UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02652

Name of Registrant: | | Vanguard Index Funds |

Address of Registrant: | | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| | |

Name and address of agent for service: | | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2018—December 31, 2018

Item 1: Reports to Shareholders

Annual Report| December 31, 2018 Vanguard 500 Index Fund |

See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

Contents

| A Note From Our CEO | 1 |

| | |

| Your Fund’s Performance at a Glance | 2 |

| | |

| About Your Fund’s Expenses | 3 |

| | |

| Performance Summary | 5 |

| | |

| Financial Statements | 8 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our CEO

Tim Buckley

Chairman and Chief Executive Officer

Dear Shareholder,

Over the years, I’ve found that prudent investors exhibit a common trait: discipline. No matter how the markets move or what new investing fad hits the headlines, those who stay focused on their goals and tune out the noise are set up for long-term success.

The prime gateway to investing is saving, and you don’t usually become a saver without a healthy dose of discipline. Savers make the decision to sock away part of their income, which means spending less and delaying gratification, no matter how difficult that may be.

Of course, disciplined investing extends beyond diligent saving. The financial markets, in the short term especially, are unpredictable; I have yet to meet the investor who can time them perfectly. It takes discipline to resist the urge to go all-in when markets are frothy or to retreat when things look bleak.

Staying put with your investments is one strategy for handling volatility. Another, rebalancing, requires even more discipline because it means steering your money away from strong performers and toward poorer performers.

Patience—a form of discipline—is also the friend of long-term investors. Higher returns are the potential reward for weathering the market’s turbulence and uncertainty.

It’s important to be prepared for that turbulence, whenever it appears. Don’t panic. Don’t chase returns or look for answers outside the asset classes you trust. And be sure to rebalance periodically, even when there’s turmoil.

Whether you’re a master of self-control, get a boost from technology, or work with a professional advisor, know that discipline is necessary to get the most out of your investment portfolio. And know that Vanguard is with you for the entire ride.

Thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

Chairman and Chief Executive Officer

January 17, 2019

Your Fund’s Performance at a Glance

· For the 12 months ended December 31, 2018, Vanguard 500 Index Fund returned –4.52% for Investor Shares and –4.43% for Admiral Shares. The fund, which provides exposure to the stocks of the largest U.S. companies, closely tracked its target index, the Standard & Poor’s 500 Index, which returned –4.38%.

· The broad U.S. stock market returned about –5%, its first negative calendar-year result since 2008. Growth stocks outperformed value; large-capitalization stocks bested small- and mid-caps.

· Among sectors, financials and industrials were the biggest detractors. Health care and information technology contributed most.

· For the ten years ended December 31, 2018, the 500 Index Fund posted an average annual return of about 13%, in line with its target index.

· In November, Vanguard lowered the investment minimum for your fund’s Admiral Shares from $10,000 to $3,000.

Market Barometer

| | Average Annual Total Returns

Periods Ended December 31, 2018 |

| | One Year | Three Years | Five Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | -4.78% | 9.09% | 8.21% |

| Russell 2000 Index (Small-caps) | -11.01 | 7.36 | 4.41 |

| Russell 3000 Index (Broad U.S. market) | -5.24 | 8.97 | 7.91 |

| FTSE All-World ex US Index (International) | -14.13 | 4.58 | 1.05 |

| | | | |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 0.01% | 2.06% | 2.52% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 1.28 | 2.30 | 3.82 |

| FTSE Three-Month U.S. Treasury Bill Index | 1.86 | 0.98 | 0.59 |

| | | | |

| CPI | | | |

| Consumer Price Index | 1.91% | 2.03% | 1.51% |

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

· Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

· Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compareongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

Six Months Ended December 31, 2018

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| 500 Index Fund | 6/30/2018 | 12/31/2018 | Period |

| Based on Actual Fund Return | | | |

| Investor Shares | $1,000.00 | $930.77 | $0.68 |

| ETF Shares | 1,000.00 | 931.45 | 0.10 |

| Admiral™ Shares | 1,000.00 | 931.25 | 0.19 |

| Institutional Select Shares | 1,000.00 | 931.42 | 0.05 |

| Based on Hypothetical 5% Yearly Return | | | |

| Investor Shares | $1,000.00 | $1,024.50 | $0.71 |

| ETF Shares | 1,000.00 | 1,025.10 | 0.10 |

| Admiral Shares | 1,000.00 | 1,025.00 | 0.20 |

| Institutional Select Shares | 1,000.00 | 1,025.16 | 0.05 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.14% for Investor Shares, 0.02% for ETF Shares, 0.04% for Admiral Shares, and 0.01% for Institutional Select Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (184/365).

500 Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

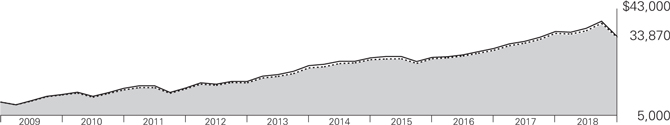

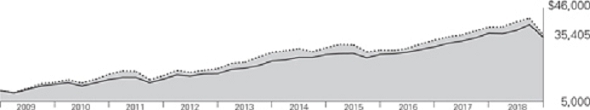

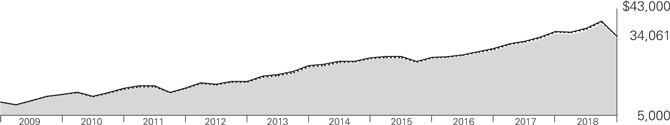

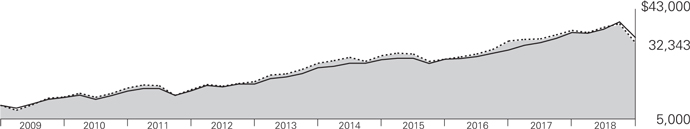

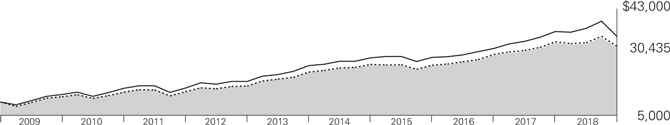

Cumulative Performance: December 31, 2008, Through December 31, 2018

Initial Investment of $10,000

| | | Average Annual Total Returns | |

| | | Periods Ended December 31, 2018 | Final Value |

| | | One | Five | Ten | of a $10,000 |

| | | Year | Years | Years | Investment |

| 500 Index Fund Investor Shares | -4.52% | 8.34% | 12.97% | $33,870 |

| S&P 500 Index | -4.38 | 8.49 | 13.12 | 34,304 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | -5.30 | 7.86 | 13.22 | 34,625 |

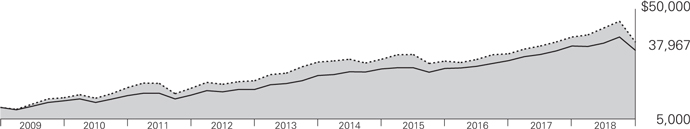

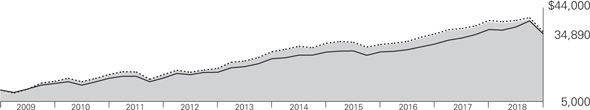

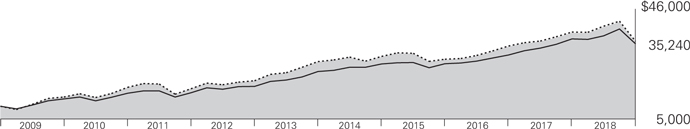

| | | | Since | Final Value |

| | One | Five | Inception | of a $10,000 |

| | Year | Years | (9/7/2010) | Investment |

| 500 Index Fund | | | | |

| ETF Shares Net Asset Value | -4.42% | 8.45% | 12.81% | $27,248 |

| S&P 500 Index | -4.38 | 8.49 | 12.85 | 27,325 |

| Dow Jones U.S. Total Stock Market FloatAdjusted Index | -5.30 | 7.86 | 12.63 | 26,886 |

"Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards.

See Financial Highlights for dividend and capital gains information.

500 Index Fund

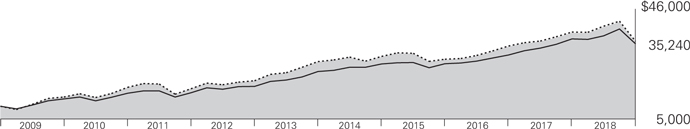

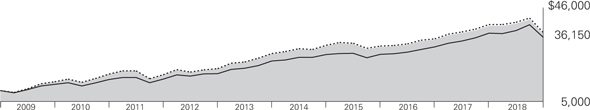

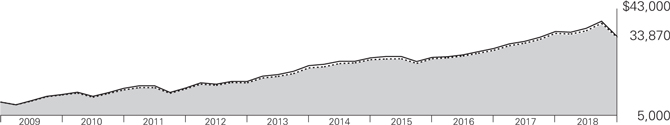

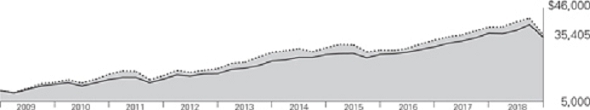

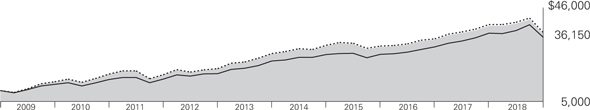

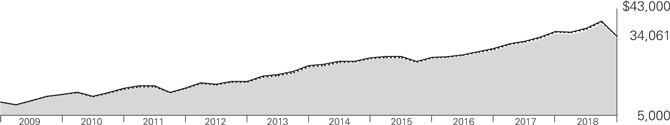

| | Average Annual Total Returns | |

| | Periods Ended December 31, 2018 | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| 500 Index Fund Admiral Shares | -4.43% | 8.46% | 13.10% | $34,247 |

| S&P 500 Index | -4.38 | 8.49 | 13.12 | 34,304 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | -5.30 | 7.86 | 13.22 | 34,625 |

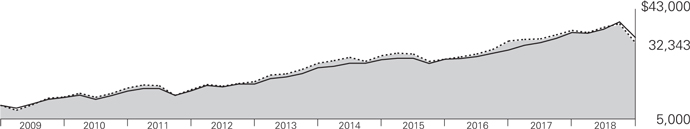

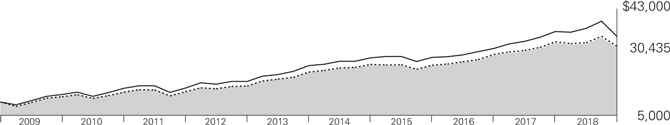

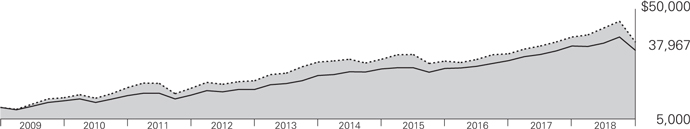

| | | Since | Final Value |

| | One | Inception | of a $5,000,000,000 |

| | Year | (6/24/2016) | Investment |

| 500 Index Fund Institutional Select Shares | -4.40% | 10.78% | $6,471,250,500 |

| S&P 500 Index | -4.38 | 10.79 | 6,471,833,715 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | -5.30 | 10.46 | 6,423,697,561 |

“Since Inception” performance is calculated from the Institutional Select Shares’ inception date for both the fund and its comparative standards.

