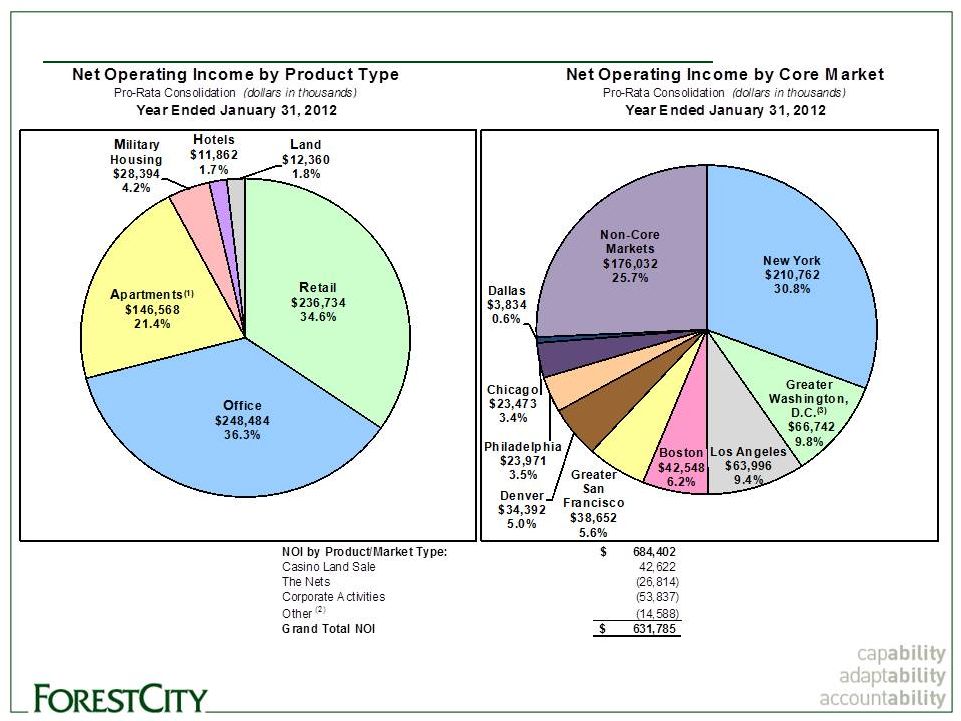

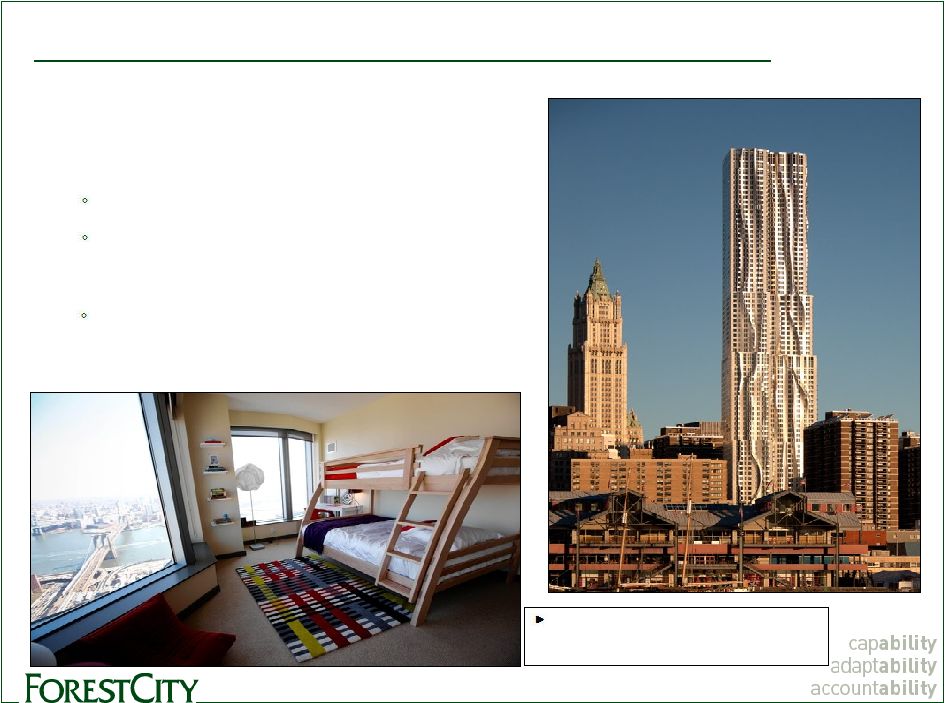

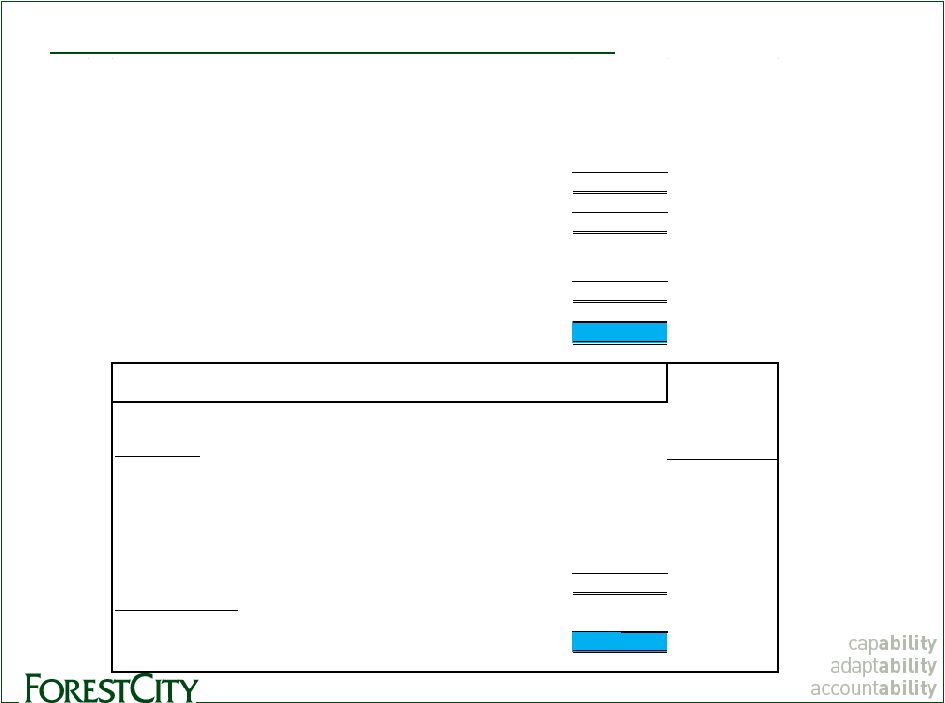

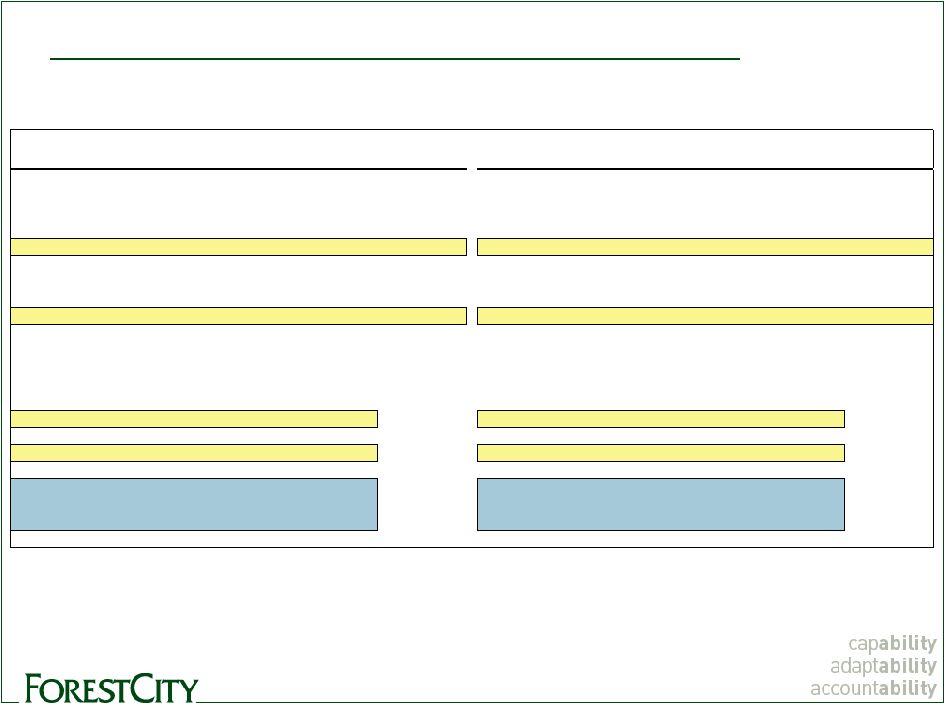

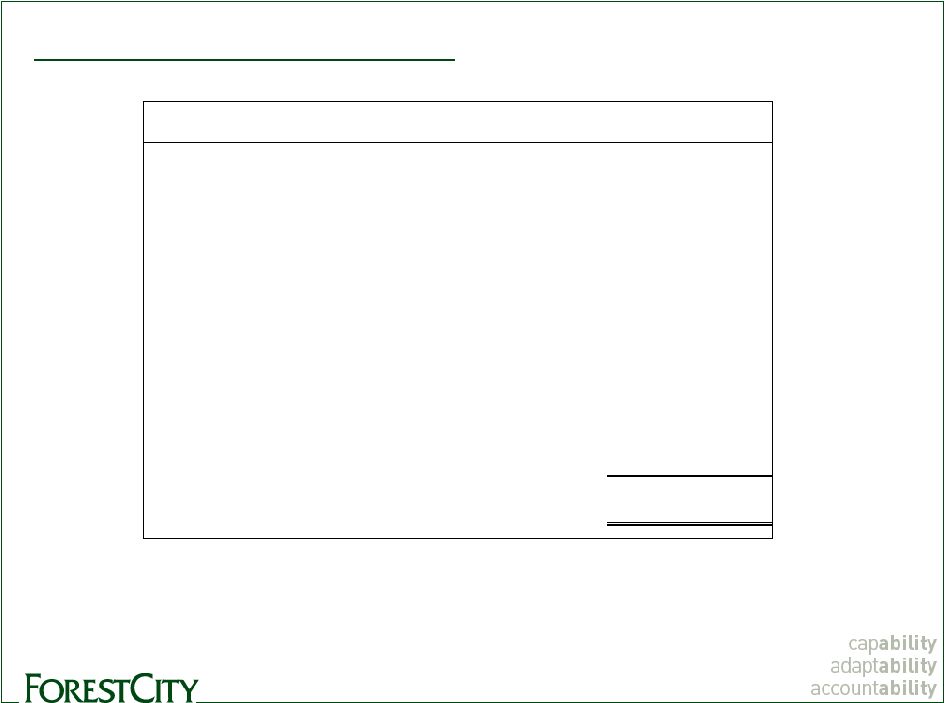

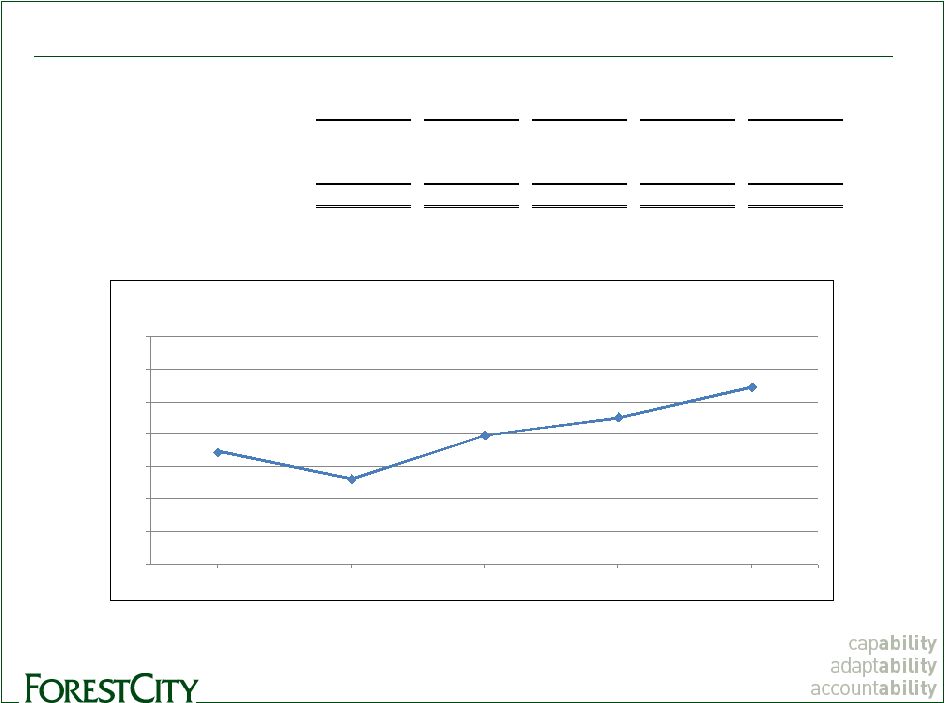

Net Asset Value Components Footnotes 32 Net Asset Value Components – January 31, 2012 (1) Pro-rata Q4 2011 NOI is reconciled to NOI at full consolidation by Product Group for the three months ended January 31, 2012 in the Supplemental Operating Information section of the supplemental package for the year ended January 31, 2012. (2) The pro-rata annualized NOI is calculated by taking the Q4 2011 NOI times a multiple of four. (3) The net stabilized adjustments column represents net adjustments required to arrive at a fully stabilized NOI for those properties currently in initial lease up periods, net of the removal of partial period NOI for recently sold