UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03329

Variable Insurance Products Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | December 31, 2020 |

Item 1.

Reports to Stockholders

Fidelity® Variable Insurance Products:

High Income Portfolio

Annual Report

December 31, 2020

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. Performance numbers are net of all underlying fund operating expenses, but do not include any insurance charges imposed by your insurance company’s separate account. If performance information included the effect of these additional charges, the total returns would have been lower. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended December 31, 2020 | Past 1 year | Past 5 years | Past 10 years |

| Initial Class | 2.75% | 6.99% | 5.58% |

| Service Class | 2.65% | 6.85% | 5.46% |

| Service Class 2 | 2.42% | 6.70% | 5.30% |

| Investor Class | 2.74% | 6.92% | 5.51% |

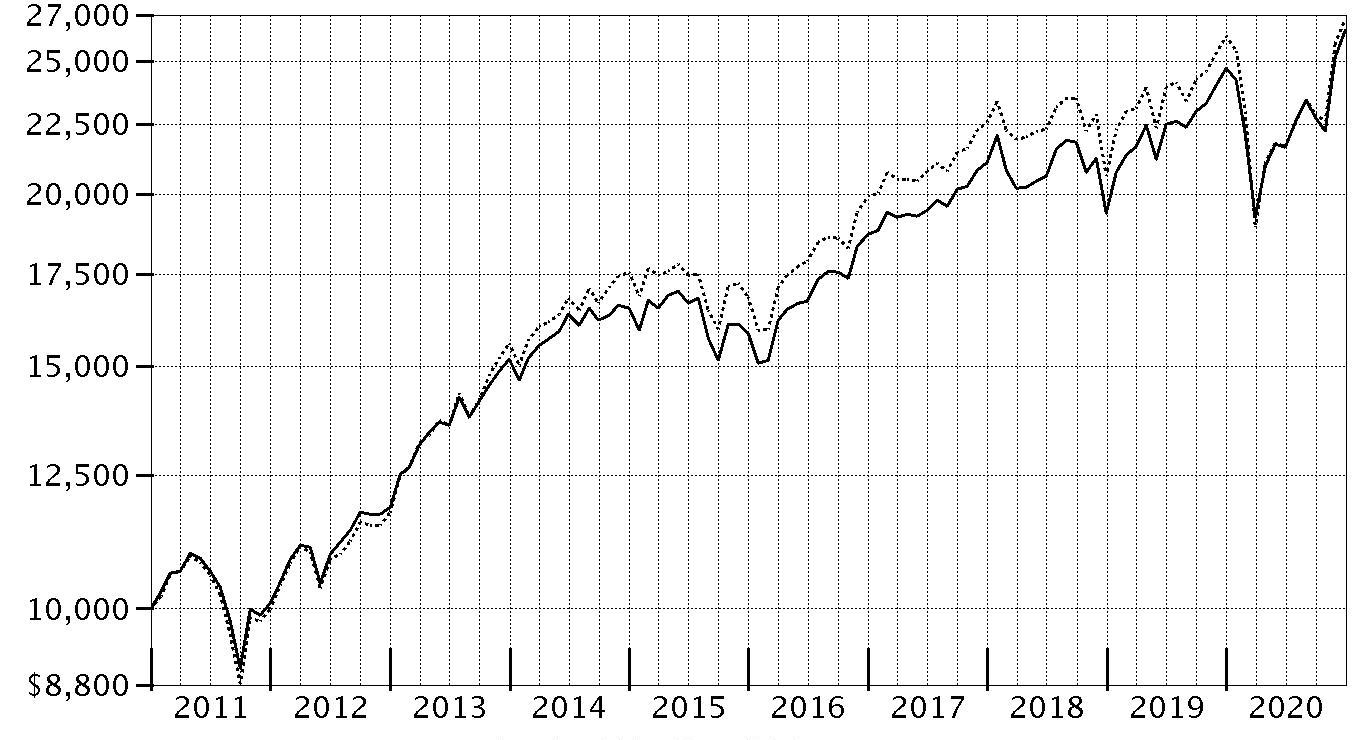

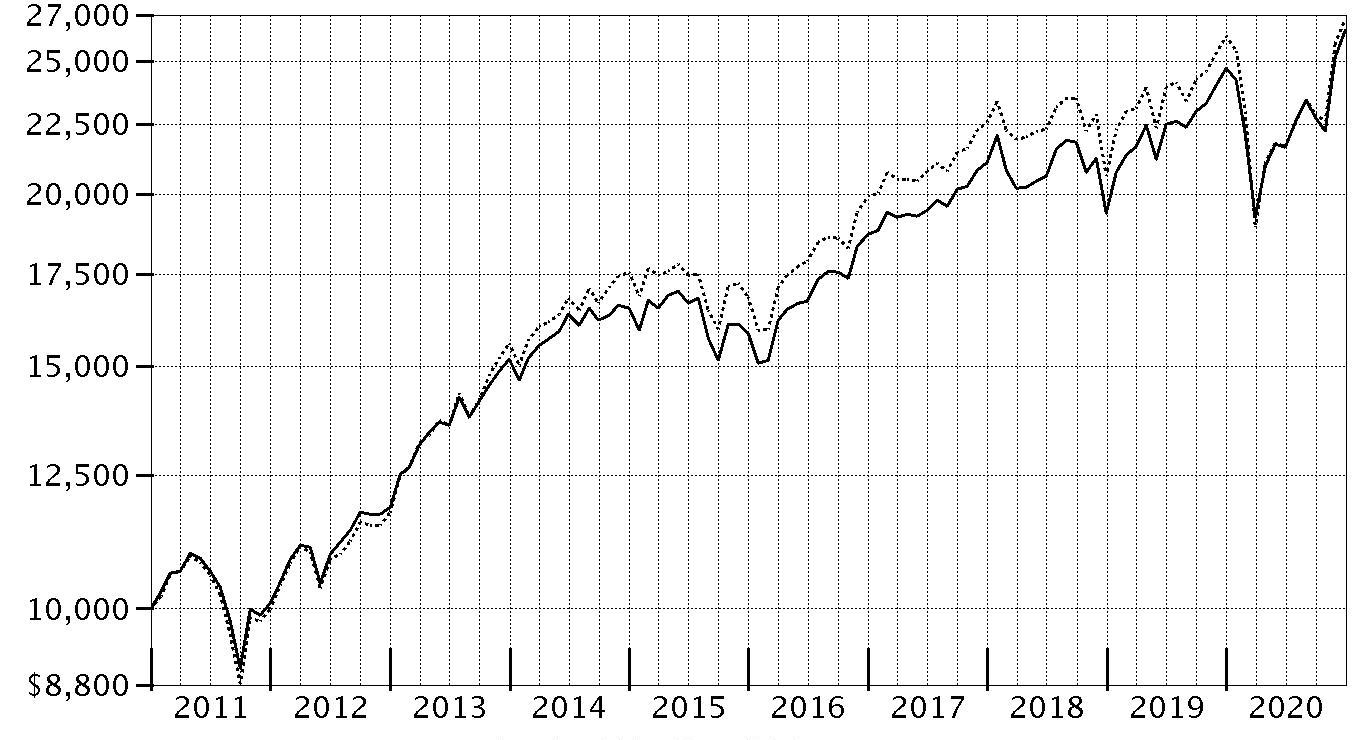

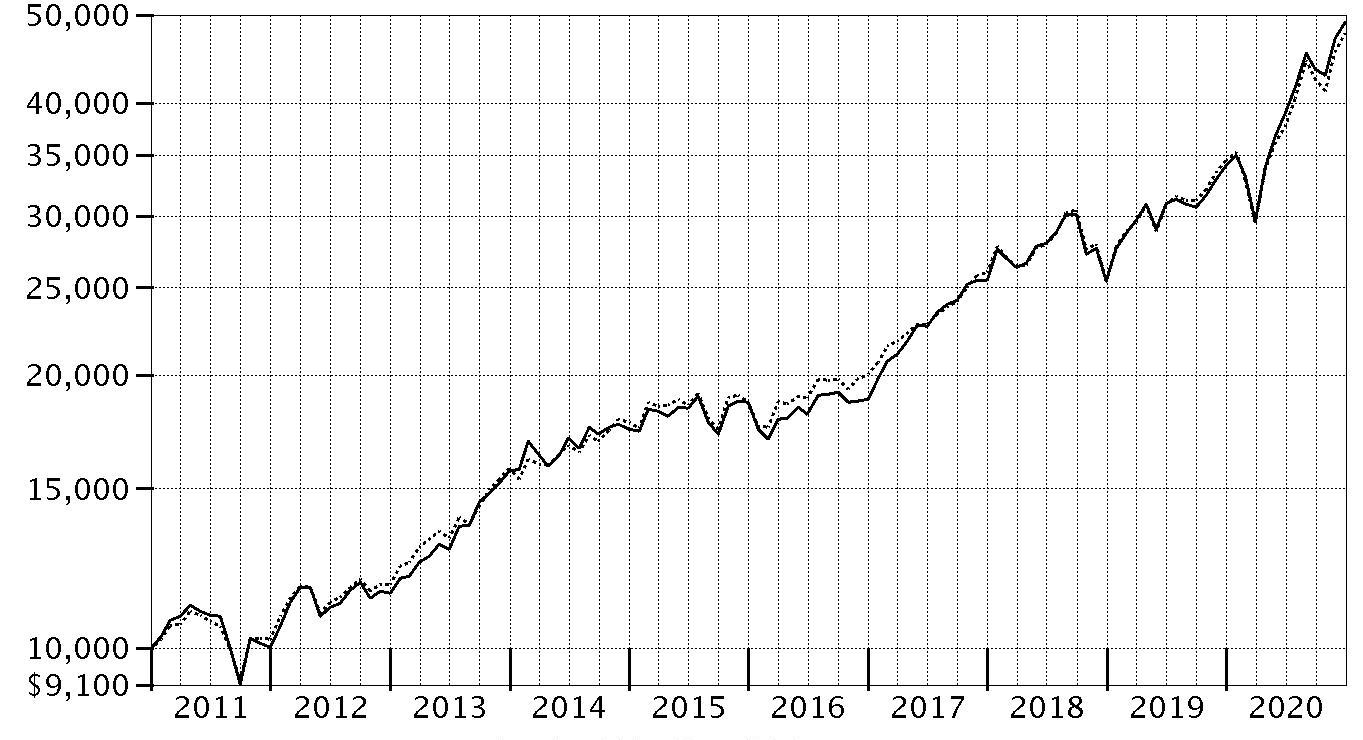

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in VIP High Income Portfolio - Initial Class on December 31, 2010.

