UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3373

Westcore Trust

(exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Richard C. Noyes, Secretary

Westcore Trust

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

| Date of fiscal year end: | December 31 |

| Date of reporting period: | January 1, 2017 – June 30, 2017 |

| Item 1. | Reports to Stockholders. |

Table of Contents

| SHAREHOLDER LETTER | 1 |

| FUND OVERVIEWS | |

| Westcore Small‐Cap Growth Fund | 2 |

| Westcore Small‐Cap Growth Fund II | 4 |

| Westcore Mid‐Cap Value Dividend Fund | 6 |

| Westcore Mid‐Cap Value Dividend Fund II | 8 |

| Westcore Smid‐Cap Value Dividend Fund | 10 |

| Westcore Small‐Cap Value Dividend Fund | 12 |

| Westcore Global Large‐Cap Dividend Fund | 14 |

| Westcore Large‐Cap Dividend Fund | 16 |

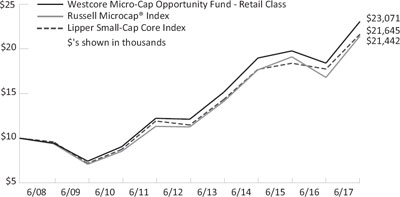

| Westcore Micro‐Cap Opportunity Fund | 18 |

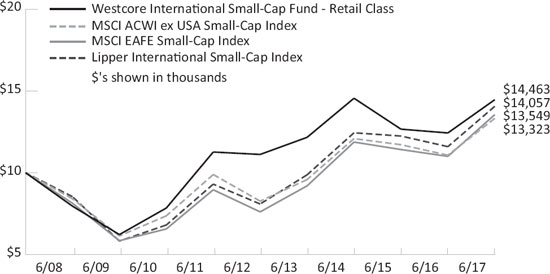

| Westcore International Small‐Cap Fund | 20 |

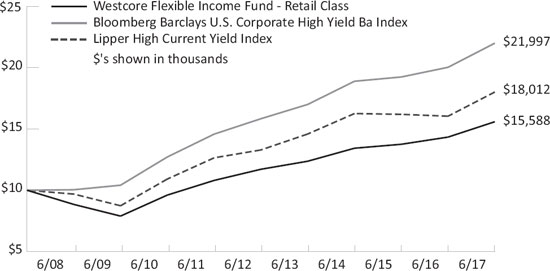

| Westcore Flexible Income Fund | 22 |

| Westcore Plus Bond Fund | 24 |

| Westcore Municipal Opportunities Fund | 26 |

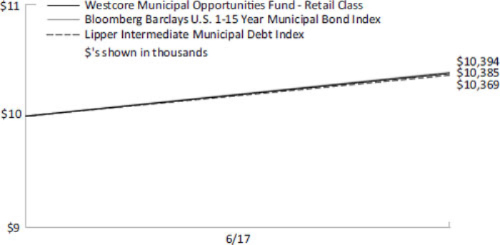

| Westcore Colorado Tax‐Exempt Fund | 28 |

| FUND EXPENSES | 30 |

| IMPORTANT DISCLOSURES | 34 |

| FINANCIAL STATEMENTS | 39 |

| Statements of Investments | 39 |

| Statements of Assets and Liabilities | 86 |

| Statements of Operations | 89 |

| Statements of Changes in Net Assets | 92 |

| Financial Highlights | 97 |

| Notes to Financial Statements | 123 |

Semi-Annual Report | June 30, 2017 |  | |

Intentionally Left Blank

| Westcore Funds | Shareholder Letter |

June 30, 2017 (Unaudited)

Dear Fellow Shareholders,

Equity markets showed strength across the board in the first six months of 2017. The S&P 500® Index and the Dow Jones Industrial Average each rose more than 9%, the Nasdaq Composite Index gained 14.07%, and international stocks, as represented by the MSCI ACWI Index, gained 11.48%. Various factors contributed to the strong first half, including improving economies, strengthening corporate earnings, and low volatility in the U.S., European, and Asian stock markets.

Many sectors performed well on the domestic front. The health care, industrials, and financials sectors produced positive returns. Financial stocks in the S&P 500® Index have led all sectors since the Presidential election. Another positive sector was information technology, which fueled the Nasdaq. On the downside, energy and telecommunication services posted negative returns for both the second quarter and year‐to‐date. In the first half, stocks of larger companies performed better than stocks of smaller companies, and growth outperformed value.

U.S. bond yields declined even as the Federal Reserve increased the short‐term federal‐funds target rate two times this year. The second increase, which occurred in June, pushed the rate up another 0.25% and marked the fourth rate hike since the end of 2015. These rate increases reflect the Fed’s apparent view that economic growth will continue and inflation is likely to rise. However, skepticism remains in the markets. U.S. inflation measures dropped from 1.8% in February to 1.4% in June, both of which are short of the Federal Reserve’s desired goal of 2%. Weaker measures of inflation, such as these, can cause bond yields to decline, and when that occurs, bond prices rise. Given this environment in the first half of the year, U.S. bonds generally produced stable to slightly positive returns.

The municipal bond market saw yields decrease during the second quarter. The 10‐year AAA rated municipal bond yield fell from 2.25% to 1.96%.

As noted above, international markets performed well in the first six months of the year. Investors focused on signs of global economic recovery while keeping a watchful eye on the intentions signaled by central banks. Increased demand strengthened foreign currencies and as they grew stronger, the U.S. dollar weakened.

For more information on the first half of the year and how your Westcore Funds performed, please see the following pages. In addition, the Westcore Fund family is very proud of recent awards received by our value and fixed income funds. To learn more about these awards, please visit our website at www.westcore.com.

As we navigate these ever‐changing markets, you, our shareholders, are our priority.

Thank you for investing in the Westcore Funds.

| | |

Mary K. Anstine

Chairman | Janice M. Teague

President | |

The views of the author and information discussed in the shareholder letter and the manager commentaries are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund or any securities or any sectors mentioned in this letter or the manager commentaries. The subject matter contained in this letter and the manager commentaries has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Denver Investments, Westcore Funds, nor any Westcore Fund accept any liability for losses either direct or consequential caused by the use of this information. Diversification cannot guarantee gain or prevent losses.

Semi-Annual Report | June 30, 2017 |  | 1 |

| Westcore Small-Cap Growth Fund | Fund Overview |

June 30, 2017 (Unaudited)

Fund Strategy

Investing in a diversified portfolio of equity securities of primarily small-sized companies with growth potential.

Fund Management

Brian C. Fitzsimons, CFA Portfolio Manager

Mitch S. Begun, CFA Portfolio Manager

Adam C. Bliss Portfolio Manager

CFA is a trademark owned by CFA Institute.

