Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) 1 Special Purpose Combined Statements of Net Assets Acquired as of December 31, 2016 and 2015 and Special Purpose Combined Statements of Revenues and Direct Expenses for the years ended December 31, 2016, 2015 and 2014 Exhibit 99.2

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) 2 Index to Special Purpose Combined Financial Statements Report of Independent Auditors .................................................................................................................................... 3 Special Purpose Combined Statements of Net Assets Acquired as of December 31, 2016 and 2015 ........................... 5 Special Purpose Combined Statements of Revenues and Direct Expenses for the years ended December 31, 2016, 2015 and 2014 ............................................................................................................................................................... 6 Notes to the Special Purpose Combined Financial Statements ...................................................................................... 7

PricewaterhouseCoopers LLP, Two Commerce Square, Suite 1800, 2001 Market Street, Philadelphia, PA 19103-7045 T: (267) 300-3000, F: (267) 330-3300, www.pwc.com/us 3 Report of Independent Auditors To the Management of E. I. du Pont de Nemours and Company We have audited the accompanying special purpose combined financial statements of the Cereal Broadleaf Herbicides and Chewing Insecticides Business of E. I. du Pont de Nemours and Company (the “Business”), which comprise the special purpose combined statements of net assets acquired as of December 31, 2016 and 2015, and the related special purpose combined statements of revenues and direct expenses for each of the three years in the period ended December 31, 2016. Management's Responsibility for the Special Purpose Combined Financial Statements Management is responsible for the preparation and fair presentation of the special purpose combined financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of special purpose combined financial statements that are free from material misstatement, whether due to fraud or error. Auditors’ Responsibility Our responsibility is to express an opinion on the special purpose combined financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the special purpose combined financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the special purpose combined financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the special purpose combined financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the Business’ preparation and fair presentation of the special purpose combined financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Business’ internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the special purpose combined financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the special purpose combined financial statements referred to above present fairly, in all material respects, the net assets acquired of the Cereal Broadleaf Herbicides and Chewing Insecticides Business of E. I. du Pont de Nemours and Company as of December 31, 2016 and 2015, and the results of its revenues and direct expenses for each of the three years in the period ended December 31, 2016 in accordance with accounting principles generally accepted in the United States of America.

4 Emphasis of Matter The accompanying special purpose combined financial statements were prepared in connection with E. I. du Pont de Nemours and Company’s divestiture of the Cereal Broadleaf Herbicides and Chewing Insecticides Business and, as described in Note 1, were prepared in accordance with an SEC waiver received by the buyer, for the purpose of the buyer complying with Rule 3-05 of the Securities and Exchange Commission’s Regulation S-X. These special purpose combined financial statements are not intended to be a complete presentation of the financial position or results of operations of the Cereal Broadleaf Herbicides and Chewing Insecticides Business of E. I. du Pont de Nemours and Company. Our opinion is not modified with respect to this matter. Philadelphia, Pennsylvania December 14, 2017

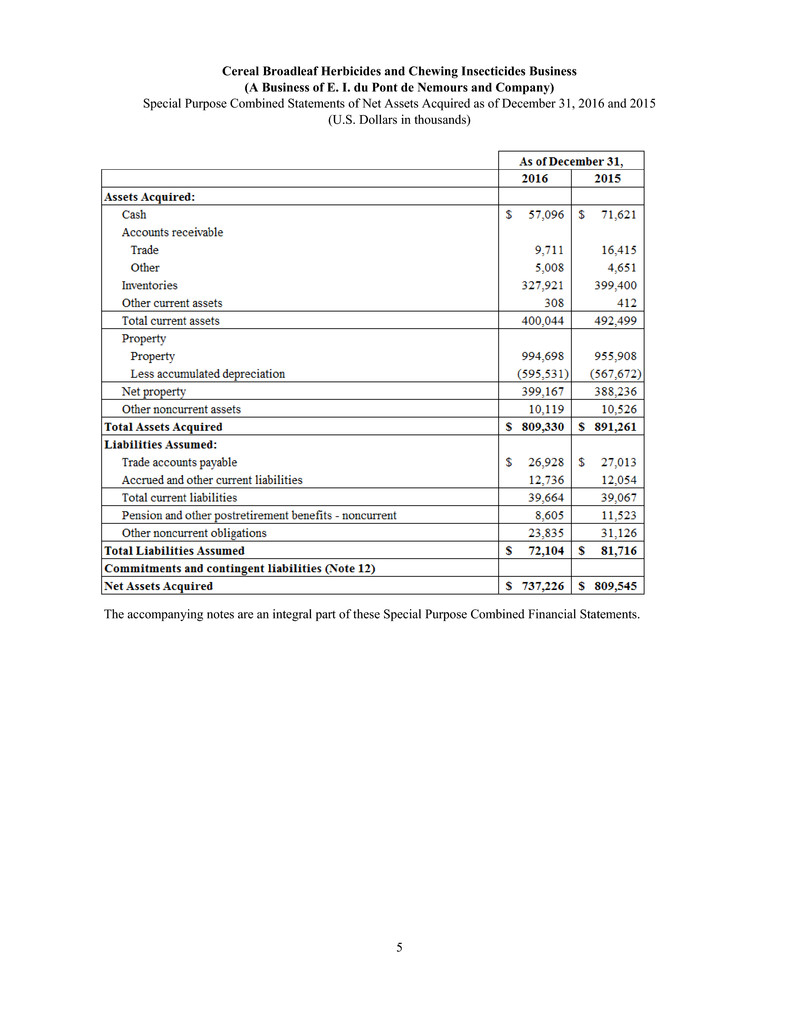

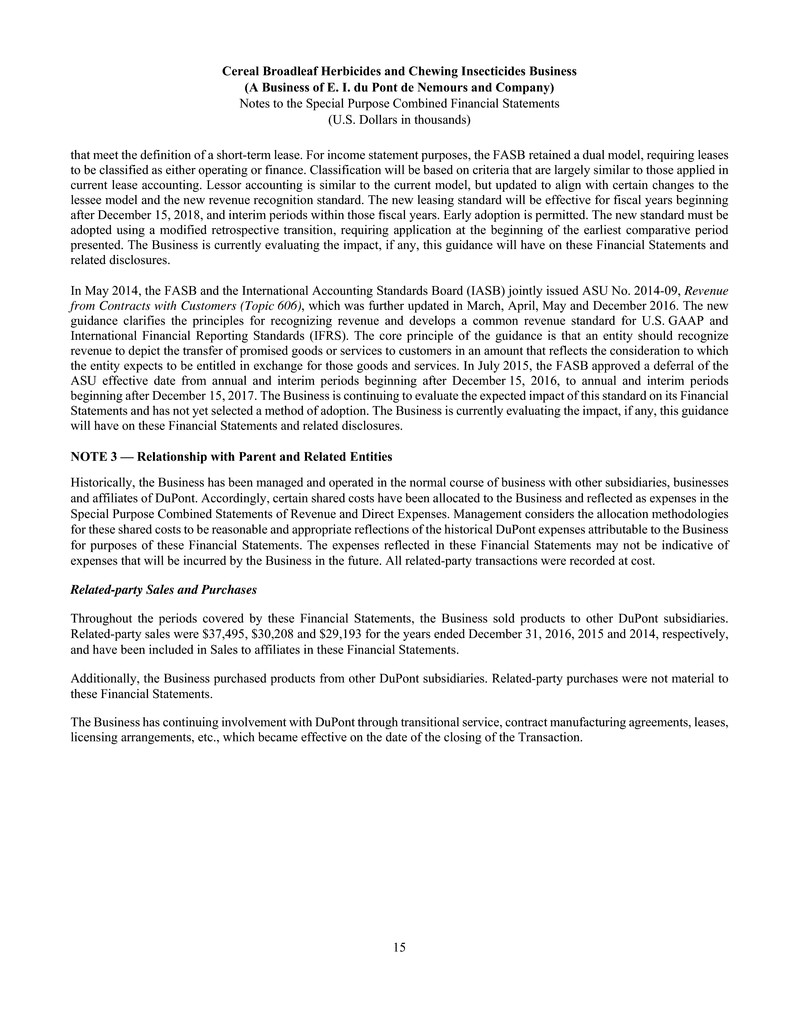

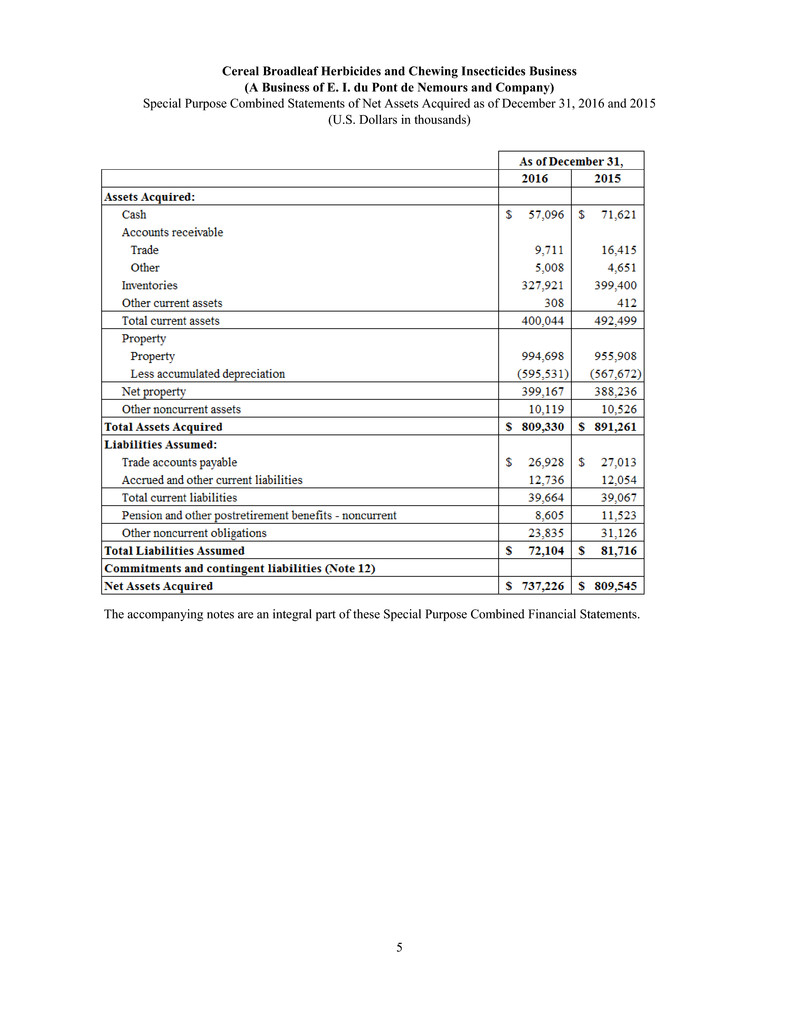

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Special Purpose Combined Statements of Net Assets Acquired as of December 31, 2016 and 2015 (U.S. Dollars in thousands) 5 The accompanying notes are an integral part of these Special Purpose Combined Financial Statements.

