- OSBC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Old Second Bancorp (OSBC) DEF 14ADefinitive proxy

Filed: 12 Mar 02, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

| Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

Old Second Bancorp, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

March 12, 2002

Dear Stockholder:

You are cordially invited to attend the 2002 annual meeting of stockholders of Old Second Bancorp, Inc. to be held on Tuesday, April 16, 2002 at 11:00 a.m., local time. The meeting will be held at our offices located at 37 South River Street, Aurora, Illinois.

The formal items of business to be considered at the meeting include the election of four directors, the approval of a new stock incentive plan and the ratification of our independent auditors, each of which is described in the following pages. In addition, we will report on our performance in 2001 and address questions or comments from stockholders.

We encourage you to attend the meeting in person.Whether or not you plan to attend, however, please read the enclosed proxy statement and then complete, sign and date the enclosed proxy and return it in the accompanying postpaid return envelope as promptly as possible. This will save us additional expense in soliciting proxies and will ensure that your shares are represented at the meeting.

A copy of our annual report to stockholders for the year 2001 is also enclosed. Thank you for your continued support and we look forward to seeing you at the meeting.

Sincerely, | ||

| James E. Benson Chairman | William B. Skoglund President and Chief Executive Officer | |

OLD SECOND BANCORP, INC.

37 South River Street, Aurora, Illinois 60507

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 16, 2002

TO THE STOCKHOLDERS:

The annual meeting of stockholders of Old Second Bancorp, Inc., will be held on Tuesday, April 16, 2002 at 11:00 a.m. at our premises located at 37 South River Street, Aurora, Illinois, for the following purposes:

The Board of Directors is not aware of any other business to come before the meeting. Stockholders of record at the close of business on March 4, 2002, are the stockholders entitled to vote at the meeting and any and all adjournments or postponements of the meeting. In the event there are not sufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the annual meeting, the meeting may be adjourned or postponed in order to permit further solicitation of proxies.

By Order of the Board of Directors | ||

| James E. Benson Chairman | William B. Skoglund Chief Executive Officer and President | |

Aurora, Illinois March 12, 2002 | ||

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE US THE EXPENSE OF FURTHER REQUESTS FOR PROXIES TO ENSURE A QUORUM AT THE MEETING. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED WITHIN THE UNITED STATES.

Old Second Bancorp, Inc.

37 South River Street • Aurora, IL 60507 • (630) 892-0202

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Old Second Bancorp, Inc., a Delaware corporation, of proxies to be voted at the annual meeting of stockholders. This meeting is to be held at our premises located at 37 South River Street, Aurora, Illinois on April 16, 2002 at 11:00 a.m., local time, or at any postponements or adjournments of the meeting. Old Second conducts full service community banking and trust business through its wholly-owned subsidiaries: The Old Second National Bank of Aurora, Yorkville National Bank, Kane County Bank, Maple Park Mortgage and Old Second Financial Corporation.

A copy of our annual report for the year ended December 31, 2001, which includes audited financial statements, is enclosed. This proxy statement was mailed to stockholders on or about March 12, 2002.

Why am I receiving this proxy statement and proxy form?

You are receiving a proxy statement and proxy form from us because on March 4, 2002, you owned shares of our common stock. This proxy statement describes issues on which we would like you, as a stockholder, to vote. It also gives you information on these issues so that you can make an informed decision.

When you sign the enclosed proxy form, you appoint the proxy holder as your representative at the meeting. The proxy holder will vote your shares as you have instructed in the proxy form, ensuring that your shares will be voted whether or not you attend the meeting. Even if you plan to attend the meeting, you should complete, sign and return your proxy form in advance of the meeting just in case your plans change.

If you have signed and returned the proxy form and an issue comes up for a vote at the meeting that is not identified on the form, the proxy holder will vote your shares, under your proxy, in accordance with his or her best judgment.

What matters will be voted on at the meeting?

You are being asked to vote on the election of four directors of Old Second, the approval of the Old Second Bancorp, Inc. 2002 Long-Term Incentive Plan and the ratification and approval of Ernst & Young LLP to serve as our independent auditors for 2002. These matters are more fully described in this proxy statement.

How do I vote?

A form of proxy is enclosed for use at the meeting. If the proxy is executed and returned, it may nevertheless be revoked at any time insofar as it has not been exercised. Stockholders attending the meeting may, on request, vote their own shares even though they have previously sent in a proxy. Unless revoked or instructions to the contrary are contained in the proxies, the shares represented by validly executed proxies will be voted at the meeting and will be voted "for" the election of the nominees for director named in this proxy statement, "for" the ratification and approval of the long term incentive plan and "for" the ratification and approval of the selection of Ernst & Young LLP as our independent accountants for the fiscal year ending December 31, 2002.

What does it mean if I receive more than one proxy form?

It means that you have multiple holdings reflected in our stock transfer records and/or in accounts with stockbrokers. Please sign and returnALL proxy forms to ensure that all your shares are voted.

1

If I hold shares in the name of a broker, who votes my shares?

If you received this proxy statement from your broker, your broker should have given you instructions for directing how the broker should vote your shares. It will then be your broker's responsibility to vote your shares for you in the manner you direct.

Under the rules of the Nasdaq National Market System, brokers may generally vote on routine matters, such as the election of directors, but cannot vote on non-routine matters, such as the approval of a long-term incentive plan, unless they have received voting instructions from the person for whom they are holding shares. Therefore, if you do not give your broker instructions as to how to vote your shares, your broker will be able to vote on the election of directors but will not have discretionary authority to cast a vote—whether "for" or "against" or "abstain"—on the approval of the long-term incentive plan. If your broker does not receive instructions from you on how to vote particular shares on the proposed adoption of the long-term incentive plan or the ratification and approval of the auditors and your broker does not have discretionary authority to vote on these matters, the proxy form will be returned to us, indicating that he or she does not have the authority to vote on these matters. This is generally referred to as a "broker non-vote" and will affect the outcome of the voting as described below, under "How many votes are needed for approval of each proposal?" Therefore, we encourage you to provide directions to your broker as to how you want your shares voted on the matters to be brought before the meeting. You should do this by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the meeting.

How many votes do we need to hold the annual meeting?

A majority of the shares that were outstanding and entitled to vote as of the record date must be present in person or by proxy at the meeting in order to hold the meeting and conduct business. On March 4, 2002, the record date, there were 5,601,194 shares outstanding. A majority of these shares must be present in person or by proxy at the meeting.

Shares are counted as present at the meeting if the stockholder either:

What happens if any nominee is unable to stand for re-election?

The Board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. Proxies cannot be voted for more than four nominees. The Board has no reason to believe any nominee will be unable to stand for re-election.

What options do I have in voting on each of the proposals?

You may vote "for" or "withhold authority to vote for" each nominee for director. You may vote "for," "against" or "abstain" on any other proposal that may properly be brought before the meeting.

How many votes are needed for each proposal?

The four individuals receiving the highest number of votes cast "for" their election will be elected as directors of Old Second.

The proposed adoption of the long-term incentive plan and the ratification and approval of Ernst & Young LLP as our independent auditors must each receive the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote. An abstention will have

2

the same effect as a vote against the approval of the amendment to the long-term incentive plan and the ratification and approval of our auditors. Broker non-votes will not be counted as entitled to vote, but will count for purposes of determining whether or not a quorum is present on the matter. So long as a quorum is present, broker non-votes will have no effect on the outcome of the vote on the adoption of the long-term incentive plan or the ratification and approval of our auditors.

How are votes counted?

Voting results will be tabulated and certified by the election judges.

Where do I find the voting results of the meeting?

