As filed with the Securities and Exchange Commission on May 5, 2017

File No. _-_____, ___-_______

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

( ) Pre-Effective Amendment No. ____

( ) Post-Effective Amendment No. ____

GREAT-WEST FUNDS, INC.

(Exact Name of Registrant as Specified in Charter)

8515 E. Orchard Road

Greenwood Village, Colorado 80111

Registrant’s Telephone Number, including Area Code (866) 831-7129

David L. Musto

President and Chief Executive Officer

Great-West Funds, Inc.

8515 E. Orchard Road

Greenwood Village, Colorado 80111

(Address of Principal Executive Offices)

Copy to:

Renee M. Hardt, Esq.

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

TITLE OF SECURITIES BEING REGISTERED: Shares of Common Stock (par value $0.10 per share) of the Registrant.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Dear Shareholder,

We wish to provide you with some important information concerning your investment in the Great-West Stock Index Fund (the “Target Fund”). The Board of Directors of Great-West Funds, Inc. (“Great-West Funds”) has approved this reorganization of the Target Fund, a series of Great-West Funds, into the Great-West S&P 500® Index Fund (the “Acquiring Fund”), which is also a series of Great-West Funds. As a result, effective on or about July 14, 2017, shareholders of the Target Fund will become shareholders of the Acquiring Fund.

The Target Fund and the Acquiring Fund (collectively, the “Funds”) share a common investment adviser, Great-West Capital Management, LLC and common sub-adviser, Irish Life Investment Managers Limited. The Target Fund’s investment objective is similar to that of the Acquiring Fund. Each Fund seeks to track the performance of its underlying index, before fees and expenses. The two Funds differ in the underlying indexes they seek to track. The Target Fund tracks the S&P 500® Index and the S&P MidCap 400® Index, weighted according to their pro rata share of the market, while the Acquiring Fund tracks the S&P 500® Index.

The Funds are subject to an identical management fee breakpoint schedule. However, since the Acquiring Fund has surpassed both management fee breakpoints (at $1 billion and $2 billion), it has a lower effective total management fee than the Target Fund, which has not passed any of the management fee breakpoints. As a result, shareholders of the Target Fund will pay a lower total expense upon effectiveness of this reorganization.

This reorganization is intended to be a tax-free transaction for federal income tax purposes, and the closing of this reorganization will be conditioned upon, among other things, receiving an opinion of counsel to the effect that this reorganization will qualify as a tax-free reorganization for federal income tax purposes. As a result, it is anticipated that shareholders will not recognize any gain or loss as a direct result of this reorganization.

Detailed information about the Agreement and Plan of Reorganization and the reasons for the Board’s approval of the Plan are contained in the enclosed materials.

NO ACTION ON YOUR PART IS REQUIRED TO EFFECT THE REORGANIZATION. You will automatically receive shares of the Acquiring Fund in exchange for your shares of the Target Fund on or about July 14, 2017. If you have any questions, please contact us at (866) 831-7129.

If you have any questions after considering the enclosed materials, please call.

|

| Sincerely, |

|

|

|

| David Musto |

| President & Chief Executive Officer |

| Great-West Funds, Inc. |

Important Information for Great-West Stock Index Fund Shareholders

The enclosed Information Statement/Prospectus describes the contemplated reorganization of the Great-West Stock Index Fund (the “Target Fund”) into the Great-West S&P 500® Index Fund (the “Acquiring Fund” and, together with the Target Fund, the “Funds”). The Target Fund and the Acquiring Fund are collectively referred to herein as the “Funds” or individually as a “Fund.”

Although we recommend that you read the complete Information Statement/Prospectus, for your convenience, we have provided the following brief overview of this reorganization. Please refer to the more complete information about this reorganization contained elsewhere in the Information Statement/Prospectus.

SHAREHOLDER APPROVAL IS NOT REQUIRED TO EFFECT THE REORGANIZATION. YOU ARE NOT ASKED TO RETURN A PROXY OR TO TAKE ANY OTHER ACTION AT THIS TIME.

| Q. | Why am I receiving this Information Statement/Prospectus? |

On February 23, 2017, the Board of Directors of Great-West Funds (the “Board”) approved the reorganization of the Target Fund into the Acquiring Fund. As of the close of business on the effective date of the merger, investments in the Investor Class shares1 of the Target Fund will automatically become investments in the Investor Class shares of the Acquiring Fund with an equal total net asset value. You will not incur any fees or charges or any tax liability as a direct result of this reorganization. It is currently anticipated that this reorganization will close on or about July 14, 2017.

| Q. | Why has this reorganization been proposed for the Target Fund? |

| A. | Based on the recommendation by Great-West Capital Management, LLC (“GWCM”), each Fund’s investment adviser, as part of an overall product rationalization strategy, the Board has concluded that this reorganization of the Target Fund into the Acquiring Fund is in the best interest of the Target Fund and its shareholders, and that the Target Fund’s existing shareholders will not be diluted as a result of the Reorganization. In reaching this conclusion, the Board considered a number of factors, which are summarized below and are discussed in greater detail in the enclosed materials. |

The Board believes that the reorganization will benefit the Target Fund and its shareholders by, among other things, allowing the merger of a smaller fund into a larger combined fund with similar investment objectives and a lower total expense ratio.

The Acquiring Fund tracks the S&P 500® Index, while the Target Fund tracks both the S&P 500® Index and the S&P MidCap 400® Index, weighted according to their pro rata share of the market. Due to the Target Fund’s weighting of these indices, the Target Fund has a 92% holdings overlap with the Acquiring Fund, which means that the Target Fund invests 92% of its assets in stocks comprising the S&P 500® Index and only 8% of its assets in stocks comprising the S&P MidCap 400® Index. Today, the relatively small asset size of the Target Fund makes it less economically viable to operate both the Target Fund and the Acquiring Fund than to operate as a single combined fund. A larger combined fund has the potential to achieve greater economies of scale, if any, and a lower expense ratio by spreading certain duplicative fixed

1 Effective May 1, 2017, “Initial Class shares” have been renamed to “Investor Class shares.”

costs over a larger asset base (e.g., legal expenses, custody fees, audit fees, mailing costs and other expenses).

| Q. | How do the fees and expenses compare? |

| A. | The Funds have the same management fee schedule, which includes breakpoints. However, due to the larger asset size of the Acquiring Fund, the effective management fee of the Acquiring Fund is lower than the Target Fund because the Acquiring Fund is past its second breakpoint. Therefore, the Acquiring Fund has a lower total operating expense ratio than the Target Fund. |

| Q. | Will Target Fund shareholders receive new shares in exchange for their current shares? |

| A. | Yes. Once the reorganization is completed, each Target Fund shareholder will receive shares of the Acquiring Fund in an amount equal in total value to the total value of the Target Fund shares surrendered by such shareholder, in each case as of the close of trading on the closing date of the reorganization. |

| Q. | Will I have to pay federal income taxes as a result of the reorganization? |

| A. | No. The reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. It is expected that investors in the Target Fund will recognize no gain or loss for federal income tax purposes as a direct result of the reorganization. The section entitled “The Proposed Reorganization—Material Federal Income Tax Consequences” of the Information Statement/Prospectus provides additional information regarding the federal income tax consequences of the reorganization. |

| Q. | Who will bear the costs of the reorganization? |

| A. | GWCM will bear all expenses of the reorganization even if the reorganization is not completed, including legal costs, audit fees, and printing and mailing expenses. GWCM estimates the costs of the reorganization to be $60,400. |

| Q. | What is the timetable for the reorganization? |

| A. | The reorganization is expected to occur at the close of business on or about July 14, 2017. |

| Q. | Whom do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding the reorganization, please call (866) 831-7129. |

Information Statement/Prospectus

Dated [__], 2017

Relating to the Acquisition of the Assets and Liabilities of

GREAT-WEST STOCK INDEX FUND

by GREAT-WEST S&P 500® INDEX FUND

This Information Statement/Prospectus is being furnished to shareholders of Great-West Stock Index Fund (the “Target Fund”), a series of Great-West Funds, Inc. (the “Great-West Funds”), a Maryland corporation and an open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act). This Information Statement/Prospectus is provided in connection with the reorganization of the Target Fund into Great-West S&P 500® Index Fund (the “Acquiring Fund”), a series of Great-West Funds. The Target Fund and the Acquiring Fund are referred to herein collectively as the “Funds” and individually as a “Fund.” Upon completion of this reorganization, holders of Investor Class shares of the Target Fund will receive Investor Class shares of the Acquiring Fund, with the same total value as the total value of the Target Fund shares surrendered by such shareholders, each case as of the close of trading on the closing date of this reorganization. The Board has determined that this reorganization is in the best interests of the Target Fund. The address, principal executive office and telephone number of Great-West Funds is 8515 East Orchard Road, Greenwood Village, Colorado 80111 and (866) 831-7129.

