UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT COMPANY

| Investment Company Act file number: | 811-2652 |

| Name of Registrant: | Vanguard Index Funds |

| Address of Registrant: | P.O. Box 2600

Valley Forge, PA 19482 |

| Name and address of agent for service: | Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

| Date of fiscal year end: | December 31 |

| Date of reporting period: | January 1, 2006—June 30, 2006 |

| Item 1: | Reports to Shareholders |

|

Vanguard® 500 Index Fund |

|

|

> Semiannual Report |

|

|

|

|

|

June 30, 2006 |

|

> During the fiscal half-year ended June 30, 2006, Vanguard 500 Index Fund, like its benchmark, retreated in the second quarter after performing strongly in the first quarter.

> The fund’s Investor Shares gained 2.6% during the six months (the Admiral Shares returned 2.7%), in line with the fund’s benchmark index.

> Solid performances within the index’s energy and industrials sectors were offset by losses in the poorly performing health care and information technology sectors.

Contents | |

| |

Your Fund’s Total Returns | 1 |

Chairman’s Letter | 2 |

Fund Profile | 6 |

Performance Summary | 7 |

Financial Statements | 8 |

About Your Fund’s Expenses | 22 |

Trustees Approve Advisory Arrangement | 24 |

Glossary | 25 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the cover of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Six Months Ended June 30, 2006 | |

| Total |

| Return |

Vanguard 500 Index Fund | |

Investor Shares | 2.6% |

Admiral™ Shares1 | 2.7 |

S&P 500 Index | 2.7 |

Average Large-Cap Core Fund2 | 1.3 |

Your Fund’s Performance at a Glance |

December 31, 2005–June 30, 2006 |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard 500 Index Fund | | | | |

Investor Shares | $114.92 | $116.99 | $0.970 | $0.000 |

Admiral Shares | 114.92 | 117.00 | 1.025 | 0.000 |

1 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

2 Derived from data provided by Lipper Inc.

1

Chairman’s Letter

Dear Shareholder,

For the six months ended June 30, 2006, Vanguard 500 Index Fund’s Investor Shares returned 2.6% and the Admiral Shares returned 2.7%, as the U.S. stock market climbed steadily, then drifted backward. The alignment of the fund’s result with that of the index benchmark, the Standard & Poor’s 500 Index, was an accomplishment that reflects the fund’s superior trading and portfolio-construction methodologies and its consistently low expenses. For the period, the fund topped the average performance of large-capitalization core funds by more than 1 percentage point.

Stocks started strongly, then retreated on inflation concerns

The U.S. stock market climbed from January into early May, taking its cues from healthy economic data, strong corporate earnings, and historically low unemployment rates. In a strange twist, these positive dynamics helped to nudge the market off track in mid-May, as investors feared that the economy—and inflationary pressures—had gained too much steam. The broad U.S. market lost roughly half of its 2006 gains in a volatile May and June, but still returned about 3.5% for the half-year.

International equities traced a similar path, though their highs were generally higher and the declines, greater. As a group, they outpaced U.S. stocks for the half-year, with European stocks performing particularly well.

2

Bonds struggled to maintain footing as interest rates climbed

The Federal Reserve Board raised its target for the federal funds rate four times during the period, to 5.25%, marking the 17th consecutive rate hike since the central bank began its inflation-fighting campaign two years ago. The broad market for taxable U.S. bonds finished the six months with a modestly negative return, while municipal bond returns were modestly positive.

Yields of U.S. Treasury securities rose at both ends of the maturity spectrum, but the yield curve remained relatively flat, with only 20 basis points separating the yields of the shortest- and longest-term issues. High-yield bonds were one of the better-performing segments of a stagnant fixed income market.

Losses in May and June minimized the fund’s six-month return

The 2.6% return of the 500 Index Fund’s Investor Shares for the fiscal half-year closely tracked the performance of the S&P 500 Index. The fund’s showing echoed investor sentiment, which was bullish through the first four months of the year, then increasingly bearish in May and June as inflation fears—and volatility—increased.

Market Barometer | | | |

| | | Total Returns |

| | Periods Ended June 30, 2006 |

| Six Months | One Year | Five Years1 |

Stocks | | | |

Russell 1000 Index (Large-caps) | 2.8% | 9.1% | 3.1% |

Russell 2000 Index (Small-caps) | 8.2 | 14.6 | 8.5 |

Dow Jones Wilshire 5000 Index (Entire market) | 3.5 | 10.0 | 4.1 |

MSCI All Country World Index ex USA (International) | 10.0 | 28.4 | 11.9 |

| | | |

Bonds | | | |

Lehman Aggregate Bond Index (Broad taxable market) | –0.7% | –0.8% | 5.0% |

Lehman Municipal Bond Index | 0.3 | 0.9 | 5.0 |

Citigroup 3-Month Treasury Bill Index | 2.2 | 4.0 | 2.2 |

| | | |

CPI | | | |

Consumer Price Index | 3.1% | 4.3% | 2.7% |

1 Annualized.

3

The energy and industrials sectors produced healthy returns during the six months. As energy supplies continued to be tight and prices increased, big oil firms such as ExxonMobil, ConocoPhillips, and Chevron earned robust returns. In the industrials sector, both Caterpillar and Textron were standout performers.

Another bright spot for the index was the telecommunication services sector. Although the sector represents only 3% of the index’s holdings, it was up 14% during the six months. Firms such as BellSouth and Qwest Communications advanced steadily, bolstering relatively weak returns of other sectors.

Concerns about the sustainability of strong consumer spending in the face of rising short-term interest rates and surging energy prices weighed on the retailers and entertainment companies that make up the consumer discretionary sector, which gained 2.6%, on par with the fund’s overall performance. The financial services sector, the index’s largest weighting, gained 3%.

The index’s information technology and health care sectors both declined. Among IT companies, both earnings and corporate spending continued to disappoint. Industry giants Intel and Microsoft both reported lackluster earnings for the period.

Ignoring today’s ups and downs can give you a long-term focus

Successful long-term investing doesn’t mean paying attention to today’s headlines, chasing yesterday’s performance, or trying to predict what

Annualized Expense Ratios1 | | | |

Your fund compared with its peer group | | | |

| | | Average |

| Investor | Admiral | Large-Cap |

| Shares | Shares | Core Fund |

500 Index Fund | 0.18% | 0.09% | 1.41% |

1 Fund expense ratios reflect the six months ended June 30, 2006. Peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2005.

4

tomorrow’s hot stocks will be. As we are always quick to mention, reaching your long-term goals requires a bit more patience—a task for which the Vanguard 500 Index Fund is eminently well-suited.

The fund’s broad diversification helps to position you to benefit from the U.S. economy’s potential for long-term growth. And the fund’s extraordinarily low expenses provide you with exposure to the U.S. large-cap stock market with remarkable efficiency—a goal that the fund has helped investors meet for almost three decades. Indeed, Vanguard 500 Index Fund, one of the greatest innovations in mutual fund history, will celebrate its 30th anniversary on August 31.

Long-term investing success is far more likely when you ignore the market’s daily noise. When you maintain a steady, diversified mix of low-cost stock, bond, and cash investments tailored to your specific needs, you’ll stand a better chance of reaching your financial goals.

Thank you for investing with Vanguard.

Sincerely,

John J. Brennan

Chairman and Chief Executive Officer

July 12, 2006

5

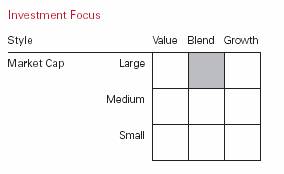

Fund Profile

As of June 30, 2006

Portfolio Characteristics | | |

| | Target |

| Fund | Index1 |

Number of Stocks | 509 | 500 |

Median Market Cap | $48.6B | $48.6B |

Price/Earnings Ratio | 16.7x | 16.7x |

Price/Book Ratio | 2.7x | 2.7x |

Yield | | 1.9% |

Investor Shares | 1.8% | |

Admiral Shares | 1.9% | |

Return on Equity | 18.8% | 18.8% |

Earnings Growth Rate | 15.7% | 15.7% |

Foreign Holdings | 0.0% | 0.0% |

Turnover Rate | 6%2 | — |

Expense Ratio | | — |

Investor Shares | 0.18%2 | |

Admiral Shares | 0.09%2 | |

Short-Term Reserves | 0% | — |

Sector Diversification (% of portfolio) | |

| | Target |

| Fund | Index1 |

Consumer Discretionary | 10% | 10% |

Consumer Staples | 10 | 10 |

Energy | 10 | 10 |

Financials | 22 | 22 |

Health Care | 12 | 12 |

Industrials | 12 | 12 |

Information Technology | 15 | 15 |

Materials | 3 | 3 |

Telecommunication Services | 3 | 3 |

Utilities | 3 | 3 |

Volatility Measures | | |

| | Target |

| Fund | Index1 |

R-Squared | 1.00 | 1.00 |

Beta | 1.00 | 1.00 |

Ten Largest Holdings3 (% of total net assets) |

| | |

ExxonMobil Corp. | oil, gas, and consumable fuels | 3.2% |

General Electric Co. | industrial conglomerates | 3.0 |

Citigroup, Inc. | diversified financial services | 2.1 |

Bank of America Corp. | diversified financial services | 1.9 |

Microsoft Corp. | software | 1.8 |

The Procter & Gamble Co. | household products | 1.6 |

Johnson & Johnson | pharmaceuticals | 1.5 |

Pfizer Inc. | pharmaceuticals | 1.5 |

American International Group, Inc. | insurance | 1.3 |

Altria Group, Inc. | tobacco | 1.3 |

Top Ten | | 19.2% |

1 S&P 500 Index.

2 Annualized.

3 “Ten Largest Holdings” excludes any temporary cash investments and equity index products.

