Exhibit (99)(b)

WACHOVIA FIRST QUARTER 2007

QUARTERLY EARNINGS REPORT

APRIL 16, 2007

TABLEOF CONTENTS

READERSAREENCOURAGEDTOREFERTO WACHOVIA’SRESULTSFORTHEYEARENDED DECEMBER 31, 2006,PRESENTEDINACCORDANCEWITH U.S.GENERALLYACCEPTEDACCOUNTINGPRINCIPLES (“GAAP”),WHICHMAYBEFOUNDIN WACHOVIA’S 2006 ANNUAL REPORTON FORM 10-K.

ALLNARRATIVECOMPARISONSAREWITH FOURTH QUARTER 2006UNLESSOTHERWISENOTED.

THEINFORMATIONCONTAINEDHEREININCLUDESCERTAINNON-GAAPFINANCIALMEASURES. PLEASEREFERTOPAGES 42-46FORANIMPORTANTEXPLANATIONOFOURUSEOFNON-GAAPMEASURESANDRECONCILIATIONOFTHOSENON-GAAPMEASURESTO GAAP.

Wachovia 1Q07 Quarterly Earnings Report

EXPLANATIONOF “COMBINED” RESULTS

CERTAINTABLESANDNARRATIVECOMPARISONSINTHIS QUARTERLY EARNINGS REPORTINCLUDEREFERENCESTO “COMBINED”RESULTSFORFIRSTQUARTER 2006ANDEARLIERPERIODS. “COMBINED”RESULTSFORTHEFIRSTQUARTEROF 2006ANDPRIORQUARTERSREPRESENT WACHOVIA’SACTUALRESULTSPLUSTHEACTUALRESULTSOF GOLDEN WEST. “COMBINED”RESULTSINCLUDEPURCHASEACCOUNTINGANDOTHERCLOSINGADJUSTMENTS (PAA)ASOFTHEACTUALCLOSINGDATEOF OCTOBER 1, 2006; “COMBINED”RESULTSFORPRIORPERIODSINCLUDEAMORTIZATION/ACCRETIONBASEDONPRELIMINARYFAIRVALUEPURCHASEACCOUNTINGADJUSTMENTSFORSECURITIES,LOANS,PREMISESANDEQUIPMENT,DEPOSITS,LONG-TERMDEBTANDDEPOSITBASEINTANGIBLE (DBI). INADDITION, “COMBINED”RESULTSALSOINCLUDEA “FUNDINGCOST”WHICHREPRESENTSINTERESTEXPENSECALCULATEDATARATEOF 5.35%ONTHECASHPORTIONOFTHEPURCHASEPRICEANDMERGER-RELATEDANDRESTRUCTURINGEXPENSES. READERSSHOULDNOTETHATSUCHPURCHASEACCOUNTINGADJUSTMENTSANDFUNDINGCOSTSMAYHAVEBEENDIFFERENTIFTHEMERGERHADBEENCOMPLETEDINPRIORPERIODS,ALTHOUGHFORPURPOSESOFPRESENTINGTHE “COMBINED”RESULTSWEHAVEASSUMEDTHEYWERENOTDIFFERENT.

THE “COMBINED”RESULTSAREFORILLUSTRATIVEPURPOSESONLYANDTHEPRESENTATIONOFRESULTSONTHIS “COMBINED”BASISISNOTAPRESENTATIONTHATCONFORMSWITHGENERALLYACCEPTEDACCOUNTINGPRINCIPLES. READERSAREENCOURAGEDTOREFERTO WACHOVIA’SRESULTSPRESENTEDINACCORDANCEWITHGENERALLYACCEPTEDACCOUNTINGPRINCIPLES,WHICHMAYBEFOUNDINEXHIBIT (99)(C) TO WACHOVIA’SCURRENTREPORTONFORM 8-K,FILEDON APRIL 16, 2007. ALLNARRATIVECOMPARISONSARETOWACHOVIA-ONLYRESULTSFORPRIORPERIODSUNLESSOTHERWISENOTED. SEEALSO “SUPPLEMENTAL ILLUSTRATIVE COMBINED INFORMATION”ONPAGE 48FORAFURTHERDISCUSSIONREGARDINGTHE “COMBINED”PRESENTATION.

IN 4Q06,ASARESULTOFPERFORMINGOUR STAFF ACCOUNTING BULLETIN NO. 108,CONSIDERINGTHE EFFECTSOF PRIOR YEAR MISSTATEMENTSWHENQUANTIFYING MISSTATEMENTSIN CURRENT YEAR FINANCIAL STATEMENTS, (SAB 108)REVIEW,WEELECTEDTORECORDCERTAINIMMATERIAL,PRIORYEARADJUSTMENTSWHICHAREUNRELATEDTO SAB 108ANDWHICHAREFURTHERDISCUSSEDANDOUTLINEDONPAGE 18. THESEADJUSTMENTSAREREFERREDTOAS “4Q06ADJUSTMENTS”ANDINSOMEINSTANCES,OURREPORTEDRESULTSAREDISCUSSEDEXCLUDINGTHEEFFECTOFTHESE 4Q06ADJUSTMENTSTOILLUSTRATETHEEFFECTSONCOREOPERATINGTRENDSWITHOUTSUCHADJUSTMENTS.

ALLNARRATIVECOMPARISONSOF “COMBINED”RESULTSPERTAINTO 1Q07 REPORTEDRESULTSVERSUS 1Q06 “COMBINED”RESULTSUNLESSOTHERWISENOTED. INADDITION, “COMBINED”RESULTSDONOTREFLECTTHEACQUISITIONOF WESTCORPAND WFS FINANCIAL INCCOMPLETEDON MARCH 1, 2006,FORPERIODSPRIORTOTHEACQUISITIONDATE.

FOREASEOFUSE,COMMENTSPERTAININGTO AS REPORTEDOR ACTUALRESULTSAREPRESENTEDINBOLDTYPE.

“COMBINED” SUMMARY

| | |

1Q06: | | REPORTEDRESULTSPLUS GOLDEN WEST’SRESULTSPLUSTHREEMONTHSOF PAAAND DBIACCRETION/AMORTIZATIONANDFUNDINGCOSTS. |

Page-1

Wachovia 1Q07 Quarterly Earnings Report

First Quarter 2007 Financial Highlights

| • | | Earnings of $2.3 billion flat with 4Q06 and up 33% from 1Q06; EPS of $1.20 flat, and up 10% from 1Q06 |

| | — | Excluding net merger-related and restructuring expenses, EPS of $1.20 down 1% from 4Q06 which included $0.02 gain from sale of corporate and institutional trust businesses; up 7% from 1Q06 |

| • | | Segment results compared to 4Q06 reflect strength in Capital Management; weaker results in General Bank and Wealth Management, largely reflecting seasonality and environmental headwinds; and lower results in Corporate & Investment Bank from strong 4Q06 levels |

| | — | Environmental factors largely mask underlying sales momentum and disciplined execution |

| | | | | | |

| | | Segment Earnings

| |

| | | vs. 4Q06

| | | vs. 1Q06

| |

General Bank | | -8 | % | | +41 | % |

Wealth Management | | -11 | % | | +14 | % |

Corporate & Investment Bank | | -26 | % | | -23 | % |

Capital Management | | +19 | % | | +42 | % |

1Q07 vs. Adjusted Reported 4Q06

The following chart adjusts 4Q06 Reported results to illustrate operating trends without the impact of 4Q06 Adjustments; additional detail is included on pages 7, 8 and 18.

| | | | | | | | | | | | | |

(In millions)

| | A

Reported

1Q07

| | B

Reported

4Q06

| | C

4Q06

Adjustments

| | | B+C

Adjusted

Reported

4Q06

| | 1Q07 vs Adj 4Q06

| |

Net interest income(Tax-equivalent) | | $ | 4,497 | | 4,612 | | (24 | ) | | 4,588 | | (2 | )% |

Fee and other income | | | 3,741 | | 3,980 | | (115 | ) | | 3,865 | | (3 | ) |

| | |

|

| |

| |

|

| |

| |

|

|

Total revenue(Tax-equivalent) | | | 8,238 | | 8,592 | | (139 | ) | | 8,453 | | (3 | ) |

Provision for credit losses | | | 177 | | 206 | | — | | | 206 | | (14 | ) |

Total noninterest expense | | | 4,588 | | 4,931 | | (198 | ) | | 4,733 | | (3 | ) |

Minority interest in income of consolidated subsidiaries | | | 136 | | 125 | | — | | | 125 | | 9 | |

| | |

|

| |

| |

|

| |

| |

|

|

Pre-tax income from continuing operations(Tax-equivalent) | | | 3,337 | | 3,330 | | 59 | | | 3,389 | | (2 | ) |

Income taxes(Tax-equivalent) | | | 1,035 | | 1,075 | | 72 | | | 1,147 | | (10 | ) |

| | |

|

| |

| |

|

| |

| |

|

|

Income from continuing operations | | | 2,302 | | 2,255 | | (13 | ) | | 2,242 | | 3 | |

