Xcerra Corporation To Be Acquired by Cohu Xcerra Employee Presentation David Tacelli, President and CEO May 8, 2018 COMPANY CONFIDENTIAL Exhibit 99.2

Additional Information and Where to Find It Cohu Inc., (“Cohu”) will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 (the “Registration Statement”) containing a prospectus with respect to the Cohu common stock to be issued in the proposed transaction and a joint proxy statement of Cohu and Xcerra Corporation (“Xcerra”) in connection with the proposed transaction (the “Joint Proxy Statement/Prospectus”) and other documents concerning the proposed transaction. The definitive Joint Proxy Statement/Prospectus will be delivered to the stockholders of Xcerra and Cohu after the Registration Statement is declared effective by the SEC. This communication is not a substitute for the Registration Statement, the definitive Joint Proxy Statement/Prospectus or any other documents that Xcerra or Cohu may file or may have filed with the SEC, or will send or have sent to stockholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of these documents (when they become available) and other documents filed by Xcerra and Cohu with the SEC at the SEC’s website at www.sec.gov. The Joint Proxy Statement/Prospectus and other documents filed by Xcerra or Cohu may also be obtained free of charge by visiting the Xcerra Investor Relations page on its corporate website at https://xcerra.com/investors or by contacting Xcerra Investor Relations by telephone at (781) 467-5063 or by mail at Xcerra Investor Relations, Xcerra Corporation, 825 University Avenue, Norwood, MA 02062, attention Rich Yerganian or by visiting the Cohu Investor Relations page on its corporate website at https://cohu.gcs-web.com or by contacting Cohu Investor Relations by telephone at (858) 848-8106 or by mail at Cohu Corporate Headquarters, 12367 Crosthwaite Circle, Poway, CA 92064, attention Jeffrey D. Jones.

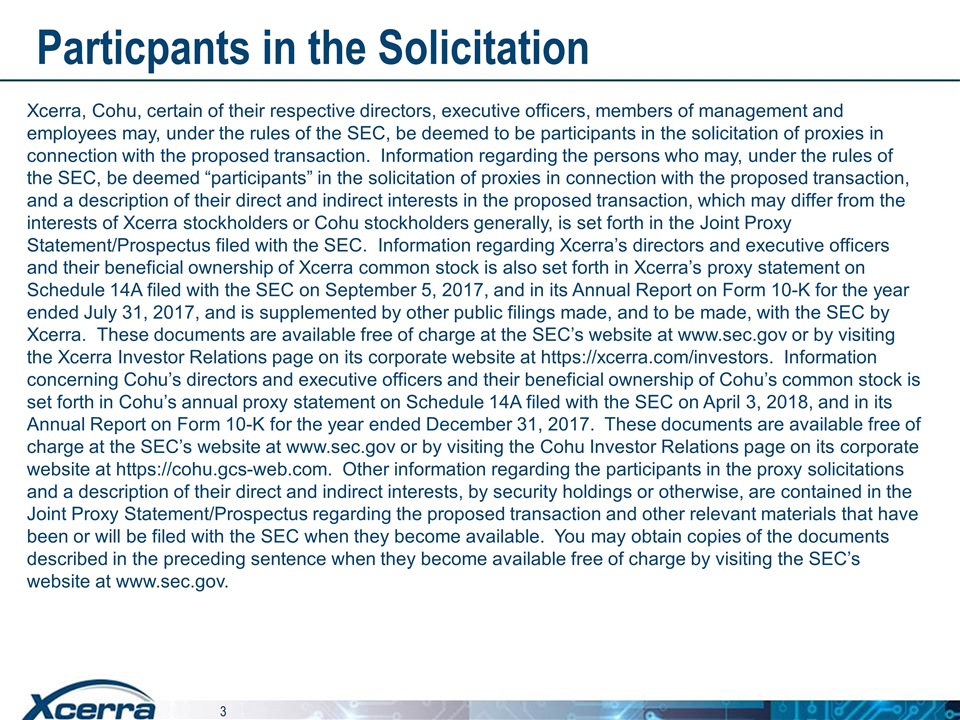

Particpants in the Solicitation Xcerra, Cohu, certain of their respective directors, executive officers, members of management and employees may, under the rules of the SEC, be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed “participants” in the solicitation of proxies in connection with the proposed transaction, and a description of their direct and indirect interests in the proposed transaction, which may differ from the interests of Xcerra stockholders or Cohu stockholders generally, is set forth in the Joint Proxy Statement/Prospectus filed with the SEC. Information regarding Xcerra’s directors and executive officers and their beneficial ownership of Xcerra common stock is also set forth in Xcerra’s proxy statement on Schedule 14A filed with the SEC on September 5, 2017, and in its Annual Report on Form 10-K for the year ended July 31, 2017, and is supplemented by other public filings made, and to be made, with the SEC by Xcerra. These documents are available free of charge at the SEC’s website at www.sec.gov or by visiting the Xcerra Investor Relations page on its corporate website at https://xcerra.com/investors. Information concerning Cohu’s directors and executive officers and their beneficial ownership of Cohu’s common stock is set forth in Cohu’s annual proxy statement on Schedule 14A filed with the SEC on April 3, 2018, and in its Annual Report on Form 10-K for the year ended December 31, 2017. These documents are available free of charge at the SEC’s website at www.sec.gov or by visiting the Cohu Investor Relations page on its corporate website at https://cohu.gcs-web.com. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the Joint Proxy Statement/Prospectus regarding the proposed transaction and other relevant materials that have been or will be filed with the SEC when they become available. You may obtain copies of the documents described in the preceding sentence when they become available free of charge by visiting the SEC’s website at www.sec.gov.

