Exhibit 99.1

Doing the Right Thing… with Energy

Don L. Blankenship

Chairman, President & CEO

September 26, 2005

Safe Harbor Statement

Statements made in this presentation which are not historical in nature are forward looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 including, without limitation, forecasts of revenues, earnings estimates, and related information, all of which are based on current factual information and certain assumptions which management believes to be reasonable at this time. However, the company’s actual results for the current and future fiscal periods and corporate developments will depend on a number of economic, competitive and other factors outside the control of the company that could cause the company’s actual results for future periods to differ materially from those expressed in this presentation. Information concerning those factors is available in the company’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. In providing projections and other forward-looking statements, the company does not make, and specifically disclaims, any undertaking or obligation to update them at any time in the future or at all.

Share Repurchase Status/Considerations

Share Repurchase: Background

2004-2005 – Board discusses plans for uses of expected free cash flow, including stock repurchases

Aug. 16, 2005 – Massey issues a press release in response to certain shareholders who expressed an interest in the Company considering stock repurchases

Sept. 16, 2005 – Schedule 13D filed by JANA Partners LLC requesting a leveraged restructuring of $1.5 billion to conduct stock repurchases

Sept. 19, 2005 – Schedule 13D filed by Third Point LLC requesting stock repurchases

Share Repurchase: Plan Path Forward

Ultimate goal: continue to increase long-term shareholder value

Work with financial and other advisors to evaluate uses of expected free cash flow

Decide on a course of action

Announce decision to shareholders

Share Repurchase: Progress to Date

Board met and selected Hunton & Williams as its legal advisor

Board selected UBS Investment Bank to provide financial guidance and evaluation

Board commenced evaluation process

Coal’s Place in the World

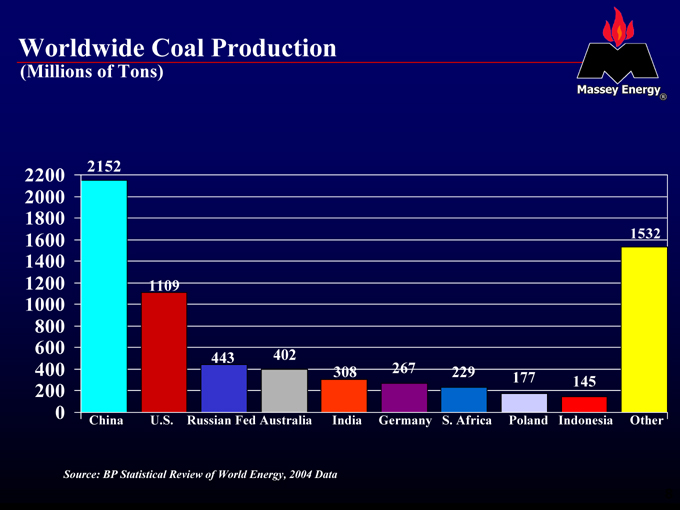

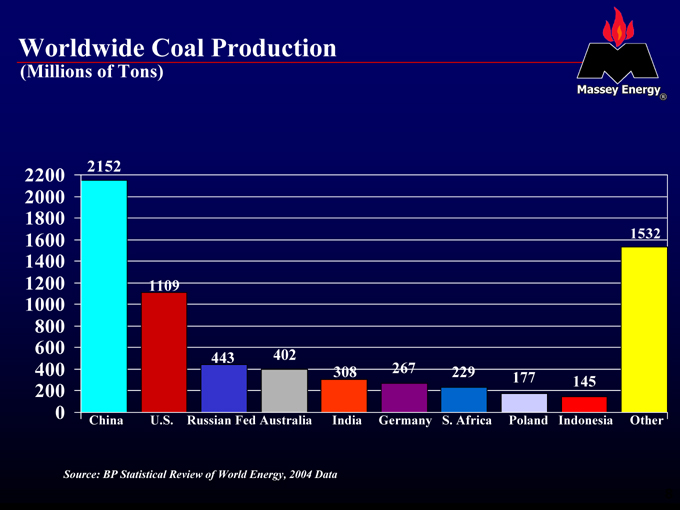

Worldwide Coal Production

(Millions of Tons)

2200 2000 1800 1600 1400 1200 1000 800 600 400 200 0

2152

1109

443

402

308

267

229

177

145

1532

China U.S. Russian Fed Australia India Germany S. Africa Poland Indonesia Other

Source: BP Statistical Review of World Energy, 2004 Data

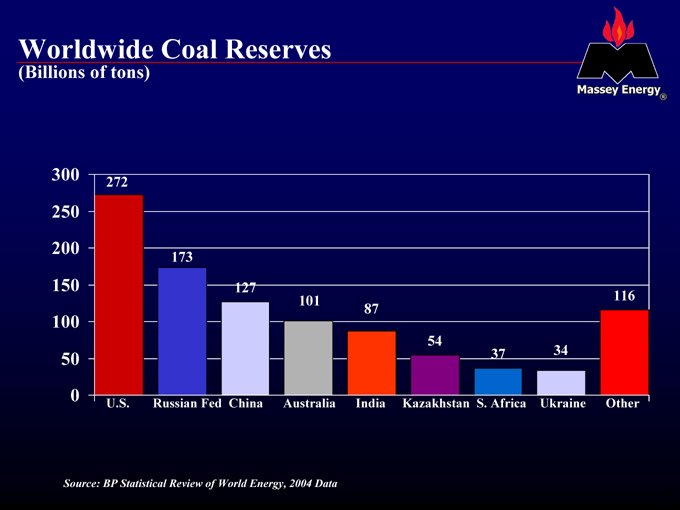

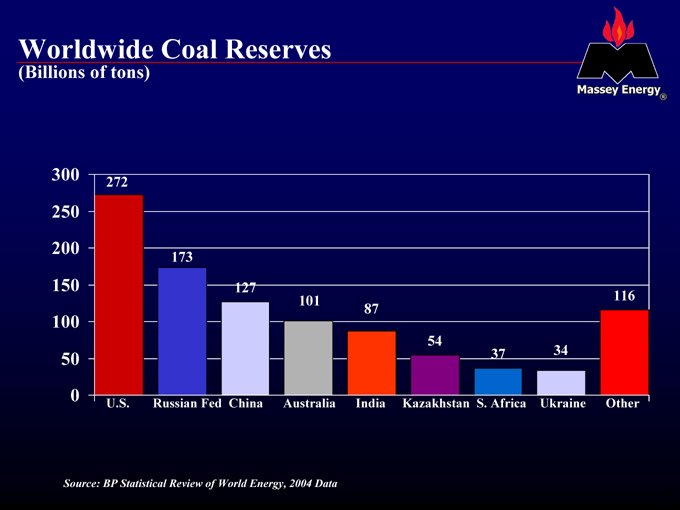

Worldwide Coal Reserves

(Billions of tons)

300

250 200

150 100

50 0

272

173

127

101

87

54

37

34

116

U.S. Russian Fed China Australia India Kazakhstan S. Africa Ukraine Other

Source: BP Statistical Review of World Energy, 2004 Data

9

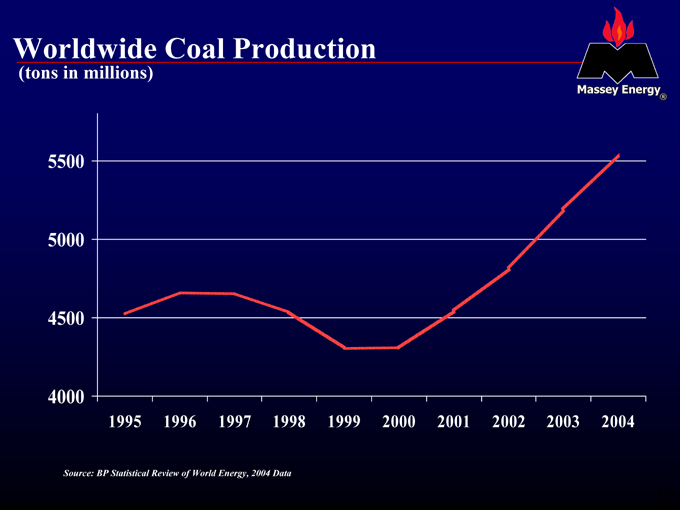

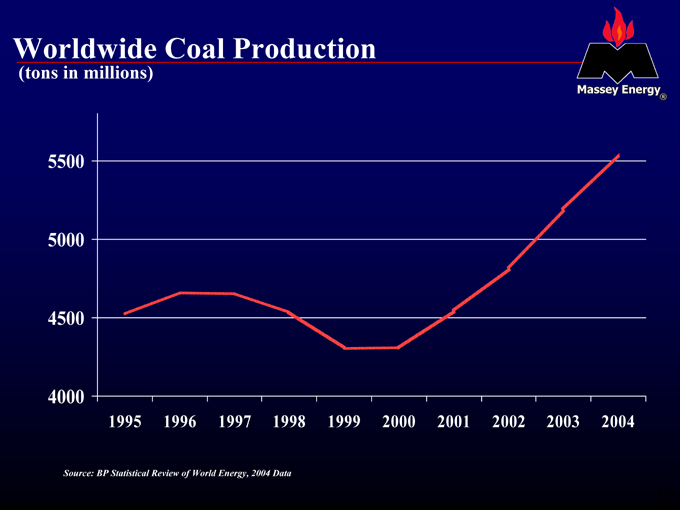

Worldwide Coal Production

(tons in millions)

