- TRST Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

TrustCo Bank Corp NY (TRST) DEF 14ADefinitive proxy

Filed: 1 Apr 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

TrustCo Bank Corp NY | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

5 Sarnowski Drive, Glenville, New York 12302

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Shareholders of TrustCo Bank Corp NY:

Notice is hereby given that the Annual Meeting of Shareholders of TrustCo Bank Corp NY, a New York corporation, will be held at Mallozzi’s Restaurant and Banquet House, 1930 Curry Road, Rotterdam, New York 12303, on May 19, 2016, at 4:00 pm local time, for the purpose of considering and voting upon the following matters:

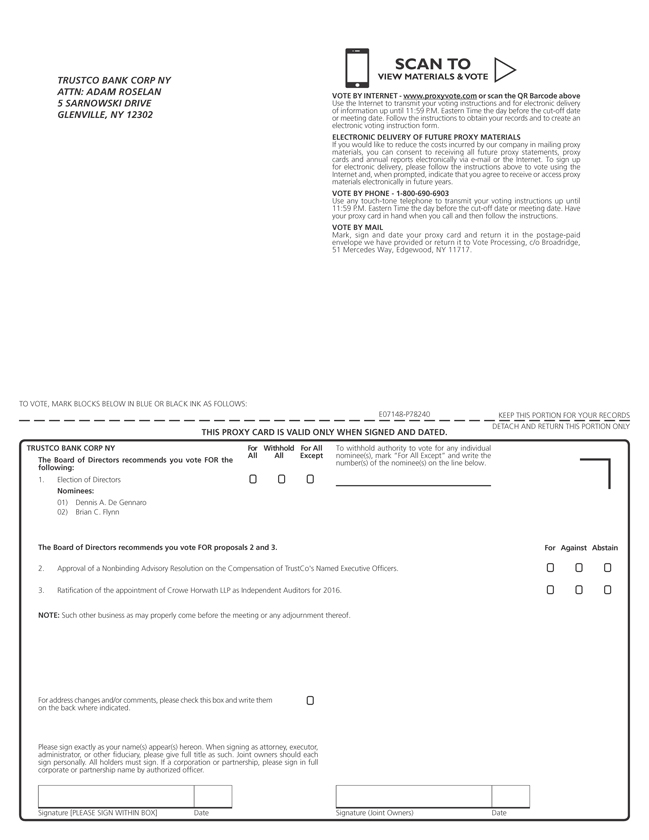

| 1. | Election of Directors. |

| 2. | Approval of a Nonbinding Advisory Resolution on the Compensation of TrustCo’s Named Executive Officers. |

| 3. | Ratification of the Appointment of Crowe Horwath LLP as TrustCo’s Independent Auditors for 2016. |

| 4. | Any other business that properly may be brought before the meeting or any adjournment thereof. |

By Order of the Board of Directors,

| ||

| Robert M. Leonard, Secretary | ||

April 1, 2016

YOUR VOTE IS IMPORTANT

TO US

EVEN IF YOU PLAN TO ATTEND THE MEETING, PLEASE SIGN AND RETURN THE ENCLOSED CARD AS PROMPTLY AS POSSIBLE. YOU MAY ALSO VOTE USING THE INTERNET OR TELEPHONE. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE EXERCISE OF THE PROXY.

Important Notice Regarding the Internet Availability of Proxy Materials for the

Shareholder Meeting to be Held on May 19, 2016:

This Notice, the Proxy Statement attached to this Notice and TrustCo’s Annual Report to shareholders for the year ended December 31, 2015 are available free of charge at https://materials.proxyvote.com/898349.

TRUSTCO BANK CORP NY

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS

May 19, 2016

This proxy statement is furnished in connection with the solicitation by the board of directors of TrustCo Bank Corp NY (also referred to as “TrustCo” or the “Company”) of proxies to be voted at TrustCo’s Annual Meeting of Shareholders. The Annual Meeting will be held at 4:00 pm local time on Thursday, May 19, 2016, at Mallozzi’s Restaurant and Banquet House, 1930 Curry Road, Rotterdam, New York 12303. This proxy statement and the enclosed form of proxy were first mailed to shareholders on or about April 1, 2016.

The record date for the Annual Meeting is March 21, 2016. Only shareholders of record at the close of business on March 21, 2016 are entitled to notice of and to vote at the Annual Meeting. Shareholders of record on that date are entitled to one vote for each share of TrustCo common stock they hold. As of March 1, 2016, there were 95,368,575 shares of common stock outstanding.

The Annual Meeting will be held if a majority of the outstanding shares of TrustCo’s common stock, constituting a quorum, is represented at the meeting. If shareholders return a properly executed proxy card, their shares will be counted for purposes of determining a quorum at the meeting, even if they abstain from voting. Abstentions and broker non-votes count as shares present at the Annual Meeting for purposes of determining a quorum. If a shareholder owns shares in “street name” through a bank or broker, the shareholder may instruct his or her bank or broker how to vote the shares. A “broker non-vote” occurs when a shareholder who owns shares through a bank or broker fails to provide the bank or broker with voting instructions and either the bank or broker does not have the discretionary authority to vote the shares on a particular proposal or the bank or broker otherwise fails to vote the shares.

Under the rules of the NASDAQ Stock Market and the New York Stock Exchange, brokers do not have discretionary authority to vote shares on proposals that are not “routine.” Proposal 1 (Election of Directors), and Proposal 2 (Approval of a Nonbinding Advisory Resolution on the Compensation of TrustCo’s Named Executive Officers) would not be considered routine matters under the NASDAQ Stock Market and New York Stock Exchange rules, so brokers do not have discretionary authority to vote shares held in street name on those proposals. If a shareholder wishes for his or her shares to be voted on these matters, the shareholder must provide his or her broker with voting instructions. Proposal 3 (Ratification of the Appointment of Crowe Horwath LLP as TrustCo’s Independent Auditors) is considered a routine matter, so the bank or broker will have discretionary authority to vote shares held in street name on this item.

All shares of TrustCo’s common stock represented at the Annual Meeting by properly executed proxies will be voted according to the instructions indicated on the proxy card. If shareholders return a signed proxy card but fail to instruct how the shares registered in their names

1

must be voted, the shares will be voted as recommended by TrustCo’s board of directors. The board of directors recommends that shareholders vote:

| • | “FOR” each of the nominees for director, |

| • | “FOR” the approval of the nonbinding advisory resolution approving the compensation of TrustCo’s named executive officers, and |

| • | “FOR” ratification of the appointment of Crowe Horwath LLP as TrustCo’s Independent Auditors. |

If any matter not described in this proxy statement is properly presented at the Annual Meeting, the persons named in the proxy card will use their judgment to determine how to vote the shares for which they have voting authority. TrustCo does not know of any other matters to be presented at the Annual Meeting.

Any shareholder executing a proxy solicited under this proxy statement has the power to revoke it by giving written notice to the Secretary of TrustCo at its main office address or at the meeting of shareholders at any time prior to the exercise of the proxy.

TrustCo will solicit proxies primarily by mail, although proxies also may be solicited by directors, officers, and employees of TrustCo or TrustCo’s wholly-owned subsidiary, Trustco Bank. These persons may solicit proxies personally or by telephone, and they will receive no additional compensation for such services. TrustCo also has retained Regan & Associates, Inc. to aid in the solicitation of proxies for a solicitation fee of $12,500 plus expenses and a delivery fee of $2,250. The entire cost of this solicitation will be paid by TrustCo.

THE ANNUAL MEETING

A description of the items to be considered at the Annual Meeting, as well as other information concerning TrustCo and the meeting, is set forth below.

Proposal 1 - Election of Directors

The first item to be acted upon at the Annual Meeting is the election of two directors to serve on the TrustCo board of directors. The nominees for election as directors for three-year terms expiring at TrustCo’s 2019 Annual Meeting are Dennis A. De Gennaro and Brian C. Flynn. Each of the nominees is an incumbent director, although Mr. Flynn was appointed by the board of directors to fill a vacancy and joined the board on February 16, 2016. Each nominee was approved by TrustCo’s board of directors.

