Exhibit 10.5

BAY COLONY CORPORATE CENTER

WALTHAM, MASSACHUSETTS

OFFICE LEASE

BAY COLONY CORPORATE CENTER LLC,

a Delaware limited liability company,

Landlord

and

OSCIENT PHARMACEUTICALS CORPORATION,

a Massachusetts corporation,

Tenant

DATED AS OF: June 23, 2004

TABLE OF CONTENTS

| | | | |

Paragraph | | | | Page |

1. | | Premises | | 1 |

2. | | Certain Basic Lease Terms | | 1 |

3. | | Term; Delivery of Possession of Premises | | 3 |

4. | | Condition of Premises | | 4 |

5. | | Monthly Rent | | 8 |

6. | | Letter of Credit | | 9 |

7. | | Additional Rent; Operating Expenses and Tax Expenses | | 10 |

8. | | Use of Premises; Compliance with Law | | 16 |

9. | | Alterations and Restoration | | 19 |

10. | | Repair | | 21 |

11. | | Abandonment | | 22 |

12. | | Liens | | 22 |

13. | | Assignment and Subletting | | 23 |

14. | | Indemnification of Landlord | | 28 |

15. | | Insurance | | 30 |

16. | | Mutual Waiver of Subrogation Rights | | 32 |

17. | | Utilities | | 32 |

18. | | Personal Property and Other Taxes | | 35 |

19. | | Rules and Regulations | | 36 |

20. | | Surrender; Holding Over | | 36 |

21. | | Subordination and Attornment | | 37 |

22. | | Financing Condition | | 38 |

23. | | Entry by Landlord | | 38 |

24. | | Insolvency or Bankruptcy | | 39 |

25. | | Default and Remedies | | 40 |

26. | | Damage or Destruction | | 43 |

27. | | Eminent Domain | | 45 |

28. | | Landlord’s Liability; Sale of Building | | 46 |

29. | | Estoppel Certificates | | 47 |

30. | | Right of Landlord to Perform | | 47 |

31. | | Late Charge | | 48 |

32. | | Attorneys’ Fees; Waiver of Jury Trial | | 48 |

33. | | Waiver | | 49 |

34. | | Notices | | 49 |

35. | | Deleted | | 49 |

36. | | Defined Terms and Marginal Headings | | 49 |

37. | | Time and Applicable Law | | 50 |

38. | | Successors | | 50 |

39. | | Entire Agreement; Modifications | | 50 |

40. | | Light and Air | | 50 |

41. | | Name of Building | | 50 |

42. | | Severability | | 50 |

-i-

| | | | |

43. | | Authority | | 50 |

44. | | No Offer | | 51 |

45. | | Real Estate Brokers | | 51 |

46. | | Consents and Approvals | | 51 |

47. | | Reserved Rights | | 52 |

48. | | Financial Statements | | 52 |

49. | | Deleted | | 52 |

50. | | Nondisclosure of Lease Terms | | 52 |

51. | | Furniture | | 53 |

52. | | Right of First Offer | | 53 |

53. | | Renewal Option | | 54 |

54. | | Notice of Lease; Termination Agreement | | 56 |

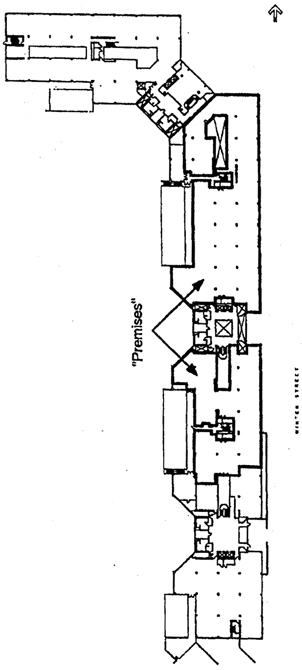

EXHIBITS

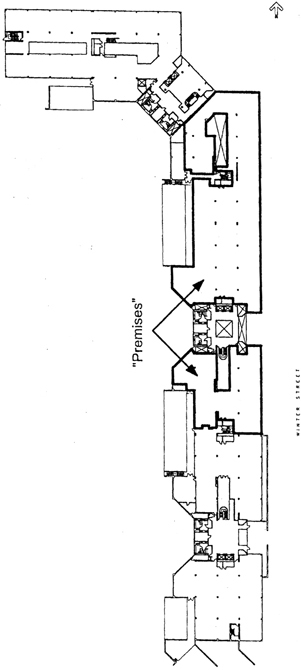

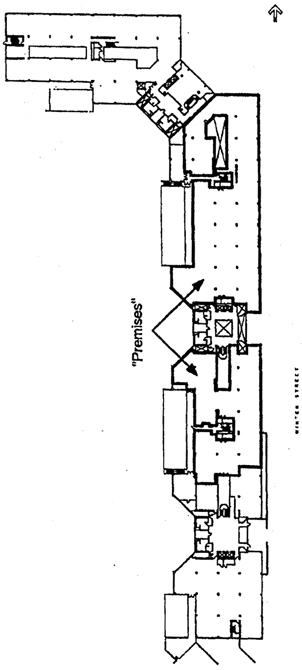

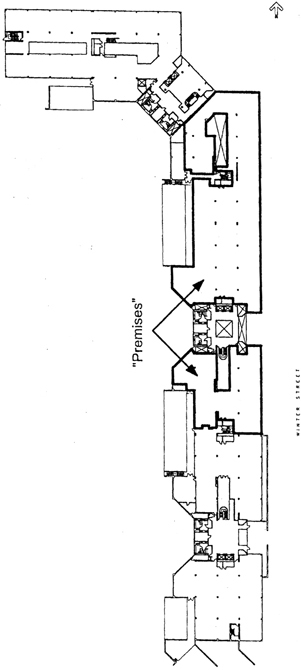

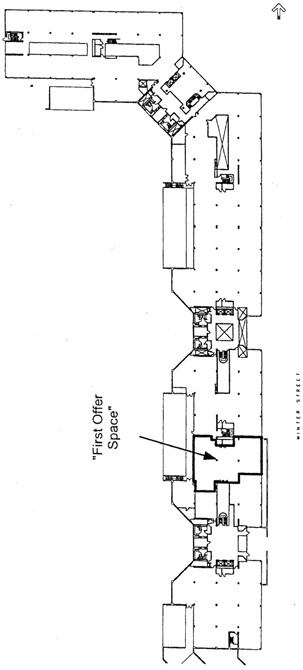

A – Outline of Premises

B – Rules and Regulations

C – Form of Commencement Date Letter

D – Description of Final Plans

E – Letter of Credit

F – List of Existing Furniture

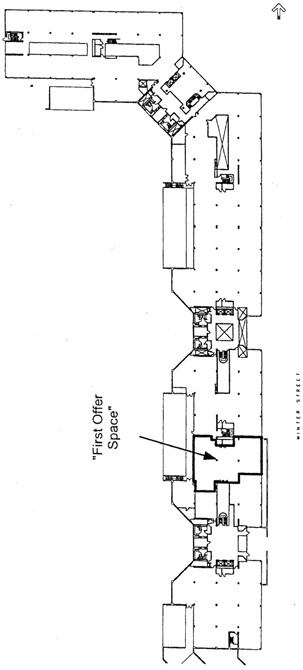

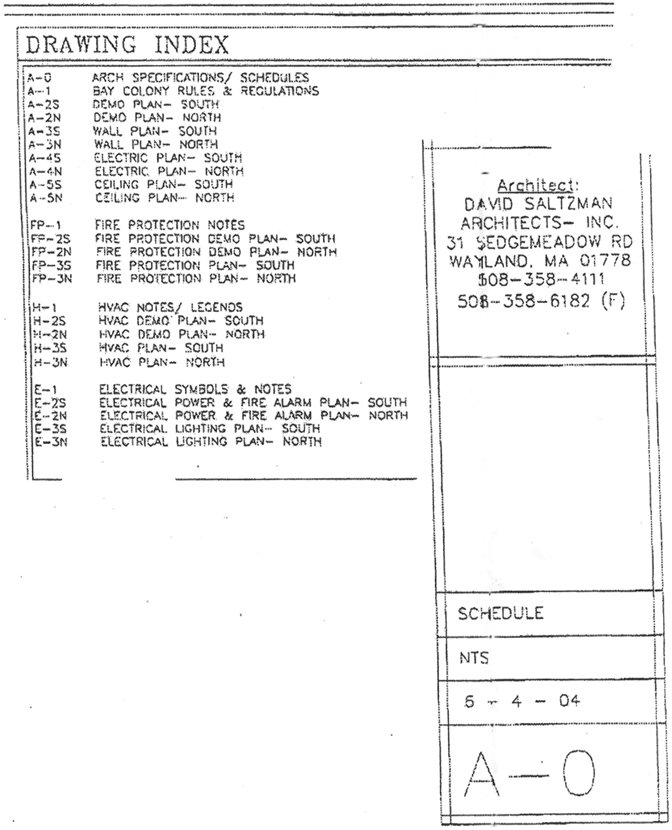

G – Outline of First Offer Space

H – Fleet SNDA

I – Form of Notice of Lease

J – Form of Termination Agreement

-ii-

LEASE

THIS LEASE is made as of the23 day of June, 2004, between BAY COLONY CORPORATE CENTER LLC, a Delaware limited liability company (“Landlord”), and OSCIENT PHARMACEUTICALS CORPORATION, a Massachusetts corporation (“Tenant”).