Discontinued operations, net of income taxes | | | — | | 46 | | — | | | 46 | | — | |

| | |

|

| |

| |

|

| |

| |

|

|

Net income | | $ | 2,302 | | 2,301 | | (13 | ) | | 2,288 | | 1 | % |

| | |

|

| |

| |

|

| |

| |

|

|

| | • | | Revenues down 3% from strong Adjusted 4Q06 levels; up 3% from Combined 1Q06 |

| | — | Net interest income down 2% and margin decreased 7 bps to 3.01% from Adjusted 4Q06 of 3.08% |

| | • | | Results largely reflect growth in lower spread loans and the securitization warehouse and improved retail deposit pricing, lower income from maturing off-balance sheet positions, declines in trading-related net interest income and the effect of FSP 13-2/FIN 48 adoption |

| | — | Fee income down 3% from strong Adjusted 4Q06 levels largely due to declines in structured products and principal investing gains somewhat offset by improvement in trading |

| | • | | Other noninterest expense down $83 million, or 2% from Adjusted 4Q06; up 3% from Combined 1Q06 |

| | — | Excluding $93 million of retirement-eligible employee stock compensation expense in 1Q07, noninterest expense down 4% from Adjusted 4Q06 driven largely by lower revenue-based incentives and sundry expense as well as expense discipline |

| | • | | Average loans up 1% and up 59% from 1Q06;up 9% from Combined 1Q06 |

| | • | | Average core deposits grew 2% and 27% from 1Q06;up 5% from Combined 1Q06 |

| | — | Strong momentum in retail checking account strategies |

| • | | Nonperforming assets of $1.8 billion or 40 bps of loans |

| • | | Net charge-offs of $155 million or 15 bps of loans |

| | — | Provision expense of $177 million largely reflects loan growth including $10 million relating to credit card |

| • | | Effective tax rate of 30.99% reflects updated information on certain tax matters |

| • | | Tangible equity of 4.7% and leverage ratio of 6.1%; repurchased 5 million shares during the quarter |

Page-2

Wachovia 1Q07 Quarterly Earnings Report

Earnings Reconciliation

Earnings Reconciliation

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

| | 2006

| | 1Q07 EPS

| |

| | | First Quarter

| | Fourth

Quarter

| | | Third Quarter

| | Second

Quarter

| | First Quarter

| | vs | | | vs | |

(After-tax in millions, except per share data)

| | Amount

| | EPS

| | Amount

| | | EPS

| | | Amount

| | EPS

| | Amount

| | EPS

| | Amount

| | EPS

| | 4Q06

| | | 1Q06

| |

Net income (GAAP) | | $ | 2,302 | | 1.20 | | 2,301 | | | 1.20 | | | 1,877 | | 1.17 | | 1,885 | | 1.17 | | 1,728 | | 1.09 | | — | % | | 10 | |

Net merger-related and restructuring expenses | | | 6 | | — | | 29 | | | 0.01 | | | 25 | | 0.02 | | 15 | | 0.01 | | 46 | | 0.03 | | (100 | ) | | (100 | ) |

| | |

|

| |

| |

|

| |

|

| |

| |

| |

| |

| |

| |

| |

|

| |

|

|

Earnings excluding merger-related and restructuring expenses | | | 2,308 | | 1.20 | | 2,330 | | | 1.21 | | | 1,902 | | 1.19 | | 1,900 | | 1.18 | | 1,774 | | 1.12 | | (1 | ) | | 7 | |

Discontinued operations, net of income taxes | | | — | | — | | (46 | ) | | (0.02 | ) | | �� | | — | | — | | — | | — | | — | | — | | | — | |

| | |

|

| |

| |

|

| |

|

| |

| |

| |

| |

| |

| |

| |

|

| |

|

|

Earnings excluding merger-related and restructuring expenses, and discontinued operations | | | 2,308 | | 1.20 | | 2,284 | | | 1.19 | | | 1,902 | | 1.19 | | 1,900 | | 1.18 | | 1,774 | | 1.12 | | 1 | | | 7 | |

Deposit base and other intangible amortization | | | 76 | | 0.04 | | 90 | | | 0.05 | | | 59 | | 0.04 | | 64 | | 0.04 | | 59 | | 0.04 | | (20 | ) | | — | |

| | |

|

| |

| |

|

| |

|

| |

| |

| |

| |

| |

| |

| |

|

| |

|

|

Earnings excluding merger-related and restructuring expenses, other intangible amortization and discontinued operations | | $ | 2,384 | | 1.24 | | 2,374 | | | 1.24 | | | 1,961 | | 1.23 | | 1,964 | | 1.22 | | 1,833 | | 1.16 | | — | % | | 7 | |

| | |

|

| |

| |

|

| |

|

| |

| |

| |

| |

| |

| |

| |

|

| |

|

|

KEY POINTS

| | • | | Expect remaining 2007 intangible amortization of $0.09 per share: 2Q07 $0.03; 3Q07 $0.03; 4Q07 $0.03, based on 1Q07 average diluted shares outstanding of 1,925 million |

Page-3

Wachovia 1Q07 Quarterly Earnings Report

Summary Results

Earnings Summary

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

| | | 2006

| | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| | | Combined

| |

(In millions, except per share data)

| | First

Quarter

| | | Fourth

Quarter

| | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | | | 1Q06

| | | 1Q07 vs

1Q06

| |

Net interest income(Tax-equivalent) | | $ | 4,497 | | | 4,612 | | 3,578 | | 3,675 | | 3,539 | | (2 | )% | | 27 | | | $ | 4,441 | | | 1 | % |

Fee and other income | | | 3,741 | | | 3,980 | | 3,465 | | 3,583 | | 3,517 | | (6 | ) | | 6 | | | | 3,545 | | | 6 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

Total revenue(Tax-equivalent) | | | 8,238 | | | 8,592 | | 7,043 | | 7,258 | | 7,056 | | (4 | ) | | 17 | | | | 7,986 | | | 3 | |

Provision for credit losses | | | 177 | | | 206 | | 108 | | 59 | | 61 | | (14 | ) | | 190 | | | | 65 | | | 172 | |

Other noninterest expense | | | 4,460 | | | 4,741 | | 3,915 | | 4,139 | | 4,079 | | (6 | ) | | 9 | | | | 4,350 | | | 3 | |

Merger-related and restructuring expenses | | | 10 | | | 49 | | 38 | | 24 | | 68 | | (80 | ) | | (85 | ) | | | 68 | | | (85 | ) |

Other intangible amortization | | | 118 | | | 141 | | 92 | | 98 | | 92 | | (16 | ) | | 28 | | | | 131 | | | (10 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

Total noninterest expense | | | 4,588 | | | 4,931 | | 4,045 | | 4,261 | | 4,239 | | (7 | ) | | 8 | | | | 4,549 | | | 1 | |

Minority interest in income of consolidated subsidiaries | | | 136 | | | 125 | | 104 | | 90 | | 95 | | 9 | | | 43 | | | | 95 | | | 43 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

Income from continuing operations before income taxes(Tax-equivalent) | | | 3,337 | | | 3,330 | | 2,786 | | 2,848 | | 2,661 | | — | | | 25 | | | | 3,277 | | | 2 | |

Income taxes(Tax-equivalent) | | | 1,035 | | | 1,075 | | 909 | | 963 | | 933 | | (4 | ) | | 11 | | | | 1,175 | | | (12 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

Income from continuing operations | | | 2,302 | | | 2,255 | | 1,877 | | 1,885 | | 1,728 | | 2 | | | 33 | | | | 2,102 | | | 10 | |

Discontinued operations, net of income taxes | | | — | | | 46 | | — | | — | | — | | — | | | — | | | | — | | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

Net income | | $ | 2,302 | | | 2,301 | | 1,877 | | 1,885 | | 1,728 | | — | % | | 33 | | | $ | 2,102 | | | 10 | % |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

Diluted earnings per common share from continuing operations | | $ | 1.20 | | | 1.18 | | 1.17 | | 1.17 | | 1.09 | | 2 | % | | 10 | | | | | | | | |

Diluted earnings per common share based on net income | | $ | 1.20 | | | 1.20 | | 1.17 | | 1.17 | | 1.09 | | — | | | 10 | | | | | | | | |

Dividend payout ratio on common shares | | | 46.67 | % | | 46.67 | | 47.86 | | 43.59 | | 46.79 | | — | | | — | | | | | | | | |

Return on average common stockholders’ equity | | | 13.47 | | | 13.09 | | 14.85 | | 15.41 | | 14.62 | | — | | | — | | | | | | | | |

Return on average assets | | | 1.34 | | | 1.31 | | 1.34 | | 1.39 | | 1.34 | | — | | | — | | | | | | | | |

Overhead efficiency ratio(Tax-equivalent) | | | 55.70 | % | | 57.38 | | 57.44 | | 58.71 | | 60.07 | | — | | | — | | | | 56.96 | % | | — | |

Operating leverage(Tax-equivalent) | | $ | (13 | ) | | 665 | | 1 | | 180 | | 436 | | — | % | | — | | | | | | | | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

KEY POINTS

| | • | | Net interest income decreased 2% as benefits from loan and securitization warehouse growth and improved retail deposit pricing were more than offset by lower income from maturing off-balance sheet positions, 4Q06 Adjustments and trading-related net interest income, as well as the effect of FSP 13-2/FIN 48 adoption |

| | — | The positive effect of retail deposit pricing strategies was somewhat negatively impacted by the effect of seasonally lower corporate deposit balances and continued migration to off-balance sheet alternatives |

| | — | Net interest income up 1% from Combined 1Q06 reflecting growth in earning assets, including Westcorp, largely offset by a shift in deposit mix to lower spread categories and the impact of the interest rate environment |

(See Appendix, pages 19-23 for further detail)

Page-4

Wachovia 1Q07 Quarterly Earnings Report

Other Financial Measures

Performance Highlights

| | | | | | | | | | | | | | | | | | |

| | | 2007

| | | 2006

| | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| |

(Dollars in millions, except per share data)

| | First

Quarter

| | | Fourth

Quarter

| | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | |

Earnings excluding merger-related and restructuring expenses, and discontinued operations (a)(b) | | | | | | | | | | | | | | | | | | |

Net income | | $ | 2,308 | | | 2,284 | | 1,902 | | 1,900 | | 1,774 | | 1 | % | | 30 | |

Return on average assets | | | 1.35 | % | | 1.30 | | 1.36 | | 1.40 | | 1.38 | | — | | | — | |

Return on average common stockholders’ equity | | | 13.50 | | | 12.98 | | 15.02 | | 15.52 | | 15.01 | | — | | | — | |

Overhead efficiency ratio(Tax-equivalent) | | | 55.57 | | | 56.81 | | 56.90 | | 58.39 | | 59.10 | | — | | | — | |

