As filed with the Securities and Exchange Commission on November 2, 2015

File No. [ ]

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

( ) Pre-Effective Amendment No.

( ) Post-Effective Amendment No.

GREAT-WEST FUNDS, INC.

(Exact Name of Registrant as Specified in Charter)

8515 E. Orchard Road

Greenwood Village, Colorado 80111

Registrant’s Telephone Number, including Area Code (866) 831-7129

Edmund F. Murphy III

President and Chief Executive Officer

Great-West Funds, Inc.

8515 E. Orchard Road

Greenwood Village, Colorado 80111

(Address of Principal Executive Offices)

Copy to:

Renee M. Hardt, Esq.

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

TITLE OF SECURITIES BEING REGISTERED: Shares of Common Stock (par value $0.10 per share) of the Registrant.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

It is proposed that this filing will become effective on December 2, 2015 pursuant to Rule 488 under the Securities Act of 1933.

Important Information for

Great-West Small Cap Growth Fund Shareholders

At a special meeting of shareholders of Great-West Small Cap Growth Fund (the “Target Fund”), a series of Great-West Funds, Inc. (the “Corporation”), you will be asked to vote upon an important change affecting your fund. The purpose of the special meeting is to allow you to vote on a reorganization of your fund into Great-West Multi-Manager Small Cap Growth Fund (the “Acquiring Fund”), a series of the Corporation. If the reorganization is approved and completed, you will become a shareholder of the Acquiring Fund. The Target Fund and the Acquiring Fund are collectively referred to herein as the “Funds” or individually as a “Fund.”

Although we recommend that you read the complete Proxy Statement/Prospectus, for your convenience, we have provided the following brief overview of the matter to be voted on.

| Q. | Why am I receiving this Proxy Statement/Prospectus? |

| A. | The shareholders of the Target Fund are being asked to approve a reorganization between the Target Fund and the Acquiring Fund pursuant to an Agreement and Plan of Reorganization, as described in more detail in this Proxy Statement/Prospectus. |

| Q. | Why has the reorganization been proposed for the Target Fund? |

| A. | Great-West Capital Management, LLC (“GWCM”), each Fund’s investment adviser, has proposed the reorganization of the Target Fund into the Acquiring Fund as part of a plan to address underperformance in the Target Fund. In order to address this issue, GWCM believes that reorganizing the Target Fund into the Acquiring Fund will allow shareholders of the Target Fund to benefit from the Acquiring Fund’s multi-manager approach following the reorganization. |

| Q. | Are the Funds managed by the same sub-adviser(s)? |

| A. | No. The sub-adviser to the Target Fund is Silvant Capital Management, LLC. The sub-advisers to the Acquiring Fund are Lord Abbett & Co. LLC (“Lord Abbett”), Peregrine Capital Management, Inc. (“Peregrine”), and Putnam Investments (“Putnam”). |

| Q. | What can you tell me about the investment selection process within the Acquiring Fund’s multi-manager structure? |

While past performance is not necessarily an indication of future results, GWCM selected the Acquiring Fund’s sub-advisers to manage the Fund because of their respective track records, portfolio managers, and investment selection processes. The Acquiring Fund’s sub-advisers seek to invest in securities of issuers with above average potential for growth. Each sub-adviser independently conducts its own research, analysis, security selection and portfolio construction for the assets which it manages pursuant to its investment philosophy. The combination of the three sub-advisers brings together three unique strategies: Lord Abbett’s microcap growth strategy providing diversification and higher alpha potential, Peregrine’s traditional fundamental stock-picking with high active share, and Putnam’s quantitative strategy with a large number of underlying holdings.

| Q. | What can you tell me about the Acquiring Fund sub-advisers’ investment selection process? |

Lord Abbett seeks long-term capital appreciation by investing principally in equity securities of micro-capitalization companies that, at the time of purchase, are similar in size to companies in the Russell Microcap® Index or have a market capitalization that is under $1 billion. Lord Abbett uses fundamental analysis to look for micro-capitalization companies that appear to have the potential for more rapid growth than the overall economy. Lord Abbett evaluates companies based on an analysis of their financial statements, products and operations, market sectors, and management. Lord Abbett may engage in active and frequent trading of portfolio securities in seeking to achieve the Fund’s investment objective.

Peregrine

Peregrine seeks long-term capital appreciation by investing in small-capitalization companies that are similar in size to issuers included in the Russell 2000® Index. In selecting securities for the Fund, Peregrine conducts rigorous research to identify companies where the prospects for rapid earnings growth (Discovery phase) or significant change (Rediscovery phase) have yet to be well understood, and are therefore not reflected in the current stock price. This research includes meeting with management of several hundred companies each year to discuss public information relevant to selecting securities for the Fund and conducting independent external research. Companies that fit into the Discovery phase are those with rapid long-term (3-5 year) earnings growth prospects. Companies that fit into the Rediscovery phase are those that have the prospect for sharply accelerating near-term earnings (next 12-18 months), or companies selling at a meaningful discount to their underlying asset value.

Putnam

Putnam seeks capital appreciation by investing in mainly common stocks of small U.S. companies that are similar in size to issuers included in the Russell 2000® Growth Index, with a focus on growth stocks. Putnam considers growth stocks to be those issued by companies whose earnings are expected to grow faster than those of similar firms, and whose business growth and other characteristics may lead to an increase in stock price.

| Q. | What are the similarities between the investment objectives and principal investment strategies of the Funds? |

| A. | The investment objectives of the Funds are substantially similar. The investment objective of the Acquiring Fund is long-term capital appreciation and the investment objective of the Acquired Fund is long-term capital growth. The Funds also have similar principal investment strategies. Under normal market conditions, each Fund invests at least 80% of its net assets in equity securities of small capitalization companies. The Target Fund may invest up to 25% of its net assets in foreign securities (securities of Canadian issuers and American Depositary Receipts (“ADRs”) are not subject to this 25% limitation). On the other hand, the Acquiring Fund has no limit on investments in foreign securities and may invest in U.S. and foreign companies, including emerging markets. Additionally, the Acquiring Fund may invest in micro-capitalization companies. A more detailed comparison of the investment objectives, strategies and risks of the Funds is contained in each Fund’s prospectus. |

| Q. | What will happen if shareholders do not approve the reorganization? |

| A. | If the reorganization is not approved by shareholders, the Board of Directors will take such actions as it deems to be in the best interests of the Target Fund, which may include additional solicitation, continuing to operate the Acquired Fund as a standalone fund, liquidating the Acquired Fund, or merging the Acquired Fund into another fund. |

| Q. | Will Target Fund shareholders receive new shares in exchange for their current shares? |

| A. | Yes. If shareholders approve the reorganization and it is completed, each Target Fund shareholder will receive shares of the Acquiring Fund in an amount equal in total value to the total value of the Target Fund shares surrendered by such shareholder, in each case as of the close of trading on the closing date of the reorganization. |

| Q. | Will I have to pay federal income taxes as a result of the reorganization? |

| A. | No. The reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. It is expected that investors in the Target Fund will recognize no gain or loss for federal income tax purposes as a direct result of the reorganization. Prior to the closing of the reorganization, the Target Fund expects to distribute all of its net investment income and net capital gains, if any. Such distribution is not expected to be currently taxable for federal income tax purposes to investors who hold shares of the Target Fund through insurance company separate accounts for variable annuity contracts and variable life insurance policies, individual retirement accounts, qualified retirement plans or college savings programs. The section entitled “The Proposed Reorganization—Material Federal Income Tax Consequences” of the Proxy Statement/Prospectus provides additional information regarding the federal income tax consequences of the reorganization. |

| Q. | Who will bear the costs of the reorganization? |

| A. | GWCM will bear all expenses of the reorganization even if the reorganization is not approved or completed. GWCM estimates the costs of the reorganization to be $39,500. |

| Q. | What is the timetable for the reorganization? |

| A. | If approved by shareholders on February 16, 2016, the reorganization is expected to occur at the close of business on March 1, 2016. |

