UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03361

Fidelity Massachusetts Municipal Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | January 31 |

|

|

Date of reporting period: | July 31, 2022 |

Item 1.

Reports to Stockholders

Fidelity® Massachusetts Municipal Income Fund

Fidelity® Massachusetts Municipal Money Market Fund

Semi-Annual Report

July 31, 2022

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2022 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Early in 2020, the outbreak and spread of COVID-19 emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. On March 11, 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread. The pandemic prompted a number of measures to limit the spread of COVID-19, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and - given the wide variability in outcomes regarding the outbreak - significant market uncertainty and volatility. To help stem the turmoil, the U.S. government took unprecedented action - in concert with the U.S. Federal Reserve and central banks around the world - to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

In general, the overall impact of the pandemic lessened in 2021, amid a resilient economy and widespread distribution of three COVID-19 vaccines granted emergency use authorization from the U.S. Food and Drug Administration (FDA) early in the year. Still, the situation remains dynamic, and the extent and duration of its influence on financial markets and the economy is highly uncertain, due in part to a recent spike in cases based on highly contagious variants of the coronavirus.

Extreme events such as the COVID-19 crisis are exogenous shocks that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets. Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we continue to take extra steps to be responsive to customer needs. We encourage you to visit us online, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

| Revenue Sources (% of Fund's net assets) |

| General Obligations | 22.7% | |

| Education | 22.0% | |

| Health Care | 16.5% | |

| Special Tax | 15.0% | |

| Transportation | 12.8% | |

| Other* | 5.5% | |

| Others (Individually Less Than 5%) | 5.5% | |

| | 100.0% | |

| |

| *Includes net other assets | | |

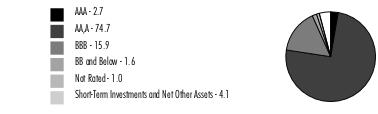

Quality Diversification (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

Fidelity® Massachusetts Municipal Income Fund

Showing Percentage of Net Assets

| Municipal Bonds - 95.8% |

| | | Principal Amount (a) | Value ($) |

| Massachusetts - 94.9% | | | |

| Amesbury Gen. Oblig. Series 2020, 5% 6/1/28 | | 1,440,000 | 1,674,335 |

| Attleboro Gen. Oblig.: | | | |

| Series 2020 B, 3% 10/15/36 | | 2,630,000 | 2,488,589 |

| Series 70 B, 5% 10/15/29 | | 1,585,000 | 1,840,052 |

| Berkshire Wind Pwr. Coop. Corp. Series 2017 2: | | | |

| 5% 7/1/25 | | 505,000 | 549,461 |

| 5% 7/1/26 | | 925,000 | 1,029,181 |

| 5% 7/1/27 | | 700,000 | 796,264 |

| 5% 7/1/30 | | 480,000 | 537,017 |

| Blue Hills Reg'l. Technical Series 2019, 4% 2/1/49 | | 2,000,000 | 2,005,975 |

| Braintree Gen. Oblig. Series 2015: | | | |

| 5% 5/15/26 | | 2,300,000 | 2,569,407 |

| 5% 5/15/27 | | 2,000,000 | 2,286,480 |

| 5% 5/15/28 | | 600,000 | 698,239 |

| Brookline Gen. Oblig. Series 2020, 5% 3/15/28 | | 3,075,000 | 3,583,564 |

| Cambridge Gen. Oblig. Series 12: | | | |

| 5% 1/1/23 | | 865,000 | 867,393 |

| 5% 1/1/24 | | 340,000 | 340,926 |

| Framingham Gen. Oblig. Series 2012 A, 4% 12/1/24 | | 1,360,000 | 1,369,841 |

| Lowell Gen. Oblig. Series 2019: | | | |

| 5% 9/1/28 | | 1,215,000 | 1,414,457 |

| 5% 9/1/29 | | 700,000 | 808,886 |

| Lynn Wtr. & Swr. Commission Gen. Rev. Series 2003 A, 5% 12/1/32 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 440,000 | 440,925 |

| Massachusetts Bay Trans. Auth. Sales Tax Rev.: | | | |

| Series 2004 B, 5.25% 7/1/30 | | 5,000,000 | 5,892,893 |

| Series 2005 B, 5.5% 7/1/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 4,000,000 | 4,869,860 |

| Series 2006 A, 5.25% 7/1/29 | | 3,005,000 | 3,610,380 |

| Series 2007 A1, 5.25% 7/1/34 | | 2,955,000 | 3,709,337 |

| Series 2020 B1, 5% 7/1/50 | | 2,750,000 | 3,032,937 |

| Massachusetts Clean Wtr. Trust: | | | |

| Series 18, 5% 2/1/29 | | 6,355,000 | 6,644,808 |

| Series 2012 B: | | | |

5% 8/1/27 | | 295,000 | 295,767 |

5% 8/1/28 | | 330,000 | 330,819 |

| Series 2021 23A: | | | |

5% 2/1/39 | | 5,000,000 | 5,848,939 |

5% 2/1/40 | | 4,750,000 | 5,519,292 |

| Series 2021 23B, 5% 2/1/39 | | 12,940,000 | 15,137,053 |

| Series 2021 B, 5% 2/1/41 | | 2,000,000 | 2,315,257 |

| Series 22, 5% 8/1/37 | | 4,110,000 | 4,723,478 |

| Series 6, 5.5% 8/1/30 | | 850,000 | 852,310 |

| Massachusetts Commonwealth Trans. Fund Rev.: | | | |

| (Rail Enhancement & Accelerated Bridge Prog.) Series 2018 A: | | | |

5% 6/1/35 | | 2,885,000 | 3,268,713 |

5% 6/1/36 | | 3,035,000 | 3,432,996 |

| (Rail Enhancement & Accelerated Bridge Programs) Series 2019 A, 5% 6/1/49 | | 24,600,000 | 27,506,109 |

| (Rail Enhancement & Accelerated Bridge Progs.) Series 2018 A, 5.25% 6/1/43 | | 14,575,000 | 16,459,566 |

| (Rail Enhancement Prog.) Series 2021 B: | | | |

5% 6/1/41 | | 6,000,000 | 6,721,035 |

5% 6/1/42 | | 15,370,000 | 17,557,652 |

| Series 2017 A, 5% 6/1/32 | | 4,580,000 | 5,194,284 |

| Series 2021 A: | | | |

4% 6/1/50 | | 1,050,000 | 1,059,595 |

5% 6/1/41 | | 8,140,000 | 9,439,492 |

5% 6/1/42 | | 9,000,000 | 10,409,321 |

5% 6/1/43 | | 3,000,000 | 3,455,249 |

5% 6/1/51 | | 5,435,000 | 6,121,667 |

| Series 2021 B, 5% 6/1/46 | | 7,615,000 | 8,613,255 |

| Massachusetts Dept. of Trans. Metropolitan Hwy. Sys. Rev.: | | | |

| Series A: | | | |

5% 1/1/25 | | 3,990,000 | 4,300,811 |

5% 1/1/35 | | 3,500,000 | 3,967,588 |

5% 1/1/37 | | 2,000,000 | 2,255,517 |

| Series C, 5% 1/1/34 | | 8,585,000 | 9,812,215 |

| Massachusetts Dev. Fin. Agcy. Rev.: | | | |

| (Babson College, MA. Proj.) Series 2017: | | | |

5% 10/1/28 | | 465,000 | 520,582 |

5% 10/1/29 | | 735,000 | 819,491 |

5% 10/1/42 | | 4,000,000 | 4,322,152 |

5% 10/1/47 | | 5,510,000 | 5,917,626 |

| (Boston College Proj.) Series T: | | | |

5% 7/1/37 | | 1,415,000 | 1,549,537 |

5% 7/1/38 | | 3,685,000 | 4,027,796 |

5% 7/1/39 | | 4,450,000 | 4,856,676 |

5% 7/1/42 | | 2,805,000 | 3,047,392 |

| (Broad Institute Proj.) Series 2017: | | | |

5% 4/1/33 | | 10,145,000 | 11,272,461 |

5% 4/1/34 | | 2,500,000 | 2,769,994 |

5% 4/1/35 | | 2,455,000 | 2,714,752 |

5% 4/1/37 | | 1,500,000 | 1,652,353 |

| (Broad Institute Proj.) Series 2017, 5% 4/1/36 | | 2,205,000 | 2,434,592 |

| (Lesley Univ. Proj.) Series 2016: | | | |

5% 7/1/29 | | 1,640,000 | 1,771,340 |

5% 7/1/32 | | 1,905,000 | 2,040,595 |

| (Newbridge On The Charles Proj.) Series 2017: | | | |

4% 10/1/24 (b) | | 500,000 | 515,603 |

4% 10/1/25 (b) | | 500,000 | 521,226 |

4% 10/1/26 (b) | | 500,000 | 525,954 |

4% 10/1/27 (b) | | 350,000 | 368,095 |

5% 10/1/37 (b) | | 1,000,000 | 1,052,549 |

5% 10/1/47 (b) | | 1,000,000 | 1,052,016 |

| (Partners Healthcare Sys., Inc. Proj.) Series 2017 S: | | | |

5% 7/1/25 | | 1,000,000 | 1,088,041 |

5% 7/1/31 | | 21,180,000 | 23,935,152 |

5% 7/1/32 | | 985,000 | 1,108,632 |

5% 7/1/34 | | 750,000 | 837,291 |

| (Suffolk Univ. Proj.) Series 2017: | | | |

5% 7/1/23 | | 2,420,000 | 2,480,440 |

5% 7/1/24 | | 2,000,000 | 2,087,471 |

5% 7/1/25 | | 1,500,000 | 1,602,530 |

5% 7/1/26 | | 1,935,000 | 2,101,918 |

5% 7/1/27 | | 2,085,000 | 2,302,851 |

5% 7/1/28 | | 4,300,000 | 4,717,083 |

| (Suffolk Univ., Proj.) Series 2017, 5% 7/1/32 | | 1,000,000 | 1,072,477 |

| (UMASS Boston Student Hsg. Proj.) Series 2016: | | | |

5% 10/1/29 | | 3,120,000 | 3,191,524 |

5% 10/1/30 | | 1,100,000 | 1,121,024 |

5% 10/1/31 | | 1,200,000 | 1,219,290 |

5% 10/1/32 | | 1,240,000 | 1,257,586 |

5% 10/1/33 | | 1,235,000 | 1,250,182 |

| (UMass Memorial Health Care Proj.) Series K: | | | |

5% 7/1/28 | | 1,260,000 | 1,382,051 |

5% 7/1/29 | | 1,320,000 | 1,442,419 |

5% 7/1/30 | | 1,390,000 | 1,513,637 |

5% 7/1/38 | | 3,750,000 | 3,992,022 |

| (Univ. of Massachusetts Health Cr., Inc. Proj.) Series 2017 L, 4% 7/1/44 | | 7,000,000 | 6,821,547 |

