UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3373

Westcore Trust

(exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

JoEllen L. Legg, Secretary

Westcore Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: December 31

Date of reporting period: January 1, 2008 - June 30, 2008

Item 1. Reports to Stockholders.

| | June 30, 2008 |

| | |

| | Westcore Equity Funds |

| | Westcore MIDCO Growth Fund |

| | Westcore Growth Fund |

| | Westcore Select Fund |

| | Westcore International Frontier Fund |

| | Westcore Blue Chip Fund |

| | Westcore Mid-Cap Value Fund |

| | Westcore Small-Cap Opportunity Fund |

| | Westcore Small-Cap Value Fund |

| | Westcore Micro-Cap Opportunity Fund |

| | |

| | Westcore Bond Funds |

| | Westcore Flexible Income Fund |

| | Westcore Plus Bond Fund |

| | Westcore Colorado Tax-Exempt Fund |

| | |

| | |

| Westcore Funds are managed by | |

| Denver Investment Advisors LLC. | |

| Shareholder Letter | 2 | |

| Average Annual Total Returns | 4 | |

| Fund Expenses | 7 | |

| Morningstar Ratings | 9 | |

| Manager’s Overview | | |

| Westcore MIDCO Growth Fund | 12 | |

| Westcore Growth Fund | 16 | |

| Westcore Select Fund | 20 | |

| Westcore International Frontier Fund | 24 | |

| Westcore Blue Chip Fund | 28 | |

| Westcore Mid-Cap Value Fund | 32 | |

| Westcore Small-Cap Opportunity Fund | 36 | |

| Westcore Small-Cap Value Fund | 40 | |

| Westcore Micro-Cap Opportunity Fund | 44 | |

| Westcore Flexible Income Fund | 48 | |

| Westcore Plus Bond Fund | 52 | |

| Westcore Colorado Tax-Exempt Fund | 56 | |

| Financial Statements | | |

| Statements of Investments | 61 | |

| Statements of Assets and Liabilities | 122 | |

| Statements of Operations | 127 | |

| Statements of Changes in Net Assets | 132 | |

| Financial Highlights | 144 | |

| Notes to Financial Statements | 175 | |

| Other Important Information | 206 | |

| 1-800-392-CORE (2673) ■ www.westcore.com | 1 |

Dear Fellow Shareholders:

As you well know, good news is often accompanied by bad news – especially when it comes to economic matters. For example, while worldwide individual incomes rose at the fastest rate in history between 2000 and 2007, worldwide economic growth has slowed, with the U.S. on the verge of a recession and many countries enduring bear markets.

Every market environment – good or bad – produces challenges. Investing successfully requires creativity, discipline and experience regardless of current conditions. To this end, each of the 12 Westcore Funds is managed by a team of investment professionals who strive to balance investment opportunities and risks to create a sound portfolio based on the best research and judgment we can offer.

Our newest fund—the Westcore Micro-Cap Opportunity Fund—began trading June 23, 2008. This fund focuses on the smallest companies trading on the major U.S. stock exchanges. Although this group of companies has provided above-average investment returns over long periods of time, many investors overlook this asset class because they are unfamiliar with it. The Westcore Micro-Cap Opportunity Fund is designed to take advantage of the opportunities that this under-researched asset class may offer.

While it is an interesting time to launch a new fund, as long-term investors, we view bear markets as periods of opportunity. The last bear market bottomed in the middle of 2002, with the Dow Jones Industrial Average falling below 8,000. In general, investments made during that period have performed better than investments made at market peaks, such as those in early 2000 and 2007. And while the late great investor John Templeton offered the sage advice of buying stocks at the point of “maximum fear,” we believe dollar-cost averaging can achieve similar results with more ease and less fear.

In this semi-annual report, each investment team has prepared a letter discussing the factors that affected current fund performance, along with a brief outlook. With daily headlines that underscore the impact of issues within the banking industry and high energy prices, it’s likely you can appreciate just how challenging the period was.

| 2 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

Although the financial markets continue to struggle on many fronts, we remain optimistic about the years ahead. The adviser to the Westcore Funds, Denver Investment Advisors LLC, has a half-century of experience navigating through both good and bad market conditions. We are confident that this investment expertise will see the Funds through the current challenges and ultimately get you closer to your financial goals.

The Shareholder Letter and the Manager Overviews included in this shareholder report contain certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

| 1-800-392-CORE (2673) ■ www.westcore.com | 3 |

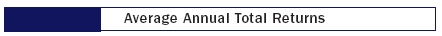

| Average Annual Total Returns as of 6/30/08 |

| Westcore MIDCO | | | | | | | | | | | Since Incep. |

| Growth Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 8/1/86 |

| Retail Class | -10.81% | | -9.97% | | 6.74% | | 8.57% | | 6.17% | | 11.30% |

| Institutional Class* | -10.79% | | -9.85% | | 6.79% | | 8.60% | | 6.18% | | 11.31% |

| Russell Midcap Growth Index | -6.81% | | -6.42% | | 8.19% | | 12.32% | | 5.64% | | 10.74% |

| Lipper Mid-Cap Growth Index | -8.42% | | -3.08% | | 10.93% | | 12.52% | | 5.75% | | 10.19% |

| | | | | | | | | | | | |

| | | | | | | | | | | | Since Incep. |

| Westcore Growth Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 6/1/88 |

| Retail Class | -13.40% | | -4.02% | | 6.68% | | 9.22% | | 5.51% | | 9.46% |

| Institutional Class* | -13.33% | | -3.96% | | 6.70% | | 9.24% | | 5.52% | | 9.46% |

| Russell 1000 Growth Index | -9.06% | | -5.96% | | 5.92% | | 7.33% | | 0.96% | | 9.94% |

| Lipper Large-Cap Growth Index | -10.30% | | -4.21% | | 5.58% | | 7.24% | | 0.62% | | 9.25% |

| | | | | | | | | | | | |

| | | | | | | | | | | | Since Incep. |

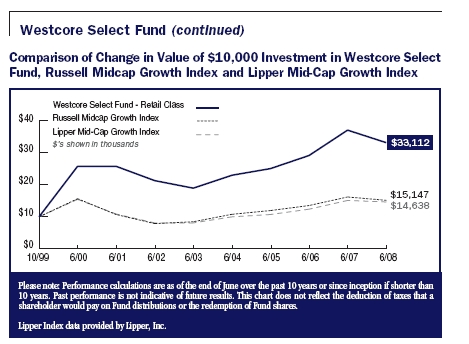

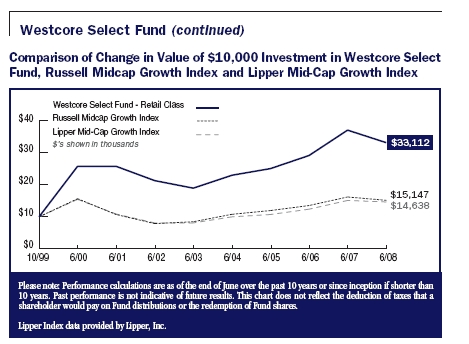

| Westcore Select Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 10/1/99 |

| Retail Class | -11.65% | | -10.52% | | 9.79% | | 11.83% | | NA | | 14.67% |

| Russell Midcap Growth Index | -6.81% | | -6.42% | | 8.19% | | 12.32% | | NA | | 4.86% |

| Lipper Mid-Cap Growth Index | -8.42% | | -3.08% | | 10.93% | | 12.52% | | NA | | 4.45% |

| | | | | | | | | | | | |

| Westcore International | | | | | | | | | | | Since Incep. |

| Frontier Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 12/15/99 |

| Retail Class | -13.67% | | -20.42% | | 5.70% | | 11.67% | | NA | | 3.49% |

| MSCI EAFE Small-Cap Index | -10.49% | | -18.65% | | 9.36% | | 18.89% | | NA | | 9.52% |

| Lipper International Small-Cap Index | -10.77% | | -14.62% | | 14.47% | | 21.40% | | NA | | 8.53% |

| | | | | | | | | | | | |

| | | | | | | | | | | | Since Incep. |

| Westcore Blue Chip Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 6/1/88 |

| Retail Class | -7.13% | | -10.12% | | 4.79% | | 8.88% | | 3.09% | | 9.68% |

| Institutional Class* | -7.06% | | -9.99% | | 4.84% | | 8.91% | | 3.11% | | 9.68% |

| S&P 500 Index | -11.91% | | -13.12% | | 4.41% | | 7.58% | | 2.88% | | 10.40% |

| Lipper Large-Cap Core Index | -10.80% | | -11.38% | | 4.82% | | 6.94% | | 2.32% | | 9.63% |

| | | | | | | | | | | | |

| Westcore Mid-Cap | | | | | | | | | | | Since Incep. |

| Value Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 10/1/98 |

| Retail Class | -9.87% | | -16.93% | | 3.99% | | 11.94% | | NA | | 10.57% |

| Russell Midcap Value Index | -8.58% | | -17.09% | | 4.97% | | 13.00% | | NA | | 10.32% |

