UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 30, 2015 OR |

| |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from ____ to ____ |

| |

Commission file number 001-00035 GENERAL ELECTRIC COMPANY (Exact name of registrant as specified in its charter) |

| New York | | 14-0689340 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 3135 Easton Turnpike, Fairfield, CT | | 06828-0001 |

| (Address of principal executive offices) | | (Zip Code) |

| |

(Registrant's telephone number, including area code) (203) 373-2211 _______________________________________________ (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | Accelerated filer |

Non-accelerated filer | Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

There were 10,096,429,000 shares of common stock with a par value of $0.06 per share outstanding at June 30, 2015.

[PAGE INTENTIONALLY LEFT BLANK]

TABLE OF CONTENTS

| | Page |

| | |

| Forward Looking Statements | 4 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) | 5 |

| Key Performance Indicators | 9 |

| Consolidated Results | 10 |

| Segment Operations | 12 |

| Corporate Items and Eliminations | 30 |

| Discontinued Operations | 32 |

| Other Consolidated Information | 33 |

| Statement of Financial Position | 34 |

| Financial Resources and Liquidity | 37 |

| Exposures | 42 |

| Critical Accounting Estimates | 44 |

| Other Items | 45 |

| Controls and Procedures | 46 |

| Other Financial Data | 46 |

| Regulations and Supervision | 47 |

| Legal Proceedings | 48 |

| Financial Statements and Notes | 51 |

| Exhibits | 104 |

| Form 10-Q Cross Reference Index | 105 |

| Signatures | 106 |

FORWARD LOOKING STATEMENTS

This document contains "forward-looking statements" – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," or "target."

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about our announced plan to reduce the size of our financial services businesses, including expected cash and non-cash charges associated with this plan; expected income; earnings per share; revenues; organic growth; margins; cost structure; restructuring charges; cash flows; return on capital; capital expenditures, capital allocation or capital structure; dividends; and the split between Industrial and GE Capital earnings.

For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

| | obtaining (or the timing of obtaining) any required regulatory reviews or approvals or any other consents or approvals associated with our announced plan to reduce the size of our financial services businesses; |

| | our ability to complete incremental asset sales as part of that plan in a timely manner (or at all) and at the prices we have assumed; |

| | changes in law, economic and financial conditions, including interest and exchange rate volatility, commodity and equity prices and the value of financial assets, including the impact of these conditions on our ability to sell or the value of incremental assets to be sold as part of our announced plan to reduce the size of our financial services businesses as well as other aspects of that plan; |

| | the impact of conditions in the financial and credit markets on the availability and cost of GECC's funding, and GECC's exposure to counterparties; |

| | the impact of conditions in the housing market and unemployment rates on the level of commercial and consumer credit defaults; |

| | pending and future mortgage loan repurchase claims and other litigation claims in connection with WMC, which may affect our estimates of liability, including possible loss estimates; |

| | our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so; |

| | the adequacy of our cash flows and earnings and other conditions, which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels; |

| | GECC's ability to pay dividends to GE at the planned level, which may be affected by GECC's cash flows and earnings, financial services regulation and oversight, and other factors; |

| | our ability to convert pre-order commitments/wins into orders; |

| | the price we realize on orders since commitments/wins are stated at list prices; |

| | customer actions or developments such as early aircraft retirements or reduced energy demand and other factors that may affect the level of demand and financial performance of the major industries and customers we serve; |

| | the effectiveness of our risk management framework; |

| | the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of financial services regulation and litigation; |

| | adverse market conditions, timing of and ability to obtain required bank regulatory approvals, or other factors relating to us or Synchrony Financial that could prevent us from completing the Synchrony Financial split-off as planned; |

| | our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures, dispositions and other strategic actions; |

| | our success in completing, including obtaining regulatory approvals for, announced transactions, such as the proposed transactions and alliances with Alstom, Appliances and our announced plan to reduce the size of our financial services businesses, and our ability to realize anticipated earnings and savings; |

| | our success in integrating acquired businesses and operating joint ventures; |

| | the impact of potential information technology or data security breaches; and |

| | the other factors that are described in "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2014. |

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A)

HOW WE TALK ABOUT OUR RESULTS

We believe that investors will gain a better understanding of our company if they understand how we measure and talk about our results. Because of the diversity in our businesses, we present our financial statements in a three- column format, which allows investors to see our industrial operations separately from our financial services operations. We believe that this provides useful information to investors. When used in this report, unless otherwise indicated by the context, we use the terms to mean the following:

| | General Electric or the Company - the parent company, General Electric Company. |

| | GE - the adding together of all affiliates other than General Electric Capital Corporation (GECC), whose continuing operations are presented on a one-line basis, giving effect to the elimination of transactions among such affiliates. Transactions between GE and GECC have not been eliminated at the GE level. We present the results of GE in the center columns of our consolidated statements of earnings, financial position and cash flows. An example of a GE metric is GE cash from operating activities (GE CFOA). |

| | General Electric Capital Corporation or GECC or Financial Services – the adding together of all affiliates of GECC, giving effect to the elimination of transactions among such affiliates. We present the results of GECC in the right-side columns of our consolidated statements of earnings, financial position and cash flows. It should be noted that GECC is sometimes referred to as GE Capital or Capital, when not in the context of discussing segment results. |

| | GE consolidated – the adding together of GE and GECC, giving effect to the elimination of transactions between GE and GECC. We present the results of GE consolidated in the left side columns of our consolidated statements of earnings, financial position and cash flows. |

| | Industrial – GE excluding GECC. We believe that this provides investors with a view as to the results of our industrial businesses and corporate items. An example of an Industrial metric is Industrial CFOA, which is GE CFOA excluding the effects of dividends from GECC. |

| | Industrial segment – the sum of our seven industrial reporting segments without giving effect to the elimination of transactions among such segments. We believe that this provides investors with a view as to the results of our industrial segments, without inter-segment eliminations and corporate items. An example of an industrial segment metric is industrial segment revenue growth. |

| | Total segment – the sum of our seven industrial reporting segments and one financial services reporting segment, without giving effect to the elimination of transactions among such segments. We believe that this provides investors with a view as to the results of all of our segments, without inter-segment eliminations and corporate items. |

| | GE Capital Verticals or Verticals – the adding together of GE Capital businesses that we expect to retain, principally its vertical financing businesses—GE Capital Aviation Services (GECAS), Energy Financial Services and Healthcare Equipment Finance—that directly relate to the Company's core industrial domain and other operations, including Working Capital Solutions, our run-off insurance activities, and allocated corporate costs. |

OTHER TERMS USED BY GE

| | Revenues – unless otherwise indicated, we refer to captions such as "revenues and other income", simply as revenues. |

| | Organic revenues – revenues excluding the effects of acquisitions, dispositions and foreign currency exchange. |

| | Earnings – unless otherwise indicated, we refer to captions such as "earnings from continuing operations attributable to the company" simply as earnings. |

| | Earnings per share (EPS) – unless otherwise indicated, we refer to "earnings per share from continuing operations attributable to the company" simply as earnings per share. |

| | Operating earnings – GE earnings from continuing operations attributable to the company excluding the impact of non-operating pension costs. |

| | Segment profit – refers to the operating profit of the industrial segments and the net earnings of the financial services segment. See page 12 for a description of the basis for segment profits. |

| | Operating pension costs – comprise the service cost of benefits earned, prior service cost amortization and curtailment loss for our principal pension plans. |

| | Non-operating pension costs – comprise the expected return on plan assets, interest cost on benefit obligations and net actuarial loss amortization for our principal pension plans. |

NON-GAAP FINANCIAL MEASURES

In the accompanying analysis of financial information, we sometimes use information derived from consolidated financial data but not presented in our financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data are considered "non-GAAP financial measures" under the SEC rules. Specifically, we have referred, in various sections of this Form 10-Q Report, to:

| | Operating earnings (loss) and operating EPS |

| | GE Industrial operating + Verticals EPS |

| | Operating and non-operating pension costs |

| | Industrial segment organic revenue growth |

| | Oil & Gas organic revenue and operating profit growth |

| | Industrial cash flows from operating activities (Industrial CFOA) |

| | Adjusted Corporate Costs (Operating) |

| | GE Capital ending net investment (ENI), excluding liquidity |

| | GECC Tier 1 common ratio estimate |

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in Exhibit 99(a) to this Form 10-Q Report. Non-GAAP financial measures referred to in this Form 10-Q Report are designated with an asterisk (*).