The chart shows how the value of your investment would have changed, and also shows how the ICE® BofA® US High Yield Constrained Index performed over the same period.

| Period Ending Values |

| $17,205 | VIP High Income Portfolio - Initial Class |

| $18,972 | ICE® BofA® US High Yield Constrained Index |

Management's Discussion of Fund Performance

Market Recap: U.S. high-yield bonds gained 6.07% in 2020, according to The ICE BofA

® US High Yield Constrained Index, capping a highly volatile and unpredictable year that will be remembered by most investors for the impact of the coronavirus pandemic. The early-2020 outbreak and spread of COVID-19 resulted in high yield suffering a swift decline through March 23, followed by a historic rebound through year-end. Declared a pandemic on March 11, the crisis and containment efforts caused broad economic contraction, along with extreme uncertainty, volatility and dislocation in financial markets. A historically rapid and expansive U.S. monetary/fiscal-policy response provided a partial offset to the economic disruption and fueled the market surge, as did resilient corporate earnings and potential for a COVID-19 vaccine breakthrough. The rally slowed in early September (-1%), due to Congress’s inability to reach a deal on additional fiscal stimulus, as well as concerns about election uncertainty, indications the U.S. economic recovery was stalling and a new wave of COVID-19 cases. November (+4%) was a much different story, as investors reacted favorably to election results. The momentum continued in December (+2%), driven by two vaccine approvals in the U.S. For the full 12 months, higher-rated bonds (+15%) fared best. The BB and B credit tiers rose 9% and 4%, respectively, while bonds rated CCC-C gained 3%. By industry, publishing/printing (+19%) led, whereas entertainment/film returned -25%.

Comments from Co-Portfolio Managers Michael Weaver and Alexandre Karam: For the year, the fund's share classes gained about 2% to 3%, lagging the 6.07% advance of the benchmark, The ICE BofAMLÒ US High Yield Constrained Index. In 2020, we took a consistent, conservative approach to investing in high-yield bonds, based on our belief that higher-quality businesses in the high-yield market offer the best balance of risk and reward over time. The fund's core high-yield bond investments gained 4.11%, well short of the benchmark and detracting from relative performance. Here, an overweighting in energy and our picks within this lagging category hurt most by a wide margin and in roughly equal measure. Security selection in diversified financials detracted to a lesser degree. The biggest individual relative detractors were oil and gas producers Chesapeake Energy, California Resources and Sanchez Energy, the latter a non-benchmark holding. Performance versus the benchmark also was hampered by our much smaller, non-benchmark allocation to floating-rate bank loans, which returned -36.88%. Our modest cash position was another drag on relative performance. In contrast, our lack of exposure to entertainment/film and positioning in broadcasting bolstered relative performance for the year. Not owning or underweighting some benchmark components facing acute pandemic-related pressure hurt our relative result. This included Hertz, Transocean, Whiting Petroleum, Sinclair Group and AMC Entertainment.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Five Holdings as of December 31, 2020

| (by issuer, excluding cash equivalents) | % of fund's net assets |

| TransDigm, Inc. | 2.6 |

| CCO Holdings LLC/CCO Holdings Capital Corp. | 2.4 |

| Occidental Petroleum Corp. | 2.4 |

| C&W Senior Financing Designated Activity Co. | 2.2 |

| Tenet Healthcare Corp. | 2.0 |

| | 11.6 |

Top Five Market Sectors as of December 31, 2020

| | % of fund's net assets |

| Energy | 14.4 |

| Telecommunications | 11.1 |

| Healthcare | 7.0 |

| Gaming | 7.0 |

| Services | 6.8 |

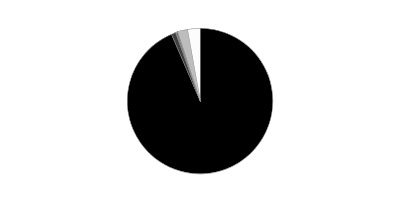

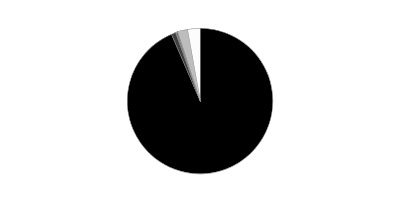

Quality Diversification (% of fund's net assets)

| As of December 31, 2020 |

| | BBB | 0.7% |

| | BB | 34.6% |

| | B | 45.9% |

| | CCC,CC,C | 14.8% |

| | Not Rated | 0.8% |

| | Equities | 0.4% |

| | Short-Term Investments and Net Other Assets | 2.8% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

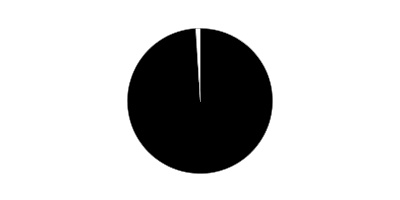

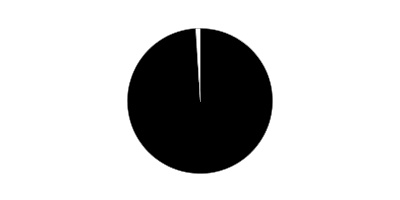

Asset Allocation (% of fund's net assets)

| As of December 31, 2020* |

| | Nonconvertible Bonds | 93.6% |

| | Convertible Bonds, Preferred Stocks | 1.0% |

| | Common Stocks | 0.4% |

| | Bank Loan Obligations | 2.2% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 2.8% |

* Foreign investments - 21.6%

Schedule of Investments December 31, 2020

Showing Percentage of Net Assets

| Corporate Bonds - 94.6% | | | |

| | | Principal Amount | Value |

| Convertible Bonds - 1.0% | | | |

| Broadcasting - 0.8% | | | |

| DISH Network Corp.: | | | |

| 2.375% 3/15/24 | | $7,126,000 | $6,640,932 |

| 3.375% 8/15/26 | | 1,580,000 | 1,506,106 |

| | | | 8,147,038 |

| Energy - 0.2% | | | |

| Mesquite Energy, Inc.: | | | |

| 15% 7/15/23 (a)(b) | | 940,000 | 940,000 |

| 15% 7/15/23 (a)(b) | | 538,879 | 538,879 |

| | | | 1,478,879 |

|

| TOTAL CONVERTIBLE BONDS | | | 9,625,917 |

|

| Nonconvertible Bonds - 93.6% | | | |

| Aerospace - 5.7% | | | |

| Allegheny Technologies, Inc.: | | | |

| 5.875% 12/1/27 | | 4,795,000 | 5,046,738 |

| 7.875% 8/15/23 | | 400,000 | 437,736 |

| BBA U.S. Holdings, Inc. 5.375% 5/1/26 (c) | | 5,085,000 | 5,212,125 |

| Bombardier, Inc.: | | | |

| 6% 10/15/22 (c) | | 915,000 | 898,210 |

| 6.125% 1/15/23 (c) | | 5,425,000 | 5,302,938 |

| 7.5% 12/1/24 (c) | | 185,000 | 177,465 |

| 7.5% 3/15/25 (c) | | 935,000 | 867,213 |

| 7.875% 4/15/27 (c) | | 1,220,000 | 1,121,717 |

| BWX Technologies, Inc.: | | | |

| 4.125% 6/30/28 (c) | | 1,785,000 | 1,858,631 |

| 5.375% 7/15/26 (c) | | 2,935,000 | 3,048,731 |

| Howmet Aerospace, Inc. 6.75% 1/15/28 | | 110,000 | 134,512 |

| Kaiser Aluminum Corp.: | | | |

| 4.625% 3/1/28 (c) | | 2,735,000 | 2,837,563 |

| 6.5% 5/1/25 (c) | | 970,000 | 1,037,900 |

| Moog, Inc. 4.25% 12/15/27 (c) | | 2,140,000 | 2,220,250 |

| TransDigm UK Holdings PLC 6.875% 5/15/26 | | 975,000 | 1,030,136 |

| TransDigm, Inc.: | | | |

| 5.5% 11/15/27 | | 9,785,000 | 10,298,713 |

| 6.25% 3/15/26 (c) | | 7,860,000 | 8,370,900 |

| 6.5% 5/15/25 | | 425,000 | 436,688 |

| 7.5% 3/15/27 | | 850,000 | 907,375 |

| 8% 12/15/25 (c) | | 4,020,000 | 4,448,492 |

| | | | 55,694,033 |

| Automotive & Auto Parts - 0.9% | | | |

| Ford Motor Credit Co. LLC: | | | |

| 4% 11/13/30 | | 3,035,000 | 3,192,608 |

| 4.687% 6/9/25 | | 1,600,000 | 1,706,000 |

| 5.113% 5/3/29 | | 2,635,000 | 2,934,600 |

| 5.125% 6/16/25 | | 1,185,000 | 1,288,451 |

| | | | 9,121,659 |

| Banks & Thrifts - 0.5% | | | |

| Ally Financial, Inc.: | | | |

| 5.75% 11/20/25 | | 2,040,000 | 2,374,565 |

| 8% 11/1/31 | | 1,415,000 | 2,075,934 |

| | | | 4,450,499 |

| Broadcasting - 1.9% | | | |

| Diamond Sports Group LLC/Diamond Sports Finance Co. 5.375% 8/15/26 (c) | | 4,470,000 | 3,631,875 |