Overhead efficiency ratio excluding brokerage(Tax-equivalent) | | | 52.37 | % | | 53.55 | | 53.29 | | 54.85 | | 55.20 | | — | | | — | |

Operating leverage(Tax-equivalent) | | $ | (51 | ) | | 675 | | 16 | | 135 | | 446 | | — | % | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Earnings excluding merger-related and restructuring expenses, other intangible amortization and discontinued operations (a)(b) | | | | | | | | | | | | | | | | | | |

Net income | | $ | 2,384 | | | 2,374 | | 1,961 | | 1,964 | | 1,833 | | — | % | | 30 | |

Dividend payout ratio on common shares | | | 45.16 | % | | 45.16 | | 45.53 | | 41.80 | | 43.97 | | — | | | — | |

Return on average tangible assets | | | 1.48 | | | 1.43 | | 1.47 | | 1.52 | | 1.49 | | — | | | — | |

Return on average tangible common stockholders’ equity | | | 33.27 | | | 31.58 | | 30.79 | | 32.63 | | 30.64 | | — | | | — | |

Overhead efficiency ratio(Tax-equivalent) | | | 54.15 | | | 55.17 | | 55.60 | | 57.03 | | 57.81 | | — | | | — | |

Overhead efficiency ratio excluding brokerage(Tax-equivalent) | | | 50.65 | % | | 51.61 | | 51.73 | | 53.21 | | 53.63 | | — | | | — | |

Operating leverage(Tax-equivalent) | | $ | (75 | ) | | 725 | | 8 | | 142 | | 444 | | — | % | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Other financial data | | | | | | | | | | | | | | | | | | |

Net interest margin | | | 3.01 | % | | 3.09 | | 3.03 | | 3.18 | | 3.21 | | — | | | — | |

Fee and other income as % of total revenue | | | 45.41 | | | 46.32 | | 49.20 | | 49.37 | | 49.84 | | — | | | — | |

Effective tax rate (c) | | | 30.22 | | | 31.74 | | 31.71 | | 33.05 | | 33.84 | | — | | | — | |

Effective tax rate(Tax-equivalent) (c) (d) | | | 30.99 | % | | 32.46 | | 32.61 | | 33.84 | | 35.06 | | — | | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Asset quality | | | | | | | | | | | | | | | | | | |

Allowance for loan losses as % of loans, net | | | 0.80 | % | | 0.80 | | 1.03 | | 1.07 | | 1.08 | | — | | | — | |

Allowance for loan losses as % of nonperforming assets | | | 194 | | | 246 | | 396 | | 421 | | 389 | | — | | | — | |

Allowance for credit losses as % of loans, net | | | 0.84 | | | 0.84 | | 1.09 | | 1.13 | | 1.14 | | — | | | — | |

Net charge-offs as % of average loans, net | | | 0.15 | | | 0.14 | | 0.16 | | 0.08 | | 0.09 | | — | | | — | |

Nonperforming assets as % of loans, net, foreclosed properties and loans held for sale | | | 0.40 | % | | 0.32 | | 0.26 | | 0.25 | | 0.28 | | — | | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Capital adequacy | | | | | | | | | | | | | | | | | | |

Tier 1 capital ratio (e) | | | 7.4 | % | | 7.4 | | 7.7 | | 7.8 | | 7.9 | | — | | | — | |

Tangible capital ratio(including FAS 115/133/158) | | | 4.4 | | | 4.5 | | 4.9 | | 4.5 | | 4.8 | | — | | | — | |

Tangible capital ratio(excluding FAS 115/133/158) | | | 4.7 | | | 4.8 | | 5.1 | | 5.0 | | 5.1 | | — | | | — | |

Leverage ratio (e) | | | 6.1 | % | | 6.0 | | 6.6 | | 6.6 | | 6.9 | | — | | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Other | | | | | | | | | | | | | | | | | | |

Average diluted common shares(In millions) | | | 1,925 | | | 1,922 | | 1,600 | | 1,613 | | 1,586 | | — | % | | 21 | |

Actual common shares(In millions) | | | 1,913 | | | 1,904 | | 1,581 | | 1,589 | | 1,608 | | — | | | 19 | |

Dividends paid per common share | | $ | 0.56 | | | 0.56 | | 0.56 | | 0.51 | | 0.51 | | — | | | 10 | |

Book value per common share | | | 36.47 | | | 36.61 | | 32.37 | | 30.75 | | 30.95 | | — | | | 18 | |

Common stock price | | | 55.05 | | | 56.95 | | 55.80 | | 54.08 | | 56.05 | | (3 | ) | | (2 | ) |

Market capitalization | | $ | 105,330 | | | 108,443 | | 88,231 | | 85,960 | | 90,156 | | (3 | ) | | 17 | |

Common stock price to book value | | | 151 | % | | 156 | | 172 | | 176 | | 181 | | (3 | ) | | (17 | ) |

FTE employees (f) | | | 110,369 | | | 109,460 | | 97,060 | | 97,316 | | 97,134 | | 1 | | | 14 | |

Total financial centers/brokerage offices | | | 4,167 | | | 4,126 | | 3,870 | | 3,847 | | 3,889 | | 1 | | | 7 | |

ATMs | | | 5,146 | | | 5,212 | | 5,163 | | 5,134 | | 5,179 | | (1 | )% | | (1 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

| (a) | See tables on page 3, and on pages 42 through 46 for reconciliation to earnings prepared in accordance with GAAP. |

| (b) | See page 3 for the most directly comparable GAAP financial measure and pages 42 through 46 for reconciliation to earnings prepared in accordance with GAAP. |

| (c) | 4Q06 includes taxes on discontinued operations. |

| (d) | The tax-equivalent tax rate applies to fully tax-equivalized revenues. |

| (e) | The first quarter of 2007 is based on estimates. |

| (f) | Amount presented in the fourth quarter of 2006 has been restated to conform with the presentation in 2007. |

KEY POINTS

| | • | | Cash overhead efficiency ratio declined 102 bps to 54.15% reflecting expense discipline |

| | • | | Net interest margin declined to 3.01% as benefits of the improved retail deposit pricing were more than offset by growth in lower-spread assets, lower contributions from maturing off-balance sheet positions, lower trading-related net interest income and the continued effect of the yield curve |

| | • | | Effective tax rate of 30.99% reflects updated information on certain tax matters |

| | • | | Tangible capital ratio of 4.7% largely reflects the adoption of FSP 13-2/FIN 48 |

| | • | | Average diluted shares up 3 million reflecting the net effect of employee stock option and restricted share activity somewhat offset by the repurchase of 5 million shares during the quarter at an average cost of $56.72 per share and the ongoing effect of 4Q06 repurchases |

(See Appendix, pages 16-23 for further detail)

Page-5

Wachovia 1Q07 Quarterly Earnings Report

Loan and Deposit Growth

Average Balance Sheet Data

| | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

| | 2006

| | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| | | Combined

| |

(In millions)

| | First

Quarter

| | Fourth

Quarter

| | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | | | 1Q06

| | 1Q07

vs

1Q06

| |

Assets | | | | | | | | | | | | | | | | | | | | | | | |

Trading assets | | $ | 29,681 | | 31,069 | | 31,160 | | 29,252 | | 27,240 | | (4 | )% | | 9 | | | $ | 27,240 | | 9 | % |

Securities | | | 108,071 | | 108,543 | | 122,152 | | 124,102 | | 117,944 | | — | | | (8 | ) | | | 119,421 | | (10 | ) |

Commercial loans, net | | | | | | | | | | | | | | | | | | | | | | | |

General Bank | | | 95,653 | | 92,990 | | 90,837 | | 88,729 | | 85,614 | | 3 | | | 12 | | | | 85,746 | | 12 | |

Corporate and Investment Bank | | | 40,938 | | 41,064 | | 39,797 | | 37,730 | | 36,867 | | — | | | 11 | | | | 36,867 | | 11 | |

Other | | | 20,697 | | 20,252 | | 19,932 | | 19,882 | | 19,988 | | 2 | | | 4 | | | | 20,182 | | 3 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total commercial loans, net | | | 157,288 | | 154,306 | | 150,566 | | 146,341 | | 142,469 | | 2 | | | 10 | | | | 142,795 | | 10 | |

Consumer loans, net | | | 257,973 | | 258,255 | | 130,544 | | 128,924 | | 118,105 | | — | | | 118 | | | | 236,856 | | 9 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total loans, net | | | 415,261 | | 412,561 | | 281,110 | | 275,265 | | 260,574 | | 1 | | | 59 | | | | 379,651 | | 9 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Loans held for sale | | | 16,748 | | 11,928 | | 12,130 | | 9,320 | | 8,274 | | 40 | | | 102 | | | | 8,378 | | 100 | |

Other earning assets (a) | | | 24,552 | | 32,792 | | 25,587 | | 25,293 | | 28,495 | | (25 | ) | | (14 | ) | | | 32,090 | | (23 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total earning assets | | | 594,313 | | 596,893 | | 472,139 | | 463,232 | | 442,527 | | — | | | 34 | | | | 566,780 | | 5 | |

Cash | | | 12,260 | | 12,418 | | 11,973 | | 12,055 | | 12,762 | | (1 | ) | | (4 | ) | | | 13,217 | | (7 | ) |

Other assets | | | 88,875 | | 89,376 | | 71,052 | | 68,325 | | 66,920 | | (1 | ) | | 33 | | | | 82,850 | | 7 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total assets | | $ | 695,448 | | 698,687 | | 555,164 | | 543,612 | | 522,209 | | — | % | | 33 | | | $ | 662,847 | | 5 | % |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | | | | | | | | | | |

Core interest-bearing deposits | | $ | 308,294 | | 299,402 | | 227,674 | | 226,140 | | 225,724 | | 3 | % | | 37 | | | $ | 286,746 | | 8 | % |

