UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-2652 |

| Name of Registrant: | Vanguard Index Funds |

| Address of Registrant: | P.O. Box 2600

Valley Forge, PA 19482 |

| Name and address of agent for service: | Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

| Date of fiscal year end: | December 31 |

| Date of reporting period: | January 1, 2007 - June 30, 2007 |

| Item 1: | Reports to Shareholders |

|

|

Vanguard® 500 Index Fund |

|

|

> Semiannual Report |

|

|

|

|

|

June 30, 2007 |

|

|

> | During the fiscal half-year ended June 30, 2007, Vanguard 500 Index Fund |

| returned 6.9%, closely tracking the performance of its benchmark. |

> | Every sector contributed to the fund’s overall returns except for financials, which |

| produced a slight loss. |

> | The benchmark S&P 500 Index climbed to its first new highs since 2000, although |

| it pulled back somewhat by the end of the period. |

Contents | |

| |

Your Fund’s Total Returns | 1 |

Chairman’s Letter | 2 |

Fund Profile | 6 |

Performance Summary | 7 |

Financial Statements | 8 |

About Your Fund’s Expenses | 23 |

Trustees Approve Advisory Arrangement | 25 |

Glossary | 26 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the cover of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Six Months Ended June 30, 2007 | | |

| Ticker | Total |

| Symbol | Returns |

Vanguard 500 Index Fund | | |

Investor Shares | VFINX | 6.9% |

Admiral™ Shares1 | VFIAX | 6.9 |

Signal™ Shares2 | VIFSX | 6.9 |

S&P 500 Index | | 7.0 |

Average Large-Cap Core Fund3 | | 6.9 |

Your Fund’s Performance at a Glance | | | |

December 31, 2006–June 30, 2007 | | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard 500 Index Fund | | | | |

Investor Shares | $130.59 | $138.42 | $1.120 | $0.000 |

Admiral Shares | 130.59 | 138.43 | 1.174 | 0.000 |

Signal Shares | 107.86 | 114.34 | 0.966 | 0.000 |

1 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

2 Signal Shares also carry lower costs and are available to certain institutional shareholders who meet specific administrative, service, and account-size criteria.

3 Derived from data provided by Lipper Inc.

1

Chairman’s Letter

Dear Shareholder,

For the six months ended June 30, 2007, Vanguard 500 Index Fund delivered a return of 6.9%. The fund met its goal of tracking the return of its benchmark during a period of generally steady stock-market growth. Your fund’s result also matched the average return of large-cap core funds.

The stock market’s ascent was driven by global liquidity

The broad U.S. stock market notched impressive gains in the year’s first half, when an abundance of cash drove record numbers of mergers and acquisitions around the globe. The gains came amid increased volatility. In February, markets worldwide fell sharply following a sell-off in China, only to recover quickly and continue upward. The six-month period closed with two dips in June, owing to fears of accelerating inflation and slowing economic growth.

The best performers in the U.S. market were the so-called mega-caps—broadly diversified companies that are well-positioned to thrive during periods of economic transition. International stocks, particularly those in emerging markets, outperformed U.S. equities. The dollar slid against the euro and the British pound, further enhancing gains for Americans investing abroad.

2

Bond investors were hobbled by a shift in sentiment

The relationship between yield and maturity returned to normal during the half-year, as yields of intermediate- and longer-term bonds moved higher than short-term yields. The accompanying drop in prices was steepest for long-term and intermediate-term bonds.

Earlier in the year, bond yields seemed to reflect an assumption that the Federal Reserve Board might cut interest rates in response to weaker economic growth. As the year progressed, inflationary pressures and economic growth looked more substantial, producing a change in market sentiment, which resulted in higher yields and lower prices.

The broad taxable bond market returned 1.0% for the period, while municipal bonds posted a return of 0.1%. The Citigroup 3-Month Treasury Bill Index—a proxy for money market yields—returned 2.5% for the half-year.

Most of the fund’s gain came during the second quarter

The 500 Index Fund closely tracked the performance of its benchmark throughout the half-year, increasing modestly in the first quarter (by less than 1%) and robustly in the second quarter. The period included new highs for the S&P 500 Index, as it edged past its March 2000 peak.

The half-year ended, however, on a down note. The index and the fund declined in June as investors grew concerned about

Market Barometer | | | |

| | | Total Returns |

| | Periods Ended June 30, 2007 |

| Six Months | One Year | Five Years1 |

Stocks | | | |

Russell 1000 Index (Large-caps) | 7.2% | 20.4% | 11.3% |

Russell 2000 Index (Small-caps) | 6.4 | 16.4 | 13.9 |

Dow Jones Wilshire 5000 Index (Entire market) | 7.6 | 20.4 | 12.0 |

MSCI All Country World Index ex USA (International) | 12.6 | 30.1 | 19.9 |

| | | |

| | | |

Bonds | | | |

Lehman U.S. Aggregate Bond Index (Broad taxable market) | 1.0% | 6.1% | 4.5% |

Lehman Municipal Bond Index | 0.1 | 4.7 | 4.6 |

Citigroup 3-Month Treasury Bill Index | 2.5 | 5.1 | 2.7 |

| | | |

| | | |

CPI | | | |

Consumer Price Index | 3.2% | 2.7% | 3.0% |

1. Annualized.

3

signs of global inflationary pressures and the broader impact of the U.S. housing industry’s downturn. Almost all of the economic sectors represented in the fund—with the exception being financials—contributed to the 6.9% return for the period. The biggest boosts came from the energy, information technology, and industrials sectors, which together represent more than one-third of the index capitalization.

Reflecting growing demand and higher prices for oil, the energy sector returned 17%. Big oil firms, such as ExxonMobil and Chevron, and oil-field service company Schlumberger were standout performers. The IT sector outpaced the broad market with a 9% return, which, combined with its large weighting (15% of assets on average), made it the second-largest contributor to the fund’s performance. Computer maker Apple and semiconductor manufacturer Intel were bright spots among the sector’s stocks.

Financials, the index’s largest sector, fell –1%, holding back returns for the period. The largest declines were posted by diversified commercial banks, such as Citigroup and Bank of America. Rising interest rates created a headwind for companies in this industry as the yield on the benchmark 10-year U.S. Treasury bond increased from 4.7% to slightly over 5% over the six months. Investors continued to be concerned about how the troubles in the subprime mortgage market and among

Annualized Expense Ratios1 | | | | |

Your fund compared with its peer group | | | | |

| | | | Average |

| Investor | Admiral | Signal | Large-Cap |

| Shares | Shares | Shares | Core Fund |

500 Index Fund | 0.16% | 0.08% | 0.08% | 1.35% |

1.Fund expense ratios reflect the six months ended June 30, 2007. Peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2006.

4

some hedge funds might affect the market in general and the financial sector in particular.

For effective investing, stick to basic principles

During the half-year ended June 30, your fund did its job: Its performance nearly matched that of its index. The difference reflected expenses, which of course a benchmark doesn‘t have. For the 12 months ended June 30, the fund returned a bit more than 20%.

Whether these handsome recent returns will persist in the near term is anyone’s guess, but you can be sure that they will not last indefinitely. As we continually remind shareholders, however, overfocusing on short-term returns actually takes your eye off the ball. When you adopt a long-term perspective, the market’s month-to-month ups and downs loom less large, and you can assess your investments more effectively.

We believe that the 500 Index Fund offers a combination of investment characteristics that can make it a wise investment for the long term. The fund provides comprehensive exposure to of the broad U.S. stock market through diverse group of stocks—offering a chance to participate in the long-term growth of the economy. Further, the has provided an especially efficient of gaining this exposure because of its historically low expenses and its low turnover, which can mitigate tax impact in nonretirement accounts.

Thank you, as always, for investing with Vanguard.