| Gray Television, Inc. 4.75% 10/15/30 (c) | | 895,000 | 908,425 |

| Netflix, Inc.: | | | |

| 4.875% 4/15/28 | | 1,385,000 | 1,561,865 |

| 5.375% 11/15/29 (c) | | 525,000 | 618,844 |

| 5.875% 11/15/28 | | 1,285,000 | 1,540,394 |

| 6.375% 5/15/29 | | 175,000 | 216,125 |

| Sinclair Television Group, Inc.: | | | |

| 5.125% 2/15/27 (c) | | 2,290,000 | 2,330,075 |

| 5.5% 3/1/30 (c) | | 1,010,000 | 1,052,925 |

| Sirius XM Radio, Inc.: | | | |

| 4.125% 7/1/30 (c) | | 575,000 | 612,016 |

| 5% 8/1/27 (c) | | 3,455,000 | 3,670,972 |

| Tegna, Inc. 5% 9/15/29 | | 425,000 | 448,977 |

| Univision Communications, Inc. 6.625% 6/1/27 (c) | | 1,815,000 | 1,949,129 |

| | | | 18,541,622 |

| Building Materials - 0.4% | | | |

| Advanced Drain Systems, Inc. 5% 9/30/27 (c) | | 3,680,000 | 3,865,398 |

| Cable/Satellite TV - 6.3% | | | |

| CCO Holdings LLC/CCO Holdings Capital Corp.: | | | |

| 4.25% 2/1/31 (c) | | 4,075,000 | 4,294,480 |

| 4.5% 8/15/30 (c) | | 1,750,000 | 1,857,188 |

| 4.5% 5/1/32 (c) | | 2,190,000 | 2,338,307 |

| 5% 2/1/28 (c) | | 8,430,000 | 8,914,725 |

| 5.125% 5/1/27 (c) | | 5,530,000 | 5,868,381 |

| CSC Holdings LLC: | | | |

| 4.125% 12/1/30 (c) | | 1,895,000 | 1,981,412 |

| 4.625% 12/1/30 (c) | | 1,130,000 | 1,179,438 |

| 5.75% 1/15/30 (c) | | 2,510,000 | 2,751,588 |

| DISH DBS Corp.: | | | |

| 5.875% 11/15/24 | | 3,685,000 | 3,863,851 |

| 7.75% 7/1/26 | | 2,070,000 | 2,317,324 |

| Dolya Holdco 18 DAC 5% 7/15/28 (c) | | 2,285,000 | 2,376,400 |

| Radiate Holdco LLC/Radiate Financial Service Ltd.: | | | |

| 4.5% 9/15/26 (c) | | 2,425,000 | 2,500,781 |

| 6.5% 9/15/28 (c) | | 2,935,000 | 3,081,750 |

| Telenet Finance Luxembourg Notes SARL 5.5% 3/1/28 (c) | | 3,000,000 | 3,199,500 |

| Virgin Media Finance PLC 5% 7/15/30 (c) | | 2,395,000 | 2,484,813 |

| Virgin Media Secured Finance PLC: | | | |

| 4.5% 8/15/30 (c) | | 690,000 | 721,050 |

| 5.5% 8/15/26 (c) | | 3,170,000 | 3,292,838 |

| 5.5% 5/15/29 (c) | | 1,555,000 | 1,685,231 |

| Ziggo Bond Co. BV: | | | |

| 5.125% 2/28/30 (c) | | 185,000 | 195,231 |

| 6% 1/15/27 (c) | | 3,095,000 | 3,270,703 |

| Ziggo BV 5.5% 1/15/27 (c) | | 2,607,000 | 2,721,056 |

| | | | 60,896,047 |

| Capital Goods - 0.5% | | | |

| Vertical U.S. Newco, Inc. 5.25% 7/15/27 (c) | | 4,830,000 | 5,119,800 |

| Chemicals - 5.1% | | | |

| Axalta Coating Systems/Dutch Holding BV 4.75% 6/15/27 (c) | | 2,155,000 | 2,292,381 |

| Bausch Health Companies, Inc. 6.25% 2/15/29 (c) | | 2,710,000 | 2,943,738 |

| CF Industries Holdings, Inc.: | | | |

| 4.95% 6/1/43 | | 1,823,000 | 2,237,733 |

| 5.15% 3/15/34 | | 170,000 | 208,897 |

| 5.375% 3/15/44 | | 1,440,000 | 1,822,687 |

| Consolidated Energy Finance SA: | | | |

| 3 month U.S. LIBOR + 3.750% 3.9665% 6/15/22 (c)(d)(e) | | 4,410,000 | 4,329,258 |

| 6.5% 5/15/26 (c) | | 3,425,000 | 3,425,000 |

| 6.875% 6/15/25 (c) | | 415,000 | 420,706 |

| Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc.: | | | |

| 5% 12/31/26 (c) | | 1,780,000 | 1,855,650 |

| 7% 12/31/27 (c) | | 260,000 | 272,225 |

| Methanex Corp.: | | | |

| 5.125% 10/15/27 | | 2,855,000 | 3,103,042 |

| 5.65% 12/1/44 | | 997,000 | 1,069,283 |

| NOVA Chemicals Corp. 5.25% 6/1/27 (c) | | 2,090,000 | 2,226,937 |

| Olin Corp.: | | | |

| 5% 2/1/30 | | 1,830,000 | 1,948,950 |

| 5.125% 9/15/27 | | 2,270,000 | 2,374,738 |

| 5.625% 8/1/29 | | 1,715,000 | 1,862,919 |

| The Chemours Co. LLC: | | | |

| 5.375% 5/15/27 | | 6,542,000 | 6,967,230 |

| 5.75% 11/15/28 (c) | | 7,390,000 | 7,537,800 |

| 7% 5/15/25 | | 205,000 | 212,497 |

| Valvoline, Inc. 4.25% 2/15/30 (c) | | 660,000 | 699,600 |

| W. R. Grace & Co.-Conn. 4.875% 6/15/27 (c) | | 1,140,000 | 1,208,993 |

| | | | 49,020,264 |

| Consumer Products - 0.3% | | | |

| Mattel, Inc.: | | | |

| 5.45% 11/1/41 | | 250,000 | 275,088 |

| 6.2% 10/1/40 | | 1,480,000 | 1,727,900 |

| Newell Brands, Inc. 5.875% 4/1/36 | | 245,000 | 297,063 |

| Prestige Brands, Inc. 6.375% 3/1/24 (c) | | 945,000 | 966,263 |

| | | | 3,266,314 |

| Containers - 1.7% | | | |

| Ardagh Packaging Finance PLC/Ardagh MP Holdings U.S.A., Inc.: | | | |

| 4.125% 8/15/26 (c) | | 95,000 | 99,275 |

| 6% 2/15/25 (c) | | 1,213,000 | 1,256,971 |

| Flex Acquisition Co., Inc.: | | | |

| 6.875% 1/15/25 (c) | | 2,965,000 | 3,009,475 |

| 7.875% 7/15/26 (c) | | 2,805,000 | 2,947,550 |

| OI European Group BV 4% 3/15/23 (c) | | 850,000 | 867,000 |

| Owens-Brockway Glass Container, Inc. 5.375% 1/15/25 (c) | | 2,115,000 | 2,278,913 |

| Trivium Packaging Finance BV: | | | |

| 5.5% 8/15/26 (c) | | 3,555,000 | 3,759,413 |

| 8.5% 8/15/27 (c) | | 2,470,000 | 2,704,650 |

| | | | 16,923,247 |

| Diversified Financial Services - 1.9% | | | |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | |

| 4.75% 9/15/24 | | 3,085,000 | 3,204,544 |

| 5.25% 5/15/27 | | 780,000 | 836,160 |

| 6.25% 5/15/26 | | 4,405,000 | 4,664,455 |

| Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp. 4.25% 2/1/27 (c) | | 900,000 | 884,250 |