TrustCo’s Certificate of Incorporation provides that TrustCo’s board of directors will consist of not less than five nor more than fifteen members, with, under TrustCo’s Bylaws, the total number of directors to be fixed by resolution of the board or the shareholders. Currently, TrustCo and Trustco Bank have eight directors. The term of Robert A. McCormick, the former chairman, president, and chief executive officer of TrustCo and Trustco Bank, will expire at the Annual

2

Meeting, and, as announced by TrustCo on February 18, 2016, Mr. McCormick has decided to retire from the board of directors at that time rather than seek a new term. The board of directors has decided not to immediately fill the vacancy on the board that will be created upon Mr. McCormick’s retirement and to reduce the size of the board until such time, if any, that the board decides to add a new director. Accordingly, effective upon the close of the Annual Meeting and Mr. McCormick’s retirement, the board will be fixed at seven members.

The pages that follow set forth information regarding TrustCo’s nominees, as well as information regarding the remaining members of TrustCo’s board. Proxies will be voted in accordance with the specific instructions contained in the proxy card; properly executed proxies that do not contain voting instructions will be voted “FOR” the election of TrustCo’s nominees. If any such nominee becomes unavailable to serve, the shares represented by all valid proxies will be voted for the election of such other person as TrustCo’s board may recommend. Each of TrustCo’s nominees has consented to being named in this proxy statement and to serve if elected. The board of directors has no reason to believe that any nominee will decline or be unable to serve if elected.

Information with regard to the business experience of each director and nominee and the ownership of common stock on December 31, 2015 has been furnished by each director and nominee or has been obtained from TrustCo’s records. TrustCo’s common stock is the only class of its equity securities outstanding.

INFORMATION ON TRUSTCO DIRECTORS AND NOMINEES

NOMINEES FOR ELECTION AS TRUSTCO DIRECTORS(1) FOR

THREE-YEAR TERMS TO EXPIRE IN 2019

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation(2) | No. of Shares (3) | Percent of Class | ||||||

| Dennis A. De Gennaro, Age 71, President and Chief Executive Officer, Camelot Associates, Corp. (commercial and residential home builder and developer). Current Chairman of the Board of Directors of TrustCo and Trustco Bank. Director of TrustCo and Trustco Bank from 2009-present. Mr. De Gennaro is highly knowledgeable about commercial and residential real estate in the Capitol Region of New York and contributes his organization skills and experience from operating a successful business enterprise. | 94,867 | (4) | * | |||||

| * | Less than 1% |

3

See footnotes on page 7.

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation(2) | No. of Shares (3) | Percent of Class | ||||||

| Brian C. Flynn,Age 65, Consultant and Certified Public Accountant (NY). Director of TrustCo and Trustco Bank since 2016. Former partner of KPMG LLP (retired 2010) where he was employed for approximately 30 years. Mr. Flynn served in KPMG’s banking and finance practice area where his specialties included providing tax services to community banks, thrift institutions and real estate developers/ operators. Since his retirement in 2010 he has served as a technical tax consultant to a community bank trade group. Mr. Flynn brings to the board extensive tax, accounting and financial reporting expertise in the financial services industry. Mr. Flynn has been designated an audit committee financial expert. | 1,000 | (5) | * | |||||

OTHER TRUSTCO DIRECTORS(1)

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation(2) | No. of Shares (3) | Percent of Class | ||||||

| Thomas O. Maggs, Age 71, President, Maggs & Associates, The Business Insurance Brokers, Inc. (insurance broker). Director of TrustCo and Trustco Bank from 2005-present. Chairman of the Board of Directors of TrustCo and Trustco Bank for 2015. Mr. Maggs contributes his experience as an entrepreneur operating a successful business enterprise and his skills for developing and evaluating business strategies. | 82,908 | (6) | * | |||||

| Anthony J. Marinello, M.D., Ph.D., Age 60, Physician. Director of TrustCo and Trustco Bank from 1995-present. Chairman of the Board of Directors of TrustCo and Trustco Bank for 2013. Dr. Marinello contributes his experience as an entrepreneur operating a successful medical practice and his skills for developing and evaluating business strategies. | 89,195 | (7) | * | |||||

| * | Less than 1% |

4

See footnotes on page 7.

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation(2) | No. of Shares (3) | Percent of Class | ||||||

| Robert A. McCormick, Age 79, Chairman of TrustCo and Trustco Bank 2001-2008. Chairman, President & Chief Executive Officer of TrustCo and Trustco Bank 1984-2002. Director of TrustCo and Trustco Bank from 1980-present. Mr. McCormick retired as an executive officer of TrustCo and Trustco Bank as of November 1, 2002. Mr. McCormick, who has been associated with TrustCo for more than 30 years and has vast experience with all aspects of its operations, will retire from the board of directors upon completion of the Annual Meeting. Robert A. McCormick is the father of Robert J. McCormick. | 782,075 | (8) | * | |||||

| Robert J. McCormick, Age 52, President and Chief Executive Officer of TrustCo since January 2004, Chairman 2009 and 2010, executive officer of TrustCo from 2001-present and Chief Executive Officer of Trustco Bank from November 2002-present. Director of TrustCo and Trustco Bank from 2005-present. Joined Trustco Bank in 1995. Mr. McCormick contributes his skills and knowledge obtained from being the chief executive officer of the Company and Trustco Bank. Robert J. McCormick is the son of Robert A. McCormick. | 2,376,933 | (9) | 2.50 | |||||

| William D. Powers, Age 74, Consultant, Chairman of the Board of Directors of TrustCo and Trustco Bank for 2012. Director of TrustCo and Trustco Bank from 1995-present. Mr. Powers contributes his experience as an entrepreneur operating a successful business enterprise and his skills for developing and evaluating business strategies. | 131,651 | (10) | * | |||||

| William J. Purdy, Age 81, President, Welbourne & Purdy Realty, Inc. Director of TrustCo and Trustco Bank from 1991-present. Chairman of the Board of Directors of TrustCo and Trustco Bank for 2011. Mr. Purdy contributes has knowledge regarding commercial and residential real estate, his experience as an entrepreneur operating a successful business enterprise, and his skills for developing and evaluating business strategies. | 83,698 | (11) | * | |||||

| * | Less than 1% |

5

See footnotes on page 7.

INFORMATION ON TRUSTCO EXECUTIVE OFFICERS

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation | No. of Shares (3) | Percent of Class | ||||||

| Robert T. Cushing, Age 60, Executive Vice President and Chief Operating Officer of TrustCo and Trustco Bank from December 16, 2014-present. Executive Vice President and Chief Financial Officer of TrustCo from January 2004-December 16, 2014, President, Chief Executive Officer and Chief Financial Officer of TrustCo from November 2002-December 2003. Executive officer of TrustCo and Trustco Bank from 1994-present. Joined TrustCo and Trustco Bank in 1994. | 790,294 | (12) | * | |||||

| Robert M. Leonard, Age 53, Secretary of TrustCo and Trustco Bank 2003-2006 and 2009-present. Assistant Secretary of TrustCo and Trustco Bank 2006-2009. Executive Vice President of TrustCo and Trustco Bank from 2013-present. Senior Vice President of TrustCo and Trustco Bank from 2010-2013. Administrative Vice President of TrustCo and Trustco Bank 2004-2009. Executive officer of TrustCo and Trustco Bank from 2003-present. Joined Trustco Bank in 1986. | 123,770 | (13) | * | |||||

| Michael M. Ozimek, Age 41, Senior Vice President and Chief Financial Officer of TrustCo and Trustco Bank from December 2014-present, Administrative Vice President of Trustco Bank from 2010-2014. Executive officer of TrustCo and Trustco Bank from 2014-present. Joined TrustCo and Trustco Bank in 2002. | 36,457 | (14) | * | |||||

| Scot R. Salvador, Age 49, Executive Vice President and Chief Banking Officer of TrustCo and Trustco Bank from January 2004-present. Executive officer of TrustCo and Trustco Bank from 2004-present. Joined Trustco Bank in 1995. | 444,893 | (15) | * | |||||

| Eric W. Schreck, Age 49, Senior Vice President and Florida Regional President Trustco Bank from 2009-present. Treasurer of TrustCo from 2010-present. Executive officer of TrustCo and Trustco Bank from 2010-present. Joined Trustco Bank in 1989. | 112,357 | (16) | * | |||||

| * | Less than 1% |

6

See footnotes on page 7-8.

