UNITED STATES

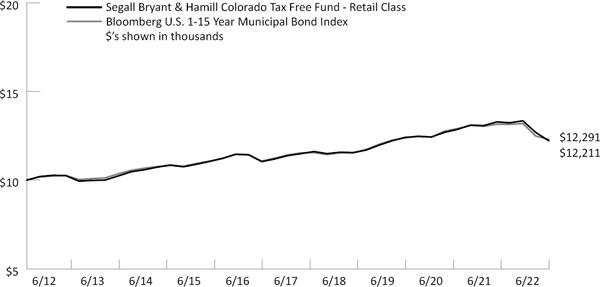

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-03373 | |

SEGALL BRYANT & HAMILL TRUST

(Exact name of registrant as specified in charter)

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Maggie Bull, Secretary |

| Segall Bryant & Hamill Trust, 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | June 30, 2022 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Segall Bryant & Hamill Small Cap Value Fund

(Ticker Symbol: Retail - SBRVX; Institutional - SBHVX)

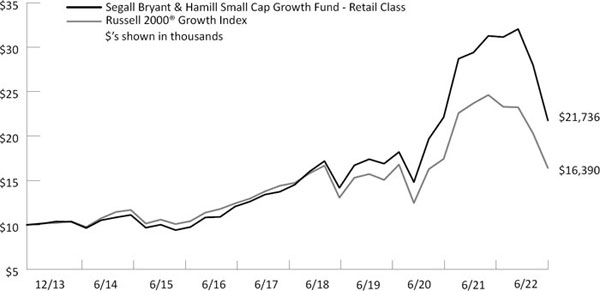

Segall Bryant & Hamill Small Cap Growth Fund

(Ticker Symbol: Retail - WTSGX; Institutional - WISGX)

Segall Bryant & Hamill Small Cap Core Fund

(Ticker Symbol: Retail - SBHCX; Institutional - SBASX)

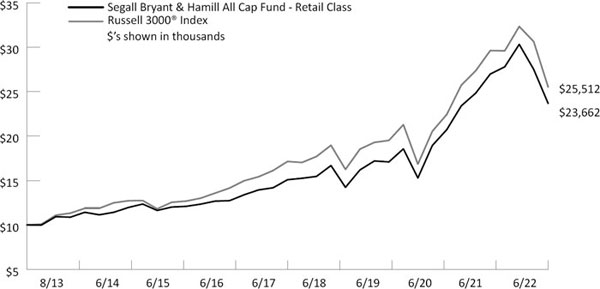

Segall Bryant & Hamill All Cap Fund

(Ticker Symbol: Retail - SBRAX; Institutional - SBHAX)

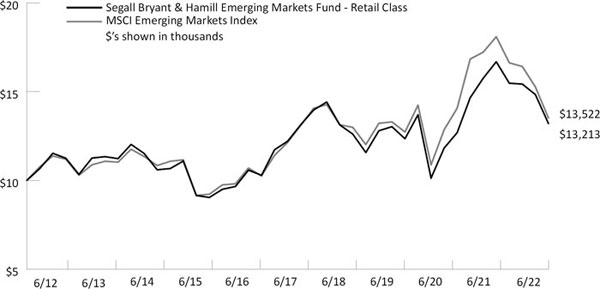

Segall Bryant & Hamill Emerging Markets Fund

(Ticker Symbol: Retail - SBHEX; Institutional - SBEMX)

Segall Bryant & Hamill International Small Cap Fund

(Ticker Symbol: Retail - SBHSX; Institutional - SBSIX)

Segall Bryant & Hamill Fundamental International Small Cap Fund

(Ticker Symbol: Retail - WTIFX; Institutional - WIIFX)

Segall Bryant & Hamill Global All Cap Fund

(Ticker Symbol: Retail - WTMVX; Institutional - WIMVX)

Segall Bryant & Hamill Workplace Equality Fund

(Ticker Symbol: Retail - WEQRX; Institutional - WEQIX)

Segall Bryant & Hamill Short Term Plus Fund

(Ticker Symbol: Retail - SBHPX; Institutional - SBAPX)

Segall Bryant & Hamill Plus Bond Fund

(Ticker Symbol: Retail - WTIBX; Institutional - WIIBX)

Segall Bryant & Hamill Quality High Yield Fund

(Ticker Symbol: Retail - WTLTX; Institutional - WILTX)

Segall Bryant & Hamill Municipal Opportunities Fund

(Ticker Symbol: Retail - WTTAX; Institutional - WITAX)

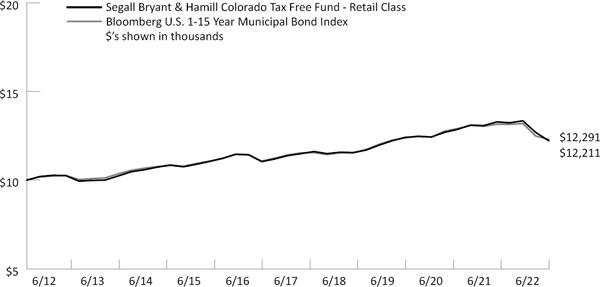

Segall Bryant & Hamill Colorado Tax Free Fund

(Ticker Symbol: Retail - WTCOX; Institutional - WICOX)

