EXHIBIT 99.1

Financial Overview

Geoff Chatas

Executive Vice President and Chief Financial Officer

Safe Harbor Statement

This document contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements involve estimates, projections, goals, forecasts, assumptions, risk and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Examples of factors that you should consider with respect to any forward-looking statements made in this document include, but are not limited to, the following: the impact of fluid and complex government laws and regulations, including those relating to the environment; the impact of recent events in the energy markets that have increased the level of public and regulatory scrutiny in the energy industry and in the capital markets; deregulation or restructuring in the electric industry that may result in increased competition and unrecovered (stranded) costs; the uncertainty regarding the timing, creation and structure of regional transmission organizations; weather conditions that directly influence the demand for electricity; recurring seasonal fluctuations in demand for electricity; fluctuations in the price of energy commodities and purchased power; economic fluctuations and the corresponding impact on our commercial and industrial customers; the ability of our subsidiaries to pay upstream dividends or distributions to us; the impact on our facilities and our businesses from a terrorist attack; the inherent risks associated with the operation of nuclear facilities, including environmental, health, regulatory and financial risks; the ability to successfully access capital markets on favorable terms; the impact that increases in our leverage may have on us; our ability to maintain our current credit ratings; the impact of derivative contracts used in the normal course of our business; investment performance of pension and benefit plans and the ability to control costs; the outcome availability and use of Internal Revenue Code Section 29 (Section 29) tax credits by synthetic fuel producers, and our continued ability to use Section 29 tax credits related to our coal and synthetic fuels businesses; our ability to successfully integrate newly acquired assets, properties or businesses into our operations as quickly or as profitably as expected; our ability to manage the risks involved with the operation of our nonregulated plants, including dependence on third parties and related counter-party risks, and a lack of operating history; our ability to manage the risks associated with our energy marketing operations; and unanticipated changes in operating expenses and capital expenditures. Many of these risks similarly impact our subsidiaries.

These and other risk factors are detailed from time to time in our SEC reports. All such factors are difficult to predict, contain uncertainties that may materially affect actual results, and may be beyond our ability to control or estimate precisely.

Financial Objectives

Live within our means

Strengthen balance sheet

Maintain access to credit markets

Target earnings growth in upper half of our sector

Reward shareholders with a growing dividend

And…communicate clear, comprehensive and timely financial information

2003 Recap

Increased ongoing earnings 2% over 2002

Sold $580 million of assets

Reduced leverage to 58.9%

Resolved complex issues regarding synthetic fuel investments

Completed build-out of nonregulated portfolio and signed wholesale contracts for output

Continued operational excellence

Increased dividend 16th consecutive year

Themes for 2004

Transition from net income growth to EPS growth

Extract value from our assets

Focus on cost control

Best in class capital expenditure stewardship

Assumptions for 2004

Electric utility base revenue growth of 2%

Clean Air regulatory amortization of $75M

Lower expected off-system sales

No planned asset acquisitions

Equity issuances of ~ $50M

Asset sales of $80 million for Railcar, Ltd.

No synthetic fuel monetization earnings assumed

2004 EPS range of $3.50—$3.65

2004 Earnings Presentation Changes

Segment figures no longer adjusted for tax benefit reallocation from holding company

2003 earnings adjusted for retroactive service company reallocation recorded in Q1 2003

Synthetic fuels now includes all third-party synthetic fuel sales

See Appendix A-1 for detail of changes

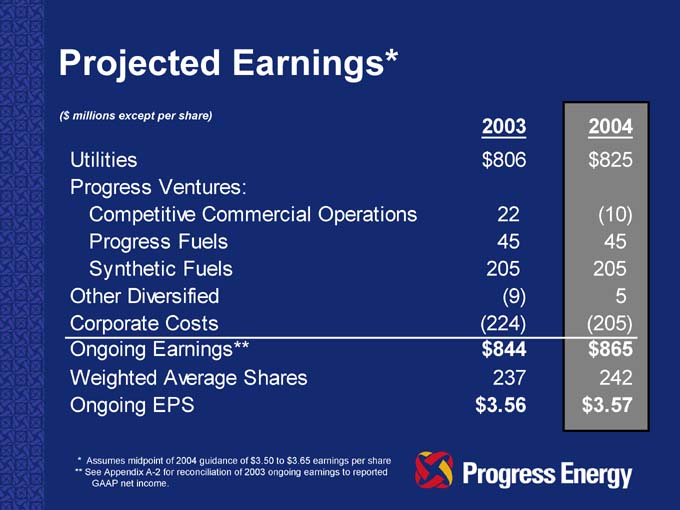

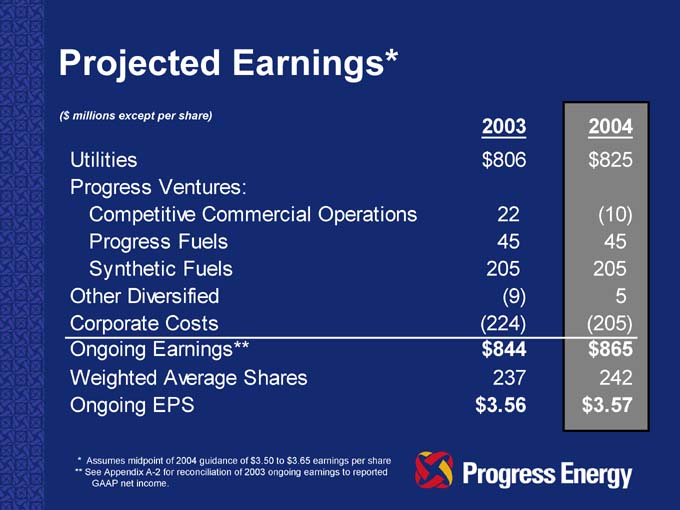

Projected Earnings*

($ millions except per share)

2003 2004

Utilities $ 806 $ 825

Progress Ventures:

Competitive Commercial Operations 22 (10)

Progress Fuels 45 45

Synthetic Fuels 205 205

Other Diversified (9) 5

Corporate Costs (224) (205)

Ongoing Earnings** $ 844 $ 865

Weighted Average Shares 237 242

Ongoing EPS $ 3.56 $ 3.57

* Assumes midpoint of 2004 guidance of $3.50 to $3.65 earnings per share ** See Appendix A-2 for reconciliation of 2003 ongoing earnings to reported GAAP net income.

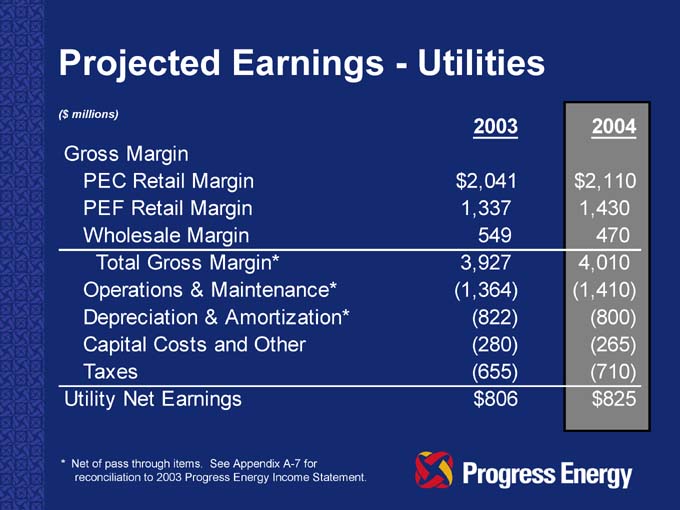

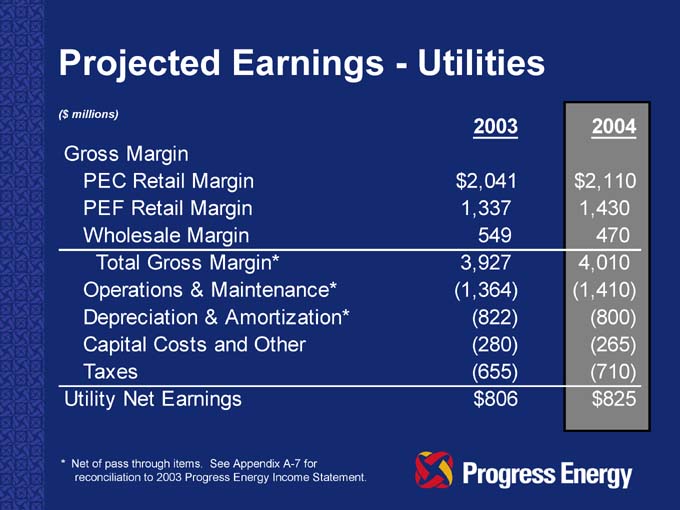

Projected Earnings—Utilities

($ millions)

2003 2004

Gross Margin

PEC Retail Margin 2,041 $ 2,110

PEF Retail Margin 1,337 1,430

Wholesale Margin 549 470

Total Gross Margin* 3,927 4,010

Operations & Maintenance* (1,364) (1,410)

Depreciation & Amortization* (822) (800)

Capital Costs and Other (280) (265)

Taxes (655) (710)

Utility Net Earnings $806 $825

* Net of pass through items. See Appendix A-7 for reconciliation to 2003 Progress Energy Income Statement.

