| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: July 31, 2022 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-3373 | |

SEGALL BRYANT & HAMILL TRUST

(Exact name of registrant as specified in charter)

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Maggie Bull, Secretary |

| Segall Bryant & Hamill Trust, 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (303) 623-2577 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2021 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| Segall Bryant & Hamill Small Cap Value Fund |

| (Ticker Symbol: Retail - SBRVX; Institutional - SBHVX) |

| |

| Segall Bryant & Hamill Small Cap Growth Fund |

| (Ticker Symbol: Retail - WTSGX; Institutional - WISGX) |

| |

| Segall Bryant & Hamill Small Cap Core Fund |

| (Ticker Symbol: Retail - SBHCX; Institutional - SBASX) |

| |

| Segall Bryant & Hamill All Cap Fund |

| (Ticker Symbol: Retail - SBRAX; Institutional - SBHAX) |

| |

| Segall Bryant & Hamill Emerging Markets Fund |

| (Ticker Symbol: Retail - SBHEX; Institutional - SBEMX) |

| |

| Segall Bryant & Hamill International Small Cap Fund |

| (Ticker Symbol: Retail - SBHSX; Institutional - SBSIX) |

| |

| Segall Bryant & Hamill Fundamental International Small Cap Fund |

| (Ticker Symbol: Retail - WTIFX; Institutional - WIIFX) |

| |

| Segall Bryant & Hamill Global All Cap Fund |

| (Ticker Symbol: Retail - WTMVX; Institutional - WIMVX) |

| |

| Segall Bryant & Hamill Workplace Equality Fund |

| (Ticker Symbol: Retail - WEQRX; Institutional - WEQIX) |

| |

| Segall Bryant & Hamill Short Term Plus Fund |

| (Ticker Symbol: Retail - SBHPX; Institutional - SBAPX) |

| |

| Segall Bryant & Hamill Plus Bond Fund |

| (Ticker Symbol: Retail - WTIBX; Institutional - WIIBX) |

| |

| Segall Bryant & Hamill Quality High Yield Fund |

| (Ticker Symbol: Retail - WTLTX; Institutional - WILTX) |

| |

| Segall Bryant & Hamill Municipal Opportunities Fund |

| (Ticker Symbol: Retail - WTTAX; Institutional - WITAX) |

| |

| Segall Bryant & Hamill Colorado Tax Free Fund |

| (Ticker Symbol: Retail - WTCOX; Institutional - WICOX) |

| |

| ANNUAL REPORT |

| DECEMBER 31, 2021 |

| SHAREHOLDER LETTER | 1 |

| | |

| FUND OVERVIEWS | |

| | |

| Segall Bryant & Hamill Small Cap Value Fund | 2 |

| | |

| Segall Bryant & Hamill Small Cap Growth Fund | 4 |

| | |

| Segall Bryant & Hamill Small Cap Core Fund | 6 |

| | |

| Segall Bryant & Hamill All Cap Fund | 8 |

| | |

| Segall Bryant & Hamill Emerging Markets Fund | 10 |

| | |

| Segall Bryant & Hamill International Small Cap Fund | 12 |

| | |

| Segall Bryant & Hamill Fundamental International Small Cap Fund | 14 |

| | |

| Segall Bryant & Hamill Global All Cap Fund | 16 |

| | |

| Segall Bryant & Hamill Workplace Equality Fund | 18 |

| | |

| Segall Bryant & Hamill Short Term Plus Fund | 20 |

| | |

| Segall Bryant & Hamill Plus Bond Fund | 22 |

| | |

| Segall Bryant & Hamill Quality High Yield Fund | 24 |

| | |

| Segall Bryant & Hamill Municipal Opportunities Fund | 26 |

| | |

| Segall Bryant & Hamill Colorado Tax Free Fund | 28 |

| | |

| FUND EXPENSES | 30 |

| | |

| IMPORTANT DISCLOSURES | 34 |

| | |

| TRUSTEES AND OFFICERS | 37 |

| | |

| FINANCIAL STATEMENTS | 40 |

| | |

| Statements of Investments | 40 |

| | |

| Statements of Assets and Liabilities | 97 |

| | |

| Statements of Operations | 101 |

| | |

| Statements of Changes in Net Assets | 105 |

| | |

| Financial Highlights | 110 |

| | |

| Notes to Financial Statements | 138 |

| | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 157 |

| | |

| SHAREHOLDER TAX INFORMATION | 158 |

| | |

| Annual Report | December 31, 2021 | |  | |

Intentionally Left Blank

| Segall Bryant & Hamill Funds | Shareholder Letter |

| | December 31, 2021 (Unaudited) |

Dear Fellow Shareholders:

We embark on 2022 with financial markets buoyed by several years of strong returns achieved in what paradoxically has been a period of significant political and social volatility. Although COVID certainly remains a risk that is foremost on our minds, we are encouraged by data suggesting that the highly contagious Omicron variant may cause much less-severe disease and could lead to the end of the pandemic, and the endemic phase of the virus. What we will take away from this incredible two-year period are entirely new ways of operating remotely. Video meeting technology has fundamentally changed the way we interact, both with each other and with external parties. Zoom, Microsoft Teams, etc. have reduced time and distance to where operational efficiencies will last indefinitely. Our team members have performed ably for the Funds and their shareholders throughout this period, and for that we are both proud and grateful. As a testament to the strength of the SBH team and culture, we are pleased to announce that Segall Bryant & Hamill was named a Pensions & Investments Best Places to Work in Money Management for 20211.

In our semiannual report in 2021, we mentioned inflation and how it was being characterized as transitory, primarily driven by supply chain issues. Today, the Federal Reserve (Fed) has recognized that it is more likely a result of very stimulative policy decisions in the wake of the COVID pandemic. Not only have we experienced price inflation, but nearly every asset has benefited from this economic stimulus, including the equity markets. As we have discussed in previous letters, we remained concerned with the high valuation level of stocks and historically low bond market interest rates, which when adjusted for inflation are in negative territory.

|  |

| | |

| Janice M. Teague | Philip L. Hildebrandt, CFA |

| Chair | President |

One phenomenon we have observed is that investors, prompted by a long period when risk candidly didn’t matter, have speculatively sought out unprofitable companies in which to invest. Why they are doing this is, frankly, a mystery to us, but when rates are low, investors feel emboldened to go further and further out on the risk curve with the hope of receiving higher returns. That rarely ends well. For us, this presents opportunities to invest in the stocks and bonds of underappreciated, high-quality companies with strong management teams. While these may not always be the companies you read about in the media, identifying such companies that are trading at reasonable valuations never goes out of style.

Passive investing has also been the golden child during this period of loose money. It is fantastic when, for example, the five tech stocks that represent 25% of the total market cap of an index go up as they bring the index return along with them. It is not nearly as much fun when those same highly concentrated positions go down. As active managers, we do not have to hold the entire list of securities that make up an index, choosing rather to own a smaller list of holdings, ideally in a more favorable mix. We believe this should bode well for active managers as the Fed begins to tighten its policies.