The Securities and Exchange Commission has not approved or disapproved these securities or determined

whether the information in this Information Statement/Prospectus is truthful or complete. Any

representation to the contrary is a criminal offense.

This Information Statement/Prospectus concisely sets forth the information shareholders of the Target Fund should know about this reorganization (in effect, investing in Investor Class shares of the Acquiring Fund) and constitutes an offering of Investor Class shares of common stock, par value $0.10 per share, of the Acquiring Fund. Please read it carefully and retain it for future reference.

SHAREHOLDER APPROVAL IS NOT REQUIRED TO EFFECT THIS REORGANIZATION. YOU ARE NOT ASKED TO RETURN A PROXY OR TO TAKE ANY OTHER ACTION AT THIS TIME.

The following document has been filed with the Securities and Exchange Commission (“SEC”) and is incorporated into this Information Statement/Prospectus by reference and also accompanies this Information Statement/Prospectus:

| | (i) | the Acquiring Fund’s prospectus, dated May 1, 2017, as supplemented through the date of this Information Statement/Prospectus. |

The following documents contain additional information about the Funds, have been filed with the SEC and are incorporated into this Information Statement/Prospectus by reference:

| | (i) | the Target Fund’s prospectus, dated May 1, 2017, as supplemented through the date of this Information Statement/Prospectus, only insofar as it relates to the Target Fund; |

| | (ii) | the audited financial statements contained in the Funds’ annual reports for the fiscal year ended December 31, 2016; |

| | (iii) | the statement of additional information relating to this proposed reorganization, dated May [ ], 2017 (the “Reorganization SAI”); and |

| | (iv) | the Funds’ statement of additional information dated May 1, 2017, as supplemented through the date of this Information Statement/Prospectus, only insofar as it relates to the Funds. |

No other parts of the documents referenced above are incorporated by reference herein.

Copies of the foregoing may be obtained without charge by calling (866) 831-7129 or writing the Funds at Great-West Funds, Inc., Attn: Secretary, 8515 East Orchard Road, Greenwood Village, Colorado 80111. If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.”

Great-West Funds is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and in accordance therewith files reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by Great-West Funds (including the registration statement relating to the Acquiring Fund on Form N-14 of which this Information Statement/Prospectus is a part) may be inspected without charge and copied (for a duplication fee at prescribed rates) at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may call the SEC at (202) 551-8090 for information about the operation of the Public Reference Room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

TABLE OF CONTENTS

SUMMARY

The following is a summary of, and is qualified by reference to, the more complete information contained in this Information Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the Agreement and Plan of Reorganization. Once this reorganization is completed, shareholders of the Target Fund will become shareholders of the Acquiring Fund and will cease to be shareholders of the Target Fund.

Shareholders should read the entire Information Statement/Prospectus carefully together with the Acquiring Fund’s Prospectus that accompanies this Information Statement/Prospectus, which is incorporated herein by reference. This Information Statement/Prospectus constitutes an offering of Investor Class shares of the Acquiring Fund only.

Background

The Target Fund was launched February 25, 1982, and the Acquiring Fund was launched September 8, 2003. Great-West Capital Management, LLC (“GWCM”) is the adviser and Irish Life Investment Managers Limited (“ILIM”) is the sub-adviser to both the Target Fund and Acquiring Fund (collectively, the “Funds”). Before ILIM, both the Target Fund and Acquiring Fund were sub-advised by Mellon Capital Management Corporation and its predecessors.

Both the Acquiring Fund and Target Fund are index funds, which means they seek to track the performance, after fees and expenses, of a particular benchmark index. The Acquiring Fund tracks the S&P 500® Index. The Target Fund tracks the S&P 500® Index and the S&P MidCap 400® Index, weighted according to their pro rata share of the market. The S&P 500® Index is a market capitalization-weighted index of the 500 leading companies in leading industries of the U.S. economy. The S&P MidCap 400® Index is a market capitalization-weighted index comprised of 400 stocks representing companies in the middle tier of U.S. stock market capitalization.

Due to the Target Fund’s weighting of these indices, as of November 30, 2016, the Target Fund has a 92% holdings overlap with the Acquiring Fund, which means that the Target Fund invests 92% of its assets in stocks comprising the S&P 500® Index and 8% of its assets in stocks comprising the S&P MidCap 400® Index.

As a result, despite the difference in the Funds’ benchmark index, the Target Fund and Acquiring Fund have similar performance. The Target Fund has performed slightly better due to the additional allocation to stocks comprising the S&P MidCap 400® Index.

The Target Fund and Acquiring Fund have an identical management fee breakpoint schedule. Since the Acquiring Fund has surpassed both management fee breakpoints (at $1 billion and $2 billion), it will have a lower effective management fee than the Target Fund, which has not passed any of the management fee breakpoints to date. As a result, shareholders of the Target Fund pay a lower total expense ratio upon effectiveness of the reorganization. For more details on fees and expenses, please see “Fees and Expenses” below.

Additionally, while the Acquiring Fund remains a very popular investment option because the S&P 500® Index is widely regarded as the best gauge for the U.S. equities market, there has been little interest in the Target Fund. The Acquiring Fund has roughly $2.5 billion in assets under management. The Target Fund has less than $300 million in assets under management, and 90% of these assets are from retirement plans sold 20 or more years ago.

The Reorganization

This Information Statement/Prospectus is being furnished to shareholders of the Target Fund in connection with the combination of the Target Fund with and into the Acquiring Fund pursuant to the terms and conditions of the Agreement and Plan of Reorganization entered into by Great-West Funds, on behalf of the Funds, and GWCM (the “Agreement”). The Agreement provides for (i) the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for Investor Class shares of common stock, par value $0.10 per share, of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution by the Target Fund of Investor Class shares of the Acquiring Fund to the holders of Investor Class shares of the Target Fund in complete liquidation and termination of the Target Fund. The Board unanimously approved the

1

Reorganization and the Agreement at a meeting held on February 23, 2017. Once this reorganization is completed, Target Fund shareholders will become shareholders of the Acquiring Fund.

It is anticipated that the closing of this reorganization (the “Closing”) will occur at the close of business on or about July 14, 2017 (the “Closing Date”), but it may be at a different time as described herein. For a more detailed discussion about this reorganization, please see “The Proposed Reorganization” below.

Reasons for the Proposed Reorganization

The Board believes that this proposed reorganization would be in the best interests of the Target Fund and the Acquiring Fund. For a more detailed discussion of the Board’s considerations regarding the approval of this reorganization, see “The Board’s Approval of the Reorganization” below.

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

The Funds have identical procedures for purchasing, exchanging and redeeming shares for each share class. The Funds offer three classes of shares: Institutional Class, Investor Class, and Class L. Institutional Class and Class L have not yet commenced operations for the Target Fund. The corresponding classes of each Fund have the same investment eligibility criteria. Each Fund normally declares and pays dividends from net investment income, if any, semi-annually. For each Fund, any capital gains are normally distributed at least once a year. See “Comparison of the Funds— Purchase and Sale of Fund Shares” below for a more detailed discussion.

