UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02383

AB BOND FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2021

Date of reporting period: October 31, 2021

ITEM 1. REPORTS TO STOCKHOLDERS.

OCT 10.31.21

ANNUAL REPORT

AB ALL MARKET REAL RETURN PORTFOLIO

As of January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, the Fund’s annual and semi-annual shareholder reports are no longer sent by mail, unless you specifically requested paper copies of the reports. Instead, the reports are made available on a website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call the Fund at (800) 221 5672. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all AB Mutual Funds you hold.

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-PORT may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| FROM THE PRESIDENT | |  |

Dear Shareholder,

We’re pleased to provide this report for the AB All Market Real Return Portfolio (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

At AB, we’re striving to help our clients achieve better outcomes by:

| + | | Fostering diverse perspectives that give us a distinctive approach to navigating global capital markets |

| + | | Applying differentiated investment insights through a connected global research network |

| + | | Embracing innovation to design better ways to invest and leading-edge mutual-fund solutions |

Whether you’re an individual investor or a multibillion-dollar institution, we’re putting our knowledge and experience to work for you every day.

For more information about AB’s comprehensive range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in AB mutual funds—and for placing your trust in our firm.

Sincerely,

Onur Erzan

President and Chief Executive Officer, AB Mutual Funds

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 1 |

ANNUAL REPORT

December 7, 2021

This report provides management’s discussion of fund performance for the AB All Market Real Return Portfolio for the annual reporting period ended October 31, 2021.

The Fund’s investment objective is to maximize real return over inflation.

NAV RETURNS AS OF OCTOBER 31, 2021 (unaudited)

| | | | | | | | |

| | |

| | | 6 Months | | | 12 Months | |

| | |

| AB ALL MARKET REAL RETURN PORTFOLIO | | | | | | | | |

| | |

| Class 1 Shares1 | | | 10.19% | | | | 45.63% | |

| | |

| Class 2 Shares1 | | | 10.36% | | | | 46.10% | |

| | |

| Class A Shares2 | | | 10.08% | | | | 45.29% | |

| | |

| Class C Shares | | | 9.71% | | | | 44.41% | |

| | |

| Advisor Class Shares2,3 | | | 10.22% | | | | 45.63% | |

| | |

| Class R Shares2,3 | | | 9.96% | | | | 45.04% | |

| | |

| Class K Shares2.3 | | | 10.10% | | | | 45.40% | |

| | |

| Class I Shares2,3 | | | 10.42% | | | | 46.17% | |

| | |

| Class Z Shares3 | | | 10.31% | | | | 46.17% | |

| | |

| MSCI AC World Commodity Producers Index (net) | | | 7.96% | | | | 65.36% | |

| 1 | Class 1 shares are only available to Bernstein Global Wealth Management private client accounts. Class 2 shares are only available to the Adviser’s institutional clients or through other limited arrangements. |

| 2 | The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the Financial Highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| 3 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions.

INVESTMENT RESULTS

The table above shows the Fund’s performance compared to its benchmark, the Morgan Stanley Capital International All Country (“MSCI AC”) World Commodity Producers Index (net), for the six- and 12-month periods ended October 31, 2021.

All share classes of the Fund underperformed the benchmark for the 12-month period, but outperformed for the six-month period, before sales

| | |

| |

2 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

charges. For the 12-month period, the strategic allocation detracted overall, relative to the benchmark, as real estate, commodity futures and inflation-sensitive equities underperformed commodity producers. Security selection within commodity equities, commodity futures, real estate investment trusts (“REITs”) and inflation-sensitive equities contributed. The Fund’s tactical overweight to commodity futures contributed, but this was offset by tactical underweights to REITs and inflation-sensitive equities.

During the six-month period, the strategic allocation contributed overall, relative to the benchmark, as commodity futures and inflation-sensitive equities outperformed commodity producers. Security selection within commodity equities, commodity futures, REITs and inflation-sensitive equities contributed. The Fund’s tactical overweight to commodity equities contributed, while tactical underweights to REITs and inflation-sensitive equities detracted.

The Fund utilized derivatives for hedging and investment purposes in the form of futures, inflation swaps and currency forwards, which added to absolute returns for both periods, while total return swaps and variance swaps detracted for both periods. Written options were utilized for hedging and investment purposes and had no material impact on performance for either period.

MARKET REVIEW AND INVESTMENT STRATEGY

Global equities recorded strong double-digit returns during the 12-month period ended October 31, 2021. Accommodative monetary policy, widespread vaccination distribution and resilient company earnings growth helped quell inflation concerns and supported equity markets throughout most of the period. Bouts of volatility increased as worsening supply-chain constraints and the negative economic impact of the coronavirus delta variant were compounded by the convergence of politically divisive budget negotiations in the US and turmoil in China’s economy. The US Federal Reserve moved gradually toward tapering but signaled that current economic conditions continued to justify low rates for the next several years, which steadied equity markets. Investors also reacted favorably to positive developments in Washington, DC, after Congress reached a deal to temporarily raise the US debt ceiling and as Chinese authorities moved to calm fears around the collapse of the heavily indebted Chinese real estate developer Evergrande and a slowdown in China’s economy. Large-cap stocks underperformed small-cap stocks on a relative basis, and value-style stocks narrowly outperformed their growth-style peers.

Fixed-income market returns were mixed as longer-term treasury returns fell in most major developed markets on rising yields—particularly in Australia, Canada and the UK. Global inflation-linked bonds significantly outperformed treasuries. Relatively low interest rates set the stage for the continued outperformance of risk assets, led by the performance of high-yield corporate bonds—particularly in the US, eurozone and emerging

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 3 |

markets. Emerging-market hard-currency sovereign bonds also had strong performance, mostly from the high-yield component. Emerging- and developed-market investment-grade corporate bonds also posted positive performance, with the US outperforming the eurozone. Securitized assets outperformed, especially in commercial mortgage-backed securities. Local-currency sovereign bonds trailed, as the US dollar was mixed against emerging-market currencies and fell versus most developed-market currencies except the yen and South Korean won. Commodity prices were strong, with Brent crude oil and copper climbing from pandemic-related lows.

Inflation assets rallied over the six- and 12-month periods, with natural resource equities, commodities, REITs and inflation breakevens all posting positive returns. The global vaccine rollout kept investor sentiment elevated, as they anticipated that a speedy rollout would allow pent-up demand for goods and services to reenter the market. Early reassurance from central banks around the world that stimulus measures would remain in place further bolstered inflation expectations and benefited these assets. Commodities were the top performers over the six-month period, as coal and natural gas prices in China and Europe spiked in response to constrained supply. Factories across regions were shuttered or forced to reduce capacity in response to the energy crunch, and in turn limited output of metals, which also saw price appreciation. Energy producers also outperformed over this period, benefiting from the energy bounce. Unprecedented supply-chain challenges kept inflation expectations elevated, which benefited breakevens. REITs posted positive returns over the period as well, but lagged the broader equity market.

The Fund’s Senior Investment Management Team continues to look for sources of value via asset allocation shifts, active security selection, risk overlay strategies and currency management. The Fund uses a blend of quantitative and fundamental research in order to determine overall portfolio risk, allocate risk across major real asset classes and identify idiosyncratic opportunities.

INVESTMENT POLICIES

The Fund seeks to maximize real return. Real return is the rate of return after adjusting for inflation. The Fund pursues an aggressive investment strategy involving a variety of asset classes. The Fund invests primarily in instruments that the Adviser expects to outperform broad equity indices during periods of rising inflation. Under normal circumstances, the Fund expects to invest its assets principally in the following instruments that, in the judgment of the Adviser, are affected directly or indirectly by the level and change in rate of inflation: inflation-indexed fixed-income securities, such as Treasury inflation-protected securities

(continued on next page)

| | |

| |

4 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

(“TIPS”) and similar bonds issued by governments outside of the United States; commodities; commodity-related equity securities; real estate equity securities; inflation-sensitive equity securities, which the Fund defines as equity securities of companies that the Adviser believes have the ability to pass along increasing costs to consumers and maintain or grow margins in rising inflation environments, including equity securities of utilities and infrastructure-related companies (“inflation-sensitive equities”); securities and derivatives linked to the price of other assets (such as commodities, stock indices and real estate); and currencies. The Fund expects its investments in fixed-income securities to have a broad range of maturities and quality levels.

The Fund seeks inflation protection from investments around the globe, both in developed- and emerging-market countries. In selecting securities for purchase and sale, the Adviser utilizes its qualitative and quantitative resources to determine overall inflation sensitivity, asset allocation and security selection. The Adviser assesses the securities’ risks and inflation sensitivity as well as the securities’ impact on the overall risks and inflation sensitivity of the Fund. When its analysis indicates that changes are necessary, the Adviser intends to implement them through a combination of changes to underlying positions and the use of inflation swaps and other types of derivatives, such as interest rate swaps.

The Fund anticipates that its targeted investment mix, other than its investments in inflation-indexed fixed-income securities, will focus on commodity-related equity securities, commodities and commodity derivatives, real estate equity securities and inflation-sensitive equities to provide a balance between expected return and inflation protection. The Fund may vary its investment allocations among these asset classes, at times significantly. Its commodities investments will include significant exposure to energy commodities, but will also include agricultural products, and industrial and precious metals, such as gold. The Fund’s investments in real estate equity securities will include REITs and other real estate-related securities.

The Fund invests in both US and non-US dollar-denominated equity or fixed-income securities. The Fund may invest in currencies for hedging or investment purposes, both in the spot market and through long or short positions in currency-related derivatives. The Fund does not ordinarily expect to hedge its foreign currency exposure because it will be balanced by investments in US dollar-denominated securities, although it may hedge the exposure under certain circumstances.