We will announce voting results at the meeting. The voting results will also be disclosed in our Form 10-Q for the quarter ended March 31, 2002, which will be filed with the Securities and Exchange Commission.

The Board of Directors is divided into three classes, approximately equal in number. Each year, we ask the stockholders to elect the members of one class for a term of three years. At the annual meeting to be held on April 16, 2002, you will be entitled to elect four directors for terms expiring in 2005. We have no knowledge that any of the nominees will refuse or be unable to serve, but if any of the nominees becomes unavailable for election, the holders of proxies reserve the right to substitute another person of their choice as a nominee when voting at the meeting.

Set forth below is information concerning the nominees for election and for the other directors whose term of office will continue after the meeting, including their age, year first elected a director and business experience of each person during the previous five years. The four nominees for directors, if elected at the annual meeting, will serve for a three year term expiring in 2005.The Board of Directors recommends you vote your shares FOR each of the nominees for director.

| NOMINEES | ||||

|---|---|---|---|---|

Name | Served as Old Second Director Since | Principal Occupation | ||

| (Term Expires 2005) | ||||

Marvin Fagel (Age 54) | 1996 | President, Aurora Packing Co., a meat packing company; Chairman of the Board and CEO, New City Packing Company, a meat packing company | ||

William Kane (Age 51) | 1999 | Partner, Label Printers Inc., a printing company | ||

Kenneth Lindgren (Age 61) | 1990 | President, Daco Incorporated, contract manufacturer of machined components | ||

Jesse Maberry (Age 58) | 1985 | Treasurer, Aurora Bearing Company, a manufacturer of rod end spherical bearings | ||

CONTINUING DIRECTORS | ||||

(Term Expires 2004) | ||||

Walter Alexander (Age 67) | 1976 | President, Alexander Lumber Co., building material sales | ||

3

Edward Bonifas (Age 42) | 2000 | Vice President, Alarm Detection Systems Inc., producer and installer of alarm systems, close-captioned video systems and card access systems, and locksmiths | ||

William Meyer (Age 54) | 1995 | President, William F. Meyer Co., a wholesale plumbing supply company | ||

William B. Skoglund (Age 51) | 1992 | President and Chief Executive Officer of Old Second and Old Second National Bank | ||

(Term Expires 2003) | ||||

James E. Benson (Age 71) | 1971 | Chairman of the Board and Director of Old Second (1993-present); Chief Executive Officer of Old Second National Bank (1974-1998) | ||

D. Chet McKee (Age 62) | 1978 | Vice President—Special Projects, Rush-Copley Medical Center (2000-present); President and CEO, Rush-Copley Medical Center (1990-2000) | ||

Gerald Palmer (Age 56) | 1998 | Vice President/General Manager, Caterpillar Inc., construction equipment manufacturer | ||

James Carl Schmitz (Age 53) | 1999 | Tax Consultant (1999-present); director of taxes with H.B. Fuller Company (1998); tax specialist with KPMG LLP (1999) |

Upon attaining age 70, an elected director assumes the status of a senior director for a period of three years. Every senior director has a right to attend all Board and committee meetings to which they are appointed and to participate in all discussions during such meetings. However, a senior director does not have the right to vote on any matter. Currently, the only senior director on the Board of Directors is Chairman Benson, who reached senior status in 2000, and plans to remain as a senior director until 2003.

Walter Alexander, a director of Old Second, is also a director of Wausau-Mosinee Paper Corporation, a corporation with a class of securities registered pursuant to Section 12 of the Exchange Act. Mr. Gerald Palmer, a director of Old Second, is also a director of JLB Industries, a corporation with a class of securities registered pursuant to Section 12 of the Exchange Act.

4

Meetings of the Board of Directors and Committees

The Board of Directors held twelve regular meetings during 2001. During 2001, all of the directors attended at least 75% of all of Old Second's Board meetings and meetings of the committees on which they served, with the exception of Mr. Palmer, who attended approximately 66% of the Board meetings, due to business travel.

The Board of Directors has established audit and nominating committees, as well as other committees, to assist in the discharge of its responsibilities. Actions taken by any committee of the Board are reported to the full Board, usually at its next meeting. The principal responsibilities of the audit and nominating committees are described below. The members of each committee serve during the period between annual stockholders' meetings.

The members of our audit committee during 2001 were Messrs. Alexander, Kane, McKee, and Schmitz. The audit committee met six times during 2001 and Walter Alexander, Chairman of the audit committee, met on a quarterly basis with the independent accountants. The audit committee charter sets forth the duties and responsibilities of the committee.

The members of our nominating committee during 2001 were Messrs. Alexander, Benson, Lindgren, Maberry, McKee, and Skoglund. The committee reviews the qualifications of, and recommends to the Board, candidates to fill vacancies on the Board as they may occur during the year. The nominating committee will consider suggestions from all sources, including stockholders, regarding possible candidates for director. Such suggestions, together with appropriate biographical information, should be submitted to our corporate secretary, who will forward it to the committee. This committee met one time during 2001.

We do not have a separate compensation committee, since compensation levels are determined by the Board of Directors of each of our subsidiaries. All of our executive officers are also executive officers of Old Second National Bank, and are compensated by the bank rather than directly by the holding company. Accordingly, their compensation is determined and approved by the compensation committee and Board of Directors of Old Second National Bank.

Compensation of Directors

All persons who serve as directors of Old Second also serve as directors of Old Second National Bank. We do not pay any fees to any of the directors in their capacity as directors of Old Second.

However, during 2001, Old Second National Bank paid directors' fees to non-employee directors consisting of a $3,500 annual retainer fee, $500 for each Board of Directors meeting attended and $200 for each committee meeting attended. Directors also have the option to defer directors' fees through a phantom stock program available to them. As previously discussed, the members of the Board of Old Second National Bank are also Board members of Old Second.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock at December 31, 2001, by each person known by us to be the beneficial owner of more than five percent of the outstanding common stock, by each director or nominee, by each executive officer named in the summary compensation table below and by all directors and executive officers of

5

Old Second as a group. Unless otherwise noted, the address of each five percent stockholder is 37 South River Street, Aurora, Illinois 60507.

| Name of Individual and Number of Persons in Group | Amount and Nature of Beneficial Ownership(1) | Percent of Class | |||

|---|---|---|---|---|---|

| 5% Stockholders | |||||

| Old Second Bancorp, Inc. (2) Profit Sharing Plan & Trust | 400,388 | 7.0 | % | ||

Banc Funds(3) 208 South LaSalle Street Chicago, Illinois 60604 | 408,360 | 7.1 | % | ||

Directors | |||||

| Walter Alexander | 38,784 | * | |||

| James Benson(4) | 109,895 | 1.9 | % | ||

| Edward Bonifas | 3,349 | * | |||

| Marvin Fagel | 17,152 | * | |||

| William Kane | 5,000 | * | |||

| Kenneth Lindgren | 27,000 | * | |||

| Jesse Maberry | 13,310 | * | |||

| D. Chet McKee | 1,500 | * | |||

| William Meyer | 24,139 | * | |||

| Gerald Palmer | 1,000 | * | |||

| James Carl Schmitz(5) | 262,820 | 4.6 | % | ||

| William B. Skoglund(6) | 52,905 | * | |||

Other Named Executive Officers | |||||

| J. Douglas Cheatham(7) | 4,002 | * | |||

All directors and executive officers | 560,856 | 9.8 | % |

6

Compliance with Section 16 (a) of The Exchange Act

Section 16(a) of the Securities Exchange Act of 1934 requires that our directors, executive officers and 10% stockholders file reports of ownership and changes in ownership with the Securities and Exchange Commission. Such persons are also required to furnish us with copies of all Section 16(a) forms they file. Based solely upon a review of these forms, we are not aware that any of our directors, executive officers or 10% stockholders failed to comply with the filing requirements of Section 16(a) during 2001.