See page 25 for a glossary of investment terms.

6

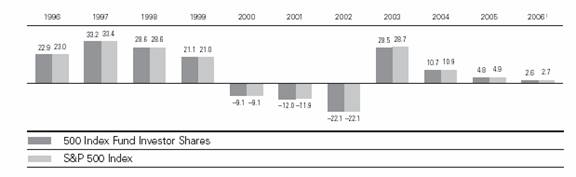

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

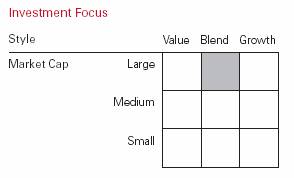

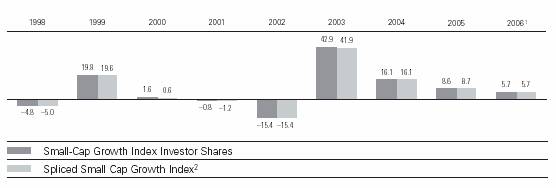

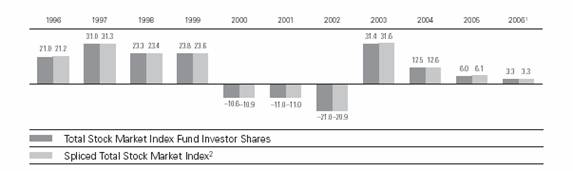

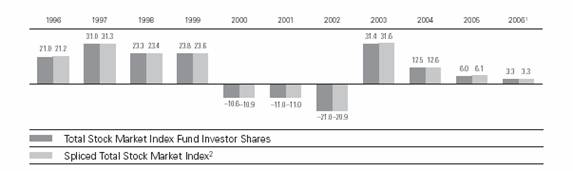

Fiscal-Year Total Returns (%): December 31, 1995–June 30, 2006

Average Annual Total Returns: Periods Ended June 30, 2006 |

| | | | |

| | | | |

| Inception Date | One Year | Five Years | Ten Years |

Investor Shares2 | 8/31/1976 | 8.49% | 2.37% | 8.24% |

Admiral Shares | 11/13/2000 | 8.59 | 2.45 | 0.533 |

1 Six months ended June 30, 2006.

2 Total return figures do not reflect the $10 annual account maintenance fee applied on balances under $10,000.

3 Return since inception.

Note: See Financial Highlights tables on pages 17 and 18 for dividend and capital gains information.

7

Financial Statements (unaudited)

Statement of Net Assets

As of June 30, 2006

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Market |

| | | Value• |

| | Shares | ($000) |

Common Stocks (99.9%)1 | | |

Consumer Discretionary (10.2%) | | |

| Time Warner, Inc. | 39,927,007 | 690,737 |

| Home Depot, Inc. | 19,272,667 | 689,769 |

* | Comcast Corp. Class A | 19,599,960 | 641,703 |

| The Walt Disney Co. | 20,464,853 | 613,946 |

| Lowe’s Cos., Inc. | 7,238,629 | 439,168 |

| News Corp., Class A | 22,061,812 | 423,146 |

| Target Corp. | 8,055,972 | 393,695 |

| McDonald’s Corp. | 11,626,486 | 390,650 |

* | Starbucks Corp. | 7,158,877 | 270,319 |

* | Viacom Inc. Class B | 6,643,771 | 238,113 |

| Best Buy Co., Inc. | 3,763,011 | 206,363 |

| CBS Corp. | 7,127,587 | 192,801 |

| Federated Department Stores, Inc. | 5,171,044 | 189,260 |

* | Kohl’s Corp. | 3,182,068 | 188,124 |

| Carnival Corp. | 4,045,201 | 168,847 |

| The McGraw-Hill Cos., Inc. | 3,344,333 | 167,986 |

| Staples, Inc. | 6,789,027 | 165,109 |

^ | General Motors Corp. | 5,268,731 | 156,955 |

| Johnson Controls, Inc. | 1,822,329 | 149,832 |

| J.C. Penney Co., Inc. (Holding Co.) | 2,195,101 | 148,191 |

| Clear Channel Communications, Inc. | 4,703,921 | 145,586 |

| NIKE, Inc. Class B | 1,763,373 | 142,833 |

| Omnicom Group Inc. | 1,594,539 | 142,057 |

* | Sears Holdings Corp. | 906,492 | 140,361 |

| Harley-Davidson, Inc. | 2,511,029 | 137,830 |

| Yum! Brands, Inc. | 2,541,860 | 127,779 |

| Gannett Co., Inc. | 2,218,052 | 124,056 |

| Starwood Hotels & Resorts Worldwide, Inc. | 2,030,608 | 122,527 |

| Harrah’s Entertainment, Inc. | 1,715,116 | 122,082 |

| Ford Motor Co. | 17,534,631 | 121,515 |

| International Game Technology | 3,169,561 | 120,253 |

| Marriott International, Inc. Class A | 3,056,443 | 116,512 |

* | Amazon.com, Inc. | 2,874,442 | 111,183 |

* | Coach, Inc. | 3,571,682 | 106,793 |

* | Office Depot, Inc. | 2,689,183 | 102,189 |

| TJX Cos., Inc. | 4,263,027 | 97,453 |

| Fortune Brands, Inc. | 1,363,491 | 96,821 |

| The Gap, Inc. | 5,140,966 | 89,453 |

| Hilton Hotels Corp. | 3,070,393 | 86,831 |

* | Bed Bath & Beyond, Inc. | 2,612,945 | 86,671 |

| Limited Brands, Inc. | 3,203,316 | 81,973 |

| Nordstrom, Inc. | 2,009,821 | 73,358 |

| H & R Block, Inc. | 3,052,356 | 72,829 |

* | Univision Communications Inc. | 2,083,034 | 69,782 |

* | Apollo Group, Inc. Class A | 1,309,921 | 67,684 |

| Genuine Parts Co. | 1,610,966 | 67,113 |

^ | Tribune Co. | 2,042,551 | 66,240 |

| Newell Rubbermaid, Inc. | 2,557,361 | 66,057 |

| Eastman Kodak Co. | 2,675,769 | 63,630 |

| Wendy's International, Inc. | 1,090,069 | 63,540 |

| D. R. Horton, Inc. | 2,532,106 | 60,315 |

| Black & Decker Corp. | 709,212 | 59,900 |

| Whirlpool Corp. | 724,226 | 59,857 |

| Mattel, Inc. | 3,621,321 | 59,788 |

| Lennar Corp. Class A | 1,303,350 | 57,830 |

| Pulte Homes, Inc. | 1,993,166 | 57,383 |

| Centex Corp. | 1,132,002 | 56,940 |

| VF Corp. | 820,998 | 55,762 |

| Harman International Industries, Inc. | 625,440 | 53,394 |

| Sherwin-Williams Co. | 1,032,998 | 49,047 |

| Darden Restaurants Inc. | 1,203,338 | 47,411 |

* | AutoZone Inc. | 499,948 | 44,095 |

| Tiffany & Co. | 1,325,231 | 43,759 |

| Leggett & Platt, Inc. | 1,699,201 | 42,446 |

| Dollar General Corp. | 2,907,937 | 40,653 |

| Circuit City Stores, Inc. | 1,418,443 | 38,610 |

| Liz Claiborne, Inc. | 979,470 | 36,299 |

8

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Family Dollar Stores, Inc. | 1,446,658 | 35,342 |

