UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended July 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 000-10761

LTX-Credence Corporation

(Exact name of registrant as specified in its charter)

| | |

| MASSACHUSETTS | | 04-2594045 |

(State or other jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

1355 California Circle

Milpitas, California 95035

(781) 467-1000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $0.05 per share | | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer’ in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-Accelerated Filer ¨

Smaller Reporting Company Filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

The aggregate market value of the Common Stock held by non-affiliates of the registrant on January 31, 2009 was $35,180,163.

Number of shares outstanding of each of the issuer’s classes of Common Stock as of September 25, 2009:

Common Stock, Par Value $0.05 Per Share, 127,550,315 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement in connection with its 2009 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K Report.

LTX-CREDENCE CORPORATION

INDEX

PART I

Introduction

Formed by the August 2008 merger of LTX Corporation and Credence Systems Corporation, LTX-Credence Corporation (“LTX-Credence” or the “Company”), provides focused, cost-optimized automated test equipment (ATE) solutions. We design, manufacture, market and service ATE solutions that address the broad, divergent test requirements of the wireless, computing, automotive and digital consumer market segments. Semiconductor designers and manufacturers worldwide use our equipment to test their devices during the manufacturing process. After testing, these devices are then incorporated in a wide range of products, including computers, mobile internet equipment such as wireless access points and interfaces, broadband access products such as cable modems and DSL modems, personal communication products such as cell phones and personal digital assistants, consumer products such as televisions, videogame systems, digital cameras and automobile electronics, and for power management in portable and automotive electronics.

LTX-Credence focuses its marketing and sales efforts on integrated device manufacturers (IDMs), outsource assembly and test providers (OSATs), which perform manufacturing services for the semiconductor industry, and fabless companies, which design integrated circuits but have no manufacturing capability. We provide our customers with a comprehensive portfolio of test systems and a global network of strategically deployed applications and support resources.

LTX-Credence Corporation was incorporated in Massachusetts in 1976. Our executive offices are located at 1355 California Circle, Milpitas, California 95035 and our telephone number is 781-467-1000. The terms “LTX-Credence” and the “Company” refer to LTX-Credence Corporation and its wholly owned subsidiaries unless the context otherwise indicates. We make our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports available, free of charge, in the Investor Relations section of the Company’s website at www.ltx-credence.com as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission.

Unless otherwise noted, all historical financial results in this report for periods prior to August 2008 are for LTX Corporation only, without any effect from the August 2008 merger of LTX Corporation and Credence Systems Corporation.

1

Industry Overview

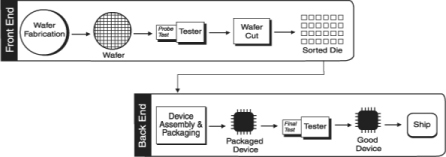

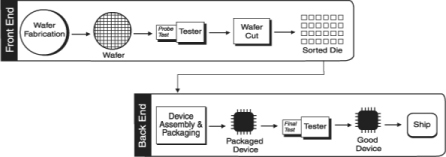

Today, most electronic products contain a combination of integrated circuits (ICs). Each of these ICs has electrical circuitry that requires validation or testing during and after the manufacturing process. The final usability of the IC is determined by ATE. The testing of devices is a critical step during the semiconductor production process. Typically, semiconductor companies test each device at two different stages during the manufacturing process to ensure its functional and electrical performance prior to shipment to the device user. These companies use semiconductor testing equipment to first test a device after it has been fabricated but before it has been packaged to eliminate non-functioning parts. Then, after the functioning devices are packaged, they are tested again to determine if they fully meet performance specifications. Testing is an important step in the manufacturing process because it allows devices to be fabricated at both maximum density and performance—a key to the competitiveness of semiconductor manufacturers. Shown below is a schematic depiction of the major steps in the semiconductor fabrication and test process.

Three primary factors ultimately drive demand for semiconductor test equipment:

| | • | | increases in unit production of semiconductor devices; |

| | • | | increases in the complexity and performance level of devices used in electronic products; and |

| | • | | the emergence of next generation device technologies. |

Increases in unit production result primarily from the proliferation of the personal computer, growth of the telecommunications industry, consumer electronics, the mobile internet, broadband network access, the increased use of digital signal processing (DSP) devices, and automotive and power management applications. These increases in unit production, in turn lead to a corresponding increase in the need for test equipment.

Furthermore, demand is increasing worldwide for smaller, more highly integrated electronic products. This has led to ever higher performance and more complex semiconductor devices, which, in turn, results in a corresponding increase in the demand for equally sophisticated test equipment.

Finally, the introduction and adoption of a new generation of end-user products requires the development of next generation device technologies. For example, access to information is migrating from the stand-alone desktop computer, which might be physically linked to a local network, to the seamless, virtual network of the internet, which is accessible from anywhere by a variety of new portable electronic communication products. A critical enabling technology for this network and multimedia convergence is system in package (SIP). SIP provides the benefits of lower cost, smaller size and higher performance by combining advanced digital, analog and embedded memory technologies on a single device. Historically, these discrete technologies were only available on several separate semiconductor devices, each performing a specific function. By integrating these functions in a single package, SIP enables lower cost, smaller size, higher performance, and lower power consumption.

The increases in unit production of devices, the increase in complexity of those devices, and, ultimately, the emergence of new semiconductor device technology have mandated changes in the design, architecture and

2

complexity of such test equipment. Semiconductor device manufacturers must still be able to test the increasing volume and complexity of devices in a reliable, cost-effective, efficient and flexible manner. However, the increased pace of technological change, together with the large capital investments required to achieve economies of scale, are changing the nature and urgency of the challenges faced by device designers and manufacturers.

The combination of ever increasing price pressure and the fact that technology that is not always cost effective to integrate into SIP has led to the need for testing solutions that cover multiple segments of the semiconductor market. There is a need to maximize utilization on the semiconductor test floor and at the same time have the most cost effective test solution for various points or integration levels in technology. This requires a suite of test solution products that are optimized in technology and cost for the segment they are addressing thus maximizing efficiency and minimizing overall cost of test.

The Merger of LTX Corporation and Credence Systems Corporation

On August 29, 2008, LTX Corporation and Credence Systems Corporation completed a merger. In connection with the merger, LTX Corporation changed its name to “LTX-Credence Corporation” and changed the symbol under which its common stock trades on the NASDAQ Global Market to “LTXC” and Credence Systems Corporation became a wholly-owned subsidiary of LTX-Credence. On January 30, 2009, the Company completed a statutory merger of Credence in which Credence was legally dissolved and merged into the Company with the Company being the surviving corporation.

The strategic rationale for the merger included the following:

Bringing together complementary technology.

The merger brings together a comprehensive portfolio of proven technologies with little overlap. Our broad product offerings provide focused, cost-effective solutions for our customers today, and a strong framework for future product development and innovation.

Building customer diversity.

The merger brings together the strong customer bases of the two companies with minimal overlap in customers and markets, immediately broadening the customer base and reducing customer concentration. It also allows us the ability to provide more comprehensive solutions to our established customers through our expanded product offerings.

Streamlining the business.