7

The table which follows sets forth information regarding compensation paid for each of the years ended December 31, 2001, 2000, and 1999 to those individuals who were either the chief executive officer or an executive officer whose annual salary exceeded $100,000.

| | | Annual Compensation | Long Term Compensation Awards | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (a) | (b) | (c) | (d) | (e) | (f) | ||||||||||

| Name and Principal Position | Fiscal Year Ended December 31st | Salary($)(1) | Other annual compensation ($) | Securities Underlying Options/ SARs(#) | All Other Compensation ($)(2) | ||||||||||

| James E. Benson Chairman of the Board of Old Second | 2001 2000 1999 | $ | 112,850 120,000 108,750 | $ | — — 5,428 | — — — | $ | — — — | |||||||

| William B. Skoglund President and Chief Executive Officer of Old Second and Old Second National Bank | 2001 2000 1999 | $ | 305,592 286,750 258,822 | $ | 24,698 17,261 16,551 | 12,000 10,000 8,500 | $ | 62,544 46,440 5,332 | (3) | ||||||

| J. Douglas Cheatham Chief Financial Officer of Old Second | 2001 2000 1999 | $ | 168,000 156,000 93,750 | $ | 15,388 7,095 — | 4,500 4,000 2,500 | $ | 31,798 23,020 25,000 | (3) (4) | ||||||

8

Stock Option Information

The following table sets forth certain information concerning the number and value of stock options granted in the fiscal year to the individuals named in the summary compensation table:

| OPTION GRANTS IN LAST FISCAL YEAR | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Individual Grants | |||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | | |||||||||

| | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | ||||||||||

| | Options Granted (#)(1) | % of Total Options Granted to Employees in Fiscal Year | Exercise or Base Price ($/Share) | | |||||||||||

| | Expiration Date | ||||||||||||||

| Name | 5% | 10% | |||||||||||||

| William B. Skoglund | 12,000 | 30.7% | $ | 39.30 | 12/18/11 | $ | 296,587 | $ | 751,609 | ||||||

| J. Douglas Cheatham | 4,500 | 11.5% | $ | 39.30 | 12/18/11 | $ | 111,220 | $ | 281,853 | ||||||

The following table sets forth information concerning the stock options at December 31, 2001 held by the named executive officers. No stock options were exercised during 2001 by any of the named executive officers.

| AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND FY-END OPTION/SAR VALUES | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Shares Acquired on Exercise (#)(b) | | Number of Securities Underlying Unexercised Options/SARs at FY-End (#)(d) | Value of Unexercised In- the-Money Options/SARs at FY-End ($)(e) | |||||||||||

| | Value Realized ($)(c)(1) | ||||||||||||||

| Name (a) | |||||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

| William B. Skoglund | — | $ | — | 33,500 | 21,500 | $ | 455,565 | $ | 145,007 | ||||||

| J. Douglas Cheatham | — | $ | — | 3,000 | 8,000 | $ | 40,122 | $ | 51,948 | ||||||

Change of Control Agreements

Effective January 2, 1996, Mr. Benson retired as Chief Executive Officer of Old Second National Bank. He retained the title of Chief Executive Officer of Old Second until June 1998, when Mr. Skoglund was named President and Chief Executive Officer of Old Second. However, during the period Mr. Benson has continued in his position as Chairman of the Board of Old Second. Mr. Benson will continue to serve in his position as Chairman of the Board of Old Second through December 31, 2002. As in the period between 1996-2001, Mr. Benson will continue to serve on Board committees of the mortgage company and banks as well as on the Board of Old Second as a senior director. In these positions, Mr. Benson will participate in exit interviews with regulatory examiners and will be available to bank management as a consultant. In exchange for these and other services to be performed during 2002, Mr. Benson will receive a fee of $86,000.

On January 1, 1997, Mr. Skoglund entered into a Compensation and Benefits Assurance Agreement with us. The initial term of the agreement was for one year and is automatically extended for successive one-year periods, unless earlier terminated by either party. The agreement provides for lump-sum payments of severance benefits in the amount of three times base salary in the event of a "Change in Control" (as defined in the agreement) of Old Second or Old Second National Bank or a qualifying termination, which includes an involuntary termination without cause or a constructive

9

termination. In these instances, Mr. Skoglund would also receive three years continuation of welfare benefits, one year of outplacement services, accelerated vesting of stock options or other incentive awards and any additional payment necessary to make him whole for any excise taxes that may be imposed.

Mr. Cheatham, Chief Financial Officer of Old Second, entered into a Benefit Assurance Agreement with us on May 17, 1999. The initial term of his agreement was through December 31, 2000, but is automatically extended for successive one-year periods, unless earlier terminated by either party. This agreement provides for lump-sum severance benefits in the amount of two times base salary in the event of a "change in control" (as defined in the Agreement) of Old Second or Old Second National Bank or a qualifying termination, which includes an involuntary termination without cause or a constructive termination. In these instances, he would receive two years continuation of welfare benefits, one year of outplacement services, accelerated vesting of stock options or other incentive awards and any additional payment necessary to make him whole for any excise tax that may be imposed.

Compensation Committee Report On Executive Compensation

The incorporation by reference of this proxy statement into any document filed with the Securities and Exchange Commission by Old Second shall not be deemed to include the following report unless such report is specifically stated to be incorporated by reference into such document.

Introduction

Old Second and Old Second National Bank share an executive management team, the members of which are compensated by the bank instead of the holding company. Accordingly, each of their compensation packages, which is based upon their roles and performance for both Old Second and Old Second National Bank, is determined and approved by the compensation committee and the Board of Directors of Old Second. The members of the committee are directors of both Old Second and Old Second National Bank. Messrs. Alexander, Fagel, Kane and Meyer were members of the compensation committee in 2001.

Compensation Philosophy and Objectives

The executive compensation program is designed to guide the committee in formulating an appropriate compensation structure for senior management. The overall objective is to align senior management compensation with the success of meeting our goals by creating strong incentives to manage the business successfully from both a financial and operating perspective. The executive compensation program is structured to accomplish the following specific objectives:

10

There are three major components to executive officer compensation: base salary and bonus, stock options and additional benefit plans. The process utilized by the committee in determining executive officer compensation levels for all of these components is based upon the committee's subjective judgment and takes into account both qualitative and quantitative factors. No specific weights are assigned to such factors with respect to any compensation component. Among the factors considered by the committee are the recommendations of the senior management with respect to the compensation of other key executive officers. However, the committee makes the final compensation decisions concerning such officers.

Base Salary and Bonus

The compensation committee reviews each executive's base salary on an annual basis. The committee believes that the base salaries should offer security to each executive and allow Old Second to attract qualified executives and maintain a stable management team and environment. The committee targets base salaries at market levels, although it may be adjusted, either up or down, to reflect Old Second's performance. Initially, base salaries are determined examining, among other things, an executive's level of responsibility, prior experience, education, breadth of knowledge, internal performance objectives and the current market level.

Annual adjustment to an executive's base salary is driven by corporate and individual performance. Corporate performance, measured primarily in terms of earnings per share, return on equity and assets and enhancement of book value per share, impacts an executive's base salary. In addition, the committee will also measure individual performance. When measuring individual performance, the committee considers the individual's efforts in achieving established financial and business objectives, managing and developing employees and enhancing long term relationships with customers. A bonus may also be granted based on specific individual goals and corporate performance.