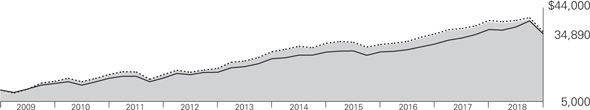

Cumulative Returns of ETF Shares: September 7, 2010, Through December 31, 2018

| | | | Since |

| | One | Five | Inception |

| | Year | Years | (9/7/2010) |

| 500 Index Fund ETF Shares Market Price | -4.47% | 50.02% | 172.43% |

| 500 Index Fund ETF Shares Net Asset Value | -4.42 | 50.05 | 172.48 |

| S&P 500 Index | -4.38 | 50.33 | 173.25 |

"Since Inception" performance is calculated from the ETF Shares’ inception date for both the fund and its comparative standards.

For the ETF Shares, the market price is determined by the midpoint of the bid-offer spread as of the closing time of the New York Stock Exchange (generally 4 p.m., Eastern time). The net asset value is also determined as of the NYSE closing time. For more information about how the ETF Shares' market prices have compared with their net asset value, visit vanguard.com, select your ETF, and then select the Price and Performance tab. The ETF premium/discount analysis there shows the percentages of days on which the ETF Shares' market price was above or below the NAV.

500 Index Fund

Sector Diversification

As of December 31, 2018

| Communication Services | 10.1% |

| Consumer Discretionary | 9.9 |

| Consumer Staples | 7.4 |

| Energy | 5.3 |

| Financials | 13.4 |

| Health Care | 15.6 |

| Industrials | 9.2 |

| Information Technology | 20.1 |

| Materials | 2.7 |

| Real Estate | 3.0 |

| Utilities | 3.3 |

The table reflects the fund’s equity exposure, based on its investments in stocks and stock index futures. Any holdings in short-term reserves are excluded. Sector categories are based on the Global Industry Classification Standard (“GICS”), except for the “Other” category (if applicable), which includes securities that have not been provided a GICS classification as of the effective reporting period.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard and Poor’s, a division of McGraw-Hill Companies, Inc. (“S&P”), and is licensed for use by Vanguard. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classification makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of its affiliates or any third party involved in making or compiling the GICS or any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

500 Index Fund

Financial Statements

Statement of Net Assets

As of December 31, 2018

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov.

| | | | | | | | Market | |

| | | | | | | | Value• | |

| | | | | Shares | | | ($000) | |

| Common Stocks (99.5%)1 | | | | | | | | |

| Communication Services (10.1%) | | | | | | | | |

| * | | Alphabet Inc. Class C | | | 5,829,972 | | | | 6,037,577 | |

| * | | Facebook Inc. Class A | | | 45,525,094 | | | | 5,967,885 | |

| * | | Alphabet Inc. Class A | | | 5,665,331 | | | | 5,920,044 | |

| | | Verizon Communications Inc. | | | 78,298,803 | | | | 4,401,959 | |

| | | AT&T Inc. | | | 137,912,898 | | | | 3,936,034 | |

| | | Walt Disney Co. | | | 28,209,421 | | | | 3,093,163 | |

| | | Comcast Corp. Class A | | | 86,031,121 | | | | 2,929,360 | |

| * | | Netflix Inc. | | | 8,263,443 | | | | 2,211,793 | |

| | | Twenty-First Century Fox Inc. Class A | | | 20,028,496 | | | | 963,771 | |

| * | | Charter Communications Inc. Class A | | | 3,340,064 | | | | 951,818 | |

| | | Activision Blizzard Inc. | | | 14,459,184 | | | | 673,364 | |

| * | | Electronic Arts Inc. | | | 5,725,288 | | | | 451,782 | |

| | | Twenty-First Century Fox Inc. | | | 9,230,177 | | | | 441,018 | |

| * | | Twitter Inc. | | | 13,704,746 | | | | 393,874 | |

| | | Omnicom Group Inc. | | | 4,248,007 | | | | 311,124 | |

| | | CBS Corp. Class B | | | 6,379,638 | | | | 278,918 | |

| | | CenturyLink Inc. | | | 18,027,593 | | | | 273,118 | |

| * | | Take-Two Interactive Software Inc. | | | 2,159,061 | | | | 222,254 | |

| | | Viacom Inc. Class B | | | 6,692,871 | | | | 172,007 | |

| * | | Discovery Communications Inc. | | | 6,819,337 | | | | 157,390 | |

| | | Interpublic Group of Cos. Inc. | | | 7,277,853 | | | | 150,142 | |

| | | News Corp. Class A | | | 9,690,119 | | | | 109,983 | |

| * | | DISH Network Corp. Class A | | | 4,340,468 | | | | 108,382 | |

| * | | TripAdvisor Inc. | | | 1,938,827 | | | | 104,580 | |

| *,^ | | Discovery Communications Inc. Class A | | | 2,982,141 | | | | 73,778 | |