VOTING INFORMATION

| Q. | Who is eligible to vote for the proposal? |

| A. | Any person who owned shares of the Target Fund (directly or beneficially) on the “record date,” which is November 18, 2015 (even if that person has since sold those shares), is eligible to vote. |

| Q. | Whom do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding the proposal or how to vote your shares, please call the proxy information line toll-free at 1-855-976-3326. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Standard Time. Please have your proxy materials available when you call. |

| Q. | How do I vote my shares? |

| A. | You may vote in any of four ways: |

| | · | | Through the Internet. Please follow the instructions on your proxy card. |

| | · | | By telephone, with a toll-free call to the phone number indicated on the proxy card. |

| | · | | By mailing in your proxy card. |

| | · | | In person at the meeting in Greenwood Village, Colorado on February 16, 2016. |

We encourage you to vote via the Internet or telephone using the control number on your proxy card and following the simple instructions because these methods result in the most efficient means of transmitting your vote and reduce the need for the Funds to conduct telephone solicitations and/or follow up mailings. If you would like to change your previous vote, you may vote again using any of the methods described above.

| Q. | Will the Corporation contact me? |

| A. | You may receive a call from representatives of the proxy solicitation firm retained by the Corporation to verify that you received your proxy materials and to answer any questions you may have about the reorganization. |

| Q. | How does the Board of Directors suggest that I vote? |

| A. | After careful consideration, the Board of Directors has agreed unanimously that the reorganization is in the best interests of your Fund and recommends that you vote “FOR” the reorganization. |

December [ ], 2015

Dear Shareholders:

We are pleased to invite you to the special meeting of shareholders of the Great-West Small Cap Growth Fund, a series of Great-West Funds, Inc. (the “Special Meeting”). The Special Meeting is scheduled for February 16, 2016, at 10 a.m., Mountain Time, at the offices of Great-West Funds, Inc. (the “Corporation”), 8515 East Orchard Road, Greenwood Village, Colorado 80111.

At the Special Meeting, you will be asked to consider and approve a very important proposal. Subject to shareholder approval, Great-West Multi-Manager Small Cap Growth Fund (the “Acquiring Fund”) will acquire all the assets and liabilities of the Great-West Small Cap Growth Fund (the “Target Fund” and together with the Acquiring Fund, the “Funds” and each a “Fund”) in exchange solely for shares of the Acquiring Fund, which will be distributed in complete liquidation and termination of the Target Fund to the shareholders of the Target Fund (the “Reorganization”).

Great-West Capital Management, LLC (“GWCM”), each Fund’s investment adviser, has proposed the Reorganization of the Target Fund into the Acquiring Fund as part of a plan to address underperformance in the Target Fund. In order to address this issue, GWCM and the Board of Directors of Great-West Funds, Inc. (the “Board”) believe that reorganizing the Target Fund into the Acquiring Fund will allow shareholders of the Target Fund to benefit from the multi-manager approach of the Acquiring Fund.

The Board believes the Reorganization is in the best interests of the Target Fund and recommends that you vote “FOR” the proposed Reorganization.

The attached Proxy Statement/Prospectus has been prepared to give you information about this proposal.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense, and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, telephone or over the Internet.

| | · | | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| | · | | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| | · | | To vote over the Internet, Visit www.proxyvote.com and follow the online directions. Please have your proxy card available. |

We appreciate your continued support and confidence in Great-West Funds, Inc.

|

| Sincerely, |

|

| /s/ Ryan L. Logsdon |

| Ryan L. Logsdon |

| Assistant Vice President, Counsel & Secretary |

IMPORTANT INFORMATION FOR SHAREHOLDERS

DECEMBER [ ], 2015

GREAT-WEST FUNDS, INC.

GREAT-WEST SMALL CAP GROWTH FUND

(the “Target Fund”)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON FEBRUARY 16, 2016

Dear Shareholder:

You are hereby notified that Great-West Funds, Inc. (the “Corporation”) will hold a special meeting of shareholders (the “Special Meeting”) of the Target Fund at 8515 East Orchard Road, Greenwood Village, Colorado 80111 on February 16, 2016 at 10 a.m. Mountain Time. The Special Meeting is being held so that shareholders can consider the following proposal and transact such other business as may be properly brought before the meeting:

1. To approve an Agreement and Plan of Reorganization which provides for (i) the transfer of all the assets of the Target Fund to the Great-West Multi-Manager Small Cap Growth Fund (the “Acquiring Fund”) in exchange solely for Initial Class shares of common stock of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution by the Target Fund of Initial Class shares of the Acquiring Fund to the holders of Initial Class shares of the Target Fund in complete liquidation and termination of the Target Fund (the “Reorganization”).

2. To transact such other business as may properly come before the Special Meeting.

Only shareholders of record as of the close of business on November 18, 2015 are entitled to vote at the Special Meeting or any adjournments thereof. Shareholders of the Target Fund and owners of certain variable annuity contracts, variable life insurance policies, individual retirement accounts, and certain qualified retirement plans are entitled to provide voting instructions with respect to their proportionate interest (including fractional interest) in the Target Fund.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense, and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, telephone or over the Internet.

| | · | | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. Proxy cards submitted by mail must be received by the tabulator prior to the closing of the polls at the Meeting in order for the votes to be recorded. |

| | · | | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. Votes submitted via telephone must be received by 11:59 p.m., Mountain Time, on February 15, 2016. |

| | · | | To vote over the Internet, visit www.proxyvote.com and follow the online directions. Please have your proxy card available. Votes submitted via the Internet must be received by 11:59 p.m., Mountain Time, on February 15, 2016. |

For any questions regarding the proxy materials or for questions about how to vote your shares, please call our proxy information line toll-free at 1-855-976-3326. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Standard Time.

The enclosed proxy is being solicited by the Board of Directors of Great-West Funds, Inc. Thank you for taking the time to review these materials and for voting your shares. We appreciate your continued support and confidence in Great-West Funds, Inc.

|

| By Order of the Board of Directors |

|

| /s/ Ryan L. Logsdon |

| Ryan L. Logsdon |

| Assistant Vice President, Counsel & Secretary |

| Great-West Funds, Inc. |

|

IMPORTANT – WE NEED YOUR PROXY VOTE IMMEDIATELY We urge you to sign and date the enclosed proxy card and return it in the enclosed addressed envelope which requires no postage if mailed in the United States (or to take advantage of the telephonic or internet voting procedures described on the proxy card). Just follow the simple instructions that appear on your proxy card. Please help reduce the need to conduct telephone solicitation and/or follow-up mailings by voting today. If you wish to attend the meeting and vote your shares in person at the meeting at that time, you will still be able to do so. |