SEGALL BRYANT & HAMILL

SEMI-ANNUAL REPORT

JUNE 30, 2022

Table of Contents

| | |

| SHAREHOLDER LETTER | 1 |

| | |

| FUND OVERVIEWS | |

| | |

| Segall Bryant & Hamill Small Cap Value Fund | 2 |

| | |

| Segall Bryant & Hamill Small Cap Growth Fund | 4 |

| | |

| Segall Bryant & Hamill Small Cap Core Fund | 6 |

| | |

| Segall Bryant & Hamill All Cap Fund | 8 |

| | |

| Segall Bryant & Hamill Emerging Markets Fund | 10 |

| | |

| Segall Bryant & Hamill International Small Cap Fund | 12 |

| | |

| Segall Bryant & Hamill Fundamental International Small Cap Fund | 14 |

| | |

| Segall Bryant & Hamill Global All Cap Fund | 16 |

| | |

| Segall Bryant & Hamill Workplace Equality Fund | 18 |

| | |

| Segall Bryant & Hamill Short Term Plus Fund | 20 |

| | |

| Segall Bryant & Hamill Plus Bond Fund | 22 |

| | |

| Segall Bryant & Hamill Quality High Yield Fund | 24 |

| | |

| Segall Bryant & Hamill Municipal Opportunities Fund | 26 |

| | |

| Segall Bryant & Hamill Colorado Tax Free Fund | 28 |

| | |

| FUND EXPENSES | 30 |

| | |

| IMPORTANT DISCLOSURES | 33 |

| | |

| FINANCIAL STATEMENTS | 36 |

| | |

| Statements of Investments | 36 |

| | |

| Statements of Assets and Liabilities | 90 |

| | |

| Statements of Operations | 94 |

| | |

| Statements of Changes in Net Assets | 98 |

| | |

| Financial Highlights | 103 |

| | |

| Notes to Financial Statements | 131 |

Semi-Annual Report | June 30, 2022 |  | |

Intentionally Left Blank

| Segall Bryant & Hamill Funds | Shareholder Letter |

| | June 30, 2022 (Unaudited) |

Dear Fellow Shareholders:

As we mentioned in our year-end 2021 shareholder letter, we entered 2022 flush from one of the most profitable two-year periods in the history of U.S. financial markets. The increase in asset values across asset classes (including stocks, bonds, commodities, and real estate) was driven by an unprecedented combination of artificially low interest rates, which had been held low since the great financial crisis, and government financial stimulus to combat pandemic-related economic effects. It had been our view that this combination of monetary and fiscal stimulus could eventually produce a powerful countervailing force: inflation. This has indeed been the case.

The rapid rise of prices this year, first thought to be supply chain related and temporary, has proven to be more durable and incredibly tenacious. The war in Ukraine and general political turmoil across the globe have amplified the effects of monetary-driven inflation. We believe this dramatic rise in inflation has been the catalyst for global monetary policy change. The U.S. Federal Reserve (Fed) has already raised interest rates several times this year and other central banks have followed suit. Not unexpectedly, the prices of stocks and bonds, which had risen to extreme valuation levels, are being severely impaired by the dynamics of this monetary policy change.

|  |

Janice M. Teague

Chair | Philip L. Hildebrandt, CFA |

| President |

This revaluation of financial assets, as the returns in the first half of 2022 very amply demonstrated, produced market returns that were nearly uniformly negative across asset classes. One aspect of our fund performance during the first half that may seem counterintuitive to our long-term shareholders is that the funds did not display the superior downside capture they have historically shown in market declines. (Downside capture compares a portfolio’s performance to that of its benchmark in months in which the benchmark index declines in value.) We believe that the end of the old market policy, built as it was on the premise of an inexhaustible supply of low-cost funds from monetary authorities, will take time to play out. During this transition, identifying which companies will continue to thrive in the new order and those whose value was built solely on free money will take time to sort out.

As professional investors, we find that transitional markets such as this often create and uncover investment opportunities on which we can capitalize. Transitional markets are when disciplined, active investing can produce strong outcomes for our shareholders. Having said that, we are mindful that this is a time to protect capital rather than to aggressively seek to grow it. Does protecting capital mean engaging in wholesale selling of stocks and bonds? In short, we think not. It simply means adherence to our time-tested discipline. We remain focused on fundamental valuation to find mispriced opportunities.

We are also cognizant that periods of market dislocation as we’ve experienced this year can create doubt and uncertainty for investors. It is why we are so thankful for our strong shareholder base and the trust placed in us. Rest assured we will continue to work diligently every day to earn your trust.

| 1 | Segall Bryant & Hamill did not solicit or pay a fee to participate in P&I’s Best Places to Work in Money Management survey. |

The views of the authors and information discussed in the shareholder letter and manager commentaries are as February 18, 2022, are subject to change, and may not reflect the writers’ current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Segall Bryant & Hamill, Segall Bryant & Hamill Funds, nor any Segall Bryant & Hamill Fund accept any liability for losses either direct or consequential caused by the use of this information. Diversification cannot guarantee gain or prevent losses.

Semi-Annual Report | June 30, 2022 |  | 1 |

| Segall Bryant & Hamill Small Cap Value Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term capital appreciation.

Fund Management

Mark T. Dickherber, CFA, CPA Portfolio Manager

Shaun P. Nicholson Portfolio Manager

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (SBRVX) | (17.46)% | (16.29)% | 3.04% | 5.85% | — | 6.79% | 12/9/19 |

| Institutional Class (SBHVX) | (17.44)% | (16.26)% | 3.15% | 5.97% | — | 6.93% | 7/31/13 |

| Russell 2000® Value Index | (17.31)% | (16.28)% | 6.18% | 4.89% | — | 6.76% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Total - 1.04%

Institutional Class Annual Expense Ratio (per the current prospectus) – Total - 0.97%

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

| 2 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Small Cap Value Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Industrials | 23.0% |

| Financials | 13.9% |

| Information Technology | 11.4% |

| Health Care | 9.1% |

| Materials | 7.6% |

| Real Estate | 7.6% |

| Consumer Staples | 7.4% |

| Utilities | 6.2% |

| Energy | 3.6% |

| Consumer Discretionary | 3.3% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Stock Performance (12/31/2021 to 6/30/2022)

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Helmerich & Payne, Inc. | 0.95 | 0.36 |

| Mercury Systems, Inc. | 1.32 | 0.26 |

| Equity Commonwealth | 4.31 | 0.24 |

| Huron Consulting Group, Inc. | 0.53 | 0.17 |

| Dril-Quip, Inc. | 1.01 | 0.16 |

Top Ten Holdings (as of 6/30/22)

| Equity Commonwealth | 5.1% |

| Coty, Inc. | 4.2% |

| Progress Software Corp. | 3.5% |

| NCR Corp. | 2.9% |

| Hain Celestial Group, Inc. (The) | 2.9% |

| ICU Medical, Inc. | 2.7% |

| Compass Minerals International, Inc. | 2.7% |

| SPX Corp. | 2.6% |

| Orthofix Medical, Inc. | 2.5% |

| Regal Rexnord Corp. | 2.5% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Regal Rexnord Corp. | 2.92 | -1.03 |

| Glatfelter Corp. | 1.43 | -1.07 |

| FARO Technologies, Inc. | 1.53 | -1.14 |

| Compass Minerals International, Inc. | 3.50 | -1.19 |

| Hain Celestial Group, Inc. (The) | 3.34 | -1.72 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 34 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2022 |  | 3 |

| Segall Bryant & Hamill Small Cap Growth Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term capital appreciation.