| Lipper Mid-Cap Value Index | -7.62% | | -14.03% | | 5.56% | | 11.89% | | NA | | 10.20% |

| | | | | | | | | | | | |

| Westcore Small-Cap | | | | | | | | | | | Since Incep. |

| Opportunity Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 12/28/93 |

| Retail Class | -9.20% | | -24.18% | | 3.43% | | 10.37% | | 4.98% | | 9.44% |

| Institutional Class* | -9.14% | | -24.08% | | 3.47% | | 10.40% | | 5.00% | | 9.45% |

| Russell 2000 Index | -9.37% | | -16.19% | | 3.79% | | 10.29% | | 5.53% | | 8.42% |

| Lipper Small-Cap Core Index | -7.04% | | -13.50% | | 5.09% | | 11.07% | | 6.95% | | 9.91% |

| 4 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

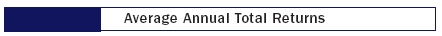

| Average Annual Total Returns as of 6/30/08 (continued) |

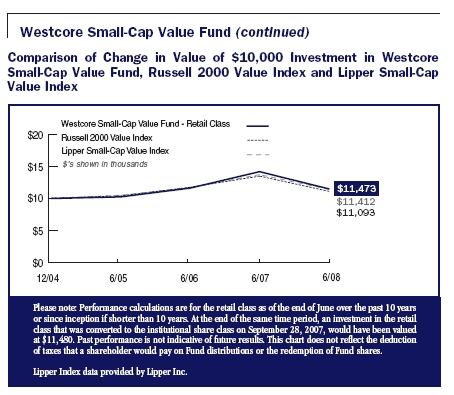

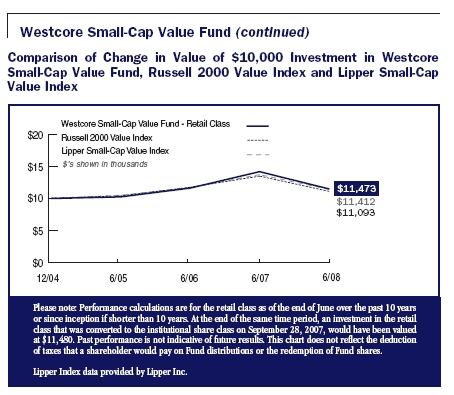

| Westcore Small-Cap | | | | | | | | | | | Since Incep. |

| Value Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 12/13/04 |

| Retail Class | -8.71% | | -18.95% | | 3.90% | | NA | | NA | | 3.95% |

| Institutional Class* | -8.71% | | -18.90% | | 3.92% | | NA | | NA | | 3.97% |

| Russell 2000 Value Index | -9.84% | | -21.63% | | 1.39% | | NA | | NA | | 1.83% |

| Lipper Small-Cap Value Index | -8.26% | | -19.38% | | 2.83% | | NA | | NA | | 3.71% |

| | | | | | | | | | | | |

| Westcore Micro-Cap | | | | | | | | | | | Since Incep. |

| Opportunity Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 6/23/08 |

| Retail Class | NA | | NA | | NA | | NA | | NA | | -5.50% |

| Russell Micro-Cap Index | NA | | NA | | NA | | NA | | NA | | -6.17% |

| Lipper Small-Cap Core Index | NA | | NA | | NA | | NA | | NA | | -4.10% |

| | | | | | | | | | | | |

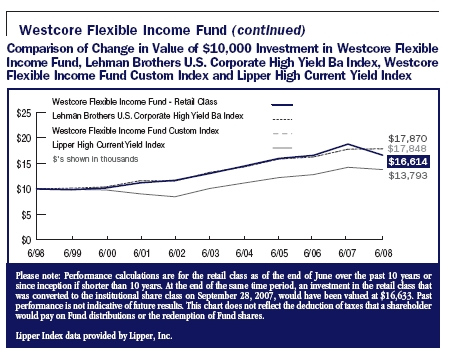

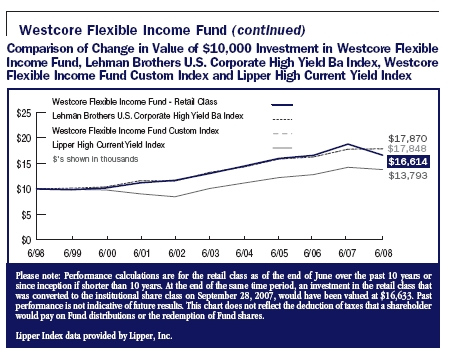

| Westcore Flexible | | | | | | | | | | | Since Incep. |

| Income Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 6/1/88 |

| Retail Class | -5.24% | | -11.57% | | 1.32% | | 4.99% | | 5.21% | | 7.91% |

| Institutional Class* | -5.08% | | -11.47% | | 1.36% | | 5.02% | | 5.22% | | 7.92% |

| Lehman Brothers U.S. Corporate | | | | | | | | | | | |

| High Yield Ba Index | -0.14% | | 0.39% | | 4.06% | | 6.15% | | 5.97% | | 8.56% |

| Westcore Flexible Income Fund | | | | | | | | | | | |

| Custom Index 1 | -0.14% | | 0.39% | | 4.06% | | 6.15% | | 5.96% | | 8.69% |

| Lipper High Current Yield Index | -2.02% | | -3.14% | | 4.12% | | 6.46% | | 3.27% | | 6.89% |

| | | | | | | | | | | | |

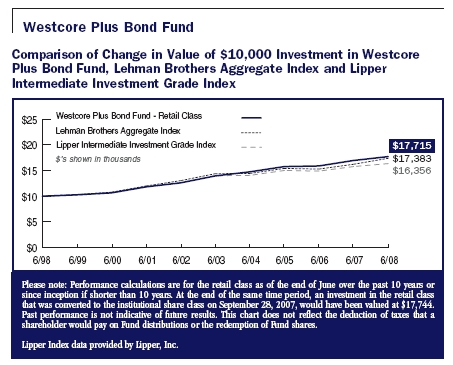

| | | | | | | | | | | | Since Incep. |

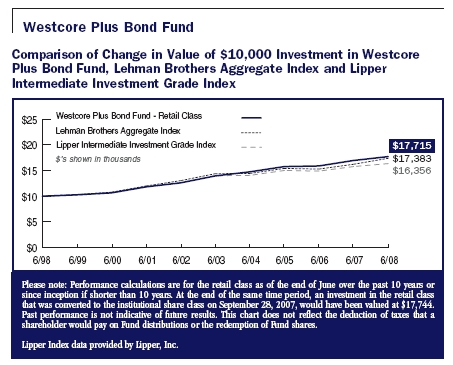

| Westcore Plus Bond Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 6/1/88 |

| Retail Class | 0.14% | | 4.43% | | 3.94% | | 4.89% | | 5.88% | | 6.86% |

| Institutional Class* | 0.28% | | 4.61% | | 4.00% | | 4.92% | | 5.90% | | 6.87% |

| Lehman Brothers Aggregate Index | 1.13% | | 7.12% | | 4.08% | | 3.86% | | 5.68% | | 7.46% |

| Lipper Intermediate Investment | | | | | | | | | | | |

| Grade Index | -0.98% | | 3.65% | | 2.89% | | 3.18% | | 5.04% | | 6.62% |

| | | | | | | | | | | | |

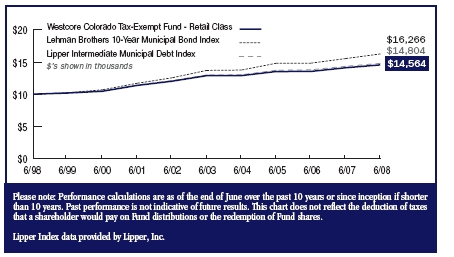

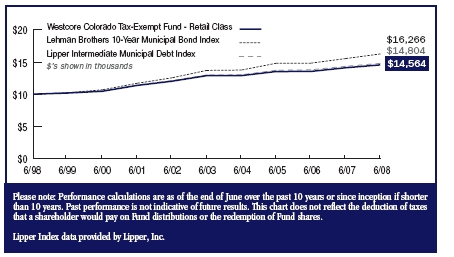

| Westcore Colorado | | | | | | | | | | | Since Incep. |

| Tax-Exempt Fund | 6-month | | 1-Year | | 3-Year | | 5-Year | | 10-Year | | 6/1/91 |

| Retail Class | 0.46% | | 3.19% | | 2.49% | | 2.48% | | 3.83% | | 4.98% |

| Lehman Brothers 10-Year | | | | | | | | | | | |

| Municipal Bond Index | 0.36% | | 4.66% | | 3.17% | | 3.49% | | 4.99% | | 6.21% |

| Lipper Intermediate Municipal | | | | | | | | | | | |

| Debt Index | 0.25% | | 3.22% | | 2.55% | | 2.66% | | 4.00% | | 5.05% |

| | | | | | | | | | | | |

| *The inception date for each Fund's institutional class is September 28, 2007. The institutional class' returns prior to their inception date reflect the returns of the Fund's retail class. |

| 1-800-392-CORE (2673) ■ www.westcore.com | 5 |

| (1) | Westcore Flexible Income Fund Custom Index is comprised of the Lehman Brothers Long-Term Government/Corporate Bond Index for the time period 6/1/88 - 9/30/00 and the Lehman Brothers U.S. Corporate High Yield Ba Index for the time period 10/1/00 - 6/30/08 to reflect the change in the Fund’s investment strategy on 10/1/00. The Adviser believes that the Custom Index is the best benchmark measurement for historical performance over five years. |

The performance data quoted represent past performance. Past performance does not guarantee future results and current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 1-800-392-CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. The performance data quoted does not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 90 days of purchase. If imposed, the fee would reduce the performance quoted. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Certain risks that may affect performance are described below. These risks and other risks are described in the prospectus.