5500 5000 4500 4000

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

Source: BP Statistical Review of World Energy, 2004 Data

10

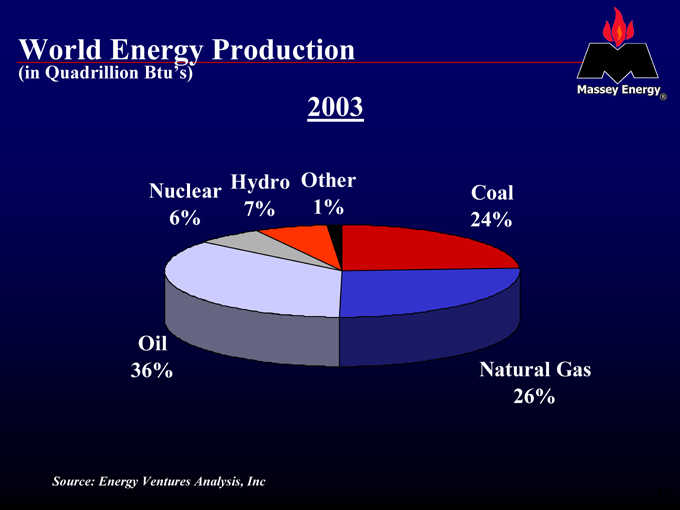

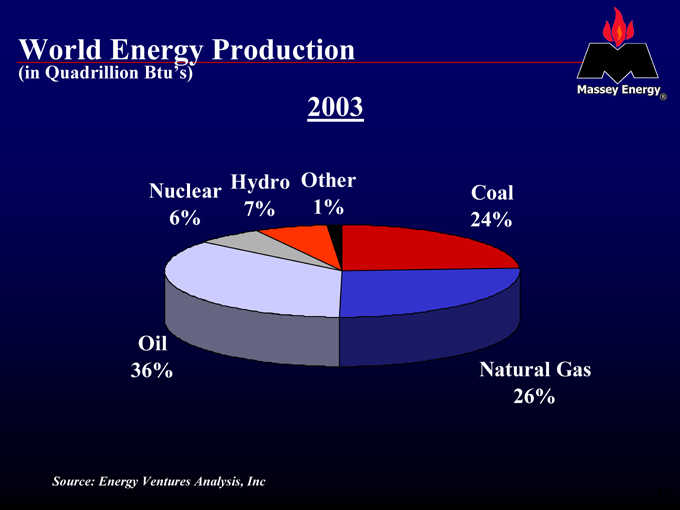

World Energy Production

(in Quadrillion Btu’s)

2003

Nuclear 6%

Hydro 7%

Other 1%

Coal 24%

Oil 36%

Natural Gas 26%

Source: Energy Ventures Analysis, Inc

11

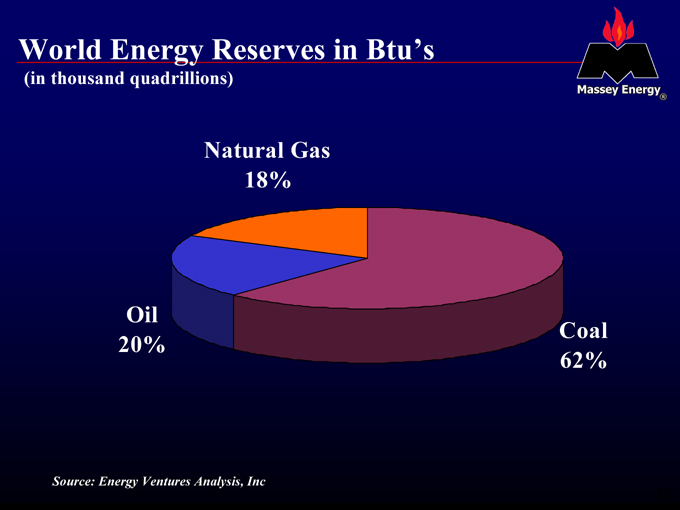

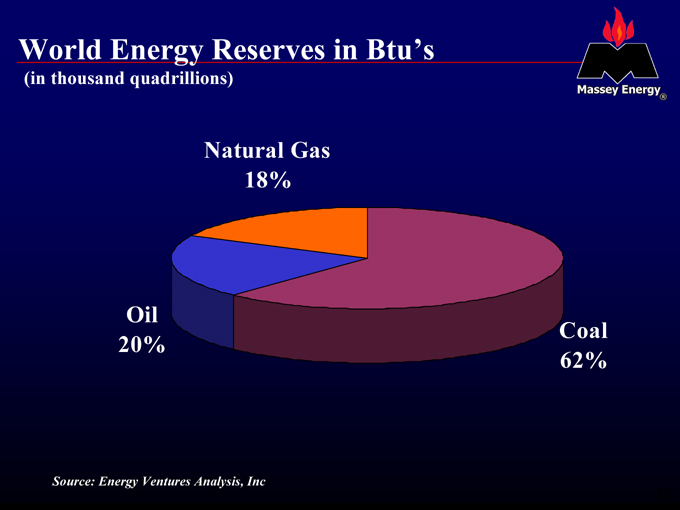

World Energy Reserves in Btu’s

(in thousand quadrillions)

Natural Gas 18%

Oil 20%

Coal 62%

Source: Energy Ventures Analysis, Inc

12

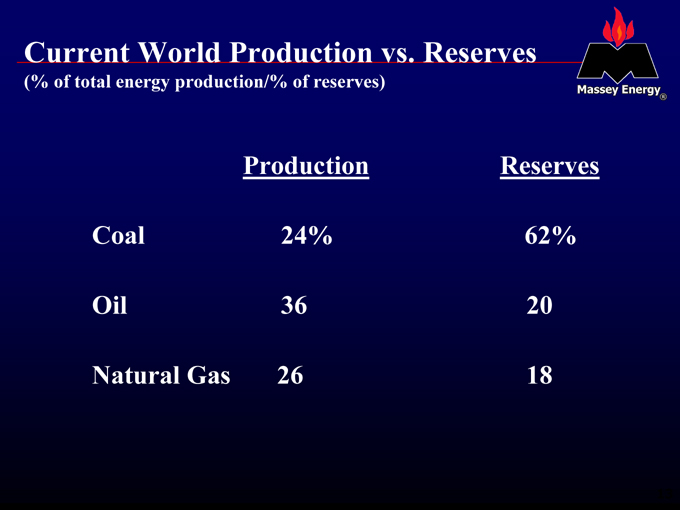

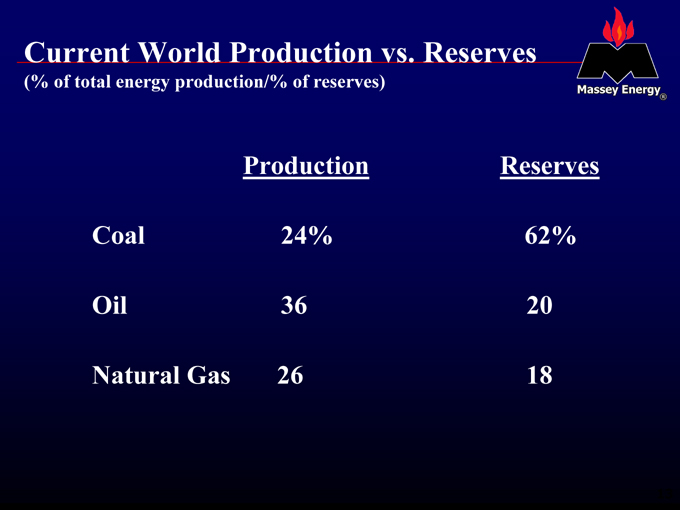

Current World Production vs. Reserves

(% of total energy production/% of reserves)