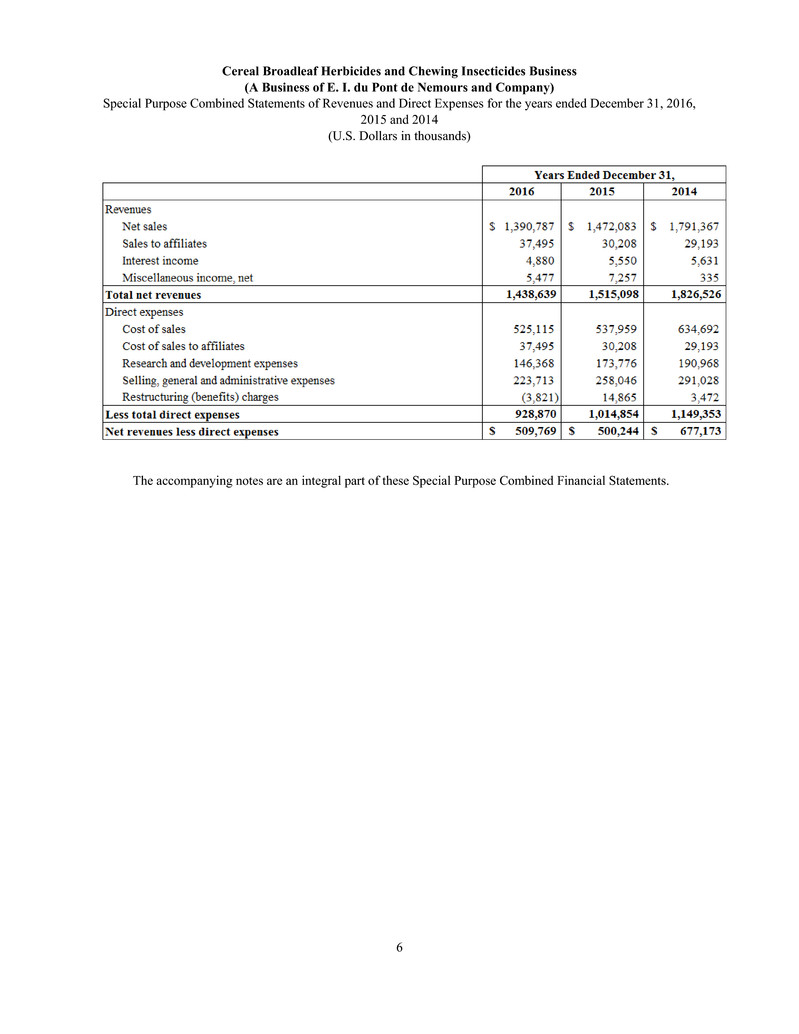

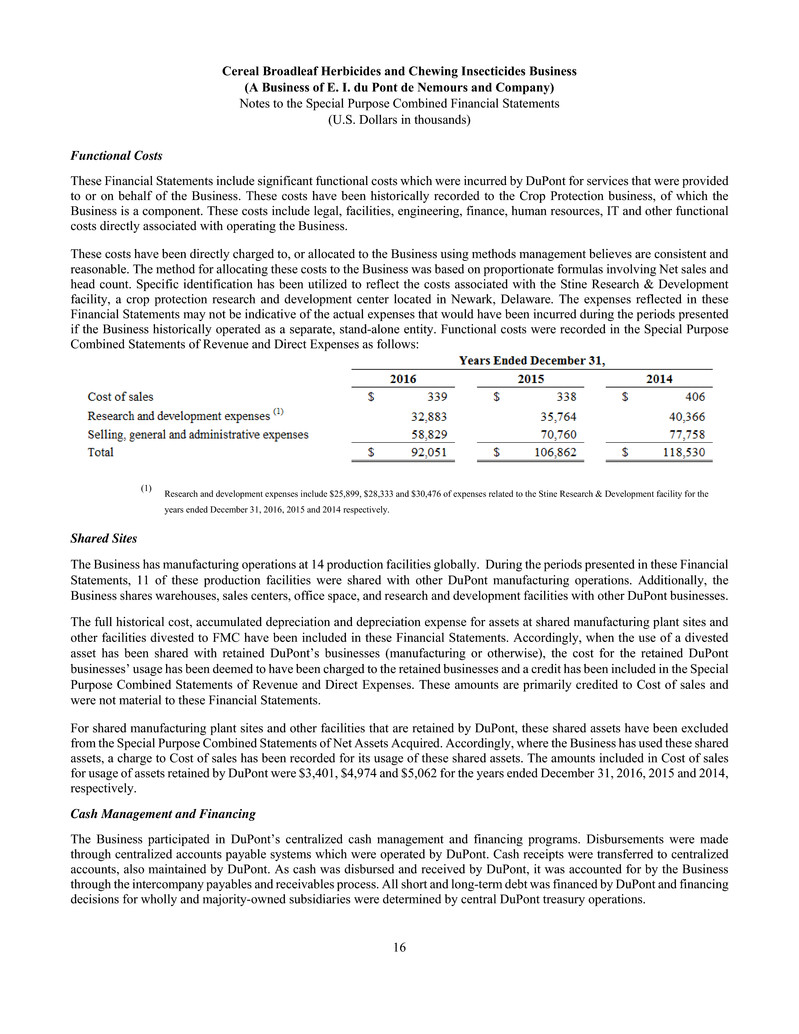

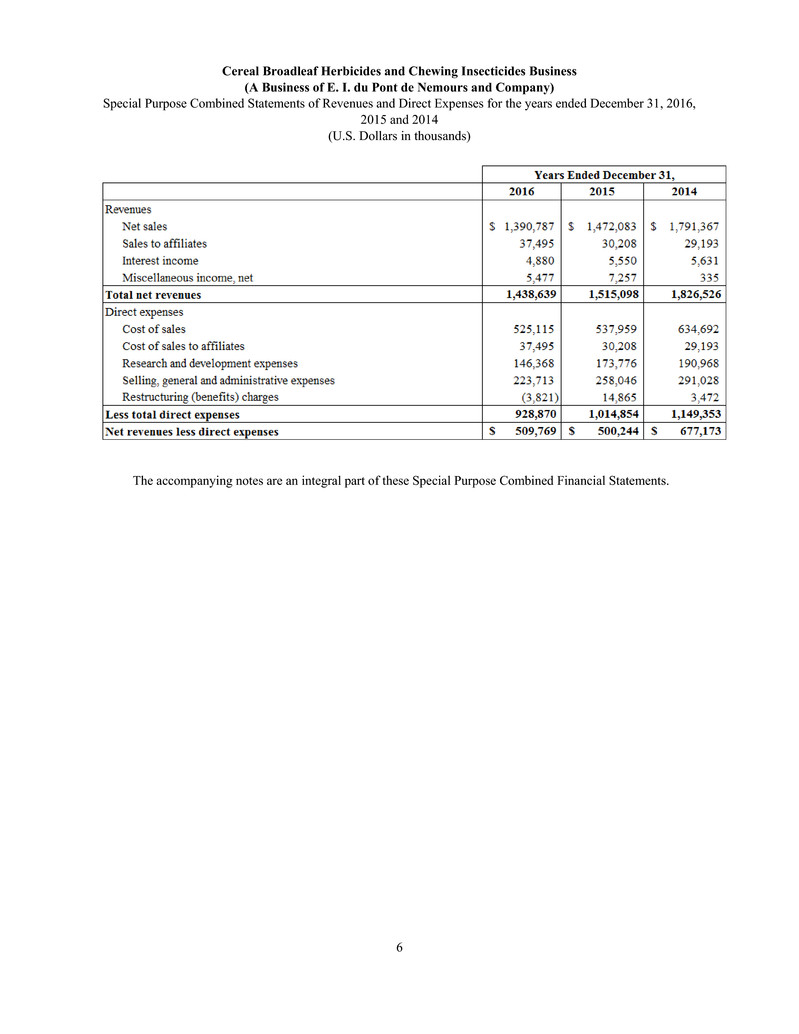

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Special Purpose Combined Statements of Revenues and Direct Expenses for the years ended December 31, 2016, 2015 and 2014 (U.S. Dollars in thousands) 6 The accompanying notes are an integral part of these Special Purpose Combined Financial Statements.

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 7 NOTE 1 – Basis of Presentation Background E. I. du Pont de Nemours and Company (“DuPont”) was founded in 1802 and was incorporated in Delaware in 1915. The DuPont Crop Protection business works with farmers around the world, using science to find better ways to realize the full potential of their crops in order to raise healthier, more nutritious food. On March 31, 2017, DuPont entered into a purchase and sale agreement (the “Transaction Agreement”) under which FMC Corporation (“FMC”) agreed to acquire certain assets and assume certain liabilities related to the DuPont Crop Protection (“Crop Protection”) Business (together, the “Transaction” or “Sale”). The business operations transferred to FMC as part of the Transaction include certain insecticide and herbicide active ingredient products (“Actives”) and formulated products containing these active ingredients, as well as manufacturing sites, intellectual property and the Crop Protection research & development (“R&D”) pipeline and organization, excluding seed treatment, nematicides, and late-stage R&D programs (collectively referred to as the “Business” or “Cereal Broadleaf Herbicides and Chewing Insecticides Business”). The divested Actives are as follows: • Chlorsulfuron Methyl herbicide • Ethametsulfuron Methyl herbicide • Flupyrsulfuron Methyl herbicide • Lenacil herbicide • Metsulfuron Methyl herbicide • Tribenuron Methyl herbicide • Azimsulfuron herbicide • Thifensulfuron Methyl herbicide • Triflusulfuron Methyl herbicide • Rynaxypyr® (Chlorantraniliprole) insecticide • Cyazypyr® (Cyantraniliprole) insecticide • Indoxacarb insecticide Description of Business The Cereal Broadleaf Herbicides and Chewing Insecticides Business is a global crop protection business engaged in the development of crop protection products that are specifically targeted to achieve gains in crop yields and productivity. The Business leverages its technology, customer relationships and industry knowledge to improve the quantity, quality and safety of the global food supply and the global production agriculture industry in the cereal broadleaf herbicides and chewing insecticides product space. The Business delivers a broad portfolio of herbicide and insecticide products that are specifically targeted to achieve gains in crop yields and productivity. The Business’ research and development platform focuses on leveraging technology to increase grower productivity through the effective use of herbicides and insecticides. The Business’ products are marketed and sold to growers and other end users through a network of wholesale distributors and crop input retailers. The Business operates in over 50 countries around the world. The major commodities, raw materials and supplies for the Business include benzene derivatives, other aromatics and carbamic acid related intermediates, and insect control products.

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 8 Basis of Presentation The accompanying Special Purpose Combined Financial Statements (the “Financial Statements”) were prepared by DuPont management in accordance with accounting principles generally accepted in the United States of America (“GAAP”). These Financial Statements have been prepared to reflect the assets acquired and liabilities assumed by FMC, in accordance with the Transaction Agreement. As a result of the Transaction, DuPont has divested certain Actives and manufacturing sites along with the research and development platform and the stock of four legal entities (organized under the laws of China, Russia, Bermuda and Switzerland) of the Business to FMC. These Financial Statements are not intended to be a complete presentation of financial position, results of operations, or cash flows of the Business in conformity with GAAP. The Business has not been historically accounted for as a separate entity, subsidiary or division of DuPont. The products of the Business are sold through multiple legal entities that are shared with other DuPont businesses (mixed-use legal entities) globally. As such, certain discrete costs and balance sheet information are not available for these active ingredient products. Due to the extent to which the Business was fully integrated into DuPont during the periods required for these Financial Statements, the presentation of full or carve-out financial statements for the Business in accordance with the Securities and Exchange Commission’s (“SEC”) Rule 3-05 of Regulation S-X, including a reasonable and appropriate allocation of corporate overhead, interest expense and taxes, is impracticable. Thus, the Special Purpose Combined Statements of Net Assets Acquired and Statements of Revenues and Direct Expenses have been prepared. FMC obtained pre-clearance from the SEC to use the abbreviated financial statements presented in this report in relation to the SEC’s Rule 3-05 of Regulation S-X. These Financial Statements have been prepared from the accounting records of DuPont using historical results of operations and financial position and present the net assets acquired by FMC and the associated revenues and direct expenses, including certain allocated expenses, of the Business. The Transaction Agreement generally excludes the transfer of cash, accounts receivable, accounts payable, legal liabilities, environmental liabilities, personnel liabilities other than certain vacation accruals, and pension assets and liabilities, except for where these assets and liabilities pertain to the legal entities whose stock was acquired by FMC (See Note 15) or where required by law. Transactions with other DuPont businesses have been deemed to have been paid in the period the sale or purchase occurred. Related-party sales transactions with other DuPont businesses have been shown as Sales to affiliates. Related-party sales and purchases have been recorded at cost and included in Cost of sales to affiliates. All intercompany accounts and transactions within the Business have been eliminated. These Financial Statements are not necessarily indicative of the results of operations, cash flows or financial position that would have occurred if the Business had been an independent stand-alone company. DuPont uses a centralized approach to cash management. Cash, debt and related interest expense have not been allocated to the Business in these Financial Statements, except for capitalized interest. For those legal entities for which the stock was acquired by FMC, cash has been included in these Financial Statements. As the Business has historically been managed as part of the operations of DuPont and has not been operated as a stand-alone company, it is impracticable to prepare historical cash flow information regarding the Business’ operating, investing, and financing cash flow activity. As such, the statements of cash flows are not presented in these Financial Statements. Allocation of Costs & Expenses These Financial Statements include revenues and expenses directly attributable to the Business, which includes costs for facilities, functions, and services used by the Business. Costs for certain functions and services performed by centralized DuPont organizations have historically been charged to the Crop Protection business, of which the Business is a component, based on usage or other allocation methods. All charges and allocations of cost for facilities, functions, and services performed by DuPont have been deemed paid by the Business to DuPont in the period in which the cost was recorded in the Special

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 9 Purpose Combined Statements of Revenues and Direct Expenses. Direct expenses include sales and marketing, depreciation, research and development, employee compensation and benefits and any other expenses directly related to the Business. These Financial Statements reflect a consistent allocation methodology for each reporting period presented. Allocations of DuPont corporate overhead expenses (general support functions, expenses associated with executive management, corporate planning, investor relations, etc.) not directly related to the operations of the Business, as well as allocations of income taxes, have been excluded from these Financial Statements. The operations of the Business are included in the consolidated U.S. federal, state and local, and non-U.S. tax returns of DuPont. A provision for income taxes has not been presented in these Financial Statements as the Business has not operated as a stand- alone company and no allocation of DuPont’s income tax provision/benefit has historically been made to the Business. While a provision for income taxes has been excluded from these Financial Statements, FMC has assumed certain income tax liabilities specific to the four legal entities whose common stock was acquired by FMC. Such balances have been reflected in the Special Purpose Combined Statements of Net Assets Acquired. There was no direct interest expense incurred by, or allocated to the Business as no third party debt was transferred with the Transaction; therefore, no interest expense has been reflected in these Financial Statements. Interest income has been reflected in these Financial Statements as sales of product in Latin America and North America were conducted utilizing shared DuPont customer financing programs (See Note 7). NOTE 2 — Summary of Significant Accounting Policies Use of Estimates The preparation of these Financial Statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets acquired, liabilities assumed, revenues and direct expenses, and the related footnote disclosures. Management’s estimates are based on historical experience, facts and circumstances available at the time and various other assumptions that are believed to be reasonable. On an ongoing basis, the Business evaluates its estimates, assumptions and judgments. Actual results could differ from those estimates. Significant estimates utilized in the preparation of these Financial Statements include: • Actuarial data used in the computation of pension expense and related liabilities; • Valuation of inventory; • Customer incentive programs; • Restructuring related severance costs; • Valuation of stock options utilizing the Black-Scholes pricing model; • Calculation of deferred taxes; and • Estimated useful lives for property. Revenue Recognition Revenue is recognized when the earnings process is complete. The Business derives its revenue from the sales of an herbicide and insect control portfolio of products to a diversified base of customers around the world. Revenue for product sales is recognized based on shipping terms, when title and risk of loss have been transferred, collectability is reasonably assured and pricing is fixed or determinable. A majority of product sales are sold free on board shipping point or, with respect to non-United States of America customers, an equivalent basis. Accruals are made for sales returns and other allowances based on historical experience. The Business accounts for cash sales incentives as a reduction in Sales. Sales reductions associated with these cash sales incentives were $366,608, $340,202 and $375,391 for the years ended December 31, 2016, 2015 and 2014, respectively,

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 10 and were reflected in Net sales in these Financial Statements. The Business accounts for noncash sales incentives as a charge to Cost of sales or Selling, general and administrative expenses. The charges associated with these noncash sales incentives were not material to these Financial Statements. Amounts billed to customers for shipping and handling fees are included in Net sales and costs incurred by the Business for the delivery of goods are classified as Cost of sales in the Special Purpose Combined Statements of Revenues and Direct Expenses. Taxes on revenue producing transactions are excluded from Net sales. The Business periodically enters into prepayment contracts with customers and receives advance payments for products to be delivered in future periods. These advance payments have been historically recorded as deferred revenue and reported as accrued and other current liabilities in DuPont’s financial statements. Revenue associated with advance payments is recognized as shipments are made and title, ownership and risk of loss pass to the customer. The liabilities associated with these contracts have not been included in these Financial Statements as they were not assumed by FMC. Barter Transactions To reduce credit exposure primarily in Argentina, the Business collects payments on certain customer accounts in grains. In those circumstances when the Business participates in the negotiation of the sales contract, the Business records income and the related cost on a net basis. The Business does not take physical custody of the grains. Such payments in grains are negotiated at any time between product sale to the customer and when payments are due. When negotiating with the customer, the Business contemporaneously negotiates with a merchant to sell the grains. By entering into the contracts with merchants, the Business mitigates the commodity price exposure from the time a contract is signed with a customer until the time a merchant collects the grains from the customer on the Business’ behalf. The merchant converts the grains to cash for the Business. Any difference between the original receivable balance with the customer and the amount collected by the Business is debited or credited to the customer’s account. These transactions are not considered material to the financial statements. Since these contracts were not assumed by FMC, they have been excluded from the Special Purpose Combined Statements of Net Assets Acquired. Customer Incentive Programs Customer incentive program costs are recorded in accordance with the Revenue Recognition Topic 605 of the Accounting Standards Codification (“ASC”). Sales incentive program costs are recorded as a reduction to Net sales in these Special Purpose Combined Statements of Revenues and Direct Expenses at the time of sale. Some incentive programs require that customers meet certain performance criteria, including purchase volume, promptness of payment and market share increases. For such programs, rebates and incentives are also recognized as a reduction to Net sales. Management evaluates these amounts based on estimates of whether performance criteria will be achieved. Where external sales representatives are determined to be agents, the cost of these related programs is expensed as incurred and recorded in Selling, general and administrative expenses in the Special Purpose Combined Statements of Revenues and Direct Expenses. The cost of marketing programs is expensed as incurred and included in Selling, general and administrative expenses in the Special Purpose Combined Statements of Revenues and Direct Expenses. DuPont management analyzes and reviews the customer incentive program balances on a quarterly basis, and adjustments are recorded as appropriate. Guarantees DuPont, in the normal course of business, has directly guaranteed various debt obligations under agreements with third parties related to certain customer and vendor financing programs of the Business. The revenues and direct expenses associated with these programs have been included in these Financial Statements. Since these guarantees were not assumed by FMC, they have been excluded from the Special Purpose Combined Statements of Net Assets Acquired.

