages the Great-West Bond Index Fund, Great-West Government Money Market Fund, Great-West Short Duration Bond Fund, Great-West U.S. Government Mortgage Securities Fund, Great-West Lifetime Funds, Great-West SecureFoundation Funds, collective investment trusts managed by GWCM, stable value funds managed by GWCM and GWL&A, and certain fixed income separate accounts of GWL&A. Mr. Brown joined GWL&A in 2015 with 20 years of industry experience. Mr. Brown received a B.S. in finance from the Metropolitan State College of Denver and a M.B.A. from the University of Colorado.

Andrew Corwin, CFA, Assistant Portfolio Manager, has managed the Funds since 2014. In addition to the Funds, Mr. Corwin manages the Great-West Lifetime Funds, Great-West SecureFoundation Funds, and collective investment trusts managed by GWCM. Mr. Corwin was previously an Investment Analyst and Investment Consultant at Strategies, LLC from 2009-2011. Mr. Corwin received a B.S. in business administration with an emphasis in finance as well as a minor in mathematics from the University of Colorado.

GWCM has been named as a defendant in a complaint captioned Obeslo et al. v. Great-West Capital Management, LLC, which was filed in the United States District Court for the District of Colorado on January 29, 2016, subsequently amended on April 8, 2016, and consolidated on August 22, 2016 with a separate complaint captioned Duplass, Zwain, Bourgeois, Pfister & Weinstock APLC 401(k) Plan v. Great-West Capital Management, LLC, which was also filed in the United States District Court for the District of Colorado on May 20, 2016 (together the “Consolidated Complaint”). The Consolidated Complaint, which was filed by purported shareholders of the Great-West Funds, alleges that GWCM breached its fiduciary duty under Section 36(b) of the 1940 Act with respect to its receipt of advisory fees paid by the Great-West Funds. The Consolidated Complaint, which the plaintiffs purport to bring on behalf of the Great-West Funds, relates to the advisory fees paid by Great-West Funds. The Consolidated Complaint requests relief in the form of (1) a declaration that GWCM violated Section 36(b) of the 1940 Act, (2) permanently enjoining GWCM from further violating Section 36(b), (3) awarding compensatory damages, including repayment of excessive investment advisory fees, (4) rescinding the investment advisory agreement between GWCM and the Great-West Funds and (5) awarding reasonable costs from the Consolidated Complaint.

GWCM has been named as a defendant in an additional complaint captioned Obeslo et al. v. Great-West Life and Annuity Insurance Company and Great-West Capital Management, LLC, which was filed in the United States District Court for the District of Colorado on December 23, 2016 (“Second Obeslo Complaint”). The Second Obeslo Complaint, which was filed by purported shareholders of the Great-West Funds, alleges that the defendants breached their respective fiduciary duty under Section 36(b) of the 1940 Act with respect to shareholder services fees paid by the Great-West Funds and previously by GWCM to GWL&A. The Second Obeslo Complaint, which the plaintiffs

18

purport to bring on behalf of the Great-West Funds, relates to the shareholder services fees paid by Great-West Funds and previously by GWCM. The Second Obeslo Complaint requests relief in the form of (1) a declaration that the defendants violated Section 36(b) of the 1940 Act, (2) awarding compensatory damages, including repayment of excessive shareholder services fees, (3) rescinding the administrative services agreement between GWL&A and the Great-West Funds and (4) awarding reasonable costs from the Second Obeslo Complaint.

GWCM believes that the Consolidated Compliant and the Second Obeslo Complaint are without merit, and intends to defend itself vigorously against the allegations. GWCM also believes that the Consolidated Compliant and Second Obeslo Complaint will not have a material adverse effect on the ability of GWCM to perform its obligations under its investment advisory agreement with the Fund.

