| SHAREHOLDER LETTER | (UNAUDITED) |

DEAR FELLOW SHAREHOLDERS

Global economic issues dominated the investment landscape in the first half of 2015. These issues included Greece’s continued struggle to avoid bankruptcy and new concerns over slowing growth in China. In spite of these worries, the S&P 500® Index and 10-year Treasury bond ended the first half of 2015 relatively unchanged.

Throughout early 2015, investors became increasingly concerned that Greece would declare bankruptcy and/or be removed from the European Union (EU). While this situation was not new, the larger issue of Europe’s reaction to a default by Greece and its potential “domino” effect on the rest of the continent moved to the forefront. Greek political unrest was also concerning as proposals for austerity programs were repeatedly turned down. In spite of the relatively insignificant size of Greece’s economy, Greece and the rest of the EU were at a standstill until a last-minute bailout deal (largely led by Germany) allowed Europe to return to normal. Investors then breathed a sigh of relief until China’s economic growth materially slowed.

While Greece’s economy is smaller than the economies of many U.S. cities, China’s economy is arguably the largest in the world. The Shanghai Composite Index, which tracks China’s primary stock market, dropped over 17% from June 12 to June 30. In our opinion this decline largely reflects two things, slowing economic growth and a rapidly increasing amount of non-performing loans coming to light, despite the government’s efforts to insulate the capital markets. The Chinese government attempted to intervene in the downturn, purchasing $145 billion in equities. As we’ve seen historically, government intervention rarely works in the long term and there appears to be little expectation that it will work in this circumstance. The slowing economic growth in China is a situation that will require close monitoring. The U.S. and global economies are more closely tied together than at any time it the past and a slowdown in China has the potential to depress U.S. economic growth.

Global volatility and slowing growth in China may affect the Federal Reserve’s willingness to raise the Fed Funds Rate this year. Slower economic growth in China has resulted in a strengthening U.S. dollar and is negatively impacting U.S. profit growth. With very little evident inflation and the potential for slowing earnings for U.S. companies, we believe there is less incentive for the Fed to raise rates. Fed watchers will have an interesting second half of 2015 determining how to balance the newly evolving contravening factors the Fed must weigh in order to determine its next move.

We will continue to monitor these events and the multitude of other factors that impact your investments in the Westcore Funds. Our portfolio managers and analysts are deeply dedicated to the success of your investments and we sincerely appreciate your confidence in us. Please let us know if you have any questions or require additional information.

| | | |

|  | |

| Mary K. Anstine | John W. Zimmerman, CFA | |

| Chairman | President | |

John W. Zimmerman is a registered representative of ALPS Distributors, Inc.

CFA is a trademark owned by the CFA Institute.

The Shareholder Letter and the Manager Commentaries included in this shareholder report contain certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

| PAGE 1 |

| |

| p: 800.392.CORE (2673) | www.westcore.com |

| WESTCORE GROWTH FUND (WTEIX, WILGX) | (UNAUDITED) |

Fund Strategy

Investing primarily in equity securities of large companies with growth potential.

Fund Management

Craig W. Juran, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 28.

Average Annual Total Returns

| | | | | | | | |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

| Retail Class (WTEIX) | 6.05% | 11.58% | 16.02% | 17.19% | 7.82% | 9.16% | 6/1/1988 |

| Institutional Class (WILGX) | 6.21 | 11.89 | 16.27 | 17.40 | 7.95 | 9.21 | 9/28/2007 |

Russell 1000® Growth Index | 3.96 | 10.56 | 17.99 | 18.59 | 9.11 | 10.08 | |

| Lipper Large-Cap Growth Index | 4.42 | 10.56 | 18.11 | 17.23 | 7.97 | 9.19 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.11%, Net: 1.11%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.05%, Net: 0.91%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2015 until at least April 30, 2016. The first waiver/reimbursement applies so that the ratio of expenses to average net assets, as reported in the Fund’s Financial Highlights, will be no more than 1.15% for the Fund’s Retail Class for such period. The second waiver/reimbursement applies so that Fund level Other Expenses for the Institutional Class will be in the same proportion as the Retail Class waivers/reimbursements. The third waiver/reimbursement applies so that the institutional class-specific Other Expenses are reimbursed. The Adviser has contractually agreed to waive/reimburse all of these class-specific Other Expenses, but only to the extent that the difference between the net Institutional Class and net Retail Class expense ratios, after applying the waiver/reimbursement, does not exceed 25 basis points. These agreements may not be terminated or modified prior to this date without the approval of the Board of Trustees.

Craig W. Juran is a registered representative of ALPS Distributors, Inc.

Manager Commentary

| | |

| ■ | Equity markets advanced in the first half of 2015, as a slow but improving U.S. economy was offset by turmoil in Europe associated with the potential exit of Greece from the European Union and continued troubles in emerging markets. As the U.S. economy continues to heal, we think the Federal Reserve is getting closer to normalizing its interest-rate policy, and we think this is a positive step. Although there may be some dislocations associated with a slight increase in interest rates, we believe the longer-term benefits will outweigh short-term volatility associated with a return to more normalized Fed policy. |

| | |

| ■ | For the first six months of 2015, the Westcore Growth Fund outperformed its benchmark, the Russell 1000® Growth Index. The Fund’s returns, relative to the benchmark, were enhanced by holdings in the information technology, health care and industrials sectors. Holdings in consumer discretionary, energy and materials sectors detracted from the Fund’s relative performance. |

| | |

| ■ | Among the Fund’s strongest contributors in the first half of 2015 were Apple Inc., Gilead Sciences, Inc. and Palo Alto Networks, Inc. Apple delivered strong performance as investors became more intrigued with the Apple watch and its potential implications. Although the watch is early in its adoption phase, it potentially might help consumers live healthier life styles, along with supporting the Apple ecosystem. Gilead Sciences, a biotechnology company, delivered strong performance driven by robust first quarter results. These strong results, along with positive commentary about its drug pipeline, drove the stock higher. Palo Alto Networks, an enterprise network security platform provider, delivered strong performance as cybersecurity remained one of the biggest concerns for most corporations. Its next-generation firewall solves many problems that traditional firewalls struggle with. We believe the company is well positioned and that network security is an attractive longer-term growth market. |

| | |

| ■ | Among the Fund’s biggest detractors in the first six months of 2015 were Chipotle Mexican Grill Inc., Goodyear Tire & Rubber Co and Alibaba Group Holding Ltd. Chipotle underperformed in the first half of 2015 after issuing earnings estimates that disappointed some investors. We believe that Chipotle remains one of the best-positioned restaurants to capture consumers’ increasing desire for healthier products and higher-quality foods. We anticipated that Goodyear Tire’s improving fundamentals would lead to accelerating earnings in 2015. In January, however, the company reduced its financial forecasts based on challenging winter weather in Europe and the impact of a stronger U.S. dollar. This uncertainty led us to exit the position. International e-commerce company Alibaba Group struggled as it faced pressure from Chinese government regulation that led to slower revenue growth. We believe the company has compelling longer-term growth opportunities and that some of the near-term headwinds should dissipate in the second half of 2015. |