Shares of TrustCo Common Stock Beneficially Owned | ||||||||

| Name and Principal Occupation | No. of Shares (3) | Percent of Class | ||||||

| Sharon J. Parvis, Age 65, Assistant Secretary of TrustCo and Trustco Bank from 2005-present, Vice President of Trustco Bank from 1996-present. Executive officer of TrustCo and Trustco Bank from 2005-present. Joined Trustco Bank in 1987. | 27,522 | (17) | * | |||||

| Thomas M. Poitras, Age 53, Assistant Secretary of TrustCo and Trustco Bank 2003-2006 and 2009-present. Secretary of TrustCo and Trustco Bank 2006-2009, Vice President of Trustco Bank from 2001-present. Executive officer of TrustCo and Trustco Bank from 2005-present. Joined Trustco Bank in 1986. | 68,191 | (18) | * | |||||

| * | Less than 1% |

TRUSTCO DIRECTORS, NOMINEES, AND EXECUTIVE OFFICERS AS A GROUP (15 INDIVIDUALS) BENEFICIALLY OWN 5,245,811 SHARES OF COMMON STOCK, WHICH REPRESENTS 5.51% OF THE OUTSTANDING SHARES.

Footnotes:

| (1) | Directors of TrustCo Bank Corp NY are also directors of Trustco Bank. |

| (2) | Each of the directors has held, or retired from, the same position or another executive position with the same employer during the past five years. |

| (3) | Based on 95,262,223 shares issued and outstanding as of December 31, 2015. Beneficial ownership of less that 1% is denoted by an asterisk. |

| (4) | Voting or investment power shared by Mr. De Gennaro’s spouse or other immediate family members as to 94,867 shares. Also includes currently exercisable options to acquire 2,000 shares. |

| (5) | Voting or investment power as to all shares shared by Mr. Flynn’s spouse. |

| (6) | Voting or investment power shared by Mr. Maggs’ immediate family members as to 20,156 shares. Includes for Mr. Maggs currently exercisable options to acquire 6,000 shares. |

| (7) | Voting or investment power shared by Dr. Marinello’s spouse or other immediate family members as to 89,195 shares. Also includes currently exercisable options to acquire 6,000 shares. |

| (8) | Voting or investment power shared by Mr. McCormick’s spouse as to 69,994 shares. Also includes currently exercisable options to acquire 6,000 shares. |

| (9) | Includes for Mr. McCormick 603,859 shares in trust at Trustco Bank for which he is co-trustee, and 379,217 shares that are held by Trustco Bank as a co-trustee of trusts for the benefit of Mr. McCormick or his family. Also includes currently exercisable options to acquire 563,800 shares. |

| (10) | Voting or investment power shared by Mr. Powers’ spouse or other immediate family members as to 125,651 shares. Also includes currently exercisable options to acquire 6,000 shares. |

| (11) | Includes for Mr. Purdy currently exercisable options to acquire 6,000 shares. |

| (12) | Includes for Mr. Cushing currently exercisable options to acquire 282,700 shares. |

| (13) | Voting or investment power shared by Mr. Leonard’s spouse or other immediate family members as to 19,722 shares. Also includes currently exercisable options to acquire 56,200 shares. |

7

See footnotes on page 8.

| (14) | Includes for Mr. Ozimek currently exercisable options to acquire 29,550 shares. |

| (15) | Includes for Mr. Salvador currently exercisable options to acquire 313,271 shares. |

| (16) | Voting or investment power shared by Mr. Schreck’s spouse or other immediate family members as to 6,992 shares. Also includes currently exercisable options to acquire 29,550 shares. |

| (17) | Includes for Ms. Parvis currently exercisable options to acquire 25,850 shares. |

| (18) | Voting or investment power shared by Mr. Poitras’ spouse as to 2,394 shares. Also includes currently exercisable options to acquire 29,250 shares. |

Board Meetings and Committees

TrustCo’s full board held ten meetings during 2015. All of the directors, except for Robert A. McCormick and Robert J. McCormick, would be considered to be “independent directors” under the listing qualifications rules for companies such as TrustCo, whose shares are traded on The NASDAQ Stock Market. TrustCo’s independent directors met in executive session twice during 2015. All directors fully attended all board meetings (except one board member missed one meeting) and all independent directors fully attended both executive session meetings during 2015.

TrustCo maintains a Nominating and Corporate Governance Committee, an Audit Committee, a Compensation Committee, a Board Compliance Committee, and a Risk Committee. The charter of each of the committees may be found on TrustCo’s website (www.trustcobank.com) under the “Investor Relations” tab.

The Nominating and Corporate Governance Committee held seven meetings in 2015. The directors currently serving on the Nominating and Corporate Governance Committee are Dr. Anthony J. Marinello (Chairman), Dennis A. De Gennaro, Brian C. Flynn, Thomas O. Maggs, William D. Powers, and William J. Purdy. The function of the Nominating and Corporate Governance Committee is to assist the board by recommending and reviewing individuals for consideration as directors and develop and annually review governance guidelines applicable to the Company.

TrustCo’s Audit Committee held eleven meetings in 2015. The directors currently serving on the Audit Committee are William D. Powers (Chairman), Dennis A. De Gennaro, Brian C. Flynn, Thomas O. Maggs, Dr. Anthony J. Marinello, and William J. Purdy. The purpose of the Audit Committee is to oversee the Company’s accounting and financial reporting processes and audits of the Company’s financial statements; the committee’s functions also include the review of TrustCo’s and Trustco Bank’s internal audit procedures and the review of the adequacy of internal accounting controls for TrustCo and Trustco Bank. In addition, the Audit Committee annually recommends the use of external audit firms by TrustCo and Trustco Bank in the coming year, after reviewing performance of the existing vendors and available audit resources. Please refer to the discussion under “Audit Committee” for a more detailed description of the Audit Committee’s activities.

TrustCo’s Compensation Committee held six meetings in 2015. The directors currently serving on the Compensation Committee are Thomas O. Maggs (Chairman), Dennis A. De Gennaro, Brian C. Flynn, Dr. Anthony J. Marinello, William D. Powers, and William J. Purdy. The

8

function of the Compensation Committee is to generally oversee the employee compensation and benefit policies, plans and programs of TrustCo and Trustco Bank, including the establishment, annual review and approval of the compensation of the executive officers. In addition, the Compensation Committee is responsible for annually reviewing board compensation and making appropriate recommendations for changes thereto. Please refer to the discussion under “Executive Compensation” for a more detailed description of the Compensation Committee’s activities relative to the named executive officers.

The board of directors of Trustco Bank created the Board Compliance Committee in June 2015, and the committee held six meetings in 2015. The directors currently serving on the Board Compliance Committee are William D. Powers (Chairman), Dennis A. De Gennaro, Brian C. Flynn, Thomas O. Maggs, Dr. Anthony J. Marinello, and William J. Purdy. The function of the Compliance Committee is to provide assistance to the board in fulfilling its oversight responsibility relating to compliance with legal and regulatory requirements and Trustco Bank’s policies, including overseeing Trustco Bank’s communications and responses to and cooperation with the Office of the Comptroller of Currency (“OCC”) and other governmental authorities with jurisdiction over TrustCo or Trustco Bank, and any agreements, orders or directives with respect to such authorities, including the July 21, 2015 agreement between Trustco Bank and the OCC.

The board of directors of TrustCo created the Risk Committee in February 2016. The directors currently serving on the Risk Committee are William J. Purdy (Chairman), Dennis A. De Gennaro, Brian C. Flynn, Thomas O. Maggs, Dr. Anthony J. Marinello, and William D. Powers. The function of the Risk Committee is to oversee the Company’s enterprise risk management program and to ensure that risk is appropriately identified, measured, treated, monitored, and reported within the governance structure approved by the board.

Each member during 2015 of the committees described above attended all meetings of each such committee. Although he is now a member of each committee, Mr. Flynn was not a member of the board of directors of TrustCo or Trustco Bank during 2015.