Advisory Fees

For its services, with respect to each Fund, GWCM is entitled to a fee, which is calculated daily and paid monthly, at an annual rate of 0.25% of each Target Fund’s average daily net assets and 0.10% of each Acquiring Fund’s average daily net assets. GWCM is responsible for all fees and expenses incurred in performing the services set forth in the investment advisory agreement and all other fees and expenses, except that the Funds pay all shareholder services fees with respect to Investor Class shares, and any extraordinary expenses, including litigation costs.

With respect to each Fund invested in the GWL&A Contract, GWCM has contractually agreed to reduce its management fee by 0.35% of the amount each Fund is allocated to the GWL&A Contract. Such agreement’s current term ends on April 30, 2018. The agreement automatically renews for one-year terms unless it is terminated by Great-West Funds or GWCM upon written notice within 90 days of the end of the current term or upon termination of the advisory agreement.

A discussion regarding the basis for the Board’s approval of the investment advisory agreement with GWCM is available in the Funds’ Semi-Annual Report to shareholders for the period ended June 30, 2016, and will be available in the Funds’ Semi-Annual Report to shareholders for the period ended June 30, 2017.

Directors and Officers

As of the date of this Information Statement/Prospectus, there are six members of the Board, one of whom is an “interested person” (as defined in the 1940 Act) and five of whom are not interested persons (the “independent directors”). The names and business addresses of the directors and officers of the Funds and their principal occupations and other affiliations during the past five years are set forth under “Management of Great-West Funds” in the Funds’ Statement of Additional Information, as supplemented, which is incorporated herein by reference.

Purchase and Sale of Fund Shares

Each Fund is not sold directly to the general public, but instead may be offered as an underlying investment for Permitted Accounts. Permitted Accounts may place orders on any business day to purchase and redeem shares of the Funds based on instructions received from owners of variable contracts or IRAs, or from participants of retirement plans or college savings programs. Please contact your registered representative, IRA custodian or trustee, retirement plan sponsor or administrator or college savings program for information concerning the procedures for purchasing and redeeming shares of the Funds.

The Funds do not have any initial or subsequent investment minimums. However, Permitted Accounts may impose investment minimums.

For a complete description of purchase, redemption and exchange options, see the section of each Fund’s Prospectus entitled “Shareholder Information.”

Each Fund earns dividends, interest and other income from its investments, and ordinarily distributes this income (less expenses) to shareholders as dividends semi-annually. Each Fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gains distributions at least once

19

annually. Both dividends and capital gains distributions of each Fund are reinvested in additional shares of such Fund at net asset value.

Each Target Fund intends to distribute to its shareholders, prior to the closing of this reorganization, all its net investment income and net capital gains, if any, for the period ending on the Closing Date. See “The Proposed Reorganization - Material Federal Tax Consequences” below.

Federal Income Tax Information

Each Fund qualifies and intends to continue to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). If a Fund qualifies as a regulated investment company and distributes its income as required by the Code, such Fund will not be subject to federal income tax to the extent that its net investment income and realized net capital gains are distributed to shareholders. Currently, Permitted Accounts generally are not subject to federal income tax on any Fund distributions. Owners of variable contracts, retirement plan participants, and IRA owners are also generally not subject to federal income tax on Fund distributions until such amounts are withdrawn from the variable contract, retirement plan or IRA. Distributions from a college savings program generally are not taxed provided that they are used to pay for qualified higher education expenses. More information regarding federal income taxation of Permitted Account owners may be found in the applicable prospectus and/or disclosure documents for that Permitted Account.

Payments to Insurers, Broker-Dealers and Other Financial Intermediaries

Each Fund and its related companies may make payments to insurance companies, broker-dealers and other financial intermediaries for the sale of Fund shares and/or other services. These payments may be a factor that an insurance company, broker-dealer or other financial intermediary considers in including a Fund as an investment option in a Permitted Account. These payments also may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson, visit your financial intermediary’s web site, or consult the variable contract prospectus for more information.