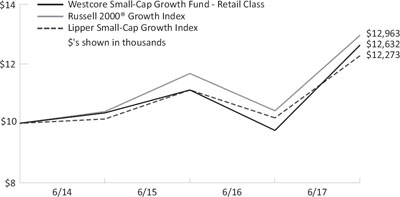

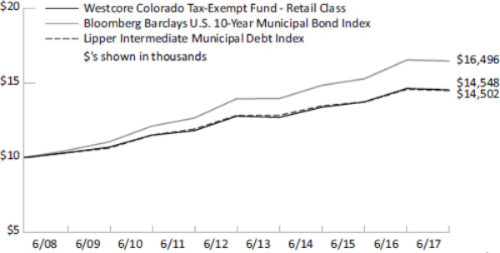

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

| Retail Class (WTSGX) | 15.89% | 29.44% | 6.86% | – | – | 6.85% | 12/20/2013 |

| Institutional Class (WISGX) | 15.88 | 29.64 | 7.25 | – | – | 7.21 | 12/20/2013 |

Russell 2000® Growth Index | 9.97 | 24.40 | 7.64 | – | – | 7.62 | |

| Lipper Small-Cap Growth Index | 10.98 | 20.55 | 6.56 | – | – | 5.97 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 5.93%, Net: 1.24% Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 2.63%, Net: 0.99%

Sector Allocation(as of 6/30/17)

| Information Technology | 24.0% |

| Health Care | 19.4 |

| Consumer Discretionary | 18.6 |

| Industrials | 13.3 |

| Financials | 8.9 |

| Energy | 4.0 |

| Materials | 2.8 |

| Consumer Staples | 2.5 |

| Real Estate | 1.9 |

| Telecommunication Services | 1.8 |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/17)

| Advisory Board Co. | 2.7% |

| Monolithic Power Systems, Inc. | 2.6 |

| Evercore Partners, Inc. | 2.3 |

| EPAM Systems, Inc. | 2.2 |

| Envestnet, Inc. | 2.1 |

| Acadia Healthcare Co., Inc. | 2.1 |

| Live Nation Entertainment, Inc. | 2.0 |

| PolyOne Corp. | 2.0 |

| Vail Resorts, Inc. | 2.0 |

| Globant SA | 1.9 |

| Total (% of Net Assets) | 21.8% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.westcore.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2017 until at least April 30, 2018. The first waiver/reimbursement applies so that the ratio of expenses to average net assets, as reported in the Fund’s Financial Highlights, will be no more than 1.24% for the Fund’s Retail Class for such period. The second waiver/ reimbursement applies so that Fund level Other Expenses for the Institutional Class will be in the same proportion as the Retail Class waivers/ reimbursements. The third waiver/reimbursement applies so that the institutional class-specific Other Expenses are reimbursed. The Adviser has contractually agreed to waive/ reimburse all of these class-specific Other Expenses, but only to the extent that the difference between the net Institutional Class and net Retail Class expense ratios, after applying the waiver/reimbursement, does not exceed 25 basis points. These agreements may not be terminated or modified by the Adviser prior to April 30, 2018 without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

| 2 |  | www.westcore.com |

| Westcore Small-Cap Growth Fund | Fund Overview |

June 30, 2017 (Unaudited)

Manager Commentary

Market Overview

For the first six months of 2017, the Russell 2000® Growth Index returned 9.97%, while the Russell 2000® Value Index returned 0.54%. Looking back, the last twelve months have been quite a stylistic roller coaster and, interestingly, after the Russell 2000® Value Index’s post-election rally in the fourth quarter of 2016, followed by the Russell 2000® Growth Index’s rally in 2017, the two indexes have performed nearly identically for the last twelve months, returning approximately 25% each. Taking a step back, this has been a remarkable bull market for equities.

Fund Performance

For the first half of 2017, the Westcore Small-Cap Growth Fund outperformed its benchmark, returning 15.89% (retail class) compared to the Russell 2000® Growth Index’s 9.97% return for the same period.

Contributors to Return

The three sectors that contributed most to the Fund’s performance relative to its benchmark in the first half of 2017 were information technology, health care, and industrials. The Fund’s best-performing stock in the period was Advisory Board Co., which provides performance improvement software and solutions to the health care and higher education industries. The stock outperformed largely based on speculation that the company would be acquired. Regardless of whether a transaction comes to fruition in the near term, we believe in the company’s long-term growth opportunities and its competitive positioning. Also outperforming in the first half of the year was Intersect ENT, Inc., a medical device company focused on therapies for patients suffering from chronic sinusitis. The stock outperformed during the first half as near-term reimbursement concerns abated. As the market for chronic sinusitis therapies continues to expand, we are excited about the potential for Intersect’s currently available and pipeline products. Another top contributor was LendingTree, Inc., the premier lead-generation company for the lending industry. LendingTree continued to gain market share in the industry and expand its product set.

Detractors from Return

The three sectors that detracted most from the Fund’s performance relative to its benchmark in the first half of 2017 were energy,

telecommunication services, and real estate. The Fund’s worst-performing stock in the period was PDC Energy, Inc., an exploration and production company focused on operations in the Niobrara Formation and Permian Basin. Regulatory concerns in Colorado drove the stock’s underperformance. We believe, however, that the issues will prove transitory and have limited impact on the company’s long-term growth prospects. PDC has, in our opinion, continued to execute well and grow production. IMAX Corp., a leader in film technologies, was also a significant drag on the Fund’s performance in the first half of 2017. Despite a strong growth rate for new IMAX installations, the company suffered as global box office sales for films have been consistently weak. We believe the growth opportunity for IMAX screens remains robust, especially in China. Recent cost reductions and stock buyback authorization should, in our opinion, help support the stock at its current valuation. Microsemi Corp., a provider of semiconductors to the aerospace and defense, communications, data center, and industrial markets, was also weak in the first half of the year. In particular, concerns regarding optical equipment spending in China hampered the stock. In our opinion, Microsemi remains attractive due to its robust growth profile, tailwinds across nearly all segments of its business, and significant cash-flow generation.

Outlook and Positioning

As of the end of the first half of 2017, the Fund was overweighted in the consumer discretionary and financials sectors and underweighted primarily in the health care and industrials sectors.

The current economic recovery remains one of the longest on record, now sitting at 96 months. We still believe that we are in the later innings of an economic cycle. Despite this, the economy has continued to chug along at a relatively low-growth rate and we believe this favors strong growth companies that are less dependent on economic growth or cyclical trends. However, in our opinion, valuations have become increasingly difficult to justify in some of the higher-growth areas of the market. As a result, we have been actively executing our risk management disciplines by trimming or exiting positions in some of the more expensive areas of the market as they achieve our price targets.

Stock Performance (for the six months ended 6/30/17)

| 5 Highest | Average Weight | Contribution to Return |

| Advisory Board Co. | 2.35% | 1.03% |

| Take-Two Interactive Software, Inc. | 1.46 | 0.99 |

| Intersect ENT, Inc. | 0.98 | 0.96 |

| RingCentral, Inc. | 1.37 | 0.84 |

| LendingTree, Inc. | 1.38 | 0.81 |

| 5 Lowest | Average Weight | Contribution to Return |

| Microsemi Corp. | 1.99% | -0.26% |

| RSP Permian, Inc. | 0.97 | -0.32 |

| IMAX Corp. | 1.57 | -0.47 |

| National CineMedia, Inc. | 0.89 | -0.54 |

| PDC Energy, Inc. | 1.35 | -0.69 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 36 for a description of the methodology used to construct this chart.

Semi-Annual Report | June 30, 2017 |  | 3 |

| Westcore Small-Cap Growth Fund II | Fund Overview |

June 30, 2017 (Unaudited)

Fund Strategy

Investing in a diversified portfolio of equity securities of primarily small-sized companies with growth potential.