Foreign and other time deposits | | | 33,605 | | 32,953 | | 35,133 | | 36,300 | | 32,616 | | 2 | | | 3 | | | | 32,634 | | 3 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total interest-bearing deposits | | | 341,899 | | 332,355 | | 262,807 | | 262,440 | | 258,340 | | 3 | | | 32 | | | | 319,380 | | 7 | |

Short-term borrowings | | | 55,669 | | 65,239 | | 71,030 | | 69,069 | | 70,014 | | (15 | ) | | (20 | ) | | | 76,296 | | (27 | ) |

Long-term debt | | | 141,979 | | 139,364 | | 80,726 | | 71,725 | | 56,052 | | 2 | | | 153 | | | | 111,114 | | 28 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total interest-bearing liabilities | | | 539,547 | | 536,958 | | 414,563 | | 403,234 | | 384,406 | | — | | | 40 | | | | 506,790 | | 6 | |

Noninterest-bearing deposits | | | 60,976 | | 63,025 | | 63,553 | | 65,498 | | 64,490 | | (3 | ) | | (5 | ) | | | 64,636 | | (6 | ) |

Other liabilities | | | 25,605 | | 28,979 | | 26,905 | | 25,817 | | 25,387 | | (12 | ) | | 1 | | | | 25,861 | | (1 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total liabilities | | | 626,128 | | 628,962 | | 505,021 | | 494,549 | | 474,283 | | — | | | 32 | | | | 597,287 | | 5 | |

Stockholders’ equity | | | 69,320 | | 69,725 | | 50,143 | | 49,063 | | 47,926 | | (1 | ) | | 45 | | | | 65,560 | | 6 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total liabilities and stockholders’ equity | | $ | 695,448 | | 698,687 | | 555,164 | | 543,612 | | 522,209 | | — | % | | 33 | | | $ | 662,847 | | 5 | % |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

(a) Includes interest-bearing bank balances, federal funds sold and securities purchased under resale agreements. | |

| | | | | | | | | |

Memoranda | | | | | | | | | | | | | | | | | | | | | | | |

Low-cost core deposits | | $ | 253,008 | | 250,569 | | 238,875 | | 243,249 | | 243,905 | | 1 | % | | 4 | | | $ | 259,175 | | (2 | )% |

Other core deposits | | | 116,262 | | 111,858 | | 52,352 | | 48,389 | | 46,309 | | 4 | | | 151 | | | | 92,207 | | 26 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total core deposits | | $ | 369,270 | | 362,427 | | 291,227 | | 291,638 | | 290,214 | | 2 | % | | 27 | | | $ | 351,382 | | 5 | % |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

KEY POINTS

| | • | | Securities relatively stable, down 10% from Combined 1Q06 largely reflecting $13.2 billion of sales relating to the Golden West merger |

| | • | | Commercial loans increased $3.0 billion, or 2%, as strength in middle-market and business banking, commercial real estate portfolios and foreign loans was somewhat offset by a $1.9 billion decline in leasing including $1.4 billion relating to the adoption of FSP 13-2/FIN 48; up 10% from 1Q06 |

| | • | | Consumer loans remained relatively stable as growth in real estate-secured and auto was more than offset by the $1.4 billion average effect of securitization and sales; increased $139.9 billion from 1Q06 driven by the addition of Golden West;Consumer loans up 9% from Combined 1Q06 largely reflecting growth in real estate-secured and auto, including the impact of Westcorp, and strength in credit card |

| | • | | Loans held for sale increased $4.8 billion largely reflecting growth in the commercial mortgage securitization warehouse |

| | • | | Other earning assets down $8.2 billion driven by lower fed funds sold and repos reflecting temporary excess 4Q06 liquidity related to balance sheet repositioning, including deleveraging, in connection with the Golden West merger |

| | • | | Long-term debt (original maturity > 12 months) increased $2.6 billion driven by the effect of 1Q07 issuances of $12.4 billion and the continuing effect of 4Q06 issuances of $10.4 billion |

| | • | | Core deposits increased $6.8 billion, or 2%, reflecting strength in retail CDs, interest-bearing and foreign; up 27% from 1Q06 driven by merger activity |

| | — | Up $17.9 billion, or 5%, from Combined 1Q06 driven by strength in retail CDs, NOW and foreign |

(See Appendix, pages 19 - 21 for further detail)

Page-6

Wachovia 1Q07 Quarterly Earnings Report

Fee and Other Income

Fee and Other Income

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

| | 2006

| | | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| | | Combined

| |

(In millions)

| | First

Quarter

| | Fourth

Quarter

| | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | | | | 1Q06

| | | 1Q07

vs

1Q06

| |

Service charges | | $ | 614 | | 646 | | 638 | | 622 | | 574 | | | (5 | )% | | 7 | | | $ | 576 | | | 7 | % |

Other banking fees | | | 416 | | 452 | | 427 | | 449 | | 428 | | | (8 | ) | | (3 | ) | | | 443 | | | (6 | ) |

Commissions | | | 659 | | 633 | | 562 | | 588 | | 623 | | | 4 | | | 6 | | | | 630 | | | 5 | |

Fiduciary and asset management fees | | | 920 | | 856 | | 823 | | 808 | | 761 | | | 7 | | | 21 | | | | 761 | | | 21 | |

Advisory, underwriting and other investment banking fees | | | 407 | | 433 | | 292 | | 318 | | 302 | | | (6 | ) | | 35 | | | | 302 | | | 35 | |

Trading account profits | | | 168 | | 29 | | 123 | | 164 | | 219 | | | — | | | (23 | ) | | | 219 | | | (23 | ) |

Principal investing | | | 48 | | 142 | | 91 | | 189 | | 103 | | | (66 | ) | | (53 | ) | | | 103 | | | (53 | ) |

Securities gains (losses) | | | 53 | | 47 | | 94 | | 25 | | (48 | ) | | 13 | | | — | | | | (48 | ) | | — | |

Other income | | | 456 | | 742 | | 415 | | 420 | | 555 | | | (39 | ) | | (18 | ) | | | 559 | | | (18 | ) |

| | |

|

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

Total fee and other income | | $ | 3,741 | | 3,980 | | 3,465 | | 3,583 | | 3,517 | | | (6 | )% | | 6 | | | $ | 3,545 | | | 6 | % |

| | |

|

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

| |

|

|

KEY POINTS

| | • | | Fee and other income decreased 6%; grew 6% vs. 1Q06 which included $133 million relating to MBNA fee and Archipelago/NYSE gain |

| | — | Fee income up 11% from 1Q06 exclusive of the above mentioned one-time fee and gain |

Fee and Other Income

| | | | | | | | | | | | | |

(In millions)

| | A

Reported

1Q07

| | B

Reported

4Q06

| | C 4Q06

Adjustments

| | | B+C

Adjusted

Reported

4Q06

| | 1Q07 vs

Adj 4Q06

| |

Service charges | | $ | 614 | | 646 | | (22 | ) | | 624 | | (2 | )% |

Securities gains | | | 53 | | 47 | | — | | | 47 | | 13 | |

Other income | | | 3,074 | | 3,287 | | (93 | ) | | 3,194 | | (4 | ) |

| | |

|

| |

| |

|

| |

| |

|

|

Total fee and other income | | $ | 3,741 | | 3,980 | | (115 | ) | | 3,865 | | (3 | )% |

| | |

|

| |

| |

|

| |

| |

|

|

| | — | Down 3% vs. strong Adjusted 4Q06 levels which included robust commercial mortgage securitization income and principal investing gains, as well as fiduciary and asset management fees and record advisory and underwriting fees |

| | • | | Service charges down 5%; rose 7% from 1Q06 |

| | — | Service charges decreased 2% vs. Adjusted 4Q06 as strength in commercial was more than offset by seasonally lower consumer volumes |

| | • | | Other banking fees declined 8% driven by the effect of the HomEq divestiture and declines in consumer and commercial mortgage banking fees as well as seasonally lower interchange fees; down 3% from 1Q06 as strength in interchange was more than offset by lower mortgage banking fees |

| | • | | Commissions increased 4% and 6% from 1Q06 on strength in retail brokerage transaction activity driven by higher equity syndicate volumes |

| | • | | Fiduciary and asset management fees grew 7% driven by the addition of European Credit Management (“ECM”) and continued growth in retail brokerage managed account fees; up 21% from 1Q06 |

| | — | Results vs. 1Q06 largely reflect strength in retail brokerage managed account fees and the effect of acquisitions |

| | • | | Advisory, underwriting and other investment banking fees decreased $26 million, or 6%, from robust 4Q06 levels; up 35% from 1Q06 on strength in equities reflecting enhanced CIB/CMG partnership, and growth in high yield and loan syndications |

| | • | | Trading account profits increased $139 million driven by strength in global rate and credit products |

| | • | | Principal investing net gains of $48 million decreased $94 million from strong 4Q06 levels |

| | • | | Other income decreased $286 million driven by $133 million decline in commercial mortgage securitization activity, $93 million relating to 4Q06 Adjustments and $49 million decrease in consumer loan securitization activity |

(See Appendix, pages 22-23 for further detail)

Page-7

Wachovia 1Q07 Quarterly Earnings Report

Noninterest Expense

Noninterest Expense

| | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

| | 2006

| | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| | | Combined

| |

(In millions)

| | First

Quarter

| | Fourth

Quarter

| | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | | | 1Q06

| | 1Q07

vs

1Q06

| |

Salaries and employee benefits | | $ | 2,972 | | 3,023 | | 2,531 | | 2,652 | | 2,697 | | (2 | )% | | 10 | | | $ | 2,889 | | 3 | % |

Occupancy | | | 312 | | 323 | | 284 | | 291 | | 275 | | (3 | ) | | 13 | | | | 294 | | 6 | |

Equipment | | | 307 | | 314 | | 291 | | 299 | | 280 | | (2 | ) | | 10 | | | | 300 | | 2 | |

Advertising | | | 61 | | 47 | | 54 | | 56 | | 47 | | 30 | | | 30 | | | | 52 | | 17 | |