1.Premises. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, on the terms and conditions set forth herein, the space outlined on the attachedExhibit A (the “Premises”) which Premises consist of “Increment 1” and “Increment 2,” as shown onExhibit A. The Premises are located on the floor specified in Paragraph 2 below of the building located at 1000 Winter Street, Waltham, Massachusetts (the “Building”). The parcel(s) of land (the “Land”) on which the Building is located and the other improvements on the Land (including the Building, driveways, and landscaping) are referred to herein as the “Real Property.” The Real Property is situated within Bay Colony Corporate Center (the “Office Park”).

Tenant’s lease of the Premises shall include the right to use, in common with others and subject to the other provisions of this Lease, the public lobbies, entrances, stairs, elevators and other public portions of the Building and the parking lots, driveways and sidewalks serving the Office Park. All of the windows and outside walls of the Premises and any space in the Premises used for shafts, stacks, pipes, conduits, ducts, electrical equipment or other utilities or Building facilities are reserved solely to Landlord and Landlord shall have rights of access through the Premises for the purpose of operating, maintaining and repairing the same, subject to the provisions of Paragraph 23 below regarding Landlord’s access to the Premises.

2.Certain Basic Lease Terms. As used herein, the following terms shall have the meaning specified below:

| | a. | Floor(s) on which the Premises are located: Second (2nd) floor. The Premises are currently designated as Suite 2200. Landlord and Tenant agree that for the purpose of this Lease, Increment 1 shall be deemed to contain 8,688 rentable square feet of space and Increment 2 shall be deemed to contain 22,813 rentable square feet of space, for a total rentable square footage for the Premises of 31,501 rentable square feet of space. |

| | b. | Lease term: Approximately seven (7) years and eight (8) months. The Lease term as to Increment 1 shall commence on the date hereof (the “Increment 1 Commencement Date”). The Lease term as to Increment 2 shall commence on the date of Substantial Completion (as defined in Paragraph 4.b. below) of the portion of the Tenant Improvements (as defined in Paragraph 4.a. below) that are located in Increment 2 (the “Increment 2 Commencement Date”). References in this Lease to the “Commencement Date” shall be deemed to refer to the Increment 1 Commencement Date as to Increment 1 and be deemed to refer to the Increment 2 Commencement Date as to Increment 2. |

1

The Lease term shall end on the date (the “Expiration Date”) that is the last day of the ninetieth (90th) full calendar month following the Increment 2 Commencement Date.

| | c. | Monthly Rent: The sums set forth below for the respective periods: |

| | | | | |

Period | | Monthly

Rate | | |

Increment 1 Commencement Date through July 31, 2004 | | $ | 1,810.00 | | (electricity and

cleaning for

Increment 1

only) |

August 1, 2004 through July 31, 2005 | | $ | 50,821.61 | | |

August 1, 2005 through July 31, 2007 | | $ | 60,376.92 | | |

August 1, 2007 through July 31, 2009 | | $ | 65,627.08 | | |

August 1, 2009 through Expiration Date | | $ | 70,877.25 | | |

Notwithstanding the above, Tenant’s Monthly Rent shall be fully abated for the following six (6) calendar months: November and December of 2005, November and December of 2006, and November and December of 2007.

| | d. | Security: Letter of credit in the amount of Three Hundred Ninety Three Thousand Seven Hundred Sixty Two and 50/100 Dollars ($393,762.50). |

| | e. | Tenant’s Share: 11.2838%, which percentage is based upon (A) the rentable square feet of the Premises set forth in Paragraph 2.a. above, divided by (B) the total rentable square feet of the Building, which Landlord and Tenant agree, for the purpose of this Lease, shall be deemed to contain 279,189 rentable square feet. |

Base Year: The calendar year 2004.

| | f. | Base Tax Year: The fiscal tax year ending June 30, 2005. |

2

| | g. | Initial Contemplated Use of Premises: Biopharmaceutical development. Paragraph 8.a. below sets forth the permitted uses of the Premises. |

| | h. | Real estate broker(s): Shorenstein Realty Services, L.P., Trammell Crow Company and Spaulding & Slye. |

| | i. | Tenant’s Electrical Charge: Three Thousand Two Hundred Eighty One and 35/100 Dollars ($3,281.35) per month. |

3.Term; Delivery of Possession of Premises.

a.Term. The term of this Lease shall commence as to Increment 1 on the Increment 1 Commencement Date (as defined in Paragraph 2.b. above) and commence as to Increment 2 on the Increment 2 Commencement Date (as defined in Paragraph 2.b. above) and, unless sooner terminated pursuant to the terms hereof or at law, shall expire on the Expiration Date (as defined in Paragraph 2.b.). Upon either party’s request after the Increment 2 Commencement Date, Landlord and Tenant shall execute a letter to substantially the form ofExhibit C attached hereto confirming the Increment 2 Commencement Date.

b.Delivery of Increment 1 and Increment 2. Increment 1 shall initially be delivered by Landlord to Tenant in its as-is condition on the date of this Lease. In the event of any delay in the delivery of Increment 1 to Tenant in its as-is condition caused by fire or other casualty, acts of God or any other cause beyond the reasonable control of Landlord, this Lease shall not be void or voidable, nor shall Landlord be liable to Tenant for any loss or damage resulting therefrom, but Landlord shall use reasonable diligent efforts to deliver Increment 1 to Tenant as soon as is reasonably possible after the date of this Lease. No delay in delivery of possession of Increment 1 to Tenant shall amend Tenant’s obligations under this Lease; provided, however, that if Increment 1 is not delivered to Tenant on the date of this Lease, then the Increment 1 Commencement Date shall be modified to be the date that Increment 1 is actually delivered to Tenant in its as-is condition. Notwithstanding the initial delivery of Increment 1 to Tenant in its as-is condition, Tenant Improvements will subsequently be constructed in Increment 1 pursuant to Paragraph 4 below.

Increment 2 shall be delivered to Tenant upon Substantive 1 Completion of the portion of the Tenant Improvements that are to be constructed in Increment 2 pursuant to Paragraph 4 below.

If Substantial Completion of the Tenant Improvements I located in Increment 1 and/or Increment 2 is delayed for any reason whatsoever, this Lease shall not be void or voidable. Further, no delay in the Substantial Completion of the Tenant Improvements shall amend Tenant’s obligations under this Lease. In no event shall Landlord be liable to Tenant for any delay in completion of the Tenant Improvements that is caused or occasioned by strikes, lockout, labor disputes, shortages of material or labor, fire or other casualty, acts of God or any other cause beyond the commercially reasonable control of Landlord (“Force Majeure”). Notwithstanding the foregoing, if the Tenant Improvements for both Increment 1 and Increment 2 are not Substantially Completed by the Target Completion Date (as defined in Paragraph 4.c.

3

below) due to Landlord’s failure to comply with the construction schedule set forth in Paragraph 4.c. below for any reason other than delays caused by Force Majeure or a Tenant Delay (as defined in Paragraph 4.d. below) (any such delay caused by other than Force Majeure or a Tenant Delay being referred to hereinafter as a “Landlord Delay”), then Tenant’s Monthly Rent shall be abated one (1) day for each day beyond the Target Completion Date that the Tenant Improvements were not Substantially Completed due to a Landlord Delay, which abatement shall be applied as soon as the Target Completion Date (as extended by any delays caused by Force Majeure or a Tenant Delay) has been passed. In no event shall Tenant’s Monthly Rent be abated if the Tenant Improvements are not completed by the Target Completion Date due to Force Majeure and/or a Tenant Delay(s).

c.Early Occupancy. If, at Tenant’s request, Landlord permits Tenant to take occupancy of Increment 1 and/or Increment 2 prior to their respective Commencement Dates set forth above, then the Commencement Date as to that increment shall be the date of such early occupancy by Tenant; provided, however, that the Expiration Date of this Lease shall not be affected by such early occupancy of either increment of the Premises. Tenant’s entry into the Premises for the purposes provided for in Paragraph 4.e. below shall not constitute occupancy of the Premises for the purposes of this Paragraph 3.c.

4.Condition of Premises. Except as otherwise expressly provided in this Paragraph 4, Tenant shall accept the Premises in their “as-is” condition and Landlord shall have no obligation to make or pay for any improvements or renovations in or to the Premises.

a.Tenant Improvements; Final Plans; Budget. Landlord shall cause Landlord’s designated contractor (“Contractor”) to construct the improvements in the Premises (the “Tenant Improvements”) which are specifically described in the construction plans and specifications described on the attached Exhibit D (the “Final Plans”).

