The nominees standing for election at the Annual Meeting were considered and selected by the Nominating and Corporate Governance Committee and unanimously approved by TrustCo’s independent directors.

The Nominating and Corporate Governance Committee is appointed by the board of directors in part to review and identify individuals qualified to become board members and to recommend to the board the nominees for consideration at the Annual Meeting.

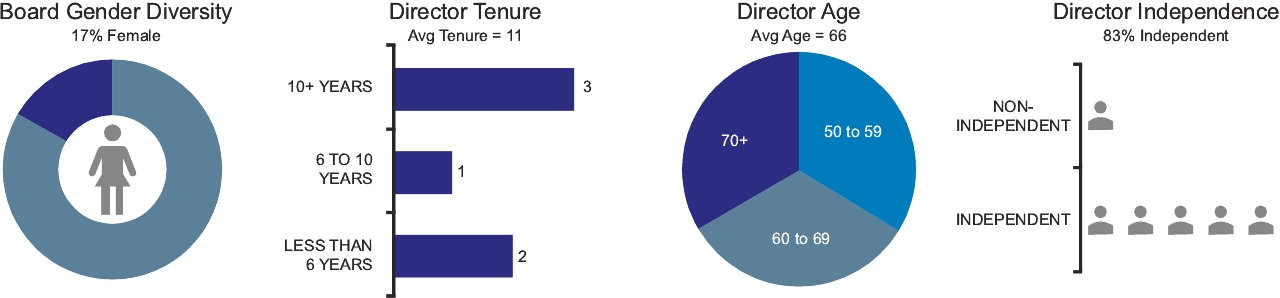

As a general matter, the board believes that a candidate for board membership should have high personal and professional ethics, integrity, and values; an inquiring and independent mind, practical wisdom, and mature judgment; broad policy-making experience in business, government, or community organizations; expertise useful to TrustCo and complementary to the background and experience of other board members; willingness to devote the time necessary to carrying out the duties and responsibilities of board membership; commitment to serve on the board over a period of several years to develop knowledge about TrustCo, its strategy, and its principal operations; and willingness to represent the best interests of all of TrustCo’s constituencies. Although neither the committee nor the full board of directors has a formal policy with respect to diversity, the committee and the board have a general objective of having a board that encompasses a broad range of talents and expertise and reflects a diversity of background, experience, and perspective.

After a potential candidate is identified, the committee investigates and assesses the qualifications, experience, and skills of the candidate. The investigation process may, but need not, include one or more meetings with the candidate by a member or members of the committee. From time to time, but at least once each year, the committee meets to evaluate the needs of the board and to discuss the candidates for nomination to the board. Such candidates may be presented to the shareholders for election or elected to fill vacancies. All nominees must be approved by the committee and by a majority of the independent members of the board.

TrustCo’s board of directors agrees with the view of many shareholders that board diversity is a key contributor to company performance. The board continues to consider diversity in the context of its board refreshment program. In that regard, the board adopted a mandatory retirement age for new directors first taking office in or after 2017. Through the board’s self-evaluation process, the board’s needs in terms of the experience and expertise of its members are continuously evaluated and the needs identified are considered in the process of identifying potential board candidates. The board is committed to seeking out highly qualified women and minority candidates, as well as candidates with diverse backgrounds, skills, and experiences as part of each search for qualified directors the Company undertakes.

The committee will consider written recommendations by shareholders for nominees for election to the board. The persons identified in such recommendations will be evaluated under the same criteria and procedures used for other board candidates. Under TrustCo’s bylaws, written nominations of persons for election to the board of directors must be delivered or mailed to the board not fewer than 14 and not more than 50 days prior to any meeting of shareholders called for the purpose of the election of directors, or not later than 7 days prior to the meeting if fewer than 21 days’ notice of the meeting is provided.

Shareholder Communications with Board and Board Attendance at Annual Meeting of Shareholders

TrustCo provides a process for shareholders to send communications to the board. Shareholders who wish to contact the board or any of its members may do so in writing to TrustCo Bank Corp NY, Attention: Michael Hall, Corporate Secretary, P.O. Box 1082, Schenectady, New York 12301-1082. Additionally, immediately after the Annual Meeting of Shareholders, TrustCo conducts a shareholders’ assembly which provides a forum for shareholders to express their views.

Although TrustCo does not have a policy with regard to board members’ participation in the Annual Meeting of Shareholders, the directors are encouraged to participate in such meetings, and all of our directors then in office participated in both the 2020 Annual Meeting and the Shareholders’ Assembly.

Stock Ownership Guidelines

The Company’s board of directors has adopted stock ownership guidelines for both senior management and members of the board. The board believes directors and designated members of senior management should have a financial investment in the Company. As CEO, Mr. McCormick is expected to own (including options to acquire shares and other equity-based awards that are not performance-based) a number of shares equal in value to four times his base salary, and as Executive Vice Presidents, Messrs. Salvador, Leonard, Ozimek, and Curley are each expected to own a number of shares equal in value to two times their base salary (including options to acquire shares and other equity-based awards that are not performance-based). These guidelines for members of senior management are expected to be achieved within five years of being appointed to their positions. As of December 31, 2020, Messrs. McCormick Salvador, Leonard, and Curley have achieved compliance with the requirements. Mr. Ozimek is within the five-year period allotted for the accumulation of the required value of shares. Shares acquired through the exercise of stock options or through other compensation-related awards must be retained by directors and members of senior management until the required share ownership