UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03329

Variable Insurance Products Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | December 31, 2022 |

Item 1.

Reports to Stockholders

Fidelity® Variable Insurance Products:

Equity-Income Portfolio

Annual Report

December 31, 2022

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company's separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

| Average Annual Total Returns |

| | | | |

Periods ended December 31, 2022 | Past 1 year | Past 5 years | Past 10 years |

| Initial Class | -4.96% | 8.16% | 10.19% |

| Service Class | -5.09% | 8.04% | 10.08% |

| Service Class 2 | -5.25% | 7.88% | 9.91% |

| Investor Class | -5.02% | 8.07% | 10.10% |

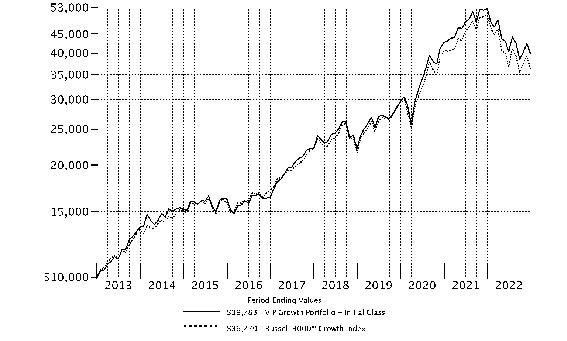

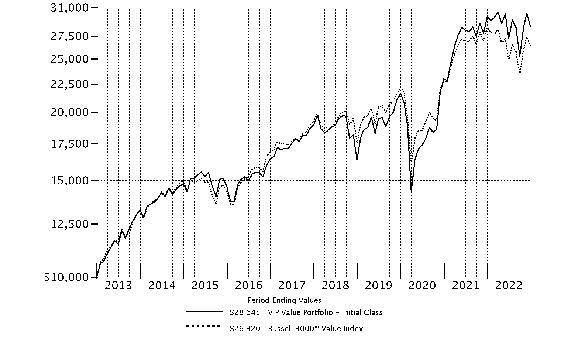

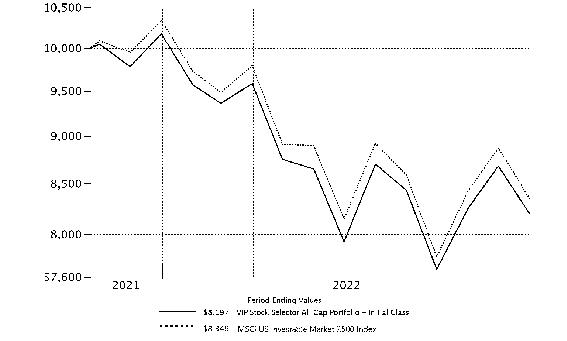

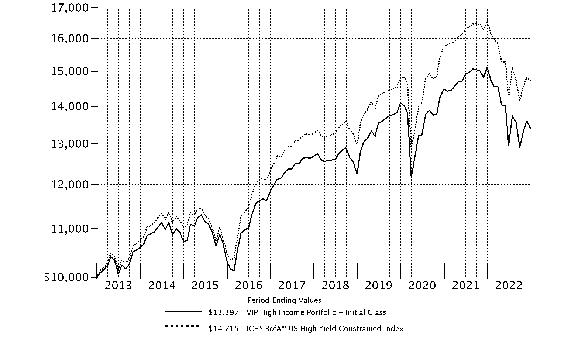

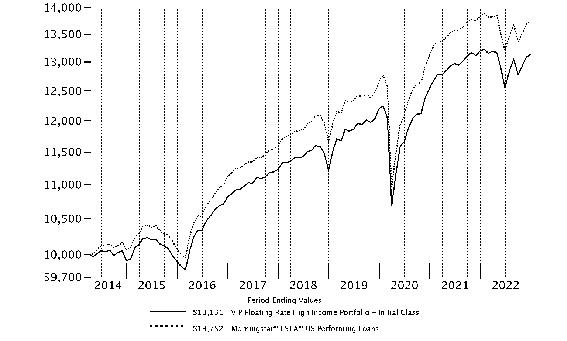

| $10,000 Over 10 Years |

| |

Let's say hypothetically that $10,000 was invested in VIP Equity-Income Portfolio - Initial Class, a class of the fund, on December 31, 2012. The chart shows how the value of your investment would have changed, and also shows how the Russell 3000® Value Index performed over the same period. |

|

|

Market Recap:

U.S. equities returned -18.11% in 2022, according to the S&P 500 ® index, as a multitude of risk factors challenged the global economy. It was the index's lowest calendar-year return since 2008 and first retreat since 2018. High inflation prompted the Federal Reserve to aggressively tighten monetary policy, and market interest rates eclipsed their highest level in a decade, stoking recession fears and sending stocks into bear market territory. Since March, the Fed hiked its benchmark rate seven times, by 4.25 percentage points - the fastest-ever pace of monetary tightening - while also shrinking its massive portfolio. Against this backdrop, the S&P 500 ® posted its worst year-to-date result (-23.87%) in 20 years through September, a seasonally weak month that stayed true to form, with volatility spiking due to growing certainty the Fed would persist in its effort to cool inflation, even at the expense of economic growth. Three of the index's worst monthly returns ever were recorded in 2022, as it shed 8% to 9% in April, June and September. Gains of similar proportion were made in July and October, amid optimism on inflation and policy easing. November (+6%) began with a rate hike of 0.75% and ended on a high note when the Fed signaled its intent to slow its pace of rate rises. For the year, value stocks handily outpaced growth. This headwind was pronounced in the growthier communication services (-40%), consumer discretionary (-37%) and information technology (-28%) sectors. In sharp contrast, energy (+66%) shined.