13

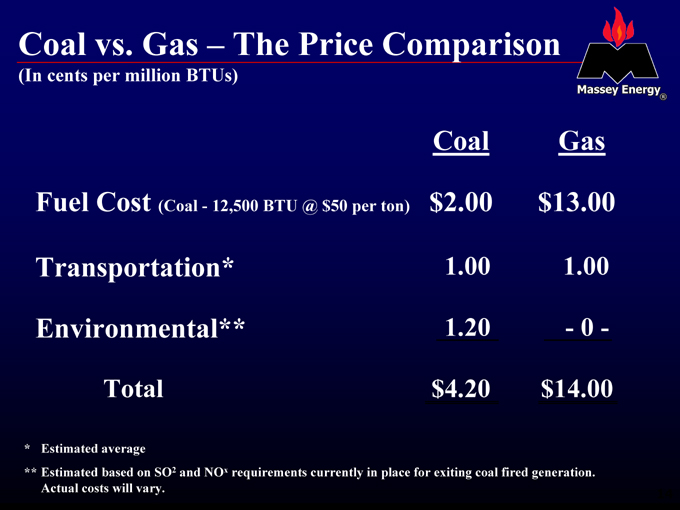

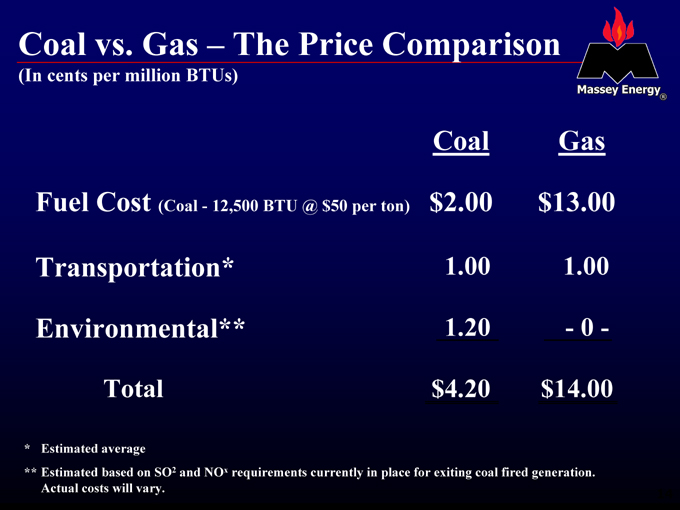

Coal vs. Gas – The Price Comparison

(In cents per million BTUs)

Fuel | | Cost (Coal—12,500 BTU @ $50 per ton) $2.00 $13.00 |

Transportation* | | 1.00 1.00 |

* Estimated average

** Estimated based on SO2 and NOx requirements currently in place for exiting coal fired generation.

Actual costs will vary.

14

U.S. Coal

15

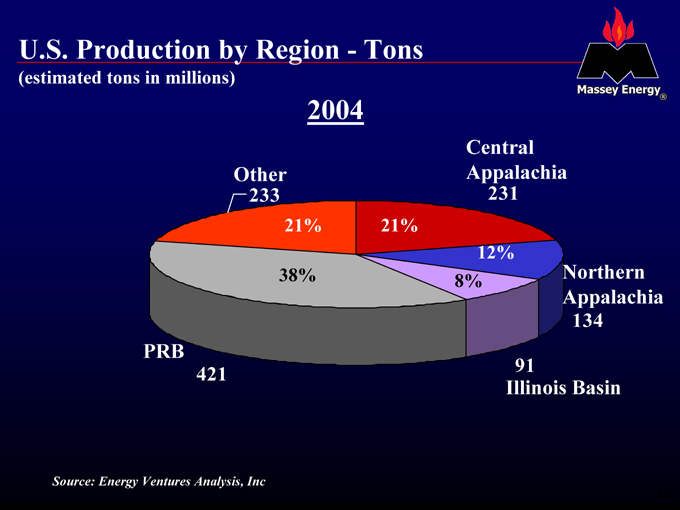

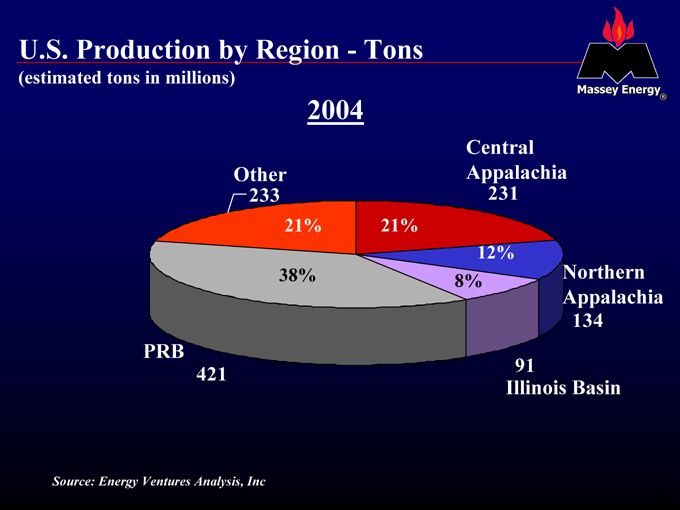

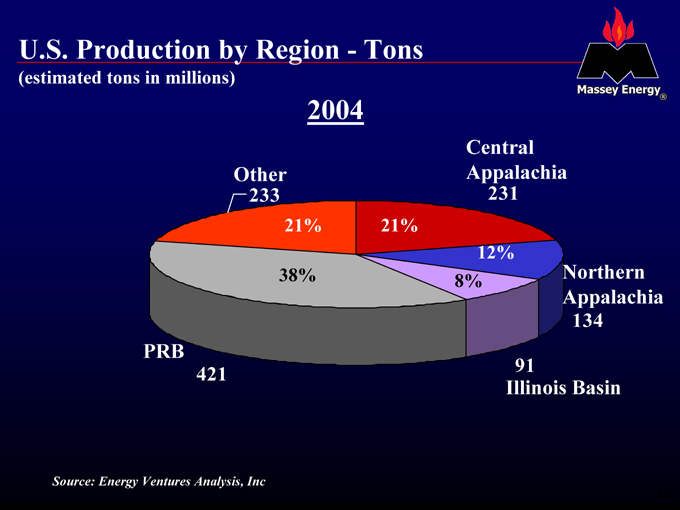

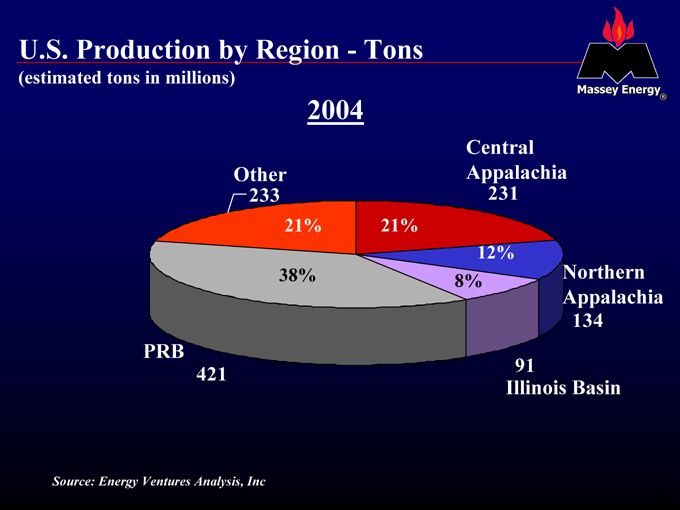

U.S. Production by Region—Tons

(estimated tons in millions)

