- TRST Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

TrustCo Bank Corp NY (TRST) DEF 14ADefinitive proxy

Filed: 2 Apr 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§240.14a-12 | |

TrustCo Bank Corp NY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

2018 PROXY STATEMENT |

| and | ||||||||

Notice of Annual Meeting

|

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 10 | ||||

Shareholder Communications with Board and Board Attendance at Annual Meeting of Shareholders | 11 | |||

| 11 | ||||

Proposal 2 – Advisory Resolution on the Compensation of TrustCo’s Named Executive Officers | 11 | |||

| 11 | ||||

| 12 | ||||

Proposal 3 – Ratification of the Appointment of Independent Auditors | 12 | |||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 23 |

| TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

Performance for the 2014 Awards Under the Equity Incentive Plan. | 25 | |||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

| 36 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

Compensation Policies and Practices that Present Material Risks to the Company | 41 | |||

| 41 | ||||

| 42 | ||||

Ownership of TrustCo Common Stock by Certain Beneficial Owners | 43 | |||

Transactions with TrustCo and Trustco Bank Directors, Executive Officers and Associates | 44 | |||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 47 |

| TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

5 Sarnowski Drive, Glenville, New York 12302

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Shareholders of TrustCo Bank Corp NY:

Notice is hereby given that the Annual Meeting of Shareholders of TrustCo Bank Corp NY, a New York corporation, will be held at Mallozzi’s Restaurant and Banquet House, 1930 Curry Road, Rotterdam, New York 12303, on May 17, 2018, at 10:00 AM local time, for the purpose of considering and voting upon the following matters:

| 1. | Election of Directors. |

| 2. | Approval of a Nonbinding Advisory Resolution on the Compensation of TrustCo’s Named Executive Officers. |

| 3. | Ratification of the Appointment of Crowe Horwath LLP as TrustCo’s Independent Auditors for 2018. |

| 4. | Any other business that properly may be brought before the meeting or any adjournment thereof. |

By Order of the Board of Directors,

| ||||

| ||||

| Michael J. Hall, Secretary |

April 2, 2018

YOUR VOTE IS IMPORTANT TO US

EVEN IF YOU PLAN TO ATTEND THE MEETING, PLEASE, AS PROMPTLY AS POSSIBLE, SIGN AND RETURN THE ENCLOSED PROXY CARD, OR VOTE USING THE INTERNET OR TELEPHONE, FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE EXERCISE OF THE PROXY.

Important Notice Regarding the Internet Availability of Proxy Materials for the

Shareholder Meeting to be Held on May 17, 2018:

This Notice, the Proxy Statement attached to this Notice, and TrustCo’s Annual Report to shareholders for the year ended December 31, 2017 are available free of charge at https://materials.proxyvote.com/898349.

| PROXY STATEMENT SUMMARY FOR ANNUAL MEETING OF SHAREHOLDERS | ||||||||

TRUSTCO BANK CORP NY

ANNUAL MEETING OF SHAREHOLDERS

MAY 17, 2018

This proxy statement is furnished in connection with the solicitation by the board of directors of TrustCo Bank Corp NY (also referred to as “TrustCo” or the “Company”) of proxies to be voted at TrustCo’s Annual Meeting of Shareholders. The Annual Meeting will be held at 10:00 AM local time on Thursday, May 17, 2018, at Mallozzi’s Restaurant and Banquet House, 1930 Curry Road, Rotterdam, New York 12303. This proxy statement and the enclosed form of proxy were first mailed to shareholders on or about April 2, 2018.

The record date for the Annual Meeting is March 19, 2018. Only shareholders of record at the close of business on March 19, 2018 are entitled to notice of and to vote at the Annual Meeting. Shareholders of record on that date are entitled to one vote for each share of TrustCo common stock they hold. As of March 19, 2018, there were 96,354,600 shares of common stock outstanding.

The Annual Meeting will be held if a majority of the outstanding shares of TrustCo’s common stock, constituting a quorum, is represented at the meeting. If shareholders return a properly executed proxy card, their shares will be counted for purposes of determining a quorum at the meeting, even if they abstain from voting. Abstentions and brokernon-votes count as shares present at the Annual Meeting for purposes of determining a quorum. If a shareholder owns shares in “street name” through a bank or broker, the shareholder may instruct his or her bank or broker how to vote the share using the instructions provided by the bank or broker. A “brokernon-vote” occurs when a shareholder who owns shares through a bank or broker fails to provide the bank or broker with voting instructions and either the bank or broker does not have the discretionary authority to vote the shares on a particular proposal or the bank or broker otherwise fails to vote the shares.

Under the rules of the NASDAQ Stock Market and the New York Stock Exchange, brokers do not have discretionary authority to vote shares on proposals that are not “routine.” Proposal 1 (Election of Directors) and Proposal 2 (Advisory Resolution on the Compensation of TrustCo’s Named Executive Officers) would not be considered routine matters under the NASDAQ Stock Market and New York Stock Exchange rules, so brokers do not have discretionary authority to vote shares held in street name on those proposals. If a shareholder wishes for his or her shares to be voted on these matters, the shareholder must provide his or her broker with voting instructions. Proposal 3 (Ratification of the Appointment of Crowe Horwath LLP as TrustCo’s Independent Auditors) is considered a routine matter, so the bank or broker will have discretionary authority to vote shares held in street name on this item.

All shares of TrustCo’s common stock represented at the Annual Meeting by properly executed proxies will be voted according to the instructions indicated on the proxy card. If shareholders of record return a signed proxy card but fail to instruct how the shares registered in their names must be voted, the shares will be voted as recommended by TrustCo’s board of directors. The board of directors recommends that shareholders vote:

| • | “FOR” each of the nominees for director, |

| • | “FOR” the approval of the nonbinding advisory resolution approving the compensation of TrustCo’s named executive officers, and |

| • | “FOR” ratification of the appointment of Crowe Horwath LLP as TrustCo’s Independent Auditors. |

If any matter not described in this proxy statement is properly presented at the Annual Meeting, the persons named in the proxy card will use their judgment to determine how to vote the shares for which they have voting authority. TrustCo does not know of any other matters to be presented at the Annual Meeting.

Any shareholder executing a proxy solicited under this proxy statement has the power to revoke it by giving written notice to the Secretary of TrustCo at its main office address or at the meeting of shareholders at any time prior to the exercise of the proxy.

| TrustCo Bank Corp NY 2018 Proxy Statement 1 | ||||||||

| PROXY STATEMENT SUMMARY FOR ANNUAL MEETING OF SHAREHOLDERS | ||||||||

TrustCo will solicit proxies primarily by mail, although proxies also may be solicited by directors, officers, and employees of TrustCo or TrustCo’s wholly-owned subsidiary, Trustco Bank. These persons may solicit proxies personally or by telephone, and they will receive no additional compensation for such services. TrustCo has retained Alliance Advisors, LLC to aid in the solicitation of proxies for a solicitation fee of $11,000, plus expenses. The entire cost of this solicitation will be paid by TrustCo.

| 2 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| THE ANNUAL MEETING | ||||||||

A description of the items to be considered at the Annual Meeting, as well as other information concerning TrustCo and the meeting, is set forth below.

Proposal 1 - Election of Directors

The first item to be acted upon at the Annual Meeting is the election of three directors to serve on the TrustCo board of directors. The nominees for election as directors for three-year terms expiring at TrustCo’s 2021 Annual Meeting are Thomas O. Maggs, Robert J. McCormick, and Lisa M. Reutter. Each of the nominees is an incumbent director, and each nominee was approved by the Nominating and Corporate Governance Committee of TrustCo’s board of directors, as well as by the full board of directors of TrustCo.

TrustCo’s Certificate of Incorporation provides that TrustCo’s board of directors will consist of not less than five nor more than fifteen members, with, under TrustCo’s Bylaws, the total number of directors to be fixed by resolution of the board or the shareholders. Currently, the board of each of TrustCo and Trustco Bank is fixed at seven members.