Proxy Statement/Prospectus

Dated December [�� ], 2015

Relating to the Acquisition of the Assets and Liabilities of

GREAT-WEST SMALL CAP GROWTH FUND

by GREAT-WEST MULTI-MANAGER SMALL CAP GROWTH FUND

This Proxy Statement/Prospectus is being furnished to shareholders of Great-West Small Cap Growth Fund (the “Target Fund”), a series of Great-West Funds, Inc. (the “Corporation”), a Maryland corporation and an open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and relates to the special meeting of shareholders of the Target Fund to be held at the offices of the Corporation, 8515 East Orchard Road, Greenwood Village, Colorado 80111, on February 16, 2016 at 10 a.m., Mountain Time and at any and all adjournments thereof (the “Special Meeting”). This Proxy Statement/Prospectus is provided in connection with the solicitation by the Board of Directors of the Corporation (the “Board”) of proxies to be voted at the Special Meeting, and any and all adjournments thereof. The purpose of the Special Meeting is to consider the proposed reorganization (the “Reorganization”) of the Target Fund into Great-West Multi-Manager Small Cap Growth Fund (the “Acquiring Fund”), a series of the Corporation. The Target Fund and the Acquiring Fund are referred to herein collectively as the “Funds” and individually as a “Fund.” If shareholders approve the Reorganization and it is completed, holders of Initial Class shares of the Target Fund will receive Initial Class shares of the Acquiring Fund, with the same total value as the total value of the Target Fund shares surrendered by such shareholders, in each case as of the close of trading on the closing date of the Reorganization. The Board has determined that the Reorganization is in the best interests of the Target Fund. The address, principal executive office and telephone number of the Funds and the Corporation is 8515 East Orchard Road, Greenwood Village, Colorado 80111 and (866) 831-7129.

The enclosed proxy and this Proxy Statement/Prospectus are first being sent to shareholders of the Target Fund on or about December 15, 2015. Shareholders of record as of the close of business on November 18, 2015 (the “Record Date”) are entitled to vote at the Special Meeting and any adjournments thereof.

The Securities and Exchange Commission has not approved or disapproved these securities or determined whether the information in this Proxy Statement/Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Proxy Statement/Prospectus concisely sets forth the information shareholders of the Target Fund should know before voting on the Reorganization (in effect, investing in Initial Class shares of the Acquiring Fund) and constitutes an offering of Initial Class shares of common stock, par value $0.10 per share, of the Acquiring Fund. Please read it carefully and retain it for future reference.

The following document has been filed with the Securities and Exchange Commission (“SEC”) and is incorporated into this Proxy Statement/Prospectus by reference and also accompanies this Proxy Statement/Prospectus:

| | (i) | the Acquiring Fund’s prospectus, dated September 8, 2015, as supplemented through the date of this Proxy Statement/Prospectus. |

The following documents contain additional information about the Funds, have been filed with the SEC and are incorporated into this Proxy Statement/Prospectus by reference:

| | (i) | the Target Fund’s prospectus, dated May 1, 2015, as supplemented through the date of this Proxy Statement/Prospectus, only insofar as it relates to the Target Fund; |

| | (ii) | the unaudited financial statements contained in the Target Fund’s semi-annual report for the six-month period ended June 30, 2015. |

| | (iii) | the audited financial statements contained in the Target Fund’s annual report for the fiscal year ended December 31, 2014; |

| | (iv) | the statement of additional information relating to the proposed Reorganization, dated December [ ], 2015 (the “Reorganization SAI”); and |

| | (v) | the Funds’ statement of additional information dated September 8, 2015, as supplemented through the date of this Proxy Statement/Prospectus, only insofar as it relates to the Funds. |

No other parts of the documents referenced above are incorporated by reference herein.

Copies of the foregoing may be obtained without charge by calling (866) 831-7129 or writing the Funds at 8515 East Orchard Road, Greenwood Village, Colorado 80111. If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.” Since the Acquiring Fund commenced operations on September 10, 2015, it does not have an annual report or semi-annual report as of the date of this Proxy Statement/Prospectus.

The Corporation is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and in accordance therewith files reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by the Corporation (including the registration statement relating to the Acquiring Fund on Form N-14 of which this Proxy Statement/Prospectus is a part) may be inspected without charge and copied (for a duplication fee at prescribed rates) at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may call the SEC at (202) 551-8090 for information about the operation of the Public Reference Room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

TABLE OF CONTENTS

-i-

TABLE OF CONTENTS

(continued)

-ii-

SUMMARY

The following is a summary of, and is qualified by reference to, the more complete information contained in this Proxy Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the Agreement and Plan of Reorganization. As discussed more fully below and elsewhere in this Proxy Statement/Prospectus, the Board believes the proposed Reorganization is in the best interests of the Target Fund and that the interests of the Target Fund’s existing shareholders would not be diluted as a result of the Reorganization, and the Board believes the proposed Reorganization is in the best interests of the Acquiring Fund and that the interests of the Acquiring Fund’s existing shareholders would not be diluted as a result of the Reorganization. If the Reorganization is approved and completed, shareholders of the Target Fund will become shareholders of the Acquiring Fund and will cease to be shareholders of the Target Fund.

Shareholders should read the entire Proxy Statement/Prospectus carefully together with the Acquiring Fund’s Prospectus that accompanies this Proxy Statement/Prospectus, which is incorporated herein by reference. This Proxy Statement/Prospectus constitutes an offering of Initial Class shares of the Acquiring Fund only.

Background

Great-West Capital Management, LLC (“GWCM”), each Fund’s investment adviser, has proposed the Reorganization of the Target Fund into the Acquiring Fund as part of a plan to address underperformance in the Target Fund. In order to address this issue, GWCM believes that reorganizing the Target Fund into the Acquiring Fund will allow shareholders of the Target Fund to benefit from the multi-manager approach of the Acquiring Fund.

The Reorganization

This Proxy Statement/Prospectus is being furnished to shareholders of the Target Fund in connection with the proposed combination of the Target Fund with and into the Acquiring Fund pursuant to the terms and conditions of the Agreement and Plan of Reorganization entered into by the Corporation, on behalf of the Funds and GWCM (the “Agreement”). The Agreement provides for (i) the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for Initial Class shares of common stock, par value $0.10 per share, of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution by the Target Fund of Initial Class shares of the Acquiring Fund to the holders of Initial Class shares of the Target Fund in complete liquidation and termination of the Target Fund.

If shareholders approve the Reorganization and it is completed, Target Fund shareholders will become shareholders of the Acquiring Fund. The Board has determined that the Reorganization is in the best interests of the Target Fund and that the interests of existing shareholders will not be diluted as a result of the Reorganization. The Board unanimously approved the Reorganization and the Agreement at a meeting held on September 17, 2015. The Board recommends a vote “FOR” the Reorganization.

GWCM estimates the costs of the Reorganization to be $39,500. GWCM will pay all Reorganization expenses.

The Board is asking shareholders of the Target Fund to approve the Reorganization at the Special Meeting to be held on February 16, 2016. Approval of the Reorganization requires the affirmative vote of the holders of a majority of the total number of shares outstanding and entitled to vote. See “Voting Information and Requirements” below.

1

If shareholders of the Target Fund approve the Reorganization, it is expected that the closing of the Reorganization (the “Closing”) will occur at the close of business on or about March 1, 2016 (the “Closing Date”), but it may be at a different time as described herein. If the Reorganization is not approved, the Board will take such action as it deems to be in the best interests of the Target Fund. The Closing may be delayed and the Reorganization may be abandoned at any time by the mutual agreement of the parties. In addition, either Fund may, at its option, terminate the Agreement at or before the Closing if (i) the Closing has not occurred on or before ten months from the date of the Agreement, unless such date is extended by mutual agreement of the parties, or (ii) the other party materially breaches its obligations under the Agreement or makes a material and intentional misrepresentation in the Agreement or in connection with the Agreement.