Westcore Select Fund:

This Fund may participate in the Initial Public Offering (“IPO”) market, and a significant portion of the Fund’s since inception return is attributable to its investment in IPOs, which in turn have had a magnified impact due to the Fund’s relatively small asset base. As the Fund’s assets continue to grow, it will be increasingly less likely to experience substantially similar performance by investing in IPOs.

Westcore International Frontier, Small-Cap Opportunity, Small-Cap Value and Micro-Cap Opportunity Funds:

Investing in smaller-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds

Westcore Select Fund:

Investing in non-diversified funds generally will be more volatile and loss of principal could be greater than investing in more diversified funds

Westcore International Frontier Fund:

Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus

Westcore Flexible Income and Plus Bond Funds:

These Funds are subject to additional risk in that they may invest in high-yield/high-risk bonds and are subject to greater levels of liquidity risk.

Westcore Colorado Tax-Exempt Fund:

This Fund invests primarily in instruments issued by or on behalf of one state and generally will be more volatile and loss of principal could be greater due to state specific risk.

| 6 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the last six months of the fiscal half-year/366 (to reflect the half-year period). The annualized expense ratios for the last six months were as follows:

| Fund | Retail Class | | Institutional Class | |

| Westcore MIDCO Growth Fund | 1.03% | | 0.93% | |

| Westcore Growth Fund | 1.02% | | 0.92% | |

| Westcore Select Fund | 1.15% | | N/A | |

| Westcore International Frontier Fund | 1.50% | | N/A | |

| Westcore Blue Chip Fund | 1.09% | | 0.99% | |

| Westcore Mid-Cap Value Fund | 1.16% | | N/A | |

| Westcore Small-Cap Opportunity Fund | 1.30% | | 1.09% | |

| Westcore Small-Cap Value Fund | 1.30% | | 1.22% | |

| Westcore Micro-Cap Opportunity Fund | 1.30% | | N/A | |

| Westcore Flexible Income Fund | 0.85% | | 0.75% | |

| Westcore Plus Bond Fund | 0.55% | | 0.46% | |

| Westcore Colorado Tax-Exempt Fund | 0.65% | | N/A | |

Disclosure Of Fund Expenses (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs (such as the 2% fee on redemption of Fund shares made within 90 days of purchase; and (2) ongoing costs, including management fees and other Fund expenses. The examples on the next page are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on January 1, 2008 and held until June 30, 2008.

Actual Return. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical 5% Return. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The expenses shown in the table on the next page are meant to highlight ongoing Fund costs only and do not reflect transaction costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 1-800-392-CORE (2673) ■ www.westcore.com | 7 |

| | | Beginning | | Ending | | Expense Paid |

| | | Account | | Account | | During Period |

| | | Value | | Value | | 1/1/08 to |

| Fund | | 1/1/08 | | 6/30/08 | | 6/30/08 |

| Westcore MIDCO Growth Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 891.90 | | $ | 4.83 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,019.76 | | $ | 5.15 |

| Institutional Class | Actual Fund Return | $ | 1,000.00 | | $ | | 892.10 | | $ | 4.40 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,020.22 | | $ | 4.69 |

| Westcore Growth Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 866.00 | | $ | 4.74 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,019.78 | | $ | 5.13 |

| Institutional Class | Actual Fund Return | $ | 1,000.00 | | $ | | 866.70 | | $ | 4.27 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,020.29 | | $ | 4.62 |

| Westcore Select Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 883.50 | | $ | 5.39 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,019.14 | | $ | 5.78 |

| Westcore International | | | | | | | | | |

| Frontier Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 863.30 | | $ | 6.95 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,017.40 | | $ | 7.52 |

| Westcore Blue Chip Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 928.70 | | $ | 5.24 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,019.43 | | $ | 5.48 |

| Institutional Class | Actual Fund Return | $ | 1,000.00 | | $ | | 929.40 | | $ | 4.75 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,019.94 | | $ | 4.97 |

| Westcore Mid-Cap | | | | | | | | | |

| Value Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 901.30 | | $ | 5.48 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,019.10 | | $ | 5.82 |

| Westcore Small-Cap | | | | | | | | | |

| Opportunity Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 908.00 | | $ | 6.17 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,018.40 | | $ | 6.53 |

| Institutional Class | Actual Fund Return | $ | 1,000.00 | | $ | | 908.60 | | $ | 5.17 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,019.44 | | $ | 5.47 |

| Westcore Small-Cap | | | | | | | | | |

| Value Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 912.90 | | $ | 6.20 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,018.38 | | $ | 6.54 |

| Institutional Class | Actual Fund Return | $ | 1,000.00 | | $ | | 912.90 | | $ | 5.77 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,018.82 | | $ | 6.10 |

| Westcore Micro-Cap | | | | | | | | | |

| Opportunity Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 945.00 | | $ | 0.24 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,000.71 | | $ | 0.25 |

| Westcore Flexible | | | | | | | | | |

| Income Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | | 947.60 | | $ | 4.12 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,020.64 | | $ | 4.27 |

| Institutional Class | Actual Fund Return | $ | 1,000.00 | | $ | | 949.20 | | $ | 3.63 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,021.14 | | $ | 3.76 |

| Westcore Plus Bond Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | 1,001.40 | | $ | 2.74 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,022.13 | | $ | 2.77 |

| Institutional Class | Actual Fund Return | $ | 1,000.00 | | $ | 1,001.90 | | $ | 2.29 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,022.58 | | $ | 2.31 |

| Westcore Colorado | | | | | | | | | |

| Tax-Exempt Fund | | | | | | | | | |

| Retail Class | Actual Fund Return | $ | 1,000.00 | | $ | 1,004.60 | | $ | 3.24 |