The Fund may enter into derivatives, such as options, futures contracts, forwards, swaps or structured notes, to a significant extent,

(continued on next page)

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 5 |

subject to the limits of applicable law. The Fund intends to use leverage for investment purposes through the use of cash made available by derivatives transactions to make other investments in accordance with its investment policies. In determining when and to what extent to employ leverage or enter into derivatives transactions, the Adviser considers factors such as the relative risks and returns expected of potential investments and the cost of such transactions. The Adviser considers the impact of derivatives in making its assessments of the Fund’s risks. The resulting exposures to markets, sectors, issuers or specific securities will be continuously monitored by the Adviser.

The Fund may seek to gain exposure to physical commodities traded in the commodities markets through use of a variety of derivative instruments, including investments in commodity index-linked notes. The Adviser expects that the Fund will seek to gain exposure to commodities and commodity-related instruments and derivatives primarily through investments in AllianceBernstein Cayman Inflation Strategy, Ltd., a wholly owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary is advised by the Adviser and has the same investment objective and substantially similar investment policies and restrictions as the Fund except that the Subsidiary, unlike the Fund, may invest, without limitation, in commodities and commodity-related instruments. The Fund is subject to the risks associated with the commodities, derivatives and other instruments in which the Subsidiary invests, to the extent of its investment in the Subsidiary. The Fund limits its investment in the Subsidiary to no more than 25% of its net assets. Investment in the Subsidiary is expected to provide the Fund with commodity exposure within the limitations of federal tax requirements that apply to the Fund.

The Fund is “non-diversified”, which means that it may concentrate its assets in a smaller number of issuers than a diversified fund.

| | |

| |

6 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

DISCLOSURES AND RISKS

Benchmark Disclosure

The MSCI AC World Commodity Producers Index is unmanaged and does not reflect fees and expenses associated with the active management of a mutual fund portfolio. The MSCI AC World Commodity Producers Index is a free float-adjusted, market capitalization index designed to track the performance of global listed commodity producers, including emerging markets. Commodities sectors include: energy, grains, industrial metals, petroleum, precious metals and softs. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns include the reinvestment of dividends after deduction of non-US withholding tax. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s assets will fluctuate as the stock, commodity and bond markets fluctuate. The value of the Fund’s investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness), that affect large portions of the market.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Interest-Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is generally greater for fixed-income securities with longer maturities or durations. The current historically low interest rate environment heightens the risks associated with rising interest rates.

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 7 |

DISCLOSURES AND RISKS (continued)

Commodity Risk: Investing in commodities and commodity-linked derivative instruments, either directly or through the Subsidiary, may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments.

Derivatives Risk: The Fund may enter into derivative transactions such as

forwards, options, futures and swaps. Derivatives may be difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Fund. Derivatives, especially over-the-counter derivatives, are also subject to counterparty risk, which is the risk that the counterparty (the party on the other side of the transaction) on a derivative transaction will be unable or unwilling to honor its contractual obligations to the Fund. Derivatives may result in significant losses, including losses that are far greater than the value of the derivatives reflected on the statement of assets and liabilities.

Leverage Risk: To the extent the Fund uses leveraging techniques, its net asset value (“NAV”) may be more volatile because leverage tends to exaggerate the effect of changes in interest rates and any increase or decrease in the value of the Fund’s investments.

Illiquid Investments Risk: Illiquid investments risk exists when certain investments are or become difficult to purchase or sell. Difficulty in selling such investments may result in sales at disadvantageous prices affecting the value of your investment in the Fund. Causes of illiquid investments risk may include low trading volumes and large positions. Foreign fixed-income securities may have more illiquid investments risk because secondary trading markets for these securities may be smaller and less well-developed and the securities may trade less frequently. Illiquid investments risk may be higher in a rising interest-rate environment, when the value and liquidity of fixed-income securities generally go down.

Foreign (Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade due to adverse market, economic, political, regulatory or other factors.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Fund’s investments or reduce its returns.

Subsidiary Risk: By investing in the Subsidiary, the Fund is indirectly exposed to the risks associated with the Subsidiary’s investments. The

| | |

| |

8 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

DISCLOSURES AND RISKS (continued)

derivatives and other investments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the Fund. The Subsidiary is not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and, unless otherwise noted in the Fund’s prospectus, is not subject to all of the investor protections of the 1940 Act. However, the Fund wholly owns and controls the Subsidiary, and the Fund and the Subsidiary are managed by the Adviser, making it unlikely the Subsidiary will take actions contrary to the interests of the Fund or its shareholders.

Real Estate Risk: The Fund’s investments in real estate securities have many of the same risks as direct ownership of real estate, including the risk that the value of real estate could decline due to a variety of factors that affect the real estate market generally. Investments in REITs may have additional risks. REITs are dependent on the capability of their managers, may have limited diversification, and could be significantly affected by changes in taxes.

Non-Diversification Risk: The Fund may have more risk because it is “non-diversified”, meaning that it can invest more of its assets in a smaller number of issuers. Accordingly, changes in the value of a single security may have a more significant effect, either negative or positive, on the Fund’s NAV.

Active Trading Risk: The Fund expects to engage in active and frequent trading of its portfolio securities and its portfolio turnover rate may greatly exceed 100%. A higher rate of portfolio turnover increases transaction costs, which may negatively affect the Fund’s return. In addition, a high rate of portfolio turnover may result in substantial short-term gains, which may have adverse tax consequences for Fund shareholders.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results. Some of these techniques may incorporate, or rely upon, quantitative models, but there is no guarantee that these models will generate accurate forecasts, reduce risk or otherwise perform as expected.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 9 |

DISCLOSURES AND RISKS (continued)

more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.abfunds.com. For Class 1 shares, go to www.bernstein.com and click on “Investments”, found in the footer, then “Mutual Fund Information—Mutual Fund Performance at a Glance.”

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com. For Class 1 shares, go to www.bernstein.com, click on “Investments”, found in the footer, then “Mutual Fund Information—Prospectuses, SAIs and Shareholder Reports.” Please read the prospectus and/or summary prospectus carefully before investing.

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares and a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| |

