UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-3373

Westcore Trust

(exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

David T. Buhler, Secretary

Westcore Trust

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: December 31

Date of reporting period: June 30, 2014

Item 1. Reports to Stockholders.

| | |

| | |

| | |

2014 SEMI-ANNUAL REPORT |

| | | |

| | | |

JUNE 30, 2014 | |

| | |

| | Retail | Institutional |

Fund | Class | Class |

|

WESTCORE EQUITY FUNDS |

Westcore Growth Fund | WTEIX | WILGX |

Westcore MIDCO Growth Fund | WTMGX | WIMGX |

Westcore Select Fund | WTSLX | – |

Westcore Small-Cap Growth Fund | WTSGX | WISGX |

Westcore Blue Chip Dividend Fund | WTMVX | WIMVX |

Westcore Mid-Cap Value Dividend Fund | WTMCX | – |

Westcore Small-Cap Value Dividend Fund | WTSVX | WISVX |

Westcore Micro-Cap Opportunity Fund | WTMIX | – |

Westcore International Small-Cap Fund | WTIFX | – |

| | | |

WESTCORE BOND FUNDS |

Westcore Flexible Income Fund | WTLTX | WILTX |

Westcore Plus Bond Fund | WTIBX | WIIBX |

Westcore Colorado Tax-Exempt Fund | WTCOX | – |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Westcore Funds are managed by Denver Investments. |

| |

The mountain logo together with “Westcore Funds Denver Investments” is a registered service mark of Denver Investments. |

|

| SHAREHOLDER LETTER | 1 |

| | |

| FUND OVERVIEWS | |

| | |

| Westcore Growth Fund | 2 |

| | |

| Westcore MIDCO Growth Fund | 4 |

| | |

| Westcore Select Fund | 6 |

| | |

| Westcore Small-Cap Growth Fund | 8 |

| | |

| Westcore Blue Chip Dividend Fund | 10 |

| | |

| Westcore Mid-Cap Value Dividend Fund | 12 |

| | |

| Westcore Small-Cap Value Dividend Fund | 14 |

| | |

| Westcore Micro-Cap Opportunity Fund | 16 |

| | |

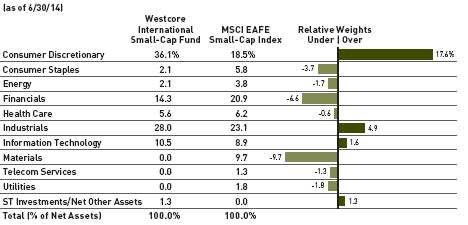

| Westcore International Small-Cap Fund | 18 |

| | |

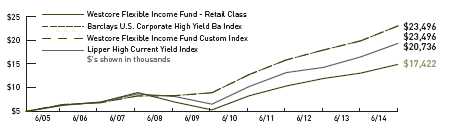

| Westcore Flexible Income Fund | 20 |

| | |

| Westcore Plus Bond Fund | 22 |

| | |

| Westcore Colorado Tax-Exempt Fund | 24 |

| | |

| FUND EXPENSES | 26 |

| | |

| IMPORTANT DISCLOSURES | 28 |

| | |

| FINANCIAL STATEMENTS | 33 |

| | |

| Statements of Investments | 34 |

| | |

| Statements of Assets and Liabilities | 64 |

| | |

| Statements of Operations | 66 |

| | |

| Statements of Changes in Net Assets | 68 |

| | |

| Financial Highlights | 72 |

| | |

| Notes to Financial Statements | 82 |

INTENTIONALLY LEFT BLANK

DEAR FELLOW SHAREHOLDER:

Both stocks and bonds continued their rallies through the first half of 2014. The S&P 500® Index posted a 7.14% increase and 10-year Treasury note prices rallied due to a decrease in interest rates from a 3.04% yield at the beginning of the year to 2.53% on June 30.

The U.S. equity market shrugged off a significant downward revision of first quarter 2014 economic growth, primarily attributing the decrease to severe weather in the period. The equity market appeared to focus on positive leading economic indicators such as the ISM® Manufacturing report and on improving readings from the Conference Board’s Leading Economic Indicators Index®. Both the Dow Jones Industrial Average and the S&P 500® Index achieved record highs in the first half of 2014 as U.S. equities finished higher for the sixth consecutive quarter. While all areas of U.S. equities increased in the period, large-cap stocks took over market leadership. A rotation to large cap leadership is typical as a bull market extends.

The bond market also rallied in the first half of 2014, quickly adjusting to the tapering of quantitative easing by the Federal Reserve and indicating that bond investors expect inflationary pressures to remain muted throughout the economy. Interest rates, as reflected by the 10-year U.S. Treasury note, started the year at the high of 3.04% and fell by a full 0.6% to a multi-year low of 2.44% before ticking back up to 2.53% at the end of June. The Westcore fixed income funds performed well in this environment.

It is relatively unusual for the equity and bond markets to have moved in tandem for such an extended period. With the valuations of both asset classes at or near historically high levels, we believe expert fundamental analysis and diversification are the keys to success. Your Westcore investment teams place a very high priority on deep, proprietary fundamental research and portfolio construction. Also, the diversity of strategies offered by the Westcore Fund family allows you to have a broad variety of actively managed strategies in which to build your investment program.

We thank you for your continued confidence in the Westcore Funds family. Please let us know if you have any questions or comments.

Diversification does not eliminate risk.

John W. Zimmerman is a registered representative of ALPS Distributors, Inc.

CFA is a trademark owned by the CFA Institute.

The Shareholder Letter and the Manager Commentaries included in this shareholder report contain certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

Fund Strategy

Investing primarily in equity securities of large companies with growth potential.

Fund Management

Ross G. Moscatelli, CFA Portfolio Manager

Craig W. Juran, CFA Portfolio Manager

CFA is a trademark owned by CFA Institute.

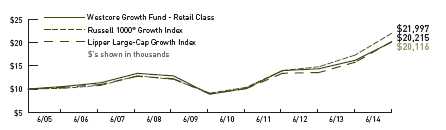

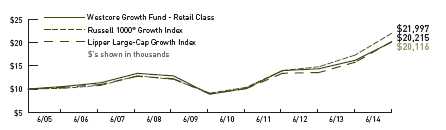

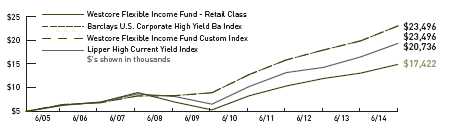

Cumulative Returns

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see pages 28 and 29 for index definitions.

Average Annual Total Returns

| | | | | | | | | | |

| | | | | | | | | | | | Since | Inception |

| | 6 Months | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | Date |

| Retail Class (WTEIX) | 1.50% | | 24.16% | | 12.90% | | 17.73% | | 7.24% | | 9.07% | 6/1/1988 |

| Institutional Class | | | | | | | | | | | | |

| (WILGX) | 1.55 | | 24.38 | | 13.09 | | 17.90 | | 7.34 | | 9.11 | 9/28/2007 |

| Russell 1000® | | | | | | | | | | | | |

| Growth Index | 6.31 | | 26.92 | | 16.26 | | 19.24 | | 8.20 | | 10.06 | |

| Lipper Large-Cap | | | | | | | | | | | | |

| Growth Index | 4.21 | | 28.07 | | 14.70 | | 17.65 | | 7.29 | | 9.14 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.09%, Net: 1.09%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.14%, Net: 0.89%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Since inception performance figures for the index are from the inception of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392. CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2014 until at least April 30, 2015, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.15% for the Fund’s Retail Class for such period. In addition, the Adviser has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse Fund level Other Expenses for the Institutional Class in the same proportion as the Retail Class waivers/reimbursements as well as reimburse the Institutional class-specific Other Expenses until at least April 30, 2015. This agreement may not be terminated or modified prior to this date except with the approval of the Board of Trustees.

Craig W. Juran is a registered representative of ALPS Distributors, Inc.