| Springleaf Finance Corp.: | | | |

| 6.875% 3/15/25 | | 2,180,000 | 2,531,525 |

| 7.125% 3/15/26 | | 1,300,000 | 1,537,250 |

| VMED O2 UK Financing I PLC 4.25% 1/31/31 (c) | | 4,450,000 | 4,546,298 |

| | | | 18,204,482 |

| Diversified Media - 0.8% | | | |

| Nielsen Co. SARL (Luxembourg) 5% 2/1/25 (c) | | 1,420,000 | 1,457,275 |

| Nielsen Finance LLC/Nielsen Finance Co.: | | | |

| 5.625% 10/1/28 (c) | | 1,850,000 | 2,010,118 |

| 5.875% 10/1/30 (c) | | 1,840,000 | 2,081,500 |

| Terrier Media Buyer, Inc. 8.875% 12/15/27 (c) | | 2,105,000 | 2,320,763 |

| | | | 7,869,656 |

| Energy - 13.8% | | | |

| Apache Corp.: | | | |

| 4.25% 1/15/30 | | 435,000 | 456,750 |

| 5.1% 9/1/40 | | 2,085,000 | 2,236,163 |

| 5.35% 7/1/49 | | 305,000 | 312,939 |

| 7.375% 8/15/47 | | 310,000 | 337,900 |

| Cheniere Energy Partners LP 5.625% 10/1/26 | | 3,190,000 | 3,325,575 |

| Cheniere Energy, Inc. 4.625% 10/15/28 (c) | | 3,640,000 | 3,822,000 |

| Citgo Petroleum Corp.: | | | |

| 6.25% 8/15/22 (c) | | 3,820,000 | 3,743,600 |

| 7% 6/15/25 (c) | | 2,125,000 | 2,119,688 |

| CNX Resources Corp. 6% 1/15/29 (c) | | 430,000 | 440,529 |

| Comstock Resources, Inc.: | | | |

| 7.5% 5/15/25 (c) | | 1,265,000 | 1,280,813 |

| 9.75% 8/15/26 | | 1,820,000 | 1,951,950 |

| 9.75% 8/15/26 | | 615,000 | 659,588 |

| Continental Resources, Inc. 5.75% 1/15/31 (c) | | 1,395,000 | 1,548,422 |

| Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp.: | | | |

| 5.625% 5/1/27 (c) | | 5,473,000 | 5,418,270 |

| 5.75% 4/1/25 | | 5,907,000 | 6,010,373 |

| 6.25% 4/1/23 | | 3,370,000 | 3,378,425 |

| CVR Energy, Inc.: | | | |

| 5.25% 2/15/25 (c) | | 4,720,000 | 4,554,800 |

| 5.75% 2/15/28 (c) | | 1,915,000 | 1,814,463 |

| DCP Midstream Operating LP: | | | |

| 5.375% 7/15/25 | | 3,420,000 | 3,757,964 |

| 5.6% 4/1/44 | | 175,000 | 180,464 |

| 6.45% 11/3/36 (c) | | 775,000 | 829,250 |

| 8.125% 8/16/30 | | 55,000 | 70,263 |

| Endeavor Energy Resources LP/EER Finance, Inc.: | | | |

| 5.5% 1/30/26 (c) | | 450,000 | 461,768 |

| 5.75% 1/30/28 (c) | | 1,635,000 | 1,763,675 |

| 6.625% 7/15/25 (c) | | 395,000 | 422,650 |

| EnLink Midstream LLC 5.625% 1/15/28 (c) | | 395,000 | 403,487 |

| EnLink Midstream Partners LP: | | | |

| 5.05% 4/1/45 | | 515,000 | 409,425 |

| 5.45% 6/1/47 | | 1,080,000 | 866,700 |

| 5.6% 4/1/44 | | 185,000 | 148,463 |

| EQM Midstream Partners LP: | | | |

| 5.5% 7/15/28 | | 110,000 | 120,214 |

| 6.5% 7/1/27 (c) | | 1,705,000 | 1,919,890 |

| EQT Corp. 3.9% 10/1/27 | | 1,490,000 | 1,480,241 |

| Global Partners LP/GLP Finance Corp. 6.875% 1/15/29 (c) | | 2,060,000 | 2,229,950 |

| Hess Midstream Partners LP: | | | |

| 5.125% 6/15/28 (c) | | 2,465,000 | 2,576,689 |

| 5.625% 2/15/26 (c) | | 5,785,000 | 6,016,400 |

| Hilcorp Energy I LP/Hilcorp Finance Co.: | | | |

| 5% 12/1/24 (c) | | 1,255,000 | 1,245,588 |

| 6.25% 11/1/28 (c) | | 670,000 | 685,075 |

| Holly Energy Partners LP/Holly Energy Finance Corp. 5% 2/1/28 (c) | | 2,885,000 | 2,906,638 |

| MEG Energy Corp. 7.125% 2/1/27 (c) | | 1,090,000 | 1,125,425 |

| New Fortress Energy LLC 6.75% 9/15/25 (c) | | 4,860,000 | 5,146,983 |

| Occidental Petroleum Corp.: | | | |

| 2.9% 8/15/24 | | 835,000 | 803,688 |

| 3.4% 4/15/26 | | 1,140,000 | 1,086,882 |

| 3.5% 8/15/29 | | 1,715,000 | 1,569,517 |

| 4.2% 3/15/48 | | 1,145,000 | 931,744 |

| 4.3% 8/15/39 | | 590,000 | 496,279 |

| 4.4% 4/15/46 | | 1,730,000 | 1,507,634 |

| 4.4% 8/15/49 | | 1,275,000 | 1,074,570 |

| 5.55% 3/15/26 | | 2,880,000 | 3,006,547 |

| 6.125% 1/1/31 | | 1,365,000 | 1,460,823 |

| 6.2% 3/15/40 | | 575,000 | 570,688 |

| 6.45% 9/15/36 | | 3,050,000 | 3,193,350 |

| 7.5% 5/1/31 | | 3,730,000 | 4,158,950 |

| 7.875% 9/15/31 | | 375,000 | 418,125 |

| 8.875% 7/15/30 | | 1,270,000 | 1,490,663 |

| PBF Holding Co. LLC/PBF Finance Corp. 9.25% 5/15/25 (c) | | 3,305,000 | 3,241,214 |

| Rockies Express Pipeline LLC: | | | |

| 4.95% 7/15/29 (c) | | 245,000 | 254,829 |

| 6.875% 4/15/40 (c) | | 385,000 | 419,015 |

| Sanchez Energy Corp. 7.25% 2/15/23 (b)(c)(f) | | 5,722,000 | 1 |

| Sunoco LP/Sunoco Finance Corp.: | | | |

| 4.5% 5/15/29 (c) | | 2,260,000 | 2,350,400 |

| 5.875% 3/15/28 | | 500,000 | 540,000 |

| 6% 4/15/27 | | 65,000 | 69,096 |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp.: | | | |

| 5.5% 1/15/28 (c) | | 450,000 | 459,563 |

| 6% 3/1/27 (c) | | 2,000,000 | 2,072,500 |

| 6% 12/31/30 (c) | | 1,290,000 | 1,330,712 |

| Targa Resources Partners LP/Targa Resources Partners Finance Corp.: | | | |

| 4.875% 2/1/31 (c) | | 2,567,000 | 2,785,195 |

| 5.125% 2/1/25 | | 5,120,000 | 5,248,000 |

| 5.375% 2/1/27 | | 665,000 | 698,496 |

| 5.5% 3/1/30 | | 498,000 | 540,679 |

| Transocean Guardian Ltd. 5.875% 1/15/24 (c) | | 928,200 | 779,688 |

| Transocean Phoenix 2 Ltd. 7.75% 10/15/24 (c) | | 180,000 | 174,600 |

| Transocean Pontus Ltd. 6.125% 8/1/25 (c) | | 464,100 | 440,890 |

| Transocean Poseidon Ltd. 6.875% 2/1/27 (c) | | 595,000 | 541,450 |

| Transocean Proteus Ltd. 6.25% 12/1/24 (c) | | 198,000 | 185,873 |

| Transocean Sentry Ltd. 5.375% 5/15/23 (c) | | 917,431 | 834,862 |

| Viper Energy Partners LP 5.375% 11/1/27 (c) | | 3,965,000 | 4,143,425 |

| Western Gas Partners LP: | | | |

| 3.95% 6/1/25 | | 430,000 | 438,600 |

| 4.1% 2/1/25 | | 1,750,000 | 1,803,498 |

| 4.65% 7/1/26 | | 660,000 | 692,597 |

| 5.05% 2/1/30 | | 2,965,000 | 3,298,563 |

| | | | 133,292,656 |

| Environmental - 0.5% | | | |

| LBC Tank Terminals Holding Netherlands BV 6.875% 5/15/23 (c) | | 3,630,000 | 3,630,000 |

| Stericycle, Inc. 3.875% 1/15/29 (c) | | 1,625,000 | 1,669,688 |

| | | | 5,299,688 |

| Food & Drug Retail - 0.2% | | | |

| Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC 3.5% 3/15/29 (c) | | 1,720,000 | 1,737,200 |