The pages that follow set forth information regarding TrustCo’s nominees, as well as information regarding the remaining members of TrustCo’s board. Proxies will be voted in accordance with the specific instructions contained in the proxy card; properly executed proxies that do not contain voting instructions will be voted “FOR” the election of TrustCo’s nominees. If any such nominee becomes unavailable to serve, the shares represented by all valid proxies will be voted for the election of such other person as TrustCo’s board may recommend. Each of TrustCo’s nominees has consented to being named in this proxy statement and to serve if elected. The board of directors has no reason to believe that any nominee will decline or be unable to serve if elected.

Information with regard to the business experience of each director and nominee and the ownership of common stock on December 31, 2017 has been furnished by each director and nominee or has been obtained from TrustCo’s records. TrustCo’s common stock is the only class of its equity securities outstanding.

| TrustCo Bank Corp NY 2018 Proxy Statement 3 | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

Information on TrustCo Directors and Nominees

Nominees for Election as TrustCo Directors(1) for Three Year Terms to Expire in 2021

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation(2) | No. of Shares (3) | Percent of Class | ||||||

| Thomas O. Maggs, Age 73, President, Maggs & Associates, The Business Insurance Brokers, Inc. (insurance broker). Director of TrustCo and Trustco Bank from 2005-present. Chair of the Board of Directors of TrustCo and Trustco Bank for 2015. Mr. Maggs contributes his experience as an entrepreneur operating a successful business enterprise and his skills for developing and evaluating business strategies. | 74,057 | (4) | * | |||||

| Robert J. McCormick, Age 54, President and Chief Executive Officer of TrustCo from 2004-present, Chair 2009 and 2010, executive officer of TrustCo from 2001-present and Chief Executive Officer of Trustco Bank from 2002-present. Director of TrustCo and Trustco Bank from 2005-present. Joined Trustco Bank in 1995. Mr. McCormick contributes his skills and knowledge obtained from being the chief executive officer of the Company and Trustco Bank. | 2,069,177 | (5) | 2.51 | |||||

| Lisa M. Reutter, Age 54, Elected to the Board of Directors of TrustCo and Trustco Bank November 2017. Ms. Reutter has been an owner of LMKD Properties, LLC since 2002. The company is a property management firm based in Altamont, New York. Ms. Reutter contributes her experience in the area of residential real estate, as an entrepreneur operating a successful business enterprise, and her skills for developing and evaluating business strategies. | 1,123 | (6) | * | |||||

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation(2) | No. of Shares (3) | Percent of Class | ||||||

| Dennis A. De Gennaro, Age 73, President and Chief Executive Officer, Camelot Associates Corp. (commercial and residential home builder and developer). Current Chair of the Board of Directors of TrustCo and Trustco Bank. Director of TrustCo and Trustco Bank from 2009-present. Mr. De Gennaro is highly knowledgeable about commercial and residential real estate in the Capital Region of New York and contributes his organizational skills and experience from operating a successful business enterprise. | 102,578 | (7) | * | |||||

| Brian C. Flynn, Age 67, Consultant and Certified Public Accountant (NY). Director of TrustCo and Trustco Bank since 2016. Former partner of KPMG LLP (retired 2010) where he was employed for approximately 30 years. Mr. Flynn served in KPMG’s banking and finance practice area where his specialties included providing tax services to community banks, thrift institutions and real estate developers/ operators. Since his retirement in 2010, he has served as a technical tax consultant to a community bank trade group. Mr. Flynn brings to the board extensive tax, accounting and financial reporting expertise in the financial services industry. Mr. Flynn has been designated an audit committee financial expert. | 10,000 | (8) | * | |||||

| Anthony J. Marinello, M.D., Ph.D., Age 62, Physician. Director of TrustCo and Trustco Bank from 1995-present. Chair of the Board of Directors of TrustCo and Trustco Bank for 2013. Dr. Marinello contributes his experience as an entrepreneur operating a successful medical practice and his skills for developing and evaluating business strategies. | 93,643 | (9) | * | |||||

| * | Less than 1% |

See Footnotes on Page 6

| 4 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

Other TrustCo Directors(1)(continued)

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation(2) | No. of Shares (3) | Percent of Class | ||||||

| William D. Powers, Age 76, Consultant, Powers & Company, LLC, retired. Chair of the Board of Directors of TrustCo and Trustco Bank for 2012. Director of TrustCo and Trustco Bank from 1995-present. Mr. Powers contributes his experience as an entrepreneur operating a successful business enterprise and his skills for developing and evaluating business strategies. | 89,651 | (10) | * | |||||

Information on TrustCo Executive Officers

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation(2) | No. of Shares (3) | Percent of Class | ||||||

| Kevin M. Curley, Age 50, Senior Vice President of TrustCo and Trustco Bank from 2011-present. Administrative Vice President of TrustCo and Trustco Bank from2004-2016. Executive Officer of TrustCo and Trustco Bank from 2017- present. Joined Trustco Bank in 1993. | 109,353 | (11) | * | |||||

| Robert T. Cushing, Age 62, Retired from TrustCo and Trustco Bank effective December 22, 2017. Executive Vice President and Chief Operating Officer of TrustCo and Trustco Bank from 2014-December 2017. Executive Vice President and Chief Financial Officer of TrustCo from 2004-2014. President, Chief Executive Officer and Chief Financial Officer of TrustCo from 2002-2003. Executive Officer of TrustCo and Trustco Bank from 1994-2017. Joined TrustCo and Trustco Bank in 1994. | 570,426 | (12) | * | |||||

| Michael J. Hall, Age 52, Vice President of TrustCo and Trustco Bank from 2015-present. Assistant Secretary of TrustCo and Trustco Bank for 2016. Executive Officer and Secretary of TrustCo and Trustco Bank 2017-present. Attorney with McNamee, Lochner, Titus & William, P.C. from 1992-2015. Joined TrustCo and Trustco Bank in 2015. | 2,901 | (13) | * | |||||

| Robert M. Leonard, Age 55, Secretary of TrustCo and Trustco Bank from 2003-2006 and 2009-2016. Assistant Secretary of TrustCo and Trustco Bank from 2006-2009. Executive Vice President of TrustCo and Trustco Bank from 2013-present. Senior Vice President of TrustCo and Trustco Bank from 2010-2013. Administrative Vice President of TrustCo and Trustco Bank from 2004-2009. Executive Officer of TrustCo and Trustco Bank from 2003-present. Joined Trustco Bank in 1986. | 150,226 | (14) | * | |||||

| Michael M. Ozimek, Age 43, Senior Vice President and Chief Financial Officer of TrustCo and Trustco Bank from 2014-present. Administrative Vice President of Trustco Bank from 2010-2014. Executive Officer of TrustCo and Trustco Bank from 2014-present. Joined TrustCo and Trustco Bank in 2002. | 24,626 | (15) | * | |||||

| Scot R. Salvador, Age 51, Executive Vice President and Chief Banking Officer of TrustCo and Trustco Bank from 2004-present. Executive Officer of TrustCo and Trustco Bank from 2004-present. Joined Trustco Bank in 1995. | 256,149 | (16) | * | |||||

| Eric W. Schreck, Age 51, Senior Vice President and Florida Regional President of Trustco Bank from 2009-present. Treasurer of TrustCo from 2010-present. Executive Officer of TrustCo and Trustco Bank from 2010-present. Joined Trustco Bank in 1989. | 102,785 | (17) | * | |||||

| * | Less than 1% |

See Footnotes on Page 6

| TrustCo Bank Corp NY 2018 Proxy Statement 5 | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

TRUSTCO DIRECTORS, NOMINEES, AND EXECUTIVE OFFICERS AS A GROUP (14 INDIVIDUALS) BENEFICIALLY OWN 3,656,695 SHARES OF COMMON STOCK, WHICH REPRESENTS 3.80% OF THE OUTSTANDING SHARES.