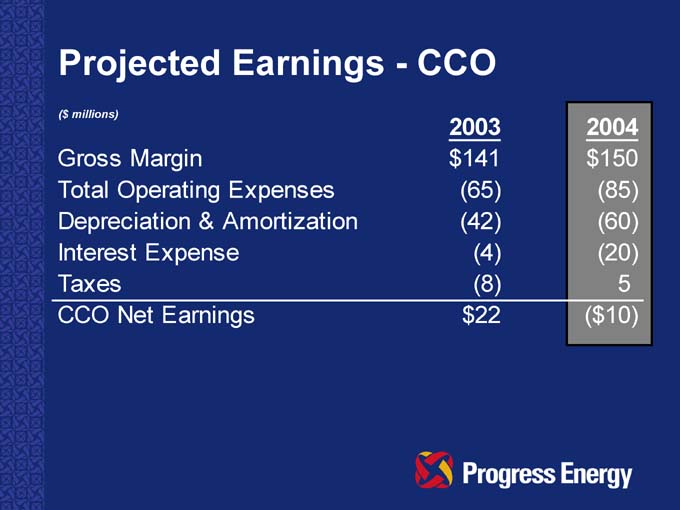

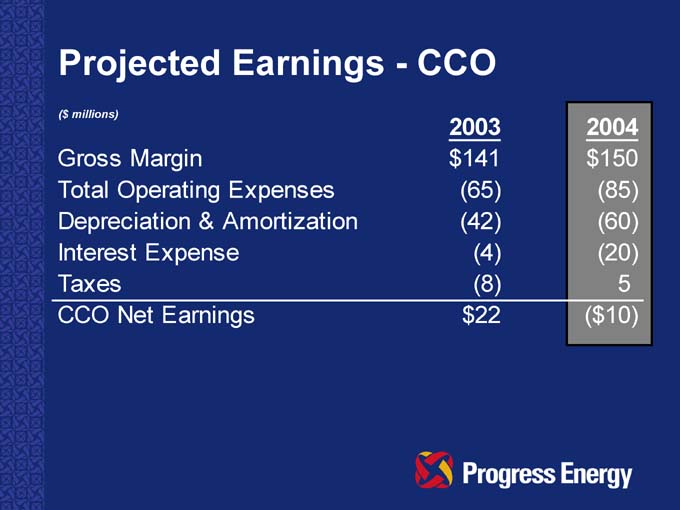

Projected Earnings—CCO

($ millions)

2003 2004

Gross Margin $ 141 $ 150

Total Operating Expenses (65) (85)

Depreciation & Amortization (42) (60)

Interest Expense (4) (20)

Taxes (8) 5

CCO Net Earnings $22 ($ 10)

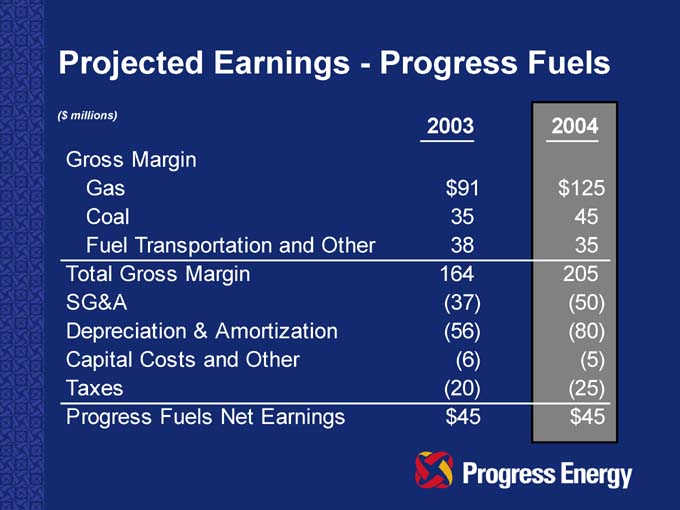

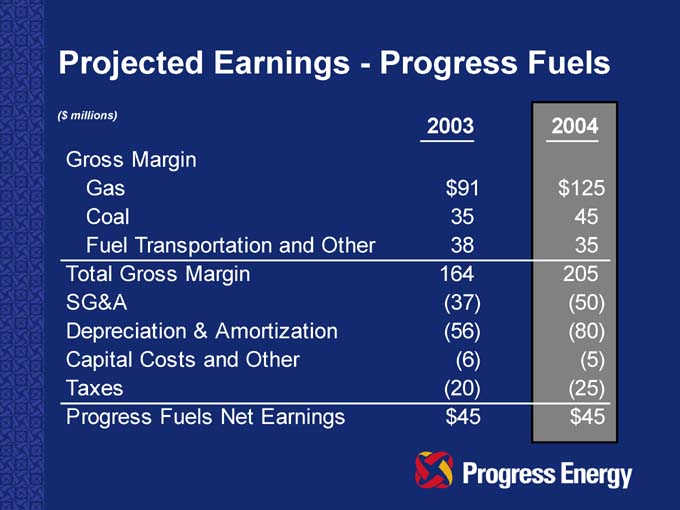

Projected Earnings—Progress Fuels

($ millions) 2003 2004

Gross Margin

Gas $ 91 $ 125

Coal 35 45

Fuel Transportation and Other 38 35

Total Gross Margin 164 205

SG&A (37) (50)

Depreciation & Amortization (56) (80)

Capital Costs and Other (6) (5)

Taxes (20) (25)

Progress Fuels Net Earnings $ 45 $45

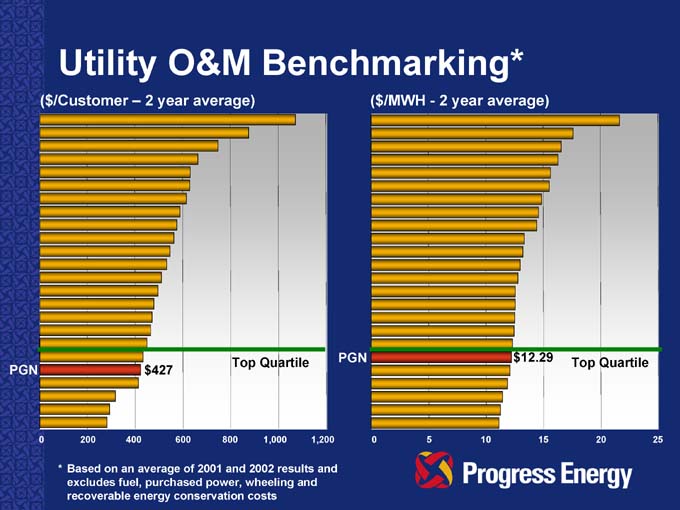

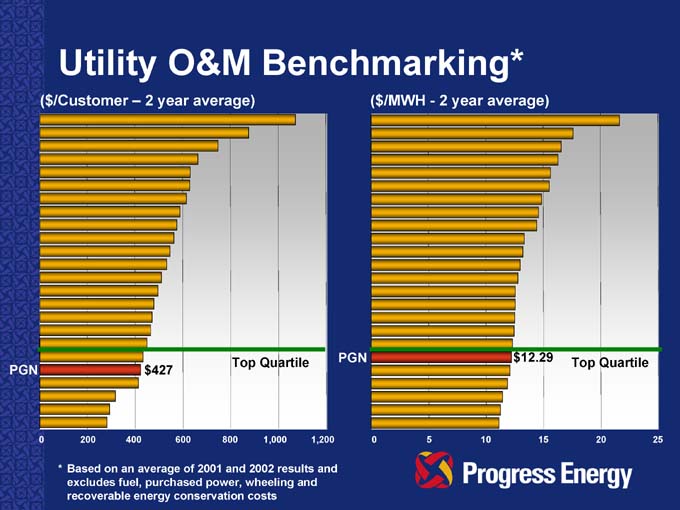

Utility O&M Benchmarking*

($ /Customer – 2 year average)