Investors rode a wave of optimism into 2014 as robust equity markets, an improving housing market and an expanding economy produced a confidence not seen in years. Economic growth came to a standstill in the first quarter, as one of the worst winters on record forced travel delays, stopped construction activity, shut down shopping malls and closed many schools. Additionally, conflict between Russia and Ukraine and a potential civil war in Iraq created uncertainty which led to fear and nervousness in the markets. As sentiment changed, many high growth and momentum stocks underperformed significantly as investors gravitated towards more predictable business models. Despite fluctuating sentiment in the first half of the year, markets advanced higher while digesting fear, volatility and nervousness which we believe is a sign of resilient markets.

For the first six months of 2014, the Westcore Growth Fund underperformed its benchmark, the Russell 1000® Growth Index. Reduced interest rates caused investors to seek dividend-yielding stocks with steady cash flows in favor of those with accelerating growth and earnings momentum. This negatively impacted the Fund’s return relative to the benchmark as we emphasize companies that are fast growing and have increasing earnings.

During the first six months of the year, the Fund’s performance compared to its benchmark was enhanced by holdings in the information technology and industrial sectors. The Fund’s strongest contributors were Apple Inc., EOG Resources Inc. and United Rentals Inc. After underperforming in 2013, Apple regained investors’ confidence delivering strong quarterly results in April. It also announced a massive increase in its buyback authorization, a 7-for-1 stock split and another dividend increase. Energy sector companies like EOG benefited from uncertainty in Ukraine and Iraq which supported oil prices. Investors also recognized EOG’s strong performance and substantial growth opportunities. United Rentals performed well as demand for commercial construction equipment accelerated and the pricing environment improved.

The Fund’s weakest sectors relative to the benchmark during the first six months of 2014 were health care, financials and energy. Fund holdings in Amazon.com Inc., Nu Skin Enterprises Inc., and NetSuite Inc. were its largest detractors. Shares of Amazon were sold off early in 2014 as investors questioned its valuation and pace of profit growth. We sold the Fund’s position in Amazon, but remain intrigued in its long-term prospects. NetSuite shares were sold off as investors rotated out of higher growth and earnings momentum companies into more defensive companies. A sell-off of Nu Skin ensued at the beginning of 2014 as the Chinese Government opened an investigation into Nu Skin’s business practices. As China was a major engine for Nu Skin’s growth, we opted to sell the Fund’s position amidst the uncertainty, but we continue to monitor the situation.

The fundamental backdrop for equity markets, in our opinion, remains positive. Central banks around the world are looking at ways to facilitate faster economic growth in order to alleviate significant unemployment/underemployment. Additionally, we believe interest rates should remain low (although with a bias to increase) for the foreseeable future as investors’ appetite for fixed income securities remains high due to the aging populations of most developed economies. Slow but improving economic growth, along with relatively low interest rates, should provide a backdrop for improving earnings growth in the second half of 2014.

| PAGE 2 |

|

| Stock Performance |

| (for the six months ended 6/30/14) | | |

| | Average | | Contribution |

| 5 Highest | Weight | | to Return |

| Apple Inc. | 6.13% | | 1.07% |

| EOG Resources Inc. | 1.66 | | 0.64 |

| United Rentals Inc. | 1.84 | | 0.56 |

| Delta Air Lines Inc. | 1.59 | | 0.55 |

| NXP Semiconductors N.V. | 1.12 | | 0.47 |

| | | | |

| 5 Lowest | | | |

| Twitter Inc. | 0.17% | | -0.23% |

| Bristol-Myers Squibb Co. | 1.68 | | -0.25 |

| NetSuite Inc. | 0.18 | | -0.27 |

| Nu Skin Enterprises Inc. | 0.08 | | -0.35 |

| Amazon.com Inc. | 1.33 | | -0.49 |

| | | | |

| Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com. |

| |

| Please see page 30 for a description of the methodology used to construct this chart. |

| | | | |

| | | | |

| Top Ten Holdings |

| (as of 6/30/14) | | | |

| Apple Inc. | | | 6.9% |

| Microsoft Corp. | | | 3.7 |

| Facebook Inc. | | | 3.3 |

| PPG Industries Inc. | | | 2.9 |

| Cummins Inc. | | | 2.8 |

| Gilead Sciences Inc. | | | 2.7 |

| Google Inc. Class A | | | 2.4 |

| Google Inc. Class C | | | 2.4 |

| Union Pacific Corp. | | | 2.3 |

| Fortinet Inc. | | | 2.3 |

| Total (% of Net Assets) | | | 31.7% |

| | | | |

| Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| | | | |

| Portfolio Characteristics |

| (as of 6/30/14) | | | |

| | Westcore | | Russell 1000® |

| | Growth Fund | | Growth Index |

| Weighted Average Market Capitalization ($ Bil) | $99.0 | | $102.2 |

| Price/Earnings (1 year trailing) | 21.2x | | 22.1x |

| EPS Growth (3 year historical) | 20.7% | | 14.8% |

| Beta | 1.1 | | 1.0 |

| Number of Holdings | 53 | | 672 |

| Portfolio Turnover Rate | 81% | | — |

| | | | |

| Please see page 30 for definition of terms. | | | |

| | | | |

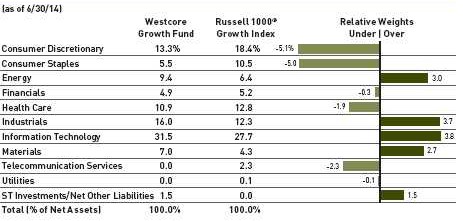

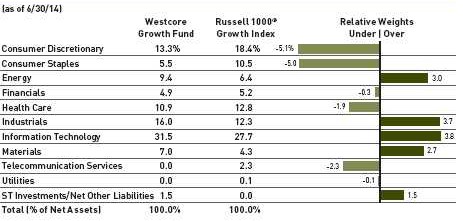

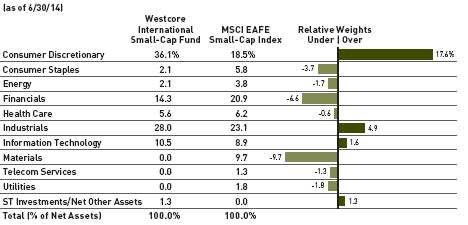

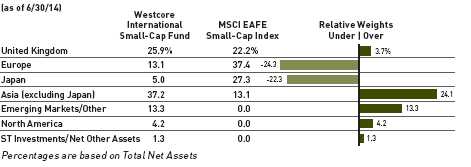

| Sector Allocation |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds. Sector designations for one Fund may be different than another Fund’s sector designations.

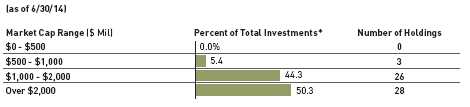

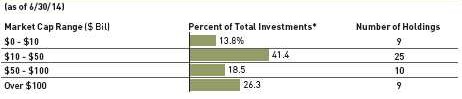

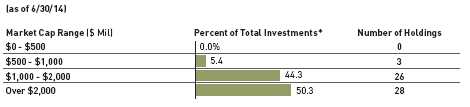

Market Capitalization

* Total Investments for this chart excludes short-term investments, including money market mutual funds.

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| Fund Strategy |

| | |

| Investing in a diversified portfolio of equity securities of primarily medium-sized companies with |

| growth potential. | |

| | |

| Fund Management |

| | |

| Mitch S. Begun, CFA Lead Portfolio Manager | Brian C. Fitzsimons, CFA Portfolio Manager |

| F. Wiley Reed, CFA Lead Portfolio Manager | Jeffrey J. Loehr, CFA Portfolio Manager |

| Adam C. Bliss Portfolio Manager | |

| | |

| CFA is a trademark owned by CFA Institute. | |

| | |

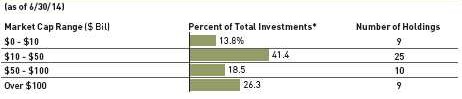

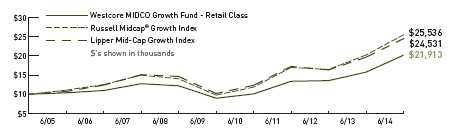

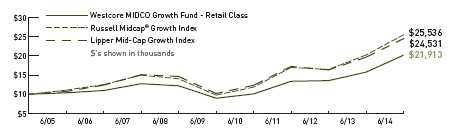

| Cumulative Returns |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see pages 28 and 29 for index definitions.