Footnotes:

| (1) | Directors of TrustCo Bank Corp NY are also directors of Trustco Bank. William J. Purdy resigned as a director of TrustCo and Trustco Bank as of June 20, 2017. |

| (2) | Each of the directors has held, or retired from, the same position or another executive position with the same employer during the past five years. |

| (3) | Based on 96,289,311 shares issued and outstanding as of December 31, 2017. Beneficial ownership of less than 1% is denoted by an asterisk. |

| (4) | Voting or investment power held by Mr. Maggs and his spouse or immediate family members as to 70,057 shares. Also includes currently exercisable options to acquire 4,000 shares. |

| (5) | Includes for Mr. McCormick 379,217 shares in trust at Trustco Bank for which he isco-trustee, and 603,859 shares that are held by Trustco Bank as aco-trustee of trusts for the benefit of Mr. McCormick or his family. Also includes currently exercisable options to acquire 130,600 shares. |

| (6) | Voting or investment power for Ms. Reutter as to 1,123 shares. |

| (7) | Voting or investment power shared by Mr. De Gennaro’s spouse or other immediate family members as to 100,578 shares. Also includes currently exercisable options to acquire 2,000 shares. |

| (8) | Voting or investment power held by Mr. Flynn and his spouse or other immediate family members as to 10,000 shares. |

| (9) | Voting or investment power held by Dr. Marinello and his spouse or other immediate family members as to 89,643 shares. Also includes currently exercisable options to acquire 4,000 shares. |

| (10) | Voting or investment power held by Mr. Powers and his spouse or other immediate family members as to 85,651 shares. Also includes currently exercisable options to acquire 4,000 shares. |

| (11) | Voting or investment power held by Mr. Curley and his spouse or other immediate family members as to 78,803 shares. Also includes currently exercisable options to acquire 30,550 shares. |

| (12) | Voting or investment power shared by Mr. Cushing’s spouse or other immediate family members as to 551,226 shares. Also includes currently exercisable options to acquire 19,200 shares. |

| (13) | Includes for Mr. Hall currently exercisable options to acquire 900 shares. |

| (14) | Voting or investment power held by Mr. Leonard and his spouse or other immediate family members as to 78,526 shares. Also includes currently exercisable options to acquire 71,700 shares. |

| (15) | Includes for Mr. Ozimek currently exercisable options to acquire 10,750 shares. |

| (16) | Includes for Mr. Salvador currently exercisable options to acquire 94,641 shares. |

| (17) | Voting or investment power held by Mr. Schreck and his spouse or other immediate family members as to 92,785 shares. Also includes currently exercisable options to acquire 10,000 shares. |

TrustCo’s full board held twelve meetings during 2017. All of the directors, except for Robert J. McCormick, would be considered to be “independent directors” under the listing qualifications rules for companies such as TrustCo, whose shares are traded on The NASDAQ Stock Market. TrustCo’s independent directors met in executive session four times during 2017 (including two such sessions of the Audit Committee). William J. Purdy resigned from the board after the board’s June meeting. Lisa M. Reutter was elected to fill Mr. Purdy’s vacancy at the board’s meeting in November. All directors fully attended all board meetings during their respective tenures. Ms. Reutter attended only the December meetings during 2017. The independent directors attended all executive session meetings held during their respective tenures during 2017.

TrustCo maintains an Audit Committee, a Compensation Committee, a Board Compliance Committee, a Fiduciary Committee, a Nominating and Corporate Governance Committee, and a Risk Committee. The charter of each of the committees may be found on TrustCo’s website (www.trustcobank.com) under the “Investor Relations” link.

The Nominating and Corporate Governance Committee held eight meetings in 2017. The directors currently serving on the Nominating and Corporate Governance Committee are Lisa M. Reutter (Chair), Dennis A. De Gennaro, Brian C. Flynn, Thomas O. Maggs, Dr. Anthony J. Marinello, and William D. Powers. The function of the Nominating and Corporate Governance Committee is to assist the board by recommending and reviewing individuals for consideration as directors and develop and annually review governance guidelines applicable to the Company.

| 6 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

TrustCo’s Audit Committee held twelve meetings and two executive sessions in 2017. The directors currently serving on the Audit Committee are Brian C. Flynn (Chair), Dennis A. De Gennaro, Thomas O. Maggs, Dr. Anthony J. Marinello, and Lisa M. Reutter. The purpose of the Audit Committee is to oversee the Company’s accounting and financial reporting processes and audits of the Company’s financial statements; the committee’s functions also include the review of TrustCo’s and Trustco Bank’s internal audit function and the review of the adequacy of internal accounting controls for TrustCo and Trustco Bank. In addition, the Audit Committee annually recommends the use of external audit firms by TrustCo and Trustco Bank in the coming year, after reviewing performance of the existing vendors and available audit resources. Please refer to the discussion under “Audit Committee” for a more detailed description of the Audit Committee’s activities.

TrustCo’s Compensation Committee held four meetings in 2017. The directors currently serving on the Compensation Committee are Thomas O. Maggs (Chair), Dennis A. De Gennaro, Brian C. Flynn, Dr. Anthony J. Marinello, William D. Powers, and Lisa M. Reutter. The function of the Compensation Committee is to generally oversee the employee compensation and benefit policies, plans and programs of TrustCo and Trustco Bank, including the establishment, annual review and approval of the compensation of the executive officers. In addition, the Compensation Committee is responsible for annually reviewing board compensation and making appropriate recommendations for changes thereto. Please refer to the discussion under “Executive Compensation” for a more detailed description of the Compensation Committee’s activities relative to the named executive officers.

The Board Compliance Committee held twelve meetings in 2017. The directors currently serving on the Board Compliance Committee are William D. Powers (Chair), Dennis A. De Gennaro, Brian C. Flynn, Thomas O. Maggs, Dr. Anthony J. Marinello, and Lisa M. Reutter. The function of the Compliance Committee is to provide assistance to the board in fulfilling its oversight responsibility relating to compliance with legal and regulatory requirements and Trustco Bank’s policies, including overseeing Trustco Bank’s communications and responses to and cooperation with the Office of the Comptroller of Currency (“OCC”) and other governmental authorities with jurisdiction over TrustCo or Trustco Bank, and any agreements, orders or directives with respect to such authorities.

The Fiduciary Committee held four meetings in 2017. The directors currently serving on the Fiduciary Committee are Robert J. McCormick (Chair), Dennis A. De Gennaro, Brian C. Flynn, Thomas O. Maggs, Dr. Anthony J. Marinello, William D. Powers, and Lisa M. Reutter. The function of the Fiduciary Committee is to assist the board of directors in fulfilling its responsibilities with respect to the Trustco Bank Financial Service Department regarding fiduciary, agency and custodial activities; oversee the Financial Services Department in providing estate administration, trust administration, investment management services, and custodial services; advise the board of directors with respect to the adoption of appropriate policies to be observed in offering such services; oversee and enforce sound risk management practices calculated to minimize risk and loss to Trustco Bank and its customers; and report to the board of directors on the activity of the Financial Services Department in the conduct of its business.

The Risk Committee held four meetings in 2017. The directors currently serving on the Risk Committee are Dr. Anthony J. Marinello (Chair), Dennis A. De Gennaro, Brian C. Flynn, Thomas O. Maggs, William D. Powers, and Lisa M. Reutter. The function of the Risk Committee is to oversee the Company’s enterprise risk management program and to ensure that risk is appropriately identified, measured, treated, monitored, and reported within the governance structure approved by the board.

Compensation Committee Interlocks and Insider Participation. No member of the Compensation Committee: (1) was an officer or employee of TrustCo or Trustco Bank; (2) was formerly an officer of TrustCo or Trustco Bank; or (3) had any relationship requiring disclosure by TrustCo under the SEC’s rules governing disclosure of related party transactions. No executive officer of TrustCo served as a director or member of a compensation committee of another entity, one of whose executive officers served as a member of TrustCo’s Board of Directors or Compensation Committee.