PGN

$427

Top Quartile

($ /MWH—2 year average)

PGN

$12.29

Top Quartile

* Based on an average of 2001 and 2002 results and excludes fuel, purchased power, wheeling and recoverable energy conservation costs

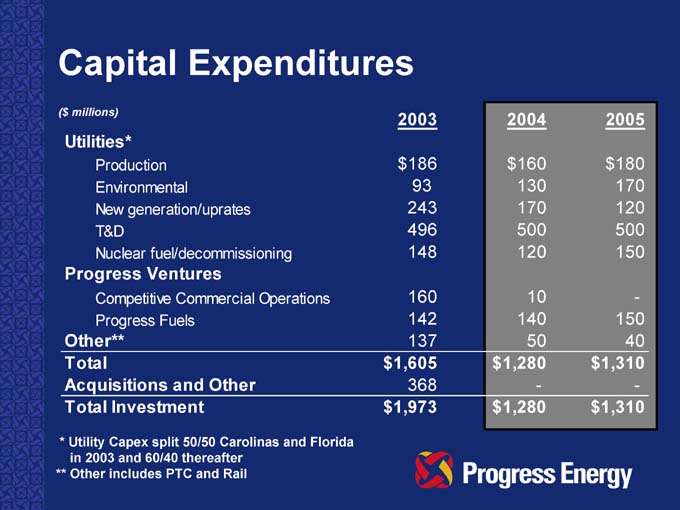

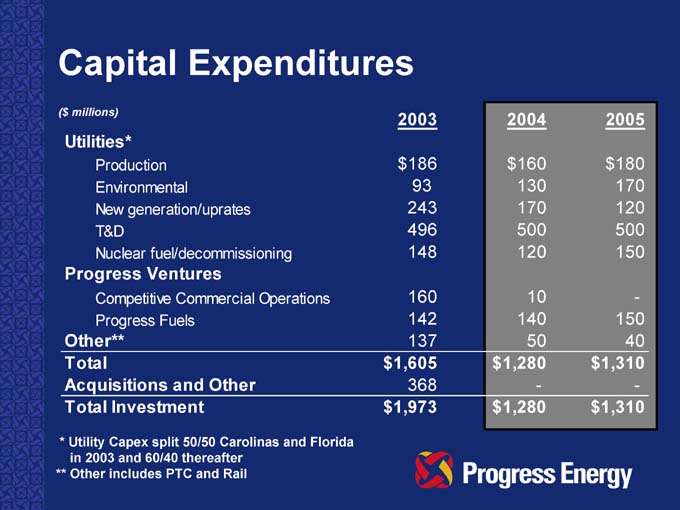

Capital Expenditures

($ millions) 2003 2004 2005

Utilities*

Production $ 186 $ 160 $ 180

Environmental 93 130 170

New generation/uprates 243 170 120

T&D 496 500 500

Nuclear fuel/decommissioning 148 120 150

Progress Ventures

Competitive Commercial Operations 160 10 -

Progress Fuels 142 140 150

Other** 137 50 40

Total $ 1,605 $ 1,280 $ 1,310

Acquisitions and Other 368 - -

Total Investment $ 1,973 $ 1,280 $ 1,310

* Utility Capex split 50/50 Carolinas and Florida in 2003 and 60/40 thereafter

** Other includes PTC and Rail

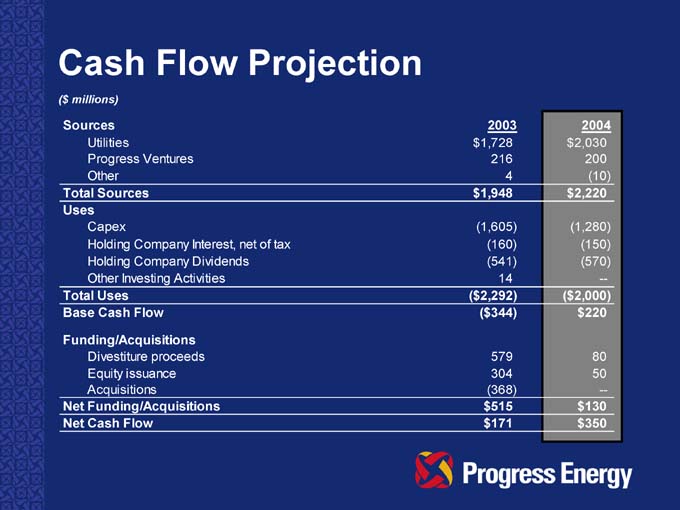

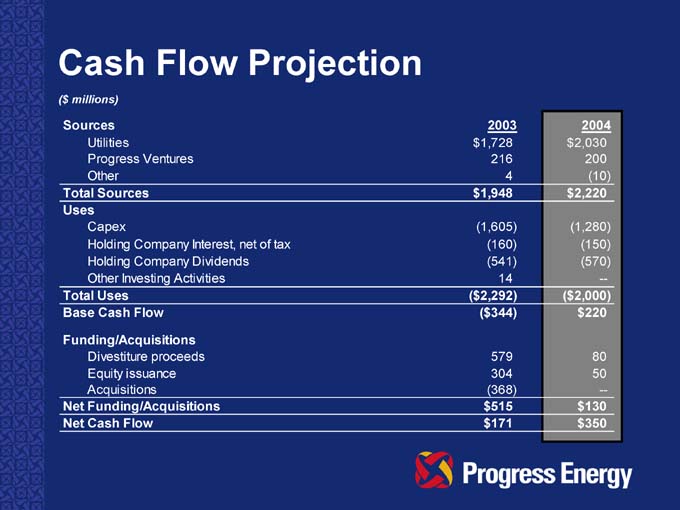

Cash Flow Projection

($ millions)

Sources 2003 2004

Utilities $ 1,728 $ 2,030

Progress Ventures 216 200

Other 4 (10)

Total Sources $ 1,948 $ 2,220

Uses

Capex (1,605) (1,280)

Holding Company Interest, net of tax (160) (150)

Holding Company Dividends (541) (570)

Other Investing Activities 14 —

Total Uses ($ 2,292) ($ 2,000)

Base Cash Flow ($ 344) $ 220

Funding/Acquisitions

Divestiture proceeds 579 80

Equity issuance 304 50

Acquisitions (368) —

Net Funding/Acquisitions $ 515 $ 130

Net Cash Flow $ 171 $ 350

Cash Flow Projection—GAAP

($ millions)

2003 2004

Operating Activities

Utilities $ 1,728 $ 2,030

Progress Ventures 216 200

Other (156) (160)

Total Cash From Operations 1,788 2,070

Investing Activities

Total Investment (1,973) (1,280)

Asset Sales and Other 593 80

Total Cash Used in Investing Activities (1,380) (1,200)

Financing Activities

Issuance of Common Stock, net 304 50

Dividends (541) (570)

Net debt issuances 41 (560)

Total Cash by Financing Activities (196) (1,080)

Net Change in Cash Flow $ 212 ($210)