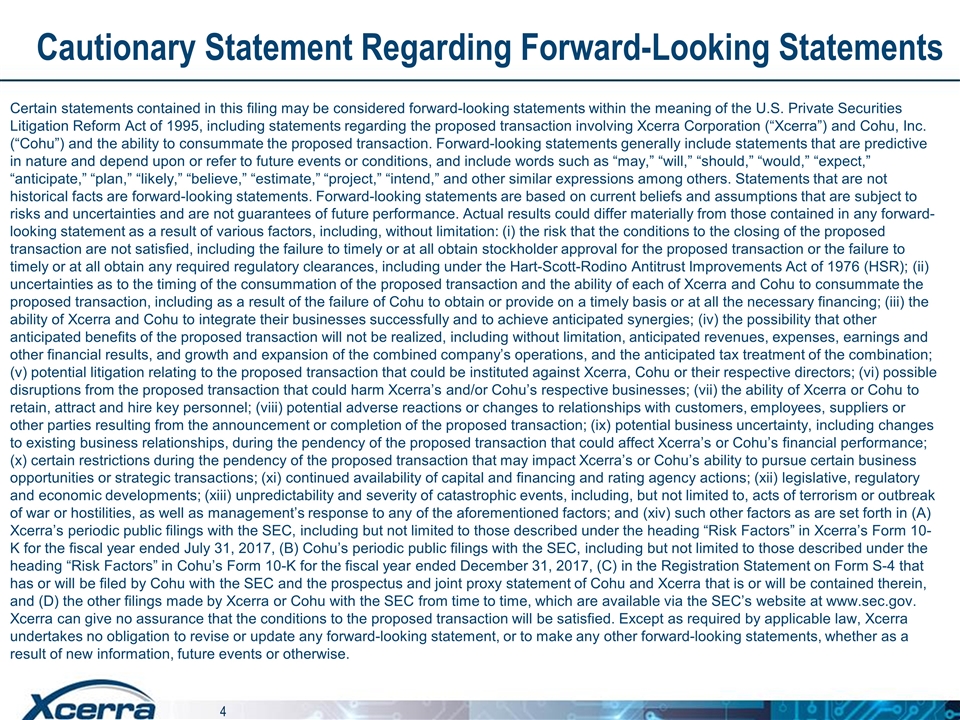

Cautionary Statement Regarding Forward-Looking Statements Certain statements contained in this filing may be considered forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding the proposed transaction involving Xcerra Corporation (“Xcerra”) and Cohu, Inc. (“Cohu”) and the ability to consummate the proposed transaction. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions among others. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: (i) the risk that the conditions to the closing of the proposed transaction are not satisfied, including the failure to timely or at all obtain stockholder approval for the proposed transaction or the failure to timely or at all obtain any required regulatory clearances, including under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR); (ii) uncertainties as to the timing of the consummation of the proposed transaction and the ability of each of Xcerra and Cohu to consummate the proposed transaction, including as a result of the failure of Cohu to obtain or provide on a timely basis or at all the necessary financing; (iii) the ability of Xcerra and Cohu to integrate their businesses successfully and to achieve anticipated synergies; (iv) the possibility that other anticipated benefits of the proposed transaction will not be realized, including without limitation, anticipated revenues, expenses, earnings and other financial results, and growth and expansion of the combined company’s operations, and the anticipated tax treatment of the combination; (v) potential litigation relating to the proposed transaction that could be instituted against Xcerra, Cohu or their respective directors; (vi) possible disruptions from the proposed transaction that could harm Xcerra’s and/or Cohu’s respective businesses; (vii) the ability of Xcerra or Cohu to retain, attract and hire key personnel; (viii) potential adverse reactions or changes to relationships with customers, employees, suppliers or other parties resulting from the announcement or completion of the proposed transaction; (ix) potential business uncertainty, including changes to existing business relationships, during the pendency of the proposed transaction that could affect Xcerra’s or Cohu’s financial performance; (x) certain restrictions during the pendency of the proposed transaction that may impact Xcerra’s or Cohu’s ability to pursue certain business opportunities or strategic transactions; (xi) continued availability of capital and financing and rating agency actions; (xii) legislative, regulatory and economic developments; (xiii) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors; and (xiv) such other factors as are set forth in (A) Xcerra’s periodic public filings with the SEC, including but not limited to those described under the heading “Risk Factors” in Xcerra’s Form 10-K for the fiscal year ended July 31, 2017, (B) Cohu’s periodic public filings with the SEC, including but not limited to those described under the heading “Risk Factors” in Cohu’s Form 10-K for the fiscal year ended December 31, 2017, (C) in the Registration Statement on Form S-4 that has or will be filed by Cohu with the SEC and the prospectus and joint proxy statement of Cohu and Xcerra that is or will be contained therein, and (D) the other filings made by Xcerra or Cohu with the SEC from time to time, which are available via the SEC’s website at www.sec.gov. Xcerra can give no assurance that the conditions to the proposed transaction will be satisfied. Except as required by applicable law, Xcerra undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Agenda Transaction Overview & Rationale Cohu Overview Markets & Customer Coverage Operations & Financials Employee Aspect Merger Process Questions