10 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

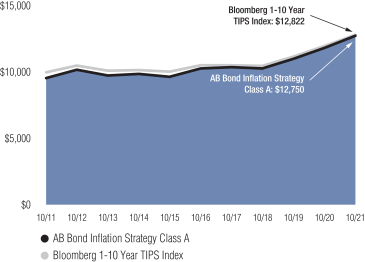

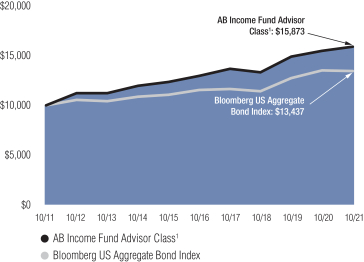

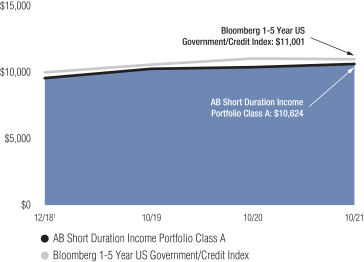

HISTORICAL PERFORMANCE

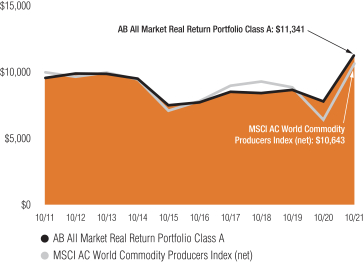

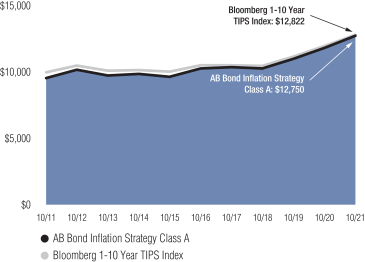

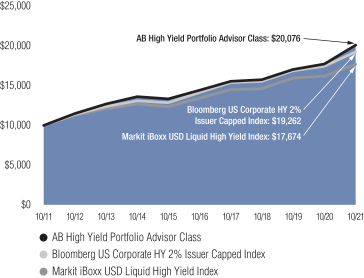

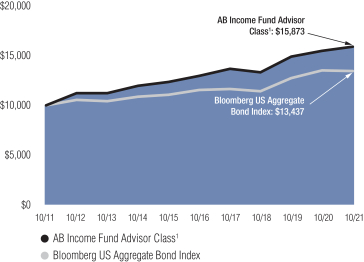

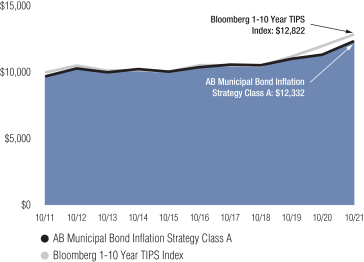

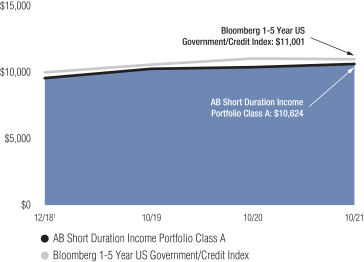

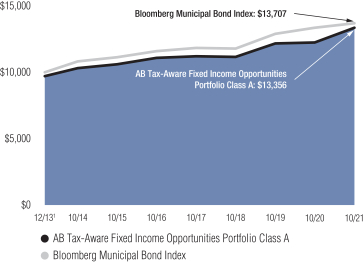

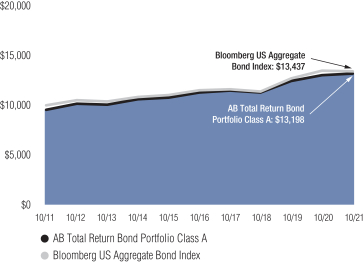

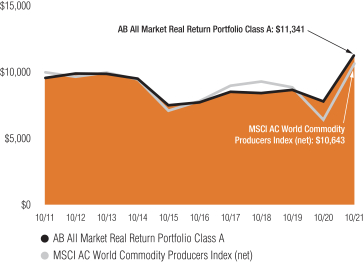

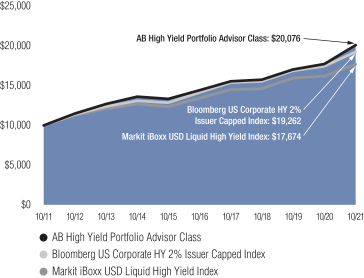

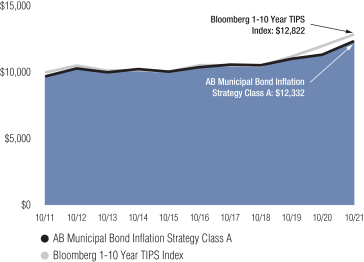

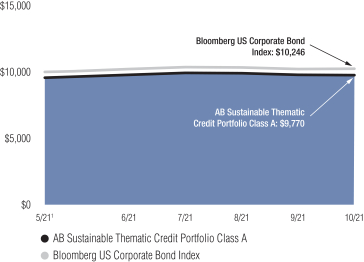

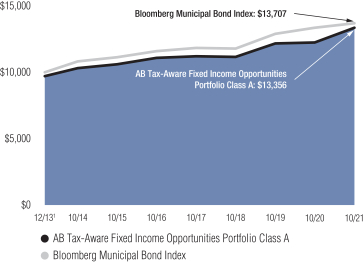

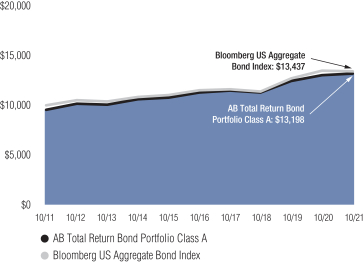

GROWTH OF A $10,000 INVESTMENT IN THE FUND (unaudited)

10/31/2011 TO 10/31/2021

This chart illustrates the total value of an assumed $10,000 investment in AB All Market Real Return Portfolio Class A shares (from 10/31/2011 to 10/31/2021) as compared to the performance of its benchmark. The chart reflects the deduction of the maximum 4.25% sales charge from the initial $10,000 investment in the Fund and assumes the reinvestment of dividends and capital gains distributions.

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 11 |

HISTORICAL PERFORMANCE (continued)

AVERAGE ANNUAL RETURNS AS OF OCTOBER 31, 2021 (unaudited)

| | | | | | | | |

| | |

| | | NAV Returns | | | SEC Returns

(reflects applicable

sales charges) | |

| | |

| CLASS 1 SHARES1 | | | | | | | | |

| | |

| 1 Year | | | 45.63% | | | | 45.63% | |

| | |

| 5 Years | | | 8.21% | | | | 8.21% | |

| | |

| 10 Years | | | 1.86% | | | | 1.86% | |

| | |

| CLASS 2 SHARES1 | | | | | | | | |

| | |

| 1 Year | | | 46.10% | | | | 46.10% | |

| | |

| 5 Years | | | 8.49% | | | | 8.49% | |

| | |

| 10 Years | | | 2.12% | | | | 2.12% | |

| | |

| CLASS A SHARES | | | | | | | | |

| | |

| 1 Year | | | 45.29% | | | | 39.12% | |

| | |

| 5 Years | | | 8.00% | | | | 7.05% | |

| | |

| 10 Years | | | 1.71% | | | | 1.27% | |

| | |

| CLASS C SHARES | | | | | | | | |

| | |

| 1 Year | | | 44.41% | | | | 43.41% | |

| | |

| 5 Years | | | 7.22% | | | | 7.22% | |

| | |

| 10 Years2 | | | 0.97% | | | | 0.97% | |

| | |

| ADVISOR CLASS SHARES3 | | | | | | | | |

| | |

| 1 Year | | | 45.63% | | | | 45.63% | |

| | |

| 5 Years | | | 8.27% | | | | 8.27% | |

| | |

| 10 Years | | | 1.99% | | | | 1.99% | |

| | |

| CLASS R SHARES3 | | | | | | | | |

| | |

| 1 Year | | | 45.04% | | | | 45.04% | |

| | |

| 5 Years | | | 7.72% | | | | 7.72% | |

| | |

| 10 Years | | | 1.47% | | | | 1.47% | |

| | |

| CLASS K SHARES3 | | | | | | | | |

| | |

| 1 Year | | | 45.40% | | | | 45.40% | |

| | |

| 5 Years | | | 8.01% | | | | 8.01% | |

| | |

| 10 Years | | | 1.74% | | | | 1.74% | |

| | |

| CLASS I SHARES3 | | | | | | | | |

| | |

| 1 Year | | | 46.17% | | | | 46.17% | |

| | |

| 5 Years | | | 8.49% | | | | 8.49% | |

| | |

| 10 Years | | | 2.11% | | | | 2.11% | |

| | |

| CLASS Z SHARES3 | | | | | | | | |

| | |

| 1 Year | | | 46.17% | | | | 46.17% | |

| | |

| 5 Years | | | 8.49% | | | | 8.49% | |

| | |

| Since Inception4 | | | 2.68% | | | | 2.68% | |

(footnotes continued on next page)

| | |

| |

12 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

HISTORICAL PERFORMANCE (continued)

The Fund’s prospectus fee table shows the Fund’s total annual operating expense ratios as 1.15%, 0.88%, 1.44%, 2.19%, 1.18%, 1.64%, 1.33%, 0.91% and 0.90% for Class 1, Class 2, Class A, Class C, Advisor Class, Class R, Class K, Class I and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Fund’s annual operating expense ratios, exclusive of extraordinary expenses, interest expense, and acquired fund fees and expenses other than the advisory fees of any AB mutual funds in which the Fund may invest, interest expense, taxes, extraordinary expenses, brokerage commissions and other transaction costs, to 1.30%, 2.05%, 1.05%, 1.55% and 1.30% for Class A, Class C, Advisor Class, Class R and Class K shares, respectively. These waivers/reimbursements may not be terminated before January 31, 2022, and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| 1 | Class 1 shares are only available to Bernstein Global Wealth Management private client accounts. Class 2 shares are only available to the Adviser’s institutional clients or through other limited arrangements. |

| 2 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 3 | These share classes are offered at NAV to eligible investors and their SEC returns are the same as their NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 4 | Inception date: 1/31/2014. |

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 13 |

HISTORICAL PERFORMANCE (continued)

SEC AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDAR QUARTER-END

SEPTEMBER 30, 2021 (unaudited)

| | | | |

| |

| | | SEC Returns

(reflects applicable

sales charges) | |

| |

| CLASS 1 SHARES1 | | | | |

| |

| 1 Year | | | 36.95% | |

| |

| 5 Years | | | 6.89% | |

| |

| 10 Years | | | 2.46% | |

| |

| CLASS 2 SHARES1 | | | | |

| |

| 1 Year | | | 37.15% | |

| |

| 5 Years | | | 7.15% | |

| |

| 10 Years | | | 2.72% | |

| |

| CLASS A SHARES | | | | |

| |

| 1 Year | | | 30.62% | |

| |

| 5 Years | | | 5.74% | |

| |

| 10 Years | | | 1.87% | |

| |

| CLASS C SHARES | | | | |

| |

| 1 Year | | | 34.50% | |

| |

| 5 Years | | | 5.87% | |

| |

| 10 Years2 | | | 1.57% | |

| |

| ADVISOR CLASS SHARES3 | | | | |

| |

| 1 Year | | | 36.95% | |

| |

| 5 Years | | | 6.92% | |

| |

| 10 Years | | | 2.58% | |

| |

| CLASS R SHARES3 | | | | |

| |

| 1 Year | | | 36.34% | |

| |

| 5 Years | | | 6.40% | |

| |

| 10 Years | | | 2.08% | |

| |

| CLASS K SHARES3 | | | | |

| |

| 1 Year | | | 36.79% | |

| |

| 5 Years | | | 6.68% | |

| |

| 10 Years | | | 2.35% | |

| |

| CLASS I SHARES3 | | | | |

| |

| 1 Year | | | 37.21% | |

| |

| 5 Years | | | 7.13% | |

| |

| 10 Years | | | 2.71% | |

| |

| CLASS Z SHARES3 | | | | |

| |

| 1 Year | | | 37.21% | |

| |

| 5 Years | | | 7.13% | |

| |

| Since Inception4 | | | 2.11% | |

(footnotes continued on next page)

| | |

| |

14 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

HISTORICAL PERFORMANCE (continued)

| 1 | Class 1 shares are only available to Bernstein Global Wealth Management private client accounts. Class 2 shares are only available to the Adviser’s institutional clients or through other limited arrangements. |

| 2 | Assumes conversion of Class C shares into Class A shares after eight years. |

| 3 | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Fund. |

| 4 | Inception date: 1/31/2014. |

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 15 |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of a mutual fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

| |

16 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

EXPENSE EXAMPLE (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

May 1,

2021 | | | Ending

Account

Value

October 31,

2021 | | | Expenses

Paid

During

Period* | | | Annualized

Expense

Ratio* | | | Total

Expenses

Paid

During

Period+ | | | Total

Annualized

Expense

Ratio+ | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,100.80 | | | $ | 6.83 | | | | 1.29 | % | | $ | 6.99 | | | | 1.32 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,018.70 | | | $ | 6.56 | | | | 1.29 | % | | $ | 6.72 | | | | 1.32 | % |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,097.10 | | | $ | 10.78 | | | | 2.04 | % | | $ | 10.94 | | | | 2.07 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,014.92 | | | $ | 10.36 | | | | 2.04 | % | | $ | 10.51 | | | | 2.07 | % |

| Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,102.20 | | | $ | 5.51 | | | | 1.04 | % | | $ | 5.67 | | | | 1.07 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.96 | | | $ | 5.30 | | | | 1.04 | % | | $ | 5.45 | | | | 1.07 | % |

| Class R | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,099.60 | | | $ | 8.15 | | | | 1.54 | % | | $ | 8.31 | | | | 1.57 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.44 | | | $ | 7.83 | | | | 1.54 | % | | $ | 7.98 | | | | 1.57 | % |

| Class K | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,101.00 | | | $ | 6.67 | | | | 1.26 | % | | $ | 6.83 | | | | 1.29 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,018.85 | | | $ | 6.41 | | | | 1.26 | % | | $ | 6.56 | | | | 1.29 | % |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,104.20 | | | $ | 4.40 | | | | 0.83 | % | | $ | 4.56 | | | | 0.86 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.02 | | | $ | 4.23 | | | | 0.83 | % | | $ | 4.38 | | | | 0.86 | % |

| Class 1 | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,101.90 | | | $ | 5.72 | | | | 1.08 | % | | $ | 5.88 | | | | 1.11 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.76 | | | $ | 5.50 | | | | 1.08 | % | | $ | 5.65 | | | | 1.11 | % |

| Class 2 | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,103.60 | | | $ | 4.29 | | | | 0.81 | % | | $ | 4.40 | | | | 0.83 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.12 | | | $ | 4.13 | | | | 0.81 | % | | $ | 4.23 | | | | 0.83 | % |

| Class Z | | | | | | | | | | | | | �� | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,103.10 | | | $ | 4.40 | | | | 0.83 | % | | $ | 4.56 | | | | 0.86 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.02 | | | $ | 4.23 | | | | 0.83 | % | | $ | 4.38 | | | | 0.86 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | Assumes 5% annual return before expenses. |

| + | In connection with the Fund’s investments in affiliated/unaffiliated underlying portfolios, the Fund incurs no direct expenses, but bears proportionate shares of the fees and expenses (i.e., operating, administrative and investment advisory fees) of the affiliated/unaffiliated underlying portfolios. The Adviser has contractually agreed to waive its fees from the Fund in an amount equal to the Fund’s pro rata share of certain acquired fund fees and expenses of the affiliated underlying portfolios. The Fund’s total expenses are equal to the classes’ annualized expense ratio plus the Fund’s pro rata share of the weighted average expense ratio of the affiliated/unaffiliated underlying portfolios in which it invests, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 17 |

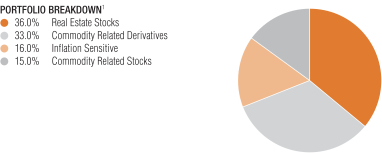

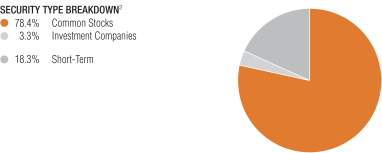

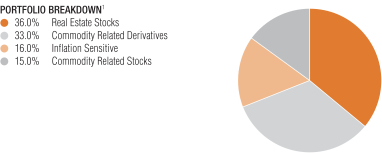

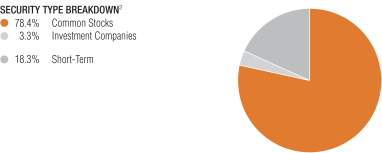

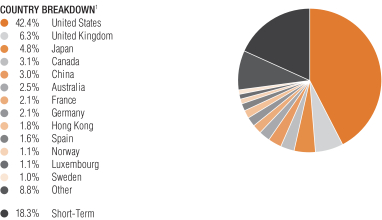

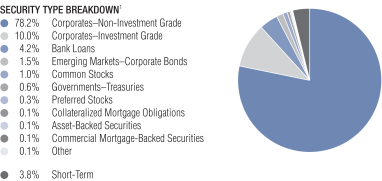

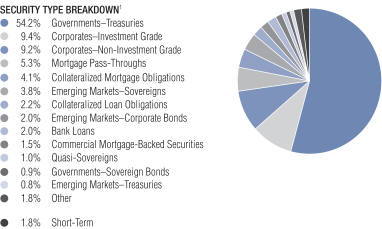

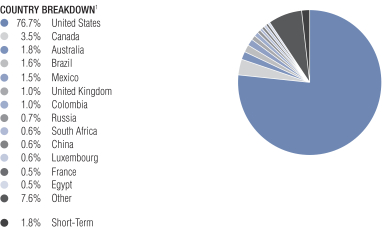

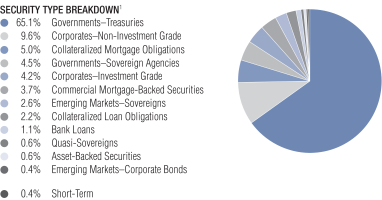

PORTFOLIO SUMMARY

October 31, 2021 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $1,332.3

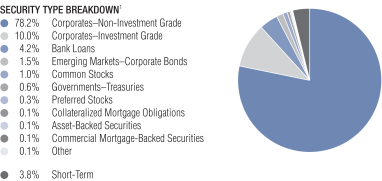

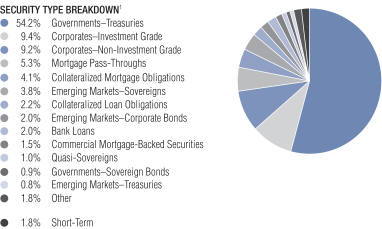

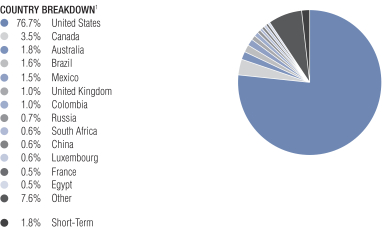

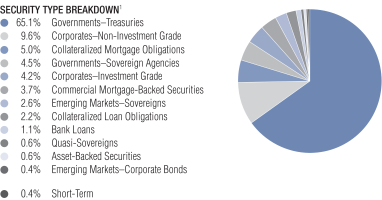

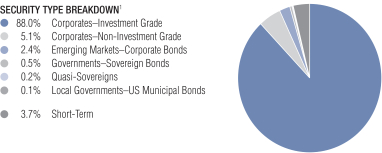

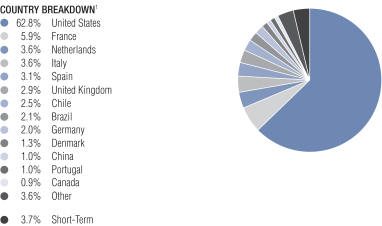

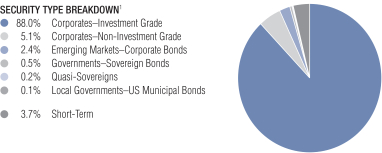

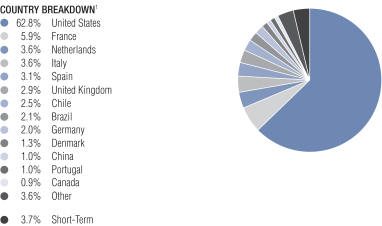

| 1 | All data are as of October 31, 2021. The portfolio breakdown is expressed as an approximate percentage of the Fund’s net assets inclusive of derivative exposure, based on the Adviser’s internal classification guidelines. |

| 2 | The Fund’s security type breakdown is expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Consolidated Portfolio of Investments” section of the report for additional details). |

| | |

| |

18 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

PORTFOLIO SUMMARY (continued)

October 31, 2021 (unaudited)

TEN LARGEST HOLDINGS2

| | | | | | | | |

| | |

| Company | | U.S. $ Value | | | Percent of

Net Assets | |

| | |

| Royal Dutch Shell PLC – Class B | | $ | 31,068,920 | | | | 2.3 | % |

| | |

| Prologis, Inc. | | | 26,950,674 | | | | 2.0 | |

| | |

| iShares Global Energy ETF | | | 23,204,849 | | | | 1.7 | |

| | |

| Simon Property Group, Inc. | | | 14,281,583 | | | | 1.1 | |

| | |

| Digital Realty Trust, Inc. | | | 13,290,758 | | | | 1.0 | |

| | |

| Chevron Corp. | | | 12,517,421 | | | | 0.9 | |

| | |

| TotalEnergies SE | | | 12,138,368 | | | | 0.9 | |

| | |

| Welltower, Inc. | | | 11,610,564 | | | | 0.9 | |

| | |

| Mitsui Fudosan Co., Ltd. | | | 11,534,805 | | | | 0.9 | |

| | |

| BP PLC | | | 11,279,965 | | | | 0.8 | |

| | |

| | $ | 167,877,907 | | | | 12.5 | % |

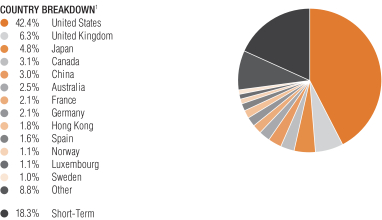

| 1 | All data are as of October 31, 2021. The Fund’s country breakdown is expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Consolidated Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 0.9% or less in the following: Austria, Belgium, Brazil, Chile, Denmark, Finland, Greece, India, Ireland, Israel, Italy, Mexico, Netherlands, New Zealand, Philippines, Russia, Singapore, South Africa, South Korea, Switzerland, Taiwan, Thailand, United Arab Emirates, United Republic of Tanzania and Zambia. |

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 19 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS

October 31, 2021

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

COMMON STOCKS – 75.4% | |

Real Estate – 33.7% | |

Diversified Real Estate Activities – 2.7% | |

Ayala Land, Inc. | | | 2,432,200 | | | $ | 1,693,518 | |

Daito Trust Construction Co., Ltd. | | | 19,100 | | | | 2,368,096 | |

Mitsubishi Estate Co., Ltd. | | | 191,600 | | | | 2,911,742 | |

Mitsui Fudosan Co., Ltd. | | | 504,500 | | | | 11,534,805 | |

New World Development Co., Ltd. | | | 1,028,750 | | | | 4,462,130 | |

Nomura Real Estate Holdings, Inc. | | | 34,400 | | | | 838,650 | |

Sumitomo Realty & Development Co., Ltd. | | | 50,600 | | | | 1,828,680 | |

Sun Hung Kai Properties Ltd. | | | 597,500 | | | | 7,921,848 | |

UOL Group Ltd. | | | 415,500 | | | | 2,228,504 | |

| | | | | | | | |

| | | | 35,787,973 | |

| | | | | |

Diversified REITs – 2.4% | |

Alexander & Baldwin, Inc. | | | 112,690 | | | | 2,764,286 | |

Broadstone Net Lease, Inc. | | | 80,450 | | | | 2,139,165 | |

Charter Hall Long Wale REIT | | | 599,370 | | | | 2,198,855 | |

Cofinimmo SA | | | 12,250 | | | | 1,976,340 | |

Essential Properties Realty Trust, Inc. | | | 179,230 | | | | 5,339,262 | |

Fibra Uno Administracion SA de CV | | | 991,230 | | | | 986,030 | |

Growthpoint Properties Ltd.(a) | | | 1,440,142 | | | | 1,221,882 | |

ICADE | | | 26,520 | | | | 2,079,748 | |

Land Securities Group PLC | | | 297,780 | | | | 2,797,488 | |

Merlin Properties Socimi SA | | | 362,400 | | | | 3,924,675 | |

Stockland | | | 1,819,436 | | | | 6,271,487 | |

| | | | | | | | |

| | | | 31,699,218 | |

| | | | | |

Health Care REITs – 1.6% | |

Medical Properties Trust, Inc. | | | 304,350 | | | | 6,491,785 | |

Physicians Realty Trust | | | 178,296 | | | | 3,389,407 | |

Welltower, Inc. | | | 144,410 | | | | 11,610,564 | |

| | | | | | | | |

| | | | 21,491,756 | |

| | | | | |

Hotel & Resort REITs – 0.9% | |

Apple Hospitality REIT, Inc. | | | 312,640 | | | | 4,911,575 | |

Park Hotels & Resorts, Inc.(b) | | | 235,610 | | | | 4,365,853 | |

RLJ Lodging Trust | | | 207,970 | | | | 2,998,927 | |

| | | | | | | | |

| | | | 12,276,355 | |

| | | | | |

Industrial REITs – 5.3% | |

Americold Realty Trust | | | 162,690 | | | | 4,794,474 | |

Ascendas Real Estate Investment Trust | | | 1,088,200 | | | | 2,492,447 | |

Centuria Industrial REIT | | | 384,710 | | | | 1,061,136 | |

Dream Industrial Real Estate Investment Trust | | | 331,324 | | | | 4,537,768 | |

GLP J-REIT | | | 1,693 | | | | 2,761,384 | |

Industrial & Infrastructure Fund Investment Corp. | | | 1,353 | | | | 2,480,789 | |

LondonMetric Property PLC | | | 676,760 | | | | 2,420,461 | |

Mitsui Fudosan Logistics Park, Inc. | | | 403 | | | | 2,142,733 | |

| | |

| |

20 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Plymouth Industrial REIT, Inc. | | | 54,286 | | | $ | 1,387,550 | |

Prologis, Inc. | | | 185,918 | | | | 26,950,674 | |

Rexford Industrial Realty, Inc. | | | 91,090 | | | | 6,121,248 | |

Segro PLC | | | 402,882 | | | | 7,120,755 | |

STAG Industrial, Inc. | | | 152,240 | | | | 6,627,007 | |

| | | | | | | | |

| | | | 70,898,426 | |

| | | | | |

Office REITs – 2.7% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 46,191 | | | | 9,429,431 | |

alstria office REIT-AG | | | 182,980 | | | | 3,420,231 | |

City Office REIT, Inc. | | | 273,270 | | | | 5,183,932 | |

Cousins Properties, Inc. | | | 165,835 | | | | 6,568,724 | |

Daiwa Office Investment Corp. | | | 284 | | | | 1,833,190 | |

Japan Prime Realty Investment Corp. | | | 525 | | | | 1,925,652 | |

Nippon Building Fund, Inc. | | | 670 | | | | 4,352,952 | |

Orix JREIT, Inc. | | | 130 | | | | 215,684 | |

True North Commercial Real Estate Investment Trust | | | 146,620 | | | | 881,426 | |

Workspace Group PLC | | | 174,140 | | | | 1,958,986 | |

| | | | | | | | |

| | | | | | | 35,770,208 | |

| | | | | | | | |

Real Estate Development – 1.6% | | | | | | | | |

China Resources Land Ltd. | | | 990,000 | | | | 3,846,613 | |

CIFI Holdings Group Co., Ltd. | | | 8,058,000 | | | | 4,472,820 | |

Emaar Properties PJSC | | | 1,560,120 | | | | 1,707,910 | |

Instone Real Estate Group SE(c) | | | 88,019 | | | | 2,319,899 | |

Longfor Group Holdings Ltd.(c) | | | 437,000 | | | | 2,114,171 | |

Megaworld Corp. | | | 17,716,000 | | | | 1,079,339 | |

Midea Real Estate Holding Ltd.(a)(c) | | | 2,554,000 | | | | 4,407,907 | |

Times China Holdings Ltd. | | | 2,686,000 | | | | 1,827,703 | |

| | | | | | | | |

| | | | | | | 21,776,362 | |

| | | | | | | | |

Real Estate Operating Companies – 2.9% | | | | | | | | |

Aroundtown SA | | | 584,280 | | | | 4,060,460 | |

CA Immobilien Anlagen AG | | | 64,239 | | | | 2,756,431 | |

Castellum AB(a) | | | 110,250 | | | | 2,938,562 | |

Central Pattana PCL | | | 820,600 | | | | 1,465,247 | |

CIFI Ever Sunshine Services Group Ltd.(c) | | | 560,120 | | | | 999,526 | |

CTP NV(c) | | | 118,359 | | | | 2,513,467 | |

Fastighets AB Balder – Class B(a)(b) | | | 70,280 | | | | 5,095,860 | |

Hulic Co., Ltd. | | | 176,200 | | | | 1,694,250 | |

LEG Immobilien SE | | | 35,330 | | | | 5,255,091 | |

Shurgard Self Storage SA | | | 36,080 | | | | 2,210,549 | |

Swire Properties Ltd. | | | 783,600 | | | | 2,100,805 | |

TAG Immobilien AG | | | 122,620 | | | | 3,725,327 | |

VGP NV | | | 7,460 | | | | 1,929,400 | |

Vonovia SE | | | 22,530 | | | | 1,366,733 | |

| | | | | | | | |

| | | | | | | 38,111,708 | |

| | | | | | | | |

Real Estate Services – 0.0% | | | | | | | | |

FirstService Corp. | | | 2,412 | | | | 481,075 | |

| | | | | | | | |

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 21 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Residential REITs – 5.6% | |

American Campus Communities, Inc. | | | 98,240 | | | $ | 5,277,453 | |

American Homes 4 Rent – Class A | | | 158,720 | | | | 6,444,032 | |

Bluerock Residential Growth REIT, Inc. | | | 80,910 | | | | 1,094,712 | |

Comforia Residential REIT, Inc. | | | 685 | | | | 1,995,350 | |

Daiwa Securities Living Investments Corp. | | | 2,130 | | | | 2,151,760 | |

Equity Residential | | | 5,540 | | | | 478,656 | |

Essex Property Trust, Inc. | | | 27,260 | | | | 9,266,492 | |

Independence Realty Trust, Inc. | | | 277,370 | | | | 6,554,253 | |

Invitation Homes, Inc. | | | 162,450 | | | | 6,701,062 | |

Killam Apartment Real Estate Investment Trust | | | 296,860 | | | | 5,454,587 | |

Mid-America Apartment Communities, Inc. | | | 35,870 | | | | 7,325,013 | |

Minto Apartment Real Estate Investment Trust(c) | | | 135,080 | | | | 2,501,643 | |