| Average Annual Total Returns |

| | | | | | | | | | | | Since | Inception |

| | 6 Months | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | Date |

| Retail Class (WTMGX) | 5.11% | | 31.60% | | 10.80% | | 19.75% | | 8.16% | | 10.95% | 8/1/1986 |

| Institutional Class | | | | | | | | | | | | |

| (WIMGX) | 5.34 | | 31.91 | | 11.03 | | 19.94 | | 8.27 | | 10.99 | 9/28/2007 |

| Russell Midcap® | | | | | | | | | | | | |

| Growth Index | 6.51 | | 26.04 | | 14.54 | | 21.16 | | 9.83 | | 10.69 | |

| Lipper Mid-Cap | | | | | | | | | | | | |

| Growth Index | 4.30 | | 24.62 | | 12.43 | | 19.19 | | 9.39 | | 9.93 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.05%, Net: 1.05%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.95%, Net: 0.88%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Since inception performance figures for the index are from the inception of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2014 until at least April 30, 2015, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.15% for the Fund’s Retail Class for such period. In addition, the Adviser has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse Fund level Other Expenses for the Institutional Class in the same proportion as the Retail Class waivers/reimbursements as well as reimburse the Institutional class-specific Other Expenses until at least April 30, 2015. This agreement may not be terminated or modified prior to this date except with the approval of the Board of Trustees.

Investing in mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

For the first half of 2014, the Westcore MIDCO Growth Fund underperformed its benchmark, the Russell Midcap® Growth Index.

Equity markets finished the first half of the year comfortably positive, although the second quarter was characterized by a sharp sell-off of growth stocks in April, followed by a rebound throughout May and June. While we are disappointed in the Fund’s performance for the period, we are not surprised to see the Fund underperform in the period as higher growth stocks suffered disproportionately. The Fund consists of companies that we believe have disruptive technologies and services that often show higher growth characteristics. We feel very good about the Fund’s positioning going forward, given that valuations have corrected significantly in many of the higher growth areas of the market.

The three sectors that contributed most to the Fund’s performance relative to its benchmark in the period were consumer discretionary, materials and financials. The Fund’s best-performing stock in the period was FireEye Inc., within the information technology sector. FireEye is emerging as a strong player in the market for next-generation security solutions with a product line that includes systems for web, email and file security, as well as malware analysis. The company announced a large acquisition in the first quarter to help complement its existing advanced persistent threat (APT) capabilities. Keurig Green Mountain, Inc., the maker of the Keurig single-serve coffee system, was the Fund’s second-best performer in the period. The company reported strong K-cup sales momentum and major new license partner wins ahead of the upcoming Keurig 2.0 product launch in the fall of this year. Within the materials sector, U.S. Silica Holdings Inc., a company that provides frac sand largely used in oil and gas recovery, was the Fund’s strongest performer. Robust demand from customers drove frac sand pricing higher after a prolonged period of pressure. As of the end of the first half of 2014, we own positions in all three companies.

The three sectors that detracted most from the Fund’s performance relative to its benchmark in the period were energy, health care and industrials. The Fund’s worst-performing stock was Lululemon Athletica Inc., within the consumer discretionary sector. This high-end athletic apparel brand retailer underperformed in the period as sales trends remained weak despite management efforts to improve supply chain and overall product quality issues. We currently continue to hold the stock as we believe strong brand equity exists. We see positive product catalysts coming in the fall which, in our opinion, will reignite sales growth. Within the industrials sector, both DigitalGlobe Inc. and Kansas City Southern were significant detractors to the Fund’s performance in the period. DigitalGlobe, a provider of imaging satellites, reported disappointing first quarter results and a subpar outlook as demand from emerging markets was weak. Kansas City Southern, a railroad network company, experienced delayed growth opportunities that are taking longer to materialize than we expected. We exited our positions in both DigitalGlobe and Kansas City Southern in the period.

As of the end of the second quarter of 2014, the Fund was overweighted primarily in the health care and materials sectors, and underweighted primarily in the financials and consumer staples sectors.

| PAGE 4 |

|

| Stock Performance |

| (for the six months ended 6/30/14) | | |

| | Average | | Contribution |

| 5 Highest | Weight | | to Return |

| FireEye Inc. | 1.12% | | 0.78% |

| Keurig Green Mountain Inc. | 1.22 | | 0.73 |

| U.S. Silica Holdings Inc. | 1.26 | | 0.70 |

| Actavis PLC | 1.80 | | 0.52 |

| Pioneer Natural Resources Co. | 1.90 | | 0.51 |

| | | | |

| 5 Lowest | | | |

| DigitalGlobe Inc. | 0.82% | | -0.25% |

| Twitter Inc. | 1.06 | | -0.29 |

| PriceSmart Inc. | 0.89 | | -0.30 |

| Kansas City Southern | 0.20 | | -0.31 |

| Lululemon Athletica Inc. | 1.31 | | -0.57 |

| |

| Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com. |

| |

| Please see page 30 for a description of the methodology used to construct this chart. |

| | | | |

| Top Ten Holdings |

| (as of 6/30/14) | | | |

| Mead Johnson Nutrition Co. | | | 2.2% |

| Perrigo Co. PLC | | | 2.1 |

| Actavis PLC | | | 2.1 |

| Ingersoll-Rand PLC | | | 2.0 |

| Varian Medical Systems Inc. | | | 2.0 |

| BorgWarner Inc. | | | 2.0 |

| Keurig Green Mountain, Inc. | | | 1.9 |

| Alexion Pharmaceuticals Inc. | | | 1.9 |

| United Continental Holdings, Inc. | | | 1.9 |

| Rockwood Holdings Inc. | | | 1.9 |

| Total (% of Net Assets) | | | 20.0% |

| |

| Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| Portfolio Characteristics |

| (as of 6/30/14) | | | |

| | Westcore MIDCO | | Russell Midcap® |

| | Growth Fund | | Growth Index |

| Weighted Average Market Capitalization ($ Bil) | $13.2 | | $12.6 |

| Price/Earnings (1 year trailing) | 28.1x | | 25.5x |

| EPS Growth (3 year historical) | 21.1% | | 16.3% |

| Beta | 1.2 | | 1.0 |

| Number of Holdings | 73 | | 544 |

| Portfolio Turnover Rate | 57% | | — |

| | | | |

| Please see page 30 for definition of terms. | | | |

| | | | |

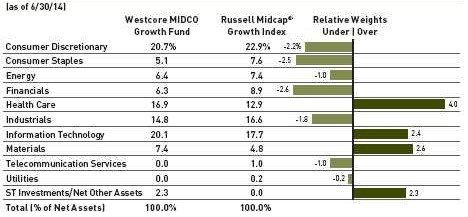

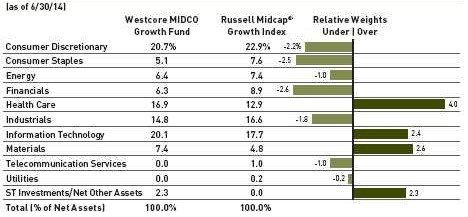

| Sector Allocation |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations.

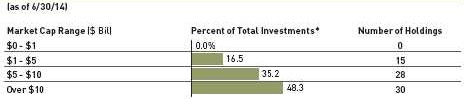

*Total Investments for this chart excludes short-term investments, including money market mutual funds.

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| Fund Strategy |

| Investing primarily in the common stock of a limited number of medium-sized companies selected for their growth potential. |

| | |

| Fund Management |

| | |

| Mitch S. Begun, CFA Lead Portfolio Manager | Brian C. Fitzsimons, CFA Portfolio Manager |

| F. Wiley Reed, CFA Lead Portfolio Manager | Jeffrey J. Loehr, CFA Portfolio Manager |

| Adam C. Bliss Portfolio Manager | |

| | |

| CFA is a trademark owned by CFA Institute. | |

| | |

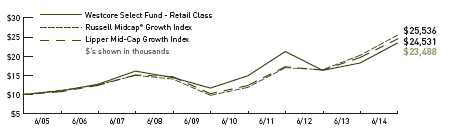

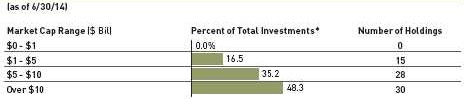

| Cumulative Returns |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see pages 28 and 29 for index definitions.

| Average Annual Total Returns |

| | | | | | | | | | | | Since | Inception |

| | 6 Months | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | Date |

| Retail Class (WTSLX) | 2.85% | | 28.68% | | 3.39% | | 14.99% | | 8.91% | | 12.10% | 10/1/1999 |

| Russell Midcap® | | | | | | | | | | | | |

| Growth Index | 6.51 | | 26.04 | | 14.54 | | 21.16 | | 9.83 | | 7.11 | |

| Lipper Mid-Cap | | | | | | | | | | | | |

| Growth Index | 4.30 | | 24.62 | | 12.43 | | 19.19 | | 9.39 | | 6.27 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.08%, Net: 1.08%

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2014 until at least April 30, 2015, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.15% for the Fund’s Retail Class for such period. This agreement may not be terminated or modified prior to this date except with the approval of the Board of Trustees.