Sincerely,

John J. Brennan

Chairman and Chief Executive Officer

July 12, 2007

5

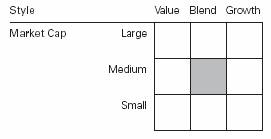

Fund Profile

As of June 30, 2007

Portfolio Characteristics | | |

| | Target |

| Fund | Index1 |

Number of Stocks | 507 | 500 |

Median Market Cap | $59.9B | $59.9B |

Price/Earnings Ratio | 17.1x | 17.1x |

Price/Book Ratio | 2.9x | 2.9x |

Yield | | 1.8% |

Investor Shares | 1.7% | |

Admiral Shares | 1.8% | |

Signal Shares | 1.8% | |

Return on Equity | 19.4% | 19.4% |

Earnings Growth Rate | 20.9% | 20.9% |

Foreign Holdings | 0.0% | 0.0% |

Turnover Rate | 4%2 | — |

Expense Ratio | | — |

Investor Shares | 0.16%2 | |

Admiral Shares | 0.08%2 | |

Signal Shares | 0.08%2 | |

Short-Term Reserves | 0% | — |

Sector Diversification (% of portfolio) | |

| | Target |

| Fund | Index1 |

Consumer Discretionary | 10% | 10% |

Consumer Staples | 9 | 9 |

Energy | 11 | 11 |

Financials | 21 | 21 |

Health Care | 12 | 12 |

Industrials | 11 | 11 |

Information Technology | 15 | 15 |

Materials | 3 | 3 |

Telecommunication Services | 4 | 4 |

Utilities | 4 | 4 |

Volatility Measures3 | |

| Fund Versus |

| Target Index1 |

R-Squared | 1.00 |

Beta | 1.00 |

Ten Largest Holdings4 (% of total net assets) |

| | |

ExxonMobil Corp. | integrated oil | |

| and gas | 3.5% |

General Electric Co. | industrial | |

| conglomerates | 2.9 |

AT&T Inc. | integrated | |

| telecommunication | |

| services | 1.9 |

Citigroup, Inc. | diversified | |

| financial services | 1.9 |

Microsoft Corp. | systems software | 1.9 |

Bank of America Corp. | diversified | |

| financial services | 1.6 |

The Procter & Gamble Co. | household products | 1.4 |

American International | | |

Group, Inc. | multi-line insurance | 1.4 |

Chevron Corp. | integrated oil | |

| and gas | 1.4 |

Pfizer Inc. | pharmaceuticals | 1.3 |

Top Ten | | 19.2% |

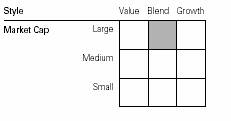

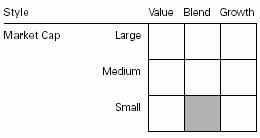

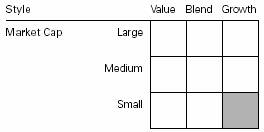

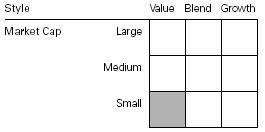

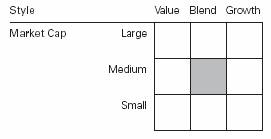

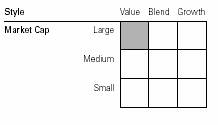

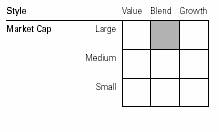

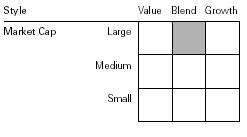

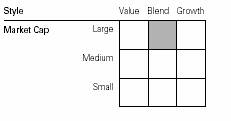

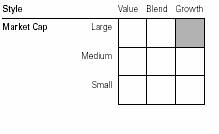

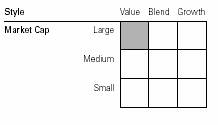

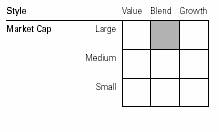

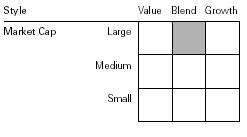

Investment Focus

1 S&P 500 Index.

2 Annualized.

3 For an explanation of R-squared, beta, and other terms used here, see the Glossary on page 26.

4 Ten Largest Holdings” excludes any temporary cash investments and equity index products.

6

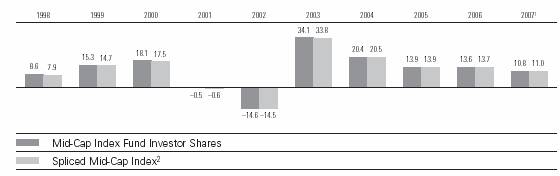

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

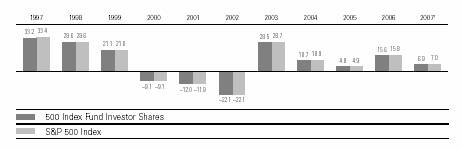

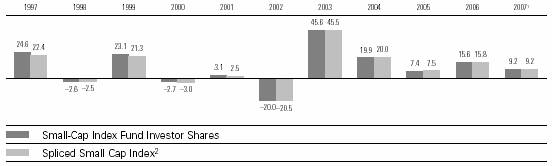

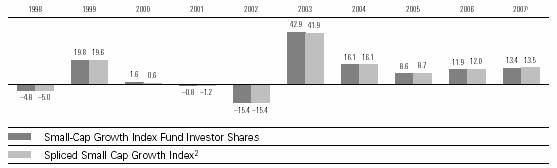

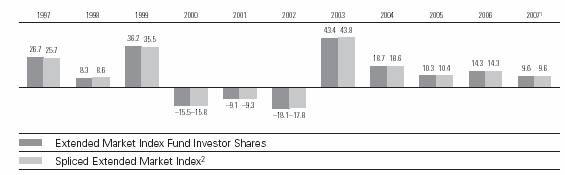

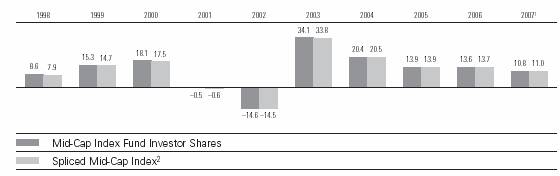

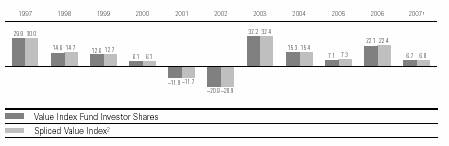

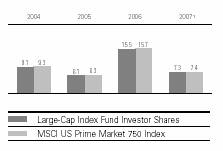

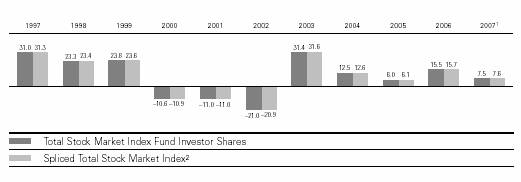

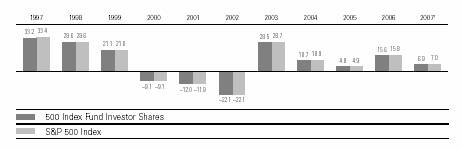

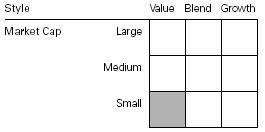

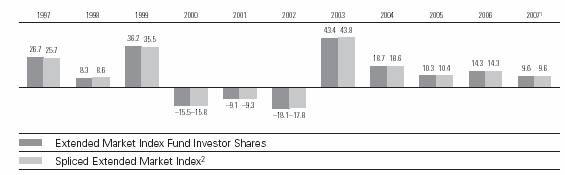

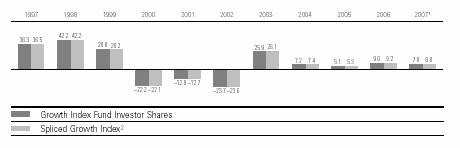

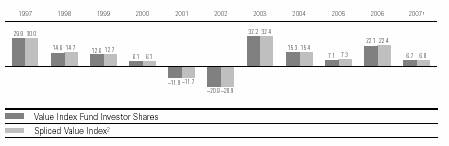

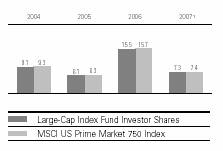

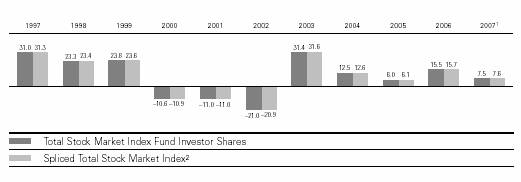

Fiscal-Year Total Returns (%): December 31, 1996–June 30, 2007

Average Annual Total Returns: Periods Ended June 30, 2007 | | | |

| | | | |

| Inception Date | One Year | Five Years | Ten Years |

Investor Shares2 | 8/31/1976 | 20.41% | 10.58% | 7.05% |

Admiral Shares | 11/13/2000 | 20.51 | 10.67 | 3.323 |

Signal Shares | 9/29/2006 | 14.073 | — | — |

1 Six months ended June 30, 2007

2 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

3 Return since inception

Note: See Financial Highlights tables on pages 17–19 for dividend and capital gains information.

