| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: July 31, 2022 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-3373 | |

| SEGALL BRYANT & HAMILL TRUST |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Derek W. Smith, Secretary |

| Segall Bryant & Hamill Trust, 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 869-4262 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | June 30, 2020 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Segall Bryant & Hamill Small Cap Value Fund

(Ticker Symbol: Retail - SBRVX; Institutional - SBHVX)

Segall Bryant & Hamill Small Cap Value Dividend Fund

(Ticker Symbol: Retail - WTSVX; Institutional - WISVX)

Segall Bryant & Hamill Small Cap Growth Fund

(Ticker Symbol: Retail - WTSGX; Institutional - WISGX)

Segall Bryant & Hamill Small Cap Core Fund

(Ticker Symbol: Retail - SBHCX; Institutional - SBASX)

Segall Bryant & Hamill Mid Cap Value Dividend Fund

(Ticker Symbol: Retail - WTMCX; Institutional - WIMCX)

Segall Bryant & Hamill All Cap Fund

(Ticker Symbol: Retail - SBRAX; Institutional - SBHAX)

Segall Bryant & Hamill Emerging Markets Fund

(Ticker Symbol: Retail - SBHEX; Institutional - SBEMX)

Segall Bryant & Hamill International Small Cap Fund

(Ticker Symbol: Retail - SBHSX; Institutional - SBSIX)

Segall Bryant & Hamill Fundamental International Small Cap Fund

(Ticker Symbol: Retail - WTIFX; Institutional - WIIFX)

Segall Bryant & Hamill Global Large Cap Fund

(Ticker Symbol: Retail - WTMVX; Institutional - WIMVX)

Segall Bryant & Hamill Workplace Equality Fund

(Ticker Symbol: Retail - WEQRX; Institutional - WEQIX)

Segall Bryant & Hamill Short Term Plus Fund

(Ticker Symbol: Retail - SBHPX; Institutional - SBAPX)

Segall Bryant & Hamill Plus Bond Fund

(Ticker Symbol: Retail - WTIBX; Institutional - WIIBX)

Segall Bryant & Hamill Quality High Yield Fund

(Ticker Symbol: Retail - WTLTX; Institutional - WILTX)

Segall Bryant & Hamill Municipal Opportunities Fund

(Ticker Symbol: Retail - WTTAX; Institutional - WITAX)

Segall Bryant & Hamill Colorado Tax Free Fund

(Ticker Symbol: Retail - WTCOX; Institutional - WICOX)

SEMI-ANNUAL REPORT

June 30, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on the Funds’ website (www.sbhfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary.

| | |

Shareholder Letter | 1 |

Fund Overviews | |

Segall Bryant & Hamill Small Cap Value Fund | 2 |

Segall Bryant & Hamill Small Cap Value Dividend Fund | 4 |

Segall Bryant & Hamill Small Cap Growth Fund | 6 |

Segall Bryant & Hamill Small Cap Core Fund | 8 |

Segall Bryant & Hamill Mid Cap Value Dividend Fund | 10 |

Segall Bryant & Hamill All Cap Fund | 12 |

Segall Bryant & Hamill Emerging Markets Fund | 14 |

Segall Bryant & Hamill International Small Cap Fund | 16 |

Segall Bryant & Hamill Fundamental International Small Cap Fund | 18 |

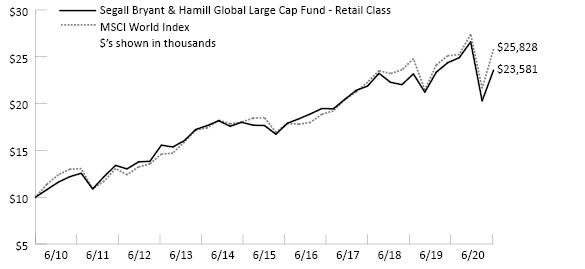

Segall Bryant & Hamill Global Large Cap Fund | 20 |

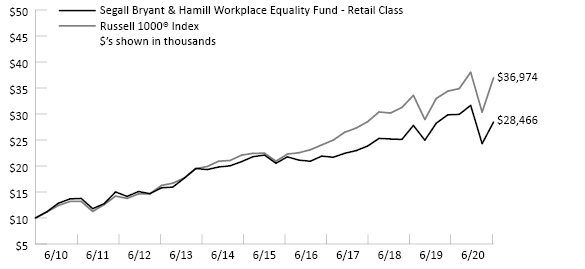

Segall Bryant & Hamill Workplace Equality Fund | 22 |

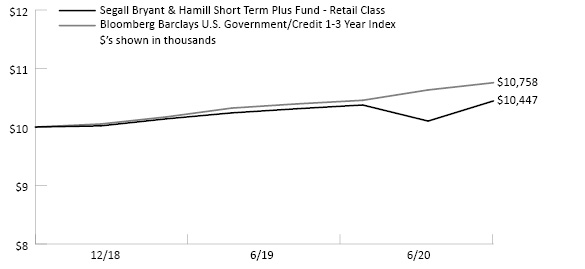

Segall Bryant & Hamill Short Term Plus Fund | 24 |

Segall Bryant & Hamill Plus Bond Fund | 26 |

Segall Bryant & Hamill Quality High Yield Fund | 28 |

Segall Bryant & Hamill Municipal Opportunities Fund | 30 |

Segall Bryant & Hamill Colorado Tax Free Fund | 32 |

Fund Expenses | 34 |

Important Disclosures | 38 |

FINANCIAL STATEMENTS | 41 |

Statements of Investments | 41 |

Statements of Assets and Liabilities | 101 |

Statements of Operations | 105 |

Statements of Changes in Net Assets | 109 |

Financial Highlights | 115 |

Notes to Financial Statements | 147 |

Change in Independent Auditor | 164 |

Liquidity Risk Management Program | 165 |

Semi-Annual Report | June 30, 2020 |  | |

Intentionally Left Blank

Segall Bryant & Hamill Funds | Shareholder Letter |

| | June 30, 2020 (Unaudited) |

Dear Fellow Shareholders,

It is hard to overstate what a wild ride the first half of 2020 has been for both the economy and the financial markets. There is no precedent in modern times for the disruption and dislocation that has swept the globe in the wake of the COVID-19 pandemic. In a matter of months, patterns of daily life for individuals, families, schools, businesses, and society at large changed dramatically, impacting the lives of almost every person on the planet. Even saying that the U.S. economy fell into a recession—declining at an annual rate of 5.0% in the first quarter and 32.9% in the second quarter and ending the longest running expansion in the country’s history—does not begin to capture the economic pain and turmoil caused by the pandemic. Nor does saying that the unemployment rate rose as high as 14.7% in April before starting to improve in May and June or that the stock market hit a bull market high and a bear market low—all in the same month—before beginning to recover in the second quarter.

Despite these significant challenges, we are pleased to report that throughout the first half of the year, most of the funds in our trust helped protect our shareholders’ capital in the first quarter while allowing them to participate strongly in the dramatic market recovery in the second quarter. Our funds with a value-oriented investment approach continued to struggle as the strong momentum in growth stocks continued unabated through both of the first two quarters. The return gap between growth and value has widened even further during this period. Overall though, we are pleased with the performance of the SBH funds during this dramatic period. This performance is consistent with what we have told our fund shareholders over the years. Our investment process is designed to help our funds weather market “storms” better than their benchmarks through our disciplined approach to investing: our focus on bottom-up research; our focus on the investment merits of each stock or bond that we buy or continue to hold (or sell); and our emphasis on understanding the risks and potential upside of every holding. Yet, it is one thing to have a well-defined philosophy and approach, but another thing altogether to maintain that discipline in the face of such unprecedented circumstances.