OUR OPERATING SEGMENTS

We are one of the largest and most diversified infrastructure and financial services corporations in the world. With products and services ranging from aircraft engines, power generation, oil and gas production equipment, and household appliances to medical imaging, business and consumer financing and industrial products.

OUR INDUSTRIAL OPERATING SEGMENTS

| Power & Water | | Aviation | | Transportation |

| Oil & Gas | | Healthcare | | Appliances & Lighting |

| Energy Management | | | | |

OUR FINANCIAL SERVICES OPERATING SEGMENT

Operational and financial overview for our operating segment are provided in the "Segment Operations" section within this MD&A.

THE GE CAPITAL EXIT PLAN

On April 10, 2015, the Company announced its plan (the GE Capital Exit Plan) to reduce the size of its financial services businesses through the sale of most of the assets of GECC over the following 24 months and to focus on continued investment and growth in the Company's industrial businesses. Under the GE Capital Exit Plan, which was approved on April 2, 2015 and aspects of which were approved on March 31, 2015, the Company will retain certain GECC businesses, principally its vertical financing businesses—GE Capital Aviation Services (GECAS), Energy Financial Services and Healthcare Equipment Finance—that directly relate to the Company's core industrial domain and other operations, including Working Capital Solutions and our run-off insurance activities (together referred to as GE Capital Verticals or Verticals). The assets planned for disposition include Real Estate, most of Commercial Lending and Leasing (CLL) and all Consumer platforms (including all U.S. banking assets). The Company expects to execute this strategy using an efficient approach for exiting non-vertical assets that works for the Company's and GECC's debt holders and the Company's shareowners. An element of this approach involves a merger of GECC into the Company to assure compliance with debt covenants as GECC exits non-vertical assets, and the creation of a new intermediate holding company to hold GECC's businesses after the merger. The Company has discussed the GE Capital Exit Plan, aspects of which are subject to regulatory review and approval, with its regulators and staff of the Financial Stability Oversight Council (FSOC) and will work closely with these bodies to take the actions necessary over time to terminate the FSOC's designation of GECC (and the new intermediate holding company, as applicable) as a nonbank systemically important financial institution (nonbank SIFI).

SALES AGREEMENTS

During the first half of 2015, GE signed agreements to sell approximately $68 billion of ENI, excluding liquidity (as originally reported at December 31, 2014) of which $32 billion and $23 billion related to the Real Estate and CLL businesses, respectively. Of these signed agreements, approximately $20 billion of Real Estate transactions have closed, including the majority of GECC's Real Estate debt and equity portfolio sold to funds managed by The Blackstone Group (which, in turn, sold a portion of this portfolio to Wells Fargo & Company). In connection with The Blackstone Group transactions, GECC will provide approximately $3.5 billion of seller financing to The Blackstone Group, which GECC intends to syndicate by 2016. The signed CLL transactions include approximately $11.2 billion related to its U.S. Sponsor Finance business with Canada Pension Plan Investment Board, approximately $8.8 billion related to its Global Fleet Services business with Element Financial Corporation and Arval and approximately $2.5 billion related to its European Sponsor Finance business with Sumitomo Mitsui Banking Corporation.

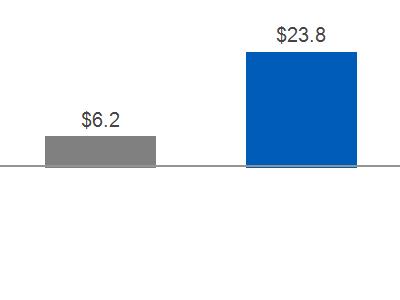

AFTER-TAX CHARGES RELATED TO THE GE CAPITAL EXIT PLAN

In connection with the GE Capital Exit Plan announced on April 10, the Company estimated that it would incur approximately $23 billion in after-tax charges through 2016, approximately $6 billion of which are expected to result in future net cash expenditures. These charges relate to: business dispositions, including goodwill allocations (approximately $13 billion), tax expense related to expected repatriation of foreign earnings and write-off of deferred tax assets (approximately $7 billion), and restructuring and other charges (approximately $3 billion).

In the first and second quarters of 2015, GE recorded $16.1 billion and $4.6 billion, respectively, of after-tax charges related to the GE Capital Exit Plan. As a result of certain businesses meeting discontinued operations criteria, $6.7 billion of first quarter after-tax charges and $4.4 billion of second quarter after-tax charges (including $4.3 billion related to CLL) were reported in discontinued operations.

GUARANTEE

As part of the GE Capital Exit Plan, on April 10, 2015, the Company and GECC entered into an amendment to their existing financial support agreement. Under this amendment (the Amendment), the Company has provided a full and unconditional guarantee (the Guarantee) of the payment of principal and interest on all tradable senior and subordinated outstanding long-term debt securities and all commercial paper issued or guaranteed by GECC identified in the Amendment. In the aggregate, the Guarantee applied to approximately $207 billion of GECC debt as of June 30, 2015. The Guarantee replaced the requirement that the Company make certain income maintenance payments to GECC in certain circumstances. GECC's U.S. public indentures were concurrently amended to provide the full and unconditional guarantee by the Company set forth in the Guarantee.

OUR EMPLOYEES AND EMPLOYEE RELATIONS

In June 2015, we negotiated new four-year collective bargaining agreements with most of our U.S. unions. These agreements will continue to provide employees with good wages and benefits while addressing competitive realities facing the Company.

PRESENTATION

The consolidated financial statements of General Electric Company (the Company) combine the industrial manufacturing and services businesses of General Electric Company (GE) with the financial services businesses of General Electric Capital Corporation (GECC or financial services).

We integrate acquisitions as quickly as possible. Revenues and earnings from the date we complete the acquisition through the end of the following fourth quarter are considered the acquisition effect of such businesses.

Amounts reported in billions in graphs and tables within this Form 10-Q report are computed based on the amounts in millions. As a result, the sum of the components reported in billions may not equal the total amount reported in billions due to rounding.

Discussions throughout this MD&A are based on continuing operations unless otherwise noted.

REFERENCES

The MD&A should be read in conjunction with the Financial Statements and Notes to the consolidated financial statements.

For additional information related to the GE Capital Exit Plan, GE Capital segment operations and the credit quality of financing receivables, refer to the General Electric Capital Corporation quarterly report on Form 10-Q for the three months ended June 30, 2015.