| | | News Corp. Class B | | | 6,219 | | | | 72 | |

| | | | | | | | | | 40,335,190 | |

| Consumer Discretionary (9.9%) | | | | | | | | |

| * | | Amazon.com Inc. | | | 7,783,149 | | | | 11,690,056 | |

| | | Home Depot Inc. | | | 21,403,764 | | | | 3,677,595 | |

| | | McDonald’s Corp. | | | 14,608,127 | | | | 2,593,965 | |

| | | NIKE Inc. Class B | | | 24,125,282 | | | | 1,788,648 | |

| | | Starbucks Corp. | | | 23,508,155 | | | | 1,513,925 | |

| * | | Booking Holdings Inc. | | | 877,958 | | | | 1,512,212 | |

| | | Lowe’s Cos. Inc. | | | 15,215,641 | | | | 1,405,317 | |

| | | TJX Cos. Inc. | | | 23,450,854 | | | | 1,049,191 | |

| | | General Motors Co. | | | 24,876,139 | | | | 832,107 | |

| | | Target Corp. | | | 9,888,774 | | | | 653,549 | |

| | | Ross Stores Inc. | | | 7,074,761 | | | | 588,620 | |

| | | Marriott International Inc. Class A | | | 5,364,662 | | | | 582,388 | |

| | | Ford Motor Co. | | | 74,038,120 | | | | 566,392 | |

| | | Yum! Brands Inc. | | | 5,917,251 | | | | 543,914 | |

| | | Dollar General Corp. | | | 4,981,374 | | | | 538,387 | |

| * | | O’Reilly Automotive Inc. | | | 1,517,671 | | | | 522,580 | |

| * | | eBay Inc. | | | 17,150,081 | | | | 481,403 | |

| | | VF Corp. | | | 6,166,167 | | | | 439,894 | |

| * | | Dollar Tree Inc. | | | 4,509,590 | | | | 407,306 | |

| | | Hilton Worldwide Holdings Inc. | | | 5,619,315 | | | | 403,467 | |

| * | | AutoZone Inc. | | | 477,831 | | | | 400,585 | |

| | | Carnival Corp. | | | 7,588,411 | | | | 374,109 | |

| | | Royal Caribbean Cruises Ltd. | | | 3,248,096 | | | | 317,631 | |

| | | Aptiv plc | | | 4,993,164 | | | | 307,429 | |

| | | Genuine Parts Co. | | | 2,782,312 | | | | 267,158 | |

| * | | Ulta Beauty Inc. | | | 1,068,392 | | | | 261,585 | |

| | | Expedia Group Inc. | | | 2,246,142 | | | | 253,028 | |

| | | Best Buy Co. Inc. | | | 4,439,195 | | | | 235,100 | |

| | | Darden Restaurants Inc. | | | 2,353,060 | | | | 234,977 | |

| | | MGM Resorts International | | | 9,496,286 | | | | 230,380 | |

| | | DR Horton Inc. | | | 6,492,484 | | | | 225,030 | |

| | | Advance Auto Parts Inc. | | | 1,382,224 | | | | 217,645 | |

| | | Lennar Corp. Class A | | | 5,483,844 | | | | 214,692 | |

| | | Kohl’s Corp. | | | 3,131,552 | | | | 207,747 | |

| * | | CarMax Inc. | | | 3,311,320 | | | | 207,719 | |

500 Index Fund

| | | | | | | | Market | |

| | | | | | | | Value• | |

| | | | | Shares | | | ($000) | |

| * | | Chipotle Mexican Grill Inc. Class A | | | 463,587 | | | | 200,172 | |

| | | Tractor Supply Co. | | | 2,311,699 | | | | 192,888 | |

| | | Tapestry Inc. | | | 5,496,446 | | | | 185,505 | |

| | | Wynn Resorts Ltd. | | | 1,856,047 | | | | 183,582 | |

| | | Hasbro Inc. | | | 2,203,874 | | | | 179,065 | |

| * | | Norwegian Cruise Line Holdings Ltd. | | | 4,165,404 | | | | 176,571 | |

| | | Macy’s Inc. | | | 5,822,145 | | | | 173,383 | |

| | | Tiffany & Co. | | | 2,056,582 | | | | 165,575 | |

| | | Newell Brands Inc. | | | 8,132,211 | | | | 151,178 | |

| | | Garmin Ltd. | | | 2,288,155 | | | | 144,886 | |

| * | | LKQ Corp. | | | 6,025,277 | | | | 142,980 | |

| * | | Mohawk Industries Inc. | | | 1,195,481 | | | | 139,823 | |

| | | BorgWarner Inc. | | | 3,943,926 | | | | 137,012 | |

| | | PVH Corp. | | | 1,433,903 | | | | 133,281 | |

| | | Whirlpool Corp. | | | 1,208,525 | | | | 129,155 | |

| | | PulteGroup Inc. | | | 4,892,310 | | | | 127,151 | |

| | | Foot Locker Inc. | | | 2,175,981 | | | | 115,762 | |

| | | L Brands Inc. | | | 4,324,237 | | | | 111,003 | |

| * | | Michael Kors Holdings Ltd. | | | 2,844,728 | | | | 107,872 | |

| | | Ralph Lauren Corp. Class A | | | 1,032,984 | | | | 106,873 | |

| | | Harley-Davidson Inc. | | | 3,083,735 | | | | 105,217 | |

| | | Gap Inc. | | | 4,045,102 | | | | 104,202 | |

| | | Nordstrom Inc. | | | 2,154,400 | | | | 100,417 | |

| | | H&R Block Inc. | | | 3,891,806 | | | | 98,735 | |

| | | Goodyear Tire & Rubber Co. | | | 4,412,322 | | | | 90,055 | |

| | | Leggett & Platt Inc. | | | 2,469,041 | | | | 88,490 | |

| | | Hanesbrands Inc. | | | 6,830,936 | | | | 85,592 | |

| *,^ | | Mattel Inc. | | | 6,535,351 | | | | 65,288 | |

| *,^ | | Under Armour Inc. Class A | | | 3,552,722 | | | | 62,777 | |

| *,^ | | Under Armour Inc. | | | 3,642,688 | | | | 58,902 | |

| | | Lennar Corp. Class B | | | 76,975 | | | | 2,412 | |

| | | Wyndham Hotels & Resorts Inc. | | | 216 | | | | 10 | |

| | | | | | | | | | 39,611,545 | |

| Consumer Staples (7.4%) | | | | | | | | |

| | | Procter & Gamble Co. | | | 47,210,675 | | | | 4,339,605 | |

| | | Coca-Cola Co. | | | 72,594,382 | | | | 3,437,344 | |

| | | PepsiCo Inc. | | | 26,748,745 | | | | 2,955,201 | |

| | | Walmart Inc. | | | 26,976,018 | | | | 2,512,816 | |

| | | Philip Morris International Inc. | | | 29,457,223 | | | | 1,966,564 | |

| | | Altria Group Inc. | | | 35,606,812 | | | | 1,758,620 | |

| | | Costco Wholesale Corp. | | | 8,303,690 | | | | 1,691,545 | |

| | | Mondelez International Inc. Class A | | | 27,550,051 | | | | 1,102,829 | |

| | | Walgreens Boots Alliance Inc. | | | 15,233,759 | | | | 1,040,923 | |

| | | Colgate-Palmolive Co. | | | 16,435,661 | | | | 978,251 | |

| | | Kimberly-Clark Corp. | | | 6,562,385 | | | | 747,718 | |

| | | Sysco Corp. | | | 9,060,573 | | | | 567,735 | |

| | | Estee Lauder Cos. Inc. Class A | | | 4,166,605 | | | | 542,075 | |

| | | Kraft Heinz Co. | | | 11,783,458 | | | | 507,160 | |

| | | Constellation Brands Inc. Class A | | | 3,148,094 | | | | 506,276 | |

| | | General Mills Inc. | | | 11,297,934 | | | | 439,942 | |

| | | Archer-Daniels-Midland Co. | | | 10,623,847 | | | | 435,259 | |

| | | Kroger Co. | | | 15,121,904 | | | | 415,852 | |

| | | Clorox Co. | | | 2,419,216 | | | | 372,898 | |

| * | | Monster Beverage Corp. | | | 7,544,980 | | | | 371,364 | |

| | | McCormick & Co. Inc. | | | 2,308,071 | | | | 321,376 | |

| | | Church & Dwight Co. Inc. | | | 4,667,283 | | | | 306,921 | |

| | | Tyson Foods Inc. Class A | | | 5,593,626 | | | | 298,700 | |

| | | Hershey Co. | | | 2,658,362 | | | | 284,923 | |

| | | Kellogg Co. | | | 4,802,235 | | | | 273,775 | |

| ^ | | Hormel Foods Corp. | | | 5,163,036 | | | | 220,358 | |

| | | Lamb Weston Holdings Inc. | | | 2,773,254 | | | | 204,001 | |

| | | JM Smucker Co. | | | 2,154,136 | | | | 201,390 | |

| | | Molson Coors Brewing Co. Class B | | | 3,546,671 | | | | 199,181 | |

| | | Conagra Brands Inc. | | | 9,208,854 | | | | 196,701 | |

| | | Brown-Forman Corp. Class B | | | 3,149,087 | | | | 149,834 | |

| *,^ | | Campbell Soup Co. | | | 3,647,856 | | | | 120,343 | |

| | | Coty Inc. Class A | | | 8,538,203 | | | | 56,011 | |

| | | | | | | | | | 29,523,491 | |

| Energy (5.3%) | | | | | | | | |

| | | Exxon Mobil Corp. | | | 80,227,601 | | | | 5,470,720 | |

| | | Chevron Corp. | | | 36,207,844 | | | | 3,939,051 | |

| | | ConocoPhillips | | | 21,814,925 | | | | 1,360,161 | |

| | | EOG Resources Inc. | | | 10,988,511 | | | | 958,308 | |

| | | Schlumberger Ltd. | | | 26,240,368 | | | | 946,753 | |

| | | Occidental Petroleum Corp. | | | 14,307,129 | | | | 878,172 | |

| | | Marathon Petroleum Corp. | | | 13,091,083 | | | | 772,505 | |

| | | Phillips 66 | | | 8,038,870 | | | | 692,549 | |

| | | Valero Energy Corp. | | | 8,039,814 | | | | 602,745 | |

| | | Kinder Morgan Inc. | | | 35,961,578 | | | | 553,089 | |

| | | Williams Cos. Inc. | | | 22,937,434 | | | | 505,770 | |

| | | Halliburton Co. | | | 16,601,107 | | | | 441,257 | |

| | | Pioneer Natural Resources Co. | | | 3,230,016 | | | | 424,812 | |

| | | ONEOK Inc. | | | 7,795,538 | | | | 420,569 | |

| | | Anadarko Petroleum Corp. | | | 9,555,625 | | | | 418,919 | |

| * | | Concho Resources Inc. | | | 3,794,822 | | | | 390,070 | |

| | | Diamondback Energy Inc. | | | 2,923,951 | | | | 271,050 | |