Material Federal Income Tax Consequences of the Reorganization

It is expected that neither Fund nor its respective investors will recognize gain or loss for federal income tax purposes as a direct result of this reorganization. For a more detailed discussion of the federal income tax consequences of this reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

COMPARISON OF THE FUNDS

Investment Objectives

The Funds have substantially similar investment objectives. Each Fund’s investment objective may be changed without shareholder approval upon providing notice at least 60 days in advance.

| | | | |

| Target Fund – Investment Objective | | | | Acquiring Fund – Investment Objective |

Seeks to track the S&P 500® Index and the S&P MidCap 400® Index, weighted according to their pro rata share of the market (the “Target Fund Benchmark Index”). | | | | Seeks to track the S&P 500® Index (the “Acquiring Fund Benchmark Index”). |

Investment Strategies

The Target Fund and the Acquiring Fund have similar principal investment strategies.

| | | | |

| Target Fund - Principal Investment Strategies | | | | Acquiring Fund - Principal Investment Strategies |

The Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in common stocks included in the Target Fund Benchmark Index. The Fund will seek investment results that track the total return of the common stocks that comprise the Target Fund Benchmark Index by owning the securities contained in the Target Fund Benchmark Index in as close as possible a proportion of the Fund as each stock’s weight in the Target Fund Benchmark Index. | | | | The Fund will invest at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in common stocks included in the Acquiring Fund Benchmark Index. The Fund will seek investment results that track the total return of the common stocks that comprise the Acquiring Fund Benchmark Index by owning the securities contained in the Acquiring Fund Benchmark Index in as close as possible a proportion of the Fund as each stock’s weight in the Acquiring Fund Benchmark Index. |

2

| | | | |

| | | |

The Fund may invest in all the stocks in the Target Fund Benchmark Index and/or through a combination of stock ownership and owning futures contracts on the Target Fund Benchmark Index and options on futures contracts, and exchange-traded funds that seek to track the Target Fund Benchmark Index. | | | | The Fund may invest in all the stocks in the Acquiring Fund Benchmark Index and/or through a combination of stock ownership and owning futures contracts on the Acquiring Fund Benchmark Index and options on futures contracts, and exchange-traded funds that seek to track the Acquiring Fund Benchmark Index. |

In evaluating this reorganization, each Target Fund shareholder should consider the risks of investing in the Acquiring Fund. The principal investment risks of investing in the Acquiring Fund are described in the section below entitled “Principal Investment Risks.”

Fees and Expenses

The tables below provide information about the fees and expenses attributable to Investor Class shares of the Funds, and the pro forma fees and expenses of the combined fund. The pro forma fees and expenses are based on the amounts shown in the table for each Fund, assuming this reorganization occurred as of December 31, 2016.

Please note, the expenses listed in the table below have been restated so that the information reflects the new fee structure and management fee breakpoints effective May 1, 2017.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | |

| Investor Class | | Target Fund 12/31/2016 | | Acquiring

Fund 12/31/2016 | | Combined Fund Pro Forma 12/31/2016 |

Management Fees | | 0.23% | | 0.20% | | 0.20% |

Distribution and Service (12b-1) Fees | | 0.00% | | 0.00% | | 0.00% |

Total Other Expenses1 | | 0.40% | | 0.36% | | 0.36% |

Shareholder Services Fee | | 0.35% | | 0.35% | | 0.35% |

Other Expenses | | 0.05% | | 0.01% | | 0.01% |

Total Annual Fund Operating Expenses | | 0.63% | | 0.56% | | 0.56% |

Expense Reimbursements | | 0.03%2 | | 0.00% | | 0.00% |

Total Annual Fund Operating Expenses After Reimbursements | | 0.60% | | 0.56% | | 0.56% |

1 “Total Other Expenses” are based on estimated amounts for the current fiscal year.

2 GWCM has contractually agreed to waive fees or reimburse expenses that exceed 0.25% of the Target Fund’s average daily net assets attributable to the Investor Class, excluding Shareholder Services Fees, acquired fund fee expenses, brokerage expenses, taxes, dividend interest on short sales, interest expenses, and any extraordinary expenses, including litigation costs (the “Expense Limit”). The agreement’s current term ends on April 30, 2018, and will automatically renew for one-year terms unless it is terminated by Great-West Funds or GWCM upon written notice within 90 days of the end of the current term or upon termination of the advisory agreement. Under the agreement, GWCM may recoup, subject to Board approval, these waivers and reimbursements in future periods, not exceeding three years following the particular waiver/reimbursement, provided Total Annual Fund Operating Expenses of a Class plus such recoupment do not exceed the Expense Limit that was in place at the time of the waiver/reimbursement as well as the current Expense Limit.

Example

This Example below is intended to help you compare the cost of investing in each Fund and the pro forma cost of investing in the combined fund. The Example does not reflect the fees and expenses of any insurance company separate accounts for certain variable annuity contracts and variable life insurance policies (“variable contracts”), individual retirement account, qualified retirement plans, or college savings programs (collectively, “Permitted Accounts”). If reflected, the expenses in the Example would be higher.

3

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that the expense reimbursement for the Target Fund is in place for all periods, your investment has a 5% return each year, that all dividends and capital gains are reinvested, and that each Fund’s operating expenses are the amount shown in the fee table and remain the same for the years shown. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | |

Investor Class | | Target Fund | | Acquiring Fund | | Combined Fund Pro Forma |

1 Year | | $61 | | $57 | | $57 |

3 Years | | $199 | | $179 | | $179 |

5 Years | | $348 | | $313 | | $313 |

10 Years | | $783 | | $701 | | $701 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Target Fund’s turnover rate was 7% of the average value of its portfolio. During the most recent fiscal year, the Acquiring Fund’s turnover rate was 7% of the average value of its portfolio.

Principal Investment Risks

The Target Fund and Acquiring Fund have the same principal investment risks, except that the Target Fund has one additional principal investment risk attendant to its investment in stocks of medium size companies (i.e., the S&P MidCap 400® Index).

The following principal investment risks are identical for both Funds:

Derivatives Risk - Using derivatives can disproportionately increase losses and reduce opportunities for gains when stock prices, currency rates or interest rates are changing. The Fund may not fully benefit from or may lose money on derivatives if changes in their value do not correspond accurately to changes in the value of the Fund’s holdings. The other parties to certain derivative contracts present the same types of credit risk as issuers of fixed income securities. Derivatives can also make a fund less liquid and harder to value, especially in declining markets.

Exchange-Traded Funds (“ETFs”) Risk - An ETF is subject to the risks associated with direct ownership of the securities comprising the index on which the ETF is based. Fund shareholders indirectly bear their proportionate share of the expenses of the ETFs in which the Fund invests. Lack of liquidity in an ETF could result in it being more volatile.

Index Risk - It is possible the Benchmark Index may perform unfavorably and/or underperform the market as a whole. As a result, it is possible that the Fund could have poor investment results even if it is tracking closely the return of the Benchmark Index, because the adverse performance of a particular stock normally will not result in eliminating the stock from the Fund. The Fund is not actively managed and the portfolio managers do not attempt to take defensive positions in declining markets. Maintaining investments in securities regardless of market conditions or the performance of individual securities could cause the Fund’s return to be lower than if the Fund employed an active strategy.

Market Risk - Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market or economic developments in the U.S. and in other countries. Market risk may affect a single company, sector of the economy or the market as a whole.

Tracking Error Risk - The Fund may not be able to precisely track the performance of the Benchmark Index.

4

The following principal risk is unique to the Target Fund:

Medium Size Company Securities Risk - The stocks of medium size companies often involve more risk and volatility than those of larger companies. Among other things, medium size companies are often dependent on a small number of products and have limited financial resources, and there is generally less publicly available information about them.

Fundamental Investment Restrictions

The Funds have identical fundamental investment restrictions that cannot be changed without shareholder approval. In addition, each Fund is a diversified fund. As a diversified fund, each Fund, with respect to 75% of its assets, may not invest more than 5% of its total assets in the securities of any one issuer (other than securities issued by other investment companies or by the U.S. government, its agencies, instrumentalities or authorities) and may not purchase more than 10% of the outstanding voting securities of any one issuer.