Fund Management

Brian C. Fitzsimons, CFA Portfolio Manager

Mitch S. Begun, CFA Portfolio Manager

Adam C. Bliss Portfolio Manager

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

| Institutional Class (WTSLX)* | 21.29% | 17.67% | -0.62% | 7.18% | 3.64% | 9.84% | 10/1/1999 |

Russell 2000® Growth Index | 9.97 | 24.40 | 7.64 | 13.98 | 7.82 | 6.47 | |

| Westcore Small-Cap Growth II Custom Index | 9.97 | 15.55 | 7.37 | 13.90 | 7.73 | 7.15 | |

Russell Midcap® Growth Index | 11.40 | 17.05 | 7.83 | 14.19 | 7.87 | 7.23 | |

| Lipper Small-Cap Growth Index | 10.98 | 20.55 | 6.56 | 12.48 | 6.46 | 6.79 | |

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.24%, Net: 1.15%

Sector Allocation(as of 6/30/17)

| Information Technology | 23.1% |

| Health Care | 18.7 |

| Consumer Discretionary | 17.9 |

| Industrials | 12.8 |

| Financials | 8.5 |

| Energy | 3.9 |

| Materials | 2.7 |

| Consumer Staples | 2.4 |

| Real Estate | 1.8 |

| Telecommunication Services | 1.7 |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/17)

| Advisory Board Co. | 2.8% |

| Monolithic Power Systems, Inc. | 2.6 |

| Evercore Partners, Inc. | 2.3 |

| EPAM Systems, Inc. | 2.2 |

| Envestnet, Inc. | 2.1 |

| Acadia Healthcare Co., Inc. | 2.1 |

| Live Nation Entertainment, Inc. | 2.0 |

| Vail Resorts, Inc. | 2.0 |

| PolyOne Corp. | 2.0 |

| Globant SA | 1.9 |

| Total (% of Net Assets) | 21.9% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

| * | Effective December 27, 2016 the Retail Class was designated Institutional Class. |

Effective December 27, 2016, the Westcore Select Fund was renamed the Westcore Small-Cap Growth Fund II and was repositioned to focus on small growth companies.

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.westcore.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2017 until at least April 30, 2018, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.15% for the Fund’s Institutional Class (formerly known as the Retail Class prior to December 27, 2016) for such period. This agreement may not be terminated or modified by the Adviser prior to April 30, 2018 without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

| 4 |  | www.westcore.com |

| Westcore Small-Cap Growth Fund II | Fund Overview |

June 30, 2017 (Unaudited)

Manager Commentary

Market Overview

For the first six months of 2017, the Russell 2000® Growth Index returned 9.97%, while the Russell 2000® Value Index returned 0.54%. Looking back, the last twelve months have been quite a stylistic roller coaster and, interestingly, after the Russell 2000® Value Index’s post-election rally in the fourth quarter of 2016, followed by the Russell 2000® Growth Index’s rally in 2017, the two indexes have performed nearly identically for the last twelve months, returning approximately 25% each. Taking a step back, this has been a remarkable bull market for equities.

Fund Performance

For the first half of 2017, the Westcore Small-Cap Growth Fund II outperformed its benchmark, returning 21.29% compared to the Russell 2000® Growth Index’s 9.97% return over the same period. At the end of the period, the Westcore Small-Cap Growth Fund II received a settlement payment from a stock that was held in the Fund several years ago, prior to its change in investment strategy on December 27, 2016. This payment added 4.96% to the Fund’s return for the first six months of 2017.

Contributors to Return

The three sectors that contributed most to the Fund’s performance relative to its benchmark in the first half of 2017 were information technology, health care, and industrials. The Fund’s best-performing stock in the period was Advisory Board Co., which provides performance improvement software and solutions to the health care and higher education industries. The stock outperformed largely based on speculation that the company would be acquired. Regardless of whether a transaction comes to fruition in the near term, we believe in the company’s long-term growth opportunities and its competitive positioning. Also outperforming in the first half of the year was Intersect ENT, Inc., a medical device company focused on therapies for patients suffering from chronic sinusitis. The stock outperformed during the first half as near-term reimbursement concerns abated. As the market for chronic sinusitis therapies continues to expand, we are excited about the potential for Intersect’s currently available and pipeline products. Another top contributor was LendingTree, Inc., the premier lead-generation company for the lending industry. LendingTree continued to gain market share in the industry and expand its product set.

Detractors from Return

The three sectors that detracted most from the Fund’s performance relative to its benchmark in the first half of 2017 were energy, telecommunication services, and real estate. The Fund’s worst-performing stock in the period was PDC Energy, Inc., an exploration and production company focused on operations in the Niobrara Formation and Permian Basin. Regulatory concerns in Colorado drove the stock’s underperformance, however, we believe the issues will prove transitory and have limited impact on the company’s long-term growth prospects. PDC has, in our opinion, continued to execute well and grow production. IMAX Corp., a leader in film technologies, was also a significant drag on the Fund’s performance in the first half of 2017. Despite a strong growth rate for new IMAX installations, the company suffered as global box office sales for films have been consistently weak. We believe the growth opportunity for IMAX screens remains robust, especially in China. Recent cost reductions and stock buyback authorization should, in our opinion, help support the stock at its current valuation. Microsemi Corp., a provider of semiconductors to the aerospace and defense, communications, data center, and industrial markets, was also weak in the first half of the year. In particular, concerns regarding optical equipment spending in China hampered the stock. In our opinion, Microsemi remains attractive due to its robust growth profile, tailwinds across nearly all segments of its business, and significant cash-flow generation.

Outlook and Positioning

As of the end of the first half of 2017, the Fund was overweighted in the consumer discretionary and energy sectors and underweighted primarily in the health care and industrials sectors.

The current economic recovery remains one of the longest on record, now sitting at 96 months. We still believe that we are in the later innings of an economic cycle. Despite this, the economy has continued to chug along at a relatively low-growth rate and we believe this favors strong growth companies that are less dependent on economic growth or cyclical trends. However, in our opinion, valuations have become increasingly difficult to justify in some of the higher-growth areas of the market. As a result, we have been actively executing our risk management disciplines by trimming or exiting positions in some of the more expensive areas of the market as they achieve our price targets.

Stock Performance (for the six months ended 6/30/17)

| 5 Highest | Average Weight | Contribution to Return |

| Advisory Board Co. | 2.38% | 1.05% |

| Take-Two Interactive Software, Inc. | 1.47 | 1.01 |

| Intersect ENT, Inc. | 0.99 | 0.96 |

| RingCentral, Inc. | 1.38 | 0.85 |

| LendingTree, Inc. | 1.39 | 0.81 |

| 5 Lowest | Average Weight | Contribution to Return |

| Microsemi Corp. | 2.01% | -0.26% |

| RSP Permian, Inc. | 0.97 | -0.32 |

| IMAX Corp. | 1.59 | -0.48 |

| National CineMedia, Inc. | 0.90 | -0.54 |

| PDC Energy, Inc. | 1.35 | -0.69 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 36 for a description of the methodology used to construct this chart.

Semi-Annual Report | June 30, 2017 |  | 5 |

| Westcore Mid-Cap Value Dividend Fund | Fund Overview |

June 30, 2017 (Unaudited)

Fund Strategy

Investing in medium-sized, dividend-paying companies whose stocks appear to be undervalued.