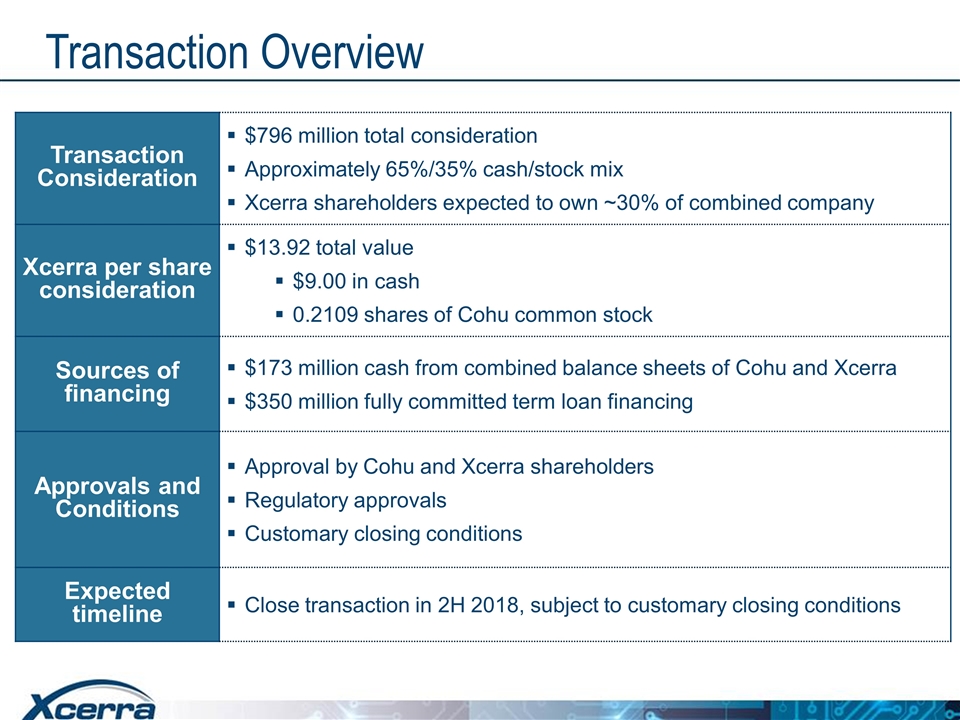

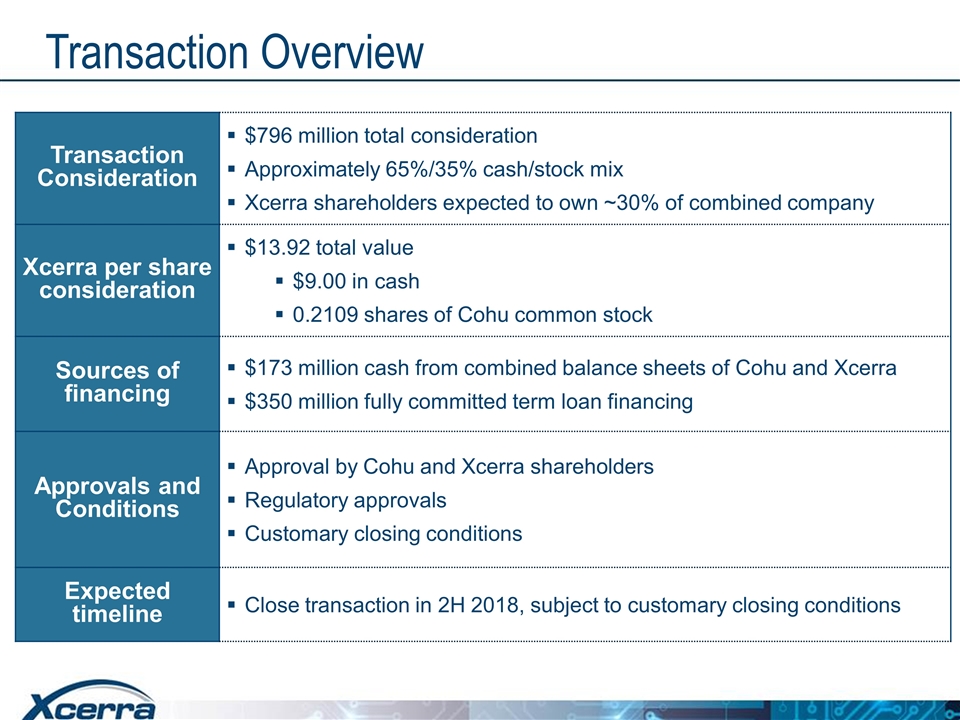

Transaction Overview Transaction Consideration $796 million total consideration Approximately 65%/35% cash/stock mix Xcerra shareholders expected to own ~30% of combined company Xcerra per share consideration $13.92 total value $9.00 in cash 0.2109 shares of Cohu common stock Sources of financing $173 million cash from combined balance sheets of Cohu and Xcerra $350 million fully committed term loan financing Approvals and Conditions Approval by Cohu and Xcerra shareholders Regulatory approvals Customary closing conditions Expected timeline Close transaction in 2H 2018, subject to customary closing conditions