7

Financial Statements (unaudited)

Statement of Net Assets

As of June 30, 2007

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Market |

| | | Value• |

| | Shares | ($000) |

Common Stocks (99.7%)1 | | |

Consumer Discretionary (10.2%) | |

* | Comcast Corp. Class A | 29,216,939 | 821,580 |

| Time Warner, Inc. | 35,722,757 | 751,607 |

| Home Depot, Inc. | 18,629,595 | 733,075 |

| The Walt Disney Co. | 18,700,176 | 638,424 |

| McDonald’s Corp. | 11,266,385 | 571,882 |

| Target Corp. | 8,035,331 | 511,047 |

| News Corp., Class A | 21,970,408 | 465,992 |

| Lowe’s Cos., Inc. | 14,202,729 | 435,882 |

* | Viacom Inc. Class B | 6,431,489 | 267,743 |

| CBS Corp. | 6,841,175 | 227,948 |

| The McGraw-Hill Cos., Inc. | 3,238,690 | 220,490 |

* | Kohl’s Corp. | 3,044,537 | 216,253 |

| Johnson Controls, Inc. | 1,861,860 | 215,548 |

| NIKE, Inc. Class B | 3,577,738 | 208,546 |

| Carnival Corp. | 4,174,835 | 203,607 |

| General Motors Corp. | 5,338,801 | 201,807 |

* | Amazon.com, Inc. | 2,934,855 | 200,774 |

* | Starbucks Corp. | 6,990,526 | 183,431 |

| Best Buy Co., Inc. | 3,820,108 | 178,284 |

| Clear Channel | | |

| Communications, Inc. | 4,684,089 | 177,152 |

| Macy’s Inc. | 4,337,346 | 172,540 |

* | DIRECTV Group, Inc. | 7,275,573 | 168,138 |

| Ford Motor Co. | 17,742,559 | 167,135 |

* | Coach, Inc. | 3,502,332 | 165,976 |

| Omnicom Group Inc. | 3,121,684 | 165,200 |

| Yum! Brands, Inc. | 4,942,952 | 161,733 |

| Staples, Inc. | 6,749,410 | 160,163 |

| J.C. Penney Co., Inc. | | |

| (Holding Co.) | 2,123,014 | 153,664 |

| Harrah’s | | |

| Entertainment, Inc. | 1,761,689 | 150,202 |

| Harley-Davidson, Inc. | 2,430,472 | 144,880 |

| Starwood Hotels & | | |

| Resorts Worldwide, Inc. | 2,029,873 | 136,144 |

| Marriott International, Inc. | | |

| Class A | 3,099,647 | 134,029 |

* | Sears Holdings Corp. | 777,018 | 131,705 |

| | | | | |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| International | | |

| Game Technology | 3,137,172 | 124,546 |

| Hilton Hotels Corp. | 3,677,949 | 123,101 |

| Gannett Co., Inc. | 2,214,469 | 121,685 |

| Fortune Brands, Inc. | 1,441,517 | 118,738 |

| TJX Cos., Inc. | 4,292,498 | 118,044 |

| Nordstrom, Inc. | 2,118,116 | 108,278 |

| The Gap, Inc. | 5,003,080 | 95,559 |

| Mattel, Inc. | 3,711,805 | 93,872 |

* | Bed Bath & Beyond, Inc. | 2,584,613 | 93,020 |

| Limited Brands, Inc. | 3,229,530 | 88,651 |

| Whirlpool Corp. | 744,658 | 82,806 |

| Genuine Parts Co. | 1,607,739 | 79,744 |

* | Office Depot, Inc. | 2,609,081 | 79,055 |

| Newell Rubbermaid, Inc. | 2,631,871 | 77,456 |

* | Apollo Group, Inc. Class A | 1,320,594 | 77,162 |

| VF Corp. | 840,754 | 76,996 |

| ^Eastman Kodak Co. | 2,714,820 | 75,553 |

| Harman International | | |

| Industries, Inc. | 615,129 | 71,847 |

* | IAC/InterActiveCorp | 2,061,885 | 71,362 |

| H & R Block, Inc. | 3,047,371 | 71,217 |

| Sherwin-Williams Co. | 1,032,968 | 68,661 |

| Tiffany & Co. | 1,290,318 | 68,464 |

* | The Goodyear Tire & | | |

| Rubber Co. | 1,946,817 | 67,671 |

| Dollar General Corp. | 2,972,370 | 65,154 |

* | Wyndham | | |

| Worldwide Corp. | 1,722,449 | 62,456 |

* | AutoZone Inc. | 451,358 | 61,665 |

| Abercrombie & Fitch Co. | 833,874 | 60,856 |

| Darden Restaurants Inc. | 1,335,820 | 58,763 |

| Polo Ralph Lauren Corp. | 579,004 | 56,806 |

| Black & Decker Corp. | 623,370 | 55,050 |

| D. R. Horton, Inc. | 2,582,105 | 51,461 |

* | Interpublic Group | | |

| of Cos., Inc. | 4,430,425 | 50,507 |

| Family Dollar Stores, Inc. | 1,424,037 | 48,873 |

| Lennar Corp. Class A | 1,315,603 | 48,098 |

| The Stanley Works | 787,908 | 47,826 |

| Hasbro, Inc. | 1,503,957 | 47,239 |

8

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Centex Corp. | 1,128,609 | 45,257 |

| Pulte Homes, Inc. | 2,007,435 | 45,067 |

| RadioShack Corp. | 1,280,135 | 42,424 |

| Liz Claiborne, Inc. | 987,709 | 36,842 |

| Leggett & Platt, Inc. | 1,667,665 | 36,772 |

| E.W. Scripps Co. Class A | 783,202 | 35,784 |

| Dow Jones & Co., Inc. | 614,068 | 35,278 |

| ^New York Times Co. | | |

| Class A | 1,352,756 | 34,360 |

* | AutoNation, Inc. | 1,427,596 | 32,035 |

| Wendy’s International, Inc. | 824,457 | 30,299 |

* | Big Lots Inc. | 1,027,285 | 30,223 |

| Jones Apparel Group, Inc. | 1,029,019 | 29,070 |

| KB Home | 722,603 | 28,449 |

| OfficeMax, Inc. | 711,926 | 27,979 |

| Brunswick Corp. | 852,880 | 27,829 |

| Snap-On Inc. | 547,773 | 27,668 |

| Tribune Co. | 798,494 | 23,476 |

| Meredith Corp. | 366,234 | 22,560 |

| Dillard’s Inc. | 569,322 | 20,456 |

| Circuit City Stores, Inc. | 1,306,698 | 19,705 |

* | Comcast Corp. Special | | |

| Class A | 150,777 | 4,216 |

* | Viacom Inc. Class A | 71,693 | 2,982 |

| CBS Corp. Class A | 71,693 | 2,390 |

| News Corp., Class B | 9,800 | 225 |

| | | 12,852,169 |

Consumer Staples (9.3%) | | |

| The Procter & Gamble Co. | 29,715,738 | 1,818,306 |

| Altria Group, Inc. | 19,847,909 | 1,392,132 |

| Wal-Mart Stores, Inc. | 22,876,487 | 1,100,588 |

| PepsiCo, Inc. | 15,371,834 | 996,863 |

| The Coca-Cola Co. | 18,964,023 | 992,008 |

| Kraft Foods Inc. | 15,137,630 | 533,601 |

| CVS/Caremark Corp. | 14,565,551 | 530,914 |

| Walgreen Co. | 9,444,569 | 411,217 |

| Anheuser-Busch Cos., Inc. | 7,169,996 | 373,987 |

| Colgate-Palmolive Co. | 4,826,793 | 313,018 |

| Kimberly-Clark Corp. | 4,304,429 | 287,923 |

| Costco Wholesale Corp. | 4,214,836 | 246,652 |

| Archer-Daniels-Midland Co. | 6,159,649 | 203,823 |

| Sysco Corp. | 5,831,501 | 192,381 |

| General Mills, Inc. | 3,268,514 | 190,947 |

| The Kroger Co. | 6,680,823 | 187,932 |

| Avon Products, Inc. | 4,141,343 | 152,194 |

| H.J. Heinz Co. | 3,065,486 | 145,519 |

| Safeway, Inc. | 4,167,277 | 141,812 |

| ConAgra Foods, Inc. | 4,700,295 | 126,250 |

| Kellogg Co. | 2,363,795 | 122,421 |

| Sara Lee Corp. | 6,932,030 | 120,617 |

| ^Reynolds American Inc. | 1,612,815 | 105,156 |

| SuperValu Inc. | 1,961,044 | 90,836 |

| Wm. Wrigley Jr. Co. | 1,618,571 | 89,523 |

| The Clorox Co. | 1,432,057 | 88,931 |

| The Hershey Co. | 1,617,715 | 81,889 |

| UST, Inc. | 1,509,704 | 81,086 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Campbell Soup Co. | 2,047,453 | 79,462 |