Fund Management

Derek R. Anguilm, CFA Portfolio Manager | Mark M. Adelmann, CFA, CPA Portfolio Manager |

Troy Dayton, CFA Portfolio Manager | Lisa Z. Ramirez, CFA Portfolio Manager |

| CFA is a trademark owned by CFA Institute. | Alex A. Ruehle, CFA Portfolio Manager |

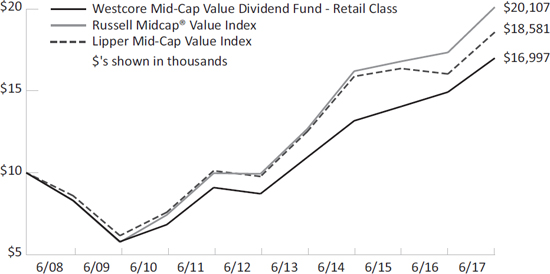

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

| Retail Class (WTMCX) | 0.95% | 13.88% | 8.87% | 14.29% | 5.45% | 9.46% | 10/1/1998 |

| Institutional Class (WIMCX) | 1.08 | 14.14 | 8.98 | 14.36 | 5.48 | 9.48 | 4/29/2016 |

Russell Midcap® Value Index | 5.18 | 15.93 | 7.46 | 15.14 | 7.23 | 10.32 | |

| Lipper Mid-Cap Value Index | 3.15 | 15.90 | 5.37 | 13.71 | 6.39 | 9.59 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.19%, Net: 1.16%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.06%, Net: 0.91%

Sector Allocation(as of 6/30/17)

| Interest Rate Sensitive | 20.4% |

| Consumer | 15.5 |

| REITs | 12.7 |

| Capital Goods | 12.0 |

| Medical / Healthcare | 8.9 |

| Utilities | 8.8 |

| Technology | 8.3 |

| Energy | 7.8 |

| Basic Materials | 5.7 |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/17)

| Ingredion, Inc. | 2.7% |

| Tyson Foods, Inc. | 2.6 |

| AmTrust Financial Services, Inc. | 2.6 |

| Public Service Enterprise Group, Inc. | 2.5 |

| Realogy Holdings Corp. | 2.5 |

| Xcel Energy, Inc. | 2.3 |

| Spire, Inc. | 2.2 |

| AmerisourceBergen Corp. | 2.2 |

| Uniti Group, Inc. | 2.1 |

| Range Resources Corp. | 2.0 |

| Total (% of Net Assets) | 23.6% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception is based on the performance of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.westcore.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2017 until at least April 30, 2018, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.15% for the Fund’s Retail Class for such period. The second waiver/reimbursement applies so that Fund level Other Expenses for the Institutional Class will be in the same proportion as the Retail Class waivers/reimbursements. The third waiver/reimbursement applies so that the institutional class-specific Other Expenses are reimbursed. The Adviser has contractually agreed to waive/reimburse all of these class-specific Other Expenses, but only to the extent that the difference between the net Institutional Class and net Retail Class expense ratios, after applying the waiver/ reimbursement, does not exceed 25 basis points. This agreement may not be terminated or modified by the Adviser prior to April 30, 2018 without the approval of the Board of Trustees.

Investing in mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

Lisa Z. Ramirez is a registered representative of ALPS Distributors, Inc.

6 |  | www.westcore.com |

| Westcore Mid-Cap Value Dividend Fund | Fund Overview |

June 30, 2017 (Unaudited)

Manager Commentary

Market Overview

U.S. equity markets experienced a strong start to the year, driven by expectations of accelerated economic growth, but value stocks took a pause in the second quarter as reality did not meet those lofty near-term expectations. Excitement around the pro-business policies of the new administration took a back seat following the failure to pass the American Health Care Act of 2017 and the announced investigation into ties between President Trump’s campaign and Russian officials. These issues drove market fears that the new administration would be unable to implement policy changes. At the same time, the outlook for inflation dimmed and other economic indicators began to signal the potential for a slowdown, despite the Federal Reserve’s apparent optimism as it raised rates for the fourth time since December 2015. As a result of a more subdued outlook for U.S. economic growth, growth stocks (which have historically been less economically sensitive than value stocks) outperformed value stocks year-to-date. Additionally, investors shifted assets to larger capitalization companies and to more defensive sectors, such as health care and utilities, and away from more cyclical sectors, such as energy and basic materials.

Fund Performance

The Westcore Mid-Cap Value Dividend Fund returned 0.95% (retail class) for the six months ended June 30, 2017, underperforming its benchmark, the Russell Midcap® Value Index, which returned 5.18% for the same period. The Fund was positioned more heavily in the smaller capitalization portion of the mid-cap universe where we have found more value over the past few years. As investors’ preferences shifted toward larger capitalization companies, this created a headwind for the Fund. However, the primary driver of underperformance year-to-date was stock selection.

Contributors to Return

The sectors that contributed most to the Fund’s performance relative to its benchmark were medical/healthcare and REITs. The Fund’s individual top performers were led by CyrusOne, Inc., a provider of mission-critical data center facilities. As it logged one of its strongest leasing quarters on record, the company announced solid financial results, which included increased full-year guidance for earnings estimates. Lam Research Corp. was also among the Fund’s strongest contributors. This semiconductor equipment company, benefited from robust demand for its 3D NAND flash storage technology, which helped drive strong financial results. Grifols SA, is a pharmaceutical company that primarily provides plasma-based therapeutics. The company reported continued improvement in the financial

performance of its bioscience division and improving margins following a period of significant capacity expansion investment. Pharmaceutical distribution company AmerisourceBergen Corp. was a solid contributor due to better-than-expected industry pricing dynamics. PVH Corp., a designer and marketer of branded dress shirts, produced strong financial results despite the backdrop of a difficult retail environment. The company revised guidance for earnings estimates up given the strength of its global brands and corresponding business momentum.

Detractors from Return

The Fund’s weakest sectors relative to its benchmark were interest rate sensitive, consumer, and technology. AmTrust Financial Services, Inc., a provider of insurance services primarily to small businesses, was the Fund’s largest individual detractor. During the second quarter, the Wall Street Journal published a story involving alleged accounting issues at AmTrust in 2013 and 2014. Although this information had been revealed previously, investors reacted anew and the stock underperformed. Noble Energy, Inc., an oil and gas exploration and production company, succumbed to market uncertainty about oil prices. This was coupled with a competitor incident in Colorado that heightened sensitivity to regulatory risk. Another energy holding, oil and gas producer SM Energy Co., also faced continued pressure from the uncertain oil price environment. We believe the market is overly penalizing the company and we are optimistic given its recent Permian Basin asset purchase. Foot Locker, Inc., a global retailer of athletic shoes and apparel, was the Fund’s largest detractor in the consumer sector. The retail environment continued to be challenging and Foot Locker was no exception. After missing quarterly financial estimates, news that Nike had decided to go direct through Amazon further pressured Footlocker’s shares. Avnet, Inc. was the Fund’s weakest performer in the technology sector. This electronics and components distributor posted sales shortfalls that were caused by consolidation of its suppliers. Additionally, increased costs associated with implementation of its process management software system contributed to the company’s disappointing financial results.