| | Hypothetical Fund Return | $ | 1,000.00 | | $ | 1,021.63 | | $ | 3.27 |

| 8 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

| Morningstar RatingsTM as of 6/30/08 |

| Fund | Overall | 3-Year | 5-Year | 10-Year |

| Westcore MIDCO Growth Fund | |

| Retail Class | ««« | ««« | «« | ««« |

| Institutional Class | ««« | ««« | «« | ««« |

| | out of 813 | out of 813 | out of 684 | out of 325 |

| | Mid-Cap | Mid-Cap | Mid-Cap | Mid-Cap |

| | Growth Funds | Growth Funds | Growth Funds | Growth Funds |

| Westcore Growth Fund | |

| Retail Class | «««« | ««« | «««« | «««« |

| Institutional Class | «««« | ««« | «««« | «««« |

| | out of 1,488 | out of 1,488 | out of 1,215 | out of 589 |

| | Large | Large | Large | Large |

| | Growth Funds | Growth Funds | Growth Funds | Growth Funds |

| Westcore Select Fund | |

| Retail Class | ««« | «««« | ««« | |

| | out of 813 | out of 813 | out of 684 | N/A |

| | Mid-Cap | Mid-Cap | Mid-Cap | |

| | Growth Funds | Growth Funds | Growth Funds | |

| Westcore International | |

| Frontier Fund | | | | |

| Retail Class | « | « | « | |

| | out of 86 | out of 86 | out of 76 | N/A |

| | Foreign Small/ | Foreign Small/ | Foreign Small/ | |

| | Mid Growth Funds | Mid Growth Funds | Mid Growth Funds | |

| Westcore Blue Chip Fund | |

| Retail Class | ««« | ««« | «««« | ««« |

| Institutional Class | ««« | ««« | «««« | ««« |

| | out of 1,715 | out of 1,715 | out of 1,325 | out of 660 |

| | Large | Large | Large | Large |

| | Blend Funds | Blend Funds | Blend Funds | Blend Funds |

| Westcore Mid-Cap Value Fund | |

| Retail Class | ««« | ««« | ««« | |

| | out of 410 | out of 410 | out of 323 | N/A |

| | Mid-Cap | Mid-Cap | Mid-Cap | |

| | Blend Funds | Blend Funds | Blend Funds | |

| Westcore Small-Cap | |

| Opportunity Fund | | | | |

| Retail Class | ««« | ««« | ««« | «« |

| Institutional Class | ««« | ««« | ««« | «« |

| | out of 549 | out of 549 | out of 429 | out of 185 |

| | Small | Small | Small | Small |

| | Blend Funds | Blend Funds | Blend Funds | Blend Funds |

| Westcore Small-Cap Value Fund | |

| Retail Class | «««« | «««« | | |

| Institutional Class | «««« | «««« | N/A | N/A |

| | out of 331 | out of 331 | | |

| | Small | Small | | |

| | Value Funds | Value Funds | | |

| 1-800-392-CORE (2673) ■ www.westcore.com | 9 |

| Morningstar RatingsTM as of 06/30/08 |

| Fund | Overall | 3-Year | 5-Year | 10-Year |

| Westcore Flexible Income Fund | |

| Retail Class | « « | « | « « | «««« |

| Institutional Class | « « | « | « « | «««« |

| | out of 476 | out of 476 | out of 413 | out of 214 |

| | High Yield | High Yield | High Yield | High Yield |

| | Bond Funds | Bond Funds | Bond Funds | Bond Funds |

| Westcore Plus Bond Fund | |

| Retail Class | «««« « | «««« | «««« « | «««« « |

| Institutional Class | «««« « | «««« | «««« « | «««« « |

| | out of 990 | out of 990 | out of 831 | out of 438 |

| | Intermediate- | Intermediate- | Intermediate- | Intermediate- |

| | Term Bond | Term Bond | Term Bond | Term Bond |

| | Funds | Funds | Funds | Funds |

| Westcore Colorado | |

| Tax-Exempt Fund | |

| Retail Class | ««« | ««« | ««« | «« |

| | out of 265 Muni | out of 265 Muni | out of 256 Muni | out of 203 Muni |

| | Single State | Single State | Single State | Single State |

| | Interm Funds | Interm Funds | Interm Funds | Interm Funds |

Please see the Average Annual Total Returns chart beginning on page 4 for complete performance.

©2008 Morningstar, Inc. All Rights Reserved. The information contained herein is: (1) proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Morningstar proprietary ratings reflect historical risk-adjusted performance as of 6/30/08 and are subject to change every month. For each fund with at least a 3-year history, Morningstar calculates a rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive a Morningstar RatingTM of 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar Rating metrics. During periods on which ratings are based, service providers of the Fund waived fees. This waiver had a material impact on the funds’ average annual returns. In the absence of fee waivers, performance would have been lower.

Morningstar ratings for the institutional class reflect historical data of the retail class for periods prior to the September 28, 2007 inception of the institutional class.

| 10 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

| 1-800-392-CORE (2673) ■ www.westcore.com | 11 |

Westcore MIDCO Growth Fund

FUND STRATEGY: Investing in a diversified portfolio of primarily medium-sized companies with growth potential.

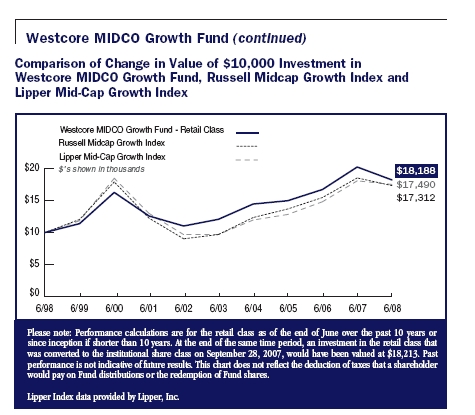

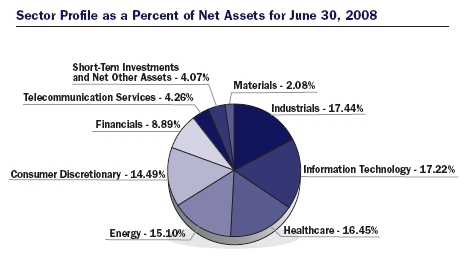

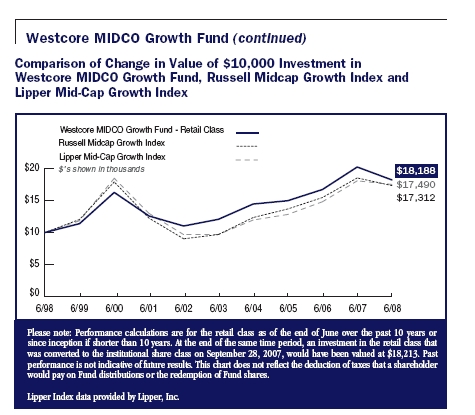

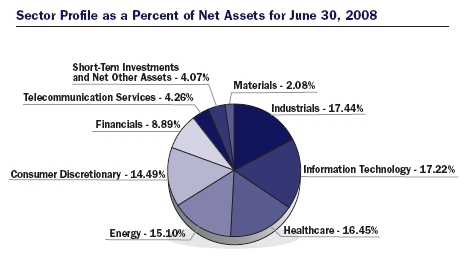

For the six months ended June 30, 2008, retail class shares of the Westcore MIDCO Growth Fund declined (10.81)%, while institutional class shares declined (10.79)%. This lagged its benchmark, the Russell Midcap Growth Index, which was down (6.81)% and also underperformed its peer group, as measured by the Lipper Mid-Cap Growth Index, which declined (8.42)%.

For the six months ended June 30, 2008, retail class shares of the Westcore MIDCO Growth Fund declined (10.81)%, while institutional class shares declined (10.79)%. This lagged its benchmark, the Russell Midcap Growth Index, which was down (6.81)% and also underperformed its peer group, as measured by the Lipper Mid-Cap Growth Index, which declined (8.42)%.

The Fund’s performance was hurt primarily by our underestimation of how high the price of oil and other commodities would rise during the period. A barrel of oil cost $96 at the beginning of the year, and at the end of June it was selling for $140. The rise was even more astounding when you consider that, at the beginning of 2002, oil was only $20 a barrel. In light of the current global economic slowdown, we simply didn’t anticipate such a sharp increase during the period.

With oil prices what they were, our underweight position versus the benchmark in energy stocks proved detrimental to the Fund’s relative performance during the period, as did our airline holdings and auto supply stocks. However, it’s notable that, although we missed out on some of the gains enjoyed by energy stocks during the six months, since mid-July, the price of oil has corrected sharply, and many oil and energy-related stocks are down (30)%.

Meanwhile, our relative performance was aided by our technology and healthcare holdings, which outperformed their constituents in the Russell Midcap Growth Index. Within the technology group, video game producer Take-Two Interactive Software, Inc. and semiconductor companies Marvell Technology Group Ltd. and Broadcom Corp. all had meaningful upward moves during the period. Drug companies Millennium Pharmaceuticals Inc. and Pharmion Corp. also contributed positively to our results when competitors acquired them at a premium to their stock prices. We believe these stocks are excellent examples of our ability to identify undervalued mid-cap growth companies.

| 12 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

Looking ahead, we find healthcare stocks attractive and the portfolio is meaningfully overweight the benchmark in this sector. A few of our favorites are Cephalon Inc., Humana Inc., Amylin Pharmaceuticals Inc. and Illumina Inc.

We’re also optimistic about our retail holdings, and have tried to strategically position the portfolio for an economic slowdown by investing in those we believe can profit even in the most challenging times, such as TJX Companies Inc. While consumers may be spending less, we think the money they do spend will be at discount retailers, where they can get more for their money.

In closing, we expect the second half of 2008 to be shaped by slowing worldwide economic growth. We believe this should mean lower oil and commodity prices and slower consumer spending. We also expect the magnitude of the current mortgage/banking crises to become clearer, which hopefully will help stabilize the stock market. Against this backdrop, we believe many attractive mid-cap growth stocks can be found, and we will continue to rely on our fundamental research to lead us to them.

| 1-800-392-CORE (2673) ■ www.westcore.com | 13 |

Russell Midcap Growth Index is an unmanaged index and measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values in the Russell 1000 Index. Lipper Mid-Cap Growth Index is an unmanaged index comprised of the 30 largest mutual funds in the Lipper Mid-Cap Growth Funds classification. This classification consists of funds that invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Mid-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P MidCap 400 Index.

An investment cannot be made directly in an index.