Board Leadership Structure and Role in Risk Oversight

The position of TrustCo’s chair of the board and the office of its president and chief executive officer are held by different persons. The chair of the board, Dennis A. De Gennaro, is an independent director who has been a member of the board since 2009. Mr. De Gennaro became chair in January 2016 to serve a term ending upon the earlier of December 31, 2018 or the date the board elects a successor. Mr. De Gennaro is a member of the Nominating and Corporate Governance Committee, the Audit Committee, the Compensation Committee, the Board Compliance Committee, the Fiduciary Committee, and the Risk Committee. Under TrustCo’s Corporate Governance Guidelines, the

| TrustCo Bank Corp NY 2018 Proxy Statement 7 | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

positions of chief executive officer and chair of the board are separate and the members of the board elect a chair as they deem appropriate from time to time from among TrustCo’s independent directors. Also under the guidelines, in order to better ensure that the chair of the board will have the opportunity to carry out the planning and direction duties associated with the chair’s position, the chair is to be elected to a term to expire three years from its start date or on such earlier date as the board elects a new chair. (The board retains, however, the authority to elect a director as chair even though the then-current chair has not served in that role for three years and is not obligated to nominate forre-election by shareholders a director whose three-year tenure as chair is not complete.) At least once each year, the Corporate Governance Committee will consider the performance of the chair relative to the Corporate Governance Guidelines and may make such recommendations as it deems appropriate.

Risk is inherent in the operation of every financial institution, and management of risk is a key part of the institution’s success. Risks faced by TrustCo and Trustco Bank include credit risk, interest rate risk, liquidity risk, operational risk, strategic risk, and reputational risk. TrustCo management is responsible for theday-to-day management of the risks faced by the Company, while the board of directors as a whole is ultimately responsible for risk management oversight. In carrying out its responsibilities in this area, the board has delegated important duties to its committees. The Risk Committee has, as noted above, responsibility to oversee the management of the Company’s enterprise risk management program and to ensure that risk is appropriately identified, measured, treated, monitored, and reported within the governance structure approved by the board. The Audit Committee assists the full board with respect to the adequacy of TrustCo’s internal controls and financial reporting process, the independence and performance of TrustCo’s internal and external auditors, and compliance with legal and regulatory requirements. The Board Compliance Committee assists the board with respect to compliance with legal and regulatory requirements. The Fiduciary Committee oversees the Company’s Financial Services Department and assists the full board in managing risk associated therewith, as well as in fulfilling its responsibilities regarding fiduciary, agency and custodial activities. Finally, the Compensation Committee has the authority to conduct annual reviews of the Company’s incentive compensation practices to assess the extent to which such arrangements and practices encourage risk-taking and whether the level of encouragement of such risk-taking is appropriate under the circumstances. The Compensation Committee has concluded that the compensation policies are not reasonably likely to have a material adverse effect on the Company.

The entire board reviews and approves, on an annual basis, all significant policies that address risk within TrustCo’s consolidated organization, including credit risk, interest rate risk, liquidity risk, operational risk, strategic risk, and reputational risk. The board monitors risk through reports received on a periodic basis from management, and the board annually approves the Company’s business continuity plan as well as its insurance program.

Each of the nominees standing for election at the Annual Meeting was considered and selected by the Nominating and Corporate Governance Committee and unanimously approved by TrustCo’s independent directors.

The Nominating and Corporate Governance Committee is appointed by the board of directors in part to review and identify individuals qualified to become board members and to recommend to the board the nominees for consideration at the Annual Meeting.

As a general matter, the board believes that a candidate for board membership should have high personal and professional ethics, integrity, and values; an inquiring and independent mind, practical wisdom, and mature judgment; broad policy-making experience in business, government, or community organizations; expertise useful to TrustCo and complementary to the background and experience of other board members; willingness to devote the time necessary to carrying out the duties and responsibilities of board membership; commitment to serve on the board over a period of several years to develop knowledge about TrustCo, its strategy, and its principal operations; and willingness to represent the best interests of all of TrustCo’s constituencies. Although neither the committee nor the full board of directors has a formal policy with respect to diversity, the committee and the board have a general objective of having a board that encompasses a broad range of talents and expertise and reflects a diversity of background, experience, and perspective.

After a potential candidate is identified, the committee investigates and assesses the qualifications, experience, and skills of the candidate. The investigation process may, but need not, include one or more meetings with the candidate by a member or members of the committee. From time to time, but at least once each year, the committee meets to evaluate the needs of the board and to discuss the candidates for nomination to the board. Such candidates may be presented to the shareholders for election or elected to fill vacancies. All nominees must be approved by the committee and by a majority of the independent members of the board.

| 8 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

The committee will consider written recommendations by shareholders for nominees for election to the board. The persons identified in such recommendations will be evaluated under the same criteria and procedures used for other board candidates. Under TrustCo’s bylaws, written nominations of persons for election to the board of directors must be delivered or mailed to the board not fewer than 14 and not more than 50 days prior to any meeting of shareholders called for the purpose of the election of directors, or not later than 7 days prior to the meeting if fewer than 21 days’ notice of the meeting is provided.

| TrustCo Bank Corp NY 2018 Proxy Statement 9 | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

The Audit Committee of TrustCo’s Board is responsible for providing oversight of TrustCo’s accounting functions, internal controls, and financial reporting process. The Audit Committee is composed of six directors, each of whom is independent under the listing standards of The NASDAQ Stock Market, and each member of the Audit Committee satisfies the “financial sophistication” requirement also set forth in those listing standards. Each Audit Committee member also satisfies the additional independence requirements contained in the Securities Exchange Act of 1934 for members of public company audit committees. The Board of Directors has determined that Brian C. Flynn meets the definitions of “audit committee financial expert” adopted by the Securities and Exchange Commission (“SEC”) and included in NASDAQ’s rules for listed companies. In addition, to assist in the performance of its duties, the Audit Committee retained Marvin and Company, PC, an independent accounting firm, as a consultant to the Committee. As a consultant to the Audit Committee, a Marvin and Company partner attends Audit Committee meetings on at least a quarterly basis, reviews all materials presented to the Audit Committee each month, responds to questions and inquiries from Audit Committee members and questions internal audit department personnel, representatives of the Company, the Company’s independent auditors, and management prior to, during, and as follow up to Audit Committee meetings.

The Audit Committee operates under a written charter approved by the Board of Directors. Each year, the Audit Committee reviews the adequacy of the charter and recommends any changes or revisions that the Committee considers necessary or appropriate. A copy of the Audit Committee’s charter may be found on TrustCo’s website (www.trustcobank.com) under the “Investor Relations” link.

It is the Audit Committee’s policy to preapprove all audit and nonaudit services provided by the Company’s independent auditors, as well as any services provided by any other registered public accounting firm. In considering nonaudit services, the Audit Committee will consider various factors including, but not limited to, whether it would be beneficial to have the service provided by the independent auditors and whether the service has the potential to compromise the independence of the independent auditors. In certain circumstances, the Audit Committee’s policies and procedures provide the Committee’s Chair with the authority to preapprove services from the Company’s independent auditors, which approval is then reviewed and approved at the next Audit Committee meeting. Accordingly, all of the services described herein were approved by the Audit Committee.

Audit Committee Report. The Audit Committee’s responsibility is to monitor and oversee TrustCo’s financial reporting and audit processes and to otherwise conduct its activities as provided for in its charter. Management is responsible for TrustCo’s internal controls and financial reporting process. TrustCo’s independent auditors for 2017, Crowe Horwath LLP, were responsible for performing an independent audit of TrustCo’s consolidated financial statements and the effectiveness of TrustCo’s internal controls over financial reporting in accordance with the Standards of the Public Company Accounting Oversight Board (United States) and issuing a report thereon. TrustCo’s Internal Audit Department is responsible for monitoring compliance with internal policies and procedures as well as evaluating the effectiveness of the Company’s governance, risk management, and internal control processes. In performing its oversight, the Audit Committee reviews the performance of Crowe Horwath LLP and TrustCo’s Director of Internal Audit.

In connection with these responsibilities, the Audit Committee met with management and Crowe Horwath LLP on February 20, 2018 to review and discuss TrustCo’s December 31, 2017 and 2016 consolidated financial statements. The Audit Committee also discussed with Crowe Horwath LLP the matters required to be communicated to audit committees in accordance with professional standards, including PCAOB Auditing Standard No. 1301, and received the written disclosures and a letter from Crowe Horwath LLP required by relevant regulatory and professional standards regarding auditor communications with audit committees concerning independence.