Outlook and Positioning

Looking ahead, we are excited about the opportunities that market and sector volatility may produce. As political, economic and market uncertainty continue, we will remain focused on finding dividend-paying stocks that we believe have sound fundamentals and are currently mispriced by the markets.

Stock Performance (for the six months ended 6/30/17)

| 5 Highest | Average Weight | Contribution to Return |

| CyrusOne, Inc. | 2.28% | 0.60% |

| Lam Research Corp. | 1.43 | 0.59 |

| Grifols SA | 1.67 | 0.44 |

| AmerisourceBergen Corp. | 1.93 | 0.39 |

| PVH Corp. | 1.44 | 0.37 |

| 5 Lowest | Average Weight | Contribution to Return |

| Avnet, Inc. | 1.88% | -0.35% |

| Foot Locker, Inc. | 1.30 | -0.41 |

| SM Energy Co. | 0.82 | -0.53 |

| Noble Energy, Inc. | 2.05 | -0.57 |

| AmTrust Financial Services, Inc. | 2.04 | -1.06 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 36 for a description of the methodology used to construct this chart.

Semi-Annual Report | June 30, 2017 |  | 7 |

| Westcore Mid-Cap Value Dividend Fund II | Fund Overview |

June 30, 2017 (Unaudited)

Fund Strategy

Investing in medium-sized, dividend-paying companies whose stocks appear to be undervalued.

| Fund Management | |

Derek R. Anguilm, CFA Portfolio Manager Troy Dayton, CFA Portfolio Manager CFA is a trademark owned by CFA Institute. | Mark M. Adelmann, CFA, CPA Portfolio Manager Lisa Z. Ramirez, CFA Portfolio Manager Alex A. Ruehle, CFA Portfolio Manager |

| |

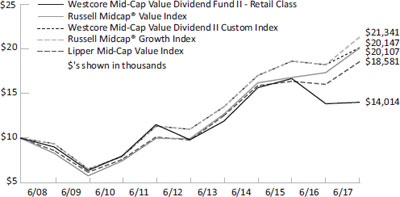

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

| Retail Class | | | | | | | |

| (WTMGX) | 1.12% | 1.16% | -3.63% | 7.40% | 3.43% | 9.44% | 8/1/1986 |

| Institutional Class | | | | | | | |

| (WIMGX) | 1.09 | 1.35 | -3.44 | 7.61 | 3.60 | 9.50 | 9/28/2007 |

Russell Midcap® | | | | | | | |

| Value Index | 5.18 | 15.93 | 7.46 | 15.14 | 7.23 | 11.83 | |

| Westcore Mid-Cap | | | | | | | |

| Value Dividend | | | | | | | |

| II Custom Index | 5.18 | 10.51 | 5.78 | 12.89 | 7.26 | 10.19 | |

Russell Midcap® | | | | | | | |

| Growth Index | 11.40 | 17.05 | 7.83 | 14.19 | 7.87 | 10.40 | |

| Lipper Mid-Cap | | | | | | | |

| Value Index | 3.15 | 15.90 | 5.37 | 13.71 | 6.39 | 10.46 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.12%, Net: 1.12%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.08%, Net: 0.93%

Sector Allocation (as of 6/30/17)

| Interest Rate Sensitive | 19.9% |

| Consumer | 15.1 |

| REITs | 12.4 |

| Capital Goods | 11.6 |

| Medical / Healthcare | 8.6 |

| Utilities | 8.5 |

| Technology | 8.0 |

| Energy | 7.6 |

| Basic Materials | 5.5 |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/17)

| Ingredion, Inc. | 2.6% |

| Tyson Foods, Inc. | 2.6 |

| AmTrust Financial Services, Inc. | 2.5 |

| Public Service Enterprise Group, Inc. | 2.5 |

| Realogy Holdings Corp. | 2.4 |

| Xcel Energy, Inc. | 2.2 |

| Uniti Group, Inc. | 2.1 |

| AmerisourceBergen Corp. | 2.1 |

| Spire, Inc. | 2.1 |

| Range Resources Corp. | 2.0 |

| Total (% of Net Assets) | 23.1% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Effective December 27, 2016, the Westcore MIDCO Growth Fund was renamed the Westcore Mid-Cap Value Dividend Fund II and was repositioned to focus on medium-sized dividend-paying companies whose stocks appear undervalued.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception is based on the performance of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.westcore.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2017 until at least April 30, 2018. The first waiver/reimbursement applies so that the ratio of expenses to average net assets, as reported in the Fund’s Financial Highlights, will be no more than 1.15% for the Fund’s Retail Class for such period. The second waiver/reimbursement applies so that Fund level Other Expenses for the Institutional Class will be in the same proportion as the Retail Class waivers/reimbursements. The third waiver/reimbursement applies so that the institutional class-specific Other Expenses are reimbursed. The Adviser has contractually agreed to waive/ reimburse all of these class-specific Other Expenses, but only to the extent that the difference between the net Institutional Class and net Retail Class expense ratios, after applying the waiver/reimbursement, does not exceed 25 basis points. These agreements may not be terminated or modified by the Adviser prior to April 30, 2018 without the approval of the Board of Trustees.

Investing in mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

Lisa Z. Ramirez is a registered representative of ALPS Distributors, Inc.

| 8 |  | www.westcore.com |

| Westcore Mid-Cap Value Dividend Fund II | Fund Overview |

June 30, 2017 (Unaudited)

Manager Commentary

Market Overview

U.S. equity markets experienced a strong start to the year, driven by expectations of accelerated economic growth, but value stocks took a pause in the second quarter as reality did not meet those lofty near-term expectations. Excitement around the pro-business policies of the new administration took a back seat following the failure to pass the American Health Care Act of 2017 and the announced investigation into ties between President Trump’s campaign and Russian officials. These issues drove market fears that the new administration would be unable to implement policy changes. At the same time, the outlook for inflation dimmed and other economic indicators began to signal the potential for a slowdown, despite the Federal Reserve’s apparent optimism as it raised rates for the fourth time since December 2015. As a result of a more subdued outlook for U.S. economic growth, growth stocks (which have historically been less economically sensitive than value stocks) outperformed value stocks year-to-date. Additionally, investors shifted assets to larger capitalization companies and to more defensive sectors, such as health care and utilities, and away from more cyclical sectors, such as energy and basic materials.

Fund Performance

The Westcore Mid-Cap Value Dividend Fund II returned 1.12% (retail class) for the six months ended June 30, 2017, underperforming its benchmark, the Russell Midcap® Value Index, which returned 5.18% over the same period. The Fund was positioned more heavily in the smaller capitalization portion of the mid-cap universe where we have found more value over the past few years. As investors’ preference shifted toward larger capitalization companies, this created a headwind for the Fund. However, the primary driver of underperformance year-to-date was stock selection.

Contributors to Return

The sectors that contributed most to the Fund’s performance relative to its benchmark were medical/healthcare and REITs. The Fund’s individual top performers were led by CyrusOne, Inc., a provider of mission-critical data center facilities. As it logged one of its strongest leasing quarters on record, the company announced solid financial results, which included increased full-year guidance for earnings estimates. Lam Research Corp. was also among the Fund’s strongest contributors. This semiconductor equipment company, benefited from robust demand for its 3D NAND flash storage technology, which helped drive strong financial results. Grifols SA, is a pharmaceutical company that primarily provides plasma-based therapeutics. The company reported continued improvement in the financial

performance of its bioscience division and improving margins following a period of significant capacity expansion investment. Pharmaceutical distribution company AmerisourceBergen Corp. was a solid contributor due to better-than-expected industry pricing dynamics. PVH Corp., a designer and marketer of branded dress shirts, produced strong financial results despite the backdrop of a difficult retail environment. The company revised guidance for earnings estimates up given the strength of its global brands and corresponding business momentum.