As we begin the second half of the year, we have been asked (and ask ourselves), what do we think a recovery will look like? We tell clients that to form an opinion about an economic upturn or prospects for either the stock market or the bond market, we need to have some notion of when herd immunity will be achieved. Herd immunity, which is a way of saying that a sufficiently large proportion of the population is not susceptible to a virus, is thought to be achieved around 60% of the population. It can be acquired in one of three ways: (1) someone is naturally immune to the virus, (2) one contracts the disease and recovers, building antibodies into the process, or (3) a person is vaccinated, which also creates antibodies to allow the body to fight an invader. Knowing when a safe and effective vaccine is broadly available, therefore, is the key, and while we can hope, this is not an event given to economic or financial analysis.

What we can do, however, is to maintain our discipline and intensify our research efforts, as opportunities often arise in market dislocations of this magnitude. We will seek to identify stocks and bonds that may have risen too high or have been sold down so low as to be attractive under the worst of cases. Our analysts and portfolio managers are energized by this opportunity. For all the accolades placed on passive strategies over the last 10 years, it is times like these when accomplished active management can create real value for investors.

|

|

Mary K. Anstine

Chairman | Philip L. Hildebrandt, CFA

President |

The views of the author and information discussed in the shareholder letter and the manager commentaries are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned in this letter or the manager commentaries. The subject matter contained in this letter and the manager commentaries has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Segall Bryant & Hamill, Segall Bryant & Hamill Funds, nor any Segall Bryant & Hamill Fund accept any liability for losses either direct or consequential caused by the use of this information. Diversification cannot guarantee gain or prevent losses.

Semi-Annual Report | June 30, 2020 |  | 1 |

Segall Bryant & Hamill Small Cap Value Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of small-capitalization companies.

Fund Management

Mark T. Dickherber, CFA, CPA Portfolio Manager |

Shaun P. Nicholson Portfolio Manager |

CFA is a trademark owned by CFA Institute.

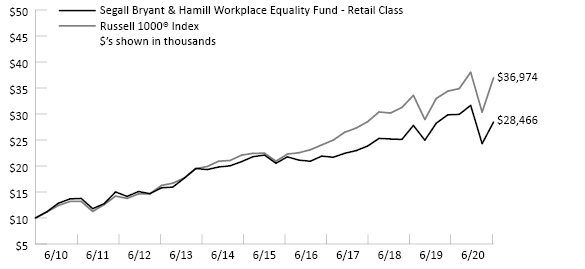

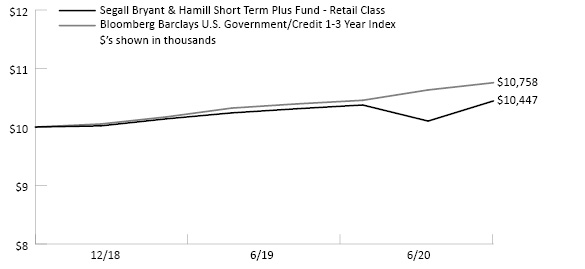

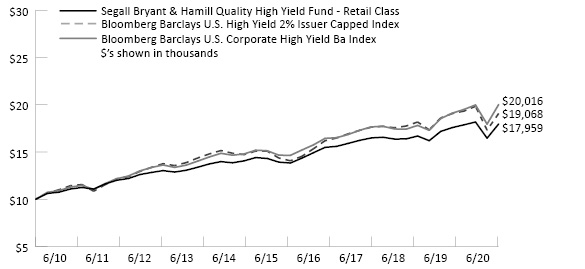

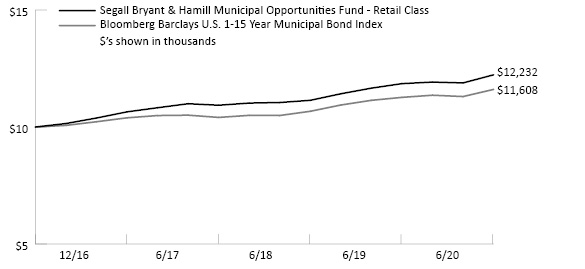

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 38.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

Retail Class (SBRVX) | (18.49)% | (12.60)% | 2.01% | 3.56% | — | 5.36% | 12/9/19 |

Institutional Class (SBHVX) | (18.49)% | (12.54)% | 2.13% | 3.69% | — | 5.51% | 7/31/13 |

Russell 2000® Value Index | (23.50)% | (17.48)% | (4.35)% | 1.26% | — | 3.10% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.24%, Net: 1.14%

Institutional Class Annual Expense Ratio (per the current prospectus) – Gross: 1.10%, Net: 0.99%

Sector Allocation (as of 6/30/20)

Information Technology | 17.4% |

Industrials | 17.0% |

Financials | 13.2% |

Health Care | 11.1% |

Materials | 7.3% |

Real Estate | 7.1% |

Consumer Staples | 7.0% |

Consumer Discretionary | 4.8% |

Utilities | 3.8% |

Energy | 3.3% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Sector weights may not sum to 100% due to rounding.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/20)

Regal Beloit Corp. | 5.3% |

Equity Commonwealth | 4.8% |

NCR Corp. | 4.7% |

Hain Celestial Group, Inc. (The) | 4.4% |

Orthofix Medical, Inc. | 4.2% |

Progress Software Corp. | 3.8% |

FARO Technologies, Inc. | 3.2% |

Magellan Health, Inc. | 2.6% |

SPX Corp. | 2.5% |

TreeHouse Foods, Inc. | 2.1% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least December 31, 2021, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to December 31, 2021, without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

2 |  | www.sbhfunds.com | www.sbhfunds.com

|

Segall Bryant & Hamill Small Cap Value Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

During the last six months, COVID-19 upended the markets. While the global economy continues to rebound, uncertainty and volatility remain a constant. For the 6-month period ending June 30, 2020, the Segall Bryant & Hamill Small Cap Value Fund (the “Fund”) returned -18.49% (Retail Class) versus -23.50% for the Russell 2000® Value Index.

Contributors to Return

During the period, Consumer Staples, Industrials, and Financials were the largest contributors to relative performance. Hain Celestial (HAIN) was a top contributor given improved results and tailwinds from stay-at-home benefits alongside the material changes the new team has made in order to improve returns and capital allocation. Papa John’s International (PZZA) was also a top contributor during the period. The company benefited from the new management team focusing on materially better new product offerings and improved efficiencies alongside the benefit of stay-at-home behaviors due to the virus.

Detractors from Return

From a sector perspective, Information Technology, Energy, and Consumer Discretionary detracted from relative performance. Within Information Technology, NCR Corporation (NCR) was a top detractor as investors seemed concerned the overall exposure to restaurants and retail, though small, could be a larger risk if the economy shuts down again. Within Health Care, the largest detractor was Orthofix Medical (OFIX). This was due to the risk of elective surgeries continuing to be postponed or stopped if hospitals have to deal with COVID-19 patients. Over the long term, we remain very optimistic in OFIX under its new leadership team.

Outlook and Positioning

What a year it has been. It has been by far the most challenging investing environment of our careers, including 2008’s tumultuous environment. After preserving capital in the first quarter of 2020, we were able to keep up with the markets sufficiently all things considered in the second quarter, despite a strong rally from the March lows with high volatility interspersed. We believe that the second half of 2020 will likely be equally volatile as vaccine hopes and monetary exuberance are balanced with the risks of elections, fiscal support, and more insolvencies than the limited number we have witnessed thus far. Managing the volatility via our Return on Invested Capital (ROIC) approach, coupled with risk mitigation, is what we do in all environments in an attempt to be on the right side of expectations.