Beginning Cash 61 273

Ending Cash $ 273 $63

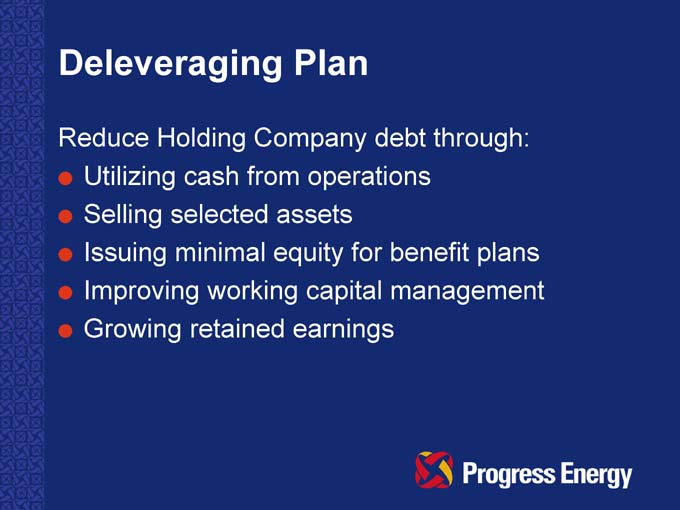

Deleveraging Plan

Reduce Holding Company debt through:

Utilizing cash from operations

Selling selected assets

Issuing minimal equity for benefit plans

Improving working capital management

Growing retained earnings

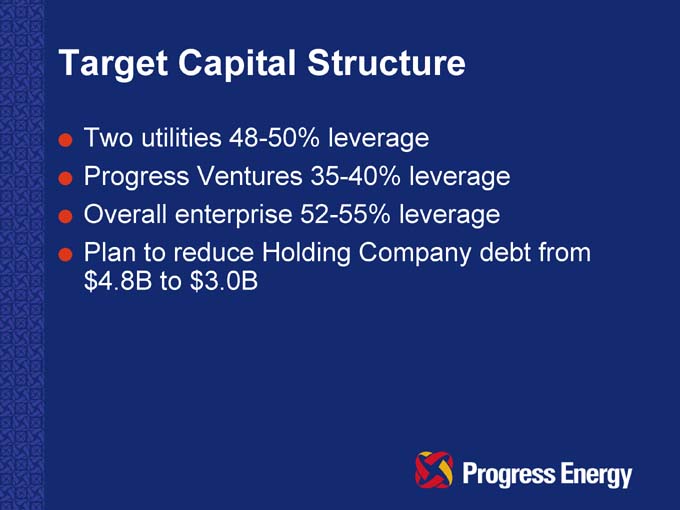

Target Capital Structure

Two utilities 48-50% leverage

Progress Ventures 35-40% leverage

Overall enterprise 52-55% leverage

Plan to reduce Holding Company debt from $4.8B to $3.0B

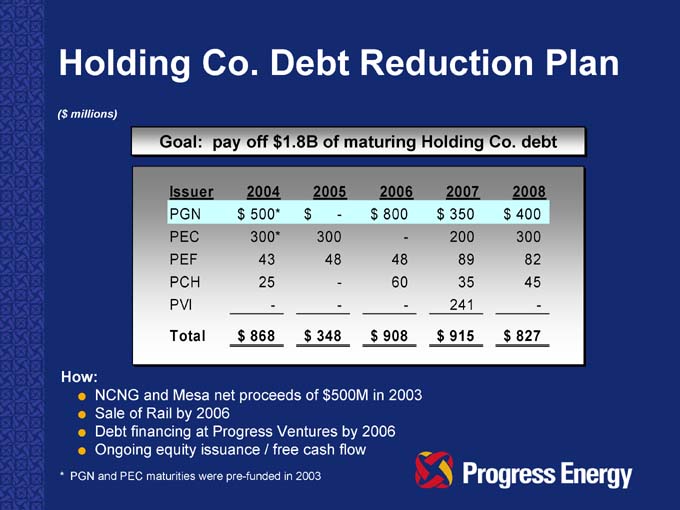

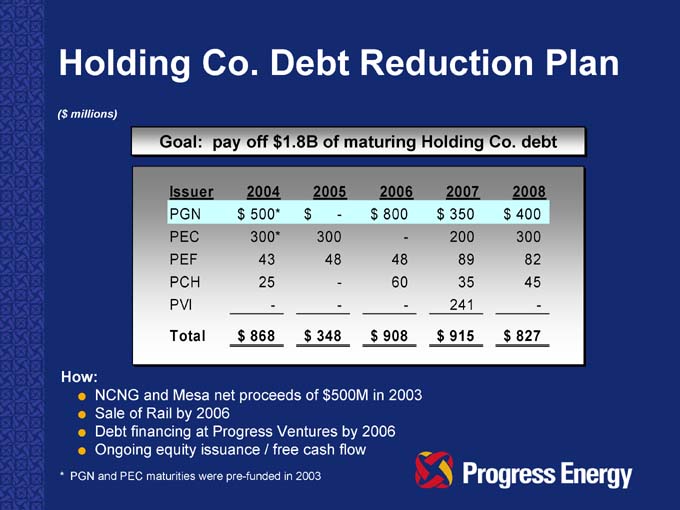

Holding Co. Debt Reduction Plan

($ millions)

Goal: pay off $1.8B of maturing Holding Co. debt

Issuer 2004 2005 2006 2007 2008

PGN $ 500* $ - $ 800 $ 350 $ 400

PEC 300* 300 - 200 300

PEF 43 48 48 89 82

PCH 25 - 60 35 45

PVI - - - 241 -

Total $ 868 $ 348 $ 908 $ 915 $ 827

How:

NCNG and Mesa net proceeds of $500M in 2003

Sale of Rail by 2006

Debt financing at Progress Ventures by 2006

Ongoing equity issuance / free cash flow

* PGN and PEC maturities were pre-funded in 2003

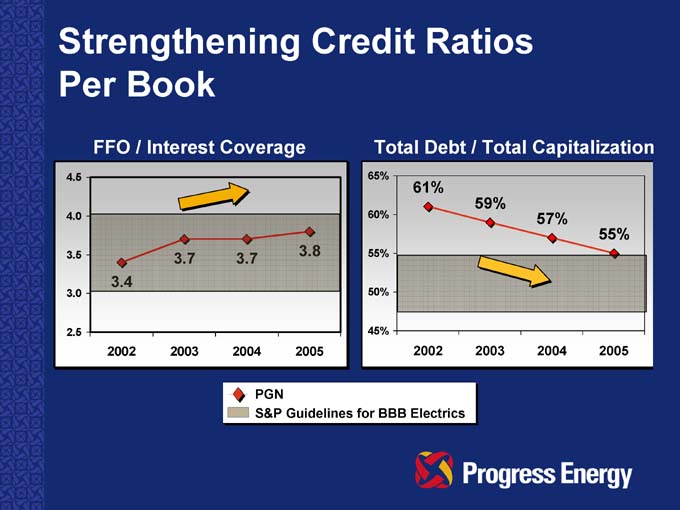

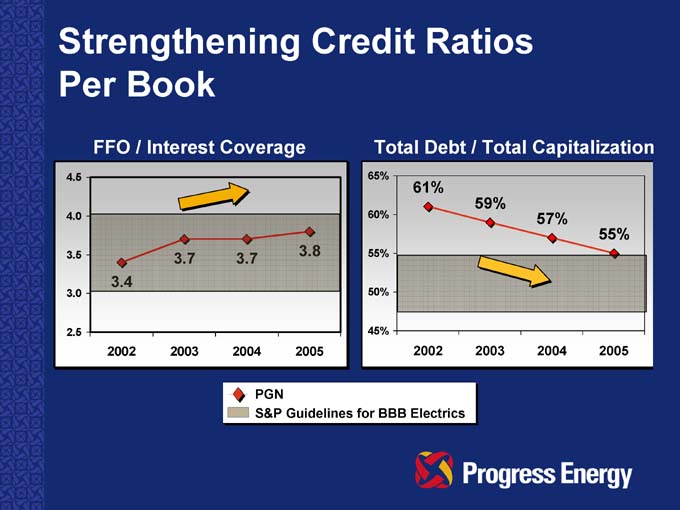

Strengthening Credit Ratios Per Book

FFO / Interest Coverage

3.4

2002

3.7

2003

3.7

2004

3.8

2005

Total Debt / Total Capitalization

61%

2002

59%

2003

57%

2004

55%

2005

PGN

S&P Guidelines for BBB Electrics

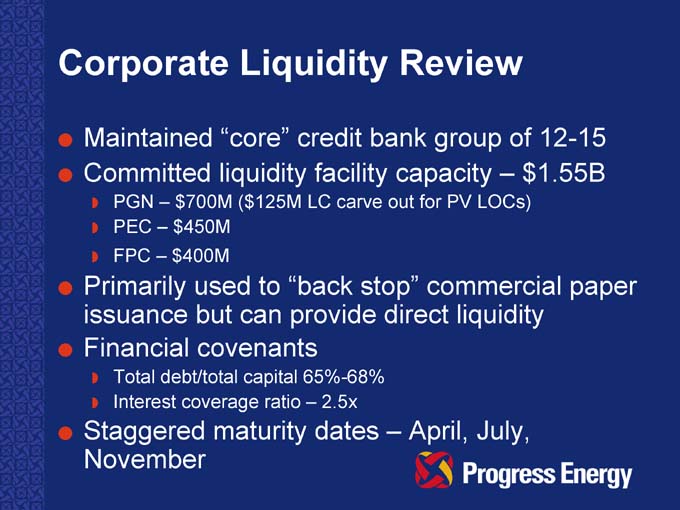

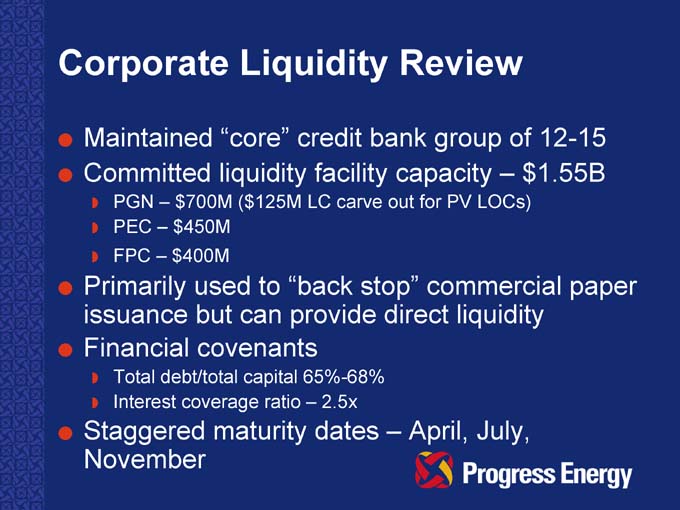

Corporate Liquidity Review

Maintained “core” credit bank group of 12-15

Committed liquidity facility capacity – $1.55B

PGN – $700M ($125M LC carve out for PV LOCs)

PEC – $450M

FPC – $400M

Primarily used to “back stop” commercial paper issuance but can provide direct liquidity

Financial covenants

Total debt/total capital 65%-68%

Interest coverage ratio – 2.5x

Staggered maturity dates – April, July, November

Other Financial Issues

Synthetic fuels program sunset

Pension status

Progress Rail

Progress Telecom

Deferred Tax Credit Utilization Options

Debt reduction

Stock buyback

Reinvest cash

Securitization for earlier access

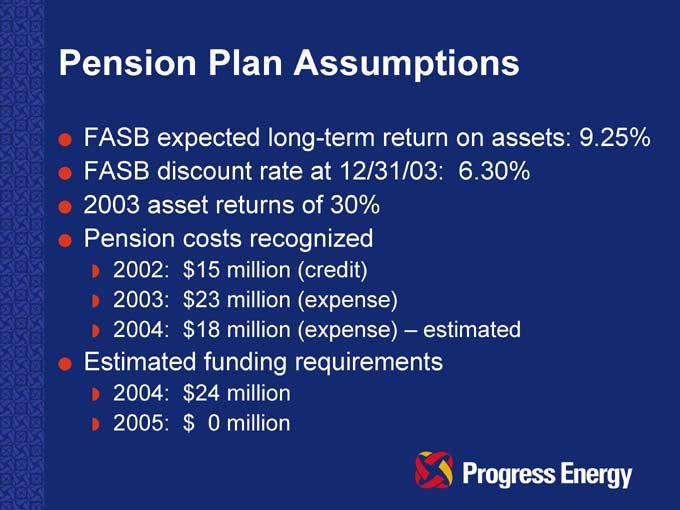

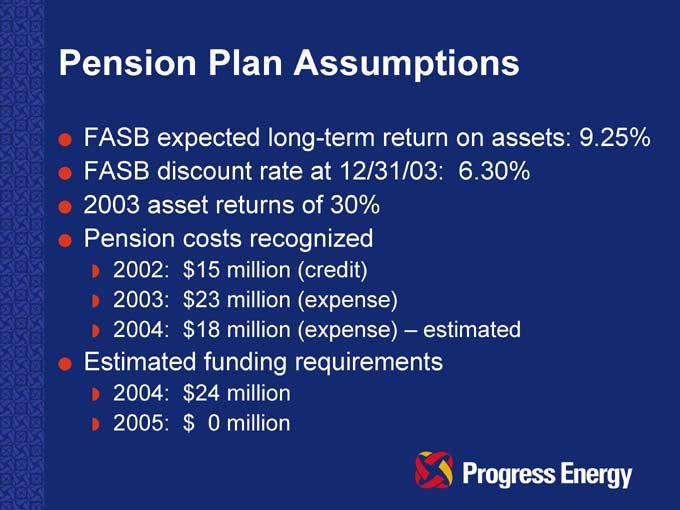

Pension Plan Assumptions

FASB expected long-term return on assets: 9.25%

FASB discount rate at 12/31/03: 6.30%

2003 asset returns of 30%

Pension costs recognized

2002: $15 million (credit)

2003: $23 million (expense)

2004: $18 million (expense) – estimated

Estimated funding requirements

2004: $24 million

2005: $ 0 million

Progress Rail

Locomotive and Railcar Services

Engineering and Trackwork

Finalized Railcar, Ltd. sale in February 2004

Prospects for divestiture

Progress Telecom

Asset contribution with EPIK Communications

55% ownership in new entity, Progress Telecom LLC

Reduced funding requirements

Preserves and stabilizes the value of the telecom assets

Provides future flexibility around these assets

Summary

Growth Transition

What You Heard Today

Operational excellence

Strong service territories

Constructive regulatory relations

Focus on cost management and efficient use of capital

Prospects for 2005 and Beyond

Earnings

No equity converts

Limited equity issuances

Retail margin growth

Cost management

Recontracting regulated wholesale and nonregulated generation

Jackson EMC contract

Gas prices and production

Economic recovery

Clean Air amortization

Stock option expensing

Pension costs

Free Cash Flows

Fuel prices

Organic growth (~3%)

Capital spending

Dividends

Limited equity issuances

Why Invest in Progress Energy?