Based upon the Audit Committee’s discussions with management and the independent auditors, and its review of the information described in the preceding paragraphs, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in TrustCo’s Annual Report on Form10-K for the year ended December 31, 2017, filed with the SEC on March 1, 2018.

| AUDIT COMMITTEE: | Brian C. Flynn, Chair | |

| Dennis A. De Gennaro | ||

| Thomas O. Maggs | ||

| Dr. Anthony J. Marinello | ||

| William D. Powers | ||

| Lisa M. Reutter |

| 10 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

Shareholder Communications with Board and Board Attendance at Annual Meeting of Shareholders

TrustCo provides an informal process for shareholders to send communications to the board. Shareholders who wish to contact the board or any of its members may do so in writing to TrustCo Bank Corp NY, Attention: Corporate Secretary, P.O. Box 1082, Schenectady, New York 12301-1082. Additionally, immediately after the Annual Meeting of Shareholders, TrustCo conducts a shareholders’ assembly which provides a forum for shareholders to express their views.

Although TrustCo does not have a policy with regard to board members’ attendance at the Annual Meeting of Shareholders, the directors are encouraged to attend such meetings, and all of the directors attended both the 2017 Annual Meeting and the Shareholders’ Assembly.

Vote Required and Recommendation

The three nominees for election to the TrustCo board for three-year terms expiring at the 2021 Annual Meeting of Shareholders who receive the greatest number of votes will be elected to the board. Each nominee must, however, receive the affirmative vote of a majority of the outstanding shares of TrustCo common stock in order to be elected.

THE TRUSTCO BOARD RECOMMENDS THAT TRUSTCO SHAREHOLDERS VOTE “FOR” THE ELECTION OF THE TRUSTCO DIRECTOR NOMINEES AS TRUSTCO DIRECTORS, WHICH IS ITEM 1 ON THE TRUSTCO PROXY CARD.

Proposal 2 - Advisory Resolution on the Compensation of TrustCo’s Named Executive Officers

TrustCo has annually provided shareholders with the opportunity to vote to approve, on a nonbinding advisory basis, the compensation of the named executive officers as disclosed in this proxy statement, including the Compensation Discussion and Analysis, and the tabular disclosure regarding the compensation of the named executive officers and the accompanying narrative. (This opportunity is often referred to as a“say-on-pay” vote or proposal.)

Thesay-on-pay proposal described below gives TrustCo shareholders the opportunity to endorse, or not endorse, the compensation of the named executive officers. The vote on the proposal is not intended to address any specific element of executive compensation. Further, the vote is advisory, which means that it is not binding on TrustCo, its board of directors, or the Compensation Committee. The Compensation Committee will, however, take into account the outcome of the vote when considering future executive compensation decisions. Please refer to the “Compensation Discussion and Analysis” for a discussion of the effect of the vote on thesay-on-pay proposal at TrustCo’s 2017 annual meeting on the Compensation Committee’s decisions during 2017.

As discussed in more detail in the Compensation Discussion and Analysis, TrustCo seeks to offer a compensation structure for its executive officers designed to compare favorably with its peer group while taking into account the experience and responsibilities of each particular executive officer. TrustCo also seeks to provide compensation incentives that promote the enhancement of shareholder value in conjunction with encouraging and rewarding a high level of performance evidenced through the achievement of corporate and individual financial and business objectives and managing and minimizing the level of risk inherent in any compensation program. The Compensation Committee and the board of directors believe that the policies and procedures described in the Compensation Discussion and Analysis are effective in implementing the Company’s compensation program and achieving its goals and that the compensation of the Company’s named executive officers in 2017 reflects and supports these compensation policies and procedures.

In light of the foregoing, TrustCo is asking shareholders to approve the following resolution at the Annual Meeting:

RESOLVED, that the shareholders of TrustCo Bank Corp NY approve, on an advisory basis, the compensation of the named executive officers, as disclosed in TrustCo’s Proxy Statement for the 2018 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table, and the other related tables and narrative disclosure.

| TrustCo Bank Corp NY 2018 Proxy Statement 11 | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

Vote Required and Recommendation

The affirmative vote of a majority of all of TrustCo’s issued and outstanding shares of common stock is required to adopt the foregoing resolution approving the compensation of TrustCo’s named executive officers. Abstentions on properly executed proxy cards and shares not voted by brokers and other entities holding shares on behalf of beneficial owners will have the same effect as a vote “against” this proposal. Dissenters’ rights are not available to shareholders who object to the proposal.

THE TRUSTCO BOARD RECOMMENDS THAT TRUSTCO SHAREHOLDERS VOTE “FOR” THIS PROPOSAL, WHICH IS ITEM 2 ON THE TRUSTCO PROXY CARD.

Proposal 3 - Ratification of the Appointment of Independent Auditors

The Audit Committee of TrustCo’s Board of Directors has recommended, and the Board of Directors on February 20, 2018 reappointed, Crowe Horwath LLP as TrustCo’s Independent Auditors for the year ending December 31, 2018. At the Annual Meeting, shareholders will consider and vote on the ratification of the engagement of Crowe Horwath LLP for the fiscal year ending December 31, 2018. Information with respect to the services provided in 2017 and 2016 to TrustCo by Crowe Horwath LLP is presented under the Audit Committee discussion, above. Representatives of Crowe Horwath LLP are expected to be present at the Annual Meeting to make a statement if they so desire and are also expected to be available to respond to appropriate questions that may be raised.

The following table presents fees for professional audit services, as well as other professional or consulting services, rendered by Crowe Horwath LLP. The services included audits of TrustCo’s annual consolidated financial statements for the years ended December 31, 2017 and 2016 and of the effectiveness of internal controls over financial reporting, tax return preparation services, and other services provided by Crowe Horwath LLP during the years ended December 31, 2017 and 2016.

| 2017 | 2016 | |||||||

Audit fees | $ | 481,000 | 451,000 | |||||

Audit related fees(1) | 15,000 | 6,800 | ||||||

Tax fees(2) | 99,950 | 114,700 | ||||||

All other fees(3) | 0 | 181,000 | ||||||

|

|

|

| |||||

Total Fees | $ | 595,950 | 753,500 | |||||

| (1) | For 2017, audit-related fees consisted of professional services for FormS-3 Registration Statement consent procedures. For 2016, audit-related fees consisted of assistance in responding to an SEC comment letter. |

| (2) | For 2017 and 2016, tax fees consisted of tax return preparation services and assistance with tax audits. |

| (3) | For 2016, all other fees consisted of operational internal audit compliance services related to the Company’snon-financial compliance function. |

TrustCo’s Audit Committee held twelve meetings and two executive sessions in 2017. The directors currently serving on the Audit Committee are Brian C. Flynn, (Chair), Dennis A. De Gennaro, Thomas O. Maggs, Dr. Anthony J. Marinello and Lisa M. Reutter. The purpose of the Audit Committee is to oversee the Company’s accounting and financial reporting processes and audits of the Company’s financial statements; the Committee’s functions also include the review of TrustCo’s and Trustco Bank’s internal audit function and the review of the adequacy of internal accounting controls for TrustCo and Trustco Bank. In addition, the Audit Committee annually recommends the use of external audit firms by TrustCo and Trustco Bank in the coming year, after reviewing performance of the existing vendors and available audit resources. Please refer to the discussion under “Audit Committee” for a more detailed description of the Audit Committee’s activities.

Vote Required and Recommendation

The affirmative vote of a majority of all of TrustCo’s issued and outstanding shares of common stock is required to ratify the appointment of Crowe Horwath LLP as TrustCo’s Independent Auditors for the year ending December 31, 2018. Abstentions on properly executed proxy cards and shares not voted by brokers and other entities holding shares on behalf of beneficial owners will have the same effect as a vote “against” this proposal. Dissenters’ rights are not available to shareholders who object to the proposal.

| 12 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES | ||||||||

THE TRUSTCO BOARD RECOMMENDS THAT TRUSTCO SHAREHOLDERS VOTE “FOR” THIS PROPOSAL, WHICH IS ITEM 3 ON THE TRUSTCO PROXY CARD.