CORPORATE INFORMATION

GE's Investor Relations website at www.ge.com/investor-relations and our corporate blog at www.gereports.com, as well as GE's Facebook page and Twitter accounts, including @GE_Reports, contain a significant amount of information about GE, including financial and other information for investors. GE encourages investors to visit these websites from time to time, as information is updated and new information is posted.

CONSOLIDATED RESULTS

THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

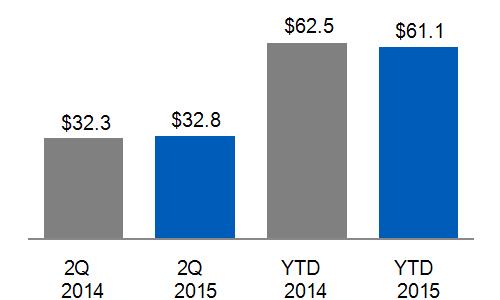

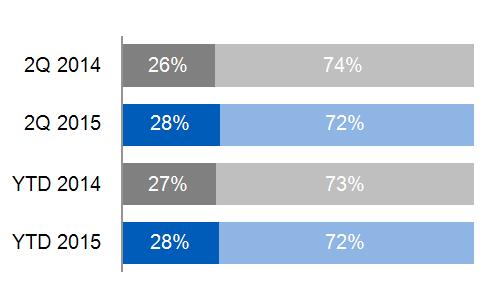

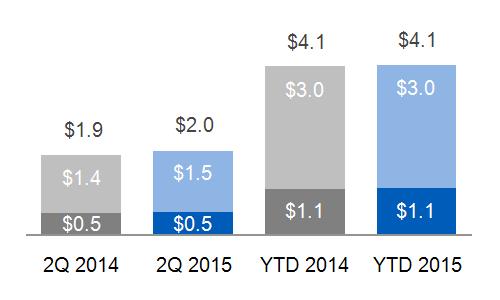

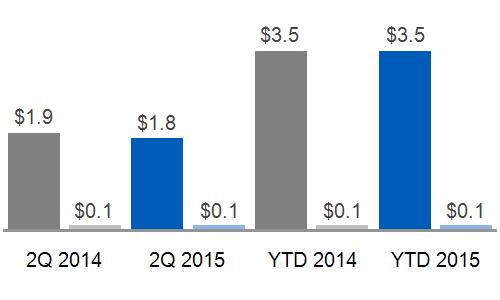

| | INDUSTRIAL SEGMENT EQUIPMENT & SERVICES REVENUES |

| | | Equipment Services |

COMMENTARY: 2015 - 2014 | | |

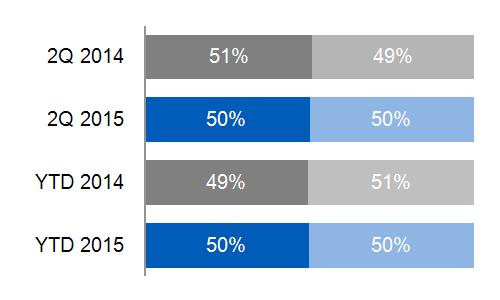

THREE MONTHS ENDED Consolidated revenues increased $0.5 billion, or 2%. Industrial segment revenues were flat, reflecting the unfavorable impact of foreign exchange of $1.3 billion, partially offset by organic growth* of 5%. Financial Services revenues decreased 1% as a result of the effects of dispositions, the effects of currency exchange and organic revenue declines, partially offset by higher gains and the effects of acquisitions. The effects of acquisitions increased consolidated revenues $0.2 billion and $0.7 billion in 2015 and 2014, respectively. The effects of dispositions on revenues were an insignificant amount and a decrease $0.5 billion in 2015 and 2014, respectively. | | SIX MONTHS ENDED Consolidated revenues decreased $1.4 billion, or 2%, primarily due to the impact of foreign exchange of $2.5 billion. Industrial segment revenues were flat, reflecting the unfavorable impact of foreign exchange of $2.3 billion, partially offset by organic growth* of 4%. Financial Services revenues decreased 13%, primarily due to the effects of the GE Capital Exit Plan. The effects of acquisitions increased consolidated revenues $0.4 billion and $1.3 billion in 2015 and 2014, respectively. Dispositions affected our ongoing results through lower revenues of $0.3 billion and $2.5 billion in 2015 and 2014, respectively. |