During periods of dislocation, such as when Fed policy begins to change, we believe our focus on identifying strong investments from the bottom up increases our opportunity set. We remain committed to our investment processes regardless of the macro-environment. We believe there will always be investment opportunities presented by this disciplined approach and the search for investment opportunities has been, and will remain, our primary goal.

We want to thank you for the trust and confidence you have placed in our Funds, and we will continue to work each day to earn it.

| 1 | Segall Bryant & Hamill did not solicit or pay a fee to participate in P&I’s Best Places to Work in Money Management survey. |

The views of the authors and information discussed in the shareholder letter and manager commentaries are as February 18, 2022, are subject to change, and may not reflect the writers’ current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Segall Bryant & Hamill, Segall Bryant & Hamill Funds, nor any Segall Bryant & Hamill Fund accept any liability for losses either direct or consequential caused by the use of this information. Diversification cannot guarantee gain or prevent losses.

| | |

| Annual Report | December 31, 2021 | |  | 1 |

| Segall Bryant & Hamill Small Cap Value Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of small-capitalization companies.

Fund Management

Mark T. Dickherber, CFA, CPA Portfolio Manager

Shaun P. Nicholson Portfolio Manager

CFA is a trademark owned by CFA Institute.

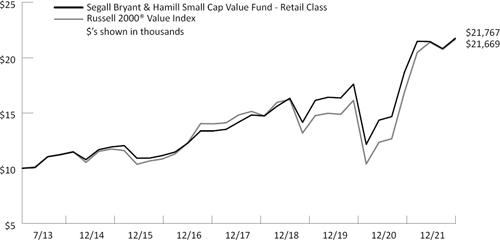

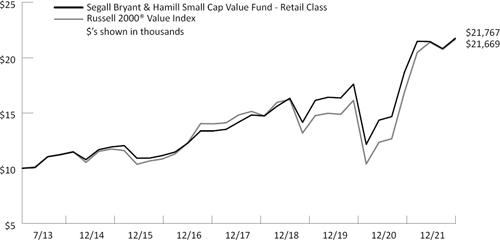

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | | | | | Since | Inception |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (SBRVX) | 16.47% | 15.44% | 10.23% | — | 9.68% | 12/9/19 |

| Institutional Class (SBHVX) | 16.62% | 15.57% | 10.37% | — | 9.83% | 7/31/13 |

| Russell 2000® Value Index | 28.27% | 17.99% | 9.07% | — | 9.62% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.08%, Net: 1.08%

Institutional Class Annual Expense Ratio (per the current prospectus) – Gross: 1.01%, Net: 0.99%

| | Sector Allocation (as of 12/31/21) | |

| | | |

| | Industrials | 23.1% |

| | Financials | 13.6% |

| | Information Technology | 13.4% |

| | Consumer Staples | 10.7% |

| | Materials | 9.5% |

| | Health Care | 8.5% |

| | Consumer Discretionary | 5.9% |

| | Real Estate | 5.5% |

| | Utilities | 3.4% |

| | Energy | 2.6% |

| | |

| | Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology. |

| | |

| | Sector weights may not sum to 100% due to rounding. |

| | |

| | The sector allocation table above does not include any cash or cash equivalents. |

| | |

| | Top Ten Holdings (as of 12/31/21) | |

| | | |

| | Coty, Inc. | 5.8% |

| | Regal Rexnord Corp. | 4.3% |

| | Hain Celestial Group, Inc. (The) | 4.2% |

| | Equity Commonwealth | 3.7% |

| | NCR Corp. | 3.7% |

| | Progress Software Corp. | 3.2% |

| | Compass Minerals International, Inc. | 3.1% |

| | Orthofix Medical, Inc. | 2.9% |

| | SPX Corp. | 2.2% |

| | FARO Technologies, Inc. | 2.2% |

| | |

| | Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund. |

| | |

| | |

| | |

| | |

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2022, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

| | |

| 2 |  | | www.sbhfunds.com |

| Segall Bryant & Hamill Small Cap Value Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

The continued easy monetary policy alongside the continued tailwind of fiscal policies were major headwinds for the Segall Bryant & Hamill Small Cap Value Fund during the first half of 2021. As these factors abated, the Fund outperformed slightly in the second half of the year despite the impact of supply chain disruptions and inflation which we believe impacted the Fund’s holdings disproportionately (versus the benchmark) given the Fund’s tilt toward more asset-intensive versus asset-light businesses. Most of the headwinds from a factor and exposure standpoint in the first half of 2021 were due to market dynamics that were at odds with our investment philosophy and process. For example, zombie companies (i.e., those that haven’t earned enough profit to cover interest costs for at least three years) and companies with very high short interest and money-losing businesses markedly outperformed. We think overall investor sentiment is too high and does not accurately reflect the risks associated with potential outcomes. This is due, in our opinion, to investors’ belief that the Federal Reserve (Fed) and Congress as always (and very quickly) will step in to backstop any negative market event. While that may prove true, we believe it is prudent to maintain a risk-adjusted view of the world, investing with management teams that can improve returns by becoming more efficient, divesting businesses not deemed core, and improving overall culture and governance matters at their respective companies. For the year 2021, the Segall Bryant & Hamill Small Cap Value Fund returned 16.47% (Retail Class) compared to a return of 28.27% for its benchmark, the Russell 2000® Value Index.

Contributors to Return

Over the last twelve months, two sectors in the Fund were positive contributors on a relative basis—Consumer Staples and Communication Services. Consumer Staples holdings performed well overall with Coty Inc. (COTY) seeing strong returns. Communication Services was a sector to which the Fund had no exposure and therefore it contributed positively due only to allocation effect. The Fund was overweight Consumer Staples which contributed positively to relative performance.

Coty Inc. (COTY), PDC Energy, Inc. (PDCE) and Regal Rexnord Corp. (RRX) were among the strongest positive contributions on an absolute basis. Coty saw recognition by the market of the transformation that has been unfolding for over a year at the company as management continued to meet or beat expectations. We did trim the Fund’s position slightly. PDC Energy continued to focus on debt reduction while enjoying higher cash flows and returns as oil prices have risen. We trimmed the Fund’s position slightly. Regal Rexnord continued to execute on its own transformation plan while we believe the closing of an important acquisition positions the company to continue to compound value. We did trim the Fund’s position slightly on the stock’s appreciation.

Detractors from Return

The three sectors that detracted most over the last twelve months were Real Estate, Information Technology, and Consumer Discretionary. The Real Estate industry, which the Fund was materially underweight, saw strong gains; the Fund’s largest Real Estate holding did not perform well relative to the group. In Information Technology, the Fund’s holdings showed positive returns; however, those returns, in general, lagged the overall index returns and the Fund was materially overweight this sector. Consumer Discretionary Fund holdings generally showed strong positive returns; however, the Fund was materially underweight the sector which caused a sizeable allocation headwind.