Fund Management

Brian C. Fitzsimons, CFA Portfolio Manager

Mitch S. Begun, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

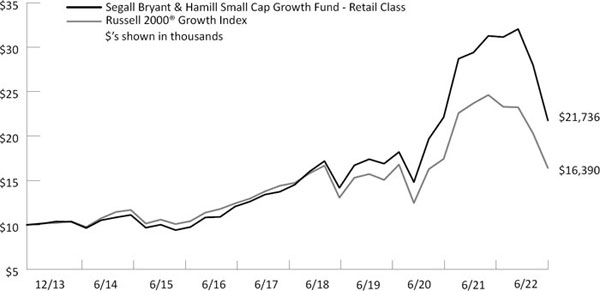

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (WTSGX) | (32.16)% | (30.49)% | 7.71% | 11.47% | — | 9.53% | 12/20/13 |

| Institutional Class (WISGX) | (32.10)% | (30.35)% | 7.88% | 11.65% | — | 9.79% | 12/20/13 |

| Russell 2000® Growth Index | (29.45)% | (33.43)% | 1.40% | 4.80% | — | 5.97% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Total: 1.03%

Institutional Class Annual Expense Ratio (per the current prospectus) — Total: 0.87%

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

| 4 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Small Cap Growth Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Health Care | 26.2% |

| Information Technology | 26.2% |

| Industrials | 16.6% |

| Consumer Discretionary | 9.0% |

| Financials | 7.6% |

| Materials | 3.5% |

| Communication Services | 3.1% |

| Real Estate | 2.3% |

| Consumer Staples | 1.7% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Stock Performance (12/31/2021 to 6/30/2022)

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Turning Point Therapeutics, Inc. | 0.78 | 0.67 |

| Anaplan, Inc. | 1.27 | 0.52 |

| Stryker Corp. | 0.09 | 0.27 |

| AeroVironment, Inc. | 0.30 | 0.26 |

| Ritchie Bros. Auctioneers Inc. | 1.25 | 0.17 |

| Top Ten Holdings (as of 6/30/22) |

| Silicon Laboratories, Inc. | 2.4% |

| Tetra Tech, Inc. | 2.3% |

| Sprout Social, Inc. | 2.2% |

| Endava PLC | 2.1% |

| Omnicell, Inc. | 2.0% |

| Power Integrations, Inc. | 1.9% |

| Option Care Health, Inc. | 1.9% |

| MAXIMUS, Inc. | 1.8% |

| Globus Medical, Inc. | 1.8% |

| Turning Point Therapeutics, Inc. | 1.8% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Trupanion, Inc. | 1.60 | -1.02 |

| Endava PLC | 2.27 | -1.12 |

| Warby Parker, Inc. | 1.08 | -1.18 |

| Goosehead Insurance, Inc. | 1.40 | -1.23 |

| AZEK Co., Inc. (The) | 1.69 | -1.51 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 34 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2022 |  | 5 |

| Segall Bryant & Hamill Small Cap Core Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term capital appreciation.

Fund Management

Jeffrey C. Paulis, CFA, Portfolio Manager

Mark T. Dickherber, CFA, CPA Portfolio Manager

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns*

| | | | | | | Since | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (SBHCX) | (21.11)% | (15.15)% | 8.56% | 9.11% | 10.13% | 8.46% | 12/31/19 |

| Institutional Class (SBASX) | (21.02)% | (15.01)% | 8.75% | 9.29% | 10.31% | 8.63% | 12/15/03 |

| Russell 2000® Index | (23.43)% | (25.20)% | 4.21% | 5.17% | 9.35% | 7.66% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.35%, Net: 1.14%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.10%, Net: 0.99%

| * | The quoted performance of the Fund reflects the past performance of Lower Wacker Small Cap Investment Fund, LLC (the “Partnership”), an unregistered limited partnership managed by the portfolio managers of the Fund. The Partnership was organized into the Institutional Class shares on December 31, 2019, the date the Fund commenced operations. The Fund has been managed in the same style since the Partnership’s inception on December 15, 2003. The Fund’s annual returns and long-term performance reflect the actual fees and expenses that were charged when the Fund was a limited partnership. From its inception on December 15, 2003 through December 31, 2019, the Partnership was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended or Subchapter M of the Internal Revenue Code of 1986, as amended, which, if they had been applicable, might have adversely affected the Fund’s performance. |

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

| 6 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Small Cap Core Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Industrials | 21.7% |

| Information Technology | 19.4% |

| Health Care | 12.0% |

| Consumer Discretionary | 9.8% |

| Materials | 8.4% |

| Financials | 8.0% |

| Consumer Staples | 4.9% |

| Energy | 3.7% |

| Real Estate | 2.3% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Stock Performance (12/31/2021 to 6/30/2022)

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Anaplan, Inc. | 0.96 | 0.27 |

| Devon Energy Corp. | 2.33 | 0.26 |

| Vocera Communications, Inc. | 0.39 | 0.23 |

| Agilysys, Inc. | 0.74 | 0.14 |

| BWX Technologies, Inc. | 0.76 | 0.09 |

Top Ten Holdings (as of 6/30/22)

| Devon Energy Corp. | 2.3% |

| KBR, Inc. | 2.3% |

| Carlisle Cos., Inc. | 2.1% |

| EnPro Industries, Inc. | 1.9% |

| Tenable Holdings, Inc. | 1.9% |

| Seacoast Banking Corp. of Florida | 1.9% |

| WNS Holdings, Ltd. | 1.9% |

| Graphic Packaging Holding Co. | 1.9% |

| Pure Storage, Inc. | 1.8% |

| Silicon Laboratories, Inc. | 1.8% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| Average | Contribution |

| 5 Lowest | Weight | to Return |

| Under Armour, Inc. | 0.82 | -0.63 |

| Pegasystems Inc. | 0.83 | -0.68 |

| Endava PLC | 1.55 | -0.73 |

| Regal Rexnord Corp. | 2.33 | -0.80 |

| Hain Celestial Group, Inc. (The) | 1.97 | -0.91 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 34 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2022 |  | 7 |

| Segall Bryant & Hamill All Cap Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term capital appreciation.