*Non-GAAP Financial Measure

THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

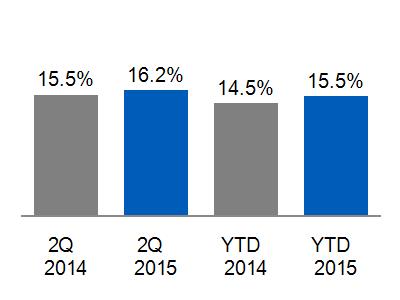

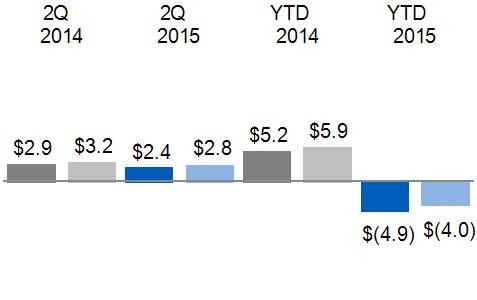

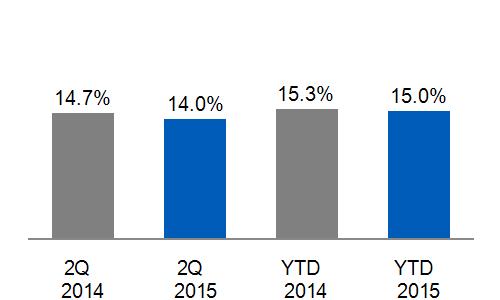

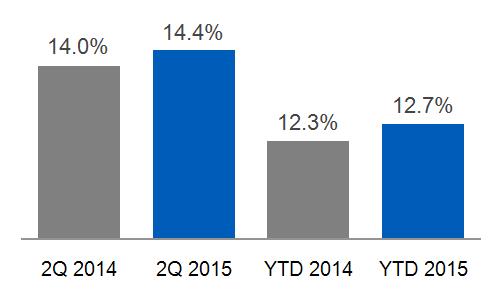

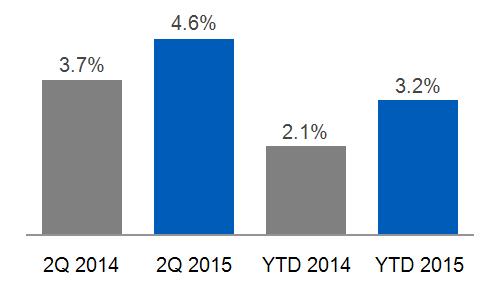

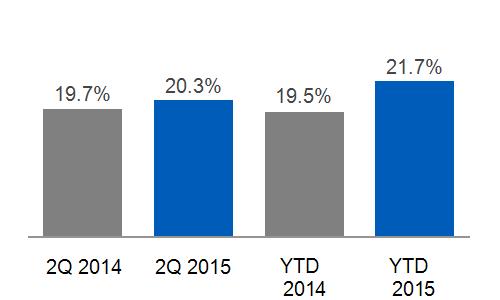

| | INDUSTRIAL SELLING, GENERAL & ADMINISTRATIVE (SG&A) AS A % OF SALES |

| | |

Earnings Operating Earnings* |

| COMMENTARY: 2015 - 2014 | | |

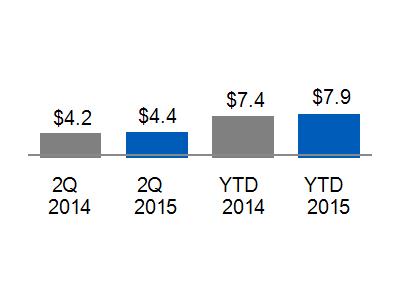

THREE MONTHS ENDED Consolidated earnings decreased $0.5 billion, or 17% primarily due to lower financial services income. Industrial segment profit increased 5% with five of seven segments growing earnings. Industrial segment margin increased 70 basis points (bps) driven by higher productivity, volume and pricing, partially offset by negative business mix and the impact of the stronger U.S. dollar. Financial Services earnings decreased 78% primarily due to core decreases, including charges associated with the GE Capital Exit Plan, partially offset by higher gains and the effects of dispositions. The effects of acquisitions on our consolidated net earnings were an insignificant amount and an increase of $0.1 billion in 2015 and 2014, respectively. The effects of dispositions on net earnings and settlements were an increase of $0.3 billion in 2015 and a decrease of $0.2 billion in 2014. Industrial SG&A as a percentage of total sales decreased to 14.0% primarily as a result of favorable impacts of global cost reduction initiatives, lower acquisitions costs and non-operating pension costs, partially offset by restructuring costs. | | SIX MONTHS ENDED Consolidated earnings decreased $10.1 billion primarily due to lower financial services income resulting from charges associated with the GE Capital Exit Plan of $9.4 billion. The charges included: tax expense related to expected repatriation of foreign earnings and write-off of deferred tax assets; asset impairments due to shortened hold periods; and charges on businesses held for sale, including goodwill allocation. Industrial segment profit increased 6% with five of seven segments growing earnings. Industrial segment margin increased 100 bps driven by higher productivity, volume and pricing, partially offset by the impact of the stronger U.S. dollar, the effects of inflation and negative business mix. Financial Services earnings decreased significantly primarily due to charges associated with the GE Capital Exit Plan. The effects of acquisitions on our consolidated net earnings were increases of $0.1 billion in 2015 and $0.2 billion in 2014. The effects of dispositions and settlements on net earnings were an increase of $0.3 billion in 2015 and a decrease of $1.4 billion in 2014. Industrial SG&A as a percentage of total sales decreased to 15.0% primarily as a result of favorable impacts of global cost reduction initiatives, partially offset by higher non-operating pension costs, restructuring and acquisition-related costs. |

See the "Other Consolidated Information" section within the MD&A of this Form 10-Q for a discussion of income taxes.

*Non-GAAP Financial Measure

SEGMENT OPERATIONS

SEGMENT REVENUES AND PROFIT

Segment revenues include revenues and other income related to the segment.

Segment profit is determined based on internal performance measures used by the Chief Executive Officer (CEO) to assess the performance of each business in a given period. In connection with that assessment, the CEO may exclude matters such as charges for restructuring; rationalization and other similar expenses; acquisition costs and other related charges; technology and product development costs; certain gains and losses from acquisitions or dispositions; and litigation settlements or other charges, for which responsibility preceded the current management team.

Segment profit excludes results reported as discontinued operations and accounting changes. Segment profit also excludes the portion of earnings or loss attributable to noncontrolling interests of consolidated subsidiaries, and as such only includes the portion of earnings or loss attributable to our share of the consolidated earnings or loss of consolidated subsidiaries.

Segment profit excludes or includes interest and other financial charges and income taxes according to how a particular segment's management is measured:

| | Interest and other financial charges and income taxes are excluded in determining segment profit (which we sometimes refer to as "operating profit") for the industrial segments. |

| | Interest and other financial charges and income taxes are included in determining segment profit (which we sometimes refer to as "net earnings") for the GE Capital segment. |

Certain corporate costs, such as shared services, employee benefits and information technology are allocated to our segments based on usage. A portion of the remaining corporate costs is allocated based on each segment's relative net cost of operations.

PLANNED ACQUISITION OF ALSTOM IMPACTS MULTIPLE SEGMENTS

During the second quarter of 2014, GE's offer to acquire the Thermal, Renewables and Grid businesses of Alstom for approximately €12.4 billion (to be adjusted for the assumed net cash or liability at closing) was positively recommended by Alstom's board of directors. As part of the transaction, Alstom and the French Government signed a memorandum of understanding for the formation of three joint ventures in grid technology, renewable energy, and global nuclear and French steam power. Alstom will invest approximately €2.6 billion in these joint ventures at the closing of the proposed transaction.

In the fourth quarter of 2014, Alstom completed its review of the proposed transaction with the works council and obtained approval from its shareholders. Also in the fourth quarter of 2014, GE and Alstom entered into an amendment to the original agreement where GE has agreed to pay Alstom a net amount of approximately €0.3 billion of additional consideration at closing. In exchange for this funding, Alstom has agreed to extend the trademark licensing of the Alstom name from 5 years to 25 years as well as other contractual amendments.

In the second quarter of 2015, the European Commission indicated that it had competition concerns with the proposed transaction. In response, and while GE continues to believe that the transaction is pro-competitive, GE has proposed remedies to address the Commission's concerns while preserving the strategic and economic rationale of the proposed transaction. In addition, Alstom has agreed to contribute financially to the remedies being offered by GE through a €300 million reduction in the purchase price of the transaction. The transaction continues to remain subject to regulatory approvals and is still targeted to close in 2015.

The acquisition and alliances with Alstom will impact our Power & Water and Energy Management segments. The impact of acquired businesses on individual segments will be affected by a number of variables, including operating performance, purchase accounting impacts and expected synergies. In addition, due to the amount of time between signing and closing, the operations of the businesses may fluctuate and impact the overall valuation of the acquired businesses at the time of close and, accordingly, may affect the amounts assigned to the assets and liabilities recorded in purchase accounting.

PLANNED SALE OF APPLIANCES

In the third quarter of 2014, we signed an agreement to sell our Appliances business to Electrolux for approximately $3.3 billion. On July 1, 2015, we were notified that the Department of Justice had initiated court proceedings seeking to enjoin the sale of Appliances to Electrolux. Electrolux and GE intend to defend the proposed transaction and GE is targeting to close the deal in 2015.