Detractors from Return

The Fund’s weakest sectors relative to its benchmark were interest rate sensitive, consumer, and technology. AmTrust Financial Services, Inc., a provider of insurance services primarily to small businesses, was the Fund’s largest individual detractor. During the second quarter, the Wall Street Journal published a story involving alleged accounting issues at AmTrust in 2013 and 2014. Although this information had been revealed previously, investors reacted anew and the stock underperformed. Noble Energy, Inc., an oil and gas exploration and production company, succumbed to market uncertainty about oil prices. This was coupled with a competitor incident in Colorado that heightened sensitivity to regulatory risk. Another energy holding, oil and gas producer SM Energy Co., also faced continued pressure from the uncertain oil price environment. We believe the market is overly penalizing the company and we are optimistic given its recent Permian Basin asset purchase. Foot Locker, Inc., a global retailer of athletic shoes and apparel, was the Fund’s largest detractor in the consumer sector. The retail environment continued to be challenging and Foot Locker was no exception. After missing quarterly financial estimates, news that Nike had decided to go direct through Amazon further pressured Footlocker’s shares. Avnet, Inc. was the Fund’s weakest performer in the technology sector. This electronics and components distributor posted sales shortfalls that were caused by consolidation of its suppliers. Additionally, increased costs associated with implementation of its process management software system contributed to the company’s disappointing financial results.

Outlook and Positioning

Looking ahead, we are excited about the opportunities that market and sector volatility may produce. As political, economic and market uncertainty continue, we will remain focused on finding dividend-paying stocks that we believe have sound fundamentals and are currently mispriced by the markets.

Stock Performance (for the six months ended 6/30/17)

| 5 Highest | Average Weight | Contribution to Return |

| CyrusOne, Inc. | 2.29% | 0.60% |

| Lam Research Corp. | 1.44 | 0.60 |

| Grifols SA | 1.67 | 0.45 |

| AmerisourceBergen Corp. | 1.93 | 0.38 |

| PVH Corp. | 1.44 | 0.37 |

| 5 Lowest | Average Weight | Contribution to Return |

| Avnet, Inc. | 1.89% | -0.36% |

| Foot Locker, Inc. | 1.30 | -0.40 |

| SM Energy Co. | 0.82 | -0.53 |

| Noble Energy, Inc. | 2.06 | -0.57 |

| AmTrust Financial Services, Inc. | 2.04 | -1.07 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 36 for a description of the methodology used to construct this chart.

Semi Annual Report | June 30, 2017 |  | 9 |

| Westcore Smid-Cap Value Dividend Fund | Fund Overview |

June 30, 2017 (Unaudited)

Fund Strategy

Investing in small- and medium-sized, dividend-paying companies whose stocks appear to be undervalued.

| Fund Management | |

Derek R. Anguilm, CFA Portfolio Manager | Mark M. Adelmann, CFA, CPA Portfolio Manager |

Troy Dayton, CFA Portfolio Manager | Lisa Z. Ramirez, CFA Portfolio Manager |

| Alex A. Ruehle, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

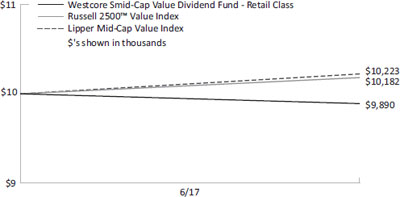

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

| Retail Class (WTSDX) | -0.70% | — | — | — | — | -1.40% | 12/16/2016 |

| Institutional Class (WISDX) | -0.60 | — | — | — | — | -1.30 | 12/16/2016 |

| Russell 2500™ Value Index | 1.95 | — | — | — | — | 1.82 | |

| Lipper Mid-Cap Value Index | 3.15 | — | — | — | — | 2.23 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 42.04%, Net: 1.22%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 34.19%, Net: 1.09%

Sector Allocation (as of 6/30/17)

| Interest Rate Sensitive | 27.1% |

| Consumer | 13.2 |

| Capital Goods | 12.7 |

| REITs | 12.1 |

| Technology | 8.8 |

| Medical / Healthcare | 8.3 |

| Basic Materials | 6.0 |

| Energy | 5.9 |

| Utilities | 4.7 |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/17) | |

| Phibro Animal Health Corp. | 2.4% |

| TiVo Corp. | 2.3 |

| Spire, Inc. | 2.2 |

| Realogy Holdings Corp. | 2.1 |

| Enerplus Corp. | 2.1 |

| Ingredion, Inc. | 2.1 |

| Greenbrier Cos., Inc. | 2.0 |

| AmTrust Financial Services, Inc. | 2.0 |

| Fifth Third Bancorp | 1.9 |

| Radian Group, Inc. | 1.9 |

| Total (% of Net Assets) | 20.9% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

NEW FUND RISK: There can be no assurance that the Fund will grow to or maintain an economically viable size. There may be limited or no performance history for investors to evaluate.

Performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.westcore.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses until at least April 30, 2018, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.20% for the Fund’s Retail Class for such period. Subsequent to any such waivers or reimbursements with respect to the Fund’s Retail Class, the Adviser will waive or reimburse Fund level Other Expenses for the Institutional Class in the same proportion as the Retail Class waivers/ reimbursements and also waive or reimburse Institutional class-specific Other Expenses, but only to the extent that the difference between the net Institutional Class and net Retail Class expense ratios does not exceed 25 basis points, after applying the waiver/reimbursement. These agreements may not be terminated or modified by the Adviser prior to April 30, 2018 without the approval of the Board of Trustees.

Investing in small- and mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

Lisa Z. Ramirez is a registered representative of ALPS Distributors, Inc.

| 10 |  | www.westcore.com |

| Westcore Smid-Cap Value Dividend Fund | Fund Overview |

June 30, 2017 (Unaudited)

Manager Commentary

Market Overview

U.S. equity markets experienced a strong start to the year, driven by expectations of accelerated economic growth, but value stocks took a pause in the second quarter as reality did not meet those lofty near-term expectations. Excitement around the pro-business policies of the new administration took a back seat following the failure to pass the American Health Care Act of 2017 and the announced investigation into ties between President Trump’s campaign and Russian officials. These issues drove market fears that the new administration would be unable to implement policy changes. At the same time, the outlook for inflation dimmed and other economic indicators began to signal the potential for a slowdown, despite the Federal Reserve’s apparent optimism as it raised rates for the fourth time since December 2015. As a result of a more subdued outlook for U.S. economic growth, growth stocks (which have historically been less economically sensitive than value stocks) outperformed value stocks year-to-date. Additionally, investors shifted assets to larger capitalization companies and to more defensive sectors, such as health care and utilities, and away from more cyclical sectors, such as energy and basic materials.