The merger provides us with the opportunity to eliminate redundancies, minimize costs, leverage technologies, and establish efficient operations that enable us to bring solutions to market quickly and profitably. It also provides us the size and scope we believe is necessary to enable financial strength and growth in our industry.

Business Strategy

Our objective is to be the leading supplier of focused, cost-optimized ATE solutions for the wireless, computing, automotive and digital consumer markets. Key elements of our business strategy include:

Advance our offering of focused, cost-optimized ATE solutions. We believe that providing a range of scalable test platforms targeted at the specific test requirements of individual market segments is the best approach to enable our customers to address the technical, business and cost requirements of their devices. Our customers’ focus on test costs demands this segment-focused scalability approach, we are strongly

3

positioned to address our customers’ requirements. We intend to leverage our proven technologies efficiently across our platforms to accelerate the availability of new capabilities, with a focus on optimizing the cost of our solutions for the individual market segments we address.

Concentrate our sales, applications consulting, and service efforts on key accounts. We recognize that large, diversified IDMs and OSATs, and certain fabless companies purchase most of the world’s test equipment, and that the level of support we are able to provide to them has a direct impact on future business. We believe that focusing our sales and support resources on these key semiconductor companies is the most efficient way to maximize revenue. Therefore, we have organized our sales, field service, and field applications organizations around these key companies and located our resources close to their facilities. This has helped us to increase our responsiveness to customers’ needs and has enabled us to develop collaborative relationships that help guide us in developing future technologies.

Further improve the flexibility of our business model. In order to focus our resources, improve our responsiveness to customer needs, reduce fixed costs and working capital requirements, and manage the cyclicality of our industry more effectively, we have implemented a lean, flexible business model. Key to this business model is our outsourced manufacturing, with substantially all of our manufacturing functions outsourced to third parties. Through strategic alliances, we have also outsourced certain distribution, repair and support functions. In addition, we engage contract employees to address periods of peak demand. Our business model allows us to maintain tight control over all expense items. Overall, we intend to continue to identify and implement programs which enhance our ability to meet customers’ needs while reducing fixed costs.

Product Strategy

Our product strategy is driven by our objective to be the leading supplier of focused, cost-optimized ATE solutions for the wireless, computing, automotive and digital consumer markets. We concentrate on the technical, business and cost requirements of the core technologies within those markets, which include: CPU, chipset and graphics, DSP and ASIC, MCU, mobility RF, and power and mixed signal.

To address the divergent, segmented requirements of these technologies, LTX-Credence offers four segment focused, scalable platforms to enable us to address our customers’ technical performance requirements, while at the same time providing a cost-optimized solution. This segment-focused approach allows prioritization of segment-specific test requirements, including:

| | • | | Capital cost and zero-pin infrastructure cost |

| | • | | Equipment size and footprint |

| | • | | Instrument capability and scope |

| | • | | Applications functionality and usage |

| | • | | Multi-site test capability |

Each of our four platforms addresses a specific market segment with relatively little overlap in capability and pricing. The Sapphire platform provides optimized performance for CPU, graphics and high end digital testing. The Diamond platform offers high density packaging for low cost testing of microcontrollers and cost sensitive digital consumer devices. The X-Series test platform offers configurations for optimal testing of DSP, power, automotive, mixed signal and RF applications. The ASL platform is a market leader for testing linear, low-end mixed signal and power management devices.

4

Product Portfolio Overview

Our product portfolio consists of four segment focused, scalable platforms:

Sapphire Platform

The Sapphire platform provides optimized performance for CPU, graphics and high-end digital testing. It is designed to be a highly reconfigurable and scalable functional and structural tester for a wide range of high performance ICs. Sapphire is used for silicon debug and validation, characterization, wafer sort and final test. The platform allows a variety of digital and mixed signal instruments to be easily configured to test devices demanding compelling performance. We are no longer funding engineering or research and development related to the Sapphire platform. We are, however, funding maintenance and support for the existing Sapphire installed base.

Diamond Platform

The Diamond platform offers high density packaging for low cost testing of microcontrollers and cost sensitive digital consumer devices. Diamond leverages electronics integration and air-cooling to produce a compact form factor and utilizes high density technology in a variety of instruments for digital and mixed signal addressing embedded analog testing. It is used for engineering as well as wafer sort and final production testing.

X-Series Platform

The X-Series platform offers configurations for optimal testing of DSP, power, automotive, mixed signal and RF applications. The X-Series offers four scalable, compatible configurations, each using common instrumentation and software, to enable flexible deployment while optimizing capital investment. It offers a wide range of digital, analog, RF and DSP test hardware coupled with our enVision software to provide a flexible, scalable test environment that addresses the test requirements of complex mixed signal and RF devices on a single system.

ASL Platform

The ASL platform is the market leader for testing linear, low end mixed signal and power management devices. The ASL tests traditional analog function blocks such as amplifiers, regulators, switches and converters, either as individual ICs or as larger function ICs such as battery power management devices in portable electronics devices. It is highly configurable and relatively low cost, matching the test requirements of low ASP devices.

Service

Our worldwide service organization is capable of performing installations and all necessary maintenance of test systems sold by us, including routine servicing of spare parts manufactured by third parties. We provide various parts and labor warranties on test systems or options designed and manufactured by us, and warranties on components that have been purchased from other manufacturers and incorporated into our test systems. We also provide training on the maintenance and operation of test systems we sell.

Our service revenues (which do not include the service revenues of Credence Systems Corporation for fiscal 2008 and 2007) were $57.8 million, or 42.0% of net sales, in fiscal 2009, $27.4 million, or 20.2% of net sales, in fiscal 2008, and $29.3 million, or 19.9% of net sales, in fiscal 2007.

We offer a wide range of service contracts, which gives our customers the flexibility to select the maintenance program best suited to their needs. Customers may purchase service contracts which extend

5

maintenance beyond the initial warranty period. Many customers enter into annual or multiple-year service contracts over the life of the equipment. The pricing of contracts is based upon the level of service provided to the customer and the time period of the service contract. We believe that service revenues should be less affected by the cyclical nature of the semiconductor industry than sales of test equipment. We maintain service centers around the world, both directly and through strategic alliances with companies that are located in the United States, Europe and Asia.

Engineering and Product Development

The test equipment market is characterized by rapid technological change and new product introductions, as well as advancing industry standards. Our competitive position will depend upon our ability to successfully enhance our test platforms, develop new instrumentation, and introduce these new products on a timely and cost-effective basis. We seek to maintain close relationships with our customers in order to be responsive to their product development and production needs.

Our engineering strategy is to focus on development of our Diamond, X-Series and ASL platforms. Consolidation of platform technologies, both hardware and software, is a key focus moving forward, leveraging the combined company’s knowledge and expertise into cost-effective solutions.

Engineering and product development expenses (which do not include expenditures of Credence Systems Corporation for fiscal year 2008 and 2007) were $71.2 million, $46.0 million, and $50.0 million, during fiscal 2009, 2008, and 2007, respectively.

Sales and Distribution

We sell our products through a worldwide direct sales organization and through distributors. Our direct sales organization is structured around key accounts, with a sales force of 28 people as of July 31, 2009. We also use distributors to sell our products in certain markets such as in Taiwan/China (Spirox), Southeast Asia (UST), Japan (F-Brain) and Korea (Neosem).