| | |

| ■ | We continue to see positive data that suggests the U.S. economy is picking up steam. After a slow start to the year, in which the U.S. economy was hampered by severe winter weather, we are starting to see signs of acceleration driven by improved hiring, lower gasoline prices and a pick-up in housing activity. Although the equity markets will likely remain volatile, it is becoming evident to us that a synchronized global recovery may be gaining traction, which may help reduce the fears of deflation and restore confidence in global economies. |

| PAGE 2 |

| |

| 2015 Semi-Annual Report |

| WESTCORE GROWTH FUND (continued) | (UNAUDITED) |

Stock Performance

(for the year ended 6/30/15)

| | | | | |

| 5 Highest | Average

Weight | Contribution

to Return |

| Apple Inc. | 9.92 | % | 1.54 | % |

| Gilead Sciences Inc. | 4.32 | | 1.00 | |

| Walt Disney Co. | 3.79 | | 0.72 | |

| Palo Alto Networks Inc. | 1.65 | | 0.61 | |

| Amazon.com Inc. | 1.78 | | 0.60 | |

| | | | | |

| 5 Lowest | | | | |

| Chipotle Mexican Grill Inc. | 2.82 | % | -0.34 | % |

| Goodyear Tire & Rubber Co. | 0.29 | | -0.34 | |

| Alibaba Group Holding Ltd. | 0.45 | | -0.37 | |

| SanDisk Corp. | 0.15 | | -0.40 | |

| Microsoft Corp. | 0.62 | | -0.49 | |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 30 for a description of the methodology used to construct this chart.

Top Ten Holdings

(as of 6/30/15)

| | | |

| Apple Inc. | 9.5 | % |

| Gilead Sciences Inc. | 5.1 | |

| Facebook Inc. | 4.9 | |

| Home Depot Inc. | 3.7 | |

| Illumina Inc. | 3.6 | |

| Walt Disney Co. | 3.5 | |

| Visa Inc. | 3.2 | |

| Priceline Group Inc. | 3.2 | |

| Celgene Corp. | 2.9 | |

| Allergan PLC | 2.8 | |

| Total (% of Net Assets) | 42.4 | % |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding.

Portfolio Characteristics

(as of 6/30/15)

| | Westcore

Growth Fund | Russell 1000®

Growth Index |

| Weighted Average Market Capitalization ($ Bil) | $135.6 | $122.4 |

| Price/Earnings (1 year trailing) | 26.1x | 22.7x |

| EPS Growth (3 year historical) | 21.9% | 14.0% |

| Beta | 1.1 | 1.0 |

| Number of Holdings | 41 | 644 |

| Portfolio Turnover Rate (1 year trailing) | 104% | — |

Please see definition of terms beginning on page 30.

Sector Allocation

(as of 6/30/15)

| | | | | | | |

| | Westcore

Growth Fund | Russell 1000®

Growth Index | Relative Weights

Under | Over |

| Consumer Discretionary | 19.5 | % | 21.0 | % | -1.5 | % |

| Consumer Staples | 5.2 | | 10.5 | | -5.3 | |

| Energy | 4.4 | | 1.0 | | 3.4 | |

| Financials | 4.2 | | 5.4 | | -1.2 | |

| Health Care | 19.0 | | 18.3 | | 0.7 | |

| Industrials | 8.7 | | 11.1 | | -2.4 | |

| Information Technology | 33.7 | | 27.0 | | 6.7 | |

| Materials | 4.3 | | 3.9 | | 0.4 | |

| Telecommunication Services | 0.0 | | 1.8 | | -1.8 | |

| Utilities | 0.0 | | 0.0 | | 0.0 | |

| ST Investments/Net Other Assets | 1.0 | | 0.0 | | 1.0 | |

| Total (% of Net Assets) | 100.0 | % | 100.0 | % | | |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

Market Capitalization

(as of 6/30/15)

Market Cap Range ($ Bil) | Percent of Total Equities | | Number of Holdings |

| $0 - $10 | 10.2 | % | | 6 |

| $10 - $50 | 38.3 | | | 20 |

| $50 - $100 | 13.0 | | | 5 |

| Over $100 | 38.5 | | | 10 |

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| PAGE 3 |

| |

| p: 800.392.CORE (2673) | www.westcore.com |

| WESTCORE MIDCO GROWTH FUND (WTMGX, WIMGX) | (UNAUDITED) |

Fund Strategy

Investing in a diversified portfolio of equity securities of primarily medium-sized companies with growth potential.

Fund Management

| |

Mitch S. Begun, CFA Lead Portfolio Manager |

F. Wiley Reed, CFA Lead Portfolio Manager |

Adam C. Bliss Portfolio Manager |

Brian C. Fitzsimons, CFA Portfolio Manager |

Jeffrey J. Loehr, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 28.

Average Annual Total Returns

| | | | | | | | | | | | | | |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

| Retail Class (WTMGX) | 7.08 | % | 6.51 | % | 19.36 | % | 15.86 | % | 8.46 | % | 10.79 | % | 8/1/1986 |

| Institutional Class (WIMGX) | 7.12 | | 6.70 | | 19.59 | | 16.05 | | 8.59 | | 10.84 | | 9/28/2007 |

Russell Midcap® Growth Index | 4.18 | | 9.45 | | 19.24 | | 18.69 | | 9.69 | | 10.61 | | |

| Lipper Mid-Cap Growth Index | 5.54 | | 9.19 | | 17.84 | | 16.75 | | 9.58 | | 9.90 | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.04%, Net: 1.04%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.99%, Net: 0.90%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2015 until at least April 30, 2016. The first waiver/reimbursement applies so that the ratio of expenses to average net assets, as reported in the Fund’s Financial Highlights, will be no more than 1.15% for the Fund’s Retail Class for such period. The second waiver/reimbursement applies so that Fund level Other Expenses for the Institutional Class will be in the same proportion as the Retail Class waivers/reimbursements. The third waiver/reimbursement applies so that the institutional class-specific Other Expenses are reimbursed. The Adviser has contractually agreed to waive/reimburse all of these class-specific Other Expenses, but only to the extent that the difference between the net Institutional Class and net Retail Class expense ratios, after applying the waiver/reimbursement, does not exceed 25 basis points. These agreements may not be terminated or modified prior to this date without the approval of the Board of Trustees.