Please see Average Annual Total Return information on pages 4 and 5.

| 14 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

| Top 10 Holdings as of June 30, 2008 |

| 2.66% | T. Rowe Price Group Inc. (TROW) An asset management firm that provides investment, |

| | record keeping and communications services to corporate and public retirement plans |

| 2.49% | Cephalon Inc. (CEPH) Discovers, develops and markets biopharmaceutical products to |

| | treat neurological disorders and cancer |

| 2.28% | Cameron International Corp. (CAM) Manufactures oil and gas pressure control |

| | equipment for use in oil and gas drilling, production, and transmission to onshore, |

| | offshore and subsea applications |

| 2.28% | Eaton Vance Corp. (EV) Creates, markets and manages mutual funds |

| 2.27% | TJX Companies Inc. (TJX) Retails off-price apparel and home fashions |

| 2.23% | Oceaneering International Inc. (OII) A global provider of engineered services and |

| | products to the offshore oil and gas industry |

| 2.13% | Ultra Petroleum Corp. (UPL) A natural gas exploration and production company focused |

| | on the Green River Basin of Wyoming in the U.S. |

| 2.10% | Denbury Resources Inc. (DNR) Acquires, develops, operates and explores oil and gas |

| | properties primarily in the Gulf Coast region of the U.S. |

| 2.08% | Noble Corp. (NE) Provides diversified services for the oil and gas industry |

| 2.08% | Celanese Corp. Series A (CE) A global industrial chemicals company |

| Percent of Net Assets in Top Ten Holdings: 22.60% |

| Top ten holdings do not include any cash, cash equivalent or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| 1-800-392-CORE (2673) ■ www.westcore.com | 15 |

Westcore Growth Fund

FUND STRATEGY: Investing primarily in large companies with growth potential

“We cannot create the opportunity for greatness. That either strikes us or passes us by. We can, however, prepare ourselves against the event of opportunity’s finding us unready.” – Great Captains Before Napoleon

“We cannot create the opportunity for greatness. That either strikes us or passes us by. We can, however, prepare ourselves against the event of opportunity’s finding us unready.” – Great Captains Before Napoleon

Deteriorating economic conditions in the United States and a potential global downturn gripped the financial markets over the past six months. Investors, consumers and government regulators alike became anxious as the mounting turmoil from tightening credit, rising energy prices and a softening labor market created a very unsettling environment with little visibility.

The first three months of the year were dominated by swift sell-offs in the market and “emergency” interest rate cuts by the U.S. Federal Reserve. Although the Fed’s rate cuts did not stop until the target interest rate reached 2%, it was arguably the Fed’s act of partnering with JPMorgan Chase in its expedited acquisition of Bear Stearns that helped stabilize the equity markets in mid-March. Not to be overlooked, the fiscal stimulus package elevated hopes that consumer spending could continue and aid in the economic recovery.

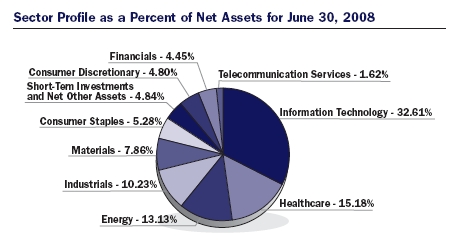

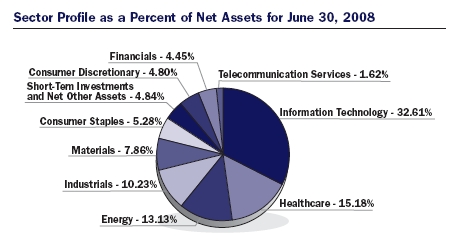

Nevertheless, the S&P 500, the Russell 1000 Growth and the Lipper Large-Cap Growth indices closed the period in the red, declining (11.91)%, (9.06)% and (10.30)%, respectively for the six month period ended June 30, 2008. After a very strong 2007, the Westcore Growth Fund was unable to avoid the damage, and the Fund’s retail class shares ended the period with a (13.40)% loss, while its institutional class shares declined (13.33)%.

While we are disappointed with the Fund’s performance during the first six months of this year, our long-term objective remains in place, as evidenced by the Fund’s solid relative performance for the one-year period. For the 12 months ended June 30, 2008, the Fund’s retail class and institutional class shares declined (4.02)% and (3.96)%, respectively, versus a (5.96)% loss for the Russell 1000 Growth Index and a (13.12)% loss for the S&P 500 Index.

| 16 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

The Fund’s greatest detractors came from the consumer discretionary and financials sectors. More specifically, it was our lack of an investment in Wal-Mart Stores, Inc that impacted the performance of the Fund’s consumer discretionary weighting relative to the benchmark. Wal-Mart Stores’ share price climbed 18% in the period as it proved to be the prime beneficiary of consumer “trade-down”. Among our financial holdings, IntercontinentalExchange, Inc., a global electronic marketplace for trading in futures and over-the-counter commodities, declined (39)%, as investors became concerned that the government’s effort to curtail “speculation” in commodities would lead to increased scrutiny and limit trading volumes.

Positive returns on a sector basis were hard to come by. Materials and energy were the only two sectors to post positive returns for both the Fund and its benchmark. Relative to the benchmark, the Fund’s investments in the materials and healthcare sectors made positive contributions. Potash Corp. of Saskatchewan Inc., a manufacturer of solid and liquid phosphate fertilizers, rose 58%, as the food supply shortage became a global issue. Given the limited supply of potash in the world, we believe the company’s growth prospects remain undervalued. Within healthcare, Covidien Ltd., a diversified medical device and pharmaceutical company, which was spun-out from Tyco Inc. a little over a year ago, climbed 8%. We believe the top-line and margin prospects will truly begin to show through for Covidien starting in 2009.

Although the current economic conditions remain challenging, our research team continues to proactively search for the best opportunities and we believe we are beginning to see signs of healing. Nonetheless, our disciplined process has taught us to be patient as “opportunity may knock, but temptation leans on the bell.” In the first quarter alone, we conducted face-to-face meetings with more that 80% of the companies in which the Fund is invested, including Google Inc., Apple Inc., Covidien Ltd. and Visa Inc. Higher conviction was born out of this effort and was reflected in the active reduction in the number of investments in the Fund. Proceeds from the sales were reinvested in the companies we believe have the highest-quality prospects supported by catalysts for growth and sustainable competitive advantages.

Currently, we see significant opportunity for the long term in the financial sector, especially in those companies with no need to raise additional capital. We also see select opportunities in the industrials sector, particularly mining equipment companies whose earnings growth we believe will accelerate as the world attempts to increase production to keep up with growing global demand. Although investment in such companies may not bear fruit in the next week or month, we are optimistic it will position the Fund so that when opportunity knocks, we will be at the door.

| 1-800-392-CORE (2673) ■ www.westcore.com | 17 |

Westcore Growth Fund (continued)

In closing, we remain committed to our investment philosophy and will continue the search for what we believe are well-positioned, large-cap growth companies that have identifiable catalysts for growth. Even as earnings growth slows for the broader market, we believe investors will become more focused on companies that can deliver superior growth regardless of the economic environment. In our opinion, this bodes well for large-cap growth companies in general and our large-cap growth holdings in particular. Thank you for your investment in and support of the Westcore Growth Fund.

Russell 1000 Growth Index is an unmanaged index that measures the performance of the largest 1,000 firms in the Russell 3000 Index, which represents approximately 98% of the investable U.S. equity market.

Lipper Large-Cap Growth Index is an unmanaged index comprised of the 30 largest mutual funds in the Lipper Large-Cap Growth Funds classification. This classification consists of funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Large-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index.

An investment cannot be made directly in an index.

Please see Average Annual Total Return information on pages 4 and 5.

| 18 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

| Top 10 Holdings as of June 30, 2008 |

| 4.52% | Apple Inc. (AAPL) Designs, manufactures and markets personal computers and related |

| | personal computing and communicating solutions |

| 4.49% | Google Inc. (GOOG) Provides a web-based search engine through its Google.com website |

| 3.13% | Research In Motion Ltd. (RIMM) Designs, manufactures and markets wireless consumer |

| | and business-to-business electronic technology for the mobile personal communications |

| | market |

| 3.03% | MasterCard Inc. Class A (MA) Offers transaction processing services for credit and |

| | debit cards and related services |

| 2.52% | Cisco Systems Inc. (CSCO) Supplies data networking products to the corporate enterprise |

| | and public wide area service provider markets |

| 2.51% | Monsanto Co. (MON) Provides technology-based solutions and agricultural products for |

| | growers and downstream customers in the agricultural markets |

| 2.41% | Gilead Sciences Inc. (GILD) Discovers, develops and commercializes therapeutics for viral |

| | diseases |

| 2.39% | Microsoft Corp. (MSFT) Develops, manufactures, licenses, sells and supports |

| | software products |

| 2.32% | Visa Inc. Class A (V) Operates a retail electronic payment network and manages global |

| | financial services |

| 2.17% | Exxon Mobil Corp. (XOM) Operates petroleum and petrochemical businesses on a |

| | worldwide basis |

| Percent of Net Assets in Top Ten Holdings: 29.49% |

Top ten holdings do not include any cash, cash equivalent or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| 1-800-392-CORE (2673) ■ www.westcore.com | 19 |

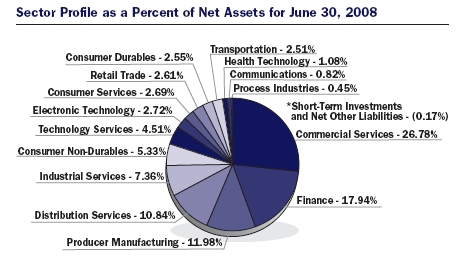

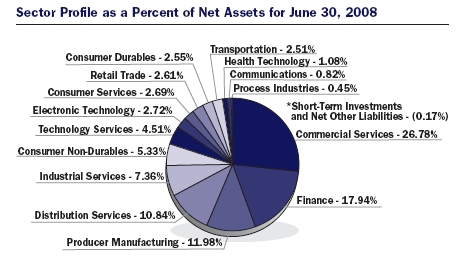

Westcore Select Fund

FUND STRATEGY: Investing in a limited number of primarily medium-sized companies selected for their growth potential.