2004

Other

233

Central Appalachia

231

Northern Appalachia

134

91

Illinois Basin

PRB

421

21%

21%

12%

8%

38%

Source: Energy Ventures Analysis, Inc

16

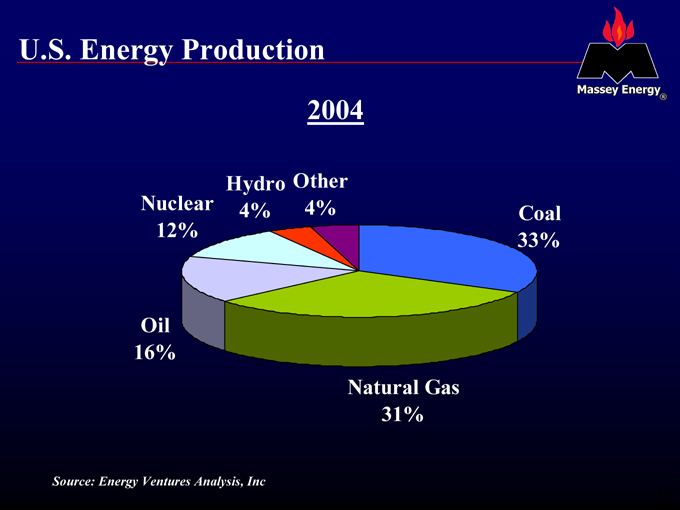

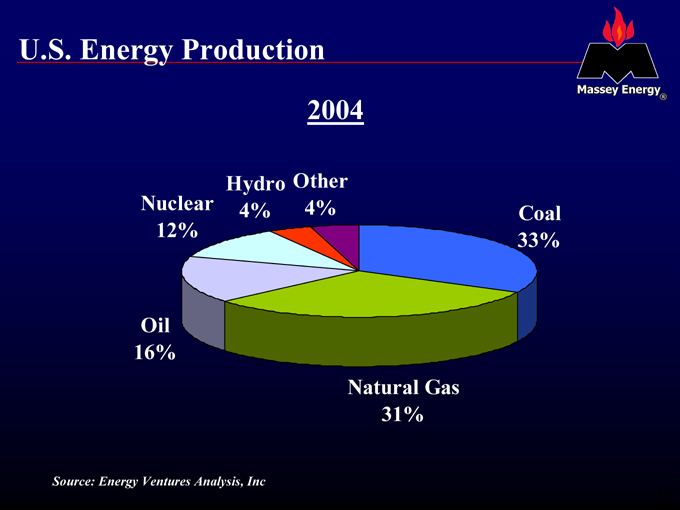

U.S. Energy Production

2004

Nuclear 12%

Hydro 4%

Other 4%

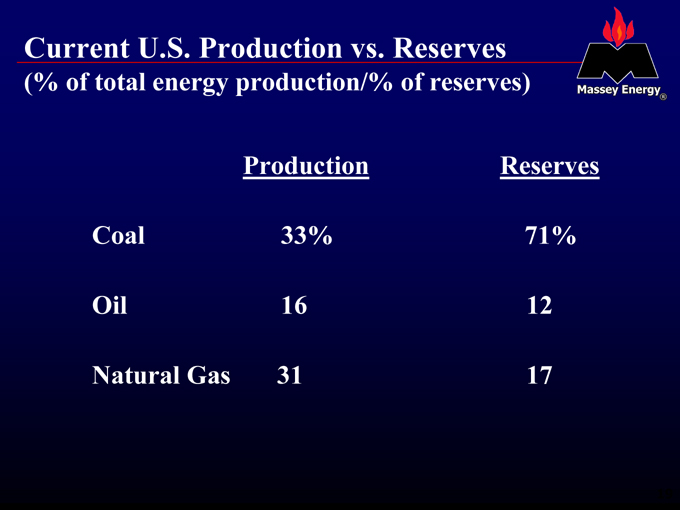

Coal 33%

Oil 16%

Natural Gas 31%

Source: Energy Ventures Analysis, Inc

17

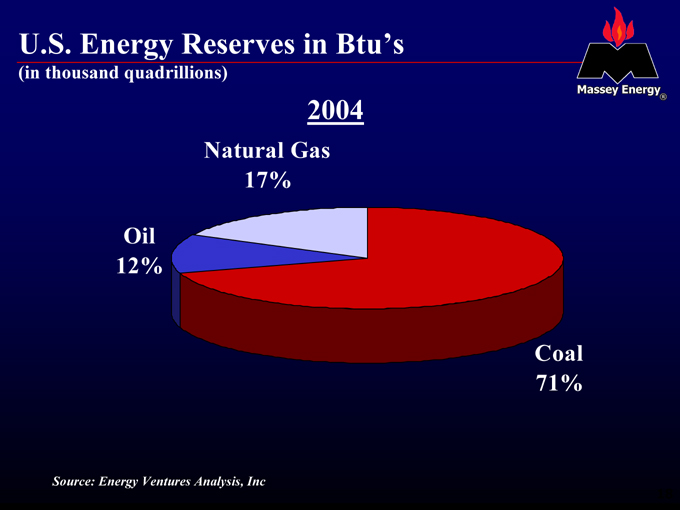

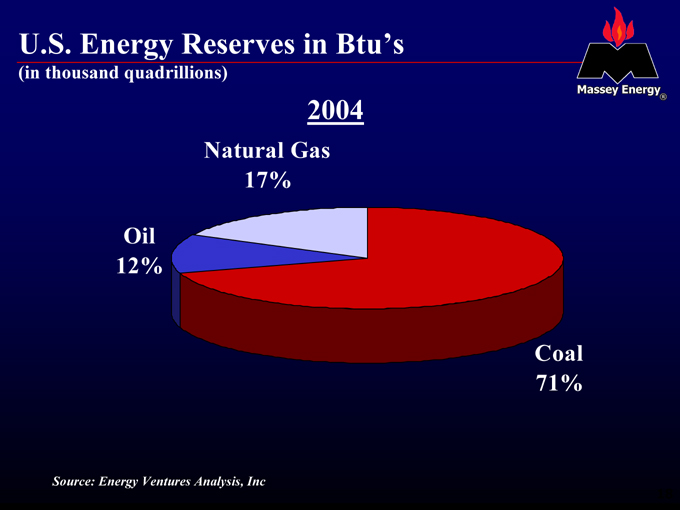

U.S. Energy Reserves in Btu’s

(in thousand quadrillions)

2004

Natural Gas 17%

Oil 12%

Coal 71%

Source: Energy Ventures Analysis, Inc

18

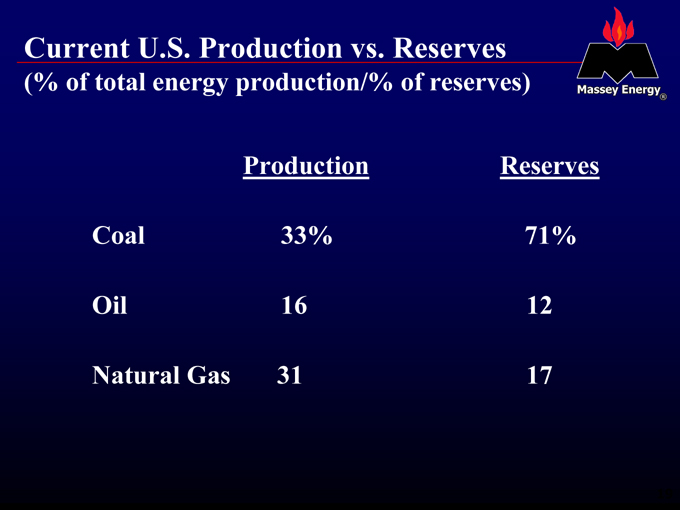

Current U.S. Production vs. Reserves

(% of total energy production/% of reserves)

19

Central Appalachian Coal

20

U.S. Production by Region—Tons

(estimated tons in millions)

2004

Other

233

Central Appalachia

231

Northern Appalachia

134

91

Illinois Basin

PRB

421

21%

21%

12%

8%

38%

Source: Energy Ventures Analysis, Inc

21

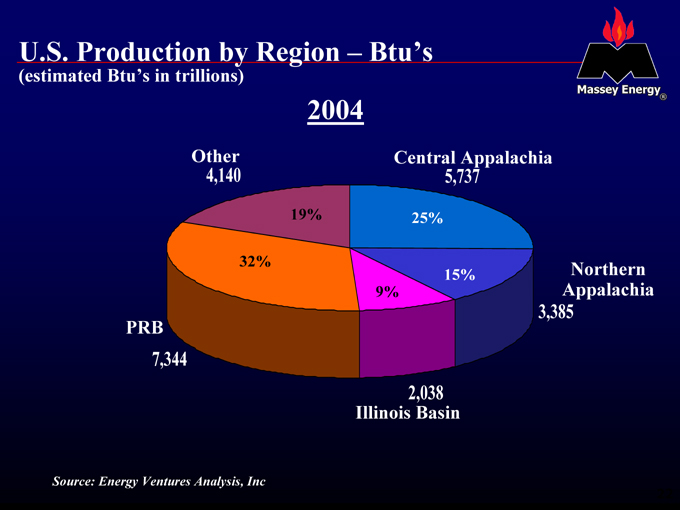

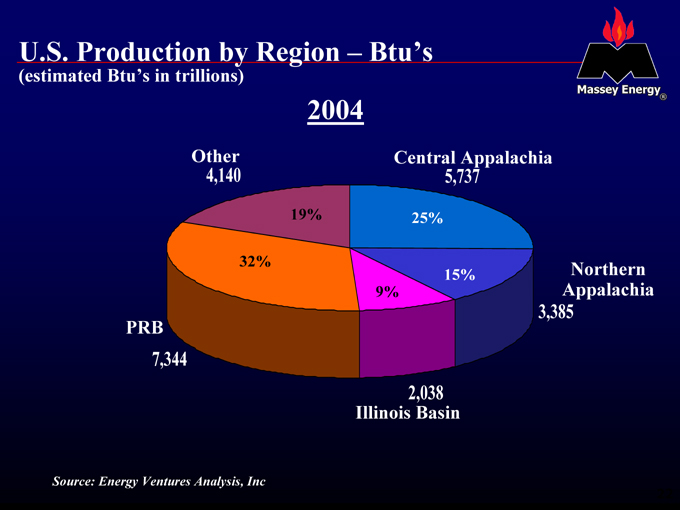

U.S. Production by Region – Btu’s

(estimated Btu’s in trillions)