Fund Management

Ralph M. Segall, CFA, CIC Portfolio Manager

Suresh Rajagopal, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

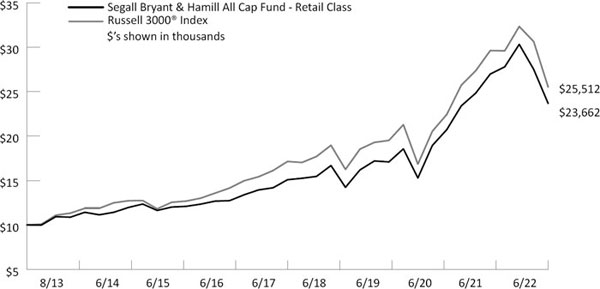

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (SBRAX) | (21.95)% | (12.30)% | 11.21% | 11.16% | — | 10.14% | 12/9/19 |

| Institutional Class (SBHAX) | (21.90)% | (12.30)% | 11.28% | 11.27% | — | 10.28% | 7/31/13 |

| Russell 3000® Index | (21.10)% | (13.87)% | 9.77% | 10.60% | — | 11.08% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Total: 0.83%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.87%, Net: 0.84%

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.99% and 0.84% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

| 8 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill All Cap Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Information Technology | 19.4% |

| Health Care | 17.7% |

| Financials | 16.2% |

| Industrials | 12.1% |

| Consumer Discretionary | 10.9% |

| Consumer Staples | 6.1% |

| Energy | 5.6% |

| Communication Services | 5.4% |

| Materials | 4.7% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Stock Performance (12/31/2021 to 6/30/2022)

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| McKesson Corp. | 1.84 | 0.50 |

| Suncor Energy, Inc. | 1.43 | 0.35 |

| Quanta Services, Inc. | 3.16 | 0.31 |

| Perrigo Co. PLC | 0.62 | 0.22 |

| Chevron Corp. | 2.19 | 0.19 |

Top Ten Holdings (as of 6/30/22)

| Microsoft Corp. | 4.6% |

| Alphabet, Inc. | 4.1% |

| Quanta Services, Inc. | 3.6% |

| UnitedHealth Group, Inc. | 3.0% |

| Raytheon Technologies Corp. | 2.8% |

| Visa, Inc. | 2.6% |

| Reinsurance Group of America, Inc. | 2.6% |

| Globe Life, Inc. | 2.6% |

| Amazon.com, Inc. | 2.4% |

| Catalent, Inc. | 2.4% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Alphabet, Inc. | 4.18 | -1.03 |

| Microsoft Corp. | 4.66 | -1.03 |

| Amazon.com, Inc. | 2.84 | -1.13 |

| Zebra Technologies Corp. | 1.88 | -1.25 |

| Marvell Technology, Inc. | 2.65 | -1.61 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 34 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2022 |  | 9 |

| Segall Bryant & Hamill Emerging Markets Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term capital appreciation.

Fund Management

Scott E. Decatur, Ph.D. Portfolio Manager

Nicholas C. Fedako, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

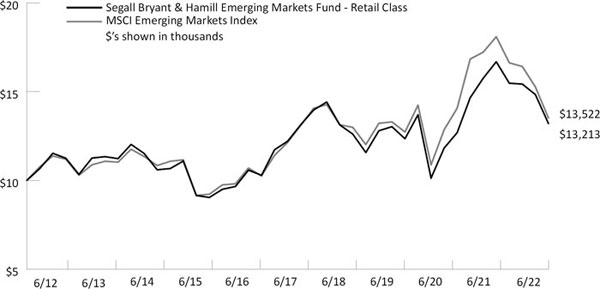

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class* (SBHEX) | (14.36)% | (20.82)% | 0.46% | 1.59% | 2.83% | 1.00% | 6/30/14 |

| Institutional Class** (SBEMX) | (14.43)% | (20.73)% | 0.60% | 1.75% | 3.01% | 1.19% | 6/30/11 |

| MSCI Emerging Markets Index | (17.63)% | (25.29)% | 0.57% | 2.18% | 3.06% | 1.17% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.86%, Net: 1.38%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.69%, Net: 1.23%

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.38% and 1.23% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in foreign companies are subject to special risks, including currency fluctuations, social, economic, and political uncertainties, which could increase volatility.

| 10 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Emerging Markets Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Financials | 21.2% |

| Information Technology | 18.6% |

| Consumer Discretionary | 15.2% |

| Communication Services | 10.2% |

| Materials | 8.7% |

| Consumer Staples | 5.7% |

| Industrials | 5.6% |

| Energy | 5.4% |

| Health Care | 3.7% |

| Utilities | 2.8% |

| Real Estate | 1.8% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Stock Performance (12/31/2021 to 6/30/2022)

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Alinma Bank | 0.31 | 0.28 |

| Triveni Engineering and Industries, Ltd. | 0.35 | 0.23 |

| Sasol, Ltd. | 0.34 | 0.18 |

| Tongwei Group Co., Ltd. | 0.14 | 0.17 |

| Daqo New Energy Corp. | 0.21 | 0.15 |

Top Ten Holdings (as of 6/30/22)

| Taiwan Semiconductor Manufacturing Co., Ltd. | 5.0% |

| Tencent Holdings, Ltd. | 3.3% |

| Samsung Electronics Co., Ltd. | 2.3% |

| Alibaba Group Holding, Ltd. | 2.3% |

| Bank of China, Ltd. | 1.4% |

| Riyad Bank | 1.1% |

| China Construction Bank Corp. | 1.1% |

| Vale S.A. | 1.1% |

| Zhongsheng Group Holdings, Ltd. | 1.1% |

| China Tower Corp., Ltd. | 1.0% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Surgutneftegas PJSC | 0.15 | -0.42 |

| Tencent Holdings, Ltd. | 3.18 | -0.66 |

| Gazprom PJSC | 0.23 | -0.70 |

| Samsung Electronics Co., Ltd. | 2.92 | -1.03 |

| Taiwan Semiconductor Manufacturing Co., Ltd. | 5.72 | -1.87 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 34 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2022 |  | 11 |

| Segall Bryant & Hamill International Small Cap Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term capital appreciation.