Investing in mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Manager Commentary

| | |

| ■ | For the first half of 2015, the Westcore MIDCO Growth Fund outperformed its benchmark, the Russell Midcap® Growth Index. |

| | |

| ■ | Despite an eventful backdrop, including turbulence in the Eurozone due to the potential exit of Greece and rising anxiety in Asian markets, U.S. equity returns were fairly uneventful. Year-to-date returns for small-cap indexes were ahead of large-cap indexes with the Russell 2000® Index up 4.75% versus the Russell 1000® Index’s 1.71% gain, and the Russell Midcap® Index up 2.35%. More interesting to us is the discrepancy between the returns of growth stocks and value stocks thus far in 2015. The Russell Midcap® Growth Index ended the first half up 4.18% versus the Russell Midcap® Value index’s gain of just 0.41%. This trend was consistent across market capitalizations and is a continuation of a theme we have seen for the last ten years–companies that are growing faster are being rewarded due to their scarcity in a slowly growing economy. At this juncture, we expect this trend to continue as global growth concerns are at the forefront and the U.S. economy chugs along with decent growth. |

| | |

| ■ | The sectors that contributed most to the Fund’s performance relative to its benchmark in the period were information technology, consumer discretionary and financials. The Fund’s best-performing stock was consumer discretionary sector holding Netflix, Inc. The stock outperformed as the company invested well in original content and international expansion. Netflix’s largest growth opportunity, expansion into international markets, should be completed by the end of 2016. Tesla Motors Inc., also within the consumer discretionary sector, performed well as investors got more comfortable with the Model X electric car rollout and the company’s opportunities in new energy storage solutions. Demand for Tesla’s cars remains high and longer term, we believe Tesla’s expertise in battery management software and manufacturing solutions provides broader opportunities. Tableau Software Inc., an analytics software solutions provider, was also among the Fund’s top contributors. The stock was strong as demand for the company’s data visualization and analytics solutions remained healthy. Tableau is just starting its international push and we think it has a long runway for growth. |

| | |

| ■ | Two sectors detracted from the Fund’s performance relative to its benchmark in the first half of 2015, consumer staples and energy. The Fund’s worst-performing stock was consumer staples sector holding Keurig Green Mountain Inc. The maker of Keurig single-serve brewers and Green Mountain branded K-cups, struggled as its recently launched 2.0 brewing system underperformed expectations. We remain confident in the product’s potential and the company’s pipeline of innovation. Applied Materials Inc., a semiconductor equipment provider, was also a significant detractor in the period. The company was unable to overcome global regulatory scrutiny of its planned merger with Tokyo Electron Ltd. and slower-than-anticipated capital expenditure spending by semiconductor manufacturers. Wynn Resorts Ltd., a leading casino company, was also a drag on the Fund’s performance as the company cut its dividend and indicated more uncertainty regarding a gaming revenue recovery in Macau. We think the dividend cut was prudent in light of current circumstances and that Wynn will recover nicely once the market recovers. |

| | |

| ■ | As of the end of the first half of 2015, the Fund was overweighted primarily in the information technology and energy sectors, and underweighted primarily in the consumer discretionary and industrials sectors. |

| PAGE 4 |

| |

| 2015 Semi-Annual Report |

| WESTCORE MIDCO GROWTH FUND (continued) | (UNAUDITED) |

Stock Performance

(for the year ended 6/30/15)

| | | | | |

| 5 Highest | Average

Weight | Contribution

to Return |

| Netflix Inc. | 2.20 | % | 1.52 | % |

| Pharmacyclics Inc. | 0.33 | | 0.75 | |

| FireEye Inc. | 1.35 | | 0.69 | |

| Tableau Software Inc. | 1.86 | | 0.59 | |

| Tesla Motors Inc. | 2.26 | | 0.55 | |

| | | | | |

| 5 Lowest | | | | |

| Zulily Inc. | 0.55 | % | -0.34 | % |

| Applied Materials Inc. | 1.67 | | -0.41 | |

| United Continental Holdings Inc. | 2.02 | | -0.43 | |

| Wynn Resorts Ltd | 1.38 | | -0.50 | |

| Keurig Green Mountain Inc. | 1.56 | | -0.75 | |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 30 for a description of the methodology used to construct this chart.

Top Ten Holdings

(as of 6/30/15)

| Tesla Motors Inc. | 2.1 | % |

| Tableau Software Inc. | 2.0 | |

| Affiliated Managers Group Inc. | 2.0 | |

| BioMarin Pharmaceutical Inc. | 2.0 | |

| Under Armour Inc. | 2.0 | |

| Fiserv Inc. | 1.9 | |

| Restoration Hardware Holdings Inc. | 1.9 | |

| BorgWarner Inc. | 1.9 | |

| Tractor Supply Co. | 1.9 | |

| LinkedIn Corp. | 1.9 | |

| Total (% of Net Assets) | 19.6 | % |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding.

Portfolio Characteristics

(as of 6/30/15)

| | Westcore MIDCO

Growth Fund | Russell Midcap®

Growth Index |

| Weighted Average Market Capitalization ($ Bil) | $11.3 | $13.2 |

| Price/Earnings (1 year trailing) | 25.5x | 24.7x |

| EPS Growth (3 year historical) | 20.1% | 14.5% |

| Beta | 1.2 | 1.1 |

| Number of Holdings | 75 | 507 |

| Portfolio Turnover Rate (1 year trailing) | 62% | — |

Please see definition of terms beginning on page 30.

Sector Allocation

(as of 6/30/15)

| | | | | | | |

| | Westcore MIDCO

Growth Fund | Russell Midcap®

Growth Index | Relative Weights

Under | Over |

| Consumer Discretionary | 18.8 | % | 24.5 | % | -5.7 | % |

| Consumer Staples | 3.9 | | 7.4 | | -3.5 | |

| Energy | 4.5 | | 1.2 | | 3.3 | |

| Financials | 8.4 | | 11.1 | | -2.7 | |

| Health Care | 13.9 | | 14.4 | | -0.5 | |

| Industrials | 11.7 | | 15.6 | | -3.9 | |

| Information Technology | 28.0 | | 20.0 | | 8.0 | |

| Materials | 6.1 | | 5.3 | | 0.8 | |

| Telecommunication Services | 0.0 | | 0.4 | | -0.4 | |

| Utilities | 0.0 | | 0.1 | | -0.1 | |

| ST Investments/Net Other Assets | 4.7 | | 0.0 | | 4.7 | |

| Total (% of Net Assets) | 100.0 | % | 100.0 | % | | |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

Market Capitalization

(as of 6/30/15)

| | | | | |

Market Cap Range ($ Bil) | Percent of Total Equities | | Number of Holdings |

| $0 - $1 | 0.0 | % | | 0 |

| $1 - $5 | 21.9 | | | 21 |

| $5 - $10 | 32.4 | | | 27 |

| Over $10 | 45.7 | | | 27 |

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| |

| PAGE 5 |

| |

| p: 800.392.CORE (2673) | www.westcore.com |

| WESTCORE SELECT FUND (WTSLX) | (UNAUDITED) |

Fund Strategy

Investing primarily in the common stock of a limited number of medium-sized companies selected for their growth potential.

Fund Management

| |

Mitch S. Begun, CFA Lead Portfolio Manager |

F. Wiley Reed, CFA Lead Portfolio Manager |

Adam C. Bliss Portfolio Manager |

Brian C. Fitzsimons, CFA Portfolio Manager |

Jeffrey J. Loehr, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 28.

Average Annual Total Returns

| | | | | | | | | | | | | | |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

| Retail Class (WTSLX) | 3.36 | % | 5.06 | % | 14.82 | % | 10.63 | % | 8.51 | % | 11.64 | % | 10/1/1999 |

Russell Midcap® Growth Index | 4.18 | | 9.45 | | 19.24 | | 18.69 | | 9.69 | | 7.22 | | |

| Lipper Mid-Cap Growth Index | 5.54 | | 9.19 | | 17.84 | | 16.75 | | 9.58 | | 6.45 | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.10%, Net: 1.10%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2015 until at least April 30, 2016. The waiver/reimbursement applies so that the ratio of expenses to average net assets, as reported in the Fund’s financial statements, will be no more than 1.15% for the Fund’s Retail Class for such period. Please see the Fund’s Prospectus for more information. This agreement may not be terminated or modified prior to this date without the approval of the Board of Trustees. Without the fee waivers and expense reimbursements, total return figures would have been lower.