2004

Other

4,140

Central Appalachia

5,737

Northern Appalachia

3,385

2,038

Illinois Basin

PRB

7,344

32%

19%

25%

15%

9%

Source: Energy Ventures Analysis, Inc

22

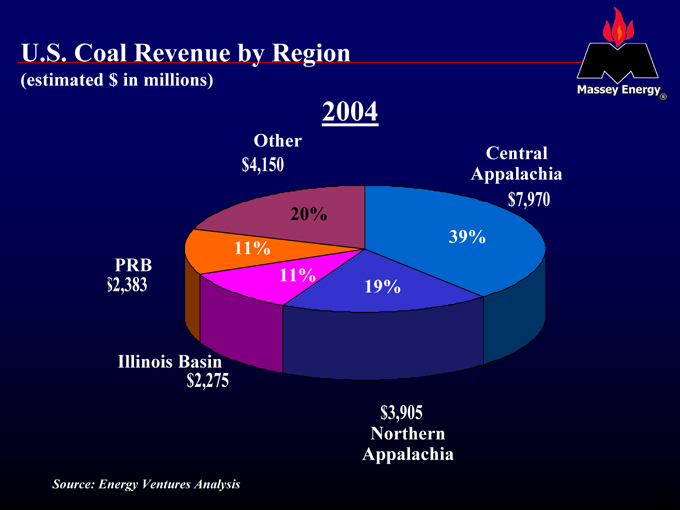

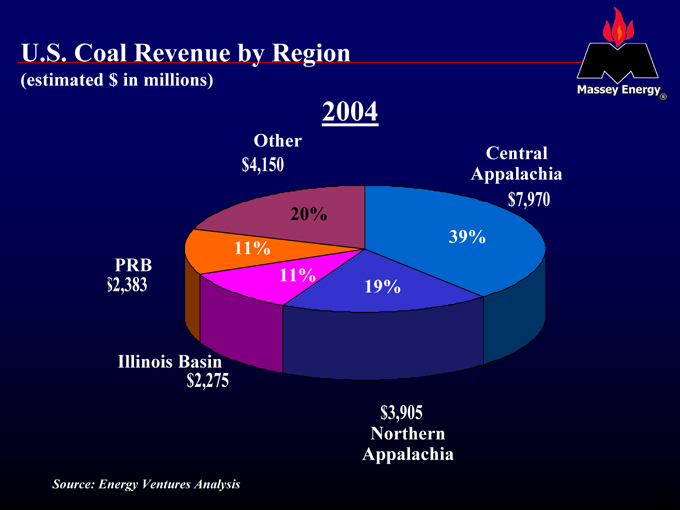

U.S. Coal Revenue by Region

(estimated $ in millions)

2004

Other

$4,150

PRB

$2,383

Illinois Basin

$2,275 $3,905

Northern Appalachia

Central Appalachia

$7,970

20%

11%

11%

19%

39%

Source: Energy Ventures Analysis

23

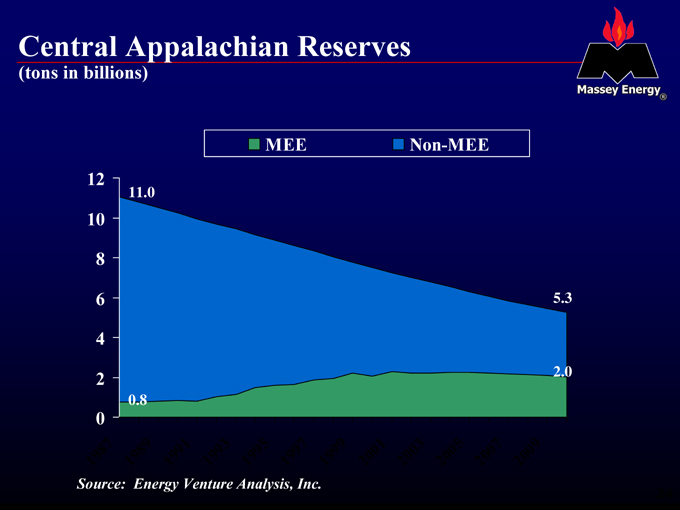

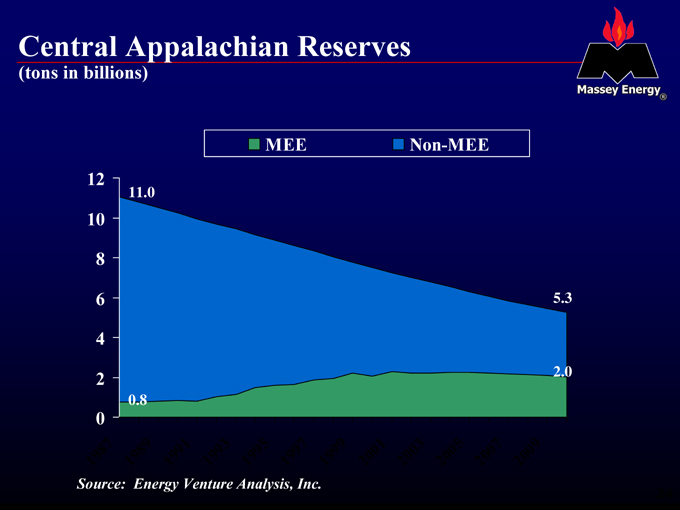

Central Appalachian Reserves

(tons in billions)

MEE Non-MEE

12 10 8 6 4 2 0

11.0

0.8

5.3

2.0

1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009

Source: Energy Venture Analysis, Inc.

24

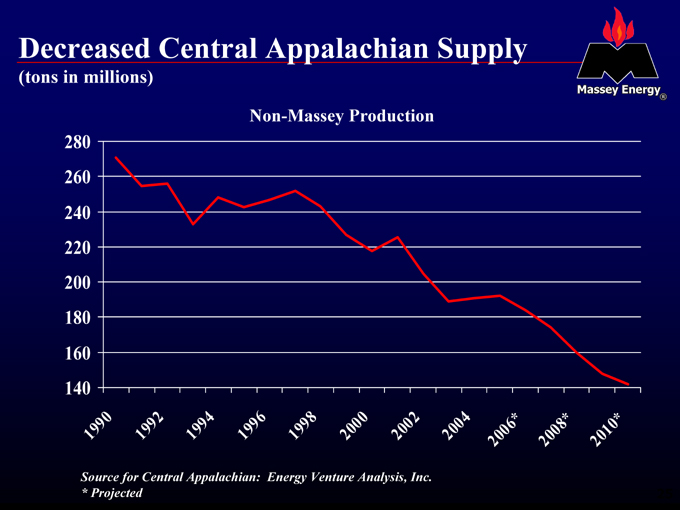

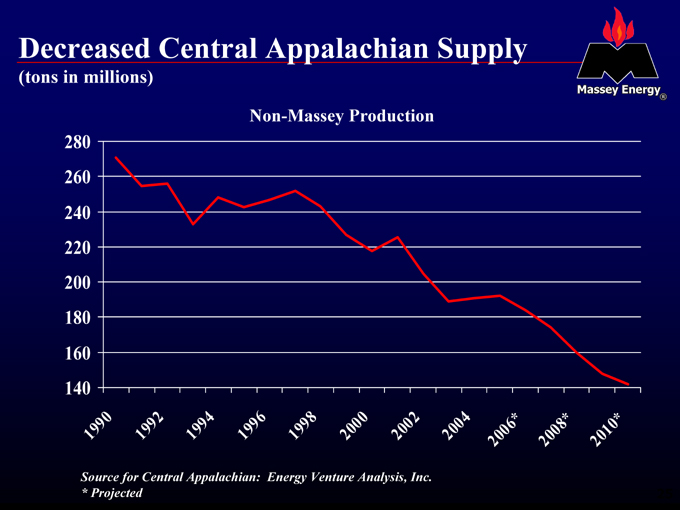

Decreased Central Appalachian Supply

(tons in millions)

Non-Massey Production

280 260 240 220 200 180 160 140

1990

1992 1994

1996

1998 2000 2002 2004 2006*

2008*

2010*

Source for Central Appalachian: Energy Venture Analysis, Inc. * Projected

25

Increased Massey Production

(tons in millions)

50 40 30 20 10 0

1990

1992

1994 1996 1998

2000

2002 2004

2006*

2008*

2010*

26

Central Appalachian Challenges

A number of issues have created challenges for coal companies in Central Appalachia

Labor issues Productivity declines Material cost increases Transportation issues

Permitting and bonding difficulties

27

Massey Coal

28

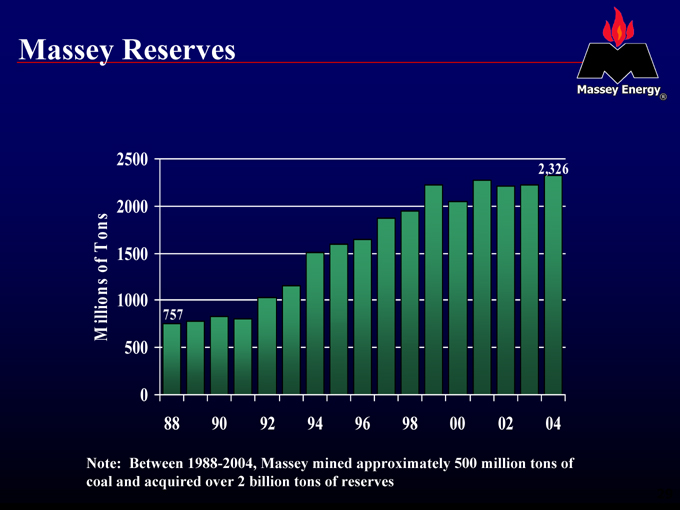

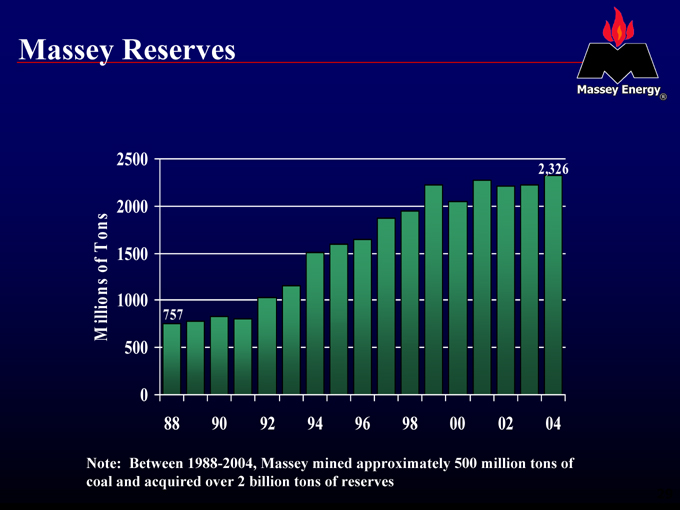

Massey Reserves

Millions of Tons

2500 2000 1500 1000 500 0

757

2,326

88 90 92 94 96 98 00 02 04

Note: Between 1988-2004, Massey mined approximately 500 million tons of coal and acquired over 2 billion tons of reserves