| Coca-Cola Enterprises, Inc. | 2,635,728 | 63,257 |

| Tyson Foods, Inc. | 2,388,706 | 55,036 |

| Brown-Forman Corp. | | |

| Class B | 744,612 | 54,416 |

| ^Whole Foods Market, Inc. | 1,335,746 | 51,159 |

| The Estee Lauder | | |

| Cos. Inc. Class A | 1,114,794 | 50,734 |

| McCormick & Co., Inc. | 1,223,932 | 46,730 |

* | Constellation Brands, Inc. | | |

| Class A | 1,825,403 | 44,321 |

| The Pepsi Bottling | | |

| Group, Inc. | 1,235,895 | 41,625 |

| Molson Coors | | |

| Brewing Co. Class B | 447,423 | 41,369 |

| Dean Foods Co. | 1,228,396 | 39,149 |

| Wm. Wrigley Jr. Co. | | |

| Class B | 415,980 | 22,879 |

| | | 11,708,663 |

Energy (10.7%) | | |

| ExxonMobil Corp. | 53,160,102 | 4,459,069 |

| Chevron Corp. | 20,281,949 | 1,708,551 |

| ConocoPhillips Co. | 15,423,472 | 1,210,743 |

| Schlumberger Ltd. | 11,121,816 | 944,687 |

| Occidental | | |

| Petroleum Corp. | 7,868,484 | 455,428 |

| Marathon Oil Corp. | 6,473,206 | 388,133 |

| Valero Energy Corp. | 5,180,710 | 382,647 |

| Devon Energy Corp. | 4,197,569 | 328,628 |

| Halliburton Co. | 8,625,710 | 297,587 |

* | Transocean Inc. | 2,719,198 | 288,181 |

| Apache Corp. | 3,125,077 | 254,975 |

| Baker Hughes, Inc. | 3,022,855 | 254,313 |

| Anadarko | | |

| Petroleum Corp. | 4,377,924 | 227,608 |

| XTO Energy, Inc. | 3,617,673 | 217,422 |

| Williams Cos., Inc. | 5,651,274 | 178,693 |

* | Weatherford | | |

| International Ltd. | 3,183,033 | 175,831 |

* | National Oilwell Varco Inc. | 1,676,033 | 174,710 |

| EOG Resources, Inc. | 2,308,129 | 168,632 |

| Spectra Energy Corp. | 5,962,373 | 154,783 |

| Hess Corp. | 2,574,909 | 151,817 |

| Chesapeake Energy Corp. | 3,864,007 | 133,695 |

| Noble Corp. | 1,264,487 | 123,313 |

| Peabody Energy Corp. | 2,500,389 | 120,969 |

| El Paso Corp. | 6,607,978 | 113,855 |

| Smith International, Inc. | 1,891,783 | 110,934 |

| Murphy Oil Corp. | 1,775,229 | 105,520 |

| Sunoco, Inc. | 1,146,006 | 91,314 |

* | Nabors Industries, Inc. | 2,656,631 | 88,678 |

| ENSCO International, Inc. | 1,406,847 | 85,832 |

| CONSOL Energy, Inc. | 1,715,486 | 79,101 |

| BJ Services Co. | 2,768,096 | 78,725 |

| Rowan Cos., Inc. | 1,045,498 | 42,845 |

| | | 13,597,219 |

9

| | Market |

| | Value• |

| Shares | ($000) |

Financials (20.8%) | | |

Citigroup, Inc. | 46,678,587 | 2,394,145 |

Bank of America Corp. | 41,878,381 | 2,047,434 |

American International | | |

Group, Inc. | 24,481,277 | 1,714,424 |

JPMorgan Chase & Co. | 32,237,244 | 1,561,894 |

Wells Fargo & Co. | 31,516,570 | 1,108,438 |

Wachovia Corp. | 18,055,959 | 925,368 |

The Goldman Sachs | | |

Group, Inc. | 3,854,656 | 835,497 |

Morgan Stanley | 9,945,712 | 834,246 |

Merrill Lynch & Co., Inc. | 8,217,601 | 686,827 |

American Express Co. | 11,216,642 | 686,234 |

Fannie Mae | 9,182,392 | 599,886 |

U.S. Bancorp | 16,407,947 | 540,642 |

MetLife, Inc. | 6,998,409 | 451,257 |

Prudential Financial, Inc. | 4,412,611 | 429,038 |

Freddie Mac | 6,242,743 | 378,935 |

Lehman Brothers | | |

Holdings, Inc. | 5,026,161 | 374,550 |

Washington Mutual, Inc. | 8,389,627 | 357,734 |

The Allstate Corp. | 5,731,962 | 352,573 |

The Travelers Cos., Inc. | 6,265,985 | 335,230 |

Capital One Financial Corp. | 3,899,588 | 305,884 |

The Bank of | | |

New York Co., Inc. | 7,133,801 | 295,625 |

The Hartford Financial | | |

Services Group Inc. | 2,988,223 | 294,370 |

SunTrust Banks, Inc. | 3,365,355 | 288,546 |

AFLAC Inc. | 4,615,874 | 237,256 |

PNC Financial | | |

Services Group | 3,254,898 | 232,986 |

State Street Corp. | 3,383,957 | 231,463 |

SLM Corp. | 3,882,358 | 223,546 |

Regions Financial Corp. | 6,650,178 | 220,121 |

Loews Corp. | 4,206,269 | 214,436 |

BB&T Corp. | 5,120,004 | 208,282 |

Fifth Third Bancorp | 5,190,910 | 206,442 |

Franklin Resources Corp. | 1,554,721 | 205,954 |

The Chubb Corp. | 3,788,660 | 205,118 |

Countrywide | | |

Financial Corp. | 5,599,678 | 203,548 |

Simon Property | | |

Group, Inc. REIT | 2,107,972 | 196,126 |

Charles Schwab Corp. | 9,548,395 | 195,933 |

ACE Ltd. | 3,072,189 | 192,073 |

Lincoln National Corp. | 2,555,165 | 181,289 |

National City Corp. | 5,433,356 | 181,039 |

The Chicago | | |

Mercantile Exchange | 335,085 | 179,056 |

Mellon Financial Corp. | 3,928,766 | 172,866 |

Progressive Corp. of Ohio | 6,947,508 | 166,254 |

Marsh & McLennan | | |

Cos., Inc. | 5,241,369 | 161,853 |

Bear Stearns Co., Inc. | 1,123,204 | 157,249 |

XL Capital Ltd. Class A | 1,754,720 | 147,905 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| The Principal Financial | | |