Fund Management

Scott E. Decatur, Ph.D. Portfolio Manager

Nicholas C. Fedako, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

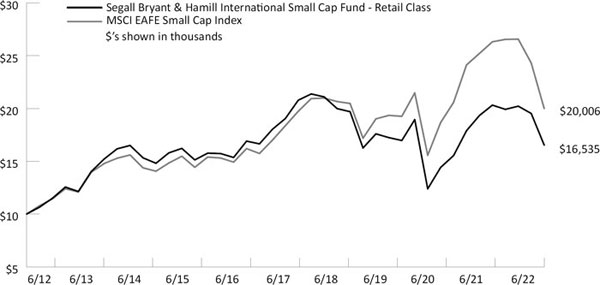

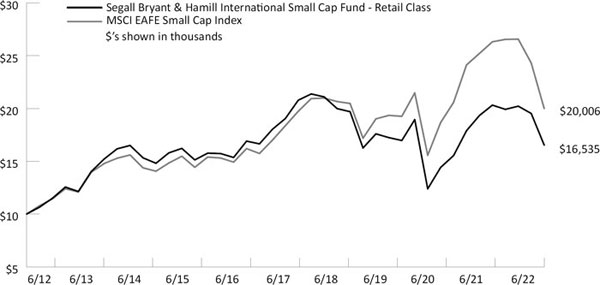

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class* (SBHSX) | (18.25)% | (18.61)% | (1.38)% | (2.80)% | 5.16% | 3.19% | 6/30/14 |

| Institutional Class** (SBSIX) | (18.21)% | (18.54)% | (1.23)% | (2.60)% | 5.38% | 3.41% | 5/31/11 |

| MSCI EAFE Small Cap Index | (24.71)% | (23.98)% | 1.12% | 1.72% | 7.18% | 4.37% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.36%, Net: 1.18%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.13%, Net: 1.03%

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.18% and 1.03% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Investing in foreign companies are subject to special risks, including currency fluctuations, social, economic, and political uncertainties, which could increase volatility.

| 12 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill International Small Cap Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Industrials | 21.9% |

| Consumer Discretionary | 12.0% |

| Real Estate | 11.5% |

| Financials | 10.9% |

| Information Technology | 9.6% |

| Materials | 9.5% |

| Health Care | 6.6% |

| Consumer Staples | 6.5% |

| Communication Services | 4.3% |

| Utilities | 3.0% |

| Energy | 2.9% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Stock Performance (12/31/2021 to 6/30/2022)

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| New Hope Corp., Ltd. | 0.65 | 0.29 |

| u-blox Holding A.G. | 0.69 | 0.21 |

| Cosmo Energy Holdings Co., Ltd. | 0.68 | 0.20 |

| Inabata & Co., Ltd. | 0.15 | 0.19 |

| Rheinmetall A.G. | 0.18 | 0.19 |

| Top Ten Holdings (as of 6/30/22) |

| |

| Scandinavian Tobacco Group A/S | 1.1% |

| u-blox Holdings A.G. | 1.0% |

| Redrow PLC | 1.0% |

| Computacenter PLC | 1.0% |

| MIRAI Corp. | 1.0% |

| Galenica A.G. | 0.9% |

| GrainCorp, Ltd. | 0.9% |

| Vistry Group PLC | 0.9% |

| Incitec Pivot, Ltd. | 0.9% |

| Television Franchaise 1 | 0.9% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Vistry Group PLC | 0.92 | -0.33 |

| ITV PLC | 0.69 | -0.35 |

| Redrow PLC | 1.01 | -0.41 |

| Getinge A.B. | 0.91 | -0.47 |

| Royal Mail PLC | 0.78 | -0.54 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 34 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2022 |  | 13 |

| Segall Bryant & Hamill Fundamental International Small Cap Fund | Fund Overview |

| June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term capital appreciation.

Fund Management

John C. Fenley, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

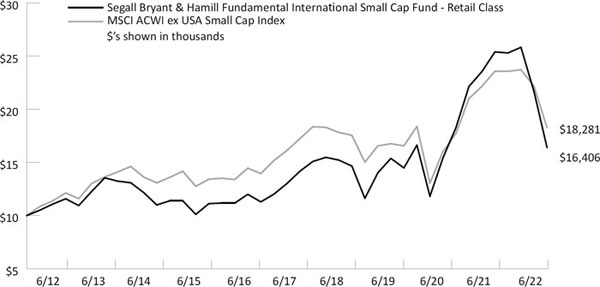

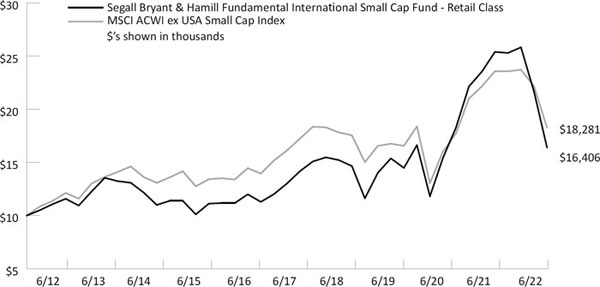

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (WTIFX) | (36.47)% | (35.40)% | 2.18% | 4.75% | 5.07% | 5.10% | 12/15/99 |

| Institutional Class (WIIFX) | (36.40)% | (35.32)% | 2.34% | 4.91% | 5.18% | 5.15% | 4/29/16 |

| MSCI ACWI ex USA Small Cap Index | (22.92)% | (22.45)% | 2.94% | 2.55% | 6.22% | 6.06% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.51%, Net: 1.25%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.36%, Net: 1.10%

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Institutional Class shares prior to their inception is based on the performance of the Retail Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.25% and 1.10% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus.

| 14 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Fundamental International Small Cap Fund | Fund Overview |

| June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Industrials | 29.5% |

| Information Technology | 26.6% |

| Consumer Discretionary | 23.4% |

| Financials | 9.3% |

| Consumer Staples | 2.6% |

| Health Care | 1.6% |

| Communication Services | 1.3% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Stock Performance (12/31/2021 to 6/30/2022)

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Clipper Logistics PLC | 3.41 | 0.32 |

| Razer, Inc. | 1.29 | 0.21 |

| PAX Global Technology, Ltd. | 2.66 | 0.08 |

| Yifeng Pharmacy Chain Co., Ltd. | 1.22 | 0.05 |

| Mercell Holding A.S.A. | 0.80 | 0.03 |

Top Ten Holdings (as of 6/30/22)

| Constellation Software, Inc. | 6.2% |

| Victoria PLC | 4.7% |

| Brodrene A. & O. Johansen A/S | 4.3% |

| Fluidra S.A. | 4.2% |

| Evolution Gaming Group A.B. | 3.9% |

| GFL Environmental, Inc. | 3.8% |

| BayCurrent Consulting, Inc. | 3.7% |

| Topicus.com, Inc. | 3.6% |

| Strike Co., Ltd. | 3.6% |

| Epsilon Net S.A. | 3.5% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Strike Co., Ltd. | 3.61 | -1.76 |

| Instalco A.B. | 3.17 | -1.81 |

| Cherry A.G. | 2.18 | -2.00 |

| Victoria PLC | 3.65 | -3.14 |

| Brodrene A. & O. Johansen A/S | 5.78 | -3.42 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 34 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2022 |  | 15 |

| Segall Bryant & Hamill Global All Cap Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term capital appreciation.