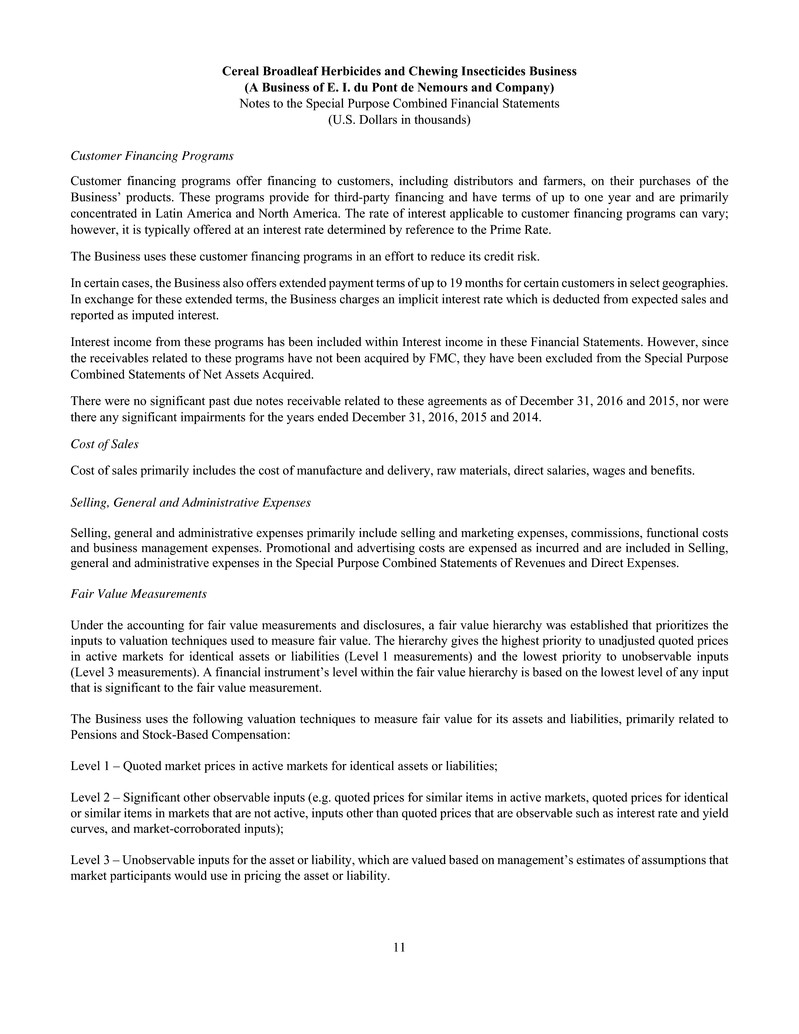

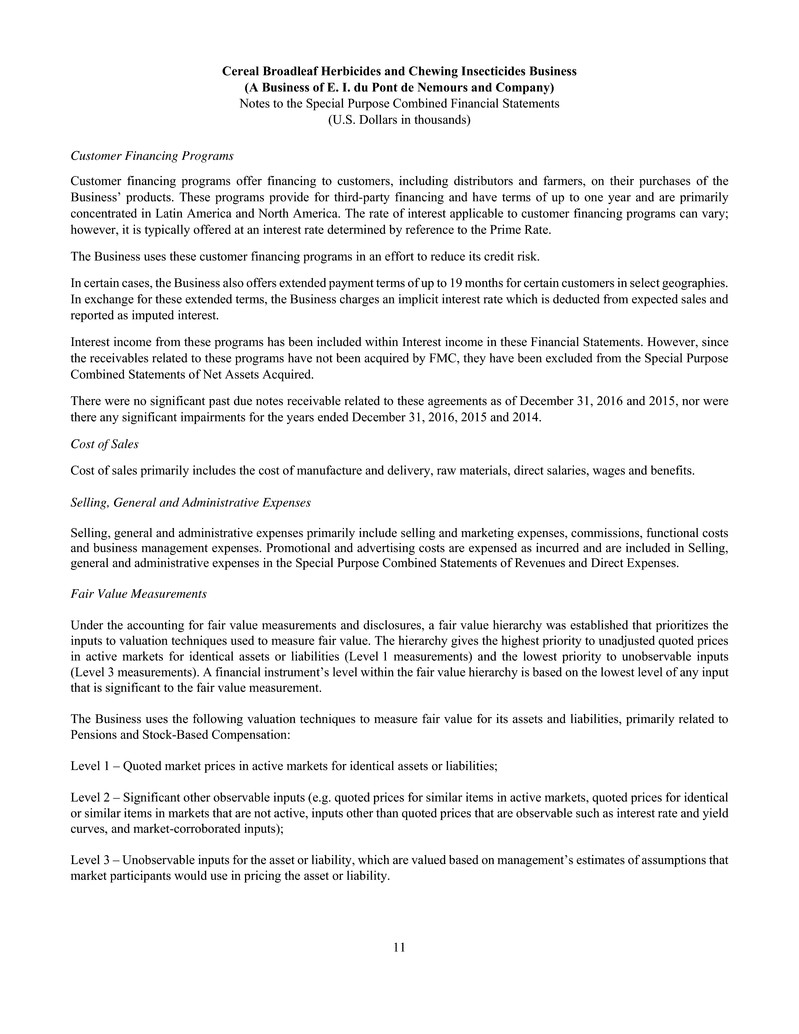

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 11 Customer Financing Programs Customer financing programs offer financing to customers, including distributors and farmers, on their purchases of the Business’ products. These programs provide for third-party financing and have terms of up to one year and are primarily concentrated in Latin America and North America. The rate of interest applicable to customer financing programs can vary; however, it is typically offered at an interest rate determined by reference to the Prime Rate. The Business uses these customer financing programs in an effort to reduce its credit risk. In certain cases, the Business also offers extended payment terms of up to 19 months for certain customers in select geographies. In exchange for these extended terms, the Business charges an implicit interest rate which is deducted from expected sales and reported as imputed interest. Interest income from these programs has been included within Interest income in these Financial Statements. However, since the receivables related to these programs have not been acquired by FMC, they have been excluded from the Special Purpose Combined Statements of Net Assets Acquired. There were no significant past due notes receivable related to these agreements as of December 31, 2016 and 2015, nor were there any significant impairments for the years ended December 31, 2016, 2015 and 2014. Cost of Sales Cost of sales primarily includes the cost of manufacture and delivery, raw materials, direct salaries, wages and benefits. Selling, General and Administrative Expenses Selling, general and administrative expenses primarily include selling and marketing expenses, commissions, functional costs and business management expenses. Promotional and advertising costs are expensed as incurred and are included in Selling, general and administrative expenses in the Special Purpose Combined Statements of Revenues and Direct Expenses. Fair Value Measurements Under the accounting for fair value measurements and disclosures, a fair value hierarchy was established that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. The Business uses the following valuation techniques to measure fair value for its assets and liabilities, primarily related to Pensions and Stock-Based Compensation: Level 1 – Quoted market prices in active markets for identical assets or liabilities; Level 2 – Significant other observable inputs (e.g. quoted prices for similar items in active markets, quoted prices for identical or similar items in markets that are not active, inputs other than quoted prices that are observable such as interest rate and yield curves, and market-corroborated inputs); Level 3 – Unobservable inputs for the asset or liability, which are valued based on management’s estimates of assumptions that market participants would use in pricing the asset or liability.

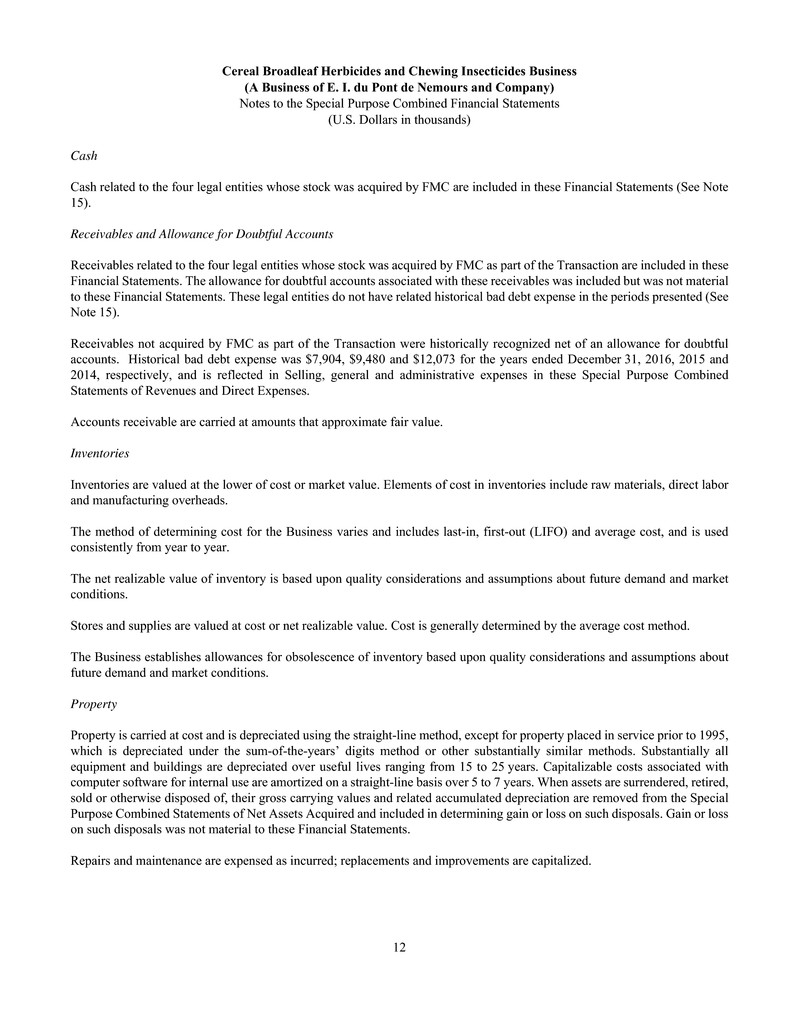

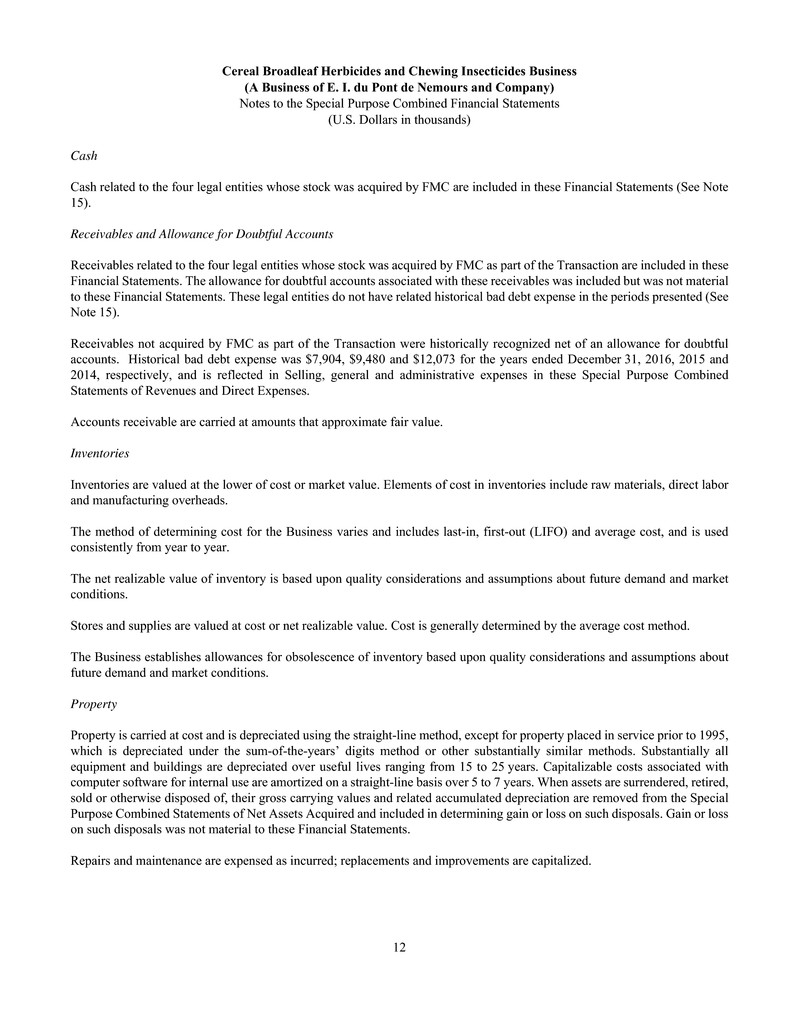

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 12 Cash Cash related to the four legal entities whose stock was acquired by FMC are included in these Financial Statements (See Note 15). Receivables and Allowance for Doubtful Accounts Receivables related to the four legal entities whose stock was acquired by FMC as part of the Transaction are included in these Financial Statements. The allowance for doubtful accounts associated with these receivables was included but was not material to these Financial Statements. These legal entities do not have related historical bad debt expense in the periods presented (See Note 15). Receivables not acquired by FMC as part of the Transaction were historically recognized net of an allowance for doubtful accounts. Historical bad debt expense was $7,904, $9,480 and $12,073 for the years ended December 31, 2016, 2015 and 2014, respectively, and is reflected in Selling, general and administrative expenses in these Special Purpose Combined Statements of Revenues and Direct Expenses. Accounts receivable are carried at amounts that approximate fair value. Inventories Inventories are valued at the lower of cost or market value. Elements of cost in inventories include raw materials, direct labor and manufacturing overheads. The method of determining cost for the Business varies and includes last-in, first-out (LIFO) and average cost, and is used consistently from year to year. The net realizable value of inventory is based upon quality considerations and assumptions about future demand and market conditions. Stores and supplies are valued at cost or net realizable value. Cost is generally determined by the average cost method. The Business establishes allowances for obsolescence of inventory based upon quality considerations and assumptions about future demand and market conditions. Property Property is carried at cost and is depreciated using the straight-line method, except for property placed in service prior to 1995, which is depreciated under the sum-of-the-years’ digits method or other substantially similar methods. Substantially all equipment and buildings are depreciated over useful lives ranging from 15 to 25 years. Capitalizable costs associated with computer software for internal use are amortized on a straight-line basis over 5 to 7 years. When assets are surrendered, retired, sold or otherwise disposed of, their gross carrying values and related accumulated depreciation are removed from the Special Purpose Combined Statements of Net Assets Acquired and included in determining gain or loss on such disposals. Gain or loss on such disposals was not material to these Financial Statements. Repairs and maintenance are expensed as incurred; replacements and improvements are capitalized.