| | | Marathon Oil Corp. | | | 15,762,200 | | | | 226,030 | |

500 Index Fund

| | | | | | | | Market | |

| | | | | | | | Value• | |

| | | | | Shares | | | ($000) | |

| | | Baker Hughes a GE Co. Class A | | | 9,735,695 | | | | 209,317 | |

| | | Devon Energy Corp. | | | 8,878,674 | | | | 200,125 | |

| | | Hess Corp. | | | 4,719,423 | | | | 191,137 | |

| | | Apache Corp. | | | 7,197,985 | | | | 188,947 | |

| | | National Oilwell Varco Inc. | | | 7,259,501 | | | | 186,569 | |

| | | Cabot Oil & Gas Corp. | | | 8,164,170 | | | | 182,469 | |

| | | Noble Energy Inc. | | | 9,084,927 | | | | 170,433 | |

| | | TechnipFMC plc | | | 8,068,418 | | | | 157,980 | |

| | | HollyFrontier Corp. | | | 3,018,880 | | | | 154,325 | |

| | | Cimarex Energy Co. | | | 1,810,628 | | | | 111,625 | |

| | | Helmerich & Payne Inc. | | | 2,064,754 | | | | 98,984 | |

| * | | Newfield Exploration Co. | | | 3,793,561 | | | | 55,614 | |

| | | | | | | | | | 21,180,055 | |

| Financials (13.3%) | | | | | | | | |

| * | | Berkshire Hathaway Inc. Class B | | | 35,620,768 | | | | 7,273,048 | |

| | | JPMorgan Chase & Co. | | | 63,012,774 | | | | 6,151,307 | |

| | | Bank of America Corp. | | | 172,949,801 | | | | 4,261,483 | |

| | | Wells Fargo & Co. | | | 80,278,244 | | | | 3,699,222 | |

| | | Citigroup Inc. | | | 46,275,685 | | | | 2,409,112 | |

| | | US Bancorp | | | 28,785,034 | | | | 1,315,476 | |

| | | CME Group Inc. | | | 6,779,749 | | | | 1,275,406 | |

| | | American Express Co. | | | 13,273,589 | | | | 1,265,239 | |

| | | Chubb Ltd. | | | 8,732,407 | | | | 1,128,052 | |

| | | Goldman Sachs Group Inc. | | | 6,555,332 | | | | 1,095,068 | |

| | | PNC Financial Services Group Inc. | | | 8,743,198 | | | | 1,022,167 | |

| | | Morgan Stanley | | | 24,773,515 | | | | 982,270 | |

| | | Charles Schwab Corp. | | | 22,775,616 | | | | 945,871 | |

| | | BlackRock Inc. | | | 2,301,255 | | | | 903,979 | |

| | | Intercontinental Exchange Inc. | | | 10,793,314 | | | | 813,060 | |

| | | Bank of New York Mellon Corp. | | | 17,238,503 | | | | 811,416 | |

| | | S&P Global Inc. | | | 4,754,508 | | | | 807,981 | |

| | | MetLife Inc. | | | 18,700,775 | | | | 767,854 | |

| | | Marsh & McLennan Cos. Inc. | | | 9,545,045 | | | | 761,217 | |

| | | Capital One Financial Corp. | | | 8,975,495 | | | | 678,458 | |

| | | Progressive Corp. | | | 11,048,936 | | | | 666,582 | |

| | | Aon plc | | | 4,563,513 | | | | 663,352 | |

| | | American International Group Inc. | | | 16,763,427 | | | | 660,647 | |

| | | Aflac Inc. | | | 14,425,060 | | | | 657,206 | |

| | | Prudential Financial Inc. | | | 7,826,355 | | | | 638,239 | |

| | | BB&T Corp. | | | 14,601,642 | | | | 632,543 | |

| | | Travelers Cos. Inc. | | | 5,019,120 | | | | 601,040 | |

| | | Allstate Corp. | | | 6,527,029 | | | | 539,328 | |

| | | State Street Corp. | | | 7,191,607 | | | | 453,575 | |

| | | Moody’s Corp. | | | 3,159,022 | | | | 442,390 | |

| | | SunTrust Banks Inc. | | | 8,512,790 | | | | 429,385 | |

| | | T. Rowe Price Group Inc. | | | 4,560,379 | | | | 421,014 | |

| | | M&T Bank Corp. | | | 2,659,308 | | | | 380,627 | |

| | | Discover Financial Services | | | 6,367,349 | | | | 375,546 | |

| | | Willis Towers Watson plc | | | 2,462,788 | | | | 373,999 | |

| | | Northern Trust Corp. | | | 4,196,374 | | | | 350,775 | |

| | | Hartford Financial Services Group Inc. | | | 6,800,110 | | | | 302,265 | |

| | | Synchrony Financial | | | 12,534,629 | | | | 294,062 | |

| | | Fifth Third Bancorp | | | 12,429,791 | | | | 292,473 | |

| | | KeyCorp | | | 19,611,814 | | | | 289,863 | |

| | | Ameriprise Financial Inc. | | | 2,641,767 | | | | 275,721 | |

| | | Citizens Financial Group Inc. | | | 8,871,096 | | | | 263,738 | |

| | | Regions Financial Corp. | | | 19,601,153 | | | | 262,264 | |

| | | Arthur J Gallagher & Co. | | | 3,478,024 | | | | 256,330 | |

| * | | Berkshire Hathaway Inc. Class A | | | 829 | | | | 253,674 | |

| | | MSCI Inc. Class A | | | 1,669,070 | | | | 246,071 | |

| | | Huntington Bancshares Inc. | | | 20,126,960 | | | | 239,913 | |

| | | Loews Corp. | | | 5,240,114 | | | | 238,530 | |

| | | Cincinnati Financial Corp. | | | 2,866,225 | | | | 221,903 | |

| | | Principal Financial Group Inc. | | | 4,989,511 | | | | 220,387 | |

| * | | First Republic Bank | | | 2,493,174 | | | | 216,657 | |

| | | E*TRADE Financial Corp. | | | 4,814,558 | | | | 211,263 | |

| | | Comerica Inc. | | | 3,066,358 | | | | 210,628 | |

| | | Cboe Global Markets Inc. | | | 2,127,539 | | | | 208,137 | |

| | | Lincoln National Corp. | | | 4,051,149 | | | | 207,865 | |

| * | | SVB Financial Group | | | 1,009,726 | | | | 191,767 | |

| | | Raymond James Financial Inc. | | | 2,441,987 | | | | 181,708 | |

| | | Nasdaq Inc. | | | 2,173,545 | | | | 177,296 | |

| | | Everest Re Group Ltd. | | | 770,747 | | | | 167,838 | |

| | | Franklin Resources Inc. | | | 5,635,744 | | | | 167,156 | |

| | | Zions Bancorp NA | | | 3,639,463 | | | | 148,272 | |

| | | Torchmark Corp. | | | 1,943,232 | | | | 144,829 | |

| | | Invesco Ltd. | | | 7,789,213 | | | | 130,391 | |

| | | Unum Group | | | 4,142,041 | | | | 121,693 | |

| | | People’s United Financial Inc. | | | 7,146,950 | | | | 103,131 | |

| | | Affiliated Managers Group Inc. | | | 997,564 | | | | 97,203 | |

| | | Jefferies Financial Group Inc. | | | 5,322,804 | | | | 92,404 | |

| | | Assurant Inc. | | | 987,217 | | | | 88,297 | |

| * | | Brighthouse Financial Inc. | | | 2,246,095 | | | | 68,461 | |

| | | | | | | | | | 53,246,124 | |

500 Index Fund

| | | | | | | | Market | |

| | | | | | | | Value• | |

| | | | | Shares | | | ($000) | |

| Health Care (15.5%) | | | | | | | | |

| | | Johnson & Johnson | | | 50,821,665 | | | | 6,558,536 | |

| | | Pfizer Inc. | | | 109,536,080 | | | | 4,781,250 | |

| | | UnitedHealth Group Inc. | | | 18,229,528 | | | | 4,541,340 | |

| | | Merck & Co. Inc. | | | 49,275,377 | | | | 3,765,132 | |

| | | AbbVie Inc. | | | 28,503,743 | | | | 2,627,760 | |

| | | Abbott Laboratories | | | 33,280,869 | | | | 2,407,205 | |

| | | Amgen Inc. | | | 12,074,725 | | | | 2,350,587 | |

| | | Medtronic plc | | | 25,449,683 | | | | 2,314,903 | |

| | | Eli Lilly & Co. | | | 17,865,346 | | | | 2,067,378 | |

| | | Thermo Fisher Scientific Inc. | | | 7,628,314 | | | | 1,707,140 | |

| | | Bristol-Myers Squibb Co. | | | 30,929,173 | | | | 1,607,698 | |

| | | CVS Health Corp. | | | 24,504,922 | | | | 1,605,563 | |

| | | Gilead Sciences Inc. | | | 24,513,109 | | | | 1,533,295 | |

| * | | Cigna Corp. | | | 7,215,333 | | | | 1,370,336 | |

| | | Anthem Inc. | | | 4,901,034 | | | | 1,287,159 | |

| | | Danaher Corp. | | | 11,687,843 | | | | 1,205,250 | |

| * | | Biogen Inc. | | | 3,817,943 | | | | 1,148,895 | |

| | | Becton Dickinson and Co. | | | 5,083,179 | | | | 1,145,342 | |

| * | | Intuitive Surgical Inc. | | | 2,163,912 | | | | 1,036,341 | |

| * | | Boston Scientific Corp. | | | 26,221,568 | | | | 926,670 | |

| | | Stryker Corp. | | | 5,885,193 | | | | 922,504 | |

| * | | Celgene Corp. | | | 13,250,106 | | | | 849,199 | |

| * | | Illumina Inc. | | | 2,785,485 | | | | 835,451 | |

| | | Allergan plc | | | 6,007,860 | | | | 803,011 | |

| * | | Vertex Pharmaceuticals Inc. | | | 4,842,540 | | | | 802,457 | |

| | | Zoetis Inc. | | | 9,104,263 | | | | 778,779 | |

| | | Humana Inc. | | | 2,599,549 | | | | 744,719 | |

| | | HCA Healthcare Inc. | | | 5,086,636 | | | | 633,032 | |

| | | Baxter International Inc. | | | 9,376,999 | | | | 617,194 | |

| * | | Edwards Lifesciences Corp. | | | 3,960,971 | | | | 606,702 | |

| * | | Regeneron Pharmaceuticals Inc. | | | 1,470,635 | | | | 549,282 | |

| * | | Centene Corp. | | | 3,890,524 | | | | 448,577 | |

| * | | Alexion Pharmaceuticals Inc. | | | 4,227,397 | | | | 411,579 | |

| | | McKesson Corp. | | | 3,702,524 | | | | 409,018 | |