Our sales to customers outside the United States are primarily denominated in United States dollars. Our sales outside North America (which do not include sales of Credence Systems Corporation for fiscal 2008 and 2007) were 64%, 61%, and 67%, of total net sales in fiscal 2009, 2008, and 2007, respectively. See Note 9 to our Consolidated Financial Statements for additional information relating to foreign revenues.

Customers

Our customers include many of the world’s leading semiconductor device manufacturers. In fiscal year 2009, Spirox and AMD accounted for 14% and 10% of our net sales, respectively. In fiscal years 2009, 2008 and 2007, Texas Instruments accounted for 10%, 30%, and 38%, respectively, of our net sales (which do not include sales of Credence Systems Corporation for fiscal 2008 or 2007). In fiscal year 2008, STMicroelectronics accounted for 11% of our net sales. A representative list of combined LTX-Credence customers follows:

| | | | |

| Advanced Micro Devices (AMD) | | Intel | | Silicon Laboratories |

| Amkor | | KYEC | | Skyworks |

| Anadigics | | Maxim Integrated Products | | SMSC |

| Atmel | | Mediatek | | STATSChipPac |

| austriamicrosystems | | Melexis | | Spirox |

| ASE | | NEC | | STMicroelectronics |

| Carsem | | Ralink | | Texas Instruments |

| Fairchild | | Renesas | | Triquint |

| Giga Solution | | RF Micro Devices | | Unisem |

| Infineon Technologies | | Sigurd | | UTAC |

6

Because a relatively small number of semiconductor companies purchase most of the world’s semiconductor test equipment, we have concentrated our sales and support efforts on these key customers. We believe that sales to a limited number of customers will continue to account for a high percentage of net sales for the foreseeable future.

Manufacturing and Supply

We outsource our final assembly, system integration, and testing operations of our Sapphire, X-Series, ASL and Diamond products, to Benchmark Electronics, Jabil Circuit and Plexus Corporation. We outsource certain components and subassemblies to other contract manufacturers as well. We use standard components and prefabricated parts manufactured to our specifications. These components and subassemblies are used to produce testers in configurations specified by our customers. Some of the components for our products are available from a number of different suppliers; however, many components are purchased from a single supplier or a limited group of suppliers. Although we believe that all single source components currently are available in adequate amounts, we cannot be certain that shortages will not develop in the future. We are dependent on certain semiconductor device manufacturers, who are sole source suppliers of custom components for our products. We have no written supply agreements with these sole source suppliers and purchase our custom components through individual purchase orders. We continuously evaluate sources for our custom components. We cannot assure you that such alternative sources will be qualified or available to us.

Our facilities in Norwood, Massachusetts and Milpitas, California perform research and development activities, which include assembly, system integration and testing for prototypes.

Competition

Many other domestic and foreign companies participate in the markets for each of our products and the industry is highly competitive. We compete principally on the basis of performance, cost of test, reliability, customer service, applications support, price and ability to deliver our products on a timely basis. Our primary competitors in the market for test systems include Advantest Corporation, Teradyne Inc., and Verigy Ltd. Certain of these companies have a substantially larger share of our addressable market than we do and the majority of our major competitors have greater financial and other resources than we do. A majority of these competitors have a larger installed base of equipment than we do. All of our major competitors are suppliers of other types of ATE and also supply products to other markets. We expect our competitors to enhance their current products and they could introduce new products with comparable or better price and performance. In addition, new competitors, including semiconductor manufacturers themselves, may offer new technologies, which may in turn reduce the value of our product lines.

Backlog

At July 31, 2009, our backlog of unfilled orders for all products and services was $57.9 million, compared with $35.8 million at July 31, 2008 (which did not include the backlog of Credence Systems Corporation). Historically, test systems generally ship within twelve months of receipt of a customer’s purchase order. While backlog is calculated on the basis of firm orders, orders may be subject to cancellation or delay by the customer with limited or no penalty. Our backlog at any particular date, therefore, is not necessarily indicative of actual sales which may be generated for any succeeding period. Historically, our backlog levels have fluctuated based upon the ordering patterns of our customers and changes in our manufacturing capacity.

Proprietary Rights

The development of our products is largely based on proprietary information. We rely upon a combination of contract provisions, copyright, trademark and trade secret laws to protect our proprietary rights in products. We also have a policy of seeking patents on technology considered of particular strategic importance. Our other

7

patents have later expiration dates and relate to various technologies, including technology relating to proprietary instrumentation and pin electronics. Although we believe that the copyrights, trademarks and patents we own are of value, we believe that they will not determine our success, which depends principally upon our management, engineering, applications, manufacturing, marketing and service skills. However, we intend to protect our rights when, in our view, these rights are infringed upon.

The use of patents to protect hardware and software has increased in the test equipment industry. We have at times been notified of claims that we may be infringing patents issued to others. Although there are no pending actions against us regarding any patents, no assurance can be given that infringement claims by third parties will not negatively impact our business and results of operations. As to any claims asserted against us, we may seek or be required to obtain a license under the third party’s intellectual property rights. There can be no assurance, however, that a license will be available under reasonable terms or at all. In addition, we could decide to engage in litigation to challenge such claims or a third party could engage in litigation to enforce such claims. Such litigation could be expensive and time consuming and could negatively impact our business and results of operations.

Employees

At July 31, 2009, we employed 608 employees and 19 temporary workers. None of our employees are represented by a labor union, and we have experienced no work stoppages. Many of our employees are highly skilled, and we believe our future success will depend in large part on our ability to attract and retain these employees. We consider relations with our employees to be good.

Environmental Affairs

Our facilities are subject to numerous laws and regulations designed to protect the environment. We do not anticipate that compliance with these laws and regulations will have a material effect on our capital expenditures, earnings or competitive position.

This report includes or incorporates forward-looking statements that involve substantial risks and uncertainties and fall within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify these forward-looking statements by our use of the words “believes,” “anticipates,” “plans,” “expects,” “may,” “will,” “would,” “intends,” “estimates,” and similar expressions, whether in the negative or affirmative. We cannot guarantee that we actually will achieve these plans, intentions or expectations. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements, particularly under the heading “Business Risks,” that we believe could cause our actual results to differ materially from the forward-looking statements that we make. We do not assume any obligation to update any forward-looking statement we make.

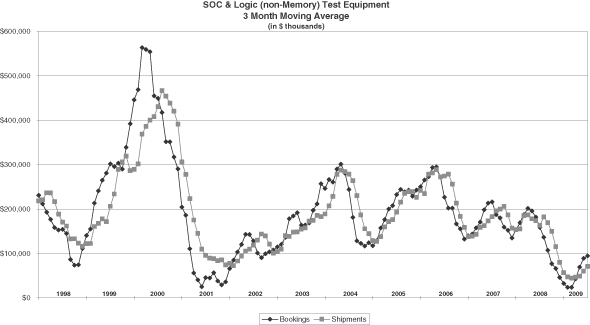

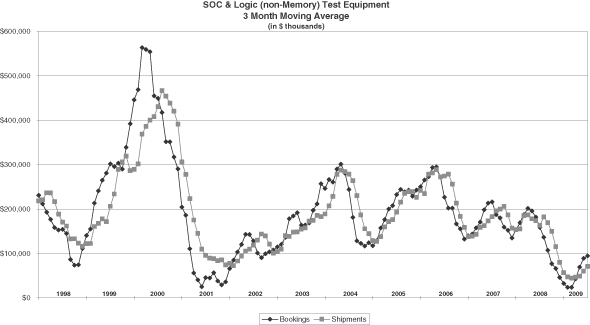

Our sole market is the highly cyclical semiconductor industry, which causes a cyclical impact on our financial results.