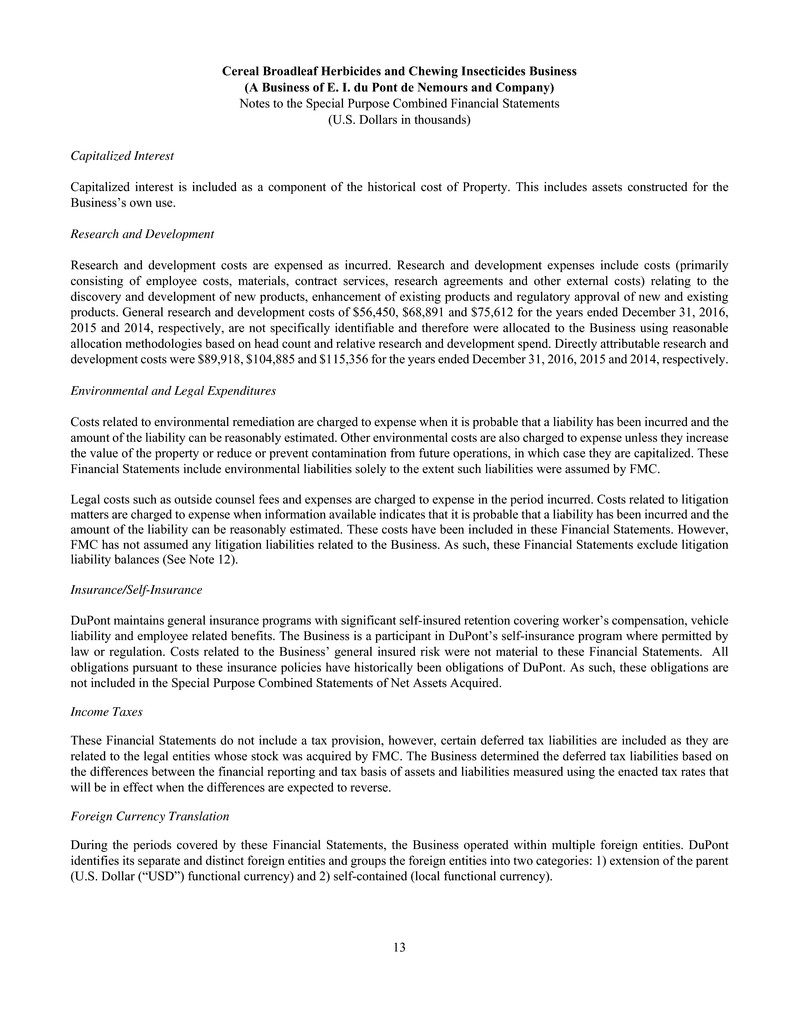

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 13 Capitalized Interest Capitalized interest is included as a component of the historical cost of Property. This includes assets constructed for the Business’s own use. Research and Development Research and development costs are expensed as incurred. Research and development expenses include costs (primarily consisting of employee costs, materials, contract services, research agreements and other external costs) relating to the discovery and development of new products, enhancement of existing products and regulatory approval of new and existing products. General research and development costs of $56,450, $68,891 and $75,612 for the years ended December 31, 2016, 2015 and 2014, respectively, are not specifically identifiable and therefore were allocated to the Business using reasonable allocation methodologies based on head count and relative research and development spend. Directly attributable research and development costs were $89,918, $104,885 and $115,356 for the years ended December 31, 2016, 2015 and 2014, respectively. Environmental and Legal Expenditures Costs related to environmental remediation are charged to expense when it is probable that a liability has been incurred and the amount of the liability can be reasonably estimated. Other environmental costs are also charged to expense unless they increase the value of the property or reduce or prevent contamination from future operations, in which case they are capitalized. These Financial Statements include environmental liabilities solely to the extent such liabilities were assumed by FMC. Legal costs such as outside counsel fees and expenses are charged to expense in the period incurred. Costs related to litigation matters are charged to expense when information available indicates that it is probable that a liability has been incurred and the amount of the liability can be reasonably estimated. These costs have been included in these Financial Statements. However, FMC has not assumed any litigation liabilities related to the Business. As such, these Financial Statements exclude litigation liability balances (See Note 12). Insurance/Self-Insurance DuPont maintains general insurance programs with significant self-insured retention covering worker’s compensation, vehicle liability and employee related benefits. The Business is a participant in DuPont’s self-insurance program where permitted by law or regulation. Costs related to the Business’ general insured risk were not material to these Financial Statements. All obligations pursuant to these insurance policies have historically been obligations of DuPont. As such, these obligations are not included in the Special Purpose Combined Statements of Net Assets Acquired. Income Taxes These Financial Statements do not include a tax provision, however, certain deferred tax liabilities are included as they are related to the legal entities whose stock was acquired by FMC. The Business determined the deferred tax liabilities based on the differences between the financial reporting and tax basis of assets and liabilities measured using the enacted tax rates that will be in effect when the differences are expected to reverse. Foreign Currency Translation During the periods covered by these Financial Statements, the Business operated within multiple foreign entities. DuPont identifies its separate and distinct foreign entities and groups the foreign entities into two categories: 1) extension of the parent (U.S. Dollar (“USD”) functional currency) and 2) self-contained (local functional currency).

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 14 For foreign entities where the USD is the functional currency, all foreign currency-denominated asset and liability amounts are re-measured into USD at end-of-period exchange rates, except for inventories, prepaid expenses, property and goodwill, which are re-measured at historical rates. Foreign currency income and expenses are re-measured at average exchange rates in effect during the year, except for expenses related to balance sheet amounts re-measured at historical exchange rates. For foreign entities where the local currency is the functional currency, assets and liabilities denominated in local currencies are translated into USD at end-of-period exchange rates. Assets and liabilities denominated in other than the local currency are re-measured into the local currency prior to translation into USD. Income and expenses are translated into USD at average exchange rates in effect during the period. Exchange gains and losses have not been included in the Special Purpose Combined Statements of Revenues and Direct Expenses as they have not been historically calculated at the divested product level. Further, DuPont’s cash management and treasury organizational structure manages foreign currency positions and the related hedging programs at a global level. For these reasons it is impracticable to assign exchange gains and losses to the Business. Employee Benefits The employees of the Business are participants in various pension and postretirement benefit plans. For purposes of these Financial Statements, these benefit plans are classified as multiemployer plans. Multiemployer plans are sponsored by DuPont and the total related assets and liabilities of these plans are retained by DuPont. Accordingly, the assets and liabilities related to these plans are not recorded in these Financial Statements. However, certain non-U.S. specific employee pension assets and liabilities were transferred to FMC and have been included in the Special Purpose Combined Statements of Net Assets Acquired. Expenses related to these plans were allocated to the Business based on head count and reported within Cost of sales, Research and development expenses and Selling, general and administrative expenses in the Special Purpose Combined Statements of Revenues and Direct Expenses during the years ended December 31, 2016, 2015 and 2014 (See Note 13). Recently Adopted Accounting Pronouncements In November 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-17, Income Taxes (Topic 740), Balance Sheet Classification of Deferred Taxes. The amendments under the new guidance require that deferred tax liabilities and assets be classified as noncurrent in a classified statement of financial position. The guidance is effective for financial statements issued for annual periods beginning after December 15, 2016, and interim periods within those annual periods. Earlier application is permitted for all entities as of the beginning of an interim or annual reporting period. The amendments in this ASU may be applied either prospectively to all deferred tax liabilities and assets or retrospectively to all periods presented. The company adopted this guidance effective January 1, 2016 on a retrospective basis. New Accounting Pronouncements to be Implemented In October 2016, the FASB issued ASU No. 2016-16, Income Taxes (Topic 740), Intra-Entity Transfers of Assets Other Than Inventory. The new guidance requires that entities recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs, rather than when the asset is sold to an outside party. The guidance is effective for annual reporting periods beginning after December 15, 2017, including interim periods within those annual reporting periods. Early adoption is permitted as of the beginning of an annual reporting period. The new guidance requires adoption on a modified retrospective basis through a cumulative-effect adjustment directly to retained earnings as of the beginning of the period of adoption. The Business is currently evaluating the impact, if any, this guidance will have on these Financial Statements and related disclosures. In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). The amendments under the new guidance will require lessees to recognize almost all leases on their balance sheet as a right-of-use asset and a lease liability, other than leases

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 15 that meet the definition of a short-term lease. For income statement purposes, the FASB retained a dual model, requiring leases to be classified as either operating or finance. Classification will be based on criteria that are largely similar to those applied in current lease accounting. Lessor accounting is similar to the current model, but updated to align with certain changes to the lessee model and the new revenue recognition standard. The new leasing standard will be effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted. The new standard must be adopted using a modified retrospective transition, requiring application at the beginning of the earliest comparative period presented. The Business is currently evaluating the impact, if any, this guidance will have on these Financial Statements and related disclosures. In May 2014, the FASB and the International Accounting Standards Board (IASB) jointly issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), which was further updated in March, April, May and December 2016. The new guidance clarifies the principles for recognizing revenue and develops a common revenue standard for U.S. GAAP and International Financial Reporting Standards (IFRS). The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. In July 2015, the FASB approved a deferral of the ASU effective date from annual and interim periods beginning after December 15, 2016, to annual and interim periods beginning after December 15, 2017. The Business is continuing to evaluate the expected impact of this standard on its Financial Statements and has not yet selected a method of adoption. The Business is currently evaluating the impact, if any, this guidance will have on these Financial Statements and related disclosures. NOTE 3 — Relationship with Parent and Related Entities Historically, the Business has been managed and operated in the normal course of business with other subsidiaries, businesses and affiliates of DuPont. Accordingly, certain shared costs have been allocated to the Business and reflected as expenses in the Special Purpose Combined Statements of Revenue and Direct Expenses. Management considers the allocation methodologies for these shared costs to be reasonable and appropriate reflections of the historical DuPont expenses attributable to the Business for purposes of these Financial Statements. The expenses reflected in these Financial Statements may not be indicative of expenses that will be incurred by the Business in the future. All related-party transactions were recorded at cost. Related-party Sales and Purchases Throughout the periods covered by these Financial Statements, the Business sold products to other DuPont subsidiaries. Related-party sales were $37,495, $30,208 and $29,193 for the years ended December 31, 2016, 2015 and 2014, respectively, and have been included in Sales to affiliates in these Financial Statements. Additionally, the Business purchased products from other DuPont subsidiaries. Related-party purchases were not material to these Financial Statements. The Business has continuing involvement with DuPont through transitional service, contract manufacturing agreements, leases, licensing arrangements, etc., which became effective on the date of the closing of the Transaction.