Performance Information

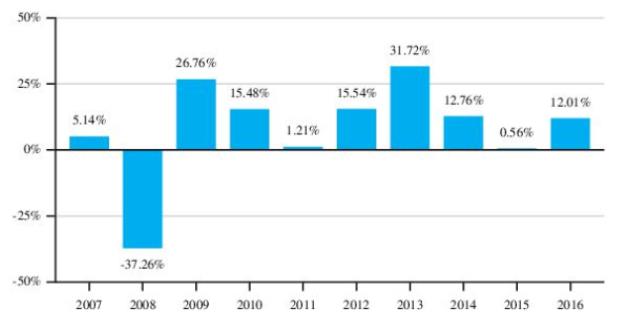

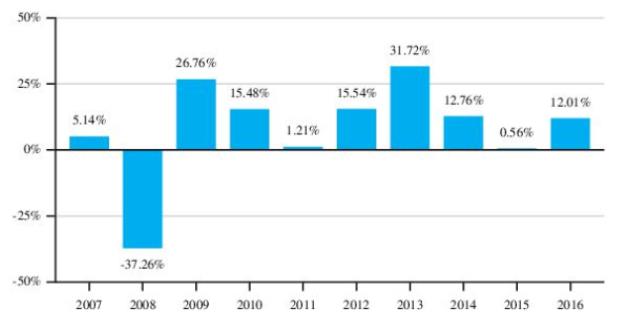

The bar charts and tables below provide an indication of the risk of investment in the Funds by showing changes in the performance of the Funds’ Investor Class shares for the last ten calendar years and comparing their average annual total return to the performance of a broad-based securities market index (and for the Target Fund, a secondary index, and a composite index). The returns shown below for the Funds are historical and are not an indication of future performance. Total return figures assume reinvestment of dividends and capital gains distributions and include the effect of the Funds’ recurring expenses, but do not include fees and expenses of any Permitted Account. If those fees and expenses were reflected, the Funds’ performance shown would have been lower.

Updated performance information may be obtained at www.greatwestfunds.com (the web site does not form a part of this Prospectus).

Acquiring Fund Calendar Year Total Returns

5

| | | | |

| | | Quarter Ended | | Total Return |

Best Quarter | | June 2009 | | 15.88% |

Worst Quarter | | December 2008 | | -22.09% |

Average Annual Total Returns for the Periods Ended December 31, 2016

| | | | | | |

| | | One Year | | Five Years | | Ten Years |

Investor Class | | 11.27% | | 13.99% | | 6.30% |

S&P 500® Index (reflects no deduction for fees, expenses or taxes) | | 11.96% | | 14.66% | | 6.95% |

Target Fund Calendar Year Total Returns

| | | | |

| | | Quarter Ended | | Total Return |

Best Quarter | | June 2009 | | 16.11% |

Worst Quarter | | December 2008 | | -22.33% |

Average Annual Total Returns for the Periods Ended December 31, 2016

| | | | | | |

| | | One Year | | Five Years | | Ten Years |

Investor Class | | 12.01% | | 14.08% | | 6.56% |

S&P 500® Index (reflects no deduction for fees, expenses or taxes) | | 11.96% | | 14.66% | | 6.95% |

S&P MidCap 400® Index (reflects no deduction for fees, expenses or taxes) | | 20.74% | | 15.33% | | 9.16% |

6

| | | | | | |

Composite Index (reflects no deduction for fees, expenses or taxes)* | | 12.73% | | 14.73% | | 7.16% |

*The Composite Index reflects the performance of the S&P 500® Index and the S&P MidCap 400® Index, weighted according to their pro rata share of the market.

Investment Adviser

GWCM, a wholly owned subsidiary of Great-West Life & Annuity Insurance Company (“GWL&A”), serves as investment adviser to each Fund. GWCM provides investment advisory, fund operations, and accounting services to Great-West Funds. GWCM is registered as an investment adviser under the Investment Advisers Act of 1940. GWCM’s address is 8515 East Orchard Road, Greenwood Village, Colorado 80111. As of December 31, 2016, GWCM provides investment management services for mutual funds and other investment portfolios representing assets of $28.3 billion. GWCM and its affiliates have been providing investment management services since 1969.

GWCM has been named as a defendant in a complaint captioned Obeslo et al. v. Great-West Capital Management, LLC, which was filed in the United States District Court for the District of Colorado on January 29, 2016, subsequently amended on April 8, 2016, and consolidated on August 22, 2016 with a separate complaint captioned Duplass, Zwain, Bourgeois, Pfister & Weinstock APLC 401(k) Plan v. Great-West Capital Management, LLC, which was also filed in the United States District Court for the District of Colorado on May 20, 2016 (together the “Consolidated Complaint”). The Consolidated Complaint, which was filed by purported shareholders of the Great-West Funds, alleges that GWCM breached its fiduciary duty under Section 36(b) of the 1940 Act with respect to its receipt of advisory fees paid by the Great-West Funds. The Consolidated Complaint, which the plaintiffs purport to bring on behalf of the Great-West Funds, relates to the advisory fees paid by Great-West Funds. The Consolidated Complaint requests relief in the form of (1) a declaration that GWCM violated Section 36(b) of the 1940 Act, (2) permanently enjoining GWCM from further violating Section 36(b), (3) awarding compensatory damages, including repayment of excessive investment advisory fees, (4) rescinding the investment advisory agreement between GWCM and the Great-West Funds and (5) awarding reasonable costs from the Consolidated Complaint.

GWCM has been named as a defendant in an additional complaint captioned Obeslo et al. v. Great-West Life and Annuity Insurance Company and Great-West Capital Management, LLC, which was filed in the United States District Court for the District of Colorado on December 23, 2016 (“Second Obeslo Complaint”). The Second Obeslo Complaint, which was filed by purported shareholders of the Great-West Funds, alleges that the defendants breached their respective fiduciary duty under Section 36(b) of the 1940 Act with respect to shareholder services fees paid by the Great-West Funds and previously by GWCM to GWL&A. The Second Obeslo Complaint, which the plaintiffs purport to bring on behalf of the Great-West Funds, relates to the shareholder services fees paid by Great-West Funds and previously by GWCM. The Second Obeslo Complaint requests relief in the form of (1) a declaration that the defendants violated Section 36(b) of the 1940 Act, (2) awarding compensatory damages, including repayment of excessive shareholder services fees, (3) rescinding the administrative services agreement between GWL&A and the Great-West Funds and (4) awarding reasonable costs from the Second Obeslo Complaint.

GWCM believes that the Consolidated Compliant and the Second Obeslo Complaint are without merit, and intends to defend itself vigorously against the allegations. GWCM also believes that the Consolidated Compliant and Second Obeslo Complaint will not have a material adverse effect on the ability of GWCM to perform its obligations under its investment advisory agreement with the Fund.

Sub-Adviser

Great-West Funds and GWCM operate under a manager-of-managers structure under an order issued by the SEC. The current order permits GWCM to enter into, terminate or materially amend certain sub-advisory agreements without shareholder approval. This means GWCM is responsible for monitoring the sub-adviser’s performance through quantitative and qualitative analysis and periodically reports to the Board as to whether each sub-adviser’s agreement should be renewed, terminated or modified.

7

Great-West Funds will furnish to shareholders of the Funds all information about a new sub-adviser or sub-advisory agreement that would be included in a proxy statement within 90 days after the addition of the new sub-adviser or the implementation of any material change in the sub-advisory agreement.

GWCM will not enter into a sub-advisory agreement with any sub-adviser that is an affiliated person, as defined in Section 2(a)(3) of the 1940 Act, of Great-West Funds or GWCM other than by reason of serving as a sub-adviser to one or more funds without such agreement, including the compensation to be paid thereunder, being approved by the shareholders of the Funds.