Board Leadership Structure and Role in Risk Oversight

Board Leadership.The position of TrustCo’s chairman of the board and the office of its president and chief executive officer are held by different persons. The chairman of the board, Dennis A. De Gennaro, is an independent director who has been a member of the board since 2009. Mr. De Gennaro became chairman in January 2016 to serve a term ending upon the earlier of December 31, 2018 or the date the board elects a successor chairman. Mr. De Gennaro is a member of the Nominating and Corporate Governance Committee, the Audit Committee, the Compensation Committee, the Board Compliance Committee and the Risk Committee. Under TrustCo’s Corporate Governance Guidelines, the positions of chief executive officer and chairman of the board are separate and the members of the board elect a chairman as they deem appropriate from time to time from among TrustCo’s independent directors. Also under the guidelines, in order to better ensure that the chairman of the board will have the opportunity to carry out the planning and direction duties associated with the chairman’s position, the chairman is to be elected to a term to expire three years from its start date or on such earlier date as the board elects a new chairman. (The board retains,

9

however, the authority to elect a director as chairman even though the then-current chairman has not served in that role for three years and is not obligated to nominate for re-election by shareholders a director whose three-year tenure as chairman is not complete.) At least once each year, the Corporate Governance Committee will consider the performance of the chairman relative to the Corporate Governance Guidelines and may make such recommendations as it deems appropriate.

The board of directors has determined that the separation of the roles of chairman of the board and chief executive officer enhances board independence and oversight. More specifically, the board believes that separating the roles will allow the Company’s president and chief executive officer, Robert J. McCormick, to better focus on developing and implementing corporate initiatives, enhancing shareholder value and strengthening business and operations, while allowing the chairman of the board to lead the board in its fundamental role of providing advice to, and independent oversight of, management.

Role in Risk Oversight.Risk is inherent in the operation of every financial institution, and management of risk is a key part of the institution’s success. Risks faced by TrustCo and Trustco Bank include credit risk, interest rate risk, liquidity risk, operational risk, strategic risk, and reputational risk. TrustCo management is responsible for the day-to-day management of the risks faced by the Company, while the board of directors as a whole is ultimately responsible for risk management oversight. In carrying out its responsibilities in this area, the board has delegated important duties to its committees. The newly formed Risk Committee will have, as noted above, responsibility to oversee the management of the Company’s Enterprise Risk Management program and to ensure that risk is appropriately identified, measured, treated, monitored, and reported within the governance structure approved by the board. The Audit Committee assists the full board with respect to the adequacy of TrustCo’s internal controls and financial reporting process, the independence and performance of TrustCo’s internal and external auditors, and compliance with legal and regulatory requirements. The Trustco Bank Board Compliance Committee assists the board with respect to compliance with legal and regulatory requirements. Finally, the Compensation Committee has the authority to conduct annual reviews of the Company’s incentive compensation practices to assess the extent to which such arrangements and practices encourage risk-taking and whether the level of encouragement of such risk-taking is appropriate under the circumstances. The Compensation Committee has concluded that the compensation policies are not reasonably likely to have a material adverse effect on the Company.

The entire board reviews and approves, on an annual basis, all significant policies that address risk within TrustCo’s consolidated organization, including credit risk, interest rate risk, liquidity risk, operational risk, strategic risk, and reputational risk. The board monitors risk through reports received on a periodic basis from management, and the board annually approves the Company’s business continuity plan as well as its insurance program.

Director Nominations

Each of the nominees standing for election at the Annual Meeting was considered and selected by the Nominating and Corporate Governance Committee and unanimously approved by TrustCo’s independent directors.

10

The Nominating and Corporate Governance Committee is appointed by the board of directors in part to review and identify individuals qualified to become board members and to recommend to the board the nominees for consideration at the Annual Meeting.

As a general matter, the board believes that a candidate for board membership should have high personal and professional ethics, integrity, and values; an inquiring and independent mind, practical wisdom, and mature judgment; broad policy-making experience in business, government, or community organizations; expertise useful to TrustCo and complementary to the background and experience of other board members; willingness to devote the time necessary to carrying out the duties and responsibilities of board membership; commitment to serve on the board over a period of several years to develop knowledge about TrustCo, its strategy, and its principal operations; and willingness to represent the best interests of all of TrustCo’s constituencies. Although neither the committee nor the full board of directors has a formal policy with respect to diversity, the committee and the board have a general objective of having a board that encompasses a broad range of talents and expertise and reflects a diversity of background, experience, and viewpoints.

After a potential candidate is identified, the committee will investigate and assess the qualifications, experience, and skills of the candidate. The investigation process may, but need not, include one or more meetings with the candidate by a member or members of the committee. From time to time, but at least once each year, the committee meets to evaluate the needs of the board and to discuss the candidates for nomination to the board. Such candidates may be presented to the shareholders for election or appointed to fill vacancies. All nominees must be approved by the committee and by a majority of the independent members of the board.

The committee will consider written recommendations by shareholders for nominees for election to the board. The persons identified in such recommendations will be evaluated under the same criteria and procedures used for other board candidates. Under TrustCo’s bylaws, written nominations of persons for election to the board of directors must be delivered or mailed to the board not fewer than 14 and not more than 50 days prior to any meeting of shareholders called for the purpose of the election of directors, or not later than 7 days prior to the meeting if fewer than 21 days’ notice of the meeting is provided.

Audit Committee

The Audit Committee of TrustCo’s board is responsible for providing oversight of TrustCo’s accounting functions, internal controls, and financial reporting process. The Audit Committee is composed of six directors, each of whom is independent under the listing standards of The NASDAQ Stock Market, and each member of the Audit Committee satisfies the “financial sophistication” requirement also set forth in those listing standards. Each Audit Committee member also satisfies the additional independence requirements contained in the Securities Exchange Act of 1934 for members of public company audit committees. The board of directors has determined that Brian C. Flynn, who was appointed to the board of directors effective February 16, 2016, meets the definitions of “audit committee financial expert” adopted by the Securities and Exchange Commission (“SEC”) and included in NASDAQ’s rules for listed companies. In addition, to assist

11

in the performance of its duties, the Audit Committee retained Marvin and Company, PC, an independent accounting firm, as a consultant to the committee. As consultants to the Audit Committee, a Marvin and Company managing partner participates fully in all Audit Committee meetings, reviews all materials presented to the Audit Committee, responds to questions and inquiries from Audit Committee members and questions internal audit department personnel, representatives of the Company, Independent Auditors, and management prior to, during, and as follow up to Audit Committee meetings.

The Audit Committee operates under a written charter approved by the board of directors. Each year, the Audit Committee reviews the adequacy of the charter and recommends any changes or revisions that the committee considers necessary or appropriate. A copy of the Audit Committee’s charter may be found on TrustCo’s website (www.trustcobank.com) under the “Investor Relations” tab.

It is the Audit Committee’s policy to preapprove all audit and nonaudit services provided by the Company’s Independent Auditors, as well as any services provided by a Registered Public Accounting firm. In considering nonaudit services, the Audit Committee will consider various factors including, but not limited to, whether it would be beneficial to have the service provided by the Independent Auditors and whether the service could compromise the independence of the Independent Auditors. In certain circumstances, the Audit Committee’s policies and procedures provide the committee’s chairman with the authority to preapprove services from the Company’s Independent Auditors, which approval is then reviewed and approved at the next Audit Committee meeting. Accordingly, all of the services described above were approved by the Audit Committee.

Audit Committee Report.The Audit Committee’s responsibility is to monitor and oversee TrustCo’s financial reporting and audit processes and to otherwise conduct its activities as provided for in its charter. Management is responsible for TrustCo’s internal controls and financial reporting process. TrustCo’s Independent Auditors for 2015, Crowe Horwath LLP, were responsible for performing an independent audit of TrustCo’s consolidated financial statements and the effectiveness of TrustCo’s internal controls over financial reporting in accordance with the Standards of the Public Company Accounting Oversight Board (United States) and issuing a report thereon. TrustCo’s Internal Audit Department is responsible for monitoring compliance with internal policies and procedures. In performing its oversight, the Audit Committee reviews the performance of Crowe Horwath LLP and TrustCo’s internal auditors.