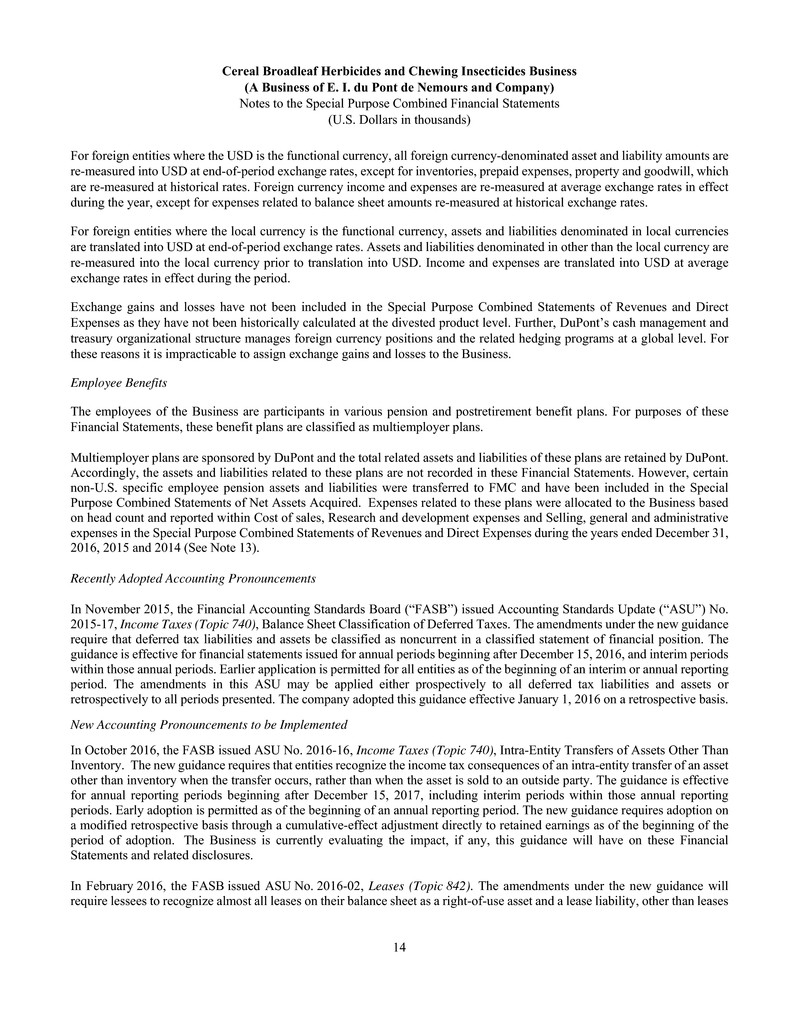

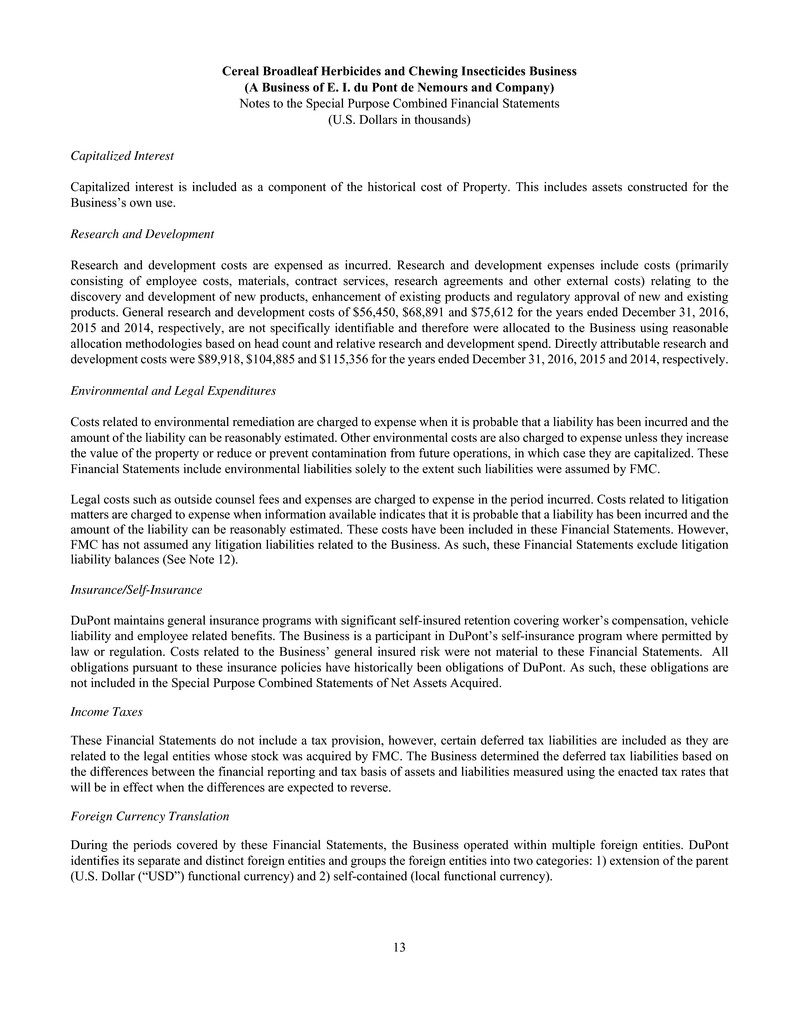

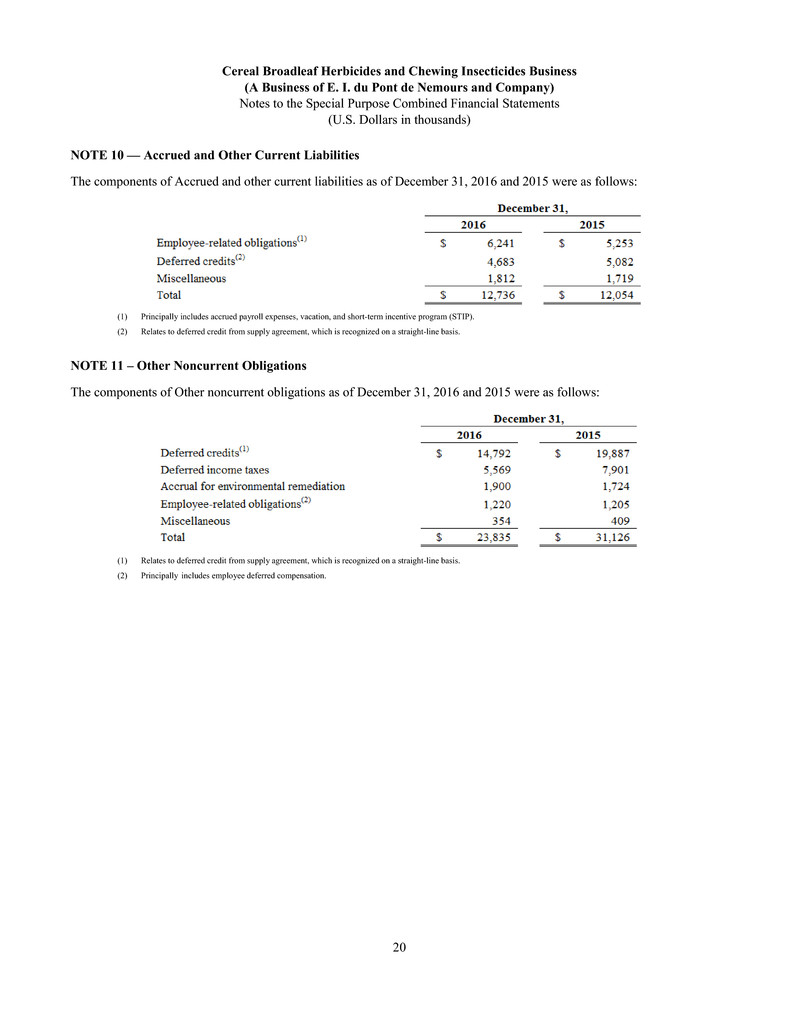

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 16 Functional Costs These Financial Statements include significant functional costs which were incurred by DuPont for services that were provided to or on behalf of the Business. These costs have been historically recorded to the Crop Protection business, of which the Business is a component. These costs include legal, facilities, engineering, finance, human resources, IT and other functional costs directly associated with operating the Business. These costs have been directly charged to, or allocated to the Business using methods management believes are consistent and reasonable. The method for allocating these costs to the Business was based on proportionate formulas involving Net sales and head count. Specific identification has been utilized to reflect the costs associated with the Stine Research & Development facility, a crop protection research and development center located in Newark, Delaware. The expenses reflected in these Financial Statements may not be indicative of the actual expenses that would have been incurred during the periods presented if the Business historically operated as a separate, stand-alone entity. Functional costs were recorded in the Special Purpose Combined Statements of Revenue and Direct Expenses as follows: (1) Research and development expenses include $25,899, $28,333 and $30,476 of expenses related to the Stine Research & Development facility for the years ended December 31, 2016, 2015 and 2014 respectively. Shared Sites The Business has manufacturing operations at 14 production facilities globally. During the periods presented in these Financial Statements, 11 of these production facilities were shared with other DuPont manufacturing operations. Additionally, the Business shares warehouses, sales centers, office space, and research and development facilities with other DuPont businesses. The full historical cost, accumulated depreciation and depreciation expense for assets at shared manufacturing plant sites and other facilities divested to FMC have been included in these Financial Statements. Accordingly, when the use of a divested asset has been shared with retained DuPont’s businesses (manufacturing or otherwise), the cost for the retained DuPont businesses’ usage has been deemed to have been charged to the retained businesses and a credit has been included in the Special Purpose Combined Statements of Revenue and Direct Expenses. These amounts are primarily credited to Cost of sales and were not material to these Financial Statements. For shared manufacturing plant sites and other facilities that are retained by DuPont, these shared assets have been excluded from the Special Purpose Combined Statements of Net Assets Acquired. Accordingly, where the Business has used these shared assets, a charge to Cost of sales has been recorded for its usage of these shared assets. The amounts included in Cost of sales for usage of assets retained by DuPont were $3,401, $4,974 and $5,062 for the years ended December 31, 2016, 2015 and 2014, respectively. Cash Management and Financing The Business participated in DuPont’s centralized cash management and financing programs. Disbursements were made through centralized accounts payable systems which were operated by DuPont. Cash receipts were transferred to centralized accounts, also maintained by DuPont. As cash was disbursed and received by DuPont, it was accounted for by the Business through the intercompany payables and receivables process. All short and long-term debt was financed by DuPont and financing decisions for wholly and majority-owned subsidiaries were determined by central DuPont treasury operations.

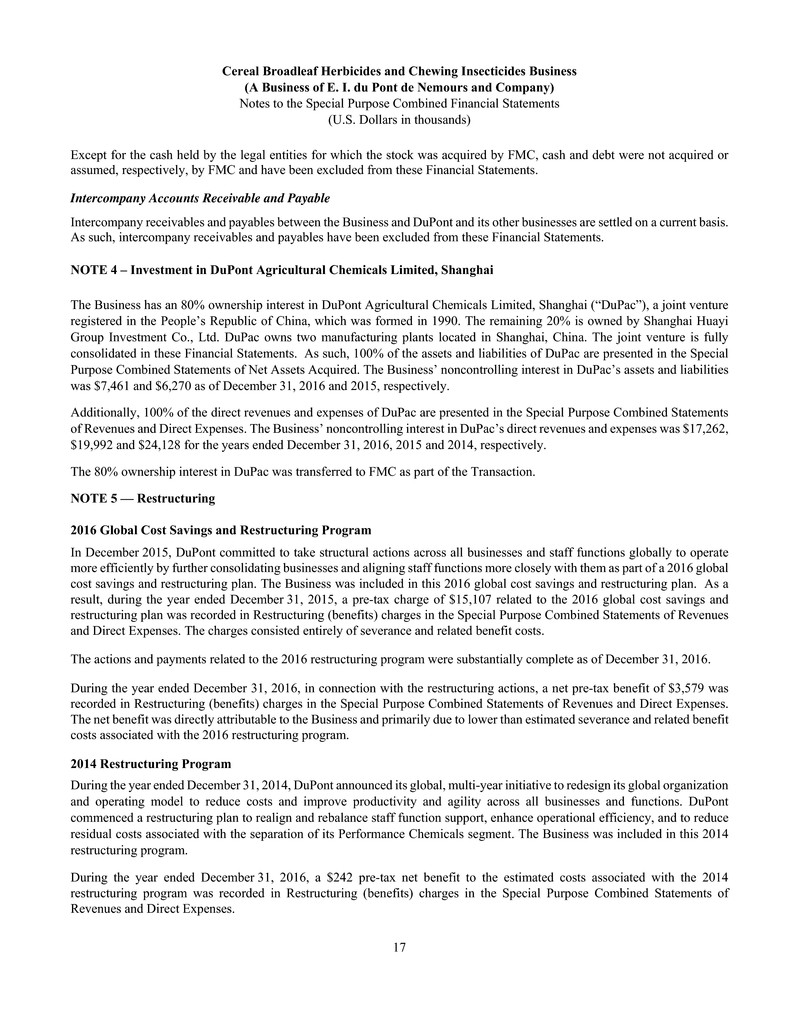

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 17 Except for the cash held by the legal entities for which the stock was acquired by FMC, cash and debt were not acquired or assumed, respectively, by FMC and have been excluded from these Financial Statements. Intercompany Accounts Receivable and Payable Intercompany receivables and payables between the Business and DuPont and its other businesses are settled on a current basis. As such, intercompany receivables and payables have been excluded from these Financial Statements. NOTE 4 – Investment in DuPont Agricultural Chemicals Limited, Shanghai The Business has an 80% ownership interest in DuPont Agricultural Chemicals Limited, Shanghai (“DuPac”), a joint venture registered in the People’s Republic of China, which was formed in 1990. The remaining 20% is owned by Shanghai Huayi Group Investment Co., Ltd. DuPac owns two manufacturing plants located in Shanghai, China. The joint venture is fully consolidated in these Financial Statements. As such, 100% of the assets and liabilities of DuPac are presented in the Special Purpose Combined Statements of Net Assets Acquired. The Business’ noncontrolling interest in DuPac’s assets and liabilities was $7,461 and $6,270 as of December 31, 2016 and 2015, respectively. Additionally, 100% of the direct revenues and expenses of DuPac are presented in the Special Purpose Combined Statements of Revenues and Direct Expenses. The Business’ noncontrolling interest in DuPac’s direct revenues and expenses was $17,262, $19,992 and $24,128 for the years ended December 31, 2016, 2015 and 2014, respectively. The 80% ownership interest in DuPac was transferred to FMC as part of the Transaction. NOTE 5 — Restructuring 2016 Global Cost Savings and Restructuring Program In December 2015, DuPont committed to take structural actions across all businesses and staff functions globally to operate more efficiently by further consolidating businesses and aligning staff functions more closely with them as part of a 2016 global cost savings and restructuring plan. The Business was included in this 2016 global cost savings and restructuring plan. As a result, during the year ended December 31, 2015, a pre-tax charge of $15,107 related to the 2016 global cost savings and restructuring plan was recorded in Restructuring (benefits) charges in the Special Purpose Combined Statements of Revenues and Direct Expenses. The charges consisted entirely of severance and related benefit costs. The actions and payments related to the 2016 restructuring program were substantially complete as of December 31, 2016. During the year ended December 31, 2016, in connection with the restructuring actions, a net pre-tax benefit of $3,579 was recorded in Restructuring (benefits) charges in the Special Purpose Combined Statements of Revenues and Direct Expenses. The net benefit was directly attributable to the Business and primarily due to lower than estimated severance and related benefit costs associated with the 2016 restructuring program. 2014 Restructuring Program During the year ended December 31, 2014, DuPont announced its global, multi-year initiative to redesign its global organization and operating model to reduce costs and improve productivity and agility across all businesses and functions. DuPont commenced a restructuring plan to realign and rebalance staff function support, enhance operational efficiency, and to reduce residual costs associated with the separation of its Performance Chemicals segment. The Business was included in this 2014 restructuring program. During the year ended December 31, 2016, a $242 pre-tax net benefit to the estimated costs associated with the 2014 restructuring program was recorded in Restructuring (benefits) charges in the Special Purpose Combined Statements of Revenues and Direct Expenses.