The sub-adviser is responsible for the daily portfolio management of the Target and the Acquiring Fund and for making decisions to buy, sell, or hold any particular security. The sub-adviser bears all expenses in connection with the performance of its services, such as compensating and furnishing office space for its officers and employees connected with investment and economic research, trading and investment management of the Funds. GWCM, in turn, pays sub-advisory fees to the sub-adviser for its services out of GWCM’s advisory fee described below. The following is additional information regarding the Target and the Acquiring Fund’s sub-adviser:

Target Fund and Acquiring Fund Sub-Adviser

Irish Life Investment Managers Limited (“ILIM”) has been the sub-adviser for the Funds since 2016. ILIM is registered as an investment adviser with the SEC. ILIM’s address is Beresford Court, Beresford Place, Dublin 1, Ireland. ILIM is an affiliate of GWCM and GWL&A. ILIM is a subsidiary of Canada Life Group U.K. Ltd, which similar to GWCM, is owned through a series of wholly owned subsidiaries of Great-West Lifeco Inc., which is a financial services holding company with operations in Canada, the United States and Europe and is a member of the Power Financial Corporation group of companies. Power Financial Corporation is a majority-owned subsidiary of Power Corporation of Canada. The Desmarais Family Residuary Trust, a trust established pursuant to the Last Will and Testament of the Honourouble Paul G Desmarais, directly and indirectly controls a majority of the voting shares of Power Corporation of Canada.

The Indexation Team in ILIM manages the Funds’ portfolios. The following individuals on the Indexation Team have primary responsibility for the portfolio management of the Funds (each of these individuals has been a portfolio manager since ILIM was hired as a sub-adviser in 2016).

Nicola Dowdall is a Senior Fund Manager and has worked on the Indexation Team since 2000. Prior to joining the Indexation Team, she worked for two years as an investment accountant with ILIM. Prior to joining ILIM, Ms. Dowdall worked as an audit manager in practice. Ms. Dowdall graduated with a degree in Accounting from Dundalk Institution of Technology and is a Chartered Certified Accountant.

Michael Lynch, CFA is a Senior Fund Manager and has worked on the Indexation Team since 2006. Prior to joining ILIM, he worked for 6 years in Investment Technology Group Europe. He graduated with a degree in Commerce and he also holds a Masters in Economics, both from University College Cork.

Peter Leonard, CFA is a Senior Fund Manager and has worked on the Indexation Team since 2012. Prior to working in ILIM, Peter worked in the investments industry for 8 years as a private client fund manager and in investment management audit. Mr. Leonard graduated from Trinity College Dublin with a B.A. Business & Economics degree and is a qualified chartered accountant and a Qualified Financial Advisor.

Advisory Fees

For its services GWCM is entitled to a fee, which is calculated daily and paid monthly, at an annual rate of 0.25% of each of the Target and Acquiring Fund’s average daily net assets up to $1 billion dollars, 0.18% of the Target and Acquiring Fund’s average daily net assets over $1 billion and 0.13% of the Target and Acquiring Fund’s average daily net assets over $2 billion.

For both the Acquiring and Target Fund, GWCM is responsible for all of its fees and expenses incurred in performing its services set forth in the agreement. Each Fund pays all of its general administrative expenses, all shareholder services fees with respect to Investor Class shares, and any extraordinary expenses, including litigation

8

costs. GWCM has contractually agreed to waive fees or reimburse expenses that exceed 0.25% of each Fund’s average daily net assets attributable to Investor Class, excluding shareholder services fees, acquired fund fee expenses, brokerage expenses, taxes, dividend interest on short sales, interest expenses, and any extraordinary expenses, including litigation costs (the “Expense Limit”). The agreement’s current term ends on April 30, 2018 and automatically renews for one-year terms unless it is terminated by Great-West Funds or GWCM upon written notice within 90 days of the end of the current term or upon termination of the advisory agreement. Under the agreement, GWCM may recoup, subject to Board approval, these waivers and reimbursements in future periods, not exceeding three years following the particular waiver/reimbursement, provided Total Annual Fund Operating Expenses of a Class plus such recoupment do not exceed the Expense Limit that was in place at the time of the waiver/reimbursement as well as the current Expense Limit.

Directors and Officers

As of the date of this Information Statement/Prospectus, there are six members of the Board, one of whom is an “interested person” and five of whom are not interested persons (as defined in the 1940 Act) (the “independent directors”). The names and business addresses of the directors and officers of the Funds and their principal occupations and other affiliations during the past five years are set forth under “Management of Great-West Funds” in the Funds’ Statement of Additional Information, as supplemented, which is incorporated herein by reference.

Purchase and Sale of Fund Shares

Each Fund is not sold directly to the general public, but instead may be offered as an underlying investment for Permitted Accounts. Permitted Accounts may place orders on any business day to purchase and redeem shares of the Funds based on instructions received from owners of variable contracts or IRAs, or from participants of retirement plans or college savings programs. Please contact your registered representative, IRA custodian or trustee, retirement plan sponsor or administrator or college savings program for information concerning the procedures for purchasing and redeeming shares of the Funds.

The Funds do not have any initial or subsequent investment minimums. However, Permitted Accounts may impose investment minimums.

For a complete description of purchase, redemption and exchange options, see the section of each Fund’s Prospectus entitled “Shareholder Information.”

Each Fund earns dividends, interest and other income from its investments, and ordinarily distributes this income (less expenses) to shareholders as dividends semi-annually. Each Fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gains distributions at least once annually. Both dividends and capital gains distributions of each Fund are reinvested in additional shares of such Fund at net asset value.

The Target Fund intends to distribute to its shareholders, prior to the closing of this reorganization, all its net investment income and net capital gains, if any, for the period ending on the Closing Date. See “The Proposed Reorganization - Material Federal Tax Consequences” below.

Federal Income Tax Information

Each Fund qualifies and intends to continue to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). If a Fund qualifies as a regulated investment company and distributes its income as required by the Code, such Fund will not be subject to federal income tax to the extent that its net investment income and realized net capital gains are distributed to shareholders. Currently, Permitted Accounts generally are not subject to federal income tax on any Fund distributions. Owners of variable contracts, retirement plan participants, and IRA owners are also generally not subject to federal income tax on Fund distributions until such amounts are withdrawn from the variable contract, retirement plan or IRA. Distributions from a college savings program generally are not taxed provided that they are used to pay for qualified higher education expenses. More information regarding federal income taxation of Permitted Account owners may be found in the applicable prospectus and/or disclosure documents for that Permitted Account.

9

Payments to Insurers, Broker-Dealers and Other Financial Intermediaries

Each Fund and its related companies may make payments to insurance companies, broker-dealers and other financial intermediaries for the sale of Fund shares and/or other services. These payments may be a factor that an insurance company, broker-dealer or other financial intermediary considers in including a Fund as an investment option in a Permitted Account. These payments also may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson, visit your financial intermediary’s web site, or consult the variable contract prospectus for more information.

Further Information

Additional information concerning the Acquiring Fund and Target Fund is contained in this Information Statement/Prospectus and additional information regarding the Acquiring Fund is contained in the accompanying Acquiring Fund prospectus. The cover page of this Information Statement/Prospectus describes how you may obtain further information.

THE PROPOSED REORGANIZATION

The proposed Reorganization will be governed by the Agreement, a form of which is attached as Appendix A. The Agreement provides that the Target Fund will transfer all of its assets to the Acquiring Fund solely in exchange for the issuance of full and fractional shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. The closing of this reorganization will take place at the close of business on the Closing Date. The following discussion of the Agreement is qualified in its entirety by the full text of the Agreement.

The Target Fund will transfer all of its assets to the Acquiring Fund, and in exchange, the Acquiring Fund will assume all the liabilities of the Target Fund and deliver to the Target Fund a number of full and fractional Investor Class shares of the Acquiring Fund having a net asset value equal to the value of the assets of the Target Fund less the liabilities of the Target Fund assumed by the Acquiring Fund as of the close of regular trading on the New York Stock Exchange on the Closing Date. At the designated time on the Closing Date as set forth in the Agreement, the Target Fund will distribute in complete liquidation and termination of the Target Fund, pro rata to its shareholders of record all Acquiring Fund shares received by the Target Fund. This distribution will be accomplished by the transfer of the Acquiring Fund shares credited to the account of the Target Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the name of the Target Fund shareholders, and representing the respective pro rata number of Acquiring Fund shares due such shareholders. All issued and outstanding shares of the Target Fund will be canceled on the books of the Target Fund. As a result of the proposed Reorganization, each Target Fund Investor Class shareholder will receive a number of Acquiring Fund Investor Class shares equal in net asset value, as of the close of regular trading on the New York Stock Exchange on the Closing Date, to the net asset value of the Target Fund Investor Class shares surrendered by such shareholder as of such time.