| Group, Inc. | 2,527,020 | 147,300 |

| Ameriprise Financial, Inc. | 2,219,973 | 141,124 |

| ProLogis REIT | 2,421,422 | 137,779 |

| Genworth Financial Inc. | 3,947,726 | 135,802 |

| Vornado Realty Trust REIT | 1,232,397 | 135,366 |

| Moody’s Corp. | 2,170,333 | 134,995 |

| T. Rowe Price Group Inc. | 2,506,570 | 130,066 |

| KeyCorp | 3,701,997 | 127,090 |

| Equity Residential REIT | 2,743,659 | 125,193 |

| Archstone-Smith | | |

| Trust REIT | 2,103,592 | 124,343 |

| Legg Mason Inc. | 1,240,942 | 122,084 |

| Aon Corp. | 2,770,690 | 118,059 |

| Marshall & Ilsley Corp. | 2,445,120 | 116,461 |

| Boston | | |

| Properties, Inc. REIT | 1,122,989 | 114,691 |

| Northern Trust Corp. | 1,780,574 | 114,384 |

| Host Hotels & | | |

| Resorts Inc. REIT | 4,926,477 | 113,900 |

| CIT Group Inc. | 1,809,743 | 99,228 |

| Synovus Financial Corp. | 3,085,631 | 94,729 |

| Avalonbay | | |

| Communities, Inc. REIT | 751,526 | 89,341 |

* | E*TRADE Financial Corp. | 4,028,162 | 88,982 |

| Public Storage, Inc. REIT | 1,158,283 | 88,979 |

| Comerica, Inc. | 1,471,600 | 87,516 |

| Compass Bancshares Inc. | 1,242,851 | 85,732 |

| Unum Group | 3,234,952 | 84,465 |

| Ambac Financial | | |

| Group, Inc. | 961,864 | 83,865 |

| Kimco Realty Corp. REIT | 2,140,355 | 81,483 |

| Zions Bancorp | 1,037,983 | 79,831 |

| Huntington | | |

| Bancshares Inc. | 3,450,273 | 78,459 |

| MBIA, Inc. | 1,234,309 | 76,799 |

| M & T Bank Corp. | 714,959 | 76,429 |

| Sovereign Bancorp, Inc. | 3,407,612 | 72,037 |

| Cincinnati Financial Corp. | 1,620,084 | 70,312 |

| Plum Creek | | |

| Timber Co. Inc. REIT | 1,665,875 | 69,400 |

| Commerce Bancorp, Inc. | 1,808,298 | 66,889 |

* | CB Richard Ellis Group, Inc. | 1,769,314 | 64,580 |

| General Growth | | |

| Properties Inc. REIT | 1,214,192 | 64,291 |

| Safeco Corp. | 1,003,284 | 62,464 |

| Developers Diversified | | |

| Realty Corp. REIT | 1,180,574 | 62,228 |

| Torchmark Corp. | 902,345 | 60,457 |

| Hudson City Bancorp, Inc. | 4,578,085 | 55,944 |

| Assurant, Inc. | 937,579 | 55,242 |

| Janus Capital Group Inc. | 1,751,780 | 48,770 |

| First Horizon National Corp. | 1,188,169 | 46,339 |

| Apartment Investment & Management Co. | | |

| Class A REIT | 916,343 | 46,202 |

10

| | | Market |

| | | Value• |

| | Shares | ($000) |

| MGIC Investment Corp. | 784,939 | 44,632 |

| Federated Investors, Inc. | 837,211 | 32,090 |

| | | 26,275,924 |

Health Care (11.6%) | | |

| Pfizer Inc. | 66,230,015 | 1,693,501 |

| Johnson & Johnson | 27,334,239 | 1,684,336 |

| Merck & Co., Inc. | 20,452,106 | 1,018,515 |

| Abbott Laboratories | 14,536,022 | 778,404 |

| Wyeth | 12,693,939 | 727,870 |

| UnitedHealth Group Inc. | 12,645,754 | 646,704 |

* | Amgen, Inc. | 10,943,285 | 605,054 |

| Bristol-Myers Squibb Co. | 18,572,238 | 586,140 |

| Medtronic, Inc. | 10,867,064 | 563,566 |

| Eli Lilly & Co. | 9,310,440 | 520,267 |

* | WellPoint Inc. | 5,790,931 | 462,290 |

| Schering-Plough Corp. | 14,055,072 | 427,836 |

| Baxter International, Inc. | 6,148,188 | 346,389 |

* | Gilead Sciences, Inc. | 8,812,390 | 341,656 |

| Cardinal Health, Inc. | 3,629,799 | 256,409 |

| Aetna Inc. | 4,873,160 | 240,734 |

* | Medco Health | | |

| Solutions, Inc. | 2,643,515 | 206,168 |

* | Thermo Fisher | | |

| Scientific, Inc. | 3,981,636 | 205,930 |

* | Celgene Corp. | 3,584,984 | 205,527 |

* | Zimmer Holdings, Inc. | 2,234,339 | 189,673 |

| Stryker Corp. | 2,818,092 | 177,793 |

* | Biogen Idec Inc. | 3,288,847 | 175,953 |

| Becton, Dickinson & Co. | 2,311,828 | 172,231 |

* | Boston Scientific Corp. | 11,197,271 | 171,766 |

| Allergan, Inc. | 2,901,910 | 167,266 |

| McKesson Corp. | 2,787,592 | 166,252 |

* | Genzyme Corp. | 2,480,482 | 159,743 |

| CIGNA Corp. | 2,715,818 | 141,820 |

* | Forest Laboratories, Inc. | 2,999,536 | 136,929 |

* | St. Jude Medical, Inc. | 3,192,644 | 132,463 |

* | Express Scripts Inc. | 2,570,774 | 128,564 |

| Biomet, Inc. | 2,316,635 | 105,917 |

* | Humana Inc. | 1,585,717 | 96,586 |

| AmerisourceBergen Corp. | 1,803,187 | 89,204 |

* | Laboratory Corp. of | | |

| America Holdings | 1,109,671 | 86,843 |

* | Coventry Health Care Inc. | 1,475,214 | 85,046 |

| C.R. Bard, Inc. | 974,526 | 80,525 |

| Quest Diagnostics, Inc. | 1,492,612 | 77,093 |

| IMS Health, Inc. | 1,854,297 | 59,579 |

* | Hospira, Inc. | 1,472,239 | 57,476 |

* | Waters Corp. | 952,152 | 56,520 |

| Applera Corp.–Applied | | |

| Biosystems Group | 1,734,418 | 52,969 |

* | Barr Pharmaceuticals Inc. | 1,036,993 | 52,088 |

* | Varian Medical | | |

| Systems, Inc. | 1,202,820 | 51,132 |

* | Patterson Cos. | 1,314,661 | 48,997 |

* | King Pharmaceuticals, Inc. | 2,302,297 | 47,105 |

| Manor Care, Inc. | 691,441 | 45,144 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Mylan Laboratories, Inc. | 2,347,175 | 42,695 |

* | Millipore Corp. | 510,091 | 38,303 |

| Bausch & Lomb, Inc. | 510,285 | 35,434 |

* | Watson | | |

| Pharmaceuticals, Inc. | 964,198 | 31,365 |

| PerkinElmer, Inc. | 1,131,533 | 29,488 |

* | Tenet Healthcare Corp. | 4,469,422 | 29,096 |

| | | 14,736,354 |

Industrials (11.4%) | | |

| General Electric Co. | 97,087,383 | 3,716,505 |

| United Parcel Service, Inc. | 9,993,966 | 729,560 |

| The Boeing Co. | 7,430,520 | 714,519 |

| United Technologies Corp. | 9,384,187 | 665,620 |

| Tyco International Ltd. | 18,708,011 | 632,144 |

| 3M Co. | 6,796,361 | 589,856 |

| Caterpillar, Inc. | 6,043,265 | 473,188 |

| Honeywell | | |

| International Inc. | 7,357,992 | 414,108 |

| Emerson Electric Co. | 7,504,689 | 351,219 |

| FedEx Corp. | 2,904,652 | 322,329 |

| Lockheed Martin Corp. | 3,348,978 | 315,239 |

| General Dynamics Corp. | 3,820,226 | 298,818 |

| Union Pacific Corp. | 2,555,003 | 294,209 |

| Burlington Northern | | |

| Santa Fe Corp. | 3,360,540 | 286,116 |

| Deere & Co. | 2,123,026 | 256,334 |

| Northrop Grumman Corp. | 3,256,710 | 253,600 |

| Raytheon Co. | 4,188,515 | 225,719 |

| Illinois Tool Works, Inc. | 3,887,650 | 210,672 |

| PACCAR, Inc. | 2,343,229 | 203,955 |

| Norfolk Southern Corp. | 3,710,671 | 195,070 |

| Waste Management, Inc. | 4,882,822 | 190,674 |

| CSX Corp. | 4,125,291 | 185,968 |

| Danaher Corp. | 2,246,657 | 169,623 |

| Precision Castparts Corp. | 1,298,337 | 157,566 |

| Ingersoll-Rand Co. | 2,846,325 | 156,036 |

| Textron, Inc. | 1,183,758 | 130,344 |

| Eaton Corp. | 1,382,449 | 128,568 |

| ITT Industries, Inc. | 1,714,813 | 117,087 |

| L-3 Communications | | |

| Holdings, Inc. | 1,178,934 | 114,816 |

| Rockwell Collins, Inc. | 1,579,191 | 111,554 |

| Southwest Airlines Co. | 7,368,491 | 109,864 |

| Parker Hannifin Corp. | 1,093,000 | 107,016 |

| Rockwell Automation, Inc. | 1,488,656 | 103,372 |

| Masco Corp. | 3,564,240 | 101,474 |

| Cummins Inc. | 983,945 | 99,585 |

| Dover Corp. | 1,928,986 | 98,668 |

| Cooper Industries, Inc. | | |

| Class A | 1,727,321 | 98,613 |

| American | | |

| Standard Cos., Inc. | 1,659,460 | 97,875 |

| Pitney Bowes, Inc. | 2,071,042 | 96,966 |

| Fluor Corp. | 832,055 | 92,666 |

| R.R. Donnelley & Sons Co. | 2,076,981 | 90,369 |

11

| | | Market |

| | | Value• |

| | Shares | ($000) |

| C.H. Robinson | | |

| Worldwide Inc. | 1,615,186 | 84,830 |

* | Terex Corp. | 972,889 | 79,096 |

| Goodrich Corp. | 1,181,132 | 70,348 |

| W.W. Grainger, Inc. | 670,220 | 62,364 |

| Equifax, Inc. | 1,374,557 | 61,058 |

| Avery Dennison Corp. | 865,853 | 57,562 |

| Robert Half | | |

| International, Inc. | 1,568,853 | 57,263 |

| Pall Corp. | 1,155,083 | 53,122 |

* | Monster Worldwide Inc. | 1,233,965 | 50,716 |

| Cintas Corp. | 1,272,503 | 50,175 |

* | Allied Waste | | |

| Industries, Inc. | 2,396,638 | 32,259 |

| Ryder System, Inc. | 577,800 | 31,086 |

* | Raytheon Co. | | |

| Warrants Exp. 6/16/11 | 60,569 | 1,117 |

| | | 14,398,480 |

Information Technology (15.4%) | |

| Microsoft Corp. | 79,446,534 | 2,341,289 |

* | Cisco Systems, Inc. | 57,293,310 | 1,595,619 |

| International Business | | |

| Machines Corp. | 12,890,878 | 1,356,765 |

| Intel Corp. | 54,827,874 | 1,302,710 |

| Hewlett-Packard Co. | 24,713,927 | 1,102,735 |

* | Google Inc. | 2,058,013 | 1,077,123 |

* | Apple Computer, Inc. | 8,162,307 | 996,128 |

* | Oracle Corp. | 37,355,259 | 736,272 |

| QUALCOMM Inc. | 15,728,877 | 682,476 |

* | Dell Inc. | 21,436,797 | 612,021 |

| Texas Instruments, Inc. | 13,529,596 | 509,119 |

| Motorola, Inc. | 21,842,572 | 386,614 |

* | Corning, Inc. | 14,842,026 | 379,214 |

* | EMC Corp. | 19,802,710 | 358,429 |

* | eBay Inc. | 10,682,291 | 343,756 |

* | Yahoo! Inc. | 11,413,504 | 309,648 |

| Applied Materials, Inc. | 13,041,290 | 259,131 |

| Automatic Data | | |

| Processing, Inc. | 5,220,723 | 253,048 |

| First Data Corp. | 7,119,186 | 232,584 |

* | Adobe Systems, Inc. | 5,548,895 | 222,788 |

* | Sun Microsystems, Inc. | 33,691,707 | 177,218 |

* | Symantec Corp. | 8,502,692 | 171,754 |

* | Xerox Corp. | 8,845,543 | 163,466 |

| Western Union Co. | 7,291,362 | 151,879 |

* | Agilent Technologies, Inc. | 3,736,509 | 143,632 |

* | NVIDIA Corp. | 3,424,696 | 141,474 |

* | Electronic Arts Inc. | 2,925,777 | 138,448 |

* | Juniper Networks, Inc. | 5,343,995 | 134,508 |

| Electronic Data | | |

| Systems Corp. | 4,802,010 | 133,160 |

* | MEMC Electronic | | |

| Materials, Inc. | 2,117,507 | 129,422 |

* | Broadcom Corp. | 4,390,569 | 128,424 |

| Paychex, Inc. | 3,207,684 | 125,485 |

| Analog Devices, Inc. | 3,086,740 | 116,185 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | SanDisk Corp. | 2,153,602 | 105,397 |