Sun Communities, Inc. | | | 51,497 | | | | 10,092,382 | |

UDR, Inc. | | | 129,870 | | | | 7,211,681 | |

UNITE Group PLC (The) | | | 160,040 | | | | 2,389,523 | |

| | | | | | | | |

| | | | | | | 74,938,599 | |

| | | | | | | | |

Retail REITs – 3.9% | |

AEON REIT Investment Corp. | | | 2,358 | | | | 3,187,644 | |

Brixmor Property Group, Inc. | | | 240,460 | | | | 5,636,382 | |

CapitaLand Integrated Commercial Trust | | | 2,464,760 | | | | 3,925,020 | |

Eurocommercial Properties NV | | | 144,615 | | | | 3,375,262 | |

Federal Realty Investment Trust | | | 42,430 | | | | 5,106,451 | |

Link REIT | | | 579,901 | | | | 5,137,597 | |

Mercialys SA | | | 154,538 | | | | 1,678,775 | |

NETSTREIT Corp. | | | 185,876 | | | | 4,505,634 | |

Simon Property Group, Inc. | | | 97,432 | | | | 14,281,583 | |

SITE Centers Corp. | | | 282,270 | | | | 4,485,270 | |

| | | | | | | | |

| | | | | | | 51,319,618 | |

| | | | | | | | |

Specialized REITs – 4.1% | |

American Tower Corp. | | | 12,898 | | | | 3,636,849 | |

Crown Castle International Corp. | | | 11,850 | | | | 2,136,555 | |

CubeSmart | | | 117,980 | | | | 6,490,080 | |

Digital Realty Trust, Inc. | | | 84,220 | | | | 13,290,758 | |

EPR Properties | | | 84,920 | | | | 4,263,833 | |

Equinix, Inc. | | | 7,380 | | | | 6,177,577 | |

Iron Mountain, Inc. | | | 24,108 | | | | 1,100,289 | |

National Storage Affiliates Trust | | | 59,890 | | | | 3,740,730 | |

Public Storage | | | 19,490 | | | | 6,474,188 | |

Safestore Holdings PLC | | | 247,540 | | | | 4,072,028 | |

SBA Communications Corp. | | | 3,004 | | | | 1,037,371 | |

VICI Properties, Inc.(a) | | | 31,384 | | | | 921,120 | |

Weyerhaeuser Co. | | | 39,071 | | | | 1,395,616 | |

| | | | | | | | |

| | | | | | | 54,736,994 | |

| | | | | | | | |

| | | | | | | 449,288,292 | |

| | | | | | | | |

| | |

| |

22 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Energy – 9.8% | |

Integrated Oil & Gas – 7.3% | | | | | | | | |

BP PLC | | | 2,354,456 | | | $ | 11,279,965 | |

Chevron Corp. | | | 109,332 | | | | 12,517,421 | |

Exxon Mobil Corp. | | | 127,375 | | | | 8,211,866 | |

Gazprom PJSC (Sponsored ADR) | | | 392,220 | | | | 3,863,367 | |

LUKOIL PJSC (Sponsored ADR) | | | 19,679 | | | | 2,007,848 | |

OMV AG | | | 30,138 | | | | 1,824,655 | |

PetroChina Co., Ltd. – Class H | | | 13,632,000 | | | | 6,572,634 | |

Repsol SA | | | 509,184 | | | | 6,521,899 | |

Royal Dutch Shell PLC – Class A | | | 29,773 | | | | 682,066 | |

Royal Dutch Shell PLC – Class B | | | 1,353,841 | | | | 31,068,920 | |

TotalEnergies SE | | | 242,404 | | | | 12,138,368 | |

| | | | | | | | |

| | | | | | | 96,689,009 | |

| | | | | | | | |

Oil & Gas Equipment & Services – 0.2% | | | | | | | | |

Subsea 7 SA | | | 366,830 | | | | 3,292,850 | |

| | | | | | | | |

| | |

Oil & Gas Exploration & Production – 1.3% | | | | | | | | |

Aker BP ASA | | | 137,490 | | | | 5,275,753 | |

Canadian Natural Resources Ltd. | | | 25,521 | | | | 1,084,684 | |

EOG Resources, Inc. | | | 98,232 | | | | 9,082,531 | |

Pioneer Natural Resources Co. | | | 3,684 | | | | 688,834 | |

Williams Cos., Inc. (The) | | | 33,310 | | | | 935,678 | |

| | | | | | | | |

| | | | | | | 17,067,480 | |

| | | | | | | | |

Oil & Gas Refining & Marketing – 0.4% | | | | | | | | |

ENEOS Holdings, Inc. | | | 860,500 | | | | 3,469,751 | |

Gevo, Inc.(a)(b) | | | 33,479 | | | | 242,053 | |

Idemitsu Kosan Co., Ltd. | | | 16,000 | | | | 436,997 | |

Neste Oyj | | | 2,377 | | | | 132,332 | |

Renewable Energy Group, Inc.(b) | | | 8,841 | | | | 565,824 | |

VERBIO Vereinigte BioEnergie AG | | | 3,118 | | | | 247,915 | |

| | | | | | | | |

| | | | | | | 5,094,872 | |

| | | | | | | | |

Oil & Gas Storage & Transportation – 0.6% | | | | | | | | |

Antero Midstream Corp. | | | 8,901 | | | | 94,707 | |

Cheniere Energy, Inc.(b) | | | 6,466 | | | | 668,584 | |

Enbridge, Inc. | | | 68,600 | | | | 2,873,484 | |

EnLink Midstream LLC(b) | | | 7,120 | | | | 55,892 | |

Gibson Energy, Inc.(a) | | | 4,015 | | | | 80,910 | |

Keyera Corp.(a) | | | 6,059 | | | | 155,294 | |

Kinder Morgan, Inc. | | | 53,441 | | | | 895,137 | |

Koninklijke Vopak NV(a) | | | 1,792 | | | | 71,318 | |

ONEOK, Inc. | | | 12,218 | | | | 777,309 | |

Pembina Pipeline Corp.(a) | | | 15,080 | | | | 499,214 | |

Targa Resources Corp. | | | 6,269 | | | | 342,726 | |

TC Energy Corp. | | | 26,846 | | | | 1,452,278 | |

| | | | | | | | |

| | | | | | | 7,966,853 | |

| | | | | | | | |

| | | | | | | 130,111,064 | |

| | | | | | | | |

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 23 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Materials – 7.9% | |

Aluminum – 0.4% | | | | | | | | |

Alcoa Corp. | | | 77,671 | | | $ | 3,568,983 | |

Norsk Hydro ASA | | | 164,613 | | | | 1,209,159 | |

| | | | | | | | |

| | | | | | | 4,778,142 | |

| | | | | | | | |

Commodity Chemicals – 0.4% | | | | | | | | |

Beijing Sanju Environmental Protection and New Material Co., Ltd.(b) | | | 689,885 | | | | 656,598 | |