Investing in mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Manager Commentary

For the first half of 2014, the Westcore Select Fund underperformed its benchmark, the Russell Midcap® Growth Index.

Equity markets finished the first half of the year comfortably positive, although the second quarter was characterized by a sharp sell-off of growth stocks in April, followed by a rebound throughout May and June. While we are disappointed in the Fund’s performance for the period, we are not surprised to see the Fund underperform in the period as higher growth stocks suffered disproportionately. The Fund consists of companies that we believe have disruptive technologies and services that often show higher growth characteristics. We feel very good about the Fund’s positioning going forward, given that valuations have corrected significantly in many of the higher growth areas of the market.

The three sectors that contributed most to the Fund’s performance relative to its benchmark in the first half of the year were consumer discretionary, consumer staples and financials. The Fund’s best-performing stock in the period was FireEye Inc., within the information technology sector. FireEye is emerging as a strong player in the market for next-generation security solutions with a product line that includes systems for web, email and file security, as well as malware analysis. The company announced a large acquisition in the first quarter to help complement its existing advanced persistent threat (APT) capabilities. Pioneer Natural Resources Co., an energy exploration and production company, was the Fund’s second-best performer in the period. It continued to have very good well results in the Permian Basin in West Texas and is managing costs well. In addition, Pioneer is looking to export some of its condensate (natural gas liquid) production in the Eagleford Shale in South Texas. Under Armour Inc., a branded athletic apparel and footwear company in the consumer discretionary sector, performed well in the period as accelerating sales and profits continued to indicate larger domestic and global distribution opportunities. As of the end of the first half of 2014, we own positions in all three companies.

The three sectors that detracted most from the Fund’s performance relative to its benchmark in the period were health care, industrials and materials. The Fund’s worst-performing stock was Lululemon Athletica Inc., within the consumer discretionary sector. This high-end athletic apparel brand retailer underperformed in the period as sales trends remained weak despite management efforts to improve supply chain and overall product quality issues. We currently continue to hold the stock as we believe strong brand equity exists. We see positive product catalysts coming in the fall which, in our opinion, will reignite sales growth. Within the industrials sector, both DigitalGlobe Inc. and Kansas City Southern were significant detractors to the Fund’s performance in the period. DigitalGlobe, a provider of imaging satellites, reported disappointing first quarter results and a subpar outlook as demand from emerging markets was weak. Kansas City Southern, a railroad network company, experienced delayed growth opportunities that are taking longer to materialize than we expected. We exited our positions in both DigitalGlobe and Kansas City Southern in the period.

As of the end of the first half of 2014, compared to the benchmark, the Fund was overweighted primarily in the information technology and health care sectors, and underweighted primarily in the financials and consumer discretionary sectors.

| PAGE 6 |

|

| Stock Performance |

| (for the six months ended 6/30/14) | | |

| | Average | | Contribution |

| 5 Highest | Weight | | to Return |

| FireEye Inc. | 1.57% | | 1.05% |

| Pioneer Natural Resources Co. | 3.35 | | 0.89 |

| Under Armour Inc. | 2.73 | | 0.81 |

| Pandora Media Inc. | 2.71 | | 0.72 |

| TripAdvisor Inc. | 2.67 | | 0.69 |

| | | | |

| 5 Lowest | | | |

| DigitalGlobe Inc. | 1.72% | | -0.49% |

| Clovis Oncology Inc. | 0.98 | | -0.53 |

| Fortune Brands Home & | | | |

| Security, Inc. | 1.82 | | -0.54 |

| Kansas City Southern | 0.40 | | -0.60 |

| Lululemon Athletica Inc. | 2.56 | | -1.09 |

| |

| Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com. |

| |

| Please see page 30 for a description of the methodology used to construct this chart. |

| | | | |

| | | | |

| Top Ten Holdings |

| (as of 6/30/14) | | | |

| Mead Johnson Nutrition Co. | | | 4.3% |

| Affiliated Managers Group Inc. | | | 3.8 |

| Perrigo Co. PLC | | | 3.7 |

| Wynn Resorts, Ltd. | | | 3.6 |

| BorgWarner Inc. | | | 3.5 |

| Pandora Media Inc. | | | 3.5 |

| United Continental Holdings, Inc. | | | 3.4 |

| Ingersoll-Rand PLC | | | 3.3 |

| Amphenol Corp. | | | 3.3 |

| Rockwood Holdings Inc. | | | 3.3 |

| Total (% of Net Assets) | | | 35.7% |

| |

| Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| Portfolio Characteristics |

| (as of 6/30/14) | | | |

| | Westcore | | Russell Midcap® |

| | Select Fund | | Growth Index |

| Weighted Average Market Capitalization ($ Bil) | $13.6 | | $12.6 |

| Price/Earnings (1 year trailing) | 27.8x | | 25.5x |

| EPS Growth (3 year historical) | 25.2% | | 16.3% |

| Beta | 1.3 | | 1.0 |

| Number of Holdings | 32 | | 544 |

| Portfolio Turnover Rate | 76% | | — |

| | | | |

| Please see page 30 for definition of terms. | | | |

| | | | |

| Sector Allocation |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations.

Market Capitalization

* Total Investments for this chart excludes short-term investments, including money market mutual funds.

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| Fund Strategy |

| Investing in a diversified portfolio of equity securities of primarily small-sized companies with |

| growth potential. | |

| | |

| Fund Management |

| Mitch S. Begun, CFA Lead Portfolio Manager | Brian C. Fitzsimons, CFA Portfolio Manager |

| F. Wiley Reed, CFA Lead Portfolio Manager | Jeffrey J. Loehr, CFA Portfolio Manager |

| Adam C. Bliss Portfolio Manager | |

| | |

| CFA is a trademark owned by CFA Institute. | |

| | |

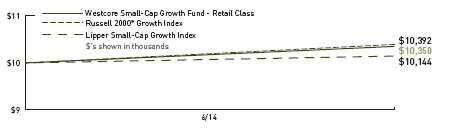

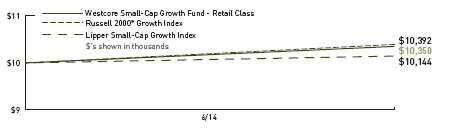

| Cumulative Returns |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see pages 28 and 29 for index definitions.

| Average Annual Total Returns |

| | | | | | | | | | | | Since | Inception |

| | 6 Months | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | Date |

| Retail Class (WTSGX) | 2.17% | | — | | — | | — | | — | | 3.50% | 12/20/2013 |

| Institutional Class | | | | | | | | | | | | |

| (WISGX) | 2.27 | | — | | — | | — | | — | | 3.60 | 12/20/2013 |

| Russell 2000® | | | | | | | | | | | | |

| Growth Index | 2.21 | | — | | — | | — | | — | | 3.92 | |

| Lipper Small-Cap | | | | | | | | | | | | |

| Growth Index | 0.04 | | — | | — | | — | | — | | 1.44 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 3.26%, Net: 1.30%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 3.11%, Net: 1.15%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Since inception performance figures for the index are from the inception of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. The performance data quoted does not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 90 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2014 until at least April 30, 2015, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.30% for the Fund’s Retail Class for such period. In addition, the Adviser has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse Fund level Other Expenses for the Institutional Class in the same proportion as the Retail Class waivers/reimbursements as well as reimburse the Institutional class-specific Other Expenses until at least April 30, 2015. This agreement may not be terminated or modified prior to this date except with the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds. NEW FUND RISK: There can be no assurance that the Fund will grow to or maintain an economically viable size. There may be limited or no performance history for investors to evaluate.