TrustCo’s board of directors is not aware of any other matters that may come before the Annual Meeting. If any matter not described in this proxy statement is properly presented at the Annual Meeting, the persons named in the proxy card will use their judgment to determine how to vote the shares for which they have voting authority.

| TrustCo Bank Corp NY 2018 Proxy Statement 13 | ||||||||

| EXECUTIVE COMPENSATION | ||||||||

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (the “CD&A”) describes the objectives, policies and components of TrustCo’s 2017 executive compensation program for its named executive officers. In addition, the CD&A will discuss and analyze the decisions of and actions taken by the Compensation Committee during, before and after 2017 as those decisions and actions relate to such objectives and policies and the compensation paid to or earned by the named executive officers during 2017.

TrustCo identified the following as executive officers for 2017:

| • | Robert J. McCormick, President and Chief Executive Officer, TrustCo and Trustco Bank. |

| • | Michael M. Ozimek, Senior Vice President and Chief Financial Officer, TrustCo and Trustco Bank. |

| • | Robert T. Cushing, former Executive Vice President and Chief Operating Officer, TrustCo and Trustco Bank.1 |

| • | Scot R. Salvador, Executive Vice President and Chief Banking Officer, TrustCo and Trustco Bank. |

| • | Robert M. Leonard, Executive Vice President and Chief Risk Officer, TrustCo and Trustco Bank. |

| • | Kevin M. Curley, Senior Vice President TrustCo and Trustco Bank. |

| • | Eric W. Schreck, Treasurer, TrustCo, and Senior Vice President, Trustco Bank. |

| • | Michael J. Hall, Vice President, Counsel, and Secretary, TrustCo and Trustco Bank. |

Of those, Messrs. McCormick, Ozimek, Cushing1, Salvador, Leonard, and Schreck are the named executive officers.

| (1) | Mr. Cushing retired effective December 22, 2017. |

Objectives of Executive Compensation Program

Our executive compensation program is designed to promote the following compensation objectives:

| • | Encourage and reward the achievement of our short-term and long-term financial and strategic objectives; |

| • | Align executive interests with the interests of our shareholders to ensure their focus on long-term return to shareholders and consideration of excessive risk mitigation; and |

| • | Provide a comprehensive compensation program that fosters the retention of current executive officers and serves to attract new highly-talented, results-driven executives as the need may arise. |

Engagement, Feedback and Changes

In 2017 and early 2018, TrustCo continued its vigorous shareholder engagement program reaching out to its 25 largest investors, representing 46.1% of its outstanding shares. Through that outreach, TrustCo had conversations with investors representing 26% of the outstanding shares. In response to the input received, a number of meaningful changes to TrustCo’s governance structure and compensation program were made. The changes include strides in diversity, environmental, social, governance (ESG) practices, and adjustments to long-term compensation. Additionally, in 2017, shareholders representing 95% of the votes cast supported the“say-on-pay” vote.

| 14 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| EXECUTIVE COMPENSATION | ||||||||

TrustCo values shareholder views and insights and believes that its engagement program builds informed relationships, promotes transparency, and improves accountability. The ultimate goal is to appropriately relate executive pay to corporate performance and provide our investors with a meaningful voice relating to our corporate governance practices. After listening to shareholder feedback and performing further analysis, TrustCo implemented the following changes:

| Compensation Feature | What TrustCo Heard | What TrustCo Did | ||||||

| Board Diversity | Companies with more diverse boards perform better. | TrustCo conducted an extensive search identifying numerous qualified candidates and ultimately elected Lisa M. Reutter to the board. | ||||||

| Environmental, Social, Governance | Companies that are focused on broad issues of good corporate citizenship perform better. | Trustco Bank is very proud of the diversity of its workforce, has significantly enhanced the responsiveness of its governance program, and is increasing its focus on several environmental issues, such as supporting alternative fuel vehicles and utilizing LED lighting. These initiatives are not only beneficial to society and the environment but are also financially beneficial to the Company. | ||||||

| Board Declassification | Some investors are of the view that board declassification represents better governance. | The Nominating and Corporate Governance Committee commissioned a review of the topic directing management analyze the issue and report findings to the Committee. | ||||||

| Director Tenure | Board refreshment should be a governance priority. | Through several actions, over the past three years TrustCo has reduced its average board tenure from 19 years to just over 10 years. Additionally, the board adopted a mandatory retirement age of 72 for all new board members. | ||||||

| Single Metric in Long-Term Incentive Plan | Single metrics are disfavored. | Along with the relative metric of ROE, TrustCo added a second metric, efficiency ratio, throughout the three-year performance period. | ||||||

Over the past several years, TrustCo has made significant and meaningful changes to the way it approaches governance and the way it discloses information about its operation and the compensation of its executives. The goal of these efforts is to provide shareholders with the data needed to fully evaluate the Company’s performance as measured against relevant metrics. The changes made demonstrate TrustCo’s commitment to such matters. As also indicated in last year’s proxy, TrustCo’s shareholder outreach is viewed as ongoing and not transactional. TrustCo will make governance enhancements and address other and new matters as they are presented.

| TrustCo Bank Corp NY 2018 Proxy Statement 15 | ||||||||

| EXECUTIVE COMPENSATION | ||||||||

Highlights of 2017 Business Results

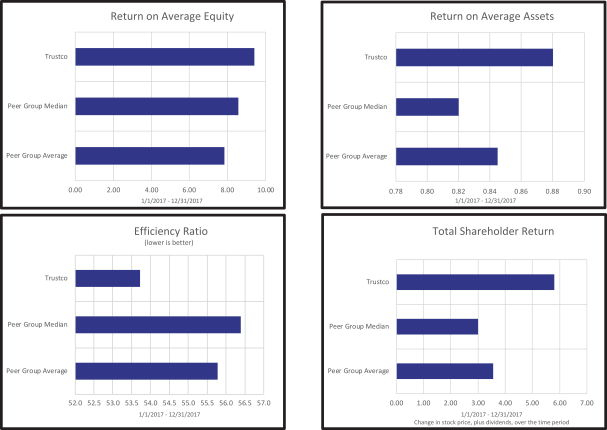

TrustCo continued its strong performance in 2017. The chart below summarizes key results.

| Company Performance | ||||

| Performance Metric | 2017 Results | 2016 Results | ||

| Net Income | $43.1 million | $42.6 million | ||

| Return on Average Equity | 9.64% | 9.94% | ||

| Return on Average Assets | 0.88 | 0.89 | ||

| Diluted Earnings Per Share | $0.448 | $0.445 | ||

| Nonperforming Loans to Total Loans | 0.67% | 0.73% | ||

| Efficiency Ratio | 53.72% | 55.67% | ||

Like all U.S. companies, TrustCo’s 2017 results were impacted by the tax law changes that were adopted in late 2017. All of the metrics listed above would have shown greater performance were it not for the necessary adjustment of deferred tax assets due to the changes. Specifically, TrustCo wrote down approximately $5.1 million of its deferred tax assets as a result of the tax law changes in 2017. As a result, compared to 2016, TrustCo’s 2017 net income rose from $42.6 million to $43.1 million, an increase of 1.2%, whilepre-tax earnings for the same period rose from $68.3 million to $76 million, an increase of 12.4%.

Please refer page 37 of the 2017 Annual Report for more information on how the Efficiency Ratio was calculated.

Compensation Committee and Management Role in Determining Compensation for the Named Executive Officers

The Compensation Committee has responsibility for overseeing the Company’s executive compensation policies and practices, including establishing annual salaries, long-term incentive and equity-incentive arrangements, annual incentive arrangements, and all other benefits and other compensation programs for the Company’s named executive officers. The Compensation Committee is solely responsible for setting the compensation of Mr. McCormick, the Company’s Chief Executive Officer (“CEO”). As for the other named executive officers, the CEO generally makes recommendations to the Compensation Committee in light of the named executive officers’ performance, the Company’s performance, and other factors. The Committee then evaluates the recommendations and determines the levels and structure of these executive officers’ compensation.