properties. For those properties currently in initial lease up periods we have included stabilization adjustments as follows: a) NOI for phased and new openings is removed until the property has been open for one year or achieves 80% lease commitment, whichever comes first. b) NOI for the properties in lease up that have met the requirements of a) are reflected at 5% of the pro-rata cost disclosed in our Development Pipeline disclosure (Prior Two Year Openings). This assumption does not reflect Forest City’s anticipated NOI, but rather is used in order to establish a hypothetical basis for valuation of lease up properties. c) At the conclusion of the initial development period at each of our military housing communities, we estimate the ongoing property management fees, net of operating expenses, to be $15.0 million. The net stabilized adjustments are not comparable to any GAAP measure and therefore do not have a reconciliation to its nearest comparable GAAP measure. (4) Amounts are derived from the respective pro-rata balance sheet line item as of January 31, 2012 and are reconciled to their GAAP equivalents in the Selected Financial Information section of the supplemental package for the year ended January 31, 2012. (5) Phased and new property openings that have not achieved the parameters of 3(a) will have their assets shown in the Development Pipeline section of the model. Westchester’s Ridge Hill, as of January 31, 2012, had $270.0 million of costs incurred at pro-rata consolidation and $157.2 million of mortgage debt at pro-rata consolidation which were transferred to CRP. 8 Spruce Street, as of January 31, 2012, had $351.9 million of costs incurred at pro-rata consolidation and $218.2 million of mortgage debt at pro-rata consolidation which were transferred to CRP. Foundry Lofts, as of January 31, 2012, had $54.9 million of costs incurred at pro-rata consolidation and $47.7 million of mortgage debt at pro-rata consolidation which were transferred to CRP. In order to account for the phased openings of Westchester’s Ridge Hill, 8 Spruce Street and Foundry Lofts as NAV components we have made the following adjustments: All costs and associated debt for Westchester’s Ridge Hill, 8 Spruce Street and Foundry Lofts, for purposes exclusive to this disclosure, are accounted for as a component of “Adjusted Projects Under Construction” in the Development Pipeline section of this schedule. Accordingly, all NOI, through the net stabilized adjustments column, and debt have been removed from the CRP section of the NAV schedule. (6) Includes $152.8 million of straight-line rent receivable (net of $15.6 million of allowance for doubtful accounts). (7) Includes $41.2 million of straight-line rent payable. |