| E.W. Scripps Co. Class A | 792,482 | 34,188 |

| Jones Apparel Group, Inc. | 1,063,545 | 33,810 |

*^ | Interpublic Group of Cos., Inc. | 4,011,090 | 33,493 |

| New York Times Co. Class A | 1,352,110 | 33,181 |

| KB Home | 702,972 | 32,231 |

| The Stanley Works | 659,526 | 31,143 |

| Brunswick Corp. | 884,769 | 29,419 |

* | AutoNation, Inc. | 1,366,230 | 29,292 |

| Hasbro, Inc. | 1,606,661 | 29,097 |

| OfficeMax, Inc. | 659,680 | 26,882 |

| Snap-On Inc. | 542,658 | 21,934 |

| Meredith Corp. | 389,651 | 19,303 |

| Dow Jones & Co., Inc. | 549,382 | 19,234 |

*^ | The Goodyear Tire & Rubber Co. | 1,647,314 | 18,285 |

| Dillard’s Inc. | 573,205 | 18,257 |

* | Big Lots Inc. | 1,060,266 | 18,109 |

| RadioShack Corp. | 1,254,090 | 17,557 |

^ | Cooper Tire & Rubber Co. | 570,301 | 6,353 |

| The McClatchy Co. Class A | 113,734 | 4,563 |

* | Comcast Corp. Special Class A | 100,518 | 3,295 |

* | Viacom Inc. Class A | 71,693 | 2,577 |

| CBS Corp. Class A | 71,693 | 1,940 |

| News Corp., Class B | 9,800 | 198 |

| | | 10,920,877 |

Consumer Staples (9.6%) | | |

| The Procter & Gamble Co. | 30,596,785 | 1,701,181 |

| Altria Group, Inc. | 19,469,885 | 1,429,674 |

| Wal-Mart Stores, Inc. | 23,313,424 | 1,123,008 |

| PepsiCo, Inc. | 15,407,964 | 925,094 |

| The Coca-Cola Co. | 19,109,972 | 822,111 |

| Walgreen Co. | 9,426,166 | 422,669 |

| Anheuser-Busch Cos., Inc. | 7,212,278 | 328,808 |

| Colgate-Palmolive Co. | 4,799,716 | 287,503 |

| Kimberly-Clark Corp. | 4,292,165 | 264,827 |

| Archer-Daniels-Midland Co. | 6,104,408 | 251,990 |

| Costco Wholesale Corp. | 4,395,458 | 251,112 |

| CVS Corp. | 7,615,725 | 233,803 |

| Sysco Corp. | 5,770,064 | 176,333 |

| General Mills, Inc. | 3,318,506 | 171,434 |

| The Kroger Co. | 6,759,269 | 147,758 |

| Avon Products, Inc. | 4,197,250 | 130,115 |

| H.J. Heinz Co. | 3,121,266 | 128,659 |

| Sara Lee Corp. | 7,082,154 | 113,456 |

| Kellogg Co. | 2,279,329 | 110,388 |

| Safeway, Inc. | 4,189,756 | 108,934 |

| ConAgra Foods, Inc. | 4,837,892 | 106,966 |

| Reynolds American Inc. | 796,904 | 91,883 |

| The Hershey Co. | 1,657,038 | 91,253 |

| The Clorox Co. | 1,398,500 | 85,266 |

| Whole Foods Market, Inc. | 1,294,334 | 83,666 |

| Wm. Wrigley Jr. Co. | 1,650,685 | 74,875 |

| UST, Inc. | 1,506,231 | 68,067 |

| Campbell Soup Co. | 1,716,882 | 63,713 |

| SuperValu Inc. | 1,893,885 | 58,142 |

| Coca-Cola Enterprises, Inc. | 2,826,912 | 57,584 |

| Brown-Forman Corp. Class B | 774,628 | 55,347 |

* | Dean Foods Co. | 1,263,771 | 47,000 |

* | Constellation Brands, Inc. Class A | 1,836,354 | 45,909 |

| Estee Lauder Cos. Class A | 1,109,850 | 42,918 |

| McCormick & Co., Inc. | 1,234,997 | 41,434 |

| The Pepsi Bottling Group, Inc. | 1,259,515 | 40,493 |

| Molson Coors Brewing Co. Class B | 534,723 | 36,297 |

| Tyson Foods, Inc. | 2,346,661 | 34,871 |

| Alberto-Culver Co. Class B | 703,759 | 34,287 |

| Wm. Wrigley Jr. Co. Class B | 415,980 | 18,844 |

| | | 10,307,672 |

Energy (10.2%) | | |

| ExxonMobil Corp. | 56,413,963 | 3,460,997 |

| Chevron Corp. | 20,667,202 | 1,282,607 |

| ConocoPhillips Co. | 15,396,773 | 1,008,950 |

| Schlumberger Ltd. | 11,001,220 | 716,289 |

| Occidental Petroleum Corp. | 3,993,230 | 409,506 |

| Valero Energy Corp. | 5,740,784 | 381,877 |

| Halliburton Co. | 4,814,789 | 357,305 |

| Marathon Oil Corp. | 3,380,678 | 281,610 |

| Baker Hughes, Inc. | 3,179,429 | 260,236 |

| Devon Energy Corp. | 4,104,072 | 247,927 |

* | Transocean Inc. | 3,029,344 | 243,317 |

| Apache Corp. | 3,077,410 | 210,033 |

| Anadarko Petroleum Corp. | 4,278,190 | 204,027 |

* | Weatherford International Ltd. | 3,249,794 | 161,255 |

| EOG Resources, Inc. | 2,259,735 | 156,690 |

| XTO Energy, Inc. | 3,383,847 | 149,803 |

| Kerr-McGee Corp. | 2,121,837 | 147,149 |

| Williams Cos., Inc. | 5,540,351 | 129,423 |

| Hess Corp. | 2,237,026 | 118,227 |

| Chesapeake Energy Corp. | 3,835,724 | 116,031 |

| BJ Services Co. | 2,999,735 | 111,770 |

* | National Oilwell Varco Inc. | 1,627,853 | 103,076 |

* | Nabors Industries, Inc. | 2,901,188 | 98,031 |

| Kinder Morgan, Inc. | 972,507 | 97,144 |

| El Paso Corp. | 6,474,538 | 97,118 |

| Noble Corp. | 1,277,834 | 95,096 |

| Sunoco, Inc. | 1,240,635 | 85,964 |

9

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Murphy Oil Corp. | 1,538,376 | 85,934 |