In making its decisions, the Compensation Committee considers a number of factors including among others:

| • | TrustCo’s and Trustco Bank’s attainment of net income goals; |

| • | The Company’s operating performance against its past performance and that of its peers; |

| • | Total shareholder return; |

| • | Total asset targets; |

| • | Overall profitability from year to year; |

| • | Company efficiency; and |

| • | Banking experience of individual named executive officers, the scope of their responsibility within the overall organization, their individual performance and the specific contributions they made to TrustCo and Trustco Bank during the course of the year. |

The Compensation Committee also considers other relevant factors, including involvement in the community that might better position the organization to serve the immediate needs of Trustco Bank’s market. The Compensation Committee generally considers most or all of the above criteria but does not generally assign a specific weight to any of these factors in making compensation decisions and may choose certain criteria in one year and others in other years. Except for specific goals set with respect to certain compensation programs described herein or otherwise set forth below, the Compensation Committee makes compensation decisions on a discretionary basis considering such factors and criteria as it deems appropriate from year to year.

| 16 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| EXECUTIVE COMPENSATION | ||||||||

As part of the Company’s analysis, review, and implementation of its executive compensation program, the Compensation Committee reviews aspects of the financial performance of a group of companies the Company considers to be its peers as well as the compensation paid to certain executive officers of these peer companies. For example, annual bonus awards paid pursuant to the Company’s Executive Officer Incentive Plan are based on the achievement of certain performance metrics relative to the achievement of the same metrics by these peer companies. In addition, the Compensation Committee typically reviews the total compensation, including base salary, incentive compensation, equity awards, and other compensation, paid to the top three to five executive officers of these peer companies. While the Compensation Committee considers certain aspects of the financial performance of peer companies and the compensation paid to the named executive officers of those peer companies relative to the Company’s performance and compensation paid to the Company’s named executive officers, it does not specifically benchmark compensation against these peer companies. Rather, the Compensation Committee uses the information as a general guide to setting compensation for the Company’s named executive officers.

The Compensation Committee typically determines the Company’s then-current peer group in December of each year in connection with setting certain aspects of annual compensation for the following year. The criteria the Compensation Committee uses to determine peer companies is generally the same from year to year and consists of New York, New Jersey and Florida-based banks and thrifts with assets of between $2 and $10 billion (measured as of the end of September of each year). The Compensation Committee is of the view that inasmuch as the Company’s major market areas are in Upstate New York, Downstate New York/Northern New Jersey and Florida, thesecomparably-sized companies are a reasonable representation of its peers. As of December 31, 2016, the Company had total assets of approximately $4.87 billion. The composition of the peer group may change from year to year as new companies enter the relevant market or on account of changes in the size of companies or mergers or acquisitions.

In December 2016, the Compensation Committee selected a peer group consisting of 24 banks and thrifts. The Company’s peer group selected in 2016 consisted of the following companies (the “Peer Group”):

| Arrow Financial Corp | Lakeland Bancorp | |

| Bridge Bancorp | NBT Bancorp | |

| Capital City Bank Group | Northfield Bancorp | |

| Community Bank System | OceanFirst Financial Corp | |

| CenterState Bank Corp | Oritani Financial Corp | |

| ConnectOne Bancorp, Inc. | Peapack Gladstone Financial | |

| Dime Community Bancshares | Provident Financial Services | |

| FCB Financial Holdings | Seacoast Banking Corp of Florida | |

| Financial Institutions | Stonegate Bank | |

| First of Long Island | Suffolk Bancorp | |

| Flushing Financial Corp | Sun Bancorp | |

| Kearny Financial Corp | Tompkins Financial Corp |

| TrustCo Bank Corp NY 2018 Proxy Statement 17 | ||||||||

| EXECUTIVE COMPENSATION | ||||||||

In December 2016, as part of itsyear-end review of the Company’s executive compensation program, the Compensation Committee reviewed the base salary and total compensation paid to the officers of the companies in the Peer Group based upon December 2015 information, that being the most current information available. In addition, the Compensation Committee also compared the Company’s overall performance with that of companies in the Peer Group.

| CEO Compensation | Peer Group | |||

Median | $ | 1,328,315 | ||

Mean | $ | 1,858,816 | ||

25th Percentile | $ | 1,146,694 | ||

75th Percentile | $ | 2,297,567 | ||

90th Percentile | $ | 3,597,422 | ||

Minimum | $ | 574,980 | ||

Maximum | $ | 4,954,935 | ||

TrustCo CEO, Robert J. McCormick | $ | 1,703,019 | ||

TrustCo Percent Rank | 59.2% | |||

| NEO Compensation | Peer Group | |||

Median | $ | 576,580 | ||

Mean | $ | 667,524 | ||

25th Percentile | $ | 464,311 | ||

75th Percentile | $ | 739,464 | ||

90th Percentile | $ | 1,031,216 | ||

Minimum | $ | 295,511 | ||

Maximum | $ | 2,295,521 | ||

Michael M. Ozimek, Chief Financial Officer | $ | 358,144 | ||

Robert T. Cushing, Chief Operating Officer (retired) | $ | 966,378 | ||

Scot R. Salvador, Chief Banking Officer | $ | 1,006,583 | ||

Robert M. Leonard, Chief Risk Officer | $ | 719,218 | ||

Eric W. Schreck, Senior Vice President | $ | 407,818 | ||

TrustCo NEOs Mean | $ | 691,628 | ||

Trustco NEO Percent Rank | 72.7% | |||

| 18 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| EXECUTIVE COMPENSATION | ||||||||

Utilizing performance data as of September 30, 2016, the Compensation Committee concluded the Company’s overall performance compared favorably with that of the Peer Group. With the benefit of actualyear-end 2017 numbers, the comparison is as follows:

Although included as a part of the peer group when it was established, the above charts do not reflect performance information for Stonegate Bank, Suffolk Bancorp or Sun Bancorp. Due to acquisitions, the 2017 data was not available for these banks.

Also of note is that while the Company is of similar size to the members of its peer group, the Compensation Committee also takes into consideration the unique size of the Company’s executive group as compared to other companies in the Peer Group. TrustCo and Trustco Bank typically have operated with four senior executive officers, all of whom have a very broad scope of responsibilities. The Compensation Committee believes that the other institutions in the Peer Group have a larger pool of such officers having similar responsibilities.

The Compensation Committee periodically, but not necessarily annually, retains compensation consultants, reviews information provided by or through third-party sources, and often relies on TrustCo’s Human Resources Department to gather such information.

In 2017, management engaged McLagan (Aon) for background and market research services. Information thus obtained was also shared with the Committee.

| TrustCo Bank Corp NY 2018 Proxy Statement 19 | ||||||||

| EXECUTIVE COMPENSATION | ||||||||

2017 Executive Compensation Program

For 2017 there were three basic elements to TrustCo’s executive compensation program, each of which hassub-elements:

| Annual Compensation | Salary, Incentive Bonus, Other Benefits | |

| Long-Term Compensation | Stock Options, Restricted Stock Units, Performance Shares, Performance Bonus Program | |

| Retirement Compensation | Defined Benefit Pension Plan, 401(k) Plan, and Supplemental Retirement Plan | |

As a general matter, the Compensation Committee initially considers total compensation levels of the Peer Group prior to making compensation decisions with respect to each of the individual elements of executive compensation. The description below provides discussion and analysis for each element of TrustCo’s executive compensation program for 2017, including the relevant history of those components and the compensation decisions made for 2017.

Annual salary is the base compensation for the Company’s named executive officers and is intended to provide a portion of compensation which is fixed to give our named executive officers resources upon which to live and provide them with a certain level of financial security. The salaries for our named executive officers are established based upon the scope of their respective responsibilities, taking into account competitive market compensation paid by the Peer Group for similar positions along with the performance of these companies relative to the performance of the Company. Salaries are reviewed at least annually and are also reviewed upon the request of the board of directors.