Orthofix Medical, Inc. (OFIX), eHealth, Inc. (EHTH) and Compass Minerals International, Inc. (CMP) generated the weakest contributions to returns on an absolute basis. Orthofix has been impacted by delays and suspensions of elective surgeries which has slowed growth materially for the time being. As a result of the stock’s weakness, we added to the Fund’s position. eHealth, Inc. (EHTH) had a change in CEO during peak selling season alongside specific market dynamics that led to missing of expectations. However, with a strong activist board and high confidence in the new CEO’s pedigree and demeanor, we added to the Fund’s position. Compass Minerals International, Inc. (CMP) missed Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) expectations given higher logistical costs while in tandem lowering their dividend to allocate more capital to their lithium project. We added to the Fund’s position on the pullback.

Outlook and Positioning

We believe it is prudent to maintain a risk-adjusted view of the world, investing with managements that can improve returns by becoming more efficient, divesting businesses not deemed core, and improving overall culture and governance matters at their respective companies. Over the past several months, we’ve been encouraged by the market’s move to start rewarding companies with improving fundamentals, and more prudent and disciplined management teams.

We enter 2022 encouraged with the management teams of the Fund’s holdings and confident in the Fund’s holdings. In our opinion, the teams have handled with remarkable success the myriad issues with which they were faced in 2021—from pandemic challenges, supply chain issues, employment difficulties, and inflationary pressures, among others. Our years of experience managing the Fund have taught us the value, particularly during challenging times, of focusing the Fund’s investments on companies with newer management teams—those that, in our view, have better discipline and integrity, and the ability to improve returns and governance even in the face of challenging environments. This approach gives us confidence that the Fund can perform even during tough times such as that which we experienced in the first half of 2021.

| |

| Stock Performance (for the year ended 12/31/21) |

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Coty, Inc. | 3.71 | 1.21 |

| PDC Energy, Inc. | 1.14 | 1.15 |

| Regal Beloit Corp. | 3.17 | 0.98 |

| Six Flags Entertainment Corp. | 2.09 | 0.79 |

| Regal Rexnord Corp. | 1.02 | 0.78 |

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Dril-Quip, Inc. | 0.92 | -0.31 |

| CIRCOR International, Inc. | 1.12 | -0.40 |

| Compass Minerals International, Inc. | 2.31 | -0.50 |

| eHealth, Inc. | 0.61 | -0.72 |

| Orthofix Medical, Inc. | 3.56 | -1.02 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 35 for a description of the methodology used to construct this table.

| | |

| Annual Report | December 31, 2021 | |  | 3 |

| Segall Bryant & Hamill Small Cap Growth Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Fund Strategy

Investing in a diversified portfolio of equity securities of primarily small-sized companies with growth potential.

Fund Management

Brian C. Fitzsimons, CFA Portfolio Manager

Mitch S. Begun, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

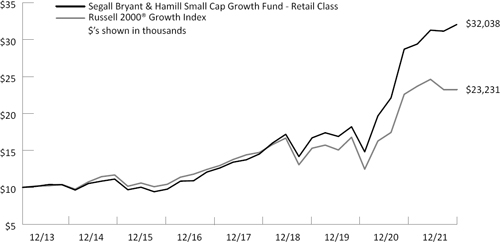

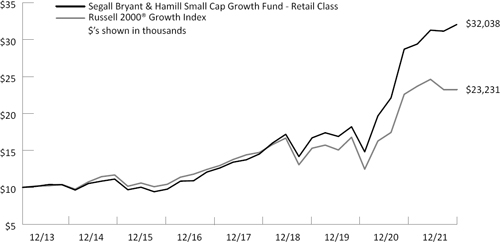

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | | | | | Since | Inception |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (WTSGX) | 11.62% | 31.25% | 24.07% | — | 15.60% | 12/20/13 |

| Institutional Class (WISGX) | 11.79% | 31.43% | 24.25% | — | 15.88% | 12/20/13 |

| Russell 2000® Growth Index | 2.83% | 21.17% | 14.53% | — | 11.07% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.04%, Net: 1.04%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.97%, Net: 0.97%

| | Sector Allocation (as of 12/31/21) | |

| | | |

| | Health Care | 27.5% |

| | Information Technology | 21.3% |

| | Industrials | 16.9% |

| | Financials | 10.6% |

| | Consumer Discretionary | 10.4% |

| | Materials | 4.4% |

| | Communication Services | 3.6% |

| | Real Estate | 2.1% |

| | Consumer Staples | 1.2% |

| | |

| | Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology. |

| | |

| | Sector weights may not sum to 100% due to rounding. |

| | |

| | The sector allocation table above does not include any cash or cash equivalents. |

| | |

| | Top Ten Holdings (as of 12/31/21) | |

| | | |

| | Silicon Laboratories, Inc. | 2.4% |

| | Endava PLC | 2.4% |

| | AZEK Co., Inc. (The) | 2.3% |

| | Churchill Downs, Inc. | 2.2% |

| | Trupanion, Inc. | 2.1% |

| | Omnicell, Inc. | 2.1% |

| | Tetra Tech, Inc. | 1.9% |

| | Sprout Social, Inc. | 1.9% |

| | Bright Horizons Family Solutions, Inc. | 1.9% |

| | Inspire Medical Systems, Inc. | 1.9% |

| | |

| | Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2022, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

| | |

| 4 |  | | www.sbhfunds.com |

| Segall Bryant & Hamill Small Cap Growth Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

For 2021, the Segall Bryant & Hamill Small Cap Growth Fund returned 11.62% (Retail Class) compared to the Fund’s benchmark, the Russell 2000® Growth Index’s 2.83% return.

The tailwinds unleashed in 2021 by the distribution of vaccines, reopening of the economy, and easy monetary conditions created an economic acceleration typically seen at the beginning of expansions. Consequently, the broader equity markets delivered extraordinary returns during the year (+25%). Notably, however, the Russell 2000® Growth Index was left behind as its lower representation of strong performing cyclical sectors was a headwind. Another contributing factor for its underperformance was its relatively high exposure to the biotechnology industry which was down 30% on the year. From our vantage point, the dispersion in returns across styles and sectors created an attractive environment for active management.

Contributors to Return

The three sectors that contributed most to the Fund’s performance relative to its benchmark in the year were Information Technology, Health Care, and Materials. Although stock selection was the primary driver of returns, the Fund’s underweight position in the biotechnology industry relative to the Russell 2000® Growth Index was also a tailwind to relative performance. Endava PLC (DAVA), a leading next-generation IT services provider, was the Fund’s best performing stock in 2021. The importance of modern, digital information technology architectures has been highlighted during the pandemic and drove an acceleration in growth for the company, which also generated best-in-class margins among its peers. Currently, we remain optimistic about the duration of its growth opportunities. Semiconductor company SiTime Corporation (SITM) was also a top contributor in 2021 as it is rapidly disrupting a large segment of the chip industry, most notably in timing solutions that essentially work as the heartbeat of electronic devices. We believe that the company is taking material market share from legacy solutions due to its superior efficiency across a host of attributes. Another semiconductor company Silicon Labs, Inc. (SLAB) also performed well in the period, particularly after reporting strong third quarter results. This was SLAB’s first quarter as a pureplay Internet-of-Things company after selling its legacy business segments. Its attractive growth profile, profitability leverage, and significant share repurchases have helped buoy the stock and we remain constructive on its prospects.