| CONSOL Energy, Inc. | 1,409,962 | 65,873 |

| Rowan Cos., Inc. | 1,018,358 | 36,243 |

| | | 10,919,508 |

| Financials (21.4%) | | |

| Citigroup, Inc. | 46,352,459 | 2,236,043 |

| Bank of America Corp. | 42,550,656 | 2,046,687 |

| American International Group, Inc. | 24,219,113 | 1,430,139 |

| JPMorgan Chase & Co. | 32,397,193 | 1,360,682 |

| Wells Fargo & Co. | 15,664,593 | 1,050,781 |

| Wachovia Corp. | 14,997,728 | 811,077 |

| Morgan Stanley | 9,990,877 | 631,523 |

| American Express Co. | 11,512,288 | 612,684 |

| The Goldman Sachs Group, Inc. | 4,028,445 | 605,999 |

| Merrill Lynch & Co., Inc. | 8,615,452 | 599,291 |

| U.S. Bancorp | 16,611,214 | 512,954 |

| Fannie Mae | 9,030,991 | 434,391 |

| Washington Mutual, Inc. | 8,964,314 | 408,593 |

| Freddie Mac | 6,445,426 | 367,454 |

| MetLife, Inc. | 7,076,374 | 362,381 |

| Prudential Financial, Inc. | 4,587,407 | 356,442 |

| Lehman Brothers Holdings, Inc. | 4,994,237 | 325,375 |

| The Allstate Corp. | 5,926,517 | 324,358 |

| The St. Paul Travelers, Cos. Inc. | 6,494,415 | 289,521 |

| SunTrust Banks, Inc. | 3,391,794 | 258,658 |

| Capital One Financial Corp. | 2,826,623 | 241,535 |

| The Hartford Financial Services Group Inc. | 2,825,990 | 239,079 |

| The Bank of New York Co., Inc. | 7,186,432 | 231,403 |

| Countrywide Financial Corp. | 5,665,468 | 215,741 |

| AFLAC Inc. | 4,641,458 | 215,132 |

| BB&T Corp. | 5,128,380 | 213,289 |

| SLM Corp. | 3,830,887 | 202,731 |

| PNC Financial Services Group | 2,766,688 | 194,138 |

| The Chubb Corp. | 3,878,284 | 193,526 |

| Fifth Third Bancorp | 5,176,651 | 191,277 |

| Progressive Corp. of Ohio | 7,301,057 | 187,710 |

| National City Corp. | 5,070,389 | 183,497 |

| State Street Corp. | 3,102,496 | 180,224 |

| Golden West Financial Corp. | 2,385,626 | 177,013 |

| Bear Stearns Co., Inc. | 1,127,397 | 157,926 |

| ACE Ltd. | 3,039,606 | 153,774 |

| Charles Schwab Corp. | 9,613,748 | 153,628 |

| Lincoln National Corp. | 2,683,899 | 151,479 |

| The Principal Financial Group, Inc. | 2,584,894 | 143,849 |

| Simon Property Group, Inc. REIT | 1,704,300 | 141,355 |

| Regions Financial Corp. | 4,251,742 | 140,818 |

| Marsh & McLennan Cos., Inc. | 5,135,569 | 138,095 |

| KeyCorp | 3,774,777 | 134,684 |

| Loews Corp. | 3,792,773 | 134,454 |

| Mellon Financial Corp. | 3,860,562 | 132,919 |

| North Fork Bancorp, Inc. | 4,348,084 | 131,182 |

| Equity Office Properties Trust REIT | 3,422,215 | 124,945 |

| Moody’s Corp. | 2,266,430 | 123,430 |

| Franklin Resources Corp. | 1,421,789 | 123,426 |

| Legg Mason Inc. | 1,234,374 | 122,845 |

| Equity Residential REIT | 2,705,801 | 121,030 |

| ProLogis REIT | 2,289,812 | 119,345 |

| Genworth Financial Inc. | 3,409,891 | 118,801 |

| Vornado Realty Trust REIT | 1,105,541 | 107,846 |

| Aon Corp. | 2,973,933 | 103,552 |

| XL Capital Ltd. Class A | 1,685,287 | 103,308 |

| Ameriprise Financial, Inc. | 2,284,247 | 102,037 |

| Archstone-Smith Trust REIT | 1,987,334 | 101,096 |

| CIT Group Inc. | 1,861,241 | 97,324 |

| Marshall & Ilsley Corp. | 2,105,878 | 96,323 |

| Northern Trust Corp. | 1,725,871 | 95,441 |

| T. Rowe Price Group Inc. | 2,460,378 | 93,027 |

* | E*TRADE Financial Corp. | 3,985,898 | 90,958 |

| M & T Bank Corp. | 739,151 | 87,161 |

| AmSouth Bancorp | 3,219,543 | 85,157 |

| Synovus Financial Corp. | 3,016,776 | 80,789 |

| Ambac Financial Group, Inc. | 983,097 | 79,729 |

| Comerica, Inc. | 1,516,607 | 78,848 |

| Zions Bancorp | 991,826 | 77,303 |

| Boston Properties, Inc. REIT | 853,599 | 77,165 |

| Cincinnati Financial Corp. | 1,622,030 | 76,252 |

| MBIA, Inc. | 1,248,473 | 73,098 |

| Kimco Realty Corp. REIT | 1,979,870 | 72,245 |

| Sovereign Bancorp, Inc. | 3,490,871 | 70,900 |

| Compass Bancshares Inc. | 1,207,016 | 67,110 |

| Safeco Corp. | 1,114,122 | 62,781 |

| Commerce Bancorp, Inc. | 1,715,637 | 61,197 |

| Plum Creek Timber Co. Inc. REIT | 1,717,144 | 60,959 |

| Public Storage, Inc. REIT | 770,139 | 58,454 |

| Torchmark Corp. | 936,543 | 56,867 |

| Huntington Bancshares Inc. | 2,287,791 | 53,946 |

| MGIC Investment Corp. | 815,128 | 52,983 |

| UnumProvident Corp. | 2,782,383 | 50,445 |

| First Horizon National Corp. | 1,150,039 | 46,232 |

| Apartment Investment &Management Co. Class A REIT | 899,387 | 39,078 |

| Janus Capital Group Inc. | 2,000,242 | 35,804 |

| Federated Investors, Inc. | 784,224 | 24,703 |

| | | 22,979,431 |

10

| | | Market |

| | | Value• |

| | Shares | ($000) |

Health Care (12.2%) | | |

| Johnson & Johnson | 27,608,927 | 1,654,327 |

| Pfizer Inc. | 68,321,504 | 1,603,506 |

| Merck & Co., Inc. | 20,349,901 | 741,347 |

* | Amgen, Inc. | 10,995,103 | 717,211 |

| Abbott Laboratories | 14,230,651 | 620,599 |

| Eli Lilly & Co. | 10,537,487 | 582,407 |

| UnitedHealth Group Inc. | 12,559,563 | 562,417 |

| Wyeth | 12,549,763 | 557,335 |

| Medtronic, Inc. | 11,254,300 | 528,052 |

| Bristol-Myers Squibb Co. | 18,346,782 | 474,448 |

* | WellPoint Inc. | 5,947,531 | 432,802 |

| Schering-Plough Corp. | 13,814,799 | 262,896 |

* | Gilead Sciences, Inc. | 4,242,628 | 250,994 |

| Cardinal Health, Inc. | 3,895,909 | 250,624 |

| Baxter International, Inc. | 6,105,447 | 224,436 |

| Aetna Inc. | 5,283,586 | 210,974 |

| Caremark Rx, Inc. | 4,131,546 | 206,040 |

* | Boston Scientific Corp. | 11,320,422 | 190,636 |

| HCA Inc. | 3,800,665 | 163,999 |

* | Medco Health Solutions, Inc. | 2,816,817 | 161,347 |

| Allergan, Inc. | 1,426,999 | 153,060 |

* | Biogen Idec Inc. | 3,205,886 | 148,529 |

* | Genzyme Corp. | 2,420,435 | 147,768 |

| Becton, Dickinson & Co. | 2,304,377 | 140,867 |

| McKesson Corp. | 2,836,702 | 134,119 |

* | Zimmer Holdings, Inc. | 2,308,431 | 130,934 |

* | Forest Laboratories, Inc. | 3,036,236 | 117,472 |

| Stryker Corp. | 2,722,463 | 114,643 |

| CIGNA Corp. | 1,117,602 | 110,095 |

* | St. Jude Medical, Inc. | 3,373,847 | 109,380 |

* | Express Scripts Inc. | 1,363,707 | 97,832 |

| Quest Diagnostics, Inc. | 1,515,656 | 90,818 |

* | Fisher Scientific International Inc. | 1,149,622 | 83,980 |

* | Coventry Health Care Inc. | 1,493,617 | 82,059 |

* | Humana Inc. | 1,523,165 | 81,794 |

| AmerisourceBergen Corp. | 1,947,406 | 81,635 |

* | Laboratory Corp. of America Holdings | 1,167,281 | 72,640 |

| Biomet, Inc. | 2,306,101 | 72,158 |

| C.R. Bard, Inc. | 968,942 | 70,985 |

* | MedImmune Inc. | 2,325,086 | 63,010 |

* | Hospira, Inc. | 1,460,063 | 62,695 |

| Applera Corp.– Applied Biosystems Group | 1,707,436 | 55,236 |

* | Thermo Electron Corp. | 1,510,663 | 54,746 |

| IMS Health, Inc. | 1,855,789 | 49,828 |

* | Barr Pharmaceuticals Inc. | 985,177 | 46,983 |

* | Patterson Cos. | 1,291,686 | 45,119 |

| Health Management Associates Class A | 2,241,490 | 44,180 |

* | Waters Corp. | 973,757 | 43,235 |

| Mylan Laboratories, Inc. | 1,961,997 | 39,240 |

* | King Pharmaceuticals, Inc. | 2,254,656 | 38,329 |

| Manor Care, Inc. | 736,288 | 34,547 |

* | Tenet Healthcare Corp. | 4,381,845 | 30,585 |

* | Millipore Corp. | 485,070 | 30,555 |

| PerkinElmer, Inc. | 1,181,428 | 24,692 |

| Bausch & Lomb, Inc. | 500,564 | 24,548 |

* | Watson Pharmaceuticals, Inc. | 946,061 | 22,024 |

| | | 13,146,717 |

Industrials (11.7%) | | |

| General Electric Co. | 96,956,052 | 3,195,671 |

| United Parcel Service, Inc. | 10,113,467 | 832,642 |

| The Boeing Co. | 7,455,360 | 610,668 |

| United Technologies Corp. | 9,429,021 | 597,989 |

| 3M Co. | 7,029,710 | 567,790 |

| Tyco International Ltd. | 19,007,106 | 522,695 |

| Caterpillar, Inc. | 6,248,164 | 465,363 |

| FedEx Corp. | 2,846,033 | 332,587 |

| Emerson Electric Co. | 3,831,642 | 321,130 |

| Honeywell International Inc. | 7,722,785 | 311,228 |

| Burlington Northern Santa Fe Corp. | 3,401,366 | 269,558 |

| General Dynamics Corp. | 3,769,338 | 246,741 |

| Lockheed Martin Corp. | 3,302,054 | 236,889 |

| Union Pacific Corp. | 2,507,703 | 233,116 |

| Norfolk Southern Corp. | 3,876,215 | 206,292 |

| Northrop Grumman Corp. | 3,205,302 | 205,332 |

| Raytheon Co. | 4,156,359 | 185,249 |

| Illinois Tool Works, Inc. | 3,871,201 | 183,882 |

| Deere & Co. | 2,192,471 | 183,049 |

| Waste Management, Inc. | 5,095,176 | 182,815 |

| Cendant Corp. | 9,334,960 | 152,066 |

| CSX Corp. | 2,071,232 | 145,898 |

| Danaher Corp. | 2,200,643 | 141,545 |

| Ingersoll-Rand Co. | 3,051,100 | 130,526 |

| PACCAR, Inc. | 1,558,293 | 128,372 |

| Rockwell Automation, Inc. | 1,651,192 | 118,902 |

| Textron, Inc. | 1,215,983 | 112,089 |

| Masco Corp. | 3,712,625 | 110,042 |

| Southwest Airlines Co. | 6,597,354 | 107,999 |

| Eaton Corp. | 1,404,012 | 105,862 |

| Dover Corp. | 1,894,165 | 93,629 |

| Rockwell Collins, Inc. | 1,595,191 | 89,123 |

| Parker Hannifin Corp. | 1,115,429 | 86,557 |

| Pitney Bowes, Inc. | 2,075,080 | 85,701 |

| L-3 Communications Holdings, Inc. | 1,129,778 | 85,208 |

| ITT Industries, Inc. | 1,720,839 | 85,182 |

| Cooper Industries, Inc. Class A | 855,332 | 79,477 |

| Fluor Corp. | 808,896 | 75,171 |

| American Standard Cos., Inc. | 1,660,525 | 71,851 |

11

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Robert Half International, Inc. | 1,597,627 | 67,100 |