Comments from Portfolio Manager Ramona Persaud:

For the year, the fund's share classes returned roughly -5%, outperforming the -7.98% result of the benchmark Russell 3000 ® Value Index. The top contributor to performance versus the benchmark were stock picks in health care. Also boosting performance was an underweighting in real estate and an overweighting in energy. The fund's biggest individual relative contributor was an overweighting in Exxon Mobil, which gained about 87% the past year. The company was among our biggest holdings. Also bolstering performance was our outsized stake in Eli Lilly, which gained 34%. Avoiding Meta Platforms, a benchmark component that returned roughly -29%, also helped relative performance. Conversely, the largest detractor from performance versus the benchmark was stock selection in the consumer staples sector, primarily within the food, beverage & tobacco industry. An overweighting in information technology also hindered relative performance. Also hampering the fund's relative performance were stock picks in the financials sector, especially within the diversified financials industry. Not owning Chevron, a benchmark component that gained about 58%, was the largest individual relative detractor. Another notable relative detractor was an out-of-benchmark stake in Taiwan Semiconductor (-37%). Another key detractor was our out-of-benchmark position in Microsoft (-28%). The fund's foreign holdings also detracted overall, in part due to a broadly strong U.S. dollar. Notable changes in positioning include increased exposure to the energy sector and a lower allocation to consumer discretionary.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Top Holdings (% of Fund's net assets) |

| |

| Exxon Mobil Corp. | 3.6 | |

| JPMorgan Chase & Co. | 3.2 | |

| Bank of America Corp. | 2.4 | |

| Johnson & Johnson | 2.3 | |

| Walmart, Inc. | 2.1 | |

| Danaher Corp. | 2.1 | |

| Linde PLC | 1.9 | |

| Bristol-Myers Squibb Co. | 1.8 | |

| Cigna Corp. | 1.7 | |

| Wells Fargo & Co. | 1.6 | |

| | 22.7 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Health Care | 18.5 | |