Further Information

Additional information concerning the Acquiring Funds and Target Funds is contained in this Information Statement/Prospectus and additional information regarding the Acquiring Funds is contained in the accompanying Acquiring Funds’ prospectus. The cover page of this Information Statement/Prospectus describes how you may obtain further information.

THE PROPOSED REORGANIZATION

The proposed reorganization will be governed by the Agreement, a form of which is attached as Appendix A. The Agreement provides that each Target Fund will transfer all of its assets to the corresponding Acquiring Fund solely in exchange for the issuance of full and fractional shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. The closing of this reorganization will take place at the close of business on the Closing Date. The following discussion of the Agreement is qualified in its entirety by the full text of the Agreement.

Each Target Fund will transfer all of its assets to the corresponding Acquiring Fund, and in exchange, the Acquiring Fund will assume all the liabilities of the Target Fund and deliver to the Target Fund a number of full and fractional Investor Class shares of the Acquiring Fund having a net asset value equal to the value of the assets of the Target Fund less the liabilities of the Target Fund assumed by the Acquiring Fund as of the close of regular trading on the New York Stock Exchange on the Closing Date. At the designated time on the Closing Date as set forth in the Agreement, each Target Fund will distribute in complete liquidation and termination of each Target Fund, pro rata to its shareholders of record all corresponding Acquiring Fund shares received by the Target Fund. This distribution will be accomplished by the transfer of Acquiring Fund shares credited to the account of the corresponding Target Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the name of the Target Fund shareholders, and representing the respective pro rata number of Acquiring Fund shares due such shareholders. All issued and outstanding shares of each Target Fund will be

20

canceled on the books of the Target Fund. As a result of the proposed reorganization, each Target Fund’s Investor Class shareholder will receive a number of the corresponding Acquiring Fund’s Investor Class shares equal in net asset value, as of the close of regular trading on the New York Stock Exchange on the Closing Date, to the net asset value of the Target Fund Investor Class shares surrendered by such shareholder as of such time.

The consummation of this reorganization is subject to the terms and conditions set forth in the Agreement and the representations and warranties set forth in the Agreement being true. The Agreement may be terminated by the mutual agreement of the Funds. In addition, the Funds may at their option terminate the Agreement at or before the Closing if (i) the Closing has not occurred on or before ten months from the date of the Agreement, unless such date is extended by mutual agreement of the parties, or (ii) the other party materially breaches its obligations under the Agreement or makes a material and intentional misrepresentation in the Agreement or in connection with the Agreement.

Each Target Fund will, within a reasonable period of time before the Closing Date, furnish the corresponding Acquiring Fund with a list of the Target Fund’s portfolio securities and other investments. Each Acquiring Fund will, within a reasonable period of time before the Closing Date, furnish the corresponding Target Fund with a list of the securities, if any, on the Target Fund’s list referred to above that do not conform to the Acquiring Fund’s investment objective, policies, and restrictions. Each Target Fund, if requested by the corresponding Acquiring Fund, will dispose of securities on the Acquiring Fund’s list before the Closing Date. In addition, if it is determined that the portfolios of each Target Fund and corresponding Acquiring Fund, when aggregated, would contain investments exceeding certain percentage limitations imposed upon the Acquiring Fund with respect to such investments, the Target Fund, if requested by the Acquiring Fund, will dispose of a sufficient amount of such investments as may be necessary to avoid violating such limitations as of the Closing Date. Notwithstanding the foregoing, nothing in the Agreement will require each Target Fund to dispose of any investments or securities if, in the reasonable judgment of the Target Fund Board or GWCM, such disposition would adversely affect the tax-free nature of this reorganization for federal income tax purposes or would otherwise not be in the best interests of the Target Fund. It is expected that Target Funds shareholders will recognize no gain or loss for federal income tax purposes as a direct result of this reorganization. For a more detailed discussion of the federal income tax consequences of this reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