We think the remainder of the year is likely to prove at least as challenging, if not more so, as the first six months. In fact, we think much of the decade is going to be ever more volatile and in need of prudent risk managers balancing scenarios and return opportunities versus a simple “stocks just go up” approach due to the zombie-filled landscape (“zombie” companies are those with low or negative ROIC, significant debt, and/or requiring bailouts). Our hope is that capitalism is allowed to thrive, and bad capital allocators are punished if historical decisions have been too risky and return destructive. We are very grateful for your trust in us to navigate these difficult times; we know trusting in active management has been no easy task the last decade.

Stock Performance (for the six months ended 6/30/20)

5 Highest | Average

Weight | Contribution

to Return | | 5 Lowest | Average

Weight | Contribution

to Return |

Hain Celestial Group, Inc. | 4.76% | 1.50% | | IBERIABANK Corp. | 1.00% | -1.11% |

Papa John’s International, Inc. | 1.15 | 0.50 | | Orthofix Medical, Inc. | 4.33 | -1.22 |

Progress Software Corp. | 3.46 | 0.44 | | Jack in the Box Inc. | 2.08 | -1.33 |

Astec Industries, Inc. | 1.32 | 0.43 | | WPX Energy, Inc. | 1.46 | -1.58 |

Chembio Diagnostics, Inc. | 0.33 | 0.38 | | NCR Corp. | 4.47 | -2.60 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 39 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2020 |  | 3 |

Segall Bryant & Hamill Small Cap Value Dividend Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Fund Strategy

Investing primarily in small, dividend-paying companies whose stocks appear to be undervalued.

Fund Management

Ralph M. Segall, CFA, CIC Portfolio Manager |

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 38.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

Retail Class (WTSVX) | (25.36)% | (23.83)% | (9.29)% | (2.17)% | 5.53% | 3.79% | 12/13/04 |

Institutional Class (WISVX) | (25.36)% | (23.72)% | (9.15)% | (2.01)% | 5.69% | 3.91% | 9/28/07 |

Russell 2000® Value Index | (23.50)% | (17.48)% | (4.35)% | 1.26% | 7.82% | 4.99% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.33%, Net: 1.14%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.17%, Net: 0.99%

Sector Allocation (as of 6/30/20)

Financials | 24.3% |

Industrials | 13.7% |

Real Estate | 12.4% |

Information Technology | 11.6% |

Utilities | 8.1% |

Materials | 7.3% |

Consumer Discretionary | 6.7% |

Health Care | 5.1% |

Energy | 3.7% |

Consumer Staples | 3.2% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Sector weights may not sum to 100% due to rounding.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/20)

InterDigital, Inc. | 2.7% |

Crane Co. | 2.6% |

Black Hills Corp. | 2.5% |

STAG Industrial, Inc. | 2.5% |

Physicians Realty Trust | 2.4% |

Atlantica Sustainable Infrastructure PLC | 2.4% |

EVERTEC, Inc. | 2.2% |

TTEC Holdings, Inc. | 2.2% |

EnerSys | 2.2% |

Ensign Group, Inc. (The) | 2.1% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Institutional Class shares prior to their inception is based on the performance of the Retail Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

From May 1, 2020 until at least April 30, 2021, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to April 30, 2021 without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

4 |  | www.sbhfunds.com | www.sbhfunds.com

|

Segall Bryant & Hamill Small Cap Value Dividend Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

To say that 2020 has been an unimaginable year would be a gross understatement. The first quarter was one of the worst quarters on record, ending the longest bull market in history. The violent sell-off was a consequence of the COVID-19 virus becoming a global pandemic, resulting in the near shutdown of the domestic (and global) economy. In the second quarter, we witnessed a dramatic recovery in the markets, despite the fact that we are still in the midst of the pandemic and it is likely we will see adverse economic impacts well into the future.

The Segall Bryant & Hamill Small Cap Value Dividend Fund (the “Fund”) contracted -25.36% (Retail Class) for the year-to-date period through June 30, 2020, trailing the -23.50% return of the Russell 2000® Value Index. Dividend-paying stocks, which have historically offered downside protection during market turmoil, underperformed due to the real or perceived cash flow impact on many businesses.

Contributors to Return

Sectors that contributed most to relative performance year-to-date were Information Technology (driven by selection), Real Estate (driven by allocation), and Utilities (driven by selection).

Information Technology holding, TTEC Holdings, Inc. (TTEC), was another top performer related to their ability to implement at-home and other virtual technologies necessary to maintain client business continuity related to work from home. QTS Realty Trust (QTS), a data center REIT, was another top contributor year to date. With healthy trends, solid backlog, and ample funding available for growth, we remain constructive on the stock.

Detractors from Return

Sectors that detracted the most from the Fund’s performance year-to-date were Energy (driven by allocation), Consumer Discretionary (driven by selection), and Consumer Staples (driven by allocation).

On an individual stock basis, Energy holding Enerplus Corporation (ERF), an oil and gas exploration and production (E&P) company, underperformed its peers. Solvency of many E&P energy companies began to be questioned. Financials holding Redwood Trust, Inc. (RWT), an originator and distributor of high quality, non-standard mortgages, was another top detractor. While we expected the quality of their underwriting and relatively conservative balance sheet management to support them through the economic slowdown, significant and rapid disruptions in the fixed income funding markets resulted in the sudden and unexpected forced selling of assets and we exited the position.

As was announced on July 23, 2020, the Fund’s Board of Trustees voted to merge the Segall Bryant & Hamill Small Cap Value Dividend Fund into the Segall Bryant & Hamill Small Cap Value Fund on or about September 25, 2020. Please see the Manager Commentary for the Segall Bryant & Hamill Small Cap Value Fund in this report for details about that fund. Please see the supplement to the Fund’s prospectus for complete details.

Stock Performance (for the six months ended 6/30/20)

5 Highest | Average

Weight | Contribution

to Return | | 5 Lowest | Average

Weight | Contribution

to Return |

Pan American Silver Corp. | 0.69% | 1.04% | | OUTFRONT Media Inc. | 1.69% | -1.31% |

TTEC Holdings, Inc. | 2.15 | 0.71 | | Allegiant Travel Co. | 0.86 | -1.33 |

NIC Inc. | 0.31 | 0.55 | | Enerplus Corp. | 1.29 | -1.79 |

QTS Realty Trust, Inc. | 2.18 | 0.49 | | PBF Energy, Inc. | 0.71 | -1.96 |

Brooks Automation, Inc. | 0.56 | 0.43 | | Redwood Trust, Inc. | 1.09 | -2.79 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 39 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2020 |  | 5 |

Segall Bryant & Hamill Small Cap Growth Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Fund Strategy

Investing in a diversified portfolio of equity securities of primarily small-sized companies with growth potential.