Reasons for the Proposed Reorganization

The Board believes that the proposed Reorganization would be in the best interests of the Target Fund and the Acquiring Fund. In approving the Reorganization, the Board considered a number of principal factors in reaching its determination, including the following:

| | · | | the compatibility of the Funds’ investment objectives, principal investment strategies and related risks; |

| | · | | the relative fees and expense ratios of the Funds; |

| | · | | the anticipated federal income tax-free nature of the Reorganization; |

| | · | | the expected costs of the Reorganization and the fact that the Funds would not bear any of such costs; |

| | · | | the terms of the Reorganization and whether the Reorganization would dilute the interests of shareholders of the Funds; |

| | · | | the effect of the Reorganization on shareholder rights; |

| | · | | alternatives to the Reorganization; and |

| | · | | any potential benefits of the Reorganization to GWCM and its affiliates as a result of the Reorganization. |

For a more detailed discussion of the Board’s considerations regarding the approval of the Reorganization, see “The Board’s Approval of the Reorganization.”

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

The Funds have identical procedures for purchasing, exchanging and redeeming shares for each share class. The Funds offer three classes of shares: Institutional Class, Initial Class, and Class L. Class L has not yet commenced operations for the Funds. There are no Institutional Class shareholders of the Target Fund. The corresponding classes of each Fund have the same investment eligibility criteria. Each Fund normally declares and pays dividends from net investment income, if any, semi-annually. For each Fund, any capital gains are normally distributed at least once a year. See “Comparison of the Funds— Purchase and Sale of Fund Shares” below for a more detailed discussion.

2

Material Federal Income Tax Consequences of the Reorganization

As a condition to closing, the Funds will receive an opinion from Vedder Price P.C. (which will be based on certain factual representations and certain customary assumptions and exclusions) substantially to the effect that the Reorganization will qualify as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither Fund nor its respective investors will recognize gain or loss for federal income tax purposes as a direct result of the Reorganization. In connection with the Reorganization, a portion of the Target Fund’s portfolio assets may be sold prior to the Reorganization, which could result in the Target Fund declaring taxable distributions to its shareholders on or prior to the Closing Date. Such distributions are not expected to be currently taxable for federal income tax purposes to investors who hold Target Fund shares through a Permitted Account. It is estimated that approximately 56% of the Target Fund’s portfolio will be sold prior to or following the Reorganization in connection with this portfolio repositioning. It is estimated that such portfolio repositioning would have resulted in realized gains of approximately $175,970 (approximately $0.24 per share) and brokerage commissions or other transaction costs of approximately $19,805, based on average commission rates normally paid by the Acquiring Fund, if such sales occurred on September 30, 2015. For a more detailed discussion of the federal income tax consequences of the Reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

COMPARISON OF THE FUNDS

Investment Objectives

The Funds have substantially similar investment objectives. The investment objective of the Acquiring Fund is long-term capital appreciation, and the investment objective of the Target Fund is long-term capital growth. Each Fund’s investment objective may be changed without shareholder approval upon providing notice at least 60 days in advance.

Investment Strategies

The Target Fund and the Acquiring Fund have similar principal investment strategies.

| | | | |

Principal Investment Strategies - Target Fund | | | | Principal Investment Strategies - Acquiring Fund |

The Fund will, under normal circumstances, invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in the common stocks of a diversified group of growth companies that are included in the Russell 2000® Index at the time of purchase, or if not included in that index, have market capitalizations of $3 billion or below at the time of purchase. | | | | The Fund will, under normal circumstances, invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of small capitalization companies, which we define as companies with market capitalizations within or below the range of the Russell 2000® Index at the time of purchase. The highest market capitalization of any company in the Russell 2000® Index was approximately $6.528 billion as of July 31, 2015, and is expected to change frequently. |

3

| | | | |

When consistent with the Fund’s investment objectives and investment strategies, the Fund will invest up to 25% of its net assets in foreign securities; however, securities of Canadian issuers and American Depositary Receipts (“ADRs”) are not subject to this 25% limitation. | | | | The Fund may invest in U.S. and foreign, including emerging markets, companies. Foreign companies may be traded on U.S. or non-U.S. securities exchanges, may be denominated in the U.S. Dollar or other currencies, and may include American Depositary Receipts (“ADRs”). The Fund may also invest in micro-capitalization companies. |

The Fund will identify companies believed to have favorable opportunities for capital appreciation within their industry grouping and invest in these companies when they: are determined to be in the developing stages of their life cycle; and have demonstrated, or are expected to achieve, long-term earnings growth. | | | | The Fund’s investment portfolio is managed by three sub-advisers: Peregrine Capital Management, Inc. (“Peregrine”), Putnam Investment Management, LLC. (“Putnam”) and Lord, Abbett & Co. LLC (“Lord Abbett”) (each, a “Sub-Adviser,” and collectively, the “Sub-Advisers”). GWCM maintains a strategic asset allocation of the Fund’s assets with each Sub-Adviser. The Sub-Advisers seek to invest in securities of issuers with above average potential for growth. Specifically, Peregrine seeks long-term capital appreciation by investing in small-capitalization companies that are similar in size to issuers included in the Russell 2000® Index; Putnam seeks capital appreciation by investing mainly in common stocks of small U.S. companies that are similar in size to issuers included in the Russell 2000® Growth Index, with a focus on growth stocks; and Lord Abbett seeks long-term capital appreciation by investing principally in equity securities of micro-capitalization companies that, at the time of purchase, are similar in size to companies in the Russell Microcap® Index or have a market capitalization that is under $1 billion. |

In evaluating the Reorganization, each Target Fund shareholder should consider the risks of investing in the Acquiring Fund. The principal risks of investing in the Acquiring Fund are described in the section below entitled “Principal Investment Risks.”

Temporary Investment Strategies

The Acquiring Fund, like the Target Fund, may hold cash or cash equivalents and may invest up to 100% of its assets in money market instruments, as deemed appropriate by GWCM or the Sub-Advisers, for temporary defensive purposes to respond to adverse market, economic or political conditions, or as a cash reserve. Should the Acquiring Fund take this action, it may be inconsistent with the Acquiring Fund’s principal investment strategies and the Acquiring Fund may not achieve its investment objective.

Money market instruments include a variety of short-term fixed income securities, usually with a maturity of less than 13 months. Some common types of money market instruments include Treasury bills and notes, which are securities issued by the U.S. Government, commercial paper, which is a promissory note issued by a company, bankers’ acceptances, which are credit instruments guaranteed by a bank, and negotiable certificates of deposit, which are issued by banks in large denominations.

4

U.S. Government securities are obligations of and, in certain cases, guaranteed by, the U.S. Government, its agencies or instrumentalities. However, the U.S. Government does not guarantee the net asset value of Acquiring Fund shares. Also, with respect to securities supported only by the credit of the issuing agency or instrumentality, there is no guarantee that the U.S. Government will provide support to such agencies or instrumentalities and such securities may involve risk of loss of principal and interest.

Fees and Expenses

The tables below provide information about the fees and expenses attributable to Initial Class shares of the Funds, and the pro forma fees and expenses of the combined fund. Shareholder fees reflect the fees currently in effect for the Target Fund as of its fiscal year ended December 31, 2014, and for the Acquiring Fund as of September 8, 2015. The pro forma fees and expenses are based on the amounts shown in the table for each Fund, assuming the Reorganization occurred as of September 30, 2015.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | |

Initial Class | | Target

Fund

12/31/2014 | | Acquiring

Fund

9/8/2015 | | Combined Fund

Pro Forma

9/30/2015 |

Management Fees | | 0.60% | | 0.90% | | 0.90% |

Distribution and Service (12b-1) Fees | | 0.00% | | 0.00% | | 0.00% |

Total Other Expenses | | 0.57% | | 0.35%1 | | 0.35%1 |

Administrative Services Fee | | 0.35% | | 0.35% | | 0.35% |

Other Expenses | | 0.22% | | — | | — |

Total Annual Fund Operating Expenses | | 1.17%2 | | 1.25% | | 1.25% |

Expense Reimbursements | | 0.07% | | — | | — |

Total Annual Fund Operating Expenses After Reimbursements | | 1.10% | | — | | — |

1 “Total Other Expenses” are based on estimated amounts for the current fiscal year.