Investing in mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Manager Commentary

| | |

| ■ | For the first half of 2015, the Westcore Select Fund underperformed its benchmark, the Russell Midcap® Growth Index. |

| | |

| ■ | Despite an eventful backdrop, including turbulence in the Eurozone due to the potential exit of Greece and rising anxiety in Asian markets, U.S. equity returns were fairly uneventful. Year-to-date returns for small-cap indexes were ahead of large-cap indexes with the Russell 2000® Index up 4.75% versus the Russell 1000® Index’s 1.71% gain, and the Russell Midcap® Index up 2.35%. More interesting to us is the discrepancy between the returns of growth stocks and value stocks thus far in 2015. The Russell Midcap® Growth Index ended the first half up 4.18% versus the Russell Midcap® Value index’s gain of just 0.41%. This trend was consistent across market capitalizations and is a continuation of a theme we have seen for the last ten years–companies that are growing faster are being rewarded due to their scarcity in a slowly growing economy. At this juncture, we expect this trend to continue as global growth concerns are at the forefront and the U.S. economy chugs along with decent growth. |

| | |

| ■ | The three sectors that contributed most to the Fund’s performance relative to its benchmark in the period were consumer discretionary, information technology and financials. The Fund’s best-performing stock was consumer discretionary sector holding Netflix, Inc. The stock outperformed as the company invested well in original content and international expansion. Netflix’s largest growth opportunity, expansion into international markets, should be completed by the end of 2016. Tesla Motors Inc., also within the consumer discretionary sector, performed well as investors got more comfortable with the Model X electric car rollout and the company’s opportunities in new energy storage solutions. Demand for Tesla’s cars remains high and longer term, we believe Tesla’s expertise in battery management software and manufacturing solutions provides broader opportunities. Tableau Software Inc., an analytics software solutions provider, was also among the Fund’s top contributors. The stock was strong as demand for the company’s data visualization and analytics solutions remained healthy. Tableau is just starting its international push and we think it has a long runway for growth. |

| | |

| ■ | The three sectors that detracted most to the Fund’s performance relative to its benchmark in the period were consumer staples, industrials and materials. The Fund’s worst-performing stock was Wynn Resorts Ltd., a leading casino company. The stock struggled as the company cut its dividend and indicated more uncertainty regarding a gaming revenue recovery in Macau. We think the dividend cut was prudent in light of current circumstances and that Wynn will recover nicely once the market recovers. Applied Materials Inc., a semiconductor equipment provider, was also a significant detractor in the period. The company was unable to overcome global regulatory scrutiny of its planned merger with Tokyo Electron Ltd. and slower-than-anticipated capital expenditure spending by semiconductor manufacturers. Deckers Outdoor Corp., owner of the Ugg footwear brand, struggled as holiday sales and spring preorders for its flagship Ugg brand slowed sizably. We exited the position in the first quarter. |

| | |

| ■ | As of the end of the first half of 2015, the Fund was overweighted primarily in the information technology and energy sectors, and underweighted primarily in the consumer discretionary and consumer staples sectors. |

| PAGE 6 |

| |

| 2015 Semi-Annual Report |

| WESTCORE SELECT FUND (continued) | (UNAUDITED) |

Stock Performance

(for the year ended 6/30/15)

| | | | | |

| 5 Highest | Average

Weight | Contribution

to Return |

| Netflix Inc. | 2.86 | % | 1.92 | % |

| FireEye Inc. | 2.87 | | 1.49 | |

| Tesla Motors Inc. | 3.42 | | 0.87 | |

| Tableau Software Inc. | 2.68 | | 0.79 | |

| Lululemon Athletica Inc. | 2.15 | | 0.58 | |

| | | | | |

| 5 Lowest | | | | |

| Melco Crown Entertainment Ltd. | 1.68 | % | -0.41 | % |

| Deckers Outdoor Corp. | 0.75 | | -0.59 | |

| Applied Materials Inc. | 3.31 | | -0.81 | |

| United Continental Holdings Inc. | 3.80 | | -0.84 | |

| Wynn Resorts Ltd. | 2.55 | | -0.93 | |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 30 for a description of the methodology used to construct this chart.

Top Ten Holdings

(as of 6/30/15)

| Affiliated Managers Group Inc. | 4.5 | % |

| Tesla Motors Inc. | 3.9 | |

| Amphenol Corp. | 3.6 | |

| BorgWarner Inc. | 3.5 | |

| United Continental Holdings Inc. | 3.5 | |

| ServiceNow Inc. | 3.5 | |

| SVB Financial Group | 3.4 | |

| LinkedIn Corp. | 3.3 | |

| Under Armour Inc. | 3.2 | |

| Team Health Holdings Inc. | 3.2 | |

| Total (% of Net Assets) | 35.6 | % |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding.

Portfolio Characteristics

(as of 6/30/15)

| | | |

| | Westcore

Select Fund | Russell Midcap®

Growth Index |

| Weighted Average Market Capitalization ($ Bil) | $12.6 | $13.2 |

| Price/Earnings (1 year trailing) | 24.5x | 24.7x |

| EPS Growth (3 year historical) | 20.1% | 14.5% |

| Beta | 1.1 | 1.1 |

| Number of Holdings | 34 | 507 |

| Portfolio Turnover Rate (1 year trailing) | 65% | — |

Please see definition of terms beginning on page 30.

Sector Allocation

(as of 6/30/15)

| | | | | | | |

| | Westcore

Select Fund | Russell Midcap®

Growth Index | Relative Weights

Under | Over |

| Consumer Discretionary | 19.2 | % | 24.5 | % | -5.3 | % |

| Consumer Staples | 2.7 | | 7.4 | | -4.7 | |

| Energy | 4.0 | | 1.2 | | 2.8 | |

| Financials | 7.9 | | 11.1 | | -3.2 | |

| Health Care | 16.3 | | 14.4 | | 1.9 | |

| Industrials | 13.7 | | 15.6 | | -1.9 | |

| Information Technology | 26.2 | | 20.0 | | 6.2 | |

| Materials | 5.9 | | 5.3 | | 0.6 | |

| Telecommunication Services | 0.0 | | 0.4 | | -0.4 | |

| Utilities | 0.0 | | 0.1 | | -0.1 | |

| ST Investments/Net Other Assets | 4.1 | | 0.0 | | 4.1 | |

| Total (% of Net Assets) | 100.0 | % | 100.0 | % | | |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

Market Capitalization

(as of 6/30/15)

| | | | | |

Market Cap Range ($ Bil) | Percent of Total Equities | | Number of Holdings |

| $0 - $1 | 0.0 | % | | 0 |

| $1 - $5 | 21.2 | | | 8 |

| $5 - $10 | 31.7 | | | 12 |

| Over $10 | 47.1 | | | 14 |

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| |

| PAGE 7 |

| |

| p: 800.392.CORE (2673) | www.westcore.com |

| WESTCORE SMALL-CAP GROWTH FUND (WTSGX, WISGX) | (UNAUDITED) |

Fund Strategy

Investing in a diversified portfolio of equity securities of primarily small-sized companies with growth potential.