* | Autodesk, Inc. | 2,181,701 | 102,715 |

* | Network Appliance, Inc. | 3,501,554 | 102,245 |

* | Cognizant Technology | | |

| Solutions Corp. | 1,356,540 | 101,863 |

| Maxim Integrated | | |

| Products, Inc. | 3,026,262 | 101,107 |

| CA, Inc. | 3,881,664 | 100,263 |

| KLA-Tencor Corp. | 1,808,267 | 99,364 |

* | Intuit, Inc. | 3,232,740 | 97,241 |

* | Computer Sciences Corp. | 1,634,508 | 96,681 |

* | Fiserv, Inc. | 1,587,168 | 90,151 |

* | Micron Technology, Inc. | 7,137,562 | 89,434 |

* | NCR Corp. | 1,697,662 | 89,195 |

| ^Linear Technology Corp. | 2,395,239 | 86,660 |

| Fidelity National | | |

| Information Services, Inc. | 1,543,765 | 83,796 |

| Xilinx, Inc. | 2,811,031 | 75,251 |

| National | | |

| Semiconductor Corp. | 2,632,966 | 74,434 |

* | ^Advanced Micro | | |

| Devices, Inc. | 5,194,300 | 74,279 |

| Altera Corp. | 3,353,247 | 74,207 |

* | VeriSign, Inc. | 2,313,234 | 73,399 |

* | Avaya Inc. | 4,245,251 | 71,490 |

* | BMC Software, Inc. | 1,927,238 | 58,395 |

* | Citrix Systems, Inc. | 1,706,360 | 57,453 |

* | LSI Corp. | 7,278,826 | 54,664 |

* | Affiliated Computer | | |

| Services, Inc. Class A | 937,081 | 53,151 |

* | Tellabs, Inc. | 4,136,441 | 44,508 |

* | Lexmark International, Inc. | 893,497 | 44,058 |

| Molex, Inc. | 1,337,992 | 40,153 |

| Jabil Circuit, Inc. | 1,693,288 | 37,371 |

* | Novellus Systems, Inc. | 1,193,917 | 33,871 |

* | Compuware Corp. | 2,845,474 | 33,747 |

* | Teradyne, Inc. | 1,784,983 | 31,380 |

* | Solectron Corp. | 8,499,272 | 31,277 |

* | Convergys Corp. | 1,287,804 | 31,216 |

* | Unisys Corp. | 3,285,858 | 30,033 |

* | Ciena Corp. | 800,003 | 28,904 |

* | ^JDS Uniphase Corp. | 1,981,241 | 26,608 |

| Tektronix, Inc. | 771,206 | 26,020 |

* | Novell, Inc. | 3,290,959 | 25,637 |

* | QLogic Corp. | 1,494,935 | 24,891 |

* | ^PMC Sierra Inc. | 746,307 | 5,769 |

* | Sanmina-SCI Corp. | 1,407,599 | 4,406 |

| Molex, Inc. Class A | 4,051 | 108 |

| | | 19,425,316 |

Materials (3.1%) | | |

| E.I. du Pont de | | |

| Nemours & Co. | 8,716,517 | 443,148 |

| Dow Chemical Co. | 8,995,501 | 397,781 |

| Monsanto Co. | 5,128,906 | 346,406 |

| Alcoa Inc. | 8,205,502 | 332,569 |

12

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Freeport-McMoRan | | |

| Copper & Gold, Inc. | | |

| Class B | 3,542,736 | 293,409 |

| Praxair, Inc. | 3,007,510 | 216,511 |

| Nucor Corp. | 2,847,091 | 166,982 |

| Newmont Mining Corp. | | |

| (Holding Co.) | 4,256,908 | 166,275 |

| Air Products & | | |

| Chemicals, Inc. | 2,044,100 | 164,284 |

| Weyerhaeuser Co. | 2,037,438 | 160,815 |

| International Paper Co. | 4,110,322 | 160,508 |

| United States Steel Corp. | 1,116,418 | 121,410 |

| PPG Industries, Inc. | 1,549,209 | 117,910 |

| Vulcan Materials Co. | 899,191 | 102,993 |

| Allegheny Technologies Inc. | 963,929 | 101,097 |

| Rohm & Haas Co. | 1,343,108 | 73,441 |

| Ecolab, Inc. | 1,653,924 | 70,623 |

| MeadWestvaco Corp. | 1,742,733 | 61,553 |

| Temple-Inland Inc. | 999,852 | 61,521 |

| Sigma-Aldrich Corp. | 1,239,168 | 52,875 |

| Ball Corp. | 963,360 | 51,222 |

| Eastman Chemical Co. | 794,927 | 51,138 |

| Sealed Air Corp. | 1,526,505 | 47,352 |

* | Pactiv Corp. | 1,231,906 | 39,285 |

| International Flavors & | | |

| Fragrances, Inc. | 732,708 | 38,203 |

| Ashland, Inc. | 524,262 | 33,527 |

| Bemis Co., Inc. | 983,845 | 32,644 |

* | Hercules, Inc. | 1,093,240 | 21,482 |

| | | 3,926,964 |

Telecommunication Services (3.7%) | |

| AT&T Inc. | 58,183,214 | 2,414,603 |

| Verizon | | |

| Communications Inc. | 27,398,484 | 1,127,996 |

| Sprint Nextel Corp. | 27,306,662 | 565,521 |

| Alltel Corp. | 3,260,207 | 220,227 |

* | Qwest Communications | | |

| International Inc. | 14,658,358 | 142,186 |

| Embarq Corp. | 1,425,507 | 90,334 |

| Windstream Corp. | 4,498,790 | 66,402 |

| CenturyTel, Inc. | 1,034,841 | 50,759 |

| Citizens | | |

| Communications Co. | 3,235,420 | 49,405 |

| | | 4,727,433 |

Utilities (3.5%) | | |

| Exelon Corp. | 6,347,665 | 460,840 |

| TXU Corp. | 4,332,868 | 291,602 |

| Dominion Resources, Inc. | 3,305,860 | 285,329 |

| Southern Co. | 7,094,636 | 243,275 |

| FPL Group, Inc. | 3,835,198 | 217,609 |

| Duke Energy Corp. | 11,885,205 | 217,499 |

| Public Service Enterprise | | |

| Group, Inc. | 2,385,328 | 209,384 |

| Entergy Corp. | 1,861,537 | 199,836 |

| FirstEnergy Corp. | 2,876,616 | 186,203 |

| Edison International | 3,074,595 | 172,546 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| PPL Corp. | 3,634,006 | 170,035 |

| American Electric | | |

| Power Co., Inc. | 3,763,057 | 169,488 |

| PG&E Corp. | 3,316,996 | 150,260 |

| Constellation Energy | | |

| Group, Inc. | 1,704,947 | 148,620 |

| Sempra Energy | 2,489,457 | 147,451 |

* | AES Corp. | 6,299,843 | 137,841 |

| Consolidated Edison Inc. | 2,552,821 | 115,183 |

| Progress Energy, Inc. | 2,398,784 | 109,361 |

| Ameren Corp. | 1,946,398 | 95,393 |

| Questar Corp. | 1,626,961 | 85,985 |

* | Allegheny Energy, Inc. | 1,563,733 | 80,908 |

| DTE Energy Co. | 1,661,441 | 80,115 |

| Xcel Energy, Inc. | 3,858,841 | 78,990 |

| KeySpan Corp. | 1,658,626 | 69,629 |

| NiSource, Inc. | 2,589,652 | 53,632 |

| CenterPoint Energy Inc. | 3,031,061 | 52,740 |

| Pinnacle West Capital Corp. | 947,164 | 37,744 |

| CMS Energy Corp. | 2,121,306 | 36,486 |

| Integrys Energy Group, Inc. | 715,141 | 36,279 |

* | Dynegy, Inc. | 3,781,131 | 35,694 |

| TECO Energy, Inc. | 1,966,847 | 33,790 |

| Nicor Inc. | 422,155 | 18,119 |

| | | 4,427,866 |

Total Common Stocks | | |

(Cost $72,172,652) | 126,076,388 |

Temporary Cash Investments (0.4%)1 | |

Money Market Fund (0.4%) | | |

2 | Vanguard Market Liquidity | | |

| Fund, 5.281% | 289,489,370 | 289,489 |

2 | Vanguard Market Liquidity | | |

| Fund, 5.281%—Note E | 154,550,900 | 154,551 |

| | | 444,040 |

| | | | |

13

| | Face | Market |

| | Amount | Value• |

| | ($000) | ($000) |

U.S. Agency Obligations (0.0%) | | |

3 | Federal Home Loan | | |

| Mortgage Corp. | | |

4 | 5.197%, 7/9/2007 | 33,000 | 32,967 |

4 | 5.189%, 7/13/2007 | 10,000 | 9,985 |

| | | 42,952 |

Total Temporary Cash Investments | |

(Cost $486,986) | | 486,992 |

Total Investments (100.1%) | | |

(Cost $72,659,638) | 126,563,380 |

Other Assets and Liabilities (–0.1%) | |

Other Assets—Note B | | 692,031 |

Liabilities—Note E | | (845,813) |

| | | (153,782) |

Net Assets (100%) | 126,409,598 |

| | | | | | |

At June 30, 2007, net assets consisted of:5 | |

| Amount |

| ($000) |

Paid-in Capital | 79,103,783 |

Overdistributed Net Investment Income | (111,391) |

Accumulated Net Realized Losses | (6,486,661) |

Unrealized Appreciation | |

Investment Securities | 53,903,742 |

Futures Contracts | 125 |

Net Assets | 126,409,598 |

| |

| |

Investor Shares—Net Assets | |

Applicable to 514,686,351 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 71,245,279 |