As soon as reasonably possible after the date hereof, Landlord shall provide Tenant with an estimated budget for the Tenant Improvements, which budget shall include Contractor’s fee, the Construction Management Fee (as defined in Paragraph 4.e. below) and a reasonable contingency. Tenant shall have three (3) business days after the receipt of the estimated budget to approve or reasonably disapprove of the estimated budget or to approve or reasonably disapprove of particular line items in the estimated budget. If Tenant disapproves of the budget or any line item thereon within such three (3) business day period, then Landlord shall cause Landlord’s architect to modify the Final Plans to satisfactorily address the desired change to the budget. Any and all revisions to the Final Plans shall be subject to Landlord’s reasonable approval. Upon the revision of the Final Plans, Landlord shall cause Contractor to promptly prepare and submit to Tenant a revised estimated budget, Tenant shall respond to the revised estimated budget in the manner described above with regard to the initial budget. Any delay in Substantial Completion of the Tenant Improvements caused directly or indirectly by any revision to the Final Plans or the initial estimated budget or any subsequently revised budget (other than revisions required to correct errors or incomplete work by Landlord, Landlord’s architect or Contractor) shall constitute a Tenant Delay as defined in Paragraph 4.d. below. In the event Tenant shall fail to raise any objections to the initial budget or any revised budget within the three (3) business day period(s) described above, Tenant shall be deemed to have approved the

4

proposed budget or revised budget, as applicable. The budget, as approved by Landlord and Tenant, is referred to hereinafter as the “Final Budget”

Notwithstanding anything to the contrary in this Paragraph 4.a, or elsewhere in this Paragraph 4, Landlord and Tenant agree that, although the Final Budget represents a good faith estimate by Contractor of the costs of the construction of the Tenant Improvements, the Final Budget is only an estimate based on information presently known by Contractor with regard to the present condition of the Premises and the anticipated costs of the design and construction of the Tenant Improvements. Tenant hereby authorizes Landlord to make expenditures from the contingency category of the Final Budget to cover any unforeseen expenses; provided, however, in no event may Landlord spend amounts in excess of the Final Budget contingency without Tenant’s prior written consent.

b.Changes. If Tenant requests any change, addition or alteration in or to the Final Plans (“Changes”), Landlord shall cause Landlord’s architect to prepare additional plans implementing such Change (which additional plans shall be subject to Landlord’s reasonable approval) and Landlord’s reasonable architectural charges in connection therewith shall be added to the cost of the Tenant Improvements. As soon as practicable after the completion of such additional plans, Landlord shall notify Tenant of the estimated cost of the Change. Within three (3) business days after receipt of such cost estimate, Tenant shall notify Landlord in writing whether Tenant approves the Change. If Tenant approves the Change, Landlord shall proceed with the Change and the cost of the Change shall be added to the cost of the Tenant Improvements and the Final Budget adjusted accordingly. If Tenant fails to approve the Change within such three (3) business day period, the requested Change shall not be incorporated into the Tenant Improvements.

c.Construction; Substantial Completion. Landlord shall cause Contractor to commence the construction of the Tenant Improvements as soon as is reasonably possible after the approval by Landlord and Tenant of the Final Budget and Tenant’s delivery to Landlord of the Letter of Credit, in the form required by Paragraph 6 below. In no event shall Landlord be required to commence construction of the Tenant Improvements prior to the date the Letter of Credit is received by Landlord. If Tenant has not delivered the Letter of Credit to Landlord on or before the date (the “LOC Date”) that is ten (10) business days following the date of this Lease, then any delay in the Substantial Completion of the Tenant Improvements that is caused by Tenant’s failure to deliver the Letter of Credit to Landlord on or before the LOC Date, shall constitute a Tenant Delay for purposes of the third grammatical paragraph of Paragraph 3 above.

Landlord and Contractor shall adhere to the following schedule for construction:

Receive permits for construction not later than July 15, 2004

Substantial Completion of Tenant Improvements in Increment 2 on or before August 12, 2004

5

Substantial Completion of Tenant Improvements in Increment 1 on or before September 16,2004 (“Target Completion Date”)

Tenant acknowledges that the portion of the Tenant Improvements being constructed in Increment 1 will be constructed therein after Tenant has commenced occupancy of Increment 1. Landlord and Tenant shall agree upon a mutually acceptable staging schedule for the construction of the Tenant Improvements so that Tenant can vacate the portions of Increment 1 that are required to be vacated in order for certain of the Tenant Improvement work to be performed therein; provided, however, that any delay in the Substantial Completion of the Tenant Improvements caused by such staging shall constitute a Tenant Delay, rather than a Landlord Delay, for purposes of applying Paragraph 3.b. above. Tenant shall not be entitled to any abatement of the electricity or cleaning charge during the construction of the Tenant Improvements in Increment 1, nor of Monthly Rent if the Tenant Improvements are not completed prior to August 1, 2004; subject, however, to the third grammatical paragraph of Paragraph 3.b. above.

Landlord shall provide and cause to be installed only those wall terminal boxes and/or floor monuments required for Tenant’s telephone or computer systems as are shown on the Final Plans. Landlord will provide ordinary power wiring to locations shown on the Final Plans and shall provide and cause to be installed conduits as required for Tenant’s telephone and computer systems as shown on the Final Plans, but shall in no event install, pull or hook up such wires or provide wiring necessary for special conditioned power to the Premises. Further, notwithstanding anything to the contrary herein, Landlord and Tenant shall cooperate with each other to resolve any space plan issues raised by applicable local building codes. The Tenant Improvements shall be deemed to be “Substantially Completed” when (i) they have, as determined by Landlord’s architect, been completed in accordance with the Final Plans, subject only to correction or completion of “Punch List” items, which items shall be limited to minor items of incomplete or defective work or materials or mechanical maladjustments that are of such a nature that they do not materially interfere with or impair Tenant’s use of the Premises for Tenant’s business and (ii) any governmental approvals (which may be oral approvals by inspectors or other officials, and may be temporary or conditional in accordance with local practice) and permits required for the lega1 occupancy of the Premises have been issued. The definition of “Substantially Completed” shall also apply to the terms “Substantial Completion” and “Substantially Complete”.

d.Tenant Delays. Tenant shall be responsible for, and shall pay to Landlord, any and all costs and expenses incurred by Landlord in connection with any delay in the commencement or completion of the Tenant Improvements and any increase in the cost of the Tenant Improvements caused by (i) any Changes requested by Tenant in the Final Plans (including any cost or delay resulting from proposed changes that are not ultimately made), (ii) any failure by Tenant to timely pay any amounts due from Tenant hereunder, including any additional costs resulting from any Change (it being acknowledged that if Tenant fails to make or otherwise delays making such payments, Landlord may stop work on the Tenant Improvements rather than incur costs which Tenant is obligated to fund but has not yet funded and any delay from such a work stoppage will be a Tenant Delay), (iii) the inclusion in the Tenant Improvements of any so-called “long lead” materials (such as fabrics, paneling, carpeting or other items that are not readily available within industry standard lead times (e.g., custom made

6

items that require time to procure beyond that customarily required for standard items, or items that are currently out of stock and will require extra time to back order) and for which suitable substitutes exist), (iv) Tenant’s failure to respond within three (3) business days to reasonable inquiries by Landlord or Contractor regarding the construction of the Tenant Improvements, or (v) any other delay requested or caused by Tenant. Each of the foregoing is referred to herein as a “Tenant Delay”.

e.Cost of Tenant Improvements. Landlord shall bear the cost of the construction of the Tenant Improvements (including the architectural costs for the preparation of the Tenant Approved Plans and the Final Plans, Contractor’s fee and the Construction Management Fee (as defined below)), limited however to a maximum expenditure by Landlord therefor of Four Hundred Seventy Two Thousand Five Hundred Fifteen Dollars ($472,515.00) (“Landlord’s Allowance”). A portion of Landlord’s Allowance not to exceed One Hundred Fifty Seven Thousand Five Hundred Five Dollars ($157,515.00) may be applied to the reasonable architectural and engineering costs for the design of the Tenant Improvements and to wiring and cabling, Tenant’s security system in the Premises, signage, moving expenses and costs of breaking down and reinstalling the Furniture (as defined in Paragraph 51 below) (“Soft Costs”). No portion of Landlord’s Allowance may (i) be applied to the cost of equipment, trade fixtures, furniture or free rent, (ii) be applied to any portion of the Premises which is then the subject of a sublease, or (iii) be used to prepare any portion of the Premises for a proposed subtenant or assignee. Disbursements of Landlord’s Allowance for payment of Soft Costs pursuant to the foregoing shall be made by Landlord within thirty (30) days following Landlord’s receipt of Tenant’s written request therefor accompanied by written invoices (in form reasonably acceptable to Landlord) evidencing the subject costs.