The consummation of this reorganization is subject to the terms and conditions set forth in the Agreement and the representations and warranties set forth in the Agreement being true. The Agreement may be terminated by the mutual agreement of the Funds. In addition, either Fund may at its option terminate the Agreement at or before the Closing due if (i) the Closing has not occurred on or before ten months from the date of the Agreement, unless such date is extended by mutual agreement of the parties, or (ii) the other party materially breaches its obligations under the Agreement or makes a material and intentional misrepresentation in the Agreement or in connection with the Agreement.

The Target Fund will, within a reasonable period of time before the Closing Date, furnish the Acquiring Fund with a list of the Target Fund’s portfolio securities and other investments. The Acquiring Fund will, within a reasonable period of time before the Closing Date, furnish the Target Fund with a list of the securities, if any, on the Target Fund’s list referred to above that do not conform to the Acquiring Fund’s investment objective, policies, and restrictions. The Target Fund, if requested by the Acquiring Fund, will dispose of securities on the Acquiring Fund’s list before the Closing Date. In addition, if it is determined that the portfolios of the Target Fund and

10

Acquiring Fund, when aggregated, would contain investments exceeding certain percentage limitations imposed upon the Acquiring Fund with respect to such investments, the Target Fund, if requested by the Acquiring Fund, will dispose of a sufficient amount of such investments as may be necessary to avoid violating such limitations as of the Closing Date. Notwithstanding the foregoing, nothing in the Agreement will require the Target Fund to dispose of any investments or securities if, in the reasonable judgment of the Target Fund Board or the GWCM, such disposition would adversely affect the tax-free nature of this reorganization for federal income tax purposes or would otherwise not be in the best interests of the Target Fund. It is expected that Target Fund shareholders will recognize no gain or loss for federal income tax purposes as a direct result of the reorganization. For a more detailed discussion of the federal income tax consequences of this reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

Description of Securities to be Issued

Shares of Common Stock. The Acquiring Fund offers three classes of shares – Institutional Class, Investor Class and Class L. Only Investor Class shares will be issued in this reorganization. Each share of the Acquiring Fund represents an equal proportionate interest in that Fund with each other share and is entitled to such dividends and distributions out of the income belonging to such Fund as are declared by the Board. Each share class represents interests in the same portfolio of investments. Differing expenses will result in differing net asset values and dividends and distributions. Upon any liquidation of the Acquiring Fund, Investor Class shareholders are entitled to share pro rata in the net assets belonging to the Acquiring Fund allocable to the Investor Class available for distribution after satisfaction of outstanding liabilities of the Acquiring Fund allocable to the Investor Class. Additional classes of shares may be authorized in the future.

Voting Rights of Shareholders. Shareholders of the Acquiring Fund are entitled to one vote for each Fund share owned and fractional votes for fractional shares owned. However, shareholders of any particular class of the Acquiring Fund will vote separately on matters relating solely to such class and not on matters relating solely to any other class(es).

Pursuant to current interpretations of the 1940 Act, insurance companies that invest in the Acquiring Fund will solicit voting instructions from owners of variable contracts that are issued through separate accounts registered under the 1940 Act with respect to any matters that are presented to a vote of shareholders of the Acquiring Fund. Shares attributable to the Acquiring Fund held in variable contracts will be voted by insurance company separate accounts based on instructions received from owners of variable contracts. The number of votes that an owner of a variable contract has the right to cast will be determined by applying his/her percentage interest in the Acquiring Fund (held through a variable contract) to the total number of votes attributable to the Acquiring Fund. In determining the number of votes, fractional shares will be recognized. Shares held in the variable contracts for which the Acquiring Fund does not receive instructions and shares owned by GWCM, which provided initial capital to the Acquiring Fund, will be voted in the same proportion as shares for which the Acquiring Fund has received instructions. As a result of such proportionate voting a small number of variable contracts owners may determine the outcome of the shareholder vote(s).

Continuation of Shareholder Accounts and Plans; Share Certificates

The Acquiring Fund will establish an account for each Target Fund shareholder containing the appropriate number of shares of the appropriate class of the Acquiring Fund. The shareholder services and shareholder programs of the Funds are identical.

Service Providers

The Bank of New York Mellon serves as the custodian for the assets of each Fund. DST Systems, Inc. serves as the Funds’ transfer agent and dividend paying agent. Deloitte & Touche LLP serves as the independent auditors for each Fund.

11

Material Federal Income Tax Consequences

As a condition to each Fund’s obligation to consummate this reorganization, each Fund will receive an opinion from Vedder Price P.C. (which opinion will be based on certain factual representations and certain customary assumptions and exclusions) substantially to the effect that, on the basis of the existing provisions of the Code, current administrative rules and court decisions, for federal income tax purposes:

| | 1. | The transfer by the Target Fund of all its assets to the Acquiring Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund, immediately followed by the pro rata distribution of all the Acquiring Fund shares received by the Target Fund to the Target Fund shareholders in complete liquidation of the Target Fund and the termination of the Target Fund as soon as possible thereafter, will constitute “a reorganization” within the meaning of Section 368(a)(1) of the Code, and the Acquiring Fund and the Target Fund will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code with respect to this reorganization. |

| | 2. | No gain or loss will be recognized by the Acquiring Fund upon the receipt of all the assets of the Target Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. |

| | 3. | No gain or loss will be recognized by the Target Fund upon the transfer of all the Target Fund’s assets to the Acquiring Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund or upon the distribution (whether actual or constructive) of the Acquiring Fund shares so received to the Target Fund shareholders solely in exchange for such shareholders’ shares of the Target Fund in complete liquidation of the Target Fund. |

| | 4. | No gain or loss will be recognized by Target Fund shareholders upon the exchange, pursuant to this reorganization, of all their shares of the Target Fund solely for Acquiring Fund shares. |

| | 5. | The aggregate basis of the Acquiring Fund shares received by each Target Fund shareholder pursuant to this reorganization will be the same as the aggregate basis of the shares of the Target Fund exchanged therefor by such shareholder. |

| | 6. | The holding period of the Acquiring Fund shares received by each Target Fund shareholder in this reorganization will include the period during which the shares of the Target Fund exchanged therefor were held by such shareholder, provided such Target Fund shares are held as capital assets at the effective time of this reorganization. |

| | 7. | The basis of the assets of the Target Fund received by the Acquiring Fund will be the same as the basis of such assets in the hands of the Target Fund immediately before the effective time of this reorganization. |

| | 8. | The holding period of the assets of the Target Fund received by the Acquiring Fund will include the period during which such assets were held by the Target Fund. |

No opinion will be expressed as to (1) the effect of this reorganization on the Target Fund, the Acquiring Fund or any Target Fund shareholder with respect to any asset (including without limitation any stock held in a passive foreign investment company as defined in Section 1297(a) of the Code) as to which any unrealized gain or loss is required to be recognized under federal income tax principles (i) at the end of a taxable year (or on the termination thereof) or (ii) upon the transfer of such asset regardless of whether such transfer would otherwise be a non-taxable transaction under the Code or (2) any other federal tax issues (except those set forth above) and all state, local or foreign tax issues of any kind.

Prior to the closing of this reorganization, the Target Fund will declare a distribution to its shareholders, which together with all previous distributions, will have the effect of distributing to shareholders at least all its net investment income and realized net capital gains (after reduction by any available capital loss carryforwards and excluding any net capital gain on which the Target Fund paid federal income tax), if any, through the Closing Date of this reorganization. This distribution may include net capital gains resulting from the sale of portfolio assets discussed below. Additional distributions may be made if necessary. All dividends and distributions will be reinvested in additional shares of the Target Fund.