Communications and supplies | | | 173 | | 166 | | 158 | | 162 | | 167 | | 4 | | | 4 | | | | 180 | | (4 | ) |

Professional and consulting fees | | | 177 | | 239 | | 200 | | 184 | | 167 | | (26 | ) | | 6 | | | | 174 | | 2 | |

Sundry expense | | | 458 | | 629 | | 397 | | 495 | | 446 | | (27 | ) | | 3 | | | | 461 | | (1 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Other noninterest expense | | | 4,460 | | 4,741 | | 3,915 | | 4,139 | | 4,079 | | (6 | ) | | 9 | | | | 4,350 | | 3 | |

Merger-related and restructuring expenses | | | 10 | | 49 | | 38 | | 24 | | 68 | | (80 | ) | | (85 | ) | | | 68 | | (85 | ) |

Other intangible amortization | | | 118 | | 141 | | 92 | | 98 | | 92 | | (16 | ) | | 28 | | | | 131 | | (10 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

Total noninterest expense | | $ | 4,588 | | 4,931 | | 4,045 | | 4,261 | | 4,239 | | (7 | )% | | 8 | | | $ | 4,549 | | 1 | % |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

| |

|

|

KEY POINTS

| | • | | Other noninterest expense decreased 6%; rose 9% vs. 1Q06 driven by merger activity |

| | — | Other noninterest expense down $83 million, or 2%, from Adjusted 4Q06 reflecting expense discipline despite $93 million higher employee stock compensation expense |

Noninterest Expense

| | | | | | | | | | | | | |

(In millions)

| | A

Reported

1Q07

| | B

Reported

4Q06

| | C 4Q06

Adjustments

| | | B+C

Adjusted

Reported

4Q06

| | 1Q07 vs

Adj 4Q06

| |

Salaries and employee benefits | | $ | 2,972 | | 3,023 | | (99 | ) | | 2,924 | | 2 | % |

Sundry expense | | | 458 | | 629 | | (99 | ) | | 530 | | (14 | ) |

Other expense | | | 1,030 | | 1,089 | | — | | | 1,089 | | (5 | ) |

| | |

|

| |

| |

|

| |

| |

|

|

Other noninterest expense | | $ | 4,460 | | 4,741 | | (198 | ) | | 4,543 | | (2 | )% |

| | |

|

| |

| |

|

| |

| |

|

|

| | — | 1Q07 results include $16 million relating to efficiency initiative spending, $31 million associated with de novo expansion and branch consolidations and $26 million relating to credit card |

| | • | | Salaries and employee benefits decreased 2% and up 10% from 1Q06;up $48 million from Adjusted 4Q06 as $93 million increase in employee stock compensation expense more than offset lower revenue-based incentives |

| | • | | Professional and consulting fees decreased 26% reflecting discipline and reductions from seasonally high 4Q06 levels |

| | • | | Sundry expense decreased 27%, down 14% from Adjusted 4Q06 |

| | — | 1Q07 sundry expense reflects lower legal costs and expense discipline in travel and entertainment expense and other areas |

(See Appendix, page 23 for further detail)

Page-8

Wachovia 1Q07 Quarterly Earnings Report

General Bank

This segment includes Retail and Small Business, and Commercial.

General Bank

Performance Summary

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

| | | 2006

| | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| | | Combined

| |

(Dollars in millions)

| | First

Quarter

| | | Fourth

Quarter

| | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | | | 1Q06

| | | 1Q07

vs

1Q06

| |

Income statement data | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income(Tax-equivalent) | | $ | 3,705 | | | 3,764 | | 2,819 | | 2,779 | | 2,531 | | (2 | )% | | 46 | | | $ | 3,483 | | | 6 | % |

Fee and other income | | | 862 | | | 946 | | 891 | | 847 | | 868 | | (9 | ) | | (1 | ) | | | 884 | | | (2 | ) |

Intersegment revenue | | | 48 | | | 58 | | 48 | | 48 | | 43 | | (17 | ) | | 12 | | | | 43 | | | 12 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

Total revenue(Tax-equivalent) | | | 4,615 | | | 4,768 | | 3,758 | | 3,674 | | 3,442 | | (3 | ) | | 34 | | | | 4,410 | | | 5 | |

Provision for credit losses | | | 162 | | | 147 | | 122 | | 95 | | 62 | | 10 | | | — | | | | 62 | | | 161 | |

Noninterest expense | | | 2,030 | | | 1,996 | | 1,676 | | 1,737 | | 1,656 | | 2 | | | 23 | | | | 1,901 | | | 7 | |

Income taxes(Tax-equivalent) | | | 884 | | | 958 | | 715 | | 673 | | 629 | | (8 | ) | | 41 | | | | 894 | | | (1 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

Segment earnings | | $ | 1,539 | | | 1,667 | | 1,245 | | 1,169 | | 1,095 | | (8 | )% | | 41 | | | $ | 1,553 | | | (1 | )% |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

Performance and other data | | | | | | | | | | | | | | | | | | | | | | | | | |

Economic profit | | $ | 1,159 | | | 1,283 | | 982 | | 896 | | 854 | | (10 | )% | | 36 | | | | | | | | |

Risk adjusted return on capital (RAROC) | | | 48.22 | % | | 51.94 | | 57.44 | | 54.76 | | 58.38 | | — | | | — | | | | | | | | |

Economic capital, average | | $ | 12,622 | | | 12,439 | | 8,384 | | 8,218 | | 7,308 | | 1 | | | 73 | | | | | | | | |

Cash overhead efficiency ratio(Tax-equivalent) | | | 43.98 | % | | 41.86 | | 44.59 | | 47.29 | | 48.10 | | — | | | — | | | | 43.13 | % | | — | % |

Lending commitments | | $ | 145,326 | | | 139,940 | | 128,380 | | 121,181 | | 115,788 | | 4 | | | 26 | | | | | | | | |

Average loans, net | | | 326,808 | | | 324,168 | | 196,396 | | 191,769 | | 177,458 | | 1 | | | 84 | | | $ | 297,145 | | | 10 | % |

Average core deposits | | $ | 292,389 | | | 288,578 | | 216,591 | | 214,666 | | 211,169 | | 1 | | | 38 | | | $ | 272,263 | | | 7 | % |

FTE employees | | | 57,224 | | | 56,556 | | 45,250 | | 44,973 | | 44,927 | | 1 | % | | 27 | | | | | | | | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

| |

|

|

| |

|

|

General Bank Key Metrics

| | | | | | | | | | | | | | | | |

| | | 2007

| | 2006

| | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| |

| | | First

Quarter

| | Fourth

Quarter

| | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | |

Customer overall satisfaction score (a) | | 6.63 | | 6.64 | | 6.62 | | 6.61 | | 6.62 | | — | % | | — | |

New/Lost ratio | | 1.26 | | 1.29 | | 1.30 | | 1.31 | | 1.27 | | (2 | ) | | (1 | ) |

Online active customers(In thousands)(b) | | 4,103 | | 3,997 | | 3,833 | | 3,634 | | 3,421 | | 3 | | | 20 | |

Financial centers | | 3,399 | | 3,375 | | 3,133 | | 3,109 | | 3,159 | | 1 | % | | 8 | |

| | |

| |

| |

| |

| |

| |

|

| |

|

|

| (a) | Gallup survey measured on a 1-7 scale; 6.4 = “best in class”. |

| (b) | Retail and small business. |

SEGMENTEARNINGSOF $1.5BILLIONDOWN 8%ANDUP 41%FROM 1Q06

| | • | | Revenue of $4.6 billion down 3%, and up 34% from 1Q06 driven by acquisitions and strong loan and deposit growth |

| | — | Net interest income down $59 million, or 2%, largely reflecting $15 million relating to day count, $15 million relating to lower mortgage loans and $29 million due to narrowing spreads on loans and deposits; up 6% from Combined 1Q06 |

| | — | Fees down $84 million as lower branch and loan sale gains, seasonally lower consumer service charges and interchange fees more than offset improvement in commercial service charges |

| | • | | Excluding the 1Q06 $100 million MBNA fee, fees up $94 million, or 12%, driven by strength in consumer and commercial service charges and interchange fees |

| | • | | Expenses up $34 million, or 2%, as benefits of strong expense control were more than offset by $46 million of higher employee stock compensation expense; up 23% from 1Q06 driven largely by merger activity |

| | — | Reflects $31 million due to de novo expansion and branch consolidation costs and $26 million relating to credit card |

| | • | | Average loans up 1% and up 84% from 1Q06 reflecting merger activity; loans up 10% from Combined 1Q06 |

| | — | Commercial loans up 3% on growth in business banking, middle-market and commercial real estate |

| | — | Consumer loans flat as strength in credit card and auto offset by decreases in real estate-secured |

| | • | | Average core deposits up 1% and up 38% from 1Q06 reflecting merger activity |

| | — | Core deposits up 7% from Combined 1Q06 driven by growth in retail CDs and commercial deposits |

| | — | Retail net new checking account sales up 44% to 270,000 including 38,000 in World Savings network |

| | • | | Opened 29 de novo branches during the quarter; 21 California branches now branded Wachovia |

(See Appendix, pages 25 - 29 for further discussion of business unit results

Page-9

Wachovia 1Q07 Quarterly Earnings Report

Wealth Management

Wealth Management

Performance Summary

| | | | | | | | | | | | | | | | | | |

| | | 2007

| | | 2006

| | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| |

(Dollars in millions)

| | First

Quarter

| | | Fourth

Quarter

| | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | |

Income statement data | | | | | | | | | | | | | | | | | | |

Net interest income(Tax-equivalent) | | $ | 146 | | | 149 | | 148 | | 149 | | 150 | | (2 | )% | | (3 | ) |

Fee and other income | | | 195 | | | 200 | | 197 | | 194 | | 188 | | (3 | ) | | 4 | |