In connection with these responsibilities, the Audit Committee met with management and Crowe Horwath LLP on February 16, 2016 to review and discuss TrustCo’s December 31, 2015 and 2014 consolidated financial statements. The Audit Committee also discussed with Crowe Horwath LLP the matters required to be communicated to audit committees in accordance with professional standards and received the written disclosures and a letter from Crowe Horwath LLP required by relevant regulatory and professional standards regarding auditor communications with audit committees concerning independence.

Based upon the Audit Committee’s discussions with management and the Independent Auditors, and its review of the information described in the preceding paragraphs, the Audit

12

Committee recommended that the board of directors include the audited consolidated financial statements in TrustCo’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC.

| AUDIT COMMITTEE: | William D. Powers, Chairman | |

| Dennis A. De Gennaro | ||

| Brian C. Flynn | ||

| Thomas O. Maggs | ||

| Dr. Anthony J. Marinello | ||

| William J. Purdy |

Shareholder Communications with Board and Board Attendance at Annual Meeting of Shareholders

TrustCo provides an informal process for shareholders to send communications to the board. Shareholders who wish to contact the board or any of its members may do so in writing to TrustCo Bank Corp NY, Attention: Corporate Secretary, P.O. Box 1082, Schenectady, New York 12301-1082.

Although TrustCo does not have a policy with regard to board members’ attendance at the Annual Meeting of Shareholders, the directors are encouraged to attend such meetings, and all of the directors attended the 2015 Annual Meeting.

Vote Required and Recommendation

The two nominees for election to the TrustCo board for three-year terms expiring at the 2019 Annual Meeting of Shareholders who receive the greatest number of votes will be elected to the board. Each nominee must, however, receive the affirmative vote of a majority of the outstanding shares of TrustCo common stock in order to be elected a director.

THE TRUSTCO BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF THE TRUSTCO DIRECTOR NOMINEES AS TRUSTCO DIRECTORS, WHICH IS ITEM 1 ON THE TRUSTCO PROXY CARD.

Proposal 2 - Advisory Resolution on the Compensation of TrustCo’s Named Executive Officers

Section 14A the Securities Exchange Act of 1934 requires TrustCo to provide shareholders with the opportunity to vote to approve, on a nonbinding advisory basis, the compensation of the named executive officers as disclosed in this proxy statement, including the Compensation Discussion and Analysis, and the tabular disclosure regarding the compensation of the named executive officers and the accompanying narrative. (This opportunity is often referred to as a “say-on-pay” vote or proposal.) At least once every six years, TrustCo must hold a non-binding, advisory vote on the frequency of future say-on-pay votes, with stockholders having the choice of every year, every two years, or every three years. TrustCo held its first frequency vote at its 2011 annual meeting of shareholders, and the next frequency vote will be held in 2017.

13

Although TrustCo’s shareholders have approved holding the say-on-pay vote every third year, TrustCo’s Compensation Committee and the full board of directors have determined that an annual advisory vote on the compensation of the named executive officers would better serve the Company and its shareholders. In the view of the board, since the compensation of the named executive officers is evaluated, adjusted as appropriate, and approved on an annual basis, the views of the Company’s shareholders as expressed in the say-on-pay advisory vote should also be considered annually. Annual advisory votes, in the view of the board, provide an effective means of communicating shareholder views about the Company’s executive compensation programs.

The say-on-pay proposal described below gives TrustCo shareholders the opportunity to endorse, or not endorse, the compensation of the named executive officers. The vote on the proposal is not intended to address any specific element of executive compensation. Further, the vote is advisory, which means that it is not binding on TrustCo, its board of directors, or the Compensation Committee. The Compensation Committee will, however, take into account the outcome of the vote when considering future executive compensation decisions.

As discussed in more detail in the Compensation Discussion and Analysis, TrustCo seeks to offer a compensation structure for its executive officers designed to compare favorably with its peer group while taking into account the experience and responsibilities of each particular executive officer. TrustCo also seeks to provide compensation incentives that promote the enhancement of shareholder value in conjunction with encouraging and rewarding a high level of performance evidenced through the achievement of corporate and individual financial and business objectives and managing and minimizing the level of risk inherent in any compensation program. The Compensation Committee and the board of directors believe that the policies and procedures described in the Compensation Discussion and Analysis are effective in implementing the Company’s compensation program and achieving its goals and that the compensation of the Company’s named executive officers in 2015 reflects and supports these compensation policies and procedures.

Resolution

In light of the foregoing, TrustCo is asking shareholders to approve the following resolution at the Annual Meeting:

RESOLVED, that the shareholders of TrustCo Bank Corp NY approve, on an advisory basis, the compensation of the named executive officers, as disclosed in TrustCo’s Proxy Statement for the 2016 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 2015 Summary Compensation Table, and the other related tables and narrative disclosure.

Vote Required and Recommendation

The affirmative vote of a majority of all of TrustCo’s issued and outstanding shares of common stock is required to adopt the foregoing resolution approving the compensation of TrustCo’s named executive officers. Abstentions on properly executed proxy cards and shares not

14

voted by brokers and other entities holding shares on behalf of beneficial owners will have the same effect as a vote “against” this proposal. Dissenters’ rights are not available to shareholders who object to the proposal.

THE TRUSTCO BOARD RECOMMENDS THAT TRUSTCO SHAREHOLDERS VOTE “FOR” THIS PROPOSAL, WHICH IS ITEM 2 ON THE TRUSTCO PROXY CARD.

Proposal 3 - Ratification of the Appointment of Independent Auditors

The Audit Committee of TrustCo’s board of directors has recommended, and the board of directors on February 16, 2016 reappointed, Crowe Horwath LLP as TrustCo’s Independent Auditors for the year ending December 31, 2016. At the Annual Meeting, shareholders will consider and vote on the ratification of the engagement of Crowe Horwath LLP for the fiscal year ending December 31, 2016. Information with respect to the services provided in 2015 and 2014 to TrustCo by Crowe Horwath LLP is presented under the Audit Committee discussion, above. Representatives of Crowe Horwath LLP are expected to be present at the Annual Meeting to make a statement if they so desire and are also expected to be available to respond to appropriate questions that may be raised.

The following table presents fees for professional audit services, as well as other professional or consulting services, rendered by Crowe Horwath LLP. The services included audits of TrustCo’s annual consolidated financial statements for the years ended December 31, 2015 and 2014 and of the effectiveness of internal controls over financial reporting, tax return preparation services, and other services provided by Crowe Horwath LLP during the years ended December 31, 2015 and 2014.

| 2015 | 2014 | |||||||

| Audit fees | $ | 405,000 | 393,500 | |||||

| Audit related fees(1) | 7,500 | 15,000 | ||||||

| Tax fees(2) | 103,500 | 170,074 | ||||||

| All other fees | -- | -- | ||||||

|

|

|

| |||||

| Total Fees | $ | 516,000 | 578,574 | |||||

| (1) | For 2015, audit related fees consisted of consent procedures for the Company’s Registration Statement on Form S-8 filed with the SEC. For 2014, audit related fees consisted of consent procedures for the Company’s Registration Statement on Form S-3 filed with the SEC. |

| (2) | For 2015 and 2014, tax fees consisted of tax return preparation services and assistance with tax audits. |

Vote Required and Recommendation

The affirmative vote of a majority of all of TrustCo’s issued and outstanding shares of common stock is required to ratify the appointment of Crowe Horwath LLP as TrustCo’s Independent Auditors for the year ending December 31, 2016. Abstentions on properly executed proxy cards and shares not voted by brokers and other entities holding shares on behalf of

15

beneficial owners will have the same effect as a vote “against” this proposal. Dissenters’ rights are not available to shareholders who object to the proposal.

THE TRUSTCO BOARD RECOMMENDS THAT TRUSTCO SHAREHOLDERS VOTE “FOR” THIS PROPOSAL, WHICH IS ITEM 3 ON THE TRUSTCO PROXY CARD.

Other Matters

TrustCo’s board of directors is not aware of any other matters that may come before the Annual Meeting. If any matter not described in this proxy statement is properly presented at the Annual Meeting, the persons named in the proxy card will use their judgment to determine how to vote the shares for which they have voting authority.