SEGMENT RESULTS

| SUMMARY OF OPERATING SEGMENTS |

| | | | | | | | | | | | | | | | | | |

| | Three months ended June 30 | | Six months ended June 30 |

| (In millions) | | 2015 | | | 2014 | | | V% | | | 2015 | | | 2014 | | | V% |

| | | | | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | | | |

| Power & Water | $ | 6,801 | | $ | 6,292 | | | 8 % | | $ | 12,517 | | $ | 11,801 | | | 6 % |

| Oil & Gas | | 4,062 | | | 4,761 | | | (15)% | | | 8,023 | | | 9,069 | | | (12)% |

| Energy Management | | 1,768 | | | 1,856 | | | (5)% | | | 3,453 | | | 3,528 | | | (2)% |

| Aviation | | 6,252 | | | 6,090 | | | 3 % | | | 11,926 | | | 11,868 | | | - % |

| Healthcare | | 4,337 | | | 4,483 | | | (3)% | | | 8,412 | | | 8,681 | | | (3)% |

| Transportation | | 1,420 | | | 1,306 | | | 9 % | | | 2,728 | | | 2,533 | | | 8 % |

| Appliances & Lighting | | 2,235 | | | 2,120 | | | 5 % | | | 4,176 | | | 3,977 | | | 5 % |

| Total industrial segment revenues | | 26,875 | | | 26,908 | | | - % | | | 51,235 | | | 51,457 | | | - % |

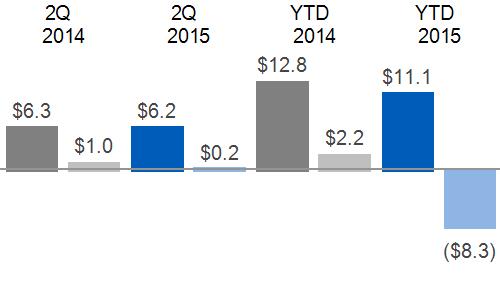

| GE Capital | | 6,218 | | | 6,275 | | | (1)% | | | 11,141 | | | 12,839 | | | (13)% |

| Total segment revenues | | 33,093 | | | 33,183 | | | - % | | | 62,376 | | | 64,296 | | | (3)% |

| Corporate items and eliminations | | (339) | | | (923) | | | (63)% | | | (1,325) | | | (1,808) | | | (27)% |

| Consolidated revenues | $ | 32,754 | | $ | 32,260 | | | 2 % | | $ | 61,051 | | $ | 62,488 | | | (2)% |

| | | | | | | | | | | | | | | | | | |

| Segment profit (loss) | | | | | | | | | | | | | | | | | |

| Power & Water | $ | 1,221 | | $ | 1,133 | | | 8 % | | $ | 2,092 | | $ | 2,021 | | | 4 % |

| Oil & Gas | | 583 | | | 665 | | | (12)% | | | 1,015 | | | 1,111 | | | (9)% |

| Energy Management | | 82 | | | 69 | | | 19 % | | | 110 | | | 74 | | | 49 % |

| Aviation | | 1,269 | | | 1,197 | | | 6 % | | | 2,583 | | | 2,312 | | | 12 % |

| Healthcare | | 705 | | | 730 | | | (3)% | | | 1,292 | | | 1,300 | | | (1)% |

| Transportation | | 331 | | | 270 | | | 23 % | | | 556 | | | 472 | | | 18 % |

| Appliances & Lighting | | 165 | | | 102 | | | 62 % | | | 268 | | | 155 | | | 73 % |

| Total industrial segment profit | | 4,356 | | | 4,166 | | | 5 % | | | 7,916 | | | 7,445 | | | 6 % |

| GE Capital | | 218 | | | 1,002 | | | (78)% | | | (8,289) | | | 2,248 | | | U |

| Total segment profit (loss) | | 4,574 | | | 5,168 | | | (11)% | | | (373) | | | 9,693 | | | U |

| Corporate items and eliminations | | (1,186) | | | (1,474) | | | (20)% | | | (2,878) | | | (3,016) | | | (5)% |

| GE interest and other financial charges | | (414) | | | (401) | | | 3 % | | | (803) | | | (765) | | | 5 % |

| GE provision for income taxes | | (584) | | | (409) | | | 43 % | | | (890) | | | (727) | | | 22 % |

| Earnings (loss) from continuing operations | | | | | | | | | | | | | | | | | |

| attributable to the Company | | 2,390 | | | 2,884 | | | (17)% | | | (4,944) | | | 5,185 | | | U |

| Earnings (loss) from discontinued | | | | | | | | | | | | | | | | | |

| operations, net of taxes | | (3,750) | | | 661 | | | U | | | (9,989) | | | 1,359 | | | U |

| Consolidated net earnings (loss) | | | | | | | | | | | | | | | | | |

| attributable to the Company | $ | (1,360) | | $ | 3,545 | | | U | | $ | (14,933) | | $ | 6,544 | | | U |

| | | \ | | | | | | | | | \ | | | | | | |

POWER & WATER

OPERATIONAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

| 2015 YTD SUB-SEGMENT REVENUES | | EQUIPMENT/SERVICES REVENUES |

(a) Includes Water Process Technologies and Nuclear | | |

| Services Equipment |

| | |

| Equipment Services | | | Equipment Services |

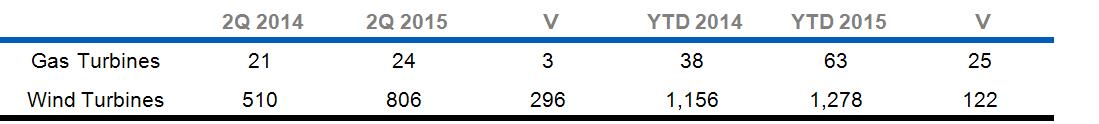

| UNIT SALES | | |

|

FINANCIAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

| SEGMENT REVENUES & PROFIT | | SEGMENT PROFIT MARGIN |

Revenue Profit | | |

| | | |

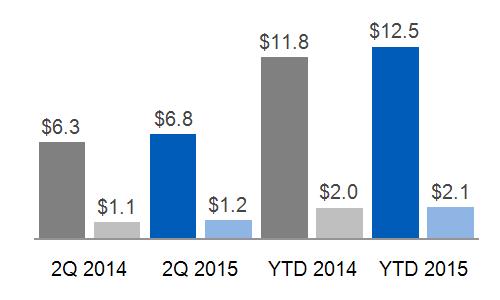

| SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2015 - 2014 |

| THREE MONTHS ENDED | | | Segment revenues up $0.5 billion or 8%; Segment profit up $0.1 billion or 8% as a result of: The increase in revenues was primarily due to higher volume, mainly driven by higher equipment sales at Renewable Energy and higher prices, partially offset by lower equipment sales at Distributed Power and the effects of the stronger U.S. dollar. The increase in profit was mainly due to higher volume, higher price and higher base cost productivity more than offsetting H turbine build costs. These increases were partially offset by negative business mix. |

| | Revenues | Profit |

| June 30, 2014 | $ | 6.3 | $ | 1.1 |

| Volume | | 0.8 | | 0.1 |

| Price | | 0.1 | | 0.1 |

| Foreign Exchange | | (0.4) | | - |

| (Inflation)/Deflation | | N/A | | - |

| Mix | | N/A | | (0.2) |

| Productivity | | N/A | | 0.1 |

| Other | | - | | - |

| June 30, 2015 | $ | 6.8 | $ | 1.2 |

| | | | | |

| | | |

| | |

| SIX MONTHS ENDED | | | Segment revenues up $0.7 billion or 6%; Segment profit up $0.1 billion or 4% as a result of: The increase in revenues was primarily due to higher volume, mainly driven by higher equipment sales at PGP and higher service sales at PGS, higher price and higher other income, partially offset by lower volume of equipment sales at Distributed Power, as well as the impact of the stronger U.S. dollar. The increase in profit was mainly due to higher volume and higher price, partially offset by unfavorable business mix, lower productivity and the impact of the stronger U.S. dollar. |