The compensation of Mr. Benson, the Chairman of the Board during 2001, was based upon his continuing advisory role and his individual performance and contributions to Old Second and the community. Accordingly, Mr. Benson's base salary was the same as his 2000 base salary. As the President and Chief Executive Officer of Old Second, Mr. Skoglund's base salary increased by approximately 8.85% in 2001 to reflect a salary commensurate with his role and responsibilities. In determining Mr. Skoglund's salary in 2001, the committee also considered Mr. Skoglund's individual performance and his long-term contributions to Old Second's success. Overall, salary increases for the other senior executive officers were at a rate comparable to the increases provided to officers with similar duties and responsibilities at comparable organizations.

11

Stock Awards

Our current long-term incentive plan is intended to promote equity ownership in Old Second by the directors and selected officers and employees, to increase their proprietary interest in the success of Old Second and to encourage them to remain in the employ of Old Second or its subsidiaries. To reinforce our long-term perspective and to retain valued executives, these options vest ratably over a three year period following grant. Options are issued at the market value of the common stock, thereby providing a benefit only upon future stock appreciation.

Executives receive stock option grants that are generally comparable to the long-term incentive opportunities granted to individuals with similar positions at financial institutions of similar size. In 2001, the number of stock options granted were similar in number to those granted in 2000.

Benefits, Qualified Service Plans and Perquisites

Benefits offered to executives are intended to serve a different purpose than base salary and stock options. While the benefits offered are competitive with the marketplace and help attract and retain executives, generally, the benefits offered provide a safety net of protection against financial catastrophes that can result from illness, disability, or death. Benefits offered to executives are generally those offered to the general employee population, with some variation to promote tax efficiency and replacement of benefit opportunities lost to regulatory limits. Old Second offers eligible employees three tax-qualified plans: a 401(k) savings plan, a profit sharing plan and a pension plan.

The 401(k) savings program allows a maximum voluntary salary deferral of up to 12% (with a partial company match), subject to statutory limitations. The profit sharing arrangement provides an annual discretionary contribution to the retirement account of each employee based in part on our profitability in a given year, and on each participant's annual compensation. The pension plan targets a 50% pay replacement, integrated with the participant's social security benefits, at normal retirement age following a full career of service. Excluding employees of non-banking subsidiaries who participate in the 401(k) plan only, participation in these plans is generally offered to full-time salaried and regular part-time employees. Benefits under these plans, taken as a whole, are believed to be competitive with comparable banks and bank holding companies.

Conclusion

The committee believes these executive compensation policies and programs effectively serve the interests of stockholders and Old Second. The committee believes these policies motivate executives to contribute to Old Second's overall future successes, thereby enhancing the value of Old Second for the benefit of all stockholders.

Respectfully,

Mr. Walter Alexander

Mr. Marvin Fagel

Mr. William Kane

Mr. William Meyer

Mr. Gerald Palmer

12

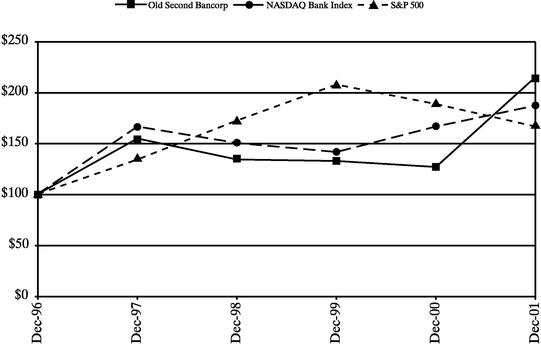

Stockholder Return Performance Presentation

The incorporation by reference of this proxy statement into any document filed with the Securities and Exchange Commission by Old Second shall not be deemed to include the following performance graph and related information unless such graph and related information is specifically stated to be incorporated by reference into such document.

The following graph represents the five-year cumulative total stockholder return for Old Second, the S&P 500, and the Nasdaq Bank Index.

| | Old Second Bancorp, Inc. | Nasdaq Bank Index | S&P 500 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| December 31, 1996 | $ | 100.00 | $ | 100.00 | $ | 100.00 | |||

| December 31, 1997 | $ | 154.76 | $ | 166.45 | $ | 133.32 | |||

| December 31, 1998 | $ | 134.46 | $ | 149.35 | $ | 171.33 | |||

| December 31, 1999 | $ | 132.25 | $ | 140.74 | $ | 207.33 | |||

| December 31, 2000 | $ | 126.48 | $ | 165.55 | $ | 188.42 | |||

| December 31, 2001 | $ | 214.75 | $ | 186.51 | $ | 166.12 | |||

Pension Plan

Excluding employees of non-banking subsidiaries, all full-time salaried and regular part-time employees who have completed one year of service are eligible for participation in our pension plan and the remuneration credited to each participant includes all direct salaries and wages paid. Generally speaking, retirement benefits are based on final average monthly earnings during the highest five consecutive years of employment during the last ten years before retirement and integrates with a portion of the primary social security benefit payable to the participant. A participant receives monthly the amount calculated under the following formula: (i) 12/3% times the number of years of credited service up to a maximum of 30, and (ii) 1/2% times the year of credited service over 30 years; less (iii) one-half the primary social security benefit payable to the participant.

The following table illustrates the annual amount of retirement income available under both our pension plan and SERP (after deducting1/2 of the social security benefit, but without limit the retirement benefits for the single plan defined benefit limit of Section 415(c), for the combined plan

13

Section 415 limits, and for the includable compensation limitation of Section 401 (a)(17) of the Internal Revenue Code (the "Code") from such plan for a person 65 years of age in specified average earnings and years of service classification). The SERP restores benefits lost under the pension plan due to the limits imposed under Sections 401 (a) (17) and 415 of the Code. The objective of the SERP is to permit those employees who are affected by the limitations of Code Sections 401 (a)(17) and 415 to receive the same benefit they would have received under the Pension Plan but for the limitations imposed by the Code.

In certain cases, a participant's actual benefit may be less than that provided below:

| | Years of Service | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Covered Compensation | ||||||||||||||||||

| 15 | 20 | 25 | 30 | 35 | 40 | |||||||||||||

| $ 15,000 | $ | 2,250 | $ | 3,000 | $ | 3,750 | $ | 4,500 | $ | 5,250 | $ | 6,000 | ||||||

| $ 25,000 | $ | 3,750 | $ | 5,000 | $ | 6,250 | $ | 7,500 | $ | 8,750 | $ | 10,000 | ||||||

| $ 35,000 | $ | 5,370 | $ | 7,160 | $ | 8,950 | $ | 10,740 | $ | 12,250 | $ | 14,000 | ||||||

| $ 50,000 | $ | 8,498 | $ | 11,198 | $ | 13,997 | $ | 16,797 | $ | 18,046 | $ | 20,000 | ||||||

| $ 75,000 | $ | 14,109 | $ | 18,812 | $ | 23,515 | $ | 28,218 | $ | 30,093 | $ | 31,968 | ||||||

| $100,000 | $ | 20,313 | $ | 27,084 | $ | 33,855 | $ | 40,626 | $ | 43,126 | $ | 45,626 | ||||||

| $125,000 | $ | 26,563 | $ | 35,417 | $ | 44,272 | $ | 53,126 | $ | 56,251 | $ | 59,476 | ||||||

| $150,000 | $ | 32,813 | $ | 43,751 | $ | 54,688 | $ | 65,626 | $ | 69,376 | $ | 73,126 | ||||||

| $175,000 | $ | 39,063 | $ | 52,084 | $ | 65,105 | $ | 78,126 | $ | 82,501 | $ | 86,876 | ||||||

| $200,000 | $ | 45,313 | $ | 60,417 | $ | 75,522 | $ | 90,626 | $ | 95,626 | $ | 100,626 | ||||||

| $225,000 | $ | 51,563 | $ | 68,751 | $ | 85,938 | $ | 103,126 | $ | 108,751 | $ | 114,376 | ||||||

| $250,000 | $ | 57,813 | $ | 77,084 | $ | 96,355 | $ | 115,626 | $ | 121,876 | $ | 128,126 | ||||||

| $275,000 | $ | 64,063 | $ | 85,417 | $ | 106,772 | $ | 128,126 | $ | 135,001 | $ | 141,876 | ||||||

| $300,000 | $ | 70,313 | $ | 93,751 | $ | 117,188 | $ | 140,626 | $ | 148,126 | $ | 155,626 | ||||||

| $325,000 | $ | 76,563 | $ | 102,084 | $ | 127,605 | $ | 153,126 | $ | 161,251 | $ | 169,376 | ||||||

| $350,000 | $ | 82,813 | $ | 110,417 | $ | 138,022 | $ | 165,626 | $ | 174,376 | $ | 183,126 | ||||||