| | | Agilent Technologies Inc. | | | 6,040,189 | | | | 407,471 | |

| | | Zimmer Biomet Holdings Inc. | | | 3,865,297 | | | | 400,909 | |

| * | | IQVIA Holdings Inc. | | | 3,003,029 | | | | 348,862 | |

| * | | Cerner Corp. | | | 6,244,996 | | | | 327,488 | |

| | | ResMed Inc. | | | 2,701,120 | | | | 307,577 | |

| * | | IDEXX Laboratories Inc. | | | 1,634,335 | | | | 304,019 | |

| * | | Align Technology Inc. | | | 1,379,864 | | | | 288,985 | |

| * | | ABIOMED Inc. | | | 853,164 | | | | 277,312 | |

| * | | Waters Corp. | | | 1,435,813 | | | | 270,866 | |

| * | | Mettler-Toledo International Inc. | | | 474,782 | | | | 268,527 | |

| * | | Mylan NV | | | 9,774,432 | | | | 267,819 | |

| | | Cardinal Health Inc. | | | 5,677,589 | | | | 253,220 | |

| * | | Laboratory Corp. of America Holdings | | | 1,912,714 | | | | 241,691 | |

| | | Cooper Cos. Inc. | | | 930,756 | | | | 236,877 | |

| * | | Henry Schein Inc. | | | 2,888,455 | | | | 226,802 | |

| * | | WellCare Health Plans Inc. | | | 947,736 | | | | 223,751 | |

| | | AmerisourceBergen Corp. Class A | | | 2,973,622 | | | | 221,237 | |

| | | Quest Diagnostics Inc. | | | 2,578,393 | | | | 214,703 | |

| * | | Incyte Corp. | | | 3,349,492 | | | | 212,994 | |

| * | | Hologic Inc. | | | 5,108,414 | | | | 209,956 | |

| * | | Varian Medical Systems Inc. | | | 1,727,880 | | | | 195,786 | |

| | | Universal Health Services Inc. Class B | | | 1,614,389 | | | | 188,173 | |

| | | PerkinElmer Inc. | | | 2,106,588 | | | | 165,473 | |

| | | Dentsply Sirona Inc. | | | 4,213,865 | | | | 156,798 | |

| * | | DaVita Inc. | | | 2,390,362 | | | | 123,008 | |

| * | | Nektar Therapeutics Class A | | | 3,277,605 | | | | 107,735 | |

| | | Perrigo Co. plc | | | 2,366,820 | | | | 91,714 | |

| | | | | | | | | | 61,939,037 | |

| Industrials (9.1%) | | | | | | | | |

| | | Boeing Co. | | | 10,007,835 | | | | 3,227,527 | |

| | | 3M Co. | | | 11,034,372 | | | | 2,102,489 | |

| | | Union Pacific Corp. | | | 13,961,870 | | | | 1,929,949 | |

| | | Honeywell International Inc. | | | 14,029,386 | | | | 1,853,562 | |

| | | United Technologies Corp. | | | 15,379,543 | | | | 1,637,614 | |

| | | Caterpillar Inc. | | | 11,182,475 | | | | 1,420,957 | |

| | | United Parcel Service Inc. Class B | | | 13,174,028 | | | | 1,284,863 | |

| | | General Electric Co. | | | 164,825,076 | | | | 1,247,726 | |

| | | Lockheed Martin Corp. | | | 4,689,184 | | | | 1,227,816 | |

| | | CSX Corp. | | | 15,201,433 | | | | 944,465 | |

| | | Deere & Co. | | | 6,095,837 | | | | 909,316 | |

| | | General Dynamics Corp. | | | 5,275,452 | | | | 829,354 | |

| | | Raytheon Co. | | | 5,392,938 | | | | 827,007 | |

| | | Northrop Grumman Corp. | | | 3,290,114 | | | | 805,749 | |

| * | | Norfolk Southern Corp. | | | 5,160,816 | | | | 771,748 | |

| | | FedEx Corp. | | | 4,593,930 | | | | 741,139 | |

| | | Illinois Tool Works Inc. | | | 5,784,654 | | | | 732,858 | |

| | | Emerson Electric Co. | | | 11,865,621 | | | | 708,971 | |

| | | Waste Management Inc. | | | 7,432,697 | | | | 661,436 | |

| | | Delta Air Lines Inc. | | | 11,820,974 | | | | 589,867 | |

| | | Eaton Corp. plc | | | 8,212,033 | | | | 563,838 | |

| | | Roper Technologies Inc. | | | 1,959,866 | | | | 522,343 | |

| | | Johnson Controls International plc | | | 17,508,466 | | | | 519,126 | |

500 Index Fund

| | | | | | | | Market | |

| | | | | | | | Value• | |

| | | | | Shares | | | ($000) | |

| | | Southwest Airlines Co. | | | 9,589,879 | | | | 445,738 | |

| | | Ingersoll-Rand plc | | | 4,655,268 | | | | 424,700 | |

| | | PACCAR Inc. | | | 6,622,700 | | | | 378,421 | |

| | | Fortive Corp. | | | 5,569,982 | | | | 376,865 | |

| | | Cummins Inc. | | | 2,799,683 | | | | 374,150 | |

| | | Parker-Hannifin Corp. | | | 2,508,279 | | | | 374,085 | |

| * | | United Continental Holdings Inc. | | | 4,337,723 | | | | 363,197 | |

| | | Rockwell Automation Inc. | | | 2,287,291 | | | | 344,191 | |

| | | Stanley Black & Decker Inc. | | | 2,863,251 | | | | 342,846 | |

| * | | Verisk Analytics Inc. Class A | | | 3,120,120 | | | | 340,218 | |

| * | | IHS Markit Ltd. | | | 6,799,803 | | | | 326,187 | |

| * | | TransDigm Group Inc. | | | 919,951 | | | | 312,838 | |

| | | Harris Corp. | | | 2,230,372 | | | | 300,320 | |

| | | AMETEK Inc. | | | 4,400,303 | | | | 297,900 | |

| | | Republic Services Inc. Class A | | | 4,122,571 | | | | 297,196 | |

| | | Fastenal Co. | | | 5,441,724 | | | | 284,548 | |

| | | Cintas Corp. | | | 1,641,194 | | | | 275,704 | |

| | | L3 Technologies Inc. | | | 1,490,454 | | | | 258,832 | |

| | | American Airlines Group Inc. | | | 7,771,217 | | | | 249,534 | |

| | | WW Grainger Inc. | | | 864,058 | | | | 243,975 | |

| | | Xylem Inc. | | | 3,403,098 | | | | 227,055 | |

| | | Expeditors International of Washington Inc. | | | 3,268,322 | | | | 222,540 | |

| | | CH Robinson Worldwide Inc. | | | 2,607,146 | | | | 219,235 | |

| | | Equifax Inc. | | | 2,283,180 | | | | 212,633 | |

| | | Textron Inc. | | | 4,600,891 | | | | 211,595 | |

| | | Dover Corp. | | | 2,770,941 | | | | 196,598 | |

| * | | Copart Inc. | | | 3,899,580 | | | | 186,322 | |

| | | Kansas City Southern | | | 1,927,991 | | | | 184,027 | |

| | | Masco Corp. | | | 5,794,433 | | | | 169,429 | |

| * | | United Rentals Inc. | | | 1,535,743 | | | | 157,460 | |

| | | Nielsen Holdings plc | | | 6,730,531 | | | | 157,023 | |

| | | Huntington Ingalls Industries Inc. | | | 813,229 | | | | 154,766 | |

| | | JB Hunt Transport Services Inc. | | | 1,653,872 | | | | 153,876 | |

| | | Snap-on Inc. | | | 1,054,445 | | | | 153,200 | |

| | | Allegion plc | | | 1,799,903 | | | | 143,470 | |

| | | Alaska Air Group Inc. | | | 2,334,344 | | | | 142,045 | |

| | | Arconic Inc. | | | 8,144,268 | | | | 137,312 | |

| | | Jacobs Engineering Group Inc. | | | 2,263,670 | | | | 132,334 | |

| | | Robert Half International Inc. | | | 2,300,450 | | | | 131,586 | |

| | | AO Smith Corp. | | | 2,724,690 | | | | 116,344 | |

| | | Pentair plc | | | 3,024,175 | | | | 114,253 | |

| | | Fortune Brands Home & Security Inc. | | | 2,679,909 | | | | 101,810 | |

| | | Rollins Inc. | | | 2,789,287 | | | | 100,693 | |

| | | Flowserve Corp. | | | 2,477,712 | | | | 94,203 | |

| | | Fluor Corp. | | | 2,663,869 | | | | 85,777 | |

| | | Quanta Services Inc. | | | 2,765,158 | | | | 83,231 | |

| | | | | | | | | | 36,659,982 | |

| Information Technology (20.0%) | | | | | | | | |

| | | Microsoft Corp. | | | 146,457,745 | | | | 14,875,713 | |

| | | Apple Inc. | | | 85,426,039 | | | | 13,475,103 | |

| | | Visa Inc. Class A | | | 33,298,615 | | | | 4,393,419 | |

| | | Intel Corp. | | | 86,484,577 | | | | 4,058,721 | |

| | | Cisco Systems Inc. | | | 85,196,774 | | | | 3,691,576 | |

| | | Mastercard Inc. Class A | | | 17,217,931 | | | | 3,248,163 | |

| | | Oracle Corp. | | | 48,295,933 | | | | 2,180,561 | |

| * | | Adobe Inc. | | | 9,249,785 | | | | 2,092,671 | |

| | | Broadcom Inc. | | | 7,834,481 | | | | 1,992,152 | |

| * | | salesforce.com Inc. | | | 14,496,209 | | | | 1,985,546 | |

| | | International Business Machines Corp. | | | 17,221,251 | | | | 1,957,540 | |

| * | | PayPal Holdings Inc. | | | 22,329,121 | | | | 1,877,656 | |

| | | Texas Instruments Inc. | | | 18,201,450 | | | | 1,720,037 | |

| | | Accenture plc Class A | | | 12,079,529 | | | | 1,703,334 | |

| | | NVIDIA Corp. | | | 11,558,944 | | | | 1,543,119 | |

| | | QUALCOMM Inc. | | | 22,969,654 | | | | 1,307,203 | |

| | | Automatic Data Processing Inc. | | | 8,295,138 | | | | 1,087,659 | |

| | | Intuit Inc. | | | 4,918,157 | | | | 968,139 | |

| | | Cognizant Technology Solutions Corp. Class A | | | 10,972,201 | | | | 696,515 | |

| * | | Micron Technology Inc. | | | 21,224,841 | | | | 673,464 | |

| | | Fidelity National Information Services Inc. | | | 6,205,227 | | | | 636,346 | |