Subject to the expenditure restrictions set forth in the last sentence of Paragraph 4.a. above, Tenant shall pay for all costs of the construction of the Tenant Improvements in excess of Landlord’s Allowance (the “Excess Cost”). Based on the estimated cost of the construction of the Tenant Improvements, as shown on the Final Budget (the “Estimated Costs”), the prorata share of the Estimated Costs payable by Landlord and Tenant shall be determined and an appropriate percentage share established for each (a “Share of Costs”). Tenant and Landlord shall fund the cost of the construction (including the applicable portion of the applicable fees) as the same is performed, in accordance with their respective Share of Costs for the construction, with Tenant’s payments being made to Landlord within thirty (30) days of Landlord’s written demand. At such time as Landlord’s Allowance has been entirely disbursed, Tenant shall pay the remaining Excess Cost, if any, to Landlord, which payment shall be made, at Landlord’s option, in advance or in course of construction installments. Upon Tenant’s written request, Landlord or Contractor shall provide Tenant with a breakdown of all construction costs to date and of Landlord’s and Tenant’s prior contributions toward such costs.

Notwithstanding the foregoing, Landlord shall retain from the amount of Landlord’s Allowance, as compensation to Landlord for review of the Final Plans and for construction inspection, administration and management with regard to the Tenant Improvements, a sum (the “Construction Management Fee”) equal to (i) five percent (5%) of the first One Hundred Thousand Dollars ($100,000.00) of the hard construction costs for the Tenant Improvements and the costs of the mechanical, engineering and plumbing drawings for the

7

Tenant Improvements, plus (ii) three percent (3%) of such costs in excess of One Hundred Thousand Dollars ($100,000.00). At the time Landlord makes any disbursement of Landlord’s Allowance, Landlord shall retain from Landlord’s Allowance, as a partial payment of the Construction Management Fee, a proportionate amount of the Construction Management Fee based upon Landlord’s reasonable estimation of the amount required to be withheld from each disbursement in order to ensure that the entire Construction Management Fee is retained over the course of construction on a prorata basis. At such time as Landlord’s Allowance has been entirely disbursed, Tenant shall, within ten (10) business days of written demand, pay to Landlord the remainder, if any, of the Construction Management Fee not yet paid to Landlord. Landlord’s aforementioned written demand shall detail the manner in which the Construction Management Fee was calculated and specify which portion of the Construction Management Fee was previously paid and the portion owed.

f.Early Entry. Notwithstanding anything to the contrary in this Lease, Tenant may, prior to the Substantial Completion of Tenant Improvements, enter the Premises for the purpose of installing telephones, electronic communication or related equipment fixtures, furniture and equipment, provided that Tenant shall be solely responsible for any of such equipment, fixtures, furniture or material and for any loss or damage thereto from any cause whatsoever, excluding only the gross negligence or deliberate misconduct of Landlord or Landlord’s contractors. Such early access to the Premises and such installation shall be permitted only to the extent that Landlord determines that such early access and installation activities will not delay Landlord’s completion of the construction of the Tenant Improvements. Landlord and Tenant shall cooperate in the scheduling of Tenant’s early access to the Premises and of Tenant’s installation activities in an attempt to maximize the benefits to Tenant of this Paragraph 4.e. without interfering with Contractor’s completion of the construction of the Tenant Improvements. The provisions of the final grammatical paragraph of Paragraph 8.a. below, the provisions of Paragraph 9.a. below, and the provisions of Paragraphs 14 and 15 below shall apply in full during the period of any such early entry, and Tenant shall (i) provide certificates of insurance evidencing the existence and amounts of liability insurance carried by Tenant and its agents and contractors, reasonably satisfactory to Landlord, prior to such early entry, and (ii) comply with all applicable laws, regulations, permits and other approvals applicable to such early entry work in the Premises.

5.Monthly Rent.

a. Commencing as of the Commencement Date, and continuing thereafter on or before the first day of each calendar month during the term hereof, Tenant shall pay to Landlord, as monthly rent for the Premises, the applicable Monthly Rent and Tenant’s Electrical Charge specified in Paragraph 2 above for the periods referred to therein. If Tenant’s obligation to pay Monthly Rent hereunder commences on a day other than the first day of a calendar month, or if the term of this Lease terminates on a day other than the last day of a calendar month, then the Monthly Rent and Tenant’s Electrical Charge payable for such partial month shall be appropriately prorated on the basis of a thirty (30)-day month. Monthly Rent, Tenant’s Electrical Charge and the Additional Rent specified in Paragraph 7 shall be paid by Tenant to Landlord, in advance, without deduction, offset, prior notice or demand, in immediately available funds of lawful money of the United States of America, or by good check as described below, to the lockbox location designated by Landlord, or to such other person or at

8

such other place as Landlord may from time to time designate in writing. Payments made by check must be drawn either on a California financial institution or on a financial institution that is a member of the federal reserve system. Notwithstanding the foregoing, Tenant shall pay to Landlord together with Tenant’s execution of this Lease an amount equal to the Monthly Rent payable for the first full calendar month of the Lease term after Tenant’s obligation to pay Monthly Rent shall have commenced hereunder, which amount shall be applied to the Monthly Rent first due and payable hereunder.

b. All amounts payable by Tenant to Landlord under this Lease, or otherwise payable in connection with Tenant’s occupancy of the Premises, in addition to the Monthly Rent and Tenant’s Electrical Charge hereunder and Additional Rent under Paragraph 7, shall constitute rent owed by Tenant to Landlord hereunder.

c. Any rent not paid by Tenant to Landlord when due shall bear interest from the date due to the date of payment by Tenant at an annual rate of interest (the “Interest Rate”) equal to the lesser of (i) twelve percent (12%) per annum or (ii) the maximum annual interest rate allowed by law on such due date for business loans (not primarily for personal, family or household purposes) not exempt from the usury law. Failure by Tenant to pay rent when due, including any interest accrued under this subparagraph, shall constitute an Event of Default (as defined in Paragraph 25 below) giving rise to all the remedies afforded Landlord under this Lease and at law for nonpayment of rent.

d. No security or guaranty which may now or hereafter be furnished to Landlord for the payment of rent due hereunder or for the performance by Tenant of the other terms of this Lease shall in any way be a bar or defense to any of Landlord’s remedies under this Lease or at law.

6.Letter of Credit. As security for the performance by ‘ Tenant of Tenant’s obligations hereunder, Tenant shall cause to be delivered to Landlord, within thirty (30) days following the date of this Lease, an original irrevocable standby letter of credit (the “Letter of Credit”) in the amount specified in Paragraph 2.d. above, naming Landlord as beneficiary, which Landlord may draw upon to cure any Event of Default under this Lease or to compensate Landlord for any damage (subject to the limitations on damages expressly provided for in the last grammatical paragraph of Paragraph 14.b. below) Landlord incurs as a result of an Event of Default. Tenant’s failure to deliver the Letter of Credit within the aforementioned thirty (30) day period shall constitute an Event of Default entitling Landlord to exercise the remedies set forth in Paragraph 25.b. below. Any such draw on the Letter of Credit shall not constitute a waiver of any other rights of Landlord with respect to any such Event of Default or failure to perform. The Letter of Credit shall be issued by a major commercial bank reasonably acceptable to Landlord, with a metropolitan Boston, or New York, New York, service and claim point for the Letter of Credit, have an expiration date not earlier than the sixtieth (60th) day after the Expiration Date (or, in the alternative, have a term of not less than one (1) year and be automatically renewable for an additional one (1) year period unless notice of non-renewal is given by the issuer to Landlord not later than sixty (60) days prior to the expiration thereof) and shall provide that Landlord may make partial and multiple draws thereunder, up to the face amount thereof. In addition, the Letter of Credit shall provide that, in the event of Landlord’s assignment or other transfer of its interest in this Lease, the Letter of Credit shall be freely transferable by Landlord,

9

without charge and without recourse, to the assignee or transferee of such interest and the bank shall confirm the same to Landlord and such assignee or transferee. The Letter of Credit shall provide for payment to Landlord upon the issuer’s receipt of a sight draft from Landlord together with Landlord’s certificate certifying that the requested sum is due and payable from Tenant and Tenant has failed to pay, and with no other conditions, shall be in the form attached hereto asExhibit E, or otherwise in form and content satisfactory to Landlord. If the Letter of Credit has an expiration date earlier than the date sixty (60) days following the Expiration Date, then throughout the term hereof (including any renewal or extension of the term) Tenant shall provide evidence of renewal of the Letter of Credit to Landlord at least sixty (60) days prior to the date the Letter of Credit expires. If Landlord draws on the Letter of Credit pursuant to the terms hereof, Tenant shall immediately replenish the Letter of Credit or provide Landlord with an additional letter of credit conforming to the requirement of this paragraph so that the amount available to Landlord from the Letter of Credit(s) provided hereunder is the amount specified in Paragraph 2.d. above. Tenant’s failure to deliver any replacement, additional or extension of the Letter of Credit, or evidence of renewal of the Letter of Credit, within the time specified under this Lease shall entitle Landlord to draw upon the Letter of Credit then in effect. If Landlord liquidates the Letter of Credit as provided in the preceding sentence, Landlord shall hold the funds received from the Letter of Credit as security for Tenant’s performance under this Lease, and Landlord shall not be required to segregate such security deposit from its other funds and no interest shall accrue or be payable to Tenant with respect thereto. No holder of a Superior Interest (as defined in Paragraph 21 below), nor any purchaser at any judicial or private foreclosure sale of the Real Property or any portion thereof, shall be responsible to Tenant for such security deposit unless and only to the extent such holder or purchaser shall have actually received the same. If Tenant is not in default at the expiration or termination of this Lease, Landlord shall return to Tenant the Letter of Credit or the balance of the security deposit then held by Landlord, as applicable within thirty (30) days following the expiration or earlier termination of this Lease; provided, however, that in no event shall any such return be construed as an admission by Landlord that Tenant has performed all of its covenants and obligations hereunder.