| Financials | 15.3 | |

| Consumer Staples | 10.2 | |

| Energy | 10.0 | |

| Information Technology | 8.8 | |

| Communication Services | 8.6 | |

| Industrials | 8.5 | |

| Utilities | 6.2 | |

| Materials | 4.7 | |

| Consumer Discretionary | 3.6 | |

| Real Estate | 1.8 | |

| |

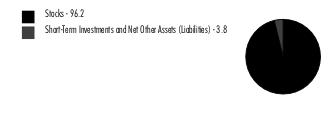

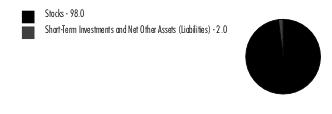

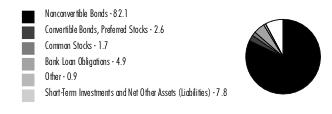

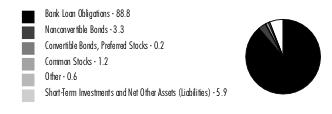

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 16.6% |

|

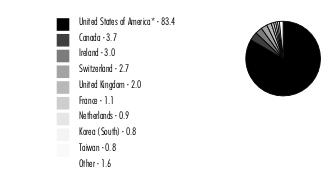

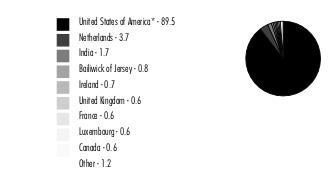

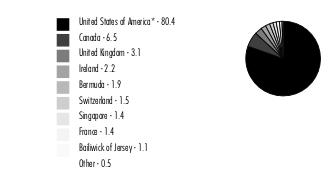

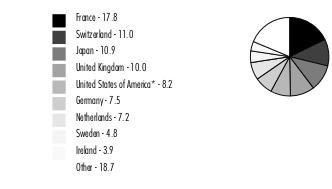

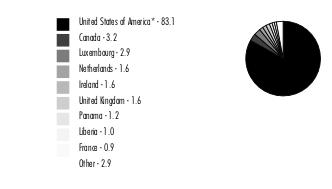

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

| |

Showing Percentage of Net Assets

| Common Stocks - 96.2% |

| | | Shares | Value ($) |

| COMMUNICATION SERVICES - 8.6% | | | |

| Diversified Telecommunication Services - 1.8% | | | |

| AT&T, Inc. | | 2,463,570 | 45,354,324 |

| Verizon Communications, Inc. | | 1,357,860 | 53,499,684 |

| | | | 98,854,008 |

| Entertainment - 1.7% | | | |

| Activision Blizzard, Inc. | | 579,300 | 44,345,415 |

| The Walt Disney Co. (a) | | 612,997 | 53,257,179 |

| | | | 97,602,594 |

| Interactive Media & Services - 0.9% | | | |

| Alphabet, Inc. Class A (a) | | 545,760 | 48,152,405 |

| Media - 2.3% | | | |

| Comcast Corp. Class A | | 2,176,833 | 76,123,850 |

| Interpublic Group of Companies, Inc. | | 623,773 | 20,777,879 |

| Shaw Communications, Inc. Class B | | 1,155,700 | 33,296,792 |

| | | | 130,198,521 |

| Wireless Telecommunication Services - 1.9% | | | |

| Rogers Communications, Inc. Class B (non-vtg.) | | 395,300 | 18,500,857 |

| T-Mobile U.S., Inc. (a) | | 641,318 | 89,784,520 |

| | | | 108,285,377 |

TOTAL COMMUNICATION SERVICES | | | 483,092,905 |

| CONSUMER DISCRETIONARY - 3.6% | | | |

| Diversified Consumer Services - 0.2% | | | |

| H&R Block, Inc. | | 377,000 | 13,764,270 |

| Hotels, Restaurants & Leisure - 1.3% | | | |

| McDonald's Corp. | | 284,780 | 75,048,073 |

| Multiline Retail - 0.7% | | | |

| Dollar Tree, Inc. (a) | | 121,900 | 17,241,536 |

| Target Corp. | | 127,908 | 19,063,408 |

| | | | 36,304,944 |

| Specialty Retail - 1.3% | | | |

| Best Buy Co., Inc. | | 139,600 | 11,197,316 |

| Burlington Stores, Inc. (a) | | 69,478 | 14,087,359 |

| Dick's Sporting Goods, Inc. | | 21,600 | 2,598,264 |

| Lowe's Companies, Inc. | | 11,400 | 2,271,336 |

| TJX Companies, Inc. | | 526,174 | 41,883,450 |

| | | | 72,037,725 |

| Textiles, Apparel & Luxury Goods - 0.1% | | | |

| Columbia Sportswear Co. | | 47,100 | 4,125,018 |

| Tapestry, Inc. | | 82,500 | 3,141,600 |

| | | | 7,266,618 |

TOTAL CONSUMER DISCRETIONARY | | | 204,421,630 |

| CONSUMER STAPLES - 10.2% | | | |

| Beverages - 2.9% | | | |

| Diageo PLC | | 439,200 | 19,224,607 |

| Keurig Dr. Pepper, Inc. | | 1,702,700 | 60,718,282 |

| The Coca-Cola Co. | | 1,339,946 | 85,233,965 |

| | | | 165,176,854 |

| Food & Staples Retailing - 3.3% | | | |

| Albertsons Companies, Inc. | | 631,700 | 13,101,458 |

| Alimentation Couche-Tard, Inc. Class A (multi-vtg.) | | 196,200 | 8,621,787 |

| BJ's Wholesale Club Holdings, Inc. (a) | | 270,205 | 17,876,763 |

| Costco Wholesale Corp. | | 56,600 | 25,837,900 |

| Walmart, Inc. | | 834,445 | 118,315,957 |

| | | | 183,753,865 |

| Food Products - 1.4% | | | |

| Bunge Ltd. | | 168,500 | 16,811,245 |

| Mondelez International, Inc. | | 719,971 | 47,986,067 |

| Nestle SA (Reg. S) | | 92,157 | 10,645,003 |

| | | | 75,442,315 |

| Household Products - 1.5% | | | |

| Procter & Gamble Co. | | 562,844 | 85,304,637 |

| Personal Products - 0.2% | | | |

| Unilever PLC | | 247,400 | 12,490,692 |

| Tobacco - 0.9% | | | |

| Philip Morris International, Inc. | | 488,400 | 49,430,964 |

TOTAL CONSUMER STAPLES | | | 571,599,327 |

| ENERGY - 10.0% | | | |

| Oil, Gas & Consumable Fuels - 10.0% | | | |

| Canadian Natural Resources Ltd. | | 662,100 | 36,767,577 |

| ConocoPhillips Co. | | 629,104 | 74,234,272 |

| Enterprise Products Partners LP | | 1,344,244 | 32,423,165 |

| Exxon Mobil Corp. | | 1,834,766 | 202,374,693 |

| Hess Corp. | | 285,900 | 40,546,338 |

| Imperial Oil Ltd. | | 754,735 | 36,761,280 |

| Phillips 66 Co. | | 465,600 | 48,459,648 |

| Suncor Energy, Inc. | | 1,070,900 | 33,969,834 |

| Valero Energy Corp. | | 432,834 | 54,909,321 |

| | | | 560,446,128 |

| FINANCIALS - 15.3% | | | |

| Banks - 9.8% | | | |

| Bank of America Corp. | | 3,996,209 | 132,354,442 |

| Huntington Bancshares, Inc. | | 2,646,170 | 37,310,997 |

| JPMorgan Chase & Co. | | 1,345,475 | 180,428,198 |

| M&T Bank Corp. | | 356,967 | 51,781,633 |

| PNC Financial Services Group, Inc. | | 353,900 | 55,894,966 |

| Wells Fargo & Co. | | 2,249,901 | 92,898,412 |

| | | | 550,668,648 |

| Capital Markets - 0.8% | | | |

| BlackRock, Inc. Class A | | 61,054 | 43,264,696 |

| Consumer Finance - 0.9% | | | |

| Capital One Financial Corp. | | 540,416 | 50,237,071 |

| Insurance - 3.8% | | | |

| American Financial Group, Inc. | | 256,100 | 35,157,408 |

| Chubb Ltd. | | 311,282 | 68,668,809 |

| Hartford Financial Services Group, Inc. | | 532,600 | 40,387,058 |