Detractors from Return

The three sectors that detracted most from the Fund’s performance relative to its benchmark in the year were Consumer Discretionary, Financials, and Consumer Staples. The Fund’s worst-performing stock in 2021 was Amedisys, Inc. (AMED), a leading provider of home health, hospice, and personal care services, after the company reported an unexpected increase in staff turnover in their hospice segment sales force in the second half of the year. While growth expectations have deteriorated, we believe the issue is a short-term setback and new hires will ramp productivity in time. Everbridge, Inc. (EVBG), a leading provider of critical event management software, was also a significant drag on performance in the year. The unexpected departure of its CEO, accompanied by a moderation in growth expectations for 2022 drove shares materially lower in the fourth quarter. While we expect some disruption from the rapid change, we believe the company has a strong competitive position with leading technologies that operate at scale. Bright Horizons Family Solutions, Inc. (BFAM), a provider of child care services, was weak in the period as utilization rates in its centers remain depressed given the ongoing pandemic. Ultimately, we believe that employers recognize the importance of providing child care as a benefit to their employees and the pandemic has made this more evident despite a potentially more hybrid workforce operating both remotely and in office.

Outlook and Positioning

As of the end of 2021, the Fund remains overweight primarily in the Financials sector and underweight primarily in the Consumer Discretionary and Consumer Staples sectors.

Equities essentially ended the year at all-time highs as investors looked beyond the recent rise of Omicron variant cases. Conversely, in our view, looming higher interest rates and normalizing, i.e., slowing, growth could present challenges in 2022. Our focus remains on building a portfolio of companies that we believe can exhibit fundamentally stable growth characteristics across an entire economic cycle as this has typically helped protect investor capital in down markets. Additionally, as economic growth peaks, we believe investors will again find high quality growth an attractive area of the market as companies with unique, disruptive products and services can typically succeed without cyclical tailwinds.

We wish you the best in 2022 and as always, thank you for your continued interest and support.

| |

| Stock Performance (for the year ended 12/31/21) |

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Endava PLC | 2.34 | 2.07 |

| SiTime Corp. | 1.22 | 1.60 |

| Globant S.A. | 2.03 | 1.30 |

| Asana, Inc. | 0.51 | 1.08 |

| Silicon Laboratories, Inc. | 2.08 | 1.07 |

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Bright Horizons Family Solutions, Inc. | 2.36 | -0.66 |

| Turning Point Therapeutics, Inc. | 0.80 | -0.72 |

| Everbridge, Inc. | 1.16 | -0.81 |

| SelectQuote, Inc. | 0.52 | -0.92 |

| Amedisys, Inc. | 1.73 | -1.02 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 35 for a description of the methodology used to construct this table.

| | |

| Annual Report | December 31, 2021 | |  | 5 |

| Segall Bryant & Hamill Small Cap Core Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of small-capitalization companies.

Fund Management

Jeffrey C. Paulis, CFA, Portfolio Manager

Mark T. Dickherber, CFA, CPA Portfolio Manager

CFA is a trademark owned by CFA Institute.

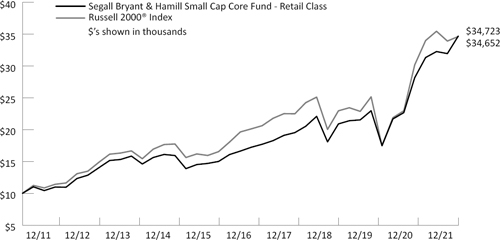

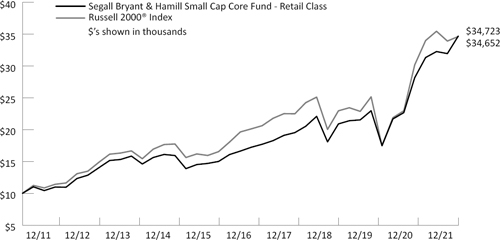

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 34.

Average Annual Total Returns*

| | | | | | Since | Inception |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (SBHCX) | 23.26% | 24.28% | 15.85% | 13.26% | 10.15% | 12/31/19 |

| Institutional Class (SBASX) | 23.48% | 24.49% | 16.03% | 13.43% | 10.32% | 12/15/03 |

| Russell 2000® Index | 14.82% | 20.02% | 12.02% | 13.23% | 9.49% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.26%, Net: 1.14%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.27%, Net: 0.99%

| | Sector Allocation (as of 12/31/21) | |

| | | |

| | Industrials | 25.0% |

| | Information Technology | 21.4% |

| | Health Care | 12.7% |

| | Consumer Discretionary | 12.5% |

| | Financials | 8.1% |

| | Materials | 7.8% |

| | Consumer Staples | 5.2% |

| | Energy | 2.4% |

| | Real Estate | 1.3% |

| | |

| | Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology. |

| | |

| | Sector weights may not sum to 100% due to rounding. |

| | |

| | The sector allocation table above does not include any cash or cash equivalents. |

| | |

| | Top Ten Holdings (as of 12/31/21) | |

| | | |

| | Regal Rexnord Corp. | 3.3% |

| | Hain Celestial Group, Inc. (The) | 2.4% |

| | Element Solutions, Inc. | 2.2% |

| | Silicon Laboratories, Inc. | 2.2% |

| | EnPro Industries, Inc. | 2.1% |

| | Pure Storage, Inc. | 2.0% |

| | Capri Holdings, Ltd. | 1.9% |

| | WNS Holdings, Ltd. | 1.7% |

| | Devon Energy Corp. | 1.6% |

| | Gildan Activewear, Inc. | 1.6% |

| | |

| | Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund. |

| | |

| | |

| | |

| | |

| | |

| | |

| * | The quoted performance of the Fund reflects the past performance of Lower Wacker Small Cap Investment Fund, LLC (the “Partnership”), an unregistered limited partnership managed by the portfolio managers of the Fund. The Partnership was organized into the Institutional Class shares on December 31, 2019, the date the Fund commenced operations. The Fund has been managed in the same style since the Partnership’s inception on December 15, 2003. The Fund’s annual returns and long-term performance reflect the actual fees and expenses that were charged when the Fund was a limited partnership. From its inception on December 15, 2003 through December 31, 2019, the Partnership was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended or Subchapter M of the Internal Revenue Code of 1986, as amended, which, if they had been applicable, might have adversely affected the Fund’s performance. |

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2022, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

| | |

| 6 |  | | www.sbhfunds.com |

| Segall Bryant & Hamill Small Cap Core Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

The market continued its recovery from the COVID-19 pandemic as economies continued to reopen in 2021. The year began with a dramatic rise in low Return on Invested Capital (ROIC) stocks during the first quarter which ultimately subsided as risks related to COVID-19 variants, inflation, labor, supply chains, amongst others, arose through the remainder of the year. As these risks became more apparent through the year, the market rotated to higher ROIC companies, particularly in the second half of 2021, which benefited the performance of the Segall Bryant & Hamill Small Cap Core Fund. The Fund returned 23.26% (Retail Class) for the one-year period ended December 31, 2021. Its benchmark, the Russell 2000® Index, returned 14.82%.