We sell capital equipment to companies that design, manufacture, assemble, and test semiconductor devices. The semiconductor industry is highly cyclical, causing in turn a cyclical impact on our financial results. In fiscal 2006, the industry entered a growth period that was reflected in our improving operating results during fiscal 2006. However, our incoming product orders in the fourth quarter of fiscal 2006 decreased from the third quarter’s level and continued to decrease in the first two quarters of fiscal 2007. Industry order rates did not increase significantly in fiscal 2008 and declined significantly in fiscal 2009. Although industry conditions have recently improved, the timing and level of a sustained industry recovery is uncertain at this time as we enter our

8

fiscal 2010. Any failure to expand in cycle upturns to meet customer demand and delivery requirements or contract in cycle downturns at a pace consistent with cycles in the industry could have an adverse effect on our business.

Any significant downturn in the markets for our customers’ semiconductor devices or in general economic conditions would likely result in a reduction in demand for our products and would negatively impact our business. Downturns in the semiconductor test equipment industry have been characterized by diminished product demand, excess production capacity, accelerated erosion of selling prices and excessive inventory levels. We believe the markets for newer generations of devices, including system in package (“SIP”), will also experience similar characteristics. Our market is also characterized by rapid technological change and changes in customer demand. In the past, we have experienced delays in commitments, delays in collecting accounts receivable and significant declines in demand for our products during these downturns, and we cannot be certain that we will be able to maintain or exceed our current level of sales.

Additionally, as a capital equipment provider, our revenue is driven by the capital expenditure budgets and spending patterns of our customers who often delay or accelerate purchases in reaction to variations in their businesses. Because a high portion of our costs are fixed, we are limited in our ability to reduce expenses and inventory purchases quickly in response to decreases in orders and revenues. In a contraction, we may not be able to reduce our significant fixed costs, such as continued investment in research and development and capital equipment requirements and materials purchases from our suppliers.

We may not be able to pay our debt and other obligations.

If our cash flow is inadequate to meet our obligations, we could face substantial liquidity problems. During the year ended July 31, 2009, we repurchased approximately $87.0 million principal amount of Credence’s 3.5% Convertible Senior Subordinated Notes due May 2010, reducing our cash and cash equivalents. If we are unable to generate sufficient cash flow or otherwise obtain funds necessary to make the required payments on the remaining balance of Convertible Senior Subordinated Notes due May 2011, or certain of our other obligations, we would be in default under the terms thereof, which could permit the holders of those obligations to accelerate their maturity and also could cause default under future indebtedness we may incur. In addition, in the event of a material adverse change (as such term is defined in our loan agreements with Silicon Valley Bank) we would be in default under our revolving credit loan which could permit the bank to accelerate the maturity of the loan. Any such default could have material adverse effect on our business, prospects, financial position and operating results. In addition, we may not be able to repay amounts due in respect of our obligations, if payment of those obligations were to be accelerated following the occurrence of any other event of default as defined in the instruments creating those obligations. As of the date of this filing, we have $9.9 million outstanding under our revolving line of credit. An event of default may accelerate payments of these obligations.

We have substantial indebtedness.

As of the date of this report, we have $1.5 million principal amount of 3.5% Credence Convertible Senior Subordinated Notes (due May 2010), $33.9 million principal amount of 3.5% Credence Convertible Senior Subordinated Notes (due May 2011), as well as $9.9 million in borrowings under our revolving credit facility. We may incur substantial additional indebtedness in the future. The level of indebtedness, among other things, could

| | • | | make it difficult for us to make payments on our debt and other obligations; |

| | • | | make it difficult for us to obtain any necessary future financing for working capital, capital expenditures, debt service requirements or other purposes; |

| | • | | require the dedication of a substantial portion of any cash flow from operations to service for indebtedness, thereby reducing the amount of cash flow available for other purposes, including capital expenditures; |

9

| | • | | limit our flexibility in planning for, or reacting to changes in, our business and the industries in which we compete; |

| | • | | place us at a possible competitive disadvantage with respect to less leveraged competitors and competitors that have better access to capital resource; and |

| | • | | make us more vulnerable in the event of a further downturn in our business. |

There can be no assurance that we will be able to meet our debt service obligations, including our obligations under the Notes.

We may need additional financing, which could be difficult to obtain.

We expect that our existing cash and cash equivalents and marketable securities, and borrowings from available bank financings, will be sufficient to meet our cash requirements to fund operations and expected capital expenditures for the foreseeable future. In the event we need to raise additional funds, we cannot be certain that we will be able to obtain such additional financing on favorable terms, if at all. Further, if we issue additional equity securities, stockholders may experience additional dilution or the new equity securities may have rights, preferences or privileges senior to those of existing holders of common stock. Future financings may place restrictions on how we operate our business. If we cannot raise funds on acceptable terms, if and when needed, we may not be able to develop or enhance our products and services, take advantage of future opportunities, grow our business or respond to competitive pressures, which could seriously harm our business.

The market for semiconductor test equipment is highly concentrated, and we have limited opportunities to sell our products.

The semiconductor industry is highly concentrated, and a small number of semiconductor device manufacturers and contract assemblers account for a substantial portion of the purchases of semiconductor test equipment generally, including our test equipment. In fiscal year 2009, Spirox and AMD accounted for 14% and 10% of our net sales, respectively. In fiscal years 2009, 2008 and 2007, Texas Instruments accounted for 10%, 30%, and 38%, respectively, of our net sales (which do not include sales of Credence Systems Corporation for fiscal 2008 or 2007). In fiscal year 2008, STMicroelectronics accounted for 11% of our net sales. Sales to our ten largest customers accounted for 69% of revenues in fiscal year 2009 and 78% in fiscal year 2008. Our customers may cancel orders with few or no penalties. If a major customer reduces orders for any reason, our revenues, operating results, and financial condition will be affected.

Our ability to increase our sales will depend in part upon our ability to obtain orders from new customers. Semiconductor manufacturers select a particular vendor’s test system for testing the manufacturer’s new generations of devices and make substantial investments to develop related test program applications and interfaces. Once a manufacturer has selected a test system vendor for a generation of devices, that manufacturer is more likely to purchase test systems from that vendor for that generation of devices, and, possibly, subsequent generations of devices as well. Therefore, the opportunities to obtain orders from new customers may be limited.

Our sales and operating results have fluctuated significantly from period to period, including from one quarter to another, and they may continue to do so.