| | | HP Inc. | | | 29,986,763 | | | | 613,529 | |

| | | Applied Materials Inc. | | | 18,626,443 | | | | 609,830 | |

| | | Analog Devices Inc. | | | 7,013,798 | | | | 601,994 | |

| * | | Red Hat Inc. | | | 3,349,145 | | | | 588,244 | |

| * | | Fiserv Inc. | | | 7,549,671 | | | | 554,825 | |

| * | | Autodesk Inc. | | | 4,149,645 | | | | 533,686 | |

| | | TE Connectivity Ltd. | | | 6,499,545 | | | | 491,561 | |

| | | Amphenol Corp. Class A | | | 5,709,714 | | | | 462,601 | |

| | | Corning Inc. | | | 15,163,861 | | | | 458,100 | |

| | | Xilinx Inc. | | | 4,794,978 | | | | 408,388 | |

| | | Lam Research Corp. | | | 2,941,010 | | | | 400,477 | |

| | | Paychex Inc. | | | 6,056,502 | | | | 394,581 | |

| | | Motorola Solutions Inc. | | | 3,099,001 | | | | 356,509 | |

| | | Hewlett Packard Enterprise Co. | | | 26,970,197 | | | | 356,276 | |

| ^ | | Microchip Technology Inc. | | | 4,482,459 | | | | 322,378 | |

| * | | FleetCor Technologies Inc. | | | 1,680,859 | | | | 312,169 | |

| | | Global Payments Inc. | | | 2,999,038 | | | | 309,291 | |

500 Index Fund

| | | | | | | | Market | |

| | | | | | | | Value• | |

| | | | | Shares | | | ($000) | |

| * | | Advanced Micro Devices Inc. | | | 16,670,013 | | | | 307,728 | |

| * | | VeriSign Inc. | | | 2,016,603 | | | | 299,042 | |

| | | NetApp Inc. | | | 4,774,759 | | | | 284,910 | |

| | | DXC Technology Co. | | | 5,310,304 | | | | 282,349 | |

| | | Maxim Integrated Products Inc. | | | 5,252,079 | | | | 267,068 | |

| | | KLA-Tencor Corp. | | | 2,901,944 | | | | 259,695 | |

| | | Total System Services Inc. | | | 3,182,092 | | | | 258,672 | |

| | | Citrix Systems Inc. | | | 2,424,338 | | | | 248,398 | |

| * | | Synopsys Inc. | | | 2,829,838 | | | | 238,386 | |

| * | | Cadence Design Systems Inc. | | | 5,342,623 | | | | 232,297 | |

| | | Symantec Corp. | | | 12,113,840 | | | | 228,891 | |

| * | | ANSYS Inc. | | | 1,584,294 | | | | 226,459 | |

| | | Skyworks Solutions Inc. | | | 3,361,865 | | | | 225,312 | |

| * | | Keysight Technologies Inc. | | | 3,554,085 | | | | 220,638 | |

| * | | Gartner Inc. | | | 1,721,042 | | | | 220,018 | |

| | | Broadridge Financial Solutions Inc. | | | 2,210,669 | | | | 212,777 | |

| * | | Arista Networks Inc. | | | 985,571 | | | | 207,660 | |

| | | Western Digital Corp. | | | 5,480,405 | | | | 202,611 | |

| * | | Fortinet Inc. | | | 2,741,908 | | | | 193,113 | |

| | | Seagate Technology plc | | | 4,931,844 | | | | 190,320 | |

| * | | Akamai Technologies Inc. | | | 3,084,398 | | | | 188,395 | |

| * | | F5 Networks Inc. | | | 1,149,705 | | | | 186,287 | |

| | | Jack Henry & Associates Inc. | | | 1,463,743 | | | | 185,193 | |

| | | Juniper Networks Inc. | | | 6,535,701 | | | | 175,876 | |

| * | | Qorvo Inc. | | | 2,367,308 | | | | 143,767 | |

| | | Western Union Co. | | | 8,385,006 | | | | 143,048 | |

| | | Alliance Data Systems Corp. | | | 887,010 | | | | 133,123 | |

| | | FLIR Systems Inc. | | | 2,619,317 | | | | 114,045 | |

| | | Xerox Corp. | | | 3,924,937 | | | | 77,557 | |

| * | | IPG Photonics Corp. | | | 678,622 | | | | 76,881 | |

| | | | | | | | | | 80,169,592 | |

| Materials (2.7%) | | | | | | | | |

| | | DowDuPont Inc. | | | 43,477,540 | | | | 2,325,179 | |

| | | Linde plc | | | 10,442,646 | | | | 1,629,471 | |

| | | Ecolab Inc. | | | 4,816,379 | | | | 709,693 | |

| | | Air Products & Chemicals Inc. | | | 4,159,378 | | | | 665,708 | |

| | | Sherwin-Williams Co. | | | 1,561,239 | | | | 614,285 | |

| | | LyondellBasell Industries NV Class A | | | 5,961,019 | | | | 495,718 | |

| | | PPG Industries Inc. | | | 4,545,880 | | | | 464,725 | |

| | | Newmont Mining Corp. | | | 10,095,418 | | | | 349,806 | |

| | | International Paper Co. | | | 7,677,192 | | | | 309,851 | |

| | | Nucor Corp. | | | 5,950,270 | | | | 308,284 | |

| | | Ball Corp. | | | 6,429,896 | | | | 295,647 | |

| | | Freeport-McMoRan Inc. | | | 27,445,469 | | | | 282,963 | |

| | | International Flavors & Fragrances Inc. | | | 1,920,170 | | | | 257,821 | |