Contributors to Return

On a sector level, Health Care, Industrials, and Information Technology were the largest contributors to the Fund’s performance relative to the benchmark. Endava Plc (DAVA) a digital technology outsourcer, was the largest individual contributor to the Fund’s return. Demand for Endava’s solutions structurally inflected higher as a result of COVID-19 as companies across industries struggled to engage digitally with their customers, accept new payment methods, and bring efficiency to their business—all things Endava’s solutions enable. Zurn Water Solutions Corporation (ZWS), a designer and manufacturer of water solutions focused on flow control, quality, and safety, was another large contributor. ZWS transformed into a pure-play water company by merging its industrial business with another company. In addition to solid business fundamentals and management execution, we believe the transformation attracted environmental, social, and governance (ESG) investors which resulted in multiple expansion and stock price appreciation.

Detractors from Return

On a sector level, Real Estate and Financials were the largest relative detractors from the Fund’s performance. Amedisys, Inc (AMED), a provider of home health and hospice services, was the largest detractor. Amedisys faced numerous internal and external headwinds during 2021. Repeated COVID-19 spikes reduced the length of patient stay in its hospice business while elevated staff quarantine levels and pandemic-related nurse burnout caused

staffing shortages which impacted the company’s short-term financial results. Anaplan, Inc (PLAN), a provider of SaaS planning solutions, was the second largest detractor. Anaplan reported solid, but inconsistent results which, coupled with a CFO and head of sales change during the year, weighed on investor sentiment and the multiple.

Outlook and Positioning

As we begin 2022, the solid economic backdrop in the U.S. continues to be challenged by many global issues related to labor and supply chains. Over the next few quarters (not first quarter 2022), we see a path for many of these issues to become incrementally less bad which, combined with the fading of the Delta/Omicron variants and an inventory restocking cycle, could strengthen investor sentiment for cyclical companies. Accordingly, the Fund’s positioning remains fairly balanced between sustainably high ROIC companies and improving ROIC companies as it had been for the last several quarters. However, entering the third year of the recovery, we also see the prospects for increasing market volatility developing driven by Federal Reserve (Fed) actions (higher rate tightening prospects and potential quantitative tightening), midterm elections, and a slowing of economic backdrop as we move through the second half of the year.

As we move through 2022, we would not be surprised to see the mix of higher ROIC companies in the strategy increase as the cycle matures and the backdrop for low ROIC companies becomes increasingly unfavorable (higher rates, slower growth). Further, many high growth names underperformed dramatically in 2021 and our team is busy evaluating the merits of many of these companies as we believe they could rebound should the Fed raise rates too aggressively or if economic growth begins to surprise to the downside. Regardless, through our research efforts, our team will remain focused on seeking to identify both higher ROIC and improving ROIC investment opportunities and seeking to ensure these investment opportunities also possess solid niche market and competitive advantaged positioning, strong management teams, and attractive risk-adjusted return potential—all attributes which have represented the key pillars to our investment approach for many years.

| |

| Stock Performance (for the year ended 12/31/21) |

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Endava PLC | 1.56 | 1.35 |

| Devon Energy Corp. | 1.09 | 1.14 |

| Zurn Water Solutions Corp. | 1.58 | 1.14 |

| Rogers Corp. | 1.70 | 0.99 |

| Silicon Laboratories, Inc. | 1.76 | 0.95 |

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| 8x8, Inc. | 0.34 | -0.32 |

| Phreesia, Inc. | 0.47 | -0.33 |

| Haemonetics Corp. | 0.27 | -0.34 |

| Anaplan, Inc. | 0.88 | -0.34 |

| Amedisys, Inc. | 1.33 | -0.83 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 35 for a description of the methodology used to construct this table.

| | |

| Annual Report | December 31, 2021 | |  | 7 |

| Segall Bryant & Hamill All Cap Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of any size, including small- and mid-capitalization companies.

Fund Management

Ralph M. Segall, CFA, CIC Portfolio Manager

Suresh Rajagopal, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

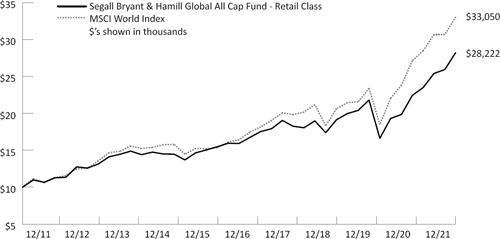

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | | | | | Since | Inception |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (SBRAX) | 29.57% | 28.68% | 18.95% | — | 14.08% | 12/9/19 |

| Institutional Class (SBHAX) | 29.55% | 28.76% | 19.07% | — | 14.22% | 7/31/13 |

| Russell 3000® Index | 25.66% | 25.79% | 17.97% | — | 14.96% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 0.99%, Net: 0.99%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.92%, Net: 0.84%

| | Sector Allocation (as of 12/31/21) | |

| | | |

| | Information Technology | 24.9% |

| | Health Care | 16.7% |

| | Financials | 15.3% |

| | Consumer Discretionary | 14.0% |

| | Industrials | 10.9% |

| | Communication Services | 5.4% |

| | Consumer Staples | 4.6% |

| | Materials | 3.5% |

| | Energy | 2.6% |

| | |

| | Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology. |

| | |

| | Sector weights may not sum to 100% due to rounding. |

| | |

| | The sector allocation table above does not include any cash or cash equivalents. |

| | |

| | Top Ten Holdings (as of 12/31/21) | |

| | | |

| | Microsoft Corp. | 4.7% |

| | Alphabet, Inc. | 4.0% |

| | Marvell Technology, Inc. | 3.5% |

| | Amazon.com, Inc. | 3.1% |

| | Quanta Services, Inc. | 2.7% |

| | Ares Management Corp. | 2.7% |

| | Visa, Inc. | 2.6% |

| | Zebra Technologies Corp. | 2.6% |

| | TJX Cos., Inc. (The) | 2.5% |

| | UnitedHealth Group, Inc. | 2.2% |

| | |

| | Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2022, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.99% and 0.84% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

| | |

| 8 |  | | www.sbhfunds.com |

| Segall Bryant & Hamill All Cap Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

For the fiscal year ended December 31, 2021, the Segall Bryant & Hamill All Cap Fund returned 29.57% (Retail Class) compared to a return of 25.66% for its benchmark, the Russell 3000® Index. Security selection was the most significant contributor to relative performance for the year. As a reminder, the investment approach of the Fund is to participate in all markets by investing in companies that that we believe can generate meaningful Returns on Invested Capital (ROIC), produce quality financial metrics (e.g., free cash flow growth, consistent earnings growth, and margin expansion) and possess strong management teams.

Contributors to Return

At the sector level, the Fund’s best-performing sectors during the year relative to the benchmark were Health Care, Information Technology, and Industrials. Outperformance in the Communication Services sector was primarily from Alphabet (GOOG) and lack of exposure to underperforming names within the sector. Health Care was driven by strong idiosyncratic performance of several holdings as was Information Technology. At the individual stock level, Marvell Technology (MRVL) was a top contributor due to design wins related to its data center, 5G deployments, enterprise networking, and autos which pushed growth expectations meaningfully higher in 2022.