| Marsh & McLennan Companies, Inc. | | 105,100 | 17,391,948 |

| The Travelers Companies, Inc. | | 296,540 | 55,598,285 |

| | | | 217,203,508 |

TOTAL FINANCIALS | | | 861,373,923 |

| HEALTH CARE - 18.5% | | | |

| Biotechnology - 2.5% | | | |

| AbbVie, Inc. | | 368,339 | 59,527,266 |

| Amgen, Inc. | | 295,975 | 77,734,874 |

| | | | 137,262,140 |

| Health Care Providers & Services - 3.2% | | | |

| Cigna Corp. | | 284,209 | 94,169,810 |

| UnitedHealth Group, Inc. | | 165,912 | 87,963,224 |

| | | | 182,133,034 |

| Life Sciences Tools & Services - 2.1% | | | |

| Danaher Corp. | | 445,568 | 118,262,659 |

| Pharmaceuticals - 10.7% | | | |

| AstraZeneca PLC (United Kingdom) | | 482,136 | 65,242,345 |

| Bristol-Myers Squibb Co. | | 1,415,237 | 101,826,302 |

| Eli Lilly & Co. | | 250,358 | 91,590,971 |

| Johnson & Johnson | | 725,296 | 128,123,538 |

| Merck & Co., Inc. | | 468,200 | 51,946,790 |

| Roche Holding AG (participation certificate) | | 231,551 | 72,762,020 |

| Royalty Pharma PLC | | 754,100 | 29,802,032 |

| Sanofi SA | | 654,455 | 63,106,861 |

| | | | 604,400,859 |

TOTAL HEALTH CARE | | | 1,042,058,692 |

| INDUSTRIALS - 8.5% | | | |

| Aerospace & Defense - 3.2% | | | |

| Huntington Ingalls Industries, Inc. | | 102,800 | 23,713,904 |

| Lockheed Martin Corp. | | 64,400 | 31,329,956 |

| Northrop Grumman Corp. | | 98,901 | 53,961,375 |

| The Boeing Co. (a) | | 358,800 | 68,347,812 |

| | | | 177,353,047 |

| Air Freight & Logistics - 0.5% | | | |

| United Parcel Service, Inc. Class B | | 172,414 | 29,972,450 |

| Building Products - 0.5% | | | |

| Johnson Controls International PLC | | 472,200 | 30,220,800 |

| Electrical Equipment - 0.8% | | | |

| AMETEK, Inc. | | 305,552 | 42,691,725 |

| Industrial Conglomerates - 1.7% | | | |

| General Electric Co. | | 785,220 | 65,793,584 |

| Hitachi Ltd. | | 269,900 | 13,580,364 |

| Siemens AG | | 122,329 | 16,863,215 |

| | | | 96,237,163 |

| Machinery - 1.3% | | | |

| Crane Holdings Co. | | 186,400 | 18,723,880 |

| Fortive Corp. | | 359,116 | 23,073,203 |

| ITT, Inc. | | 372,852 | 30,238,297 |

| | | | 72,035,380 |

| Professional Services - 0.2% | | | |

| KBR, Inc. | | 234,000 | 12,355,200 |

| Trading Companies & Distributors - 0.3% | | | |

| Watsco, Inc. (b) | | 66,758 | 16,649,445 |

TOTAL INDUSTRIALS | | | 477,515,210 |

| INFORMATION TECHNOLOGY - 8.8% | | | |

| Communications Equipment - 1.4% | | | |

| Cisco Systems, Inc. | | 1,662,054 | 79,180,253 |

| IT Services - 1.5% | | | |

| Accenture PLC Class A | | 94,800 | 25,296,432 |

| Amdocs Ltd. | | 454,733 | 41,335,230 |

| Paychex, Inc. | | 45,400 | 5,246,424 |

| Visa, Inc. Class A | | 64,242 | 13,346,918 |

| | | | 85,225,004 |

| Semiconductors & Semiconductor Equipment - 1.8% | | | |

| NXP Semiconductors NV | | 329,500 | 52,070,885 |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | | 633,291 | 47,173,847 |

| | | | 99,244,732 |

| Software - 3.0% | | | |

| Gen Digital, Inc. | | 661,800 | 14,182,374 |

| Microsoft Corp. | | 273,250 | 65,530,815 |

| Open Text Corp. | | 1,026,600 | 30,418,901 |

| Roper Technologies, Inc. | | 134,894 | 58,286,348 |

| | | | 168,418,438 |

| Technology Hardware, Storage & Peripherals - 1.1% | | | |

| Apple, Inc. | | 87,429 | 11,359,650 |

| Samsung Electronics Co. Ltd. | | 1,082,546 | 47,545,891 |

| Seagate Technology Holdings PLC | | 96,000 | 5,050,560 |

| | | | 63,956,101 |

TOTAL INFORMATION TECHNOLOGY | | | 496,024,528 |

| MATERIALS - 4.7% | | | |

| Chemicals - 2.1% | | | |

| Linde PLC | | 321,489 | 104,863,282 |

| Nutrien Ltd. | | 174,600 | 12,746,832 |

| | | | 117,610,114 |

| Containers & Packaging - 1.3% | | | |

| Ball Corp. | | 476,900 | 24,388,666 |

| Crown Holdings, Inc. | | 576,259 | 47,374,252 |

| | | | 71,762,918 |

| Metals & Mining - 1.3% | | | |

| Anglo American PLC (United Kingdom) | | 486,300 | 19,043,454 |

| Freeport-McMoRan, Inc. | | 1,477,100 | 56,129,800 |

| | | | 75,173,254 |

TOTAL MATERIALS | | | 264,546,286 |

| REAL ESTATE - 1.8% | | | |

| Equity Real Estate Investment Trusts (REITs) - 1.8% | | | |

| American Tower Corp. | | 175,973 | 37,281,640 |

| Lamar Advertising Co. Class A | | 372,108 | 35,126,995 |

| Public Storage | | 111,096 | 31,127,988 |

| | | | 103,536,623 |

| UTILITIES - 6.2% | | | |

| Electric Utilities - 3.6% | | | |

| Constellation Energy Corp. | | 201,349 | 17,358,297 |

| Exelon Corp. | | 758,549 | 32,792,073 |

| FirstEnergy Corp. | | 487,100 | 20,428,974 |

| NextEra Energy, Inc. | | 1,012,616 | 84,654,698 |

| PG&E Corp. (a) | | 1,081,900 | 17,591,694 |

| Southern Co. | | 443,200 | 31,648,912 |

| | | | 204,474,648 |

| Independent Power and Renewable Electricity Producers - 0.3% | | | |

| Vistra Corp. | | 765,701 | 17,764,263 |

| Multi-Utilities - 2.3% | | | |

| Ameren Corp. | | 325,858 | 28,975,293 |

| CenterPoint Energy, Inc. | | 1,024,168 | 30,714,798 |

| Dominion Energy, Inc. | | 617,900 | 37,889,628 |

| WEC Energy Group, Inc. | | 316,025 | 29,630,504 |

| | | | 127,210,223 |

TOTAL UTILITIES | | | 349,449,134 |

| TOTAL COMMON STOCKS (Cost $3,736,381,206) | | | 5,414,064,386 |

| | | | |

| Money Market Funds - 3.8% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 4.37% (c) | | 210,245,495 | 210,287,544 |