To the extent that a portion of the Target Fund’s portfolio assets are sold prior to this reorganization, the federal income tax effect of such sales would depend on the holding periods of such assets and the difference between the price at which such portfolio assets were sold and the Target Fund’s basis in such assets. Any net capital gains (net

12

long-term capital gain in excess of any net short-term capital loss) recognized in these sales, after the application of any available capital loss carryforwards (capital losses from prior taxable years that may be used to offset future capital gains), would be distributed to the Target Fund’s shareholders as capital gain dividends. Any net short-term capital gains (in excess of any net long-term capital loss and after application of any available capital loss carryforwards) would be distributed as ordinary dividends. All such distributions would be made during or with respect to the Target Fund’s taxable year in which the sale occurs.

Investors who hold shares of the Target Fund through a Permitted Account are not expected to be currently taxed for federal income tax purposes on any dividends or distributions made by the Target Fund in connection with this reorganization.

It is estimated that approximately 8% of the Target Fund’s portfolio will be sold prior to or following this reorganization in connection with this portfolio repositioning. It is estimated that such portfolio repositioning would have resulted in realized gains of approximately $5,032,744 (approximately $0.44 per share) and brokerage commissions or other transaction costs of approximately $6,057, based on average commission rates normally paid by the Acquiring Fund, if such sales occurred on December 31, 2016. The sale of such investments could result in distributions to shareholders of the Target Fund prior to this reorganization. Reorganization costs do not include any commissions or other transaction costs that would be incurred due to portfolio repositioning.

Although it is not expected to affect investors who hold shares of the Funds through a Permitted Account, the Acquiring Fund’s ability to use, after this reorganization, the Target Fund’s or the Acquiring Fund’s pre-Reorganization capital losses, if any, may be limited under certain federal income tax rules applicable to reorganizations of this type. The effect of these potential limitations will depend on a number of factors, including the amount of the losses, the amount of gains to be offset, the exact timing of this reorganization and the amount of unrealized capital gains in the Funds at the time of this reorganization.

In addition, shareholders of the Target Fund will receive a proportionate share of any income and gains realized by the Acquiring Fund and not distributed to its shareholders prior to this reorganization when such income and gains are eventually distributed by the Acquiring Fund. As a result, shareholders of the Target Fund may receive a greater amount of distributions than they would have had this reorganization not occurred. Investors who hold shares of the Acquiring Fund through Permitted Accounts are not expected to be subject to current federal income taxation on such distributions.

This description of material federal income tax consequences of this reorganization is made without regard to the particular facts and circumstances of any shareholder. Shareholders are urged to consult their own tax advisors as to the specific consequences to them of this reorganization, including the applicability and effect of state, local, non-U.S. and other tax laws.

Reorganization Expenses

The expenses associated with this reorganization include, but are not limited to, legal and auditing fees, as well as the costs of printing and distributing this Information Statement/Prospectus. GWCM will pay all reorganization expenses.

Estimated Reorganization costs have been allocated as follows: Printing costs are estimated at $33,000, Portfolio transitioning costs are estimated at $4,150, and legal and auditing fees are estimated at $23,250, all of which are also included in the total expense estimate.

Capitalization

The following table sets forth the capitalization of the Target Fund and the Acquiring Fund as of December 31, 2016, and the pro forma capitalization of the combined fund as if this reorganization had occurred on that date. These numbers may differ at the Closing Date.

13

Capitalization Table as of December 31, 2016

| | | | | | | | |

Investor Class | | Target Fund | | Acquiring Fund | | Pro Forma Adjustments | | Pro Forma Combined Fund |

Net Assets | | $277,102,256 | | $1,370,742,930 | | | | $1,647,845,186 |

Shares Outstanding | | 11,395,876 | | 72,003,524 | | 3,159,982 | | 86,559,382 |

Net Asset Value Per Share | | $24.32 | | $19.04 | | | | $19.04 |

Shares Authorized | | 70,000,000 | | 150,000,000 | | | | 150,000,000 |

Legal Matters

Certain legal matters concerning the federal income tax consequences of this reorganization will be passed on by Vedder Price P.C., 222 North LaSalle Street, Chicago, Illinois 60601.

Information Filed with the Securities and Exchange Commission

This Information Statement/Prospectus and the Reorganization SAI do not contain all the information set forth in the registration statements and the exhibits relating thereto and the annual and semi-annual reports, as applicable, which the Funds have filed with the SEC pursuant to the requirements of the Securities Act of 1933, as amended, and the 1940 Act, to which reference is hereby made. The SEC file number for the registration statement containing the current Prospectus and Statement of Additional Information for the Target Fund and Acquiring Fund is Registration No. 2-75503. Such Prospectuses and Statement of Additional Information relating to the Funds are incorporated herein by reference, insofar as they relate to the Funds.

Financial Highlights

The financial highlights of the Acquiring Fund have been derived from financial statements audited by Deloitte & Touche LLP, the Acquiring Fund’s independent registered public accounting firm.

14

GREAT-WEST FUNDS, INC.

GREAT-WEST S&P 500® INDEX FUND

Financial Highlights

Selected data for a share of capital stock of the Fund throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Income (Loss) from Investment Operations: | | | Less Distributions: | | | | | | | |

| | | Net asset value, beginning of year | | Net investment income(a) | | | Net realized and unrealized gain (loss) | | | Total from investment operations | | | From net investment income | | | From net realized gains | | | Total Distributions | | | Net asset value, end of year | | | Total Return (b) | |

Initial Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12/31/2016 | | $17.57 | | | 0.29 | | | | 1.68 | | | | 1.97 | | | | (0.17) | | | | (0.33) | | | | (0.50) | | | | $19.04 | | | | 11.27% | |

12/31/2015 | | $18.03 | | | 0.27 | | | | (0.13) | | | | 0.14 | | | | (0.22) | | | | (0.38) | | | | (0.60) | | | | $17.57 | | | | 0.75% | |

12/31/2014 | | $16.38 | | | 0.24 | | | | 1.89 | | | | 2.13 | | | | (0.27) | | | | (0.21) | | | | (0.48) | | | | $18.03 | | | | 13.00% | |

12/31/2013 | | $12.75 | | | 0.22 | | | | 3.79 | | | | 4.01 | | | | (0.28) | | | | (0.10) | | | | (0.38) | | | | $16.38 | | | | 31.62% | |

12/31/2012 | | $11.34 | | | 0.21 | | | | 1.53 | | | | 1.74 | | | | (0.20) | | | | (0.13) | | | | (0.33) | | | | $12.75 | | | | 15.42% | |

Class L | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12/31/2016 | | $14.13 | | | 0.20 | | | | 1.34 | | | | 1.54 | | | | (0.19) | | | | (0.33) | | | | (0.52) | | | | $15.15 | | | | 10.97% | |

12/31/2015 | | $14.63 | | | 0.19 | | | | (0.11) | | | | 0.08 | | | | (0.22) | | | | (0.36) | | | | (0.58) | | | | $14.13 | | | | 0.50% | |

12/31/2014 | | $13.43 | | | 0.17 | | | | 1.54 | | | | 1.71 | | | | (0.30) | | | | (0.21) | | | | (0.51) | | | | $14.63 | | | | 12.74% | (c) |

12/31/2013 | | $10.55 | | | 0.15 | | | | 3.13 | | | | 3.28 | | | | (0.30) | | | | (0.10) | | | | (0.40) | | | | $13.43 | | | | 31.28% | (c) |

12/31/2012 | | $ 9.52 | | | 0.17 | | | | 1.27 | | | | 1.44 | | | | (0.28) | | | | (0.13) | | | | (0.41) | | | | $10.55 | | | | 15.16% | (c) |

Institutional Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12/31/2016 | | $ 9.35 | | | 0.19 | | | | 0.89 | | | | 1.08 | | | | (0.30) | | | | (0.33) | | | | (0.63) | | | | $ 9.80 | | | | 11.66% | |