2 GWCM has contractually agreed to pay expenses that exceed 0.75% of the Target Fund’s average daily net assets, excluding Distribution and Service (12b-1) Fees and Administrative Services Fees. These expense reimbursements shall continue in effect indefinitely and will be discontinued only upon termination or amendment of the investment advisory agreement with GWCM.

Example

This Example below is intended to help you compare the cost of investing in each Fund and the pro forma cost of investing in the combined fund. The Example does not reflect the fees and expenses of any insurance company separate accounts for certain variable annuity contracts and variable life insurance policies (“variable contracts”), individual retirement account, qualified retirement plans, or college savings programs (collectively, “Permitted Accounts”). If reflected, the expenses in the Example would be higher.

5

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that the expense reimbursement for the Target Fund is in place for all periods, your investment has a 5% return each year, that all dividends and capital gains are reinvested, and that each Fund’s operating expenses are the amount shown in the fee table and remain the same for the years shown. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | |

Initial Class | | Target

Fund | | Acquiring

Fund | | Combined

Fund Pro

Forma |

1 Year | | $112 | | $127 | | $127 |

3 Years | | $350 | | $397 | | $397 |

5 Years | | $606 | | $686 | | $686 |

10 Years | | $1,340 | | $1,511 | | $1,511 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Target Fund’s turnover rate was 81% of the average value of its portfolio. No portfolio turnover information is provided for the Acquiring Fund because the Acquiring Fund commenced operations on September 10, 2015.

Principal Investment Risks

The principal risks of each Fund are similar, but some principal risks differ between the Funds and are described below. The following principal risks are identical for both Funds:

Currency Risk - Adverse fluctuations in exchange rates between the U.S. Dollar and other currencies may cause the Fund to lose money on investments denominated in foreign currencies.

Foreign Securities Risk - Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, currency valuation or economic developments. In addition, emerging markets may be more volatile and less liquid than the markets of more mature economies, and the securities of emerging markets issuers often are subject to rapid and large changes in price. Foreign securities also include ADRs, which may be less liquid than the underlying shares in their primary trading market.

Growth Stock Risk - Growth stocks can be volatile for several reasons. Since they usually reinvest a high proportion of earnings in their own business, they may not pay the dividends usually associated with value stocks that can cushion their decline in a falling market. Also, since investors buy these stocks because of the expected superior earnings growth, earnings disappointments may result in sharp price declines.

Management Risk - A strategy used by the portfolio managers may fail to produce the intended results.

Market Risk - Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market or economic developments in the U.S. and in other countries. Market risk may affect a single company, sector of the economy or the market as a whole.

While the above principal risks of each Fund are identical, the Acquiring Fund is also subject to the following principal risks:

Multi-Manager Risk - Each Sub-Adviser makes investment decisions independently. It is possible that the security selection process of the Sub-Advisers may not complement one another and the Fund may have buy and sell transactions in the same security on the same day. The Sub-Advisers selected may underperform the market generally or other sub-advisers that could have been selected.

6

Portfolio Turnover Risk - High portfolio turnover rates generally result in higher transaction costs (which are borne directly by the Fund and indirectly by shareholders).

Small and Micro-Cap Company Securities Risk - The stocks of small- and micro-capitalization companies often involve more risk and volatility than those of larger companies. Among other things, small- and micro-capitalization companies are often dependent on a small number of products and have limited financial resources, and there is generally less publicly available information about them. Small and micro-cap securities have lower trading volume and are less liquid than larger, more established companies.

The Target Fund is also subject to depositary receipts risk, investment style risk, small and medium size company securities risk, all of which are described in the Target Fund’s prospectus which is incorporated by reference.

Fundamental Investment Restrictions

The Funds have identical fundamental investment restrictions that cannot be changed without shareholder approval. In addition, each Fund is a diversified fund. As a diversified fund, each Fund, with respect to 75% of its assets, may not invest more than 5% of its total assets in the securities of any one issuer (other than securities issued by other investment companies or by the U.S. government, its agencies, instrumentalities or authorities) and may not purchase more than 10% of the outstanding voting securities of any one issuer.

Performance Information

No performance data is provided for the Acquiring Fund because the Acquiring Fund has less than one year of performance as of the date of this Proxy Statement/Prospectus. The information will appear in a future version of the Acquiring Fund’s Prospectus after the Fund has annual returns for one complete calendar year.

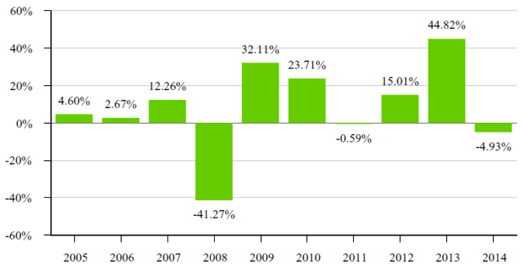

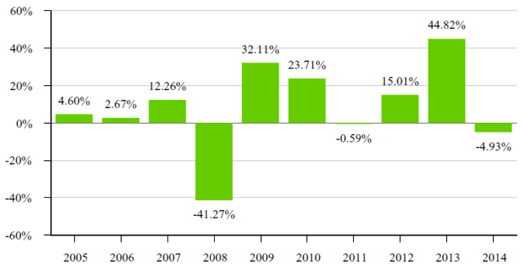

The bar chart and table below provide an indication of the risk of investment in the Target Fund by showing changes in the performance of the Target Fund’s Initial Class for the last ten calendar years and comparing its average annual total return to the performance of a broad-based securities market index. The returns shown below for the Target Fund are historical and are not an indication of future performance. Total return figures assume reinvestment of dividends and capital gains distributions and include the effect of the Target Fund’s recurring expenses, but do not include fees and expenses of any Permitted Account. If those fees and expenses were reflected, the Target Fund’s performance shown would have been lower.

Updated performance information may be obtained at www.greatwestfunds.com (the web site does not form a part of this Prospectus).

7

Target Fund Calendar Year Total Returns

| | | | |

| | | |

| | | Quarter Ended | | Total Return |

Best Quarter for Target Fund | | June 2009 | | 18.90% |

Worst Quarter for Target Fund | | December 2008 | | -28.71% |

Target Fund Average Annual Total Returns for the Periods Ended December 31, 2014

| | | | | | |

| | | | |

| | | One Year | | Five Years | | Ten Years |

Target Fund Initial Class | | -4.93% | | 14.26% | | 6.18% |

Russell 2000® Growth Index (reflects no deduction for fees, expenses or taxes) | | 5.60% | | 16.80% | | 8.54% |

Investment Adviser

GWCM, a wholly owned subsidiary of Great-West Life & Annuity Insurance Company (“GWL&A”), serves as investment adviser to each Fund. GWCM provides investment advisory, accounting and administrative services to Great-West Funds and is the investment adviser of the Funds. GWCM is registered as an investment adviser under the Investment Advisers Act of 1940. GWCM’s address is 8515 East Orchard Road, Greenwood Village, Colorado 80111. As of June 30, 2015, GWCM provides investment management services for mutual funds and other investment portfolios representing assets of $31.5 billion. GWCM and its affiliates have been providing investment management services since 1969.