Fund Management

Mitch S. Begun, CFA Lead Portfolio Manager |

F. Wiley Reed, CFA Lead Portfolio Manager |

Adam C. Bliss Portfolio Manager |

Brian C. Fitzsimons, CFA Portfolio Manager |

Jeffrey J. Loehr, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

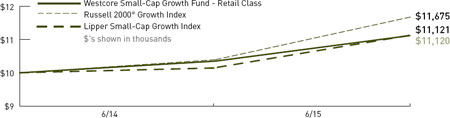

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 28.

Average Annual Total Returns

| | | | | | | | | | | | | | |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

| Retail Class (WTSGX) | 5.70 | % | 7.44 | % | — | | — | | — | | 7.20 | % | 12/20/2013 |

| Institutional Class (WISGX) | 6.06 | | 8.11 | | — | | — | | — | | 7.71 | | 12/20/2013 |

Russell 2000® Growth Index | 8.74 | | 12.34 | | — | | — | | — | | 10.70 | | |

| Lipper Small-Cap Growth Index | 7.54 | | 9.63 | | — | | — | | — | | 7.22 | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 5.18%, Net: 1.30%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 3.61%, Net: 1.05%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. The performance data quoted does not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 90 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2015 until at least April 30, 2016. The first waiver/reimbursement applies so that the ratio of expenses to average net assets, as reported in the Fund’s Financial Highlights, will be no more than 1.30% for the Fund’s Retail Class for such period. The second waiver/reimbursement applies so that Fund level Other Expenses for the Institutional Class will be in the same proportion as the Retail Class waivers/reimbursements. The third waiver/reimbursement applies so that the institutional class-specific Other Expenses are reimbursed. The Adviser has contractually agreed to waive/reimburse all of these class-specific Other Expenses, but only to the extent that the difference between the net Institutional Class and net Retail Class expense ratios, after applying the waiver/reimbursement, does not exceed 25 basis points. These agreements may not be terminated or modified prior to this date without the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

Manager Commentary

| | |

| ■ | For the first half of 2015, the Westcore Small-Cap Growth Fund underperformed its benchmark, the Russell 2000® Growth Index. |

| | |

| ■ | Despite an eventful backdrop, including turbulence in the Eurozone due to the potential exit of Greece and rising anxiety in Asian markets, U.S. equity returns were fairly uneventful. Year-to-date returns for small-cap indexes were ahead of large-cap indexes with the Russell 2000® Index up 4.75% versus the Russell 1000® Index’s 1.71% gain, and the Russell Midcap® Index up 2.35%. More interesting to us is the discrepancy between the returns of growth stocks and value stocks thus far in 2015. The Russell 2000® Growth Index ended the first half up 8.74% versus the Russell 2000® Value index’s gain of just 0.76%. This trend was consistent across market capitalizations and is a continuation of a theme we have seen for the last ten years–companies that are growing faster are being rewarded due to their scarcity in a slowly growing economy. At this juncture, we expect this trend to continue as global growth concerns are at the forefront and the U.S. economy chugs along with decent growth. |

| | |

| ■ | The three sectors that contributed most to the Fund’s performance relative to its benchmark in the period were financials, information technology and materials. The Fund’s best-performing stock was Sage Therapeutics Inc. This biotechnology company outperformed as additional data emerged regarding its drug candidate for the treatment of nervous system disorders. We believe the company has an attractive drug pipeline that is undervalued. Security software provider FireEye Inc. outperformed following its acquisition of Mandiant last year. FireEye is the market leader in high-end advanced persistent threat (APT) solutions and demand remains strong for its security solutions. However, we exited the position as its market capitalization grew larger than our target universe. Globant SA, an information technology sector company, was also a top contributor in the period. This software solutions provider benefited as companies and consumers increasingly utilized applications via the cloud and on mobile devices. We have a favorable view of Globant’s growth prospects. |

| | |

| ■ | The three sectors that detracted most from the Fund’s performance relative to its benchmark in the period were consumer discretionary, health care and industrials. The Fund’s worst-performing stock was Vince Holding Corp. This high-end apparel and accessories brand in the consumer discretionary sector performed poorly as its wholesale business segment faced continued pressure from weak department store ordering patterns. We believe this slowdown will prove temporary and that Vince remains an exciting up-and-coming brand. Within the health care sector, both OvaScience Inc. and OraSure Technologies Inc. were significant drags on the Fund’s performance. OvaScience underperformed after reporting data on Augment, its treatment for improving in vitro-fertilization (IVF) pregnancy rates. Although this initial data was positive, investors clearly wanted a more robust clinical analysis. We believe Augment, along with other products in OvaScience’s pipeline, have an opportunity to penetrate what could be a huge market. OraSure underperformed after reporting weaker-than-expected fourth quarter 2014 results for its rapid hepatitis C test, OraQuick HCV. Given uncertainty regarding growth potential for this test, we exited the position. |

| | |

| ■ | As of the end of the first half of 2015, the Fund was overweighted in the financials and energy sectors, and underweighted primarily in the industrials and consumer discretionary sectors. |

| PAGE 8 |

| |

| 2015 Semi-Annual Report |

| WESTCORE SMALL-CAP GROWTH FUND (continued) | (UNAUDITED) |

Stock Performance

(for the year ended 6/30/15)

| | | | | |

| 5 Highest | Average

Weight | Contribution

to Return |

| Sage Therapeutics Inc. | 1.02 | % | 0.73 | % |

| FireEye Inc. | 1.03 | | 0.67 | |

| Globant SA | 0.76 | | 0.63 | |

| IMAX Corp. | 1.78 | | 0.57 | |

| Clovis Oncology Inc. | 1.13 | | 0.57 | |

| | | | | |

| 5 Lowest | | | | |

| Vera Bradley Inc. | 0.62 | % | -0.39 | % |

| OvaScience Inc. | 1.34 | | -0.47 | |

| Saia Inc. | 1.27 | | -0.50 | |

| OraSure Technologies Inc. | 0.59 | | -0.55 | |

| Vince Holding Corp. | 0.94 | | -0.73 | |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392. CORE (2673) or email invest@westcore.com.

Please see page 30 for a description of the methodology used to construct this chart.

Top Ten Holdings

(as of 6/30/15)

| | | |

| Restoration Hardware Holdings Inc. | 2.2 | % |

| Virtusa Corp. | 2.1 | |

| Acadia Healthcare Co. Inc. | 2.1 | |

| Team Health Holdings Inc. | 2.0 | |

| Inphi Corp. | 2.0 | |

| PolyOne Corp. | 2.0 | |

| Vail Resorts Inc. | 1.9 | |

| Eagle Bancorp Inc. | 1.9 | |

| Evercore Partners Inc. | 1.9 | |

| Western Alliance Bancorp | 1.9 | |

| Total (% of Net Assets) | 20.0 | % |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding.