29

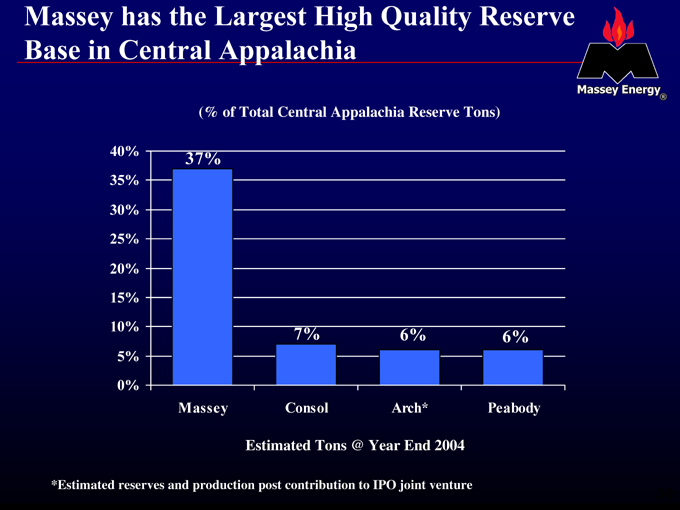

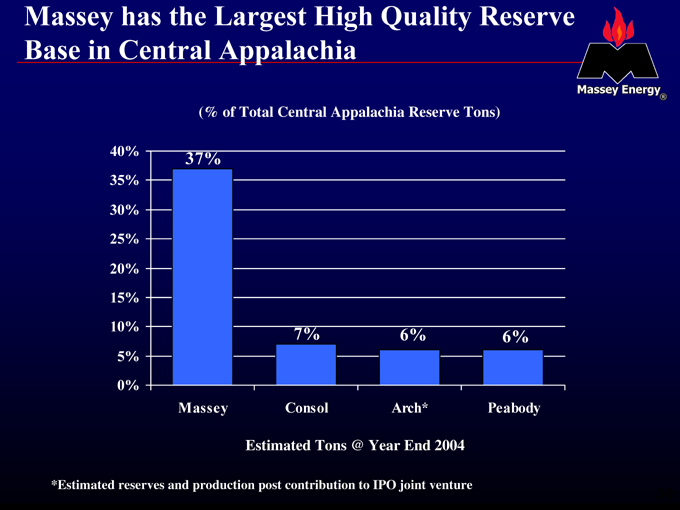

Massey has the Largest High Quality Reserve Base in Central Appalachia

(% of Total Central Appalachia Reserve Tons)

40% 35% 30% 25% 20% 15% 10% 5% 0%

37%

7%

6%

6%

Massey Consol Arch* Peabody

Estimated Tons @ Year End 2004

*Estimated reserves and production post contribution to IPO joint venture

30

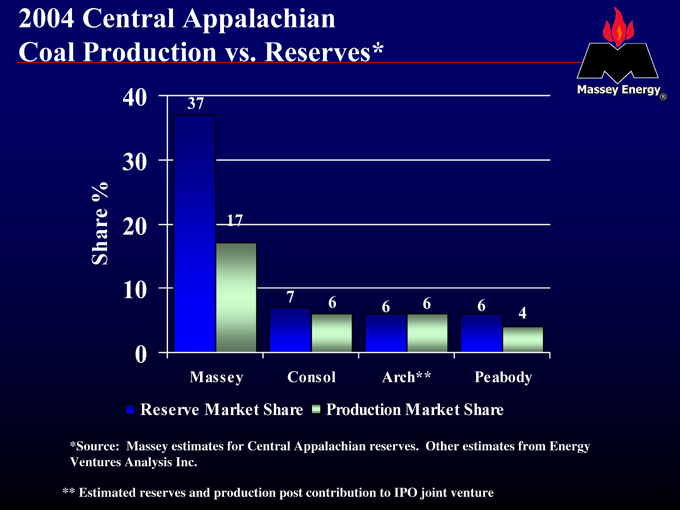

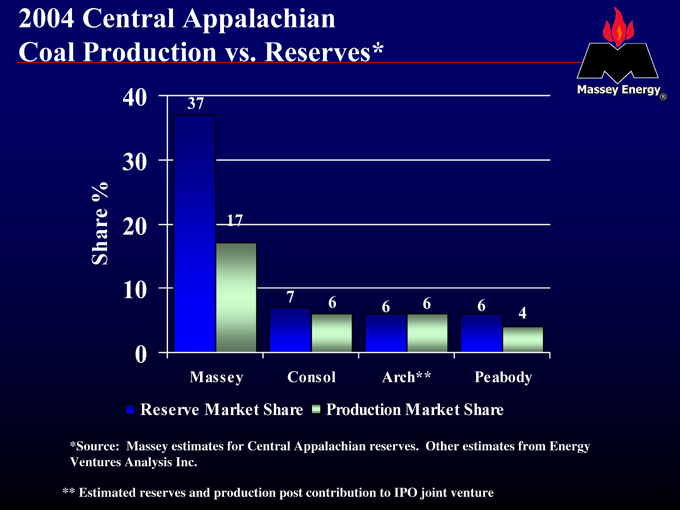

2004 Central Appalachian Coal Production vs. Reserves*

Share %

40 30 20 10 0

37

17

Massey Consol Arch** Peabody

Reserve Market Share Production Market Share

*Source: Massey estimates for Central Appalachian reserves. Other estimates from Energy Ventures Analysis Inc.

** Estimated reserves and production post contribution to IPO joint venture

31

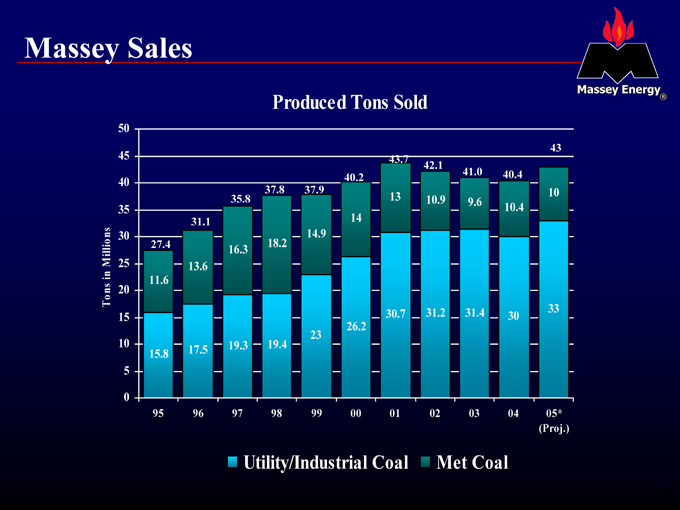

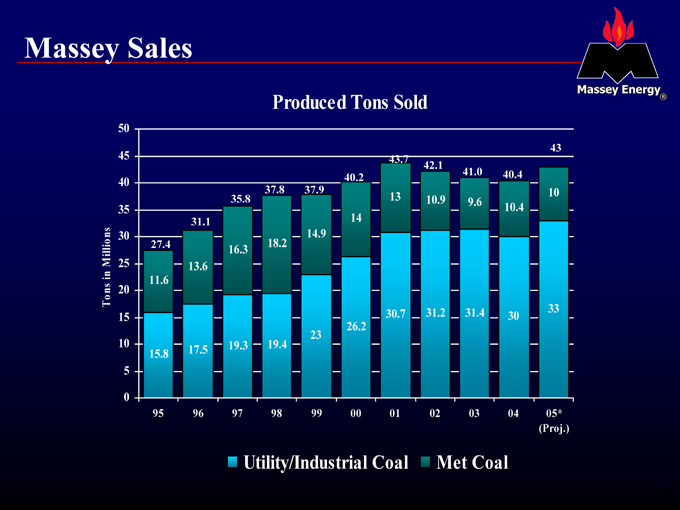

Massey Sales

Produced Tons Sold

Tons in Millions

50 45 40 35 30 25 20 15 10 5 0

27.4

31.1

35.8

37.8

37.9

40.2

43.7

42.1

41.0

40.4

43

11.6

13.6

16.3

18.2

14.9

14

13

10.9

9.6

10.4

10

30.7 31.2 31.4 33 30 26.2 23 17.5 19.3 19.4 15.8

95 96 97 98 99 00 01 02 03 04 05* (Proj.)