| Fidelity Securities Lending Cash Central Fund 4.37% (c)(d) | | 5,257,574 | 5,258,100 |

| TOTAL MONEY MARKET FUNDS (Cost $215,545,644) | | | 215,545,644 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $3,951,926,850) | 5,629,610,030 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (1,032,427) |

| NET ASSETS - 100.0% | 5,628,577,603 |

| | |

Legend

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.37% | 37,073,593 | 815,254,441 | 642,040,490 | 4,246,783 | 1,002 | (1,002) | 210,287,544 | 0.5% |

| Fidelity Securities Lending Cash Central Fund 4.37% | 28,726,908 | 732,465,197 | 755,934,005 | 111,655 | - | - | 5,258,100 | 0.0% |

| Total | 65,800,501 | 1,547,719,638 | 1,397,974,495 | 4,358,438 | 1,002 | (1,002) | 215,545,644 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equities: | | | | |

Communication Services | 483,092,905 | 483,092,905 | - | - |

Consumer Discretionary | 204,421,630 | 204,421,630 | - | - |

Consumer Staples | 571,599,327 | 529,239,025 | 42,360,302 | - |

Energy | 560,446,128 | 560,446,128 | - | - |

Financials | 861,373,923 | 861,373,923 | - | - |

Health Care | 1,042,058,692 | 840,947,466 | 201,111,226 | - |

Industrials | 477,515,210 | 447,071,631 | 30,443,579 | - |

Information Technology | 496,024,528 | 496,024,528 | - | - |

Materials | 264,546,286 | 245,502,832 | 19,043,454 | - |

Real Estate | 103,536,623 | 103,536,623 | - | - |

Utilities | 349,449,134 | 349,449,134 | - | - |

|

| Money Market Funds | 215,545,644 | 215,545,644 | - | - |

| Total Investments in Securities: | 5,629,610,030 | 5,336,651,469 | 292,958,561 | - |

| Statement of Assets and Liabilities |

| | | | December 31, 2022 |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $5,087,760) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $3,736,381,206) | | $5,414,064,386 | | |

Fidelity Central Funds (cost $215,545,644) | | 215,545,644 | | |

| | | | | |

| Total Investment in Securities (cost $3,951,926,850) | | | $ | 5,629,610,030 |

| Foreign currency held at value (cost $9) | | | | 10 |

| Receivable for fund shares sold | | | | 1,390,675 |

| Dividends receivable | | | | 11,647,122 |

| Distributions receivable from Fidelity Central Funds | | | | 772,433 |

| Prepaid expenses | | | | 6,435 |

| Other receivables | | | | 20,088 |

Total assets | | | | 5,643,446,793 |

| Liabilities | | | | |

| Payable for fund shares redeemed | | $6,721,373 | | |

| Accrued management fee | | 2,016,393 | | |

| Distribution and service plan fees payable | | 340,468 | | |

| Other affiliated payables | | 417,273 | | |

| Other payables and accrued expenses | | 115,583 | | |

| Collateral on securities loaned | | 5,258,100 | | |

| Total Liabilities | | | | 14,869,190 |

| Net Assets | | | $ | 5,628,577,603 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 3,967,344,534 |

| Total accumulated earnings (loss) | | | | 1,661,233,069 |

| Net Assets | | | $ | 5,628,577,603 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Initial Class : | | | | |

Net Asset Value , offering price and redemption price per share ($3,235,039,729 ÷ 137,324,073 shares) | | | $ | 23.56 |

| Service Class : | | | | |

Net Asset Value , offering price and redemption price per share ($286,804,858 ÷ 12,266,298 shares) | | | $ | 23.38 |

| Service Class 2 : | | | | |

Net Asset Value , offering price and redemption price per share ($1,509,526,521 ÷ 66,456,236 shares) | | | $ | 22.71 |

| Investor Class : | | | | |

Net Asset Value , offering price and redemption price per share ($597,206,495 ÷ 25,547,912 shares) | | | $ | 23.38 |

| Statement of Operations |

| | | | Year ended December 31, 2022 |

| Investment Income | | | | |

| Dividends | | | $ | 137,337,905 |

| Income from Fidelity Central Funds (including $111,655 from security lending) | | | | 4,358,438 |

| Total Income | | | | 141,696,343 |

| Expenses | | | | |

| Management fee | $ | 24,750,498 | | |

| Transfer agent fees | | 4,077,080 | | |

| Distribution and service plan fees | | 4,120,061 | | |

| Accounting fees | | 1,042,495 | | |

| Custodian fees and expenses | | 78,723 | | |

| Independent trustees' fees and expenses | | 20,027 | | |

| Audit | | 86,802 | | |

| Legal | | 7,480 | | |

| Interest | | 692 | | |

| Miscellaneous | | 26,171 | | |

| Total expenses before reductions | | 34,210,029 | | |

| Expense reductions | | (192,841) | | |

| Total expenses after reductions | | | | 34,017,188 |

| Net Investment income (loss) | | | | 107,679,155 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 189,457,656 | | |

| Fidelity Central Funds | | 1,002 | | |

| Foreign currency transactions | | (333,956) | | |

| Total net realized gain (loss) | | | | 189,124,702 |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (623,187,236) | | |

| Fidelity Central Funds | | (1,002) | | |

| Assets and liabilities in foreign currencies | | (68,834) | | |

| Total change in net unrealized appreciation (depreciation) | | | | (623,257,072) |

| Net gain (loss) | | | | (434,132,370) |

| Net increase (decrease) in net assets resulting from operations | | | $ | (326,453,215) |

| Statement of Changes in Net Assets |

| |

| | Year ended December 31, 2022 | | Year ended December 31, 2021 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 107,679,155 | $ | 94,277,467 |