| | Revenues | Profit |

| June 30, 2014 | $ | 11.8 | $ | 2.0 |

| Volume | | 1.2 | | 0.2 |

| Price | | 0.1 | | 0.1 |

| Foreign Exchange | | (0.7) | | (0.1) |

| (Inflation)/Deflation | | N/A | | - |

| Mix | | N/A | | (0.1) |

| Productivity | | N/A | | (0.1) |

| Other | | 0.1 | | 0.1 |

| June 30, 2015 | $ | 12.5 | $ | 2.1 |

| | | | | | |

OIL & GAS

OPERATIONAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

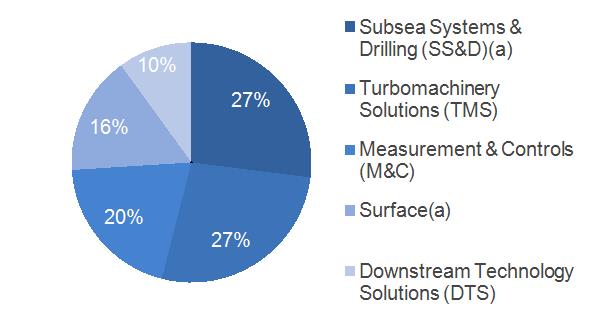

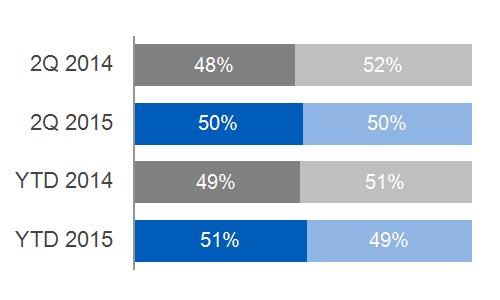

| 2015 YTD SUB-SEGMENT REVENUES | | EQUIPMENT/SERVICES REVENUES |

| | |

(a)Our drilling product line, previously part of Drilling & Surface (D&S), was realigned as part of Subsea Systems effective January 1, 2015. Accordingly, D&S is now Surface and Subsea Systems is now Subsea Systems & Drilling. | | Services Equipment |

| | |

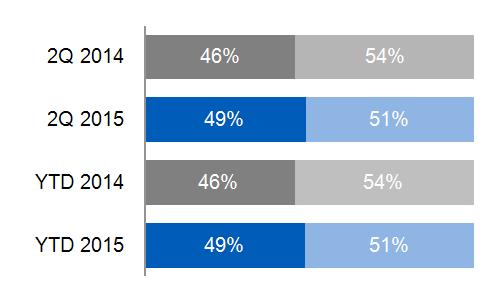

| Equipment Services | | (a)Prior period reflects an update for Oil & Gas services backlog. | Equipment Services |

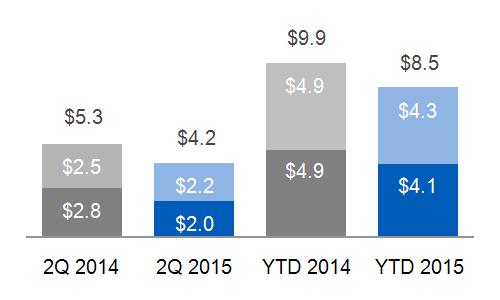

FINANCIAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

| SEGMENT REVENUES & PROFIT | | SEGMENT PROFIT MARGIN |

Revenues Profit | | |

| | | |

| SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2015 - 2014 |

| THREE MONTHS ENDED | | | Segment revenues down $0.7 billion or 15%; Segment profit down $0.1 billion or 12% as a result of: The decrease in revenues was primarily due to the effects of the stronger U.S. dollar and lower volume, mainly driven by lower equipment sales at Turbomachinery and M&C and lower service sales at Surface. Organic revenues* for the second quarter of 2015 were down 4% compared with the second quarter of 2014. The decrease in profit reflects the effects of the stronger U.S. dollar ($0.1 billion). Organic operating profit* grew 5% in the second quarter of 2015. |

| | Revenues | Profit |

| June 30, 2014 | $ | 4.8 | $ | 0.7 |

| Volume | | (0.3) | | - |

| Price | | - | | - |

| Foreign Exchange | | (0.5) | | (0.1) |

| (Inflation)/Deflation | | N/A | | - |

| Mix | | N/A | | - |

| Productivity | | N/A | | - |

| Other | | 0.1 | | 0.1 |

| June 30, 2015 | $ | 4.1 | $ | 0.6 |

| | | | | |

| | | |

| | |

| SIX MONTHS ENDED | | | Segment revenues down $1.1 billion or 12%; Segment profit down $0.1 billion or 9% as a result of: The decrease in revenues was primarily due to the effects of the stronger U.S. dollar and lower volume. Organic revenues* for the six months ended June 30, 2015 were down 2% compared with the same period of 2014. The decrease in profit reflects the effects of the stronger U.S. dollar ($0.2 billion). Organic operating profit* grew 8% in the six months ended June 30, 2015. |

| | Revenues | Profit |

| June 30, 2014 | $ | 9.1 | $ | 1.1 |

| Volume | | (0.2) | | - |

| Price | | - | | - |

| Foreign Exchange | | (0.8) | | (0.2) |

| (Inflation)/Deflation | | N/A | | - |

| Mix | | N/A | | - |

| Productivity | | N/A | | 0.2 |

| Other | | (0.1) | | (0.1) |

| June 30, 2015 | $ | 8.0 | $ | 1.0 |

| | | | | | |

*Non-GAAP Financial Measure

ENERGY MANAGEMENT

OPERATIONAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

| 2015 YTD SUB-SEGMENT REVENUES | | EQUIPMENT/SERVICES REVENUES |

| | |

Services Equipment |

| | |

| Equipment Services | | | Equipment Services |

| | | |

| | | |

FINANCIAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

| SEGMENT REVENUES & PROFIT | | SEGMENT PROFIT MARGIN | |

| | |

Revenue Profit |

| | | |

| | COMMENTARY: 2015 - 2014 | | | |

| | THREE MONTHS ENDED Segment revenues down $0.1 billion or 5% as a result of: | | SIX MONTHS ENDED Segment revenues down $0.1 billion or 2% as a result of: | |

| | The impact of the stronger U.S. dollar ($0.2 billion), partially offset by higher sales volume ($0.1 billion). | | The impact of the stronger U.S. dollar ($0.3 billion), partially offset by higher volume ($0.2 billion). | |

| | Segment profit up 19% as a result of: | | Segment profit up 49% as a result of: | |

| | Continued cost reductions. | | Improved productivity ($0.1 billion). | |

AVIATION

AVIATION

OPERATIONAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

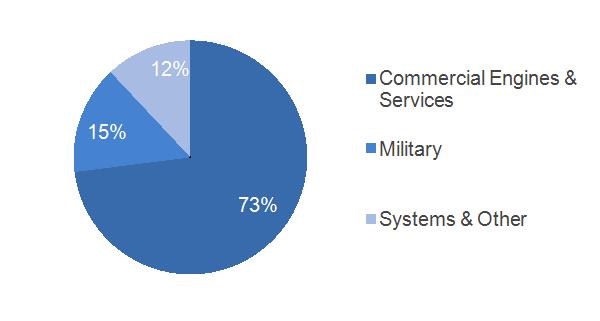

| 2015 YTD SUB-SEGMENT REVENUES | | EQUIPMENT/SERVICES REVENUES |

| | |

Services Equipment |

| | |

| Equipment Services | | | Equipment Services |

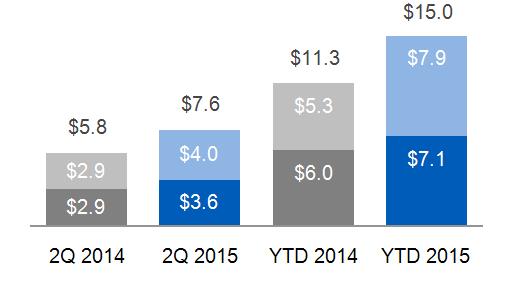

| UNIT SALES | | |

(a)GEnx engines are a subset of commercial engines (b)Commercial spares shipment rate in millions of dollars per day |

FINANCIAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

| SEGMENT REVENUES & PROFIT | | SEGMENT PROFIT MARGIN |

Revenues Profit | | |

| | | |

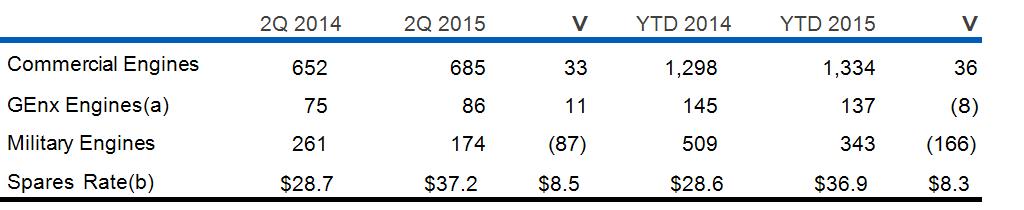

| SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2015 - 2014 |

| THREE MONTHS ENDED | | | Segment revenues up $0.2 billion or 3%; Segment profit up $0.1 billion or 6% as a result of: The increase in revenues was primarily due to higher prices in our Commercial Engines business and spare parts. The increase in profit was mainly due to higher prices in our Commercial Engines business and spare parts, partially offset by higher inflation. |

| | Revenues | Profit |

| June 30, 2014 | $ | 6.1 | $ | 1.2 |

| Volume | | - | | - |

| Price | | 0.2 | | 0.2 |

| Foreign Exchange | | - | | - |

| (Inflation)/Deflation | | N/A | | (0.1) |

| Mix | | N/A | | - |

| Productivity | | N/A | | - |

| Other | | - | | (0.1) |

| June 30, 2015 | $ | 6.3 | $ | 1.3 |

| | | | | |

| | | |

| | |

| SIX MONTHS ENDED | | | Segment revenues up $0.1 billion; Segment profit up $0.3 billion or 12% as a result of: The increase in revenues was primarily due to higher prices, partially offset by lower volume driven by Military. The increase in profit was mainly due to higher prices in our Commercial Engines and Commercial Services businesses as well as improved productivity. These increases were partially offset by the effects of inflation and lower volume. |

| | Revenues | Profit |

| June 30, 2014 | $ | 11.9 | $ | 2.3 |

| Volume | | (0.3) | | (0.1) |

| Price | | 0.4 | | 0.4 |

| Foreign Exchange | | - | | - |

| (Inflation)/Deflation | | N/A | | (0.2) |

| Mix | | N/A | | 0.1 |

| Productivity | | N/A | | 0.1 |

| Other | | - | | - |

| June 30, 2015 | $ | 11.9 | $ | 2.6 |

| | | | | | |

HEALTHCARE

OPERATIONAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

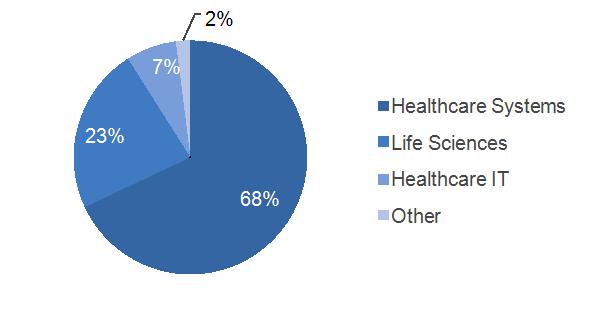

| 2015 YTD SUB-SEGMENT REVENUES | | EQUIPMENT/SERVICES REVENUES |

| | |

| Services Equipment |

| | |

| Equipment Services | | | Equipment Services |

| | | |

| | |

FINANCIAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

| SEGMENT REVENUES & PROFIT | | SEGMENT PROFIT MARGIN |

Revenue Profit | | |

| | | |

| SEGMENT REVENUES & PROFIT WALK: | COMMENTARY: 2015 - 2014 |

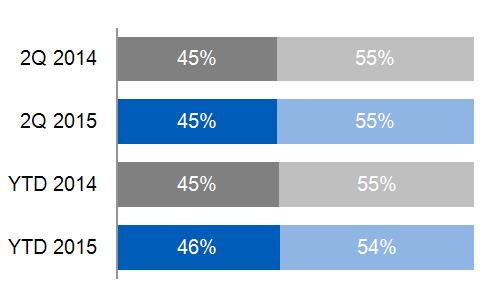

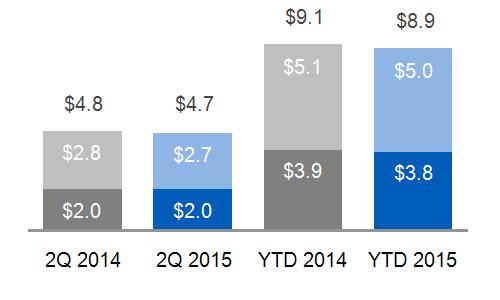

| THREE MONTHS ENDED | | | Segment revenues down $0.1 billion or 3%; Segment profit down 3% as a result of: The decrease in revenues was due to the impact of the stronger U.S. dollar and lower prices, mainly in Healthcare Systems. These decreases were partially offset by higher volume, mainly driven by Life Sciences. The decrease in profit was due to lower prices, mainly in Healthcare Systems, partially offset by higher productivity, including SG&A cost reductions. |

| | Revenues | Profit |

| June 30, 2014 | $ | 4.5 | $ | 0.7 |

| Volume | | 0.2 | | - |

| Price | | (0.1) | | (0.1) |

| Foreign Exchange | | (0.3) | | - |

| (Inflation)/Deflation | | NA | | - |

| Mix | | N/A | | - |

| Productivity | | N/A | | 0.1 |

| Other | | - | | - |

| June 30, 2015 | $ | 4.3 | $ | 0.7 |

| | | | | |

| | | |

| | |

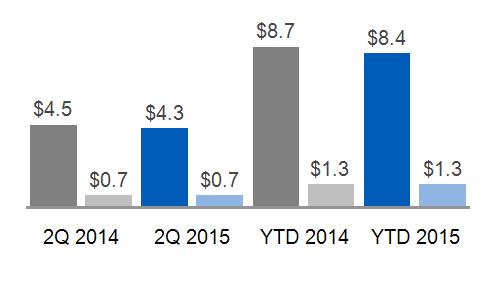

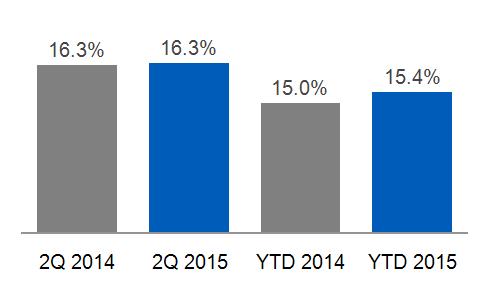

| SIX MONTHS ENDED | | | Segment revenues down $0.3 billion or 3%; Segment profit down 1% as a result of: The decrease in revenues was due to the impact of the stronger U.S. dollar and lower prices, mainly in Healthcare Systems. These decreases were partially offset by higher volume, mainly driven by Life Sciences. The decrease in profit was due to the effects of inflation and lower prices, mainly in Healthcare Systems, partially offset by higher productivity, including SG&A cost reductions, and increased volume. |