Covered compensation under the qualified and nonqualified pension formulas and the respective years of credited service as of December 31, 2001 for the executive officers named in the cash compensation table are as follows: William B. Skoglund, $352,536 (29 years of service) and J. Douglas Cheatham, $198,798 (2 years of service).

Compensation Committee Interlocks and Insider Participation

Our directors and executive officers and their associates were customers of, and had transactions with Old Second and our subsidiaries in the ordinary course of business during 2001. Additional transactions may be expected to take place in the future. All outstanding loans, commitments to loans, transactions in repurchase agreements, certificates of deposit and depository relationships, in the opinion of management, were in the ordinary course of business and were made on substantially the same terms, including interest rates, collateral, and repayment terms on extensions of credit, as those prevailing at the time for comparable transactions with other persons and did not involve more than the normal risk of collectibility or present unfavorable features. The total debt for all of the directors and executive officers of Old Second and their associates, including all loans with Old Second National Bank, represents 15.5% of stockholders' equity as of December 31, 2001.

14

APPROVE THE OLD SECOND BANCORP, INC.

2002 LONG-TERM STOCK INCENTIVE PLAN

Introduction

Our Board of Directors has adopted the Old Second Bancorp, Inc. 2002 Long-Term Incentive Plan and will present the plan to our stockholders for their approval at the annual meeting. The plan is intended to promote equity ownership of Old Second by our directors, officers and employees and our subsidiaries, to increase their proprietary interest in the success of Old Second and to encourage them to remain in our service or employ. Set forth below is a general summary of the terms of the plan, but such summary is qualified in its entirety by reference to the specific terms of the plan, which is attached to this proxy statement as Exhibit A.

Administration

The plan is to be administered by the compensation committee of the Old Second National Bank. This committee will have the authority to select the individuals to whom awards may be granted, to determine the terms of each award, to interpret the provisions of the plan and to make all other determinations that it may deem necessary or advisable for the administration of the plan.

The plan provides for the grant of "incentive stock options," as defined under Section 422(b) of the Internal Revenue Code, options that do not so qualify (referred to as "nonqualified options"), restricted stock awards and stock appreciation rights, as determined in each individual case by the committee. Incentive stock options may be granted only to our employees and not our directors.

Our Board has determined that 250,000 shares of our common stock will be available for issuance under the plan. In general, if any award granted under the plan expires, terminates, is forfeited or is canceled for any reason, the shares of common stock allocable to such award may again be made subject to an award granted under the plan.

Awards

Our directors, officers and employees are eligible to receive grants under the plan. Options may be granted subject to a vesting requirement and will become fully vested upon a merger or change of control of Old Second. The exercise price of incentive stock options granted under the plan must at least equal the fair market value of the common stock subject to the option (determined as provided in the plan) on the date the option is granted. The exercise price of nonqualified options restricted stock awards and stock appreciation rights will be determined by the committee.

An incentive stock option granted under the plan to an employee owning more than 10% of the total combined voting power of all classes of our capital stock is subject to the further restriction that such option must have an exercise price of at least 110% of the fair market value of the shares of common stock issuable upon exercise of the option, (determined as of the date the option is granted) and may not have an exercise term of more than five years

Each individual eligible to participate in the plan will be notified of his or her selection by the committee. To receive an award, an individual must execute an award agreement which will specify the type of award to be granted, the number of shares of common stock (if any) to which the award relates, the terms and conditions of the award and the date granted. In the case of an award of options, the award agreement will also specify the price at which the shares of common stock subject to the option may be purchased, the date(s) on which the option becomes exercisable and whether the option is an incentive stock option or a nonqualified option.

The full exercise price for all shares of common stock purchased upon the exercise of options granted under the plan must be paid by cash or personal check. Incentive stock options granted under

15

the plan remain outstanding and are exercisable only until the expiration of three months (or such lesser period as the committee may determine) from the date on which the person to whom they were granted ceases to be employed by us. Nonqualified options restricted stock awards and stock appreciation rights granted under the plan remain outstanding and are exercisable for such period as the committee may determine. Awards generally are not transferable.

Incentive stock options granted to employees under the plan are subject to the further restriction that the aggregate fair market value (determined as of the date of grant) of common stock as to which any such incentive stock option first becomes exercisable in any calendar year, is limited to $100,000. To the extent options covering more than $100,000 worth of common stock first become exercisable in any one calendar year, the excess will be treated as nonqualified options. For purposes of determining which, if any, options have been granted in excess of the $100,000 limit, options will be considered to become exercisable in the order granted.

Amendment and Termination

The plan expires ten years after its adoption, unless sooner terminated by our Board. Our Board has authority to amend the plan in such manner as it deems advisable, except that the Board is not permitted, without stockholder approval, to amend the plan to increase the number of shares of common stock with respect to which incentive stock options may be awarded or to change the classes of individuals eligible to receive incentive stock options. The plan provides for appropriate adjustment, as determined by the committee, in the number and kind of shares subject to the plan, and the number, kind and per share exercise price of shares subject to unexercised options, in the event of any change in the outstanding shares of common stock by reason of a stock split, stock dividend, combination or reclassification of shares, recapitalization, merger or similar event.

No awards have been made by the committee pursuant to 2002 incentive plan at this time. The Board of Directors anticipates that it will issue stock options during the first year of the plan. The issuance of stock under the plan will have a dilutive effect on the ownership interests of our other stockholders.

16

Federal Income Tax Information

The following information is a general summary of some of the current federal income tax consequences to participants and to us in relation to the plan. Tax laws may change, and actual tax consequences will depend on a participant's individual circumstances as well as state and local tax laws.

A participant generally will not recognize any income when an incentive stock option is granted, and will not incur any tax when the option is exercised unless the participant is subject to the alternative minimum tax. If the participant exercises an incentive stock option and holds the shares for more than one year after exercise and for more than two years after the date the option was granted, the participant generally will realize long-term capital gain or loss, rather than ordinary income or loss, when he or she sells the shares. The gain or loss will be the difference between the amount received from the sale and the amount paid for the shares. If the participant sells the shares less than a year after exercise or less than two years after the date of grant, the participant will generally realize ordinary income to the extent the fair market value of the share on the date of exercise exceeds the exercise price (referred to as the "spread"). Any additional gain, or any loss, as applicable, will be a capital gain or loss, taxable at short-term capital gain rates if the shares are held twelve months or less and at long-term capital gain rates if the shares are held longer than twelve months.