Manager Commentary

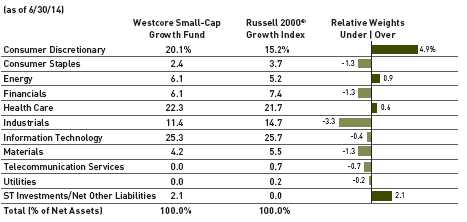

For the first half of 2014, the Westcore Small-Cap Growth Fund slightly underperformed its benchmark, the Russell 2000® Growth Index.

Equity markets finished the first half of the year comfortably positive, although the second quarter was characterized by a sharp sell-off of growth stocks in April, followed by a rebound throughout May and June. While we are disappointed that the Fund’s performance lagged the benchmark slightly for the period, we are not surprised as higher growth stocks suffered disproportionately. The Fund consists of companies that we believe have disruptive technologies and services that often show higher growth characteristics. We feel very good about the Fund’s positioning going forward, particularly given that valuations have corrected significantly in many of the higher growth areas of the market.

The three sectors that contributed most to the Fund’s performance relative to its benchmark in the first half of the year were health care, materials and industrials. The Fund’s best-performing stock in the period was biotechnology company InterMune, Inc., which announced successful clinical trial results for a drug to treat Idiopathic Pulmonary Fibrosis. Pacira Pharmaceuticals, Inc., also within the health care sector, was another significant contributor as it continued to show a strong sales trajectory for its post-surgical pain management drug Exparel®. Within the materials sector, U.S. Silica Holdings Inc., a company that provides frac sand largely used in oil and gas recovery, was the Fund’s strongest performer. Robust demand from customers drove frac sand pricing higher after a prolonged period of pressure. We continue to maintain positions in Pacira and U.S. Silica; however, we exited InterMune in the second quarter.

The three sectors that detracted most to the Fund’s performance relative to its benchmark in the period were consumer staples, financials and information technology. The Fund’s worst-performing stock was Natural Grocers by Vitamin Cottage Inc., within the consumer staples sector. This natural and organic retailer underperformed after reporting weaker-than-expected sales results in the second quarter, largely attributed to an increase in regional competitor new store openings. As of period-end we continued to hold the position as we believe its differentiated model within the natural and organic industry will gain market share in the long term. PriceSmart Inc., also within the consumer staples sector, was a drag on performance in the period. PriceSmart, an operator of warehouse clubs in Latin America and the Caribbean, reported weaker-than-expected sales results in the first half of the year, driven by regional cannibalization from the company’s own new store openings. We believe these impacts will be short-lived and remain excited about the company’s dominant market position and ultimate unit growth opportunity in new and existing regions. Imperva, Inc., a security software provider in the information technology sector, announced disappointing results in the second quarter as it suffered from execution issues and potential competitive threats. We exited the position in the period.

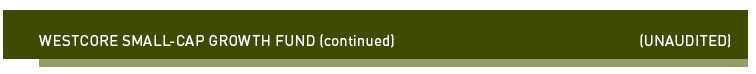

As of the end of the first half of 2014, compared to the benchmark, the Fund was overweighted primarily in the consumer discretionary and energy sectors, and underweighted primarily in the industrials and materials sectors.

| PAGE 8 |

|

| Stock Performance |

| (for the six months ended 6/30/14) | | |

| | Average | | Contribution |

| 5 Highest | Weight | | to Return |

| InterMune, Inc. | 0.56% | | 1.10% |

| FireEye Inc. | 0.60 | | 1.07 |

| Pacira Pharmaceuticals, Inc. | 1.62 | | 0.87 |

| U.S. Silica Holdings Inc. | 1.50 | | 0.83 |

| Exact Sciences Corp. | 1.50 | | 0.71 |

| | | | |

| 5 Lowest | | | |

| PriceSmart Inc. | 1.19% | | -0.37% |

| Imperva, Inc. | 0.76 | | -0.38 |

| Clovis Oncology Inc. | 1.02 | | -0.39 |

| Cornerstone Ondemand, Inc. | 0.85 | | -0.43 |

| Natural Grocers by Vitamin | | | |

| Cottage Inc. | 1.29 | | -0.93 |

| |

| Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com. |

| | | | |

| Please see page 30 for a description of the methodology used to construct this chart. |

| | | | |

| | | | |

| Top Ten Holdings |

| (as of 6/30/14) | | | |

| IMAX Corp. | | | 2.2% |

| NCI Building Systems Inc. | | | 2.1 |

| Grand Canyon Education Inc. | | | 2.1 |

| Pacira Pharmaceuticals, Inc. | | | 2.1 |

| Lennox International Inc. | | | 2.1 |

| OraSure Technologies Inc. | | | 2.1 |

| Deckers Outdoor Corp. | | | 2.1 |

| PolyOne Corp. | | | 2.1 |

| InvenSense Inc. | | | 2.0 |

| Evercore Partners Inc. | | | 2.0 |

| Total (% of Net Assets) | | | 20.9% |

| |

| Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| Portfolio Characteristics |

| (as of 6/30/14) | | | |

| | Westcore Small-Cap | | Russell 2000® |

| | Growth Fund | | Growth Index |

| Weighted Average Market Capitalization ($ Bil) | $2.3 | | $1.9 |

| Price/Earnings (1 year trailing) | 28.5x | | 26.8x |

| EPS Growth (3 year historical) | 27.0% | | 16.0% |

| Beta | 1.0 | | 1.0 |

| Number of Holdings | 76 | | 1163 |

| Portfolio Turnover Rate | 81% | | — |

| | | | |

| Please see page 30 for definition of terms. |

| | | | |

| Sector Allocation |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds. Sector designations for one Fund may be different than another Fund’s sector designations.

Market Capitalization

* Total Investments for this chart excludes short-term investments, including money market mutual funds.

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| Fund Strategy |

| Investing in large, well-established, dividend-paying companies both in the United States and in developed foreign markets. |

| | |

| Fund Management |

| Troy Dayton, CFA Portfolio Manager | Paul A. Kuppinger, CFA Portfolio Manager |

| Mark M. Adelmann, CFA, CPA Portfolio Manager | Lisa Z. Ramirez, CFA Portfolio Manager |

| Derek R. Anguilm, CFA Portfolio Manager | Alex A. Ruehle, CFA Portfolio Manager |

| | |

| CFA is a trademark owned by CFA Institute. |

| | |

| Cumulative Returns |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see pages 28 and 29 for index definitions.

| Average Annual Total Returns |

| | | | | | | | | | | | Since | | Inception |

| | 6 Months | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | | Date |

| Retail Class (WTMVX) | 5.38% | | 18.23% | | 13.09% | | 14.24% | | 6.33% | | 8.92% | | 6/1/1988 |

| Institutional Class | | | | | | | | | | | | | |

| (WIMVX) | 5.49 | | 18.41 | | 13.35 | | 14.41 | | 6.45 | | 8.96 | | 9/28/2007 |

| S&P 500® Index | 7.14 | | 24.61 | | 16.59 | | 18.83 | | 7.78 | | 10.25 | | |

| Lipper Large-Cap | | | | | | | | | | | | | |

| Core Index | 6.58 | | 23.38 | | 15.47 | | 17.34 | | 7.16 | | 9.42 | | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.14%, Net: 0.99%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 0.98%, Net: 0.92%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Since inception performance figures for the index are from the inception of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2014 until at least April 30, 2015, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 0.99% for the Fund’s Retail Class for such period. In addition, the Adviser has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse Fund level Other Expenses for the Institutional Class in the same proportion as the Retail Class waivers/reimbursements as well as reimburse the Institutional class-specific Other Expenses until at least April 30, 2015. This agreement may not be terminated or modified prior to this date except with the approval of the Board of Trustees.

Investments in foreign companies are subject to special risks, including currency fluctuations, social, economic, and political uncertainties, which could increase volatility.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

Lisa Z. Ramirez is a registered representative of ALPS Distributors, Inc.