| Food/Beverage/Tobacco - 3.4% | | | |

| C&S Group Enterprises LLC 5% 12/15/28 (c) | | 3,000,000 | 2,992,290 |

| JBS U.S.A. LLC/JBS U.S.A. Finance, Inc.: | | | |

| 5.75% 6/15/25 (c) | | 2,925,000 | 3,020,063 |

| 6.75% 2/15/28 (c) | | 940,000 | 1,056,090 |

| JBS U.S.A. Lux SA / JBS Food Co.: | | | |

| 5.5% 1/15/30 (c) | | 2,735,000 | 3,141,859 |

| 6.5% 4/15/29 (c) | | 5,495,000 | 6,401,675 |

| Kraft Heinz Foods Co. 5% 7/15/35 | | 2,075,000 | 2,513,650 |

| Performance Food Group, Inc.: | | | |

| 5.5% 10/15/27 (c) | | 1,830,000 | 1,930,650 |

| 6.875% 5/1/25 (c) | | 2,480,000 | 2,653,600 |

| Post Holdings, Inc.: | | | |

| 4.625% 4/15/30 (c) | | 1,125,000 | 1,183,455 |

| 5% 8/15/26 (c) | | 2,300,000 | 2,374,750 |

| 5.625% 1/15/28 (c) | | 1,050,000 | 1,118,250 |

| 5.75% 3/1/27 (c) | | 1,635,000 | 1,731,056 |

| TreeHouse Foods, Inc. 4% 9/1/28 | | 1,465,000 | 1,515,359 |

| U.S. Foods, Inc. 6.25% 4/15/25 (c) | | 1,645,000 | 1,758,094 |

| | | | 33,390,841 |

| Gaming - 6.4% | | | |

| Affinity Gaming LLC 6.875% 12/15/27 (c) | | 1,235,000 | 1,292,119 |

| Boyd Gaming Corp.: | | | |

| 4.75% 12/1/27 | | 1,090,000 | 1,132,238 |

| 6% 8/15/26 | | 930,000 | 964,875 |

| 6.375% 4/1/26 | | 2,460,000 | 2,555,473 |

| Caesars Entertainment, Inc.: | | | |

| 6.25% 7/1/25 (c) | | 3,365,000 | 3,583,725 |

| 8.125% 7/1/27 (c) | | 4,540,000 | 5,025,882 |

| Caesars Resort Collection LLC 5.25% 10/15/25 (c) | | 6,330,000 | 6,397,035 |

| Golden Entertainment, Inc. 7.625% 4/15/26 (c) | | 3,070,000 | 3,296,413 |

| Golden Nugget, Inc. 6.75% 10/15/24 (c) | | 4,845,000 | 4,810,213 |

| MCE Finance Ltd.: | | | |

| 4.875% 6/6/25 (c) | | 2,075,000 | 2,138,330 |

| 5.375% 12/4/29 (c) | | 940,000 | 975,907 |

| 5.75% 7/21/28 (c) | | 1,420,000 | 1,513,010 |

| MGM Growth Properties Operating Partnership LP: | | | |

| 4.5% 9/1/26 | | 2,695,000 | 2,899,551 |

| 4.5% 1/15/28 | | 2,895,000 | 3,079,933 |

| 4.625% 6/15/25 (c) | | 560,000 | 599,760 |

| 5.75% 2/1/27 | | 870,000 | 976,027 |

| Scientific Games Corp. 5% 10/15/25 (c) | | 2,210,000 | 2,280,477 |

| Stars Group Holdings BV 7% 7/15/26 (c) | | 2,315,000 | 2,436,538 |

| Station Casinos LLC: | | | |

| 4.5% 2/15/28 (c) | | 2,835,000 | 2,856,263 |

| 5% 10/1/25 (c) | | 3,520,000 | 3,560,656 |

| VICI Properties, Inc. 4.625% 12/1/29 (c) | | 2,410,000 | 2,578,700 |

| Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp. 5.25% 5/15/27 (c) | | 1,935,000 | 1,994,501 |

| Wynn Macau Ltd.: | | | |

| 4.875% 10/1/24 (c) | | 1,845,000 | 1,871,522 |

| 5.5% 10/1/27 (c) | | 2,950,000 | 3,051,406 |

| | | | 61,870,554 |

| Healthcare - 7.0% | | | |

| Avantor Funding, Inc. 4.625% 7/15/28 (c) | | 2,795,000 | 2,955,713 |

| Bausch Health Companies, Inc.: | | | |

| 5% 2/15/29 (c) | | 595,000 | 611,779 |

| 5.25% 1/30/30 (c) | | 3,020,000 | 3,163,450 |

| 5.25% 2/15/31 (c) | | 2,085,000 | 2,178,241 |

| Catalent Pharma Solutions 4.875% 1/15/26 (c) | | 400,000 | 408,000 |

| Centene Corp.: | | | |

| 4.25% 12/15/27 | | 980,000 | 1,038,800 |

| 4.625% 12/15/29 | | 5,100,000 | 5,662,071 |

| 5.375% 8/15/26 (c) | | 3,945,000 | 4,166,906 |

| Charles River Laboratories International, Inc.: | | | |

| 4.25% 5/1/28 (c) | | 290,000 | 303,775 |

| 5.5% 4/1/26 (c) | | 1,325,000 | 1,387,805 |

| Community Health Systems, Inc.: | | | |

| 5.625% 3/15/27 (c) | | 1,490,000 | 1,602,123 |

| 6% 1/15/29 (c) | | 1,190,000 | 1,285,509 |

| 8% 3/15/26 (c) | | 2,480,000 | 2,672,200 |

| 8.125% 6/30/24 (c) | | 1,190,000 | 1,231,650 |

| CTR Partnership LP/CareTrust Capital Corp. 5.25% 6/1/25 | | 3,145,000 | 3,253,361 |

| DaVita HealthCare Partners, Inc. 4.625% 6/1/30 (c) | | 3,060,000 | 3,243,600 |

| HCA Holdings, Inc. 5.875% 2/15/26 | | 170,000 | 195,500 |

| Hologic, Inc.: | | | |

| 3.25% 2/15/29 (c) | | 2,030,000 | 2,065,525 |

| 4.625% 2/1/28 (c) | | 395,000 | 419,194 |

| IMS Health, Inc. 5% 5/15/27 (c) | | 2,745,000 | 2,918,004 |

| Molina Healthcare, Inc. 3.875% 11/15/30 (c) | | 855,000 | 916,988 |

| Radiology Partners, Inc. 9.25% 2/1/28 (c) | | 2,216,000 | 2,493,665 |

| RP Escrow Issuer LLC 5.25% 12/15/25 (c) | | 820,000 | 857,654 |

| Teleflex, Inc.: | | | |

| 4.25% 6/1/28 (c) | | 535,000 | 567,100 |

| 4.875% 6/1/26 | | 2,115,000 | 2,202,328 |

| Tenet Healthcare Corp.: | | | |

| 4.625% 6/15/28 (c) | | 680,000 | 712,300 |

| 4.875% 1/1/26 (c) | | 1,550,000 | 1,621,471 |

| 5.125% 5/1/25 | | 1,030,000 | 1,050,075 |

| 6.125% 10/1/28 (c) | | 4,680,000 | 4,884,305 |

| 6.25% 2/1/27 (c) | | 2,720,000 | 2,883,200 |

| 7% 8/1/25 | | 7,260,000 | 7,504,299 |

| U.S. Renal Care, Inc. 10.625% 7/15/27 (c) | | 1,250,000 | 1,381,250 |

| Vizient, Inc. 6.25% 5/15/27 (c) | | 240,000 | 258,000 |

| | | | 68,095,841 |

| Homebuilders/Real Estate - 1.3% | | | |

| Howard Hughes Corp. 5.375% 3/15/25 (c) | | 3,200,000 | 3,300,000 |

| MPT Operating Partnership LP/MPT Finance Corp. 5.25% 8/1/26 | | 1,515,000 | 1,586,205 |

| Service Properties Trust: | | | |

| 3.95% 1/15/28 | | 150,000 | 144,938 |

| 4.375% 2/15/30 | | 2,385,000 | 2,325,375 |

| 4.95% 2/15/27 | | 920,000 | 924,600 |

| 4.95% 10/1/29 | | 905,000 | 907,263 |

| 5.5% 12/15/27 | | 845,000 | 923,527 |

| Starwood Property Trust, Inc. 4.75% 3/15/25 | | 415,000 | 425,375 |

| Uniti Group LP / Uniti Group Finance, Inc. 8.25% 10/15/23 | | 1,685,000 | 1,697,638 |

| | | | 12,234,921 |

| Hotels - 0.3% | | | |

| Hilton Domestic Operating Co., Inc.: | | | |

| 3.75% 5/1/29 (c) | | 295,000 | 307,594 |

| 4% 5/1/31 (c) | | 1,055,000 | 1,113,141 |

| Wyndham Hotels & Resorts, Inc. 4.375% 8/15/28 (c) | | 1,060,000 | 1,101,393 |

| | | | 2,522,128 |

| Insurance - 2.6% | | | |

| Alliant Holdings Intermediate LLC: | | | |

| 4.25% 10/15/27 (c) | | 260,000 | 265,850 |

| 6.75% 10/15/27 (c) | | 8,742,000 | 9,353,940 |

| AmWINS Group, Inc. 7.75% 7/1/26 (c) | | 6,340,000 | 6,808,526 |

| AssuredPartners, Inc. 5.625% 1/15/29 (c) | | 795,000 | 829,781 |

| HUB International Ltd. 7% 5/1/26 (c) | | 2,155,000 | 2,253,677 |

| USI, Inc. 6.875% 5/1/25 (c) | | 5,270,000 | 5,401,750 |

| | | | 24,913,524 |

| Leisure - 0.7% | | | |

| Carnival Corp. 7.625% 3/1/26 (c) | | 1,345,000 | 1,465,364 |

| NCL Corp. Ltd. 5.875% 3/15/26 (c) | | 525,000 | 553,219 |

| Royal Caribbean Cruises Ltd.: | | | |

| 9.125% 6/15/23 (c) | | 470,000 | 509,950 |

| 11.5% 6/1/25 (c) | | 2,005,000 | 2,338,331 |

| Viking Cruises Ltd. 13% 5/15/25 (c) | | 635,000 | 758,825 |

| Voc Escrow Ltd. 5% 2/15/28 (c) | | 715,000 | 709,638 |

| | | | 6,335,327 |

| Metals/Mining - 1.0% | | | |

| First Quantum Minerals Ltd.: | | | |

| 6.875% 10/15/27 (c) | | 1,175,000 | 1,270,469 |

| 7.25% 4/1/23 (c) | | 4,195,000 | 4,301,217 |

| FMG Resources (August 2006) Pty Ltd. 4.5% 9/15/27 (c) | | 40,000 | 44,440 |

| Howmet Aerospace, Inc. 5.95% 2/1/37 | | 95,000 | 114,475 |

| Nufarm Australia Ltd. 5.75% 4/30/26 (c) | | 3,603,000 | 3,702,083 |

| | | | 9,432,684 |

| Publishing/Printing - 0.2% | | | |

| Meredith Corp. 6.875% 2/1/26 | | 2,405,000 | 2,344,875 |

| Restaurants - 1.1% | | | |

| 1011778 BC Unlimited Liability Co./New Red Finance, Inc.: | | | |

| 4% 10/15/30 (c) | | 6,875,000 | 6,926,563 |

| 5.75% 4/15/25 (c) | | 755,000 | 807,850 |

| Yum! Brands, Inc. 7.75% 4/1/25 (c) | | 2,250,000 | 2,491,875 |

| | | | 10,226,288 |

| Services - 6.5% | | | |

| AECOM 5.125% 3/15/27 | | 3,525,000 | 3,922,726 |

| APX Group, Inc. 6.75% 2/15/27 (c) | | 2,032,000 | 2,184,400 |

| Aramark Services, Inc.: | | | |

| 4.75% 6/1/26 | | 1,955,000 | 2,012,575 |

| 5% 2/1/28 (c) | | 8,965,000 | 9,446,869 |

| 6.375% 5/1/25 (c) | | 4,365,000 | 4,665,094 |

| Ascend Learning LLC: | | | |

| 6.875% 8/1/25 (c) | | 2,470,000 | 2,541,013 |

| 6.875% 8/1/25 (c) | | 335,000 | 344,631 |

| ASGN, Inc. 4.625% 5/15/28 (c) | | 1,020,000 | 1,060,800 |

| Booz Allen Hamilton, Inc. 3.875% 9/1/28 (c) | | 2,865,000 | 2,950,950 |

| Brand Energy & Infrastructure Services, Inc. 8.5% 7/15/25 (c) | | 5,105,000 | 5,213,481 |