Net Asset Value Per Share— | |

Investor Shares | $138.42 |

| |

| |

Admiral Shares—Net Assets | |

Applicable to 368,066,140 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 50,950,616 |

Net Asset Value Per Share— | |

Admiral Shares | $138.43 |

| |

| |

Signal Shares—Net Assets | |

Applicable to 36,852,554 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 4,213,703 |

Net Asset Value Per Share— | |

Signal Shares | $114.34 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker/dealers. See Note E in Notes to Financial Statements.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 0.1%, respectively, of net assets. See Note C in Notes to Financial Statements.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 The issuer operates under a congressional charter; its securities are neither issued nor guaranteed by the U.S. government. If needed, access to additional funding from the U.S. Treasury (beyond the issuer’s line of credit) would require congressional action.

4 Securities with a value of $42,952,000 have been segregated as initial margin for open futures contracts.

5 See Note C in Notes to Financial Statements for the tax-basis components of net assets.

REIT—Real Estate Investment Trust.

14

Statement of Operations

| Six Months Ended |

| June 30, 2007 |

| ($000) |

Investment Income | |

Income | |

Dividends | 1,149,933 |

Interest1 | 18,025 |

Security Lending | 890 |

Total Income | 1,168,848 |

Expenses | |

The Vanguard Group—Note B | |

Investment Advisory Services | 1,936 |

Management and Administrative | |

Investor Shares | 48,263 |

Admiral Shares | 14,536 |

Signal Shares | 690 |

Marketing and Distribution | |

Investor Shares | 7,753 |

Admiral Shares | 4,200 |

Signal Shares | 63 |

Custodian Fees | 84 |

Shareholders’ Reports | |

Investor Shares | 582 |

Admiral Shares | 41 |

Signal Shares | 5 |

Trustees’ Fees and Expenses | 77 |

Total Expenses | 78,230 |

Net Investment Income | 1,090,618 |

Realized Net Gain (Loss) | |

Investment Securities Sold | 128,211 |

Futures Contracts | 36,927 |

Realized Net Gain (Loss) | 165,138 |

Change in Unrealized Appreciation (Depreciation) | |

Investment Securities | 6,984,987 |

Futures Contracts | (1,324) |

Change in Unrealized Appreciation (Depreciation) | 6,983,663 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 8,239,419 |

1 Interest income from an affiliated company of the fund was $17,015,000.

15

Statement of Changes in Net Assets | | |

| | |

| Six Months Ended | Year Ended |

| June 30, | December 31, |

| 2007 | 2006 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 1,090,618 | 1,973,649 |

Realized Net Gain (Loss) | 165,138 | (746,123) |

Change in Unrealized Appreciation (Depreciation) | 6,983,663 | 15,119,814 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 8,239,419 | 16,347,340 |

Distributions | | |

Net Investment Income | | |

Investor Shares | (594,069) | (1,208,833) |

Admiral Shares | (431,774) | (780,509) |

Signal Shares | (19,921) | (3,554) |

Realized Capital Gain | | |

Investor Shares | — | — |

Admiral Shares | — | — |

Signal Shares | — | — |

Total Distributions | (1,045,764) | (1,992,896) |

Capital Share Transactions—Note F | | |

Investor Shares | (5,001,821) | (6,327,783) |

Admiral Shares | 1,641,922 | 3,047,783 |

Signal Shares | 3,383,611 | 714,446 |

Net Increase (Decrease) from Capital Share Transactions | 23,712 | (2,565,554) |

Total Increase (Decrease) | 7,217,367 | 11,788,890 |

Net Assets | | |

Beginning of Period | 119,192,231 | 107,403,341 |

End of Period1 | 126,409,598 | 119,192,231 |

1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($111,391,000) and ($156,245,000).

16

Financial Highlights

Investor Shares | | | | | | |

| | | | | | |

| Six Months | | | | | |

| Ended | | | |

For a Share Outstanding | June 30, | Year Ended December 31, |

Throughout Each Period | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $130.59 | $114.92 | $111.64 | $102.67 | $81.15 | $105.89 |

Investment Operations | | | | | | |

Net Investment Income | 1.17 | 2.11 | 1.95 | 1.951 | 1.44 | 1.32 |

Net Realized and Unrealized Gain (Loss) | | | | | | |

on Investments | 7.78 | 15.70 | 3.31 | 8.97 | 21.51 | (24.70) |

Total from Investment Operations | 8.95 | 17.81 | 5.26 | 10.92 | 22.95 | (23.38) |

Distributions | | | | | | |

Dividends from Net Investment Income | (1.12) | (2.14) | (1.98) | (1.95) | (1.43) | (1.36) |

Distributions from Realized Capital Gains | — | — | — | — | — | — |

Total Distributions | (1.12) | (2.14) | (1.98) | (1.95) | (1.43) | (1.36) |

Net Asset Value, End of Period | $138.42 | $130.59 | $114.92 | $111.64 | $102.67 | $81.15 |

| | | | | | |

| | | | | | |

Total Return2 | 6.88% | 15.64% | 4.77% | 10.74% | 28.50% | –22.15% |

| | | | | | |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $71,245 | $72,013 | $69,375 | $84,167 | $75,342 | $56,224 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets | 0.16%* | 0.18% | 0.18% | 0.18% | 0.18% | 0.18% |

Ratio of Net Investment | | | | | | |

Income to Average Net Assets | 1.74%* | 1.74% | 1.75% | 1.86%1 | 1.61% | 1.43% |

Portfolio Turnover Rate3 | 4%* | 5% | 6% | 3% | 1% | 6% |

| | | | | | | | |

1 Net investment income per share and the ratio of net investment income to average net assets include $0.32 and 0.31%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares.

* Annualized.

16

Admiral Shares | | | | | | |

| | | | | | |

| Six Months | | | | | |

| Ended | | | |

For a Share Outstanding | June 30, | | Year Ended December 31, |

Throughout Each Period | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

Net Asset Value, Beginning of Period | $130.59 | $114.92 | $111.64 | $102.68 | $81.15 | $105.89 |

Investment Operations | | | | | | |

Net Investment Income | 1.234 | 2.222 | 2.052 | 2.031 | 1.507 | 1.374 |

Net Realized and Unrealized Gain (Loss) | | | | | | |

on Investments | 7.780 | 15.700 | 3.310 | 8.97 | 21.510 | (24.700) |

Total from Investment Operations | 9.014 | 17.922 | 5.362 | 11.00 | 23.017 | (23.326) |

Distributions | | | | | | |

Dividends from Net Investment Income | (1.174) | (2.252) | (2.082) | (2.04) | (1.487) | (1.414) |

Distributions from Realized Capital Gains | — | — | — | — | — | — |

Total Distributions | (1.174) | (2.252) | (2.082) | (2.04) | (1.487) | (1.414) |

Net Asset Value, End of Period | $138.43 | $130.59 | $114.92 | $111.64 | $102.68 | $81.15 |

| | | | | | |

| | �� | | | | |

Total Return | 6.93% | 15.75% | 4.87% | 10.82% | 28.59% | –22.10% |

| | | | | | |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $50,951 | $46,467 | $38,028 | $22,412 | $18,098 | $11,922 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets | 0.08%* | 0.09% | 0.09% | 0.09% | 0.12% | 0.12% |

Ratio of Net Investment Income to | | | | | | |

Average Net Assets | 1.82%* | 1.83% | 1.84% | 1.96%1 | 1.67% | 1.50% |

Portfolio Turnover Rate2 | 4%* | 5% | 6% | 3% | 1% | 6% |

| | | | | | | | |

1 Net investment income per share and the ratio of net investment income to average net assets include $0.32 and 0.31%, respectively, resulting from a special dividend from Microsoft Corp. in November 2004.

2 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares.

* Annualized.