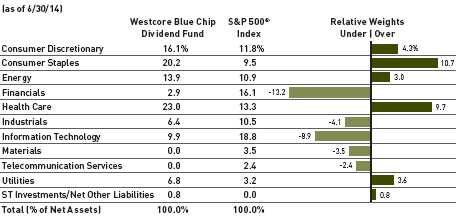

Manager Commentary

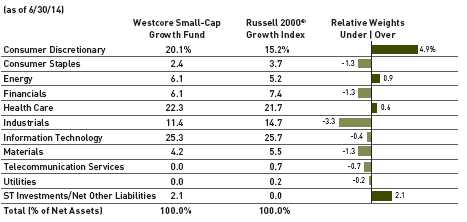

The Westcore Blue Chip Dividend Fund underperformed its benchmark the S&P 500® Index for the six months ended June 30, 2014. Generally, major stock market indices have, so far in 2014, produced single digit results with large-capitalization stocks outperforming smaller-capitalization stocks. Economic growth continues to be positive but below historical norms for this point in the economic cycle. The Federal Reserve continues tapering its quantitative easing program and expects interest rates to remain low well into 2015. Trading volatility as measured by the Chicago Board Options Exchange Volatility Index (VIX) is at eight year lows. Companies continue to borrow at a torrid pace and initial public offerings (IPO’s) have also increased. Investors’ appetite for higher returns remains strong as they seem to be willing to assume more risk to achieve greater returns.

General Dynamics Corp. continued to be an outstanding performer after a strong first quarter. The company reported strong earnings, driven by strength in the business jet segment and meaningful share buybacks. We continue to believe the business jet cycle is in its early stages of expansion, and the defense cycle has troughed. We believe the strong cash flow of the company should reward shareholders through dividend growth as well as continued share buybacks. Global oil exploration and production company, Royal Dutch Shell PLC had strong results as oil prices remained at elevated levels. Investors also seemed enthused since the company has reined in its capital expenditure program. We foresee Royal Dutch growing revenues in the low single digits over the next five years, while increasing its payout ratio.

Retail handbag and accessory company, Coach Inc., contributed to the Fund’s overall underperformance. While we believe Coach maintains a strong brand name, the consumer has been more price sensitive than originally anticipated as the company executes a turnaround strategy to regain market share. Coach has a strong balance sheet with no debt and we continue to assess whether these recent difficulties in terms of product repositioning may impair future dividend growth. American toy manufacturer Mattel Inc. underperformed through the first half of 2014. The company had a difficult holiday season due to weather and a cost-minded consumer. Mattel also had a disappointing second quarter after missing earnings expectations. Profit margins were pressured by the clearing of excess inventories. We expect improvement in the second half of the year as the new MEGA acquisition begins to contribute to the business. The dividend yield remains attractive and we believe it will continue to grow.

Our outlook on the equity markets remains positive going into the second half of 2014. Home sales rebounded in the second quarter and consumers seem to be shrugging off the effects of the long, cold spring. The Consumer Confidence Index® rose to its highest level since January 2008. In general, valuations are high, but not excessive. Interest rates remain low, and while bonds have had strong returns thus far in 2014, they generally appear less attractive than stocks. Geopolitical issues remain a wild card, and currently are worsening with what some believe is civil war in both the Ukraine and Iraq, and a potential debt default in Argentina. In this environment we believe company fundamentals and valuations will become increasingly relevant in driving returns.

| PAGE 10 |

|

| Stock Performance |

| (for the six months ended 6/30/14) | | |

| | Average | | Contribution |

| 5 Highest | Weight | | to Return |

| General Dynamics Corp. | 3.52% | | 0.77% |

| Total S.A. | 3.48 | | 0.67 |

| Royal Dutch Shell PLC | 3.42 | | 0.62 |

| Novartis AG | 3.53 | | 0.54 |

| British American Tobacco PLC | 3.44 | | 0.49 |

| | | | |

| 5 Lowest | | | |

| Accenture PLC | 3.32% | | -0.04% |

| Wal-Mart Stores Inc. | 3.31 | | -0.12 |

| Darden Restaurants Inc. | 2.95 | | -0.25 |

| Mattel Inc. | 3.19 | | -0.66 |

| Coach Inc. | 2.71 | | -1.34 |

| |

| Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com. |

| | | | |

| Please see page 30 for a description of the methodology used to construct this chart. |

|

| | | | |

| | | | |

| Top Ten Holdings |

| (as of 6/30/14) | | | |

| Chevron Corp. | | | 3.6% |

| Royal Dutch Shell PLC | | | 3.6 |

| Kimberly-Clark Corp. | | | 3.6 |

| LVMH Moet Hennessy Louis Vuitton S.A. | | 3.6 |

| AbbVie Inc. | | | 3.5 |

| Microsoft Corp. | | | 3.5 |

| Canadian Utilities Ltd. | | | 3.5 |

| McDonald's Corp. | | | 3.5 |

| Sodexo | | | 3.5 |

| British American Tobacco PLC | | | 3.4 |

| Total (% of Net Assets) | | | 35.3% |

| | | | |

| Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| | | | |

| Portfolio Characteristics |

| (as of 6/30/14) | | | |

| | Westcore Blue Chip | | S&P 500® |

| | Dividend Fund | | Index |

| Weighted Average Market Capitalization ($ Bil) | $122.1 | | $118.2 |

| Price/Cash Flow (1 year trailing) | 11.8x | | 13.2x |

| Price/Book Value | 4.2x | | 3.5x |

| Price/Earnings (1 year trailing) | 17.0x | | 18.5x |

| Beta | 0.9 | | 1.0 |

| Number of Holdings | 30 | | 500 |

| Portfolio Turnover Rate | 5% | | — |

| | | | |

| Please see page 30 for definition of terms. |

| | | | |

| Sector Allocation |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations.

Market Capitalization

* Total Investments for this chart excludes short-term investments, including money market mutual funds.

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| Fund Strategy |

| | |

| Investing in medium-sized, dividend-paying companies whose stocks appear to be undervalued. |

| | |

| Fund Management |

| | |

| Troy Dayton, CFA Portfolio Manager | Mark M. Adelmann, CFA, CPA Portfolio Manager |

| Derek R. Anguilm, CFA Portfolio Manager | Lisa Z. Ramirez, CFA Portfolio Manager |

| | |

| CFA is a trademark owned by CFA Institute. | |

| | |

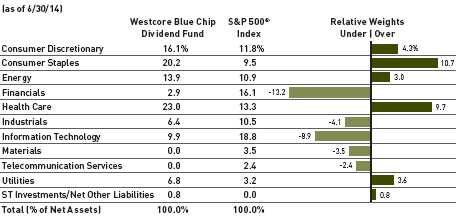

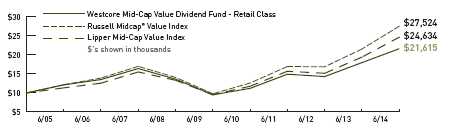

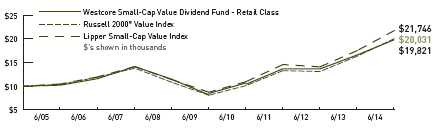

| Cumulative Returns |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see pages 28 and 29 for index definitions.

| Average Annual Total Returns |

| | | | | | | | | | | | Since | Inception |

| | 6 Months | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | Date |

| Retail Class | | | | | | | | | | | | |

| (WTMCX) | 6.61% | | 20.30% | | 13.14% | | 17.85% | | 8.01% | | 9.58% | 10/1/1998 |

| Russell Midcap® | | | | | | | | | | | | |

| Value Index | 11.14 | | 27.76 | | 17.56 | | 22.97 | | 10.66 | | 10.89 | |

| Lipper Mid-Cap | | | | | | | | | | | | |

| Value Index | 8.08 | | 26.83 | | 16.21 | | 20.86 | | 9.44 | | 10.36 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.24%, Net: 1.24%

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2014 until at least April 30, 2015, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.25% for the Fund’s Retail Class for such period. This agreement may not be terminated or modified prior to this date except with the approval of the Board of Trustees.

Investing in mid-cap funds generally will be more volatile and loss of principal could be greater than investing in large-cap funds.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

Lisa Z. Ramirez is a registered representative of ALPS Distributors, Inc.