Based on the data available in December of 2016, the Compensation Committee concluded that the base salaries and total compensation of named executive officers McCormick, Cushing, and Salvador were competitive with the Peer Group. Although the Compensation Committee believes that these executive officers’ performance through the third quarter of 2016 led to the Company’s solid performance relative to the Peer Group, consistent with the Company’s policy to gradually increase the proportion of performance-based compensation to fixed compensation, the Compensation Committee elected not to increase their base salaries. For these named executive officers, the Compensation Committee believes that the Company’s Executive Officer Incentive Plan (annual performance bonuses) and/or the Amended and Restated TrustCo Bank Corp NY 2010 Equity Incentive Plan (“Equity Incentive Plan”) (stock options, restricted units, and performance share awards) are properly structured to reward exceptional performance with appropriate increased compensation.

As to Messrs. Ozimek, Leonard, and Schreck, taking into account the scope of their respective responsibilities, the compensation paid by the Peer Group for similar positions, and the performance of the Company relative to the Peer Group, the Committee concluded that the base salaries and total compensation these name executive officers was found to be below the average compensation levels. The Committee concluded that modest increases were, therefore, appropriate.

Accordingly, named executive officer compensation for 2017 was set as follows:

| Name and Position | 2017 Annual Base Salary | Increase over 2016 | ||||||

Robert J. McCormick | $ | 880,000 | 0 | % | ||||

Michael M. Ozimek | $ | 250,000 | 6 | % | ||||

Robert T. Cushing | $ | 640,000 | 0 | % | ||||

Scot R. Salvador | $ | 520,000 | 0 | % | ||||

Robert M. Leonard | $ | 330,000 | 13 | % | ||||

Eric W. Schreck | $ | 283,400 | 4 | % | ||||

| 20 TrustCo Bank Corp NY 2018 Proxy Statement | ||||||||

| EXECUTIVE COMPENSATION | ||||||||

Executive Officer Incentive Plan for 2017.

The Executive Officer Incentive Plan provides for annual bonus compensation for the named executive officers based upon the achievement of certain corporate performance targets. The Compensation Committee reviews and adjusts as appropriate the plan bonus opportunities, performance targets, structure, and other metrics on an annual basis. In March 2017, the Compensation Committee met and approved the bonus opportunities, performance targets, structure, and other metrics for the year.

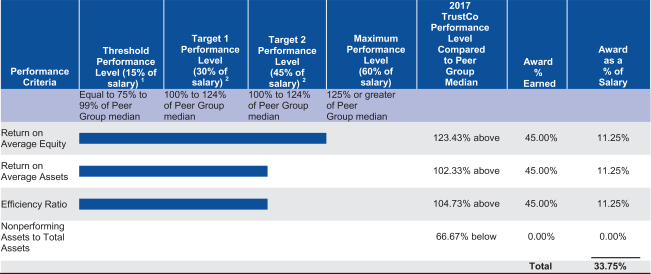

The corporate performance targets set for 2017 included return on average equity, return on average assets, efficiency ratio, and the ratio of nonperforming assets to total assets, each as measured against the composite performance of the Peer Group. The Compensation Committee selected these particular performance measures because it considers them to be important factors in driving corporate performance. Bonuses for 2017 would only be awarded for achievement of corporate targets and are based on threshold (15% of base salary), target (either 30% or 45% of base salary, see below) and maximum (60% of base salary) level of achievement.

The following table sets forth the corporate performance targets, weightings, levels of achievement and other details under the Executive Officer Incentive Plan for 2017. Each metric is weighted at 25%.

2017 Executive Officer Incentive Plan

| (1) | Provided that performance is better than 2016 performance. |

| (2) | Provided that performance is better than 2016 performance, payout will be based on Target 2 percentage, otherwise Target 1 percentage. For comparison purposes, 2017 income was adjusted per the plan terms to exclude “infrequent, unusual orone-timenon-recurring items”, i.e. write down of deferred tax assets |

Consistent with the Company’s practice of placing more emphasis on long-term compensation and to reward executives for sustained performance over more than one year, in March 2017, when the Compensation Committee approved the bonus opportunities and performance targets for 2017, it required, as allowed under the plan, that to the extent that the achievement level for 2017 resulted in bonus amounts in excess of 30% of base salary for the executives, payment of the amount in excess of 30% (the “Contingent Bonus”) would be contingent on achievement of the same corporate performance goals set for 2017 (return on average equity, return on average assets, efficiency ratio, and the ratio ofnon-performing assets) relative to the Peer Group average performance for 2018. Payment levels were based on threshold (100% of Contingent Bonus), target (115% of Contingent Bonus) and maximum (125% of Contingent Bonus) level of achievement. At the threshold level, the Contingent Bonus would not be earned unless performance for at least two of the performance goals for 2018 are within 25% of the Peer Group average performance level for 2018. Payment of any amount in excess of 100% of the Contingent Bonus would be subject to achievement of corporate performance goals at a level better than the Peer Group average performance. Thus, for 2017, the Executive Officers Incentive Plan

| TrustCo Bank Corp NY 2018 Proxy Statement 21 | ||||||||

Performance Criteria Threshold Performance Level (15% of salary) 1 Target 1 Performance Level (30% of salary) 2 Target 2 Performance Level (45% of salary) 2 Maximum Performance Level (60% of salary) 2017 TrustCo Performance Level Compared to Peer Group Median Award % Earned Award as a % of Salary Return on Average Equity Equal to 75% to 99% of Peer Group median 100% to 124% of Peer Group median 100% to 124% of Peer Group median 125% or greater of Peer Group median 123.43% above 45.00% 11.25% Return on Average Assets 102.33% above 45.00% 11.25% Efficiency Ratio 104.73% above 45.00% 11.25% Nonperforming Assets to Total Assets 66.67% below 0.00% 0.00% Total 33.75%

| EXECUTIVE COMPENSATION | ||||||||

generated a bonus of 33.75% of base salary to the participating executive officers, with 3.75% thereof subject to the Contingent Bonus payment feature.

2017 Contingent Bonus Payment

| Performance Level | Performance Criteria | Bonus Payment | ||||||

Threshold | At least two of the performance goals set for 2018 are achieved at a level of 75% to 99% of the peer group median performance | 100% of Contingent Bonus | ||||||

Target | All performance goals for 2018 are achieved at 100% to 125% of the peer group median performance | 115% of Contingent Bonus | ||||||

Maximum | All performance goals for 2018 are achieved at 125% or greater than the peer group median performance | 125% of Contingent Bonus |

The Compensation Committee believes that the Executive Officer Incentive Plan, as currently structured with the long-term performance feature, will encourage and reward executives for achievement of key corporate performance goals that will contribute to long-term sustained performance, drive long-term shareholder value creation, and encourage executive decision making that mitigates long-term risk. Moreover, the Committee believes that payment levels relative to base salary percentages are generally consistent with Peer Group bonus compensation levels and serve to reward executives for superior performance over more than one year with enhanced performance-based compensation in lieu of increased fixed compensation.

The Company provides certain other annual benefits to the named executive officers in the form of (i) benefits under its executive medical reimbursement plan described below, (ii) use of Company cars, (iii) country club memberships, (iv) financial planning services and (v) additional tax “gross up” payments. In addition to the specific reasons set forth below for providing these benefits, the Compensation Committee believes they help to provide a comprehensive compensation program that fosters the retention of our current executive officers and will serve to attract new highly talented, results-driven executives as the need may arise. The Compensation Committee believes that the value of these other annual benefits to the Company’s overall executive compensation program and the individual named executive officers outweighs the cost to the Company, which is set forth in the “All Other Compensation” column of the “Summary Compensation Table” below.

Executive Medical Reimbursement Plan.

Messrs. McCormick, Cushing, Salvador, and Leonard are participants in the Company’s executive medical reimbursement plan. The plan is intended to provide for the reimbursement of medical, hospitalization, and dental expenses that exceed the deductible orco-payment limits under the Company’s general medical insurance plans. The plan is intended to provide selected named executive officers with the basic resources upon which to live and provide them with a certain level of financial security in the face of extraordinary medical expenses, thus ensuring they remain focused on the Company’s business goals.

The Company provides all of the named executive officers with the use of a car. The Compensation Committee believes that this benefit is generally consistent with industry practice (a majority of the Peer Group companies provide a similar benefit) and recognizes and rewards the named executive officers for their achievement to the level of a senior executive.