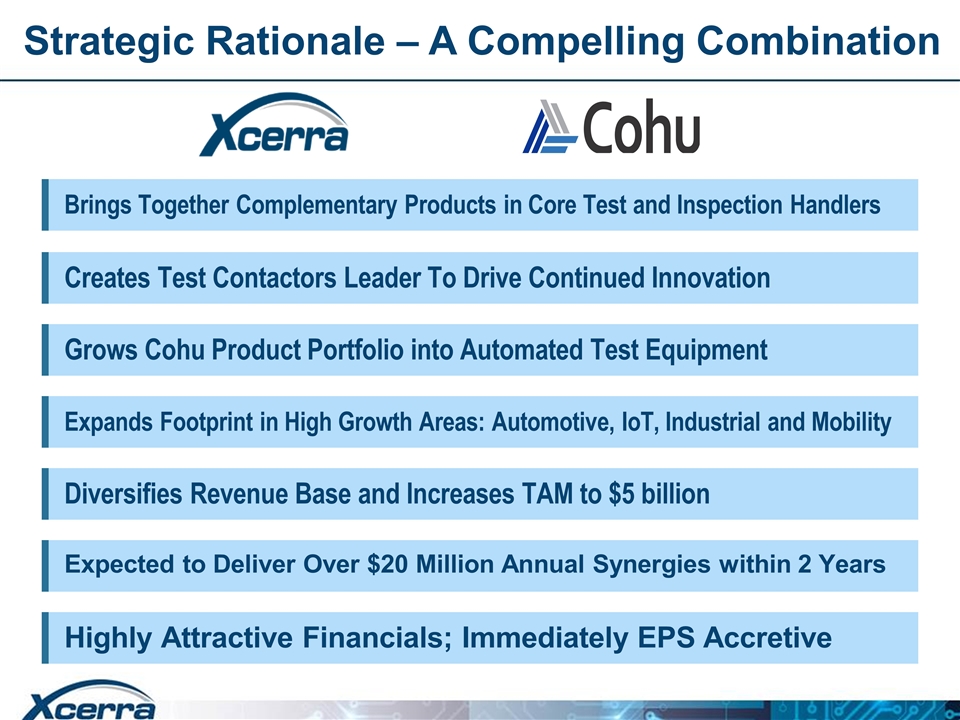

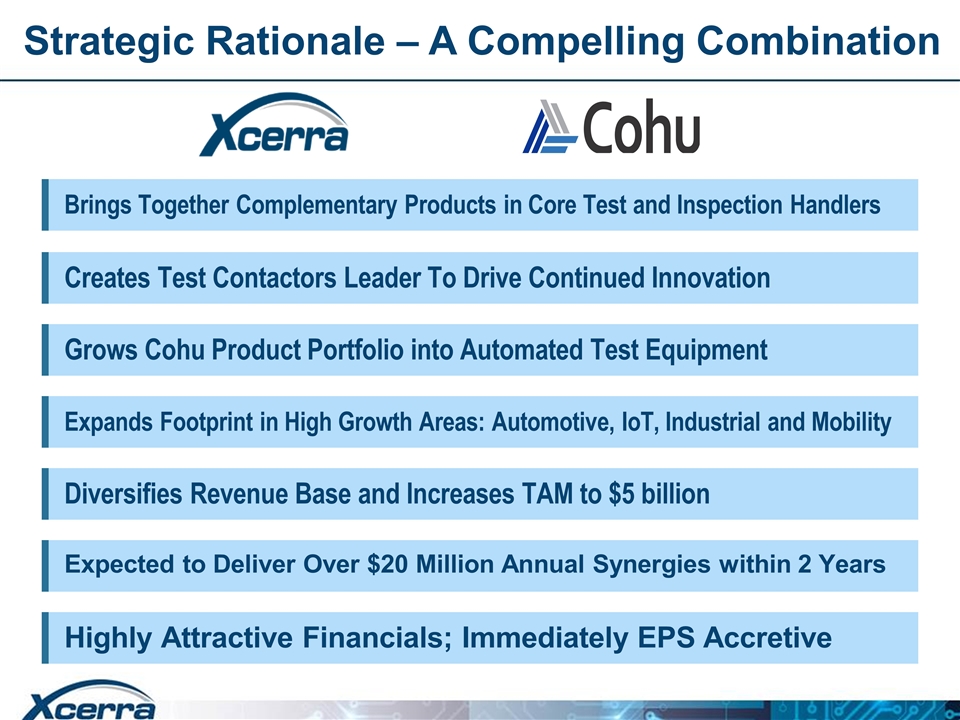

Strategic Rationale – A Compelling Combination Brings Together Complementary Products in Core Test and Inspection Handlers Creates Test Contactors Leader To Drive Continued Innovation Grows Cohu Product Portfolio into Automated Test Equipment Expands Footprint in High Growth Areas: Automotive, IoT, Industrial and Mobility Diversifies Revenue Base and Increases TAM to $5 billion Expected to Deliver Over $20 Million Annual Synergies within 2 Years Highly Attractive Financials; Immediately EPS Accretive

Who is Cohu?