Fund Management

Suresh Rajagopal, CFA Portfolio Manager

Ralph M. Segall, CFA, CIC Portfolio Manager

CFA is a trademark owned by CFA Institute.

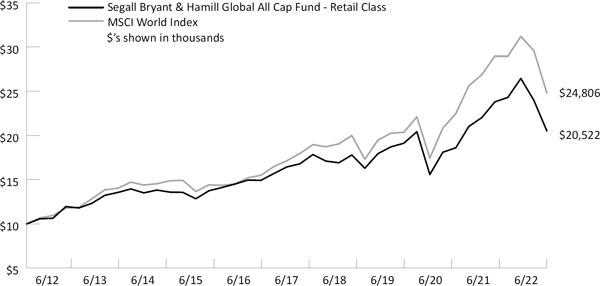

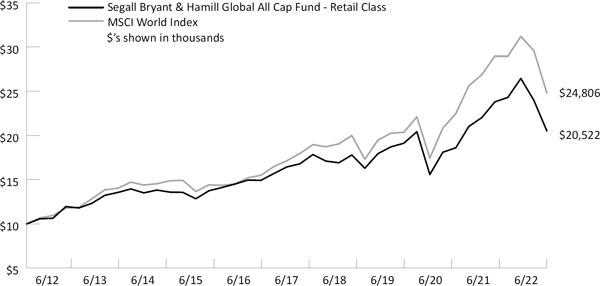

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (WTMVX) | (22.41)% | (13.79)% | 3.12% | 4.54% | 7.45% | 7.97% | 6/1/88 |

| Institutional Class (WIMVX) | (22.28)% | (13.64)% | 3.25% | 4.68% | 7.63% | 8.04% | 9/28/07 |

| MSCI World Index | (20.51)% | (14.34)% | 7.00% | 7.67% | 9.51% | 7.11% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.18%, Net: 0.89%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.17%, Net: 0.74%

Please note that for longer term performance numbers, prior to April 29, 2016 the Fund was known as the Westcore Blue Chip Dividend Fund, prior to April 30, 2018 the Fund was known as the Westcore Global Large-Cap Dividend Fund, and prior to September 19, 2020 the Fund was known as the Segall Bryant & Hamill Global Large Cap Fund.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Institutional Class shares prior to their inception is based on the performance of the Retail Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.89% and 0.74% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investments in foreign companies are subject to special risks, including currency fluctuations, social, economic, and political uncertainties, which could increase volatility.

| 16 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Global All Cap Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Information Technology | 22.6% |

| Health Care | 17.8% |

| Consumer Discretionary | 13.9% |

| Financials | 11.5% |

| Industrials | 11.2% |

| Consumer Staples | 6.8% |

| Energy | 5.0% |

| Materials | 4.3% |

| Communication Services | 3.3% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Stock Performance (12/31/2021 to 6/30/2022)

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| Suncor Energy, Inc. | 1.69 | 0.40 |

| McKesson Corp. | 1.32 | 0.28 |

| Quanta Services, Inc. | 2.57 | 0.28 |

| Perrigo Co. PLC | 0.75 | 0.26 |

| Dollarama, Inc. | 1.75 | 0.21 |

Top Ten Holdings (as of 6/30/22)

| Microsoft Corp. | 4.4% |

| Alphabet, Inc. | 3.3% |

| Quanta Services, Inc. | 3.1% |

| UnitedHealth Group, Inc. | 2.8% |

| Linde PLC | 2.7% |

| Visa, Inc. | 2.7% |

| Diageo PLC | 2.5% |

| JPMorgan Chase & Co. | 2.5% |

| Globe Life, Inc. | 2.4% |

| Aon PLC | 2.3% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| AZEK Co., Inc. (The) | 0.90 | -0.84 |

| ASML Holding N.V. | 1.82 | -0.85 |

| Amazon.com, Inc. | 2.35 | -0.92 |

| Microsoft Corp. | 4.46 | -0.98 |

| Marvell Technology, Inc. | 2.63 | -1.52 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 34 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2022 |  | 17 |

| Segall Bryant & Hamill Workplace Equality Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term capital appreciation.

Fund Management

Suresh Rajagopal, CFA Portfolio Manager John N. Roberts, Esq. Portfolio Manager

William J. Barritt, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Date |

| Retail Class (WEQRX) | (23.00)% | (15.54)% | 3.27% | 7.43% | 8.79% | 8.47% | 6/1/88 |

| Institutional Class (WEQIX) | (22.91)% | (15.46)% | 3.41% | 7.62% | 9.00% | 8.55% | 9/28/07 |

| Russell 1000® Index | (20.94)% | (13.04)% | 10.17% | 11.00% | 12.82% | 10.50% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.28%, Net: 0.89%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.26%, Net: 0.74%