Fund Performance

The Westcore Smid-Cap Value Dividend Fund returned -0.70% (retail class) for the six months ended June 30, 2017, underperforming its benchmark, the Russell 2500TM Value Index, which returned 1.95% over the same period.

Contributors to Return

The sectors that contributed most to the Fund’s performance relative to its benchmark were energy, REITs, and medical/healthcare. The Fund’s individual top performers were led by CyrusOne, Inc., a provider of mission-critical data center facilities. The company logged one of its strongest leasing quarters on record and announced solid financial results, which included increased full-year guidance for earnings estimates. Animal health and mineral nutrition company Phibro Animal Health Corp. posted better-than-expected results, driven by strong performance in its nutritional products and vaccines business units. GEO Group, Inc., a developer, owner, and operator of prisons and post-release services, was another strong contributor. Its solid performance was driven by a favorable outlook for Federal use of private prisons and by solid financial results. Realogy Holdings Corp.

is a residential real estate and brokerage company. It posted strong financial results due to recent improvements in technology solutions and talent retention, which resulted in share price appreciation. Lam Research Corp. was also among the Fund’s strongest performers. This semiconductor equipment company benefited from robust demand for its 3D NAND flash storage technology, which helped drive strong financial results.

Detractors from Return

The Fund’s weakest sectors relative to its benchmark were consumer, interest rate sensitive, and technology. AmTrust Financial Services, Inc., a provider of insurance services primarily to small businesses, was the Fund’s largest individual detractor. During the second quarter, the Wall Street Journal published a story involving alleged accounting issues at AmTrust in 2013 and 2014. Although this information had been revealed previously, investors reacted anew and the stock underperformed. Oil and gas producer SM Energy Co. continued to face pressure from the uncertain oil price environment. We believe the market is overly penalizing the company and are optimistic given its recent Permian Basin asset purchase. Specialty fashion retailer Cato Corp. was another detractor. It experienced share price weakness as the company continued its effort to fix past merchandising missteps against the backdrop of a difficult retail environment. Dairy processor and distributor Dean Foods Co. also detracted from performance. Its financial results missed consensus expectations and concerns around potential competitive industry pricing with new retail grocery entrants into the U.S. market pressured the stock. AMC Entertainment Holdings, Inc., an owner and operator of movie theaters, was another drag on the Fund’s performance. Difficult box office sales and ongoing negotiations around Premium Video on Demand (PVOD) pricing led to its underperformance.

Outlook and Positioning

Looking ahead, we are excited about the opportunities that market and sector volatility may produce. As political, economic and market uncertainty continue, we will remain focused on finding dividend-paying stocks that we believe have sound fundamentals and are currently mispriced by the markets.

Stock Performance (for the six months ended 6/30/17)

| 5 Highest | Average Weight | Contribution to Return |

| CyrusOne, Inc. | 2.28% | 0.57% |

| Phibro Animal Health Corp. | 1.95 | 0.53 |

| GEO Group, Inc. | 1.46 | 0.49 |

| Realogy Holdings Corp. | 2.00 | 0.47 |

| Lam Research Corp. | 1.11 | 0.42 |

| 5 Lowest | Average Weight | Contribution to Return |

| AMC Entertainment Holdings, Inc. | 1.13% | -0.40% |

| Dean Foods Co. | 2.11 | -0.49 |

| Cato Corp. | 1.03 | -0.50 |

| SM Energy Co. | 1.54 | -1.07 |

| AmTrust Financial Services, Inc. | 1.93 | -1.12 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 36 for a description of the methodology used to construct this chart.

Semi-Annual Report | June 30, 2017 |  | 11 |

| Westcore Small-Cap Value Dividend Fund | Fund Overview |

June 30, 2017 (Unaudited)

Fund Strategy

Investing primarily in small, dividend-paying companies whose stocks appear to be undervalued.

Fund Management

Derek R. Anguilm, CFA Portfolio Manager Troy Dayton, CFA Portfolio Manager | Mark M. Adelmann, CFA, CPA Portfolio Manager Lisa Z. Ramirez, CFA Portfolio Manager Alex A. Ruehle, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

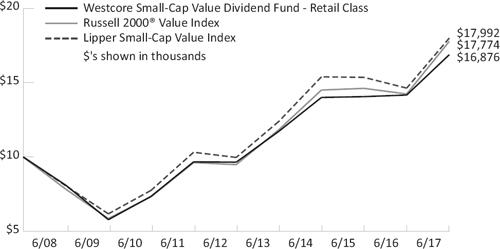

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

| Retail Class (WTSVX) | -2.56% | 19.15% | 6.42% | 11.83% | 5.37% | 7.19% | 12/13/2004 |

| Institutional Class (WISVX) | -2.47 | 19.29 | 6.61 | 12.04 | 5.51 | 7.30 | 9/28/2007 |

Russell 2000® Value Index | 0.54 | 24.86 | 7.02 | 13.39 | 5.92 | 7.34 | |

| Lipper Small-Cap Value Index | 0.79 | 22.99 | 5.35 | 12.53 | 6.05 | 7.59 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.46%, Net: 1.31%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.25%, Net: 1.09%

Sector Allocation (as of 6/30/17)

| Interest Rate Sensitive | 28.8% |

| Technology | 13.5 |

| Consumer | 13.2 |

| Capital Goods | 12.5 |

| REITs | 10.2 |

| Medical / Healthcare | 6.7 |

| Utilities | 4.7 |

| Energy | 4.2 |

| Basic Materials | 4.1 |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The sector allocation table above does not include any cash or cash equivalents.

Top Ten Holdings (as of 6/30/17)

| Enerplus Corp. | 2.8% |

| Dean Foods Co. | 2.8 |

| TiVo Corp. | 2.6 |

| AmTrust Financial Services, Inc. | 2.5 |

| CBL & Associates Properties, Inc. | 2.5 |

| Spire, Inc. | 2.4 |

| Sinclair Broadcast Group, Inc. | 2.4 |

| Radian Group, Inc. | 2.2 |

| Realogy Holdings Corp. | 2.2 |

| Umpqua Holdings Corp. | 2.1 |

| Total (% of Net Assets) | 24.5% |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments. Holdings are subject to change and may not reflect the current or future position of the Fund.

Performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception is based on the performance of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, visit www.westcore.com. Average annual total returns reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return figures would have been lower. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2017 until at least April 30, 2018. The first waiver/reimbursement applies so that the ratio of expenses to average net assets, as reported in the Fund’s Financial Highlights, will be no more than 1.30% for the Fund’s Retail Class for such period. The second waiver/ reimbursement applies so that Fund level Other Expenses for the Institutional Class will be in the same proportion as the Retail Class waivers/ reimbursements. The third waiver/reimbursement applies so that the institutional class-specific Other Expenses are reimbursed. The Adviser has contractually agreed to waive/ reimburse all of these class-specific Other Expenses, but only to the extent that the difference between the net Institutional Class and net Retail Class expense ratios, after applying the waiver/reimbursement, does not exceed 25 basis points. These agreements may not be terminated or modified by the Adviser prior to April 30, 2018 without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

Lisa Z. Ramirez is a registered representative of ALPS Distributors, Inc.

| 12 |  | www.westcore.com |

| Westcore Small-Cap Value Dividend Fund | Fund Overview |

June 30, 2017 (Unaudited)

Manager Commentary

Market Overview

U.S. equity markets experienced a strong start to the year, driven by expectations of accelerated economic growth, but value stocks took a pause in the second quarter as reality did not meet those lofty near-term expectations. Excitement around the pro-business policies of the new administration took a back seat following the failure to pass the American Health Care Act of 2017 and the announced investigation into ties between President Trump’s campaign and Russian officials. These issues drove market fears that the new administration would be unable to implement policy changes. At the same time, the outlook for inflation dimmed and other economic indicators began to signal the potential for a slowdown, despite the Federal Reserve’s apparent optimism as it raised rates for the fourth time since December 2015. As a result of a more subdued outlook for U.S. economic growth, growth stocks (which have historically been less economically sensitive than value stocks) outperformed value stocks year-to-date. Additionally, investors shifted assets to larger capitalization companies and to more defensive sectors, such as health care and utilities, and away from more cyclical sectors, such as energy and basic materials.