Portfolio Characteristics

(as of 6/30/15)

| | | |

| | Westcore Small-Cap

Growth Fund | Russell 2000®

Growth Index |

| Weighted Average Market Capitalization ($ Bil) | $2.4 | $2.1 |

| Price/Earnings (1 year trailing) | 31.5x | 19.6x |

| EPS Growth (3 year historical) | 29.0% | 11.3% |

| Beta | 1.2 | 1.3 |

| Number of Holdings | 89 | 1,163 |

| Portfolio Turnover Rate (1 year trailing) | 92% | — |

Please see definition of terms beginning on page 30.

Sector Allocation

(as of 6/30/15)

| | | | | | | |

| | Westcore Small-Cap

Growth Fund | Russell 2000®

Growth Index | Relative Weights

Under | Over |

| Consumer Discretionary | 15.4 | % | 18.3 | % | -2.9 | % |

| Consumer Staples | 2.9 | | 3.3 | | -0.4 | |

| Energy | 4.6 | | 1.5 | | 3.1 | |

| Financials | 10.6 | | 7.2 | | 3.4 | |

| Health Care | 28.2 | | 27.5 | | 0.7 | |

| Industrials | 9.2 | | 13.2 | | -4.0 | |

| Information Technology | 25.1 | | 23.9 | | 1.2 | |

| Materials | 2.0 | | 4.2 | | -2.2 | |

| Telecommunication Services | 0.8 | | 0.8 | | 0.0 | |

| Utilities | 0.0 | | 0.1 | | -0.1 | |

| ST Investments/Net Other Assets | 1.2 | | 0.0 | | 1.2 | |

| Total (% of Net Assets) | 100.0 | % | 100.0 | % | | |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

Market Capitalization

(as of 6/30/15)

| | | | | |

Market Cap Range ($ Mil) | Percent of Total Equities | | Number of Holdings |

| $0 - $500 | 9.6 | % | | 12 |

| $500 - $1,000 | 12.8 | | | 12 |

| $1,000 - $2,000 | 24.8 | | | 23 |

| Over $2,000 | 52.8 | | | 42 |

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| |

| PAGE 9 |

| |

| p: 800.392.CORE (2673) | www.westcore.com |

| WESTCORE BLUE CHIP DIVIDEND FUND (WTMVX, WIMVX) | (UNAUDITED) |

Fund Strategy

Investing in large, well-established, dividend-paying companies both in the United States and in developed foreign markets.

Fund Management

| |

Troy Dayton, CFA Portfolio Manager |

Mark M. Adelmann, CFA, CPA Portfolio Manager |

Derek R. Anguilm, CFA Portfolio Manager |

Paul A. Kuppinger, CFA Portfolio Manager |

Lisa Z. Ramirez, CFA Portfolio Manager |

Alex A. Ruehle, CFA Portfolio Manager |

| |

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 28.

Average Annual Total Returns

| | | | | | | | | | | | | | |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

| Retail Class (WTMVX) | -1.90 | % | -2.79 | % | 10.67 | % | 12.05 | % | 4.97 | % | 8.46 | % | 6/1/1988 |

| Institutional Class (WIMVX) | 1.86 | | -2.64 | | 10.91 | | 12.21 | | 5.11 | | 8.51 | | 9/28/2007 |

S&P 500® Index | 1.23 | | 7.42 | | 17.31 | | 17.34 | | 7.89 | | 10.15 | | |

| Russell Developed Large-Cap Index | 2.67 | | 1.50 | | 14.66 | | 13.38 | | 6.59 | | — | | |

| Westcore Blue Chip Dividend Fund Custom Index | 2.67 | | 1.50 | | 13.89 | | 15.28 | | 6.94 | | 9.97 | | |

| Lipper Large-Cap Core Index | 0.76 | | 5.25 | | 16.43 | | 15.82 | | 7.20 | | 9.27 | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.14%, Net: 0.99%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.01%, Net: 0.82%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2015 until at least April 30, 2016. The first waiver/reimbursement applies so that the ratio of expenses to average net assets, as reported in the Fund’s Financial Highlights, will be no more than 0.99% for the Fund’s Retail Class for such period. The second waiver/reimbursement applies so that Fund level Other Expenses for the Institutional Class will be in the same proportion as the Retail Class waivers/reimbursements. The third waiver/reimbursement applies so that the institutional class-specific Other Expenses are reimbursed. The Adviser has contractually agreed to waive/reimburse all of these class-specific Other Expenses, but only to the extent that the difference between the net Institutional Class and net Retail Class expense ratios, after applying the waiver/reimbursement, does not exceed 25 basis points. These agreements may not be terminated or modified prior to this date without the approval of the Board of Trustees.

Investments in foreign companies are subject to special risks, including currency fluctuations, social, economic, and political uncertainties, which could increase volatility.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

Lisa Z. Ramirez is a registered representative of ALPS Distributors, Inc.

Manager Commentary

| | |

| ■ | The Westcore Blue Chip Dividend Fund underperformed its new benchmark, the Russell Developed Large-Cap Index and the S&P 500® Index, for the first half of 2015. Although weather-related issues caused a slow start to the year, the U.S. economy has since gained momentum with strong job creation, rising consumer confidence and early signs of wage gains. The strong U.S. dollar has had a negative impact on earnings, particularly for larger companies with more foreign currency exposure. Globally, China’s economy is decelerating and there are concerns that real estate and stock market speculation have reached the “bubble” stage. Russia is in recession due to economic sanctions and the precipitous decline in energy prices. Greece is the headline grabber as it stumbles toward default and possible exit from the European Union. These divergent economic paths have elevated market volatility. |

| | |

| ■ | In the first six months of 2015, the information technology, telecommunication services and materials sectors produced the Fund’s best returns relative to its benchmark. Apple Inc. was a significant contributor driven by stronger than expected quarterly results and anticipation of a successful launch of its iWatch. Apple’s revenues grew more quickly than expected, primarily driven by the success of its most recent iPhone release. We sold the position as its valuations relative to our dividend projections became less competitive. Luxury goods company LVMH Moet Hennessy Louis Vuitton SE outperformed as growth accelerated following a slowdown in 2014. The repositioning of the Louis Vuitton brand is working with nearly all divisions returning to profitability. Currency pressure created a tailwind and LMVH has managed well through the turbulent environment and we see potential for strong dividend growth ahead. |

| | |

| ■ | The Fund’s weakest sectors relative to its benchmark were utilities, industrials and consumer staples. Wal-Mart Stores Inc. was the Fund’s largest detractor in the period as sales growth was tepid and increased investments in labor and e-commerce resulted in profit margin pressure. We believe the company’s investments will result in improved sales and cash flow, and that the stock is significantly undervalued. Utility sector stocks have been pressured this year by rising interest rates and the expectation of further rate increases. Edison International was the Fund’s weakest utility holding in the period, due to a proposal by a consumer advocacy group to throw out the already-approved settlement on the San Onofre nuclear plant investigation. We have already factored the settlement into our valuation of the company, and don’t believe that reopening the case will lead to a worse outcome or a different assessment of the company’s value. It could, however, take longer to come to a similar conclusion and cause more volatility in the stock price. |

| | |

| ■ | As we look to the second half of 2015, we expect volatility to remain elevated. The Federal Reserve continues to keep investors guessing as to when it will increase short-term rates. Additionally, we believe the divergence of global economic growth will keep investor angst at high levels. However, it is difficult for us to envision an end to domestic economic improvement and positive market returns with the consumer gaining confidence, housing activity strengthening and interest rates at abnormally low levels. We believe well thought out stock selection will be even more important for the balance of the year as, broadly speaking, valuations appear stretched. |