| (Wentworth Institute of Technology Proj.) Series 2017: | | | |

5% 10/1/34 | | 1,425,000 | 1,500,499 |

5% 10/1/35 | | 1,495,000 | 1,571,487 |

5% 10/1/46 | | 4,250,000 | 4,397,955 |

| (Wheaton College, MA. Proj.) Series 2017 H: | | | |

5% 1/1/29 | | 1,435,000 | 1,580,504 |

5% 1/1/31 | | 1,580,000 | 1,717,725 |

5% 1/1/32 | | 1,665,000 | 1,799,581 |

5% 1/1/33 | | 1,745,000 | 1,875,525 |

5% 1/1/34 | | 1,835,000 | 1,961,405 |

5% 1/1/35 | | 1,000,000 | 1,066,459 |

5% 1/1/36 | | 1,000,000 | 1,063,192 |

5% 1/1/42 | | 5,775,000 | 6,067,657 |

5% 1/1/47 | | 1,895,000 | 1,978,502 |

5% 1/1/53 | | 3,425,000 | 3,561,699 |

| Bonds Series A1, 5%, tender 1/31/30 (c) | | 15,280,000 | 17,746,877 |

| Series 2008 B: | | | |

0% 1/1/37 (Assured Guaranty Corp. Insured) | | 1,745,000 | 1,040,591 |

0% 1/1/40 (Assured Guaranty Corp. Insured) | | 5,000,000 | 2,599,755 |

0% 1/1/41 (Assured Guaranty Corp. Insured) | | 5,000,000 | 2,484,576 |

0% 1/1/42 (Assured Guaranty Corp. Insured) | | 5,000,000 | 2,371,015 |

| Series 2012 C: | | | |

5.25% 7/1/25 | | 1,000,000 | 1,002,569 |

5.25% 7/1/26 | | 1,000,000 | 1,002,554 |

| Series 2013 F: | | | |

4% 7/1/32 | | 2,050,000 | 2,056,231 |

4% 7/1/43 | | 21,685,000 | 21,090,235 |

5% 7/1/27 | | 1,300,000 | 1,326,854 |

5% 7/1/37 | | 3,925,000 | 3,980,608 |

| Series 2013 G, 5% 7/1/44 | | 10,360,000 | 10,483,464 |

| Series 2014 A: | | | |

5% 3/1/32 | | 1,700,000 | 1,751,061 |

5% 3/1/33 | | 1,250,000 | 1,286,568 |

5% 3/1/34 | | 4,375,000 | 4,500,257 |

5% 3/1/39 | | 4,000,000 | 4,104,550 |

| Series 2014 F: | | | |

5% 7/15/23 | | 350,000 | 358,092 |

5% 7/15/24 | | 400,000 | 409,561 |

5% 7/15/25 | | 550,000 | 562,475 |

5% 7/15/26 | | 500,000 | 511,041 |

5% 7/15/27 | | 200,000 | 204,322 |

5% 7/15/28 | | 320,000 | 326,463 |

5.625% 7/15/36 | | 800,000 | 815,269 |

5.75% 7/15/43 | | 4,700,000 | 4,783,619 |

| Series 2015 D, 5% 7/1/44 | | 10,975,000 | 11,408,885 |

| Series 2015 H1: | | | |

5% 7/1/26 | | 3,585,000 | 3,869,510 |

5% 7/1/29 | | 3,750,000 | 4,010,324 |

5% 7/1/30 | | 1,800,000 | 1,917,777 |

5% 7/1/31 | | 1,190,000 | 1,263,378 |

5% 7/1/32 | | 1,000,000 | 1,058,366 |

5% 7/1/33 | | 1,000,000 | 1,055,415 |

| Series 2015 K, 4% 10/1/30 | | 500,000 | 507,535 |

| Series 2015 Q: | | | |

5% 8/15/28 | | 1,000,000 | 1,087,044 |

5% 8/15/29 | | 1,000,000 | 1,083,660 |

5% 8/15/32 | | 1,500,000 | 1,613,571 |

5% 8/15/33 | | 1,550,000 | 1,665,471 |

5% 8/15/34 | | 1,790,000 | 1,921,719 |

5% 8/15/38 | | 1,690,000 | 1,804,646 |

| Series 2015: | | | |

5% 1/1/25 | | 3,525,000 | 3,729,066 |

5% 1/1/27 | | 2,695,000 | 2,842,774 |

5% 1/1/28 | | 1,850,000 | 1,947,311 |

5% 1/1/29 | | 2,945,000 | 3,091,004 |

| Series 2016 A: | | | |

5% 1/1/31 | | 5,000 | 5,361 |

5.25% 1/1/42 | | 7,000,000 | 7,376,534 |

| Series 2016 E: | | | |

5% 7/1/31 | | 1,000,000 | 1,075,941 |

5% 7/1/32 | | 2,200,000 | 2,359,113 |

5% 7/1/33 | | 1,500,000 | 1,602,603 |

5% 7/1/34 | | 1,500,000 | 1,599,346 |

5% 7/1/35 | | 1,500,000 | 1,597,155 |

5% 7/1/36 | | 1,000,000 | 1,063,567 |

5% 7/1/37 | | 2,000,000 | 2,123,904 |

| Series 2016 I: | | | |

5% 7/1/25 | | 510,000 | 543,085 |

5% 7/1/27 | | 1,150,000 | 1,255,017 |

5% 7/1/27 | | 1,100,000 | 1,193,608 |

5% 7/1/29 | | 1,680,000 | 1,807,440 |

5% 7/1/30 | | 2,400,000 | 2,569,447 |

5% 7/1/31 | | 2,500,000 | 2,668,854 |

5% 7/1/32 | | 1,960,000 | 2,087,585 |

5% 7/1/34 | | 3,035,000 | 3,245,239 |

5% 7/1/36 | | 2,000,000 | 2,131,680 |

5% 7/1/37 | | 1,470,000 | 1,563,292 |

5% 7/1/38 | | 1,000,000 | 1,061,089 |

5% 7/1/41 | | 14,790,000 | 15,454,427 |

| Series 2016 N: | | | |

5% 12/1/34 | | 1,000,000 | 1,079,651 |

5% 12/1/36 | | 2,520,000 | 2,709,114 |

| Series 2016: | | | |

4% 10/1/36 | | 1,250,000 | 1,258,746 |

5% 7/1/26 | | 1,710,000 | 1,872,172 |

5% 7/1/29 | | 2,000,000 | 2,167,120 |

5% 7/1/30 | | 2,000,000 | 2,160,373 |

5% 7/1/31 | | 1,700,000 | 1,831,058 |

5% 10/1/32 | | 1,760,000 | 1,938,519 |

5% 9/1/33 | | 475,000 | 522,083 |

5% 10/1/33 | | 1,500,000 | 1,648,361 |

5% 10/1/34 | | 1,500,000 | 1,641,980 |

5% 9/1/35 | | 375,000 | 411,406 |

5% 10/1/35 | | 1,500,000 | 1,634,173 |

5% 7/1/36 | | 3,000,000 | 3,185,033 |

5% 9/1/36 | | 315,000 | 344,684 |

5% 9/1/37 | | 840,000 | 890,818 |

5% 10/1/37 | | 2,000,000 | 2,165,265 |

5% 10/1/39 | | 5,000,000 | 5,397,440 |

5% 7/1/40 | | 5,325,000 | 5,674,585 |

5% 7/1/41 | | 5,145,000 | 5,404,817 |

5% 10/1/43 | | 5,000,000 | 5,192,078 |

5% 9/1/46 | | 3,235,000 | 3,477,420 |

5% 10/1/46 | | 4,000,000 | 4,276,670 |

5% 10/1/48 | | 6,000,000 | 5,939,098 |

5% 9/1/52 | | 9,115,000 | 9,525,239 |

| Series 2017 A: | | | |

5% 1/1/35 | | 2,000,000 | 2,132,918 |

5% 1/1/40 | | 1,000,000 | 1,056,124 |

| Series 2017 H: | | | |

5% 1/1/23 | | 325,000 | 329,424 |

5% 1/1/24 | | 260,000 | 271,053 |

5% 1/1/24 (Escrowed to Maturity) | | 840,000 | 878,958 |

| Series 2017: | | | |

5% 7/1/25 | | 1,105,000 | 1,190,861 |

5% 7/1/26 | | 160,000 | 172,443 |

5% 7/1/27 | | 1,000,000 | 1,120,121 |

5% 7/1/37 | | 600,000 | 625,960 |