7.Additional Rent; Operating Expenses and Tax Expenses.

a.Operating Expenses. Tenant shall pay to Landlord at the times hereinafter set forth, Tenant’s Share, as specified in Paragraph 2.e. above, of any increase in the Operating Expenses (as defined below) incurred by Landlord in each calendar year subsequent to the Base Year specified in Paragraph 2.f. above, over the Operating Expenses incurred by Landlord during the Base Year. The amounts payable under this Paragraph 7.a. and Paragraph 7.b. below are termed “Additional Rent” herein.

The term “Operating Expenses” shall mean the total costs and expenses incurred by Landlord in connection with the management, operation, maintenance, repair and ownership of the Real Property (including, without limitation, costs and expenses incurred in connection with the management, operation, maintenance, repair and ownership of other portions of the Office Park, to the extent fairly allocable to the Real Property), including, without limitation, the following costs: (1) salaries, wages, bonuses and other compensation (including hospitalization, medical, surgical, retirement plan, pension plan, union dues, life insurance, including group life insurance, welfare and other fringe benefits, and vacation, holidays and other paid absence

10

benefits) relating to employees of Landlord or its agents engaged in the operation, repair, or maintenance of the Real Property; (2) payroll, social security, workers’ compensation, unemployment and similar fixes with respect to such employees of Landlord or its agents, and the cost of providing disability or other benefits imposed by law or otherwise, with respect to such employees; (3) the cost of uniforms (including the cleaning, replacement and pressing thereof) provided to such employees; (4) premiums and other charges incurred by Landlord with respect to fire, other casualty, rent and liability insurance, any other insurance as is deemed necessary or advisable in the reasonable judgment of Landlord, or any insurance required by the holder of any Superior Interest (as defined in Paragraph 21 below), and, after the Base Year, costs of repairing an insured casualty to the extent of the deductible amount under the applicable insurance policy; (5) water charges and sewer rents or fees; (6) license, permit and inspection fees; (7) sales, use and excise taxes on goods and services purchased by Landlord in connection with the operation, maintenance or repair of the Real Property and Building systems and equipment; (8) telephone, telegraph, postage, stationery supplies and other expenses incurred in connection with the operation, maintenance, or repair of the Real Property; (9) management fees and expenses; (10) costs of repairs to and maintenance of the Real Property, including building systems and appurtenances thereto and normal repair and replacement of worn-out equipment, facilities and installations, but excluding the replacement of major building systems (except to the extent provided in (16) and (17) below); (11) fees and expenses for janitorial, window cleaning, guard, extermination, water treatment, rubbish removal, plumbing and other services and inspection or service contracts for elevator, electrical, mechanical, HVAC and other building equipment and systems or as may otherwise be necessary or proper for the operation, repair or maintenance of he Real Property; (12)costs of supplies, tools, materials, and equipment used in connection with the operation, maintenance or repair of the Real Property; (13) accounting, legal and other professional fees and expenses; (14) fees and expenses for painting the exterior or the public or common areas of the Building and the cost of maintaining the sidewalks, landscaping and other common areas of the Real Property; (15) costs and expenses for electricity, chilled water, air conditioning water for heating, gas, fuel, steam, heat, lights, power and other energy related utilities required ii connection with the operation, maintenance and repair of the Real Property (provided, however, that if the cost of any energy related utility for the Base Year is greater than the cost of such utility in subsequent year(s) of the Lease term due to unusual increases or fluctuations in the rate for such utility in the Base Year and such unusual increases or fluctuations are not present in the applicable subsequent year(s), Operating Expenses for the Base Year may be adjusted, for purposes of determining the Operating Expenses payable by Tenant in the applicable subsequent year(s), to reflect what the cost of such utility would have been in the Base Year had normal rates applied); (16) the cost of any capital improvements made by Landlord to the Real Property or capital assets acquired by Landlord after the Base Year in order to comply with any local, state or federal law, ordinance, rule, regulation, code or order of any governmental entity or insurance requirement (collectively, “Legal Requirement”) with which the Real Property was not required to comply during the Base Year, or to comply with any amendment or other change to the enactment or interpretation of any Legal Requirement from its enactment or interpretation during the Base Year; (17) the cost of any capital improvements made by Landlord to the Building or capital assets acquired by Landlord after the Base Year for the protection of the health and safety of the occupants of the Real Property or that are designed to reduce other Operating Expenses (provided, however, that, with regard to capital improvements or asset; designed to reduce other Operating Expenses, the costs thereof may only

11

be included in Operating Expenses if, at the time such costs were incurred, Landlord reasonably estimated (and upon Tenant’s written request, Landlord shall deliver to Tenant a written statement and explanation of Landlord’s estimation) that the annual saving in Operating Expenses that would result from such expenditure would be equal to or exceed the annual amortized amount of the cost to be included in Operating Expenses pursuant to this Paragraph 7.a.); (18) the cost of furniture, draperies, carpeting, landscaping and other customary and ordinary items of personal property (excluding paintings, sculptures and other works of art) provided by Landlord for use in common areas of the Building or the Real Properly or in the Building office (to the extent that such Building office is dedicated to the operation and management of the Real Property); (19) any expenses and costs resulting from substitution of work, labor, material or services in lieu of any of the above itemizations, or for any additional work, labor, services or material resulting from compliance with any Legal Requirement applicable to the Real Property or any parts thereof; and (20) Building office rent or rental value fairly allocated among the buildings within the Office Park. With respect to the costs of items included in Operating expenses under (16) and (17), such costs shall be amortized over a reasonable period, as reasonably determined by Landlord in accordance with generally accepted property management practices, together with interest on the unamortized balance at a rate per annum equal to three (3) percentage points over the six-month United States Treasury bill rate in effect at the time such item is constructed or acquired, or at such higher rate as may have been paid by Landlord on funds borrowed for the purpose of constructing or acquiring such item, but in either case not more than the maximum rate permitted by law at the time such item is constructed or acquired.

Notwithstanding the foregoing, Operating Expenses shall not include the following: (i) depreciation on the Building or equipment or systems therein; (ii) financing or refinancing costs, including all interest, principal, points and other fees or expenses incurred in the application for or obtaining any loan; (iii) rental under any ground or underlying lease; (iv) interest (except as expressly provided in this Paragraph 7.a.); (v) Tax Expenses (as defined in Paragraph 7.b. below); (vi) attorneys’ and other professional fees and expenses incurred in connection with lease negotiations with current or prospective Building tenants, lease disputes with past, current or prospective Building tenants, the enforcement of leases affecting the Real Property, the sale or refinancing of all or any part of the Real Property, the defense of Landlord’s title to or interest in the Real Property, or disputes with past, current or prospective employees of Landlord or Landlord’s agents; (vii) the cost (including any amortization thereof) of any equipment, improvements or alterations which would be properly classified as capital expenditures according to generally accepted property management practices (except to the extent expressly included in Operating Expenses pursuant to Paragraphs 7.a.(16) and (17) above); (viii) the cost (including architectural, engineering and permit costs) of decorating, improving for tenant occupancy, painting or redecorating portions of the Building to be demised to tenants; (ix) wages, salaries, benefits or other similar compensation paid to executive employees of Landlord or Landlord’s agents above the rank of regional property manager or the cost of labor and employees with respect to personnel not located at the Building on a full-time basis unless such costs are appropriately allocated between the Building and the other responsibilities of such personnel; (x) advertising and promotional expenditures; (xi) real estate broker’s or other leasing or sales commissions; (xii) penalties or other costs incurred due to a violation by Landlord, as determined by written admission, stipulation, final judgment or arbitration award, of any of the terms and conditions of this Lease or any other lease relating to