Our quarterly and annual operating results are affected by a wide variety of factors that could adversely affect sales or profitability or lead to significant variability in our operating results or our stock price. This may be caused by a combination of factors, including the following:

| | • | | sales of a limited number of test systems account for a substantial portion of our net sales in any particular fiscal quarter, and a small number of transactions could therefore have a significant impact; |

10

| | • | | order cancellations by customers; |

| | • | | lower gross margins in any particular period due to changes in: |

| | • | | the configurations of test systems sold, |

| | • | | the customers to whom we sell these systems, or |

| | • | | a long sales cycle, due to the high selling price of our test systems, the significant investment made by our customers, and the time required to incorporate our systems into our customers’ design or manufacturing process; and |

| | • | | changes in the timing of product orders due to: |

| | • | | unexpected delays in the introduction of products by our customers, |

| | • | | shorter than expected lifecycles of our customers’ semiconductor devices, |

| | • | | uncertain market acceptance of products developed by our customers, or |

| | • | | our own research and development. |

We cannot predict the impact of these and other factors on our sales and operating results in any future period. Results of operations in any period, therefore, should not be considered indicative of the results to be expected for any future period. Because of this difficulty in predicting future performance, our operating results may fall below expectations of securities analysts or investors in some future quarter or quarters. Our failure to meet these expectations would likely adversely affect the market price of our common stock.

A substantial amount of the shipments of our test systems for a particular quarter occur late in the quarter. Our shipment pattern exposes us to significant risks in the event of problems during the complex process of final integration, test and acceptance prior to shipment. If we were to experience problems of this type late in our quarter, shipments could be delayed and our operating results could fall below expectations.

Our dependence on subcontractors and sole source suppliers may prevent us from delivering an acceptable product on a timely basis.

We rely on subcontractors to manufacture our test systems and many of the components and subassemblies for our products, and we rely on sole source suppliers for certain components. We may be required to qualify new or additional subcontractors and suppliers due to capacity constraints, competitive or quality concerns or other risks that may arise, including a result of a change in control of, or deterioration in the financial condition of, a supplier or subcontractor. The process of qualifying subcontractors and suppliers is a lengthy process. Our reliance on subcontractors gives us less control over the manufacturing process and exposes us to significant risks, especially inadequate capacity, late delivery, substandard quality, and high costs. In addition, the manufacture of certain of these components and subassemblies is an extremely complex process. If a supplier became unable to provide parts in the volumes needed or at an acceptable price, we would have to identify and qualify acceptable replacements from alternative sources of supply, or manufacture such components internally. The failure to qualify acceptable replacements quickly would delay the manufacturing and delivery of our products, which could cause us to lose revenues and customers.

We also may be unable to engage alternative production and testing services on a timely basis or upon terms favorable to us, if at all. If we are required for any reason to seek a new manufacturer of our test systems, an alternate manufacturer may not be available and, in any event, transitioning to a new manufacturer would require a significant lead time of six months or more and would involve substantial expense and disruption of our business. Our test systems are highly sophisticated and complex capital equipment, with many custom

11

components, and require specific technical know-how and expertise. These factors could make it more difficult for us to find a new manufacturer of our test systems if our relationship with our outsource suppliers is terminated for any reason, which would cause us to lose revenues and customers.

We are dependent on certain semiconductor device manufacturers as sole source suppliers of components manufactured in accordance with our proprietary design and specifications. We have no written supply agreement with these sole source suppliers and purchase our custom components through individual purchase orders.

Compliance with current and future environmental regulations may be costly and disruptive to our operations.

We may be subject to environmental and other regulations due to our production and marketing of products in certain states and countries. We are in the process of planning for and evaluating the impact of a directive to reduce the amount of hazardous materials in certain electronic components such as printed circuit boards. The directive is known as Directive 2002/95/EC of the European Parliament and of the Council of 27 January 2003 on the restriction of the use of certain hazardous substances in electrical and electronic equipment. “RoHS” is short for restriction of hazardous substances. The RoHS Directive banned the placing on the EU market of new electrical and electronic equipment containing more than agreed levels of lead, cadmium, mercury, hexavalent chromium, polybrominated biphenyl (PBB) and polybrominated diphenyl ether (PBDE), except where exemptions apply, from July 1, 2006. Manufacturers are required to ensure that their products, including their constituent materials and components, do not contain more than the minimum levels of the six restricted materials in order to be allowed to export goods into the Single Market (i.e. of the European Community’s 27 Member States). We are uncertain as to the impact of compliance on future expenses and supply of materials used to manufacture our equipment. Any interruption in supply due to the unavailability of lead free products could have a significant impact on the manufacturing and delivery of our products. If a supplier became unable to provide parts in the volumes needed or at an acceptable price, we would have to identify and qualify acceptable replacements from alternative sources of supply or manufacture such components internally. The failure to qualify acceptable replacements quickly would delay the manufacturing and delivery of our products, which could cause us to lose revenues and customers.

Future mergers and acquisitions may be difficult to integrate, disrupt our business, dilute stockholder value or divert management attention.

We have in the past, and may in the future, seek to acquire or invest in additional businesses, products, technologies or engineers. For example, in August 2008 we completed our merger with Credence Systems Corporation and in June 2003, we completed our acquisition of StepTech, Inc. We may have to issue debt or equity securities to pay for future mergers or acquisitions, which could be dilutive to then current stockholders. We have also incurred and may continue to incur certain liabilities or other expenses in connection with acquisitions, which could materially adversely affect our business, financial condition and results of operations.

Mergers and acquisitions of high-technology companies are inherently risky, and no assurance can be given that future mergers or acquisitions will be successful and will not materially adversely affect our business, operating results or financial condition. Our past and future mergers and acquisitions may involve many risks, including:

| | • | | difficulties in managing our growth following mergers and acquisitions; |

| | • | | difficulties in the integration of the acquired personnel, operations, technologies, products and systems of the acquired companies; |

| | • | | uncertainties concerning the intellectual property rights we purport to acquire; |

| | • | | unanticipated costs or liabilities associated with the mergers and acquisitions; |

12

| | • | | diversion of managements’ attention from other business concerns; |

| | • | | adverse effects on our existing business relationships with our or our acquired companies’ customers; |

| | • | | potential difficulties in completing projects associated with purchased in-process research and development; and |

| | • | | inability to retain employees of acquired companies. |

Any of the events described in the foregoing paragraphs could have an adverse effect on our business, financial condition and results of operations and could cause the price of our common stock to decline.

We may not be able to deliver custom hardware options and related applications to satisfy specific customer needs in a timely manner.

We must develop and deliver customized hardware and applications to meet our customers’ specific test requirements. Our test equipment may fail to meet our customers’ technical or cost requirements and may be replaced by competitive equipment or an alternative technology solution. Our inability to provide a test system that meets requested performance criteria when required by a device manufacturer would severely damage our reputation with that customer. This loss of reputation may make it substantially more difficult for us to sell test systems to that manufacturer for a number of years. We have, in the past, experienced delays in introducing some of our products and enhancements.

Our dependence on international sales and non-U.S. suppliers involves significant risk.

International sales have constituted a significant portion of our revenues in recent years, and we expect that this composition will continue. International sales accounted for 64% of our revenues for fiscal year 2009 and 61% of our revenues for fiscal year 2008. In addition, we rely on non-U.S. suppliers for several components of the equipment we sell. As a result, a major part of our revenues and the ability to manufacture our products are subject to the risks associated with international commerce. A reduction in revenues or a disruption or increase in the cost of our manufacturing materials could hurt our operating results. These international relationships make us particularly sensitive to changes in the countries from which we derive sales and obtain supplies. Our outsource manufacturing suppliers in Malaysia and Thailand increases our exposure to these types of international risks. International sales and our relationships with suppliers may be hurt by many factors, including:

| | • | | changes in law or policy resulting in burdensome government controls, tariffs, restrictions, embargoes or export license requirements; |

| | • | | political and economic instability in our target international markets; |

| | • | | longer payment cycles common in foreign markets; |

| | • | | difficulties of staffing and managing our international operations; |

| | • | | less favorable foreign intellectual property laws making it harder to protect our technology from appropriation by competitors; and |

| | • | | difficulties collecting our accounts receivable because of the distance and different legal rules. |

In the past, we have incurred expenses to meet new regulatory requirements in Europe, experienced periodic difficulties in obtaining timely payment from non-U.S. customers, and been affected by economic conditions in several Asian countries. Our foreign sales are typically invoiced and collected in U.S. dollars. A strengthening in the dollar relative to the currencies of those countries where we do business would increase the prices of our products as stated in those currencies and could hurt our sales in those countries. Significant fluctuations in the exchange rates between the U.S. dollar and foreign currencies could cause us to lower our prices and thus reduce our profitability. These fluctuations could also cause prospective customers to push out or delay orders because

13

of the increased relative cost of our products. In the past, there have been significant fluctuations in the exchange rates between the dollar and the currencies of countries in which we do business. While we have not entered into significant foreign currency hedging arrangements, we may do so in the future. If we do enter into foreign currency hedging arrangements, they may not be effective.

Our market is highly competitive, and we have limited resources to compete.

The test equipment industry is highly competitive in all areas of the world. Many other domestic and foreign companies participate in the markets for each of our products, and the industry is highly competitive. Our competitors in the market for semiconductor test equipment include Advantest Corporation, Teradyne Inc,, and Verigy Ltd. Certain of these major competitors have substantially greater financial resources and more extensive engineering, manufacturing, marketing, and customer support capabilities.

We expect our competitors to enhance their current products and to introduce new products with comparable or better price and performance. The introduction of competing products could hurt sales of our current and future products. In addition, new competitors, including semiconductor manufacturers themselves, may offer new testing technologies, which may in turn reduce the value of our product lines. Increased competition could lead to intensified price-based competition, which would hurt our business and results of operations. Unless we are able to invest significant financial resources in developing products and maintaining customer support centers worldwide, we may not be able to compete effectively.

We are exposed to the risks associated with the volatility of the U.S. and global economies.

The lack of visibility regarding whether or when there will be sustained growth periods for the sale of electronic goods and information technology equipment, and uncertainty regarding the amount of sales, underscores the need for caution in predicting growth in the semiconductor test equipment industry in general and in our revenues and profits specifically. Slow or negative growth in the domestic economy may continue to materially and adversely affect our business, financial condition and results of operations for the foreseeable future. Our results of operations would be further adversely affected if we were to experience lower than anticipated order levels, cancellations of orders in backlog, extended customer delivery requirements or pricing pressure as a result of a slowdown. At lower levels of revenue, there is a higher likelihood that these types of changes in our customers’ requirements would adversely affect our results of operations because in any particular quarter a limited number of transactions accounts for an even greater portion of sales for the quarter.

Development of our products requires significant lead-time, and we may fail to correctly anticipate the technical needs of our customers.

Our customers make decisions regarding purchases of our test equipment while their devices are still in development. Our test systems are used by our customers to develop, test and manufacture their new devices. We therefore must anticipate industry trends and develop products in advance of the commercialization of our customers’ devices, requiring us to make significant capital investments to develop new test equipment for our customers well before their devices are introduced. If our customers fail to introduce their devices in a timely manner or the market does not accept their devices, we may not recover our capital investment through sales in significant volume. In addition, even if we are able to successfully develop enhancements or new generations of our products, these enhancements or new generations of products may not generate revenue in excess of the costs of development, and they may be quickly rendered obsolete by changing customer preferences or the introduction of products embodying new technologies or features by our competitors. Furthermore, if we were to make announcements of product delays, or if our competitors were to make announcements of new test systems, these announcements could cause our customers to defer or forego purchases of our existing test systems, which would also hurt our business.

14

Our success depends on attracting and retaining key personnel.

Our success will depend substantially upon the continued service of our executive officers and key personnel, none of whom are bound by an employment or non-competition agreement. Our success will depend on our ability to attract and retain highly qualified managers and technical, engineering, marketing, sales and support personnel. Competition for such specialized personnel is intense, and it may become more difficult for us to hire or retain them. Our volatile business cycles only aggravate this problem. Layoffs in any industry downturn could make it more difficult for us to hire or retain qualified personnel. Our business, financial condition and results of operations could be materially adversely affected by the loss of any of our key employees, by the failure of any key employee to perform in his or her current positions, or by our inability to attract and retain skilled employees.

We may not be able to protect our intellectual property rights.

Our success depends in part on our ability to obtain intellectual property rights and licenses and to preserve other intellectual property rights covering our products and development and testing tools. To that end, we have obtained certain domestic and international patents and may continue to seek patents on our inventions when appropriate. We have also obtained certain trademark registrations. The process of seeking intellectual property protection can be time consuming and expensive. We cannot ensure that:

| | • | | patents will issue from currently pending or future applications; |

| | • | | our existing patents or any new patents will be sufficient in scope or strength to provide meaningful protection or any commercial advantage to us; |

| | • | | foreign intellectual property laws will protect our intellectual property rights; or |

| | • | | others will not independently develop similar products, duplicate our products or design around our technology. |

If we do not successfully enforce our intellectual property rights, our competitive position could suffer, which could harm our operating results. We also rely on trade secrets, proprietary know-how and confidentiality provisions in agreements with employees and consultants to protect our intellectual property. Other parties may not comply with the terms of their agreements with us, and we may not be able to adequately enforce our rights against these people.

Third parties may claim we are infringing their intellectual property, and we could suffer significant litigation costs, licensing expenses or be prevented from selling our products.

Intellectual property rights are uncertain and involve complex legal and factual questions. We may be unknowingly infringing on the intellectual property rights of others and may be liable for that infringement, which could result in significant liability for us. If we do infringe the intellectual property rights of others, we could be forced to either seek a license to intellectual property rights of others or alter our products so that they no longer infringe the intellectual property rights of others. A license could be very expensive to obtain or may not be available at all. Similarly, changing our products or processes to avoid infringing the rights of others may be costly or impractical.

We are responsible for any patent litigation costs. If we were to become involved in a dispute regarding intellectual property, whether ours or that of another company, we may have to participate in legal proceedings. These types of proceedings may be costly and time consuming for us, even if we eventually prevail. If we do not prevail, we might be forced to pay significant damages, obtain licenses, modify our products or processes, stop making products or stop using processes.

15

Our stock price is volatile.

In the twelve-month period ending on July 31, 2009, our stock price ranged from a low of $0.09 to a high of $2.20. The price of our common stock has been and likely will continue to be subject to wide fluctuations in response to a number of events and factors, such as:

| | • | | quarterly variations in operating results; |

| | • | | variances of our quarterly results of operations from securities analyst estimates; |

| | • | | changes in financial estimates and recommendations by securities analysts; |

| | • | | announcements of technological innovations, new products, or strategic alliances; and |

| | • | | news reports relating to trends in our markets. |

In addition, the stock market in general, and the market prices for semiconductor-related companies in particular, have experienced significant price and volume fluctuations that often have been unrelated to the operating performance of the companies affected by these fluctuations. These broad market fluctuations may adversely affect the market price of our common stock, regardless of our operating performance.

We may record impairment charges which would adversely impact our results of operations.

We review our goodwill, intangible assets and long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amounts of these assets may not be recoverable, and also review goodwill annually in accordance with SFAS No. 142, “Goodwill and Other Intangibles”.

One potential indicator of goodwill impairment is whether our fair value, as measured by its market capitalization, has remained below our net book value for a significant period of time. Whether our market capitalization triggers an impairment charge in any future period will depend on the underlying reasons for the decline in stock price, the significance of the decline, and the length of time the stock price has been trading at such prices.

In the event that we determine in a future period that impairment exists for any reason, we would record an impairment charge in the period such determination is made, which would adversely impact our financial position and results of operations.

If we do not meet the Nasdaq Global Market continued listing requirements, our common stock may be delisted.

As of July 31, 2009, the closing bid price of our common stock on the Nasdaq Global Market was $0.90, which is below the minimum $1.00 per share requirement for continued inclusion on the Nasdaq Global Market pursuant to Nasdaq Marketplace Rule 4450(a)(5), or the Rule. In accordance with the Rule, if our stock price were to remain below $1.00 for a period of 30 consecutive business days, Nasdaq would provide written notification that our securities may be delisted unless the bid price of our common stock closes at $1.00 per share or more for a minimum of 10 consecutive business days within 180 calendar days from such notification. As of the date of this filing, our last closing bid price was $1.80.

There can be no assurance that the bid price of our common stock will stay above $1.00 per share, or that we will be able to achieve compliance with the Rule within the given compliance period.

16

Uncertainty about the recently completed merger of LTX and Credence may adversely affect our relationships with customers, suppliers and employees.

In response to the merger of LTX and Credence, existing or prospective customers or suppliers of LTX-Credence may:

| | • | | delay, defer or cease purchasing goods or services from or providing goods or services to us; |

| | • | | delay or defer other decisions concerning LTX-Credence, or refuse to extend credit to us; or |

| | • | | otherwise seek to change the terms on which they do business with us. |

Any such delays or changes to terms could seriously harm the business of the Company.

In addition, as a result of the merger current and prospective employees could experience uncertainty about their future with the Company. These uncertainties may impair our ability to retain, recruit or motivate key personnel.

We have incurred significant costs in connection with the merger.

We have incurred substantial expenses related to the merger. We have incurred direct transaction costs of approximately $12.0 million in connection with the merger, all of which has been paid as of July 31, 2009.

Internal control deficiencies or weaknesses that are not yet identified could emerge.

Over time we may identify and correct deficiencies or weaknesses in our internal controls and, where and when appropriate, report on the identification and correction of these deficiencies or weaknesses. However, the internal control procedures can provide only reasonable, and not absolute, assurance that deficiencies or weaknesses are identified. Deficiencies or weaknesses that have not been identified by us could emerge and the identification and correction of these deficiencies or weaknesses could have a material impact on our results of operations. If our internal controls over financial reporting are not considered adequate, we may experience a loss of public confidence, which could have an adverse effect on our business and stock price.

Charges to earnings resulting from the application of the purchase method of accounting may adversely affect the market value of our common stock following the completion of the merger.

In accordance with United States generally accepted accounting principles, which we refer to in this Report as GAAP, the merger of LTX and Credence has been accounted for using the purchase method of accounting, which will result in charges to earnings that could have an adverse impact on the market value of our common stock following the completion of the merger. Under the purchase method of accounting, the total estimated purchase price has been allocated to Credence’s net tangible assets, identifiable intangible assets or expense for in-process research and development based on their respective fair values as of August 29, 2008. We will incur additional amortization expense based on the identifiable amortizable intangible assets acquired in connection with the merger agreement and their relative useful lives. Additionally, to the extent the value of goodwill or identifiable intangible assets or other long-lived assets may become impaired, we will be required to incur material charges relating to the impairment. These amortization and potential impairment charges could have a material impact on our results of operations.

17

| Item 1B. | Unresolved Staff Comments |

None.

All of our facilities are leased. We have achieved worldwide ISO 9001:2000 certification at our facilities. We maintain our headquarters in Milpitas, California, where research and development, sales and customer support and corporate administration are located in a 90,068 square foot facility under a lease which expires in 2017. Under the same lease, we lease another 88,145 square foot facility, which is currently being marketed to potential sublessors. We lease a 56,380 square foot facility in Norwood, Massachusetts for administration, sales and support, research and development pursuant to a lease that expires in 2016. We also lease an 180,000 square foot manufacturing and research and development facility in Hillsboro, Oregon pursuant to a lease that expires in January 2010. Upon expiration of the lease in January 2010, we will relocate to a different facility in Hillsboro, Oregon which totals approximately 17,500 square feet under a lease that expires in 2015. We also lease sales and customer support offices at various locations in the United States totaling approximately 18,000 square feet.

Our European headquarters is located in Munich, Germany, and our Asian headquarters is located in Singapore. We also maintain sales and support offices at other locations in Europe and in Asia. Office space leased in Asia and Europe totals approximately 170,000 square feet.

We believe that our existing facilities are adequate to meet our current and foreseeable future requirements.

We have no material pending legal proceedings.

| Item 4. | Submission of Matters to a Vote of Security Holders |

None.

18

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Effective with the closing of our merger agreement with Credence Systems Corporation on August 29, 2008, the symbol for our common stock on the Nasdaq National Market changed to “LTXC”. Prior to that date, our common stock traded on the Nasdaq National Market under the symbol “LTXX”. The following table shows the high and low closing sale prices per share of our common stock, as reported on the Nasdaq National Market, for the periods indicated:

| | | | | | |

Period | | High | | Low |

Fiscal Year Ended July 31, 2009 | | | | | | |

First Quarter | | $ | 2.20 | | $ | 0.48 |

Second Quarter | | | 0.73 | | | 0.09 |

Third Quarter | | | 0.56 | | | 0.18 |

Fourth Quarter | | | 0.93 | | | 0.37 |

Fiscal Year Ended July 31, 2008 | | | | | | |

First Quarter | | $ | 4.29 | | $ | 3.26 |

Second Quarter | | | 3.33 | | | 2.28 |

Third Quarter | | | 3.71 | | | 2.55 |

Fourth Quarter | | | 3.30 | | | 2.04 |

We have never declared or paid any dividends on our common stock. We currently intend to retain future earnings to fund the development and growth of our business and, therefore, we do not anticipate paying any cash dividends in the foreseeable future. In addition, our credit agreement with a bank contains certain covenants that prohibit us from paying cash dividends.

As of September 25, 2009, we had approximately 858 stockholders of record of our common stock.

Compensation Plans

The following table shows information relating to our compensation plans as of July 31, 2009:

| | | | | | | | |

| | | Equity Compensation Plan Information | |

Plan Category | | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights | | Weighted average

exercise price of

outstanding options,

warrants and rights | | Number of securities remaining

available for future issuance

under equity compensation

plans (excluding securities in

first column) | |

Equity compensation plans approved by security holders | | 12,181,352 | | $ | 7.32 | | 7,420,539 | * |

Equity compensation plans not approved by security holders | | — | | | — | | — | |

| | | | | | | | |

Total | | 12,181,352 | | $ | 7.32 | | 7,420,539 | * |

| | | | | | | | |

| * | Includes 1,364 shares available for issuance under an employee stock purchase plan which is intended to qualify as such under Section 423 of the Internal Revenue Code. In addition, the Company’s Board of Directors approved an amendment to the Company’s Employee Stock Purchase Plan increasing the shares available for issuance under that plan by 1,200,000, subject to approval by the Company’s shareholders. These shares are excluded from the table above. |

This table excludes an aggregate of 21,841 shares issuable upon exercise of outstanding options assumed by us in connection with the StepTech acquisition. The weighted average exercise price of the excluded options is $1.06.

19

| Item 6. | Selected Financial Data |

The following table contains our selected consolidated financial data and is qualified by the more detailed consolidated financial statements and notes thereto included elsewhere in this report. The selected consolidated financial data for and as of the end of each of the five fiscal years in the period ended July 31, 2009 are derived from our audited consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Years Ended July 31,

(In thousands) | |

| | | 2009 (b) | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 137,378 | | | $ | 135,825 | | | $ | 147,639 | | | $ | 216,503 | | | $ | 134,531 | |

Cost of sales | | | 87,805 | | | | 67,981 | | | | 77,441 | | | | 109,975 | | | | 90,806 | |

Inventory-related provision (a) | | | 19,311 | | | | — | | | | 4,175 | | | | 221 | | | | 47,457 | |

Engineering and product development expenses | | | 71,165 | | | | 46,020 | | | | 50,044 | | | | 53,807 | | | | 66,302 | |

Selling, general and administrative expenses | | | 50,585 | | | | 26,707 | | | | 26,382 | | | | 31,135 | | | | 29,366 | |

Impairment charges | | | 5,799 | | | | — | | | | — | | | | — | | | | — | |

Amortization of purchased intangible assets | | | 15,967 | | | | — | | | | — | | | | — | | | | — | |

Acquired in-process research and development | | | 6,300 | | | | — | | | | — | | | | — | | | | — | |

Restructuring | | | 21,205 | | | | — | | | | (377 | ) | | | 6,282 | | | | 31,726 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from operations | | | (140,759 | ) | | | (4,883 | ) | | | (10,026 | ) | | | 15,083 | | | | (131,126 | ) |

Other income (expense) | | | 4,190 | | | | 1,192 | | | | (640 | ) | | | (2,842 | ) | | | (1,600 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | $ | (136,569 | ) | | $ | (3,691 | ) | | $ | (10,666 | ) | | $ | 12,241 | | | $ | (132,726 | ) |

Provision (benefit) for income taxes | | | 763 | | | | (3,091 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (137,332 | ) | | $ | (600 | ) | | $ | (10,666 | ) | | $ | 12,241 | | | $ | (132,726 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (1.13 | ) | | $ | (0.01 | ) | | $ | (0.17 | ) | | $ | 0.20 | | | $ | (2.17 | ) |

Diluted | | $ | (1.13 | ) | | $ | (0.01 | ) | | $ | (0.17 | ) | | $ | 0.20 | | | $ | (2.17 | ) |

Weighted average common shares used in computing net income (loss) per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 121,938 | | | | 62,611 | | | | 62,130 | | | | 61,684 | | | | 61,144 | |

Diluted | | | 121,938 | | | | 62,611 | | | | 62,130 | | | | 62,207 | | | | 61,144 | |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Working capital | | $ | 47,223 | | | $ | 86,506 | | | $ | 87,279 | | | $ | 143,287 | | | $ | 182,957 | |

Property and equipment, net | | | 38,301 | | | | 27,213 | | | | 32,483 | | | | 37,633 | | | | 47,135 | |

Total assets | | | 275,169 | | | | 169,727 | | | | 201,122 | | | | 327,690 | | | | 316,392 | |

Total debt | | | 85,730 | | | | 17,900 | | | | 47,222 | | | | 147,691 | | | | 148,293 | |

Stockholders’ equity | | | 105,404 | | | | 117,280 | | | | 113,108 | | | | 117,639 | | | | 99,900 | |

Other Information (unaudited): | | | | | | | | | | | | | | | | | | | | |

Current ratio | | | 1.39 | | | | 3.43 | | | | 2.32 | | | | 2.13 | | | | 3.78 | |

Asset turnover | | | 0.50 | | | | 0.80 | | | | 0.73 | | | | 0.66 | | | | 0.43 | |

Debt as a percentage of total capitalization | | | 44.8 | % | | | 13.2 | % | | | 29.3 | % | | | 56.0 | % | | | 60.0 | % |

Additions to property and equipment | | | 8,944 | | | | 7,527 | | | | 8,399 | | | | 6,743 | | | | 11,616 | |

Depreciation and amortization | | | 34,259 | | | | 11,933 | | | | 13,867 | | | | 14,403 | | | | 18,494 | |

| (a) | See Note 2 to the Consolidated Financial Statements. |

| (b) | 2009 includes the results of the combined company LTX-Credence as a result of a merger completed August 29, 2008. Selected financial data presented for 2005-2008 does not include Credence’s results. |

20

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read together with the Consolidated Financial Statements and Notes thereto appearing elsewhere in this annual report on Form 10-K. Certain statements in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements that involve risks and uncertainties. Words such as may, will, should, would, anticipates, expects, intends, plans, believes, seeks, estimates and similar expressions identify such forward-looking statements. The forward-looking statements contained herein are based on current expectations and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements. Factors that might cause such a difference include, among other things, those set forth under “Risk Factors” and those appearing elsewhere in this Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis only as of the date hereof. We assume no obligations to update these forward-looking statements to reflect actual results or changes in factors or assumptions affecting forward-looking statements.

Overview

We design, manufacture, market and service semiconductor test solutions worldwide to leading companies in the semiconductor industry. Our semiconductor test equipment can test a broad range of analog, digital, mixed signal (a combination of analog and digital) and system in package, or SIP, semiconductor devices, all on a single test platform.

We focus our marketing and sales on integrated device manufacturers (IDMs), subcontractors, which perform manufacturing services for the semiconductor industry, foundries, which provide wafer manufacturing capability, and fabless companies, which design integrated circuits but have no manufacturing capability.

Merger with Credence Systems Corporation

On August 29, 2008, we completed a merger with Credence Systems Corporation (“Credence”) and changed our name to LTX-Credence Corporation. However, because the merger with Credence was completed after the July 31 end of our 2008 fiscal year, our financial information for fiscal 2008 and previous fiscal years does not include the financial information or results of operations of Credence. Our financial information for fiscal 2009 includes the financial information and results of operations of Credence since the date of the merger on August 29, 2008.

As further discussed in Note 9 to the accompanying Consolidated Financial Statements, the merger of LTX and Credence did not result in new operating segments for reporting purposes under the provisions of SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information.”