A participant generally will not recognize any income when a nonqualified option is granted. When a participant exercises a nonqualified option, the spread must be recognized as ordinary income. When the participant sells the shares, any additional gain or loss will be a capital gain or loss.

When a participant recognizes ordinary income on the exercise of a nonqualified option, we will generally be entitled to a tax deduction in the amount of the ordinary income recognized by the participant. We will also be entitled to a deduction if a participant recognizes ordinary income by selling shares acquired on exercise of an incentive stock option before the one-year or two-year holding periods end.

RATIFICATION OF OUR INDEPENDENT AUDITORS

We have selected Ernst & Young LLP to be our independent auditors for the year ending December 31, 2002. The Board of Directors will propose the adoption of a resolution at the annual meeting ratifying and approving the selection of Ernst & Young LLP. Representatives of Ernst & Young are expected to be present at the annual meeting with the opportunity to make a statement, if they desire to do so, and to be available to respond to appropriate questions.

Accountant Fees

Audit Fees. The aggregate fees and expenses billed by Ernst & Young LLP in connection with the audit of our annual financial statements as of and for the year ended December 31, 2001 and for the required review of our financial information included in our Securities and Exchange Commission filings for the year 2001 was $144,000.

Financial Information Systems Design and Implementation Fees. There were no fees incurred for these services for the year 2001.

All Other Fees. The aggregate fees and expenses billed by Ernst & Young LLP for all other services rendered to us during the year ended December 31, 2001 was $43,000. Other fees include $15,000 relating to the audit of employee benefit plans and $28,000 relating to tax return preparation and tax consulting.

The audit committee, after consideration of the matter, does not believe that the rendering of these services by Ernst & Young LLP to be incompatible with maintaining Ernst & Young LLP's independence as our principal accountant.

17

The Board of Directors recommends that you vote your shares FOR ratification of this appointment.

The incorporation by reference of this proxy statement into any document filed with the Securities and Exchange Commission by Old Second shall not be deemed to include the following report and related information unless such report is specifically stated to be incorporated by reference into such document.

The audit committee assists the Board in carrying out its oversight responsibilities for our financial reporting process, audit process and internal controls. The audit committee also reviews the audited financial statements and recommends to the Board that they be included in our annual report on Form 10-K. The committee is comprised solely of independent directors.

The audit committee has reviewed and discussed our audited financial statements for the fiscal year ended December 31, 2001 with our management and Ernst & Young LLP, our independent auditors. The committee has also discussed with Ernst & Young LLP the matters required to be discussed by SAS 61 (Codification for Statements on Auditing Standards) as well as having received and discussed the written disclosures and the letter from Ernst & Young LLP required by Independence Standards Board Statement No. 1 (Independence Discussions with Audit Committees). Based on the review and discussions with management and Ernst & Young LLP, the committee has recommended to the Board that the audited financial statements be included in our annual report on Form 10-K for the fiscal year ending December 31, 2001 for filing with the Securities and Exchange Commission.

Audit Committee:

Walter Alexander, Chairman

William Kane

D. Chet McKee

James Schmitz

STOCKHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

Any proposals of stockholders intended to be presented at the 2003 annual meeting of stockholders must be received by us on or before October 23, 2002, and must otherwise comply with our bylaws.

We will bear the cost of this proxy solicitation. Solicitation will be made primarily through the use of the mail, but our officers, directors, or regular employees may solicit proxies personally or by telephone or telegraph without additional remuneration for such activity. In addition, we will reimburse brokerage houses and other custodians, nominees, or fiduciaries for their reasonable expense in forwarding proxies and proxy material to the beneficial owner of such shares.

As of the date of this proxy statement, we do not know of any other matters to be brought before the annual meeting. However, if any other matters should properly come before the meeting, it is the intention of the persons named in the enclosed proxy to vote thereon in accordance with their best judgment.

If any stockholder fails to indicate a choice in items (1), (2) or (3) on the proxy card, the shares of such stockholder shall be voted FOR in each instance.

18

By Order of the Board of Directors

| James E. Benson Chairman | William B. Skoglund Chief Executive Officer and President | |

Aurora, Illinois March 12, 2002 | ||

ALL STOCKHOLDERS ARE URGED TO SIGN

AND MAIL THEIR PROXIES PROMPTLY

19

EXHIBIT A

OLD SECOND BANCORP, INC.

2002 LONG-TERM INCENTIVE PLAN

Section 1. Purpose of the Plan.

TheOLD SECOND BANCORP, INC. 2002 LONG-TERM INCENTIVE PLAN (the "Plan") is intended to provide a means whereby directors (including senior and emeriti directors), officers, and employees ofOLD SECOND BANCORP, INC., a Delaware corporation (the "Company"), and the Related Corporations may sustain a sense of proprietorship and personal involvement in the continued development and financial success of the Company and the Related Corporations, and to encourage them to remain with and devote their best efforts to the business of the Company and the Related Corporations, thereby advancing the interests of the Company and its stockholders. Accordingly, the Company may permit certain directors, officers, and employees to acquire Shares or otherwise participate in the financial success of the Company, on the terms and conditions established herein.

Section 2. Definitions.

The following terms, when used herein and unless the context clearly requires otherwise, shall have the following meanings (such meanings to be equally applicable to both the singular and plural forms of the terms defined):

A-1

However, in no event shall a Change in Control be deemed to have occurred, with respect to the Participant if the Participant is part of a purchasing group which consummates the Change-in-Control transaction. The Participant shall be deemed "part of a purchasing group" for purposes of the preceding sentence if the Participant is a equity participant in the purchase company or group (except for (i) passive ownership of less than two percent (2%) of the stock of the purchasing company; or (ii) ownership of equity participation in the purchasing company or group which is otherwise not significant, as determined prior to the Change in Control by a majority of the nonemployee continuing Directors).

A-2

Section 3. Administration of the Plan.

The Plan shall be administered by the Board, or a committee appointed by the Board. The Board, or the Committee, as the case may be, shall have sole authority to:

All decisions made by the Board, or the Committee, as the case may be, in administering the Plan shall be final.

Section 4. Shares Subject to the Plan.

The aggregate number of Shares that may be obtained by directors, officers and employees under the Plan shall be 250,000 Shares. Each person is eligible to receive awards with respect to an aggregate maximum of 125,000 Shares over the term of the Plan. Any Shares that remain unissued at the termination of the Plan shall cease to be subject to the Plan, but until termination of the Plan, the Company shall at all times make available sufficient Shares to meet the requirements of the Plan. Any Shares subject to distribution or payment upon exercise of an award or lapse of restrictions on Restricted Stock but which are not issued because of a surrender, forfeiture, expiration, termination or cancellation shall once again be available for issuance pursuant to a subsequent award.

A-3

Section 5. Stock Options.

(a) Type of Options. The Board may issue options that constitute Incentive Stock Options to officers and employees and Nonqualified Options to directors, officers and employees of the Company and the Related Corporations; provided that Nonqualified Options may be granted to a senior director or an emeritus director only if he or she renders bona fide services not in connection with the offer and sale of securities in a capital-raising transaction. The grant of each option shall be confirmed by a stock option agreement that shall be executed by the Company and the optionee as soon as practicable after such grant. The stock option agreement shall expressly state or incorporate by reference the provisions of the Plan and state whether the option is an Incentive Stock Option or a Nonqualified Option.

(b) Terms of Options. Except as provided in paragraphs (c) and (d) of this Section, each option granted under the Plan shall be subject to the terms and conditions set forth by the Committee in the stock option agreement including, without limitation, option price, vesting schedule and option term.