After a challenging first quarter, U.S. equities gained strength in April and May, only to suffer a significant correction again in June. Midway through the year it was clear to us that the negative economic headwinds we’ve highlighted over the last 6-12 months have not only prevailed, but also intensified on a global scale.

After a challenging first quarter, U.S. equities gained strength in April and May, only to suffer a significant correction again in June. Midway through the year it was clear to us that the negative economic headwinds we’ve highlighted over the last 6-12 months have not only prevailed, but also intensified on a global scale.

Until recently, economic growth outside of the U.S. has helped to cushion the U.S. slowdown. However, what was once limited to write-offs in the subprime mortgage market is now a full-scale, global credit crisis. The other critical factor that has created tremendous economic pressure is the substantial rise in oil prices. Increases in the prices of numerous other commodities along with rising food prices suggest that material inflationary pressures are mounting. Against this backdrop, the U.S. Federal Reserve has attempted to maintain a delicate balancing act in an effort to stimulate economic growth without fueling inflation and precipitating further weakness in the U.S. dollar. We’re finding that there is not a quick and easy solution to turn things around in a short period of time.

Navigating through these volatile times has been especially challenging. The overall market declines have been broad-based with few places to hide. During the six months ended June 30, 2008, mid-cap growth stocks held up relatively well compared to other segments of the market. Although the Westcore Select Fund outperformed the Russel Midcap Growth Index in the first quarter, a disappointing second quarter pressured the Fund to a (11.65)% loss for the six-month period and caused it to underperform its benchmark, the Russell Midcap Growth Index, which declined (6.81)%. The Fund’s performance also lagged its peer group, the Lipper Mid-Cap Growth Index, which lost (8.42)%.

Our underperformance was largely a result of positioning the Fund in anticipation of a decline in oil prices during the period. In particular, we held a significantly smaller weighting than the benchmark Index in energy stocks. We also invested in Continental Airlines Inc. and Delta Air Lines Inc. on the premise that they would benefit substantially if oil prices declined. In addition, we had meaningful exposure in the consumer discretionary sector, investing in retailers like Crocs Inc., best known for its footwear, and gaming stocks like International Game Technology, a manufacturer of computerized gaming equipment. Thus far this positioning hasn’t played out well, as oil continued to be strong during the period. However, we think we’re nearing an inflection point that could cause oil prices to pull back from recent highs and believe this would bode well for the Fund’s performance.

| 20 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

A few areas in the Fund where our stock selection was particularly strong compared to the Index were healthcare, information technology and telecommunications. Healthcare was one of the largest positions in the Fund and an area in which we were significantly overweight relative to the benchmark. Although, collectively, our holdings in this sector produced a negative total return during the first half, they outperformed the benchmark constituents largely due to the recent buyout of Millennium Pharmaceuticals Inc.. Millennium was purchased by Japan-based Takeda Pharmaceutical at a significant premium to its stock price.

Strong stock selection within the information technology sector also bolstered our relative performance. We were especially pleased with the impressive results posted by Take-Two Interactive Software, Inc., a developer of interactive software games for personal computers, and Broadcom Corp., a manufacturer of semiconductors for the wireless communications market.

The Fund also benefited from several well-chosen stocks within the telecommunications sector. Our position in NII Holdings Inc., a wireless communications provider, was up significantly, contributing to the Fund’s overall performance.

As mentioned earlier in this letter, our underweight position in the energy sector during the period resulted in a meaningful opportunity cost. There is much debate and speculation in the industry over the future direction of oil prices, with persuasive arguments on both sides. We continue to look for new ideas in this sector, but we’ll likely remain underweight until greater clarity arises.

We also believe that good values can be found in the consumer discretionary group, but that serious headwinds remain. It appears that consumers are changing their behaviors to cope with these difficult times and are increasingly cautious in their outlook. While the near-term economic conditions remain negative, we will continue to look diligently for new ideas that we believe will result in longer-term rewards for our shareholders.

As we enter the second half of the year, it’s apparent to us that investor confidence has waned due to the unlikelihood of a quick turnaround in the economy. Despite the current challenges, we remain focused on our research and uncovering compelling opportunities over the long term. We encourage shareholders to think long term as well, and believe that staying true to their asset allocation goals and diversification guidelines will serve them well over time.

| 1-800-392-CORE (2673) ■ www.westcore.com | 21 |

Russell Midcap Growth Index is an unmanaged index and measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values in the Russell 1000 Index.

Lipper Mid-Cap Growth Index is an unmanaged index comprised of the 30 largest mutual funds in the Lipper Mid-Cap Growth Funds classification. This classification consists of funds that invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Mid-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P MidCap 400 Index.

Westcore Select Fund may participate in the Initial Public Offering (“IPO”) market, and a significant portion of the Fund’s since inception return is attributable to its investment in IPOs, which in turn have had a magnified impact due to the Fund’s relatively small asset base. As the Fund’s assets continue to grow, it will be increasingly less likely to experience substantially similar performance by investing in IPOs.

An investment cannot be made directly in an index.

Please see Average Annual Total Return information on pages 4 and 5

| 22 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

| Top 10 Holdings as of June 30, 2008 |

| 5.89% | Broadcom Corp. (BRCM) Provides integrated silicon solutions that enable broadband |

| | digital transmission of voice, data and video content to homes and businesses |

| 5.27% | Cephalon Inc. (CEPH) Discovers, develops and markets biopharmaceutical products to |

| | treat neurological disorders and cancer |

| 5.21% | Delta Air Lines Inc. (DAL) Provides scheduled air transportation for passengers, freight |

| | and mail throughout the U.S. and internationally |

| 5.03% | Marvell Technology Group Ltd. (MRVL) Designs, develops and markets integrated circuits |

| | for communications-related markets |

| 4.85% | Invesco Ltd. (IVZ) An independent investment management group specializing in investment |

| | management services, covering equities, fixed income and real estate properties |

| 4.85% | NII Holdings Inc. (NIHD) Provides mobile communications for business customers in |

| | Latin America |

| 4.84% | TJX Companies Inc. (TJX) Retails off-price apparel and home fashions |

| 4.79% | Polycom Inc. (PLCM) Develops, manufactures and markets a line of video, voice, data and |

| | web conferencing collaboration solutions |

| 4.73% | Newfield Exploration Co. (NFX) An independent oil and gas company which explores, |

| | develops and acquires oil and natural gas properties |

| 4.43% | Akamai Technologies Inc. (AKAM) Provides global delivery services for internet content, |

| | streaming media and applications and global internet traffic management |

| Percent of Net Assets in Top Ten Holdings: 49.89% |

Top ten holdings do not include any cash, cash equivalent or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| 1-800-392-CORE (2673) ■ www.westcore.com | 23 |

Westcore International Frontier Fund

FUND STRATEGY: Investing in small, international companies that are poised for growth.

The Westcore International Frontier Fund was unsuccessful at avoiding the market turmoil of the six-month period ended June 30, 2008, and declined (13.67)%. By comparison, its benchmark, the MSCI EAFE Small-Cap Index lost (10.49)% and its peer group, the Lipper International Small Cap Index declined (10.77)%. Needless to say, we are disappointed by the Fund’s underperformance and negative returns. History shows that markets do not move in a straight line and this volatility has been more pronounced over the past year. While we may see brief, unsustainable rallies, such as those we enjoyed in April and May, it seems more likely to us, over the next few quarters, the markets will continue to suffer as investors respond to concerns surrounding the credit crisis and rapid inflation in energy and agricultural commodities.

The Westcore International Frontier Fund was unsuccessful at avoiding the market turmoil of the six-month period ended June 30, 2008, and declined (13.67)%. By comparison, its benchmark, the MSCI EAFE Small-Cap Index lost (10.49)% and its peer group, the Lipper International Small Cap Index declined (10.77)%. Needless to say, we are disappointed by the Fund’s underperformance and negative returns. History shows that markets do not move in a straight line and this volatility has been more pronounced over the past year. While we may see brief, unsustainable rallies, such as those we enjoyed in April and May, it seems more likely to us, over the next few quarters, the markets will continue to suffer as investors respond to concerns surrounding the credit crisis and rapid inflation in energy and agricultural commodities.

With that said, we expect our investment process to continue leading us to growing companies with healthy balance sheets and strong free cash flow generation. While we view these as key components to successful long-term stock performance, we are mindful that even financially strong companies are not immune to severe price corrections. Such was the case with the Fund’s three largest detractors during the period: Esprinet S.p.A., Rightmove PLC and En-Japan Inc.