Corteva, Inc. | | | 75,330 | | | | 3,250,490 | |

Ecopro Co., Ltd. | | | 4,315 | | | | 371,012 | |

Guangzhou Tinci Materials Technology Co., Ltd. | | | 15,240 | | | | 392,196 | |

Kuraray Co., Ltd. | | | 32,400 | | | | 293,189 | |

LG Chem Ltd. | | | 404 | | | | 289,892 | |

Mitsubishi Chemical Holdings Corp. | | | 64,200 | | | | 531,411 | |

W-Scope Corp.(a)(b) | | | 36,600 | | | | 292,930 | |

| | | | | | | | |

| | | | | | | 6,077,718 | |

| | | | | | | | |

Construction Materials – 0.3% | | | | | | | | |

CSR Ltd. | | | 454,731 | | | | 2,041,377 | |

GCC SAB de CV | | | 210,117 | | | | 1,550,261 | |

| | | | | | | | |

| | | | | | | 3,591,638 | |

| | | | | | | | |

Copper – 0.4% | | | | | | | | |

First Quantum Minerals Ltd. | | | 128,343 | | | | 3,038,502 | |

Lundin Mining Corp. | | | 198,211 | | | | 1,724,897 | |

OZ Minerals Ltd. | | | 59,404 | | | | 1,129,974 | |

| | | | | | | | |

| | | | | | | 5,893,373 | |

| | | | | | | | |

Diversified Chemicals – 0.2% | | | | | | | | |

Daicel Corp. | | | 46,400 | | | | 347,409 | |

Kemira Oyj(a) | | | 21,483 | | | | 329,933 | |

LANXESS AG | | | 3,639 | | | | 245,205 | |

Sumitomo Chemical Co., Ltd. | | | 370,100 | | | | 1,823,229 | |

| | | | | | | | |

| | | | | | | 2,745,776 | |

| | | | | | | | |

Diversified Metals & Mining – 2.2% | | | | | | | | |

Anglo American PLC | | | 229,732 | | | | 8,739,700 | |

China Molybdenum Co., Ltd.(a) | | | 825,000 | | | | 510,017 | |

Ganfeng Lithium Co., Ltd. | | | 11,600 | | | | 303,714 | |

GEM Co., Ltd. | | | 163,600 | | | | 278,263 | |

Glencore PLC(b) | | | 1,751,964 | | | | 8,760,837 | |

MMC Norilsk Nickel PJSC (ADR) | | | 63,294 | | | | 1,976,241 | |

Nanjing Hanrui Cobalt Co., Ltd. | | | 24,200 | | | | 298,908 | |

Orocobre Ltd.(a)(b) | | | 164,922 | | | | 1,113,784 | |

Rio Tinto Ltd. | | | 10,788 | | | | 739,115 | |

Rio Tinto PLC | | | 98,024 | | | | 6,111,940 | |

Zhejiang Huayou Cobalt Co., Ltd. | | | 18,600 | | | | 322,594 | |

| | | | | | | | |

| | | | | | | 29,155,113 | |

| | | | | | | | |

Fertilizers & Agricultural Chemicals – 0.2% | | | | | | | | |

CF Industries Holdings, Inc. | | | 39,470 | | | | 2,241,896 | |

| | | | | | | | |

| | |

| |

24 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Gold – 1.1% | |

Agnico Eagle Mines Ltd. | | | 113,374 | | | $ | 6,017,726 | |

AngloGold Ashanti Ltd. | | | 193,632 | | | | 3,572,266 | |

Barrick Gold Corp. | | | 138,320 | | | | 2,540,938 | |

Northern Star Resources Ltd. | | | 115,284 | | | | 798,092 | |

Regis Resources Ltd. | | | 484,394 | | | | 726,421 | |

St. Barbara Ltd. | | | 588,647 | | | | 647,276 | |

| | | | | | | | |

| | | | | | | 14,302,719 | |

| | | | | | | | |

Industrial Gases – 0.1% | |

Air Liquide SA | | | 3,162 | | | | 527,920 | |

Air Products and Chemicals, Inc. | | | 1,861 | | | | 557,946 | |

Linde PLC | | | 1,884 | | | | 601,373 | |

| | | | | | | | |

| | | | | | | 1,687,239 | |

| | | | | | | | |

Paper Packaging – 0.1% | |

Sealed Air Corp. | | | 12,212 | | | | 724,416 | |

Smurfit Kappa Group PLC | | | 8,472 | | | | 444,073 | |

| | | | | | | | |

| | | | | | | 1,168,489 | |

| | | | | | | | |

Paper Products – 0.4% | |

Stora Enso Oyj – Class R | | | 205,540 | | | | 3,420,086 | |

Suzano SA(b) | | | 226,500 | | | | 1,975,725 | |

| | | | | | | | |

| | | | | | | 5,395,811 | |

| | | | | | | | |

Precious Metals & Minerals – 0.0% | |

Industrias Penoles SAB de CV(b) | | | 47,462 | | | | 605,885 | |

| | | | | | | | |

|

Specialty Chemicals – 0.5% | |

Albemarle Corp. | | | 1,742 | | | | 436,319 | |

Beijing Easpring Material Technology Co., Ltd. | | | 26,500 | | | | 366,828 | |

Chr Hansen Holding A/S | | | 1,373 | | | | 109,242 | |

Danimer Scientific, Inc.(a)(b) | | | 23,998 | | | | 354,210 | |

Ecolab, Inc. | | | 2,270 | | | | 504,439 | |

Evonik Industries AG | | | 12,030 | | | | 389,782 | |

IMCD NV | | | 1,814 | | | | 402,789 | |

Johnson Matthey PLC | | | 10,190 | | | | 380,857 | |

Koninklijke DSM NV | | | 2,601 | | | | 568,262 | |

Livent Corp.(b) | | | 12,480 | | | | 352,186 | |

Novozymes A/S – Class B | | | 3,794 | | | | 279,082 | |

Shanghai Putailai New Energy Technology Co., Ltd. | | | 11,260 | | | | 313,054 | |

Shenzhen Capchem Technology Co., Ltd. | | | 15,000 | | | | 336,322 | |

Sika AG | | | 1,915 | | | | 648,763 | |

Symrise AG | | | 1,138 | | | | 157,410 | |

Umicore SA(a) | | | 18,619 | | | | 1,067,548 | |

Wacker Chemie AG | | | 2,572 | | | | 464,778 | |

| | | | | | | | |

| | | | | | | 7,131,871 | |

| | | | | | | | |

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 25 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Steel – 1.6% | |

APERAM SA | | | 79,411 | | | $ | 4,734,771 | |

ArcelorMittal SA | | | 254,432 | | | | 8,604,924 | |

Commercial Metals Co. | | | 21,118 | | | | 679,577 | |

Evraz PLC | | | 190,089 | | | | 1,614,616 | |

Steel Dynamics, Inc. | | | 21,346 | | | | 1,410,544 | |

Vale SA (Sponsored ADR) – Class B | | | 303,110 | | | | 3,858,590 | |

| | | | | | | | |

| | | | | | | 20,903,022 | |

| | | | | | | | |

| | | | | | | 105,678,692 | |

| | | | | | | | |

Capital Goods – 4.0% | |

Aerospace & Defense – 0.0% | |

Hexcel Corp.(b) | | | 9,342 | | | | 530,065 | |

| | | | | | | | |

|

Agricultural & Farm Machinery – 0.1% | |

Lindsay Corp. | | | 3,157 | | | | 459,880 | |

Toro Co. (The) | | | 2,984 | | | | 284,883 | |

| | | | | | | | |

| | | | | | | 744,763 | |

| | | | | | | | |

Building Products – 0.8% | |

A O Smith Corp. | | | 9,429 | | | | 688,977 | |

Carrier Global Corp. | | | 26,585 | | | | 1,388,535 | |

Cie de Saint-Gobain | | | 20,068 | | | | 1,384,944 | |

Fletcher Building Ltd. | | | 350,720 | | | | 1,803,863 | |

Johnson Controls International PLC | | | 4,652 | | | | 341,317 | |

Kingspan Group PLC | | | 2,980 | | | | 343,072 | |

Lennox International, Inc. | | | 1,674 | | | | 500,995 | |

Nibe Industrier AB | | | 31,588 | | | | 469,829 | |

Owens Corning | | | 23,487 | | | | 2,193,921 | |

ROCKWOOL International A/S | | | 778 | | | | 355,791 | |

Xinyi Glass Holdings Ltd. | | | 128,000 | | | | 360,697 | |

Zurn Water Solutions Corp. | | | 19,008 | | | | 689,610 | |

| | | | | | | | |

| | | | | | | 10,521,551 | |

| | | | | | | | |

Construction & Engineering – 0.2% | |

Arcosa, Inc. | | | 16,172 | | | | 836,577 | |

Ferrovial SA(a) | | | 13,768 | | | | 434,629 | |

Vinci SA | | | 14,256 | | | | 1,524,112 | |

| | | | | | | | |

| | | | | | | 2,795,318 | |

| | | | | | | | |

Construction & Farm Machinery & Heavy Trucks – 0.0% | | | | | | | | |

Cummins, Inc. | | | 1,456 | | | | 349,207 | |

| | | | | | | | |

| | |

Electrical Components & Equipment – 1.4% | | | | | | | | |

ABB Ltd. | | | 11,759 | | | | 389,026 | |

Acuity Brands, Inc. | | | 8,773 | | | | 1,802,237 | |

Advent Technologies Holdings, Inc.(a)(b) | | | 56,712 | | | | 543,868 | |

AFC Energy PLC(b) | | | 301,665 | | | | 248,864 | |

Amara Raja Batteries Ltd. | | | 27,760 | | | | 253,314 | |

Ballard Power Systems, Inc.(a)(b) | | | 36,133 | | | | 654,867 | |

Blink Charging Co.(a)(b) | | | 11,843 | | | | 376,607 | |

| | |

| |

26 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Camel Group Co., Ltd. | | | 281,700 | | | $ | 576,129 | |

Ceres Power Holdings PLC(b) | | | 14,001 | | | | 238,633 | |

Contemporary Amperex Technology Co., Ltd. | | | 3,300 | | | | 330,568 | |

EnerSys | | | 6,595 | | | | 527,864 | |

Eve Energy Co., Ltd. | | | 21,200 | | | | 375,785 | |

First Solar, Inc.(b) | | | 7,065 | | | | 844,903 | |

FuelCell Energy, Inc.(a)(b) | | | 54,794 | | | | 437,804 | |

Gotion High-tech Co., Ltd.(b) | | | 40,500 | | | | 372,976 | |

GS Yuasa Corp. | | | 13,500 | | | | 293,890 | |

Hubbell, Inc. | | | 3,509 | | | | 699,589 | |

Legrand SA | | | 3,523 | | | | 384,324 | |

Nexans SA | | | 2,646 | | | | 265,483 | |

nVent Electric PLC | | | 25,762 | | | | 913,263 | |

Plug Power, Inc.(b) | | | 12,000 | | | | 459,240 | |

PowerCell Sweden AB(a)(b) | | | 11,096 | | | | 247,991 | |

Prysmian SpA | | | 36,230 | | | | 1,369,823 | |

Rockwell Automation, Inc. | | | 6,271 | | | | 2,002,957 | |

Schneider Electric SE | | | 2,732 | | | | 471,046 | |

Signify NV(c) | | | 11,990 | | | | 580,992 | |

SMA Solar Technology AG | | | 8,964 | | | | 473,952 | |

Sunrun, Inc.(a)(b) | | | 12,799 | | | | 738,246 | |

Vertiv Holdings Co. | | | 57,410 | | | | 1,474,289 | |

| | | | | | | | |

| | | | | | | 18,348,530 | |

| | | | | | | | |

Heavy Electrical Equipment – 0.4% | |

Bloom Energy Corp.(b) | | | 14,667 | | | | 458,490 | |

CS Wind Corp. | | | 5,270 | | | | 314,617 | |

ITM Power PLC(a)(b) | | | 49,114 | | | | 328,440 | |

Ming Yang Smart Energy Group Ltd. | | | 104,319 | | | | 504,922 | |

NARI Technology Co., Ltd. | | | 62,560 | | | | 380,923 | |

NEL ASA(b) | | | 164,208 | | | | 347,672 | |

Nordex SE(b) | | | 22,766 | | | | 418,378 | |

Siemens Energy AG(b) | | | 22,603 | | | | 648,719 | |

Siemens Gamesa Renewable Energy SA(a)(b) | | | 14,778 | | | | 401,010 | |

TPI Composites, Inc.(b) | | | 11,283 | | | | 379,447 | |

Unison Co., Ltd./South Korea(b) | | | 117,462 | | | | 347,216 | |

Vestas Wind Systems A/S | | | 6,247 | | | | 270,055 | |

Xinjiang Goldwind Science & Technology Co., Ltd. – Class H | | | 218,000 | | | | 487,512 | |

| | | | | | | | |

| | | | | | | 5,287,401 | |

| | | | | | | | |

Industrial Conglomerates – 0.1% | | | | | | | | |

General Electric Co. | | | 4,926 | | | | 516,590 | |

Honeywell International, Inc. | | | 2,617 | | | | 572,128 | |

Roper Technologies, Inc. | | | 1,074 | | | | 523,972 | |

| | | | | | | | |

| | | | | | | 1,612,690 | |

| | | | | | | | |

Industrial Machinery – 0.9% | | | | | | | | |

Chart Industries, Inc.(b) | | | 2,449 | | | | 434,746 | |

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 27 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