(c) Additional Terms Applicable to All Options. Each option shall be subject to the following terms and conditions:

(i) Written Notice. An option may be exercised only by giving written notice to the Company specifying the number of Shares to be purchased. The Committee may specify a reasonable minimum number of Shares that may be purchased on any exercise of an option; provided that the minimum number will not prevent the option holder from exercising an option for the full number of Shares for which it is then exercisable.

(ii) Method of Exercise. Except as otherwise provided in any written option agreement, the exercise price of an option shall be paid in full (i) in cash; (ii) in Common Stock valued at its Fair Market Value on the date of exercise, provided it has been owned by the optionee for at least six (6) months prior to the exercise; (iii) in cash by an unaffiliated broker-dealer to whom the holder of the option has submitted an exercise notice consisting of a fully endorsed option; (iv) by agreeing to surrender SARs then exercisable by him valued at their Fair Market Value on the date of exercise; (v) by such other medium of payment as the Committee, in its discretion, shall authorize; or (vi) by any combination of clauses (i) through (v) above, as the optionee shall elect. In the case of payment pursuant to clauses (ii) through (v) above, the optionee's election must be made on or prior to the date of exercise of the option and must be irrevocable. In lieu of a separate election governing each exercise of an option, an optionee may file a blanket election that shall govern all future exercises of options until revoked by the optionee.

(iii) Term of Option. An option shall be exercisable as provided under the Plan or by the Board.

(iv) Retirement. If an optionee's Termination of Service occurs due to Retirement, his or her options shall become fully vested and exercisable and he or she shall have the right to exercise any Nonqualified Options within a period of three (3) years after the date of Retirement, or as may otherwise be provided by the Committee, and shall have the right to exercise any Incentive Options within the period set forth in subparagraph (d)(ii) of this Section.

(v) Disability or Death of Optionee. If an optionee's Termination of Service occurs due to Disability or death his or her options shall become fully vested and exercisable and he or she, or his or her beneficiary, executor, administrator or personal representative, shall have the right to exercise the options within a period of twelve (12) months after the date of such termination, or as may otherwise be provided by the Committee.

A-4

(vi) Termination for Cause. If an optionee's Termination of Service occurs due to Cause, his or her options, whether vested or unvested, shall be immediately forfeited,provided, however, that following a Change in Control, vested options shall not be forfeited under this provision.

(vii) Death Following Termination of Service. If an optionee dies following his or her Termination of Service, any vested options may be exercised until the later of (y) one (1) year from the date of death, or (z) the date the exercise period would have otherwise expired due to the reason for the Termination of Service (e.g. Disability or Retirement).

(viii)Transferability. No option may be transferred, assigned or encumbered by an optionee, except: (A) by will or the laws of descent and distribution; (B) by gifting for the benefit of descendants for estate planning purposes; or (C) pursuant to a certified domestic relations order.

(d) Additional Terms Applicable to Incentive Options. Each Incentive Option shall be subject to the following terms and conditions:

(i) Option Price. The Incentive Option price per Share shall be 100% of the fair market value of a Share on the date the Incentive Option is granted. Notwithstanding the preceding sentence, the Incentive Option price per Share granted to an individual who, at the time such option is granted, owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company (a "10% Stockholder") shall not be less than 110% of the fair market value of a Share on the date the option is granted.

(ii) Term of Option. Notwithstanding any other provision of the Plan, no Incentive Option may be exercised more than ten (10) years after the date of grant. No Incentive Option granted to a 10% Stockholder may be exercised more than five (5) years after the date of grant. Notwithstanding any other provisions hereof, no Incentive Option may be exercised more than three (3) months after the optionee terminates employment with the Company, except in the event of death or Disability, in which case the option may be exercised as provided in subparagraph (c)(v) of this Section.

(iii) Annual Exercise Limit. The aggregate fair market value of Shares which first become exercisable with respect to an Incentive Option during any calendar year shall not exceed $100,000. For purposes of the preceding sentence, the fair market value of each Share shall be determined on the date the option with respect to such Share is granted. To the extent all or any portion of an Option is intended to be an Incentive Option but does not satisfy the limitations of this subsection, that portion which fails to satisfy this subsection shall be deemed a Nonqualified Option for all purposes under the Plan, including any post termination of employment exercise period applicable to the termination of employment.

(iv) Transferability. No Incentive Option may be transferred, assigned or encumbered by an optionee, except by will or the laws of descent and distribution, and during the optionee's lifetime an option may only be exercised by him or her.

(v) Notice of Disqualifying Dispositions. If an optionee sells or otherwise disposes of any Shares acquired pursuant to the exercise of an Incentive Option on or before the later of (1) the date two (2) years after the date of grant, and (2) the date one year after the exercise of the Incentive Option (in either case, a "Disqualifying Disposition"), the optionee must immediately notify the Company in writing of such disposition. The optionee may be subject to income tax withholding by the Company on the compensation income recognized by the optionee from the Disqualifying Disposition.

A-5

Section 6. Restricted Stock Awards.

(a) Grants. An award of Restricted Stock under the Plan ("RSAs") shall be evidenced by a written agreement in such form and consistent with the Plan as the Committee shall approve from time to time. A grantee can accept an RSA only by signing and delivering to the Company a purchase agreement in such form as the Committee shall establish, and full payment of the purchase price, within thirty (30) days from the date the RSA agreement was delivered to the grantee. If the grantee does not accept the RSA in this manner within thirty (30) days, then the offer of the RSA will terminate, unless the Committee determines otherwise.

(b) Restriction Period. RSAs awarded under the Plan shall be subject to such terms, conditions and restrictions as shall be determined by the Committee at the time of grant, including, without limitation: (i) prohibitions against transfer; (ii) substantial risks of forfeiture; (iii) attainment of performance objectives; and (iv) repurchase by the Company or right of first refusal for such period or periods as shall be determined by the Committee. The Committee shall have the power to permit, in its discretion, an acceleration of the expiration of the applicable restriction period with respect to any part or all of the RSAs awarded to a grantee.

(c) Restrictions Upon Transfer. RSAs awarded, and the right to vote underlying Shares and to receive dividends thereon, may not be sold, assigned, transferred, exchanged, pledged, hypothecated or otherwise encumbered during the restriction period applicable to such Shares, except: (i) by will or the laws of descent and distribution; (ii) by gifting for the benefit of descendants for estate planning purposes; or (iii) pursuant to a certified domestic relations order. Subject to the foregoing, and except as otherwise provided in the Plan, the grantee shall have all the other rights of a stockholder including, without limitation, the right to receive dividends and the right to vote such Shares.

(d) Lapse of Restrictions. Each restricted stock agreement shall specify the terms and conditions upon which any restrictions upon Shares awarded under the Plan shall lapse, as determined by the Board. Upon the lapse of such restrictions, Shares, free of the foregoing restrictive legend, shall be issued to the grantee or his or her legal representative.

(e) Termination Prior to Lapse of Restrictions. In the event of a grantee's Termination of Service prior to the lapse of restrictions applicable to any RSAs awarded to such grantee, all Shares as to which there still remain restrictions shall be forfeited by such grantee without payment of any consideration to the grantee, and neither the grantee nor any successors, heirs, assigns, or personal representatives of such grantee shall thereafter have any further rights or interest in such Shares or certificates.

(f) Legends. Each certificate issued by the Company that represents any Plan Shares pursuant to this Section 6 shall bear the following legend:

"This certificate and the shares represented hereby are subject to the terms and conditions (including forfeiture and restrictions against transfer) contained in the Old Second Bancorp, Inc. 2002 Long-Term Incentive Plan and related agreements. Release from such terms and conditions shall be obtained only in accordance with the provisions of such Plan and agreements, copies of which are on file in the office of the Secretary of said Company."