| CoreCivic, Inc.: | | | |

| 4.625% 5/1/23 | | 495,000 | 476,438 |

| 5% 10/15/22 | | 860,000 | 860,000 |

| Double Eagle III Midco 1 LLC 7.75% 12/15/25 (c) | | 1,500,000 | 1,590,570 |

| Fair Isaac Corp. 5.25% 5/15/26 (c) | | 1,065,000 | 1,211,438 |

| Frontdoor, Inc. 6.75% 8/15/26 (c) | | 1,570,000 | 1,674,013 |

| Gartner, Inc. 3.75% 10/1/30 (c) | | 955,000 | 1,002,750 |

| GEMS MENASA Cayman Ltd. 7.125% 7/31/26 (c) | | 5,480,000 | 5,685,500 |

| Laureate Education, Inc. 8.25% 5/1/25 (c) | | 2,375,000 | 2,517,500 |

| PowerTeam Services LLC 9.033% 12/4/25 (c) | | 1,170,000 | 1,301,754 |

| Service Corp. International 5.125% 6/1/29 | | 1,420,000 | 1,572,650 |

| Sotheby's 7.375% 10/15/27 (c) | | 3,590,000 | 3,845,788 |

| Tempo Acquisition LLC: | | | |

| 5.75% 6/1/25 (c) | | 1,345,000 | 1,429,063 |

| 6.75% 6/1/25 (c) | | 3,210,000 | 3,317,696 |

| The GEO Group, Inc.: | | | |

| 5.875% 10/15/24 | | 330,000 | 273,900 |

| 6% 4/15/26 | | 2,455,000 | 1,951,725 |

| | | | 63,053,324 |

| Super Retail - 1.5% | | | |

| EG Global Finance PLC: | | | |

| 6.75% 2/7/25 (c) | | 2,170,000 | 2,235,100 |

| 8.5% 10/30/25 (c) | | 3,690,000 | 3,929,850 |

| L Brands, Inc.: | | | |

| 5.25% 2/1/28 | | 235,000 | 244,988 |

| 6.625% 10/1/30 (c) | | 360,000 | 397,800 |

| 6.694% 1/15/27 | | 850,000 | 937,125 |

| 6.75% 7/1/36 | | 2,115,000 | 2,356,374 |

| 6.875% 11/1/35 | | 285,000 | 319,913 |

| LBM Acquisition LLC 6.25% 1/15/29 (c) | | 360,000 | 374,519 |

| The William Carter Co. 5.625% 3/15/27 (c) | | 1,575,000 | 1,657,688 |

| Wolverine World Wide, Inc. 6.375% 5/15/25 (c) | | 2,335,000 | 2,486,775 |

| | | | 14,940,132 |

| Technology - 3.8% | | | |

| Arches Buyer, Inc.: | | | |

| 4.25% 6/1/28 (c) | | 1,905,000 | 1,929,194 |

| 6.125% 12/1/28 (c) | | 1,905,000 | 1,967,294 |

| Black Knight InfoServ LLC 3.625% 9/1/28 (c) | | 2,525,000 | 2,584,969 |

| Boxer Parent Co., Inc. 7.125% 10/2/25 (c) | | 800,000 | 868,358 |

| Camelot Finance SA 4.5% 11/1/26 (c) | | 2,410,000 | 2,515,438 |

| CDK Global, Inc.: | | | |

| 4.875% 6/1/27 | | 1,105,000 | 1,165,775 |

| 5.25% 5/15/29 (c) | | 465,000 | 515,183 |

| Entegris, Inc. 4.375% 4/15/28 (c) | | 1,820,000 | 1,938,300 |

| Gartner, Inc. 4.5% 7/1/28 (c) | | 1,470,000 | 1,550,850 |

| Match Group Holdings II LLC 4.125% 8/1/30 (c) | | 685,000 | 710,688 |

| Northwest Fiber LLC/Northwest Fiber Finance Sub, Inc. 10.75% 6/1/28 (c) | | 3,700,000 | 4,218,000 |

| Nuance Communications, Inc. 5.625% 12/15/26 | | 3,135,000 | 3,317,206 |

| ON Semiconductor Corp. 3.875% 9/1/28 (c) | | 1,115,000 | 1,151,238 |

| Qorvo, Inc. 4.375% 10/15/29 | | 1,500,000 | 1,650,330 |

| Rackspace Hosting, Inc. 5.375% 12/1/28 (c) | | 1,982,000 | 2,076,541 |

| SS&C Technologies, Inc. 5.5% 9/30/27 (c) | | 200,000 | 213,604 |

| TTM Technologies, Inc. 5.625% 10/1/25 (c) | | 7,895,000 | 8,082,506 |

| | | | 36,455,474 |

| Telecommunications - 10.8% | | | |

| Altice Financing SA: | | | |

| 5% 1/15/28 (c) | | 940,000 | 963,157 |

| 7.5% 5/15/26 (c) | | 5,260,000 | 5,550,878 |

| Altice France Holding SA 6% 2/15/28 (c) | | 4,250,000 | 4,324,375 |

| C&W Senior Financing Designated Activity Co.: | | | |

| 6.875% 9/15/27 (c) | | 13,430,000 | 14,489,179 |

| 7.5% 10/15/26 (c) | | 6,270,000 | 6,670,465 |

| Cablevision Lightpath LLC: | | | |

| 3.875% 9/15/27 (c) | | 455,000 | 457,844 |

| 5.625% 9/15/28 (c) | | 360,000 | 376,650 |

| CenturyLink, Inc.: | | | |

| 4.5% 1/15/29 (c) | | 2,410,000 | 2,452,175 |

| 5.125% 12/15/26 (c) | | 4,810,000 | 5,079,168 |

| 5.625% 4/1/25 | | 1,725,000 | 1,860,844 |

| 6.875% 1/15/28 | | 162,000 | 187,891 |

| Frontier Communications Corp.: | | | |

| 5% 5/1/28 (c) | | 2,380,000 | 2,481,150 |

| 5.875% 10/15/27 (c) | | 840,000 | 908,250 |

| 6.75% 5/1/29 (c) | | 2,335,000 | 2,498,450 |

| Level 3 Financing, Inc.: | | | |

| 3.625% 1/15/29 (c) | | 340,000 | 339,150 |

| 4.25% 7/1/28 (c) | | 2,320,000 | 2,383,800 |

| 4.625% 9/15/27 (c) | | 1,979,000 | 2,066,937 |

| Millicom International Cellular SA: | | | |

| 4.5% 4/27/31 (c) | | 200,000 | 216,000 |

| 6.625% 10/15/26 (c) | | 2,780,000 | 2,986,763 |

| Sable International Finance Ltd. 5.75% 9/7/27 (c) | | 515,000 | 547,831 |

| SFR Group SA: | | | |

| 5.125% 1/15/29 (c) | | 3,850,000 | 3,984,750 |

| 7.375% 5/1/26 (c) | | 5,850,000 | 6,157,125 |

| 8.125% 2/1/27(c) | | 6,580,000 | 7,254,516 |

| Sprint Capital Corp.: | | | |

| 6.875% 11/15/28 | | 6,978,000 | 9,200,353 |

| 8.75% 3/15/32 | | 1,820,000 | 2,881,743 |

| Telecom Italia Capital SA: | | | |

| 6% 9/30/34 | | 1,185,000 | 1,443,437 |

| 7.721% 6/4/38 | | 235,000 | 326,650 |

| Uniti Group, Inc.: | | | |

| 7.125% 12/15/24 (c) | | 4,065,000 | 4,105,650 |

| 7.875% 2/15/25 (c) | | 8,450,000 | 9,077,075 |

| Zayo Group Holdings, Inc.: | | | |

| 4% 3/1/27 (c) | | 1,600,000 | 1,604,000 |

| 6.125% 3/1/28 (c) | | 1,810,000 | 1,914,075 |

| | | | 104,790,331 |

| Transportation Ex Air/Rail - 0.3% | | | |

| XPO Logistics, Inc. 6.25% 5/1/25 (c) | | 3,000,000 | 3,228,420 |

| Utilities - 6.2% | | | |

| Clearway Energy Operating LLC: | | | |

| 4.75% 3/15/28 (c) | | 585,000 | 627,413 |

| 5% 9/15/26 | | 2,150,000 | 2,225,250 |

| 5.75% 10/15/25 | | 1,720,000 | 1,810,300 |

| DCP Midstream Operating LP: | | | |

| 5.125% 5/15/29 | | 3,300,000 | 3,660,096 |

| 5.625% 7/15/27 | | 2,305,000 | 2,558,550 |

| Global Partners LP/GLP Finance Corp. 7% 8/1/27 | | 2,782,000 | 2,976,740 |

| InterGen NV 7% 6/30/23 (c) | | 6,695,000 | 6,494,150 |

| NextEra Energy Partners LP 4.5% 9/15/27 (c) | | 565,000 | 632,388 |

| NRG Energy, Inc.: | | | |

| 3.375% 2/15/29 (c) | | 415,000 | 424,877 |

| 3.625% 2/15/31 (c) | | 820,000 | 843,616 |

| 5.25% 6/15/29 (c) | | 2,105,000 | 2,315,500 |

| 5.75% 1/15/28 | | 1,190,000 | 1,300,075 |

| 6.625% 1/15/27 | | 900,000 | 950,436 |

| NSG Holdings II LLC/NSG Holdings, Inc. 7.75% 12/15/25 (c) | | 7,590,854 | 8,046,305 |