Manager Commentary

The Westcore Mid-Cap Value Dividend Fund underperformed its benchmark, the Russell Midcap® Value Index, for the first six months of 2014.

Generally major stock market indices have, so far in 2014, produced single digit results with large-capitalization stocks outperforming smaller-capitalization stocks. Economic growth continues to be positive but below historical norms for this point in the economic cycle. The Federal Reserve continues tapering its quantitative easing program and expects interest rates to remain low well into 2015. Trading volatility as measured by the Chicago Board Options Exchange Volatility Index (VIX) is at eight year lows. Companies continue to borrow at a torrid pace and initial public offerings (IPO’s) have also increased. Investors’ appetite for higher returns remains strong as they seem to be willing to assume more risk to achieve greater returns.

Over the past six months the sectors that contributed most to the Fund’s performance relative to the benchmark were medical/ healthcare, commercial services and capital goods. Questcor Pharmaceuticals Inc. was the Fund’s top-performing stock for the first half of this year. It was recently announced that global specialty pharmaceutical company, Mallinkrodt plc and Questcor had reached an agreement for Questcor to be acquired. Avago Technologies Ltd. reported strong wireless performance led by Samsung sales and greater exposure to the Chinese market. We remain confident about Avago and believe the market is still undervaluing its future cash flow stream. Tyson Foods Inc. is a manufacturer of poultry, beef, and pork. During the period it purchased Hillshire Farms. We believe the acquisition makes strategic sense and bolsters the company’s value-added strategy while providing benefits to both the chicken and pork businesses.

The energy, consumer cyclical and interest rate sensitive sectors were the Fund’s most challenging relative to the benchmark in the first half of the year. Within the energy sector, Ensco PLC was the Fund’s weakest performer for the year. We were surprised by the softness in demand for new rigs given high oil prices. A lack of clarity as to the length of this demand softness resulted in a decision to sell the stock during the second quarter. Within the consumer cyclical sector retail handbag and accessory company, Coach Inc., underperformed. While we believe Coach has a strong brand name, the consumer has been more price-sensitive. We sold the stock and await stabilization in its North American business. Concerns that property catastrophe pricing was softening weighed on insurance stocks and Fund holding, Endurance Specialty Holdings Ltd., was negatively impacted. Reported results have been generally in line with expectations and we believe management is successfully building the company into a broader, more globally relevant business.

Our outlook on the equity markets remains positive going into the second half of 2014. Home sales rebounded in the second quarter and consumers seem to be shrugging off the effects of the long, cold spring. The Consumer Confidence Index® rose to its highest level since January 2008. In general, valuations are high, but not excessive. Interest rates remain low, and while bonds have had strong returns thus far in 2014, they generally appear less attractive than stocks. Geopolitical issues remain a wild card, and currently are worsening with what some believe is civil war in both the Ukraine and Iraq, and a potential debt default in Argentina. In this environment we believe company fundamentals and valuations will become increasingly relevant in driving returns.

| PAGE 12 |

|

| Stock Performance |

| (for the six months ended 6/30/14) |

| |

| | Average | | Contribution |

| 5 Highest | Weight | | to Return |

| Questcor | | | |

| Pharmaceuticals Inc. | 2.84% | | 1.84% |

| Avago Technologies Ltd. | 1.74 | | 0.62 |

| Westar Energy Inc. | 2.24 | | 0.46 |

| Tyson Foods Inc. | 2.22 | | 0.43 |

| American Water | | | |

| Works Co. Inc. | 2.34 | | 0.42 |

| | | | |

| 5 Lowest | | | |

| West Pharmaceutical | | | |

| Services Inc. | 1.37% | | -0.24% |

| Whirlpool Corp. | 2.10 | | -0.25 |

| Ensco PLC | 0.68 | | -0.27 |

| Endurance Specialty | | | |

| Holdings Ltd. | 2.02 | | -0.27 |

| Coach Inc. | 1.81 | | -0.84 |

| |

| Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com. |

| |

| Please see page 30 for a description of the methodology used to construct this chart. |

| | | | |

| | | | |

| Top Ten Holdings |

| (as of 6/30/14) | | | |

| Cinemark Holdings Inc. | | | 3.2% |

| Oshkosh Corp. | | | 2.8 |

| Avery Dennison Corp. | | | 2.7 |

| Reinsurance Group of America, Inc. | | 2.7 |

| Unum Group | | | 2.5 |

| American Water Works Co. Inc. | | | 2.4 |

| Omnicare Inc. | | | 2.4 |

| Universal Health Services Inc. | | | 2.4 |

| Westar Energy Inc. | | | 2.3 |

| NASDAQ OMX Group, Inc. | | | 2.3 |

| Total (% of Net Assets) | | | 25.7% |

| |

| Top ten holdings do not include any cash, cash equivalents or exchange traded fund investments and are subject to change. There are no guarantees that the Fund will continue to remain invested in any particular holding. |

| | | | |

| Portfolio Characteristics |

| (as of 6/30/14) | | | |

| | Westcore Mid-Cap | | Russell Midcap® |

| | Value Dividend Fund | | Value Index |

| Weighted Average Market Capitalization ($ Bil) | $8.9 | | $11.1 |

| Price/Cash Flow (1 year trailing) | 11.5x | | 13.0x |

| Price/Book Value | 2.6x | | 2.2x |

| Price/Earnings (1 year trailing) | 17.2x | | 18.4x |

| Beta | 0.84 | | 1.0 |

| Number of Holdings | 52 | | 561 |

| Portfolio Turnover Rate | 34% | | — |

| | | | |

| Please see page 30 for definition of terms. | | | |

| | | | |

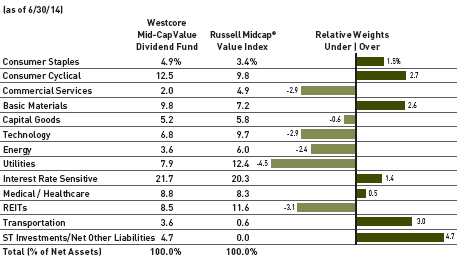

| Sector Allocation |

Sector classifications presented herein are based on the sector categorization methodology of the Adviser to the Funds which may result in the sector designations for one Fund being different than another Fund’s sector designations.

Market Capitalization

* Total Investments for this chart excludes short-term investments, including money market mutual funds.

Market capitalization ranges were determined by the Adviser to the Fund and are for presentation purposes only. These market capitalization ranges do not necessarily correlate to the benchmark’s market capitalization ranges.

| Fund Strategy |

| Investing primarily in small-cap, dividend paying stocks that appear to be undervalued. |

| |

| Fund Management |

| Troy Dayton, CFA Portfolio Manager | Mark M. Adelmann, CFA, CPA Portfolio Manager |

| Derek R. Anguilm, CFA Portfolio Manager | Lisa Z. Ramirez, CFA Portfolio Manager |

| | |

| CFA is a trademark owned by CFA Institute. |

| | |

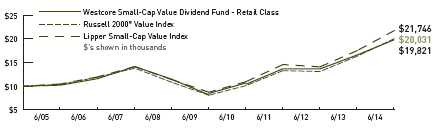

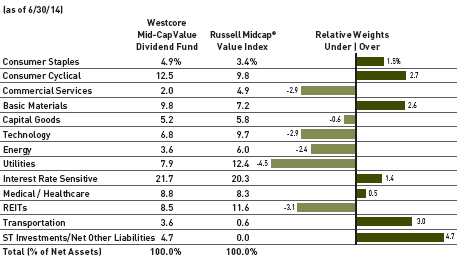

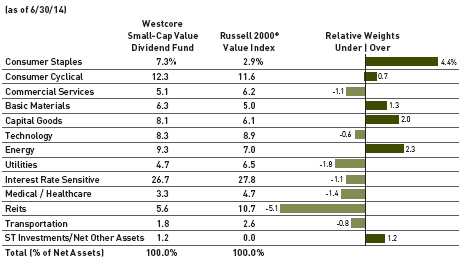

| Cumulative Returns |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years (or for the life of the Fund if shorter). Performance calculations are as of the end of June each year. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Lipper Index data provided by Lipper, Inc.