Utility/Industrial Coal Met Coal

32

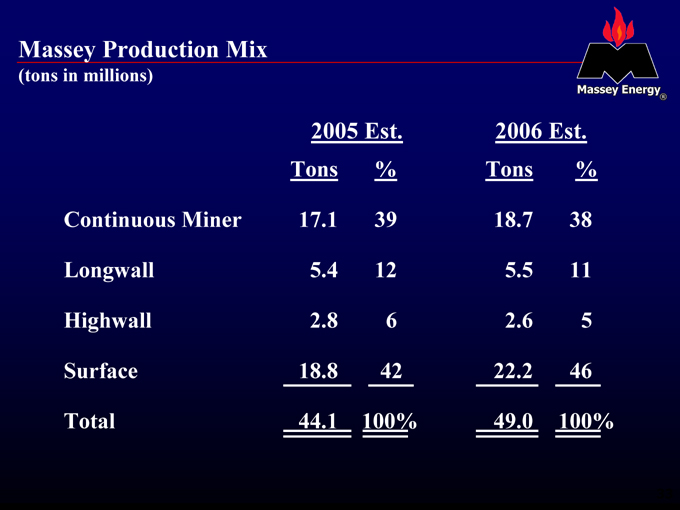

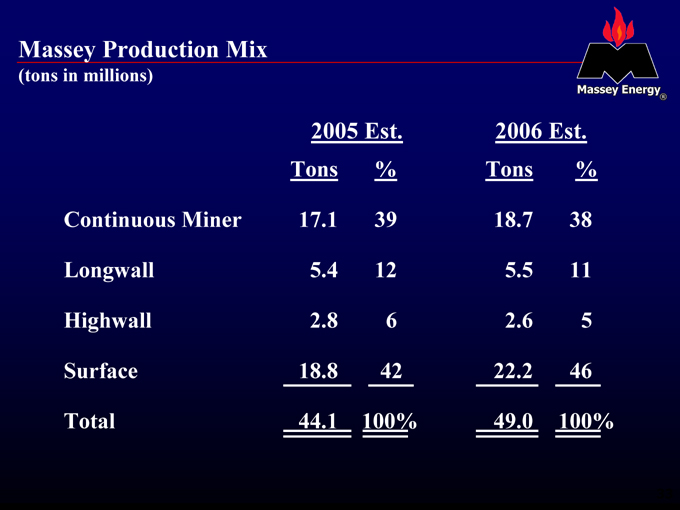

Massey Production Mix

(tons in millions)

Continuous | | Miner 17.1 39 18.7 38 |

Total | | 44.1 100% 49.0 100% |

33

Massey Challenges

34

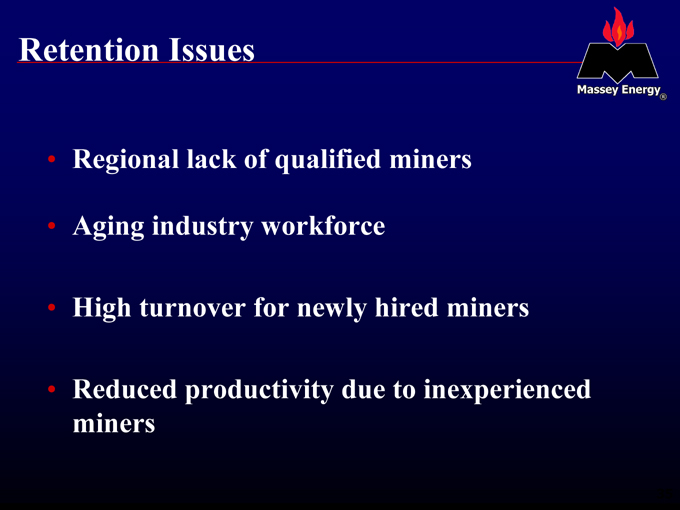

Retention Issues

Regional lack of qualified miners

Aging industry workforce

High turnover for newly hired miners

Reduced productivity due to inexperienced miners

35

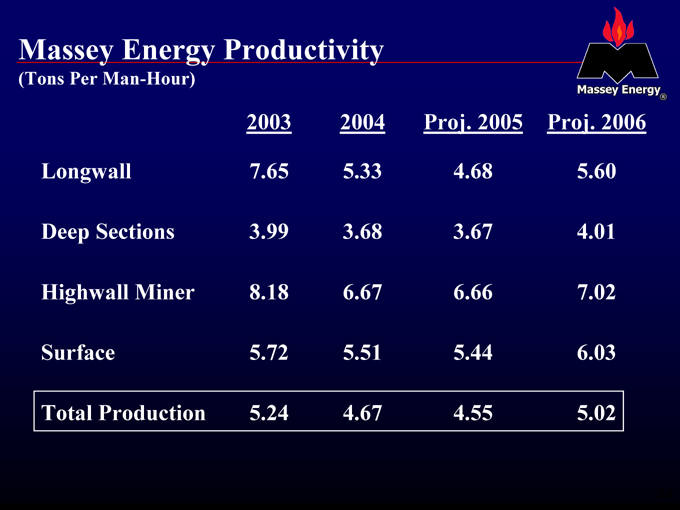

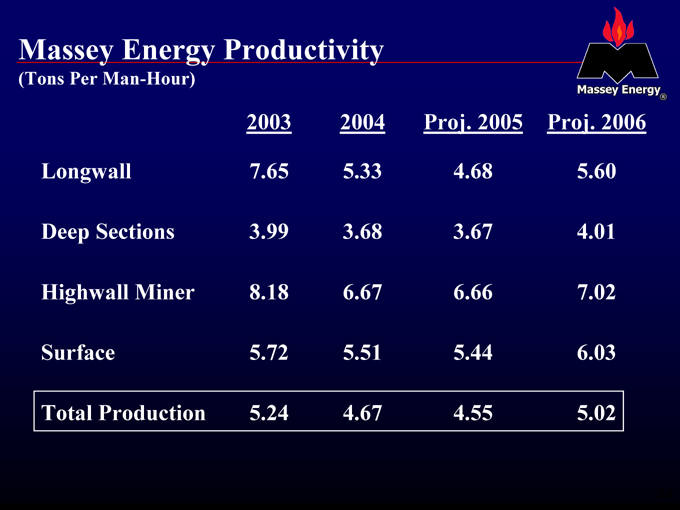

Massey Energy Productivity

(Tons Per Man-Hour)

