Exhibit 99.10

Financial Overview

Eric Tolbert

Vice President and Chief Financial Officer

September 27, 2005

Financial Review

Recent Financial Results

6 | | mos. 2003 6 mos. 2004 6 mos. 2005 |

Produced coal $628.3 mm $729.2 mm $935.0 mm revenue Tons sold 20.7 mm 20.7 mm 22.3 mm

Average per ton $30.43 $35.16 $41.97 realization EBITDA $88.1 mm $135.5mm $242.2 mm*

*Includes pre-tax gain of $34 million on sale of Big Elk.

Income Statement

Income Statement—Revenue

($ in millions)

Year Ended Dec. 31, 2004 Produced coal revenue $1,457 Freight and handling revenue $ 149 Purchased coal revenue $ 105 Other revenue $ 56 Total revenues $1,767

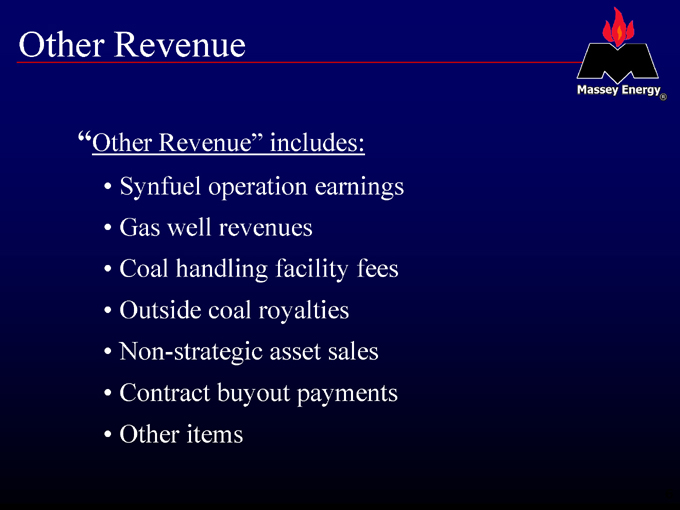

Other Revenue

“ Other Revenue” includes:

Synfuel operation earnings Gas well revenues Coal handling facility fees Outside coal royalties Non-strategic asset sales Contract buyout payments Other items

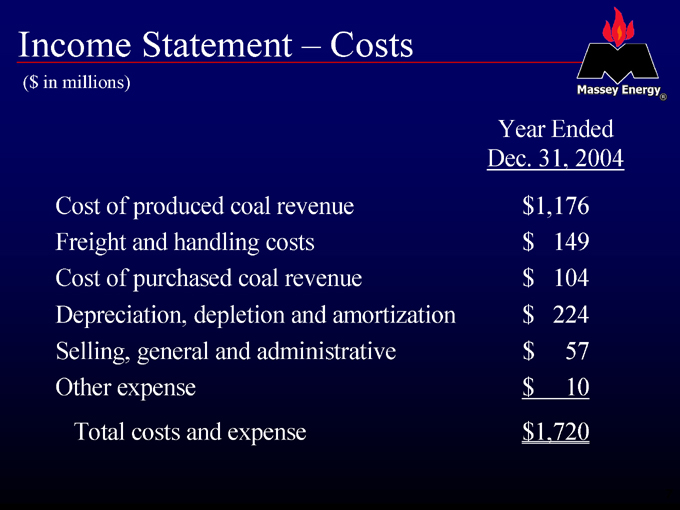

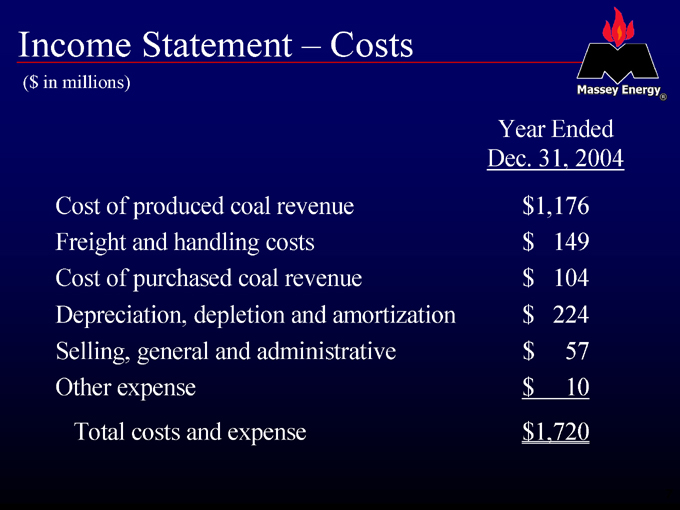

Income Statement – Costs

($ in millions)

Year Ended Dec. 31, 2004 Cost of produced coal revenue $1,176 Freight and handling costs $ 149 Cost of purchased coal revenue $ 104 Depreciation, depletion and amortization $ 224 Selling, general and administrative $ 57 Other expense $ 10 Total costs and expense $1,720

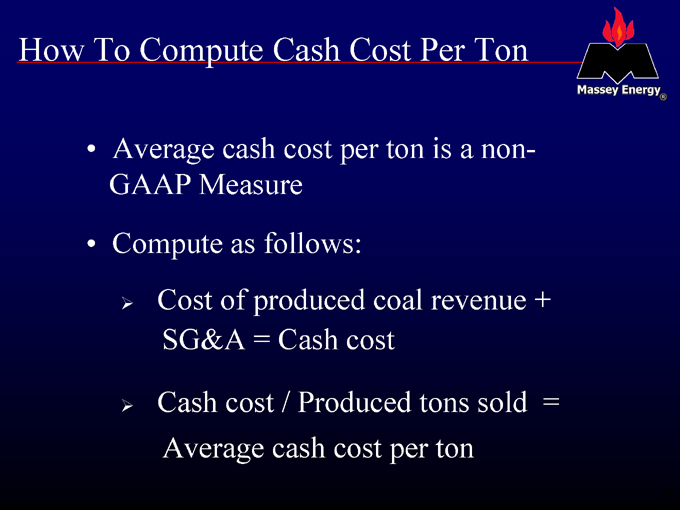

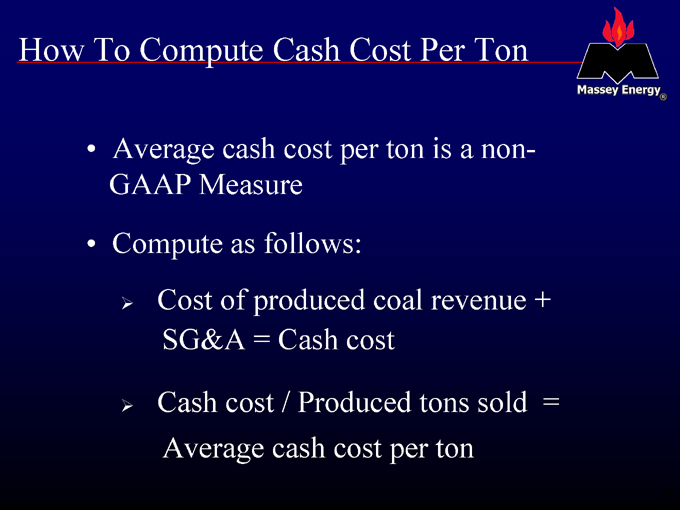

How To Compute Cash Cost Per Ton

Average cash cost per ton is a non-GAAP Measure Compute as follows:

Cost of produced coal revenue + SG&A = Cash cost

Cash cost / Produced tons sold = Average cash cost per ton

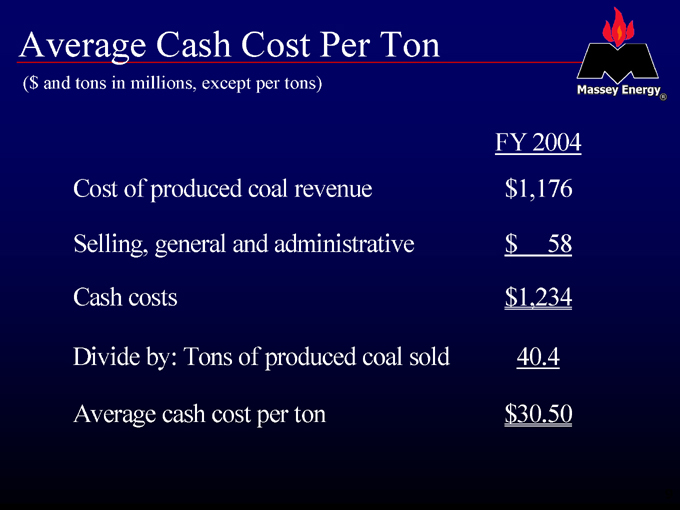

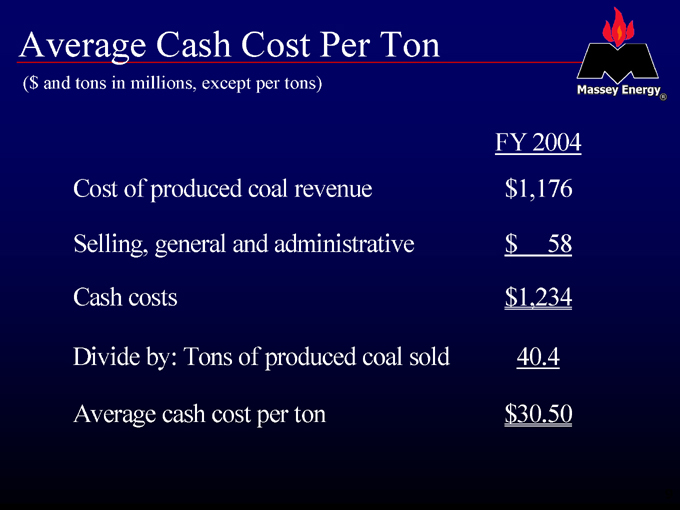

Average cash cost per ton($ and tons in millions, except per tons)

FY 2004 Cost of produced coal revenue $1,176

Selling, general and administrative $ 58 Cash costs $1,234 Divide by: Tons of produced coal sold 40.4 Average cash cost per ton $30.50

9

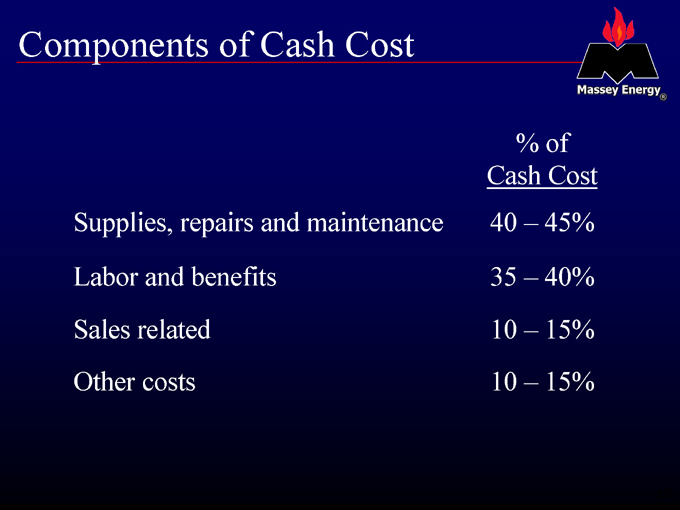

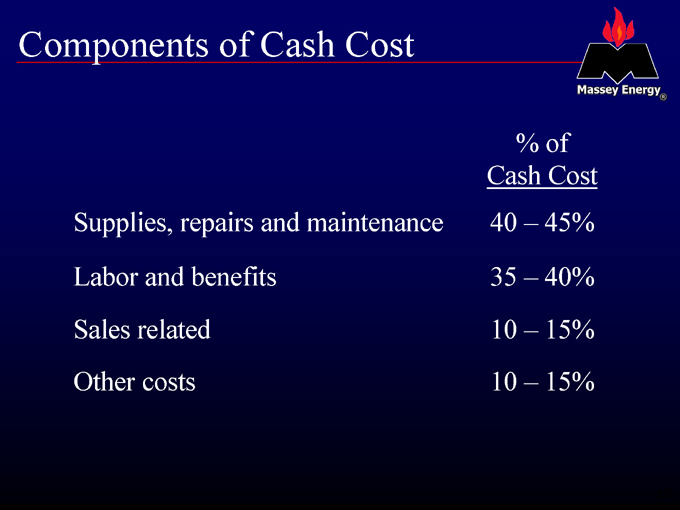

Components of Cash Cost

% of Cash Cost Supplies, repairs and maintenance 40 – 45% Labor and benefits 35 – 40% Sales related 10 – 15% Other costs 10 – 15%

10

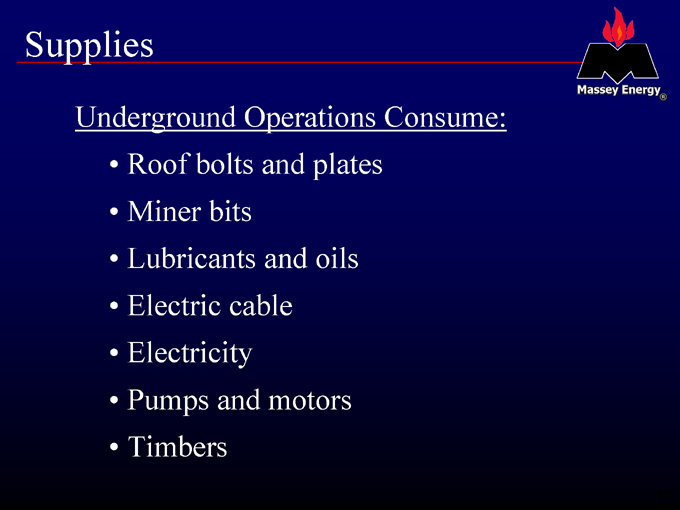

Supplies

Underground Operations Consume:

Roof bolts and plates Miner bits Lubricants and oils Electric cable Electricity Pumps and motors Timbers

11

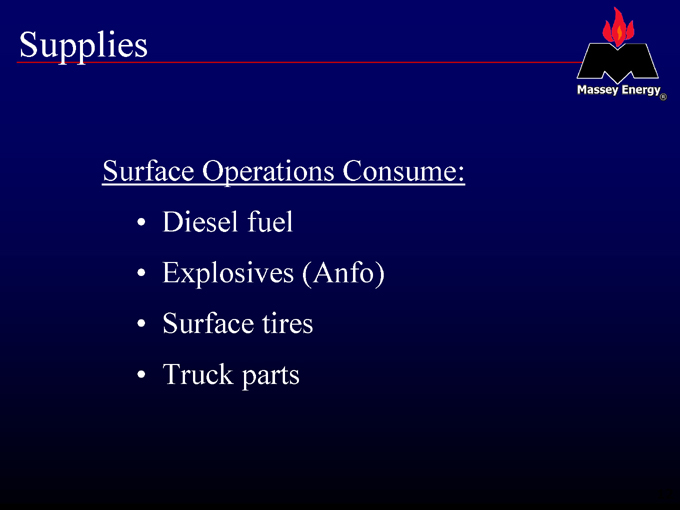

Supplies

Surface Operations Consume:

Diesel fuel Explosives (Anfo) Surface tires Truck parts

12

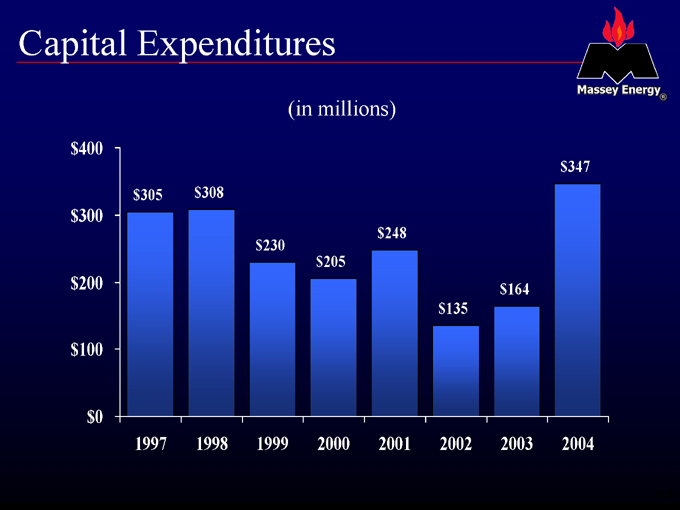

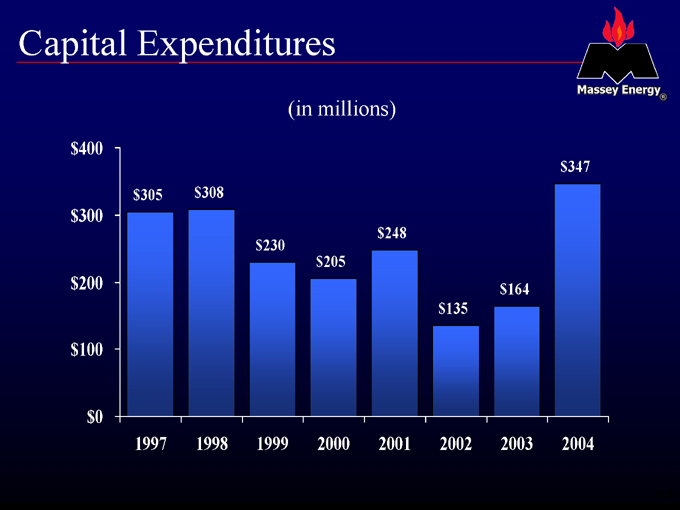

Capital Expenditures

(in millions) $400 $300 $200 $100 $0 $347 $305 $308

$248 $230 $205 $164 $135

1997 1998 1999 2000 2001 2002 2003 2004 13

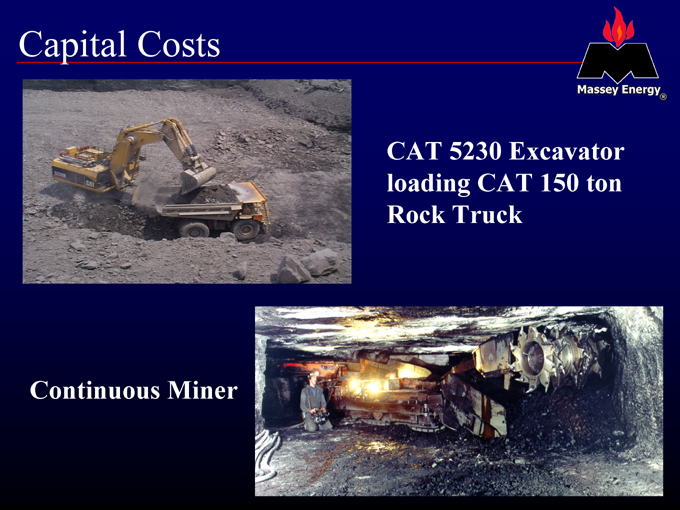

Capital Costs

CAT 5230 Excavator loading CAT 150 ton Rock Truck

Continuous Miner

14

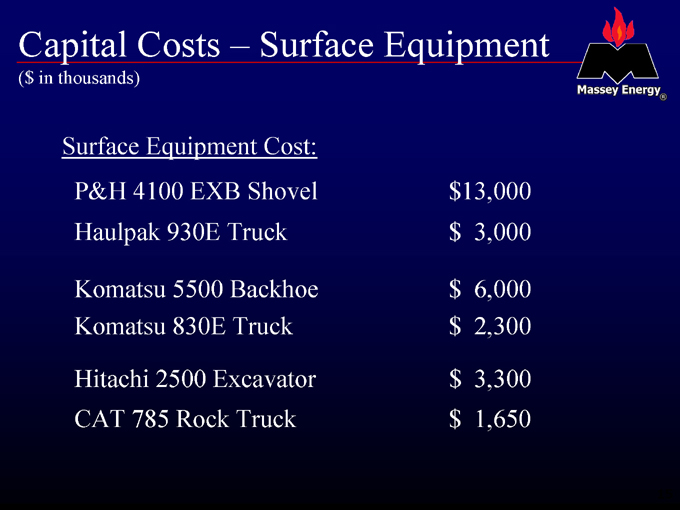

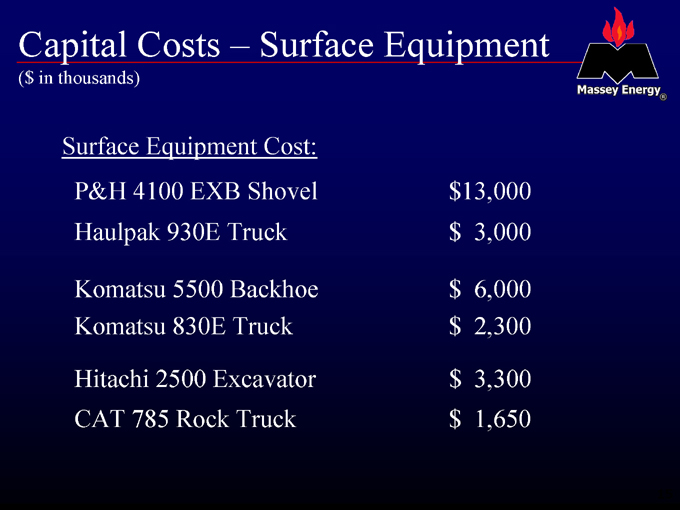

Capital Costs – Surface Equipment

($ in thousands)

Surface Equipment Cost:

P&H 4100 EXB Shovel $13,000 Haulpak 930E Truck $ 3,000

Komatsu 5500 Backhoe $ 6,000 Komatsu 830E Truck $ 2,300

Hitachi 2500 Excavator $ 3,300 CAT 785 Rock Truck $ 1,650

15

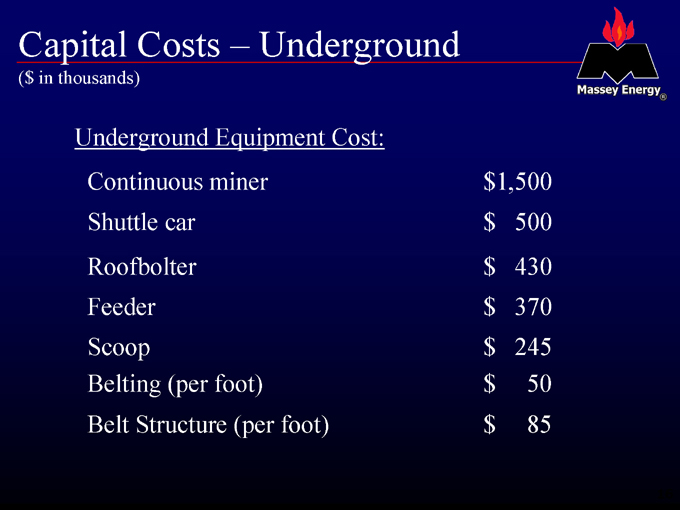

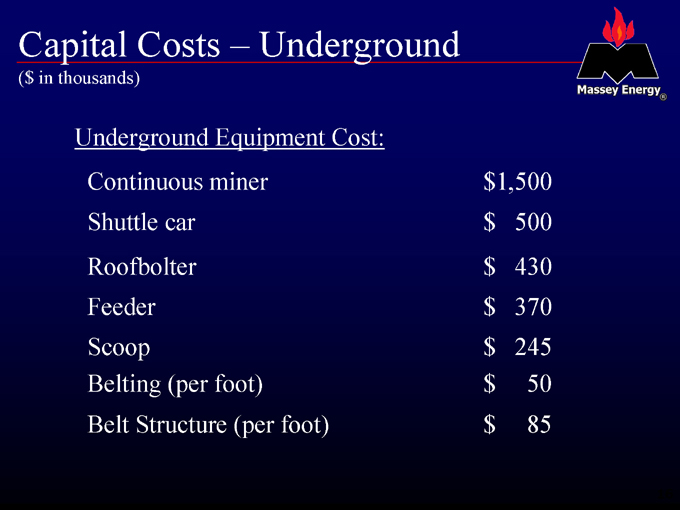

Capital Costs – Underground

($ in thousands)

Underground Equipment Cost:

Continuous miner $1,500 Shuttle car $ 500 Roofbolter $ 430 Feeder $ 370 Scoop $ 245 Belting (per foot) $ 50 Belt Structure (per foot) $ 85

16

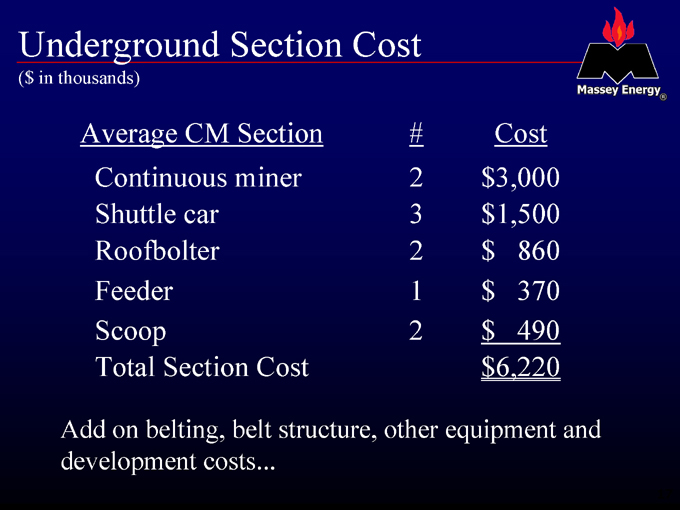

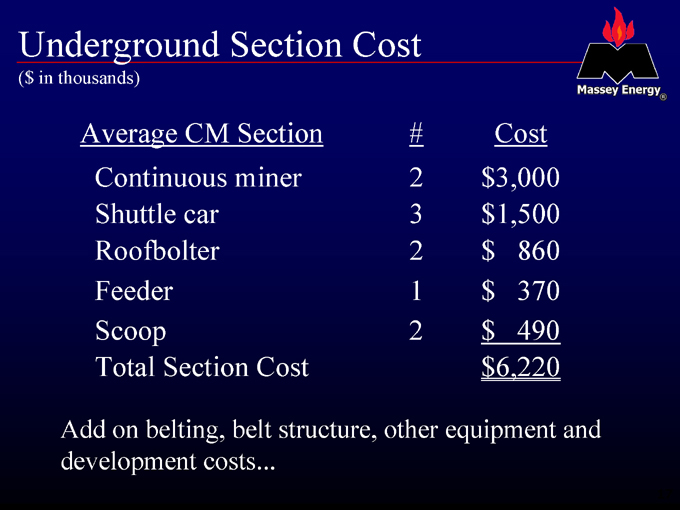

Underground Section Cost

($ in thousands)

Average CM Section # Cost Continuous miner 2 $3,000 Shuttle car 3 $1,500 Roofbolter 2 $ 860 Feeder 1 $ 370 Scoop 2 $ 490 Total Section Cost $6,220

Add on belting, belt structure, other equipment and development costs.

17

Balance Sheet

18

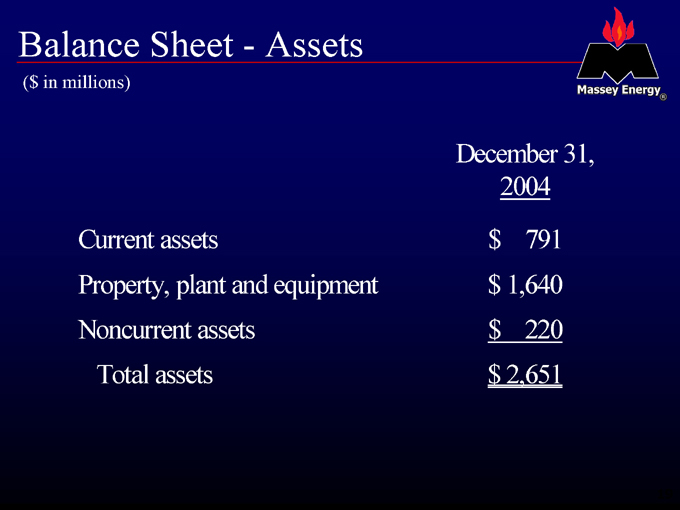

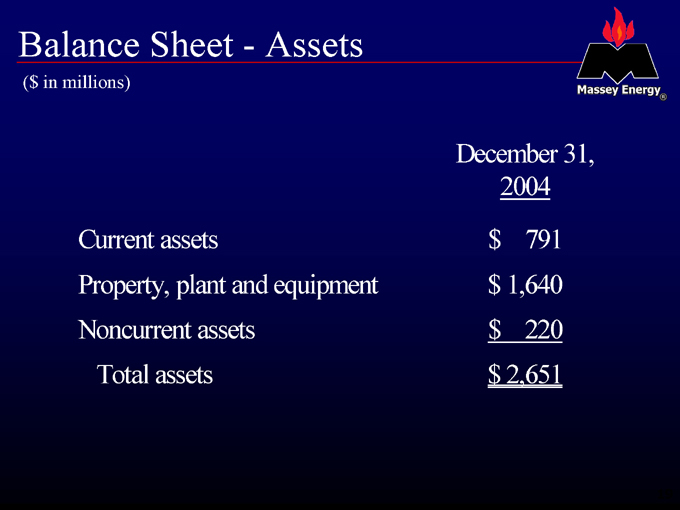

Balance Sheet—Assets

($ in millions)

December 31, 2004 Current assets $ 791 Property, plant and equipment $ 1,640 Noncurrent assets $ 220 Total assets $ 2,651

19

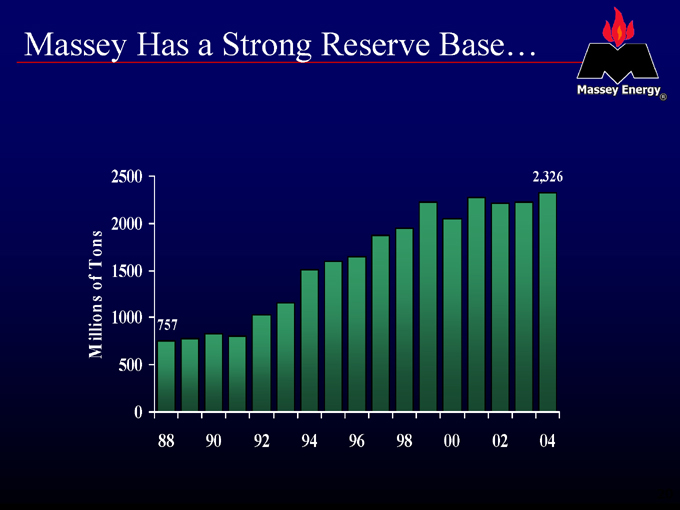

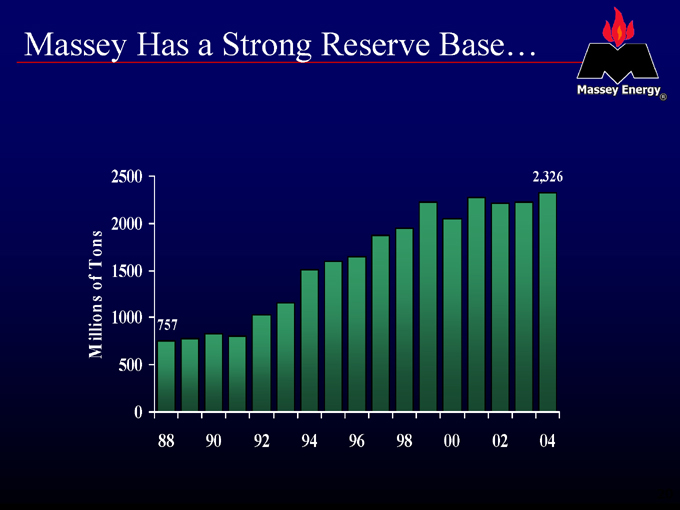

Massey Has a Strong Reserve Base…

M illions of Tons

2500 2000 1500 1000 500 0

757

2,326

88 90 92 94 96 98 00 02 04 20

Coal Reserves

Massey’s reserve base at 12/31/04 of 2.3 billion tons

Leased (81%) and “Fee” coal (19%)

Massey controls approximately 37% of the best reserves in Central Appalachia

21

Industry Accounting Concepts

Advance surface mine costs “Pit Coal” Longwall panel costs Mineral rights and mining properties Deferred royalties

22

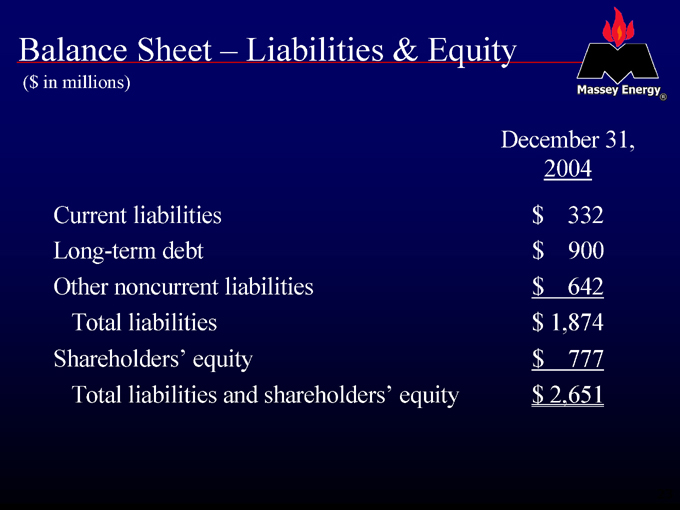

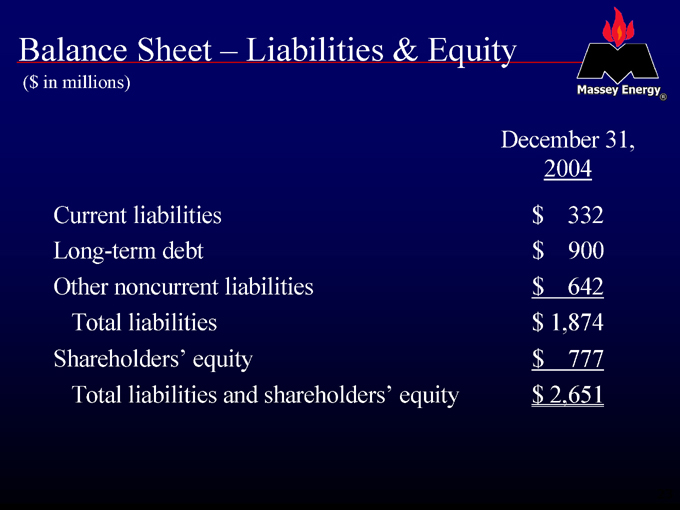

Balance Sheet – Liabilities & Equity

($ in millions)

December 31, 2004 Current liabilities $ 332 Long-term debt $ 900 Other noncurrent liabilities $ 642 Total liabilities $ 1,874 Shareholders’ equity $ 777 Total liabilities and shareholders’ equity $ 2,651

23

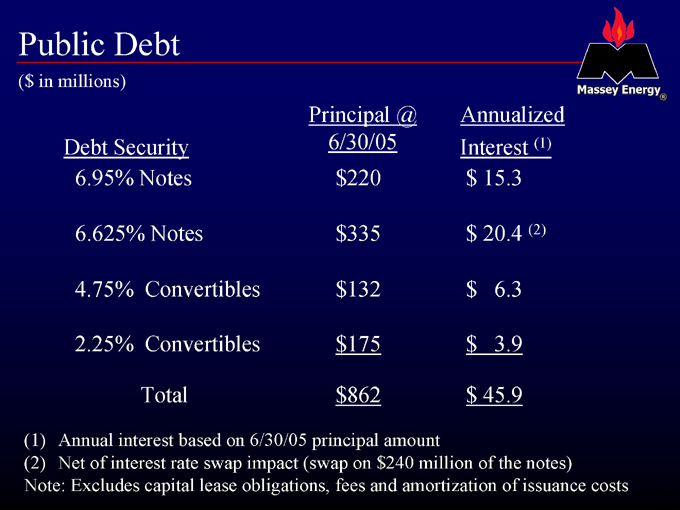

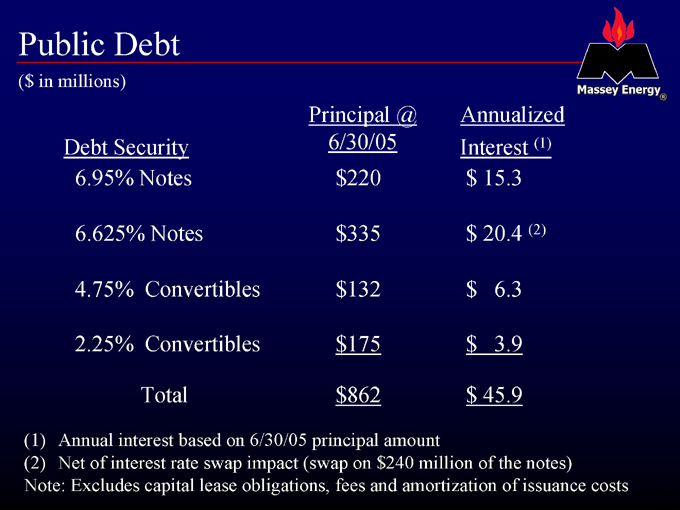

Public Debt

($ in millions)

Principal @ Annualized Debt Security 6/30/05 Interest (1) 6.95% Notes $220 $ 15.3

6.625% Notes $335 $ 20.4 (2) 4.75% Convertibles $132 $ 6.3 2.25% Convertibles $175 $ 3.9 Total $862 $ 45.9

(1) | | Annual interest based on 6/30/05 principal amount |

(2) Net of interest rate swap impact (swap on $240 million of the notes) Note: Excludes capital lease obligations, fees and amortization of issuance costs

24

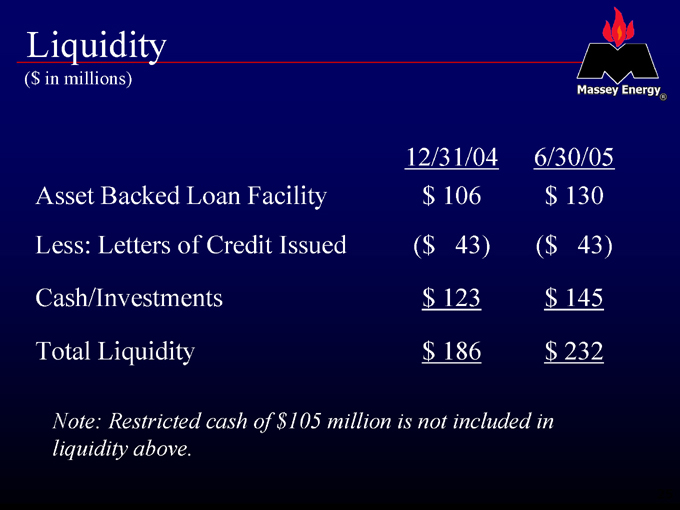

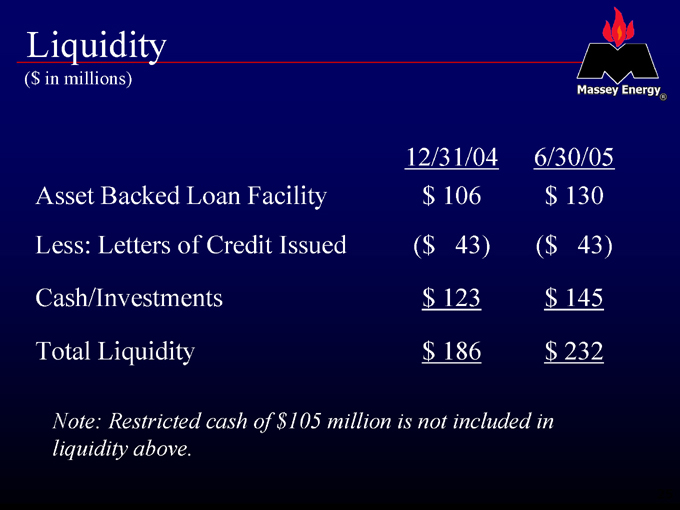

Liquidity

($ in millions)

12/31/04 6/30/05 Asset Backed Loan Facility $ 106 $ 130 Less: Letters of Credit Issued ($ 43) ($ 43) Cash/Investments $ 123 $ 145

Total Liquidity $ 186 $ 232

Note: Restricted cash of $105 million is not included in liquidity above.

25

“Legacy Liabilities”

Pension

Retiree medical (Postretirement healthcare and life insurance benefits) Black lung (“Pneumoconiosis”) Workers compensation Reclamation

26

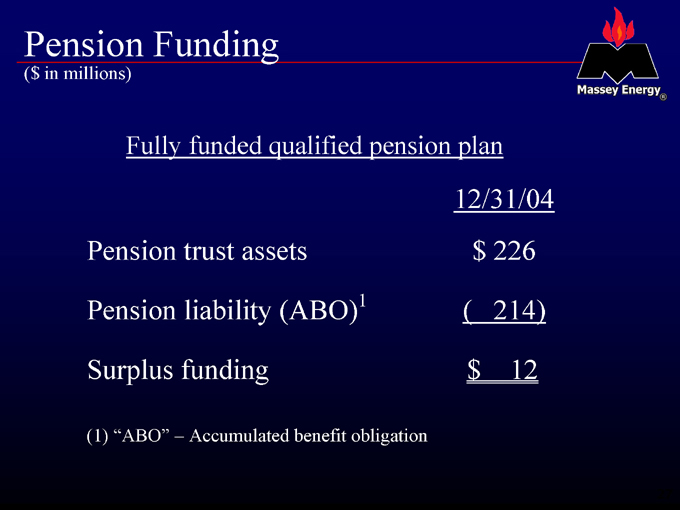

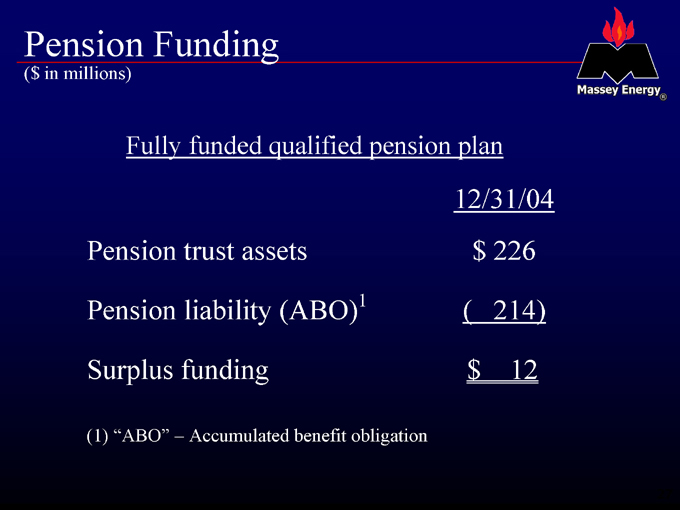

Pension Funding

($ in millions)

Fully funded qualified pension plan

12/31/04 Pension trust assets $ 226

Pension liability (ABO)1 ( 214)

Surplus funding $ 12

(1) | | “ABO” – Accumulated benefit obligation |

27

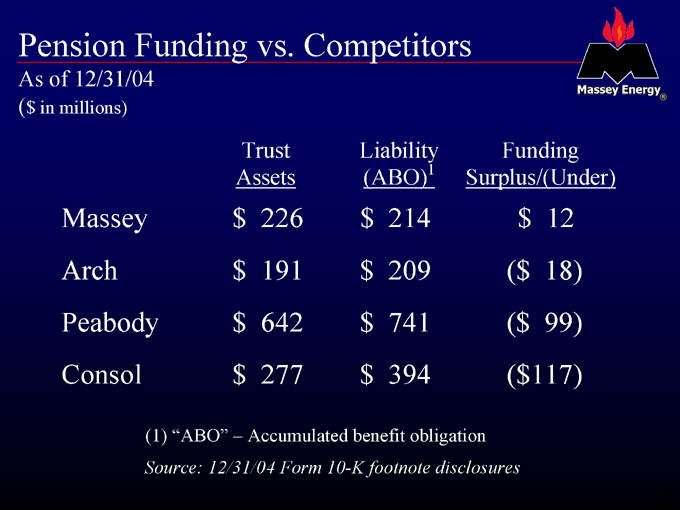

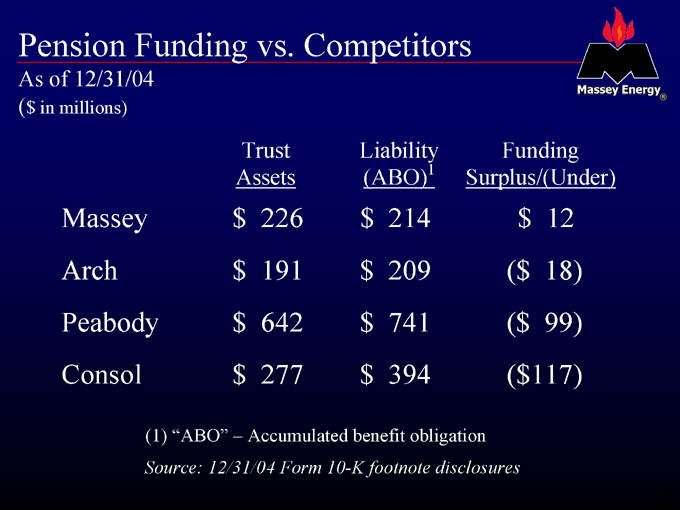

Pension Funding vs. Competitors

As of 12/31/04

($ in millions)

Trust Liability Funding Assets (ABO)1 Surplus/(Under)

Massey $ 226 $ 214 $ 12 Arch $ 191 $ 209 ($ 18) Peabody $ 642 $ 741 ($ 99) Consol $ 277 $ 394 ($117)

(1) | | “ABO” – Accumulated benefit obligation |

Source: 12/31/04 Form 10-K footnote disclosures

28

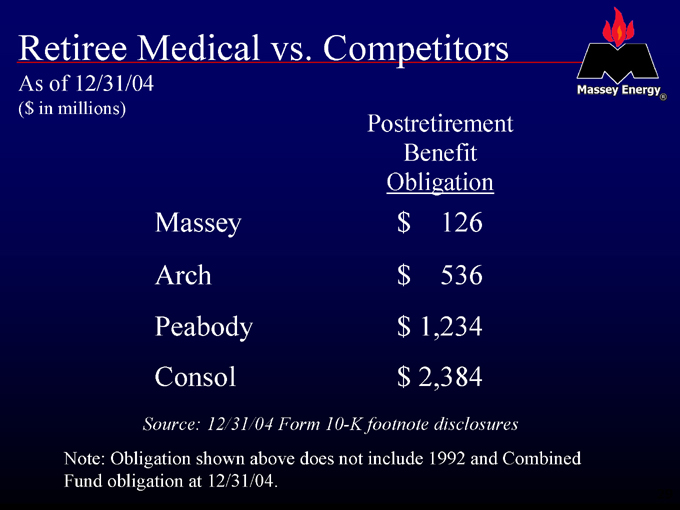

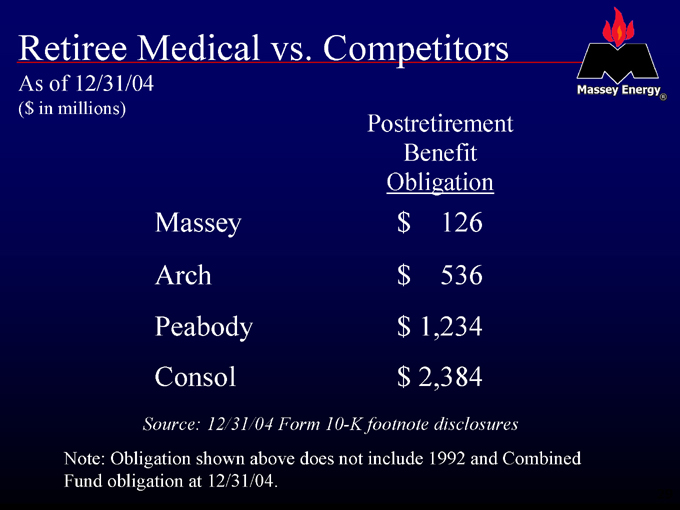

Retiree Medical vs. Competitors

As of 12/31/04

($ in millions)

Postretirement Benefit Obligation

Massey $ 126 Arch $ 536 Peabody $ 1,234 Consol $ 2,384

Source: 12/31/04 Form 10-K footnote disclosures

Note: Obligation shown above does not include 1992 and Combined Fund obligation at 12/31/04.

29

New Accounting Rules

30

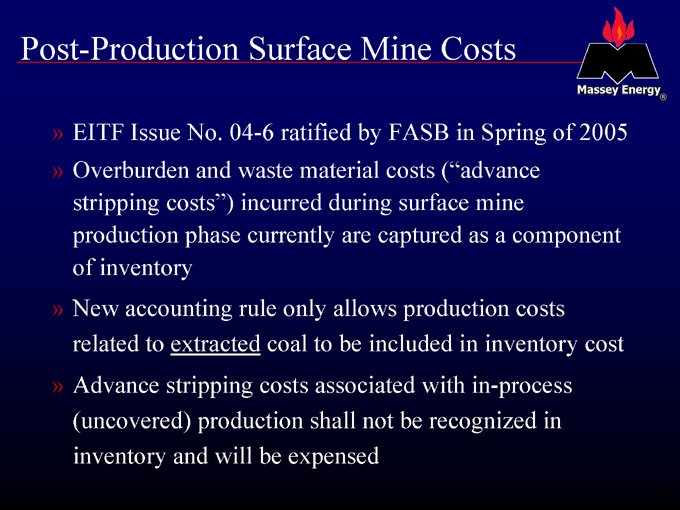

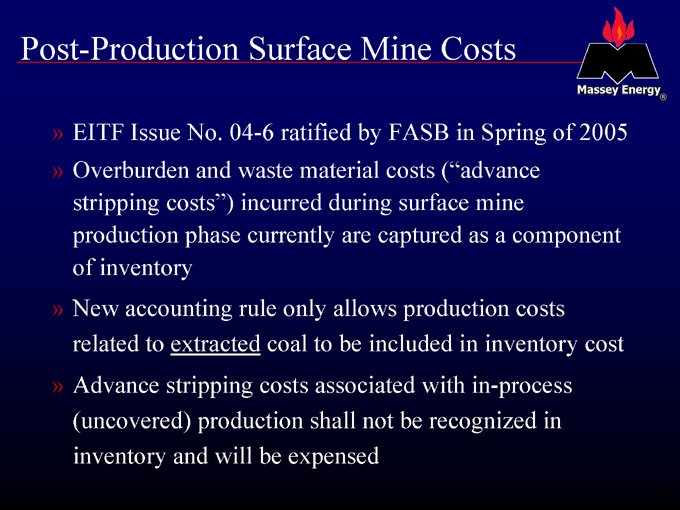

Post-Production Surface Mine Costs

EITF Issue No. 04-6 ratified by FASB in Spring of 2005 Overburden and waste material costs (“advance stripping costs”) incurred during surface mine production phase currently are captured as a component of inventory New accounting rule only allows production costs related to extracted coal to be included in inventory cost Advance stripping costs associated with in-process (uncovered) production shall not be recognized in inventory and will be expensed

31

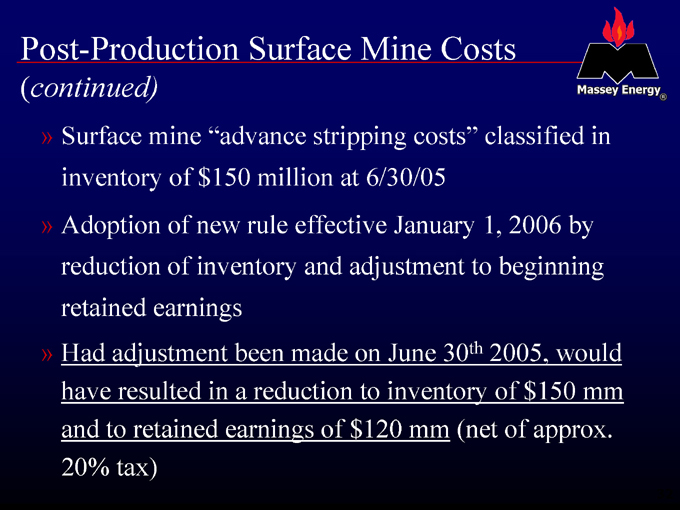

Post-Production Surface Mine Costs

(continued)

Surface mine “advance stripping costs” classified in inventory of $150 million at 6/30/05 Adoption of new rule effective January 1, 2006 by reduction of inventory and adjustment to beginning retained earnings Had adjustment been made on June 30th 2005, would have resulted in a reduction to inventory of $150 mm and to retained earnings of $120 mm (net of approx. 20% tax)

32

Stock Option Expensing – FAS 123(R)

Adoption on January 1, 2006

Impact will include expensing of stock options through income statement FY 2004 basic earnings per share impact of stock option expensing would have been about $0.02 per share (net of tax)

33

Doing the Right Thing. with Energy

34