Fund Management

Brian C. Fitzsimons, CFA Portfolio Manager |

Mitch S. Begun, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

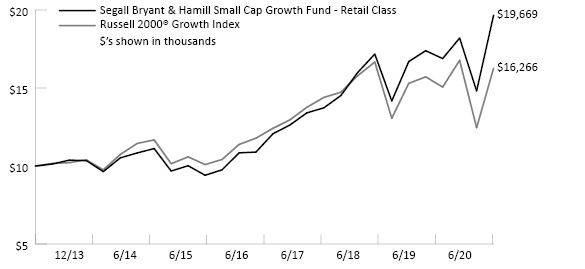

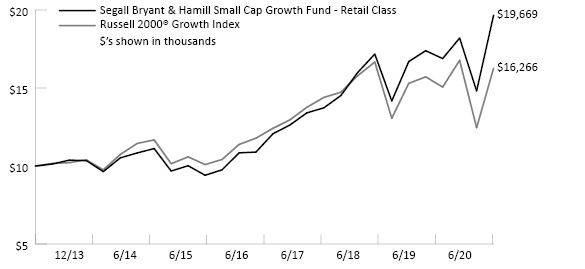

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 38.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

Retail Class (WTSGX) | 8.05% | 13.08% | 15.91% | 12.08% | — | 10.92% | 12/20/13 |

Institutional Class (WISGX) | 8.10% | 13.29% | 16.11% | 12.30% | — | 11.21% | 12/20/13 |

Russell 2000® Growth Index | (3.06)% | 3.48% | 7.86% | 6.86% | — | 7.74% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Total: 1.12%

Institutional Class Annual Expense Ratio (per the current prospectus) — Total: 0.98%

Sector Allocation (as of 6/30/20)

Health Care | 25.1% |

Information Technology | 21.6% |

Industrials | 17.5% |

Consumer Discretionary | 12.2% |

Financials | 10.6% |

Real Estate | 3.5% |

Materials | 3.1% |

Communication Services | 2.4% |

Consumer Staples | 0.5% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Sector weights may not sum to 100% due to rounding.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/20)

Goosehead Insurance, Inc. | 2.9% |

Globant S.A. | 2.7% |

Amedisys, Inc. | 2.4% |

Generac Holdings, Inc. | 2.3% |

Bright Horizons Family Solutions, Inc. | 2.2% |

Envestnet, Inc. | 2.0% |

QTS Realty Trust, Inc. | 2.0% |

Inphi Corp. | 2.0% |

Churchill Downs, Inc. | 2.0% |

Silicon Laboratories, Inc. | 1.8% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

From May 1, 2020 until at least April 30, 2021, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to April 30, 2021 without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

6 |  | www.sbhfunds.com | www.sbhfunds.com

|

Segall Bryant & Hamill Small Cap Growth Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

The longest economic expansion on record came to a sudden, tragic halt with the spread of the COVID-19 virus in the first quarter of 2020. As the global economy hit the stop button, market participants rushed to safety causing a significant headwind to small cap equities with the Russell 2000® Growth Index falling approximately 40% in less than one month’s time. However, the second quarter saw a dramatic snapback rally that left the Russell 2000 Growth Index down just 3.06% year-to-date. Despite the economy entering a severe recession, market participants looked optimistically to the future. While the prospect of vaccination or treatment innovations likely has created some tailwind, the equity markets certainly were emboldened by the Federal Reserve’s supportive actions.

For the first half of 2020, the Segall Bryant & Hamill Small Cap Growth Fund (the “Fund”) returned 8.05% (Retail Class) versus -3.06% for the Russell 2000® Growth Index, outperforming in both quarters.

Contributors to Return

The three sectors that contributed most to the Fund’s performance relative to its benchmark in the period were Information Technology, Industrials, and Consumer Discretionary, primarily driven by selection. Teladoc Health, Inc. (TDOC), a leader in virtual health care delivery, was the portfolio’s best performing stock. The COVID-19 pandemic is driving awareness of the benefits of virtual care that has accelerated demand across its customer base. Everbridge, Inc. (EVBG), a provider of critical events management software, also significantly outperformed in the first half of 2020 as the company saw robust interest in its broad suite of public and employee safety solutions. Independent insurance agency Goosehead Insurance, Inc. (GSHD) was also a top contributor given the company delivered peer leading growth in premiums written as its unique business model of separating sales and service continues to drive market share gains.

Detractors from Return

The three sectors that detracted most from the Fund’s performance relative to its benchmark in the period were Materials, Health Care, and Energy. Selection was negative in both Materials and Energy, however, the portfolio’s underweight allocation in Health Care hurt the portfolio given the strength in the sector. The portfolio’s worst-performing stock in the period was Hexcel Corp. (HXL), a carbon fiber provider to the aerospace and defense markets. Key customers have cut production plans given the sharp slowdown in travel demand and potential credit issues with certain airlines. Despite near-term headwinds, we believe the long-term growth outlook for the company remains robust given its strong competitive positioning. Another significant detractor was OneSpaWorld Holdings Ltd. (OSW), a leading provider of wellness services onboard cruise ships. Cruise cancellations have put extreme pressure on the company, and we exited the position during the period given we would expect a long road ahead for a recovery. Huron Consulting (HURN), a global consultancy firm that collaborates with clients to drive strategic growth, ignite innovation and navigate constant change, was also an underperformer as its two primary end markets, hospitals and education, were severely disrupted due to COVID-19. We believe the company remains well positioned to generate strong results as the pandemic disruption subsides.

Outlook and Positioning

As of the end of the first half of 2020, the Fund’s portfolio was overweight primarily in the Financials and Industrials sectors and underweight primarily in the Health Care and Consumer Staples sectors. The resilience of the fundamentals at the majority of the Fund’s portfolio companies during the first half of the year has been impressive given the backdrop. We believe that the pandemic has accelerated many of the trends that were already in place, in effect, making the stronger companies even better competitively positioned to grow in the future. Our focus on high quality, fundamentally stable growth companies has been rewarded, not just in protecting in the downside of the first quarter drawdown but also in the recovery rally of the second quarter.

Stock Performance (for the six months ended 6/30/20)

5 Highest | Average

Weight | Contribution

to Return | | 5 Lowest | Average

Weight | Contribution

to Return |

Teladoc Health, Inc. | 1.26% | 1.86% | | Meridian Bancorp Inc. | 0.59% | -0.82% |

Live Nation Entertainment, Inc. | 0.45 | 1.33 | | OneSpaWorld Holdings Ltd. | 0.21 | -0.85 |

Everbridge, Inc. | 1.58 | 1.25 | | Ingevity Corp. | 1.26 | -0.88 |

Goosehead Insurance, Inc. | 2.35 | 1.23 | | Huron Consulting Group Inc. | 1.51 | -0.92 |

Ollie’s Bargain Outlet Holdings Inc. | 1.66 | 1.10 | | Hexcel Corp. | 1.52 | -1.28 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 39 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2020 |  | 7 |

Segall Bryant & Hamill Small Cap Core Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of small-capitalization companies.

Fund Management

Jeffrey C. Paulis, CFA, CPA Portfolio Manager |

Mark T. Dickherber, CFA, CPA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

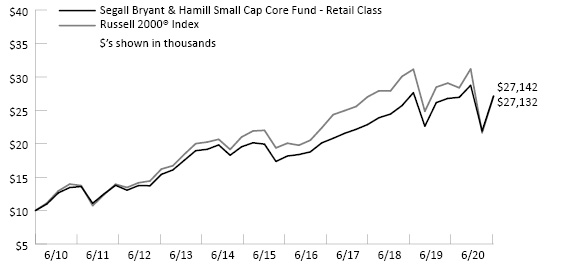

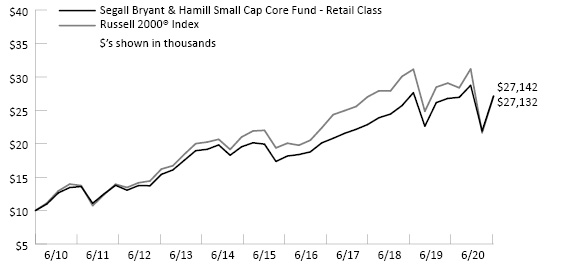

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 38.