Please note that for the longer term performance numbers, prior to April 29, 2016 the Fund was known as the Westcore Growth Fund, prior to April 30, 2018, the Fund was known as the Westcore Large Cap Dividend Fund, and prior to May 1, 2019 the Fund was known as the Segall Bryant & Hamill Large Cap Dividend Fund.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Institutional Class shares prior to their inception is based on the performance of the Retail Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.89% and 0.74% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

| 18 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Workplace Equality Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Information Technology | 26.9% |

| Health Care | 16.6% |

| Financials | 11.1% |

| Industrials | 10.0% |

| Consumer Discretionary | 9.7% |

| Communication Services | 7.1% |

| Consumer Staples | 5.6% |

| Energy | 4.3% |

| Materials | 3.0% |

| Real Estate | 2.9% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Stock Performance (12/31/2021 to 6/30/2022)

| | | |

| | Average | Contribution |

| 5 Highest | Weight | to Return |

| McKesson Corp. | 1.96 | 0.47 |

| Chevron Corp. | 2.15 | 0.24 |

| Raytheon Technologies Corp. | 2.55 | 0.21 |

| UnitedHealth Group, Inc. | 2.86 | 0.10 |

| Reinsurance Group of America, Inc. | 1.76 | 0.10 |

Top Ten Holdings (as of 6/30/22)

| Microsoft Corp. | 5.4% |

| Alphabet, Inc. | 4.9% |

| UnitedHealth Group, Inc. | 3.2% |

| Visa, Inc. - Class A | 3.1% |

| Raytheon Technologies Corp. | 2.9% |

| Apple, Inc. | 2.7% |

| Danaher Corp. | 2.7% |

| Amazon.com, Inc. | 2.6% |

| Keysight Technologies, Inc. | 2.4% |

| JPMorgan Chase & Co. | 2.3% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| | Average | Contribution |

| 5 Lowest | Weight | to Return |

| Applied Materials, Inc. | 2.02 | -0.95 |

| NVIDIA Corp. | 1.92 | -1.04 |

| Microsoft Corp. | 5.34 | -1.17 |

| Alphabet, Inc. | 5.06 | -1.22 |

| Amazon.com, Inc. | 3.55 | -1.38 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 34 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2022 |  | 19 |

| Segall Bryant & Hamill Short Term Plus Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to provide current income and competitive total return.

Fund Management

James D. Dadura, CFA Portfolio Manager

Gregory C. Hosbein, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | 30-Day SEC | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Yield | Date |

| Retail Class (SBHPX) | (2.58)% | (3.05)% | 0.16% | — | — | 0.82% | 3.16% | 12/14/18 |

| Institutional Class (SBAPX) | (2.63)% | (2.97)% | 0.26% | — | — | 0.91% | 3.25% | 12/14/18 |

| Bloomberg U.S. Government/ | (3.10)% | (3.56)% | 0.31% | — | — | 1.17% | | |

| Credit 1-3 Year Index | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 0.80%, Net: 0.49%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.68%, Net: 0.40%

30-Day SEC Yield figures reflect all fee waivers and expense reimbursements. Without the absorption of these fee waivers and/or expense reimbursements, the figures would have been 3.11% for the Retail Class and 3.02% for the Institutional Class.

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.49% and 0.40% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Fixed Income Risks: Fixed income Funds invest in bonds which entails interest rate risk and credit risk.

| 20 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Short Term Plus Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Industrial | 60.3% |

| Utility | 15.1% |

| U.S. Treasury Bonds & Notes | 11.0% |

| Municipal Bonds | 5.7% |

| Finance | 4.5% |

| Commercial Mortgage-Backed Securities | 1.0% |

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Corporate Holdings (as of 6/30/22)

| Ball Corp. | 2.2% |

| Weyerhaeuser Co. | 2.1% |

| Delta Air Lines Pass Thru Trust | 2.1% |

| Vistra Operations Co., LLC. | 2.0% |

| Graphic Packaging International, Inc. | 2.0% |

| Amphenol Corp. | 2.0% |

| General Motors Financial Co., Inc. | 2.0% |

| Kinder Morgan, Inc. | 1.9% |

| Georgia Power Co. | 1.9% |

| NextEra Energy Capital Holdings, Inc. | 1.9% |

Percentages represent the Fund’s aggregate holdings in the same corporate issuer and its affiliates. Holdings are subject to change and may not reflect the current or future position of the Fund.

Semi-Annual Report | June 30, 2022 |  | 21 |

| Segall Bryant & Hamill Plus Bond Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to acheive long-term total rate of return consistent with preservation of capital.

Fund Management

Troy A. Johnson, CFA Portfolio Manager Darren G. Hewitson, CFA Portfolio Manager

Kenneth A. Harris, CFA Portfolio Manager Gregory M. Shea, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

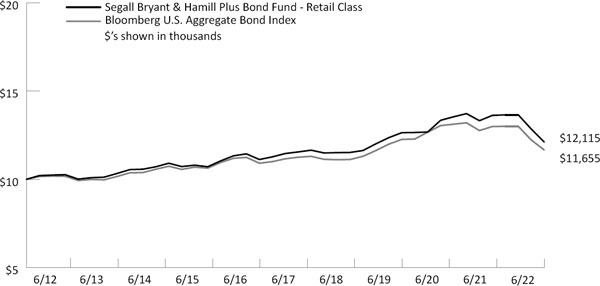

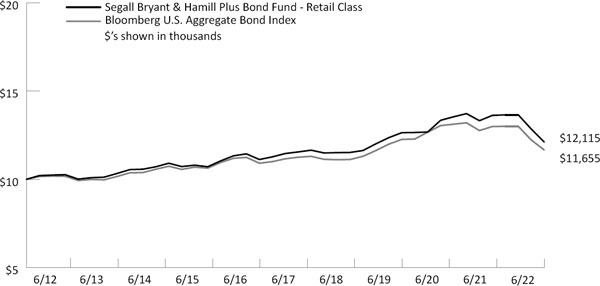

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | 30-Day SEC | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Yield | Date |

| Retail Class (WTIBX) | (11.21)% | (11.06)% | (0.66)% | 1.12% | 1.94% | 5.35% | 4.06% | 6/1/88 |

| Institutional Class (WIIBX) | (11.17)% | (10.95)% | (0.55)% | 1.27% | 2.08% | 5.41% | 4.22% | 9/28/07 |

| Bloomberg U.S. Aggregate Bond Index | (10.35)% | (10.28)% | (0.94)% | 0.88% | 1.54% | 5.60% | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 0.67%, Net: 0.55%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.51%, Net: 0.40%

30-Day SEC Yield figures reflect all fee waivers and expense reimbursements. Without the absorption of these fee waivers and/or expense reimbursements, the figures would have been 4.01% for the Retail Class and 4.15% for the Institutional Class.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Institutional Class shares prior to their inception is based on the performance of the Retail Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.55% and 0.40% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Segall Bryant & Hamill Plus Bond Fund may invest in high-yield/high-risk bonds which are subject to greater levels of liquidity risk. Additionally, investing in bonds entails interest rate risk and credit risk.