| Net realized gain (loss) | | 189,124,702 | | 547,074,338 |

| Change in net unrealized appreciation (depreciation) | | (623,257,072) | | 685,924,155 |

| Net increase (decrease) in net assets resulting from operations | | (326,453,215) | | 1,327,275,960 |

| Distributions to shareholders | | (298,100,306) | | (789,899,370) |

| Share transactions - net increase (decrease) | | (127,565,741) | | 345,216,711 |

| Total increase (decrease) in net assets | | (752,119,262) | | 882,593,301 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 6,380,696,865 | | 5,498,103,564 |

| End of period | $ | 5,628,577,603 | $ | 6,380,696,865 |

| | | | | |

| | | | | |

Financial Highlights

| VIP Equity-Income Portfolio Initial Class |

| |

| Years ended December 31, | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 26.15 | $ | 23.90 | $ | 23.77 | $ | 20.37 | $ | 23.89 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .48 | | .43 | | .39 | | .46 | | .58 |

| Net realized and unrealized gain (loss) | | (1.76) | | 5.29 | | 1.12 | | 4.84 | | (2.50) |

| Total from investment operations | | (1.28) | | 5.72 | | 1.51 | | 5.30 | | (1.92) |

| Distributions from net investment income | | (.47) C | | (.51) | | (.39) | | (.45) | | (.52) |

| Distributions from net realized gain | | (.84) C | | (2.95) | | (.99) | | (1.45) | | (1.07) |

| Total distributions | | (1.31) | | (3.47) D | | (1.38) | | (1.90) | | (1.60) D |

| Net asset value, end of period | $ | 23.56 | $ | 26.15 | $ | 23.90 | $ | 23.77 | $ | 20.37 |

Total Return E,F | | (4.96)% | | 24.89% | | 6.69% | | 27.44% | | (8.29)% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | |

| Expenses before reductions | | .51% | | .51% | | .53% | | .53% | | .53% |

| Expenses net of fee waivers, if any | | .51% | | .51% | | .53% | | .53% | | .53% |

| Expenses net of all reductions | | .51% | | .51% | | .52% | | .52% | | .52% |

| Net investment income (loss) | | 1.94% | | 1.63% | | 1.87% | | 2.11% | | 2.53% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 3,235,040 | $ | 3,766,480 | $ | 3,185,391 | $ | 3,202,982 | $ | 2,804,988 |

Portfolio turnover rate I | | 20% | | 27% | | 57% | | 32% | | 39% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

D Total distributions per share do not sum due to rounding.

E Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| VIP Equity-Income Portfolio Service Class |

| |

| Years ended December 31, | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 25.97 | $ | 23.74 | $ | 23.63 | $ | 20.26 | $ | 23.77 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .45 | | .40 | | .37 | | .44 | | .55 |

| Net realized and unrealized gain (loss) | | (1.75) | | 5.26 | | 1.10 | | 4.81 | | (2.49) |

| Total from investment operations | | (1.30) | | 5.66 | | 1.47 | | 5.25 | | (1.94) |

| Distributions from net investment income | | (.45) C | | (.48) | | (.37) | | (.43) | | (.50) |

| Distributions from net realized gain | | (.84) C | | (2.95) | | (.99) | | (1.45) | | (1.07) |

| Total distributions | | (1.29) | | (3.43) | | (1.36) | | (1.88) | | (1.57) |

| Net asset value, end of period | $ | 23.38 | $ | 25.97 | $ | 23.74 | $ | 23.63 | $ | 20.26 |

Total Return D,E | | (5.09)% | | 24.83% | | 6.55% | | 27.32% | | (8.40)% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | |

| Expenses before reductions | | .61% | | .61% | | .63% | | .63% | | .63% |

| Expenses net of fee waivers, if any | | .61% | | .61% | | .63% | | .63% | | .63% |

| Expenses net of all reductions | | .61% | | .61% | | .62% | | .62% | | .62% |

| Net investment income (loss) | | 1.84% | | 1.53% | | 1.77% | | 2.01% | | 2.43% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 286,805 | $ | 326,787 | $ | 284,767 | $ | 299,079 | $ | 264,055 |

Portfolio turnover rate H | | 20% | | 27% | | 57% | | 32% | | 39% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

D Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| VIP Equity-Income Portfolio Service Class 2 |

| |

| Years ended December 31, | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 25.27 | $ | 23.18 | $ | 23.10 | $ | 19.85 | $ | 23.32 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .40 | | .35 | | .33 | | .40 | | .51 |

| Net realized and unrealized gain (loss) | | (1.71) | | 5.13 | | 1.09 | | 4.70 | | (2.44) |

| Total from investment operations | | (1.31) | | 5.48 | | 1.42 | | 5.10 | | (1.93) |

| Distributions from net investment income | | (.41) C | | (.44) | | (.34) | | (.40) | | (.47) |

| Distributions from net realized gain | | (.84) C | | (2.95) | | (.99) | | (1.45) | | (1.07) |

| Total distributions | | (1.25) | | (3.39) | | (1.34) D | | (1.85) | | (1.54) |

| Net asset value, end of period | $ | 22.71 | $ | 25.27 | $ | 23.18 | $ | 23.10 | $ | 19.85 |

Total Return E,F | | (5.25)% | | 24.60% | | 6.44% | | 27.11% | | (8.54)% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | |

| Expenses before reductions | | .76% | | .76% | | .78% | | .78% | | .78% |

| Expenses net of fee waivers, if any | | .76% | | .76% | | .78% | | .78% | | .78% |

| Expenses net of all reductions | | .76% | | .76% | | .77% | | .77% | | .77% |

| Net investment income (loss) | | 1.69% | | 1.38% | | 1.62% | | 1.86% | | 2.28% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 1,509,527 | $ | 1,659,719 | $ | 1,563,662 | $ | 1,431,212 | $ | 1,200,026 |

Portfolio turnover rate I | | 20% | | 27% | | 57% | | 32% | | 39% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

D Total distributions per share do not sum due to rounding.

E Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| VIP Equity-Income Portfolio Investor Class |

| |

| Years ended December 31, | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 25.96 | $ | 23.74 | $ | 23.63 | $ | 20.26 | $ | 23.77 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .45 | | .41 | | .38 | | .44 | | .55 |

| Net realized and unrealized gain (loss) | | (1.74) | | 5.26 | | 1.10 | | 4.81 | | (2.48) |

| Total from investment operations | | (1.29) | | 5.67 | | 1.48 | | 5.25 | | (1.93) |

| Distributions from net investment income | | (.45) C | | (.49) | | (.38) | | (.44) | | (.51) |

| Distributions from net realized gain | | (.84) C | | (2.95) | | (.99) | | (1.45) | | (1.07) |

| Total distributions | | (1.29) | | (3.45) D | | (1.37) | | (1.88) D | | (1.58) |

| Net asset value, end of period | $ | 23.38 | $ | 25.96 | $ | 23.74 | $ | 23.63 | $ | 20.26 |

Total Return E,F | | (5.02)% | | 24.83% | | 6.57% | | 27.35% | | (8.37)% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | |

| Expenses before reductions | | .59% | | .59% | | .60% | | .61% | | .61% |

| Expenses net of fee waivers, if any | | .58% | | .58% | | .60% | | .61% | | .61% |

| Expenses net of all reductions | | .58% | | .58% | | .60% | | .60% | | .60% |

| Net investment income (loss) | | 1.86% | | 1.55% | | 1.80% | | 2.03% | | 2.45% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 597,206 | $ | 627,711 | $ | 464,283 | $ | 449,909 | $ | 382,041 |

Portfolio turnover rate I | | 20% | | 27% | | 57% | | 32% | | 39% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C The amount shown reflects reclassifications related to book to tax differences that were made in the year shown.

D Total distributions per share do not sum due to rounding.

E Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

For the period ended December 31, 2022

1. Organization.

VIP Equity-Income Portfolio (the Fund) is a fund of Variable Insurance Products Fund (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares, Service Class shares, Service Class 2 shares and Investor Class shares. All classes have equal rights and voting privileges, except for matters affecting a single class.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies . The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of ADRs, futures contracts, ETFs and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of December 31, 2022 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. Certain Funds may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received, and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of a fund include an amount in addition to trade execution, which may be rebated back to a fund. Any such rebates are included in net realized gain (loss) on investments in the Statement of Operations. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Funds may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any withholding tax reclaims income is included in the Statement of Operations in dividends. Any receivables for withholding tax reclaims are included in the Statement of Assets and Liabilities in dividends receivable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of a fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of a fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred, as applicable. Certain expense reductions may also differ by class, if applicable. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) for certain Funds, certain independent Trustees have elected to defer receipt of a portion of their annual compensation. Deferred amounts are invested in affiliated mutual funds, are marked-to-market and remain in a fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees presented below are included in the accompanying Statement of Assets and Liabilities in other receivables and other payables and accrued expenses, as applicable.

| VIP Equity-Income Portfolio | $20,088 |

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of December 31, 2022, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences resulted in distribution reclassifications.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, partnerships and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $1,823,145,114 |

| Gross unrealized depreciation | (150,243,975) |

| Net unrealized appreciation (depreciation) | $1,672,901,139 |

| Tax Cost | $3,956,708,891 |

The tax-based components of distributable earnings as of period end were as follows:

| Net unrealized appreciation (depreciation) on securities and other investments | $1,661,664,297 |

The tax character of distributions paid was as follows:

| | December 31, 2022 | December 31, 2021 |

| Ordinary Income | $107,347,297 | $257,289,641 |

| Long-term Capital Gains | 190,753,009 | 532,609,729 |

| Total | $298,100,306 | $789,899,370 |

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, as applicable, are noted in the table below.

| | Purchases ($) | Sales ($) |

| VIP Equity-Income Portfolio | 1,124,313,523 | 1,623,457,709 |

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .20% of the Fund's average net assets and an annualized group fee rate that averaged .23% during the period. The group fee rate is based upon the monthly average net assets of a group of registered investment companies with which the investment adviser has management contracts. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .43% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate 12b-1 Plans for each Service Class of shares. Each Service Class pays Fidelity Distributors Company LLC (FDC), an affiliate of the investment adviser, a service fee. For the period, the service fee is based on an annual rate of .10% of Service Class' average net assets and .25% of Service Class 2's average net assets.

For the period, total fees, all of which were re-allowed to insurance companies for the distribution of shares and providing shareholder support services, were as follows:

| Service Class | $296,999 |

| Service Class 2 | 3,823,062 |

| | $4,120,061 |

Transfer Agent Fees. Fidelity Investments Institutional Operations Company LLC (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing, and shareholder servicing agent. FIIOC receives an asset-based fee with respect to each class. Each class pays a fee for transfer agent services, typesetting and printing and mailing of shareholder reports, excluding mailing of proxy statements. For the period, transfer agent fees for each class were as follows:

| | Amount | % of Class-Level Average Net Assets |

| Initial Class | $2,108,166 | .06 |

| Service Class | 185,478 | .06 |

| Service Class 2 | 955,130 | .06 |

| Investor Class | 828,306 | .14 |

| | $4,077,080 | |

Accounting Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. For the period, the fees were equivalent to the following annual rates:

| | % of Average Net Assets |

| VIP Equity-Income Portfolio | .02 |

Brokerage Commissions. A portion of portfolio transactions were placed with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were as follows:

| | Amount |

| VIP Equity-Income Portfolio | $23,274 |

Interfund Lending Program. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the Fund, along with other registered investment companies having management contracts with Fidelity Management & Research Company LLC (FMR), or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. Activity in this program during the period for which loans were outstanding was as follows:

| | Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense |

| VIP Equity-Income Portfolio | Borrower | $7,908,800 | .32% | $692 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. Interfund trades during the period are noted in the table below.