Intersegment revenue | | | 1 | | | 3 | | 1 | | 1 | | 1 | | (67 | ) | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Total revenue(Tax-equivalent) | | | 342 | | | 352 | | 346 | | 344 | | 339 | | (3 | ) | | 1 | |

Provision for credit losses | | | — | | | — | | — | | 2 | | — | | — | | | — | |

Noninterest expense | | | 241 | | | 236 | | 235 | | 249 | | 248 | | 2 | | | (3 | ) |

Income taxes(Tax-equivalent) | | | 36 | | | 43 | | 41 | | 33 | | 34 | | (16 | ) | | 6 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Segment earnings | | $ | 65 | | | 73 | | 70 | | 60 | | 57 | | (11 | )% | | 14 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Performance and other data | | | | | | | | | | | | | | | | | | |

Economic profit | | $ | 46 | | | 53 | | 52 | | 41 | | 39 | | (13 | )% | | 18 | |

Risk adjusted return on capital (RAROC) | | | 43.63 | % | | 47.58 | | 46.77 | | 40.61 | | 39.34 | | — | | | — | |

Economic capital, average | | $ | 566 | | | 574 | | 568 | | 563 | | 556 | | (1 | ) | | 2 | |

Cash overhead efficiency ratio(Tax-equivalent) | | | 70.22 | % | | 67.38 | | 67.85 | | 72.30 | | 73.25 | | — | | | — | |

Lending commitments | | $ | 6,686 | | | 6,504 | | 6,481 | | 6,285 | | 6,229 | | 3 | | | 7 | |

Average loans, net | | | 17,180 | | | 16,794 | | 16,469 | | 16,016 | | 15,603 | | 2 | | | 10 | |

Average core deposits | | $ | 14,037 | | | 14,208 | | 13,775 | | 14,265 | | 14,609 | | (1 | ) | | (4 | ) |

FTE employees | | | 4,393 | | | 4,474 | | 4,530 | | 4,727 | | 4,758 | | (2 | )% | | (8 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

| | | | | | | |

| Wealth Management Key Metrics | | | | | | | | | | | | | | | | | | |

| | | | |

| | | 2007

| | | 2006

| | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| |

(Dollars in millions)

| | First

Quarter

| | | Fourth

Quarter

| | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | |

Investment assets under administration | | $ | 135,562 | | | 143,879 | | 138,915 | | 135,817 | | 134,293 | | (6 | )% | | 1 | |

Assets under management (a) | | $ | 76,214 | | | 75,297 | | 72,397 | | 71,184 | | 71,120 | | 1 | | | 7 | |

Wealth Management advisors | | | 940 | | | 951 | | 970 | | 996 | | 973 | | (1 | )% | | (3 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

| (a) | These assets are managed by and reported in Capital Management. |

SEGMENTEARNINGSOF $65MILLION,DOWN 11%ANDUP 14%FROM 1Q06

| | • | | Revenue of $342 million decreased 3%; up 1% from 1Q06 |

| | — | Net interest income was down 2% reflecting lower core deposits and narrowing spreads which offset loan growth |

| | — | Fee and other income decreased 3% from strong 4Q06 levels driven by lower insurance commissions, which more than offset growth in fiduciary and asset management fees |

| | • | | Expenses up 2% as lower salaries and benefits were more than offset by $8 million in higher employee stock compensation expense; down 3% from 1Q06 driven by lower salaries, benefits and incentives |

| | • | | Assets under management increased 1%, and 7% from 1Q06, on market gains |

| | — | 78% acceptance rate on introduction of new investment platform |

(See Appendix, page 30 for further discussion of business unit results)

Page-10

Wachovia 1Q07 Quarterly Earnings Report

Corporate and Investment Bank

This segment includes Corporate Lending, Investment Banking, and Treasury and International Trade Finance.

Corporate and Investment Bank

Performance Summary

| | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

| | | 2006

| | | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| |

(Dollars in millions)

| | First

Quarter

| | | Fourth

Quarter

| | | Third

Quarter

| | | Second

Quarter

| | | First

Quarter

| | | |

Income statement data | | | | | | | | | | | | | | | | | | | | | | |

Net interest income(Tax-equivalent) | | $ | 453 | | | 512 | | | 450 | | | 468 | | | 463 | | | (12 | )% | | (2 | ) |

Fee and other income | | | 1,088 | | | 1,355 | | | 992 | | | 1,217 | | | 1,242 | | | (20 | ) | | (12 | ) |

Intersegment revenue | | | (42 | ) | | (56 | ) | | (43 | ) | | (42 | ) | | (37 | ) | | (25 | ) | | 14 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total revenue(Tax-equivalent) | | | 1,499 | | | 1,811 | | | 1,399 | | | 1,643 | | | 1,668 | | | (17 | ) | | (10 | ) |

Provision for credit losses | | | — | | | 5 | | | (5 | ) | | (33 | ) | | 1 | | | — | | | — | |

Noninterest expense | | | 903 | | | 999 | | | 797 | | | 886 | | | 893 | | | (10 | ) | | 1 | |

Income taxes(Tax-equivalent) | | | 217 | | | 294 | | | 222 | | | 288 | | | 283 | | | (26 | ) | | (23 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Segment earnings | | $ | 379 | | | 513 | | | 385 | | | 502 | | | 491 | | | (26 | )% | | (23 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Performance and other data | | | | | | | | | | | | | | | | | | | | | | |

Economic profit | | $ | 159 | | | 290 | | | 167 | | | 275 | | | 301 | | | (45 | )% | | (47 | ) |

Risk adjusted return on capital (RAROC) | | | 20.10 | % | | 27.14 | | | 20.88 | | | 27.98 | | | 31.15 | | | — | | | — | |

Economic capital, average | | $ | 7,088 | | | 7,117 | | | 6,707 | | | 6,499 | | | 6,066 | | | — | | | 17 | |

Cash overhead efficiency ratio(Tax-equivalent) | | | 60.20 | % | | 55.16 | | | 57.02 | | | 53.90 | | | 53.55 | | | — | | | — | |

Lending commitments | | $ | 106,578 | | | 107,155 | | | 102,698 | | | 106,105 | | | 103,812 | | | (1 | ) | | 3 | |

Average loans, net | | | 40,946 | | | 41,069 | | | 39,801 | | | 37,733 | | | 36,871 | | | — | | | 11 | |

Average core deposits | | $ | 28,948 | | | 26,993 | | | 26,223 | | | 26,346 | | | 25,568 | | | 7 | | | 13 | |

FTE employees | | | 5,959 | | | 6,040 | | | 6,049 | | | 6,227 | | | 5,994 | | | (1 | )% | | (1 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | | | |

Corporate and Investment Bank Sub-segment Revenue | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | 2007

| | | 2006

| | | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| |

(In millions)

| | First

Quarter

| | | Fourth

Quarter

| | | Third

Quarter

| | | Second

Quarter

| | | First

Quarter

| | | |

Investment Banking | | $ | 968 | | | 1,269 | | | 868 | | | 1,093 | | | 1,102 | | | (24 | )% | | (12 | ) |

Corporate Lending | | | 282 | | | 281 | | | 269 | | | 285 | | | 315 | | | — | | | (10 | ) |

Treasury and International Trade Finance | | | 249 | | | 261 | | | 262 | | | 265 | | | 251 | | | (5 | ) | | (1 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total revenue(Tax-equivalent) | | $ | 1,499 | | | 1,811 | | | 1,399 | | | 1,643 | | | 1,668 | | | (17 | )% | | (10 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Memoranda | | | | | | | | | | | | | | | | | | | | | | |

Total net trading revenue(Tax-equivalent) | | $ | 218 | | | 182 | | | 225 | | | 281 | | | 361 | | | 20 | % | | (40 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

SEGMENTEARNINGSOF $379MILLION,DOWN 26%AND 23%FROM 1Q06

| | • | | Revenue of $1.5 billion decreased 17% and 10% from 1Q06 |

| | — | Net interest income down 12% driven by lower trading-related net interest income and narrowing spreads |

| | — | Fee and other income declined 20% from strong 4Q06 driven by lower results in structured products and M&A from record levels as well as lower principal investing results, somewhat offset by improvement in trading results |

| | • | | Strong origination revenues and underlying momentum in commercial mortgage securititization activity muted by the effect of higher 4Q06 asymmetrical hedge gains on the warehouse |

| | • | | Expenses decreased 10% driven by lower revenue-based incentives and professional and consulting fees; up 1% from 1Q06 |

| | — | 1Q07 results include $20 million higher employee stock compensation expense |

| | • | | Average loans were relatively stable; up 11% from 1Q06 |

| | • | | Average core deposits grew 7% on an increase in lower-spread money market deposits; up 13% from 1Q06 |

| | • | | Origination pipelines showed continued strong improvement during the quarter |

(See Appendix, pages 31-34 for further discussion of business unit results)

Page-11

Wachovia 1Q07 Quarterly Earnings Report

Capital Management

This segment includes Asset Management and Retail Brokerage Services.