16

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (the “CD&A”) describes the objectives, policies and components of TrustCo’s 2015 executive compensation program for its named executive officers. In addition, the CD&A will discuss and analyze the decisions of and actions taken by the Compensation Committee during, before and after 2015 as those decisions and actions relate to such objectives and policies and the compensation paid to or earned by the named executive officers during 2015.

Named Executive Officers

TrustCo has identified the following executive officers as its named executive officers for 2015:

| • | Robert J. McCormick, President & Chief Executive Officer, TrustCo and Trustco Bank |

| • | Michael M. Ozimek, Senior Vice President and Chief Financial Officer, TrustCo and Trustco Bank |

| • | Robert T. Cushing, Executive Vice President & Chief Operating Officer, TrustCo and Trustco Bank |

| • | Scot R. Salvador, Executive Vice President & Chief Banking Officer, TrustCo and Trustco Bank |

| • | Robert M. Leonard, Executive Vice President & Secretary, TrustCo and Trustco Bank |

| • | Eric W. Schreck, Treasurer, TrustCo, and Senior Vice President, Trustco Bank |

Objectives of Executive Compensation Program

Our executive compensation program is designed to promote the following compensation objectives:

| • | Encourage and reward the achievement of our short- and long-term financial and strategic objectives; |

| • | Align executive interests with the interests of our shareholders to ensure their focus on long-term return to shareholders and consideration of excessive risk mitigation; and |

| • | Provide a comprehensive compensation program that fosters the retention of current executive officers and serves to attract new highly-talented, results-driven executives as the need may arise. |

Executive Summary of Compensation Decisions for 2015

For the past several years, TrustCo has been transitioning its executive compensation program from a program with an emphasis on short-term and fixed pay to a program that puts a

17

greater emphasis on long-term and performance-based compensation. In 2015, the Compensation Committee continued to emphasize long-term and performance-based compensation through suspension of, or nominal increases in, base salaries and a continuation of the long-term and performance-based programs implemented in prior years. The following summary highlights the key decisions made and actions taken by the Compensation Committee during and prior to 2015 with respect to the compensation paid to and earned by the named executive officers for 2015.

| • | Waiver of Bonus by Executives – On July 21, 2015, the Bank entered into a Formal Agreement with its primary regulator, the OCC. In light of the compliance and governance issues identified by the OCC and the Bank’s undertaking to address these issues beginning in 2015, the Compensation Committee, upon the recommendation of Mr. McCormick, the Company’s CEO, and the acknowledgement and agreement of Messrs. McCormick, Cushing, Salvador, and Leonard, determined in November 2015 that it would be in the best interest of the Company and Bank for those executive officers to waive their 2015 annual cash bonuses under the Executive Officer Incentive Plan. Because of Mr. Ozimek’s recent appointment as Chief Financial Officer and Mr. Schreck’s level of responsibility in the organization, the Compensation Committee agreed that they should be rewarded for the achievement of a majority of the performance goals at the target level. As such, Messrs. Ozimek and Schreck earned annual bonuses equal to 21% of their 2015 base salary. |

| • | Base Salary– For the sixth consecutive year, the Compensation Committee determined not to increase the base salary for Mr. McCormick, which has thus remained frozen since 2009. Mr. Cushing’s base salary also remained unchanged. In 2015, Mr. Salvador’s salary was increased by a modest $10,000, representing an increase of 1.9%. The decision to de-emphasize salary increases for these executives has not been due to performance, but rather reflects the Compensation Committee’s emphasis on performance-based compensation via annual and long-term incentives. For example, during 2010 the base salary for Mr. McCormick represented 69.61% of his total compensation compared with 51.67% for 2015. This percentage of base salary to total compensation would have been substantially lower for 2015 if Mr. McCormick had not agreed to waive his 2015 annual bonus. Mr. Leonard received a base salary increase of 5.8% from $260,000 to $275,000 based on his performance during 2014. For 2015, Mr. Schreck received a base salary increase of 2.9% from $255,500 to $262,500, roughly in line with average annual salary increases nationwide and consistent with increases during each of the past several years based on his performance and the Compensation Committee’s views as to the appropriate positioning of his compensation relative to peer group practices. In light of his promotion to Chief Financial Officer and the attendant increase in responsibility, the Compensation Committee increased Mr. Ozimek’s salary for 2015 from $142,500 to $225,000. |

| • | Executive Officer Incentive Plan– For 2015, the Compensation Committee continued the operation of the Company’s Executive Officer Incentive Plan, which provides for the payment of annual cash bonuses based on the achievement of pre-defined annual relative performance goals that either meet or exceed the performance of the Company’s |

18

peer group. Consistent with the Company’s practice of placing more emphasis on long-term compensation, the plan continued to provide that a portion of the 2015 bonuses would be subject to long-term performance. |

| • | Long-Term Equity Incentive Compensation – For 2015, TrustCo awarded a combination of time-vested options and restricted stock units and performance-based performance share awards to the named executive officers. Consistent with the Compensation Committee’s practices for 2014 and based upon a survey performed by Arthur J. Gallagher & Company of the long-term equity incentive awards granted by the Company’s peers, the Compensation Committee maintained a split of equity awards as follows: performance shares 50%, restricted stock units 35%, and stock options 15%. This mix of equity awards is intended by the Compensation Committee to encourage performance that increases shareholder return. |

| • | Supplemental Retirement Plan (SERP) Bonus – For 2015, the Company made payments to Mr. McCormick, Mr. Cushing, Mr. Salvador and Mr. Leonard, as required in their employment agreements, in an amount equal to the incremental amount that would have been credited to them under the TrustCo Supplemental Retirement Plan, as if the plan had not been frozen in 2008, to make up for the limitations on compensation and annual benefits imposed on the Company’s Retirement Plan by the Internal Revenue Code. Messrs. McCormick, Cushing, Salvador, and Leonard saw a reduction in 2015 in their SERP payments as a consequence of the waiver of their Executive Officer Incentive Plan bonuses. |

| • | Retirement of Mr. Cushing – In December of 2014, it was announced that Mr. Cushing would retire as of May 31, 2015 and that he would provide certain services to the Company and Trustco Bank after retirement under a consulting agreement. Mr. Cushing’s retirement has subsequently been delayed and a new retirement date has not yet been set. The Consulting Agreement did not become effective due to the delay in Mr. Cushings’s retirement. |

Highlights of 2015 Business Results

TrustCo continued its strong performance in 2015. Net income was $42.2 million, compared to $44.2 million in 2014. Included in the 2014 results are $2.7 million in one-time items, without which net income would have been $41.5 million. For year end 2015, return on average equity and efficiency ratio were 10.41% and 55.08%, respectively, compared to 8.77% and 61.94% for the peer group median (the peer group consists of New York, New Jersey and Florida banks and thrifts with assests between two and ten billion dollars as of September 30, 2015). The Committee attributes this successful performance in part to the efforts of the Company’s executive officers, including the named executive officers, whose efforts are encouraged and rewarded by the Company’s executive compensation program.

Compensation Committee and Management Role in Determining Compensation for the Named Executive Officers

The Compensation Committee has responsibility for overseeing the Company’s executive compensation policies and practices, including establishing annual salaries, long-term incentive and

19

equity incentive arrangements, annual incentive arrangements, and all other benefits and other compensation programs for the Company’s named executive officers. The Compensation Committee is solely responsible for setting the compensation of Mr. McCormick, the Company’s chief executive officer (“CEO”). As for the other named executive officers, the CEO generally makes recommendations to the Compensation Committee, which then evaluates the recommendations in light of the named executive officers’ performance, the Company’s performance and other factors, and then determines the levels and structure of compensation for these executives.