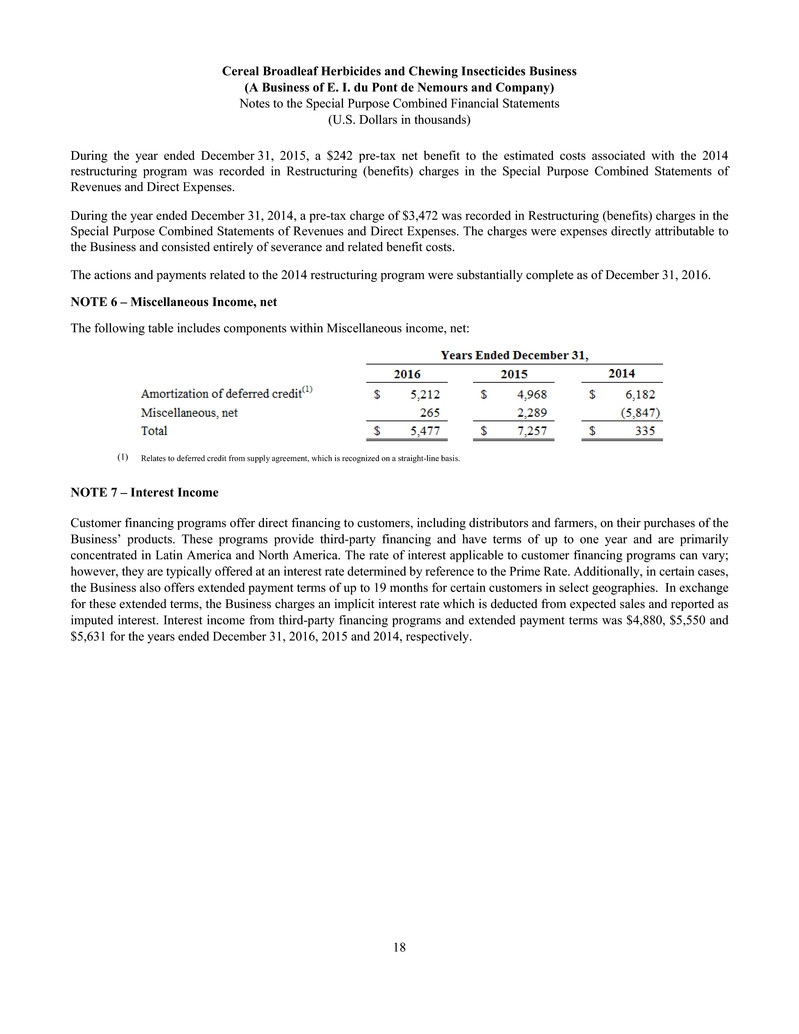

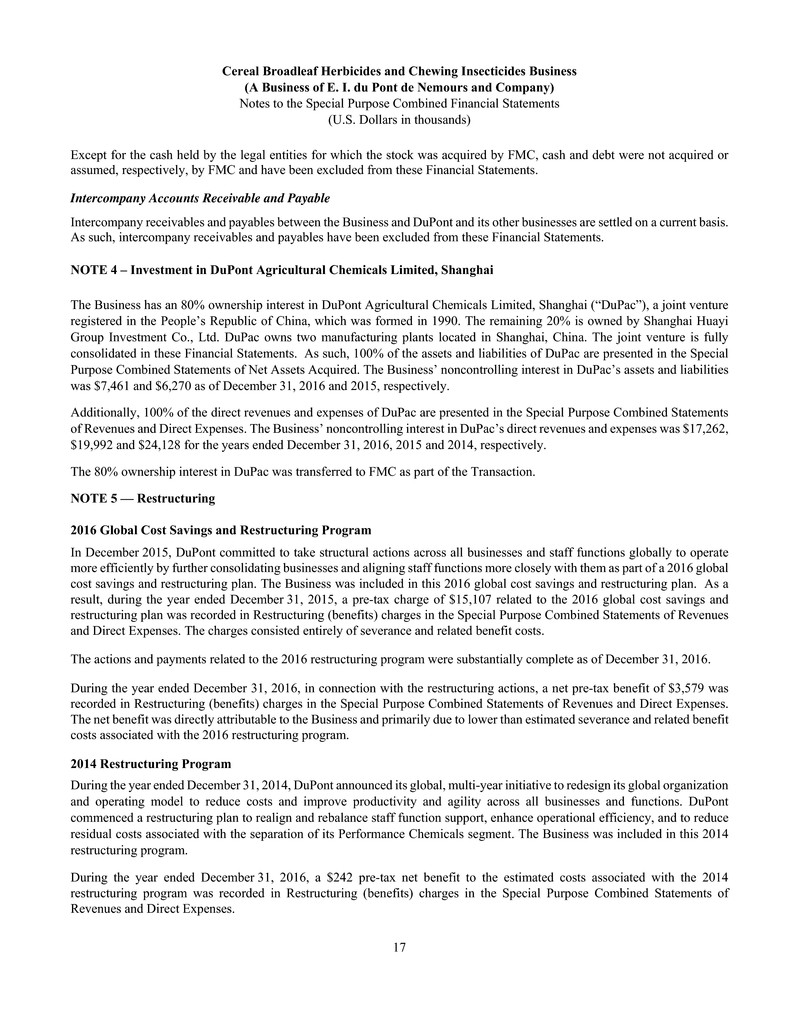

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 18 During the year ended December 31, 2015, a $242 pre-tax net benefit to the estimated costs associated with the 2014 restructuring program was recorded in Restructuring (benefits) charges in the Special Purpose Combined Statements of Revenues and Direct Expenses. During the year ended December 31, 2014, a pre-tax charge of $3,472 was recorded in Restructuring (benefits) charges in the Special Purpose Combined Statements of Revenues and Direct Expenses. The charges were expenses directly attributable to the Business and consisted entirely of severance and related benefit costs. The actions and payments related to the 2014 restructuring program were substantially complete as of December 31, 2016. NOTE 6 – Miscellaneous Income, net The following table includes components within Miscellaneous income, net: (1) Relates to deferred credit from supply agreement, which is recognized on a straight-line basis. NOTE 7 – Interest Income Customer financing programs offer direct financing to customers, including distributors and farmers, on their purchases of the Business’ products. These programs provide third-party financing and have terms of up to one year and are primarily concentrated in Latin America and North America. The rate of interest applicable to customer financing programs can vary; however, they are typically offered at an interest rate determined by reference to the Prime Rate. Additionally, in certain cases, the Business also offers extended payment terms of up to 19 months for certain customers in select geographies. In exchange for these extended terms, the Business charges an implicit interest rate which is deducted from expected sales and reported as imputed interest. Interest income from third-party financing programs and extended payment terms was $4,880, $5,550 and $5,631 for the years ended December 31, 2016, 2015 and 2014, respectively.

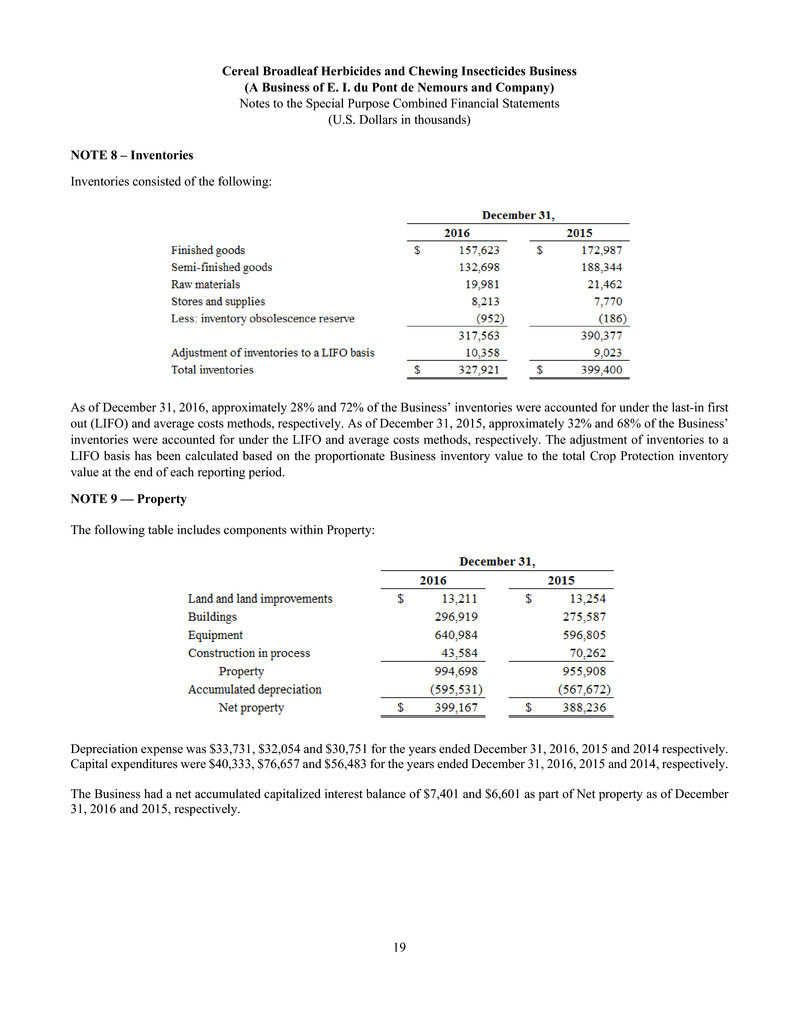

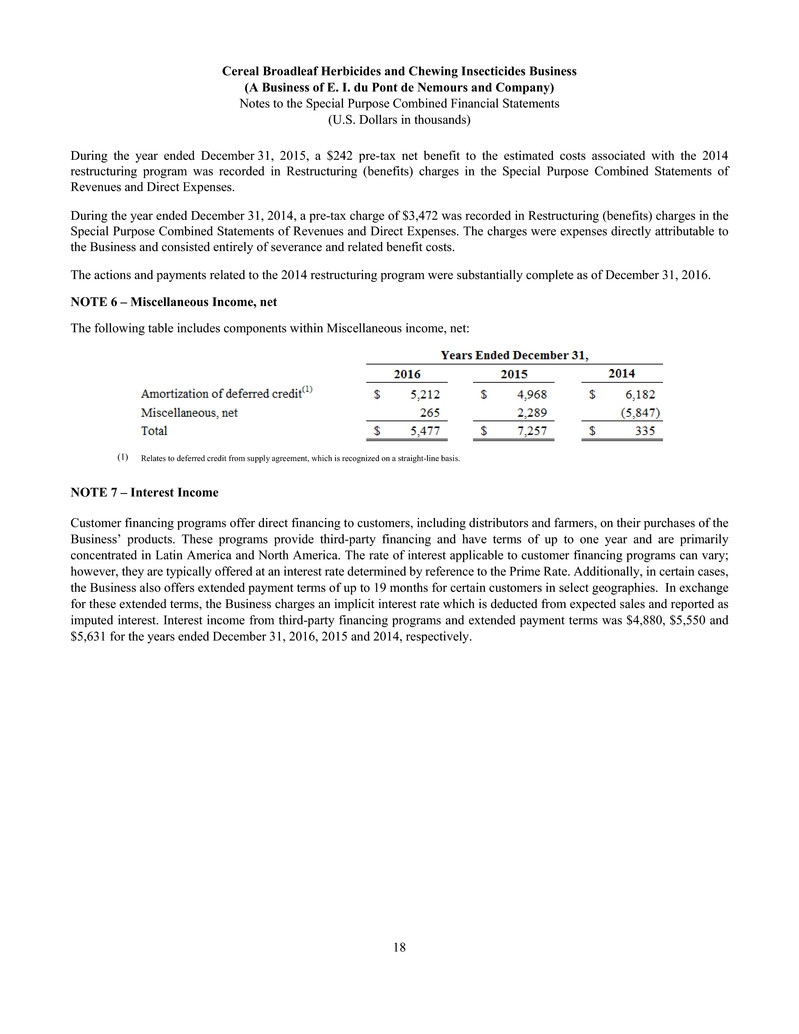

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 19 NOTE 8 – Inventories Inventories consisted of the following: As of December 31, 2016, approximately 28% and 72% of the Business’ inventories were accounted for under the last-in first out (LIFO) and average costs methods, respectively. As of December 31, 2015, approximately 32% and 68% of the Business’ inventories were accounted for under the LIFO and average costs methods, respectively. The adjustment of inventories to a LIFO basis has been calculated based on the proportionate Business inventory value to the total Crop Protection inventory value at the end of each reporting period. NOTE 9 — Property The following table includes components within Property: Depreciation expense was $33,731, $32,054 and $30,751 for the years ended December 31, 2016, 2015 and 2014 respectively. Capital expenditures were $40,333, $76,657 and $56,483 for the years ended December 31, 2016, 2015 and 2014, respectively. The Business had a net accumulated capitalized interest balance of $7,401 and $6,601 as part of Net property as of December 31, 2016 and 2015, respectively.