Detractors from Return

Materials, Energy, and Real Estate were the largest detractors on a sector level relative to the Fund’s benchmark for the year. The Energy sector suffered due to lack of exposure within the Fund, as the energy sector was the best performing sector within the benchmark index. The Fund’s holdings in the Materials sector lacked exposure to some of the basic commodity businesses that enjoyed strong year-end rallies within the benchmark. At an individual stock level, Cable One (CABO) underperformed for the year due to stepped-up capital expenditure concerns, increasing regulation and near-term concerns about user growth.

Outlook and Positioning

Investors enter 2022 flush with several strong years of returns from the financial markets, paradoxically achieved during tremendous political and social turmoil. COVID remains top of mind on our risk radar, but we are encouraged by data indicating the new super-spreading Omicron variant may be much less severe and represent the beginning of the end of the pandemic (i.e., the endemic case). How the recent surge in inflation responds to COVID-influenced demand and supply shocks is another key watch item particularly at current market valuation levels. We have been concerned about very high valuation levels for stocks and low levels of interest rates in the bond market which are now in real, that is, inflation-adjusted terms, quite negative. While the opportunity set seems to be getting smaller and smaller, the fact that the markets remain high illustrates the comment attributed to J.M. Keynes: “The market can stay irrational longer than you can stay solvent.”

Fortunately, for us, macro concerns are not a principal part of the selection process in the Fund. It always has been, and will always remain, a market of stocks rather than a stock market. In our view, there will always be investments to make in companies with the right set of investment characteristics, priced at valuations that present an attractive opportunity to reach our long-term investment goals. The constant search for such names goes on.

Thank you for your consideration and continued support.

| |

| Stock Performance (for the year ended 12/31/21) |

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Alphabet, Inc. | 3.91 | 2.23 |

| Marvell Technology, Inc. | 2.92 | 2.17 |

| Microsoft Corp. | 4.38 | 2.13 |

| Ares Management Corp. | 2.37 | 1.54 |

| Quanta Services, Inc. | 2.59 | 1.34 |

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Autodesk, Inc. | 0.46 | -0.15 |

| CoStar Group, Inc. | 1.22 | -0.21 |

| Lamb Weston Holdings, Inc. | 0.77 | -0.24 |

| Fidelity National Information Services, Inc. | 0.58 | -0.39 |

| Cable One, Inc. | 1.65 | -0.43 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 35 for a description of the methodology used to construct this table.

| | |

| Annual Report | December 31, 2021 | |  | 9 |

| Segall Bryant & Hamill Emerging Markets Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of companies tied economically to emerging markets countries.

Fund Management

Scott E. Decatur, Ph.D. Portfolio Manager

Nicholas C. Fedako, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | | | | | Since | Inception |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class* (SBHEX) | 5.22% | 10.07% | 8.45% | 5.09% | 2.55% | 6/30/14 |

| Institutional Class** (SBEMX) | 5.49% | 10.34% | 8.68% | 5.29% | 2.76% | 6/30/11 |

| MSCI Emerging Markets Index | (2.54)% | 10.94% | 9.88% | 5.49% | 3.11% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 2.36%, Net: 1.38%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 2.19%, Net: 1.23%

| | Sector Allocation (as of 12/31/21) | |

| | | |

| | Information Technology | 25.1% |

| | Financials | 19.3% |

| | Consumer Discretionary | 12.3% |

| | Communication Services | 9.1% |

| | Materials | 8.4% |

| | Energy | 6.2% |

| | Consumer Staples | 5.5% |

| | Industrials | 5.3% |

| | Health Care | 3.9% |

| | Utilities | 2.5% |

| | Real Estate | 1.9% |

| | |

| | Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology. |

| | |

| | Sector weights may not sum to 100% due to rounding. |

| | |

| | The sector allocation table above does not include any cash or cash equivalents. |

| | |

| | Top Ten Holdings (as of 12/31/21) | |

| | | |

| | Taiwan Semiconductor Manufacturing Co., Ltd. | 5.9% |

| | Tencent Holdings, Ltd. | 3.5% |

| | Samsung Electronics Co., Ltd. | 3.2% |

| | Alibaba Group Holding, Ltd. | 1.9% |

| | Bank of China, Ltd. | 1.1% |

| | Zhongsheng Group Holdings, Ltd. | 1.0% |

| | Wuchan Zhongda Group Co., Ltd. | 1.0% |

| | China Construction Bank Corp. | 1.0% |

| | KPR Mill, Ltd. | 0.9% |

| | State Bank of India | 0.9% |

| | |

| | Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2022, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.38% and 1.23% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in foreign companies are subject to special risks, including currency fluctuations, social, economic, and political uncertainties, which could increase volatility.

| | |

| 10 |  | | www.sbhfunds.com |

| Segall Bryant & Hamill Emerging Markets Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

After posting an 18.31% return for the fiscal year ended December 31, 2020, the MSCI Emerging Markets Index finished down 2.54% in 2021, just the second time in the last six years it has ended in negative territory. Markets rallied to begin 2021 as optimism grew that vaccination efforts and economies reopening would provide a jumpstart to global growth. Stocks traded lower as the year went on as concerns grew that variants of the Coronavirus could lead to new restrictions and that higher inflation would cause central bankers to tighten monetary policies. Regional index performance was mixed as Asia -5.08% and Latin America -8.09% ended lower, while EMEA (Europe, Middle East, Africa) +18.01% ended higher. China -21.72% was the worst-performing country in Asia this year and second worst in the index overall as regulatory actions against technology companies, debt concerns in its property sector, and slowing growth all weighed on equities. Two bright spots in Asia were India +26.23%, which benefited from strong stimulus programs, and Taiwan +26.13%, where semiconductor companies outperformed on rising prices and demand. Returns in Latin America were dragged down by its largest economy, Brazil -17.40%, which is facing rising interest rates, slowing growth, and a possibly contentious presidential election in 2022. The region’s second largest economy, Mexico +22.53%, was the top performer in the region, aided in part by the strong economic recovery in the U.S., its largest trading partner. In EMEA, every country ended the year higher, with the exception of Turkey where stocks rose in local terms but the lira fell 44% versus the U.S. dollar as investors questioned the current leadership’s policy of cutting interest rates despite rising inflation. The countries with the largest impacts on positive returns to the Benchmark in the region for the year were Saudi Arabia +37.70%, which saw growth in its financial sector at the prospect of higher interest rates, and Russia +19.01%, where energy companies rose on higher demand. At the sector level, 6 of 11 groups ended the year higher, led by Energy +20.95% and Utilities +12.43% which benefited from rising oil, natural gas, and electricity prices as economies reopened. The two worst-performing sectors were Consumer Discretionary -29.06% and Real Estate -21.84%, which were hit especially hard from their larger weights in Chinese equities.