| | Purchases ($) | Sales ($) | Realized Gain (Loss) ($) |

| VIP Equity-Income Portfolio | 48,272,569 | 241,235,515 | 19,101,086 |

6. Committed Line of Credit.

Certain Funds participate with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The participating funds have agreed to pay commitment fees on their pro-rata portion of the line of credit, which are reflected in Miscellaneous expenses on the Statement of Operations, and are listed below. During the period, there were no borrowings on this line of credit.

| | Amount |

| VIP Equity-Income Portfolio | $10,138 |

7. Security Lending.

Funds lend portfolio securities from time to time in order to earn additional income. Lending agents are used, including National Financial Services (NFS), an affiliate of the investment adviser. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of a fund's daily lending revenue, for its services as lending agent. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. A fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Affiliated security lending activity, if any, was as follows:

| | Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End |

| VIP Equity-Income Portfolio | $11,866 | $- | $- |

8. Expense Reductions.

Through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, custodian credits reduced the Fund's expenses by $1,232.

In addition, during the period the investment adviser or an affiliate reimbursed and/or waived a portion of fund-level operating expenses in the amount of $191,609.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Year ended December 31, 2022 | Year ended December 31, 2021 |

| VIP Equity-Income Portfolio | | |

| Distributions to shareholders | | |

| Initial Class | $172,087,787 | $463,404,060 |

| Service Class | 15,094,456 | 40,340,660 |

| Service Class 2 | 79,440,158 | 210,857,612 |

| Investor Class | 31,477,905 | 75,297,038 |

Total | $298,100,306 | $789,899,370 |

10. Share Transactions.

Transactions for each class of shares were as follows and may contain in-kind transactions:

| | Shares | Shares | Dollars | Dollars |

| | Year ended December 31, 2022 | Year ended December 31, 2021 | Year ended December 31, 2022 | Year ended December 31, 2021 |

| VIP Equity-Income Portfolio | | | | |

| Initial Class | | | | |

| Shares sold | 8,687,731 | 8,955,693 | $215,605,540 | $237,708,161 |

| Reinvestment of distributions | 7,190,967 | 18,115,164 | 172,087,787 | 463,404,059 |

| Shares redeemed | (22,577,302) | (16,345,548) | (556,735,404) | (432,790,636) |

| Net increase (decrease) | (6,698,604) | 10,725,309 | $(169,042,077) | $268,321,584 |

| Service Class | | | | |

| Shares sold | 874,027 | 461,352 | $21,820,943 | $12,148,893 |

| Reinvestment of distributions | 635,539 | 1,588,165 | 15,094,456 | 40,340,660 |

| Shares redeemed | (1,828,012) | (1,458,054) | (44,876,939) | (38,445,404) |

| Net increase (decrease) | (318,446) | 591,463 | $(7,961,540) | $14,044,149 |

| Service Class 2 | | | | |

| Shares sold | 8,220,770 | 5,231,653 | $194,576,846 | $134,560,733 |

| Reinvestment of distributions | 3,441,999 | 8,533,721 | 79,440,158 | 210,857,612 |

| Shares redeemed | (10,894,425) | (15,544,137) | (259,133,632) | (400,531,327) |

| Net increase (decrease) | 768,344 | (1,778,763) | $14,883,372 | $(55,112,982) |

| Investor Class | | | | |

| Shares sold | 3,283,706 | 3,641,902 | $81,421,149 | $94,416,901 |

| Reinvestment of distributions | 1,325,531 | 2,958,477 | 31,477,905 | 75,297,038 |

| Shares redeemed | (3,240,005) | (1,975,712) | (78,344,550) | (51,749,979) |

| Net increase (decrease) | 1,369,232 | 4,624,667 | $34,554,504 | $117,963,960 |

11. Other.

A fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may also enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

At the end of the period, the investment adviser or its affiliates were owners of record of more than 10% and certain otherwise unaffiliated shareholders each were owners of record of more than 10% of the outstanding shares as follows:

| Fund | Affiliated % | Number of Unaffiliated Shareholders | Unaffiliated Shareholders % |

| VIP Equity-Income Portfolio | 17% | 2 | 29% |

12. Risk and Uncertainties.

Many factors affect a fund's performance. Developments that disrupt global economies and financial markets, such as pandemics, epidemics, outbreaks of infectious diseases, war, terrorism, and environmental disasters, may significantly affect a fund's investment performance. The effects of these developments to a fund will be impacted by the types of securities in which a fund invests, the financial condition, industry, economic sector, and geographic location of an issuer, and a fund's level of investment in the securities of that issuer.

To the Board of Trustees of Variable Insurance Products Fund and Shareholders of VIP Equity-Income Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of VIP Equity-Income Portfolio (one of the funds constituting Variable Insurance Products Fund, referred to hereafter as the "Fund") as of December 31, 2022, the related statement of operations for the year ended December 31, 2022, the statement of changes in net assets for each of the two years in the period ended December 31, 2022, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2022 (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2022 and the financial highlights for each of the five years in the period ended December 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022 by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

February 10, 2023

We have served as the auditor of one or more investment companies in the Fidelity group of funds since 1932.

The Trustees, Members of the Advisory Board (if any), and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Except for Jonathan Chiel, each of the Trustees oversees 318 funds. Mr. Chiel oversees 186 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund is referred to herein as an Independent Trustee. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. Officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-877-208-0098.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Board Structure and Oversight Function. Robert A. Lawrence is an interested person and currently serves as Chair. The Trustees have determined that an interested Chair is appropriate and benefits shareholders because an interested Chair has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chair, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chair and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. David M. Thomas serves as Lead Independent Trustee and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.