| | | Vulcan Materials Co. | | | 2,500,645 | | | | 247,064 | |

| | | Celanese Corp. Class A | | | 2,533,833 | | | | 227,969 | |

| | | Martin Marietta Materials Inc. | | | 1,188,887 | | | | 204,334 | |

| | | Mosaic Co. | | | 6,725,352 | | | | 196,448 | |

| | | Eastman Chemical Co. | | | 2,651,826 | | | | 193,875 | |

| | | CF Industries Holdings Inc. | | | 4,370,049 | | | | 190,141 | |

| | | FMC Corp. | | | 2,549,777 | | | | 188,582 | |

| | | Westrock Co. | | | 4,808,191 | | | | 181,557 | |

| ^ | | Albemarle Corp. | | | 2,011,100 | | | | 154,995 | |

| | | Packaging Corp. of America | | | 1,789,333 | | | | 149,338 | |

| | | Avery Dennison Corp. | | | 1,641,842 | | | | 147,487 | |

| | | Sealed Air Corp. | | | 2,971,537 | | | | 103,528 | |

| | | | | | | | | | 10,894,469 | |

| Real Estate (2.9%) | | | | | | | | |

| | | American Tower Corp. | | | 8,346,720 | | | | 1,320,368 | |

| | | Simon Property Group Inc. | | | 5,860,830 | | | | 984,561 | |

| | | Crown Castle International Corp. | | | 7,860,938 | | | | 853,934 | |

| | | Prologis Inc. | | | 11,928,876 | | | | 700,464 | |

| | | Public Storage | | | 2,841,332 | | | | 575,114 | |

| | | Equinix Inc. | | | 1,523,189 | | | | 537,015 | |

| | | Welltower Inc. | | | 7,117,481 | | | | 494,024 | |

| | | Equity Residential | | | 6,981,353 | | | | 460,839 | |

| | | AvalonBay Communities Inc. | | | 2,619,136 | | | | 455,861 | |

| | | Digital Realty Trust Inc. | | | 3,909,234 | | | | 416,529 | |

| | | Ventas Inc. | | | 6,755,246 | | | | 395,790 | |

| | | Realty Income Corp. | | | 5,593,015 | | | | 352,584 | |

| * | | SBA Communications Corp. Class A | | | 2,147,687 | | | | 347,689 | |

| | | Boston Properties Inc. | | | 2,927,318 | | | | 329,470 | |

| | | Weyerhaeuser Co. | | | 14,201,202 | | | | 310,438 | |

| | | Essex Property Trust Inc. | | | 1,252,251 | | | | 307,064 | |

| | | HCP Inc. | | | 9,052,416 | | | | 252,834 | |

| * | | CBRE Group Inc. Class A | | | 6,010,257 | | | | 240,651 | |

| | | Alexandria Real Estate Equities Inc. | | | 2,038,952 | | | | 234,969 | |

| | | Host Hotels & Resorts Inc. | | | 14,069,715 | | | | 234,542 | |

| | | Extra Space Storage Inc. | | | 2,398,782 | | | | 217,042 | |

| | | UDR Inc. | | | 5,225,309 | | | | 207,027 | |

| | | Mid-America Apartment Communities Inc. | | | 2,155,657 | | | | 206,296 | |

| | | Vornado Realty Trust | | | 3,284,004 | | | | 203,707 | |

| | | Regency Centers Corp. | | | 3,208,714 | | | | 188,287 | |

500 Index Fund

| | | | | | | | Market | |

| | | | | | | | Value• | |

| | | | | Shares | | | ($000) | |

| | | Duke Realty Corp. | | | 6,784,916 | | | | 175,729 | |

| | | Iron Mountain Inc. | | | 5,419,867 | | | | 175,658 | |

| | | Federal Realty Investment Trust | | | 1,398,701 | | | | 165,103 | |

| | | Apartment Investment & Management Co. | | | 2,947,391 | | | | 129,331 | |

| | | SL Green Realty Corp. | | | 1,614,840 | | | | 127,701 | |

| | | Kimco Realty Corp. | | | 7,979,347 | | | | 116,897 | |

| | | Macerich Co. | | | 2,003,046 | | | | 86,692 | |

| | | | | | | | | | 11,804,210 | |

| Utilities (3.3%) | | | | | | | | |

| | | NextEra Energy Inc. | | | 9,055,989 | | | | 1,574,112 | |

| | | Duke Energy Corp. | | | 13,507,473 | | | | 1,165,695 | |

| | | Dominion Energy Inc. | | | 12,436,218 | | | | 888,692 | |

| | | Southern Co. | | | 19,495,839 | | | | 856,257 | |

| | | Exelon Corp. | | | 18,322,197 | | | | 826,331 | |

| | | American Electric Power Co. Inc. | | | 9,342,694 | | | | 698,273 | |

| | | Sempra Energy | | | 5,185,085 | | | | 560,974 | |

| | | Public Service Enterprise Group Inc. | | | 9,577,021 | | | | 498,484 | |

| | | Xcel Energy Inc. | | | 9,738,524 | | | | 479,817 | |

| | | Consolidated Edison Inc. | | | 5,901,631 | | | | 451,239 | |

| | | WEC Energy Group Inc. | | | 5,979,680 | | | | 414,153 | |

| | | Eversource Energy | | | 6,005,874 | | | | 390,622 | |

| | | PPL Corp. | | | 13,646,719 | | | | 386,612 | |

| | | DTE Energy Co. | | | 3,447,503 | | | | 380,260 | |

| | | Edison International | | | 6,174,898 | | | | 350,549 | |

| | | FirstEnergy Corp. | | | 9,208,603 | | | | 345,783 | |

| | | American Water Works Co. Inc. | | | 3,423,377 | | | | 310,740 | |

| | | Ameren Corp. | | | 4,630,479 | | | | 302,046 | |

| | | Entergy Corp. | | | 3,433,879 | | | | 295,554 | |

| | | Evergy Inc. | | | 4,994,125 | | | | 283,516 | |

| | | CenterPoint Energy Inc. | | | 9,500,860 | | | | 268,209 | |

| | | CMS Energy Corp. | | | 5,371,303 | | | | 266,685 | |

| * | | PG&E Corp. | | | 9,833,830 | | | | 233,553 | |

| | | NRG Energy Inc. | | | 5,490,331 | | | | 217,417 | |

| * | | Alliant Energy Corp. | | | 4,474,811 | | | | 189,061 | |

| | | AES Corp. | | | 12,540,941 | | | | 181,342 | |

| | | Pinnacle West Capital Corp. | | | 2,125,498 | | | | 181,092 | |

| | | NiSource Inc. | | | 6,879,203 | | | | 174,388 | |

| | | SCANA Corp. | | | 2,706,750 | | | | 129,329 | |

| | | | | | | | | | 13,300,785 | |

Total Common Stocks (Cost $290,571,598) | | | | | | | 398,664,480 | |

| Temporary Cash Investments (0.5%)1 | | | | | | | | |

| Money Market Fund (0.5%) | | | | | | | | |

| 2,3 | | Vanguard Market Liquidity Fund, 2.530% | | | 21,319,887 | | | | 2,131,989 | |

| | | | | Face | | | Market | |

| | | | | Amount | | | Value• | |

| | | | | ($000) | | | ($000) | |

| U.S. Government and Agency Obligations (0.0%) | | | | | | | | |

| | | United States Treasury Bill, 2.280%, 2/7/19 | | | 10,000 | | | | 9,976 | |

| 4 | | United States Treasury Bill, 2.314%, 2/28/19 | | | 32,000 | | | | 31,880 | |

| 4 | | United States Treasury Bill, 2.365%, 3/21/19 | | | 20,000 | | | | 19,900 | |

| 4 | | United States Treasury Bill, 2.474%, 5/9/19 | | | 28,000 | | | | 27,762 | |

| 4 | | United States Treasury Bill, 2.497%, 5/23/19 | | | 8,000 | | | | 7,924 | |

| | | | | | | | | | 97,442 | |

Total Temporary Cash Investments (Cost $2,229,269) | | | | | | | 2,229,431 | |

Total Investments (100.0%) (Cost $292,800,867) | | | | | | | 400,893,911 | |

| | | Amount | |

| | | ($000) | |

| Other Assets and Liabilities (0.0%) | | | | |

| Other Assets | | | | |

| Investment in Vanguard | | | 23,100 | |

| Receivables for Investment Securities Sold | | | 297,942 | |

| Receivables for Accrued Income | | | 467,536 | |

| Receivables for Capital Shares Issued | | | 796,468 | |

| Variation Margin Receivable—Futures Contracts | | | 14,508 | |

| Other Assets | | | 986 | |

| Total Other Assets | | | 1,600,540 | |

| Liabilities | | | | |

| Payables for Investment Securities Purchased | | | (444,886 | ) |

| Collateral for Securities on Loan | | | (540,005 | ) |

| Payables for Capital Shares Redeemed | | | (688,890 | ) |

| Payables to Vanguard | | | (113,321 | ) |

| Total Liabilities | | | (1,787,102 | ) |

| Net Assets (100%) | | | 400,707,349 | |

500 Index Fund

At December 31, 2018, net assets consisted of:

| | | Amount | |

| | | ($000) | |

| Paid-in Capital | | | 293,056,767 | |

| Total Distributable Earnings (Loss) | | | 107,650,582 | |

| Net Assets | | | 400,707,349 | |

| | | | | |

| Investor Shares—Net Assets | | | | |

| Applicable to 100,077,825 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | | | 23,161,935 | |

| Net Asset Value Per Share—Investor Shares | | | $231.44 | |

| | | | | |

| ETF Shares—Net Assets | | | | |

| Applicable to 394,632,889 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | | | 90,639,290 | |

| Net Asset Value Per Share—ETF Shares | | | $229.68 | |

| | | | |

| Admiral Shares—Net Assets | | | | |

| Applicable to 995,408,131 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | | | 230,375,373 | |

| Net Asset Value Per Share—Admiral Shares | | | $231.44 | |

| | | | | |

| Institutional Select Shares—Net Assets | | | | |

| Applicable to 460,963,079 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | | | 56,530,751 | |

| Net Asset Value Per Share—Institutional Select Shares | | | $122.64 | |

| · | See Note A in Notes to Financial Statements. |

| * | Non-income-producing security. |

| ^ | Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $519,980,000. |

| 1 | The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 0.0%, respectively, of net assets. |

| 2 | Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield. |

| 3 | Includes $540,005,000 of collateral received for securities on loan. |

| 4 | Securities with a value of $87,366,000 have been segregated as initial margin for open futures contracts. |

| Derivative Financial Instruments Outstanding as of Period End |

| Futures Contracts | | | | | | | | | | | |

| | | | | | | | | | | ($000) | |

| | | | | | | | | | | Value and | |

| | | | | Number of | | | | | | Unrealized | |

| | | | | Long (Short) | | | Notional | | | Appreciation | |

| | | Expiration | | Contracts | | | Amount | | | (Depreciation) | |

| Long Futures Contracts | | | | | | | | | | | | | | |

| E-mini S&P 500 Index | | March 2019 | | | 16,570 | | | | 2,075,558 | | | | (64,847 | ) |

See accompanying Notes, which are an integral part of the Financial Statements.

500 Index Fund

Statement of Operations

| | | Year Ended | |

| | | December 31, 2018 | |

| | | ($000) | |

| Investment Income | | | | |

| Income | | | | |

| Dividends | | | 8,795,154 | |

| Interest1 | | | 31,767 | |

| Securities Lending—Net | | | 3,598 | |

| Total Income | | | 8,830,519 | |

| Expenses | | | | |

| The Vanguard Group—Note B | | | | |

| Investment Advisory Services | | | 15,468 | |

| Management and Administrative—Investor Shares | | | 32,487 | |

| Management and Administrative—ETF Shares | | | 19,222 | |

| Management and Administrative—Admiral Shares | | | 73,345 | |

| Management and Administrative—Institutional Select Shares | | | 3,138 | |

| Marketing and Distribution—Investor Shares | | | 4,019 | |

| Marketing and Distribution—ETF Shares | | | 4,647 | |

| Marketing and Distribution—Admiral Shares | | | 13,909 | |

| Marketing and Distribution—Institutional Select Shares | | | 2 | |

| Custodian Fees | | | 2,346 | |

| Auditing Fees | | | 48 | |

| Shareholders’ Reports—Investor Shares | | | 373 | |

| Shareholders’ Reports—ETF Shares | | | 782 | |

| Shareholders’ Reports—Admiral Shares | | | 1,220 | |

| Shareholders’ Reports—Institutional Select Shares | | | 14 | |

| Trustees’ Fees and Expenses | | | 275 | |

| Total Expenses | | | 171,295 | |

| Net Investment Income | | | 8,659,224 | |

| Realized Net Gain (Loss) | | | | |

| Investment Securities Sold1,2 | | | 14,389,018 | |

| Futures Contracts | | | (85,932 | ) |

| Realized Net Gain (Loss) | | | 14,303,086 | |

| Change in Unrealized Appreciation (Depreciation) | | | | |

| Investment Securities1 | | | (43,303,022 | ) |

| Futures Contracts | | | (75,009 | ) |

| Change in Unrealized Appreciation (Depreciation) | | | (43,378,031 | ) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | (20,415,721 | ) |

| 1 | Interest income, realized net gain (loss), and change in unrealized appreciation (depreciation) from an affiliated company of the fund were $30,057,000, ($358,000), and $33,000, respectively. Purchases and sales are for temporary cash investment purposes. |

| 2 | Includes $14,063,188,000 of net gain (loss) resulting from in-kind redemptions; such gain (loss) is not taxable to the fund. |

See accompanying Notes, which are an integral part of the Financial Statements.

500 Index Fund

Statement of Changes in Net Assets

| | | Year Ended December 31, | |

| | | 2018 | | | 2017 | |

| | | ($000) | | | ($000) | |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net Investment Income | | | 8,659,224 | | | | 6,543,479 | |

| Realized Net Gain (Loss) | | | 14,303,086 | | | | 6,306,381 | |

| Change in Unrealized Appreciation (Depreciation) | | | (43,378,031 | ) | | | 52,957,229 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | (20,415,721 | ) | | | 65,807,089 | |

| Distributions | | | | | | | | |

| Net Investment Income | | | | | | | | |

| Investor Shares | | | (474,872 | ) | | | (502,714 | ) |

| ETF Shares | | | (1,812,323 | ) | | | (1,392,614 | ) |

| Admiral Shares | | | (4,653,557 | ) | | | (4,061,760 | ) |

| Institutional Select Shares | | | (1,066,831 | ) | | | (593,341 | ) |

| Realized Capital Gain | | | | | | | | |

| Investor Shares | | | — | | | | — | |

| ETF Shares | | | — | | | | — | |

| Admiral Shares | | | — | | | | — | |

| Institutional Select Shares | | | — | | | | — | |

| Total Distributions | | | (8,007,583 | ) | | | (6,550,429 | ) |

| Capital Share Transactions | | | | | | | | |

| Investor Shares | | | (3,019,824 | ) | | | (3,875,867 | ) |

| ETF Shares | | | 14,094,239 | | | | 14,595,756 | |

| Admiral Shares | | | 10,715,967 | | | | 16,802,846 | |

| Institutional Select Shares | | | 15,905,665 | | | | 22,089,206 | |

| Net Increase (Decrease) from Capital Share Transactions | | | 37,696,047 | | | | 49,611,941 | |

| Total Increase (Decrease) | | | 9,272,743 | | | | 108,868,601 | |

| Net Assets | | | | | | | | |

| Beginning of Period | | | 391,434,606 | | | | 282,566,005 | |

| End of Period | | | 400,707,349 | | | | 391,434,606 | |

See accompanying Notes, which are an integral part of the Financial Statements.

