Exhibit 99.8

Utility Sales

John Parker

Senior Vice President – Massey Utility Sales

September 27, 2005

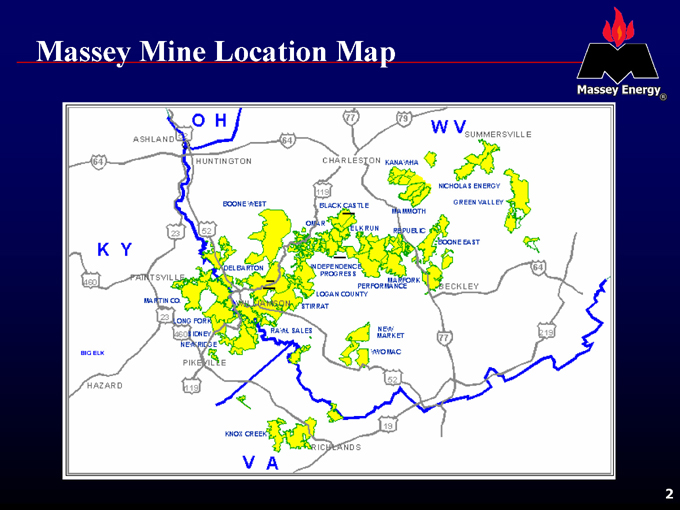

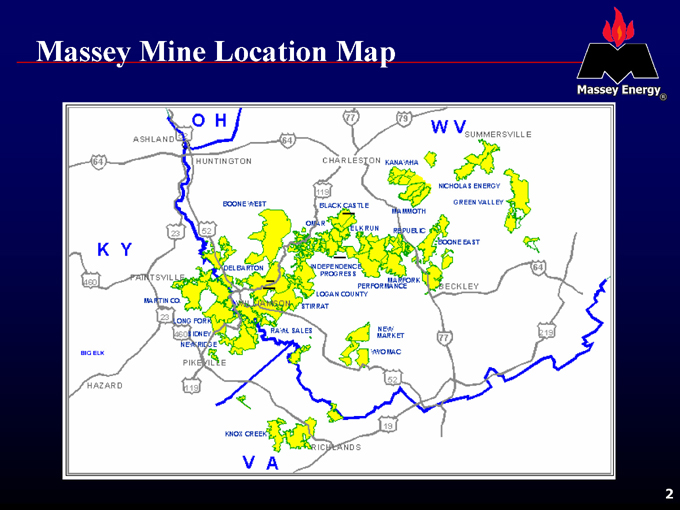

Massey Mine Location Map

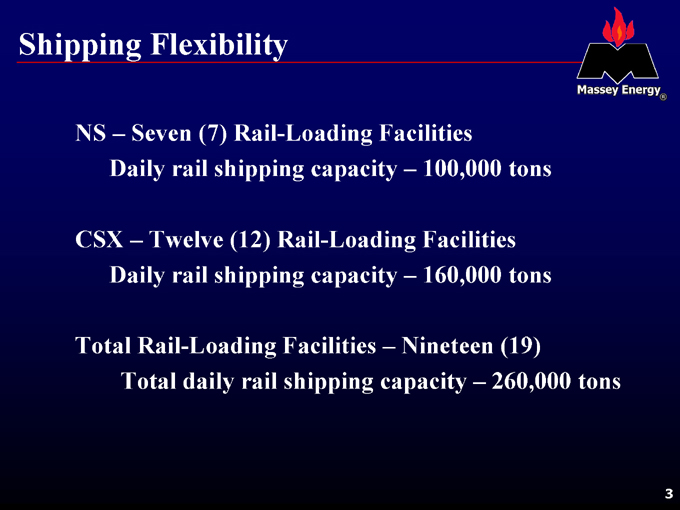

Shipping Flexibility

NS – Seven (7) Rail-Loading Facilities

Daily rail shipping capacity – 100,000 tons

CSX – Twelve (12) Rail-Loading Facilities

Daily rail shipping capacity – 160,000 tons

Total Rail-Loading Facilities – Nineteen (19)

Total daily rail shipping capacity – 260,000 tons

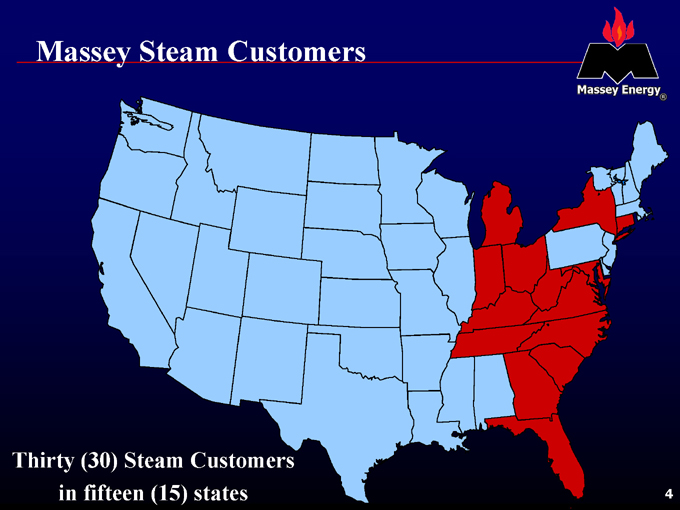

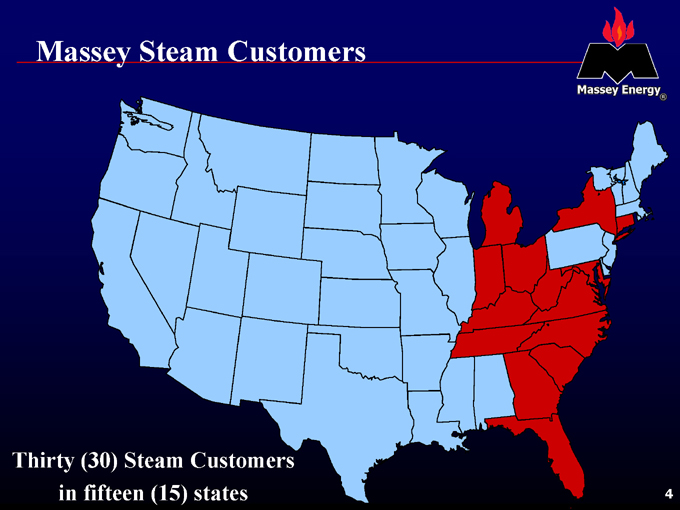

Massey Steam Customers

Thirty (30) Steam Customers in fifteen (15) states

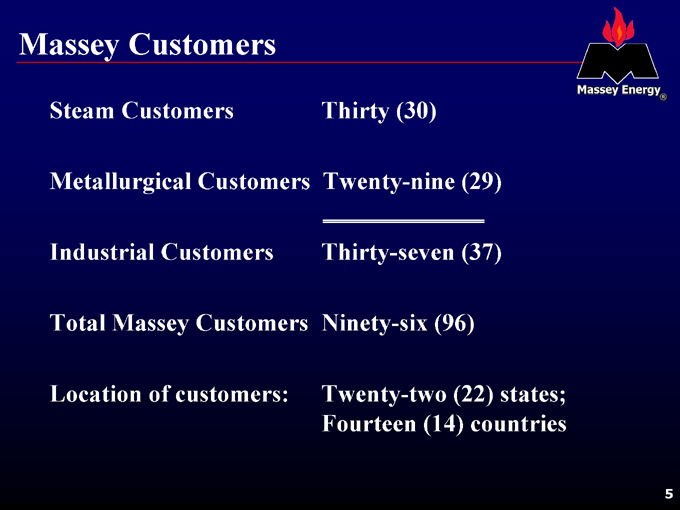

Massey Customers

Steam Customers

Metallurgical Customers

Industrial Customers

Total Massey Customers

Location of customers:

Thirty (30)

Twenty-nine (29)

Thirty-seven (37)

Ninety-six (96)

Twenty-two (22) states; Fourteen (14) countries

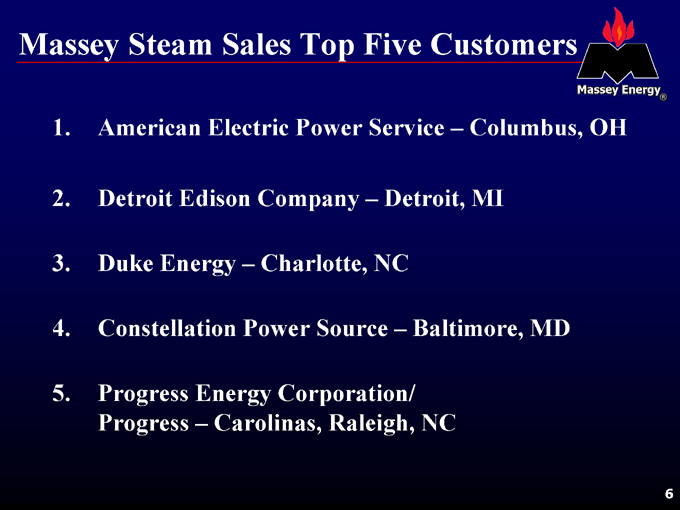

Massey Steam Sales Top Five Customers

1. American Electric Power Service – Columbus, OH

2. Detroit Edison Company – Detroit, MI

3. Duke Energy – Charlotte, NC

4. Constellation Power Source – Baltimore, MD

5. Progress Energy Corporation/ Progress – Carolinas, Raleigh, NC

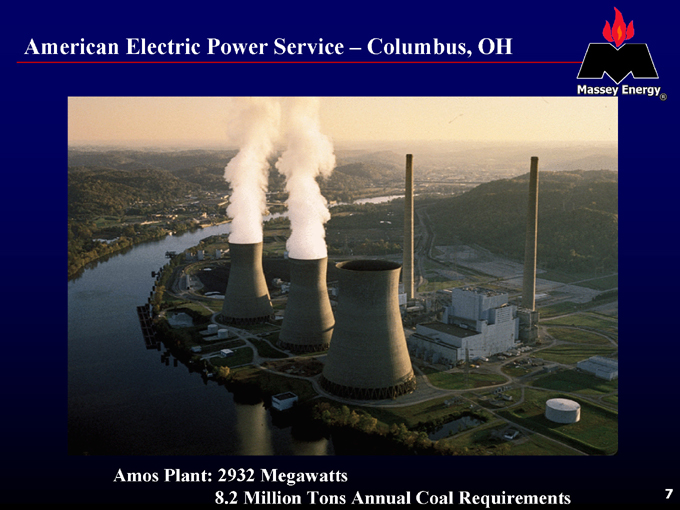

American Electric Power Service – Columbus, OH

Amos Plant: 2932 Megawatts

8.2 Million Tons Annual Coal Requirements

Detroit Edison Power – Detroit, MI

Monroe Power Plant: 3200 Megawatts

9.1 Million Tons Annual Coal Requirements

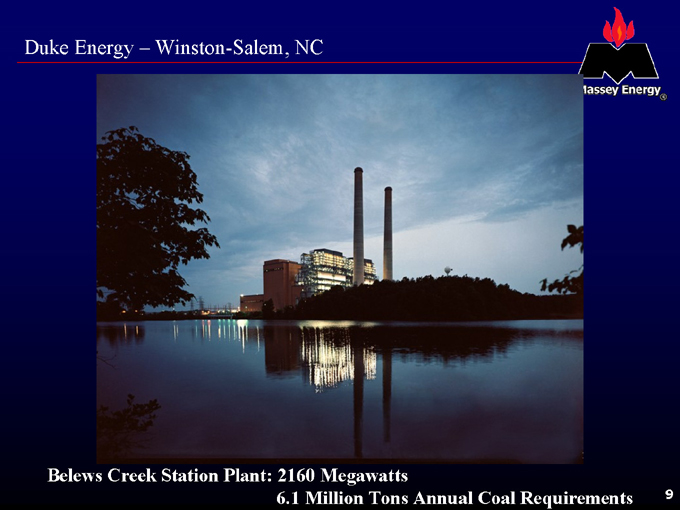

Duke Energy – Winston-Salem, NC

Belews Creek Station Plant: 2160 Megawatts

6.1 Million Tons Annual Coal Requirements

9

Constellation Power Source – Baltimore, MD

Brandon Shores Power Plant: 1300 Megawatts

3.6 Million Tons Annual Coal Requirements

10

Progress Carolina – Roxboro, NC

Hyco Station Power Plant: 2490 Megawatts

6.0 Million Tons Annual Coal Requirements

11

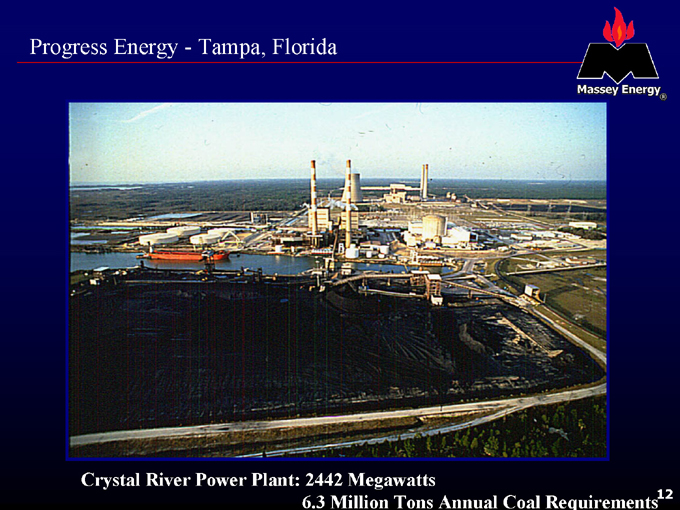

Progress Energy—Tampa, Florida

Crystal River Power Plant: 2442 Megawatts

6.3 Million Tons Annual Coal Requirements

12

Our Competition

PRB

Illinois Basin

Northern Appalachian

Imports

Transportation issues—Distance Quality requires blending

Fugitive dust problems – Railroad & Plant

Transportation disadvantage—Distance Quality

Supply constraint

Utilized Metallurgical blends

Port constraints Ocean freight volatility

Rail transportation to inland customers

13

New Scrubbers

Most of our customers will stay with Central Appalachia coal

Many Northeastern and Southeastern utilities have concerns with Illinois Basin coal quality.

14

The Steam Market

Markets firm as supply worries continue & inventory levels remain low.

15

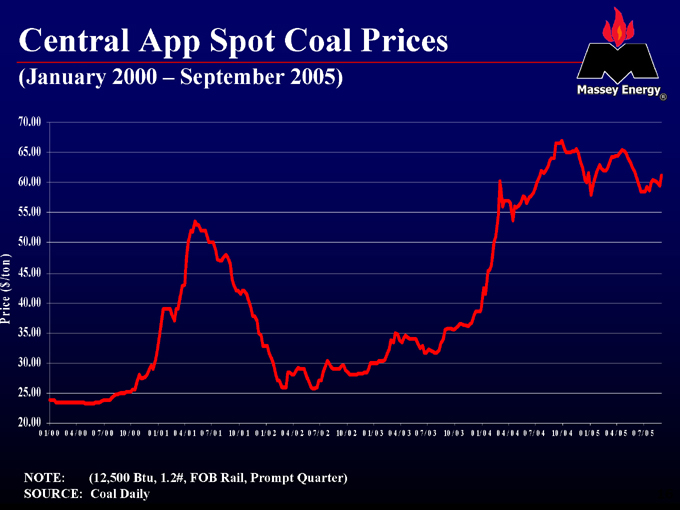

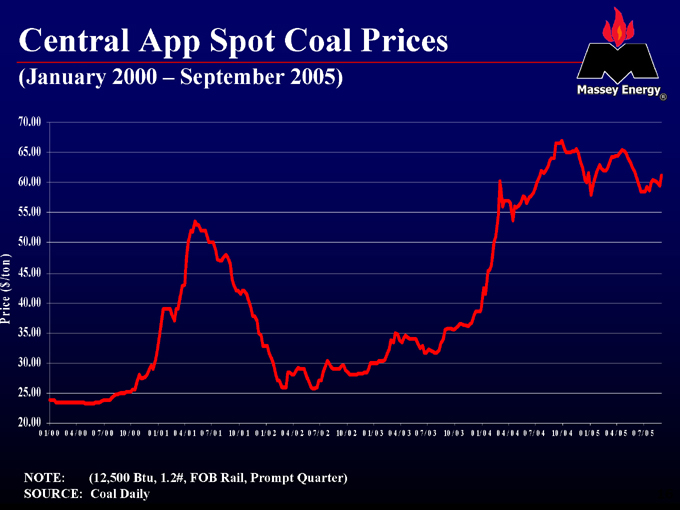

Central App Spot Coal Prices

(January 2000 – September 2005)

Price ($/ton)

70.00 65.00 60.00 55.00 50.00 45.00 40.00 35.00 30.00 25.00 20.00

0 1/ 0 0 0 4 / 0 0 0 7/ 0 0 10 / 0 0 0 1/ 0 1 0 4 / 0 1 0 7/ 0 1 10 / 0 1 0 1/ 0 2 0 4 / 0 2 0 7/ 0 2 10 / 0 2 0 1/ 0 3 0 4 / 0 3 0 7/ 0 3 10 / 0 3 0 1/ 0 4 0 4 / 0 4 0 7/ 0 4 10 / 0 4 0 1/ 0 5 0 4 / 0 5 0 7/ 0 5

NOTE: (12,500 Btu, 1.2#, FOB Rail, Prompt Quarter) SOURCE: Coal Daily

16

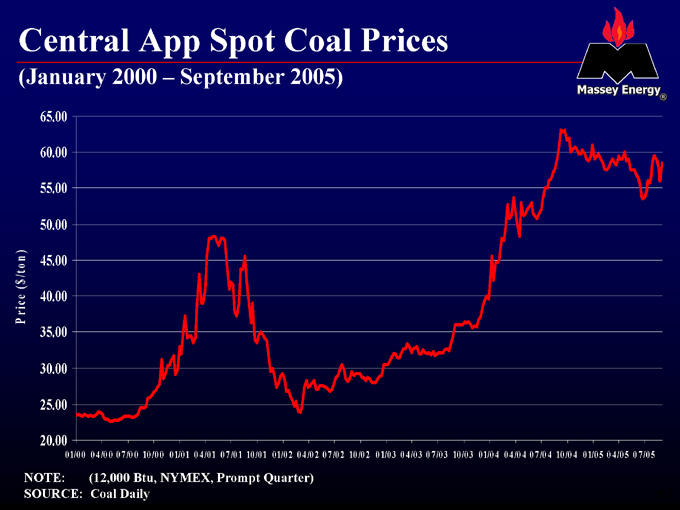

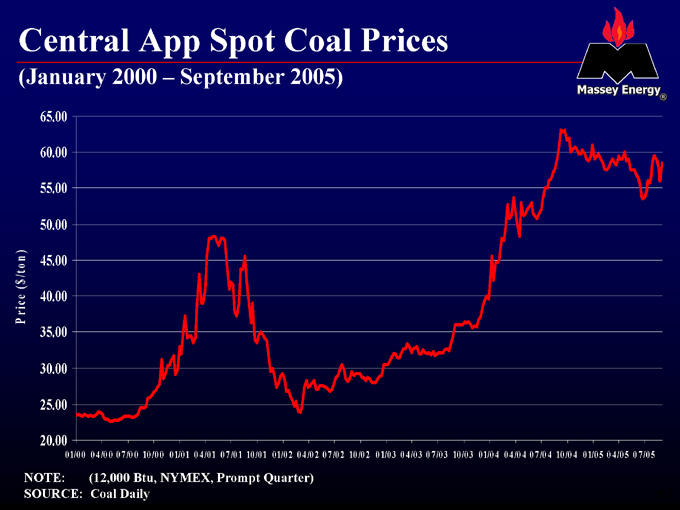

Central App Spot Coal Prices

(January 2000 – September 2005)

Price ($/ton )

65.00 60.00 55.00 50.00 45.00 40.00 35.00 30.00 25.00 20.00

0 1/0 0 0 4 /0 0 0 7 /0 0 10 /0 0 0 1/0 1 0 4 /0 1 0 7 /0 1 10 /0 1 0 1/0 2 0 4 /0 2 0 7 /0 2 10 /0 2 0 1/0 3 0 4 /0 3 0 7 /0 3 10 /0 3 0 1/0 4 0 4 /0 4 0 7 /0 4 10 /0 4 0 1/0 5 0 4 /0 5 0 7 /0 5

NOTE: (12,000 Btu, NYMEX, Prompt Quarter) SOURCE: Coal Daily

17

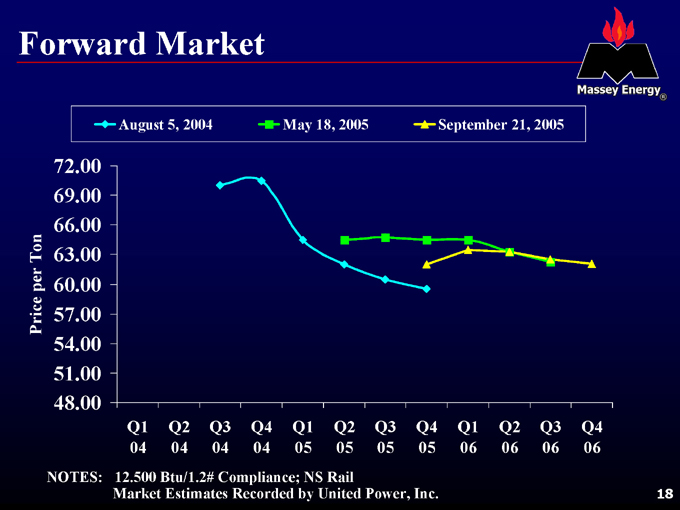

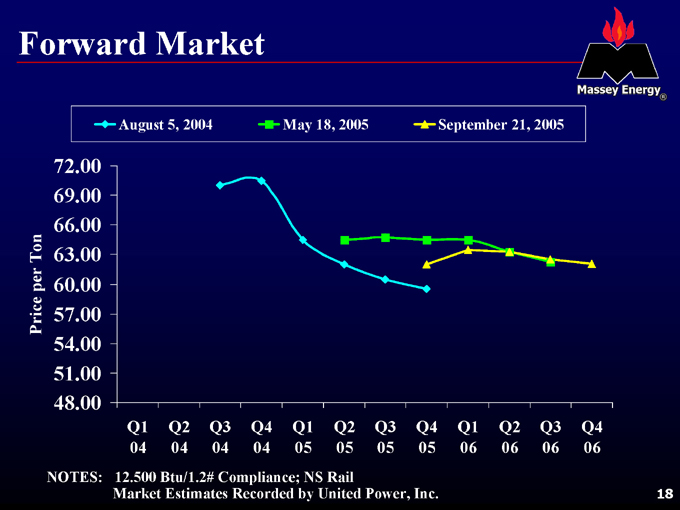

Forward Market

August 5, 2004

May 18, 2005

September 21, 2005

Price per Ton

72.00 69.00 66.00 63.00 60.00 57.00 54.00 51.00 48.00

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

04 04 04 04 05 05 05 05 06 06 06 06

NOTES: 12.500 Btu/1.2# Compliance; NS Rail

Market Estimates Recorded by United Power, Inc.

18

The Steam Market

Central Appalachia production continues to decrease

Labor, equipment and permits are the major production constraints

19

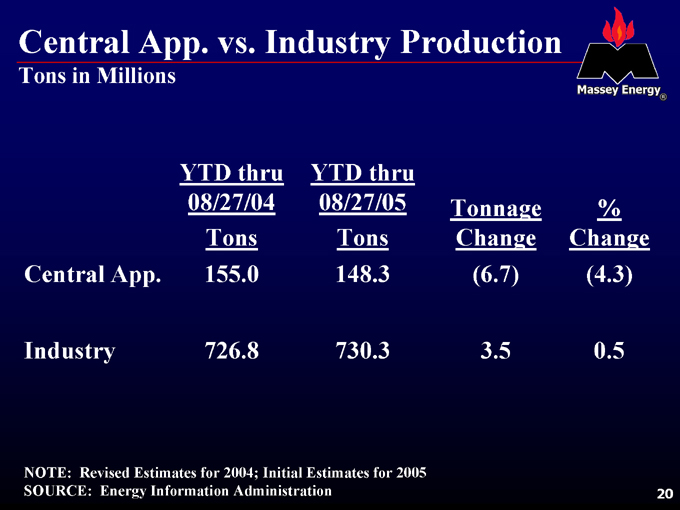

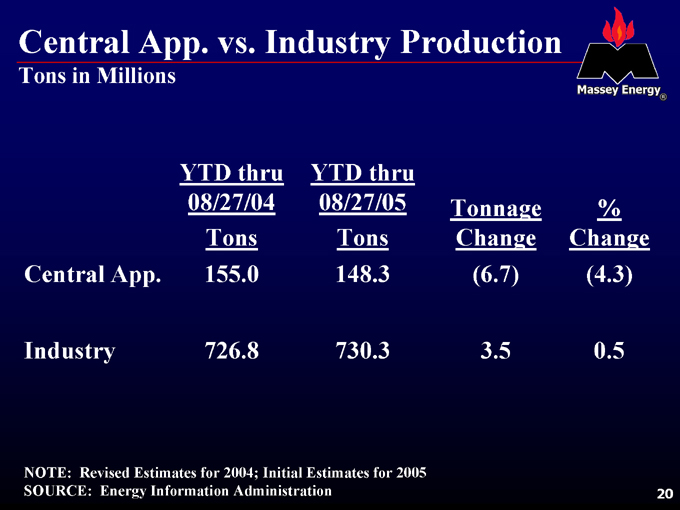

Central App. vs. Industry Production

Tons in Millions

YTD thru 08/27/04 Tons

YTD thru 08/27/05 Tons

Tonnage Change

% Change

Central App.

155.0

148.3

(6.7)

(4.3)

Industry

726.8

730.3

3.5

0.5

NOTE: Revised Estimates for 2004; Initial Estimates for 2005 SOURCE: Energy Information Administration

20

Utilities Buying Practices

Prior to 2002, many utilities had 75 – 80% of their annual burn under long-term agreements (plus 3 years).

In today’s market, most utilities are more inclined to secure 90% of their supply with 1 – 3 year agreements.

Some utilities elect to utilize lower quality coals in off-peak burn periods.

21

Summary

In summary:

Massey has a commanding presence in Central Appalachia

Extensive coal reserves

Multiple shipping sources

Diverse customers – Utility/ Metallurgical/ Industrial

The Central Appalachian coal region produces coals that can serve any market in the world.

22

Doing the Right Thing. with Energy

23