Average Annual Total Returns*

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

Retail Class (SBHCX) | (5.60)% | 1.32% | 6.99% | 6.36% | 10.50% | 8.00% | 12/31/19 |

Institutional Class (SBASX) | (5.50)% | 1.50% | 7.16% | 6.52% | 10.67% | 8.16% | 12/15/03 |

Russell 2000® Index | (12.98)% | (6.63)% | 2.01% | 4.29% | 10.50% | 7.37% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.41%, Net: 1.14%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.31%, Net: 0.99%

Sector Allocation (as of 6/30/20)

Information Technology | 23.4% |

Industrials | 21.2% |

Health Care | 15.1% |

Consumer Discretionary | 11.1% |

Financials | 6.5% |

Materials | 5.5% |

Consumer Staples | 5.2% |

Real Estate | 3.7% |

Energy | 1.6% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Sector weights may not sum to 100% due to rounding.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/20)

Hain Celestial Group, Inc. (The) | 3.6% |

Five9, Inc. | 2.7% |

Equity Commonwealth | 2.3% |

Entegris, Inc. | 2.0% |

BlackLine, Inc. | 2.0% |

Model N, Inc. | 2.0% |

Pegasystems, Inc. | 2.0% |

Horizon Therapeutics PLC | 2.0% |

Bio-Rad Laboratories, Inc. | 1.8% |

Casella Waste Systems, Inc. | 1.7% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

* The quoted performance of the Fund reflects the past performance of Lower Wacker Small Cap Investment Fund, LLC (the “Partnership”), an unregistered limited partnership managed by the portfolio managers of the Fund. The Partnership was organized into the Institutional Class shares on December 31, 2019, the date the Fund commenced operations. The Fund has been managed in the same style since the Partnership’s inception on December 15, 2003. The Fund’s annual returns and long-term performance reflect the actual fees and expenses that were charge when the Fund was a limited partnership. From its inception on December 15, 2003 through December 31, 2019, the Partnership was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended or Subchapter M of the Internal Revenue Code of 1986, as amended, which, if they had been applicable, might have adversely affected the Fund’s performance.

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least April 30, 2021, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.14% and 0.99% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to the termination date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

8 |  | www.sbhfunds.com | www.sbhfunds.com

|

Segall Bryant & Hamill Small Cap Core Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

The Segall Bryant & Hamill Small Cap Core Fund (the “Fund”) decreased 5.60% (Retail Class) for the year-to-date period ending June 30, 2020, compared to a 12.98% decrease for the Russell 2000® Index. Saying the first half of 2020 was extraordinary is an understatement as the team navigated both a bear and bull market. The global pandemic and subsequent lockdown drove significant market declines which were quickly reversed due to unprecedent global fiscal and monetary stimulus. We are heartened by our ability to outperform through such extreme market changes and excited by the companies the market volatility provided a chance to add to the Fund.

Contributors to Return

Five9, Inc. (FIVN), a provider of cloud-based contact center communications as a service (CCaaS), was the top contributor to the Fund’s performance during the six-month period ended June 30, 2020. COVID-19 driven disruption and reduction to in-person interactions, elevated the importance of contact centers for servicing customers across industries. FIVN’s leadership position in the cloud-based market drove strong near-term results and positions it well to benefit short and long term. Horizon Therapeutics Company (HZNP), a biopharmaceutical company focused on orphan drugs for rare and rheumatic conditions, was also a large contributor to performance. HZNP benefited from the successful rollout of two drugs, Krystexxa (gout) and Tepezza (Thyroid Eye Disease), that are driving substantial growth for the company.

Detractors from Return

Harsco Corporation (HSC), a provider of environmental and clean earth solutions, was one of the largest detractors. HSC reported lackluster performance during the period driven by execution issues in their Rail segment and a shortfall in their Environmental segment. Further, after a period of significant balance sheet deleveraging, the company levered up to buy an underperforming asset. Given the confluence of negative factors against a backdrop of a deteriorating economic environment, we chose to exit the position. OneSpaWorld Holdings Ltd. (OSW) was another top detractor. OSW operates spa and related services on cruise ships. Given the short- and medium-term change in outlook for the cruise industry following the COVID-19 outbreak, we chose to exit the position.

Outlook and Positioning

The first half of 2020 saw a bear market, followed by a bull market, unprecedented unemployment increases, massive global monetary and fiscal stimulus and interest rates approaching zero percent globally. Following an initial sharp decline, global stock markets rebounded as worst-case scenarios envisioned in March & April are proving overly dour and economic data has improved considerably. Despite this rebound, we believe the fundamental outlook remains uncertain and businesses globally remain cautious. While a vaccine could accelerate the recovery, we believe it is likely the U.S. economy experiences a bumpy road on its return to (“the new”) normal over the next few years. Further, the impact of COVID will permanently change business and consumer behavior with broad implications from travel and retail to demand for industrial goods and commercial real estate, which likely results in sustained slower economic growth.

Importantly for the investors in the Fund, we believe that the team’s approach of focusing on companies operating in niche markets with defendable competitive advantages is becoming an even more important weapon, similar to after the 2008/2009. We favor companies that target smaller overall markets where they can achieve high market share and operate in a less competitively intense environment which results in higher and more stable ROIC profiles.

Combining these characteristics with strong management teams and attractive reward-to-risk ratios are the key pillars of our investment philosophy and have been for nearly two decades. We believe they are critically important across market cycles, but in the wake of COVID-19 and the uncertainty of what lies ahead, we are certain that our philosophical approach is becoming an even more important factor to drive future equity returns and relative performance.

Thank you for your continued interest and support.

Stock Performance (for the six months ended 6/30/20)

5 Highest | Average

Weight | Contribution

to Return | | 5 Lowest | Average

Weight | Contribution

to Return |

Five9, Inc. | 3.15% | 2.24% | | World Fuel Services Corp. | 1.12% | -0.68% |

Hain Celestial Group, Inc. | 3.16 | 0.98 | | Ameris Bancorp | 1.05 | -0.79 |

Horizon Therapeutics Public Ltd. Co. | 1.57 | 0.96 | | Harsco Corp. | 0.39 | -0.96 |

Lattice Semiconductor Corp. | 0.66 | 0.82 | | OneSpaWorld Holdings Ltd. | 0.38 | -1.01 |

BlackLine, Inc. | 2.04 | 0.80 | | Allegiant Travel Co. | 1.23 | -1.21 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 39 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2020 |  | 9 |

Segall Bryant & Hamill Mid Cap Value Dividend Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Fund Strategy

Investing in medium-sized, dividend-paying companies whose stocks appear to be undervalued.

Fund Management

Ralph M. Segall, CFA, CIC Portfolio Manager |

CFA is a trademark owned by CFA Institute.