| R.R. Donnelley & Sons Co. | 2,011,908 | 64,280 |

| Avery Dennison Corp. | 1,029,160 | 59,753 |

| W.W. Grainger, Inc. | 712,145 | 53,575 |

| Cummins Inc. | 432,656 | 52,892 |

| Cintas Corp. | 1,283,348 | 51,026 |

* | Monster Worldwide Inc. | 1,177,776 | 50,244 |

| Goodrich Corp. | 1,149,784 | 46,325 |

| Equifax, Inc. | 1,205,349 | 41,392 |

| Ryder System, Inc. | 566,677 | 33,111 |

| Pall Corp. | 1,163,851 | 32,588 |

| American Power Conversion Corp. | 1,601,283 | 31,209 |

* | Allied Waste Industries, Inc. | 2,252,306 | 25,586 |

* | Navistar International Corp. | 573,934 | 14,125 |

* | Raytheon Co. Warrants Exp. 6/16/11 | 60,569 | 766 |

| | | 12,519,858 |

Information Technology (14.8%) | | |

| Microsoft Corp. | 81,800,949 | 1,905,962 |

* | Cisco Systems, Inc. | 56,920,290 | 1,111,653 |

| International Business Machines Corp. | 14,456,049 | 1,110,514 |

| Intel Corp. | 54,259,458 | 1,028,217 |

| Hewlett-Packard Co. | 26,010,154 | 824,002 |

* | Google Inc. | 1,921,686 | 805,821 |

| QUALCOMM Inc. | 15,628,777 | 626,245 |

* | Oracle Corp. | 36,311,014 | 526,147 |

* | Dell Inc. | 21,200,398 | 517,502 |

| Motorola, Inc. | 23,045,945 | 464,376 |

* | Apple Computer, Inc. | 7,935,640 | 453,284 |

| Texas Instruments, Inc. | 14,537,330 | 440,336 |

* | Yahoo! Inc. | 11,690,897 | 385,800 |

* | Corning, Inc. | 14,528,364 | 351,441 |

| First Data Corp. | 7,144,517 | 321,789 |

* | eBay Inc. | 10,785,522 | 315,908 |

| Automatic Data Processing, Inc. | 5,379,136 | 243,944 |

* | EMC Corp. | 22,068,117 | 242,087 |

| Applied Materials, Inc. | 14,580,921 | 237,377 |

* | Adobe Systems, Inc. | 5,588,340 | 169,662 |

* | Symantec Corp. | 9,660,382 | 150,122 |

* | Sun Microsystems, Inc. | 32,693,405 | 135,678 |

* | Broadcom Corp. | 4,281,509 | 128,659 |

* | Agilent Technologies, Inc. | 3,973,078 | 125,390 |

* | Electronic Arts Inc. | 2,861,680 | 123,167 |

* | Network Appliance, Inc. | 3,486,015 | 123,056 |

| Paychex, Inc. | 3,112,242 | 121,315 |

* | Xerox Corp. | 8,583,221 | 119,393 |

| Electronic Data Systems Corp. | 4,845,900 | 116,592 |

* | Advanced Micro Devices, Inc. | 4,524,963 | 110,500 |

| Analog Devices, Inc. | 3,375,721 | 108,496 |

* | Micron Technology, Inc. | 6,771,546 | 101,979 |

* | Lucent Technologies, Inc. | 41,639,239 | 100,767 |

* | Intuit, Inc. | 1,596,910 | 96,437 |

| Maxim Integrated Products, Inc. | 2,987,027 | 95,913 |

| Linear Technology Corp. | 2,832,129 | 94,848 |

* | SanDisk Corp. | 1,819,837 | 92,775 |

* | Freescale Semiconductor, Inc. Class B | 3,069,895 | 90,255 |

| CA, Inc. | 4,250,956 | 87,357 |

* | Juniper Networks, Inc. | 5,269,113 | 84,253 |

* | Computer Sciences Corp. | 1,737,558 | 84,167 |

| KLA-Tencor Corp. | 1,858,917 | 77,275 |

| National Semiconductor Corp. | 3,144,328 | 74,992 |

* | Fiserv, Inc. | 1,642,201 | 74,490 |

* | Autodesk, Inc. | 2,150,251 | 74,098 |

| Xilinx, Inc. | 3,212,163 | 72,755 |

* | NVIDIA Corp. | 3,294,972 | 70,150 |

* | Citrix Systems, Inc. | 1,702,580 | 68,342 |

* | NCR Corp. | 1,695,505 | 62,123 |

* | Altera Corp. | 3,347,249 | 58,744 |

* | Affiliated Computer Services, Inc. Class A | 1,094,650 | 56,495 |

* | Tellabs, Inc. | 4,196,031 | 55,849 |

* | Lexmark International, Inc. | 984,365 | 54,957 |

* | VeriSign, Inc. | 2,278,600 | 52,795 |

* | BMC Software, Inc. | 1,982,279 | 47,376 |

| Molex, Inc. | 1,323,093 | 44,416 |

* | Avaya Inc. | 3,833,813 | 43,782 |

| Jabil Circuit, Inc. | 1,626,221 | 41,631 |

* | JDS Uniphase Corp. | 15,617,250 | 39,512 |

* | Comverse Technology, Inc. | 1,881,986 | 37,207 |

* | LSI Logic Corp. | 3,649,351 | 32,662 |

* | Novellus Systems, Inc. | 1,189,274 | 29,375 |

* | Solectron Corp. | 8,520,906 | 29,141 |

| Sabre Holdings Corp. | 1,228,210 | 27,021 |

* | Ciena Corp. | 5,421,975 | 26,080 |

* | QLogic Corp. | 1,503,141 | 25,914 |

* | Teradyne, Inc. | 1,844,554 | 25,695 |

| Symbol Technologies, Inc. | 2,356,878 | 25,431 |

* | Convergys Corp. | 1,301,869 | 25,386 |

* | Compuware Corp. | 3,566,132 | 23,893 |

* | Sanmina-SCI Corp. | 4,954,587 | 22,791 |

| Tektronix, Inc. | 759,786 | 22,353 |

* | Novell, Inc. | 3,168,662 | 21,008 |

* | Freescale Semiconductor, Inc. Class A | 719,000 | 20,851 |

* | Unisys Corp. | 3,185,309 | 20,004 |

* | PMC Sierra Inc. | 1,961,795 | 18,441 |

* | ADC Telecommunications, Inc. | 1,089,832 | 18,375 |

* | Andrew Corp. | 1,482,368 | 13,134 |

12

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | Parametric Technology Corp. | 1,033,290 | 13,133 |

* | Gateway, Inc. | 2,450,430 | 4,656 |

| Molex, Inc. Class A | 4,051 | 116 |

| | | 15,925,635 |

Materials (3.1%) | | |

| E.I. du Pont de Nemours & Co. | 8,593,344 | 357,483 |

| Dow Chemical Co. | 8,967,087 | 349,985 |

| Alcoa Inc. | 8,122,708 | 262,851 |

| Newmont Mining Corp. (Holding Co.) | 4,185,594 | 221,543 |

| Monsanto Co. | 2,529,131 | 212,928 |

| Praxair, Inc. | 3,007,302 | 162,394 |

| Nucor Corp. | 2,895,825 | 157,099 |

| Phelps Dodge Corp. | 1,896,188 | 155,791 |

| International Paper Co. | 4,589,456 | 148,239 |

| Weyerhaeuser Co. | 2,301,489 | 143,268 |

| Air Products & Chemicals, Inc. | 2,095,382 | 133,937 |

| PPG Industries, Inc. | 1,540,384 | 101,665 |

| Freeport-McMoRan Copper & Gold, Inc. Class B | 1,761,625 | 97,612 |

| United States Steel Corp. | 1,166,230 | 81,776 |

| Vulcan Materials Co. | 935,229 | 72,948 |

| Ecolab, Inc. | 1,698,429 | 68,922 |

| Rohm & Haas Co. | 1,341,646 | 67,243 |

| Allegheny Technologies Inc. | 805,208 | 55,753 |

| MeadWestvaco Corp. | 1,690,723 | 47,222 |

| Sigma-Aldrich Corp. | 623,043 | 45,258 |

| Ashland, Inc. | 663,904 | 44,282 |

| Temple-Inland Inc. | 1,032,757 | 44,274 |

| Eastman Chemical Co. | 760,360 | 41,059 |

| Sealed Air Corp. | 758,078 | 39,481 |

| Ball Corp. | 971,589 | 35,988 |

* | Pactiv Corp. | 1,334,241 | 33,022 |

| Bemis Co., Inc. | 981,011 | 30,039 |

| International Flavors & Fragrances, Inc. | 734,889 | 25,897 |

| Louisiana-Pacific Corp. | 987,076 | 21,617 |

* | Hercules, Inc. | 1,051,587 | 16,047 |

| | | 3,275,623 |

Telecommunication Services (3.3%) | | |

| AT&T Inc. | 36,251,696 | 1,011,060 |

| Verizon Communications Inc. | 27,200,505 | 910,945 |

| BellSouth Corp. | 16,865,460 | 610,530 |

| Sprint Nextel Corp. | 27,776,811 | 555,258 |

| Alltel Corp. | 3,628,087 | 231,581 |

* | Qwest Communications International Inc. | 14,631,694 | 118,370 |

* | Embarq Corp. | 1,382,069 | 56,651 |

| Citizens Communications Co. | 3,060,192 | 39,935 |

| CenturyTel, Inc. | 1,072,963 | 39,861 |

| | | 3,574,191 |

Utilities (3.4%) | | |

| Exelon Corp. | 6,235,482 | 354,362 |

| Duke Energy Corp. | 11,519,511 | 338,328 |

| TXU Corp. | 4,311,501 | 257,785 |

| Dominion Resources, Inc. | 3,237,398 | 242,125 |

| Southern Co. | 6,910,701 | 221,488 |

| FirstEnergy Corp. | 3,073,066 | 166,591 |

| FPL Group, Inc. | 3,759,897 | 155,585 |

| Public Service Enterprise Group, Inc. | 2,335,712 | 154,437 |

| Entergy Corp. | 1,936,462 | 137,005 |

| PG&E Corp. | 3,245,031 | 127,465 |

| American Electric Power Co., Inc. | 3,668,217 | 125,636 |

| Edison International | 3,035,508 | 118,385 |

| PPL Corp. | 3,542,607 | 114,426 |

* | AES Corp. | 6,111,788 | 112,762 |

| Sempra Energy | 2,407,594 | 109,497 |

| Consolidated Edison Inc. | 2,286,701 | 101,621 |

| Progress Energy, Inc. | 2,350,555 | 100,768 |

| Ameren Corp. | 1,907,526 | 96,330 |

| Constellation Energy Group, Inc. | 1,662,655 | 90,648 |

| Xcel Energy, Inc. | 3,762,182 | 72,159 |

| DTE Energy Co. | 1,656,467 | 67,484 |

| KeySpan Corp. | 1,626,261 | 65,701 |

* | Allegheny Energy, Inc. | 1,520,161 | 56,352 |

| NiSource, Inc. | 2,539,677 | 55,467 |

| Pinnacle West Capital Corp. | 923,924 | 36,874 |

| CenterPoint Energy Inc. | 2,889,210 | 36,115 |

| TECO Energy, Inc. | 1,939,872 | 28,982 |

* | CMS Energy Corp. | 2,056,711 | 26,614 |

* | Dynegy, Inc. | 3,430,939 | 18,767 |

| Nicor Inc. | 411,136 | 17,062 |

^ | Peoples Energy Corp. | 357,236 | 12,828 |

| | | 3,619,649 |

Total Common Stocks | | |

(Cost $73,079,153) | | 107,189,161 |

Temporary Cash Investments (0.2%)1 | | |

Money Market Fund (0.2%) | | |

2 Vanguard Market | | |

| Liquidity Fund, 5.136% | 20,169,799 | 20,170 |

2 Vanguard Market | | |

| Liquidity Fund, 5.136%—Note E | 177,713,600 | 177,714 |

| | | 197,884 |

13

| Face | Market |

| Amount | Value• |

| ($000) | ($000) |

U.S. Agency Obligation (0.0%) | | |

3 Federal Home Loan Bank | | |

4 5.393%, 9/29/06 | 25,000 | 24,684 |

3 Federal National Mortgage Assn. | | |

4 4.847%, 7/5/06 | 25,000 | 24,993 |

| | 49,677 |

Total Temporary Cash Investments | | |

(Cost $247,539) | | 247,561 |

Total Investments (100.1%) | | |

(Cost $73,326,692) | | 107,436,722 |

Other Assets and Liabilities (–0.1%) | | |

Other Assets—Note B | | 320,659 |

Liabilities—Note E | | (449,847) |

| | (129,188) |

Net Assets (100%) | | 107,307,534 |

At June 30, 2006, net assets consisted of:5 |

| Amount |

| ($000) |

Paid-in Capital | 79,508,480 |

Overdistributed Net Investment Income | (101,009) |

Accumulated Net Realized Losses | (6,210,265) |

Unrealized Appreciation (Depreciation) | |

Investment Securities | 34,110,030 |

Futures Contracts | 298 |

Net Assets | 107,307,534 |

| |

Investor Shares—Net Assets | |

Applicable to 571,438,245 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 66,855,160 |

Net Asset Value Per Share— | |

Investor Shares | $116.99 |

| |

Admiral Shares—Net Assets | |

Applicable to 345,753,860 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 40,452,374 |

Net Asset Value Per Share— | |

Admiral Shares | $117.00 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. See Note E in Notes to Financial Statements.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 0.1%, respectively, of net assets. See Note C in Notes to Financial Statements.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 The issuer operates under a congressional charter; its securities are neither issued nor guaranteed by the U.S. government. If needed, access to additional funding from the U.S. Treasury (beyond the issuer’s line of credit) would require congressional action.

4 Securities with a value of $49,677,000 have been segregated as initial margin for open futures contracts.

5 See Note C in Notes to Financial Statements for the tax-basis components of net assets.

REIT—Real Estate Investment Trust.

14

Statement of Operations

| Six Months Ended |

| June 30, 2006 |

| ($000) |

Investment Income | |

Income | |

Dividends | 1,018,895 |

Interest1 | 3,740 |

Security Lending | 1,875 |

Total Income | 1,024,510 |

Expenses | |

The Vanguard Group—Note B | |

Investment Advisory Services | 577 |

Management and Administrative | |

Investor Shares | 51,104 |

Admiral Shares | 13,019 |

Marketing and Distribution | |

Investor Shares | 9,367 |

Admiral Shares | 3,530 |

Custodian Fees | 207 |

Shareholders’ Reports | |

Investor Shares | 796 |

Admiral Shares | 35 |

Trustees’ Fees and Expenses | 57 |

Total Expenses | 78,692 |

Net Investment Income | 945,818 |

Realized Net Gain (Loss) | |

Investment Securities Sold | (373,972) |

Futures Contracts | (2,566) |

Realized Net Gain (Loss) | (376,538) |

Change in Unrealized Appreciation (Depreciation) | |

Investment Securities | 2,307,456 |

Futures Contracts | 2,482 |

Change in Unrealized Appreciation (Depreciation) | 2,309,938 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 2,879,218 |

1 Interest income from an affiliated company of the fund was $3,078,000.

15

Statement of Changes in Net Assets

| Six Months Ended | Year Ended |

| June 30, | Dec. 31, |

| 2006 | 2005 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 945,818 | 1,866,932 |

Realized Net Gain (Loss) | (376,538) | 407,622 |

Change in Unrealized Appreciation (Depreciation) | 2,309,938 | 2,681,084 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 2,879,218 | 4,955,638 |

Distributions | | |

Net Investment Income | | |

Investor Shares | (559,233) | (1,324,414) |

Admiral Shares | (350,596) | (566,269) |

Realized Capital Gain | | |

Investor Shares | — | — |

Admiral Shares | — | — |

Total Distributions | (909,829) | (1,890,683) |

Capital Share Transactions—Note F | | |

Investor Shares | (3,822,180) | (16,859,513) |

Admiral Shares | 1,756,984 | 14,619,185 |

Net Increase (Decrease) from Capital Share Transactions | (2,065,196) | (2,240,328) |

Total Increase (Decrease) | (95,807) | 824,627 |

Net Assets | | |

Beginning of Period | 107,403,341 | 106,578,714 |

End of Period1 | 107,307,534 | 107,403,341 |

1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($101,009,000) and ($136,998,000).

16

Financial Highlights

500 Index Fund Investor Shares | | | | | | |

| | | | | | |

| Six Months | | | | | |

| Ended | | | |

For a Share Outstanding | June 30, | Year Ended December 31, |

Throughout Each Period | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

Net Asset Value, | | | | | | |

Beginning of Period | $114.92 | $111.64 | $102.67 | $ 81.15 | $105.89 | $121.86 |

Investment Operations | | | | | | |

Net Investment Income | 1.00 | 1.95 | 1.951 | 1.44 | 1.32 | 1.260 |

Net Realized and Unrealized | | | | | | |

Gain (Loss) on Investments | 2.04 | 3.31 | 8.97 | 21.51 | (24.70) | (15.955) |

Total from | | | | | | |

Investment Operations | 3.04 | 5.26 | 10.92 | 22.95 | (23.38) | (14.695) |

Distributions | | | | | | |

Dividends from | | | | | | |

Net Investment Income | (.97) | (1.98) | (1.95) | (1.43) | (1.36) | (1.275) |

Distributions from | | | | | | |

Realized Capital Gains | — | — | — | — | — | — |

Total Distributions | (.97) | (1.98) | (1.95) | (1.43) | (1.36) | (1.275) |

Net Asset Value, | | | | | | |

End of Period | $116.99 | $114.92 | $111.64 | $102.67 | $ 81.15 | $105.89 |

| | | | | | |

Total Return2 | 2.64% | 4.77% | 10.74% | 28.50% | –22.15% | –12.02% |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, | | | | | | |

End of Period (Millions) | $66,855 | $69,375 | $84,167 | $75,342 | $56,224 | $73,151 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets | 0.18%3 | 0.18% | 0.18% | 0.18% | 0.18% | 0.18% |

Ratio of Net Investment | | | | | | |

Income to Average Net Assets | 1.71%3 | 1.75% | 1.86%1 | 1.61% | 1.43% | 1.14% |

Portfolio Turnover Rate4 | 6%3 | 6% | 3% | 1% | 6% | 3% |

1 Net investment income per share and the ratio of net investment income to average net assets include $0.32 and 0.31%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Total returns do not reflect the $10 annual account maintenance fee applied on balances under $10,000.

3 Annualized.

4 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares.

17

500 Index Fund Admiral Shares | | | | | | |

| Six Months | | | | | |

| Ended | | | |

For a Share Outstanding | June 30, | Year Ended December 31, |

Throughout Each Period | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

Net Asset Value, Beginning of Period | $114.92 | $111.64 | $102.68 | $ 81.15 | $105.89 | $121.87 |

Investment Operations | | | | | | |

Net Investment Income | 1.064 | 2.052 | 2.031 | 1.507 | 1.374 | 1.313 |

Net Realized and Unrealized Gain (Loss) | | | | | | |

on Investments | 2.041 | 3.310 | 8.97 | 21.510 | (24.700) | (15.955) |

Total from Investment Operations | 3.105 | 5.362 | 11.00 | 23.017 | (23.326) | (14.642) |

Distributions | | | | | | |

Dividends from Net Investment Income | (1.025) | (2.082) | (2.04) | (1.487) | (1.414) | (1.338) |

Distributions from Realized Capital Gains | — | — | — | — | — | — |

Total Distributions | (1.025) | (2.082) | (2.04) | (1.487) | (1.414) | (1.338) |

Net Asset Value, End of Period | $117.00 | $114.92 | $111.64 | $102.68 | $ 81.15 | $105.89 |

| | | | | | |

Total Return | 2.70% | 4.87% | 10.82% | 28.59% | –22.10% | –11.98% |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $40,452 | $38,028 | $22,412 | $18,098 | $11,922 | $13,863 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets | 0.09%2 | 0.09% | 0.09% | 0.12% | 0.12% | 0.12% |

Ratio of Net Investment Income to | | | | | | |

Average Net Assets | 1.80%2 | 1.84% | 1.96%1 | 1.67% | 1.50% | 1.22% |

Portfolio Turnover Rate3 | 6%2 | 6% | 3% | 1% | 6% | 3% |

1 Net investment income per share and the ratio of net investment income to average net assets include $0.32 and 0.31%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Annualized.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares. See accompanying Notes, which are an integral part of the Financial Statements.

18

Notes to Financial Statements

Vanguard 500 Index Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers two classes of shares, Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, servicing, tenure, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4:00 p.m. Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objectives of maintaining full exposure to the stock market, enhancing returns, maintaining liquidity, and minimizing transaction costs. The fund may purchase futures contracts to immediately invest incoming cash in the market, or sell futures in response to cash outflows, thereby simulating a fully invested position in the underlying index while maintaining a cash balance for liquidity. The fund may seek to enhance returns by using futures contracts instead of the underlying securities when futures are believed to be priced more attractively than the underlying securities. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the financial statements. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market

19

Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At June 30, 2006, the fund had contributed capital of $11,792,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 11.79% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the six months ended June 30, 2006, the fund realized $314,329,000 of net capital gains resulting from in-kind redemptions—in which shareholders exchange fund shares for securities held by the fund rather than for cash. Because such gains are not taxable to the fund, and are not distributed to shareholders, they have been reclassified from accumulated net realized gains to paid-in capital.

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at December 31, 2005, the fund had available realized losses of $5,517,969,000 to offset future net capital gains of $193,358,000 through December 31, 2008, $890,248,000 through December 31, 2009, $3,087,963,000 through December 31, 2010, $145,498,000 through December 31, 2011, $44,874,000 through December 31, 2012, $757,853,000 through December 31, 2013, and $398,175,000 through December 31, 2014. The fund will use these capital losses to offset net taxable capital gains, if any, realized during the year ending December 31, 2006; should the fund realize net capital losses for the year, the losses will be added to the loss carryforward balances above.

20

At June 30, 2006, net unrealized appreciation of investment securities for tax purposes was $34,110,030,000, consisting of unrealized gains of $40,547,500,000 on securities that had risen in value since their purchase and $6,437,470,000 in unrealized losses on securities that had fallen in value since their purchase.

At June 30, 2006, the aggregate settlement value of open futures contracts expiring in September 2006 and the related unrealized appreciation (depreciation) were:

| | | ($000) |

| | Aggregate | Unrealized |

| Number of | Settlement | Appreciation |

Futures Contracts | Long Contracts | Value | (Depreciation) |

S&P 500 Index | 287 | 91,797 | (154) |

E-mini S&P 500 Index | 350 | 22,390 | 452 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

D. During the six months ended June 30, 2006, the fund purchased $2,994,025,000 of investment securities and sold $5,007,152,000 of investment securities other than temporary cash investments.

E. The market value of securities on loan to broker-dealers at June 30, 2006, was $172,110,000, for which the fund received cash collateral of $177,714,000.

F. Capital share transactions for each class of shares were:

| Six Months Ended | Year Ended |

| June 30, 2006 | December 31, 2005 |

| Amount | Shares | Amount | Shares |

| ($000) | (000) | ($000) | (000) |

Investor Shares | | | | |

Issued | 4,713,716 | 39,857 | 10,254,612 | 92,341 |

Issued in Lieu of Cash Distributions | 536,242 | 4,565 | 1,263,113 | 11,331 |

Redeemed | (9,072,138) | (76,666) | (28,377,238) | (253,914) |

Net Increase (Decrease)—Investor Shares | (3,822,180) | (32,244) | (16,859,513) | (150,242) |

Admiral Shares | | | | |

Issued | 4,732,549 | 39,970 | 18,807,375 | 167,602 |

Issued in Lieu of Cash Distributions | 305,852 | 2,605 | 487,001 | 4,337 |

Redeemed | (3,281,417) | (27,723) | (4,675,191) | (41,782) |

Net Increase (Decrease)—Admiral Shares | 1,756,984 | 14,852 | 14,619,185 | 130,157 |

21

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended June 30, 2006 | | | |

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

500 Index Fund | 12/31/2005 | 6/30/2006 | Period1 |

Based on Actual Fund Return | | | |

Investor Shares | $1,000.00 | $1,026.44 | $0.90 |

Admiral Shares | 1,000.00 | 1,027.01 | 0.45 |

Based on Hypothetical 5% Yearly Return | | | |

Investor Shares | $1,000.00 | $1,023.90 | $0.90 |

Admiral Shares | 1,000.00 | 1,024.35 | 0.45 |

1 These calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.18% for Investor Shares and 0.09% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

22

Note that the expenses shown in the table on page 22 are meant to highlight and help you compare ongoing costs only and do not reflect any transactional costs or account maintenance fees. They do not include your fund’s low-balance fee, which is described in the prospectus. If this fee were applied to your account, your costs would be higher. Your fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate fund prospectus.

23

Trustees Approve Advisory Arrangement

The board of trustees of Vanguard 500 Index Fund has approved the fund’s investment advisory arrangement with The Vanguard Group, Inc. Vanguard—through its Quantitative Equity Group—serves as the investment advisor for the fund. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon its most recent evaluation of the advisor’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management over both short- and long-term periods, and took into account the organizational depth and stability of the advisor. Vanguard has been managing investments for more than two decades. George U. Sauter, Vanguard managing director and chief investment officer, has been in the investment management business since 1985. Mr. Sauter has led the Quantitative Equity Group since 1987. The Quantitative Equity Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance of a relevant benchmark and peer group. The board noted that the fund has performed in line with expectations, and that its results have been consistent with its investment strategies. Information about the fund’s performance, including some of the data considered by the board, can be found in the Performance Summary section of this report.

Cost

The 500 Index Fund’s expense ratio was far below the average expense ratio charged by funds in its peer group. The fund’s advisory expense ratio was also well below its peer-group average. Information about the fund’s expense ratio appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique “at-cost” structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees, and produces “profits” only in the form of reduced expenses for fund shareholders.

The benefit of economies of scale

The board of trustees concluded that Vanguard 500 Index Fund’s low-cost arrangement with Vanguard ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

24

Glossary

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. A fund’s beta should be reviewed in conjunction with its R-squared (see definition below). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

Yield. A snapshot of a fund’s income from interest and dividends. The yield, expressed as a percentage of the fund’s net asset value, is based on income earned over the past 30 days and is annualized, or projected forward for the coming year. The index yield is based on the current annualized rate of income provided by securities in the index.

25

This page intentionally left blank.

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals.

Our independent board members bring distinguished backgrounds in business, academia, and public service to their task of working with Vanguard officers to establish the policies and oversee the activities of the funds. Among board members’ responsibilities are selecting investment advisors for the funds; monitoring fund operations, performance, and costs; reviewing contracts; nominating and selecting new trustees/directors; and electing Vanguard officers.

Each trustee serves a fund until its termination; or until the trustee’s retirement, resignation, or death; or otherwise as specified in the fund’s organizational documents. Any trustee may be removed at a shareholders’ meeting by a vote representing two-thirds of the net asset value of all shares of the fund together with shares of other Vanguard funds organized within the same trust. The table on these two pages shows information for each trustee and executive officer of the fund. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482.

Chairman of the Board, Chief Executive Officer, and Trustee |

| |

John J. Brennan1 | |

Born 1954 | Principal Occupation(s) During the Past Five Years: Chairman of the Board, Chief |

Trustee since May 1987; | Executive Officer, and Director/Trustee of The Vanguard Group, Inc., and of each |

Chairman of the Board and | of the investment companies served by The Vanguard Group. |

Chief Executive Officer | |

141 Vanguard Funds Overseen |

| |

Independent Trustees | |

| |

Charles D. Ellis | |

Born 1937 | Principal Occupation(s) During the Past Five Years: Applecore Partners (pro bono ventures |

Trustee since January 2001 | in education); Senior Advisor to Greenwich Associates (international business strategy |

141 Vanguard Funds Overseen | consulting); Successor Trustee of Yale University; Overseer of the Stern School of Business |

| at New York University; Trustee of the Whitehead Institute for Biomedical Research. |

| |

Rajiv L. Gupta | |

Born 1945 | Principal Occupation(s) During the Past Five Years: Chairman and Chief Executive Officer |

Trustee since December 20012 | of Rohm and Haas Co. (chemicals); Board Member of the American Chemistry Council; |

141 Vanguard Funds Overseen | Director of Tyco International, Ltd. (diversified manufacturing and services) (since 2005); |

| Trustee of Drexel University and of the Chemical Heritage Foundation. |

| |

Amy Gutmann | |

Born 1949 | Principal Occupation(s) During the Past Five Years: President of the University of |

Trustee since June 2006 | Pennsylvania since 2004; Professor in the School of Arts and Sciences, Annenberg School |

141 Vanguard Funds Overseen | for Communication, and Graduate School of Education of the University of Pennsylvania |

| since 2004; Provost (2001–2004) and Laurance S. Rockefeller Professor of Politics and the |

| University Center for Human Values (1990–2004), Princeton University; Director of Carnegie |

| Corporation of New York and of Philadelphia 2016 (since 2005) and of Schuylkill River |

| Development Corporation and Greater Philadelphia Chamber of Commerce (since 2004). |

JoAnn Heffernan Heisen | |

Born 1950 | Principal Occupation(s) During the Past Five Years: Corporate Vice President and Chief |

Trustee since July 1998 | Global Diversity Officer (since January 2006), Vice President and Chief Information |

141 Vanguard Funds Overseen | Officer (1997–2005), and Member of the Executive Committee of Johnson & Johnson |

| (pharmaceuticals/consumer products); Director of the University Medical Center at |

| Princeton and Women’s Research and Education Institute. |

| |

André F. Perold | |

Born 1952 | Principal Occupation(s) During the Past Five Years: George Gund Professor of Finance and |

Trustee since December 2004 | Banking, Harvard Business School (since 2000); Senior Associate Dean, Director of Faculty |

141 Vanguard Funds Overseen | Recruiting, and Chair of Finance Faculty, Harvard Business School; Director and Chairman |

| of UNX, Inc. (equities trading firm) (since 2003); Director of registered investment |

| companies advised by Merrill Lynch Investment Managers and affiliates (1985–2004), |

| Genbel Securities Limited (South African financial services firm) (1999–2003), Gensec |

| Bank (1999–2003), Sanlam, Ltd. (South African insurance company) (2001–2003), and |

| Stockback, Inc. (credit card firm) (2000–2002). |

| |

Alfred M. Rankin, Jr. | |

Born 1941 | Principal Occupation(s) During the Past Five Years: Chairman, President, Chief Executive |

Trustee since January 1993 | Officer, and Director of NACCO Industries, Inc. (forklift trucks/housewares/ lignite); |

141 Vanguard Funds Overseen | Director of Goodrich Corporation (industrial products/aircraft systems and services). |

| |

J. Lawrence Wilson | |

Born 1936 | Principal Occupation(s) During the Past Five Years: Retired Chairman and Chief Executive |

Trustee since April 1985 | Officer of Rohm and Haas Co. (chemicals); Director of Cummins Inc. (diesel engines), |

141 Vanguard Funds Overseen | MeadWestvaco Corp. (packaging products), and AmerisourceBergen Corp. (pharmaceutical |

| distribution); Trustee of Vanderbilt University and of Culver Educational Foundation. |

| |

Executive Officers1 | |

| |

Heidi Stam | |

Born 1956 | Principal Occupation(s) During the Past Five Years: Principal of The Vanguard Group, Inc., |

Secretary since July 2005 | since November 1997; General Counsel of The Vanguard Group since July 2005; |

141 Vanguard Funds Overseen | Secretary of The Vanguard Group and of each of the investment companies served |

| by The Vanguard Group since July 2005. |

| |

Thomas J. Higgins | |

Born 1957 | Principal Occupation(s) During the Past Five Years: Principal of The Vanguard Group, Inc.; |

Treasurer since July 1998 | Treasurer of each of the investment companies served by The Vanguard Group. |

141 Vanguard Funds Overseen | |

| |

Vanguard Senior Management Team |

| |

R. Gregory Barton | Kathleen C. Gubanich | Michael S. Miller |

Mortimer J. Buckley | Paul A. Heller | Ralph K. Packard |

James H. Gately | F. William McNabb, III | George U. Sauter |

| |

Founder | |

| |

John C. Bogle | |

Chairman and Chief Executive Officer, 1974–1996 |

1 Officers of the funds are “interested persons” as defined in the Investment Company Act of 1940.

2 December 2002 for Vanguard Equity Income Fund, Vanguard Growth Equity Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

More information about the trustees is in the Statement of Additional Information, available from The Vanguard Group.

|

|

| P.O. Box 2600 |

| Valley Forge, PA 19482-2600 |

Connect with Vanguard™ > www.vanguard.com

Fund Information > 800-662-7447 | Vanguard, Admiral, Connect with Vanguard, and the ship |

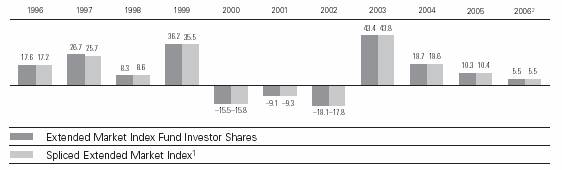

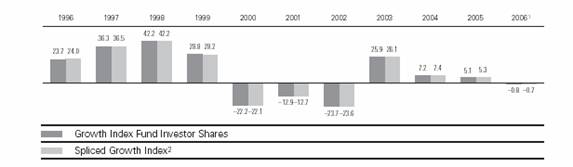

| logo are trademarks of The Vanguard Group, Inc. |