Section 7. Stock Appreciation Rights.

(a) Grants. An award of Stock Appreciation Rights under the Plan ("SARs") may be granted separately or in tandem with or by reference to an option granted prior to or simultaneously with the grant of such rights, to such eligible directors, officers and employees, as may be selected by the Committee, and shall be evidenced by a written agreement in such form and consistent with the Plan as the Committee shall approve from time to time.

A-6

(b) Terms of Grant. SARs may be granted in tandem with or with reference to a related option, in which event the grantee may elect to exercise either the option or the SAR, but not both, as to the same Share subject to the option and the SAR, or the SAR may be granted independently of a related option. SARs shall not be transferable, except: (i) by will or the laws of descent and distribution; (ii) by gifting for the benefit of descendants for estate planning purposes; or (iii) pursuant to a certified domestic relations order.

(c) Termination for Cause. If an optionee's Termination of Service occurs due to Cause, his or her SARs, whether vested or unvested, shall be immediately forfeited,provided, however, that following a Change in Control, vested SARs shall not be forfeited under this provision.

(d) Payment on Exercise. Upon exercise of a SAR, the grantee shall be paid the excess of the then fair market value of the number of Shares to which the SAR relates over the fair market value of such number of Shares at the date of grant of the SAR or of the related option, as the case may be. Such excess shall be paid in cash or in such other form as the Committee shall determine.

Section 8. Amendment or Termination of the Plan.

The Board may amend, suspend or terminate the Plan or any portion thereof at any time, but (except as provided inSection 12 below) no amendment shall be made without approval of the stockholders of the Company which shall: (a) materially increase the aggregate number of Shares with respect to which Incentive Stock Option awards may be made under the Plan; or (b) change the class of persons eligible to receive Incentive Stock Option awards under the Plan;provided, however, that no amendment, suspension or termination shall impair the rights of any individual, without his or her consent, in any award theretofore made pursuant to the Plan.

Section 9. Term of Plan.

The Plan shall be effective upon the date of its adoption by the Board; provided that Incentive Stock Options may be granted only if the Plan is approved by the stockholders within twelve (12) months before or after the date of adoption by the Board. Unless sooner terminated under the provisions ofSection 8 above, options, RSAs and SARs shall not be granted under the Plan after the expiration of ten (10) years from the Effective Date. However, awards may be exercisable after the end of the term of the Plan.

Section 10. Rights as Stockholder.

Upon delivery of any Share to a director, officer or employee, such person shall have all of the rights of a stockholder of the Company with respect to such Share, including the right to vote such Share and to receive all dividends or other distributions paid with respect to such Share.

Section 11. Merger or Consolidation.

In the event the Company is merged or consolidated with another corporation and the Company is not the surviving corporation, the surviving corporation may agree to exchange options and SARs issued under this Plan for options and SARs (with the same aggregate option price) to acquire and participate in that number of shares in the surviving corporation that have a fair market value equal to the fair market value (determined on the date of such merger or consolidation) of Shares that the grantee is entitled to acquire and participate in under this Plan on the date of such merger or consolidation. In the event of a Change in Control, options and SARs shall become immediately and fully exercisable.

A-7

Section 12. Changes in Capital and Corporate Structure.

The aggregate number of Shares and interests awarded and which may be awarded under the Plan shall be adjusted to reflect a change in the outstanding Shares of the Company by reason of a recapitalization, reclassification, reorganization, stock split, reverse stock split, combination of shares, stock dividend or similar transaction. The adjustment shall be made in an equitable manner which will cause the awards and the economic benefits thereof to remain unchanged as a result of the applicable transaction.

Section 13. Assumption of Awards by the Company.

The Company, from time to time, may substitute or assume outstanding awards granted by it or another company, whether in connection with an acquisition of another company or otherwise, by either (a) granting an Award under the Plan in substitution of such other company's award, or (b) assuming such award as if it had been granted under the Plan if the terms of such assumed award could be applied to an Award granted under the Plan. Such substitution or assumption shall be permissible if the holder of the substituted or assumed award would have been eligible to be granted an Award under the Plan if the other company had applied the rules of the Plan to such grant. In the event the Company assumes an award granted by another company, the terms and conditions of such award shall remain unchanged (except that the exercise price and the number and nature of Shares issuable upon exercise of any such option will be adjusted appropriately pursuant to Section 424(a) of the Code). In the event the Company elects to grant a new option rather than assuming an existing option, such new option may be granted with a similarly adjusted exercise price.

Section 14. Service.

An individual shall be considered to be in the service of the Company or a Related Corporation as long as he or she remains a director, officer or employee of the Company or such Related Corporation. Nothing herein shall confer on any individual the right to continued service with the Company or a Related Corporation or affect the right of the Company or such Related Corporation to terminate such service.

Section 15. Withholding of Tax.

A-8

Section 16. Delivery and Registration of Stock.

The Company's obligation to deliver Shares with respect to an award shall, if the Committee so requests, be conditioned upon the receipt of a representation as to the investment intention of the individual to whom such Shares are to be delivered, in such form as the Board shall determine to be necessary or advisable to comply with the provisions of the Securities Act or any other federal, state or local securities legislation or regulation. It may be provided that any representation requirement shall become inoperative upon a registration of the Shares or other action eliminating the necessity of such representation under securities legislation. The Company shall not be required to deliver any Shares under the Plan prior to: (a) the admission of such Shares to listing on any stock exchange on which Shares may then be listed, and (b) the completion of such registration or other qualification of such Shares under any state or federal law, rule or regulation, as the Board shall determine to be necessary or advisable. The Plan is intended to comply with Rule 16b-3, if applicable. Any provision of the Plan which is inconsistent with said rule shall, to the extent of such inconsistency, be inoperative and shall not affect the validity of the remaining provisions of the Plan.

Section 17. Indemnification.

Each person who is or shall have been a member of the Committee, or of the Board, shall be indemnified and held harmless by the Company against and from any loss, cost, liability, or expense that may be imposed upon or reasonably incurred by him or her in connection with or resulting from any claim, action, suit, or proceeding to which he or she may be a party or in which he or she may be involved by reason of any action taken or failure to act under the Plan and against and from any and all amounts paid by him or her in settlement thereof, with the Company's approval, or paid by him or her in satisfaction of any judgment in any such action, suit, or proceeding against him or her, provided he or she shall give the Company an opportunity, at its own expense, to handle and defend the same before he or she undertakes to handle and defend it on his or her own behalf. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which such persons may be entitled under the Company's Articles of Incorporation or Bylaws, as a matter of law, or otherwise, or any power that the Company may have to indemnify them or hold them harmless.

Section 18. Legal Construction.

(a) Gender and Number. Except where otherwise indicated by the context, any masculine term used herein also shall include the feminine; the plural shall include the singular and the singular shall include the plural.

(b) Severability. In the event any provision of the Plan shall be held illegal or invalid for any reason, the illegality or invalidity shall not affect the remaining parts of the Plan, and the Plan shall be construed and enforced as if the illegal or invalid provision had not been included.

(c) Requirements of Law. The granting of Awards and the issuance of Shares under the Plan shall be subject to all applicable laws, rules, and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required.

(d) Governing Law. To the extent not preempted by Federal law, the Plan, and all agreements hereunder, shall be construed in accordance with and governed by the laws of the State of Illinois.

A-9

PROXY FOR COMMON SHARES SOLICITED ON BEHALF OF THE BOARD

OF DIRECTORS FOR THE ANNUAL MEETING OF STOCKHOLDERS OF

OLD SECOND BANCORP, INC. TO BE HELD ON APRIL 16, 2002