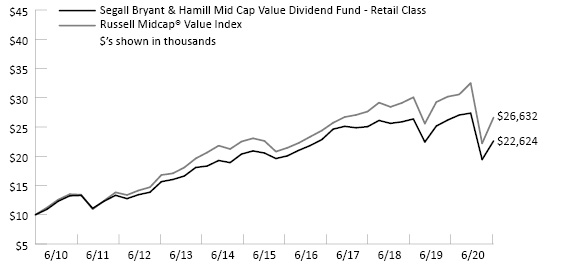

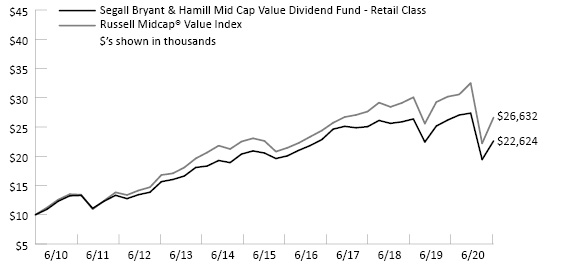

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 38.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

Retail Class (WTMCX) | (17.37)% | (13.65)% | (3.11)% | 1.94% | 8.51% | 7.64% | 10/1/98 |

Institutional Class (WIMCX) | (17.43)% | (13.69)% | (3.00)% | 2.07% | 8.58% | 7.67% | 4/29/16 |

Russell Midcap® Value Index | (18.09)% | (11.81)% | (0.54)% | 3.32% | 10.29% | 8.88% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.08%, Net: 0.99%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.98%, Net: 0.84%

Sector Allocation (as of 6/30/20)

Industrials | 15.4% |

Real Estate | 13.1% |

Information Technology | 13.0% |

Financials | 12.9% |

Utilities | 12.2% |

Consumer Discretionary | 8.8% |

Health Care | 6.8% |

Materials | 5.4% |

Consumer Staples | 4.5% |

Energy | 3.7% |

Communication Services | 2.4% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Sector weights may not sum to 100% due to rounding.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/20)

Americold Realty Trust | 3.5% |

InterDigital, Inc. | 2.5% |

CyrusOne, Inc. | 2.5% |

Republic Services, Inc. | 2.5% |

Sun Communities, Inc. | 2.5% |

TELUS Corp. | 2.4% |

Kansas City Southern | 2.4% |

Vistra Energy Corp. | 2.3% |

Grifols S.A. ADR | 2.2% |

Aaron’s, Inc. | 2.2% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Institutional Class shares prior to their inception is based on the performance of the Retail Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

From May 1, 2020 until at least April 30, 2021, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.99% and 0.84% for the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to April 30, 2021 without the approval of the Board of Trustees.

Investing in mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

10 |  | www.sbhfunds.com | www.sbhfunds.com

|

Segall Bryant & Hamill Mid Cap Value Dividend Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

To say that 2020 has been an unimaginable year would be a gross understatement. The first quarter was one of the worst quarters on record, ending the longest bull market in history. The violent sell-off was a consequence of the COVID-19 virus becoming a global pandemic, resulting in the near shutdown of the domestic (and global) economy. In the second quarter, we witnessed a dramatic recovery in the markets, despite the fact that we are still in the midst of the pandemic and it is likely we will see adverse economic impacts well into the future.

The Segall Bryant & Hamill Mid Cap Value Dividend Fund (the “Fund”) contracted -17.37% (Retail Class) for the year-to-date period through June 30, 2020, ahead of the -18.09% return of the Russell Midcap® Value Index. Dividend-paying stocks, which have historically offered downside protection during market turmoil, underperformed due to the real or perceived cash flow impact on many businesses.

Contributors to Return

Sectors that contributed most to the Fund’s relative performance year-to-date were Real Estate (driven by selection), Information Technology (driven by allocation), and Materials (driven by selection). Materials holding Newmont Corporation (NEM), a global gold producer, outperformed Materials and the markets during this period, mostly in sympathy with higher gold prices. The case for precious metals is supported by aggressive monetary and fiscal policies across the world combined with high debt loads and impaired global real GDP. Americold Realty Trust (COLD), a cold storage real estate investment trust (REIT), was also a top contributor. COVID-19 shelter in place recommendations have driven a surge in grocery demand as consumers shift to eating at home, driving increased activity at the company’s temperature-controlled storage facilities. In addition, COLD maintained its 2020 guidance and reported no delays in its development pipeline.

Detractors from Return

Sectors that detracted the most from performance year-to-date were Consumer Staples (driven by allocation), Industrials (driven by selection), and Financials (driven by allocation). Energy holding Enerplus Corporation (ERF), an oil and gas exploration and production (E&P) company, was another detractor to performance this year as oil prices collapsed from $66 per barrel at the beginning of the year to nearly $23 at the end of the first quarter. Solvency of many E&P energy companies began to be questioned. Industrial holding CAE Inc. (CAE), a global leader in modeling, simulation, and training for the commercial aerospace industry was another detractor. The stock underperformed as the aerospace industry was negatively impacted by the economic slowdown.

As was announced on July 23, 2020, the Fund’s Board of Trustees voted to liquidate the Segall Bryant & Hamill Mid Cap Value Dividend Fund on or about September 17, 2020. Please see the supplement to the Fund’s prospectus for complete details.

Stock Performance (for the six months ended 6/30/20)

5 Highest | Average

Weight | Contribution

to Return | | 5 Lowest | Average

Weight | Contribution

to Return |

Newmont Corp. | 2.19% | 1.17% | | Axis Capital Holdings Ltd. | 2.19% | -1.03% |

Americold Realty Trust | 2.62 | 0.65 | | MDU Resources Group Inc. | 1.27 | -1.08 |

CyrusOne, Inc. | 2.10 | 0.61 | | Enerplus Corp. | 1.33 | -1.27 |

Knight-Swift Transportation Holdings Inc. | 0.62 | 0.36 | | CAE Inc. | 1.83 | -1.59 |

Citrix Systems, Inc. | 0.60 | 0.34 | | OUTFRONT Media Inc. | 1.09 | -1.85 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 39 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2020 |  | 11 |

Segall Bryant & Hamill All Cap Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of any size, including small- and mid-capitalization companies.

Fund Management

Ralph M. Segall, CFA, CIC Portfolio Manager |

Suresh Rajagopal, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

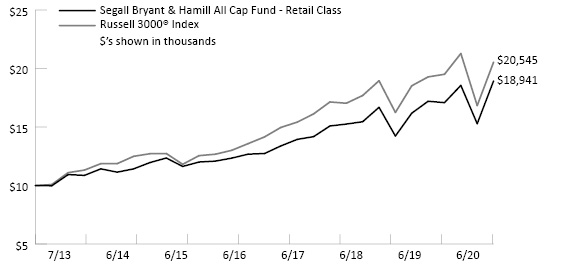

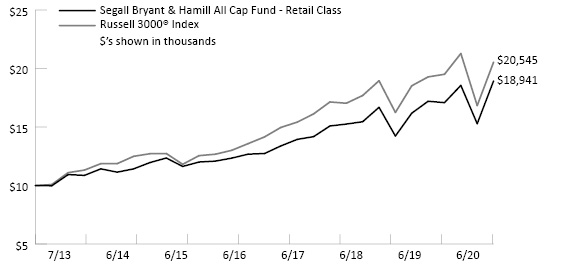

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 38.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

Retail Class (SBRAX) | 2.06% | 10.10% | 10.75% | 8.93% | — | 9.68% | 12/9/19 |

Institutional Class (SBHAX) | 2.12% | 10.24% | 10.91% | 9.08% | — | 9.84% | 7/31/13 |

Russell 3000® Index | (3.48)% | 6.53% | 10.04% | 10.03% | — | 10.97% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.16%, Net: 0.99%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.03%, Net: 0.84%

Sector Allocation (as of 6/30/20)

Information Technology | 23.4% |

Health Care | 19.7% |

Consumer Discretionary | 13.0% |

Financials | 12.5% |

Industrials | 9.2% |

Materials | 6.1% |

Consumer Staples | 6.0% |

Communication Services | 5.8% |

Energy | 0.9% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Sector weights may not sum to 100% due to rounding.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/20)

Microsoft Corp. | 5.0% |

Amazon.com, Inc. | 4.6% |

Alphabet, Inc. | 2.9% |

Visa, Inc. - Class A | 2.8% |

Marvell Technology Group, Ltd. | 2.7% |

Adobe, Inc. | 2.2% |

ServiceNow, Inc. | 2.2% |

FMC Corp. | 2.1% |

UnitedHealth Group, Inc. | 2.1% |

Danaher Corp. | 2.1% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Until at least December 31, 2021, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.99% and 0.84% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to December 31, 2021, without the approval of the Board of Trustees.