Please see pages 28 and 29 for index definitions.

| Average Annual Total Returns |

| | | | | | | | | | | | Since | Inception |

| | 6 Months | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | Date |

| Retail Class (WTSVX) | 2.57% | | 19.43% | | 13.12% | | 19.34% | | — | | 7.43% | 12/13/2004 |

| Institutional Class | | | | | | | | | | | | |

| (WISVX) | 2.64 | | 19.64 | | 13.27 | | 19.47 | | — | | 7.51 | 9/28/2007 |

| Russell 2000® | | | | | | | | | | | | |

| Value Index | 4.20 | | 22.54 | | 14.65 | | 19.88 | | — | | 7.55 | |

| Lipper Small-Cap | | | | | | | | | | | | |

| Value Index | 4.74 | | 24.17 | | 14.25 | | 20.02 | | — | | 8.44 | |

Retail Class Annual Expense Ratio (per the current prospectus) — Gross: 1.39%, Net: 1.30%

Institutional Class Annual Expense Ratio (per the current prospectus) — Gross: 1.22%, Net: 1.12%

The performance data quoted represents past performance and does not guarantee future results. Performance information for the institutional class shares prior to their inception date is based on the performance of the retail class. Since inception performance figures for the index are from the inception of the retail class. Current performance may be lower or higher than the performance quoted. To obtain current performance as of the most recent month-end, please call 800.392.CORE (2673) or visit us online at www.westcore.com. Average annual total returns and yield figures reflect the reinvestment of dividends, capital gains distributions, all fee waivers and expense reimbursements. Without the fee waivers and expense reimbursements, total return and yield figures would have been lower. Total return and yield figures represent past performance. Investment return and principal value will vary, and shares, when redeemed, may be worth more or less than their original cost. Westcore fund shares are not insured by the FDIC, the Federal Reserve Board or any other agency and are subject to investment risk.

Denver Investments (the “Adviser”) contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse other expenses from April 30, 2014 until at least April 30, 2015, so that the ratio of expenses to average net assets as reported in the Fund’s Financial Highlights will be no more than 1.30% for the Fund’s Retail Class for such period. In addition, the Adviser has contractually agreed to waive the investment advisory and/or administration fees and/or to reimburse Fund level Other Expenses for the Institutional Class in the same proportion as the Retail Class waivers/reimbursements as well as reimburse the Institutional class-specific Other Expenses until at least April 30, 2015. This agreement may not be terminated or modified prior to this date except with the approval of the Board of Trustees.

Investing in small-cap funds generally will be more volatile and loss of principal could be greater than investing in larger-cap funds.

Dividends are not guaranteed. A company’s future abilities to pay dividends may be limited and a company may cease paying dividends at any time.

Lisa Z. Ramirez is a registered representative of ALPS Distributors, Inc.

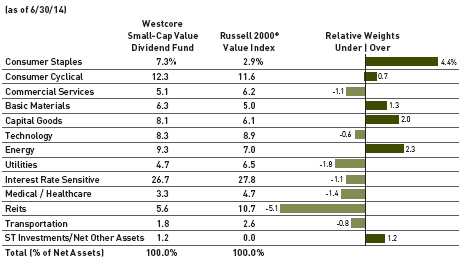

Manager Commentary

The Westcore Small-Cap Value Dividend Fund underperformed its benchmark, the Russell 2000® Value Index, for the six months ended June 30, 2014.

Generally major stock market indices have, so far in 2014, produced single digit results with large-capitalization stocks outperforming smaller-capitalization stocks. Economic growth continues to be positive but below historical norms for this point in the economic cycle. The Federal Reserve continues tapering its quantitative easing program and expects interest rates to remain low well into 2015. Trading volatility as measured by the Chicago Board Options Exchange Volatility Index (VIX) is at eight year lows. Companies continue to borrow at a torrid pace and initial public offerings (IPO’s) have also increased. Investors’ appetite for higher returns remains strong as they seem to be willing to assume more risk to achieve greater returns.

Mid-year contribution leaders relative to the benchmark were the medical/healthcare, basic materials and transportation sectors. Questcor Pharmaceuticals Inc. was the Fund’s top-performing stock in the first half of the year. It was recently announced that global specialty pharmaceutical company, Mallinkrodt plc and Questcor had reached an agreement for Questcor to be acquired. Within basic materials, Compass Minerals International Inc. reported better-than-expected earnings in the second quarter. The harsh winter depleted deicing salt inventories leading to higher contracted prices for the coming winter. These positive trends have driven earnings estimates higher for 2014 and 2015. Innophos Holdings Inc. reported better-than-expected sales and earnings due to a turnaround in the specialty phosphate business. We anticipate the company will increase prices which should allow for continued improvement in profits.

Sectors with the poorest performance relative to the benchmark were energy, consumer cyclical and capital goods. Consumer cyclical holding Pier 1 Imports Inc. underperformed, although second quarter sales were up. However, profits came under pressure due to a more promotional retail environment. Recent online sales growth was encouraging and we believe Pier 1 can continue to turn around. In April, Brink’s Co. announced that the devaluation of the Venezuelan bolivar eliminated its regional profitability for the remainder of its fiscal year. We believe Brink’s has reduced the risk of its Venezuela exposure and is focusing on improving North American profitability. Greenhill & Co. Inc. provides financial advice on mergers and acquisitions (M&A). Investors anticipated an increase in M&A activity for 2014 but Greenhill’s participation was lackluster. Recently however, Greenhill’s activity levels appear to have improved. We believe the fundamentals of the economy and financial markets support increased M&A activity and currently remain optimistic about Greenhill’s prospects.

Our outlook on the equity markets remains positive going into the second half of 2014. Home sales rebounded in the second quarter and consumers seem to be shrugging off the effects of the long, cold spring. The Consumer Confidence Index® rose to its highest level since January 2008. In general, valuations are high, but not excessive. Interest rates remain low, and while bonds have had strong returns thus far in 2014, they generally appear less attractive than stocks. Geopolitical issues remain a wild card, and currently are worsening with what some believe is civil war in both the Ukraine and Iraq, and a potential debt default in Argentina. In this environment we believe company fundamentals and valuations will become increasingly relevant in driving returns.

| PAGE 14 |

|

| Stock Performance |

| (for the six months ended 6/30/14) | | |

| | Average | | Contribution |

| 5 Highest | Weight | | to Return |

| Questcor | | | |

| Pharmaceuticals Inc. | 2.94% | | 1.90% |

| Comstock Resources Inc. | 1.50 | | 0.75 |

| Innophos Holdings Inc. | 2.30 | | 0.46 |

| Compass Minerals | | | |

| International Inc. | 2.20 | | 0.46 |

| Cash America | | | |

| International Inc. | 2.11 | | 0.44 |

| | | | |

| 5 Lowest | | | |

| Brink's Co. | 1.44% | | -0.34% |

| Greenhill & Co. Inc. | 2.36 | | -0.35 |

| Schweitzer-Mauduit | | | |

| International Inc. | 2.76 | | -0.42 |

| West Pharmaceutical | | | |

| Services Inc. | 2.66 | | -0.44 |

| Pier 1 Imports Inc. | 1.63 | | -0.64 |

| |

| Past performance does not guarantee future results. These stocks do not represent all of the securities purchased, sold or recommended by the Funds’ Adviser. To request a complete list of the contribution of each Fund holding to overall Fund performance during the period, please call 800.392.CORE (2673) or email invest@westcore.com. |

| |

| Please see page 30 for a description of the methodology used to construct this chart. |

| | | | |

| | | | |

| Top Ten Holdings |

| (as of 6/30/14) | | | |

| Dean Foods Co. | | | 3.3% |

| Greenhill & Co. Inc. | | | 3.1 |

| Brown Shoe Co. Inc. | | | 2.8 |

| Schweitzer-Mauduit International Inc. | | 2.8 |

| NICE Systems Ltd. | | | 2.6 |

| Innophos Holdings Inc. | | | 2.5 |

| Bristow Group Inc. | | | 2.4 |

| j2 Global Inc. | | | 2.4 |

| West Pharmaceutical Services Inc. | | 2.4 |

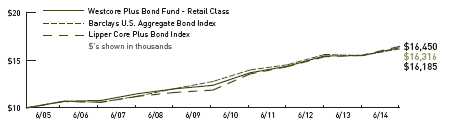

| Compass Minerals International Inc. | | 2.3 |