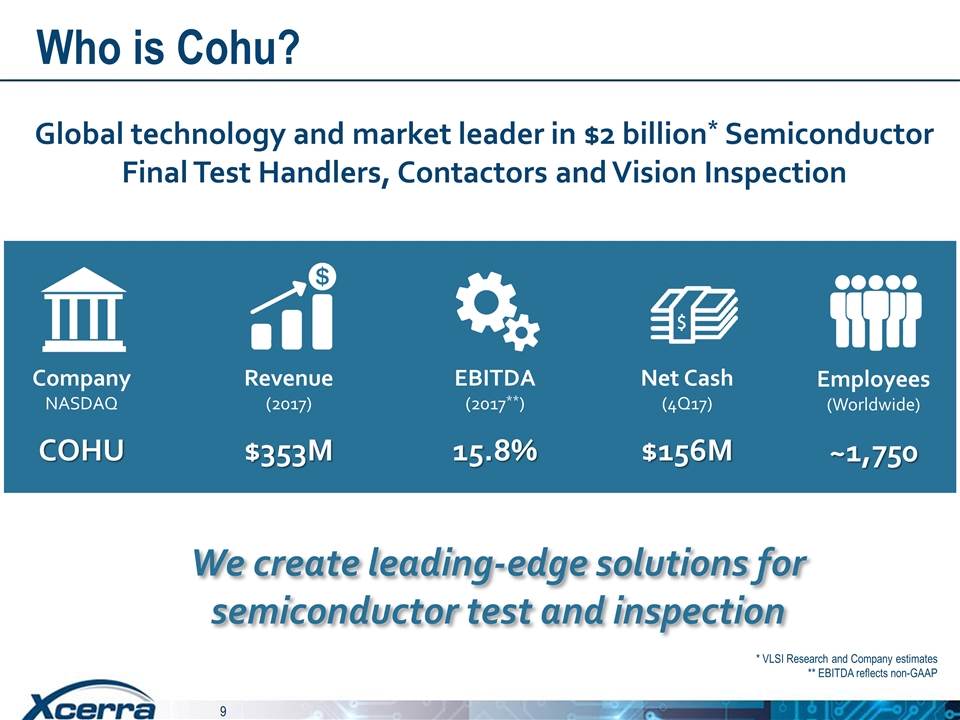

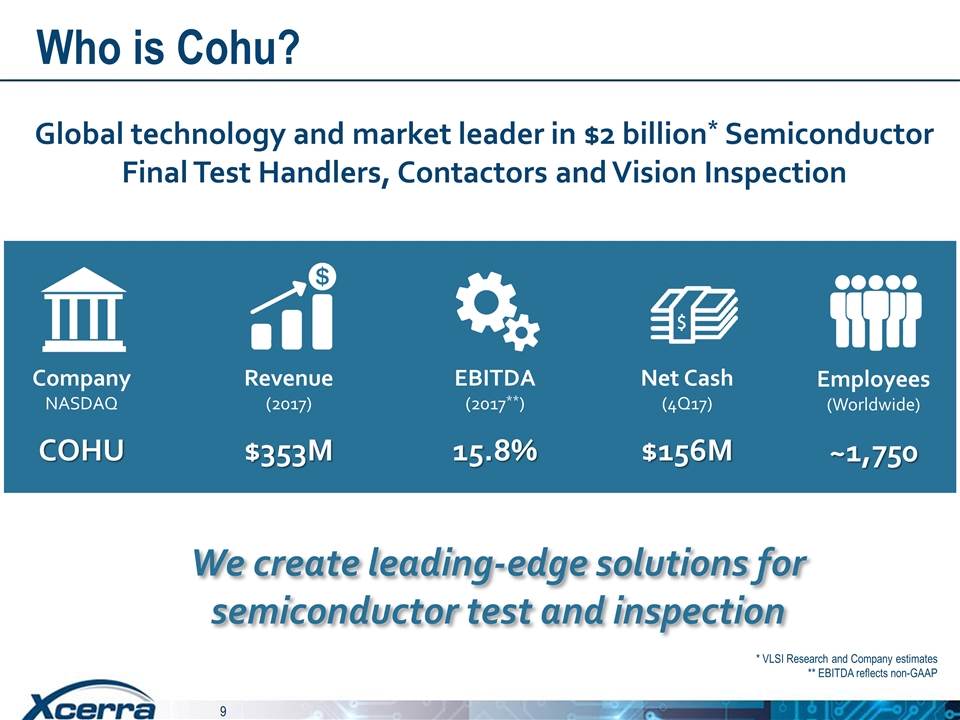

Who is Cohu? Global technology and market leader in $2 billion* Semiconductor Final Test Handlers, Contactors and Vision Inspection Company NASDAQ COHU Revenue (2017) $353M EBITDA (2017**) 15.8% Net Cash (4Q17) $156M Employees (Worldwide) ~1,750 We create leading-edge solutions for semiconductor test and inspection * VLSI Research and Company estimates ** EBITDA reflects non-GAAP

Cohu is Led By a Team of Industry Veterans Luis Müller President and CEO of Cohu Jeff Jones VP and CFO of Cohu Luis joined Cohu's Delta Design subsidiary in 2005 and has been President and Chief Executive Officer of Cohu since December 2014. He was previously President of Cohu's Semiconductor Equipment Group (SEG) from January 2011 until being named CEO, Managing Director of SEG's Rasco GmbH business unit in Germany from January 2009 to December 2010, and Vice President of SEG's High Speed Pick-and-Place handler products from July 2008 to December 2010. Prior to joining Cohu, Inc. He spent nine years at Teradyne, where he held various management positions in engineering and business development. Dr. Müller holds a PhD in Mechanical Engineering from the Massachusetts Institute of Technology. Jeff joined Cohu’s Delta Design in July 2005 as Vice President Finance and Controller. In November 2007, He was named Vice President, Finance and Chief Financial Officer of Cohu. Prior to joining Delta Design, he was a consultant and Vice President and General Manager of the Systems Group at SBS Technologies, Inc., a designer and manufacturer of embedded computer products. Prior to SBS Technologies, Jeff was an Audit Manager for Coopers & Lybrand (now PricewaterhouseCoopers). Mr. Jones is a CPA and graduate of the University of Redlands.

Cohu Target Markets

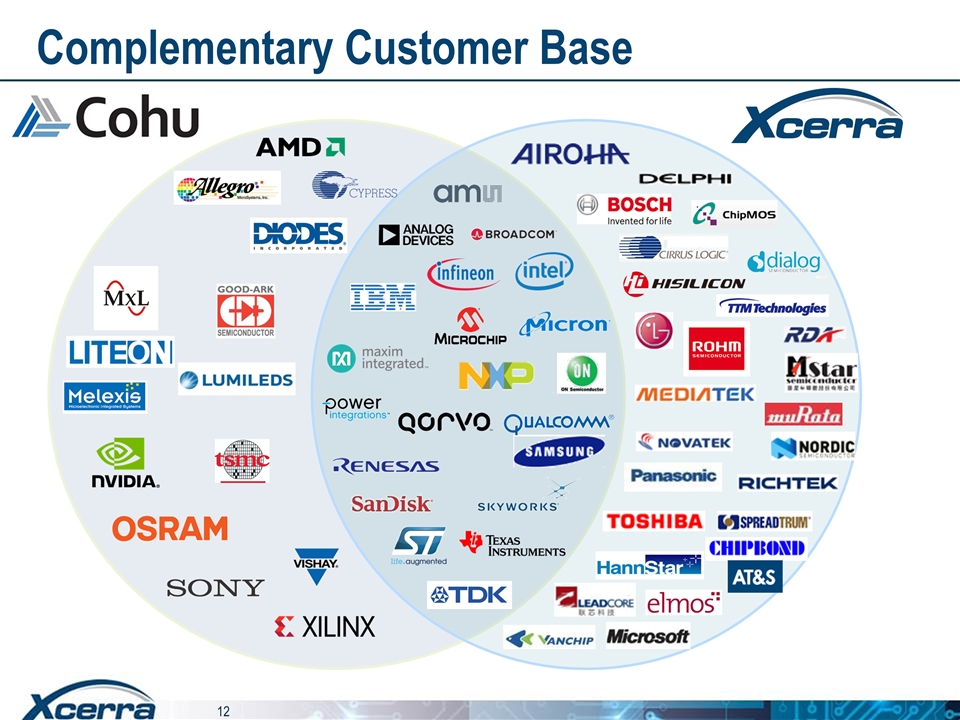

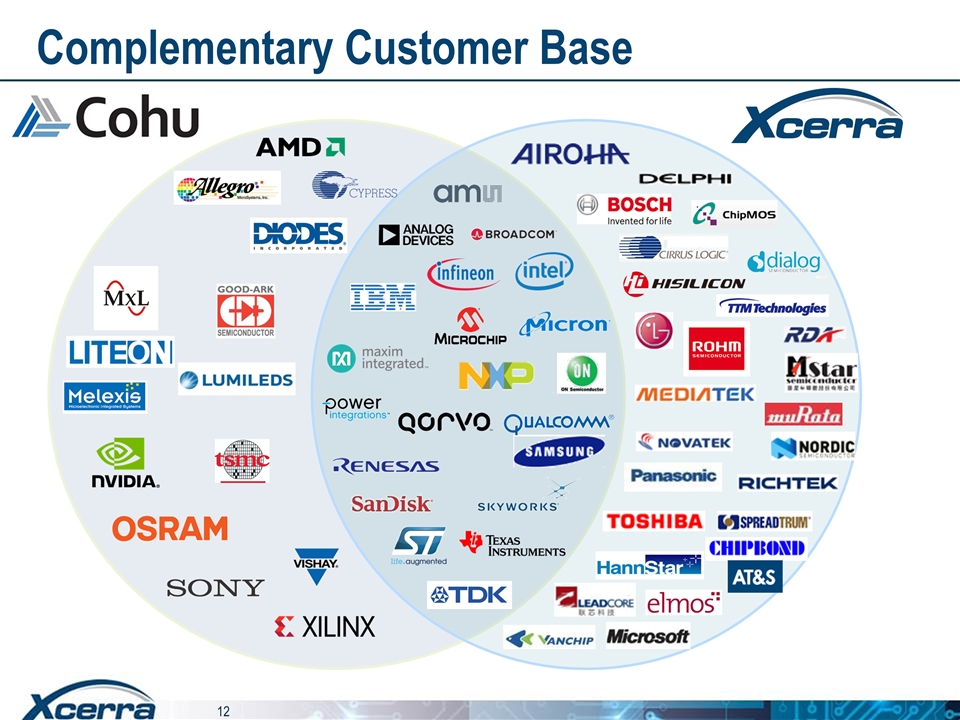

Complementary Customer Base

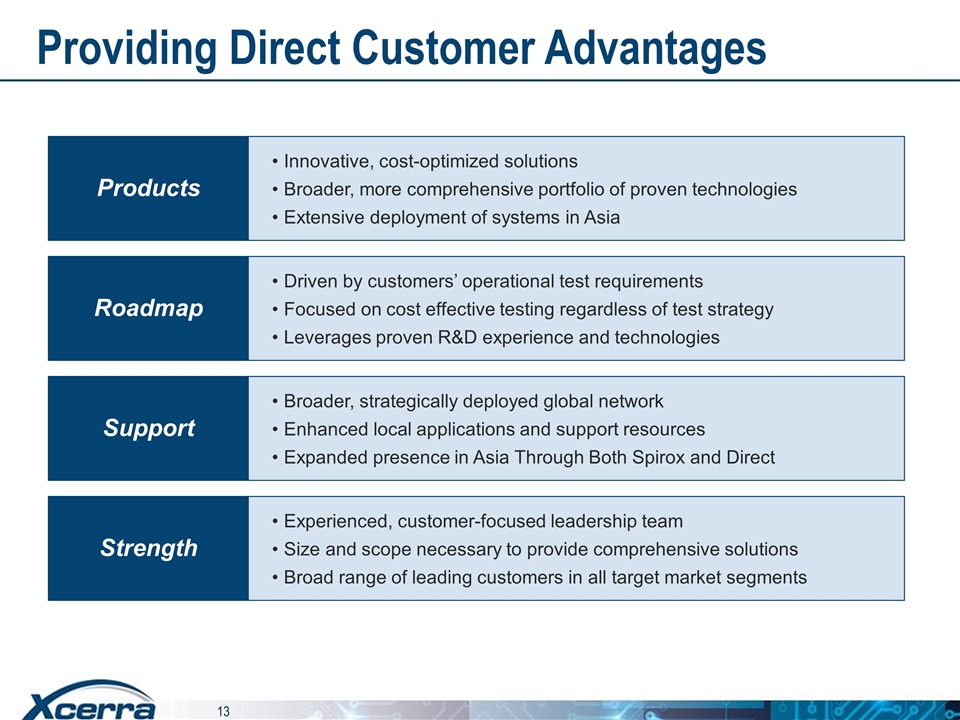

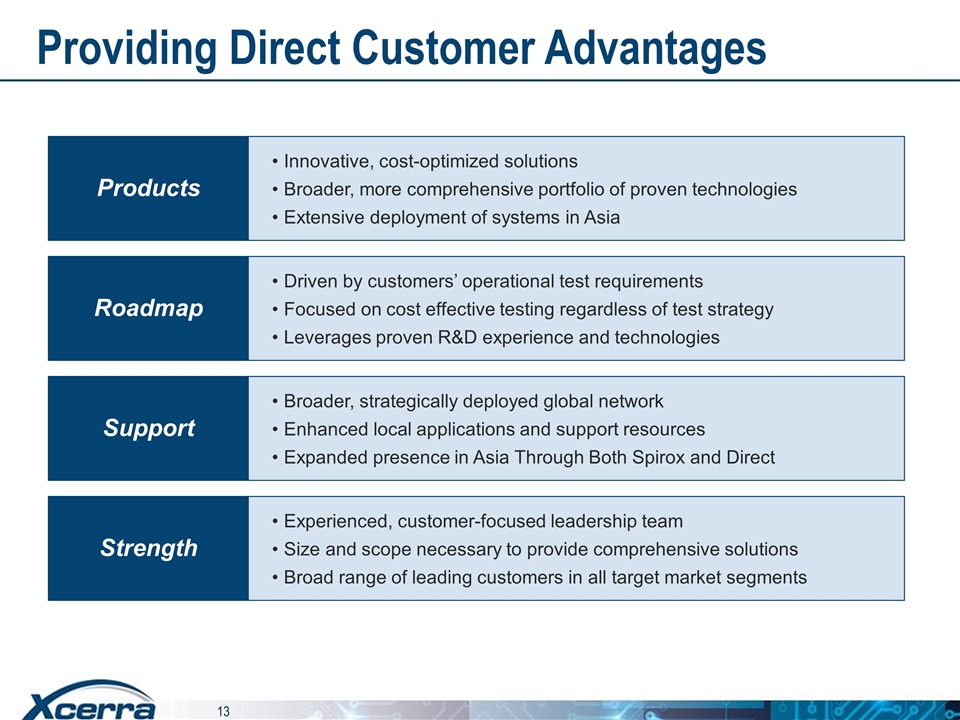

Providing Direct Customer Advantages Products Innovative, cost-optimized solutions Broader, more comprehensive portfolio of proven technologies Extensive deployment of systems in Asia Roadmap Driven by customers’ operational test requirements Focused on cost effective testing regardless of test strategy Leverages proven R&D experience and technologies Support Broader, strategically deployed global network Enhanced local applications and support resources Expanded presence in Asia Through Both Spirox and Direct Strength Experienced, customer-focused leadership team Size and scope necessary to provide comprehensive solutions Broad range of leading customers in all target market segments