5% 7/1/42 | | 2,110,000 | 2,187,189 |

5% 7/1/47 | | 2,250,000 | 2,317,225 |

| Series 2018 J2, 5% 7/1/48 | | 2,365,000 | 2,511,894 |

| Series 2018: | | | |

5% 9/1/27 | | 1,010,000 | 1,117,991 |

5% 9/1/29 | | 1,390,000 | 1,541,943 |

5% 1/1/30 | | 10,000 | 10,941 |

5% 9/1/31 | | 1,530,000 | 1,673,679 |

5% 9/1/33 | | 1,185,000 | 1,280,253 |

5% 9/1/38 | | 4,805,000 | 5,101,398 |

5% 6/1/43 | | 4,740,000 | 5,222,629 |

5% 9/1/43 | | 4,445,000 | 4,675,791 |

5% 6/1/48 | | 7,000,000 | 7,650,956 |

| Series 2019 A: | | | |

5% 7/1/30 | | 1,350,000 | 1,516,404 |

5% 7/1/31 | | 1,350,000 | 1,509,661 |

5% 7/1/32 | | 2,000,000 | 2,224,863 |

5% 7/1/33 | | 2,300,000 | 2,542,665 |

5% 7/1/34 | | 1,015,000 | 1,125,104 |

5% 7/1/34 | | 1,400,000 | 1,539,423 |

5% 7/1/36 | | 1,120,000 | 1,229,105 |

5% 7/1/38 | | 735,000 | 797,848 |

5% 7/1/44 | | 2,250,000 | 2,393,249 |

5% 7/1/49 | | 3,500,000 | 3,703,184 |

| Series 2019 K: | | | |

5% 7/1/23 | | 500,000 | 514,098 |

5% 7/1/24 | | 500,000 | 527,146 |

5% 7/1/25 | | 1,250,000 | 1,349,332 |

5% 7/1/26 | | 1,250,000 | 1,378,872 |

5% 7/1/33 | | 2,000,000 | 2,236,280 |

5% 7/1/35 | | 2,135,000 | 2,359,839 |

| Series 2019 S1: | | | |

5% 10/1/25 | | 1,965,000 | 2,145,002 |

5% 10/1/26 | | 2,535,000 | 2,825,807 |

| Series 2019 S2: | | | |

5% 10/1/32 | | 1,410,000 | 1,596,094 |

5% 10/1/33 | | 1,935,000 | 2,181,535 |

5% 10/1/34 | | 2,165,000 | 2,433,503 |

| Series 2020 A: | | | |

4% 7/1/39 | | 2,455,000 | 2,438,212 |

4% 7/1/40 | | 7,920,000 | 7,828,659 |

| Series 2021 A: | | | |

4% 7/1/34 | | 1,000,000 | 1,031,330 |

4% 7/1/35 | | 1,000,000 | 1,022,238 |

4% 7/1/36 | | 825,000 | 836,968 |

4% 7/1/37 | | 1,000,000 | 1,008,272 |

4% 7/1/38 | | 700,000 | 703,541 |

4% 7/1/39 | | 1,400,000 | 1,403,503 |

5% 7/1/32 | | 1,000,000 | 1,167,663 |

| Series 2021 B: | | | |

4% 7/1/42 | | 475,000 | 462,854 |

4% 7/1/50 | | 1,825,000 | 1,707,430 |

| Series 2021: | | | |

4% 7/1/40 | | 4,160,000 | 3,795,707 |

4% 7/1/45 | | 1,200,000 | 1,055,253 |

4% 7/1/50 | | 1,750,000 | 1,497,501 |

| Series A: | | | |

4% 6/1/49 (Pre-Refunded to 6/1/29 @ 100) | | 13,440,000 | 14,915,649 |

5% 6/1/39 (Pre-Refunded to 6/1/29 @ 100) | | 6,760,000 | 7,941,912 |

| Series B, 0% 1/1/39 (Assured Guaranty Corp. Insured) | | 3,200,000 | 1,742,952 |

| Series BB1, 5% 10/1/46 | | 355,000 | 384,651 |

| Series G: | | | |

5% 7/15/23 (b) | | 120,000 | 122,774 |

5% 7/15/24 (b) | | 130,000 | 135,484 |

5% 7/15/25 (b) | | 120,000 | 127,104 |

5% 7/15/26 (b) | | 160,000 | 172,050 |

5% 7/15/27 (b) | | 170,000 | 185,406 |

5% 7/1/28 | | 350,000 | 393,741 |

5% 7/15/28 (b) | | 175,000 | 192,296 |

5% 7/15/29 (b) | | 320,000 | 354,443 |

5% 7/1/30 | | 225,000 | 258,519 |

5% 7/15/30 (b) | | 320,000 | 356,721 |

5% 7/15/31 (b) | | 350,000 | 374,753 |

5% 7/15/32 (b) | | 400,000 | 423,699 |

5% 7/1/33 | | 550,000 | 624,466 |

5% 7/15/33 (b) | | 320,000 | 336,229 |

5% 7/1/34 | | 250,000 | 282,667 |

5% 7/15/34 (b) | | 300,000 | 314,051 |

5% 7/15/35 (b) | | 270,000 | 281,946 |

5% 7/1/36 | | 475,000 | 532,379 |

5% 7/15/36 (b) | | 235,000 | 244,891 |

5% 7/1/37 | | 1,275,000 | 1,424,578 |

5% 7/15/37 (b) | | 250,000 | 259,817 |

5% 7/15/46 (b) | | 9,540,000 | 9,676,678 |

5% 7/1/50 | | 1,900,000 | 2,061,543 |

| Series J2: | | | |

5% 7/1/43 | | 11,540,000 | 12,324,824 |

5% 7/1/53 | | 4,500,000 | 4,757,067 |

| Series K, 5% 7/1/27 | | 1,150,000 | 1,266,695 |

| Series N 2016, 5% 12/1/46 | | 7,000,000 | 7,423,713 |

| Massachusetts Edl. Fing. Auth. Rev.: | | | |

| Series 2014 I: | | | |

5% 1/1/25 (d) | | 2,660,000 | 2,824,277 |

5% 1/1/27 (d) | | 1,000,000 | 1,052,123 |

| Series 2015 A, 5% 1/1/25 (d) | | 5,450,000 | 5,786,583 |

| Series 2016, 5% 7/1/24 (d) | | 7,120,000 | 7,487,339 |

| Series 2017 A: | | | |

5% 7/1/23 (d) | | 2,500,000 | 2,567,035 |

5% 7/1/24 (d) | | 3,000,000 | 3,154,778 |

5% 7/1/25 (d) | | 4,500,000 | 4,828,568 |

5% 7/1/26 (d) | | 3,935,000 | 4,302,027 |

| Series 2018 B: | | | |

5% 7/1/27 (d) | | 9,240,000 | 10,281,896 |

5% 7/1/28 (d) | | 2,325,000 | 2,612,858 |

| Series 2019 B: | | | |

5% 7/1/23 (d) | | 500,000 | 513,407 |

5% 7/1/24 (d) | | 1,000,000 | 1,051,593 |

5% 7/1/25 (d) | | 1,365,000 | 1,464,666 |

5% 7/1/26 (d) | | 1,215,000 | 1,328,326 |

5% 7/1/28 (d) | | 1,000,000 | 1,124,391 |

5% 7/1/29 (d) | | 3,500,000 | 3,944,868 |

| Series 2020 C: | | | |

5% 7/1/28 (d) | | 2,000,000 | 2,248,782 |

5% 7/1/29 (d) | | 1,950,000 | 2,197,855 |

5% 7/1/30 (d) | | 1,950,000 | 2,212,448 |

| Series 2021 B: | | | |

5% 7/1/27 (d) | | 1,950,000 | 2,163,220 |

5% 7/1/28 (d) | | 1,850,000 | 2,080,124 |

5% 7/1/29 (d) | | 1,250,000 | 1,408,882 |

5% 7/1/30 (d) | | 1,125,000 | 1,276,412 |

5% 7/1/31 (d) | | 1,500,000 | 1,713,994 |

| Massachusetts Fed. Hwy. (Accelerated Bridge Prog.) Series A, 5% 6/15/25 | | 4,470,000 | 4,740,452 |

| Massachusetts Gen. Oblig.: | | | |

| Series 2004 A, 5.5% 8/1/30 | | 2,000,000 | 2,452,267 |

| Series 2007 A, 3 month U.S. LIBOR + 0.570% 1.432% 5/1/37 (c)(e) | | 6,840,000 | 6,474,758 |