| PAGE 10 |

| |

| 2015 Semi-Annual Report |

| WESTCORE BLUE CHIP DIVIDEND FUND (continued) | (UNAUDITED) |

Stock Performance

(for the year ended 6/30/15)

| | | | | |

| 5 Highest | Average

Weight | Contribution

to Return |

| Apple Inc. | 1.39 | % | 0.68 | % |

| LVMH Moet Hennessy Louis Vuitton SE | 1.23 | | 0.57 | |

| Pfizer Inc. | 3.54 | | 0.36 | |

| Sage Group PLC | 2.22 | | 0.33 | |

| Reckitt Benckiser Group plc | 1.15 | | 0.32 | |

| | | | | |

| 5 Lowest | | | | |

| QUALCOMM Inc. | 2.14 | % | -0.45 | % |

| Mattel Inc. | 3.14 | | -0.46 | |

| Edison International | 3.49 | | -0.47 | |

| Royal Dutch Shell PLC | 3.01 | | -0.50 | |

| Wal-Mart Stores Inc. | 3.43 | | -0.56 | |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 30 for a description of the methodology used to construct this chart.

Top Ten Holdings

(as of 6/30/15)

| | | |

| Kimberly-Clark Corp. | 3.5 | % |

| McDonald’s Corp. | 3.5 | |

| Novartis AG | 3.5 | |

| Sodexo | 3.5 | |

| Koninklijke DSM NV | 3.4 | |

| Target Corp. | 3.4 | |

| AbbVie Inc. | 3.4 | |

| Allianz SE | 3.4 | |

| British American Tobacco PLC | 3.4 | |

| Occidental Petroleum Corp. | 3.4 | |

| Total (% of Net Assets) | 34.4 | % |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding.

Notice Regarding Benchmark Change

Effective with the June 30, 2015 semi-annual report, the Westcore Board of Trustees has approved a benchmark change for the Westcore Blue Chip Dividend Fund from the S&P 500® Index to the Russell Developed Large-Cap Index. The new benchmark index reflects the global investment objective of the Fund. We will continue to present the S&P 500® Index for historical comparison purposes to the extent required.

Portfolio Characteristics

(as of 6/30/15)

| | | |

| | Westcore Blue Chip

Dividend Fund | Russell Developed

Large-Cap Index |

| Weighted Average Market Capitalization ($ Bil) | $88.2 | $87.6 |

| Price/Cash Flow (1 year trailing) | 12.9x | 14.0x |

| Price/Book Value | 4.0x | 3.2x |

| Price/Earnings (1 year trailing) | 17.4x | 18.8x |

| Beta | 0.8 | 1.0 |

| Number of Holdings | 30 | 2,426 |

| Portfolio Turnover Rate (1 year trailing) | 40% | — |

Please see definition of terms beginning on page 30.

Sector Allocation

(as of 6/30/15)

| | | | | | | |

| | Westcore Blue Chip

Dividend Fund | Russell Developed

Large-Cap Index | Relative Weights

Under | Over |

| Consumer Discretionary | 13.8 | % | 20.1 | % | -6.3 | % |

| Consumer Staples | 16.8 | | 10.3 | | 6.5 | |

| Energy | 9.9 | | 1.5 | | 8.4 | |

| Financials | 6.8 | | 20.2 | | -13.4 | |

| Health Care | 17.0 | | 4.5 | | 12.5 | |

| Industrials | 6.1 | | 19.0 | | -12.9 | |

| Information Technology | 16.6 | | 11.4 | | 5.2 | |

| Materials | 3.4 | | 5.7 | | -2.3 | |

| Telecommunication Services | 3.4 | | 4.9 | | -1.5 | |

| Utilities | 5.9 | | 2.4 | | 3.5 | |

| ST Investments/Net Other Assets | 0.3 | | 0.0 | | 0.3 | |

| Total (% of Net Assets) | 100.0 | % | 100.0 | % | | |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

Market Capitalization

(as of 6/30/15)

| | | | | |

Market Cap Range ($ Bil) | Percent of Total Equities | | Number of Holdings |

| $0 - $10 | 19.2 | % | | 6 |

| $10 - $50 | 27.0 | | | 8 |

| $50 - $100 | 17.1 | | | 5 |

| Over $100 | 36.7 | | | 11 |

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| |

| PAGE 11 |

| |

| p: 800.392.CORE (2673) | www.westcore.com |

| WESTCORE MID-CAP VALUE DIVIDEND FUND (WTMCX) | (UNAUDITED) |

Fund Strategy

Investing in medium-sized, dividend-paying companies whose stocks appear to be undervalued.

Fund Management

Troy Dayton, CFA Portfolio Manager |

Derek R. Anguilm, CFA Portfolio Manager |

Mark M. Adelmann, CFA, CPA Portfolio Manager |

Lisa Z. Ramirez, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 28.

Average Annual Total Returns

| | | | | | | | | | | | | | |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

Date |

| Retail Class (WTMCX) | 0.86 | % | 6.61 | % | 17.23 | % | 15.50 | % | 6.64 | % | 9.40 | % | 10/1/1998 |

Russell Midcap® Value Index | 0.41 | | 3.67 | | 19.13 | | 17.73 | | 8.89 | | 10.44 | | |

| Lipper Mid-Cap Value Index | 2.22 | | 3.05 | | 18.75 | | 16.62 | | 8.40 | | 9.91 | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.19%, Net: 1.19%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive certain investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2015 until at least April 30, 2016. The waiver/reimbursement applies so that the ratio of expenses to average net assets, as reported in the Fund’s financial statements, will be no more than 1.25% for the Fund’s Retail Class for such period. Please see the Fund’s Prospectus for more information. This agreement may not be terminated or modified prior to this date without the approval of the Board of Trustees. Without the fee waivers and expense reimbursements, total return figures would have been lower.

Investing in mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

Lisa Z. Ramirez is a registered representative of ALPS Distributors, Inc.

Manager Commentary

| | |

| ■ | The Westcore Mid-Cap Value Dividend Fund outperformed its benchmark, the Russell Midcap® Value Index for the first half of 2015. Although weather-related issues caused a slow start to the year, the U.S. economy has since gained momentum with strong job creation, rising consumer confidence and early signs of wage gains. The strong U.S. dollar has had a negative impact on earnings, particularly for larger companies with more foreign currency exposure. Globally, China’s economy is decelerating and there are concerns that real estate and stock market speculation have reached the “bubble” stage. Russia is in recession due to economic sanctions and the precipitous decline in energy prices. Greece is the headline grabber as it stumbles toward default and possible exit from the European Union. These divergent economic paths have elevated market volatility. |