In making its decisions, the Compensation Committee considers a number of factors including among others:

| • | TrustCo’s and Trustco Bank’s attainment of net income goals; |

| • | The Company’s operating performance against its past performance and that of its peers; |

| • | Total shareholder return over a one to five-year period and total shareholder return in relation to total compensation; |

| • | Total asset targets; |

| • | Overall profitability from year to year; and |

| • | Banking experience of individual named executive officers, the scope of their responsibility within the overall organization, their individual performance and the specific contributions they made to TrustCo and Trustco Bank during the course of the year. |

The Compensation Committee also considers other relevant factors, including involvement in the community that might better position the organization to serve the immediate needs of Trustco Bank’s market. The Compensation Committee generally considers most or all of the above criteria, but does not generally assign a specific weight to any of these factors in making compensation decisions and may choose certain criteria in one year and others in other years. Except for specific goals set with respect to certain compensation programs described herein or otherwise set forth below, the Compensation Committee makes compensation decisions on a discretionary basis considering such factors and criteria as it deems appropriate from year to year.

Use of Peer Companies

As part of the Company’s analysis, review and implementation of its executive compensation program, the Compensation Committee reviews aspects of the financial performance of a group of companies the Company considers to be peer companies as well as the compensation paid to certain executive officers of these peer companies. For example, annual bonus awards paid pursuant to the Company’s Executive Officer Incentive Plan are based on the achievement of certain performance metrics relative to the achievement of the same metrics by these peer companies. In addition, the Compensation Committee typically reviews the total compensation, including base salary, incentive compensation, equity awards and other compensation, paid to the

20

top three to five executive officers of these peer companies. While the Compensation Committee considers certain aspects of the financial performance of peer companies and the compensation paid to the named executive officers of peer companies relative to the Company’s performance and compensation paid to the Company’s named executive officers, it does not specifically benchmark compensation against these peer companies. Rather, the Compensation Committee uses the information as a general guide to setting compensation for the Company’s named executive officers.

The Compensation Committee typically determines the Company’s then current peer group in December of each year in connection with setting certain aspects of annual compensation for the following year. The criteria the Compensation Committee uses to determine peer companies is generally the same from year to year and consists of New York, New Jersey and Florida based banks and thrifts with assets of between $2 and $10 billion (measured as of the end of September of each year). The Compensation Committee is of the view that inasmuch as the Company’s major market areas are in Upstate New York, Downstate New York/Northern New Jersey and Florida, these comparably-sized companies were a reasonable representation of its peers. As of December 31, 2014, the Company had total assets of approximately $4.64 billion. The composition of the peer group may change from year to year as new companies enter the relevant market or on account of the changes in size of companies or mergers or acquisitions.

In December of 2014, the Compensation Committee selected a peer group consisting of 22 banks and thrifts.

The Company’s peer group selected in 2014 consisted of the following companies (the “Peer Group”).

Arrow Financial Corp. | Kearny Financial Corp. | |

Bridge Bancorp, Inc | Lakeland Bancorp, Inc. | |

Capital Bank Financial Corp. | NBT Bancorp Inc. | |

Capital City Bank Group, Inc. | Northfield Bancorp, Inc. | |

CenterState Banks, Inc. | OceanFirst Financial Corp. | |

Community Bank System, Inc. | Oritani Financial Corp. | |

Dime Community Bancshares, Inc. | Peapack-Gladstone Financial Corporation | |

Financial Holding, Inc. | Provident Financial Services, Inc. | |

Financial Institutions, Inc. | Seacoast Banking Corporation of Florida | |

Flushing Financial Corporation | The First of Long Island Corp | |

Hudson Valley Holding Corp. | Tompkins Financial Corp. |

In addition, for 2014, the Compensation Committee also reviewed compensation paid to the executive officers of companies in a peer group designed by Institutional Shareholder Services, Inc. (“ISS”), a third-party provider of corporate governance research and analysis and shareholder advisory services for TrustCo in 2014. The ISS peer group was composed of companies having the

21

same Global Industry Classification Standard as the Company and a similar asset size and market value. The ISS peer group consisted of the following companies (the “ISS Peer Group”).

Beneficial Mutual Bancorp, Inc. | MGIC Investment Corporation | |

Berkshire Hills Bancorp, Inc. | Northfield Bancorp, Inc. | |

BofI Holding, Inc. | Northwest Bancshares, Inc. | |

Brookline Bancorp, Inc. | OceanFirst Financial Corp. | |

Capitol Federal Financial, Inc. | Ocwen Financial Corporation | |

Dime Community Bancshares, Inc. | Oritani Financial Corp. | |

Doral Financial Corporation | Provident Financial Services, Inc. | |

ESB Financial Corporation | Radian Group Inc. | |

First Defiance Financial Corp. | Sterling Bancorp/DE | |

Flagstar Bancorp, Inc. | United Financial Bancorp, Inc. | |

Flushing Financial Corporation | WSFS Financial Corporation | |

Kearny Financial Corp. |

In December of 2014, as part of its year-end review of the Company’s executive compensation program, the Compensation Committee reviewed the base salary and total compensation paid to the top five executive officers of the companies in the Peer Group. In addition, the Compensation Committee also compared the Company’s overall performance with that of companies in the Peer Group.

For 2013 (the most recent period for which such information was available in December of 2014), the median and average total compensation for the two separate Peer Groups was as follows:

| 2014 Peer Group | 2014 ISS Peer Group | |||||||

| CEO | ||||||||

Median | 1,128,000 | 1,592,000 | ||||||

Average | 1,472,000 | 2,287,000 | ||||||

| Second most highly paid Executive Officer | ||||||||

Median | 797,000 | 826,000 | ||||||

Average | 837,000 | 1,035,000 | ||||||

| Third most highly paid Executive Officer | ||||||||

Median | 556,000 | 650,000 | ||||||

Average | 758,000 | 800,000 | ||||||

| Fourth most highly paid Executive Officer | ||||||||

Median | 500,000 | 537,000 | ||||||

Average | 716,000 | 713,000 | ||||||

| Fifth most highly paid Executive Officer | ||||||||

Median | 440,000 | 464,000 | ||||||

Average | 436,000 | 559,000 | ||||||

By comparison, the total compensation for 2013 for Messrs. McCormick, Cushing, Salvador, Leonard, and Schreck was $2,128,000, $1,388,000, $1,245,000, $567,000 and $404,000, respectively.

22

Utilizing performance data as of September 30, 2014, the Compensation Committee concluded the Company’s overall performance compared favorably with that of the Peer Group. On an annualized basis, through September 30, 2014, as reported by SNL Financial LC, TrustCo’s return on average equity was 11.80% compared to a 2014 Peer Group median, on an annualized basis, of 7.25% and a 2014 Peer Group average of 5.90%. For the same period, on an annualized basis, TrustCo’s efficiency ratio was 52.27%, compared to the 2014 Peer Group median of 59.78%, and a 2014 Peer Group average of 64.84%.

While the Company is of similar size to the members of its peer group, the Compensation Committee also takes into consideration the unique size of the Company’s executive group as compared to other companies in the Peer Group. TrustCo and Trustco Bank typically operate with four senior executive officers, all of whom have a very broad scope of responsibilities. The Compensation Committee believes that the other institutions in the Peer Group have a larger pool of such officers having similar responsibilities.

Based on the data available in December of 2014, the Compensation Committee concluded that the base salaries and total compensation of the Company’s top three named executive officers (Messrs. McCormick, Cushing and Salvador) were competitive with the Peer Group, taking into account the scope of their respective responsibilities, the compensation paid by the Peer Group for similar positions and the performance of the Company relative to the Peer Group, while the base salaries and total compensation of Messrs, Leonard and Schreck remained below the average compensation levels for the fourth and fifth highest paid executive officers of both Peer Groups.

Compensation Consultants

The Company periodically retains independent compensation consultants to assess the compensation of the named executive officers and certain other executives to ensure pay competitiveness. In addition, the Compensation Committee has the authority to retain compensation consultants, periodically reviews information provided by or through third-party sources, and often relies on TrustCo’s Human Resources Department to gather such information.

In September 2014, the Company engaged Arthur J. Gallagher & Co. (“Gallagher”) to undertake a survey of certain aspects of the compensation paid to the top five executives of each company in the Peer Group for purposes of comparing the Company’s long-term equity incentive award program with those of the Peer Group. In collecting the data, Gallagher reviewed the peer companies’ proxy statements for 2014, 2013 and 2012 which reflected the compensation paid during 2013, 2012 and 2011. Gallagher reviewed a variety of compensation elements, including (i) the value of long-term equity incentive awards granted to executives, (ii) the types of long-term equity incentive granted to executives, and (iii) salary and target bonus levels of executives, to calculate total compensation of executives and long-term equity incentive awards as a percent of total compensation. Among other methodologies, Gallagher used regression analysis to determine the “market” level of equity and cash compensation among the peer companies.