| Series 2016 B: | | | |

5% 7/1/33 | | 5,500,000 | 6,070,308 |

5% 7/1/35 | | 5,500,000 | 6,023,626 |

5% 7/1/36 | | 10,260,000 | 11,224,044 |

5% 7/1/37 | | 8,495,000 | 9,262,447 |

| Series 2016, 5% 3/1/31 | | 1,500,000 | 1,571,208 |

| Series 2017 A: | | | |

5% 4/1/34 | | 6,875,000 | 7,639,151 |

5% 4/1/35 | | 9,830,000 | 10,893,688 |

5% 4/1/42 | | 18,490,000 | 20,264,408 |

5% 4/1/47 | | 2,405,000 | 2,621,132 |

| Series 2017 D, 5% 2/1/33 | | 2,550,000 | 2,837,019 |

| Series 2017 F: | | | |

5% 11/1/38 | | 10,000,000 | 11,142,809 |

5% 11/1/39 | | 10,000,000 | 11,125,070 |

| Series 2018 B, 5% 1/1/32 | | 5,000,000 | 5,690,438 |

| Series 2019 A: | | | |

5% 1/1/35 | | 5,000,000 | 5,702,727 |

5% 1/1/37 | | 10,000,000 | 11,327,770 |

5% 1/1/49 | | 10,000,000 | 11,116,237 |

5.25% 1/1/33 | | 21,110,000 | 24,636,383 |

5.25% 1/1/44 | | 16,490,000 | 18,661,776 |

| Series 2020 D: | | | |

3% 7/1/39 | | 3,460,000 | 3,221,511 |

3% 11/1/42 | | 3,500,000 | 3,144,627 |

4% 11/1/36 | | 1,500,000 | 1,599,896 |

4% 11/1/41 | | 4,000,000 | 4,146,630 |

5% 7/1/48 | | 18,695,000 | 21,231,925 |

| Series 2021 D: | | | |

5% 9/1/49 | | 50,000,000 | 57,131,354 |

5% 9/1/50 | | 1,785,000 | 2,037,473 |

| Series A: | | | |

5% 7/1/28 | | 7,000,000 | 7,803,727 |

5% 3/1/29 | | 2,710,000 | 3,191,771 |

5% 1/1/45 | | 1,000,000 | 1,105,447 |

5% 1/1/48 | | 9,420,000 | 10,386,356 |

| Series B: | | | |

5% 7/1/33 | | 3,500,000 | 4,127,756 |

5% 7/1/34 | | 2,000,000 | 2,341,931 |

| Series C: | | | |

3% 3/1/48 | | 5,000,000 | 4,303,261 |

5% 5/1/47 | | 10,855,000 | 12,140,885 |

| Series D, 5% 7/1/45 | | 3,415,000 | 3,892,393 |

| Series E: | | | |

5% 9/1/29 | | 7,115,000 | 8,278,865 |

5% 11/1/45 | | 8,065,000 | 9,234,177 |

5% 11/1/50 | | 23,480,000 | 26,734,704 |

| Massachusetts Hsg. Fin. Agcy. Hsg. Rev.: | | | |

| Series 183, 3.5% 12/1/46 | | 580,000 | 586,080 |

| Series 2011, 3.5% 12/1/49 | | 3,295,000 | 3,342,174 |

| Series 2017, 4% 6/1/43 (d) | | 800,000 | 814,451 |

| Series 2020 A, 0.875% 12/1/23 | | 3,250,000 | 3,213,354 |

| Series 207, 4% 6/1/49 | | 1,740,000 | 1,787,165 |

| Series 214, 3.75% 12/1/49 | | 4,590,000 | 4,682,046 |

| Series 218, 3% 12/1/50 | | 1,800,000 | 1,799,357 |

| Massachusetts Hsg. Fin. Auth.: | | | |

| Series 2021 221, 3% 12/1/50 | | 3,860,000 | 3,846,975 |

| Series 2021 A2: | | | |

0.4% 6/1/24 | | 875,000 | 845,521 |

0.45% 12/1/24 | | 1,000,000 | 957,459 |

| Series 2021, 3% 6/1/51 | | 3,995,000 | 3,972,463 |

| Series 2022 224, 5% 6/1/50 | | 1,750,000 | 1,895,773 |

| Series 220: | | | |

3% 12/1/50 | | 3,340,000 | 3,337,639 |

5% 12/1/22 | | 405,000 | 409,491 |

5% 6/1/23 | | 300,000 | 307,849 |

5% 12/1/23 | | 100,000 | 104,152 |

5% 6/1/24 | | 150,000 | 158,352 |

5% 12/1/24 | | 215,000 | 229,935 |

5% 6/1/25 | | 425,000 | 460,224 |

5% 12/1/25 | | 150,000 | 164,388 |

5% 6/1/26 | | 100,000 | 110,856 |

5% 12/1/26 | | 125,000 | 140,118 |

5% 6/1/27 | | 100,000 | 113,303 |

5% 12/1/27 | | 185,000 | 211,419 |

5% 6/1/28 | | 75,000 | 85,873 |

5% 12/1/28 | | 230,000 | 265,193 |

5% 6/1/29 | | 100,000 | 116,108 |

| Massachusetts Port Auth. Rev.: | | | |

| Series 2014 B, 5% 7/1/29 (d) | | 1,270,000 | 1,326,919 |

| Series 2014 C: | | | |

5% 7/1/28 | | 3,000,000 | 3,177,487 |

5% 7/1/29 | | 4,205,000 | 4,446,057 |

5% 7/1/30 | | 3,000,000 | 3,169,805 |

| Series 2015 A: | | | |

5% 7/1/28 | | 460,000 | 499,015 |

5% 7/1/28 (d) | | 500,000 | 535,067 |

5% 7/1/29 (d) | | 1,245,000 | 1,327,089 |

5% 7/1/30 | | 1,400,000 | 1,511,223 |

5% 7/1/30 (d) | | 1,450,000 | 1,541,939 |

5% 7/1/40 (d) | | 2,000,000 | 2,089,631 |

5% 7/1/45 (d) | | 3,500,000 | 3,640,989 |

| Series 2016 A: | | | |

5% 7/1/26 | | 695,000 | 773,276 |

5% 7/1/28 | | 760,000 | 845,743 |

5% 7/1/30 | | 1,660,000 | 1,835,270 |

5% 7/1/32 | | 1,970,000 | 2,166,727 |

5% 7/1/36 | | 3,760,000 | 4,098,617 |

| Series 2016 B: | | | |

4% 7/1/46 (d) | | 12,950,000 | 12,927,988 |

5% 7/1/43 (d) | | 11,410,000 | 11,997,281 |

| Series 2017 A: | | | |

5% 7/1/30 (d) | | 1,280,000 | 1,413,300 |

5% 7/1/31 (d) | | 1,095,000 | 1,202,139 |

5% 7/1/32 (d) | | 1,370,000 | 1,496,521 |

5% 7/1/33 (d) | | 1,250,000 | 1,358,114 |

5% 7/1/35 (d) | | 2,000,000 | 2,163,910 |

5% 7/1/36 (d) | | 1,720,000 | 1,858,381 |

5% 7/1/42 (d) | | 4,540,000 | 4,825,808 |

| Series 2019 A: | | | |

5% 7/1/24 (d) | | 4,140,000 | 4,359,977 |

5% 7/1/30 (d) | | 725,000 | 826,029 |

5% 7/1/34 (d) | | 2,605,000 | 2,896,106 |

5% 7/1/37 (d) | | 1,100,000 | 1,206,963 |

5% 7/1/40 (d) | | 950,000 | 1,034,300 |

| Series 2019 B, 5% 7/1/44 | | 5,000,000 | 5,627,221 |

| Series 2019 C: | | | |

5% 7/1/31 (d) | | 3,500,000 | 3,968,787 |

5% 7/1/32 (d) | | 2,700,000 | 3,040,974 |

5% 7/1/38 (d) | | 5,000,000 | 5,465,946 |

5% 7/1/39 (d) | | 5,000,000 | 5,454,958 |

5% 7/1/49 (d) | | 2,500,000 | 2,680,981 |

| Series 2021 A: | | | |

5% 7/1/38 | | 2,125,000 | 2,463,889 |

5% 7/1/39 | | 1,125,000 | 1,301,145 |

5% 7/1/40 | | 1,045,000 | 1,205,507 |

| Series 2021 B, 5% 7/1/39 (d) | | 1,325,000 | 1,475,379 |

| Series 2021 D: | | | |

5% 7/1/46 | | 3,180,000 | 3,617,893 |

5% 7/1/51 | | 5,740,000 | 6,499,912 |

| Series 2021 E: | | | |

5% 7/1/40 (d) | | 4,000,000 | 4,442,589 |

5% 7/1/41 (d) | | 1,940,000 | 2,147,943 |

5% 7/1/51 (d) | | 11,775,000 | 12,820,568 |

| Massachusetts Port Auth. Spl. Facilities Rev. (Bosfuel Proj.) Series 2019 A: | | | |

| 5% 7/1/23 (d) | | 360,000 | 369,819 |

| 5% 7/1/24 (d) | | 615,000 | 647,678 |

| 5% 7/1/25 (d) | | 1,000,000 | 1,076,235 |

| 5% 7/1/28 (d) | | 1,500,000 | 1,685,715 |

| 5% 7/1/32 (d) | | 500,000 | 556,860 |

| 5% 7/1/34 (d) | | 1,250,000 | 1,372,600 |

| 5% 7/1/49 (d) | | 5,620,000 | 6,002,182 |

| Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev.: | | | |

| Series 2012 A, 5% 8/15/24 | | 4,120,000 | 4,125,384 |

| Series 2019 A, 5% 2/15/44 | | 21,510,000 | 24,074,951 |

| Series A: | | | |

5% 8/15/31 | | 1,850,000 | 2,201,044 |

5% 8/15/32 | | 1,500,000 | 1,776,962 |

5% 8/15/33 | | 1,675,000 | 1,974,526 |

5% 8/15/34 | | 3,000,000 | 3,518,629 |

5% 8/15/35 | | 2,000,000 | 2,336,780 |

5% 8/15/37 | | 1,400,000 | 1,628,028 |

5% 8/15/45 | | 10,000,000 | 11,417,183 |

5% 8/15/50 | | 16,615,000 | 18,866,671 |

| Series B, 5% 11/15/39 | | 1,975,000 | 2,158,781 |

| Series D, 5% 8/15/37 | | 5,000,000 | 5,346,751 |

| Massachusetts Spl. Oblig. Dedicated Tax Rev. Series 2005: | | | |

| 5.5% 1/1/27 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 2,500,000 | 2,842,981 |

| 5.5% 1/1/28 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 2,575,000 | 2,990,380 |

| 5.5% 1/1/30 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 19,080,000 | 22,863,669 |

| 5.5% 1/1/34 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 14,770,000 | 18,066,454 |

| Massachusetts State College Bldg. Auth. Rev.: | | | |

| Series 1999 A, 0% 5/1/28 (Escrowed to Maturity) | | 1,700,000 | 1,487,795 |

| Series 2003 B, 0% 5/1/28 (Assured Guaranty Corp. Insured) | | 6,080,000 | 5,231,202 |

| Series 2022 A: | | | |

4% 5/1/36 | | 600,000 | 643,655 |

4% 5/1/38 | | 750,000 | 789,675 |

4% 5/1/40 | | 1,000,000 | 1,034,781 |

4% 5/1/41 | | 625,000 | 643,233 |

4% 5/1/42 | | 550,000 | 563,360 |

5% 5/1/32 | | 600,000 | 728,714 |

5% 5/1/33 | | 500,000 | 603,842 |

5% 5/1/34 | | 500,000 | 598,592 |

5% 5/1/35 | | 500,000 | 594,266 |

| Massachusetts Tpk. Auth. Metropolitan Hwy. Sys. Rev.: | | | |

| Series 1997 C, 0% 1/1/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,800,000 | 1,786,679 |

| Sr. Series A: | | | |

0% 1/1/25 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 5,110,000 | 4,851,479 |

0% 1/1/28 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 7,700,000 | 6,719,279 |

0% 1/1/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 33,195,000 | 27,933,516 |

| Massachusetts Wtr. Resources Auth. Wtr. & Swr. Rev. Series 2020 B: | | | |

| 5% 8/1/41 | | 3,155,000 | 3,631,156 |

| 5% 8/1/42 | | 7,415,000 | 8,513,399 |

| Natick Gen. Oblig. Series 2020, 5% 6/15/29 | | 1,755,000 | 2,088,859 |

| Springfield Gen. Oblig. Series 2017, 5% 3/1/25 | | 2,420,000 | 2,620,443 |

| Univ. of Massachusetts Bldg. Auth. Facilities Rev.: | | | |

| (Bldg. Auth. Proj.) Series 2015 1: | | | |

5% 11/1/27 | | 3,500,000 | 3,840,376 |

5% 11/1/28 | | 6,000,000 | 6,556,314 |

5% 11/1/29 | | 6,230,000 | 6,789,377 |

5% 11/1/30 | | 6,000,000 | 6,525,855 |

| Series 2020 1, 5% 11/1/50 | | 4,015,000 | 4,475,395 |

| Univ. of Massachusetts Bldg. Auth. Rev. Series 2019 1: | | | |

| 5% 5/1/34 | | 600,000 | 688,300 |

| 5% 5/1/35 | | 2,000,000 | 2,286,135 |

| 5% 5/1/36 | | 3,400,000 | 3,879,054 |

| 5% 5/1/37 | | 3,200,000 | 3,636,510 |

| 5% 5/1/38 | | 3,000,000 | 3,396,823 |

| 5% 5/1/39 | | 2,000,000 | 2,257,444 |

| Worcester Gen. Oblig. Series 2021, 5% 2/15/27 | | 1,575,000 | 1,785,082 |

TOTAL MASSACHUSETTS | | | 1,695,501,967 |

| Puerto Rico - 0.9% | | | |

| Puerto Rico Commonwealth Pub. Impt. Gen. Oblig. Series 2021 A1: | | | |

| 0% 7/1/33 | | 5,238,348 | 3,113,724 |

| 5.625% 7/1/27 | | 625,000 | 677,123 |

| 5.625% 7/1/29 | | 1,925,000 | 2,126,927 |

| 5.75% 7/1/31 | | 4,525,000 | 5,077,606 |

| Puerto Rico Hsg. Fin. Auth. Series 2020, 5% 12/1/27 | | 4,435,000 | 4,985,068 |

TOTAL PUERTO RICO | | | 15,980,448 |

| TOTAL MUNICIPAL BONDS (Cost $1,760,832,902) | | | 1,711,482,415 |

| | | | |

| Municipal Notes - 1.1% |

| | | Principal Amount (a) | Value ($) |

| Massachusetts - 1.1% | | | |

| Massachusetts Dev. Fin. Agcy. Rev. (Boston Univ. Proj.) Series U-6C, 1.89% 8/1/22, LOC TD Banknorth, NA, VRDN (c) | | 14,520,000 | 14,520,000 |

| Massachusetts Health & Edl. Facilities Auth. Rev. (Baystate Health Sys. Proj.) Series 2009 J2, 1.87% 8/1/22, LOC TD Banknorth, NA, VRDN (c) | | 4,025,000 | 4,025,000 |

| | | | |

| TOTAL MUNICIPAL NOTES (Cost $18,545,000) | | | 18,545,000 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 96.9% (Cost $1,779,377,902) | 1,730,027,415 |