Sub-Advisers

The Corporation and GWCM operate under a manager-of-managers structure under an order issued by the U.S. Securities and Exchange Commission (“SEC”). The current order permits GWCM to enter into, terminate or materially amend sub-advisory agreements without shareholder approval. This means GWCM is responsible for monitoring the Sub-Advisers’ performance through quantitative and qualitative analysis and periodically reports to the Board as to whether each Sub-Adviser’s agreement should be renewed, terminated or modified.

8

The Corporation will furnish to shareholders of the Funds all information about a new sub-adviser or sub-advisory agreement that would be included in a proxy statement within 90 days after the addition of the new sub-adviser or the implementation of any material change in the sub-advisory agreement.

GWCM will not enter into a sub-advisory agreement with any sub-adviser that is an affiliated person, as defined in Section 2(a)(3) of the 1940 Act, of the Corporation or GWCM other than by reason of serving as a sub-adviser to one or more funds without such agreement, including the compensation to be paid thereunder, being approved by the shareholders of the applicable Funds.

The Sub-Advisers are responsible for the daily management of the Fund and for making decisions to buy, sell, or hold any particular security. The Sub-Advisers bears all expenses in connection with the performance of their services, such as compensating and furnishing office space for their officers and employees connected with investment and economic research, trading and investment management of the applicable Funds. GWCM, in turn, pays sub-advisory fees to the Sub-Advisers for their services out of GWCM’s advisory fee described below. The following is additional information regarding the Target Fund’s Sub-Adviser and the Acquiring Fund’s Sub-Advisers:

Target Fund Sub-Adviser

Silvant Capital Management, LLC (“Silvant”) is a Delaware limited liability company and a wholly owned subsidiary of RidgeWorth Capital Management, LLC (“RidgeWorth”), a money management holding company. RidgeWorth is indirectly owned in part by certain investment funds (the “LY Funds”) that are advised by an affiliate of Lightyear Capital LLC. Silvant is registered as an investment adviser with the SEC. Its principal business address is 3333 Piedmont Road, Suite 1500, Atlanta, Georgia 30305.

The portfolio managers of the Target Fund are Michael A. Sansoterra and Sandeep Bhatia, Ph.D., CFA. Mr. Sansoterra is the Chief Investment Officer of Silvant and the lead portfolio manager on the Large Cap Growth discipline. He is also a senior portfolio manager on the Select Large Cap Growth, Large Cap Core Growth, and the Small Cap Growth disciplines. Prior to joining Silvant, Mr. Sansoterra served as the Large Cap Diversified Growth Portfolio Manager, the Director of Research for Large/Mid Domestic Equities and a Senior Equity Analyst for Principal Global Investors from 2003 to 2007. Mr. Bhatia serves as a sector portfolio manager of Silvant with healthcare sector responsibilities. He is also a senior portfolio manager on the Select Large Cap Growth, Large Cap Core Growth, Large Cap Growth and the Small Cap Growth disciplines. Prior to joining Silvant, Mr. Bhatia served as a Senior Research Analyst for Eagle Asset Management, focusing on the healthcare sector from March 2005 through March 2007.

Acquiring Fund Sub-Advisers

Peregrine Capital Management Inc. (Peregrine) is a Minnesota corporation and is registered as an investment adviser with the SEC. Its principal business address is 800 LaSalle Avenue, Suite 1850, Minneapolis, Minnesota 55402. Peregrine is a direct wholly owned subsidiary of Wells Fargo & Company. Peregrine also provides investment advisory services to corporate and public pension plans, profit sharing plans, savings investment plans, 401(k) plans, foundations and endowments.

The portfolio managers of the Acquiring Fund from Peregrine are William A. Grierson, Daniel J. Hagen, James P. Ross and Paul E. von Kuster. They also manage the Wells Fargo Advantage Small Company Growth Fund. Mr. Grierson, Principal and Portfolio Manager, joined Peregrine in 2000. Mr. Hagen, Principal and Portfolio Manager, joined Peregrine in 1996. Mr. Ross, Principal and Portfolio Manager, joined Peregrine in 1996. Mr. von Kuster, Principal and Portfolio Manager, joined Peregrine in 1984.

9

Lord, Abbett & Co. LLC (Lord Abbett) is a Delaware limited liability company and is registered as an investment adviser with the SEC. Its principal business address is 90 Hudson Street, Jersey City, New Jersey 07302. Founded in 1929, Lord Abbett manages one of the nation’s oldest mutual fund complexes and manages approximately $136.1 billion in assets across a full range of mutual funds, institutional accounts, and separately managed accounts, including $1.4 billion for which Lord Abbett provides investment models to managed account sponsors, as of June 30, 2015.

The portfolio managers of the Acquiring Fund from Lord Abbett are F. Thomas O’Halloran, Arthur K. Weise and Matthew R. DeCicco. Mr. O’Halloran, Partner and Portfolio Manager, heads the team of portfolio managers and other investment professionals who manage Lord Abbett’s portion of the Fund’s portfolio. He joined Lord Abbett in 2001 and has been a member of the team since 2006. Arthur K. Weise, Partner and Portfolio Manager, joined Lord Abbett and the team in 2007. Matthew R. DeCicco, Portfolio Manager, joined Lord Abbett in 1999 and has been a member of the team since 2002.

Putnam Investment Management, LLC (“Putnam”) is a Delaware limited liability company and is registered as an investment adviser with the SEC. Its principal business address is One Post Office Square, Boston, Massachusetts 02109. Putnam is an affiliate of GWCM and GWL&A. Putnam is an indirect wholly owned subsidiary of Putnam Investments LLC, which generally conducts business under the name Putnam Investments. Similar to GWCM, Putnam is owned through a series of subsidiaries by Great-West Lifeco Inc., which is a financial services holding company with operations in Canada, the United States and Europe and is a member of the Power Financial Corporation group of companies. Power Financial Corporation is a majority-owned subsidiary of Power Corporation of Canada. The Desmarais Family Residuary Trust, a trust established pursuant to the Last Will and Testament of the Honourable Paul G. Desmarais, directly and indirectly controls a majority of the voting shares of Power Corporation of Canada.

Pam Gao is the portfolio manager of the Acquiring Fund. Ms. Gao, Portfolio Manager, joined Putnam in 2000 and has managed the Putnam Small Cap Growth Fund since 2010.

For a complete description of the advisory services provided to the Target Fund and the Acquiring Fund, see the section of each Fund’s Prospectus entitled “Management and Organization” and the sections of each Fund’s Statement of Additional Information entitled “Investment Adviser” and “Sub-Advisers.” Additional information about the portfolio manager compensation structure, other accounts managed by each portfolio manager and each portfolio manager’s ownership of securities in the respective Fund is provided in the Funds’ Statement of Additional Information which is incorporated herein by reference.

Advisory Fees

For its services GWCM is entitled to a fee, which is calculated daily and paid monthly, at an annual rate of 0.60% of the Target Fund’s average daily net assets and 0.90% of the Acquiring Fund’s average daily net assets.

For the Acquiring Fund, GWCM is responsible for all fees and expenses incurred in performing the services set forth in the investment advisory agreement and all other fees and expenses, except that the Acquiring Fund shall pay all administrative service fees with respect to Initial Class, and any extraordinary expenses, including litigation costs.

For the Target Fund, GWCM is responsible for all of its expenses incurred in performing its services set forth in the agreement. The Target Fund pays all other expenses incurred in its operation, all of its general administrative expenses, and all administrative services fees with respect to Initial Class, and any extraordinary expenses, including litigation costs. GWCM has contractually agreed to pay any expenses (including the management fee and expenses paid directly by the Target Fund, excluding administrative

10

services fees) which exceed an annual rate of 0.75% of the Target Fund’s average daily net assets. This expense reimbursement shall continue in effect indefinitely and will be discontinued only upon termination or amendment of the investment advisory agreement with GWCM.