China Conch Venture Holdings Ltd. | | | 79,500 | | | $ | 386,318 | |

Energy Recovery, Inc.(b) | | | 25,821 | | | | 524,683 | |

Evoqua Water Technologies Corp.(b) | | | 13,199 | | | | 552,114 | |

GEA Group AG | | | 6,521 | | | | 321,167 | |

John Bean Technologies Corp. | | | 3,342 | | | | 493,781 | |

Kurita Water Industries Ltd. | | | 3,600 | | | | 177,810 | |

McPhy Energy SA(b) | | | 10,858 | | | | 294,620 | |

Mitsubishi Heavy Industries Ltd. | | | 68,000 | | | | 1,738,954 | |

Mueller Industries, Inc. | | | 12,117 | | | | 637,839 | |

NGK Insulators Ltd. | | | 21,800 | | | | 362,995 | |

Pentair PLC | | | 8,506 | | | | 629,189 | |

Snap-on, Inc. | | | 7,402 | | | | 1,504,308 | |

SPX Corp.(b) | | | 9,623 | | | | 559,000 | |

Techtronic Industries Co., Ltd. | | | 91,000 | | | | 1,869,618 | |

Trane Technologies PLC | | | 1,599 | | | | 289,307 | |

Watts Water Technologies, Inc. | | | 1,871 | | | | 355,527 | |

Xylem, Inc./NY | | | 4,288 | | | | 559,970 | |

| | | | | | | | |

| | | | | | | 11,691,946 | |

| | | | | | | | |

Trading Companies & Distributors – 0.1% | | | | | | | | |

WW Grainger, Inc. | | | 3,997 | | | | 1,851,051 | |

| | | | | | | | |

| | | | | | | 53,732,522 | |

| | | | | | | | |

Utilities – 3.6% | | | | | | | | |

Electric Utilities – 1.1% | | | | | | | | |

Acciona SA | | | 1,777 | | | | 341,260 | |

AusNet Services Ltd. | | | 52,502 | | | | 97,635 | |

Avangrid, Inc. | | | 14,135 | | | | 744,915 | |

Contact Energy Ltd. | | | 20,730 | | | | 121,640 | |

Edison International | | | 10,410 | | | | 655,101 | |

Elia Group SA/NV(a) | | | 922 | | | | 107,564 | |

Enel SpA | | | 585,486 | | | | 4,901,561 | |

Eversource Energy | | | 9,422 | | | | 799,928 | |

Exelon Corp. | | | 13,834 | | | | 735,831 | |

Fjordkraft Holding ASA(c) | | | 2,632 | | | | 15,670 | |

Fortis, Inc./Canada | | | 12,919 | | | | 575,071 | |

Hydro One Ltd.(c) | | | 8,364 | | | | 199,841 | |

Iberdrola SA | | | 45,224 | | | | 534,029 | |

Infratil Ltd. | | | 16,493 | | | | 97,860 | |

NextEra Energy, Inc. | | | 5,340 | | | | 455,662 | |

NRG Energy, Inc. | | | 40,668 | | | | 1,622,247 | |

Orsted AS(c) | | | 1,665 | | | | 235,169 | |

PG&E Corp.(b) | | | 41,366 | | | | 479,846 | |

Red Electrica Corp. SA | | | 23,367 | | | | 486,542 | |

Spark Infrastructure Group | | | 48,115 | | | | 102,009 | |

SSE PLC | | | 9,148 | | | | 206,009 | |

Terna – Rete Elettrica Nazionale | | | 70,453 | | | | 524,930 | |

Verbund AG(a) | | | 2,666 | | | | 277,910 | |

| | | | | | | | |

| | | | | | | 14,318,230 | |

| | | | | | | | |

| | |

| |

28 | AB ALL MARKET REAL RETURN PORTFOLIO | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Gas Utilities – 0.4% | | | | | | | | |

APA Group(a) | | | 32,348 | | | $ | 200,708 | |

Atmos Energy Corp. | | | 3,586 | | | | 330,342 | |

Beijing Enterprises Holdings Ltd. | | | 13,148 | | | | 50,539 | |

Chesapeake Utilities Corp. | | | 482 | | | | 63,176 | |

China Gas Holdings Ltd. | | | 67,353 | | | | 168,114 | |

China Resources Gas Group Ltd. | | | 24,742 | | | | 132,924 | |

Enagas SA | | | 6,823 | | | | 153,104 | |

ENN Energy Holdings Ltd. | | | 20,754 | | | | 357,560 | |

Hong Kong & China Gas Co., Ltd. | | | 296,724 | | | | 460,970 | |

Italgas SpA | | | 13,310 | | | | 84,565 | |

Kunlun Energy Co., Ltd. | | | 109,202 | | | | 99,459 | |

National Fuel Gas Co. | | | 2,500 | | | | 143,575 | |

Naturgy Energy Group SA | | | 9,038 | | | | 237,481 | |

New Jersey Resources Corp. | | | 2,643 | | | | 99,932 | |

Northwest Natural Holding Co. | | | 841 | | | | 37,921 | |

ONE Gas, Inc. | | | 1,467 | | | | 98,729 | |

Snam SpA | | | 56,207 | | | | 318,345 | |

Southwest Gas Holdings, Inc. | | | 1,620 | | | | 112,185 | |

Spire, Inc. | | | 1,417 | | | | 88,931 | |

Toho Gas Co., Ltd. | | | 2,721 | | | | 80,603 | |

Tokyo Gas Co., Ltd. | | | 11,244 | | | | 195,116 | |

Towngas China Co., Ltd. | | | 26,698 | | | | 18,329 | |

UGI Corp. | | | 37,546 | | | | 1,629,872 | |

| | | | | | | | |

| | | | | | | 5,162,480 | |

| | | | | | | | |

Independent Power and Renewable Electricity Producers – 0.9% | | | | | | | | |

Albioma SA | | | 14,005 | | | | 550,943 | |

Atlantica Sustainable Infrastructure PLC(a) | | | 16,858 | | | | 663,362 | |

Azure Power Global Ltd.(a)(b) | | | 19,907 | | | | 473,588 | |

Boralex, Inc. | | | 19,602 | | | | 606,623 | |

Brookfield Renewable Corp. | | | 12,557 | | | | 520,097 | |

China Longyuan Power Group Corp. Ltd. | | | 180,000 | | | | 421,027 | |

EDP Renovaveis SA | | | 110,007 | | | | 3,064,751 | |

Energix-Renewable Energies Ltd. | | | 75,069 | | | | 353,318 | |

Enlight Renewable Energy Ltd.(b) | | | 149,790 | | | | 369,281 | |

Falck Renewables SpA(a) | | | 35,245 | | | | 355,461 | |

Innergex Renewable Energy, Inc.(a) | | | 36,920 | | | | 614,538 | |

Meridian Energy Ltd. | | | 41,937 | | | | 150,231 | |

Neoen SA(b)(c) | | | 5,486 | | | | 252,589 | |

NextEra Energy Partners LP | | | 8,157 | | | | 703,949 | |

Omega Geracao SA(b) | | | 44,100 | | | | 255,748 | |

Ormat Technologies, Inc.(a)(b) | | | 8,140 | | | | 588,766 | |

RENOVA, Inc.(b) | | | 7,500 | | | | 329,932 | |

Solaria Energia y Medio Ambiente SA(b) | | | 17,349 | | | | 347,192 | |

Terna Energy SA | | | 20,726 | | | | 280,323 | |

TransAlta Renewables, Inc. | | | 43,427 | | | | 642,843 | |

Xinyi Energy Holdings Ltd. | | | 546,000 | | | | 321,943 | |

| | | | | | | | |

| | | | | | | 11,866,505 | |

| | | | | | | | |

| | |

| |

| abfunds.com | | AB ALL MARKET REAL RETURN PORTFOLIO | 29 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| |

Independent Power Producers & Energy Traders – 0.2% | | | | | | | | |

AES Corp. (The) | | | 24,013 | | | $ | 603,447 | |

Cia Energetica de Sao Paulo (Preference Shares) | | | 93,200 | | | | 421,099 | |

Clearway Energy, Inc. | | | 18,012 | | | | 594,216 | |

Drax Group PLC | | | 62,232 | | | | 452,602 | |

ERG SpA | | | 11,773 | | | | 425,287 | |

Guangxi Guiguan Electric Power Co., Ltd. | | | 299,800 | | | | 271,255 | |

Northland Power, Inc. | | | 19,571 | | | | 629,226 | |

| | | | | | | | |

| | | | | | | 3,397,132 | |

| | | | | | | | |

Multi-Utilities – 0.5% | | | | | | | | |

ACEA SpA | | | 1,167 | | | | 25,308 | |

Algonquin Power & Utilities Corp.(a) | | | 42,489 | | | | 612,479 | |

CenterPoint Energy, Inc. | | | 16,255 | | | | 423,280 | |

Consolidated Edison, Inc. | | | 9,689 | | | | 730,551 | |

E.ON SE | | | 49,460 | | | | 627,143 | |

National Grid PLC | | | 133,115 | | | | 1,704,345 | |

NiSource, Inc. | | | 10,758 | | | | 265,400 | |

NorthWestern Corp. | | | 1,413 | | | | 80,343 | |

RWE AG | | | 17,752 | | | | 683,304 | |

Sempra Energy | | | 8,755 | | | | 1,117,401 | |

Suez SA | | | 5,247 | | | | 119,400 | |

United Utilities Group PLC | | | 35,594 | | | | 505,903 | |

Unitil Corp. | | | 434 | | | | 18,119 | |

Veolia Environnement SA | | | 8,791 | | | | 287,105 | |

| | | | | | | | |

| | | | | | | 7,200,081 | |

| | | | | | | | |

Water Utilities – 0.5% | | | | | | | | |

Aguas Andinas SA | | | 1,812,279 | | | | 345,302 | |

American States Water Co. | | | 6,475 | | | | 588,189 | |