The board of directors believes that it is more effective and efficient in the management of TrustCo and Trustco Bank and in the overall oversight of TrustCo’s operations to combine the roles of chairman and chief executive officer. TrustCo’s Audit, Compensation, Board Compliance, Nominating and Corporate Governance, and Risk committees are all chaired by independent directors. Mr. DeGennaro, our Lead Independent Director, has been a member of the board of TrustCo and Trustco Bank since 2009. Under our Corporate Governance Guidelines, the Lead Independent Director will:

| • | Chair the meetings of the independent directors of the board, |

| • | Work with the chairman and CEO to develop the board and committee agendas, |

| • | Develop the agendas for and chair executive sessions of the board’s independent directors, and |

| • | In consultation with the Nominating and Corporate Governance Committee, review and report on the results of the board’s and committees’ performance self-evaluations. |

Role in Risk Oversight

Risk is inherent in the operation of every financial institution, and management of risk is a key part of the institution’s success. Risks faced by TrustCo and Trustco Bank include information security risk, credit risk, interest rate risk, liquidity risk, operational risk, strategic risk, and reputational risk. TrustCo management is responsible for the day-to-day management of the risks faced by the Company, while the board of directors as a whole is ultimately responsible for risk management oversight. In carrying out its responsibilities in this area, the board has delegated important duties to its committees. The Risk Committee has, as noted above, responsibility to oversee the management of the Company’s enterprise risk management program and to ensure that risk, including information security risk, is appropriately identified, measured, treated, monitored, and reported within the governance structure approved by the board. The Audit Committee assists the full board with respect to the adequacy of TrustCo’s internal controls and financial reporting process, the independence and performance of TrustCo’s internal and external auditors, and compliance with legal and regulatory requirements. The Board Compliance Committee assists the board with respect to compliance with legal and regulatory requirements. The Fiduciary Committee oversees the Company’s Financial Services Department and assists the full board in managing risk associated therewith, as well as in fulfilling its responsibilities regarding fiduciary, agency, and custodial activities. Finally, the Compensation Committee has the authority to conduct annual reviews of the Company’s incentive compensation practices to assess the extent to which such arrangements and practices encourage risk-taking and whether the level of encouragement of such risk-taking is appropriate under the circumstances. The Compensation Committee has concluded that the compensation policies are not reasonably likely to have a material adverse effect on the Company.

The entire board reviews and approves, on an annual basis, all significant policies that address risk within TrustCo’s consolidated organization, including credit risk, interest rate risk, liquidity risk, operational risk, strategic risk, and reputational risk. The board monitors risk through reports received on a periodic basis from management, and the board annually approves the Company’s business continuity plan as well as its insurance program.

The nominee standing for election at the Annual Meeting was considered and selected by the Nominating and Corporate Governance Committee and unanimously approved by TrustCo’s independent directors.

The Nominating and Corporate Governance Committee is appointed by the board of directors in part to review and identify individuals qualified to become board members and to recommend to the board the nominees for consideration at the Annual Meeting.

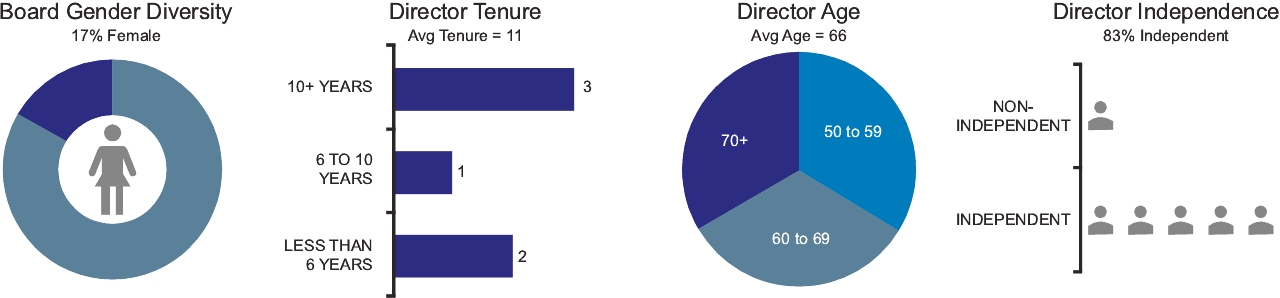

As a general matter, the board believes that a candidate for board membership should have high personal and professional ethics, integrity, and values; an inquiring and independent mind, practical wisdom, and mature judgment; broad policy-making experience in business, government, or community organizations; expertise useful to TrustCo and complementary to the background and experience of other board members; willingness to devote the time necessary to carrying out the duties and responsibilities of board membership; commitment to serve on the board over a period of several years to develop knowledge about TrustCo, its strategy, and its principal operations; and willingness to represent the best interests of all of TrustCo’s constituencies. Although neither the committee nor the full board of directors has a formal policy with respect to diversity, the committee and the board have a general objective of having a board that encompasses a broad range of talents and expertise and reflects a diversity of background, experience, and perspective.

After a potential candidate is identified, the committee investigates and assesses the qualifications, experience, and skills of the candidate. The investigation process may, but need not, include one or more meetings with the candidate by a member or members of the committee. From time to time, but at least once each year, the committee meets to evaluate the needs of the board and to discuss the candidates for nomination to the board. Such candidates may be presented to the shareholders for election or elected to fill vacancies. All nominees must be approved by the committee and by a majority of the independent members of the board.

TrustCo’s board of directors agrees with the view of many shareholders that board diversity is a key contributor to company performance. The board continues to consider diversity in the context of its board refreshment program. In that regard, the board