| Pattern Energy Operations LP 4.5% 8/15/28 (c) | | 770,000 | 812,350 |

| PG&E Corp. 5.25% 7/1/30 | | 2,935,000 | 3,228,500 |

| Pike Corp. 5.5% 9/1/28 (c) | | 3,840,000 | 4,056,000 |

| TerraForm Power Operating LLC: | | | |

| 4.75% 1/15/30 (c) | | 265,000 | 283,550 |

| 5% 1/31/28 (c) | | 2,570,000 | 2,887,781 |

| Vistra Operations Co. LLC: | | | |

| 5% 7/31/27 (c) | | 3,790,000 | 4,017,400 |

| 5.5% 9/1/26 (c) | | 7,084,000 | 7,382,945 |

| 5.625% 2/15/27 (c) | | 2,175,000 | 2,313,417 |

| | | | 59,847,639 |

|

| TOTAL NONCONVERTIBLE BONDS | | | 906,984,868 |

|

| TOTAL CORPORATE BONDS | | | |

| (Cost $876,230,314) | | | 916,610,785 |

| | | Shares | Value |

|

| Common Stocks - 0.4% | | | |

| Automotive & Auto Parts - 0.0% | | | |

| Motors Liquidation Co. GUC Trust (g) | | 3 | 6 |

| Energy - 0.4% | | | |

| California Resources Corp. (g) | | 4,962 | 117,054 |

| California Resources Corp. (a) | | 5,205 | 122,786 |

| California Resources Corp. warrants 10/27/24 (g) | | 1,768 | 7,072 |

| Denbury, Inc. (g) | | 54,291 | 1,394,736 |

| Jonah Energy LLC (b) | | 58,499 | 877,485 |

| Mesquite Energy, Inc.(b) | | 82,533 | 1,320,524 |

|

| TOTAL ENERGY | | | 3,839,657 |

|

| Telecommunications - 0.0% | | | |

| CUI Acquisition Corp. Class E (b)(g) | | 1 | 35,011 |

| TOTAL COMMON STOCKS | | | |

| (Cost $6,594,129) | | | 3,874,674 |

| | | Principal Amount | Value |

|

| Bank Loan Obligations - 2.2% | | | |

| Cable/Satellite TV - 0.1% | | | |

| WideOpenWest Finance LLC Tranche B, term loan 3 month U.S. LIBOR + 3.250% 4.25% 8/19/23 (d)(e)(h) | | 1,296,144 | 1,289,300 |

| Consumer Products - 0.2% | | | |

| Kronos Acquisition Holdings, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 12/17/26 (e)(h)(i) | | 1,515,000 | 1,513,106 |

| Energy - 0.0% | | | |

| Gavilan Resources LLC Tranche 2LN, term loan 3 month U.S. LIBOR + 6.000% 0% 3/1/24 (b)(e)(f)(h) | | 4,810,000 | 0 |

| Sanchez Energy Corp.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 8.000% 0% 5/11/20(b)(e)(f)(h) | | 1,525,908 | 0 |

| term loan 3 month U.S. LIBOR + 0.000% 7.25% 5/11/20(b)(d)(e)(f)(h) | | 658,000 | 0 |

|

| TOTAL ENERGY | | | 0 |

|

| Gaming - 0.6% | | | |

| Golden Entertainment, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.75% 10/20/24 (d)(e)(h) | | 3,072,025 | 2,995,716 |

| Golden Nugget, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 3.25% 10/4/23 (d)(e)(h) | | 2,918,532 | 2,811,363 |

|

| TOTAL GAMING | | | 5,807,079 |

|

| Healthcare - 0.0% | | | |

| U.S. Renal Care, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.1875% 6/13/26 (d)(e)(h) | | 359,091 | 356,847 |

| Services - 0.3% | | | |

| Brand Energy & Infrastructure Services, Inc. Tranche B, term loan 3 month U.S. LIBOR + 4.250% 5.25% 6/21/24 (d)(e)(h) | | 3,247,225 | 3,160,134 |

| Finastra U.S.A., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 6/13/24 (d)(e)(h) | | 171,535 | 167,837 |

|

| TOTAL SERVICES | | | 3,327,971 |

|

| Super Retail - 0.3% | | | |

| LBM Acquisition LLC Tranche B 1LN, term loan: | | | |

| 3 month U.S. LIBOR + 3.750% 12/18/27 (e)(h)(i) | | 432,727 | 432,277 |

| 3 month U.S. LIBOR + 3.750% 4.5% 12/18/27 (d)(e)(h) | | 1,947,273 | 1,945,248 |

|

| TOTAL SUPER RETAIL | | | 2,377,525 |

|

| Technology - 0.4% | | | |

| Tempo Acquisition LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.75% 10/31/26 (d)(e)(h) | | 2,443,859 | 2,424,015 |

| Ultimate Software Group, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 5/3/26 (d)(e)(h) | | 1,241,888 | 1,247,389 |

|

| TOTAL TECHNOLOGY | | | 3,671,404 |

|

| Telecommunications - 0.3% | | | |

| Intelsat Jackson Holdings SA: | | | |

| Tranche B-4, term loan 3 month U.S. LIBOR + 5.500% 8.75% 1/2/24 (d)(e)(h) | | 280,000 | 283,937 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 5.500% 6.5% 7/13/22 (d)(e)(h) | | 2,116,460 | 2,155,614 |

|

| TOTAL TELECOMMUNICATIONS | | | 2,439,551 |

|

| TOTAL BANK LOAN OBLIGATIONS | | | |

| (Cost $24,353,171) | | | 20,782,783 |

| | | Shares | Value |

|

| Money Market Funds - 1.6% | | | |

| Fidelity Cash Central Fund 0.11% (j) | | | |

| (Cost $15,870,899) | | 15,868,052 | 15,871,226 |

| TOTAL INVESTMENT IN SECURITIES - 98.8% | | | |

| (Cost $923,048,513) | | | 957,139,468 |

| NET OTHER ASSETS (LIABILITIES) - 1.2% | | | 11,973,519 |

| NET ASSETS - 100% | | | $969,112,987 |

Legend

(a) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $1,601,665 or 0.2% of net assets.

(b) Level 3 security

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $663,877,528 or 68.5% of net assets.

(d) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(e) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(f) Non-income producing - Security is in default.

(g) Non-income producing

(h) Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty.

(i) The coupon rate will be determined upon settlement of the loan after period end.

(j) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| California Resources Corp. | 10/27/20 | $33,511 |

| Mesquite Energy, Inc. 15% 7/15/23 | 7/10/20 - 11/5/20 | $1,478,879 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $202,046 |

| Total | $202,046 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $35,011 | $-- | $-- | $35,011 |

| Energy | 3,839,657 | 1,641,648 | -- | 2,198,009 |

| Financials | 6 | 6 | -- | -- |

| Corporate Bonds | 916,610,785 | -- | 915,131,905 | 1,478,880 |

| Bank Loan Obligations | 20,782,783 | -- | 20,782,783 | -- |

| Money Market Funds | 15,871,226 | 15,871,226 | -- | -- |

| Total Investments in Securities: | $957,139,468 | $17,512,880 | $935,914,688 | $3,711,900 |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 78.4% |

| Canada | 3.9% |

| Luxembourg | 3.7% |

| Netherlands | 2.7% |

| Ireland | 2.5% |

| United Kingdom | 2.1% |

| Cayman Islands | 2.1% |

| France | 1.8% |

| Multi-National | 1.7% |

| Others (Individually Less Than 1%) | 1.1% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | December 31, 2020 |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $907,177,614) | $941,268,242 | |

| Fidelity Central Funds (cost $15,870,899) | 15,871,226 | |

| Total Investment in Securities (cost $923,048,513) | | $957,139,468 |

| Cash | | 1,108,008 |

| Receivable for investments sold | | 4,207,384 |

| Receivable for fund shares sold | | 1,069,026 |

| Interest receivable | | 14,082,907 |

| Distributions receivable from Fidelity Central Funds | | 1,548 |

| Prepaid expenses | | 1,215 |

| Total assets | | 977,609,556 |

| Liabilities | | |

| Payable for investments purchased | $7,370,228 | |

| Payable for fund shares redeemed | 472,856 | |

| Accrued management fee | 440,421 | |

| Distribution and service plan fees payable | 39,757 | |

| Other affiliated payables | 95,565 | |

| Other payables and accrued expenses | 77,742 | |

| Total liabilities | | 8,496,569 |

| Net Assets | | $969,112,987 |

| Net Assets consist of: | | |

| Paid in capital | | $1,032,155,074 |

| Total accumulated earnings (loss) | | (63,042,087) |

| Net Assets | | $969,112,987 |

| Net Asset Value and Maximum Offering Price | | |

| Initial Class: | | |

| Net Asset Value, offering price and redemption price per share ($313,972,796 ÷ 59,181,292 shares) | | $5.31 |