Two strong electric utilities with solid rate agreements

Historical success in wholesale electricity markets within utilities

Ability to replicate utility wholesale success in Progress Ventures

Strong dividend record—sustainable

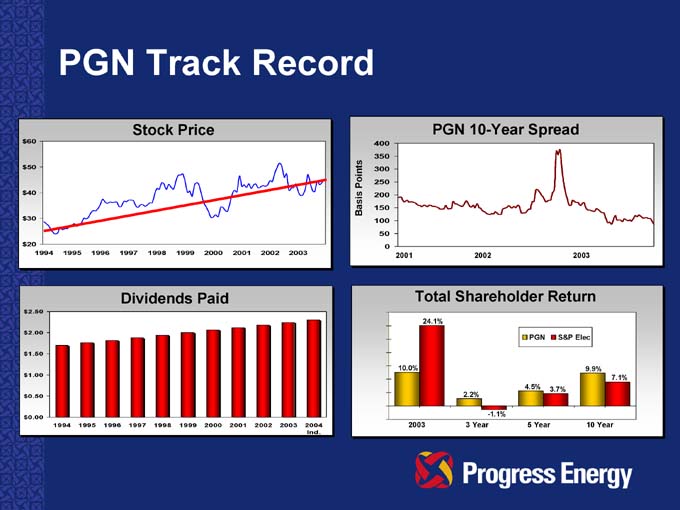

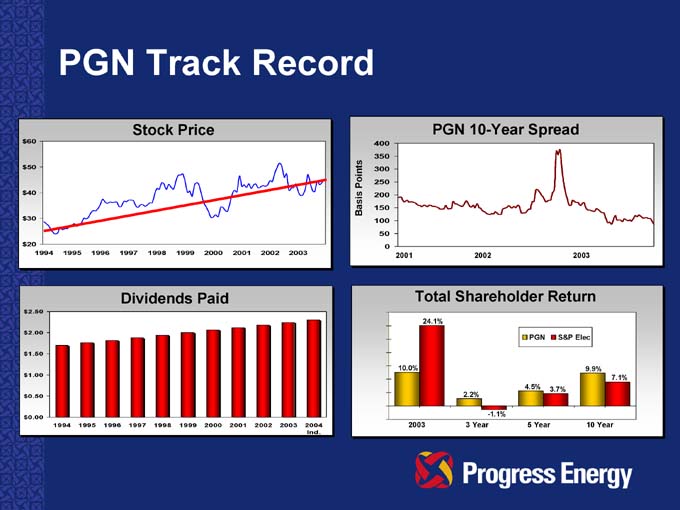

PGN Track Record

Stock Price

Dividends Paid

PGN 10-Year Spread

Total Shareholder Return

24.1%

10.0%

2003

2.2%

-1.1%

3 Year

4.5%

3.7%

5 Year

9.9%

7.1%

10 Year

PGN S&P Elec

Appendix

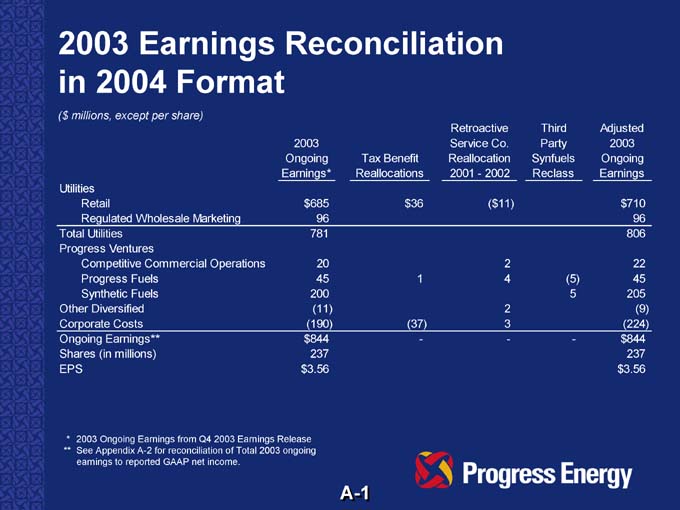

2003 Earnings Reconciliation in 2004 Format

($ millions, except per share)

Retroactive Third Adjusted

2003 Service Co. Party 2003

Ongoing Tax Benefit Reallocation Synfuels Ongoing

Earnings* Reallocations 2001—2002 Reclass Earnings

Utilities

Retail $ 685 $ 36 ($ 11) $ 710

Regulated Wholesale Marketing 96 96

Total Utilities 781 806

Progress Ventures

Competitive Commercial Operations 20 2 22

Progress Fuels 45 1 4 (5) 45

Synthetic Fuels 200 5 205

Other Diversified (11) 2 (9)

Corporate Costs (190) (37) 3 (224)

Ongoing Earnings** $ 844 - - - $ 844

Shares (in millions) 237 237

EPS $ 3.56 $ 3.56

* 2003 Ongoing Earnings from Q4 2003 Earnings Release

** See Appendix A-2 for reconciliation of Total 2003 ongoing earnings to reported GAAP net income.

A-1

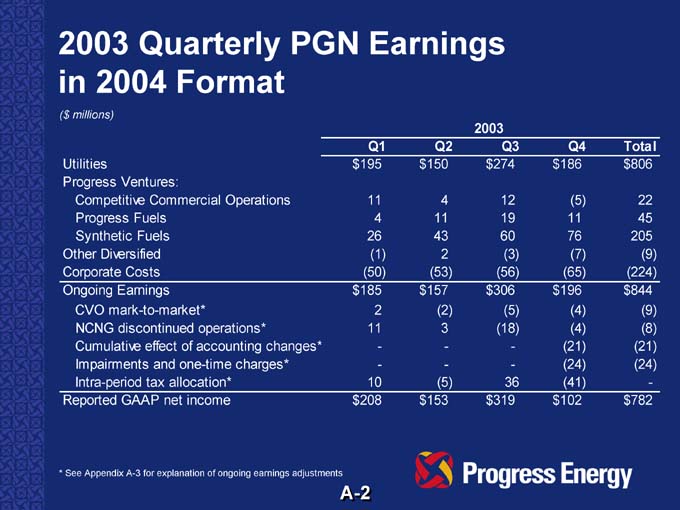

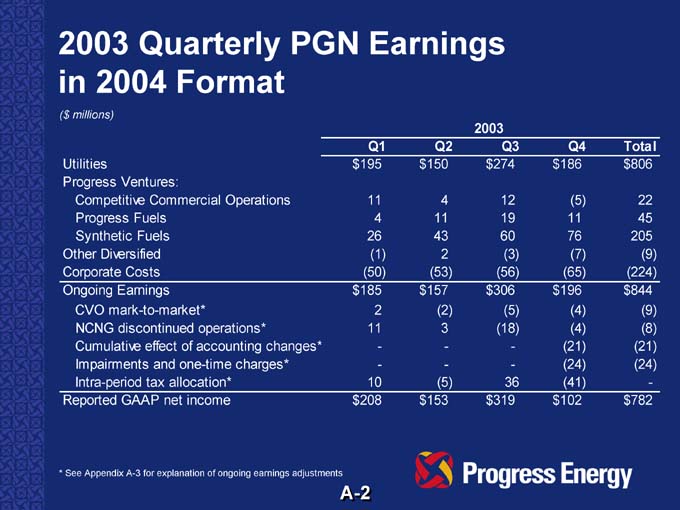

2003 Quarterly PGN Earnings in 2004 Format

($ millions)

2003

Q1 Q2 Q3 Q4 Total

Utilities $ 195 $ 150 $ 274 $ 186 $ 806

Progress Ventures:

Competitive Commercial Operations 11 4 12 (5) 22

Progress Fuels 4 11 19 11 45

Synthetic Fuels 26 43 60 76 205

Other Diversified (1) 2 (3) (7) (9)

Corporate Costs (50) (53) (56) (65) (224)

Ongoing Earnings $ 185 $ 157 $ 306 $ 196 $ 844

CVO mark-to-market* 2 (2) (5) (4) (9)

NCNG discontinued operations* 11 3 (18) (4) (8)

Cumulative effect of accounting changes* - - - (21) (21)

Impairments and one-time charges* - - - (24) (24)