Fund Performance

The Westcore Small-Cap Value Dividend Fund returned -2.56% (retail class) for the six months ended June 30, 2017, underperforming its benchmark, the Russell 2000® Value Index, which returned 0.54% for the same period.

Contributors to Return

The sectors that contributed most to the Fund’s performance relative to its benchmark were REITs, energy, and utilities. The Fund’s individual top performers were led by REIT sector holdings CyrusOne, Inc. and GEO Group, Inc. CyrusOne is a provider of mission-critical data center facilities. The company logged one of its strongest leasing quarters on record and announced solid financial results, which included increased full-year guidance for earnings estimates. GEO Group is a developer, owner, and operator of prisons and post-release services. Its strong performance was driven by a favorable outlook for Federal use of private prisons and by solid financial results. National food supplier AdvancePierre Foods Holdings, Inc. is a producer of ready-to-eat sandwiches, sandwich components, and other entrees and snacks. The company’s strong return and cash-flow improvement potential caught the attention of Tyson Foods, Inc. and in the second quarter

it was announced that Tyson would acquire AdvancePierre. Animal health and mineral nutrition company Phibro Animal Health Corp. posted better-than-expected results, driven by strong performance in its nutritional products and vaccines business units. Realogy Holdings Corp. is a residential real estate and brokerage company. It posted strong financial results due to recent improvements in technology solutions and talent retention, which resulted in share price appreciation.

Detractors from Return

The Fund’s weakest sectors relative to its benchmark were capital goods, interest rate sensitive, and consumer. From an individual stock perspective, SM Energy Co. detracted most from the Fund’s performance. This oil and gas producer continued to face pressure from the uncertain oil price environment. We believe the market is overly penalizing the company and are optimistic given its recent Permian Basin asset purchase. The Fund’s largest detractor within the interest rate sensitive sector was AmTrust Financial Services, Inc., a provider of insurance services primarily to small businesses. During the second quarter, the Wall Street Journal published a story involving alleged accounting issues at AmTrust in 2013 and 2014. Although this information had been revealed previously, investors reacted anew and the stock underperformed. Dairy processor and distributor Dean Foods Co. also detracted from performance. Its financial results missed consensus expectations and concerns around potential competitive industry pricing with new retail grocery entrants into the U.S. market pressured the stock. Engineering and construction company Chicago Bridge & Iron Co. was another drag on performance. A continuation of project cost overruns resulted in disappointing quarterly results. This, coupled with a dearth of new project awards, led to share price weakness. AMC Entertainment Holdings, Inc., an owner and operator of movie theaters, was another detractor in the period. Difficult box office sales and ongoing negotiations around Premium Video on Demand (PVOD) pricing led to its underperformance.

Outlook and Positioning

Looking ahead, we are excited about the opportunities that market and sector volatility may produce. As political, economic, and market uncertainty continue, we will remain focused on finding dividend-paying stocks that we believe have sound fundamentals and are currently mispriced by the markets.

Stock Performance (for the six months ended 6/30/17)

| 5 Highest | Average Weight | Contribution to Return |

| CyrusOne, Inc. | 2.44% | 0.64% |

| GEO Group, Inc | 1.99 | 0.55 |

| AdvancePierre Foods Holdings, Inc. | 0.91 | 0.49 |

| Phibro Animal Health Corp. | 1.71 | 0.46 |

| Realogy Holdings Corp. | 1.81 | 0.43 |

| 5 Lowest | Average Weight | Contribution to Return |

| AMC Entertainment Holdings, Inc. | 1.64% | -0.60% |

| Chicago Bridge & Iron Co. NV | 1.15 | -0.71 |

| Dean Foods Co. | 3.23 | -0.75 |

| AmTrust Financial Services, Inc. | 2.12 | -1.16 |

| SM Energy Co. | 1.61 | -1.18 |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Fund’s Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 36 for a description of the methodology used to construct this chart.

Semi-Annual Report | June 30, 2017 |  | 13 |

| Westcore Global Large-Cap Dividend Fund | Fund Overview |

June 30, 2017 (Unaudited)

Fund Strategy

Investing in large, well-established, dividend-paying companies both in the United States and in developed foreign markets.

Fund Management

Derek R. Anguilm, CFA Portfolio Manager Troy Dayton, CFA Portfolio Manager Mark M. Adelmann, CFA, CPA Portfolio Manager CFA is a trademark owned by CFA Institute. | Paul A. Kuppinger, CFA Portfolio Manager Lisa Z. Ramirez, CFA Portfolio Manager Alex A. Ruehle, CFA Portfolio Manager |

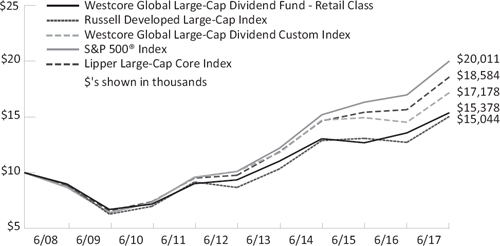

Cumulative Returns

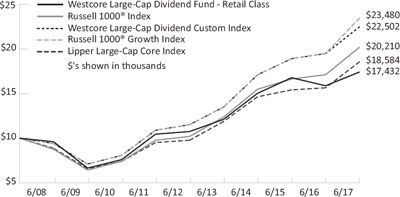

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 34.

Average Annual Total Returns

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

| Retail Class (WTMVX) | 10.16% | 13.34% | 5.63% | 10.45% | 4.40% | 8.57% | 6/1/1988 |

| Institutional Class (WIMVX) | 10.39 | 13.57 | 5.81 | 10.67 | 4.57 | 8.63 | 9/28/2007 |

| Russell Developed Large-Cap Index | 10.63 | 18.28 | 5.30 | 11.64 | 4.17 | — | |

| Westcore Global Large-Cap Dividend Custom Index | 10.63 | 18.28 | 5.30 | 11.19 | 5.55 | 9.77 | |

S&P 500® Index | 9.34 | 17.90 | 9.61 | 14.63 | 7.18 | 10.35 | |

| Lipper Large-Cap Core Index | 8.90 | 18.73 | 8.25 | 13.73 | 6.40 | 9.30 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.23%, Net: 1.00%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.23%, Net: 0.82%

Sector Allocation (as of 6/30/17)

| Consumer Discretionary | 15.1% |

| Consumer Staples | 13.6 |

| Health Care | 13.5 |

| Financials | 12.9 |