Description of Securities to be Issued

Shares of Common Stock. The Acquiring Funds offers three classes of shares – Institutional Class, Investor Class and Class L. Only Investor Class shares will be issued in this reorganization. Each share of the Acquiring Funds represents an equal proportionate interest in that Fund with each other share and is entitled to such dividends and distributions out of the income belonging to such Fund as are declared by the Board. Each share class represents interests in the same portfolio of investments. Differing expenses will result in differing net asset values and dividends and distributions. Upon any liquidation of an Acquiring Fund, Investor Class shareholders are entitled to share pro rata in the net assets belonging to the Acquiring Fund allocable to the Investor Class available for distribution after satisfaction of outstanding liabilities of the Acquiring Fund allocable to the Investor Class. Additional classes of shares may be authorized in the future.

Voting Rights of Shareholders. Shareholders of the Acquiring Funds are entitled to one vote for each Fund share owned and fractional votes for fractional shares owned. However, shareholders of any particular class of the Acquiring Funds will vote separately on matters relating solely to such class and not on matters relating solely to any other class(es).

Pursuant to current interpretations of the 1940 Act, insurance companies that invest in the Acquiring Funds will solicit voting instructions from owners of variable contracts that are issued through separate accounts registered under the 1940 Act with respect to any matters that are presented to a vote of shareholders of the Acquiring Funds. Shares attributable to the Acquiring Funds held in variable contracts will be voted by insurance company separate accounts based on instructions received from owners of variable contracts. The number of votes that an owner of a variable contract has the right to cast will be determined by applying his/her percentage interest in the Acquiring Funds (held through a variable contract) to the total number of votes attributable to the Acquiring Funds. In determining the number of votes, fractional shares will be recognized. Shares held in the variable contracts for

21

which the Acquiring Funds do not receive instructions and shares owned by GWCM, which provided initial capital to the Acquiring Funds, will be voted in the same proportion as shares for which the Acquiring Funds has received instructions. As a result of such proportionate voting a small number of variable contracts owners may determine the outcome of the shareholder vote(s).

Continuation of Shareholder Accounts and Plans; Share Certificates

Each Acquiring Fund will establish an account for the corresponding Target Fund’s shareholders containing the appropriate number of shares of the appropriate class of the Acquiring Fund. The shareholder services and shareholder programs of the Funds are identical.

Service Providers

The Bank of New York Mellon serves as the custodian for the assets of each Fund. DST Systems, Inc. serves as the Funds’ transfer agent and dividend paying agent. Deloitte & Touche LLP serves as the independent auditors for each Fund.

Material Federal Income Tax Consequences

As a condition to each Fund’s obligation to consummate this reorganization, each Fund will receive an opinion from Vedder Price P.C. (which opinion will be based on certain factual representations and certain customary assumptions and exclusions) substantially to the effect that, on the basis of the existing provisions of the Code, current administrative rules and court decisions, for federal income tax purposes:

| | 1. | The transfer by each Target Fund of all its assets to the corresponding Acquiring Fund solely in exchange for shares of such Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund, immediately followed by the pro rata distribution of all the Acquiring Fund’s shares received by the Target Fund to the Target Fund’s shareholders in complete liquidation of the Target Fund and the termination of the Target Fund as soon as possible thereafter, will constitute “a reorganization” within the meaning of Section 368(a)(1) of the Code, and the Acquiring Fund and the corresponding Target Fund will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code with respect to such reorganization. |

| | 2. | No gain or loss will be recognized by each Acquiring Fund upon the receipt of all the assets of the corresponding Target Fund solely in exchange for shares of such Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the corresponding Target Fund. |

| | 3. | No gain or loss will be recognized by each Target Fund upon the transfer of its assets to the corresponding Acquiring Fund solely in exchange for shares of such Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund or upon the distribution (whether actual or constructive) of the Acquiring Fund’s shares so received to the Target Fund’s shareholders solely in exchange for such shareholders’ shares of the Target Fund in complete liquidation of the Target Fund. |