12

the Building except to the extent such costs reflect costs that would have been concurred by Landlord absent such violation; (xiii) subject to the provisions of item (4) above, repairs and other work occasioned by fire, windstorm or other casualty, to the extent Landlord is reimbursed by insurance proceeds, and other work paid from insurance or condemnation proceeds; (xiv) costs, penalties or fines arising from Landlord’s violation of any applicable governmental rule or authority except to the extent such costs reflect costs that would have been reasonably incurred by Landlord absent such violation; (xv) overhead and profit increments paid to subsidiaries or affiliates of Landlord for management or other services on or to the Building or for supplies or other materials to the extent that the cost of the services, supplies or materials materially exceed the amounts normally payable for similar goods and services under similar circumstances (taking into account the market factors in effect on the date any relevant contracts were negotiated) in comparable buildings in the Boston metropolitan area; (xvi) charitable and political contributions; (xvii) rentals and other related expenses incurred in leasing air conditioning systems, elevators or other equipment ordinarily considered to be of a capital nature (except equipment that is not affixed to the Building and is used in providing janitorial services, and except to the extent such costs would otherwise be includable pursuant to items (16) and (17) as set forth in the immediately preceding paragraph); (xviii) any expense for which Landlord is contractually entitled to be reimbursed by a tenant or other party (other than through a provision similar to the first paragraph of this Paragraph 7.a.), including, without limitation, payments for Excess Services; (xix) the cost of services made available at no additional charge to any tenant in the Building but not to Tenant; (xx) the cost of any large-scale hazardous substance abatement, removal, or other remedial activities provided, however, Operating Expenses may include the costs attributable to those abatement, removal, or other remedial activities taken by Landlord in connection with the ordinary operation and maintenance of the Building, including costs of cleaning up any minor chemical spills, when sue! removal or spill is directly related to such ordinary maintenance and operation; (xxi) costs related solely to the sale of all or part of the Real Property; (xxii) Landlord’s general corporate overhead and administrative expense; or (xxiii) any bad debt loss or rent loss or reserves for same.

b.Tax Expenses. Tenant shall pay to Landlord as Additional Rent under this Lease, at the times hereinafter set forth, Tenant’s Share, as specified in Paragraph 2.e. above, of any increase in Tax Expenses (as defined below) incurred by Landlord in each calendar year subsequent to the Base Tax Year specified in Paragraph 2.f. above, over Tax Expenses incurred by Landlord during the Base Tax Year. Notwithstanding the foregoing, if any reassessment, reduction or recalculation of any item included in Tax Expenses during the term results it a reduction of Tax Expenses, then, to the extent Tenant paid the same, Tenant shall be refunded Tenant’s share of such reduction for such year.

The term “Tax Expenses” shall mean all taxes, assessments (whether general or special), excises, transit charges, housing fund assessments or other housing charges, improvement districts, levies or fees, ordinary or extraordinary, unforeseen as well as foreseen, of any kind, which are assessed, levied, charged, confirmed or imposed on the Real Property, on Landlord with respect to the Real Property, on the act of entering into leases of space in the Real Property, on the use or occupancy of the Real Property or any part thereof, with respect to services or utilities consumed in the use, occupancy or operation of the Real Property, on any improvements, fixtures and equipment and other personal property of Landlord located in the Real Property and used in connection with the operation of the Real Property, or on or measured

13

by the rent payable under this Lease or in connection with the business of renting space in the Real Property, including, without limitation, any gross income tax or excise tax levied with respect to the receipt of such rent, by the United States of America, the Commonwealth of Massachusetts, Middlesex County, the City of Waltham, or any political subdivision, public corporation, district or other political or public entity or public authority, and shall also include any other tax, fee or other excise, however described, which may be levied or assessed in lieu of, as a substitute (in whole or in part) for, or as an addition to, any other Tax Expense. Tax Expenses shall also include any of the foregoing which are assessed with respect to other portions of the Office Park, to the extent reasonably allocable to the Real Property. Tax Expenses shall include reasonable attorneys’ and professional fees, costs and disbursements incurred in connection with proceedings to contest, determine or reduce Tax Expenses. If it shall not be lawful for Tenant lo reimburse Landlord for any increase in Tax Expenses as defined herein, the Monthly Rent payable to Landlord prior to the imposition of such increases in Tax Expense shall be increased to net Landlord the same net Monthly Rent after imposition of such increases in Tax Expenses as would have been received by Landlord prior to the imposition of such increases in Tax Expenses.

Tax Expenses shall not include income, franchise, transfer, inheritance or capital stock taxes, unless, due to a change in the method of taxation, any of such taxes is levied or assessed against Landlord in lieu of, as a substitute (in whole or in part) for, or as an addition to, any other charge which would otherwise constitute a Tax Expense.

c.Adjustment for Occupancy Factor. Notwithstanding any other provision herein to the contrary, in the event the Building is not at least ninety-five percent (95%) occupied on average during the Base Year and/or any calendar year during the Lease term, an adjustment shall be made by Landlord in computing Operating Expenses for such year so that the Operating Expenses shall be computed for such year as though the Building had been ninety-five percent (95%) occupied on average during such year. In addition, if any particular work or service includable in Operating Expenses is not furnished to a tenant who has undertaken to perform such work or service itself, Operating Expenses shall be deemed to be increased by an amount equal to the additional Operating Expenses which would have been incurred if Landlord had furnished such work or service to such tenant. The parties agree that statements in this Lease to the effect that Landlord is to perform certain of its obligations hereunder at its own or sole cost and expense shall not be interpreted as excluding any cost from Operating Expenses or Tax Expenses if such cost is an Operating Expense or Tax Expense pursuant to the terms of this Lease.

d.Intention Regarding Expense Pass-Through. It is the intention of Landlord and Tenant that, except as herein expressly provided, the Monthly Rent paid to Landlord throughout the term of this Lease shall be absolutely net of all increases, respectively, in Tax Expenses and Operating Expenses over, respectively, Tax Expenses for the Base Year and Operating Expenses for the Base Year, and the foregoing provisions of this Paragraph 7 are intended to so provide.

e.Notice and Payment. On or before the first day of each calendar year during the term hereof subsequent to the Base Year, or as soon as practicable thereafter, Landlord shall give to Tenant notice of Landlord’s estimate of the Additional Rent, if any,

14

payable by Tenant pursuant to Paragraphs 7.a. and 7.b. for such calendar year subsequent to the Base Year. On or before the first day of each month during each such subsequent calendar year, Tenant shall pay to Landlord one-twelfth (l/12th) of the estimated Additional Rent; provided, however, that if Landlord’s notice is not given prior to the first day of any calendar year Tenant shall continue to pay Additional Rent on the basis of the prior year’s estimate until the month after Landlord’s notice is given. If at any time it appears to Landlord that the Additional Rent payable under Paragraphs 7.a. and/or 7.b. will vary from Landlord’s estimate by more than five percent (5%), Landlord may, by written notice to Tenant, revise its estimate for such year, and subsequent payments by Tenant for such year shall be based upon the revised estimate. On the first monthly payment date after any new estimate is delivered to Tenant, Tenant shall also pay any accrued cost increases, based on such new estimate.

f.Annual Accounting. Landlord shall maintain adequate records of the Operating Expenses and Tax Expenses in accordance with standard accounting principles. Within one hundred fifty (150) days after the close of each calendar year subsequent to the Base Year, or as soon after such one hundred fifty (150) day period as practicable, Landlord shall deliver to Tenant a statement of the Additional Rent payable under Paragraphs 7.a. and 7.b. for such year. The statement shall be based on the results of an audit of the operations of the Building prepared for the applicable year by a nationally recognized certified public accounting firm selected by Landlord. Upon Tenant’s request, Landlord shall promptly deliver to Tenant a copy of the auditor’s statement on which Landlord’s annual statement is based and such other information regarding the annual statement as may be reasonably required by Tenant to ascertain Landlord’s compliance with this Paragraph 7. Landlord’s annual statement shall be final and binding upon Landlord and Tenant unless either party, within six (6) months after Tenant’s receipt thereof, shall contest any item there n by giving written notice to the other, specifying each item contested and the reason therefor. Notwithstanding the foregoing, the Tax Expenses included in any such annual statement may be modified by any subsequent adjustment or retroactive application of Tax Expenses affecting the calculation of such Tax Expenses. If the annual statement shows that Tenant’s payments of Additional Rent for such calendar year pursuant to Paragraph 7.e. above exceeded Tenant’s obligations for the calendar year, Landlord shall credit the excess to the next succeeding installments of Monthly Rent and estimated Additional Rent or, if the Lease term has ended, Landlord shall forward such credit to Tenant within thirty (30) days after delivery of such statement. If the annual statement shows that Tenant’s payments of Additional Rent for such calendar year pursuant to Paragraph 7.e. above were less than Tenant’s obligation for the calendar year, Tenant shall pay the deficiency to Landlord within thirty (30) days after delivery of such statement.

g.Proration for Partial Lease Year. If this Lease terminates on a day other than the last day of a calendar year, or if Tenant’s Share changes on a day other than the first day of a calendar year, the Additional Rent payable by Tenant pursuant to this Paragraph 7 applicable to the calendar year in which this Lease terminates, or Tenant’s Share is adjusted, shall be prorated on the basis that the number of days from the commencement of such calendar year to and including such termination or adjustment date bears to three hundred sixty (360).

15

8.Use of Premises; Compliance with Law.

a.Use of Premises. The Premises may be used solely for general office purposes for the initially contemplated use by Tenant described in Paragraph 2.g above or for any other general office use consistent with the operation of the Building as a first-class office building, provided in no event may the use of the Premises be changed to (1) a use which materially increases over and above that which is typical for general office use in first class office buildings such as the Building, (a) the operating costs for the Building, (b) the burden on the Building services, or (c) the foot traffic, elevator usage or security concerns in the Building, or which creates an increased probability of the comfort and/or safety of the Landlord or other tenants of the Building being compromised or reduced, or (2) use as a school or training facility, an entertainment, sports or recreation facility, retail sales to the public, a personnel or employment agency, an office or facility of any governmental or quasi-governmental agency or authority which is inconsistent with the first-class character of the Building, a place of public assembly (including without limitation a meeting center, theater or public forum), any use by or affiliation with a foreign government (including without limitation an embassy or consulate or similar office), or a facility for the provision of social, welfare or clinical health services or sleeping accommodations (whether temporary, daytime or overnight), or (3) a use which may conflict with any exclusive uses granted to other tenants of the Real Property, or with the terms of any easement, covenant, condition or restriction, or other agreement affecting the Real Property. Upon Tenant’s written request given concurrently with Tenant’s Sublease Notice under Paragraph 13.d. below, Landlord shall advise Tenant of any then existing exclusive uses granted to tenants of the Building.

Tenant shall not do or suffer or permit anything to be done in or about the Premises or the Real Property, nor bring or keep anything therein, which would in any way subject Landlord, Landlord’s agents or the holder of any Superior Interest (as defined in Paragraph 21) to any liability, increase the premium rate of or affect any fire, casualty, liability, rent or other insurance relating to the Real Property or any of the contents of the Building, or cause a cancellation of, or give rise to any defense by the insurer to any claim under, or conflict with, any policies for such insurance. If any act or omission of Tenant results in any such increase in premium rates, Tenant shall pay to Landlord upon demand the amount of such increase. Tenant shall not do or suffer or permit anything to be done in or about the Premises or the Real Property which will in any way obstruct or interfere with the rights of other tenants or occupants of the Building or injure or annoy them, or use or suffer or permit the Premises to be used for any immoral, unlawful or objectionable purpose, nor shall Tenant cause, maintain, suffer or permit any nuisance in, on or about the Premises or the Rea1 Property. Without limiting the foregoing, no loudspeakers or other similar device which can be heard outside the Premises shall, without the prior written approval of Landlord, be used in or about the Premises. Tenant shall not commit or suffer to be committed any waste in, to or about the Premises. Landlord may from time to time conduct fire and life safety training for tenants of the Building, including evacuation drills and similar procedures. Tenant agrees to participate in such activities as reasonably requested by Landlord.

Tenant agrees not to employ any person, entity or contractor for any construction, alteration or installation work in the Premises (including moving Tenant’s equipment and furnishings in, out or around the Premises) whose presence may give rise to a labor or other disturbance in the Building and, if necessary to prevent such a disturbance in a particular situation, Landlord may require Tenant to employ union labor for the work.

16

b.Compliance with Law. Tenant shall not do or permit anything to be done in or about the Premises which will in any way conflict with any Legal Requirement (as defined in Paragraph 7.a.(16) above) now in force or which may hereafter be enacted. Tenant, at its sole cost and expense, shall promptly comply with all such present and future Legal Requirements relating to the condition, use or occupancy of the Premises, and shall perform all work to the Premises or other portions of the Real Property required to effect such compliance (or, at Landlord’s election, Landlord may perform such work at Tenant’s cost). Notwithstanding the foregoing, however, Tenant shall not be required to perform any structural changes to the Premises or other portions of the Real Property unless such changes are related to or affected or triggered by (i) Tenant’s Alterations (as defined in Paragraph 9 below), (ii) Tenant’s particular use of the Premises (as opposed to Tenant’s use of the Premises for general office purposes in a normal and customary manner), (iii) Tenant’s particular employees or employment practices, or (iv) the construction of initial improvements to the Premises, if any. The judgment of any court of competent jurisdiction or the admission of Tenant in an action against Tenant, whether or not Landlord is a party thereto, that Tenant has violated any Legal Requirement shall be conclusive of that fact as between Landlord and Tenant. Tenant shall immediately furnish Landlord with any notices received from any insurance company or governmental agency or inspection bureau regarding any unsafe or unlawful conditions within the Premises or the violation of any Legal Requirement.

The provisions of this grammatical paragraph (x) are personal to Oscient Pharmaceuticals Corporation, a Massachusetts corporation, and any person or entity to whom the foregoing has assigned its entire interest in this Lease, and shall not apply to any subtenant of all or part of the Premises, and (y) shall be inapplicable during any period that an Event of Default is continuing. Notwithstanding anything to the contrary in the immediately preceding grammatical paragraph, Tenant may defer compliance with a Legal Requirement with which Tenant is required to comply pursuant to the above so long as Tenant shall be contesting the validity thereof, provided that (i) Tenant conducts such contest expeditiously, actively, diligently and in good faith through appropriate legal proceedings, and (ii) neither such contest nor the failure to comply with the subject Legal Requirement during the pendency of such contest subjects Landlord or and other Indemnitee (as defined in Paragraph 14.b. below), or the Premises or any other part of the Real Property, to any criminal, civil, administrative or other action, sanction, penalty, fine or prosecution or subject the Premises or any other part of the Real Property to a lien or condemnation, or create a nuisance or inconvenience to other tenants of the Real Property, or create the risk of harm to persons or property, and (iii) the enforcement of any violation of the contested Legal Requirement is stayed throughout the pendency of such contest, and (iv) all holder(s) of a Superior Interest (as defined in Paragraph 21 below) either consent to such contest or, if such holder(s) condition such contest on the taking of certain action or the furnishing of certain security, such action shall be taken and such security furnished by Tenant, as applicable, at the expense of Tenant, and (v) Tenant keeps Landlord apprised of the status of the contest proceedings. If, in Landlord’s reasonable judgment, Tenant has failed to satisfy any of the aforementioned requirements for the contest of a Legal Requirement, such failure shall automatically terminate Tenant’s right to contest hereunder, shall give Landlord the right to take corrective action at Tenant’s expense, and, in addition, shall constitute a breach of the Lease and,

17

upon written notice thereof by Landlord, Paragraph 25.a.8 below shall apply to such breach. Tenant shall hold Landlord and the other Indemnitees harmless from and indemnify them against any and all Claims (as defined in Paragraph 14.b. below) to the extent arising from Tenant’s contest of, or the non-compliance with, the subject Legal Requirement.

Except for those matters that are the responsibility of Tenant pursuant to the preceding two (2) grammatical paragraphs, Landlord shall be responsible for causing (i) the Base Building and the common areas of the Building to comply with all Legal Requirements (including, without limitation, Legal Requirements regarding Hazardous Materials) required for Tenant to occupy the Premises for the purposes leased and (ii) the common areas of the Building that are reasonably anticipated to be in Tenant’s path of travel during the Lease term, to comply with Title III of the Americans with Disabilities Act. For purposes of the foregoing, “Base Building” means the structural portions of the Building (including exterior walls, roof, foundation and core of the Building), the exterior of the Building and all Base Building systems, including without limitation, elevator, plumbing, air conditioning, heating, electrical, security, life safety and power, except those special systems installed for specific tenants and the portion of any other Building system within any specific tenant space which is the responsibility of such tenant. In no event shall the foregoing prevent Landlord from including in Operating Expenses the costs of complying with any Legal Requirement that would otherwise be included in Operating Expenses pursuant to Paragraph 7.a. above.

c.Hazardous Materials. Tenant shall not cause or permit the storage, use, generation, release, handling or disposal (collectively, “Handling”) of any Hazardous Materials (as defined below), in, on, or about the Premises or the Real Property by Tenant or any agents, employees, contractors, licensees, subtenants, customers, guests or invitees of Tenant (collectively with Tenant, “Tenant Parties”), except that Tenant shall be permitted to use normal quantities of office supplies or products (such as copier fluids or cleaning supplies) customarily used in the conduct of general business office activities (“Common Office Chemicals”), provided that the Handling of such Common Office Chemicals shall comply at all times with all legal Requirements, including Hazardous Materials Laws (as defined below). Notwithstanding anything to the contrary contained herein, however, in no event shall Tenant permit any usage of Common Office Chemicals in a manner that may cause the Premises or the Real Property to be contaminated by any Hazardous Materials or in violation of any Hazardous Materials Laws. Tenant shall immediately advise Landlord in writing of (a) any and all enforcement, cleanup, remedial, removal, or other governmental or regulatory actions instituted, completed, or threatened pursuant to any Hazardous Materials Laws relating to any Hazardous Materials affecting the Premises; and (b) all claims made or threatened by any third party against Tenant, Landlord, the Premises or the Real Property relating to damage, contribution, cost recovery, compensation, loss, or injury resulting from any Hazardous Materials on or about the Premises. Without Landlord’s prior written consent, Tenant shall no take any remedial action or enter into any agreements or settlements in response to the presence of any Hazardous Materials in, on, or about the Premises. Tenant shall be solely responsible for and shall indemnify, defend and hold Landlord and all other Indemnitees (as defined in Paragraph 14.b. below), harmless from and against all Claims (as defined in Paragraph 14.b. below), to the extent arising out of (i) any Handling of Hazardous Materials by any Tenant Party or Tenant’s breach of its obligations hereunder, or (ii) any removal, cleanup, or restoration work and materials necessary to return the Real Property or any other property of whatever nature located on the Real Property to their

18

condition existing prior to the Handling of Hazardous Materials in, on or about the Premises by any Tenant Party. Tenant’s obligations under this paragraph shall survive the expiration or other termination of this Lease. For purposes of this Lease, “Hazardous Materials” means any explosive, radioactive materials, hazardous wastes, or hazardous substances, including without limitation asbestos containing materials, PCB’s, CFC’s, or substances defined as “hazardous substances” in the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, 42 U.S.C. Section 9601-9657; the Hazardous Materials Transportation Act of 1975, 49 U.S.C. Section 1801-1812; the Resource Conservation and Recovery Act of 1976, 42 U.S.C. Section 6901-6987; or any other Legal Requirement regulating, relating to, or imposing liability or standards of conduct concerning any such materials or substances now or at any time hereafter in effect (collectively, “Hazardous Materials Laws”). Notwithstanding anything to the contrary in this Paragraph 8.c, in no event shall Tenant be responsible under this Paragraph 8.c. for any acts or omissions of any customers guests or invitees of Tenant with regard to Hazardous Materials bandied outside of the Premises unless the Hazardous Materials were transported or handled on the Real Property by such person for reasons related to Tenant or Tenant’s business.

Landlord acknowledges that, to the best of Landlord’s knowledge (which, for purposes hereof, shall be limited to the actual knowledge of Shorenstein Fealty Services, L.P. (“Manager”), and to no other constituent owners or representatives of Landlord) as of the date of the Lease, there are no Hazardous Materials on the Real Property in violation of applicable Legal Requirements in effect as of the date of the Lease.

d.Applicability of Paragraph. The provisions of his Paragraph 8 are for the benefit of Landlord, the holder of any Superior Interest (as defined in Paragraph 21 below), and the other Indemnitees only and are not nor shall they be construed to be for the benefit of any tenant or occupant of the Building.

9.Alterations and Restoration.

a. Tenant shall not make or permit to be made any alterations, modifications, additions, decorations or improvements to the Premises, or any other work whatsoever that would directly or indirectly involve the penetration or removal (whether permanent or temporary) of, or require access through, in, under, or above any floor, wall or ceiling, or surface or covering thereof in the Premises (collectively, “Alterations”), except as expressly provided in this Paragraph 9. If Tenant desires any Alteration, except for Cosmetic Alterations as described in the immediately following grammatical paragraph, Tenant must obtain Landlord’s prior written approval of such Alteration, which approval shall not be unreasonably withheld or delayed.

Notwithstanding the foregoing or anything to the contrary contained elsewhere in this Paragraph 9, Tenant shall have the right, without Landlord’s consent, to make any Alteration to the Premises that meets all of the following criteria (a “Cosmetic Alteration”): (i) the Alteration is decorative in nature (such as paint, carpet or other wall or floor finishes, movable partitions or other such work), (b) Tenant provides Landlord with five (5) days’ advance written notice of the commencement of such Alteration, (c) such Alteration does not affect the Building’s electrical, mechanical, life safety, plumbing, security, or HVAC systems or any structural portion of the Building or any part of the Building other than the Premises, (d) the

19

work will not decrease the value of the Premises, does not require a building permit or other governmental permit, uses only new materials comparable in quality to those being replaced and is performed in a workman like manner and in accordance with all applicable Legal Requirements and (e) the work does not involve opening the ceiling of the Premises. At the time Tenant notifies Landlord of any Cosmetic Alteration, Tenant shall give Landlord a copy of Tenant’s plans for the work. If the Cosmetic Alteration is of such a nature that formal plans will not be prepared for the work, Tenant shall provide Landlord with a reasonably specific description of the work.

All Alterations shall be made at Tenant’s sole cost and expense (including the expense of complying with all present and future Legal Requirements, including those regarding asbestos, if applicable, and any other work required to be performed in other areas within or outside the Premises by reason of the Alterations). Tenant shall either (i) arrange for Landlord to perform the work on terms and conditions acceptable to Landlord and Tenant, each in its sole discretion or (ii) bid the project out to contractors approved by Landlord in writing in advance (which approval shall not be unreasonably withheld). Tenant shall provide Landlord with a copy of the information submitted to bidders at such time as the bidders receive their copy. Regardless of the contractors who perform the work pursuant to the above, Tenant shall pay Landlord on demand prior to or during the course of such construction an amount (the “Alteration Operations Fee”) equal to five percent (5%) of the total hard cost of the Alteration (and for purposes of calculating the Alteration Operations Fee, such hard cost shall not include permit fees) as compensation to Landlord for Landlord’s internal review of Tenant’s Plans and general oversight of the construction (which oversight shall be solely for the benefit of Landlord and shall in no event be a substitute for Tenant’s obligation to retain such project management or other services as shall be necessary to ensure that the work is performed properly and in accordance with the requirements of this Lease). Notwithstanding the foregoing, the Alteration Operations Fee shall be inapplicable to Cosmetic Alterations. Tenant shall also reimburse Landlord for Landlord’s expenses such as electrical energy consumed in connection with the work, freight elevator operation, additional cleaning expenses, additional security services, fees and charges paid to third party architects, engineers and other consultants for review of the work and the plans and specifications with respect thereto and to monitor contractor compliance with Building construction requirements, and for other miscellaneous costs incurred by Landlord as result of the work.

All such work shall be performed diligently and in a first-class workmanlike manner and in accordance with plans and specifications reasonably approved by Landlord, and shall comply with all Legal Requirements and Landlord’s reasonably and uniformly applied construction procedures, conditions and requirements for the Building as in effect from time to time (including Landlord’s requirements relating to insurance and contractor qualifications). In no event shall Tenant employ any person, entity or contractor to perform work in the Premises whose presence may give rise to a labor or other disturbance in the Building. Default by Tenant in the payment of any sums agreed to be paid by Tenant for or in connection with an Alteration (regardless of whether such agreement is pursuant to this Paragraph 9 or separate instrument) shall entitle Landlord to all the same remedies as for non-payment of rent hereunder. Any Alterations, including without limitation, moveable partitions that are affixed to the Premises (but excluding moveable, free standing partitions) and all carpeting, shall at once become part of the Building and the property of Landlord. Tenant shall give Landlord not less than five (5) days

20

prior written notice of the date the construction of the Alteration is to commence. Landlord may post and record an appropriate notice of nonresponsibility with respect to any Alteration and Tenant shall maintain any such notices posted ay Landlord in or on the Premises.

b. If Tenant desires permission to leave a specific Alteration in the Premises at the expiration or earlier termination of the Lease, Tenant shall request such permission from Landlord in writing at the time Tenant requests approval for such Alteration and Landlord shall advise Tenant at the time of Landlord’s approval of the subject Alteration whether Landlord will require the removal of the Alteration or specified portions thereof and restoration of the Premises to its previous condition at the expiration or sooner termination of this Lease; provided, however, that Landlord may only require Tenant to remove those Alterations that are structural in nature or are not in the nature of typical office improvements as to type and quantity. Except for those Alterations that, pursuant to the immediately preceding sentence, may remain in the Premises at the expiration or sooner termination of the Lease, Landlord may require all Alterations made for or by Tenant be removed by Tenant from the Premises at the expiration or sooner termination of this Lease and the Premises restored by Tenant to their condition prior to the making of the Alterations, ordinary wear and tear excepted. The removal of the Alterations so required to be removed from the Premises and the restoration of the Premises shall be performed by a genera] contractor selected by Tenant and reasonably approved by Landlord, in which event Tenant shall pay the general Contractor’s fees and costs in connection with such work. Any separate work letter or other agreement which is hereafter entered into between Landlord and Tenant pertaining to Alterations shall be deemed to automatically incorporate the terms of this Lease without the necessity for further reference thereto.

c. The provisions of this Paragraph 9 are inapplicable to the Tenant Improvements, as defined in Paragraph 4.a. above. Further, the term “Alterations” as used elsewhere in this Lease shall not include the Tenant Improvements.

10.Repair.