Esprinet S.p.A. is a Southern European information technology distributor that is struggling through the near-recessionary environments in Italy and Spain. Management recovered from a logistics integration problem a year ago but given the slowing end-demand in this region, Esprinet has not yet been able to translate the operational improvement into financial improvement. We believe that over time the company will deliver value as it has done historically.

Rightmove PLC is the largest web portal for residential properties in the U.K, providing details of all properties available to buy or rent. Its direct exposure to the U.K. housing market caused it to decline during the period. Although some of Rightmove’s clients, which include estate agents, rental agents and new home developers, have closed their offices in response to the weak environment, we believe history indicates they will re-open them when the market returns to normal. Despite the weak environment, we think the company’s subscription-based model gives it good visibility, and Rightmove remained a holding in the Fund at the end of the period.

| 24 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

En-Japan Inc. is an internet-based recruiting company. The company has grown operating income per share 55% annualized over the past seven years and generated more free cash flow than net income over the same period. However En-Japan’s stock is trading at an all-time low price-to-earnings valuation. Growth has slowed, but we strongly believe the market has over-reacted and En-Japan will continue to generate free cash flow. We feel its success will not continue to be overlooked for long.

Another holding, German-based Wirecard AG, was down 33% during the last three trading days of the quarter due to rumors of balance sheet and cash flow manipulation, insider selling, and exposure to illegal online gambling. Wirecard’s primary business is payment processing for Internet transactions. We conducted two extensive interviews with management since the rumors began and remain confident in the business and its financial reporting. Following the market rumors, management reported strong first half growth.

The Fund’s strongest contributors to performance during the period were Interhyp AG and D+S europe AG, two German-based companies recently involved in mergers and acquisitions activity. Interhyp is the leading online mortgage broker in Germany. Like many mortgage-related companies, its share price has suffered through the current credit crisis. However, Interhyp has no balance sheet risk to the real estate industry and continued to show growth in revenues and profits by taking market share from the large, traditional industry players – namely banks. Its growth profile and low valuation attracted the attention of the Dutch bank ING, which launched a public offer at a 36% premium to Interhyp’s share price.

D+S europe AG is a fast-growing provider of e-commerce service. Despite strong operational performance, its share price dwindled during the current market sell-off. This time, however, rather than an industrial buyer, a private equity firm, Apax Partners gained a controlling stake of D+S europe at a 29% premium to its share price.

With the severe correction in share prices, the Fund’s holdings are now trading at valuations we have not seen since 2002. Yet we are encouraged that our companies are performing well operationally and we are optimistic that they will generate value over the long-term. In the meantime, we remain focused on seeking to ensure that our investments are sound and continue to exercise patience until other investors recognize their value.

| 1-800-392-CORE (2673) ■ www.westcore.com | 25 |

Westcore International Frontier Fund (continued)

| |

| Country Breakdown as of June 30, 2008 |

| |

| Country | Market Value | | % | | Country | Market Value | | % |

| United Kingdom | $ | 8,453,603 | | 24.81% | | Sweden | | 1,021,254 | | 3.00% |

| Japan | | 5,714,866 | | 16.77% | | China-Hong Kong | | 893,493 | | 2.62% |

| Germany | | 3,695,203 | | 10.85% | | France | | 860,191 | | 2.52% |

| Singapore | | 3,138,274 | | 9.21% | | Cyprus | | 853,283 | | 2.51% |

| Australia | | 2,756,895 | | 8.09% | | Belgium | | 490,197 | | 1.44% |

| Italy | | 2,039,667 | | 5.99% | | Canada | | 116,211 | | 0.34% |

| Greece | | 1,874,144 | | 5.50% | | Total Investments | | 35,665,459 | | 104.68% |

| United States | | 1,538,620 | | 4.52% | | Liabilities in Excess | | | | |

| Austria | | 1,172,860 | | 3.44% | | of Other Assets | | (1,595,513) | | (4.68%) |

| Netherlands | | 1,046,698 | | 3.07% | | Net Assets | $ | 34,069,946 | | 100.00% |

| | | | | | | | | | | |

| Please note the country classification is based on the company headquarters. | | | | |

MSCI EAFE Small Cap Index is unmanaged and is an arithmetic, market value-weighted average of the performance of securities of small cap companies listed on the stock exchanges of 21 developed markets outside of North America with a capitalization range of $200 million - $1.5 billion.

Lipper International Small-Cap Index is an unmanaged index comprised of the 30 largest mutual funds in the Lipper International Small-Cap Funds classification. This classification consists of funds that invest at least 65% of their assets in equity securities of non-United States companies with market capitalizations less than $1 billion (U.S.) at the time of purchase.

An investment cannot be made directly in an index.

Please see Average Annual Total Return information on pages 4 and 5.

| 26 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

| Top 10 Holdings as of June 30, 2008 |

| 5.03% | KS Energy Services Ltd. (Singapore) Sources and distributes oil and gas equipment, |

| | general hardware hydraulic equipment, instrumentation, and spare parts |

| 4.72% | Cardno Ltd. (Australia) Provides professional services, including engineering, design, plan- |

| | ning, and surveying, for the construction, infrastructure, and natural environments industries |

| 4.35% | CTS Eventim AG (Germany) Acts as a promoter for the live entertainment business in |

| | Germany and other European countries |

| 4.27% | Savills PLC (United Kingdom) Provides consulting services and advice in matters related to |

| | commercial, agricultural and residential property to customers of the United Kingdom |

| 4.21% | En-Japan Inc. (Japan) Operates recruiting websites for job seekers, and offers education |

| | and evaluation-related services, such as job trainings and testing services in Japan |

| 4.19% | Kenedix Inc. (Japan) An asset management company investing in real estate and |

| | nonperforming loans mainly in Japan |

| 3.74% | Raffles Education Corp. Ltd. (Singapore) Provides college-level education programs and |

| | degrees in the areas of design and management across Asia |

| 3.70% | Azimut Holding S.p.A (Italy) Manages open-end mutual and pension funds for clients in |

| | central and northern Italy |

| 3.53% | Diploma PLC (United Kingdom) A company engaged in the distribution of specialized |

| | products and services through three business segments: life sciences, seals and controls |

| 3.45% | IG Group Holdings PLC (United Kingdom) Offers spread betting mostly on financial markets |

| Percent of Net Assets in Top Ten Holdings: 41.19% |

Top ten holdings do not include any cash, cash equivalent or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| 1-800-392-CORE (2673) ■ www.westcore.com | 27 |

Westcore Blue Chip Fund

FUND STRATEGY: Investing in large, well-established companies whose stocks appear to be undervalued.

The investing environment during the first half of 2008 was perhaps best characterized by fear of the financial fallout from the mortgage crisis and the continued propensity of investors to buy stocks in sectors that had performed well in the recent past, such as energy and commodities. Against this backdrop, we continued to manage the Westcore Blue Chip Fund by choosing stocks that we believe have strong free cash flow, earn good returns on capital and are reasonably priced relative to their earnings. For the six months ended June 30, 2008, this resulted in a decline of (7.13)% for the Fund’s retail class shares and (7.06)% for the Fund’s institutional class shares. During this same period, our benchmark, the S&P 500 Index, lost (11.91)%, and our peer group, as measured by the Lipper Large Core Index, declined (10.80)%.

The investing environment during the first half of 2008 was perhaps best characterized by fear of the financial fallout from the mortgage crisis and the continued propensity of investors to buy stocks in sectors that had performed well in the recent past, such as energy and commodities. Against this backdrop, we continued to manage the Westcore Blue Chip Fund by choosing stocks that we believe have strong free cash flow, earn good returns on capital and are reasonably priced relative to their earnings. For the six months ended June 30, 2008, this resulted in a decline of (7.13)% for the Fund’s retail class shares and (7.06)% for the Fund’s institutional class shares. During this same period, our benchmark, the S&P 500 Index, lost (11.91)%, and our peer group, as measured by the Lipper Large Core Index, declined (10.80)%.

The exceptional performance of several of our healthcare holdings made this the strongest contributing sector to the Fund’s overall performance during the period. Collectively, our healthcare holdings were down only (2.08)% while healthcare stocks in the S&P 500 Index declined (12.81)%. Standout performers included biotech company Amgen, Inc. and Zimmer Holdings, Inc., a manufacturer of orthopedic implants. Both companies enjoyed improving profitability and appear to us to have good prospects for continued growth.

Another strong contributor to the Fund’s performance was Quanta Services, Inc., a contracting services company that offers various network infrastructure solutions to the electric power, gas, telecommunications and cable television industries. We believe Quanta stands to benefit meaningfully from necessary upgrades to power grids. It continues to win contracts, driving revenues and cash flows higher. As a result of a 26% increase in Quanta’s stock price over the past six months, the commercial services sector was the Fund’s second largest contributor to our relative performance.