A discussion regarding the basis for the Board approving the investment advisory agreement with GWCM and sub-advisory agreements with the Sub-Advisers is available in the Target Fund’s Semi-Annual Report to shareholders for the period ended June 30, 2015 and will be available in the Acquiring Fund’s Annual Report to shareholders for the period ending December 31, 2015.

Directors and Officers

The management of each Fund, including general oversight of the duties performed by GWCM under the Investment Advisory Agreement for the Funds, is the responsibility of the Board.

As of the date of this Proxy Statement/Prospectus, there are four members of the Board, one of whom is an “interested person” (as defined in the 1940 Act) and three of whom are not interested persons (the “independent directors”). The names and business addresses of the directors and officers of the Funds and their principal occupations and other affiliations during the past five years are set forth under “Management of Great-West Funds” in the Funds’ Statement of Additional Information, as supplemented, which is incorporated herein by reference.

Purchase and Sale of Fund Shares

Each Fund is not sold directly to the general public, but instead may be offered as an underlying investment for Permitted Accounts. Permitted Accounts may place orders on any business day to purchase and redeem shares of the Funds based on instructions received from owners of variable contracts or IRAs, or from participants of retirement plans or college savings programs. Please contact your registered representative, IRA custodian or trustee, retirement plan sponsor or administrator or college savings program for information concerning the procedures for purchasing and redeeming shares of the Funds.

The Funds do not have any initial or subsequent investment minimums. However, Permitted Accounts may impose investment minimums.

For a complete description of purchase, redemption and exchange options, see the section of each Fund’s Prospectus entitled “Shareholder Information.”

Each Fund earns dividends, interest and other income from its investments, and ordinarily distributes this income (less expenses) to shareholders as dividends semi-annually. Each Fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gains distributions at least once annually. Both dividends and capital gains distributions of each Fund are reinvested in additional shares of such Fund at net asset value.

If the Reorganization is approved by the shareholders of the Target Fund, the Target Fund intends to distribute to its shareholders, prior to the closing of the Reorganization, all its net investment income and net capital gains, if any, for the period ending on the Closing Date.

Federal Income Tax Information

Each Fund intends to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). If a Fund qualifies as a regulated investment company and distributes its income as required by the Code, such Fund will not be subject to federal income tax to

11

the extent that its net investment income and realized net capital gains are distributed to shareholders. Currently, Permitted Accounts generally are not subject to federal income tax on any Fund distributions. Owners of variable contracts, retirement plan participants, and IRA owners are also generally not subject to federal income tax on Fund distributions until such amounts are withdrawn from the variable contract, retirement plan or IRA. Distributions from a college savings program generally are not taxed provided that they are used to pay for qualified higher education expenses. More information regarding federal income taxation of Permitted Account owners may be found in the applicable prospectus and/or disclosure documents for that Permitted Account.

Payments to Insurers, Broker-Dealers and Other Financial Intermediaries

Each Fund and its related companies may make payments to insurance companies, broker-dealers and other financial intermediaries for the sale of each Fund shares and/or other services. These payments may be a factor that an insurance company, broker-dealer or other financial intermediary considers in including a Fund as an investment option in a Permitted Account. These payments also may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson, visit your financial intermediary’s web site, or consult the variable contract prospectus for more information.

Further Information

Additional information concerning the Acquiring Fund and Target Fund is contained in this Proxy Statement/Prospectus and additional information regarding the Acquiring Fund is contained in the accompanying Acquiring Fund prospectus. The cover page of this Proxy Statement/Prospectus describes how you may obtain further information.

THE PROPOSED REORGANIZATION

The proposed Reorganization will be governed by the Agreement, a form of which is attached as Appendix A. The Agreement provides that the Target Fund will transfer all of its assets to the Acquiring Fund solely in exchange for the issuance of full and fractional shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. The closing of the Reorganization will take place at the close of business on the Closing Date. The following discussion of the Agreement is qualified in its entirety by the full text of the Agreement.

The Target Fund will transfer all of its assets to the Acquiring Fund, and in exchange, the Acquiring Fund will assume all the liabilities of the Target Fund and deliver to the Target Fund a number of full and fractional Initial Class shares of the Acquiring Fund having a net asset value equal to the value of the assets of the Target Fund less the liabilities of the Target Fund assumed by the Acquiring Fund as of the close of regular trading on the New York Stock Exchange on the Closing Date. At the designated time on the Closing Date as set forth in the Agreement, the Target Fund will distribute in complete liquidation and termination of the Target Fund, pro rata to its shareholders of record all Acquiring Fund shares received by the Target Fund. This distribution will be accomplished by the transfer of the Acquiring Fund shares credited to the account of the Target Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the name of the Target Fund shareholders, and representing the respective pro rata number of Acquiring Fund shares due such shareholders. All issued and outstanding shares of the Target Fund will be canceled on the books of the Target Fund. As a result of the proposed Reorganization, each Target Fund Initial Class shareholder will receive a number of Acquiring Fund Initial Class shares equal in net asset value, as of the close of regular trading on the New York Stock Exchange on the Closing Date, to the net asset value of the Target Fund Initial Class shares surrendered by such shareholder as of such time.

12

The consummation of the Reorganization is subject to the terms and conditions set forth in the Agreement and the representations and warranties set forth in the Agreement being true. The Agreement may be terminated by the mutual agreement of the Funds. In addition, either Fund may at its option terminate the Agreement at or before the Closing due if (i) the Closing has not occurred on or before ten months from the date of the Agreement, unless such date is extended by mutual agreement of the parties, or (ii) the other party materially breaches its obligations under the Agreement or makes a material and intentional misrepresentation in the Agreement or in connection with the Agreement.

The Target Fund will, within a reasonable period of time before the Closing Date, furnish the Acquiring Fund with a list of the Target Fund’s portfolio securities and other investments. The Acquiring Fund will, within a reasonable period of time before the Closing Date, furnish the Target Fund with a list of the securities, if any, on the Target Fund’s list referred to above that do not conform to the Acquiring Fund’s investment objective, policies, and restrictions. The Target Fund, if requested by the Acquiring Fund, will dispose of securities on the Acquiring Fund’s list before the Closing Date. In addition, if it is determined that the portfolios of the Target Fund and Acquiring Fund, when aggregated, would contain investments exceeding certain percentage limitations imposed upon the Acquiring Fund with respect to such investments, the Target Fund, if requested by the Acquiring Fund, will dispose of a sufficient amount of such investments as may be necessary to avoid violating such limitations as of the Closing Date. Notwithstanding the foregoing, nothing in the Agreement will require the Target Fund to dispose of any investments or securities if, in the reasonable judgment of the Target Fund Board or the GWCM, such disposition would adversely affect the tax-free nature of the Reorganization for federal income tax purposes or would otherwise not be in the best interests of the Target Fund. It is expected that Target Fund shareholders will recognize no gain or loss for federal income tax purposes as a direct result of the reorganization. It is estimated that approximately 56% of the Target Fund’s portfolio will be sold prior to or following the Reorganization in connection with this portfolio repositioning. It is estimated that such portfolio repositioning would have resulted in realized gains of approximately $175,970 (approximately $0.24 per share) and brokerage commissions or other transaction costs of approximately $19,805, based on average commission rates normally paid by the Acquiring Fund, if such sales occurred on September 30, 2015. The sale of such investments could result in distributions to shareholders of the Target Fund prior to the Reorganization. For a more detailed discussion of the federal income tax consequences of the Reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

Description of Securities to be Issued

Shares of Common Stock. The Acquiring Fund offers three classes of shares – Institutional Class, Initial Class and Class L. Class L shares have not yet commenced operations. There are no Institutional Class shareholders of the Target Fund. Only Initial Class shares will be issued in the Reorganization. Each share of the Acquiring Fund represents an equal proportionate interest in that Fund with each other share and is entitled to such dividends and distributions out of the income belonging to such Fund as are declared by the Board. Each share class represents interests in the same portfolio of investments. Differing expenses will result in differing net asset values and dividends and distributions. Upon any liquidation of the Acquiring Fund, Initial Class shareholders are entitled to share pro rata in the net assets belonging to the Acquiring Fund allocable to the Initial Class available for distribution after satisfaction of outstanding liabilities of the Acquiring Fund allocable to the Initial Class. Additional classes of shares may be authorized in the future.