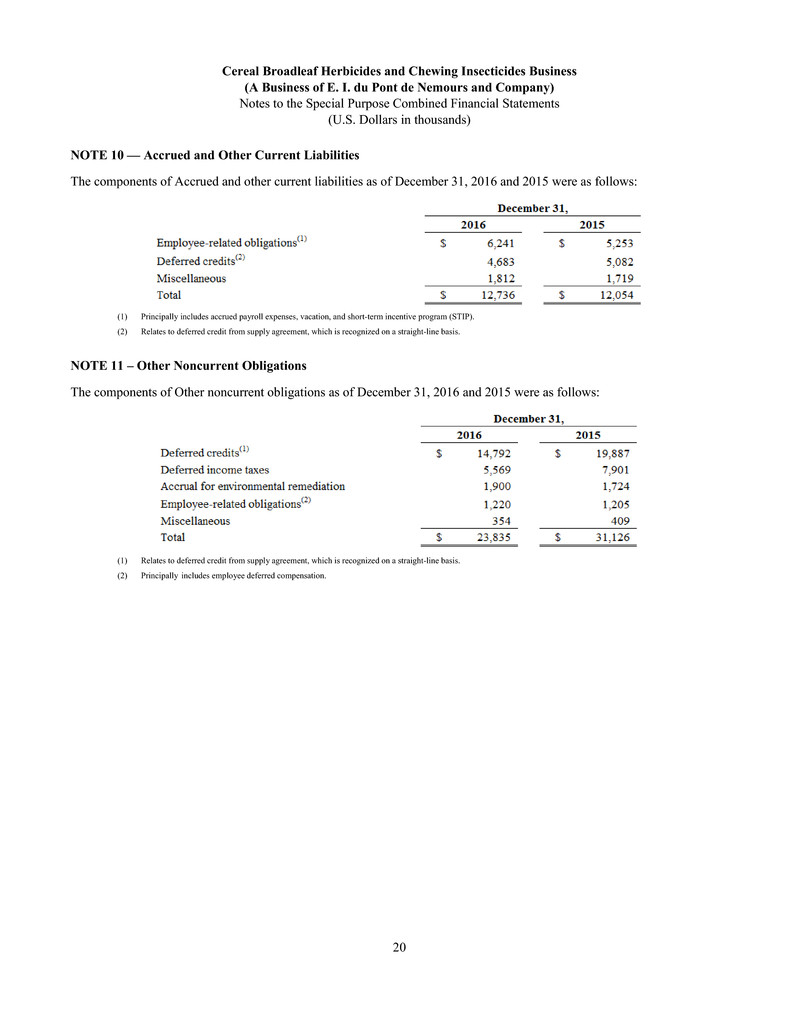

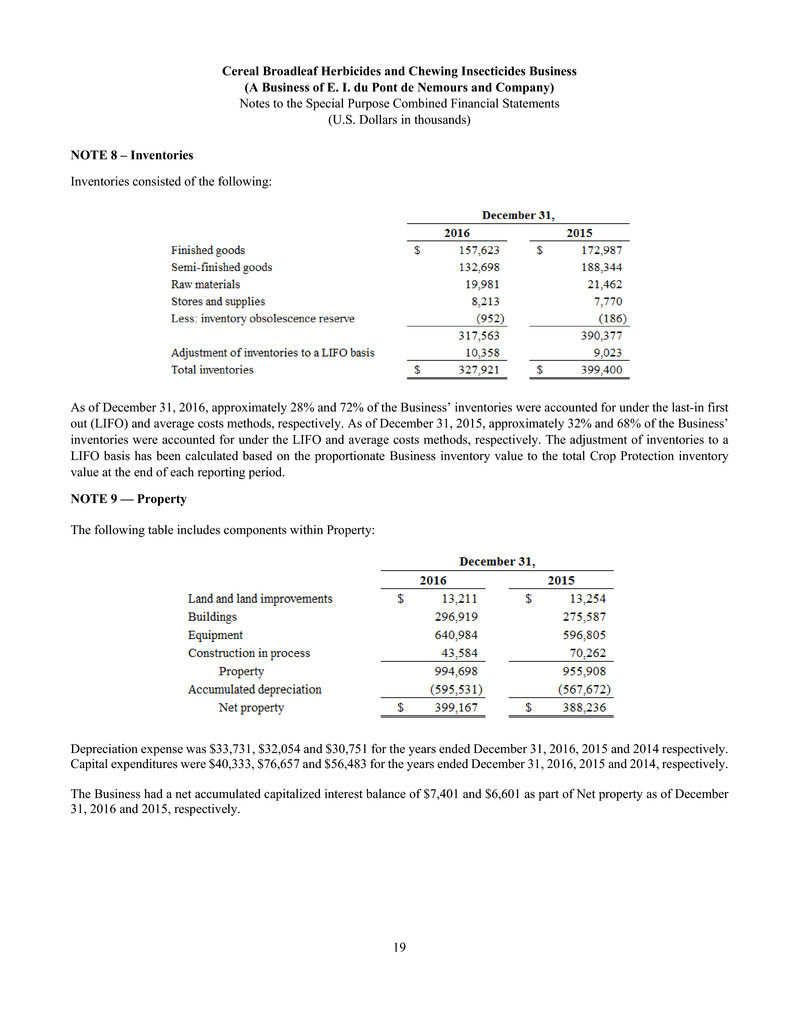

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 20 NOTE 10 — Accrued and Other Current Liabilities The components of Accrued and other current liabilities as of December 31, 2016 and 2015 were as follows: (1) Principally includes accrued payroll expenses, vacation, and short-term incentive program (STIP). (2) Relates to deferred credit from supply agreement, which is recognized on a straight-line basis. NOTE 11 – Other Noncurrent Obligations The components of Other noncurrent obligations as of December 31, 2016 and 2015 were as follows: (1) Relates to deferred credit from supply agreement, which is recognized on a straight-line basis. (2) Principally includes employee deferred compensation.

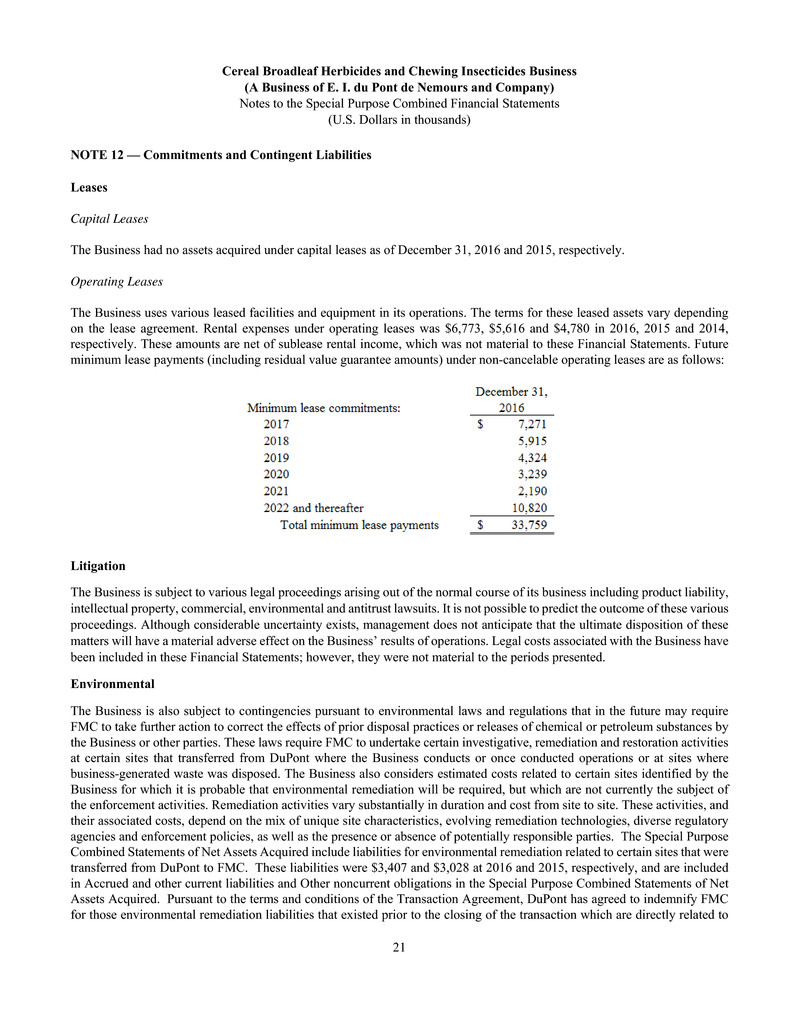

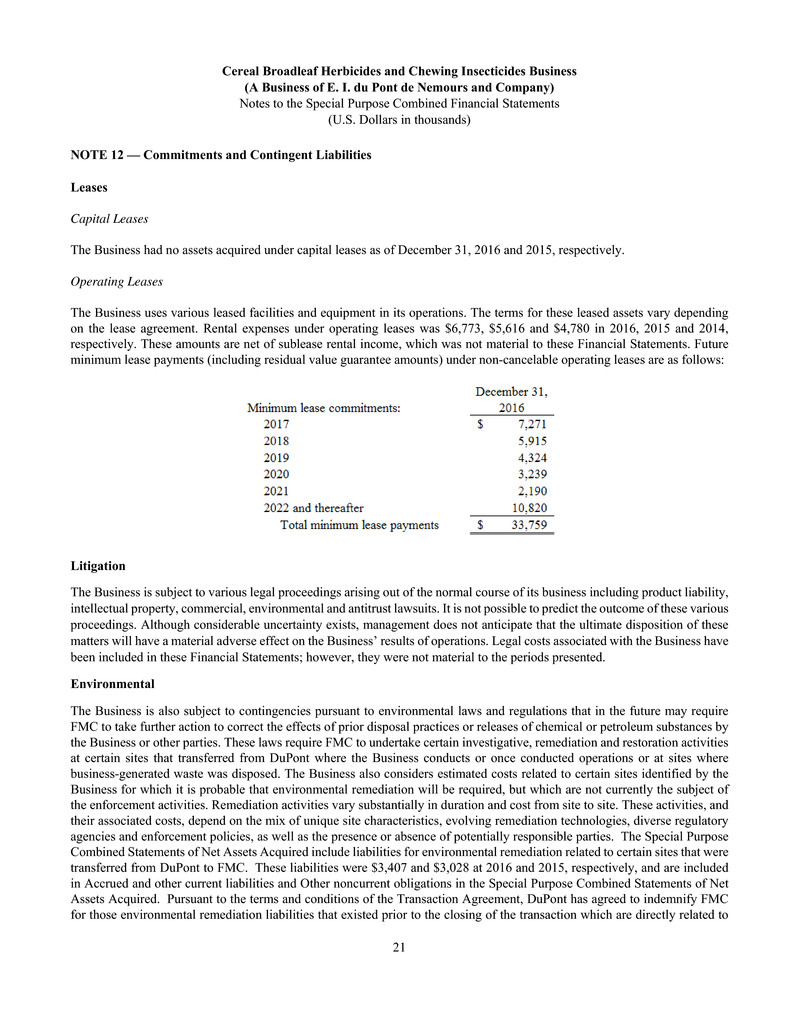

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 21 NOTE 12 — Commitments and Contingent Liabilities Leases Capital Leases The Business had no assets acquired under capital leases as of December 31, 2016 and 2015, respectively. Operating Leases The Business uses various leased facilities and equipment in its operations. The terms for these leased assets vary depending on the lease agreement. Rental expenses under operating leases was $6,773, $5,616 and $4,780 in 2016, 2015 and 2014, respectively. These amounts are net of sublease rental income, which was not material to these Financial Statements. Future minimum lease payments (including residual value guarantee amounts) under non-cancelable operating leases are as follows: Litigation The Business is subject to various legal proceedings arising out of the normal course of its business including product liability, intellectual property, commercial, environmental and antitrust lawsuits. It is not possible to predict the outcome of these various proceedings. Although considerable uncertainty exists, management does not anticipate that the ultimate disposition of these matters will have a material adverse effect on the Business’ results of operations. Legal costs associated with the Business have been included in these Financial Statements; however, they were not material to the periods presented. Environmental The Business is also subject to contingencies pursuant to environmental laws and regulations that in the future may require FMC to take further action to correct the effects of prior disposal practices or releases of chemical or petroleum substances by the Business or other parties. These laws require FMC to undertake certain investigative, remediation and restoration activities at certain sites that transferred from DuPont where the Business conducts or once conducted operations or at sites where business-generated waste was disposed. The Business also considers estimated costs related to certain sites identified by the Business for which it is probable that environmental remediation will be required, but which are not currently the subject of the enforcement activities. Remediation activities vary substantially in duration and cost from site to site. These activities, and their associated costs, depend on the mix of unique site characteristics, evolving remediation technologies, diverse regulatory agencies and enforcement policies, as well as the presence or absence of potentially responsible parties. The Special Purpose Combined Statements of Net Assets Acquired include liabilities for environmental remediation related to certain sites that were transferred from DuPont to FMC. These liabilities were $3,407 and $3,028 at 2016 and 2015, respectively, and are included in Accrued and other current liabilities and Other noncurrent obligations in the Special Purpose Combined Statements of Net Assets Acquired. Pursuant to the terms and conditions of the Transaction Agreement, DuPont has agreed to indemnify FMC for those environmental remediation liabilities that existed prior to the closing of the transaction which are directly related to