| | |

| ■ | The energy, utilities and interest rate sensitive sectors were the Fund’s top contributors, relative to its benchmark, in the first half of the year. Avago Technologies Ltd., which designs, develops and supplies analog, mixed-signal and optoelectronic products, outperformed as continued success in its wireless segment lifted results. The company sustained its leadership position as an Apple component supplier, hinted at the potential for increased component sales to Samsung and synergistically integrated Emulex Corp., which it acquired in May. Avago announced its intention to acquire Broadcom Corp., which was received positively. As the upcoming merger would place the company in the large cap space, we sold the Fund’s position. Cinemark Holdings Inc performed well in the first half of the year due to strong ticket and concession sales, as well as continued growth in international markets. We like this motion picture exhibition company’s long-term growth opportunity in Latin American markets as well as the consistent cash generation of the overall business. |

| | |

| ■ | The Fund’s weakest contributors, relative to its benchmark, in the first half of 2015 were the commercial services, transportation and capital goods sectors. Xerox Corp, a business process and document management solutions provider, detracted from performance. Xerox had a difficult second quarter as its financial results revealed weakness in its service segment revenue and in new business signings. Additionally, software implementation costs for the California Medicaid system, which Xerox manages, were higher than expected. While Xerox sentiment remains weak, we believe platform standardization, enhanced cost management, the realization of revenue from its New York Medicaid contract and better aligned sales markets are supportive of the stock near-term. Con-way Inc announced operating results that bested expectations, primarily supported by an improvement in freight operating margins. However, a growing industry truck fleet (increasing supply) is masking the improvements being made and adding volume pressures in the near-term. |

| |

| ■ | As we look to the second half of 2015, we expect volatility to remain elevated. The Federal Reserve continues to keep investors guessing as to when it will increase short-term rates. Additionally, we believe the divergence of global economic growth will keep investor angst at high levels. However, it is difficult for us to envision an end to domestic economic improvement and positive market returns with the consumer gaining confidence, housing activity strengthening and interest rates at abnormally low levels. We believe well thought out stock selection will be even more important for the balance of the year as, broadly speaking, valuations appear stretched. |

| PAGE 12 |

| |

| 2015 Semi-Annual Report |

| WESTCORE MID-CAP VALUE DIVIDEND FUND (continued) | (UNAUDITED) |

Stock Performance

(for the year ended 6/30/15)

| | | | | |

| 5 Highest | Average

Weight | Contribution

to Return |

| Omnicare Inc | 2.39 | % | 0.72 | % |

| Universal Health Services Inc | 2.74 | | 0.63 | |

| Avago Technologies Ltd. | 1.66 | | 0.62 | |

| AmerisourceBergen Corp | 3.09 | | 0.49 | |

| Cinemark Holdings Inc | 1.75 | | 0.40 | |

| | | | | |

| 5 Lowest | | | | |

| Scripps Networks Interactive Inc | 1.76 | % | -0.24 | % |

| Western Digital Corp | 0.59 | | -0.33 | |

| Con-way Inc | 1.78 | | -0.44 | |

| NetApp Inc | 1.81 | | -0.47 | |

| Xerox Corp | 2.01 | | -0.49 | |

Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com.

Please see page 30 for a description of the methodology used to construct this chart.

Top Ten Holdings

(as of 6/30/15)

| | | |

| AmerisourceBergen Corp | 3.2 | % |

| Rock-Tenn Co | 3.0 | |

| UNUM Group | 2.6 | |

| Edison International | 2.5 | |

| Universal Health Services Inc | 2.3 | |

| Goodyear Tire & Rubber Co | 2.3 | |

| Validus Holdings Ltd | 2.3 | |

| WR Berkley Corp | 2.2 | |

| American Water Works Co Inc | 2.2 | |

| Tyson Foods Inc | 2.1 | |

| Total (% of Net Assets) | 24.7 | % |

Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding.

Portfolio Characteristics

(as of 6/30/15)

| | | |

| | Westcore Mid-Cap

Value Dividend Fund | Russell Midcap®

Value Index |

| Weighted Average Market Capitalization ($ Bil) | $10.4 | $11.1 |

| Price/Cash Flow (1 year trailing) | 10.8x | 12.4x |

| Price/Book Value | 2.5x | 2.1x |

| Price/Earnings (1 year trailing) | 15.7x | 17.9x |

| Beta | 1.1 | 1.2 |

| Number of Holdings | 61 | 554 |

| Portfolio Turnover Rate (1 year trailing) | 41% | — |

Please see definition of terms beginning on page 30.

Sector Allocation

(as of 6/30/15)

| | | | | | | |

| | Westcore

Mid-Cap Value

Dividend Fund | Russell Midcap®

Value Index | Relative Weights

Under | Over |

| Consumer Staples | 5.2 | % | 3.4 | % | 1.8 | % |

| Consumer Cyclical | 11.3 | | 8.9 | | 2.4 | |

| Commercial Services | 1.8 | | 4.9 | | -3.1 | |

| Basic Materials | 8.5 | | 7.0 | | 1.5 | |

| Capital Goods | 5.7 | | 5.6 | | 0.1 | |

| Technology | 10.0 | | 9.7 | | 0.3 | |

| Energy | 1.9 | | 10.2 | | -8.3 | |

| Utilities | 8.7 | | 10.9 | | -2.2 | |

| Interest Rate Sensitive | 22.4 | | 20.2 | | 2.2 | |

| Medical/Healthcare | 12.0 | | 6.2 | | 5.8 | |

| REITs | 9.6 | | 12.0 | | -2.4 | |

| Transportation | 1.7 | | 1.0 | | 0.7 | |

| ST Investments/Net Other Assets | 1.2 | | 0.0 | | 1.2 | |

| Total (% of Net Assets) | 100.0 | % | 100.0 | % | | |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations. For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

Market Capitalization

(as of 6/30/15)

Market Cap Range ($ Bil) | Percent of Total Equities | | Number of Holdings |

| $0 - $1 | 0.0 | % | | 0 |

| $1 - $5 | 29.2 | | | 21 |

| $5 - $10 | 28.2 | | | 16 |

| Over $10 | 42.6 | | | 24 |

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| |

| PAGE 13 |

| |

| p: 800.392.CORE (2673) | www.westcore.com |

| WESTCORE SMALL-CAP VALUE DIVIDEND FUND (WTSVX, WISVX) | (UNAUDITED) |

Fund Strategy

Investing primarily in small-cap, dividend paying stocks that appear to be undervalued.

Fund Management

Troy Dayton, CFA Portfolio Manager |

Derek R. Anguilm, CFA Portfolio Manager |

Mark M. Adelmann, CFA, CPA Portfolio Manager |

Lisa Z. Ramirez, CFA Portfolio Manager |

CFA is a trademark owned by CFA Institute.

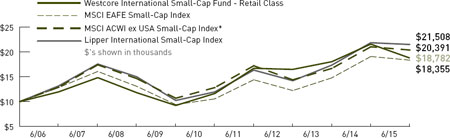

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see index definitions beginning on page 28.

Average Annual Total Returns

| | | | | | | | | | | | | | |

| | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Since

Inception | Inception

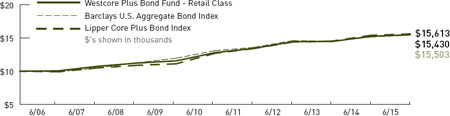

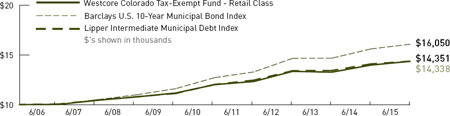

Date |