NET OTHER ASSETS (LIABILITIES) - 3.1% | 55,850,705 |

| NET ASSETS - 100.0% | 1,785,878,120 |

| | |

Security Type Abbreviations

| VRDN | - | VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly) |

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $17,593,785 or 1.0% of net assets. |

| (c) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (d) | Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

| (e) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2022, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Municipal Securities | 1,730,027,415 | - | 1,730,027,415 | - |

| Total Investments in Securities: | 1,730,027,415 | - | 1,730,027,415 | - |

Fidelity® Massachusetts Municipal Income Fund

| Statement of Assets and Liabilities |

| | | | July 31, 2022 (Unaudited) |

| | | | | |

| Assets | | | | |

Investment in securities, at value - See accompanying schedule Unaffiliated issuers (cost $1,779,377,902): | | | $ | 1,730,027,415 |

| Cash | | | | 42,312,490 |

| Receivable for fund shares sold | | | | 2,448,021 |

| Interest receivable | | | | 14,038,067 |

| Other receivables | | | | 4,040 |

Total assets | | | | 1,788,830,033 |

| Liabilities | | | | |

| Payable for fund shares redeemed | | $1,091,739 | | |

| Distributions payable | | 1,157,654 | | |

| Accrued management fee | | 513,723 | | |

| Other affiliated payables | | 155,392 | | |

| Other payables and accrued expenses | | 33,405 | | |

| Total Liabilities | | | | 2,951,913 |

| Net Assets | | | $ | 1,785,878,120 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 1,842,234,213 |

| Total accumulated earnings (loss) | | | | (56,356,093) |

| Net Assets | | | $ | 1,785,878,120 |

Net Asset Value , offering price and redemption price per share ($1,785,878,120 ÷ 154,943,638 shares) | | | $ | 11.53 |

| | | | | |

| Statement of Operations |

| | | | Six months ended July 31, 2022 (Unaudited) |

| Investment Income | | | | |

| Interest | | | $ | 25,056,301 |

| Expenses | | | | |

| Management fee | $ | 3,456,432 | | |

| Transfer agent fees | | 844,546 | | |

| Accounting fees and expenses | | 180,840 | | |

| Custodian fees and expenses | | 10,602 | | |

| Independent trustees' fees and expenses | | 3,241 | | |

| Registration fees | | 21,856 | | |

| Audit | | 25,420 | | |

| Legal | | 3,480 | | |

| Miscellaneous | | 3,384 | | |

| Total expenses before reductions | | 4,549,801 | | |

| Expense reductions | | (27,631) | | |

| Total expenses after reductions | | | | 4,522,170 |

| Net Investment income (loss) | | | | 20,534,131 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (7,621,749) | | |

| Total net realized gain (loss) | | | | (7,621,749) |

| Change in net unrealized appreciation (depreciation) on investment securities | | | | (112,073,550) |

| Net gain (loss) | | | | (119,695,299) |

| Net increase (decrease) in net assets resulting from operations | | | $ | (99,161,168) |

| Statement of Changes in Net Assets |

| |

| | Six months ended July 31, 2022 (Unaudited) | | Year ended January 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 20,534,131 | $ | 46,528,466 |

| Net realized gain (loss) | | (7,621,749) | | 10,629,071 |

| Change in net unrealized appreciation (depreciation) | | (112,073,550) | | (98,246,008) |

| Net increase (decrease) in net assets resulting from operations | | (99,161,168) | | (41,088,471) |

| Distributions to shareholders | | (20,504,204) | | (61,680,325) |

| Share transactions | | | | |

| Proceeds from sales of shares | | 518,293,500 | | 352,209,362 |

| Reinvestment of distributions | | 12,369,764 | | 36,101,327 |

| Cost of shares redeemed | | (903,301,957) | | (393,502,142) |

Net increase (decrease) in net assets resulting from share transactions | | (372,638,693) | | (5,191,453) |

| Total increase (decrease) in net assets | | (492,304,065) | | (107,960,249) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 2,278,182,185 | | 2,386,142,434 |

| End of period | $ | 1,785,878,120 | $ | 2,278,182,185 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 45,135,988 | | 28,028,547 |

| Issued in reinvestment of distributions | | 1,071,141 | | 2,881,619 |

| Redeemed | | (78,575,913) | | (31,327,255) |

| Net increase (decrease) | | (32,368,784) | | (417,089) |

| | | | | |

| Fidelity® Massachusetts Municipal Income Fund |

| |

| | Six months ended (Unaudited) July 31, 2022 | | Years ended January 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 12.16 | $ | 12.71 | $ | 12.62 | $ | 11.95 | $ | 12.07 | $ | 11.99 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | .120 | | .248 | | .280 | | .316 | | .327 | | .340 |

| Net realized and unrealized gain (loss) | | (.631) | | (.469) | | .111 | | .678 | | (.075) | | .107 |

| Total from investment operations | | (.511) | | (.221) | | .391 | | .994 | | .252 | | .447 |

| Distributions from net investment income | | (.119) | | (.248) | | (.280) | | (.316) | | (.327) | | (.340) |

| Distributions from net realized gain | | - | | (.081) | | (.021) | | (.008) | | (.045) | | (.027) |

| �� Total distributions | | (.119) | | (.329) | | (.301) | | (.324) | | (.372) | | (.367) |

| Net asset value, end of period | $ | 11.53 | $ | 12.16 | $ | 12.71 | $ | 12.62 | $ | 11.95 | $ | 12.07 |

Total Return C,D | | (4.20)% | | (1.79)% | | 3.16% | | 8.41% | | 2.15% | | 3.75% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | | | |

| Expenses before reductions | | .46% G | | .45% | | .45% | | .45% | | .46% | | .46% |

| Expenses net of fee waivers, if any | | .46% G | | .45% | | .45% | | .45% | | .46% | | .46% |

| Expenses net of all reductions | | .46% G | | .45% | | .45% | | .45% | | .45% | | .45% |

| Net investment income (loss) | | 2.08% G | | 1.97% | | 2.24% | | 2.56% | | 2.75% | | 2.80% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 1,785,878 | $ | 2,278,182 | $ | 2,386,142 | $ | 2,369,049 | $ | 2,140,001 | $ | 2,169,782 |

Portfolio turnover rate H | | 18% G | | 11% | | 20% | | 12% | | 12% | | 16% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Annualized

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

| Current 7-Day Yields |

| | | |

| Fidelity® Massachusetts Municipal Money Market Fund | .65% | |

| | | |

Yield refers to the income paid by the Fund over a given period. Yield for money market funds is usually for seven-day periods, as it is here, though it is expressed as an annual percentage rate. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. | |

| Effective Maturity Diversification (% of Fund's Investments) |

| Days |

| 1 - 7 | 81.7 | |

| 8 - 30 | 4.6 | |

| 31 - 60 | 3.6 | |

| 61 - 90 | 2.4 | |

| 91 - 180 | 4.6 | |

| > 180 | 3.1 | |

| Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

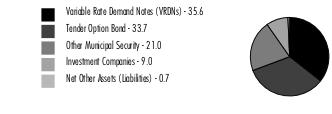

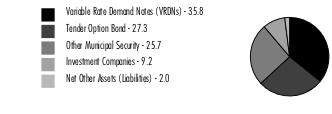

Asset Allocation (% of Fund's net assets) |

|

|

Fidelity® Massachusetts Municipal Money Market Fund

Showing Percentage of Net Assets

| Variable Rate Demand Note - 35.6% |

| | | Principal Amount (a) | Value ($) |

| Alabama - 1.1% | | | |

| Decatur Indl. Dev. Board Exempt Facilities Rev. (Nucor Steel Decatur LLC Proj.) Series 2003 A, 1.53% 8/5/22, VRDN (b)(c) | | 9,643,000 | 9,643,000 |

| West Jefferson Indl. Dev. Series 2008, 1.45% 8/5/22, VRDN (b) | | 1,300,000 | 1,300,000 |

TOTAL ALABAMA | | | 10,943,000 |

| Arkansas - 0.0% | | | |

| Blytheville Indl. Dev. Rev. (Nucor Corp. Proj.) Series 1998, 1.53% 8/5/22, VRDN (b)(c) | | 400,000 | 400,000 |

| Kansas - 0.3% | | | |

| Burlington Envir. Impt. Rev. (Kansas City Pwr. and Lt. Co. Proj.): | | | |

| Series 2007 A, 1.44% 8/5/22, VRDN (b) | | 2,200,000 | 2,200,000 |

| Series 2007 B, 1.44% 8/5/22, VRDN (b) | | 1,000,000 | 1,000,000 |

TOTAL KANSAS | | | 3,200,000 |

| Massachusetts - 33.0% | | | |

| Boston Wtr. & Swr. Commission Rev. Series 1994 A, 1.24% 8/5/22, LOC State Street Bank & Trust Co., Boston, VRDN (b) | | 1,700,000 | 1,700,000 |

| Massachusetts Dept. of Trans. Metropolitan Hwy. Sys. Rev.: | | | |

| Series 2010 A1, 1.3% 8/5/22, LOC TD Banknorth, NA, VRDN (b) | | 10,100,000 | 10,100,000 |

| Series 2010 A2, 1.25% 8/5/22, LOC TD Banknorth, NA, VRDN (b) | | 37,140,000 | 37,140,000 |

| Massachusetts Dev. Fin. Agcy. Rev.: | | | |

| (Babson College Proj.) Series 2008 A, 1.42% 8/5/22, LOC Bank of America NA, VRDN (b) | | 7,405,000 | 7,405,000 |

| (Boston Univ. Proj.) Series U-6E, 1.91% 8/1/22, LOC TD Banknorth, NA, VRDN (b) | | 4,320,000 | 4,320,000 |

| (Wilber School Apts. Proj.) Series 2008 A, 1.36% 8/5/22, LOC Bank of America NA, VRDN (b) | | 7,285,000 | 7,285,000 |

| (Worcester Polytechnic Institute Proj.) Series 2008 A, 1.29% 8/5/22, LOC TD Banknorth, NA, VRDN (b) | | 730,000 | 730,000 |

| Series 2006, 1.37% 8/5/22, LOC PNC Bank NA, VRDN (b) | | 20,340,000 | 20,340,000 |

| Series 2019, 1.4% 8/5/22, LOC Manufacturers & Traders Trust Co., VRDN (b)(d) | | 12,655,000 | 12,655,000 |