While it is clear that high energy prices and a difficult housing market are affecting consumer attitudes, our holdings of discount retailer TJX Companies Inc. and casual dining operator Darden Restaurants Inc. were both up in the first half of the year. The gains posted by these two stocks helped to buffer the losses of the consumer cyclical sector as a whole, which in the Fund declined only (3.77)% compared to a (9.72)% decline in the same sector in the S&P 500 Index.

| 28 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

Our largest individual contributor to performance was oil and gas exploration company XTO Energy Inc., which gained 33%. Aided by the strong performance of integrated oil and gas company Occidental Petroleum Corp., our collective energy holdings outperformed those in the benchmark index. However, we remain somewhat cautious on the sustainability of the recent spike in energy prices and therefore owned a slightly smaller weighting in energy than the S&P 500 Index during the period. As a result, energy created a nominal drag on the Fund’s performance relative to the benchmark.

Fund holding Wachovia Corp., a provider of commercial and retail banking services, lost 57% during the first half of the year. This caused the Fund’s absolute performance in the interest-rate sensitive sector to lag the S&P 500 Index. Helping to offset this underperformance was our decision to underweight the sector versus the benchmark. While we believe there is significant value in interest-rate sensitive stocks over time, near-term uncertainties convinced us to be cautious in this area.

Although the market continues to struggle with the slowing economy, we believe there are increasing opportunities to own companies with strong operations and balance sheets at attractive valuations. Over the next several quarters, we believe concerns about the degree of slowing should be clarified, and we expect the market will begin to improve. In the meantime, we remain focused on finding attractive investments for the Fund.

| 1-800-392-CORE (2673) ■ www.westcore.com | 29 |

S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. It is an unmanaged index.

Lipper Large-Cap Core Index is an unmanaged index comprised of the 30 largest mutual funds in the Lipper Large-Cap Core Funds classification. This classification consists of funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Large-cap core funds have more latitude in the companies in which they invest. These funds typically have an average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index.

An investment cannot be made directly in an index.

Please see Average Annual Total Return information on pages 4 and 5.

| 30 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

| Top 10 Holdings as of June 30, 2008 |

| 4.38% | Transocean Inc. (RIG) An offshore drilling contractor located throughout the world’s |

| | major oil and gas drilling regions |

| 4.05% | Cisco Systems Inc. (CSCO) Supplies data networking products to the corporate enterprise |

| | and public wide area service provider markets |

| 3.95% | International Business Machines Corp. (IBM) Provides computer solutions including |

| | systems, software, services and financing globally |

| 3.88% | Abbott Laboratories (ABT) Discovers, develops, manufactures and sells a broad and |

| | diversified line of healthcare products and services |

| 3.84% | Occidental Petroleum Corp. (OXY) Explores for, develops, produces and markets crude oil |

| | and natural gas and manufactures and markets a variety of basic chemicals, including chlorine |

| 3.56% | Teva Pharmaceutical Industries Ltd. (TEVA) Develops, manufactures and markets generic |

| | and branded pharmaceuticals for treatment of post-menopausal bone loss in women and |

| | treatment of multiple sclerosis |

| 3.45% | XTO Energy Inc. (XTO) A natural gas producer involved in the acquisition, exploration and |

| | development of long-lived producing oil and gas properties |

| 3.15% | QUALCOMM Inc. (QCOM) Develops and delivers digital wireless communications products |

| | and services based on the company’s proprietary digital technology |

| 3.04% | Zimmer Holdings Inc. (ZMH) Designs, develops, manufactures and markets orthopedic |

| | reconstructive implants and fracture management products |

| 2.99% | Marathon Oil Corp. (MRO) Explores for and produces crude oil and natural gas on a |

| | worldwide basis |

| Percent of Net Assets in Top Ten Holdings: 36.29% |

Top ten holdings do not include any cash, cash equivalent or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| 1-800-392-CORE (2673) ■ www.westcore.com | 31 |

Westcore Mid-Cap Value Fund

FUND STRATEGY: Investing primarily in medium-sized companies whose stocks appear to be undervalued.

We are pleased that, in the second quarter of the year, we outperformed our benchmark, the Russell Midcap Value Index, and produced a small positive return. However, it was not enough to overcome a disappointing first quarter. During the six-month period ended June 30, 2008, Westcore Mid-Cap Value Fund trailed its benchmark with a return of (9.87)% versus the (8.58)% return of the Index. We also underperformed our peer group during this period, as illustrated by the Lipper Mid-Cap Value Index return of (7.62)%. We are intent on overcoming these shortfalls as we head into the second half of the year.

Despite the Fund’s lackluster performance, there were three areas in which our holdings produced particularly strong gains. These were the consumer cyclical, commercial services and communications sectors. Darden Restaurants Inc., a casual dining company operating well-known restaurants that include Olive Garden, Red Lobster and Longhorn Steakhouse, has been a bright spot within the struggling restaurant industry. By effectively managing marketing and food costs in a difficult operating environment, Darden has improved same-store sales and posted better-than-expected margins. The company continues to return cash to shareholders through share repurchases and a dividend increase.

A standout performer within the commercial services sector was Quanta Services Inc., a leading provider of specialized contracting services that delivers end-to-end network solutions for the electric power, telecommunications, broadband cable, and gas pipeline industries. Strong quarterly results along with pending electric power and distribution contracts fueled the stock’s appreciation. We believe the company continues to be well positioned to capitalize on the need to improve the country’s electric power grid.

Within the communication sector, Adtran Inc., a telecom equipment company, provided a return exceeding 12% for the first half of the year. New products introduced in 2007 have translated into new customer orders in 2008, which are driving returns and cash flows higher.

| 32 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

The strongest headwinds that challenged the Fund in the first half of 2008 came from the capital goods, medical/ healthcare and energy sectors. While CNH Global N.V., a holding within the capital goods sector, is experiencing strong demand for its agricultural equipment, material inflation and supply chain inefficiencies have more than offset the robust demand year to date. CNH announced another price increase to offset higher raw material costs, and we expect the on-going restructuring will help alleviate industrial inefficiencies.

Within healthcare, Mentor Corp., a developer, manufacturer and marketer of aesthetic medical products, has not escaped the decline in consumer spending. While Mentor’s products largely appeal to the higher-end consumer, even they have, to some extent, cut back spending in light of the uncertainties plaguing the economy.

Given that our returns in the energy sector were in the 28% range for the first six months of 2008, it seems unjust to classify this as an area of weakness in the Fund. However, on a relative basis, that’s exactly what it was, as record oil prices enabled the Russell Midcap Value Index to return more than 31% in this sector. That said, it’s worth noting that Forest Oil Corp. was one of the largest individual contributors to the portfolio, with a return of more than 46%.

Looking ahead to the second half of 2008 and beyond, it remains unclear as to when the housing market will stabilize, commodity prices will plateau and lending institutions will purge themselves of non-performing loans. Further clouding the picture is a looming Presidential election in the fall. No one said investing is easy, but we believe our approach to investing in mid-cap stocks, with a focus on high-quality companies that are generating free-cash flow, will serve our investors well in the future.

| 1-800-392-CORE (2673) ■ www.westcore.com | 33 |

The Russell Midcap Value Index is an unmanaged index that measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values.

Lipper Mid-Cap Value Index is an unmanaged index comprised of the 30 largest mutual funds in the Lipper Mid-Cap Value Funds classification. This classification consists of funds that invest in companies to be undervalued relative to a major stock index.

An investment cannot be made directly in an index.

Please see Average Annual Total Return information on pages 4 and 5

| 34 | Semi-Annual Report June 30, 2008 (Unaudited) |  |

| Top 10 Holdings as of June 30, 2008 |

| 4.03% | Quanta Services Inc. (PWR) Provides specialized contracting services to electric utilities, |

| | telecommunication and cable television operators and governmental entities |

| 3.74% | General Cable Corp. (BGC) Designs, develops, manufactures, markets and distributes |

| | copper, aluminum and fiber optic wire and cable products for communications, electrical |

| | and energy markets around the world |

| 3.59% | CommScope Inc. (CTV) Designs, manufactures and markets coaxial cables and |

| | other high-performance electronic and fiber optic cable products primarily for |

| | communication applications |

| 3.20% | Invesco Ltd. (IVZ) An independent investment management group specializing in investment |

| | management services, covering equities, fixed income and real estate properties |

| 3.00% | Crown Holdings Inc. (CCK) Manufactures packaging products for household and |

| | consumer goods |

| 2.78% | PPL Corp. (PPL) Through its subsidiaries, generates and markets electricity from power |

| | plants in the northeastern and western U.S. |

| 2.68% | Darden Restaurants Inc. (DRI) Owns and operates seafood and Italian casual dining |

| | restaurants in North America |

| 2.63% | Range Resources Corp. (RRC) An independent oil and gas company, conducts operations |

| | in the Appalachian, Permian, Midcontinent and Gulf Coast regions |

| 2.55% | Affiliated Managers Group Inc. (AMG) An asset management holding company that |

| | acquires majority interests in mid-sized investment management firms |

| 2.50% | Ingram Micro Inc. (IM) A wholesale distributor of information technology products |

| | and services |

| Percent of Net Assets in Top Ten Holdings: 30.70% |