Capital Management

Performance Summary

| | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

| | | 2006

| | | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| |

(Dollars in millions)

| | First

Quarter

| | | Fourth

Quarter

| | | Third

Quarter

| | | Second

Quarter

| | | First

Quarter

| | | |

Income statement data | | | | | | | | | | | | | | | | | | | | | | |

Net interest income(Tax-equivalent) | | $ | 265 | | | 259 | | | 247 | | | 260 | | | 250 | | | 2 | % | | 6 | |

Fee and other income | | | 1,458 | | | 1,353 | | | 1,231 | | | 1,225 | | | 1,230 | | | 8 | | | 19 | |

Intersegment revenue | | | (8 | ) | | (8 | ) | | (8 | ) | | (9 | ) | | (8 | ) | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total revenue(Tax-equivalent) | | | 1,715 | | | 1,604 | | | 1,470 | | | 1,476 | | | 1,472 | | | 7 | | | 17 | |

Provision for credit losses | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Noninterest expense | | | 1,236 | | | 1,200 | | | 1,097 | | | 1,118 | | | 1,135 | | | 3 | | | 9 | |

Income taxes(Tax-equivalent) | | | 175 | | | 148 | | | 136 | | | 131 | | | 123 | | | 18 | | | 42 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Segment earnings | | $ | 304 | | | 256 | | | 237 | | | 227 | | | 214 | | | 19 | % | | 42 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Performance and other data | | | | | | | | | | | | | | | | | | | | | | |

Economic profit | | $ | 261 | | | 215 | | | 198 | | | 187 | | | 175 | | | 21 | % | | 49 | |

Risk adjusted return on capital (RAROC) | | | 77.48 | % | | 67.52 | | | 66.78 | | | 63.64 | | | 59.88 | | | — | | | — | |

Economic capital, average | | $ | 1,592 | | | 1,504 | | | 1,410 | | | 1,428 | | | 1,450 | | | 6 | | | 10 | |

Cash overhead efficiency ratio(Tax-equivalent) | | | 72.07 | % | | 74.86 | | | 74.58 | | | 75.80 | | | 77.08 | | | — | | | — | |

Lending commitments | | $ | 303 | | | 219 | | | 263 | | | 250 | | | 237 | | | 38 | | | 28 | |

Average loans, net | | | 1,554 | | | 1,419 | | | 1,235 | | | 1,039 | | | 856 | | | 10 | | | 82 | |

Average core deposits | | $ | 31,683 | | | 30,100 | | | 30,114 | | | 31,827 | | | 33,583 | | | 5 | | | (6 | ) |

FTE employees | | | 17,704 | | | 17,515 | | | 17,289 | | | 17,242 | | | 17,147 | | | 1 | % | | 3 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | | | |

| Capital Management Key Metrics | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | 2007

| | | 2006

| | | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| |

(Dollars in billions)

| | First

Quarter

| | | Fourth

Quarter

| | | Third

Quarter

| | | Second

Quarter

| | | First

Quarter

| | | |

Equity assets | | $ | 106.3 | | | 103.6 | | | 96.4 | | | 93.5 | | | 90.1 | | | 3 | % | | 18 | |

Fixed income assets | | | 144.0 | | | 114.0 | | | 106.7 | | | 101.4 | | | 106.0 | | | 26 | | | 36 | |

Money market assets | | | 64.3 | | | 61.2 | | | 49.7 | | | 45.2 | | | 45.0 | | | 5 | | | 43 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total assets under management (a) | | | 314.6 | | | 278.8 | | | 252.8 | | | 240.1 | | | 241.1 | | | 13 | | | 30 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Gross fluctuating mutual fund sales | | $ | 3.7 | | | 3.0 | | | 2.0 | | | 2.9 | | | 3.7 | | | 23 | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Full-service financial advisors series 7 | | | 8,166 | | | 8,091 | | | 7,972 | | | 7,973 | | | 7,926 | | | 1 | | | 3 | |

Financial center advisors series 6 | | | 2,521 | | | 2,497 | | | 2,477 | | | 2,541 | | | 2,454 | | | 1 | | | 3 | |

Broker client assets (b) | | $ | 773.0 | | | 760.0 | | | 729.9 | | | 704.3 | | | 689.1 | | | 2 | | | 12 | |

Customer receivables including margin loans | | $ | 4.7 | | | 4.8 | | | 4.9 | | | 5.3 | | | 5.6 | | | (2 | ) | | (16 | ) |

Traditional brokerage offices | | | 768 | | | 751 | | | 737 | | | 738 | | | 730 | | | 2 | | | 5 | |

Banking centers with brokerage services (c) | | | 1,850 | | | 1,824 | | | 1,825 | | | 1,867 | | | 1,883 | | | 1 | % | | (2 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| (a) | Includes $76 billion in assets managed for Wealth Management, which are also reported in that segment. Beginning in 4Q06, assets under management include assets retained from the divested Corporate and Institutional Trust business, which were reported in the Parent in previous quarters. |

| (b) | Beginning in 2Q06, certain mutual funds assets were added to the overall client asset total. Prior periods have not been restated. |

| (c) | Amounts presented in 2006 have been restated to conform to the presentation in 2007. |

RECORDSEGMENTEARNINGSOF $304MILLION,UP 19%AND 42%FROM 1Q06

| | • | | Revenue of $1.7 billion grew 7%; up 17% from 1Q06 |

| | — | Net interest income increased 2% driven by strong core deposit growth |

| | — | Fee and other income rose 8% primarily driven by higher retail brokerage transaction activity and equity syndicate distribution fees, the addition of ECM, and managed account fees |

| | • | | Results include successful launch of new investment products reflecting strong partnership with Corporate and Investment Bank |

| | • | | Expenses increased 3% driven by higher commissions, $17 million higher employee stock compensation expense, the addition of ECM, and increased fund distribution costs partially offset by decreases in sundry and equipment expense |

| | — | Retail brokerage pre-tax profit margin of 29% |

| | • | | Assets under management increased 13% driven by the addition of $26.2 billion from ECM and net asset inflows |

| | • | | Series 7 advisors of 8,166 reflects strong recruiting and retention efforts; net new hires of 75 during the quarter |

(See Appendix, pages 35-36 for further discussion of business unit results)

Page-12

Wachovia 1Q07 Quarterly Earnings Report

Asset Quality

Asset Quality

| | | | | | | | | | | | | | | | | | | | | | |

| | | 2007

| | | 2006

| | | 1Q07 vs

4Q06

| | | 1Q07 vs

1Q06

| |

(In millions)

| | First

Quarter

| | | Fourth

Quarter

| | | Third

Quarter

| | | Second

Quarter

| | | First

Quarter

| | | |

Nonperforming assets | | | | | | | | | | | | | | | | | | | | | | |

Nonaccrual loans | | $ | 1,584 | | | 1,234 | | | 578 | | | 619 | | | 672 | | | 28 | % | | — | |

Foreclosed properties | | | 155 | | | 132 | | | 181 | | | 99 | | | 108 | | | 17 | | | 44 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total nonperforming assets | | $ | 1,739 | | | 1,366 | | | 759 | | | 718 | | | 780 | | | 27 | % | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

as % of loans, net and foreclosed properties | | | 0.41 | % | | 0.32 | | | 0.26 | | | 0.25 | | | 0.28 | | | 27 | | | 48 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Nonperforming assets in loans held for sale | | $ | 26 | | | 16 | | | 23 | | | 23 | | | 24 | | | 63 | % | | 8 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total nonperforming assets in loans and in loans held for sale | | $ | 1,765 | | | 1,382 | | | 782 | | | 741 | | | 804 | | | 28 | % | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

as % of loans, net, foreclosed properties and loans held for sale | | | 0.40 | % | | 0.32 | | | 0.26 | | | 0.25 | | | 0.28 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Allowance for credit losses (a) | | | | | | | | | | | | | | | | | | | | | | |

Allowance for loan losses, beginning of period | | $ | 3,360 | | | 3,004 | | | 3,021 | | | 3,036 | | | 2,724 | | | 12 | % | | 23 | |

Balance of acquired entities at purchase date | | | — | | | 303 | | | — | | | — | | | 300 | | | — | | | — | |

Net charge-offs | | | (155 | ) | | (140 | ) | | (116 | ) | | (51 | ) | | (59 | ) | | 11 | | | — | |

Allowance relating to loans acquired, transferred to loans held for sale or sold | | | (3 | ) | | (18 | ) | | (15 | ) | | (18 | ) | | 12 | | | (83 | ) | | — | |

Provision for credit losses related to loans transferred to loans held for sale or sold (b) | | | 1 | | | 7 | | | (4 | ) | | 5 | | | — | | | (86 | ) | | — | |

Provision for credit losses | | | 175 | | | 204 | | | 118 | | | 49 | | | 59 | | | (14 | ) | | 197 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Allowance for loan losses, end of period | | | 3,378 | | | 3,360 | | | 3,004 | | | 3,021 | | | 3,036 | | | 1 | | | 11 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Reserve for unfunded lending commitments, beginning of period | | | 154 | | | 159 | | | 165 | | | 160 | | | 158 | | | (3 | ) | | (3 | ) |

Provision for credit losses | | | 1 | | | (5 | ) | | (6 | ) | | 5 | | | 2 | | | — | | | (50 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Reserve for unfunded lending commitments, end of period | | | 155 | | | 154 | | | 159 | | | 165 | | | 160 | | | 1 | | | (3 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Allowance for credit losses | | $ | 3,533 | | | 3,514 | | | 3,163 | | | 3,186 | | | 3,196 | | | 1 | % | | 11 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Allowance for loan losses | | | | | | | | | | | | | | | | | | | | | | |

as % of loans, net | | | 0.80 | % | | 0.80 | | | 1.03 | | | 1.07 | | | 1.08 | | | — | | | — | |

as % of nonaccrual and restructured loans (c) | | | 213 | | | 272 | | | 520 | | | 488 | | | 452 | | | — | | | — | |

as % of nonperforming assets (c) | | | 194 | | | 246 | | | 396 | | | 421 | | | 389 | | | — | | | — | |

Allowance for credit losses | | | | | | | | | | | | | | | | | | | | | | |

as % of loans, net | | | 0.84 | % | | 0.84 | | | 1.09 | | | 1.13 | | | 1.14 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Net charge-offs | | $ | 155 | | | 140 | | | 116 | | | 51 | | | 59 | | | 11 | % | | — | |

Commercial, as % of average commercial loans | | | 0.07 | % | | 0.04 | | | 0.03 | | | (0.06 | ) | | 0.05 | | | — | | | — | |

Consumer, as % of average consumer loans | | | 0.20 | | | 0.19 | | | 0.32 | | | 0.23 | | | 0.14 | | | — | | | — | |