| Massachusetts Health & Edl. Facilities Auth. Rev.: | | | |

| (Amherst College Proj.) Series 2005 J2, 1.83% 8/1/22, VRDN (b) | | 4,000,000 | 4,000,000 |

| (Baystate Health Sys. Proj.) Series 2009 J1, 1.27% 8/5/22, LOC TD Banknorth, NA, VRDN (b) | | 10,000,000 | 10,000,000 |

| (Harvard Univ. Proj.): | | | |

Series R, 1.77% 8/1/22, VRDN (b) | | 1,320,000 | 1,320,000 |

Series Y, 1.3% 8/5/22, VRDN (b) | | 34,505,000 | 34,505,000 |

| (Massachusetts Institute of Technology Proj.): | | | |

Series 2001 J1, 1.35% 8/5/22, VRDN (b) | | 13,795,000 | 13,795,000 |

Series 2001 J2, 1.3% 8/5/22, VRDN (b) | | 30,085,000 | 30,085,000 |

| (Partners HealthCare Sys., Inc. Proj.) Series 2005 F, 1.42% 8/5/22, LOC TD Banknorth, NA, VRDN (b) | | 13,840,000 | 13,840,000 |

| Series 2009 O-1, 1.31% 8/5/22, LOC Fed. Home Ln. Bank of Boston, VRDN (b) | | 7,710,000 | 7,710,000 |

| Massachusetts Hsg. Fin. Agcy. Hsg. Rev.: | | | |

| (Princeton Westford Proj.) Series 2015 A, 1.33% 8/5/22, LOC Bank of America NA, VRDN (b) | | 21,590,000 | 21,590,000 |

| Series 208, 1.36% 8/5/22 (Liquidity Facility Royal Bank of Canada), VRDN (b) | | 2,400,000 | 2,400,000 |

| Massachusetts Hsg. Fin. Agcy. Multi-Family Rev. Series 2013 F, 1.32% 8/5/22, LOC TD Banknorth, NA, VRDN (b)(c) | | 22,265,000 | 22,265,000 |

| Massachusetts Wtr. Resources Auth. Wtr. & Swr. Rev.: | | | |

| Series 1999 B, 1.23% 8/5/22, LOC TD Banknorth, NA, VRDN (b) | | 17,100,000 | 17,100,000 |

| Series 2008 C2, 1.45% 8/5/22 (Liquidity Facility Barclays Bank PLC), VRDN (b) | | 9,470,000 | 9,470,000 |

| FHLMC Massachusetts Dev. Fin. Agcy. Multi-family Hsg. Rev. (Tammy Brook Apts. Proj.) Series 2009, 1.36% 8/5/22, LOC Freddie Mac, VRDN (b) | | 5,560,000 | 5,560,000 |

| FNMA Massachusetts Dev. Fin. Agcy. Multi-family Hsg. Rev. (Avalon Acton Apts. Proj.) Series 2006, 1.39% 8/5/22, LOC Fannie Mae, VRDN (b)(c) | | 45,000,000 | 45,000,000 |

TOTAL MASSACHUSETTS | | | 340,315,000 |

| Nebraska - 0.4% | | | |

| Stanton County Indl. Dev. Rev.: | | | |

| (Nucor Corp. Proj.) Series 1996, 1.53% 8/5/22, VRDN (b)(c) | | 3,700,000 | 3,700,000 |

| Series 1998, 1.53% 8/5/22, VRDN (b)(c) | | 300,000 | 300,000 |

TOTAL NEBRASKA | | | 4,000,000 |

| Pennsylvania - 0.0% | | | |

| Beaver County Indl. Dev. Auth. Series 2018 A, 1.45% 8/5/22, LOC Truist Bank, VRDN (b) | | 200,000 | 200,000 |

| Tennessee - 0.2% | | | |

| Memphis-Shelby County Indl. Dev. Board Facilities Rev. Series 2007, 1.53% 8/5/22, VRDN (b)(c) | | 2,330,000 | 2,330,000 |

| West Virginia - 0.6% | | | |

| West Virginia Econ. Dev. Auth. Solid Waste Disp. Facilities Rev. (Appalachian Pwr. Co.- Mountaineer Proj.) Series 2008 A, 1.38% 8/5/22, VRDN (b)(c) | | 6,300,000 | 6,300,000 |

| TOTAL VARIABLE RATE DEMAND NOTE (Cost $367,688,000) | | | 367,688,000 |

| | | | |

| Tender Option Bond - 33.7% |

| | | Principal Amount (a) | Value ($) |

| California - 0.5% | | | |

| California Health Facilities Fing. Auth. Rev. Participating VRDN Series DBE 80 11, 1.47% 8/5/22 (Liquidity Facility Deutsche Bank AG New York Branch) (b)(e)(f) | | 5,115,000 | 5,115,000 |

| Colorado - 0.4% | | | |

| Colorado Health Facilities Auth. Participating VRDN Series 2022 004, 1.48% 9/9/22 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 4,500,000 | 4,500,000 |

| Connecticut - 0.2% | | | |

| Connecticut Gen. Oblig. Participating VRDN Series Floaters 016, 1.48% 9/9/22 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 2,100,000 | 2,100,000 |

| District Of Columbia - 0.0% | | | |

| Metropolitan Washington DC Arpts. Auth. Sys. Rev. Participating VRDN Series Floaters XF 06 94, 1.45% 8/5/22 (Liquidity Facility Bank of America NA) (b)(c)(e)(f) | | 170,000 | 170,000 |

| Florida - 0.2% | | | |

| Lee County Arpt. Rev. Participating VRDN Series XF 11 26, 1.4% 8/5/22 (Liquidity Facility Deutsche Bank AG New York Branch) (b)(c)(e)(f) | | 300,000 | 300,000 |

| Palm Beach County Health Facilities Auth. Hosp. Rev. Participating VRDN Series XG 03 70, 1.43% 8/5/22 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 1,860,000 | 1,860,000 |

TOTAL FLORIDA | | | 2,160,000 |

| Georgia - 0.0% | | | |

| Fulton County Dev. Auth. Rev. Participating VRDN Series XL 02 68, 1.43% 8/5/22 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 300,000 | 300,000 |

| Illinois - 0.1% | | | |

| Chicago Gen. Oblig. Participating VRDN Series XM 10 05, 1.48% 8/5/22 (Liquidity Facility Deutsche Bank AG New York Branch) (b)(e)(f) | | 300,000 | 300,000 |

| Illinois Fin. Auth. Rev. Participating VRDN Series Floaters 017, 1.48% 9/9/22 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 1,125,000 | 1,125,000 |

TOTAL ILLINOIS | | | 1,425,000 |

| Kentucky - 0.1% | | | |

| CommonSpirit Health Participating VRDN Series MIZ 90 21, 1.43% 8/5/22 (Liquidity Facility Mizuho Cap. Markets LLC) (b)(e)(f) | | 700,000 | 700,000 |

| Massachusetts - 31.5% | | | |

| Boston Gen. Oblig. Participating VRDN Series Floaters XF 26 08, 1.34% 8/5/22 (Liquidity Facility Citibank NA) (b)(e)(f) | | 2,400,000 | 2,400,000 |

| Massachusetts Bay Trans. Auth. Assessment Rev. Participating VRDN Series XL 02 78, 1.36% 8/5/22 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(e)(f) | | 2,600,000 | 2,600,000 |

| Massachusetts Commonwealth Trans. Fund Rev. Participating VRDN: | | | |

| Series Floaters XF 06 10, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 5,100,000 | 5,100,000 |

| Series Floaters XF 26 06, 1.33% 8/5/22 (Liquidity Facility Citibank NA) (b)(e)(f) | | 2,400,000 | 2,400,000 |

| Series Floaters ZF 25 67, 1.34% 8/5/22 (Liquidity Facility Citibank NA) (b)(e)(f) | | 3,300,000 | 3,300,000 |

| Series Floaters ZF 25 68, 1.34% 8/5/22 (Liquidity Facility Citibank NA) (b)(e)(f) | | 4,865,000 | 4,865,000 |

| Series XF 09 23, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 2,065,000 | 2,065,000 |

| Massachusetts Dev. Fin. Agcy. Rev. Participating VRDN: | | | |

| Series 15 XF0245, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 9,135,000 | 9,135,000 |

| Series 2016 XF2207, 1.37% 8/5/22 (Liquidity Facility Toronto-Dominion Bank) (b)(e)(f) | | 1,600,000 | 1,600,000 |

| Series 2016 XM0137, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 5,665,000 | 5,665,000 |

| Series 2018 XF 26 55, 1.37% 8/5/22 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 2,400,000 | 2,400,000 |

| Series Floaters E 130, 1.36% 8/5/22 (Liquidity Facility Royal Bank of Canada) (b)(e)(f) | | 16,800,000 | 16,800,000 |

| Series Floaters XF 27 05, 1.33% 8/5/22 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 4,740,000 | 4,740,000 |

| Series Floaters YX 10 74, 1.36% 8/5/22 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 1,200,000 | 1,200,000 |

| Series Floaters ZF 27 22, 1.36% 8/5/22 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(e)(f) | | 8,600,000 | 8,600,000 |

| Series Floaters ZM 05 72, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 4,000,000 | 4,000,000 |

| Series MS 3373, 1.35% 8/5/22 (Liquidity Facility Toronto-Dominion Bank) (b)(e)(f) | | 7,100,000 | 7,100,000 |

| Series XF 28 91, 1.37% 8/5/22 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 2,795,000 | 2,795,000 |

| Massachusetts Edl. Fing. Auth. Rev. Participating VRDN: | | | |

| Series Floaters XF 25 11, 1.38% 8/5/22 (Liquidity Facility Barclays Bank PLC) (b)(c)(e)(f) | | 1,685,000 | 1,685,000 |

| Series Floaters XG 01 39, 1.38% 8/5/22 (Liquidity Facility Barclays Bank PLC) (b)(c)(e)(f) | | 13,055,000 | 13,055,000 |

| Series XM 07 57, 1.4% 8/5/22 (Liquidity Facility Royal Bank of Canada) (b)(c)(e)(f) | | 8,000,000 | 8,000,000 |

| Massachusetts Gen. Oblig. Participating VRDN: | | | |

| Series 16 XM0221, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 1,900,000 | 1,900,000 |

| Series 2021 XF 12 37, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 9,165,000 | 9,165,000 |

| Series E 144, 1.36% 8/5/22 (Liquidity Facility Royal Bank of Canada) (b)(e)(f) | | 20,000,000 | 20,000,000 |

| Series Floaters G4, 1.36% 8/5/22 (Liquidity Facility Royal Bank of Canada) (b)(e)(f) | | 19,500,000 | 19,500,000 |

| Series Floaters G9, 1.36% 8/5/22 (Liquidity Facility Royal Bank of Canada) (b)(e)(f) | | 5,700,000 | 5,700,000 |

| Series Floaters XF 05 30, 1.37% 8/5/22 (Liquidity Facility Toronto-Dominion Bank) (b)(e)(f) | | 4,865,000 | 4,865,000 |

| Series Floaters XF 25 74, 1.34% 8/5/22 (Liquidity Facility Citibank NA) (b)(e)(f) | | 3,700,000 | 3,700,000 |

| Series Floaters XF 27 06, 1.33% 8/5/22 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 15,800,000 | 15,800,000 |

| Series Floaters ZF 26 95, 1.36% 8/5/22 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(e)(f) | | 5,900,000 | 5,900,000 |

| Series Floaters ZM 05 79, 1.36% 8/5/22 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(e)(f) | | 2,235,000 | 2,235,000 |

| Series XG 02 79, 1.35% 8/5/22 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 5,445,000 | 5,445,000 |

| Series XM 10 21, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 1,000,000 | 1,000,000 |

| Series ZL 02 83, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 6,465,000 | 6,465,000 |

| Series ZL 02 93, 1.34% 8/5/22 (Liquidity Facility Citibank NA) (b)(e)(f) | | 2,015,000 | 2,015,000 |

| Massachusetts Health & Edl. Facilities Auth. Rev. Participating VRDN Series Floaters XM 02 32, 1.35% 8/5/22 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 2,895,000 | 2,895,000 |

| Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev. Participating VRDN: | | | |

| Series 15 XF2203, 1.37% 8/5/22 (Liquidity Facility Toronto-Dominion Bank) (b)(e)(f) | | 9,260,000 | 9,260,000 |

| Series EGL 15 0004, 1.35% 8/5/22 (Liquidity Facility Citibank NA) (b)(e)(f) | | 45,460,000 | 45,460,000 |

| Series Floaters ZF 06 92, 1.36% 8/5/22 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 1,990,000 | 1,990,000 |

| Series ZL 02 95, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 1,500,000 | 1,500,000 |

| Massachusetts Spl. Oblig. Dedicated Tax Rev. Bonds Series Floaters G 29, 1.51%, tender 1/3/23 (Liquidity Facility Royal Bank of Canada) (b)(e)(f)(g) | | 5,220,000 | 5,220,000 |

| RBC Muni. Products, Inc. Trust Participating VRDN Series E 148, 1.36% 8/5/22 (Liquidity Facility Royal Bank of Canada) (b)(e)(f) | | 19,100,000 | 19,100,000 |

| Saugus Gen. Oblig. Participating VRDN Series Floaters XF 06 81, 1.37% 8/5/22 (Liquidity Facility Toronto-Dominion Bank) (b)(e)(f) | | 4,615,000 | 4,615,000 |

| Univ. of Massachusetts Bldg. Auth. Facilities Rev. Participating VRDN: | | | |

| Series XF 22 96, 1.36% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(e)(f) | | 5,200,000 | 5,200,000 |

| Series XL 0042, 1.35% 8/5/22 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(e)(f) | | 16,380,000 | 16,380,000 |

TOTAL MASSACHUSETTS | | | 324,815,000 |

| Michigan - 0.0% | | | |

| Mclaren Health Care Corp. Participating VRDN Series XL 02 71, 1.43% 8/5/22 (Liquidity Facility Bank of America NA) (b)(e)(f) | | 200,000 | 200,000 |

| Mississippi - 0.1% | | | |

| Mississippi Bus. Fin. Corp. Rev. Participating VRDN Series 2021 XF 11 05, 1.4% 8/5/22 (Liquidity Facility Deutsche Bank AG New York Branch) (b)(e)(f) | | 700,000 | 700,000 |

| Missouri - 0.2% | | | |

| Kansas City Indl. Dev. Auth. Participating VRDN Series XG 03 96, 1.58% 8/5/22 (Liquidity Facility Deutsche Bank AG New York Branch) (b)(c)(e)(f) | | 1,600,000 | 1,600,000 |

| New York - 0.0% | | | |

| New York City Gen. Oblig. Participating VRDN Series 2020 003, 1.48% 9/9/22 (Liquidity Facility Wells Fargo Bank NA) (b)(e)(f) | | 300,000 | 300,000 |

| Ohio - 0.1% | | | |

| Ohio Hosp. Rev. Participating VRDN Series 002, 1.48% 9/9/22 (Liquidity Facility Barclays Bank PLC) (b)(e)(f) | | 1,000,000 | 1,000,000 |

| Texas - 0.1% | | | |

| North Texas Tollway Auth. Rev. Bonds Series G-112, 1.53%, tender 1/3/23 (Liquidity Facility Royal Bank of Canada) (b)(e)(f)(g) | | 700,000 | 700,000 |

| Virginia - 0.0% | | | |

| Virginia Pub. Bldg. Auth. Pub. Facilities Rev. Bonds Series Floaters G 40, 1.53%, tender 2/1/23 (Liquidity Facility Royal Bank of Canada) (b)(e)(f)(g) | | 300,000 | 300,000 |

| Washington - 0.2% | | | |

| Port of Seattle Rev. Participating VRDN Series XM 10 27, 1.46% 8/5/22 (Liquidity Facility JPMorgan Chase Bank) (b)(c)(e)(f) | | 2,000,000 | 2,000,000 |

| TOTAL TENDER OPTION BOND (Cost $348,085,000) | | | 348,085,000 |

| | | | |

| Other Municipal Security - 21.0% |

| | | Principal Amount (a) | Value ($) |

| Guam - 0.1% | | | |

| Guam Int'l. Arpt. Auth. Rev. Bonds Series 2019 A, 5% 10/1/22 (Escrowed to Maturity) (c) | | 1,165,000 | 1,172,517 |

| Massachusetts - 20.9% | | | |

| Andover Gen. Oblig. BAN Series 2022, 3% 10/13/22 | | 725,000 | 726,579 |

| Billerica Gen. Oblig. BAN Series 2022, 2% 1/27/23 | | 6,625,000 | 6,676,768 |

| Boston Gen. Oblig. Bonds Series 2022 A, 5% 11/1/22 | | 5,400,000 | 5,448,991 |

| Boston Wtr. & Swr. Commission Rev. Series 2022 A, 1.2% 9/7/22, LOC State Street Bank & Trust Co., Boston, CP | | 7,200,000 | 7,200,000 |

| Brockton Gen. Oblig. BAN Series 2022 B, 2.5% 9/16/22 | | 5,600,000 | 5,608,351 |

| Framingham Gen. Oblig. BAN Series 2022, 2% 8/19/22 | | 11,089,126 | 11,094,449 |

| Gloucester Gen. Oblig. BAN Series 2022, 3% 9/16/22 | | 6,550,000 | 6,558,653 |

| Groton BAN Series 2022, 2% 2/17/23 | | 4,042,659 | 4,069,025 |

| Littleton Gen. Oblig. BAN: | | | |

| Series 2021, 2% 11/18/22 | | 3,269,000 | 3,286,532 |

| Series 2022, 3% 11/18/22 | | 2,833,500 | 2,847,283 |

| Massachusetts Dev. Fin. Agcy. Elec. Util. Rev. Bonds Series 2022, 1.55% tender 8/11/22 (Massachusetts Elec. Co. Guaranteed), CP mode (c) | | 10,300,000 | 10,300,000 |

| Massachusetts Gen. Oblig. Bonds: | | | |

| Series 2013 B, 5% 8/1/22 | | 590,000 | 590,000 |

| Series 2014 E: | | | |

5% 9/1/22 | | 100,000 | 100,293 |

5% 9/1/22 (Pre-Refunded to 9/1/22 @ 100) | | 2,305,000 | 2,311,704 |

| Series 2014 F: | | | |

5% 11/1/22 (Pre-Refunded to 11/1/22 @ 100) | | 3,880,000 | 3,913,045 |

5% 11/1/22 (Pre-Refunded to 11/1/22 @ 100) | | 3,930,000 | 3,963,095 |

| Series 2017 C, 5% 10/1/22 | | 480,000 | 483,211 |

| Series 2018 E, 5% 9/1/22 | | 100,000 | 100,296 |

| Series 2020 E, 5% 11/1/22 | | 1,900,000 | 1,916,340 |

| Series A, 5.25% 8/1/22 | | 140,000 | 140,000 |

| Series C, 5.5% 12/1/22 | | 540,000 | 547,658 |

| Series D2, 1.7%, tender (b) | | 7,465,000 | 7,465,000 |

| Massachusetts Health & Edl. Facilities Auth. Rev. Bonds: | | | |

| Series 2022 H1: | | | |

1.1% tender 8/1/22, CP mode | | 5,800,000 | 5,800,000 |

1.15% tender 8/2/22, CP mode | | 7,350,000 | 7,350,000 |

| Series 2022 H2: | | | |

1.19% tender 9/7/22, CP mode | | 5,730,000 | 5,730,000 |

1.35% tender 8/4/22, CP mode | | 6,000,000 | 6,000,000 |

| Series 2022, 1.38% tender 8/3/22, CP mode | | 8,450,000 | 8,450,000 |

| Massachusetts Hsg. Fin. Auth. RAN Series 2021, 0.25% 12/1/22 | | 2,765,000 | 2,765,000 |

| Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev. Bonds: | | | |

| Series 2012 A: | | | |

5% 8/15/22 | | 830,000 | 831,136 |

5% 8/15/22 (Pre-Refunded to 8/15/22 @ 100) | | 5,705,000 | 5,713,474 |

5% 8/15/22 (Pre-Refunded to 8/15/22 @ 100) | | 3,930,000 | 3,936,034 |

| Series 2012 B: | | | |

5% 8/15/22 (Pre-Refunded to 8/15/22 @ 100) | | 200,000 | 200,275 |

5% 8/15/22 (Pre-Refunded to 8/15/22 @ 100) | | 775,000 | 776,098 |

5% 8/15/22 (Pre-Refunded to 8/15/22 @ 100) | | 1,985,000 | 1,988,237 |

| Series A, 5% 8/15/22 (Pre-Refunded to 8/15/22 @ 100) | | 160,000 | 160,205 |

| Massachusetts Wtr. Resources Auth. Wtr. & Swr. Rev. Bonds: | | | |

| Series 2012 A, 5% | | 200,000 | 200,000 |

| Series 2012 B: | | | |

5% | | 2,405,000 | 2,405,000 |

5% | | 290,000 | 290,000 |

| Series 2013 A, 5% 8/1/22 | | 1,600,000 | 1,600,000 |

| Series 2020 C, 4% 8/1/22 | | 2,400,000 | 2,400,000 |

| Series 2022 J, 5.5% 8/1/22 | | 2,420,000 | 2,420,000 |

| Nantucket Gen. Oblig. BAN: | | | |

| Series 2021 A, 1.5% 10/14/22 | | 11,483,000 | 11,510,886 |

| Series 2022, 3% 10/14/22 | | 10,500,000 | 10,525,216 |

| Natick Gen. Oblig. BAN Series 2022, 3% 8/25/22 | | 1,800,000 | 1,801,768 |

| Needham Gen. Oblig. Bonds Series 2022, 5% 8/15/22 | | 1,600,000 | 1,602,309 |

| North Middlesex Reg'l. School District BAN Series 2022, 3% 2/3/23 | | 5,432,303 | 5,495,509 |