The Segall Bryant & Hamill Emerging Markets Fund returned 5.22% (Retail Class) for the one-year period ending December 31, 2021. The Fund’s benchmark, the MSCI Emerging Markets Index, returned -2.54%. Security

selection was strong within the Asia, Latin America and EMEA benchmark regions, but especially in Asia, where the Fund’s holdings in China, India, and Korea outperformed relative to the benchmark. Selection in Malaysia and Indonesia was a modest drag on relative returns. In Latin America, positive security selection was driven primarily by Brazil, while Peru and Chile also contributed. In EMEA, Russia was the Fund’s top performer, followed by Qatar, Poland, and Turkey. At the sector level, stock selection was positive in 10 of 11 groups with the largest relative returns coming from Consumer Discretionary, Financials, and Consumer Staples. Real Estate was the only sector where selection was negative. In our opinion, our multifactor model worked very well in 2021 as Valuation, Earnings Momentum, and Price Momentum outperformed and Profitability performed in line.

Outlook and Positioning

High-quality and value factors both performed well in emerging markets in 2021, but the best-performing segment was the intersection of the two. The Fund’s area of focus, companies we assess as high quality that we believe are trading at reasonable valuations, enjoyed strong relative returns for the year as investors began to, once again, focus on prices rather than just overly optimistic narratives when evaluating companies. Expensive companies of lesser quality, which outperformed in 2020, were the worst-performing segment this year. These trends are occurring globally but have been more pronounced in emerging markets than in other asset classes. We believe that the positioning of the Fund remains historically attractive from a valuation perspective. Even with substantial outperformance during 2021, we believe the Fund is even better positioned than it was at the end of 2020 due to the strong business performance of the companies on which we focus. We noticed a similar phenomenon during the deflation of the dot-com bubble in which the Fund’s area of focus simultaneously outperformed while becoming more attractively valued. It can be a very powerful driver of outperformance when a segment of the market that is at record valuation discounts is also performing well from a business perspective. From an asset allocation perspective, emerging markets are at some of the largest discounts versus the U.S. in 20 years, levels from which they have typically rebounded strongly. We are very optimistic on both the emerging markets asset class and the positioning of the Fund as we begin 2022.

| |

| Stock Performance (for the year ended 12/31/21) |

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 5.44 | 0.72 |

| KPR Mill, Ltd. | 0.48 | 0.68 |

| Evergreen Marine Corp. Taiwan, Ltd. | 0.40 | 0.56 |

| Yang Ming Marine Transport Corp. | 0.31 | 0.41 |

| Fubon Financial Holdings Co., Ltd. | 0.59 | 0.35 |

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Meituan | 0.66 | -0.27 |

| Samsung Electronics Co., Ltd. | 3.22 | -0.30 |

| Baidu, Inc. | 0.92 | -0.38 |

| Tencent Holdings, Ltd. | 4.46 | -0.61 |

| Alibaba Group Holding, Ltd. | 3.83 | -1.94 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 35 for a description of the methodology used to construct this table.

| | |

| Annual Report | December 31, 2021 | |  | 11 |

| Segall Bryant & Hamill International Small Cap Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of small capitalization companies located outside of the United States, including those in emerging markets.

Fund Management

Scott E. Decatur, Ph.D. Portfolio Manager

Nicholas C. Fedako, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | | | | | Since | Inception |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class* (SBHSX) | 12.97% | 7.55% | 3.96% | 8.08% | 5.32% | 6/30/14 |

| Institutional Class** (SBSIX) | 13.19% | 7.73% | 4.21% | 8.32% | 5.56% | 5/31/11 |

| MSCI EAFE Small Cap Index | 10.10% | 15.62% | 11.04% | 10.80% | 7.82% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.36%, Net: 1.18%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.18%, Net: 1.03%

| | Sector Allocation (as of 12/31/21) | |

| | | |

| | Industrials | 24.7% |

| | Consumer Discretionary | 12.1% |

| | Financials | 10.8% |

| | Information Technology | 10.8% |

| | Real Estate | 9.6% |

| | Materials | 8.3% |

| | Health Care | 7.7% |

| | Consumer Staples | 5.8% |

| | Communication Services | 4.5% |

| | Utilities | 2.8% |

| | Energy | 2.0% |

| | |

| | Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology. |

| | |

| | Sector weights may not sum to 100% due to rounding. |

| | |

| | The sector allocation table above does not include any cash or cash equivalents. |

| | |

| | Top Ten Holdings (as of 12/31/21) | |

| | | |

| | Scandinavian Tobacco Group A/S | 1.2% |

| | Redrow PLC | 1.2% |

| | GrainCorp, Ltd. | 1.1% |

| | Investec PLC | 1.1% |

| | Royal Mail PLC | 1.1% |

| | Vistry Group PLC | 1.0% |

| | Getinge A.B. | 1.0% |

| | Computacenter PLC | 1.0% |

| | ASR Nederland N.V. | 1.0% |

| | Inwido A.B. | 0.9% |

| | |

| | Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2022, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.18% and 1.03% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

Investing in foreign companies are subject to special risks, including currency fluctuations, social, economic, and political uncertainties, which could increase volatility.

| | |

| 12 |  | | www.sbhfunds.com |

| Segall Bryant & Hamill International Small Cap Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

In 2021, international small cap stocks, as measured by the MSCI EAFE Small Cap Index, rose for the third year in a row with a 10.10% return as global vaccination efforts expanded and governments took steps to reopen their economies from the pandemic. Stocks pared gains through the final four months of the year on inflation and Omicron variant concerns. U.S.-based investors saw local returns reduced as the dollar strengthened versus the euro, pound, and yen with the MSCI EAFE Small Cap Index ending 17.28% higher in local terms for the year. Regional index returns were mixed as Europe +15.76%, the United Kingdom +13.49%, and the Far East +10.95% posted positive returns, while Japan -2.28% dropped modestly. In Europe, the Netherlands +31.46% was the best-performing country as the nation’s stock market has become a hub of special purpose acquisition company (SPAC) and technology listings within the region. Germany +7.00% lagged its European peers as exporters were hurt by rising raw material costs and supply chain disruptions. The U.K. ended higher aided by a hot real estate market and beaten down industrials rebounding on recovery optimism. Australia +15.03% was the best performer in the Far East as metal and mining companies rallied as demand increased for raw materials. New Zealand was the only country in the region to end lower as the country reintroduced some COVID restrictions, and business and consumer confidence dropped. Japan also ended in negative territory as stricter quarantine measures remained in place, along with a weaker yen. At the sector level, 9 of 11 groups ended the year in positive territory, led by Financials +17.18% whose margins could improve if central bankers raise interest rates to combat inflation. Industrials +16.42%, Real Estate +13.91%, and Materials +11.62% also posted double-digit returns as economies reopened. Consumer Staples -5.28% led on the downside on concerns that rising input prices could negatively affect profits.

The Segall Bryant & Hamill International Small Cap Fund (SBHSX) returned 12.97% (Retail Class) for the one-year period ending December 31, 2021. The Fund’s benchmark, the MSCI EAFE Small Cap Index, returned 10.10%. Stock selection was positive in all four regions this year with the United Kingdom providing the largest relative gain. Within Europe, the Fund’s holdings in France, Norway, and Sweden were the top outperformers, while selection

in Switzerland caused the biggest drag. In the Far East, positive selection effects in New Zealand and Hong Kong were more than enough to offset negative selection in Australia. At the sector level, stock selection was additive in 9 of 11 groups with the largest benefits coming from Health Care, Information Technology, and Real Estate. Communication Services and Materials were the two sectors where selection ended modestly lower. In our opinion, our multifactor model performed well in 2021 with Valuation providing the largest positive impact, followed by Earnings Momentum and Profitability. The Price Momentum component ended the year lower but we believe performed well following a difficult first quarter.