12 |  | www.sbhfunds.com | www.sbhfunds.com

|

Segall Bryant & Hamill All Cap Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Manager Commentary

Fund Performance

For the year-to-date period, the Segall Bryant & Hamill All Cap Fund (the “Fund”) returned 2.06% (Retail Class) compared to a return of -3.48% for the Russell 3000® Index. For the year-to-date period, security selection contributed +425 bps to relative performance and sector allocation contributed +169 bps. Cash had a positive +64 bps total effect on the relative return.

As a reminder, the investment team’s strategy is to participate in all markets by investing in companies that maintain high Return on Invested Capital (ROIC), generate quality financial metrics (e.g., free cash flow growth, consistent earnings growth and margin expansion) and are operated by strong management teams.

Contributors to Return

At the sector level, the Fund’s best-performing areas were Health Care (+199 bps), Financials (+101 bps) and Energy (+73 bps). The outperformance in the Utilities sector was primarily related to allocation as it was a lagging group in the index, and this sector was significantly underweighted in the Fund. At the individual holding level, several names stood out in terms of their positive contributions to performance for the quarter:

● | Marvell Technology Group (MRVL) – Company benefited from significant outperformance in cloud data center applications and 5G infrastructure buildouts. |

● | Amazon.com (AMZN) – Profited from increased consumer adoption of e-commerce, accelerated by COVID-19, as well as continued Amazon Web Services growth. |

● | Catalent (CTLT) – Organization experiencing resilient demand for biologics capabilities in addition to new tailwinds from vaccine production opportunities. |

Detractors from Return

Consumer Discretionary (-22 bps), Communication Services (-21 bps), and Information Technology (-3 bps) were the largest detractors on a sector level for the year-to-date period. In terms of individual securities, several names detracted from performance:

● | JPMorgan Chase (JPM) – Economic pressures resulting from COVID-19 created concern around loan losses for financial services organizations. |

● | Reinsurance Group of America, Incorporated (RGA) – Concerns of rising claims due to COVID-19 created concern around the insured portfolio. |

● | Parker-Hannifin Corporation (PH) – Exposure to the aerospace and industrial sectors impacted by COVID-19. |

Outlook and Positioning

The market sharply recovered in the second quarter of 2020, as evidenced by the +20.5% return produced by the S&P 500® Index and +22.0% performance generated by the Russell 3000 benchmark. A confluence of factors contributed to the positive inflection higher in equities as governments, corporations, and consumers sought to navigate through unprecedented economic conditions caused by COVID-19. Timely and aggressive stimulus, both fiscal and monetary, can be given significant recognition for helping to maintain functional capital markets and broader economic sentiment. By significantly expanding its balance sheet and repairing bond market operations, the Federal Reserve (and central banks around the globe) played a crucial role toward ensuring companies were able to access liquidity. Available credit was viewed as necessary for bridging what will likely be a challenging year on cash flows and bottom lines (S&P earnings are forecasted to contract by -22.2% in 2020 per FactSet consensus). Similarly, enhanced unemployment benefits and stimulus checks helped to somewhat blunt the financial strain and confidence erosion from a consumer perspective.

While the pandemic still wages material disruption on daily life throughout the world, slowing infection rates during the second quarter, and optimism around prospective coronavirus treatments helped to provide visibility toward the reopening of commercial and social activity. The easing of lockdown restriction conditions allowed some corporations to offer up supportive demand commentary as the year progressed, relative to low investor expectations. This dynamic fueled a rally in cyclical corners of the market (crude futures appreciated +91.8%) all the while investors continued to favor mega cap technology companies in the period (NASDAQ-100 returned +30.3%) which provided helpful support at the index level. To be sure, the operating environment moving forward is far from clear. Escalating infection trends, social unrest, election rhetoric, and geopolitical tensions are just a few of the variables that the market will monitor in the back half of the calendar year against the context of valuation multiples, which stand elevated to historical averages. We believe that by focusing our bottom-up research process on ROIC-oriented companies that meet our quality standards, the All Cap Fund is well positioned to weather evolving external macro conditions.

Stock Performance (for the six months ended 6/30/20)

5 Highest | Average

Weight | Contribution

to Return | | 5 Lowest | Average

Weight | Contribution

to Return |

Amazon.com, Inc. | 3.79% | 1.92% | | Parker-Hannifin Corp. | 0.76% | -0.69% |

Microsoft Corp. | 4.56 | 1.41 | | V.F. Corp. | 1.36 | -0.85 |

Marvell Technology Group Ltd. | 2.48 | 1.30 | | Microchip Technology Inc. | 0.78 | -0.94 |

Catalent Inc. | 1.85 | 0.98 | | Reinsurance Group of America, Inc. | 1.49 | -1.07 |

Monolithic Power Systems, Inc. | 0.90 | 0.82 | | JPMorgan Chase & Co. | 2.40 | -1.15 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 39 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2020 |  | 13 |

Segall Bryant & Hamill Emerging Markets Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of companies tied economically to emerging markets countries.

Fund Management

Scott E. Decatur, Ph.D. Portfolio Manager |

Nicholas C. Fedako, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 38.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

Retail Class* (SBHEX) | (13.73)% | (9.32)% | (1.09)% | 1.28% | — | (0.02)% | 6/30/14 |

Institutional Class** (SBEMX) | (13.69)% | (9.18)% | (0.91)% | 1.49% | — | 0.17% | 6/30/11 |

MSCI Emerging Markets Index | (9.78)% | (3.39)% | 1.90% | 2.86% | — | 0.85% | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 2.56%, Net:1.38%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 2.41%, Net: 1.23%

Sector Allocation (as of 6/30/20)

Information Technology | 29.0% |

Financials | 19.3% |

Consumer Discretionary | 11.3% |

Materials | 7.1% |

Consumer Staples | 6.8% |

Communication Services | 6.5% |

Energy | 5.5% |

Industrials | 4.6% |

Health Care | 3.9% |

Real Estate | 2.9% |

Utilities | 2.4% |

Sector classifications presented are based on the Global Industry Classification Standard (GICS) methodology.

Sector weights may not sum to 100% due to rounding.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/20)

Alibaba Group Holding, Ltd. ADR | 6.3% |

Tencent Holdings, Ltd. | 5.6% |

Samsung Electronics Co., Ltd. | 4.9% |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | 3.5% |

China Mobile, Ltd. | 1.7% |

Naspers, Ltd. | 1.4% |

Muthoot Finance, Ltd. | 1.3% |

Vipshop Holdings, Ltd. ADR | 1.1% |

Surgutneftegas PJSC | 1.1% |

Riyad Bank | 1.0% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the Retail Class shares prior to their inception is based on the performance of the Institutional Class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.sbhfunds.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Segall Bryant & Hamill fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

From December 9, 2019 until at least December 31, 2021, Segall Bryant & Hamill, LLC (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.38% and 1.23% to the Fund’s Retail Class and Institutional Class, respectively, for such period. This agreement may not be terminated or modified by the Adviser prior to December 31, 2021, without the approval of the Board of Trustees.