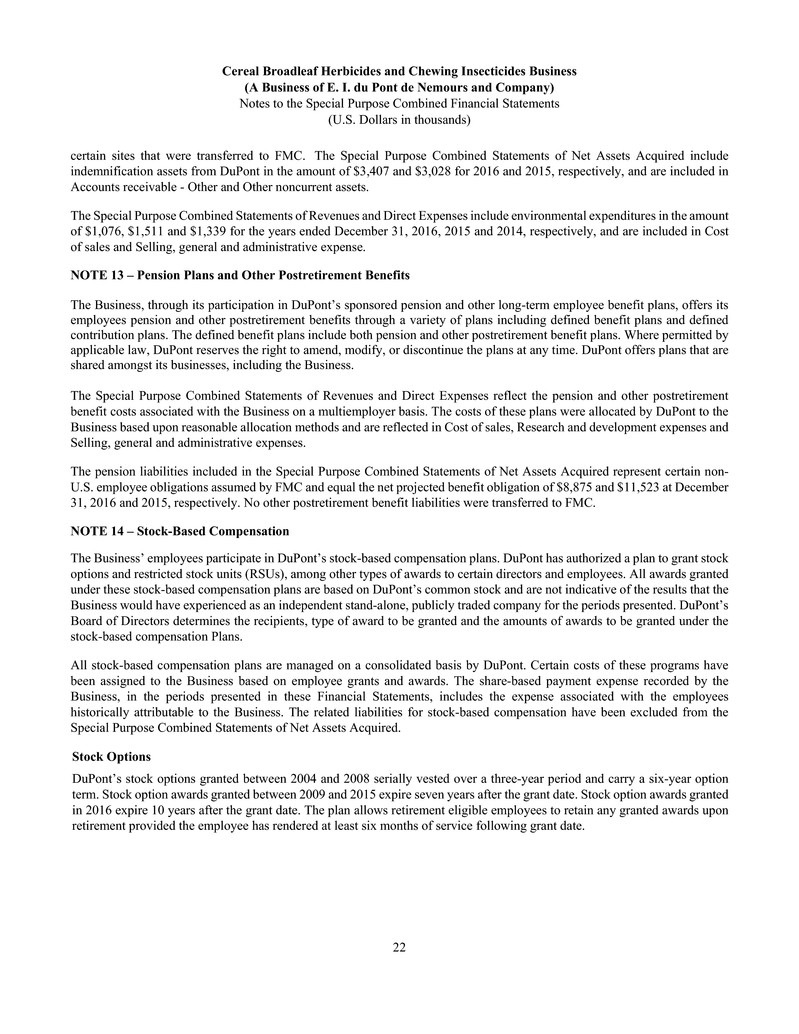

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 22 certain sites that were transferred to FMC. The Special Purpose Combined Statements of Net Assets Acquired include indemnification assets from DuPont in the amount of $3,407 and $3,028 for 2016 and 2015, respectively, and are included in Accounts receivable - Other and Other noncurrent assets. The Special Purpose Combined Statements of Revenues and Direct Expenses include environmental expenditures in the amount of $1,076, $1,511 and $1,339 for the years ended December 31, 2016, 2015 and 2014, respectively, and are included in Cost of sales and Selling, general and administrative expense. NOTE 13 – Pension Plans and Other Postretirement Benefits The Business, through its participation in DuPont’s sponsored pension and other long-term employee benefit plans, offers its employees pension and other postretirement benefits through a variety of plans including defined benefit plans and defined contribution plans. The defined benefit plans include both pension and other postretirement benefit plans. Where permitted by applicable law, DuPont reserves the right to amend, modify, or discontinue the plans at any time. DuPont offers plans that are shared amongst its businesses, including the Business. The Special Purpose Combined Statements of Revenues and Direct Expenses reflect the pension and other postretirement benefit costs associated with the Business on a multiemployer basis. The costs of these plans were allocated by DuPont to the Business based upon reasonable allocation methods and are reflected in Cost of sales, Research and development expenses and Selling, general and administrative expenses. The pension liabilities included in the Special Purpose Combined Statements of Net Assets Acquired represent certain non- U.S. employee obligations assumed by FMC and equal the net projected benefit obligation of $8,875 and $11,523 at December 31, 2016 and 2015, respectively. No other postretirement benefit liabilities were transferred to FMC. NOTE 14 – Stock-Based Compensation The Business’ employees participate in DuPont’s stock-based compensation plans. DuPont has authorized a plan to grant stock options and restricted stock units (RSUs), among other types of awards to certain directors and employees. All awards granted under these stock-based compensation plans are based on DuPont’s common stock and are not indicative of the results that the Business would have experienced as an independent stand-alone, publicly traded company for the periods presented. DuPont’s Board of Directors determines the recipients, type of award to be granted and the amounts of awards to be granted under the stock-based compensation Plans. All stock-based compensation plans are managed on a consolidated basis by DuPont. Certain costs of these programs have been assigned to the Business based on employee grants and awards. The share-based payment expense recorded by the Business, in the periods presented in these Financial Statements, includes the expense associated with the employees historically attributable to the Business. The related liabilities for stock-based compensation have been excluded from the Special Purpose Combined Statements of Net Assets Acquired. Stock Options DuPont’s stock options granted between 2004 and 2008 serially vested over a three-year period and carry a six-year option term. Stock option awards granted between 2009 and 2015 expire seven years after the grant date. Stock option awards granted in 2016 expire 10 years after the grant date. The plan allows retirement eligible employees to retain any granted awards upon retirement provided the employee has rendered at least six months of service following grant date.

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 23 For purposes of determining the fair value of stock option awards, DuPont uses the Black-Scholes option pricing model and the assumptions set forth below: • Risk-free interest rate was 1.8%, 1.4% and 1.7% for options granted in 2016, 2015 and 2014 respectively. This is based on the yield on an outstanding U.S. Treasury note with a term equal to the expected life of the option granted; • Dividend yield was 2.6%, 2.5% and 2.9% for options granted in 2016, 2015 and 2014, respectively. Dividend yield is determined by dividing the current annual dividend on DuPont’s stock by the option exercise price; • Expected volatility was 28.27%, 22.52% and 31.33% for options granted in 2016, 2015 and 2014, respectively. This is based on the expected life of the option granted; and • Expected life of each option awarded was 7.2 years for options granted in 2016 and 5.3 years for options granted in 2015 and 2014. Expected life is determined by reference to DuPont’s historical experience. RSUs DuPont issues RSUs that serially vest over a three-year period and, upon vesting, convert one-for-one to DuPont common stock. A retirement eligible employee retains any granted awards upon retirement provided the employee has rendered at least six months of service following the grant date. Additional RSUs are also granted periodically to key senior management employees. These RSUs generally vest over periods ranging from two to five years. The fair value of all stock-settled RSUs is based upon the market price of the underlying common stock as of the grant date. Compensation expense is recognized using the straight-line method over the requisite service period. Total compensation cost recorded for the Business’ stock-based compensation arrangements was not material to these Financial Statements.

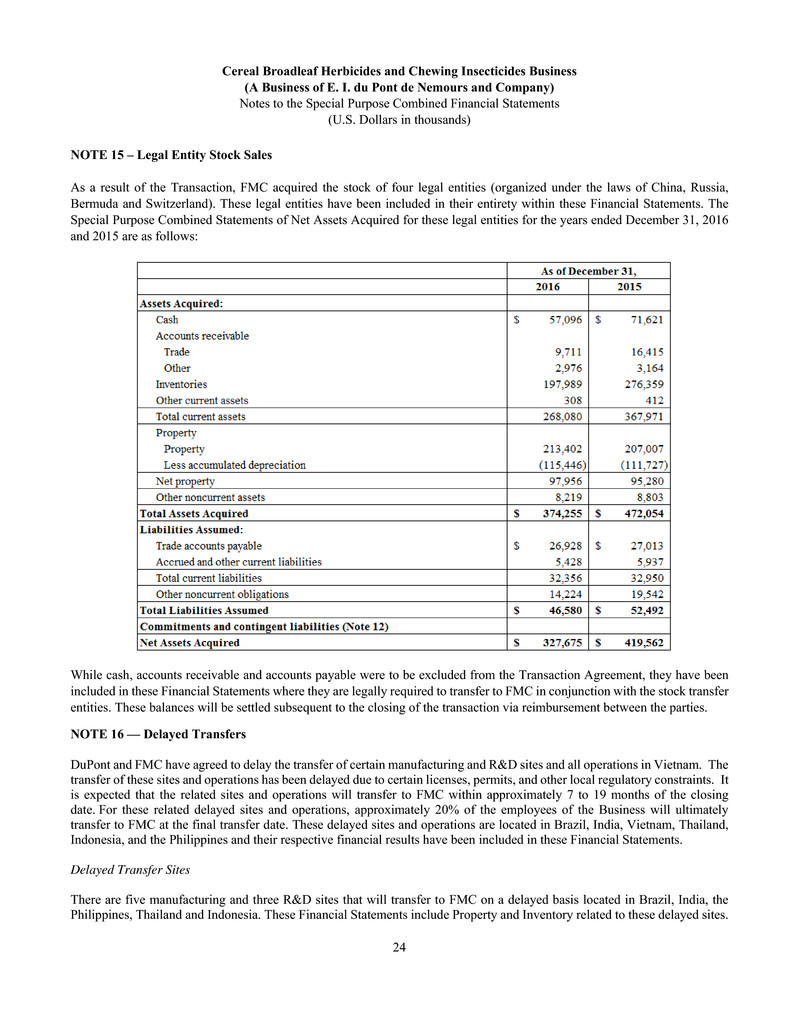

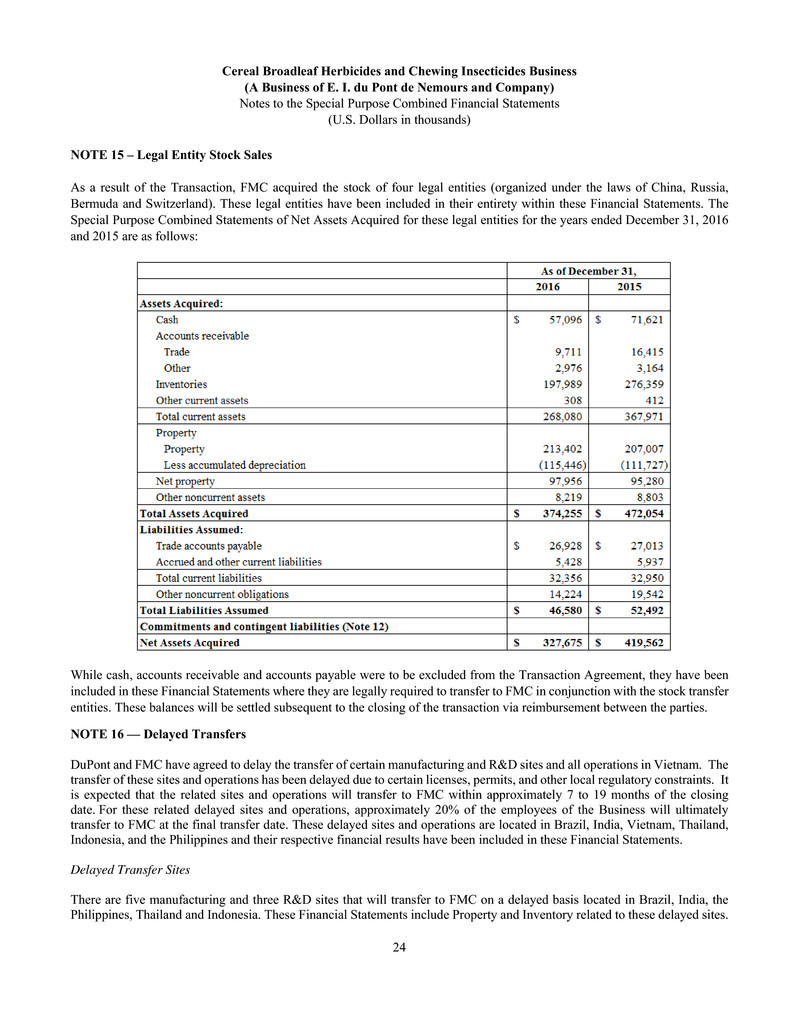

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 24 NOTE 15 – Legal Entity Stock Sales As a result of the Transaction, FMC acquired the stock of four legal entities (organized under the laws of China, Russia, Bermuda and Switzerland). These legal entities have been included in their entirety within these Financial Statements. The Special Purpose Combined Statements of Net Assets Acquired for these legal entities for the years ended December 31, 2016 and 2015 are as follows: While cash, accounts receivable and accounts payable were to be excluded from the Transaction Agreement, they have been included in these Financial Statements where they are legally required to transfer to FMC in conjunction with the stock transfer entities. These balances will be settled subsequent to the closing of the transaction via reimbursement between the parties. NOTE 16 — Delayed Transfers DuPont and FMC have agreed to delay the transfer of certain manufacturing and R&D sites and all operations in Vietnam. The transfer of these sites and operations has been delayed due to certain licenses, permits, and other local regulatory constraints. It is expected that the related sites and operations will transfer to FMC within approximately 7 to 19 months of the closing date. For these related delayed sites and operations, approximately 20% of the employees of the Business will ultimately transfer to FMC at the final transfer date. These delayed sites and operations are located in Brazil, India, Vietnam, Thailand, Indonesia, and the Philippines and their respective financial results have been included in these Financial Statements. Delayed Transfer Sites There are five manufacturing and three R&D sites that will transfer to FMC on a delayed basis located in Brazil, India, the Philippines, Thailand and Indonesia. These Financial Statements include Property and Inventory related to these delayed sites.

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 25 Net property balances at these delayed sites were $42,396 and $36,536 as of December 31, 2016 and 2015, respectively. At these delayed sites, $16,212 and $18,297 of Inventory was included in these Financial Statements as of December 31, 2016 and 2015, respectively, which represent Raw materials, Stores and supplies, and Semi-finished goods that were not transferred to FMC at the closing date due to certain local regulatory constraints. However, since FMC has agreed to ultimately acquire and compensate DuPont for any remaining inventory at time of physical site transfer, these inventory balances have been included in these Financial Statements. During the period between November 1, 2017, and the transfer date of these sites, DuPont and FMC have entered into manufacturing agreements for these sites whereby DuPont will manufacture product and sell finished goods to or on behalf of FMC. Delayed Transfer Country The manufacturing facility in Vietnam will transfer to FMC on a delayed basis. Due to local operational constraints in Vietnam, all classes of inventory have been retained by DuPont and will transfer to FMC by the final transfer date. Net property balances in Vietnam were $494 and $355 as of December 31, 2016 and 2015, respectively. Inventory values in Vietnam were $1,502 and $1,990 as of December 31, 2016 and 2015, respectively. However, since FMC has compensated DuPont for this inventory at closing, these balances have been included in the Special Purpose Combined Statements of Net Assets Acquired. NOTE 17 — Subsequent Events DuPont Merger with Dow Chemical On December 11, 2015, DuPont and The Dow Chemical Company (“Dow”) announced entry into an Agreement and Plan of Merger, as amended on March 31, 2017, (the “Merger Agreement”), under which the companies agreed to combine in an all- stock merger of equals (the “Merger Transaction”) subject to satisfaction of customary closing conditions, including receipt of regulatory approval. On March 27, 2017, DuPont and Dow announced that the European Commission (“EC”) granted conditional regulatory clearance in Europe for the Merger Transaction conditional on DuPont and Dow fulfilling certain commitments. One of the commitments was for DuPont to sell its Cereal Broadleaf Herbicides and Chewing Insecticides Business. On March 31, 2017, DuPont entered into a Transaction Agreement with FMC, whereby DuPont agreed to divest its Cereal Broadleaf Herbicides and Chewing Insecticides Business, including Rynaxypyr®, Cyazypyr® and Indoxacarb as well as the Crop Protection R&D pipeline and organization, excluding seed treatment, nematicides, and late-stage R&D programs. This divestiture satisfies DuPont’s commitments to the EC in connection with its conditional regulatory clearance of the merger with Dow. As a condition of the transaction with FMC, oversight of the divested business was transferred to an appointed management trustee and held in trust (the “Trust”). The sale transaction with FMC was completed on November 1, 2017. On August 2, 2017, DuPont and Dow received the final required regulatory approval and clearance in connection with the proposed Merger Transaction of the two companies. Effective August 31, 2017, DuPont and Dow completed the previously announced Merger Transaction. Service Agreements Effective at closing and pursuant to the terms of the Transaction Agreement, DuPont and FMC entered into manufacturing service agreements which provide both parties with certain operational support services for a specified period of time at cost as well as certain tolling and manufacturing activities for DuPont for up to five years. In addition, DuPont and FMC entered into transition service agreements to provide FMC with certain operational support services for a maximum of 30 months at cost.

Cereal Broadleaf Herbicides and Chewing Insecticides Business (A Business of E. I. du Pont de Nemours and Company) Notes to the Special Purpose Combined Financial Statements (U.S. Dollars in thousands) 26 Impact of Hurricane Maria The Business operates a manufacturing facility located in Manati, Puerto Rico. Management is currently assessing the impact that Hurricane Maria had on this facility and its operations. The parties have agreed that DuPont will pay for the repair and restoration of the damaged site. Site Separation Capital Projects As of the closing of the Transaction on November 1, 2017, certain capital projects related to the physical separation of certain sites shared between the parties were not yet complete. DuPont has agreed to pay for the remaining capital required to complete these projects. As of the date of these Financial Statements, the estimated remaining cost to complete is $849.