Total, as % of average loans, net | | | 0.15 | % | | 0.14 | | | 0.16 | | | 0.08 | | | 0.09 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Past due loans, 90 days and over, and nonaccrual loans (c) | | | | | | | | | | | | | | | | | | | | | | |

Commercial, as a % of loans, net | | | 0.28 | % | | 0.23 | | | 0.28 | | | 0.28 | | | 0.32 | | | — | | | — | |

Consumer, as a % of loans, net | | | 0.66 | % | | 0.59 | | | 0.61 | | | 0.64 | | | 0.62 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| (a) | The allowance for credit losses is the sum of the allowance for loan losses and the reserve for unfunded lending commitments. |

| (b) | The provision related to loans transferred or sold includes recovery of lower of cost or market losses. |

| (c) | These ratios do not include nonperforming assets included in loans held for sale. |

| | • | | Total NPAs of $1.8 billion rose $383 million driven by growth in consumer real estate secured and commercial loans; up 8 bps to 40 bps of loans |

| | — | World Savings well-collateralized real estate secured portfolio contributed $194 million to nonaccrual loan increase; World Savings foreclosed properties up only $4 million |

| | • | | Provision expense of $177 million, largely reflecting loan growth and includes $10 million relating to credit card |

| | — | Net charge-offs of $155 million, or 15 bps of average loans, increased $15 million driven by growth in commercial reflecting lower recoveries |

| | • | | Allowance for credit losses of $3.5 billion, or 0.84% of net loans, increased $19 million |

| | — | Allowance for commercial credit losses to loans down 3 bps to 1.22% of loans; allowance for consumer credit losses up 1 bp to 0.53% of loans |

| | — | Allowance as a percentage of nonaccruals and restructured loans declined to 213% from 272% largely reflecting the historically low loss content of World Savings well-collateralized real estate secured portfolio |

| | • | | Average LTV of consumer real estate secured nonperforming loans (assets) of 76% |

(See Appendix, pages 38-39 for further detail)

Page-13

Wachovia 1Q07 Quarterly Earnings Report

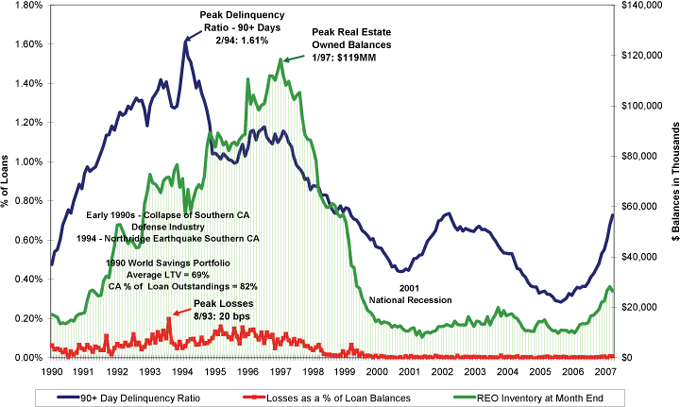

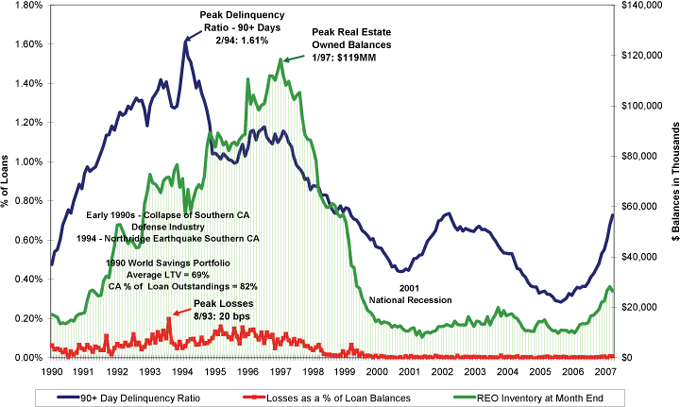

World Savings Historical Credit Trends

HISTORICALLY, SPIKESIN WORLD SAVINGS NPAS HAVE NOT MANIFESTED AS SIGNIFICANTLY HIGHER LOSSES

PERIOD-END 1Q07

| | • | | World Savings NPAs of $899 million or 74 bps of total loans |

| | — | 74% average LTV on NPAs vs. 71% for the total portfolio |

| | • | | World Savings foreclosed properties totaled $23 million |

Page-14

Wachovia 1Q07 Quarterly Earnings Report

Wachovia 2007 Full-Year Outlook

OVERALL VIEWOF FULL YEAR 2007 EARNINGS REMAINS RELATIVELY UNCHANGED FROM LAST UPDATE

FOR REFERENCE PURPOSES ONLY

ECONOMIC ASSUMPTIONSFOR FULL-YEAR 2007

| | | |

| | | ESTIMATE

| |

REAL GDP GROWTH | | 2.30 | % |

FED FUNDS (AT DEC 2007) | | 5.00 | % |

10 YEAR TREASURY BOND (AT DEC 2007) | | 4.75 | % |

(VERSUS FULL-YEAR ADJUSTED COMBINED 2006 UNLESS OTHERWISE NOTED)

| | | | | | |

| | | ADJUSTED COMBINED 2006#

| | | | 2007 OUTLOOK

|

| | | |

NET INTEREST INCOME (TE) | | $ 18.1 BILLION | | | | RELATIVELYFLATTO 2%GROWTH |

| | | |

FEE INCOME | | $ 14.5 BILLION | | | | EXPECTLOW-DOUBLE-DIGIT %GROWTH |

| | | |

NONINTEREST EXPENSE* | | $ 18.1BILLION | | | | EXPECTMID-SINGLE-DIGIT %GROWTH;MARGINALLYLOWERTHANREVENUE |

| | | |

| | | | | | | – TARGETINGYEAR-END 2007OVERHEADEFFICIENCYRATIOOF 51.5% – 53.5%** |

| | | |

MINORITY INTEREST EXPENSE* | | $ 414 MILLION | | | | EXPECTHIGH-SINGLE-DIGIT %GROWTH |

| | | |

LOANS | | $ 398.4 BILLION | | | | EXPECTHIGH-SINGLE-DIGIT %GROWTH |

| | | |

CONSUMER | | $ 249.6 BILLION | | | | MID-SINGLE-DIGIT %GROWTH |

| | | |

COMMERCIAL | | $ 148.8 BILLION | | | | LOW-DOUBLE-DIGIT %GROWTH |

| | | |

NET CHARGE-OFFS | | 8BPS | | | | EXPECTMID-TEENSBPSRANGEOFAVERAGENETLOANS |

| | | |

| | | | | | | PROVISIONMAYBEMODESTLYHIGHER |

| | | |

EFFECTIVE TAX RATE (TE) | | | | | | APPROXIMATELY 33% |

| | |

LEVERAGE RATIO | | | | TARGET > 6.0% |

| | |

TANGIBLE CAPITAL RATIO (EXCLUDES FAS 115/133ANDPENSION) | | | | TARGET > 4.7% |

| | | |

DIVIDEND PAYOUT RATIO | | | | | | 40%–50%OFEARNINGS** |

| | | |

EXCESS CAPITAL | | | | | | OPPORTUNISTICALLYREPURCHASESHARES;AUTHORIZATIONFOR 36.5MILLIONSHARESREMAINING |

| | | |

| | | | | | | FINANCIALLYATTRACTIVE,SHAREHOLDERFRIENDLYACQUISITIONS |

| # | WACHOVIA’S 2006 REPORTED RESULTS AS FOOTNOTED BELOW PLUS GOLDEN WEST’S 3Q06 YTD RESULTS PLUS THE EFFECT OF PURCHASE ACCOUNTING AND INTANGIBLE ACCRETION/AMORTIZATION AND EXCLUDING 4Q06 ADJUSTMENTS AND GOLDEN WEST’S 3Q06 CHARITABLE CONTRIBUTION. |

| * | BEFORE NET MERGER-RELATED AND RESTRUCTURING EXPENSES. |

| ** | BEFORE NET MERGER-RELATED AND RESTRUCTURING EXPENSES, AND OTHER INTANGIBLE AMORTIZATION. |

Page-15

APPENDIX

TABLEOF CONTENTS

Wachovia 1Q07 Quarterly Earnings Report

SUMMARY OPERATING RESULTS

Business segment results are presented excluding (i) merger-related and restructuring expenses, (ii) deposit base intangible and other intangible amortization expense, (iii) amounts presented as discontinued operations, and (iv) the cumulative effect of a change in accounting principle. This is the basis on which we manage and allocate capital to our business segments. We continuously assess assumptions, methodologies and reporting classifications to better reflect the true economics of our business segments.

We continuously update segment information for changes that occur in the management of our businesses. In 1Q07, we moved our cross-border leveraged leases, consisting of our portfolios of Lease-In, Lease-Out and Sale-In, Lease-Out transactions, from the Corporate and Investment Bank to the Parent to reflect the way in which these portfolios are now managed. We have updated information for 2006 to reflect this change. The impact to segment earnings for full year 2006 as a result of this and other changes was a $3 million decrease in the General Bank, a $3 million increase in Capital Management, a $7 million decrease in Wealth Management, a $91 million decrease in the Corporate and Investment Bank and a $98 million increase in the Parent.

In a rising rate environment, Wachovia benefits from a widening spread between deposit costs and wholesale funding costs. However, our funds transfer pricing (“FTP”) system, described below, credits this benefit to deposit-providing business units on a lagged basis. The effect of the FTP system results in rising charges to business units for funding to support predominantly floating-rate assets. This benefit of higher rates earned on floating-rate assets and lagging rates on longer duration deposits is captured in the central money book in the Parent segment.

In order to remove interest rate risk from each core business segment, the management reporting model employs an FTP system. The FTP system matches the duration of the funding used by each segment to the duration of the assets and liabilities contained in each segment. Matching the duration, or the effective term until an instrument can be repriced, allocates interest income and/or interest expense to each segment so its resulting net interest income is insulated from interest rate risk.