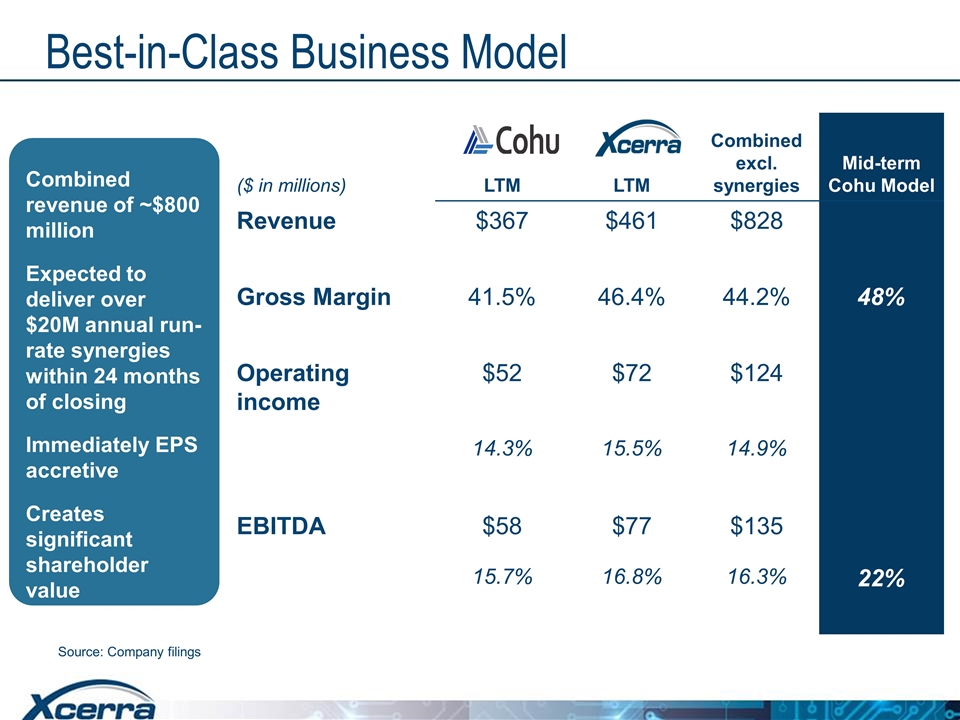

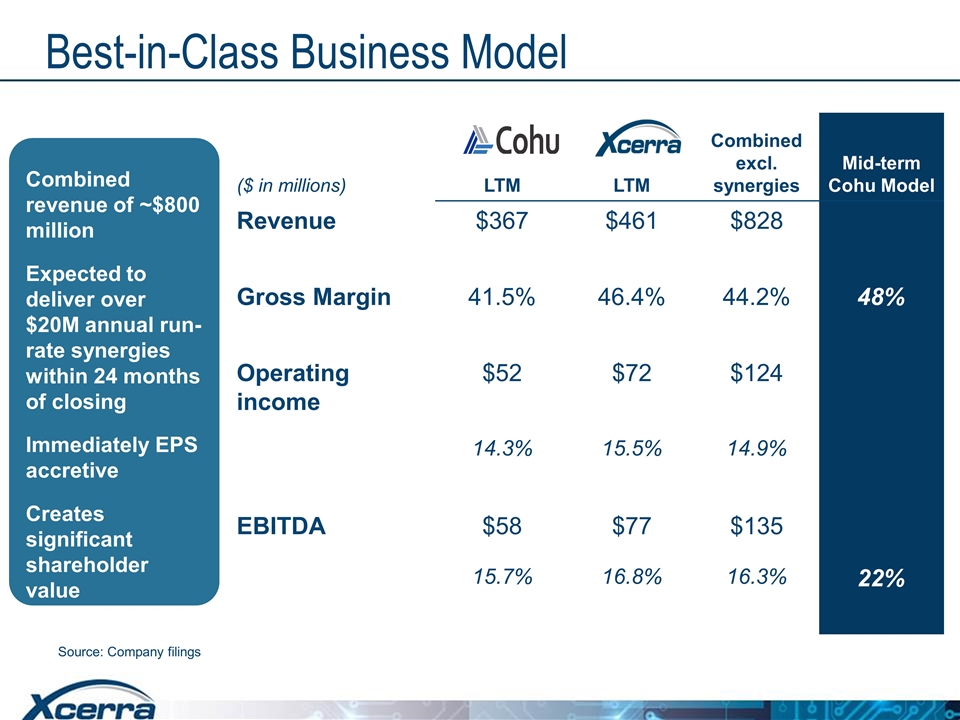

Best-in-Class Business Model ($ in millions) LTM LTM Combined excl. synergies Mid-term Cohu Model Revenue $367 $461 $828 Gross Margin 41.5% 46.4% 44.2% 48% Operating income $52 $72 $124 14.3% 15.5% 14.9% EBITDA $58 $77 $135 15.7% 16.8% 16.3% 22% Combined revenue of ~$800 million Expected to deliver over $20M annual run-rate synergies within 24 months of closing Immediately EPS accretive Creates significant shareholder value Source: Company filings

Why is it Good for Employees? Enhances scope & scale of business More opportunities for career growth and development Increased Financial Strength Scale enhances long term business model Broader customer base and more diversified Product Portfolio Greater stability in an often volatile industry

Employee Salary & Benefits August 1st restart of the ESPP will be put on hold Otherwise all benefits and profit sharing plan remain unchanged during the pendency of the closing HR integration team will create plan for the combined company’s longer term HR programs and processes

Facilities & People Both companies’ talented workforce are viewed as critical resources Will develop integration plans for the combined company – operational, product, footprint, people etc. Will determine most appropriate and effective location footprint for combined company Committed to a thoughtful but timely plan Anticipate communicating structure shortly after closing of the transaction

What to Expect – Acquisition Process Approval period (business as usual until closing) Subject to regulatory and stockholders approval and customary closing conditions Separate companies until closing – remain competitors Develop integration plans, but no changes until closing Transaction expected to close in the second half of the calendar year Post-Close Integration Period (~24 months) When the acquisition closes, integration activities begin Make decisions and take action as quickly as possible after closing

Business As Usual Continue to: Operate and compete as separate companies Support and satisfy our customers Push forward on projects Do Not: Lose focus on what we have been doing that has made us successful Speculate about the acquisition or communicate any non-public information Discuss the acquisition (especially with the media, analysts or investors) Do: Address any questions to your manager and/or HR Support integration planning activities as called upon by your manager

Questions?