Outlook and Positioning

2021 ended with both quality and value factors performing well. Historically, we believe that the intersection of the two is the best-performing segment, but it was the extremes of the two factors that led in 2021. We believe the international small cap space is still in a transitional phase, or “turn”, from expensive company leadership to our area of focus, companies that we assess as high quality with reasonable valuations. We noticed similar turns after the substantial market dislocations of 1999/2000 and 2008/2009. In our experience, the outperformance of lower quality companies often acts as a bridge between the outperformance of expensive growth companies back to the reasonably valued, high-quality segment that we focus on. As 2021 progressed, we observed outperformance trending away from lower-quality companies into high-quality ones. We expect this adjustment to continue in 2022, which we believe should continue to benefit our approach. Positioning remains very attractive, as relative valuations between our area of focus and the market actually improved over the course of 2021, despite the Fund outperforming. We believe this improvement was possible due to the strong fundamental performance of the companies in the Fund’s area of focus. It can be a powerful driver of outperformance when a segment of the market that is at record valuation discounts is also performing well from an underlying business perspective. We believe a historic opportunity exists in the international small cap space and we are optimistic about our prospects going forward.

| |

| Stock Performance (for the year ended 12/31/21) |

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| InMode, Ltd. | 0.51 | 0.73 |

| Gamesys Group PLC | 0.21 | 0.59 |

| Mitsui OSK Lines, Ltd. | 0.56 | 0.58 |

| Redde Northgate PLC | 0.96 | 0.55 |

| Getinge A.B. | 0.87 | 0.52 |

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Betsson A.B. | 0.60 | -0.17 |

| Digital Holdings, Inc. | 0.23 | -0.18 |

| Mount Gibson Iron, Ltd. | 0.24 | -0.21 |

| Millicom International Cellular S.A. | 0.33 | -0.27 |

| NRW Holdings, Ltd. | 0.50 | -0.40 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 35 for a description of the methodology used to construct this table.

| | |

| Annual Report | December 31, 2021 | |  | 13 |

Segall Bryant & Hamill

Fundamental International Small Cap Fund | Fund Overview |

| | December 31, 2021 (Unaudited) |

Fund Strategy

Investing in the stocks of small international companies that we believe are poised for growth.

Fund Management

John C. Fenley, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

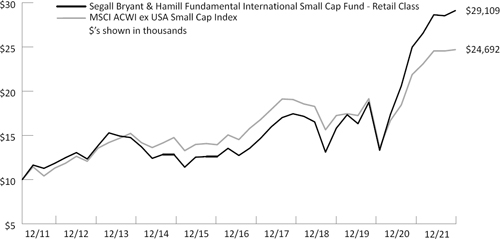

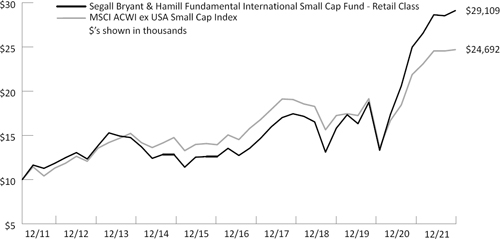

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | | | | | Since | Inception |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (WTIFX) | 16.59% | 30.48% | 17.99% | 11.28% | 7.41% | 12/15/99 |

| Institutional Class (WIIFX) | 16.70% | 30.69% | 18.17% | 11.38% | 7.46% | 4/29/16 |

| MSCI ACWI ex USA Small Cap Index | 12.93% | 16.45% | 11.21% | 9.46% | 7.46% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.69%, Net: 1.25%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.57%, Net: 1.10%

| | Sector Allocation (as of 12/31/21) | |

| | | |

| | Industrials | 29.3% |

| | Information Technology | 27.9% |

| | Consumer Discretionary | 26.0% |

| | Financials | 6.3% |

| | Consumer Staples | 3.9% |

| | Health Care | 2.0% |

| | Communication Services | 0.9% |

| | |

| | Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology. |

| | |

| | Sector weights may not sum to 100% due to rounding. |

| | |

| | The sector allocation table above does not include any cash or cash equivalents. |

| | |

| | Top Ten Holdings (as of 12/31/21) | |

| | | |

| | Hunter Douglas N.V. | 8.6% |

| | Brodrene A. & O. Johansen A/S | 6.3% |

| | Constellation Software, Inc. | 4.8% |

| | Instalco A.B. | 4.8% |

| | Clipper Logistics PLC | 4.3% |

| | Topicus.com, Inc. | 4.0% |

| | Evolution Gaming Group A.B. | 3.8% |

| | Pollard Banknote, Ltd. | 3.3% |

| | GFL Environmental, Inc. | 3.0% |

| | BayCurrent Consulting, Inc. | 2.8% |

| | |

| | Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund. |

| | |

| | |

| | |

| | |

| | |

| | |

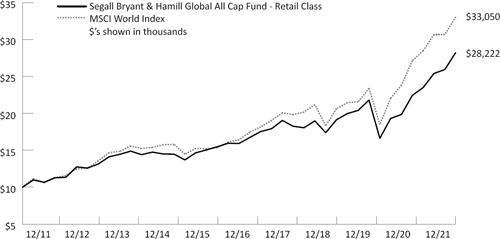

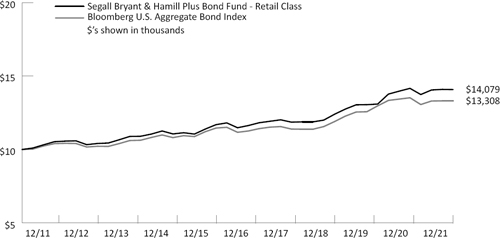

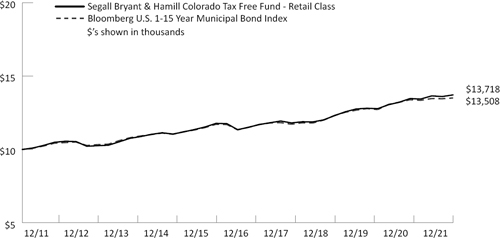

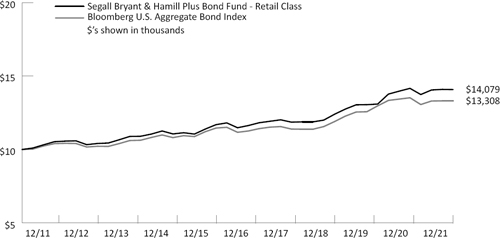

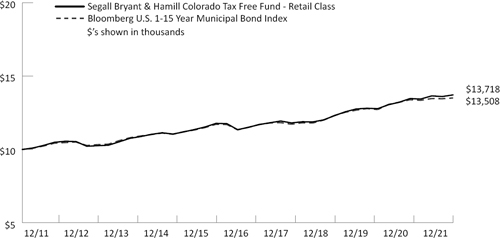

| | |