Voting Rights of Shareholders. Shareholders of the Acquiring Fund are entitled to one vote for each Fund share owned and fractional votes for fractional shares owned. However, shareholders of any particular class of the Acquiring Fund will vote separately on matters relating solely to such class and not on matters relating solely to any other class(es).

13

Pursuant to current interpretations of the 1940 Act, insurance companies that invest in the Acquiring Fund will solicit voting instructions from owners of variable contracts that are issued through separate accounts registered under the 1940 Act with respect to any matters that are presented to a vote of shareholders of the Acquiring Fund. Shares attributable to the Acquiring Fund held in variable contracts will be voted by insurance company separate accounts based on instructions received from owners of variable contracts. The number of votes that an owner of a variable contract has the right to cast will be determined by applying his/her percentage interest in the Acquiring Fund (held through a variable contract) to the total number of votes attributable to the Acquiring Fund. In determining the number of votes, fractional shares will be recognized. Shares held in the variable contracts for which the Acquiring Fund does not receive instructions and shares owned by GWCM, which provided initial capital to the Acquiring Fund, will be voted in the same proportion as shares for which the Acquiring Fund has received instructions. As a result of such proportionate voting a small number of variable contracts owners may determine the outcome of the shareholder vote(s).

Continuation of Shareholder Accounts and Plans; Share Certificates

If the Reorganization is approved, the Acquiring Fund will establish an account for each Target Fund shareholder containing the appropriate number of shares of the appropriate class of the Acquiring Fund. The shareholder services and shareholder programs of the Funds are identical.

Service Providers

The Bank of New York Mellon serves as the custodian for the assets of each Fund. DST Systems, Inc. serves as the Funds’ transfer agent and dividend paying agent. Deloitte & Touche LLP serves as the independent auditors for each Fund.

Material Federal Income Tax Consequences

As a condition to each Fund’s obligation to consummate the Reorganization, each Fund will receive an opinion from Vedder Price P.C. (which opinion will be based on certain factual representations and certain customary assumptions and exclusions) substantially to the effect that, on the basis of the existing provisions of the Code, current administrative rules and court decisions, for federal income tax purposes:

| | 1. | The transfer by the Target Fund of all its assets to the Acquiring Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund, immediately followed by the pro rata distribution of all the Acquiring Fund shares received by the Target Fund to the Target Fund shareholders in complete liquidation of the Target Fund, will constitute “a reorganization” within the meaning of Section 368(a)(1) of the Code, and the Acquiring Fund and the Target Fund will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code with respect to the Reorganization. |

| | 2. | No gain or loss will be recognized by the Acquiring Fund upon the receipt of all the assets of the Target Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. |

| | 3. | No gain or loss will be recognized by the Target Fund upon the transfer of all the Target Fund’s assets to the Acquiring Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund or upon the distribution (whether actual or constructive) of the Acquiring Fund shares so received to the Target Fund shareholders solely in exchange for such shareholders’ shares of the Target Fund in complete liquidation of the Target Fund. |

14

| | 4. | No gain or loss will be recognized by Target Fund shareholders upon the exchange, pursuant to the Reorganization, of all their shares of the Target Fund solely for Acquiring Fund shares. |

| | 5. | The aggregate basis of the Acquiring Fund shares received by each Target Fund shareholder pursuant to the Reorganization will be the same as the aggregate basis of the shares of the Target Fund exchanged therefor by such shareholder. |

| | 6. | The holding period of the Acquiring Fund shares received by each Target Fund shareholder in the Reorganization will include the period during which the shares of the Target Fund exchanged therefor were held by such shareholder, provided such Target Fund shares are held as capital assets at the effective time of the Reorganization. |

| | 7. | The basis of the assets of the Target Fund received by the Acquiring Fund will be the same as the basis of such assets in the hands of the Target Fund immediately before the effective time of the Reorganization. |

| | 8. | The holding period of the assets of the Target Fund received by the Acquiring Fund will include the period during which such assets were held by the Target Fund. |

No opinion will be expressed as to (1) the effect of the Reorganization on the Target Fund, the Acquiring Fund or any Target Fund shareholder with respect to any asset (including without limitation any stock held in a passive foreign investment company as defined in Section 1297(a) of the Code) as to which any unrealized gain or loss is required to be recognized under federal income tax principles (i) at the end of a taxable year (or on the termination thereof) or (ii) upon the transfer of such asset regardless of whether such transfer would otherwise be a non-taxable transaction under the Code or (2) any other federal tax issues (except those set forth above) and all state, local or foreign tax issues of any kind.

Prior to the closing of the Reorganization, the Target Fund will declare a distribution to its shareholders, which together with all previous distributions, will have the effect of distributing to shareholders at least all its net investment income and realized net capital gains (after reduction by any available capital loss carryforwards), if any, through the Closing Date of the Reorganization. This distribution may include net capital gains resulting from the sale of portfolio assets discussed below. Additional distributions may be made if necessary. All dividends and distributions will be reinvested in additional shares of the Target Fund.

To the extent that a portion of the Target Fund’s portfolio assets are sold prior to the Reorganization, the federal income tax effect of such sales would depend on the holding periods of such assets and the difference between the price at which such portfolio assets were sold and the Target Fund’s basis in such assets. Any net capital gains (net long-term capital gain in excess of any net short-term capital loss) recognized in these sales, after the application of any available capital loss carryforwards (capital losses from prior taxable years that may be used to offset future capital gains), would be distributed to the Target Fund’s shareholders as capital gain dividends. Any net short-term capital gains (in excess of any net long-term capital loss and after application of any available capital loss carryforwards) would be distributed as ordinary dividends. All such distributions would be made during or with respect to the Target Fund’s taxable year in which the sale occurs.

Investors who hold shares of the Target Fund through a Permitted Account are not expected to be currently taxed for federal income tax purposes on any dividends or distributions made by the Target Fund in connection with the Reorganization.

15

It is estimated that approximately 56% of the Target Fund’s portfolio will be sold prior to or following the Reorganization in connection with this portfolio repositioning. It is estimated that such portfolio repositioning would have resulted in realized gains of approximately $175,970 (approximately $0.24 per share) and brokerage commissions or other transaction costs of approximately $19,805, based on average commission rates normally paid by the Acquiring Fund, if such sales occurred on September 30, 2015. Reorganization costs do not include any commissions or other transaction costs that would be incurred due to portfolio repositioning.

Although it is not expected to affect investors who hold shares of the Funds through a Permitted Account, the Acquiring Fund’s ability to use, after the Reorganization, the Target Fund’s or the Acquiring Fund’s pre-Reorganization capital losses, if any, may be limited under certain federal income tax rules applicable to reorganizations of this type. The effect of these potential limitations will depend on a number of factors, including the amount of the losses, the amount of gains to be offset, the exact timing of the Reorganization and the amount of unrealized capital gains in the Funds at the time of the Reorganization.