| Service Class: | | |

| Net Asset Value, offering price and redemption price per share ($53,326,187 ÷ 10,134,717 shares) | | $5.26 |

| Service Class 2: | | |

| Net Asset Value, offering price and redemption price per share ($170,257,031 ÷ 33,461,297 shares) | | $5.09 |

| Investor Class: | | |

| Net Asset Value, offering price and redemption price per share ($431,556,973 ÷ 81,840,092 shares) | | $5.27 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended December 31, 2020 |

| Investment Income | | |

| Dividends | | $614,381 |

| Interest | | 53,290,192 |

| Income from Fidelity Central Funds | | 202,046 |

| Total income | | 54,106,619 |

| Expenses | | |

| Management fee | $5,123,582 | |

| Transfer agent fees | 774,827 | |

| Distribution and service plan fees | 449,068 | |

| Accounting fees and expenses | 337,222 | |

| Custodian fees and expenses | 14,976 | |

| Independent trustees' fees and expenses | 5,412 | |

| Audit | 82,252 | |

| Legal | 4,272 | |

| Miscellaneous | 56,314 | |

| Total expenses before reductions | 6,847,925 | |

| Expense reductions | (10,848) | |

| Total expenses after reductions | | 6,837,077 |

| Net investment income (loss) | | 47,269,542 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (36,762,406) | |

| Fidelity Central Funds | 3,710 | |

| Total net realized gain (loss) | | (36,758,696) |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 10,013,120 | |

| Fidelity Central Funds | 1 | |

| Total change in net unrealized appreciation (depreciation) | | 10,013,121 |

| Net gain (loss) | | (26,745,575) |

| Net increase (decrease) in net assets resulting from operations | | $20,523,967 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended December 31, 2020 | Year ended December 31, 2019 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $47,269,542 | $52,166,800 |

| Net realized gain (loss) | (36,758,696) | (12,326,337) |

| Change in net unrealized appreciation (depreciation) | 10,013,121 | 94,044,788 |

| Net increase (decrease) in net assets resulting from operations | 20,523,967 | 133,885,251 |

| Distributions to shareholders | (47,004,184) | (51,787,940) |

| Share transactions - net increase (decrease) | (48,310,959) | 73,598,351 |

| Total increase (decrease) in net assets | (74,791,176) | 155,695,662 |

| Net Assets | | |

| Beginning of period | 1,043,904,163 | 888,208,501 |

| End of period | $969,112,987 | $1,043,904,163 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

VIP High Income Portfolio Initial Class

| Years ended December 31, | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $5.43 | $4.97 | $5.46 | $5.38 | $4.95 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .266 | .286 | .288 | .290 | .320 |

| Net realized and unrealized gain (loss) | (.121) | .457 | (.473) | .091 | .402 |

| Total from investment operations | .145 | .743 | (.185) | .381 | .722 |

| Distributions from net investment income | (.265) | (.283) | (.305) | (.301) | (.292) |

| Total distributions | (.265) | (.283) | (.305) | (.301) | (.292) |

| Net asset value, end of period | $5.31 | $5.43 | $4.97 | $5.46 | $5.38 |

| Total ReturnB,C | 2.75% | 15.11% | (3.46)% | 7.13% | 14.61% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .67% | .67% | .67% | .67% | .68% |

| Expenses net of fee waivers, if any | .67% | .67% | .67% | .67% | .68% |

| Expenses net of all reductions | .67% | .67% | .67% | .67% | .68% |

| Net investment income (loss) | 5.14% | 5.31% | 5.33% | 5.22% | 6.05% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $313,973 | $327,442 | $299,239 | $355,469 | $457,620 |

| Portfolio turnover rateF | 72% | 30% | 69% | 70% | 73% |

A Calculated based on average shares outstanding during the period.

B Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

VIP High Income Portfolio Service Class

| Years ended December 31, | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $5.38 | $4.93 | $5.42 | $5.34 | $4.92 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .259 | .279 | .280 | .283 | .311 |

| Net realized and unrealized gain (loss) | (.120) | .449 | (.471) | .092 | .395 |

| Total from investment operations | .139 | .728 | (.191) | .375 | .706 |

| Distributions from net investment income | (.259) | (.278) | (.299) | (.295) | (.286) |

| Total distributions | (.259) | (.278) | (.299) | (.295) | (.286) |

| Net asset value, end of period | $5.26 | $5.38 | $4.93 | $5.42 | $5.34 |

| Total ReturnB,C | 2.65% | 14.92% | (3.60)% | 7.07% | 14.37% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .77% | .77% | .77% | .77% | .78% |

| Expenses net of fee waivers, if any | .77% | .77% | .77% | .77% | .78% |

| Expenses net of all reductions | .77% | .77% | .77% | .77% | .78% |

| Net investment income (loss) | 5.04% | 5.21% | 5.23% | 5.12% | 5.95% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $53,326 | $66,123 | $58,231 | $68,104 | $84,945 |

| Portfolio turnover rateF | 72% | 30% | 69% | 70% | 73% |

A Calculated based on average shares outstanding during the period.

B Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

VIP High Income Portfolio Service Class 2

| Years ended December 31, | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $5.22 | $4.79 | $5.27 | $5.20 | $4.80 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .244 | .262 | .264 | .267 | .296 |

| Net realized and unrealized gain (loss) | (.121) | .438 | (.451) | .090 | .383 |

| Total from investment operations | .123 | .700 | (.187) | .357 | .679 |

| Distributions from net investment income | (.253) | (.270) | (.293) | (.287) | (.279) |

| Total distributions | (.253) | (.270) | (.293) | (.287) | (.279) |

| Net asset value, end of period | $5.09 | $5.22 | $4.79 | $5.27 | $5.20 |

| Total ReturnB,C | 2.42% | 14.77% | (3.63)% | 6.91% | 14.17% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .92% | .92% | .92% | .92% | .93% |

| Expenses net of fee waivers, if any | .92% | .92% | .92% | .92% | .93% |

| Expenses net of all reductions | .92% | .92% | .92% | .92% | .93% |

| Net investment income (loss) | 4.89% | 5.06% | 5.08% | 4.97% | 5.80% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $170,257 | $187,747 | $139,564 | $166,993 | $189,179 |

| Portfolio turnover rateF | 72% | 30% | 69% | 70% | 73% |

A Calculated based on average shares outstanding during the period.

B Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

VIP High Income Portfolio Investor Class

| Years ended December 31, | 2020 | 2019 | 2018 | 2017 | 2016 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $5.39 | $4.94 | $5.43 | $5.36 | $4.93 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .263 | .283 | .284 | .287 | .317 |

| Net realized and unrealized gain (loss) | (.119) | .448 | (.470) | .083 | .403 |

| Total from investment operations | .144 | .731 | (.186) | .370 | .720 |

| Distributions from net investment income | (.264) | (.281) | (.304) | (.300) | (.290) |

| Total distributions | (.264) | (.281) | (.304) | (.300) | (.290) |

| Net asset value, end of period | $5.27 | $5.39 | $4.94 | $5.43 | $5.36 |

| Total ReturnB,C | 2.74% | 14.94% | (3.50)% | 6.95% | 14.64% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .71% | .70% | .71% | .71% | .71% |

| Expenses net of fee waivers, if any | .71% | .70% | .71% | .71% | .71% |

| Expenses net of all reductions | .71% | .70% | .71% | .71% | .71% |

| Net investment income (loss) | 5.11% | 5.28% | 5.30% | 5.18% | 6.02% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $431,557 | $462,593 | $391,173 | $456,983 | $469,732 |

| Portfolio turnover rateF | 72% | 30% | 69% | 70% | 73% |

A Calculated based on average shares outstanding during the period.

B Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended December 31, 2020

1. Organization.

VIP High Income Portfolio (the Fund) is a fund of Variable Insurance Products Fund (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Fund may only be purchased by insurance companies for the purpose of funding variable annuity or variable life insurance contracts. The Fund offers the following classes of shares: Initial Class shares, Service Class shares, Service Class 2 shares and Investor Class shares. All classes have equal rights and voting privileges, except for matters affecting a single class.

Effective January 1, 2020:

Investment advisers Fidelity Investments Money Management, Inc., FMR Co., Inc., and Fidelity SelectCo, LLC, merged with and into Fidelity Management & Research Company. In connection with the merger transactions, the resulting, merged investment adviser was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to "Fidelity Management & Research Company LLC".

Broker-dealer Fidelity Distributors Corporation merged with and into Fidelity Investments Institutional Services Company, Inc. ("FIISC"). FIISC was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to "Fidelity Distributors Company LLC".

Fidelity Investments Institutional Operations Company, Inc. converted from a Massachusetts corporation to a Massachusetts LLC, and changed its name to "Fidelity Investments Institutional Operations Company LLC".

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date ranged from less than .005% to .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds and bank loan obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of December 31, 2020 is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Dividend income is recorded on the ex-dividend date. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of December 31, 2020, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to market discount, capital loss carryforwards, partnerships and losses deferred due to wash sales.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $49,715,340 |

| Gross unrealized depreciation | (13,385,681) |

| Net unrealized appreciation (depreciation) | $36,329,659 |

| Tax Cost | $920,809,809 |

The tax-based components of distributable earnings as of period end were as follows: