UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 000-10761

LTX-Credence Corporation

(Exact name of registrant as specified in its charter)

| | |

| MASSACHUSETTS | | 04-2594045 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

825 University Ave Norwood, Massachusetts | | 02062 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (781) 461-1000

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $0.05 per share | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨

Smaller Reporting Company Filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

The aggregate market value of the Common Stock held by non-affiliates of the registrant on January 31, 2012, the last business day of the registrant’s most recently completed second fiscal quarter was $315,809,118.

Number of outstanding shares of Common Stock as of October 11, 2012: 47,746,597

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement in connection with its 2012 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

LTX-CREDENCE CORPORATION

TABLE OF CONTENTS

PART I

Introduction

LTX-Credence Corporation (“LTX-Credence” or the “Company”) provides market-focused, cost-optimized automated test equipment (ATE) solutions for the semiconductor industry. We design, manufacture, market and service ATE solutions that address the broad, divergent test requirements of the wireless, computing, automotive and digital consumer market segments of the semiconductor industry. Semiconductor designers and manufacturers worldwide use our equipment to test their devices during the manufacturing process. After testing, these devices are incorporated in a wide range of products, including personal and tablet computers, mobile internet equipment such as wireless access points and interfaces, broadband access products such as cable modems and set top boxes, personal communication and entertainment products such as mobile phones and personal digital music players, consumer products such as televisions, videogame systems and digital cameras, automobile electronics and power management devises used in portable and automotive electronics. We also sell hardware and software support and maintenance services for its test systems.

We are headquartered and have a development facility in Norwood, Massachusetts. We also have other development facilities located in Milpitas, California, Beaverton, Oregon, and Armenia and sales and service facilities located across the world to support our customer base.

We focus our marketing and sales efforts on integrated device manufacturers (IDMs); outsource assembly and test providers (OSATs), which perform assembly and testing services for the semiconductor industry; and fabless companies, which design integrated circuits but have no manufacturing capability. We offer our customers a comprehensive portfolio of test systems and provide a global network of strategically deployed applications and support resources.

We were incorporated in Massachusetts in 1976. Our principal executive offices and global headquarters are located at 825 University Avenue, Norwood, Massachusetts 02062 and our telephone number is 781-461-1000. Our common stock trades on the NASDAQ Global Market under the symbol “LTXC.” The terms “LTX-Credence,” the “Company,” “we,” “our,” and “us” refer to LTX-Credence Corporation and its wholly owned subsidiaries unless the context otherwise indicates. We make available our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports, free of charge, in the “Investors” section of our website at www.ltxc.com as soon as reasonably practicable after such material is electronically filed with, or furnished to, the U.S. Securities and Exchange Commission.

Reverse Stock-Split

On September 15, 2010, our Board of Directors approved a one-for-three reverse stock split of our common stock, pursuant to previously obtained stockholder authorization. The reverse stock split, which became effective at the close of business on September 30, 2010, reduced the number of shares of our common stock issued and outstanding from approximately 147.2 million to approximately 49.2 million. All share and per share amounts herein are presented on a post-reverse split basis.

Industry Overview

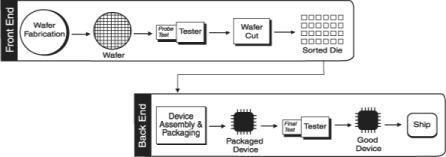

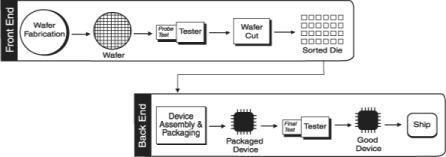

Electronic products contain different types of integrated circuits (ICs). Each of these ICs has electrical circuitry that requires validation or testing during and after the manufacturing process. The final usability of an IC is determined by automated test equipment. The testing of devices containing ICs is a critical step during the semiconductor production process. Typically, semiconductor companies test each device at two different stages during the manufacturing process to ensure its functional and electrical performance prior to shipment to the device user. Semiconductor manufacturing companies use automated testing equipment to first test a device after

1

it has been fabricated but before it has been packaged to eliminate non-functioning parts. Then, after the functioning devices are packaged, they are tested again to determine if they fully meet performance specifications. Testing is an important step in the manufacturing process because it allows devices to be fabricated at both maximum density and performance—a key to the competitiveness of semiconductor manufacturers. Shown below is a schematic depiction of the major steps in the semiconductor fabrication and test process.

Three primary factors ultimately drive demand for semiconductor test equipment:

| | • | | increases in unit production of semiconductor devices; |

| | • | | increases in the complexity and performance level of devices used in electronic products; and |

| | • | | the emergence of next generation semiconductor device technologies. |

Increases in unit production of semiconductor devices result primarily from the proliferation and increasing sophistication of personal and tablet computers and consumer electronics, the growth of the telecommunications industry, mobile communications and the mobile Internet and the resulting increase in the number of products that are able to access the internet, increases in broadband network access, the increased use of digital signal processing (DSP) devices, and the expansion of semiconductor devices in automotive and power management applications. These increases in unit production of semiconductor devices in turn lead to a corresponding increase in the need for test equipment.

Furthermore, demand continues to increase worldwide for smaller, more highly integrated electronic products. This has led to ever higher performance and increasing complexity of the semiconductor devices which operate and power these electronic products, which, in turn, results in a corresponding increase in the demand for equally sophisticated test equipment.

Finally, the introduction and adoption of new generations of end-user electronics products requires the development of new generations of semiconductor device technologies. For example, access to information has migrated from the stand-alone desktop computer, which might be physically linked to a local network, to the seamless, virtual network of the Internet, which is accessible from anywhere by a variety of new portable electronic communication products including laptop, notebook, or netbook computers, smartphones, or tablet communication devices. A critical enabling technology for this network and multimedia convergence is system-in-package (SIP) design technology, which combines several ICs in one semiconductor device package. SIP provides the benefits of lower cost, smaller size, higher performance and lower power consumption by combining advanced digital, analog and embedded memory IC technologies on a single device. Historically, the discrete technologies combined in SIP technology were only available on several separate semiconductor devices, each performing a specific function. By integrating these functions in a single semiconductor device package, SIP enables lower cost, smaller size, higher performance, and lower power consumption.

The increases in unit production of semiconductor devices, the increase in complexity of those devices, and, ultimately, the emergence of new semiconductor device technologies have mandated changes in the design,

2

architecture and complexity of semiconductor test equipment. Semiconductor device manufacturers must be able to test the increasing volume and complexity of their devices in a reliable, cost-effective, efficient and flexible manner. However, the increased pace of technological change, together with the large capital investments required to achieve economies of scale with respect to testing capability, add to the challenges faced by semiconductor device designers and manufacturers.

The combination of ever increasing price pressure, demands for more powerful yet more efficient semiconductor devices and the fact that technology cannot always be integrated into SIP in a cost effective manner has led to the need for testing solutions that cover multiple segments of the semiconductor market. There is a need to maximize utilization on the semiconductor test floor and at the same time have the most cost effective test solution for various points or integration levels in technology. This requires a suite of test solution products that are optimized for both technology and cost for the segment they are addressing, thus maximizing efficiency and minimizing the overall cost of testing.

Business Strategy

Our objective is to be the leading supplier of market-focused cost-optimized ATE solutions for the wireless, computing, automotive and entertainment markets. Key elements of our business strategy include:

Advance our offering of market-focused, cost-optimized ATE solutions. We believe that providing a range of scalable test platforms targeted at the specific test requirements of individual market segments is the best approach to enable our customers to address the technical, business and cost requirements of their devices. Our customers’ focus on test costs demands this segment-focused approach. We are strongly positioned to address our customers’ requirements due to our cost-optimized and market-focused product development. We intend to leverage our proven technologies efficiently across our product platforms to accelerate the availability of new capabilities, with a focus on optimizing the cost of our solutions for the individual market segments we address.

Concentrate our sales, applications consulting, and service efforts on key accounts. We recognize that large, diversified IDMs and OSATs and certain fabless companies, purchase most of the world’s test equipment and that the level of support we are able to provide to them has a direct impact on future business. We believe that focusing our sales and support resources on these key semiconductor companies is the most efficient way to maximize revenue. Therefore, we have organized our sales, field service, and field applications organizations around these key companies and located our resources close to their facilities. This has helped us to increase our responsiveness to customers’ needs and has enabled us to develop collaborative relationships that help guide us in developing future testing solutions.

Further improve the flexibility of our business model. In order to focus our resources, improve our responsiveness to customer needs, reduce fixed costs and working capital requirements, and manage the cyclicality of our industry more effectively, we have implemented a lean, flexible business model. Key to this business model is our decision to outsource substantially all of our manufacturing functions to third parties. Through strategic alliances, we have also outsourced certain distribution, repair and support functions. In addition, we engage contract employees to address periods of peak demand. Our business model allows us to maintain tight control over all expense items. We intend to continue to identify and implement programs which enhance our ability to meet customers’ needs while reducing fixed costs.

Product Strategy

Our product strategy is driven by our objective to be the leading supplier of market-focused, cost-optimized ATE solutions for the wireless, computing, automotive and entertainment markets. We concentrate on the technical, business and cost requirements of the core technologies within those markets, which include: precision analog, Application Specific Standard Product (ASSP) and Application Specific Integrated Circuit (ASIC), microcontroller, mobility radio frequency (“RF”), power management and mixed signal.

3

To address the divergent, segmented requirements of these technologies, we offer three segment focused, scalable product platforms to enable us to address our customers’ technical performance requirements, while at the same time providing cost-optimized solutions. This segment-focused approach allows prioritization of segment-specific test requirements, including:

| | • | | Capital cost and zero-pin infrastructure cost |

| | • | | Equipment size and footprint |

| | • | | Instrument capability and scope |

| | • | | Applications functionality and usage |

| | • | | Multi-site test capability |

Each of our three platforms addresses a specific market segment with relatively little overlap in capability and pricing. The Diamond platform offers high density packaging for low cost testing of microcontrollers and cost sensitive consumer and digital based ASSP and ASIC devices. The X-Series test platform offers configurations for optimal testing of analog based ASSP and ASIC, power, automotive, mixed signal, precision analog, and RF applications. The ASL platform is a market leader for testing linear, low-end mixed signal and power management devices.

Product Portfolio Overview

Our product portfolio consists of three segment focused, scalable platforms:

Diamond Platform

The Diamond platform offers high density packaging for low cost testing of microcontrollers and cost sensitive consumer and digital-based ASSP and ASIC devices. The Diamond platform leverages electronics integration and air-cooling to produce a compact form factor and utilizes high density technology in a variety of instruments for digital and mixed signal addressing embedded analog testing. It is used for engineering as well as wafer sort and final production testing. During the fiscal year ended July 31, 2012 (“fiscal 2012”), we introduced a new member of the Diamond platform, the Diamondx, specifically targeted at digital-based ASSP and ASIC devices.

X-Series Platform

The X-Series platform offers configurations for optimal testing of analog-based ASSP and ASIC, power, automotive, mixed signal and RF applications. The X-Series offers four scalable, compatible configurations, each using common instrumentation and software, to enable flexible deployment while optimizing capital investment. It offers a wide range of digital, analog, RF and DSP test hardware coupled with our software offerings to provide a flexible, scalable test environment that addresses the test requirements of complex mixed signal and RF devices on a single system.

ASL Platform

The ASL platform is the market leader for testing linear, low-end mixed signal, precision analog, and power management devices. The ASL tests traditional analog function blocks such as amplifiers, regulators, switches and converters, either as individual ICs or as larger function ICs such as battery power management devices in portable electronics devices. It is highly configurable and relatively low cost, matching the test requirements of low ASP devices.

4

Service

Our worldwide service organization is capable of performing installations and all necessary maintenance of test systems sold by us, including routine servicing of spare parts manufactured by third parties. We provide various parts and labor warranties on test systems and instruments designed and manufactured by us and warranties on components that have been purchased from other manufacturers and incorporated into our test systems. We also provide training on the maintenance and operation of test systems we sell.

Our service revenues were $36.8 million, or 27.8% of net sales, in fiscal 2012; $41.7 million, or 16.7% of net sales, in the fiscal year ended July 31, 2011 (“fiscal 2011”); and $45.0 million, or 20.5% of net sales, in the fiscal year ended July 31, 2010 (“fiscal 2010”).

We offer a wide range of service contracts, which gives our customers the flexibility to select the maintenance program best suited to their needs. Customers may purchase service contracts which extend maintenance beyond the initial warranty period. Many customers enter into annual or multiple-year service contracts over the life of the equipment. The pricing of contracts is based upon the level of service provided to the customer and the time period of the service contract. We believe that service revenues should be less affected by the cyclical nature of the semiconductor industry than sales of test equipment. We maintain service centers around the world, both directly and through strategic alliances with companies that are located in the United States, Europe and Asia.

Engineering and Product Development

The test equipment market is characterized by rapid technological change and new product introductions, as well as advancing industry standards. Our competitive position will depend upon our ability to successfully enhance our test platforms, develop new instrumentation, and introduce these new products on a timely and cost-effective basis. We seek to maintain close relationships with our customers in order to be responsive to their product development and production needs.

Our engineering strategy is to focus on development of our Diamond, X-Series and ASL platforms. Consolidation of platform technologies, both hardware and software, is a key focus moving forward as we leverage our knowledge and expertise into cost-effective solutions.

Engineering and product development expenses were $49.9 million, $52.7 million, and $48.9 million during fiscal 2012, 2011, and 2010, respectively.

Sales and Distribution

We sell our products through a combination of a worldwide internal direct sales organization and external distributors. Our direct sales organization is structured around key accounts, with a sales force of 34 people as of July 31, 2012. We also use third party distributors to sell our products in certain markets such as in Taiwan, China, Japan, Korea, and other countries in Southeast Asia.

Our sales to customers outside the United States are primarily denominated in United States dollars. Our sales outside the United States composed 77%, 85%, and 76% of total net sales in fiscal 2012, 2011, and 2010, respectively. See Note 8 to our Consolidated Financial Statements for additional information relating to revenues derived from sales to customers outside the United States.

5

Customers

| | | | | | | | | | | | |

| | | As of Ended July 31, | |

| | | 2012 | | | 2011 | | | 2010 | |

Our customers over 10% of net sales were the following for the periods indicated: | | | | | | | | | | | | |

Spirox | | | 22 | % | | | 14 | % | | | 24 | % |

Texas Instruments | | | 21 | % | | | 23 | % | | | 13 | % |

Atmel | | | 4 | % | | | 13 | % | | | 12 | % |

Net sales to the top ten customers were 68%, 80%, and 77% of net sales in fiscal 2012, 2011, and 2010, respectively.

Our customers include many of the world’s leading semiconductor device manufacturers. A representative list of customers includes:

| | | | |

Advanced Micro Devices (AMD) | | KYEC | | Silicon Laboratories |

Amkor | | Maxim Integrated Products | | Skyworks Solutions |

Anadigics | | Mediatek | | ST Ericsson |

Atmel | | Melexis | | STATSChipPac |

Austriamicrosystems (AMS) | | Microchip Technology | | Spirox |

ASE | | Nordic Semiconductor | | STMicroelectronics |

Carsem | | Novatek | | Texas Instruments |

Elmos | | Ralink | | Triquint Semiconductor |

Entropic Communications | | Renesas | | Unisem |

Giga Solution | | RichTek | | UTAC |

Infineon Technologies | | Sigurd | | Volterra |

Because a relatively small number of semiconductor companies purchases most of the world’s semiconductor test equipment, we have concentrated our sales and support efforts on these customers. We believe that sales to a limited number of customers will continue to account for a high percentage of our net sales for the foreseeable future.

Manufacturing and Supply

During fiscal 2012 we used both Jabil Circuit and Plexus Corporation as our outsourced partners for the manufacturing of our X-Series, ASL and Diamond products. During the first quarter of fiscal 2012, we consolidated these activities with Jabil Circuit.

We outsource certain components and subassemblies for our test equipment to contract manufacturers other than Jabil Circuit. Our products incorporate standard components and prefabricated parts manufactured to our specifications. These components and subassemblies are used to produce testers in configurations specified by our customers. Some of the standard components for our products are available from a number of different suppliers; however, many such standard components are purchased from a single supplier or a limited group of suppliers. Although we believe that all single sourced components currently are available in adequate amounts, shortages or delivery delays may develop in the future. We are dependent on certain semiconductor device manufacturers, who are sole source suppliers of custom components for our products. We have no written supply agreements with these sole source suppliers and purchase our custom components through individual purchase orders. We continuously evaluate alternative sources for the manufacture of our custom components and the supply of our standard components; however, such alternative sources may not meet our required qualifications or have capacity that is available to us.

6

Competition

There are other domestic and foreign companies that participate in the markets for each of our products and the industry is highly competitive. We compete principally on the basis of product performance, cost of test, reliability, customer service, applications support, price and ability to deliver products and service on a timely basis. Our primary competitors in the market for test systems include Advantest Corporation and Teradyne Inc. These companies have a substantially larger share of the ATE market, greater financial and other resources, and have a larger installed base of equipment than we do. We expect our competitors to enhance their current products, and to introduce new products which may have comparable or better price and performance than ours. In addition, new competitors, including semiconductor manufacturers themselves, may offer new testing technologies, which may in turn reduce the value of our product lines.

Backlog

At July 31, 2012, our backlog of unfilled orders for all products and services was $41.1 million, compared with $53.3 million at July 31, 2011. Historically, test systems generally ship within 12 months of receipt of a customer’s purchase order. While backlog is calculated on the basis of firm orders, orders may be subject to cancellation or delay by the customer with limited or no penalty. Our backlog at any particular date, therefore, is not necessarily indicative of actual sales which may be generated for any succeeding period.

Proprietary Rights

The development of our products is largely based on proprietary information. We rely upon a combination of contract provisions intellectual property registration and copyright, trademark and trade secret laws to protect our proprietary rights in products. We also have a policy of seeking patents on technology considered of particular strategic importance. Our patents cover various technologies, including technology relating to proprietary instrumentation and pin electronics. Although we believe that the copyrights, trademarks and patents we own are of value, we also believe that they alone have not and will not determine our success. We believe that our overall success depends principally upon our management, engineering, applications, manufacturing, marketing and service skills. However, we intend to protect our rights when, in our view, these rights are infringed upon.

The use of patents to protect hardware and software has increased in the test equipment industry. We have at times been notified of claims that we may be infringing patents issued to others. Although there are no pending actions against us regarding any patents, claims of infringement by third parties could negatively impact our business and results of operations. As to any claims asserted against us, we may seek or be required to obtain a license under the third party’s intellectual property rights. However, a license may not be available under reasonable terms or at all. In addition, we could decide to engage in litigation to challenge such claims or a third party could engage in litigation to enforce such claims. Such litigation could be expensive and time consuming and could negatively impact our business and results of operations.

Employees

At July 31, 2012, we had 620 employees and 19 temporary workers. None of our employees is represented by a labor union, and we have experienced no work stoppages during our history. Many of our employees are highly skilled, and we believe our future success will depend in large part on our ability to retain these employees and attract new, highly skilled employees. We consider relations with our employees to be good.

Environmental Affairs

Our facilities are subject to numerous laws and regulations designed to protect the environment. We do not anticipate that compliance with these laws and regulations will have a material effect on our capital expenditures, results of operations, or financial condition.

7

This report includes or incorporates forward-looking statements that involve substantial risks and uncertainties and fall within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify these forward-looking statements by our use of the words “believes,” “anticipates,” “plans,” “expects,” “may,” “will,” “would,” “should,” “intends,” “estimates,” “seeks” and similar expressions, whether in the negative or affirmative. We cannot guarantee that we actually will achieve these plans, intentions or expectations. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included below important factors that we believe could cause our actual results to differ materially from the forward-looking statements that we make. We do not assume any obligation to update any forward-looking statement we make.

Our sole market is the highly cyclical semiconductor industry, which causes a cyclical impact on our financial results.

We sell capital equipment to companies that design, manufacture, assemble, and test semiconductor devices. The semiconductor industry is highly cyclical, causing a cyclical impact on our financial results. Industry order rates increased in fiscal 2010 and portions of fiscal 2011. However industry conditions weakened as we entered fiscal 2012. The timing and level of sustained industry recovery is uncertain at this time. The ability to forecast the business outlook for our industry is typically limited to three months. As a result, our expectations for our business for the full fiscal year ending July 31, 2013 (“fiscal 2013”) remain uncertain. Regardless of our outlook and forecasts, any failure to expand in cycle upturns to meet customer demand and delivery requirements or contract in cycle downturns at a pace consistent with the industry could have an adverse effect on our business.

Any significant downturn in the markets for our customers’ semiconductor devices or in general economic conditions would likely result in a reduction in demand for our products and would negatively impact our business. Downturns in the semiconductor test equipment industry have been characterized by diminished product demand, excess production capacity, accelerated erosion of selling prices and excessive inventory levels. We believe the markets for newer generations of semiconductor devices will also experience similar characteristics. Our market is also characterized by rapid technological change and changes in customer demand. In the past, we have experienced delays in purchase commitments, delays in collecting accounts receivable and significant declines in demand for our products during these downturns, and we may not be able to maintain or exceed our current level of sales.

Additionally, as a capital equipment provider, our revenue is driven by the capital expenditure budgets and spending patterns of our customers who often delay or accelerate purchases in reaction to variations in their businesses. Because a high portion of our costs are fixed, we are limited in our ability to reduce expenses and inventory purchases quickly in response to decreases in orders and revenues. In an economic contraction, we may not be able to reduce our significant fixed costs, such as continued investment in research and development and capital equipment requirements and materials purchases from our suppliers.

The market for semiconductor test equipment is highly concentrated, and we have limited opportunities to sell our products.

The semiconductor industry is highly concentrated, and a small number of semiconductor device manufacturers and contract assemblers account for a substantial portion of the purchases of semiconductor test equipment generally, including our test equipment. Our top customers in fiscal 2012 were Spirox and Texas Instruments which accounted for 22% and 21% of our net sales, respectively. In fiscal 2011, our top customers were Texas Instruments, Spirox, and Atmel, which accounted for 23%, 14%, and 13% of our net sales, respectively. Sales to the top ten customers were 68%, 80%, and 77%, of net sales in fiscal 2012, 2011, and 2010, respectively. Our customers may cancel orders with few or no penalties. If a major customer reduces orders for any reason, our revenues, operating results, and financial condition will be negatively affected.

8

Our ability to increase our sales will depend, in part, on our ability to obtain orders from new customers. Semiconductor manufacturers typically select a particular vendor’s test system for testing its new generations of a device and make substantial investments to develop related test program applications and interfaces. Once a manufacturer has selected a test system vendor for a new generation of a device, that manufacturer is more likely to purchase test systems from that vendor for that generation of the device, and, possibly, subsequent generations of that device as well. Therefore, the opportunities to obtain orders from new customers may be limited, which may impair our ability to grow our revenue.

Our sales and operating results have fluctuated significantly from period to period, including from one quarter to another, and they may continue to do so.

Our quarterly and annual operating results are affected by a wide variety of factors that have had and could continue to have material and adverse effects on our financial condition and stock price or lead to significant variability in our operating results or our stock price, including the following:

| | • | | the fact that sales of a limited number of test systems may account for a substantial portion of our net sales in any particular fiscal quarter; |

| | • | | order cancellations by customers; |

| | • | | lower gross margins in any particular period due to changes in: |

| | • | | the configurations of test systems sold; |

| | • | | the customers to whom we sell our test systems; or |

| | • | | a long sales cycle due to the significant investment made by our customers in installing our test systems and the time required to incorporate our systems into our customers’ design or manufacturing process; and |

| | • | | changes in the timing of product orders due to: |

| | • | | unexpected delays in the introduction of products by our customers, |

| | • | | excess production capacity our customers, |

| | • | | shorter than expected lifecycles of our customers’ semiconductor devices, |

| | • | | uncertain market acceptance of products developed by our customers, or |

| | • | | our own research and development. |

We cannot predict the impact of these and other factors on our sales and operating results in any future period. Results of operations in any period, therefore, should not be considered indicative of the results to be expected for any future period. Because of this difficulty in predicting future performance, our operating results may fall below expectations of securities analysts or investors in some future quarter or quarters. Our failure to meet these expectations would likely adversely affect the market price of our common stock.

A substantial amount of the shipments of our test systems for a particular quarter may occur late in the quarter. Our shipment pattern may expose us to significant risks of not meeting our expected financial results for each quarter in the event of problems during the complex process of final integration, test and acceptance prior to shipment. If we were to experience problems of this type late in our quarter, shipments could be delayed and our operating results could fall below expectations.

9

Our dependence on subcontractors and sole source suppliers may prevent us from delivering an acceptable product on a timely basis.

We rely on one subcontractor to manufacture our test systems and multiple other subcontractors for the manufacture of the components and subassemblies used to produce our test systems. Certain of the suppliers for certain components and subassemblies are sole source suppliers. We have no long term supply agreements with our contract manufacturers and purchase products through individual purchase orders. We may be required to qualify new or additional subcontractors and suppliers due to capacity constraints, competitive or quality concerns or other risks that may arise, including as a result of a change in control of, or deterioration in the financial condition of, a supplier or subcontractor. The process of qualifying subcontractors and suppliers is lengthy. Our reliance on subcontractors gives us less control over the manufacturing process and exposes us to significant risks, especially inadequate capacity, late delivery, substandard quality, and high costs. In addition, the manufacture of certain of these components and subassemblies is an extremely complex process. If a supplier became unable to provide parts in the volumes needed, at the required standards of quality or at an acceptable price, we would have to identify and qualify acceptable replacement parts from alternative sources of supply, or manufacture such components or subassemblies internally. The failure to qualify acceptable replacement subcontractors or suppliers quickly would delay the manufacturing and delivery of our products, which could cause us to lose revenues and customers.

We also may be unable to engage alternative sources for the production of our testing systems on a timely basis or upon terms favorable to us, if at all. If we are required for any reason to seek a new manufacturer of our test systems, an alternate manufacturer may not be available and, in any event, transitioning to a new manufacturer would require a significant lead time of nine months or more and would involve substantial expense and disruption of our business. Our test systems are highly sophisticated and complex capital equipment, with many custom components, and final assembly requires specific technical know-how and expertise. These factors could make it more difficult for us to find a new manufacturer of our test systems if our relationship with our outsource suppliers is terminated for any reason, which would cause us to lose revenues and customers.

We are dependent on certain semiconductor device manufacturers as sole source suppliers of certain sub-assemblies and components used in our test systems which are manufactured in accordance with our proprietary design and specifications. We have no written supply agreement with these sole source suppliers and purchase our custom components through individual purchase orders. If one of our sole source suppliers were to fail to produce or provide the parts they agreed to build for us at the specifications, price or volume required, we would face a significant delay in the final production of our products because we do not have redundant capacity available and our revenue and results of operations would be materially and adversely affected.

Compliance with current and future environmental regulations may be costly and disruptive to our operations.

We may be subject to environmental and other regulations due to our production and marketing of products in certain states and countries that limit or restrict the amount of hazardous material in certain electronic components such as printed circuit boards. One such directive is Directive 2002/95/EC of the European Parliament and of the Council of 27 January 2003 on the restriction of the use of certain hazardous substances in electrical and electronic equipment. “RoHS” is short for restriction of hazardous substances. The RoHS Directive banned the placing on the EU market of new electrical and electronic equipment containing more than agreed levels of lead, cadmium, mercury, hexavalent chromium, polybrominated biphenyl (PBB) and polybrominated diphenyl ether (PBDE), except where exemptions apply, from July 1, 2006. Manufacturers are required to ensure that their products, including their constituent materials and components, do not contain more than the minimum levels of the nine restricted materials in order to be allowed to export goods into the Single Market (i.e. of the European Community’s 27 Member States). Any interruption in supply due to the unavailability of restriction free products could have a significant impact on the manufacturing and delivery of our products. If a supplier became unable to provide parts in the volumes needed or at an acceptable price, we would have to identify and qualify acceptable replacements from alternative sources of supply or manufacture such components internally.

10

As previously discussed, the failure to qualify acceptable replacements quickly would delay the manufacturing and delivery of our products, which could cause us to lose revenues and customers.

Future mergers and acquisitions may be difficult to integrate, disrupt our business, dilute stockholder value or divert management attention.

We have in the past, and may in the future, seek to acquire or invest in additional businesses, products, technologies or engineers. For example, in August 2008 we completed our merger with Credence Systems Corporation and in June 2003, we completed our acquisition of StepTech, Inc. We may have to issue debt or equity securities to pay for future mergers or acquisitions, which could be dilutive to then current stockholders or subject us to the risk described below in “We may need financing, which could be difficult to obtain.” We have also incurred and may continue to incur certain liabilities or other expenses in connection with acquisitions, which could materially adversely affect our business, financial condition and results of operations.

Mergers and acquisitions of high-technology companies are inherently risky, and future mergers or acquisitions may not be successful and could materially adversely affect our business, operating results or financial condition. Our past and future mergers and acquisitions may involve many risks, including:

| | • | | difficulties in managing our growth following mergers and acquisitions; |

| | • | | difficulties in the integration of the acquired personnel, operations, technologies, products and systems of the acquired companies; |

| | • | | uncertainties concerning the intellectual property rights we purport to acquire; |

| | • | | unanticipated costs or liabilities associated with the mergers and acquisitions; |

| | • | | diversion of managements’ attention from other business concerns; |

| | • | | adverse effects on our existing business relationships with our or our acquired companies’ customers; |

| | • | | potential difficulties in completing projects associated with purchased in-process research and development; and |

| | • | | inability to retain key employees of acquired companies. |

Any of the events described in the foregoing paragraphs could have an adverse effect on our business, financial condition and results of operations and could cause the price of our common stock to decline.

We may not be able to deliver custom hardware options and related applications to satisfy specific customer needs in a timely manner.

The success of our business relies in substantial part on our ability to develop and deliver customized hardware and applications to meet our customers’ specific test requirements. Our test equipment may fail to meet our customers’ technical or cost requirements and may be replaced by competitive equipment or an alternative technology solution. Our inability to provide a test system that meets requested performance criteria when required by a device manufacturer would severely damage our reputation with that customer. This loss of reputation together with the risks discussed above under, “The market for semiconductor test equipment is highly concentrated, and we have limited opportunities to sell our products” may make it substantially more difficult for us to sell test systems to that manufacturer for a number of years. We have, in the past, experienced delays in introducing some of our products and enhancements.

Our dependence on international sales and non-U.S. suppliers involves significant risk.

International sales have constituted a significant portion of our revenues in recent years, and we expect that to continue. International sales accounted for 77% of our revenues for fiscal 2012 and 85% of our revenues for fiscal 2011. In addition, we rely on non-U.S. suppliers for several components of the equipment we sell. As a

11

result, a major part of our revenues and the ability to manufacture our products are subject to the risks associated with international commerce. These international relationships make us particularly sensitive to economic, political, regulatory and environmental changes in the countries from which we derive sales and obtain supplies. Our sole source final assembly manufacturing supplier in Malaysia increases our exposure to these types of international risks. International sales and our relationships with suppliers may be hurt by many factors, including:

| | • | | changes in law or policy resulting in burdensome government controls, tariffs, restrictions, embargoes or export license requirements; |

| | • | | political and economic instability in our target international markets; |

| | • | | longer payment cycles common in foreign markets; |

| | • | | difficulties of staffing and managing our international operations; |

| | • | | less favorable foreign intellectual property laws making it harder to protect our technology from appropriation by competitors; |

| | • | | difficulties collecting our accounts receivable because of the distance and different laws; |

| | • | | the impact of the Foreign Corrupt Practices Act of 1977 and similar laws; and |

| | • | | adverse weather and climate events. |

In the past, we have incurred expenses to meet new regulatory requirements in Europe, experienced periodic difficulties in obtaining timely payment from non-U.S. customers, and been affected by economic conditions in several Asian countries. Our foreign sales are typically invoiced and collected in U.S. dollars. A strengthening in the U.S. dollar relative to the currencies of those countries where we do business would increase the prices of our products as stated in those currencies and could hurt our sales in those countries. Significant fluctuations in the exchange rates between the U.S. dollar and foreign currencies could cause us to lower our prices and thus reduce our profitability. These fluctuations could also cause prospective customers to push out or delay orders because of the increased relative cost of our products. In the past, there have been significant fluctuations in the exchange rates between the dollar and the currencies of countries in which we do business. From time to time we may enter into foreign currency hedging arrangements.

Our market is highly competitive, and we have limited resources to compete.

The semiconductor test equipment industry is highly competitive in all areas of the world. There are other domestic and foreign companies that participate in the markets for each of our products. Our main competitors in the industry are Advantest Corporation and Teradyne Inc. These competitors have substantially greater financial resources and more extensive engineering, manufacturing, marketing, and customer support capabilities than we have.

We expect our competitors to enhance their current products and to introduce new products that may have comparable or better price and performance. The introduction of competing products could hurt sales of our current and future products. In addition, new competitors, including semiconductor manufacturers themselves, may offer new testing technologies, which may in turn reduce the value of our product lines. Increased competition could lead to intensified price-based competition, which would hurt our business and results of operations. Unless we are able to invest significant financial resources in developing products and maintaining customer support centers worldwide, we may not be able to compete effectively.

We are exposed to the risks associated with the volatility of the U.S. and global economies.

The lack of visibility regarding whether there will be sustained increases in business capital spending and growth periods for the sale of electronic goods and information technology equipment, and uncertainty regarding the amount of sales, underscores the need for caution in predicting growth in the semiconductor test equipment

12

industry in general and in our revenues and profits specifically. Slow or negative growth in the domestic economy may continue to materially and adversely affect our business, financial condition and results of operations for the foreseeable future. Our results of operations would be further adversely affected if we were to experience lower than anticipated order levels, cancellations of orders in backlog, extended customer delivery requirements or pricing pressure as a result of a slowdown. At lower levels of revenue, there is a higher likelihood that these types of changes in our customers’ requirements would adversely affect our results of operations because in any particular quarter a limited number of transactions accounts for an even greater portion of sales for the quarter.

Development of our products requires significant lead-time, and we may fail to correctly anticipate the technical needs of our customers.

Our test systems are used by our customers to develop, test and manufacture their new semiconductor devices. We therefore must anticipate industry trends and develop products in advance of the commercialization of our customers’ semiconductor devices, requiring us to make significant capital investments to develop new test equipment for our customers well before their devices are introduced. If our customers fail to introduce their devices in a timely manner or the market does not accept their devices, we may not recover our capital investment. In addition, even if we are able to successfully develop enhancements or new generations of our products, these enhancements or new generations of products may not generate revenue in excess of the costs of development, and they may be quickly rendered obsolete by changing customer preferences or the introduction of products embodying new technologies or features by our competitors. Furthermore, if we were to make announcements of product delays, or if our competitors were to make announcements of new test systems, these announcements could cause our customers to defer or forego purchases of our test systems, which would also hurt our business.

Our success depends on attracting and retaining key personnel.

Our success depends substantially upon the continued service of our executive officers and key personnel, none of whom is bound by an employment or non-competition agreement. Our success also depends on our ability to attract and retain highly qualified managers and technical, engineering, marketing, sales and support personnel. Competition for such specialized personnel is intense, and it may become more difficult for us to hire or retain them. Our volatile business cycles only aggravate this problem. Layoffs during an industry downturn could make it more difficult for us to hire or retain qualified personnel. Our business, financial condition and results of operations could be materially adversely affected by the loss of any of our key employees, by the failure of any key employee to perform in his or her current position, or by our inability to attract additional skilled employees.

We may not be able to protect our intellectual property rights.

Our success depends in part on our ability to obtain intellectual property rights and licenses and to preserve other intellectual property rights covering our products and development and testing tools. To that end, we have obtained certain domestic and international patents and may continue to seek patents on our inventions when appropriate. We have also obtained certain trademark registrations. The process of seeking intellectual property protection can be time consuming and expensive. We cannot ensure that:

| | • | | patents will issue from currently pending or future applications; |

| | • | | our existing patents or any new patents will be sufficient in scope or strength to provide meaningful protection or any commercial advantage to us; |

| | • | | foreign intellectual property laws will protect our intellectual property rights; or |

| | • | | others will not independently develop similar products, duplicate our products or design around our technology. |

13

If we do not successfully enforce our intellectual property rights, our competitive position could suffer, which could harm our operating results. We also rely on trade secrets, proprietary know-how and confidentiality provisions in agreements with employees and consultants to protect our intellectual property. Other parties may not comply with the terms of their agreements with us, and we may not be able to adequately enforce our rights against these people.

Third parties may claim we are infringing their intellectual property, and we could incur significant litigation costs and licensing expenses or be prevented from selling our products.

Intellectual property rights are uncertain and involve complex legal and factual questions. We may be unknowingly infringing on the intellectual property rights of others and may be liable for that infringement, which could result in a significant liability for us. If we do infringe the intellectual property rights of others, we could be forced to either seek a license to intellectual property rights of others or alter our products so that they no longer infringe the intellectual property rights of others. A license could be very expensive to obtain or may not be available at all. Similarly, changing our products or processes to avoid infringing the rights of others may be costly or impractical.

If we were to become involved in a dispute regarding intellectual property, whether ours or that of another company, we may have to participate in legal proceedings. These types of proceedings may be costly and time consuming for us, even if we eventually prevail. If we do not prevail, we might be forced to pay significant damages, obtain licenses, modify our products or processes, stop making products or stop using processes.

We may need financing, which could be difficult to obtain.

We expect that our existing cash, cash equivalents and marketable securities will be sufficient to meet our cash requirements to fund operations and expected capital expenditures for the foreseeable future. In the event we need to raise additional funds, we may not be able to obtain such financing on favorable terms, if at all. Further, if we issue additional equity securities to obtain financing, stockholders may experience additional dilution or the new equity securities may have rights, preferences or privileges senior to those of existing holders of common stock and place restrictions on how we operate our business. If we incur substantial indebtedness in the future we may be required to dedicate a substantial portion of any cash flow from operations to our debt service obligations, thereby reducing the amount of cash flow available for other purposes, including capital expenditures, limit our flexibility in planning for, or reacting to changes in, our business and the industry in which we compete, make it more difficult for us to obtain any other necessary future financing and make us more vulnerable in the event of a further downturn in our business. If we cannot raise funds on acceptable terms, if and when needed, we may not be able to develop or enhance our products and services, take advantage of future opportunities, grow our business or respond to competitive pressures, which could seriously harm our business.

Our stock price is volatile.

In the twelve-month period ending on July 31, 2012, our stock price ranged from a low of $4.81 to a high of $7.78. The price of our common stock has been and likely will continue to be subject to wide fluctuations in response to a number of events and factors, such as:

| | • | | quarterly variations in operating results; |

| | • | | variances of our quarterly results of operations from securities analysts’ estimates; |

| | • | | changes in financial estimates and recommendations by securities analysts; |

| | • | | announcements of technological innovations, new products, or strategic alliances; and |

| | • | | news reports relating to trends in our markets. |

14

In addition, the stock market in general, and the market prices for semiconductor-related companies in particular, have experienced significant price and volume fluctuations that often have been unrelated to the operating performance of the companies affected by these fluctuations. These broad market fluctuations may adversely affect the market price of our common stock, regardless of our operating performance.

We may record impairment charges which would adversely impact our results of operations.

We review our goodwill, intangible assets and long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amounts of these assets may not be recoverable, and we also review goodwill annually in accordance with Financial Accounting Standards Board (“FASB”), Accounting Standards Codification (“ASC”), Topic 350,Intangibles—Goodwill and Other.

One potential indicator of goodwill impairment is whether our fair value, as measured by our market capitalization, has remained below our net book value for a significant period of time. Whether our market capitalization triggers an impairment charge in any future period will depend on the underlying reasons for the decline in stock price, the significance of the decline, and the length of time the stock price has been trading at such prices.

In the event that we determine in a future period that impairment exists for any reason, we would record an impairment charge in the period such determination is made, which would adversely impact our financial position and results of operations.

Internal control deficiencies or weaknesses that are not yet identified could emerge.

Over time we may identify and correct deficiencies or weaknesses in our internal controls and, where and when appropriate, report on the identification and correction of these deficiencies or weaknesses. However, the internal control procedures can provide only reasonable, and not absolute, assurance that deficiencies or weaknesses are identified. Deficiencies or weaknesses that have not been identified by us could emerge and the identification and correction of these deficiencies or weaknesses could have a material impact on our results of operations. If our internal controls over financial reporting are not considered adequate, we may experience a loss of public confidence, which could have an adverse effect on our business and stock price.

| Item 1B. | Unresolved Staff Comments |

None.

We have achieved worldwide ISO 9001:2008 certification at our Norwood and Milpitas facilities. We maintain our principal executive offices and global headquarters in Norwood, Massachusetts, where corporate administration, sales and support, and research and development are located in a 56,380 square foot facility under a lease which expires in 2021. We lease a 90,068 square foot facility in Milpitas, California for research and development, sales and customer support and corporate administration pursuant to a lease that expires in 2017. Under the same lease, we lease another 88,145 square foot facility, which is currently being marketed to potential sub lessees. We also lease a 17,500 square foot facility in Beaverton, Oregon pursuant to a lease that expires in January 2015 for corporate administration, research and development, and certain finance functions. We also lease sales and customer support offices at various locations in the United States totaling approximately 62,200 square feet.

In addition, we own land in Hillsboro, Oregon.

Our European headquarters is located in Munich, Germany, and our Asian headquarters is located in Singapore. We also maintain sales and support offices at other locations in Europe and Asia. Office space leased in Asia and Europe totals approximately 76,200 square feet.

We believe that our existing facilities are adequate to meet our current and foreseeable future requirements.

15

The Company is subject to various legal proceedings, claims and litigation which arise in the ordinary course of operations. We believe we have meritorious defenses against all pending claims and intend to vigorously pursue them. While it is not possible to predict or determine the outcomes of any pending actions, we believe the amount of liability, if any, with respect to such actions, would not materially affect the Company’s financial position, results of operations or cash flows.

As previously reported, on April 19, 2011, the Company received a demand letter pursuant to Massachusetts General Laws ch. 156D, § 7.42 sent on behalf of Joel Krieger, a purported LTX-Credence shareholder, whose putative class action complaint, Krieger v. LTX-Credence Corp., et. al., No. 10-04713, filed on December 3, 2010 in the Superior Court for the Commonwealth of Massachusetts, was dismissed. The letter demanded that the Company commence legal proceedings against the Company’s directors and senior officers for breaches of their fiduciary duties, gross negligence and mismanagement, waste of corporate assets, and abuse of control, all arising out of the Company’s pursuit of a merger transaction with Verigy. On October 12, 2011 the independent members of the Company’s Board of Directors determined that pursuing the claims asserted in the demand letter was not in the Company’s best interest. In January 2012, counsel to Mr. Krieger informed the Company that Mr. Krieger would no longer pursue the demand or the claims therein at this time.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

16

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock trades on the NASDAQ Global Market under the symbol “LTXC”. At the close of business on September 30, 2010, we effected a 1-for-3 reverse split of our common stock. The following table shows the high and low sale prices per share of our common stock, as reported on the NASDAQ Global Market, for the periods indicated. All amounts in the table have been adjusted to give effect to the reverse stock split:

| | | | | | | | |

Period | | High | | | Low | |

Fiscal Year Ended July 31, 2012 | | | | | | | | |

First Quarter | | $ | 7.49 | | | $ | 4.81 | |

Second Quarter | | | 7.13 | | | | 4.91 | |

Third Quarter | | | 7.78 | | | | 6.12 | |

Fourth Quarter | | | 7.30 | | | | 5.58 | |

Fiscal Year Ended July 31, 2011 | | | | | | | | |

First Quarter | | $ | 8.82 | | | $ | 4.98 | |

Second Quarter | | | 9.07 | | | | 5.90 | |

Third Quarter | | | 9.83 | | | | 7.80 | |

Fourth Quarter | | | 9.52 | | | | 7.19 | |

We have never declared or paid any dividends on our common stock. We currently intend to retain future earnings to fund the development and growth of our business and, therefore, we do not anticipate paying any cash dividends in the foreseeable future.

As of October 8, 2012, we had approximately 211 stockholders of record of our common stock.

Stock Repurchases

The following table provides information regarding repurchases of common stock made by us during the quarter ended July 31, 2012:

| | | | | | | | | | | | | | | | |

Period | | Total

Number

of

Shares

Purchased | | | Average

Price

Paid

per

Share | | | Total

Number of

Shares

Purchased

as

Part of

Publicly

Announced

Plans or

Programs

(1) | | | Approximate

Dollar Value

of

Shares that

May Yet

Be Purchased

Under

the Plans or

Programs | |

5/1/2012 – 5/31/2012 | | | — | | | $ | — | | | | — | | | | — | |

6/1/2012 – 6/30/2012 | | | 361,493 | | | $ | 6.58 | | | | 361,493 | | | $ | 16,587,947 | |

7/1/2012 – 7/31/2012 | | | 169,301 | | | $ | 6.60 | | | | 169,301 | | | $ | 15,474,033 | |

| | | | | | | | | | | | | | | | |

Total | | | 530,794 | | | $ | 6.59 | | | | 530,794 | | | | | |

| (1) | On September 15, 2011, our board of directors authorized a stock repurchase program, pursuant to which we are authorized to repurchase up to $25 million of our common stock from time to time in open market transactions. The repurchase program may be suspended or discontinued at any time and has no expiration date. |

17

Securities Authorized for Issuance under Equity Compensation Plans

Under our equity compensation plans, we can issue options and restricted stock units. The following table shows information relating to our equity compensation plans as of July 31, 2012.

| | | | | | | | | | | | |

| | | Equity Compensation Plan Information | |

Plan Category | | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights | | | Weighted average

exercise price of

outstanding options,

warrants and rights | | | Number of securities remaining

available for future issuance

under equity compensation

plans (excluding securities in

first column) | |

Equity compensation plans approved by security holders | | | 3,091,069 | | | $ | 12.27 | | | | 5,825,678 | * |

Equity compensation plans not approved by security holders | | | — | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | | 3,091,069 | | | $ | 12.27 | | | | 5,825,678 | * |

| | | | | | | | | | | | |

| * | Includes 78,458 shares available for issuance under an employee stock purchase plan which is intended to qualify as such under Section 423 of the Internal Revenue Code (“IRC”). |

18

| Item 6. | Selected Financial Data |

The following table contains our selected consolidated financial data and is qualified by the more detailed consolidated financial statements and notes thereto included elsewhere in this report. The selected consolidated financial data for and as of the end of each of the five fiscal years in the period ended July 31, 2012 are derived from our audited consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Years Ended July 31,

(In thousands) | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 (a) | | | 2008 | |

Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 132,134 | | | $ | 249,530 | | | $ | 219,082 | | | $ | 137,378 | | | $ | 135,825 | |

Cost of sales | | | 63,637 | | | | 95,290 | | | | 96,700 | | | | 87,805 | | | | 67,981 | |

Inventory-related provision | | | — | | | | — | | | | — | | | | 19,311 | | | | — | |

Engineering and product development expenses | | | 49,864 | | | | 52,697 | | | | 48,943 | | | | 71,165 | | | | 46,020 | |

Selling, general and administrative expenses | | | 36,348 | | | | 48,968 | | | | 44,956 | | | | 51,447 | | | | 27,090 | |

Amortization of purchased intangible assets | | | 3,163 | | | | 5,961 | | | | 10,655 | | | | 15,967 | | | | — | |

Restructuring | | | 1,104 | | | | 363 | | | | 2,027 | | | | 21,205 | | | | — | |

Impairment charges | | | — | | | | — | | | | — | | | | 5,799 | | | | — | |

Acquired in-process research and development | | | — | | | | — | | | | — | | | | 6,300 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

(Loss) income from operations | | | (21,982 | ) | | | 46,251 | | | | 15,801 | | | | (141,621 | ) | | | (5,266 | ) |

Other income | | | 1,175 | | | | 13,512 | | | | 2,690 | | | | 5,052 | | | | 1,575 | |

| | | | | | | | | | | | | | | | | | | | |

(Loss) income before income taxes | | | (20,807 | ) | | | 59,763 | | | | 18,491 | | | | (136,569 | ) | | | (3,691 | ) |

(Benefit from) provision for income taxes | | | (938 | ) | | | (315 | ) | | | 343 | | | | 763 | | | | (3,091 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (19,869 | ) | | $ | 60,078 | | | $ | 18,148 | | | $ | (137,332 | ) | | $ | (600 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net (loss) income per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (0.40 | ) | | $ | 1.22 | | | $ | 0.40 | | | $ | (3.38 | ) | | $ | (0.03 | ) |

Diluted | | $ | (0.40 | ) | | $ | 1.19 | | | $ | 0.39 | | | $ | (3.38 | ) | | $ | (0.03 | ) |

Weighted average common shares used in computing net (loss) income per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 49,080 | | | | 49,398 | | | | 45,198 | | | | 40,646 | | | | 20,870 | |

Diluted | | | 49,080 | | | | 50,415 | | | | 46,036 | | | | 40,646 | | | | 20,870 | |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Working capital | | $ | 163,569 | | | $ | 185,684 | | | $ | 110,984 | | | $ | 47,223 | | | $ | 86,506 | |

Property and equipment, net | | | 18,229 | | | | 20,827 | | | | 26,277 | | | | 38,301 | | | | 27,213 | |

Total assets | | | 267,068 | | | | 302,115 | | | | 248,211 | | | | 275,169 | | | | 169,727 | |

Total debt | | | — | | | | — | | | | 826 | | | | 85,730 | | | | 17,900 | |

Stockholders’ equity | | | 215,704 | | | | 240,720 | | | | 176,752 | | | | 105,404 | | | | 117,280 | |

Other Information: | | | | | | | | | | | | | | | | | | | | |

Current ratio | | | 5.33 | | | | 5.08 | | | | 3.02 | | | | 1.39 | | | | 3.43 | |

Asset turnover | | | 0.49 | | | | 0.83 | | | | 0.88 | | | | 0.50 | | | | 0.80 | |

Debt as a percentage of total capitalization | | | — | | | | — | | | | 0.50 | % | | | 44.8 | % | | | 13.2 | % |

Additions to property and equipment | | | 3,328 | | | | 6,769 | | | | 3,653 | | | | 8,944 | | | | 7,527 | |

Depreciation and amortization | | | 10,917 | | | | 17,655 | | | | 24,736 | | | | 34,259 | | | | 11,933 | |

| (a) | 2009 through 2012 includes the results of the combined company from the date of a merger completed August 29, 2008. Selected financial data presented for 2008 does not include results of the combined company. |

19

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read together with the Consolidated Financial Statements and Notes thereto appearing elsewhere in this annual report on Form 10-K. Certain statements in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements that involve risks and uncertainties. Words such as may, will, should, would, anticipates, expects, intends, plans, believes, seeks, estimates and similar expressions identify such forward-looking statements. The forward-looking statements contained herein are based on current expectations and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements. Factors that might cause such a difference include, among other things, those set forth under “Risk Factors” and those appearing elsewhere in this Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis only as of the date hereof. We assume no obligations to update any forward-looking statements to reflect actual results or changes in factors or assumptions affecting forward-looking statements.

Overview

We provide market-focused, cost-optimized automated test equipment (ATE) solutions for the semiconductor industry. We design, manufacture, market and service ATE solutions that address the broad, divergent test requirements of the wireless, computing, automotive and digital consumer markets of the semiconductor industry. Semiconductor designers and manufacturers worldwide use our equipment to test their devices during the manufacturing process. After testing, these devices are incorporated in a wide range of products, including personal and tablet computers, mobile internet equipment such as wireless access points and interfaces, broadband access products such as cable modems and set top boxes, personal communication and entertainment products such as mobile phones and personal digital music players, consumer products such as televisions, videogame systems and digital cameras, automobile electronics and power management devices used in portable and automotive electronics. We also sell hardware and software support and maintenance services for our test systems.

We focus our marketing and sales efforts on integrated device manufacturers (IDMs), outsource assembly and test providers, (OSATs), which perform assembly and testing services for the semiconductor industry, and fabless companies, which design integrated circuits but have no manufacturing capability. We offer our customers a comprehensive portfolio of test systems and provide a global network of strategically deployed applications and support resources.

On November 17, 2010, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Verigy Ltd., a corporation organized under the laws of Singapore (“Verigy”). In March 2011, prior to the closing of our merger with Verigy, the board of directors of Verigy determined that a proposal from Advantest Corporation to acquire all of the outstanding ordinary shares of Verigy for $15.00 per share in cash, on the terms and conditions set forth in a definitive implementation agreement proposed by Advantest, constituted a “Superior Offer” within the meaning of the Merger Agreement, the Verigy board of directors withdrew its recommendation in favor of the pending merger transaction between Verigy and us and, as a result we then terminated the Merger Agreement. As a result of the termination of the Merger Agreement, on March 25, 2011 Verigy paid us the $15.0 million Verigy Termination Fee required pursuant to the terms and conditions of the Merger Agreement, which is classified as other income in our statement of operations for the fiscal year ended July 31, 2011.

In the twelve months ended July 31, 2011, we incurred approximately $4.9 million of expenses related to the terminated Verigy transaction, of which $3.6 million has been recorded in selling, general and administrative expenses on our consolidated statement of operations. The remaining $1.3 million was related to a break-up fee and was recorded as a reduction of other income.

20

Industry Conditions and Outlook

We sell capital equipment and services to companies that design, manufacture, assemble or test semiconductor devices. The semiconductor industry is highly cyclical, causing a cyclical impact on our financial results. As a capital equipment provider, our revenue is driven by the capital expenditure budgets and spending patterns of our customers, who often delay or accelerate purchases in reaction to variations in their business. The level of capital expenditures by these semiconductor companies depends on the current and anticipated market demand for semiconductor devices and the products that incorporate them. Therefore, demand for our semiconductor test equipment is dependent on growth in the semiconductor industry. In particular, three primary characteristics of the semiconductor industry drive the demand for semiconductor test equipment:

| | • | | increases in unit production of semiconductor devices; |

| | • | | increases in the complexity of semiconductor devices used in electronic products; and |

| | • | | the emergence of next generation semiconductor device technologies. |

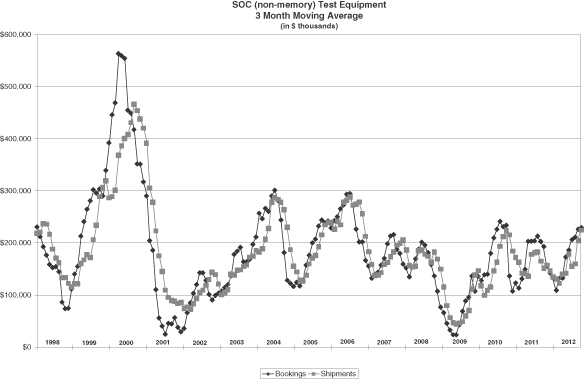

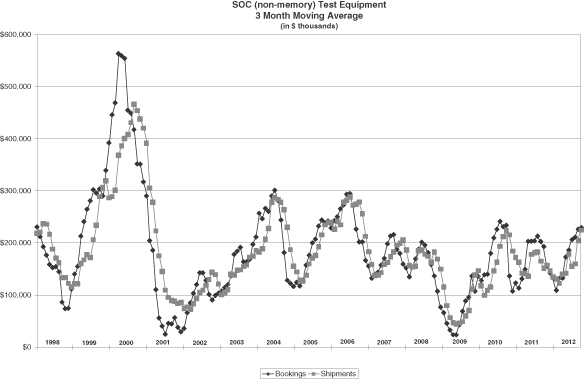

The following graph shows the cyclicality in semiconductor test equipment orders and shipments from fiscal 1998 through fiscal 2012 (using the three month moving average), as calculated by SEMI, an industry trade organization:

Consistent with our business strategy, we have continued to invest significant amounts in engineering and product development to develop and enhance our tester platforms during industry slowdowns. During these periods, we implement cost reduction measures, such as the strict oversight of expenditures and reduction in discretionary travel and other variable overhead expenses. We believe that these reductions in operating expenses preserve our ability to fund critical product research and development efforts and continue to provide our customers with the levels of responsiveness and service they require. We believe that our competitive advantage in the semiconductor test industry is primarily driven by the ability of our combined tester platforms to meet or exceed the cost and technical specifications required for the testing of advanced semiconductor devices. Our

21

current investment in engineering and product development is focused on enhancements and additions to our product offerings with new options and instruments designed for specific market segments. We believe this will continue to differentiate our tester platforms from the product offerings of our competitors.