Investing in foreign companies are subject to special risks, including currency fluctuations, social, economic, and political uncertainties, which could increase volatility.

14 |  | www.sbhfunds.com | www.sbhfunds.com

|

Segall Bryant & Hamill Emerging Markets Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Manager Commentary

Market Overview and Fund Performance

The first half of 2020 was marked by dramatic moves in global stock markets as many countries initially struggled to deal with the onset and spread of the novel coronavirus. After falling over 31% at one point, the MSCI Emerging Markets Index rallied to pare its year-to-date loss to 9.78% as governments took steps to contain the virus and central bankers provided stimulus to bolster their faltering economies. Regional performance varied as the best performer, Asia, ended the first half of the year down just 3.5% as its countries moved quickly to address the spreading virus with China actually advancing 3.5% over the same period. At the other extreme, Latin America is down 35.2% through the first half of the year due in large part to its largest constituent, Brazil, being down 38.9% with many critical of the country’s coronavirus response. The Europe, Middle East and Africa (“EMEA”) region ended 21.4% lower as strength in the Middle Eastern countries was offset by Europe. Health Care (+25.8%) is the top-performing EMEA sector this first half of the year on investor hopes for the discovery of an effective coronavirus vaccine. The worst performer was Energy -26.1% as the sector suffered a price war between Saudi Arabia and Russia along with reduced demand due to the pandemic.

The Segall Bryant & Hamill Emerging Markets Fund (the “Fund”) rebounded along with the broader market to pare its year-to-date losses at -13.73% (Retail Class), but still trailed the MSCI Emerging Markets Index return of -9.78% for the same period. The ongoing outperformance of expensively valued stocks, as measured by the MSCI Emerging Markets Growth Index (-1.5%), versus undervalued stocks, as measured by the MSCI Emerging Markets Value Index (-18.0%), remained a headwind for our Fund. The 16.5% shortfall of the value versus growth indices for half of a year is the largest on record, eclipsing the previous worst of 15.3% which occurred in the second half of 1999. Negative security selection in Asia (where value lagged growth by 18.7%) was the main driver of this period’s relative performance, mainly due to the underperformance of the Fund’s holdings in China. Selection was flat in EMEA and modestly negative in Latin America. At the sector level, positive stock selection in Financials, Utilities, and Real Estate was more than offset by negative selection in Communication Services, Consumer Discretionary, and Health Care. The performance of our investment team’s model components was mixed as profitability and momentum finished higher while valuation continued to suffer from investor preferences for expensive growth stocks.

Outlook and Positioning

While the direction of the market has been volatile over the last six months, investor preferences for expensive growth companies has been constant. The Fund has been able to defend against this growth deluge to a certain extent but has not been immune to the massive headwind. Some of the most acute underperformance versus the market this year has come from segments where we focus the Fund’s investments, specifically higher quality companies trading at reasonable valuations. It is important to note that expensive growth companies are not performing any better fundamentally than they normally have, in fact they are performing worse while value companies have in fact closed some of the growth gap over the past 3 years or so. The relative valuations of high quality, attractively priced companies started the year in very advantageous positioning and has gotten much more so with the continual price outperformance of the expensive growth companies. Comparisons to internal dislocations reached during the Dot-Com (TMT bubble) of 1999/2000 are certainly warranted now. It can be uncomfortable, for both investment managers and their clients, to maintain a value tilt, but with valuations where they currently stand, we believe the odds of a reversal soon have greatly increased. We retain our focus and remain confident in our prospects going forward.

Stock Performance (for the six months ended 6/30/20)

5 Highest | Average

Weight | Contribution

to Return | | 5 Lowest | Average

Weight | Contribution

to Return |

Tencent Holdings, Ltd. | 4.52 | 1.62 | | Banco do Brasil S.A. | 0.58 | -0.55 |

Alibaba Group Holding, Ltd. | 5.69 | 0.38 | | Itausa - Investimentos Itau S.A. | 0.69 | -0.51 |

Vipshop Holdings, Ltd. | 0.84 | 0.35 | | PT Media Nusantara Citra Tbk | 0.55 | -0.39 |

Muthoot Finance, Ltd. | 0.95 | 0.28 | | Petroleo Brasileiro S.A. | 0.45 | -0.36 |

Sinotruk Hong Kong, Ltd. | 0.76 | 0.24 | | Absa Group, Ltd. | 0.33 | -0.35 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call (800) 392-2673.

Please see page 39 for a description of the methodology used to construct this table.

Semi-Annual Report | June 30, 2020 |  | 15 |

Segall Bryant & Hamill International Small Cap Fund | Fund Overview |

| | June 30, 2020 (Unaudited) |

Fund Strategy

Investing primarily in equity securities of small capitalization companies located outside of the United States, including those in emerging markets.

Fund Management

Scott E. Decatur, Ph.D. Portfolio Manager |

Nicholas C. Fedako, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

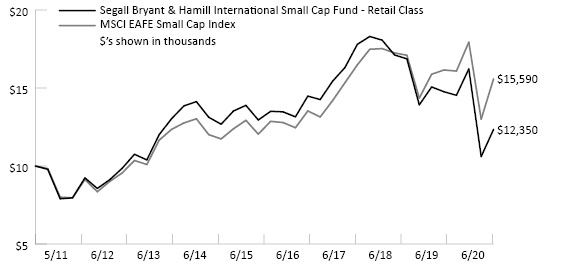

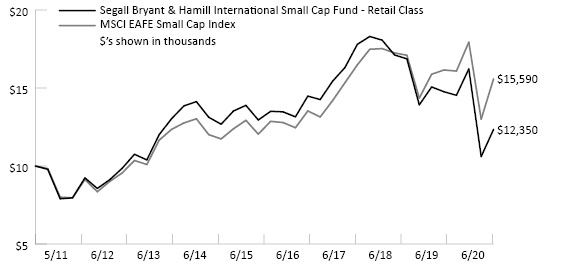

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Please see index definitions beginning on page 38.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

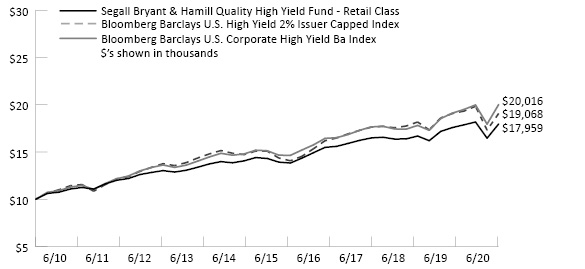

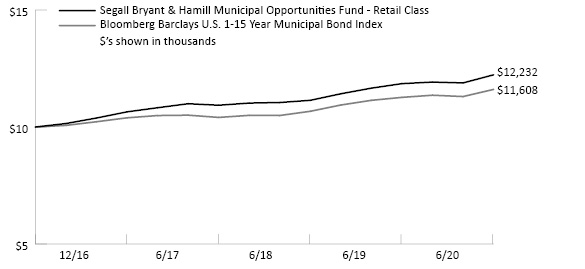

Retail Class* (SBHSX) | (23.88)% | (16.34)% | (8.87)% | (2.32)% | — | 2.35% | 6/30/14 |