2003 | | 2004 Proj. 2005 Proj. 2006 |

Longwall | | 7.65 5.33 4.68 5.60 |

Deep | | Sections 3.99 3.68 3.67 4.01 |

Highwall | | Miner 8.18 6.67 6.66 7.02 |

Surface | | 5.72 5.51 5.44 6.03 |

Total | | Production 5.24 4.67 4.55 5.02 |

36

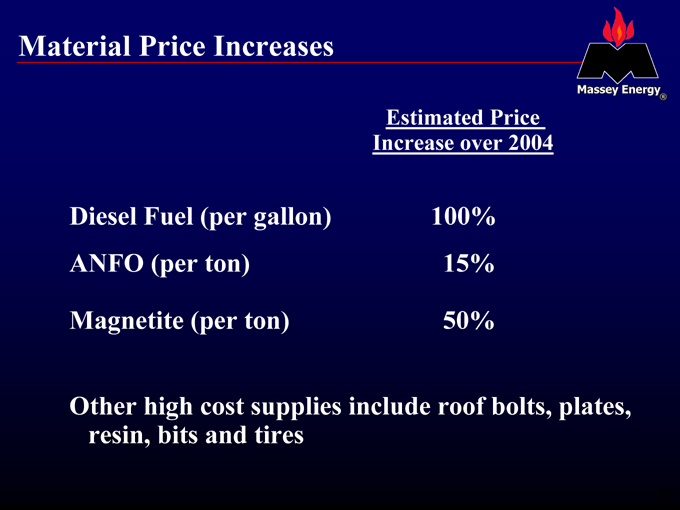

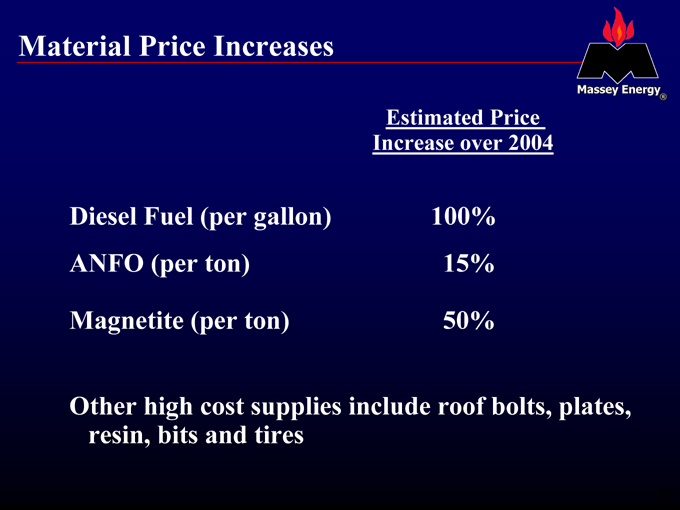

Material Price Increases

Estimated Price

Increase over 2004

Diesel | | Fuel (per gallon) 100% |

Other high cost supplies include roof bolts, plates, resin, bits and tires

37

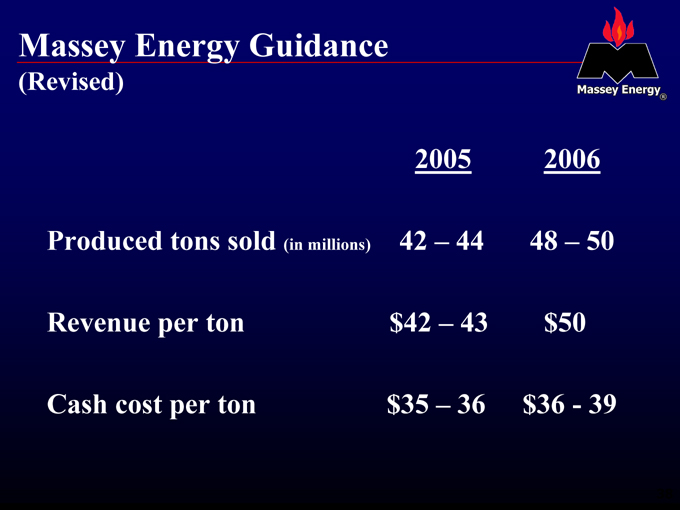

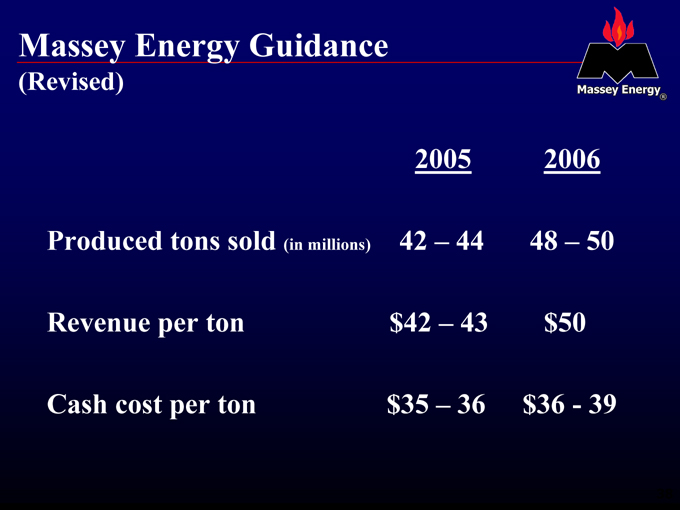

Massey Energy Guidance

(Revised)

Produced | | tons sold (in millions) 42 – 44 48 – 50 |

Revenue | | per ton $42 – 43 $50 |

Cash | | cost per ton $35 – 36 $36—39 |

38

Massey Strengths

39

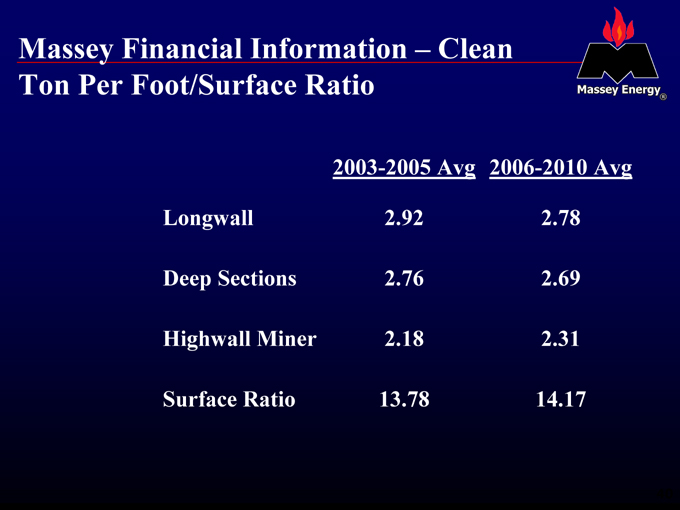

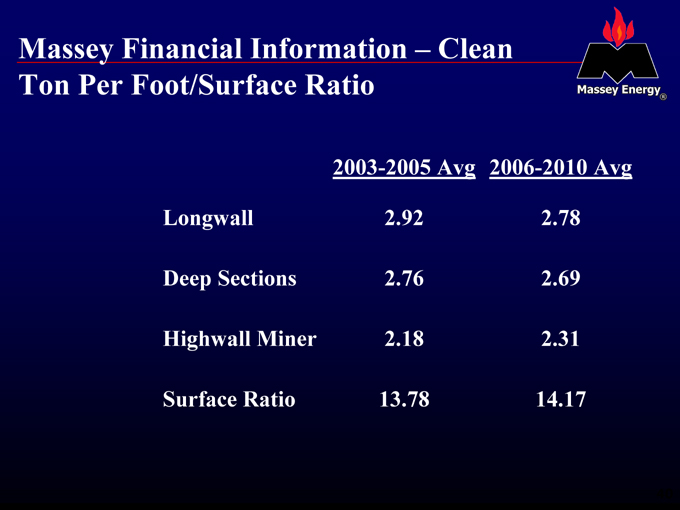

Massey Financial Information – Clean Ton Per Foot/Surface Ratio

2003-2005 | | Avg 2006-2010 Avg |

Surface | | Ratio 13.78 14.17 |

40

The Tons Produced Are The Rewards Of Mining, Not The Cost

41

Costs Are Driven

By The Distance Mined (Deep)

or Yards Mined (Surface),

Not By

The Tons Of Reward

42

Summary of our Strengths

Highest quality coal in the world

Single largest reserve base in Central Appalachia

Largest met coal producer in the U.S. State of the art equipment Low level of long-term liabilities Strong balance sheet

43

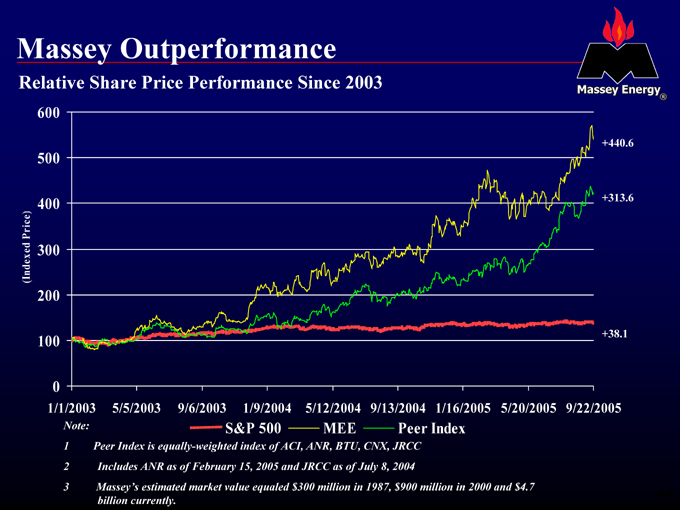

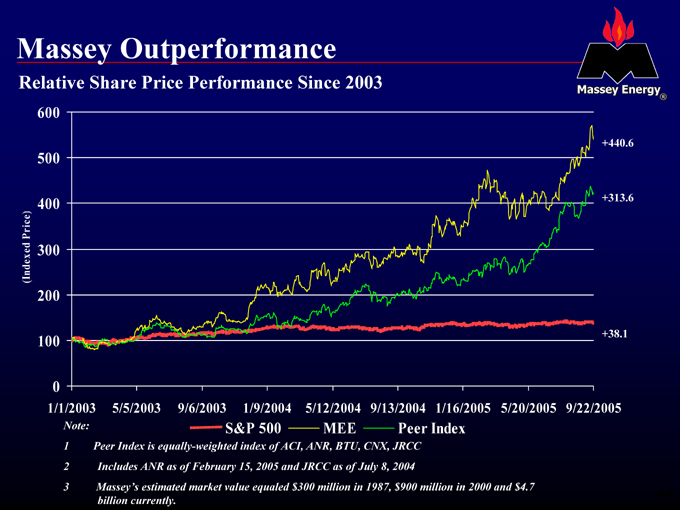

Massey Outperformance

Relative Share Price Performance Since 2003

(Indexed Price)

600 500 400 300 200 100 0

1/1/2003 5/5/2003 9/6/2003 1/9/2004 5/12/2004 9/13/2004 1/16/2005 5/20/2005 9/22/2005

+440.6 +313.6 +38.1

Note: S&P 500 MEE Peer Index

1 | | Peer Index is equally-weighted index of ACI, ANR, BTU, CNX, JRCC |

2 | | Includes ANR as of February 15, 2005 and JRCC as of July 8, 2004 |

3 | | Massey’s estimated market value equaled $300 million in 1987, $900 million in 2000 and $4.7 billion currently. |

44

Doing the Right Thing. with Energy

45