Intra-period tax allocation* 10 (5) 36 (41) -

Reported GAAP net income $ 208 $ 153 $ 319 $ 102 $ 782

* See Appendix A-3 for explanation of ongoing earnings adjustments

A-2

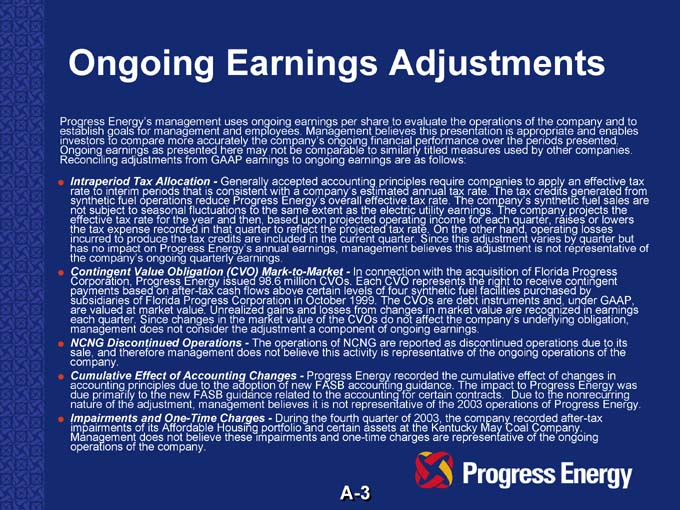

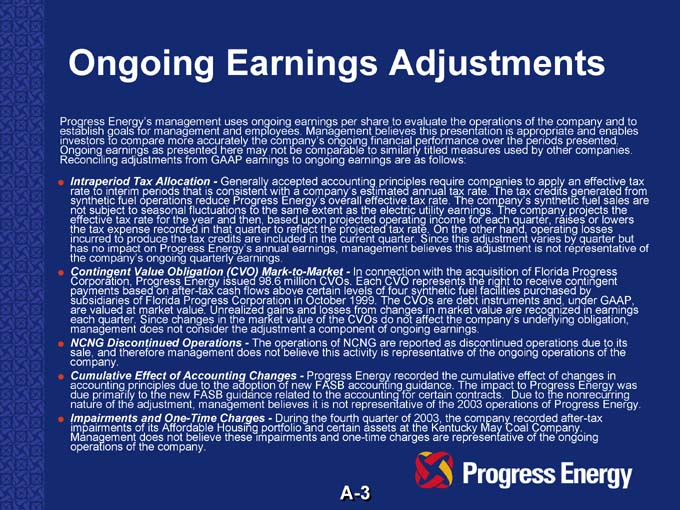

Ongoing Earnings Adjustments

Progress Energy’s management uses ongoing earnings per share to evaluate the operations of the company and to establish goals for management and employees. Management believes this presentation is appropriate and enables investors to compare more accurately the company’s ongoing financial performance over the periods presented. Ongoing earnings as presented here may not be comparable to similarly titled measures used by other companies.Reconciling adjustments from GAAP earnings to ongoing earnings are as follows:

Intraperiod Tax Allocation—Generally accepted accounting principles require companies to apply an effective tax rate to interim periods that is consistent with a company’s estimated annual tax rate. The tax credits generated fromsynthetic fuel operations reduce Progress Energy’s overall effective tax rate. The company’s synthetic fuel sales are not subject to seasonal fluctuations to the same extent as the electric utility earnings. The company projects the effective tax rate for the year and then, based upon projected operating income for each quarter, raises or lowers the tax expense recorded in that quarter to reflect the projected tax rate. On the other hand, operating losses incurred to produce the tax credits are included in the current quarter. Since this adjustment varies by quarter but has no impact on Progress Energy’s annual earnings, management believes this adjustment is not representative of the company’s ongoing quarterly earnings.

Contingent Value Obligation (CVO) Mark-to-Market—In connection with the acquisition of Florida Progress Corporation, Progress Energy issued 98.6 million CVOs. Each CVO represents the right to receive contingent payments based on after-tax cash flows above certain levels of four synthetic fuel facilities purchased by subsidiaries of Florida Progress Corporation in October 1999. The CVOs are debt instruments and, under GAAP, are valued at market value. Unrealized gains and losses from changes in market value are recognized in earningseach quarter. Since changes in the market value of the CVOs do not affect the company’s underlying obligation, management does not consider the adjustment a component of ongoing earnings.

NCNG Discontinued Operations—The operations of NCNG are reported as discontinued operations due to its sale, and therefore management does not believe this activity is representative of the ongoing operations of the company.

Cumulative Effect of Accounting Changes—Progress Energy recorded the cumulative effect of changes in accounting principles due to the adoption of new FASB accounting guidance. The impact to Progress Energy was due primarily to the new FASB guidance related to the accounting for certain contracts. Due to the nonrecurring nature of the adjustment, management believes it is not representative of the 2003 operations of Progress Energy.

Impairments and One-Time Charges—During the fourth quarter of 2003, the company recorded after-tax impairments of its Affordable Housing portfolio and certain assets at the Kentucky May Coal Company. Management does not believe these impairments and one-time charges are representative of the ongoing operations of the company.

A-3

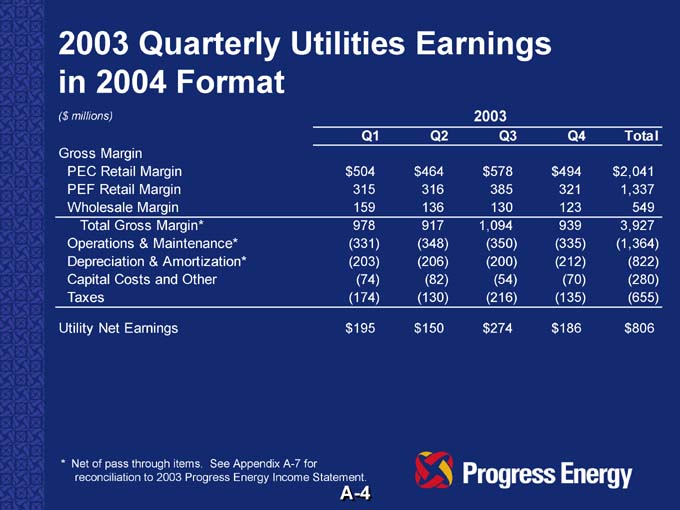

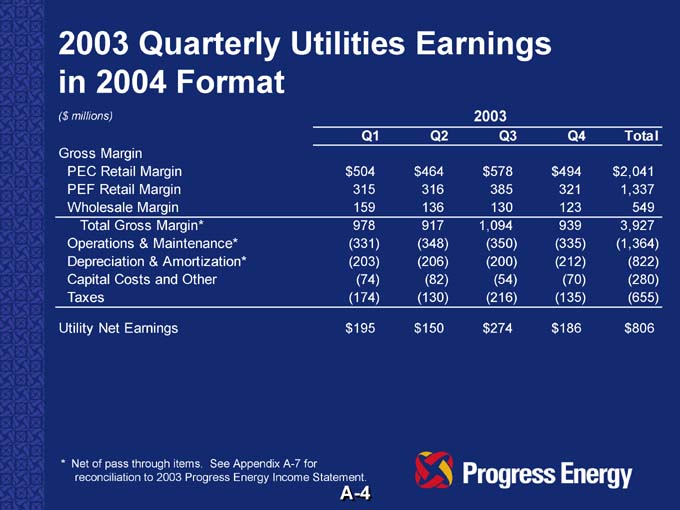

2003 Quarterly Utilities Earnings in 2004 Format

($ millions) 2003

Q1 Q2 Q3 Q4 Total

Gross Margin

PEC Retail Margin $ 504 $ 464 $ 578 $ 494 $ 2,041

PEF Retail Margin 315 316 385 321 1,337

Wholesale Margin 159 136 130 123 549

Total Gross Margin* 978 917 1,094 939 3,927

Operations & Maintenance* (331) (348) (350) (335) (1,364)

Depreciation & Amortization* (203) (206) (200) (212) (822)

Capital Costs and Other (74) (82) (54) (70) (280)

Taxes (174) (130) (216) (135) (655)

Utility Net Earnings $ 195 $ 150 $ 274 $ 186 $806

* Net of pass through items. See Appendix A-7 for reconciliation to 2003 Progress Energy Income Statement.