18

Signal Shares | | |

| Six Months | Sept. 29, |

| Ended | 20061 to |

| June 30, | Dec. 31, |

For a Share Outstanding Throughout Each Period | 2007 | 2006 |

Net Asset Value, Beginning of Period | $107.86 | $101.61 |

Investment Operations | | |

Net Investment Income | 1.008 | .502 |

Net Realized and Unrealized Gain (Loss) on Investments | 6.438 | 6.287 |

Total from Investment Operations | 7.446 | 6.789 |

Distributions | | |

Dividends from Net Investment Income | (.966) | (.539) |

Distributions from Realized Capital Gains | — | — |

Total Distributions | (.966) | (.539) |

Net Asset Value, End of Period | $114.34 | $107.86 |

| | |

Total Return | 6.93% | 6.68% |

| | |

Ratios/Supplemental Data | | |

Net Assets, End of Period (Millions) | $4,214 | $713 |

Ratio of Total Expenses to Average Net Assets | 0.08%* | 0.09%* |

Ratio of Net Investment Income to Average Net Assets | 1.82%* | 1.83%* |

Portfolio Turnover Rate2 | 4%* | 5% |

1 Inception.

2 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares.

* Annualized.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Notes to Financial Statements

Vanguard 500 Index Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers three classes of shares: Investor Shares, Admiral Shares, and Signal Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, tenure, and account-size criteria. Signal Shares are designed for institutional investors who meet certain administrative, service, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objectives of maintaining full exposure to the stock market, enhancing returns, maintaining liquidity, and minimizing transaction costs. The fund may purchase futures contracts to immediately invest incoming cash in the market, or sell futures in response to cash outflows, thereby simulating a fully invested position in the underlying index while maintaining a cash balance for liquidity. The fund may seek to enhance returns by using futures contracts instead of the underlying securities when futures are believed to be priced more attractively than the underlying securities. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

20

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At June 30, 2007, the fund had contributed capital of $11,190,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 11.19% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the six months ended June 30, 2007, the fund realized $41,585,000 of net capital gains resulting from in-kind redemptions—in which shareholders exchange fund shares for securities held by the fund rather than for cash. Because such gains are not taxable to the fund, and are not distributed to shareholders, they have been reclassified from accumulated net realized losses to paid-in capital.

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at December 31, 2006, the fund had available realized losses of $6,571,975,000 to offset future net capital gains of $193,358,000 through December 31, 2008, $890,248,000 through December 31, 2009, $3,087,963,000 through December 31, 2010, $145,498,000 through December 31, 2011, $44,874,000 through December 31, 2012, $757,853,000 through December 31, 2013, $1,156,454,000 through December 31, 2014, and $295,727,000 through December 31, 2015. The fund will use these capital losses to offset net taxable capital gains, if any, realized during the year ending December 31, 2007; should the fund realize net capital losses for the year, the losses will be added to the loss carryforward balances above.

At June 30, 2007, the cost of investment securities for tax purposes was $72,659,638,000. Net unrealized appreciation of investment securities for tax purposes was $53,903,742,000, consisting of unrealized gains of $57,792,785,000 on securities that had risen in value since their purchase and $3,889,043,000 in unrealized losses on securities that had fallen in value since their purchase.

21

At June 30, 2007, the aggregate settlement value of open futures contracts expiring in September 2007 and the related unrealized appreciation (depreciation) were:

| | | ($000) |

| | Aggregate | Unrealized |

| Number of | Settlement | Appreciation |

Futures Contracts | Long Contracts | Value | (Depreciation) |

S&P 500 Index | 690 | 261,407 | 206 |

E-mini S&P 500 Index | 460 | 34,854 | (81) |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

D. During the six months ended June 30, 2007, the fund purchased $2,945,168,000 of investment securities and sold $2,607,749,000 of investment securities other than temporary cash investments.

E. The market value of securities on loan to broker-dealers at June 30, 2007, was $149,089,000, for which the fund received cash collateral of $154,551,000.

F. Capital share transactions for each class of shares were:

| Six Months Ended | Year Ended |

| June 30, 2007 | December 31, 2006 |

| Amount | Shares | Amount | Shares |

| ($000) | (000) | ($000) | (000) |

Investor Shares | | | | |

Issued | 4,994,840 | 37,309 | 8,512,324 | 70,581 |

Issued in Lieu of Cash Distributions | 574,577 | 4,249 | 1,161,025 | 9,522 |

Redeemed | (10,571,238) | (78,319) | (16,001,132) | (132,338) |

Net Increase (Decrease)—Investor Shares | (5,001,821) | (36,761) | (6,327,783) | (52,235) |

Admiral Shares | | | | |

Issued | 5,038,295 | 37,363 | 8,509,544 | 70,199 |

Issued in Lieu of Cash Distributions | 380,164 | 2,810 | 682,499 | 5,590 |

Redeemed | (3,776,537) | (27,925) | (6,144,260) | (50,873) |

Net Increase (Decrease)—Admiral Shares | 1,641,922 | 12,248 | 3,047,783 | 24,916 |

Signal Shares | | | | |

Issued | 3,518,771 | 31,450 | 717,342 | 6,636 |

Issued in Lieu of Cash Distributions | 19,498 | 173 | 3,554 | 33 |

Redeemed | (154,658) | (1,379) | (6,450) | (60) |

Net Increase (Decrease)—Signal Shares | 3,383,611 | 30,244 | 714,446 | 6,609 |

G. In June 2006, the Financial Accounting Standards Board issued Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes.” FIN 48 establishes the minimum threshold for recognizing, and a system for measuring, the benefits of tax-return positions in financial statements, effective for the fund’s current fiscal year. Management has analyzed the fund’s tax positions taken on federal income tax returns for all open tax years (tax years ended December 31, 2004–2006) for purposes of implementing FIN 48, and has concluded that no provision for income tax is required in the fund’s financial statements.

22

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended June 30, 2007 | | | |

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

500 Index Fund | 12/31/2006 | 6/30/2007 | Period1 |

Based on Actual Fund Return | | | |

Investor Shares | $1,000.00 | $1,068.75 | $0.82 |

Admiral Shares | 1,000.00 | 1,069.26 | 0.41 |

Signal Shares | 1,000.00 | 1,069.26 | 0.41 |

Based on Hypothetical 5% Yearly Return | | | |

Investor Shares | $1,000.00 | $1,024.00 | $0.80 |

Admiral Shares | 1,000.00 | 1,024.40 | 0.40 |

Signal Shares | 1,000.00 | 1,024.40 | 0.40 |

1. The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.16% for Investor Shares, 0.08% for Admiral Shares, and 0.08% for Signal Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

23

Note that the expenses shown in the table on page 23 are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any account service fee described in the prospectus. If such a fee were applied to your account, your costs would be higher. Your fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

24

Trustees Approve Advisory Arrangement

The board of trustees of Vanguard 500 Index Fund has renewed the fund’s investment advisory arrangement with The Vanguard Group, Inc. Vanguard—through its Quantitative Equity Group—serves as the investment advisor for the fund. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management over both short- and long-term periods, and took into account the organizational depth and stability of the advisor. Vanguard has been managing investments for more than two decades. George U. Sauter, Vanguard managing director and chief investment officer, has been in the investment management business since 1985. Mr. Sauter has led the Quantitative Equity Group since 1987. The Quantitative Equity Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance of its target benchmark and peer group. The board concluded that the fund has performed in line with expectations, and that its results have been consistent with its investment strategies. Information about the fund’s most recent performance can be found in the Performance Summary section of this report.

Cost

The board concluded that the fund’s expense ratio was far below the average expense ratio charged by funds in its peer group. The board noted that the fund’s advisory expense ratio was also well below its peer-group average. Information about the fund’s expense ratio appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique “at-cost” structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees, and produces “profits” only in the form of reduced expenses for fund shareholders.

The benefit of economies of scale

The board concluded that the fund’s low-cost arrangement with Vanguard ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

25

Glossary

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. A fund’s beta should be reviewed in conjunction with its R-squared (see definition below). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

Yield. A snapshot of a fund’s income from interest and dividends. The yield, expressed as a percentage of the fund’s net asset value, is based on income earned over the past 30 days and is annualized, or projected forward for the coming year. The index yield is based on the current annualized rate of income provided by securities in the index.

26

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals.

Our independent board members bring distinguished backgrounds in business, academia, and public service to their task of working with Vanguard officers to establish the policies and oversee the activities of the funds. Among board members’ responsibilities are selecting investment advisors for the funds; monitoring fund operations, performance, and costs; reviewing contracts; nominating and selecting new trustees/directors; and electing Vanguard officers.

Each trustee serves a fund until its termination; or until the trustee’s retirement, resignation, or death; or otherwise as specified in the fund’s organizational documents. Any trustee may be removed at a shareholders’ meeting by a vote representing two-thirds of the net asset value of all shares of the fund together with shares of other Vanguard funds organized within the same trust. The table on these two pages shows information for each trustee and executive officer of the fund. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482.

Chairman of the Board, Chief Executive Officer, and Trustee |

| |

John J. Brennan1 | |

Born 1954 | Principal Occupation(s) During the Past Five Years: Chairman of the Board, Chief |

Trustee since May 1987; | Executive Officer, and Director/Trustee of The Vanguard Group, Inc., and of each |

Chairman of the Board and | of the investment companies served by The Vanguard Group. |

Chief Executive Officer | |

147 Vanguard Funds Overseen | |

| |