12/31/2015(d) | | $10.00 | | | 0.13 | | | | (0.21) | | | | (0.08) | | | | (0.24) | | | | (0.33) | | | | (0.57) | | | | $ 9.35 | | | | (0.77% | )(e) |

| | | | | | | | | | | | | | | | | | | | |

| | | Net assets, end of year (000) | | Ratio of expenses to average net assets (before reimbursement and/or waiver, if applicable) | | Ratio of expenses to average net assets (after reimbursement and/or waiver, if applicable) | | | Ratio of net investment income to average net assets (before reimbursement and/or waiver, if applicable) | | | Ratio of net investment income to average net assets (after reimbursement and/or waiver, if applicable) | | | Portfolio turnover rate(f) | |

Supplemental Data and Ratios | | | | | | | | | | | | | | | | |

Initial Class | | | | | | | | | | | | | | | | |

12/31/2016 | | $1,370,743 | | 0.60% | | | 0.60% | | | | N/A | | | | 1.61% | | | | 7% | |

12/31/2015 | | $1,309,029 | | 0.60% | | | 0.60% | | | | N/A | | | | 1.47% | | | | 10% | |

12/31/2014 | | $2,153,976 | | 0.60% | | | 0.60% | | | | N/A | | | | 1.42% | | | | 5% | |

12/31/2013 | | $1,803,943 | | 0.60% | | | 0.60% | | | | 1.49% | | | | 1.49% | | | | 4% | |

12/31/2012 | | $1,268,188 | | 0.60% | | | 0.60% | | | | 1.70% | | | | 1.70% | | | | 6% | |

Class L | | | | | | | | | | | | | | | | |

12/31/2016 | | $ 215,846 | | 0.85% | | | 0.85% | | | | N/A | | | | 1.35% | | | | 7% | |

12/31/2015 | | $ 91,235 | | 0.85% | | | 0.85% | | | | N/A | | | | 1.27% | | | | 10% | |

12/31/2014 | | $ 39,654 | | 0.85% | | | 0.85% | | | | N/A | | | | 1.19% | | | | 5% | |

12/31/2013 | | $ 11,625 | | 0.85% | | | 0.85% | | | | 1.24% | | | | 1.24% | | | | 4% | |

12/31/2012 | | $ 3,909 | | 0.85% | | | 0.85% | | | | 1.58% | | | | 1.58% | | | | 6% | |

Institutional Class | | | | | | | | | | | | | | | | |

12/31/2016 | | $1,009,653 | | 0.25% | | | 0.25% | | | | N/A | | | | 1.95% | | | | 7% | |

12/31/2015(d) | | $ 873,617 | | 0.25%(g) | | | 0.25%(g) | | | | N/A | | | | 1.97%(g) | | | | 10% | |

| (a) | Per share amounts are based upon average shares outstanding. |

| (b) | Total return does not include any fees or expenses of variable insurance contracts, if applicable. If such fees or expenses were included, returns would be lower. |

| (c) | Total return shown net of distribution fees waived. Without the waiver, the return shown would have been lower. |

| (d) | Institutional Class inception date was May 1, 2015. |

| (e) | Not annualized for periods less than one full year. |

| (f) | Portfolio turnover is calculated at the Fund level. |

See Notes to Financial Statements.

Annual Report - December 31, 2016

15

THE BOARD’S APPROVAL OF THE REORGANIZATION

Based on the considerations described below, the Board determined that this reorganization would be in the best interests of the Target Fund, and that the interests of the Target Fund’s existing shareholders would not be diluted as a result of this reorganization. Additionally, the Board determined that this reorganization would be in the best interests of the Acquiring Fund, and that the interests of the Acquiring Fund’s existing shareholders would not be diluted as a result of this reorganization. As such, the Board has approved this reorganization.

In preparation for the in-person meeting of the Target Fund Board held on February 23, 2017, at which this reorganization was considered, GWCM provided the Board with information for the meeting regarding the proposed reorganization, including the rationale therefor and alternatives considered to this reorganization of the Funds. Prior to approving this reorganization, the independent directors reviewed the foregoing information with their independent legal counsel and with management, reviewed with independent legal counsel applicable law and their duties in considering such matters, and met with independent legal counsel in a private session without management present. In approving this reorganization, the Board considered a number of factors in reaching its determination, including the following:

| | ● | | the compatibility of the Funds’ investment objectives, principal investment strategies, and principal investment risks; |

| | ● | | the relative fees and expense ratios of the Funds; |

| | ● | | the anticipated federal income tax-free nature of this reorganization; |

| | ● | | the expected costs of this reorganization and the fact that the Funds would not bear any of such costs; |

| | ● | | the terms of this reorganization and whether this reorganization would dilute the interests of shareholders of the Funds; |

| | ● | | the effect of this reorganization on shareholder rights; |

| | ● | | alternatives to this reorganization; and |

| | ● | | any potential benefits of this reorganization to GWCM and its affiliates as a result of this reorganization. |

Compatibility of Investment Objectives, Principal Investment Strategies and Related Risks

Based on the information presented, the Board noted that the Funds have substantially similar investment objectives and similar investment strategies and risks. Accordingly, the Board concluded that, to the extent the Target Fund’s principal investment strategies were consistent with those of the Acquiring Fund, its principal risks would also be consistent.

Investment Performance and Portfolio Management

The Board considered the investment performance of the Funds. While the Target Fund and Acquiring Fund have very similar performance, the Target Fund has outperformed the Acquiring Fund for each of the periods set forth below. The Target Fund has performed slightly better due to the additional (8%) allocation to stocks comprising the S&P MidCap 400® Index.

Performance* of Target Fund and Acquiring Fund as of December 31, 2016

| | | | | | | | | | | | |

| Performance Comparison | | Ticker | | Inception Date | | 1 Year

(%) | | 3 Year

(%) | | 5 Year

(%) | | 10 Year

(%) |

| Great-West Stock Index Fund Investor Class | | MXSIX | | 2/25/1982 | | 12.01 | | 8.30 | | 14.08 | | 6.56 |

| Great-West S&P 500® Index Fund Investor Class | | MXVIX | | 9/8/2003 | | 11.27 | | 8.20 | | 13.99 | | 6.30 |

| Comparison | | | | | | -0.75 | | -0.10 | | -0.09 | | -0.26 |

* Showing performance of Investor Class only.

16

Fees and Expense Ratios

The Board considered the fees and expense ratios of the Funds (including estimated expenses of the combined fund following this reorganization) and the impact of expense caps. The Board noted that, effective May 1, 2017, the Acquiring Fund’s expenses are lower than the Target Fund’s expenses. The Board acknowledged that, as of such date, the total expense ratio is 0.20% of the average daily net assets (Institutional Class) for the Acquiring Fund and 0.23% of the average daily net assets (Institutional Class) for the Target Fund.

The Board considered that both the Target Fund and Acquiring Fund are subject to an identical management fee breakpoint schedule. The Board noted that since the Acquiring Fund has surpassed both management fee breakpoints (at $1 billion and $2 billion), it has a lower effective management fee than the Target Fund, which has not passed any of the management fee breakpoints. As a result, the Board concluded that shareholders of the Target Fund will pay a lower total expense upon effectiveness of this reorganization.

Federal Income Tax Consequences of the Reorganization

The Board considered the tax implications of this reorganization. The Board noted that this reorganization will be structured with the intention that it qualify as a tax-free reorganization for federal income tax purposes. The Board recognized that with fund reorganizations, applicable tax laws could impose limits on the amount of capital loss carryforwards that an acquiring fund may use in any one year.

Costs of the Reorganization

The Board considered the projected costs of this reorganization. The Board noted that GWCM will bear all the expenses incurred in connection with this proposed reorganization.

Dilution

The terms of this reorganization are intended to avoid dilution of the interests of the shareholders of the Funds. In this regard, shareholders of the Target Fund will receive the same class of shares in the Acquiring Fund, equal in total value to the total value of the shares of the Target Fund surrendered.

Effect on Shareholder Rights

The Board noted that shareholders of the Target Fund will receive the same class of shares of the Acquiring Fund, which are subject to the same shareholder services fees. The Board also considered that both Funds are a series of Great-West Funds and as such, the rights of Target Fund shareholders are the same as the rights of Acquiring Fund shareholders. The Board also considered that shares of both Funds are entitled to one vote per share held and fractional votes for fractional shares held.

Alternatives to the Reorganization