| Salem Gen. Oblig. BAN Series 2022, 3% 11/18/22 | | 6,283,785 | 6,308,791 |

| Town of Tisbury Gen. Oblig. BAN Series 2022, 1.5% 8/16/22 | | 6,500,000 | 6,502,308 |

| Univ. of Massachusetts Bldg. Auth. Facilities Rev. Bonds: | | | |

| Series 2013 1, 4% 11/1/22 (Pre-Refunded to 11/1/22 @ 100) | | 2,500,000 | 2,521,452 |

| Series 2013, 5% 11/1/22 (Pre-Refunded to 11/1/22 @ 100) | | 1,200,000 | 1,210,112 |

| Waltham Gen. Oblig. BAN Series 2022, 3% 4/28/23 | | 6,800,000 | 6,841,491 |

| Westwood Gen. Oblig. BAN Series 2022, 2% 8/19/22 | | 2,000,000 | 2,001,188 |

| Worcester Gen. Oblig.: | | | |

| BAN Series 2022, 3% 3/1/23 | | 10,400,000 | 10,464,448 |

| Bonds Series 2022, 5% 2/1/23 | | 4,335,000 | 4,434,760 |

TOTAL MASSACHUSETTS | | | 215,582,970 |

| Michigan - 0.0% | | | |

| Kent Hosp. Fin. Auth. Hosp. Facilities Rev. Bonds (Spectrum Health Sys. Proj.) Series 2015 A, SIFMA Municipal Swap Index + 0.250% 1.58%, tender 1/24/23 (b)(h) | | 100,000 | 100,000 |

| TOTAL OTHER MUNICIPAL SECURITY (Cost $216,855,487) | | | 216,855,487 |

| | | | |

| Investment Company - 9.0% |

| | | Shares | Value ($) |

Fidelity Municipal Cash Central Fund 1.41% (i)(j) (Cost $93,162,965) | | 93,151,063 | 93,162,965 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 99.3% (Cost $1,025,791,452) | 1,025,791,452 |

NET OTHER ASSETS (LIABILITIES) - 0.7% | 6,877,101 |

| NET ASSETS - 100.0% | 1,032,668,553 |

| | |

Security Type Abbreviations

| BAN | - | BOND ANTICIPATION NOTE |

| CP | - | COMMERCIAL PAPER |

| RAN | - | REVENUE ANTICIPATION NOTE |

| VRDN | - | VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly) |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets

Legend

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (c) | Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $12,655,000 or 1.2% of net assets. |

| (e) | Provides evidence of ownership in one or more underlying municipal bonds. |

| (f) | Coupon rates are determined by re-marketing agents based on current market conditions. |

| (g) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $6,220,000 or 0.6% of net assets. |

| (h) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (i) | Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund. |

| (j) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| Additional information on each restricted holding is as follows: |

| Security | Acquisition Date | Cost ($) |

| Massachusetts Spl. Oblig. Dedicated Tax Rev. Bonds Series Floaters G 29, 1.51%, tender 1/3/23 (Liquidity Facility Royal Bank of Canada) | 7/01/21 | 5,220,000 |

| North Texas Tollway Auth. Rev. Bonds Series G-112, 1.53%, tender 1/3/23 (Liquidity Facility Royal Bank of Canada) | 7/01/21 | 700,000 |

| Virginia Pub. Bldg. Auth. Pub. Facilities Rev. Bonds Series Floaters G 40, 1.53%, tender 2/1/23 (Liquidity Facility Royal Bank of Canada) | 2/01/21 | 300,000 |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | %ownership, end of period |

| Fidelity Municipal Cash Central Fund 1.41% | 141,353,965 | 209,355,000 | 257,546,000 | 318,534 | - | - | 93,162,965 | 5.8% |

| Total | 141,353,965 | 209,355,000 | 257,546,000 | 318,534 | - | - | 93,162,965 | |

| | | | | | | | | |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Investment Valuation

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in these securities. For more information on valuation inputs, refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

Fidelity® Massachusetts Municipal Money Market Fund

| Statement of Assets and Liabilities |

| | | | July 31, 2022 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | $932,628,487 | | |

Unaffiliated issuers (cost $932,628,487) | | | |

Fidelity Central Funds (cost $93,162,965) | | 93,162,965 | | |

| | | | | |

| Total Investment in Securities (cost $1,025,791,452) | | | $ | 1,025,791,452 |

| Cash | | | | 10,300,763 |

| Receivable for investments sold | | | | 5,004,265 |

| Receivable for fund shares sold | | | | 83,745 |

| Interest receivable | | | | 2,585,288 |

| Distributions receivable from Fidelity Central Funds | | | | 76,453 |

| Other receivables | | | | 527 |

Total assets | | | | 1,043,842,493 |

| Liabilities | | | | |

| Payable for investments purchased | | 10,300,000 | | |

| Payable for fund shares redeemed | | 413,234 | | |

| Distributions payable | | 15,126 | | |

| Accrued management fee | | 302,682 | | |

| Other affiliated payables | | 116,898 | | |

| Other payables and accrued expenses | | 26,000 | | |

| Total Liabilities | | | | 11,173,940 |

| Net Assets | | | $ | 1,032,668,553 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 1,032,687,247 |

| Total accumulated earnings (loss) | | | | (18,694) |

| Net Assets | | | $ | 1,032,668,553 |

Net Asset Value , offering price and redemption price per share ($1,032,668,553 ÷ 1,030,687,722 shares) | | | $ | 1.00 |

| | | | | |

| Statement of Operations |

| | | | Six months ended July 31, 2022 (Unaudited) |

| Investment Income | | | | |

| Interest | | | $ | 2,700,567 |

| Income from Fidelity Central Funds | | | | 318,534 |

| Total Income | | | | 3,019,101 |

| Expenses | | | | |

| Management fee | $ | 1,858,720 | | |

| Transfer agent fees | | 658,224 | | |

| Accounting fees and expenses | | 61,196 | | |

| Custodian fees and expenses | | 5,053 | | |

| Independent trustees' fees and expenses | | 1,671 | | |

| Registration fees | | 11,464 | | |

| Audit | | 19,381 | | |

| Legal | | 1,726 | | |

| Miscellaneous | | 1,205 | | |

| Total expenses before reductions | | 2,618,640 | | |

| Expense reductions | | (498,899) | | |

| Total expenses after reductions | | | | 2,119,741 |

| Net Investment income (loss) | | | | 899,360 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (9,648) | | |

| Total net realized gain (loss) | | | | (9,648) |

| Net increase in net assets resulting from operations | | | $ | 889,712 |

| Statement of Changes in Net Assets |

| |

| | Six months ended July 31, 2022 (Unaudited) | | Year ended January 31, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 899,360 | $ | 117,911 |

| Net realized gain (loss) | | (9,648) | | 260,847 |

Net increase in net assets resulting from operations | | 889,712 | | 378,758 |

| Distributions to shareholders | | (898,884) | | (739,846) |

| Share transactions | | | | |

| Proceeds from sales of shares | | 42,375,017 | | 97,915,300 |

| Reinvestment of distributions | | 863,203 | | 716,786 |

| Cost of shares redeemed | | (117,479,114) | | (249,148,198) |

Net increase (decrease) in net assets and shares resulting from share transactions | | (74,240,894) | | (150,516,112) |

| Total increase (decrease) in net assets | | (74,250,066) | | (150,877,200) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 1,106,918,619 | | 1,257,795,819 |

| End of period | $ | 1,032,668,553 | $ | 1,106,918,619 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 42,375,018 | | 97,915,300 |

| Issued in reinvestment of distributions | | 863,203 | | 716,786 |

| Redeemed | | (117,479,115) | | (249,148,198) |

| Net increase (decrease) | | (74,240,894) | | (150,516,112) |

| | | | | |

| Fidelity® Massachusetts Municipal Money Market Fund |

| |

| | Six months ended (Unaudited) July 31, 2022 | | Years ended January 31, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A | | .001 | | - B | | .003 | | .009 | | .010 | | .005 |

| Net realized and unrealized gain (loss) | | - B | | .001 | | - B | | .002 | | - B | | - B |

| Total from investment operations | | .001 | | .001 | | .003 | | .011 | | .010 | | .005 |

| Distributions from net investment income | | (.001) | | - B | | (.003) | | (.010) | | (.010) | | (.005) |

| Distributions from net realized gain | | - | | (.001) | | (.001) | | (.001) | | - | | (.001) |

| Total distributions | | (.001) | | (.001) | | (.003) C | | (.011) | | (.010) | | (.005) C |

| Net asset value, end of period | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 |

Total Return D,E | | .09% | | .06% | | .32% | | 1.09% | | .99% | | .53% |

Ratios to Average Net Assets A,F,G | | | | | | | | | | | | |

| Expenses before reductions | | .49% H | | .49% | | .49% | | .49% | | .49% | | .48% |

| Expenses net of fee waivers, if any | | .40% H | | .07% | | .30% | | .49% | | .49% | | .48% |

| Expenses net of all reductions | | .40% H | | .07% | | .30% | | .49% | | .49% | | .48% |

| Net investment income (loss) | | .17% H | | .01% | | .28% | | 1.02% | | .97% | | .44% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 1,032,669 | $ | 1,106,919 | $ | 1,257,796 | $ | 1,508,879 | $ | 1,934,028 | $ | 2,511,930 |

A Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any such underlying funds is not included in the Fund's net investment income (loss) ratio.

B Amount represents less than $.0005 per share.

C Total distributions per share do not sum due to rounding.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

H Annualized

For the period ended July 31, 2022

1. Organization.

Fidelity Massachusetts Municipal Income Fund (the Income Fund) and Fidelity Massachusetts Municipal Money Market Fund (the Money Market Fund) are funds of Fidelity Massachusetts Municipal Trust (the Trust). The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Income Fund is a non-diversified fund. Each Fund is authorized to issue an unlimited number of shares. Shares of the Money Market Fund are only available for purchase by retail shareholders. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. Each Fund may be affected by economic and political developments in the state of Massachusetts. Effective after the close of business on September 9, 2022, Fidelity Massachusetts Municipal Money Market Fund will be closed to new accounts with certain exceptions.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.