| 22 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Plus Bond Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Industrial | 34.7% |

| Mortgage-Backed Securities Passthrough | 21.3% |

| U.S. Treasury Bonds & Notes | 14.8% |

| Finance | 9.9% |

| Municipal Bonds | 8.8% |

| Utility | 5.2% |

| Asset Backed Securities | 3.6% |

| Residential Mortgage-Backed Securities | 0.3% |

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Corporate Holdings (as of 6/30/22)

| SBA Tower Trust | 1.2% |

| American Airlines, Inc. | 1.2% |

| Wells Fargo & Co. | 1.1% |

| JPMorgan Chase & Co. | 1.1% |

| PDC Energy, Inc. | 0.9% |

| Capital One Financial Corp. | 0.9% |

| Anheuser-Busch Cos. LLC/Anheuser-Busch InBev | |

| Worldwide, Inc. | 0.9% |

| Silgan Holdings, Inc. | 0.9% |

| Ford Motor Credit Co. LLC | 0.8% |

| General Motors Financial Co., Inc. | 0.8% |

Percentages represent the Fund’s aggregate holdings in the same corporate issuer and its affiliates. Holdings are subject to change and may not reflect the current or future position of the Fund.

Semi-Annual Report | June 30, 2022 |  | 23 |

| Segall Bryant & Hamill Quality High Yield Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks to achieve long-term total rate of return consistent with preservation of capital.

Fund Management

Troy A. Johnson, CFA Portfolio Manager

Gregory M. Shea, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | 30-Day SEC | Inception |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Yield | Date |

| Retail Class (WTLTX) | (12.13)% | (11.04)% | 0.17% | 1.72% | 3.78% | 6.61% | 6.11% | 6/1/88 |

| Institutional Class (WILTX) | (12.10)% | (10.93)% | 0.30% | 1.85% | 3.95% | 6.67% | 6.27% | 9/28/07 |

| Bloomberg U.S. High Yield 2% Issuer Capped Index | (14.20)% | (12.82)% | 0.18% | 2.09% | 4.47% | N/A | | |

| Bloomberg U.S. Corporate High Yield Ba Index | (13.86)% | (12.27)% | 1.24% | 2.76% | 4.76% | 7.83% | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 0.88%, Net: 0.85%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.76%, Net: 0.70%

30-Day SEC Yield figures reflect all fee waivers and expense reimbursements. Without the absorption of these fee waivers and/or expense reimbursements, the figures would have been 6.10% for the Retail Class and 6.23% for the Institutional Class.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Institutional Class shares prior to their inception is based on the performance of the Retail Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.85% and 0.70% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Segall Bryant & Hamill Quality High Yield Fund may invest in high-yield/high-risk bonds which are subject to greater levels of liquidity risk. Additionally, investing in bonds entail interest rate risk and credit risk.

| 24 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Quality High Yield Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)

| Industrial | 83.3% |

| Finance | 11.4% |

| Utility | 4.3% |

Percentages are based on Total Net Assets.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/22)

| PDC Energy, Inc. | 3.4% |

| AmeriGas Partners LP/AmeriGas Financial Corp. | 2.9% |

| Compass Minerals International, Inc. | 2.7% |

| Occidental Petroleum Corp. | 2.5% |

| Range Resources Corp. | 2.5% |

| Lamar Media Corp. | 2.4% |

| Cedar Fair LP | 2.4% |

| Provident Funding Associates LP/PFG Finance Corp. | 2.3% |

| IIP Operating Parternship LP | 2.3% |

| KB Home | 2.1% |

Percentages represent the Fund’s aggregate holdings in the same corporate issuer and its affiliates. Holdings are subject to change and may not reflect the current or future position of the Fund.

Semi-Annual Report | June 30, 2022 |  | 25 |

| Segall Bryant & Hamill Municipal Opportunities Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Investment Objective

The Fund seeks income exempt from Federal income taxes.

Fund Management

Nicholas J. Foley Portfolio Manager

Kenneth A. Harris, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

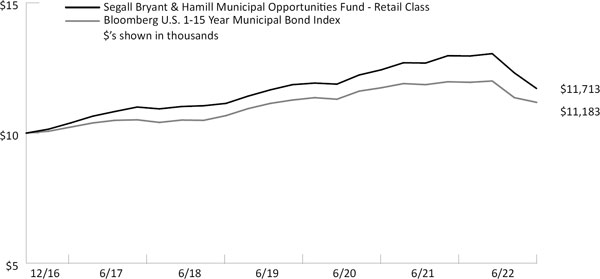

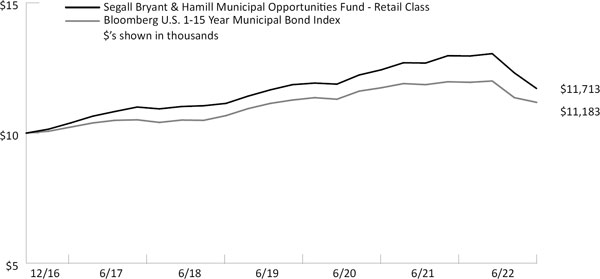

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 33.

Average Annual Total Returns

| | | | | | | Since | 30-Day SEC | Inception | |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Inception | Yield | Date | |

| Retail Class (WTTAX) | (10.23)% | (9.70)% | 0.14% | 1.92% | — | 2.90% | 2.86% | 12/16/16 | |

| Institutional Class (WITAX) | (10.15)% | (9.48)% | 0.33% | 2.08% | — | 3.07% | 3.01% | 12/16/16 | |

| Bloomberg U.S. 1-15 Year | (6.81)% | (6.53)% | 0.12% | 1.46% | — | 2.04% | | | |

| Municipal Bond Index | | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 0.74%, Net: 0.65%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.57%, Net: 0.50%

30-Day SEC Yield figures reflect all fee waivers and expense reimbursements. Without the absorption of these fee waivers and/or expense reimbursements, the figures would have been 2.58% for the Retail Class and 2.96% for the Institutional Class.

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements, if any. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2023, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.65% and 0.50% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Municipal bond fund income may be subject to state and local income taxes and the alternative minimum tax. Capital gains, if any, will be subject to capital gains tax.

Investments in municipal bonds are subject to interest rate risk, or the risk that the bonds will decline in value because of changes in market interest rates.

| 26 |  | www.sbhfunds.com | www.sbhfunds.com |

| Segall Bryant & Hamill Municipal Opportunities Fund | Fund Overview |

| | June 30, 2022 (Unaudited) |

Sector Allocation (as of 6/30/22)