A-4

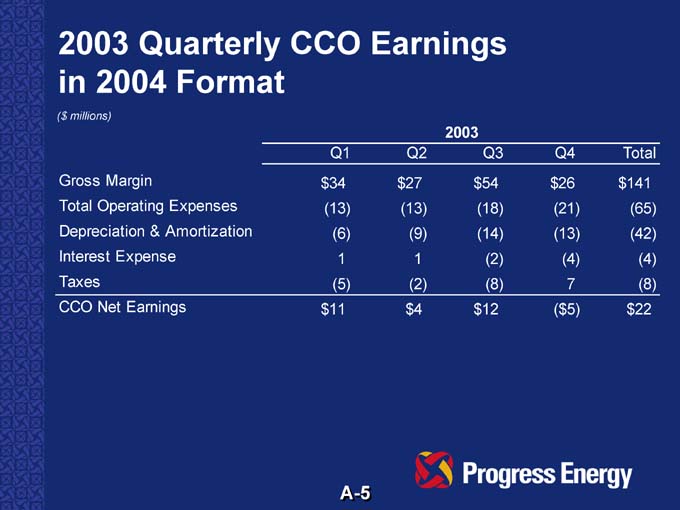

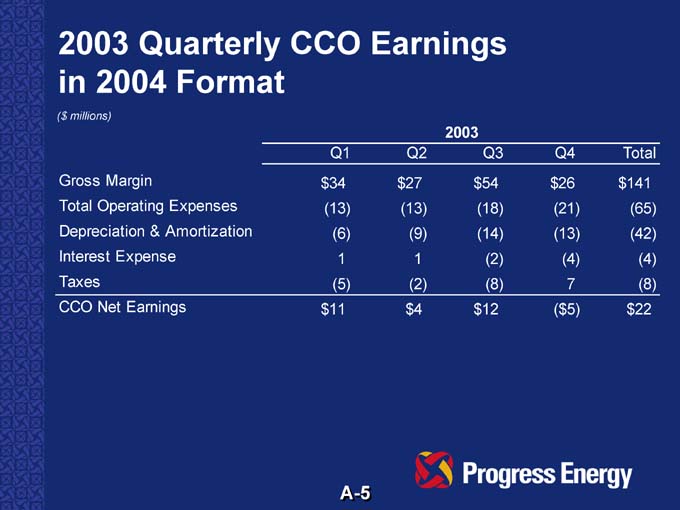

2003 Quarterly CCO Earnings in 2004 Format

($ millions)

2003

Q1 Q2 Q3 Q4 Total

Gross Margin $ 34 $ 27 $ 54 $ 26 $ 141

Total Operating Expenses (13) (13) (18) (21) (65)

Depreciation & Amortization (6) (9) (14) (13) (42)

Interest Expense 1 1 (2) (4) (4)

Taxes (5) (2) (8) 7 (8)

CCO Net Earnings $ 11 $4 $ 12 ( $5) $ 22

A-5

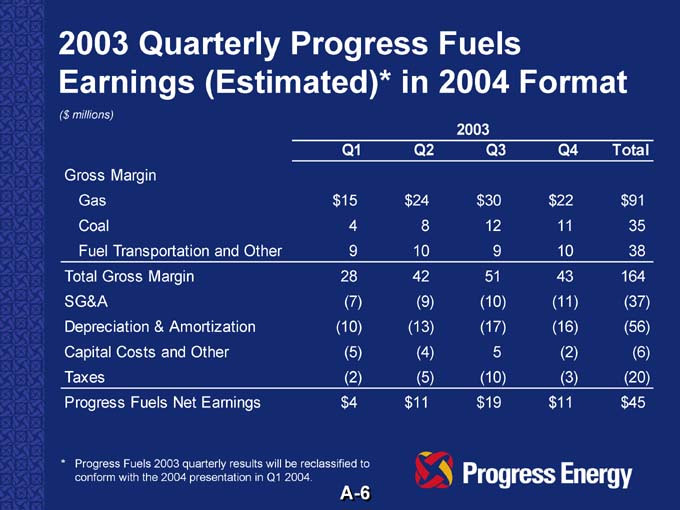

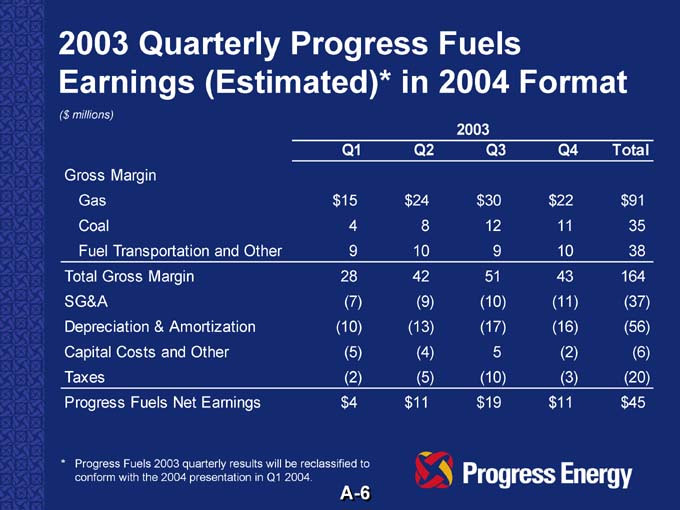

2003 Quarterly Progress Fuels Earnings (Estimated)* in 2004 Format

($ millions)

2003

Q1 Q2 Q3 Q4 Total

Gross Margin

Gas $ 15 $ 24 $ 30 $ 22 $ 91

Coal 4 8 12 11 35

Fuel Transportation and Other 9 10 9 10 38

Total Gross Margin 28 42 51 43 164

SG&A (7) (9) (10) (11) (37)

Depreciation & Amortization (10) (13) (17) (16) (56)

Capital Costs and Other (5) (4) 5 (2) (6)

Taxes (2) (5) (10) (3) (20)

Progress Fuels Net Earnings $4 $ 11 $ 19 $ 11 $ 45

* Progress Fuels 2003 quarterly results will be reclassified to conform with the 2004 presentation in Q1 2004.

A-6

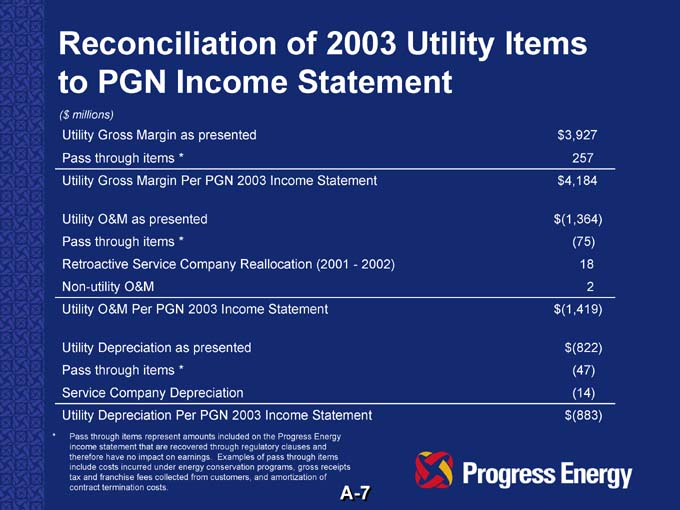

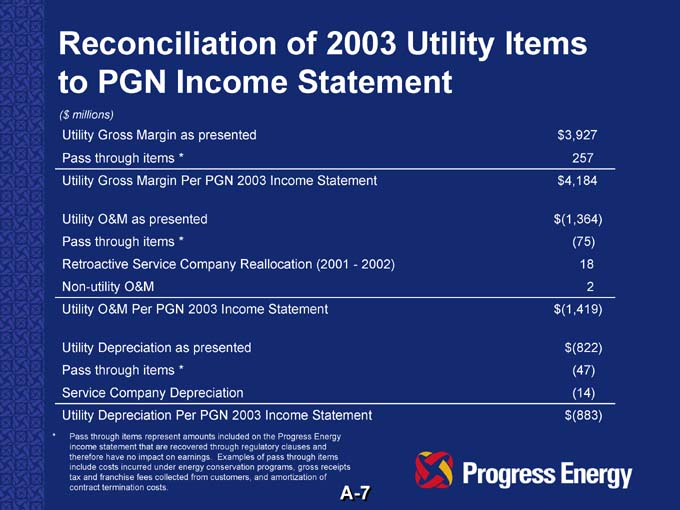

Reconciliation of 2003 Utility Items to PGN Income Statement

($ millions)

Utility Gross Margin as presented $ 3,927

Pass through items * 257

Utility Gross Margin Per PGN 2003 Income Statement $ 4,184

Utility O&M as presented $ (1,364)

Pass through items * (75)

Retroactive Service Company Reallocation (2001—2002) 18

Non-utility O&M 2

Utility O&M Per PGN 2003 Income Statement $ (1,419)

Utility Depreciation as presented $ (822)

Pass through items * (47)

Service Company Depreciation (14)

Utility Depreciation Per PGN 2003 Income Statement $ (883)

* Pass through items represent amounts included on the Progress Energy income statement that are recovered through regulatory clauses and therefore have no impact on earnings. Examples of pass through items include costs incurred under energy conservation programs, gross receipts tax and franchise fees collected from customers, and amortization of contract termination costs.

A-7