500 Index Fund

Financial Highlights

Investor Shares

| For a Share Outstanding | | Year Ended December 31, | |

| Throughout Each Period | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Net Asset Value, Beginning of Period | | | $246.82 | | | | $206.57 | | | | $188.48 | | | | $189.89 | | | | $170.36 | |

| Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income | | | 4.896 | 1 | | | 4.221 | 1 | | | 3.997 | | | | 3.775 | | | | 3.326 | |

| Net Realized and Unrealized Gain (Loss) on Investments | | | (15.776 | ) | | | 40.205 | | | | 18.069 | | | | (1.438 | ) | | | 19.507 | |

| Total from Investment Operations | | | (10.880 | ) | | | 44.426 | | | | 22.066 | | | | 2.337 | | | | 22.833 | |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| Dividends from Net Investment Income | | | (4.500 | ) | | | (4.176 | ) | | | (3.976 | ) | | | (3.747 | ) | | | (3.303 | ) |

| Distributions from Realized Capital Gains | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total Distributions | | | (4.500 | ) | | | (4.176 | ) | | | (3.976 | ) | | | (3.747 | ) | | | (3.303 | ) |

| Net Asset Value, End of Period | | | $231.44 | | | | $246.82 | | | | $206.57 | | | | $188.48 | | | | $189.89 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return2 | | | -4.52% | | | | 21.67% | | | | 11.82% | | | | 1.25% | | | | 13.51% | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net Assets, End of Period (Millions) | | | $23,162 | | | | $27,656 | | | | $26,652 | | | | $26,092 | | | | $28,040 | |

| Ratio of Total Expenses to Average Net Assets | | | 0.14% | | | | 0.14% | | | | 0.14% | | | | 0.16% | | | | 0.17% | |

| Ratio of Net Investment Income to Average Net Assets | | | 1.95% | | | | 1.87% | | | | 2.05% | | | | 2.00% | | | | 1.88% | |

| Portfolio Turnover Rate3 | | | 4% | | | | 3% | | | | 4% | | | | 3% | | | | 3% | |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

See accompanying Notes, which are an integral part of the Financial Statements.

500 Index Fund

Financial Highlights

ETF Shares

| For a Share Outstanding | | Year Ended December 31, | |

| Throughout Each Period | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Net Asset Value, Beginning of Period | | | $244.94 | | | | $205.00 | | | | $187.05 | | | | $188.45 | | | | $169.07 | |

| Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income | | | 5.196 | 1 | | | 4.434 | 1 | | | 4.155 | | | | 3.958 | | | | 3.518 | |

| Net Realized and Unrealized Gain (Loss) on Investments | | | (15.719 | ) | | | 39.874 | | | | 17.933 | | | | (1.427 | ) | | | 19.352 | |

| Total from Investment Operations | | | (10.523 | ) | | | 44.308 | | | | 22.088 | | | | 2.531 | | | | 22.870 | |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| Dividends from Net Investment Income | | | (4.737 | ) | | | (4.368 | ) | | | (4.138 | ) | | | (3.931 | ) | | | (3.490 | ) |

| Distributions from Realized Capital Gains | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total Distributions | | | (4.737 | ) | | | (4.368 | ) | | | (4.138 | ) | | | (3.931 | ) | | | (3.490 | ) |

| Net Asset Value, End of Period | | | $229.68 | | | | $244.94 | | | | $205.00 | | | | $187.05 | | | | $188.45 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | -4.42% | | | | 21.78% | | | | 11.93% | | | | 1.35% | | | | 13.63% | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net Assets, End of Period (Millions) | | | $90,639 | | | | $83,640 | | | | $56,648 | | | | $40,440 | | | | $27,630 | |

| Ratio of Total Expenses to Average Net Assets | | | 0.03% | | | | 0.04% | | | | 0.04% | | | | 0.05% | | | | 0.05% | |

| Ratio of Net Investment Income to Average Net Assets | | | 2.06% | | | | 1.97% | | | | 2.15% | | | | 2.11% | | | | 2.00% | |

| Portfolio Turnover Rate2 | | | 4% | | | | 3% | | | | 4% | | | | 3% | | | | 3% | |

| 1 | Calculated based on average shares outstanding. |

| 2 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

See accompanying Notes, which are an integral part of the Financial Statements.

500 Index Fund

Financial Highlights

Admiral Shares

| For a Share Outstanding | | Year Ended December 31, | |

| Throughout Each Period | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Net Asset Value, Beginning of Period | | | $246.82 | | | | $206.57 | | | | $188.48 | | | | $189.89 | | | | $170.36 | |

| Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income | | | 5.181 | 1 | | | 4.458 | 1 | | | 4.185 | | | | 3.990 | | | | 3.544 | |

| Net Realized and Unrealized Gain (Loss) on Investments | | | (15.808 | ) | | | 40.193 | | | | 18.074 | | | | (1.439 | ) | | | 19.503 | |

| Total from Investment Operations | | | (10.627 | ) | | | 44.651 | | | | 22.259 | | | | 2.551 | | | | 23.047 | |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| Dividends from Net Investment Income | | | (4.753 | ) | | | (4.401 | ) | | | (4.169 | ) | | | (3.961 | ) | | | (3.517 | ) |

| Distributions from Realized Capital Gains | | | — | | | | — | | | | — | | | | — | | | | — | |

| Total Distributions | | | (4.753 | ) | | | (4.401 | ) | | | (4.169 | ) | | | (3.961 | ) | | | (3.517 | ) |

| Net Asset Value, End of Period | | | $231.44 | | | | $246.82 | | | | $206.57 | | | | $188.48 | | | | $189.89 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return2 | | | -4.43% | | | | 21.79% | | | | 11.93% | | | | 1.36% | | | | 13.64% | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net Assets, End of Period (Millions) | | | $230,375 | | | | $235,232 | | | | $181,513 | | | | $152,740 | | | | $143,043 | |

| Ratio of Total Expenses to Average Net Assets | | | 0.04% | | | | 0.04% | | | | 0.04% | | | | 0.05% | | | | 0.05% | |

| Ratio of Net Investment Income to Average Net Assets | | | 2.05% | | | | 1.97% | | | | 2.15% | | | | 2.11% | | | | 2.00% | |

| Portfolio Turnover Rate3 | | | 4% | | | | 3% | | | | 4% | | | | 3% | | | | 3% | |

| 1 | Calculated based on average shares outstanding. |

| 2 | Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 3 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

See accompanying Notes, which are an integral part of the Financial Statements.

500 Index Fund

Financial Highlights

Institutional Select Shares

| | | | | | | | | June 24, | |

| | | Year Ended | | | 20161to | |

| | | Dec. 31, | | | Dec. 31, | |

| For a Share Outstanding Throughout Each Period | | 2018 | | | 2017 | | | 2016 | |

| Net Asset Value, Beginning of Period | | | $130.79 | | | | $109.45 | | | | $99.57 | |

| Investment Operations | | | | | | | | | | | | |

| Net Investment Income | | | 2.808 | 2 | | | 2.423 | 2 | | | 1.200 | |

| Net Realized and Unrealized Gain (Loss) on Investments | | | (8.400 | ) | | | 21.283 | | | | 9.859 | |

| Total from Investment Operations | | | (5.592 | ) | | | 23.706 | | | | 11.059 | |

| Distributions | | | | | | | | | | | | |

| Dividends from Net Investment Income | | | (2.558 | ) | | | (2.366 | ) | | | (1.179 | ) |

| Distributions from Realized Capital Gains | | | — | | | | — | | | | — | |

| Total Distributions | | | (2.558 | ) | | | (2.366 | ) | | | (1.179 | ) |

| Net Asset Value, End of Period | | | $122.64 | | | | $130.79 | | | | $109.45 | |

| | | | | | | | | | | | | |

| Total Return | | | -4.40% | | | | 21.83% | | | | 11.12% | |

| | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Net Assets, End of Period (Millions) | | | $56,531 | | | | $44,907 | | | | $17,753 | |

| Ratio of Total Expenses to Average Net Assets | | | 0.01% | | | | 0.01% | | | | 0.01%3 | |

| Ratio of Net Investment Income to Average Net Assets | | | 2.08% | | | | 2.00% | | | | 2.26%3 | |

| Portfolio Turnover Rate4 | | | 4% | | | | 3% | | | | 4%5 | |

| 2 | Calculated based on average shares outstanding. |

| 4 | Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units. |

| 5 | Reflects the fund’s portfolio turnover for the fiscal year ended December 31, 2016. |

See accompanying Notes, which are an integral part of the Financial Statements.

500 Index Fund

Notes to Financial Statements

Vanguard 500 Index Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers four classes of shares: Investor Shares, ETF Shares, Admiral Shares, and Institutional Select Shares. Each of the share classes has different eligibility and minimum purchase requirements, and is designed for different types of investors. ETF Shares are listed for trading on NYSE Arca; they can be purchased and sold through a broker.

On November 19, 2018, the fund announced changes to the availability and minimum investment criteria of the Investor and Admiral share classes. It is anticipated that all of the outstanding Investor Shares will be automatically converted to Admiral Shares beginning in April 2019, with the exception of those held by Vanguard funds and certain other institutional investors.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objectives of maintaining full exposure to the stock market, maintaining liquidity, and minimizing transaction costs. The fund may purchase futures contracts to immediately invest incoming cash in the market, or sell futures in response to cash outflows, thereby simulating a fully invested position in the underlying index while maintaining a cash balance for liquidity. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any assets pledged as initial margin for open contracts are noted in the Statement of Net Assets.

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

500 Index Fund

During the year ended December 31, 2018, the fund’s average investments in long and short futures contracts represented less than 1% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (December 31, 2015–2018), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes.