Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) 1 Unaudited Interim Special Purpose Combined Statements of Net Assets Acquired as of June 30, 2017 and December 31, 2016 and Interim Special Purpose Combined Statements of Revenues and Direct Expenses for the six months ended June 30, 2017 and 2016 Exhibit 99.1

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) 2 Index to the Unaudited Interim Special Purpose Combined Financial Statements Interim Special Purpose Combined Statements of Net Assets Acquired (Unaudited) as of June 30, 2017 and December 31, 2016 ........................................................................................................................................................ 3 Interim Special Purpose Combined Statements of Revenues and Direct Expenses (Unaudited) for the six months ended June 30, 2017 and 2016 ....................................................................................................................................... 4 Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) .................................. 5

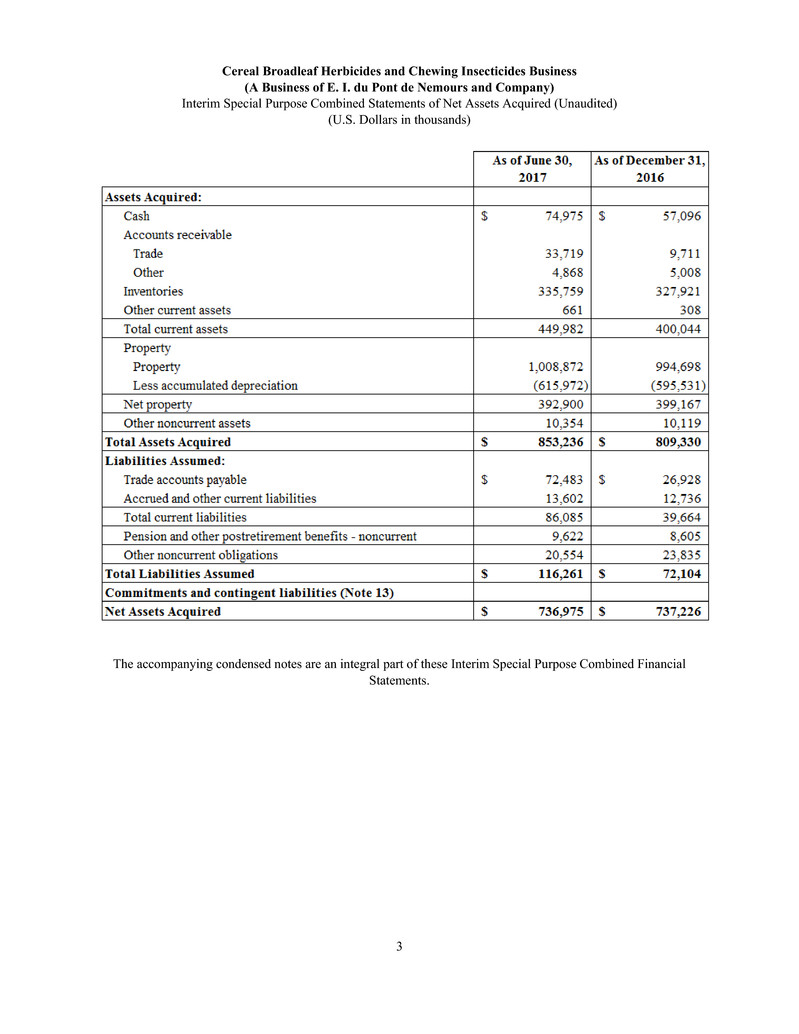

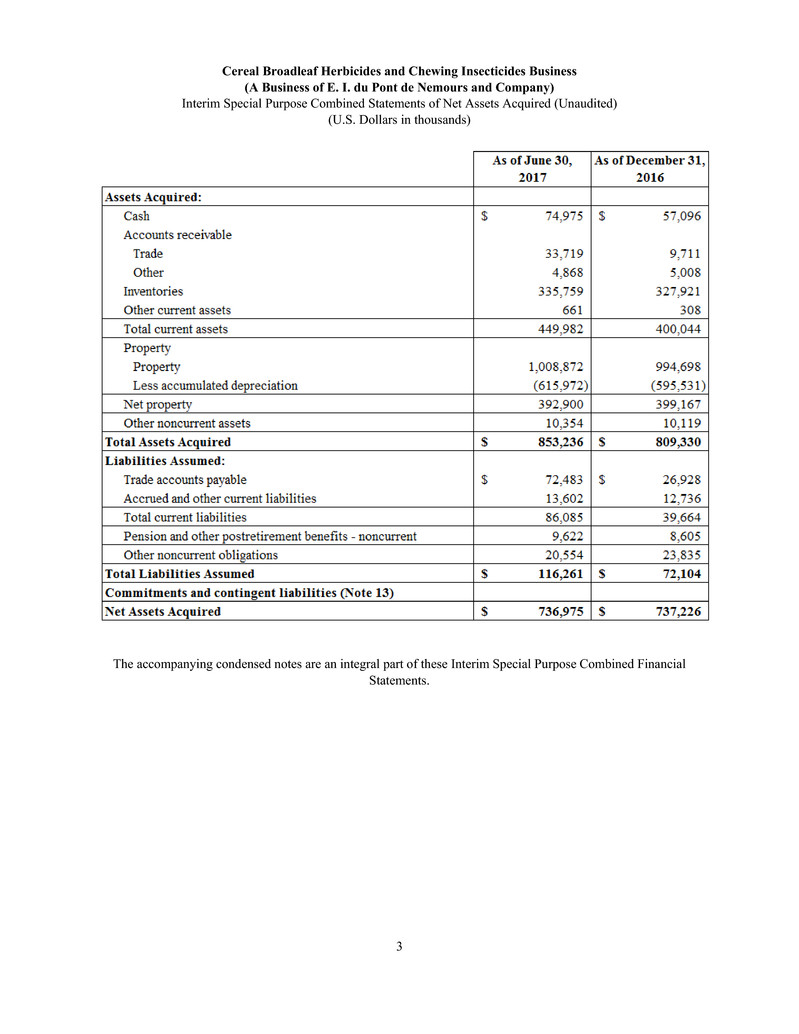

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Interim Special Purpose Combined Statements of Net Assets Acquired (Unaudited) (U.S. Dollars in thousands) 3 The accompanying condensed notes are an integral part of these Interim Special Purpose Combined Financial Statements.

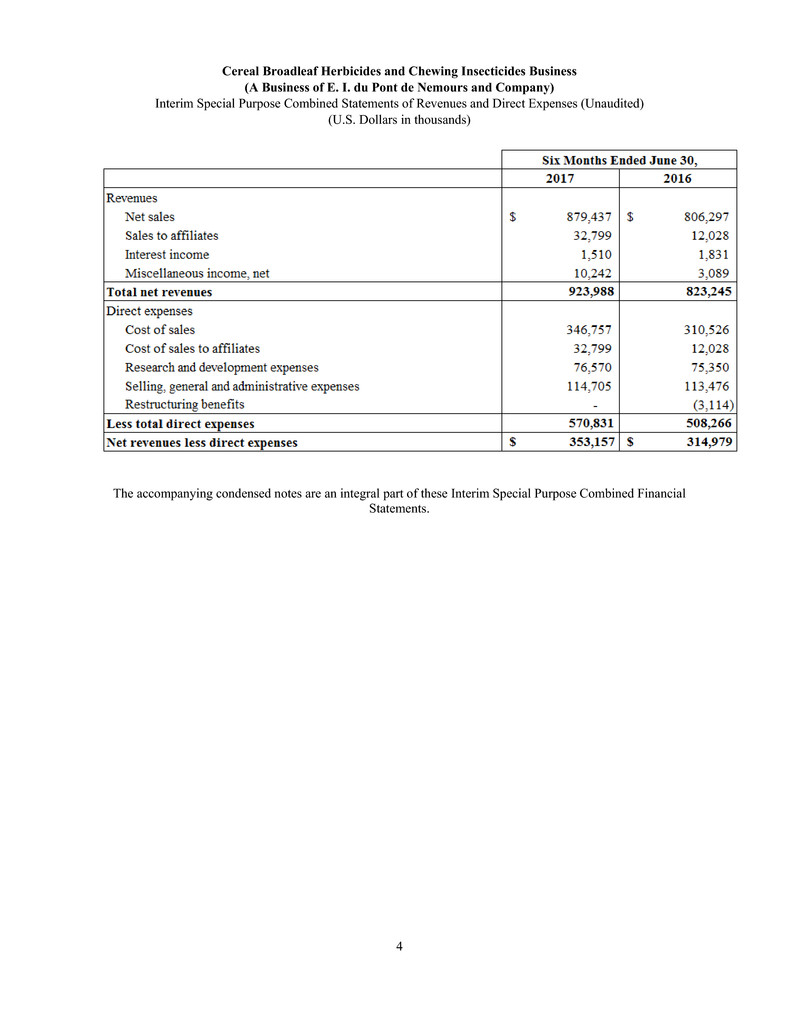

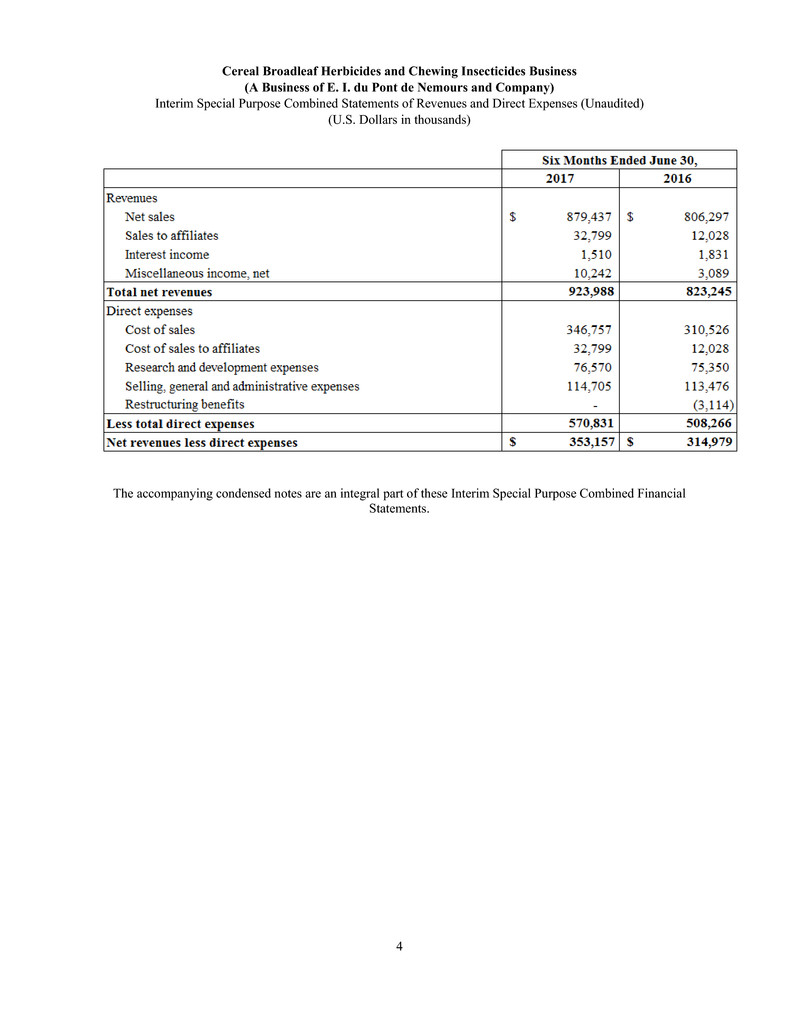

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Interim Special Purpose Combined Statements of Revenues and Direct Expenses (Unaudited) (U.S. Dollars in thousands) 4 The accompanying condensed notes are an integral part of these Interim Special Purpose Combined Financial Statements.

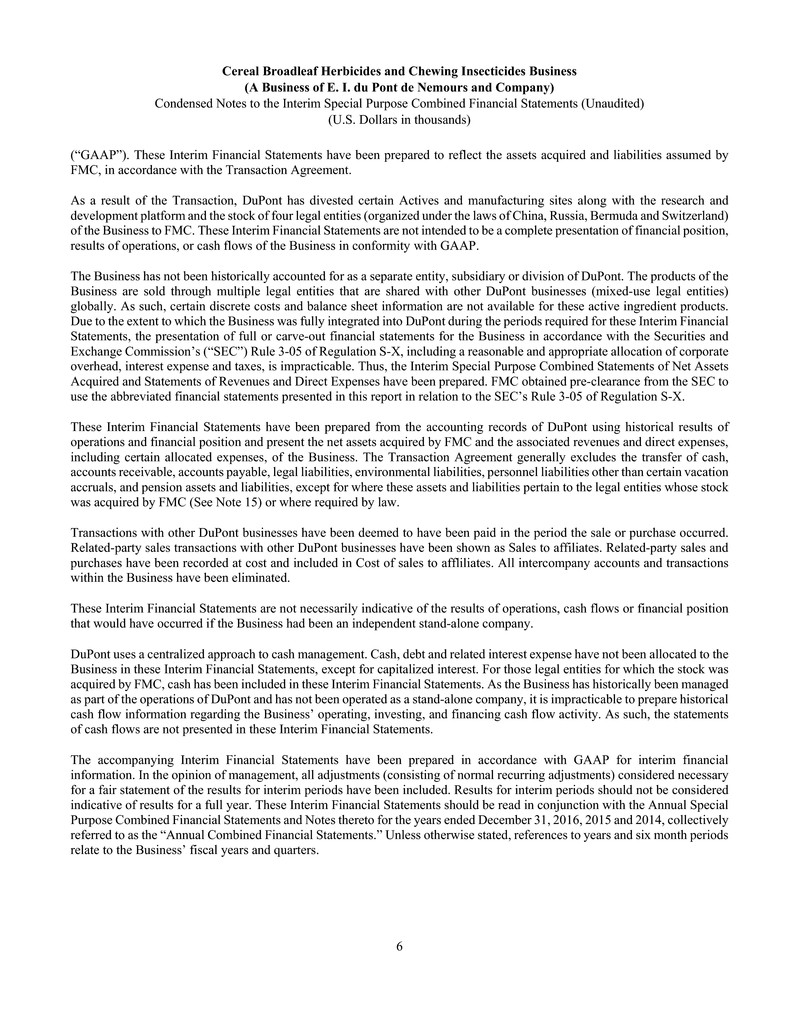

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 5 NOTE 1 — Basis of Presentation Background On March 31, 2017, E. I. du Pont de Nemours and Company (“DuPont”) entered into a purchase and sale agreement (the “Transaction Agreement”) under which FMC Corporation (“FMC”) agreed to acquire certain assets and assume certain liabilities related to the DuPont Crop Protection (“Crop Protection”) Business (together, the “Transaction” or “Sale”). The business operations transferred to FMC as part of the Transaction include certain insecticide and herbicide active ingredient products (“Actives”) and formulated products containing these active ingredients, as well as manufacturing sites, intellectual property and the Crop Protection research & development (“R&D”) pipeline and organization, excluding seed treatment, nematicides, and late-stage R&D programs (collectively referred to as the “Business” or “Cereal Broadleaf Herbicides and Chewing Insecticides Business”). The divested Actives are as follows: • Chlorsulfuron Methyl herbicide • Ethametsulfuron Methyl herbicide • Flupyrsulfuron herbicide • Lenacil herbicide • Metsulfuron Methyl herbicide • Tribenuron Methyl herbicide • Azimsulfuron herbicide • Thifensulfuron Methyl herbicide • Triflusulfuron Methyl herbicide • Rynaxypyr® (Chlorantraniliprole) insecticide • Cyazypyr® (Cyantraniliprole) insecticide • Indoxacarb insecticide Description of Business The Cereal Broadleaf Herbicides and Chewing Insecticides Business is a global crop protection business engaged in the development of crop protection products that are specifically targeted to achieve gains in crop yields and productivity. The Business leverages its technology, customer relationships and industry knowledge to improve the quantity, quality and safety of the global food supply and the global production agriculture industry in the cereal broadleaf herbicides and chewing insecticides product space. The Business delivers a broad portfolio of herbicide and insecticide products that are specifically targeted to achieve gains in crop yields and productivity. The Business’ research and development platform focuses on leveraging technology to increase grower productivity through the effective use of herbicides and insecticides. The Business’ products are marketed and sold to growers and other end users through a network of wholesale distributors and crop input retailers. The Business operates in over 50 countries around the world. The major commodities, raw materials and supplies for the Business include benzene derivatives, other aromatics and carbamic acid related intermediates, and insect control products. Basis of Presentation The accompanying Interim Special Purpose Combined Financial Statements (the “Interim Financial Statements”) were prepared by DuPont management in accordance with accounting principles generally accepted in the United States of America

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 6 (“GAAP”). These Interim Financial Statements have been prepared to reflect the assets acquired and liabilities assumed by FMC, in accordance with the Transaction Agreement. As a result of the Transaction, DuPont has divested certain Actives and manufacturing sites along with the research and development platform and the stock of four legal entities (organized under the laws of China, Russia, Bermuda and Switzerland) of the Business to FMC. These Interim Financial Statements are not intended to be a complete presentation of financial position, results of operations, or cash flows of the Business in conformity with GAAP. The Business has not been historically accounted for as a separate entity, subsidiary or division of DuPont. The products of the Business are sold through multiple legal entities that are shared with other DuPont businesses (mixed-use legal entities) globally. As such, certain discrete costs and balance sheet information are not available for these active ingredient products. Due to the extent to which the Business was fully integrated into DuPont during the periods required for these Interim Financial Statements, the presentation of full or carve-out financial statements for the Business in accordance with the Securities and Exchange Commission’s (“SEC”) Rule 3-05 of Regulation S-X, including a reasonable and appropriate allocation of corporate overhead, interest expense and taxes, is impracticable. Thus, the Interim Special Purpose Combined Statements of Net Assets Acquired and Statements of Revenues and Direct Expenses have been prepared. FMC obtained pre-clearance from the SEC to use the abbreviated financial statements presented in this report in relation to the SEC’s Rule 3-05 of Regulation S-X. These Interim Financial Statements have been prepared from the accounting records of DuPont using historical results of operations and financial position and present the net assets acquired by FMC and the associated revenues and direct expenses, including certain allocated expenses, of the Business. The Transaction Agreement generally excludes the transfer of cash, accounts receivable, accounts payable, legal liabilities, environmental liabilities, personnel liabilities other than certain vacation accruals, and pension assets and liabilities, except for where these assets and liabilities pertain to the legal entities whose stock was acquired by FMC (See Note 15) or where required by law. Transactions with other DuPont businesses have been deemed to have been paid in the period the sale or purchase occurred. Related-party sales transactions with other DuPont businesses have been shown as Sales to affiliates. Related-party sales and purchases have been recorded at cost and included in Cost of sales to affliliates. All intercompany accounts and transactions within the Business have been eliminated. These Interim Financial Statements are not necessarily indicative of the results of operations, cash flows or financial position that would have occurred if the Business had been an independent stand-alone company. DuPont uses a centralized approach to cash management. Cash, debt and related interest expense have not been allocated to the Business in these Interim Financial Statements, except for capitalized interest. For those legal entities for which the stock was acquired by FMC, cash has been included in these Interim Financial Statements. As the Business has historically been managed as part of the operations of DuPont and has not been operated as a stand-alone company, it is impracticable to prepare historical cash flow information regarding the Business’ operating, investing, and financing cash flow activity. As such, the statements of cash flows are not presented in these Interim Financial Statements. The accompanying Interim Financial Statements have been prepared in accordance with GAAP for interim financial information. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair statement of the results for interim periods have been included. Results for interim periods should not be considered indicative of results for a full year. These Interim Financial Statements should be read in conjunction with the Annual Special Purpose Combined Financial Statements and Notes thereto for the years ended December 31, 2016, 2015 and 2014, collectively referred to as the “Annual Combined Financial Statements.” Unless otherwise stated, references to years and six month periods relate to the Business’ fiscal years and quarters.

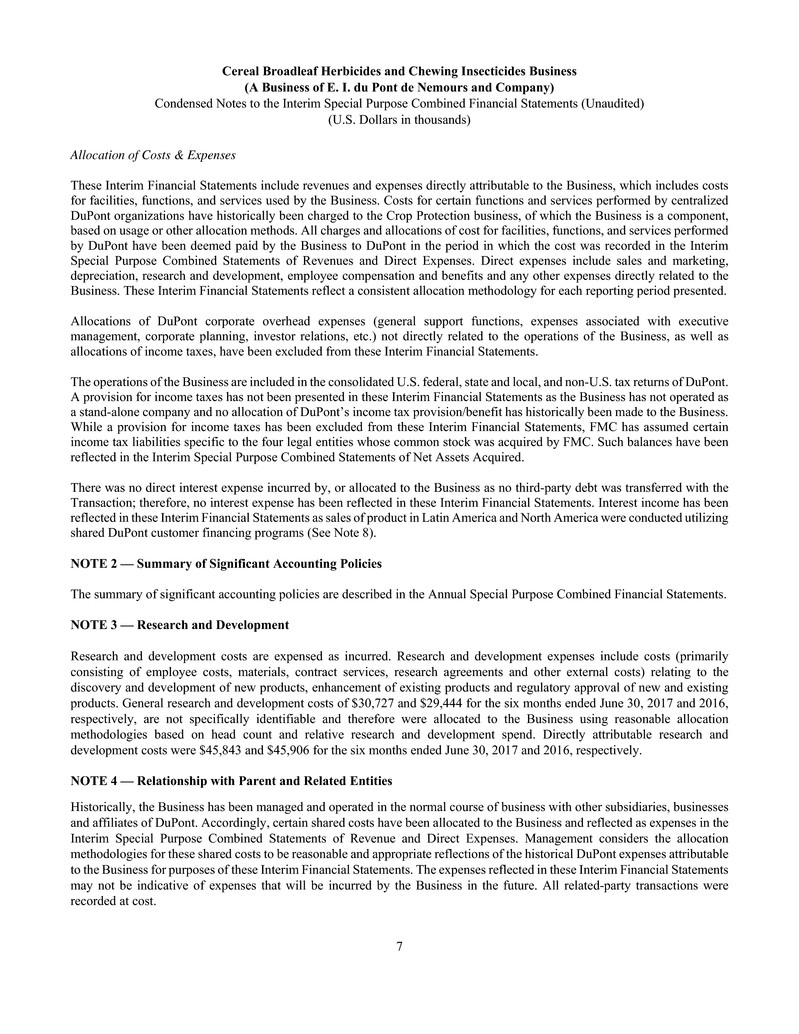

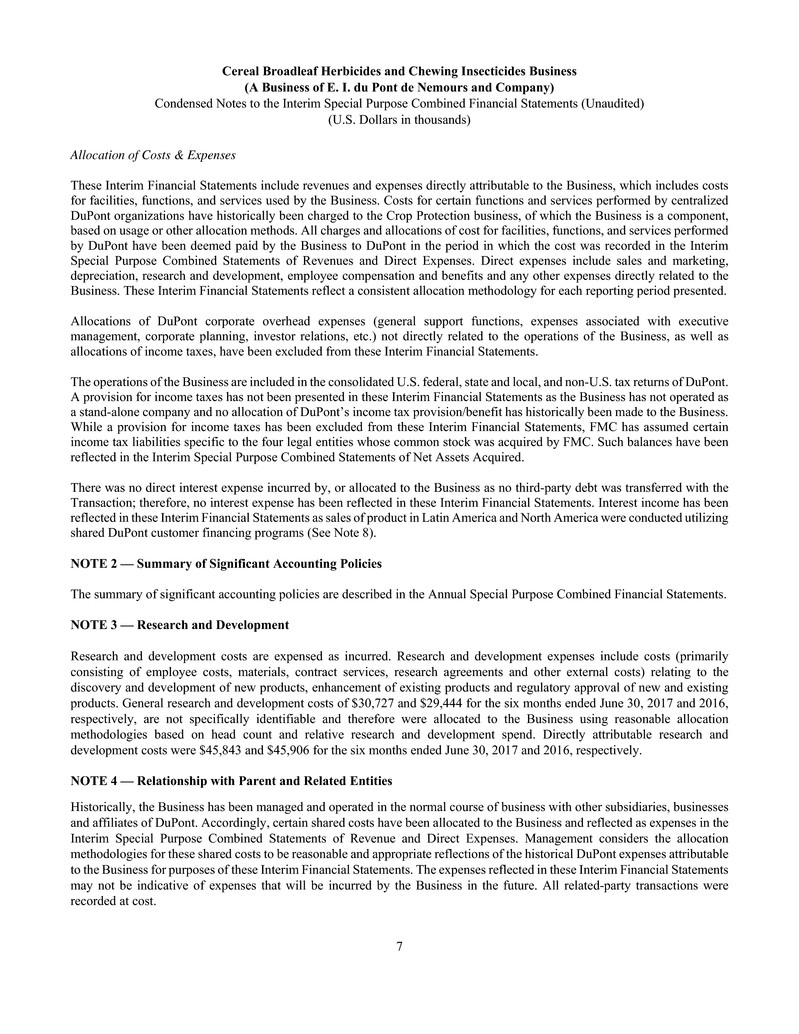

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 7 Allocation of Costs & Expenses These Interim Financial Statements include revenues and expenses directly attributable to the Business, which includes costs for facilities, functions, and services used by the Business. Costs for certain functions and services performed by centralized DuPont organizations have historically been charged to the Crop Protection business, of which the Business is a component, based on usage or other allocation methods. All charges and allocations of cost for facilities, functions, and services performed by DuPont have been deemed paid by the Business to DuPont in the period in which the cost was recorded in the Interim Special Purpose Combined Statements of Revenues and Direct Expenses. Direct expenses include sales and marketing, depreciation, research and development, employee compensation and benefits and any other expenses directly related to the Business. These Interim Financial Statements reflect a consistent allocation methodology for each reporting period presented. Allocations of DuPont corporate overhead expenses (general support functions, expenses associated with executive management, corporate planning, investor relations, etc.) not directly related to the operations of the Business, as well as allocations of income taxes, have been excluded from these Interim Financial Statements. The operations of the Business are included in the consolidated U.S. federal, state and local, and non-U.S. tax returns of DuPont. A provision for income taxes has not been presented in these Interim Financial Statements as the Business has not operated as a stand-alone company and no allocation of DuPont’s income tax provision/benefit has historically been made to the Business. While a provision for income taxes has been excluded from these Interim Financial Statements, FMC has assumed certain income tax liabilities specific to the four legal entities whose common stock was acquired by FMC. Such balances have been reflected in the Interim Special Purpose Combined Statements of Net Assets Acquired. There was no direct interest expense incurred by, or allocated to the Business as no third-party debt was transferred with the Transaction; therefore, no interest expense has been reflected in these Interim Financial Statements. Interest income has been reflected in these Interim Financial Statements as sales of product in Latin America and North America were conducted utilizing shared DuPont customer financing programs (See Note 8). NOTE 2 — Summary of Significant Accounting Policies The summary of significant accounting policies are described in the Annual Special Purpose Combined Financial Statements. NOTE 3 — Research and Development Research and development costs are expensed as incurred. Research and development expenses include costs (primarily consisting of employee costs, materials, contract services, research agreements and other external costs) relating to the discovery and development of new products, enhancement of existing products and regulatory approval of new and existing products. General research and development costs of $30,727 and $29,444 for the six months ended June 30, 2017 and 2016, respectively, are not specifically identifiable and therefore were allocated to the Business using reasonable allocation methodologies based on head count and relative research and development spend. Directly attributable research and development costs were $45,843 and $45,906 for the six months ended June 30, 2017 and 2016, respectively. NOTE 4 — Relationship with Parent and Related Entities Historically, the Business has been managed and operated in the normal course of business with other subsidiaries, businesses and affiliates of DuPont. Accordingly, certain shared costs have been allocated to the Business and reflected as expenses in the Interim Special Purpose Combined Statements of Revenue and Direct Expenses. Management considers the allocation methodologies for these shared costs to be reasonable and appropriate reflections of the historical DuPont expenses attributable to the Business for purposes of these Interim Financial Statements. The expenses reflected in these Interim Financial Statements may not be indicative of expenses that will be incurred by the Business in the future. All related-party transactions were recorded at cost.

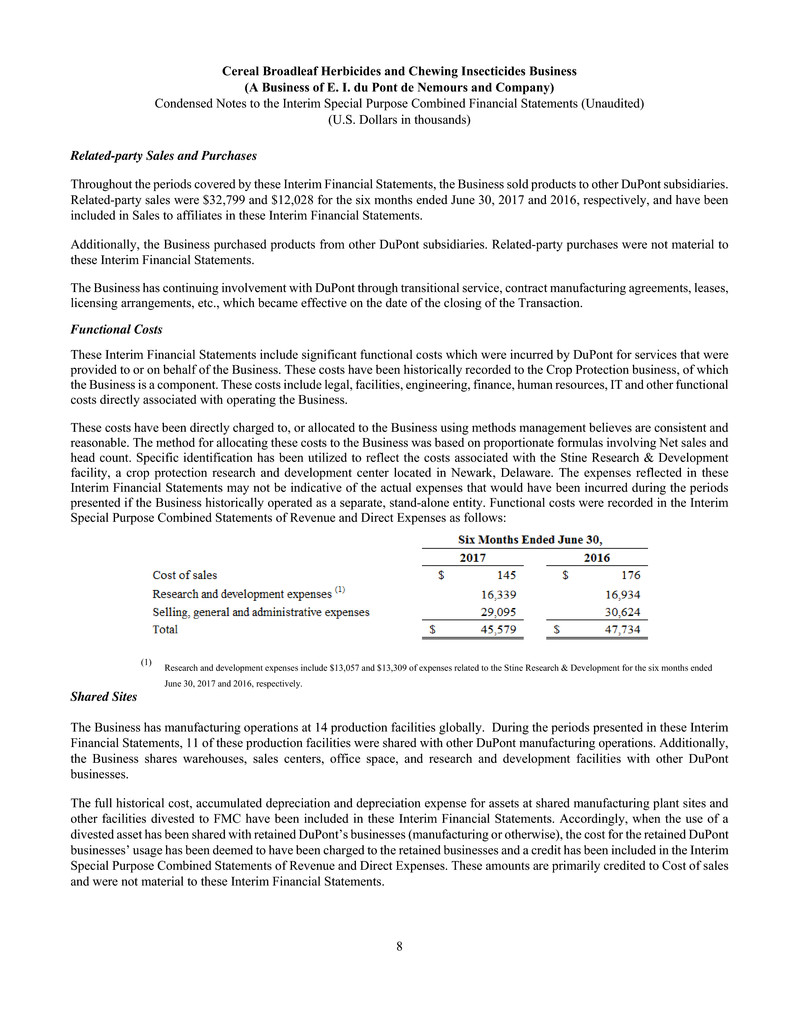

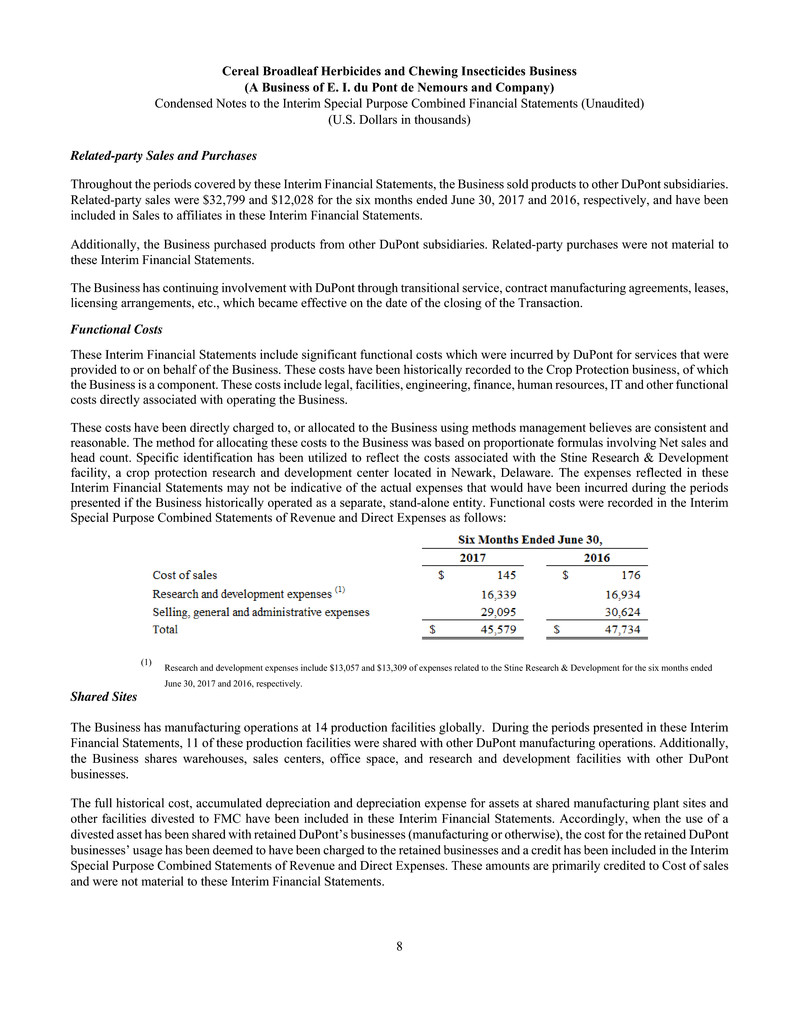

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 8 Related-party Sales and Purchases Throughout the periods covered by these Interim Financial Statements, the Business sold products to other DuPont subsidiaries. Related-party sales were $32,799 and $12,028 for the six months ended June 30, 2017 and 2016, respectively, and have been included in Sales to affiliates in these Interim Financial Statements. Additionally, the Business purchased products from other DuPont subsidiaries. Related-party purchases were not material to these Interim Financial Statements. The Business has continuing involvement with DuPont through transitional service, contract manufacturing agreements, leases, licensing arrangements, etc., which became effective on the date of the closing of the Transaction. Functional Costs These Interim Financial Statements include significant functional costs which were incurred by DuPont for services that were provided to or on behalf of the Business. These costs have been historically recorded to the Crop Protection business, of which the Business is a component. These costs include legal, facilities, engineering, finance, human resources, IT and other functional costs directly associated with operating the Business. These costs have been directly charged to, or allocated to the Business using methods management believes are consistent and reasonable. The method for allocating these costs to the Business was based on proportionate formulas involving Net sales and head count. Specific identification has been utilized to reflect the costs associated with the Stine Research & Development facility, a crop protection research and development center located in Newark, Delaware. The expenses reflected in these Interim Financial Statements may not be indicative of the actual expenses that would have been incurred during the periods presented if the Business historically operated as a separate, stand-alone entity. Functional costs were recorded in the Interim Special Purpose Combined Statements of Revenue and Direct Expenses as follows: (1) Research and development expenses include $13,057 and $13,309 of expenses related to the Stine Research & Development for the six months ended June 30, 2017 and 2016, respectively. Shared Sites The Business has manufacturing operations at 14 production facilities globally. During the periods presented in these Interim Financial Statements, 11 of these production facilities were shared with other DuPont manufacturing operations. Additionally, the Business shares warehouses, sales centers, office space, and research and development facilities with other DuPont businesses. The full historical cost, accumulated depreciation and depreciation expense for assets at shared manufacturing plant sites and other facilities divested to FMC have been included in these Interim Financial Statements. Accordingly, when the use of a divested asset has been shared with retained DuPont’s businesses (manufacturing or otherwise), the cost for the retained DuPont businesses’ usage has been deemed to have been charged to the retained businesses and a credit has been included in the Interim Special Purpose Combined Statements of Revenue and Direct Expenses. These amounts are primarily credited to Cost of sales and were not material to these Interim Financial Statements.

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 9 For shared manufacturing plant sites and other facilities that are retained by DuPont, these shared assets have been excluded from the Interim Special Purpose Combined Statements of Net Assets Acquired. Accordingly, where the Business has used these shared assets, a charge to Cost of sales has been recorded for its usage of these shared assets. The amounts included in Cost of sales for usage of assets retained by DuPont were $1,532 and $1,697 for the six months ended June 30, 2017 and 2016, respectively. Cash Management and Financing The Business participated in DuPont’s centralized cash management and financing programs. Disbursements were made through centralized accounts payable systems which were operated by DuPont. Cash receipts were transferred to centralized accounts, also maintained by DuPont. As cash was disbursed and received by DuPont, it was accounted for by the Business through the intercompany payables and receivables process. All short and long-term debt was financed by DuPont and financing decisions for wholly and majority-owned subsidiaries were determined by central DuPont treasury operations. Except for the cash held by the legal entities for which the stock was acquired by FMC, cash and debt were not acquired or assumed, respectively, by FMC and have been excluded from these Interim Financial Statements. Intercompany Accounts Receivable and Payable Intercompany receivables and payables between the Business and DuPont and its other businesses are settled on a current basis. As such, intercompany receivables and payables have been excluded from these Interim Financial Statements. NOTE 5 – Investment in DuPont Agricultural Chemicals Limited, Shanghai The Business has an 80% ownership interest in DuPont Agricultural Chemicals Limited, Shanghai (“DuPac”), a joint venture registered in the People’s Republic of China, which was formed in 1990. The remaining 20% is owned by Shanghai Huayi Group Investment Co., Ltd. DuPac owns two manufacturing plants located in Shanghai, China. The joint venture is fully consolidated in these Interim Financial Statements. As such, 100% of the assets and liabilities of DuPac are presented in the Interim Special Purpose Combined Statements of Net Assets Acquired. The Business’ noncontrolling interest in DuPac’s assets and liabilities was $1,901 and $7,461 as of June 30, 2017 and December 31, 2016, respectively. Additionally, 100% of the direct revenues and expenses of DuPac are presented in the Special Purpose Combined Statements of Revenues and Direct Expenses. The Business’ noncontrolling interest in DuPac’s direct revenues and expenses was $15,537 and $9,555 as of June 30, 2017 and 2016, respectively. The 80% ownership interest in DuPac was transferred to FMC as part of the Transaction. NOTE 6 — Restructuring 2016 Global Cost Savings and Restructuring Program In December 2015, DuPont committed to take structural actions across all businesses and staff functions globally to operate more efficiently by further consolidating businesses and aligning staff functions more closely with them as part of a 2016 global cost savings and restructuring plan. The Business was included in this 2016 global cost savings and restructuring plan. During the six months ended June 30, 2016 in connection with the restructuring actions, a net pre-tax benefit of $3,114 was recorded in Restructuring benefits in the Interim Special Purpose Combined Statements of Revenues and Direct Expenses. The net benefit was directly attributable to the Business and primarily due to lower than estimated severance and related benefit costs associated with the 2016 restructuring program. There was no impact during the period ended June 30, 2017. The actions and payments related to the 2016 restructuring program were substantially complete as of December 31, 2016.

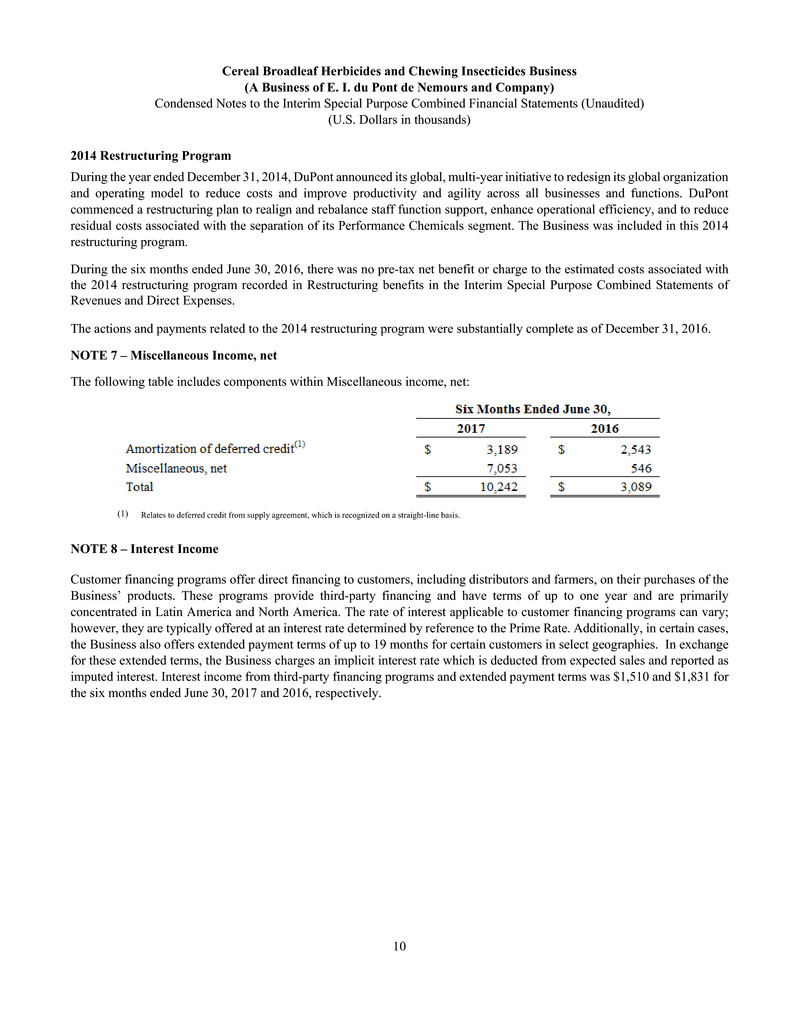

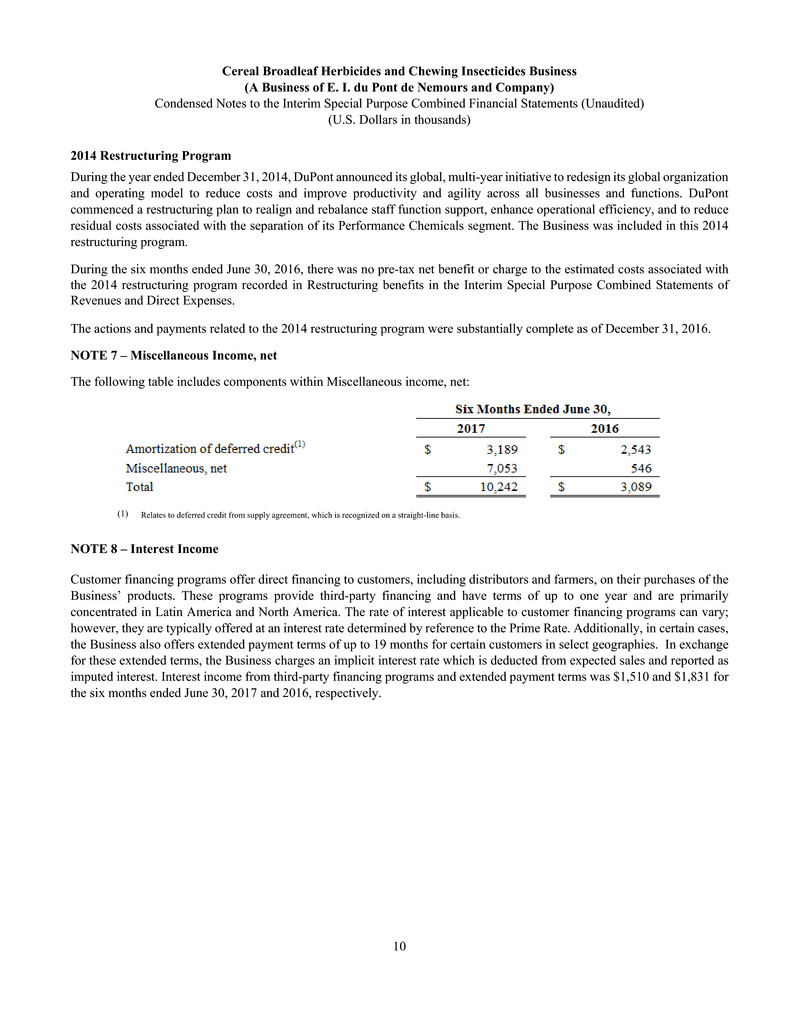

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 10 2014 Restructuring Program During the year ended December 31, 2014, DuPont announced its global, multi-year initiative to redesign its global organization and operating model to reduce costs and improve productivity and agility across all businesses and functions. DuPont commenced a restructuring plan to realign and rebalance staff function support, enhance operational efficiency, and to reduce residual costs associated with the separation of its Performance Chemicals segment. The Business was included in this 2014 restructuring program. During the six months ended June 30, 2016, there was no pre-tax net benefit or charge to the estimated costs associated with the 2014 restructuring program recorded in Restructuring benefits in the Interim Special Purpose Combined Statements of Revenues and Direct Expenses. The actions and payments related to the 2014 restructuring program were substantially complete as of December 31, 2016. NOTE 7 – Miscellaneous Income, net The following table includes components within Miscellaneous income, net: (1) Relates to deferred credit from supply agreement, which is recognized on a straight-line basis. NOTE 8 – Interest Income Customer financing programs offer direct financing to customers, including distributors and farmers, on their purchases of the Business’ products. These programs provide third-party financing and have terms of up to one year and are primarily concentrated in Latin America and North America. The rate of interest applicable to customer financing programs can vary; however, they are typically offered at an interest rate determined by reference to the Prime Rate. Additionally, in certain cases, the Business also offers extended payment terms of up to 19 months for certain customers in select geographies. In exchange for these extended terms, the Business charges an implicit interest rate which is deducted from expected sales and reported as imputed interest. Interest income from third-party financing programs and extended payment terms was $1,510 and $1,831 for the six months ended June 30, 2017 and 2016, respectively.

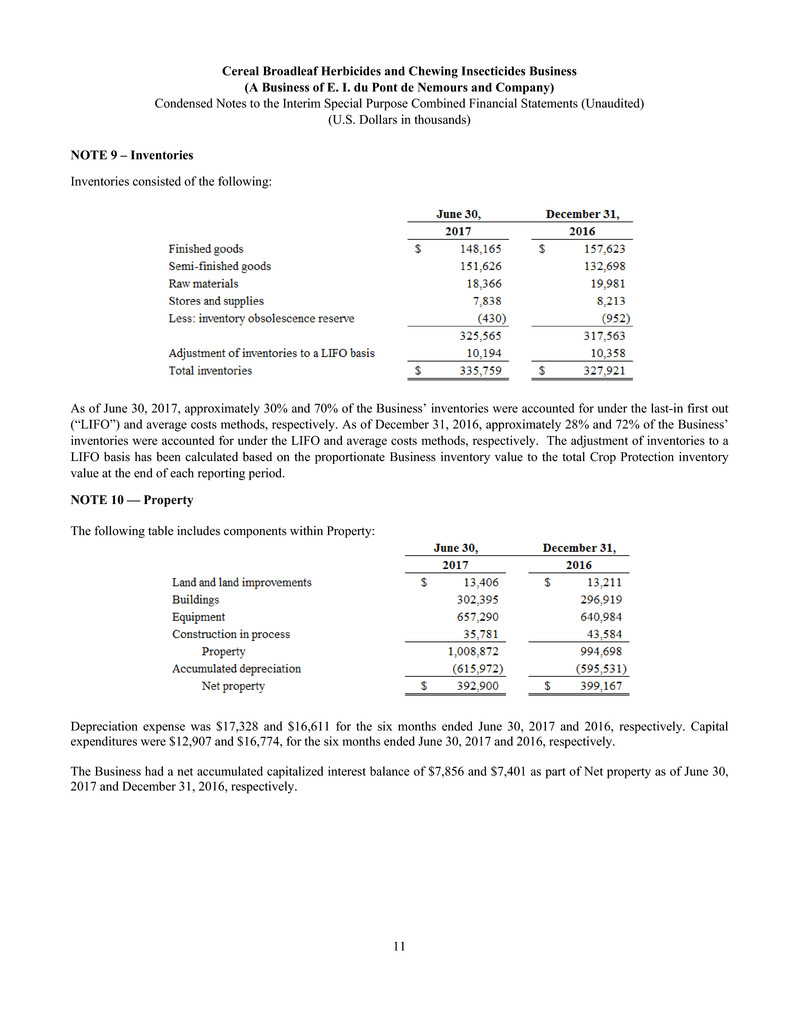

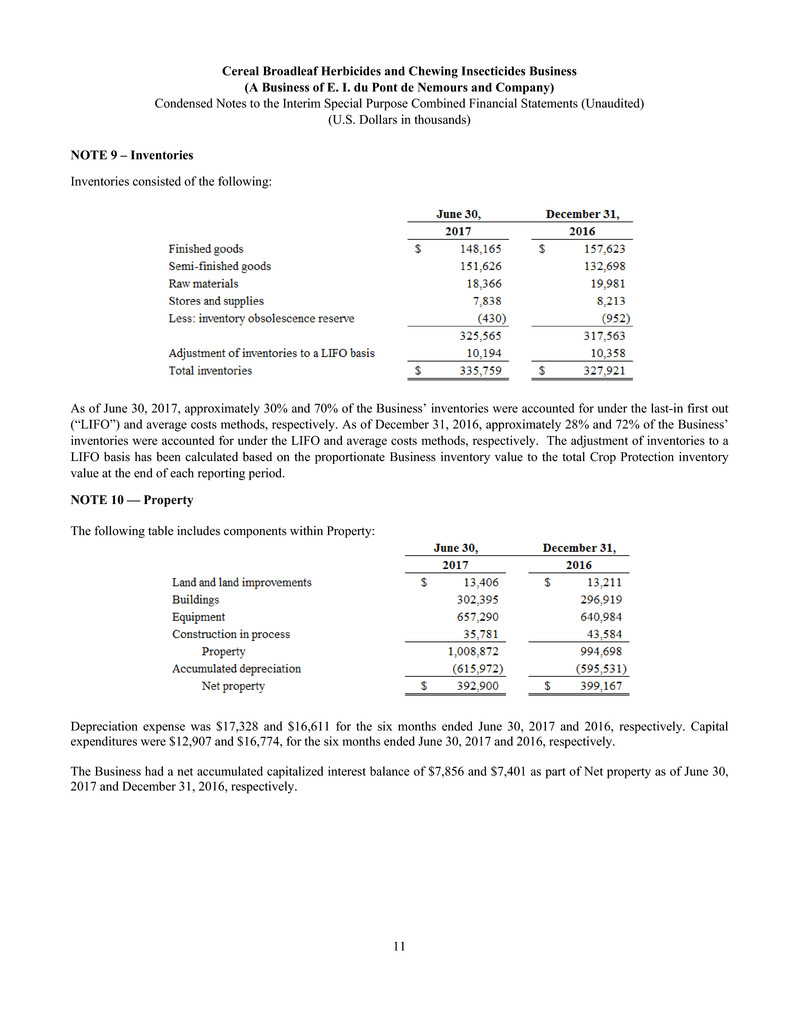

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 11 NOTE 9 – Inventories Inventories consisted of the following: As of June 30, 2017, approximately 30% and 70% of the Business’ inventories were accounted for under the last-in first out (“LIFO”) and average costs methods, respectively. As of December 31, 2016, approximately 28% and 72% of the Business’ inventories were accounted for under the LIFO and average costs methods, respectively. The adjustment of inventories to a LIFO basis has been calculated based on the proportionate Business inventory value to the total Crop Protection inventory value at the end of each reporting period. NOTE 10 — Property The following table includes components within Property: Depreciation expense was $17,328 and $16,611 for the six months ended June 30, 2017 and 2016, respectively. Capital expenditures were $12,907 and $16,774, for the six months ended June 30, 2017 and 2016, respectively. The Business had a net accumulated capitalized interest balance of $7,856 and $7,401 as part of Net property as of June 30, 2017 and December 31, 2016, respectively.

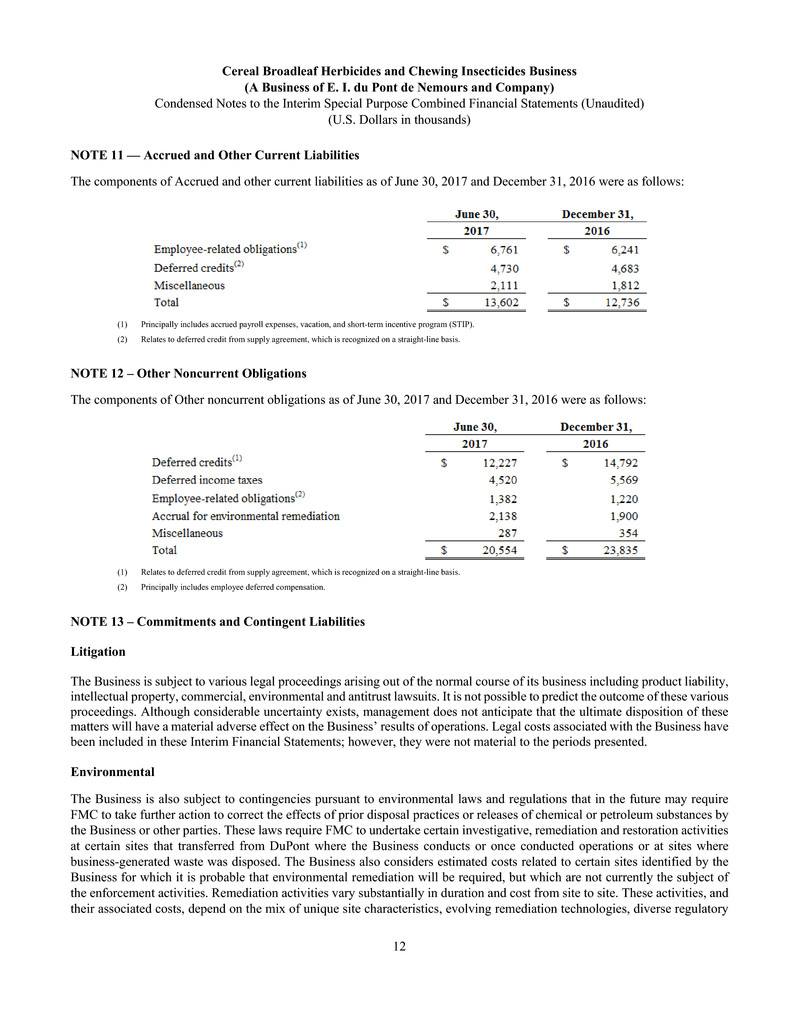

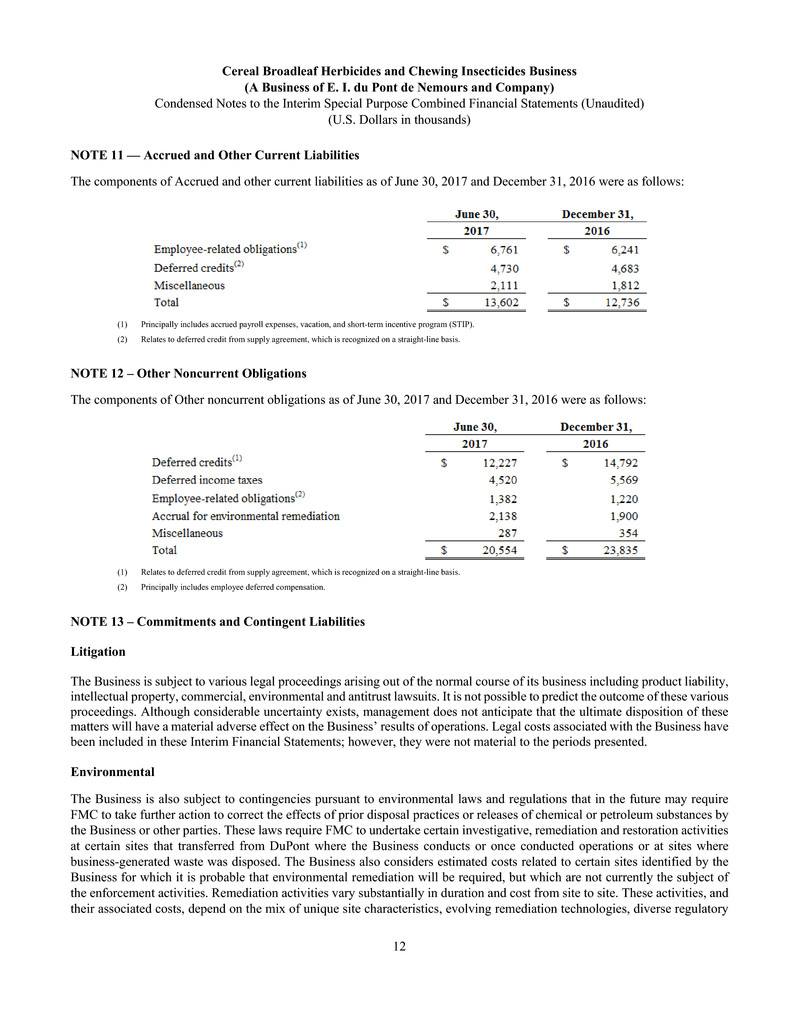

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 12 NOTE 11 — Accrued and Other Current Liabilities The components of Accrued and other current liabilities as of June 30, 2017 and December 31, 2016 were as follows: (1) Principally includes accrued payroll expenses, vacation, and short-term incentive program (STIP). (2) Relates to deferred credit from supply agreement, which is recognized on a straight-line basis. NOTE 12 – Other Noncurrent Obligations The components of Other noncurrent obligations as of June 30, 2017 and December 31, 2016 were as follows: (1) Relates to deferred credit from supply agreement, which is recognized on a straight-line basis. (2) Principally includes employee deferred compensation. NOTE 13 – Commitments and Contingent Liabilities Litigation The Business is subject to various legal proceedings arising out of the normal course of its business including product liability, intellectual property, commercial, environmental and antitrust lawsuits. It is not possible to predict the outcome of these various proceedings. Although considerable uncertainty exists, management does not anticipate that the ultimate disposition of these matters will have a material adverse effect on the Business’ results of operations. Legal costs associated with the Business have been included in these Interim Financial Statements; however, they were not material to the periods presented. Environmental The Business is also subject to contingencies pursuant to environmental laws and regulations that in the future may require FMC to take further action to correct the effects of prior disposal practices or releases of chemical or petroleum substances by the Business or other parties. These laws require FMC to undertake certain investigative, remediation and restoration activities at certain sites that transferred from DuPont where the Business conducts or once conducted operations or at sites where business-generated waste was disposed. The Business also considers estimated costs related to certain sites identified by the Business for which it is probable that environmental remediation will be required, but which are not currently the subject of the enforcement activities. Remediation activities vary substantially in duration and cost from site to site. These activities, and their associated costs, depend on the mix of unique site characteristics, evolving remediation technologies, diverse regulatory

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 13 agencies and enforcement policies, as well as the presence or absence of potentially responsible parties. The Interim Special Purpose Combined Statements of Net Assets Acquired include liabilities for environmental remediation related to certain sites that were transferred from DuPont to FMC. These liabilities were $3,428 and $3,407 as of June 30, 2017 and December 31, 2016, respectively, and are included in Accrued and other current liabilities and Other noncurrent obligations in the Interim Special Purpose Combined Statements of Net Assets Acquired. Pursuant to the terms and conditions of the Transaction Agreement, DuPont has agreed to indemnify FMC for those environmental remediation liabilities that existed prior to the closing of the transaction which are directly related to certain sites that were transferred to FMC. The Interim Special Purpose Combined Statements of Net Assets Acquired include indemnification assets from DuPont in the amount of $3,428 and $3,407 as of June 30, 2017 and December 31, 2016, respectively, and are included in Accounts receivable - Other and Other noncurrent assets. The Interim Special Purpose Combined Statements of Revenues and Direct Expenses include environmental expenditures in the amount of $500 and $244 for the six months ended June 30, 2017 and 2016, respectively, and are included in Cost of sales and Selling, general and administrative expense. NOTE 14 – Pension Plans and Other Postretirement Benefits The Business, through its participation in DuPont’s sponsored pension and other long-term employee benefit plans, offers its employees pension and other postretirement benefits through a variety of plans including defined benefit plans and defined contribution plans. The defined benefit plans include both pension and other postretirement benefit plans. Where permitted by applicable law, DuPont reserves the right to amend, modify, or discontinue the plans at any time. DuPont offers plans that are shared amongst its businesses, including the Business. The Interim Special Purpose Combined Statements of Revenues and Direct Expenses reflect the pension costs and other postretirement benefit costs associated with the Business on a multiemployer basis. The costs of these plans were allocated by DuPont to the Business based upon reasonable allocation methods and are reflected in Cost of sales, Research and development expenses and Selling, general and administrative expenses. The pension liabilities included in the Interim Special Purpose Combined Statements of Net Assets Acquired represent certain non-U.S. employee obligations assumed by FMC and equal the net projected benefit obligation of $9,941 and $8,875 as of June 30, 2017 and December 31, 2016, respectively. No other postretirement benefit liabilities were transferred to FMC.

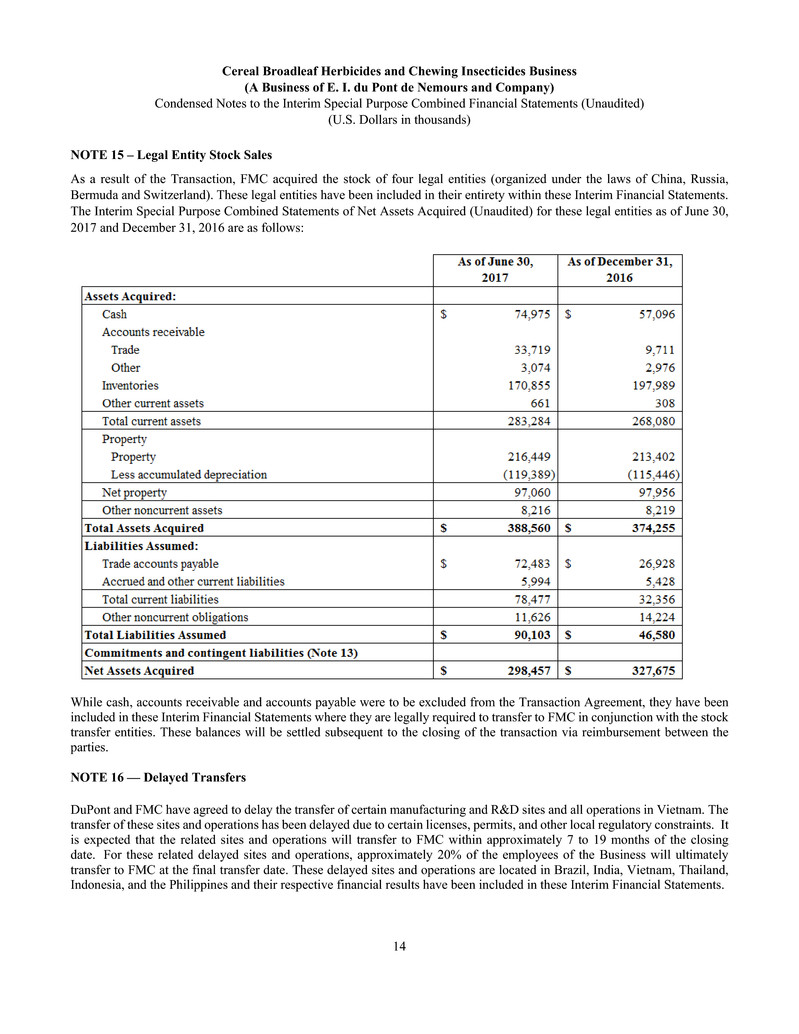

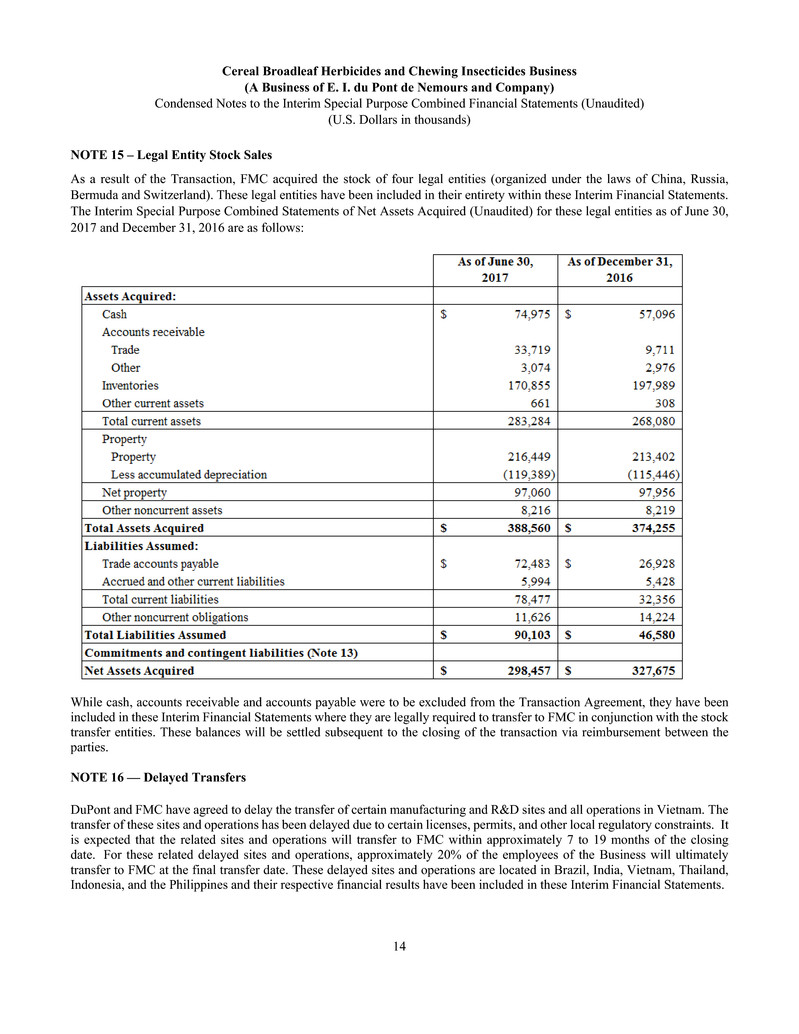

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 14 NOTE 15 – Legal Entity Stock Sales As a result of the Transaction, FMC acquired the stock of four legal entities (organized under the laws of China, Russia, Bermuda and Switzerland). These legal entities have been included in their entirety within these Interim Financial Statements. The Interim Special Purpose Combined Statements of Net Assets Acquired (Unaudited) for these legal entities as of June 30, 2017 and December 31, 2016 are as follows: While cash, accounts receivable and accounts payable were to be excluded from the Transaction Agreement, they have been included in these Interim Financial Statements where they are legally required to transfer to FMC in conjunction with the stock transfer entities. These balances will be settled subsequent to the closing of the transaction via reimbursement between the parties. NOTE 16 — Delayed Transfers DuPont and FMC have agreed to delay the transfer of certain manufacturing and R&D sites and all operations in Vietnam. The transfer of these sites and operations has been delayed due to certain licenses, permits, and other local regulatory constraints. It is expected that the related sites and operations will transfer to FMC within approximately 7 to 19 months of the closing date. For these related delayed sites and operations, approximately 20% of the employees of the Business will ultimately transfer to FMC at the final transfer date. These delayed sites and operations are located in Brazil, India, Vietnam, Thailand, Indonesia, and the Philippines and their respective financial results have been included in these Interim Financial Statements.

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 15 Delayed Transfer Sites There are five manufacturing and three R&D sites that will transfer to FMC on a delayed basis located in Brazil, India, the Philippines, Thailand and Indonesia. These Interim Financial Statements include Property and Inventory related to these delayed sites. Net property balances at these delayed sites were $41,668 and $42,396 as of June 30, 2017 and December 31, 2016, respectively. At these delayed sites, $21,040 and $16,212 of Inventory was included in these Interim Financial Statements as of June 30, 2017 and December 31, 2016, respectively, which represent Raw materials, Stores and supplies, and Semi- finished goods that were not transferred to FMC at the closing date due to certain local regulatory constraints. However, since FMC has agreed to ultimately acquire and compensate DuPont for any remaining inventory at time of physical site transfer, these inventory balances have been included in these Interim Financial Statements. During the period between November 1, 2017, and the transfer date of these sites, DuPont and FMC have entered into manufacturing agreements for these sites whereby DuPont will manufacture product and sell finished goods to or on behalf of FMC. Delayed Transfer Country The manufacturing facility in Vietnam will transfer to FMC on a delayed basis. Due to local operational constraints in Vietnam, all classes of inventory have been retained by DuPont and will transfer to FMC by the final transfer date. Net property balances in Vietnam were $473 and $494 as of June 30, 2017 and December 31, 2016, respectively. Inventory values in Vietnam were $1,584 and $1,502 as of June 30, 2017 and December 31, 2016, respectively. However, since FMC has compensated DuPont for this inventory at closing, these balances have been included in the Interim Special Purpose Combined Statements of Net Assets Acquired. NOTE 17 — Subsequent Events DuPont Merger with Dow Chemical On December 11, 2015, DuPont and The Dow Chemical Company (“Dow”) announced entry into an Agreement and Plan of Merger, as amended on March 31, 2017, (the “Merger Agreement”), under which the companies agreed to combine in an all- stock merger of equals (the “Merger Transaction”) subject to satisfaction of customary closing conditions, including receipt of regulatory approval. On March 27, 2017, DuPont and Dow announced that the European Commission (“EC”) granted conditional regulatory clearance in Europe for the Merger Transaction conditional on DuPont and Dow fulfilling certain commitments. One of the commitments was for DuPont to sell its Cereal Broadleaf Herbicides and Chewing Insecticides Business. On March 31, 2017, DuPont entered into a Transaction Agreement with FMC, whereby DuPont agreed to divest its Cereal Broadleaf Herbicides and Chewing Insecticides Business, including Rynaxypyr®, Cyazypyr® and Indoxacarb as well as the Crop Protection R&D pipeline and organization, excluding seed treatment, nematicides, and late-stage R&D programs. This divestiture satisfies DuPont’s commitments to the EC in connection with its conditional regulatory clearance of the merger with Dow. As a condition of the transaction with FMC, oversight of the divested business was transferred to an appointed management trustee and held in trust (the “Trust”). The sale transaction with FMC was completed on November 1, 2017. On August 2, 2017, DuPont and Dow received the final required regulatory approval and clearance in connection with the proposed Merger Transaction of the two companies. Effective August 31, 2017, DuPont and Dow completed the previously announced Merger Transaction.

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Condensed Notes to the Interim Special Purpose Combined Financial Statements (Unaudited) (U.S. Dollars in thousands) 16 Service Agreements Effective at closing and pursuant to the terms of the Transaction Agreement, DuPont and FMC entered into manufacturing service agreements which provide both parties with certain operational support services for a specified period of time at cost as well as certain tolling and manufacturing activities for DuPont for up to five years. In addition, DuPont and FMC entered into transition service agreements to provide FMC with certain operational support services for a maximum of 30 months at cost. Impact of Hurricane Maria The Business operates a manufacturing facility located in Manati, Puerto Rico. Management is currently assessing the impact that Hurricane Maria had on this facility and its operations. The parties have agreed that DuPont will pay for the repair and restoration of the damaged site. Site Separation Capital Projects As of the closing of the Transaction on November 1, 2017, certain capital projects related to the physical separation of certain sites shared between the parties were not yet complete. DuPont has agreed to pay for the remaining capital required to complete these projects. As of the date of these Interim Financial Statements, the estimated remaining cost to complete is $849.