Gallagher found that among the peer companies, 38% granted time-vested stock options, 69% granted time-vested full share awards (restricted stock and restricted stock units) and 56% granted performance-vested awards. Among other findings, Gallagher determined that, (i) while the

23

value of the long-term equity incentive awards (stock options, restricted stock units and performance shares) granted by the Company to the named executive officers as a group was generally in line with the Peer Group, the value of the long-term equity incentive awards granted to Mr. McCormick was slightly below market, (ii) the base salary for Mr. Leonard was below market, and (iii) the mix of time-vested stock options and time-vested full value shares (restricted stock and restricted stock units) was trending away from stock options in favor of full value shares.

2015 Executive Compensation Program

For 2015 there were three basic elements to TrustCo’s executive compensation program, each of which has sub-elements: annual compensation (comprised of salary, incentive bonus and other annual benefits), long-term compensation (comprised of stock options, restricted stock units, performance shares and the performance bonus program), and retirement compensation (comprised of defined benefit pension plan, the profit sharing/401(k) plan, and the supplemental retirement plan). As a general matter, the Compensation Committee initially considers total compensation levels of the Company Peer Group prior to making compensation decisions with respect to each of the individual elements of executive compensation.

The description below provides discussion and analysis for each element of TrustCo’s executive compensation program for 2015, including the relevant history of those components and the compensation decisions made for 2015.

Annual Compensation

Base Salary. Annual salary is the base compensation for the Company’s named executive officers and is intended to provide a portion of compensation which is fixed to give our named executive officers resources upon which to live and provide them with a certain level of financial security. The salaries for our named executive officers are established based upon the scope of their respective responsibilities, taking into account competitive market compensation paid by the Peer Group for similar positions along with the performance of these companies relative to the performance of the Company. Salaries are reviewed at least annually and are also reviewed upon the request of the board of directors.

For 2015, the Compensation Committee again determined not to increase the base salaries for Messrs. McCormick and Cushing, which remained fixed (and have remained fixed for the past six years) at $880,000 and $640,000, respectively. In making this determination, the Compensation Committee reviewed comparable base salaries of executives in the Peer Group and the relative performance of the peer companies. Although the Compensation Committee believes that these executive officers’ performance through the third quarter of 2014 led to the Company substantially outperforming our Peer Group, consistent with the Company’s policy to gradually increase the proportion of performance-based compensation to fixed compensation, the Compensation Committee elected not to increase their base salaries. Instead, the Compensation Committee believes that the Company’s Executive Officer Incentive Plan (annual performance bonuses) and/or the Equity Incentive Plan (stock options, restricted units and performance share awards under the Amended and Restated TrustCo Bank Corp NY 2010 Equity Incentive Plan) are properly structured to reward exceptional performance with appropriate increased compensation.

24

In determining the base salaries for Messrs. Salvador, Leonard and Schreck for 2015, the Compensation Committee considered the Company’s overall financial performance along with the performance of the individual officers and the responsibilities each officer holds within the organization, each officer’s experience and the goals of each department for which the officer has responsibility. The Compensation Committee also considered the base salaries paid to executive officers at Peer Group Companies holding comparable positions.

After a recommendation from Mr. McCormick, and a review of Mr. Salvador’s overall performance, and considering that Mr. Salvador’s base salary has been frozen for the past four years, the Compensation Committee increased Mr. Salvador’s base salary by a modest 1.9% from $510,000 to $520,000.

After a recommendation from Mr. McCormick, and a review the Gallagher survey of Peer Group compensation, which revealed that Mr. Leonard’s base salary was below market, and of Mr. Leonard’s overall performance during 2014, the Compensation Committee increased his 2015 base salary by 5.8% from $260,000 to $275,000.

After a recommendation from Mr. McCormick and a review of Mr. Schreck’s overall performance during 2014, consistent with prior year increases and approximately in line with average annual salary increases nationwide, the Committee increased his 2015 base salary by 2.9% from $255,000 to $262,500.

In 2014, in anticipation of Mr. Cushing’s retirement, Mr. Ozimek was promoted to the position of Chief Financial Officer of TrustCo and Trustco Bank. In recognition of the additional duties and responsibilities assumed by Mr. Ozimek and based in part on base salaries paid to Chief Financial Officers at Peer Group companies, the Compensation Committee increased his base salary from $142,500 to $225,000.

Executive Officer Incentive Plan for 2015. The Executive Officer Incentive Plan provides for annual bonus compensation for the named executive officers based on the achievement of certain corporate performance targets. The Compensation Committee reviews the plan bonus opportunities, performance targets, structure and other metrics on an annual basis. In December of 2014, the Compensation Committee met and approved the bonus opportunities, performance targets, structure and other metrics for 2015.

The corporate performance targets set for 2015 included return on average equity, efficiency ratio, and the ratio of nonperforming assets to total assets, each as measured against the composite performance of the Peer Group. The Compensation Committee selected these particular performance measures because it considers them to be important factors in driving corporate performance. Bonuses were earned for 2015 only for achievement of corporate targets equal to or better than the Peer Group median and are based on threshold (20% of base salary), target (30% of base salary) and maximum (50% of base salary) level of achievement.

25

The following table sets forth the corporate performance targets, weightings, levels of achievement and other details under the Executive Officer Incentive Plan for 2015. Results and bonus awards under the plan were capped at a maximum of 50% of salary in 2015.

2015 Executive Officer Incentive Plan

| Performance Criteria | Weighting | Threshold Performance Level (20% of salary) | Target Performance Level (30% of salary) | Maximum Performance Level (50% of salary) | 2015 TrustCo Performance Level Compared to Peer Group Median | Award % Earned | Award % of | |||||||||||||

| Return on Average Equity | 35 | % | Equal to Peer Group median to 9% above | 10% to 24% better than Peer Group median | 25% better than Peer Group median | 19% above | 30% | 10.50 | % | |||||||||||

| Efficiency Ratio | 35 | % | 13% above | 30% | 10.50 | % | ||||||||||||||

| Nonperforming Assets to Total Assets | 30 | % | -- | -- | -- | |||||||||||||||

|

| |||||||||||||||||||

| Total | 21.00 | % | ||||||||||||||||||

In calculating the bonuses earned under the Executive Officer Incentive Plan, the Compensation Committee multiplied the weighting percentages of the performance goals that were achieved (35% for each of “return on average equity” and “efficiency ratio”) by the level of achievement (20% better than peer group for “return on average equity” and 13% better than peer group for “efficiency ratio” for “target” level of achievement) and corresponding percentage of base salary (30% of base salary for target level of achievement). Based on this calculation, the Compensation Committee determined that the 2015 annual bonus was equal to 21% of the executive officers’ base salaries.

As noted above, in November 2015, and thus prior to the determination of the amounts payable to them under the Executive Officer Incentive Plan, Messrs. McCormick, Cushing, Salvador, and Leonard agreed to waive the amounts that would be payable to them. Based upon the Company’s results for 2015, the amounts that would have been payable to Messrs. McCormick, Cushing, Salvador and Leonard under the plan would have been $184,800, $134,400, $109,200 and $57,750, respectively, for a total of $486,150. As to Messrs. Ozimek and Schreck, for 2015, the level of achievement of the corporate performance targets is set forth above and the bonuses earned by those officers under the plan represented 21.00% of base salary or $47,250 and $55,125, respectively.

Contingent Bonus Payments. Consistent with the Company’s practice of placing more emphasis on long-term compensation and to reward executives for sustained performance over more than one year, in December of 2014, when the Compensation Committee approved the bonus opportunities and performance targets for 2015, it required, as allowed under the plan, that to the extent that the achievement level for 2015 resulted in bonus amounts in excess of 30% of base salary for the executives, payment of the amount in excess of 30% (the “Contingent Bonus”) would be contingent on achievement of the same corporate performance goals set for 2015 (return on average equity, efficiency ratio, and the ratio of non-performing assets) relative to the Peer Group

26