| | Revenues | Profit |

| June 30, 2014 | $ | 8.7 | $ | 1.3 |

| Volume | | 0.4 | | 0.1 |

| Price | | (0.1) | | (0.1) |

| Foreign Exchange | | (0.5) | | - |

| (Inflation)/Deflation | | N/A | | (0.1) |

| Mix | | N/A | | - |

| Productivity | | N/A | | 0.2 |

| Other | | - | | - |

| June 30, 2015 | $ | 8.4 | $ | 1.3 |

| | | | | | |

TRANSPORTATION

TRANSPORTATION

OPERATIONAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

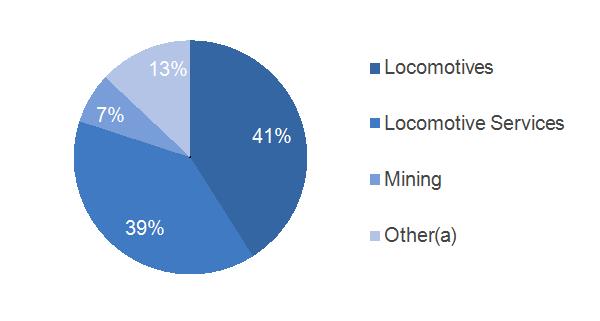

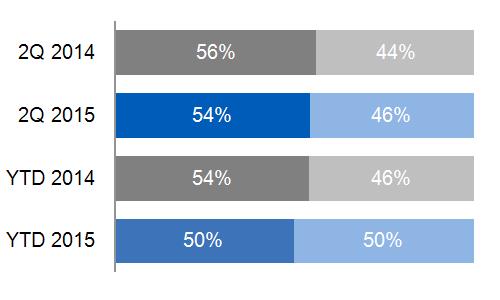

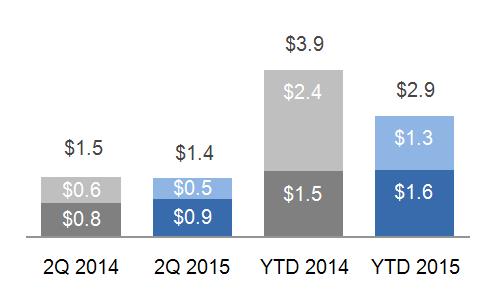

| 2015 YTD SUB-SEGMENT REVENUES | | EQUIPMENT/SERVICES REVENUES |

(a) Includes Marine, Stationary & Drilling | | |

| | Services Equipment |

| | |

| Equipment Services | | | Equipment Services |

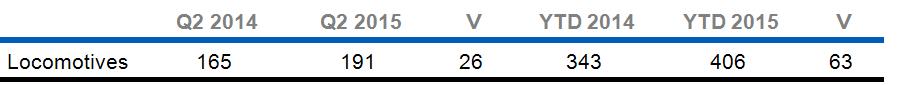

| UNIT SALES | | |

|

FINANCIAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

| SEGMENT REVENUES & PROFIT | | SEGMENT PROFIT MARGIN |

Revenue Profit | | |

| | | |

| COMMENTARY: 2015 - 2014 | |

THREE MONTHS ENDED Segment revenues up $0.1 billion or 9% as a result of: Higher volume ($0.1 billion), primarily due to higher locomotive and services sales. Segment profit up $0.1 billion or 23% as a result of: Improved productivity ($0.1 billion). | | SIX MONTHS ENDED Segment revenues up $0.2 billion or 8% as a result of: Higher volume ($0.2 billion), due to higher locomotive equipment sales. Segment profit up $0.1 billion or 18% as a result of: Higher productivity driven by locomotive sales ($0.1 billion), partially offset by an unfavorable business mix ($0.1 billion). |

APPLIANCES & LIGHTING

APPLIANCES & LIGHTING

OPERATIONAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollar in billions)

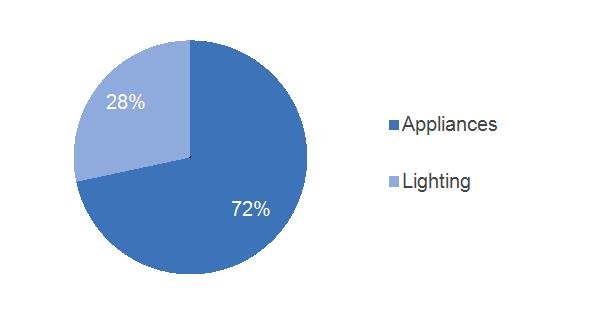

| 2015 YTD SUB-SEGMENT REVENUES | | | |

| | | |

FINANCIAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30 (Dollar in billions) |

SEGMENT REVENUES & PROFIT | | | |

Revenue Profit | | | |

| |

| COMMENTARY: 2015 - 2014 | | | |

THREE MONTHS ENDED Segment revenues up $0.1 billion or 5% as a result of: Higher volume ($0.1 billion) driven by higher sales at Appliances. Segment profit up $0.1 billion or 62% as a result of: Improved productivity ($0.1 billion), including the effects of classifying Appliances as a business held for sale in the third quarter of 2014. | | SIX MONTHS ENDED Segment revenues up $0.2 billion or 5% as a result of: Higher volume ($0.2 billion) driven by higher sales at Appliances. Segment profit up $0.1 billion or 73% as a result of: Improved productivity ($0.1 billion), including the effects of classifying Appliances as a business held for sale, partially offset by lower prices. | |

GE CAPITAL

OPERATIONAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

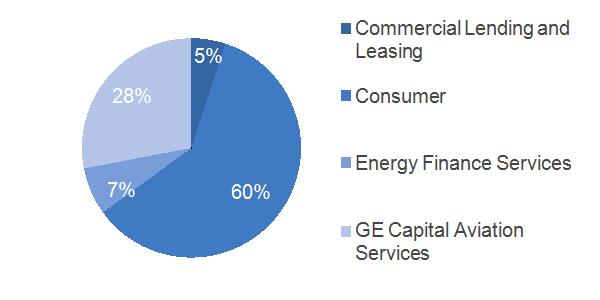

| 2015 YTD SUB-SEGMENT REVENUES | | | |

| | | |

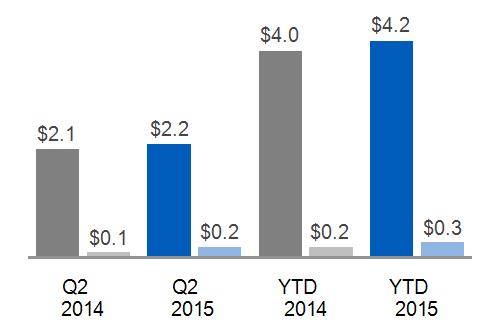

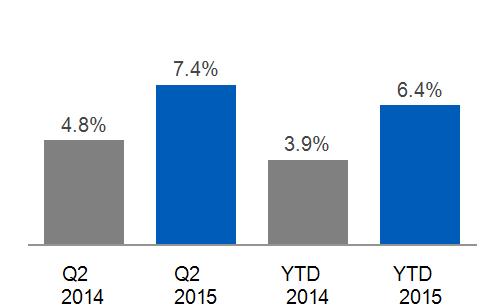

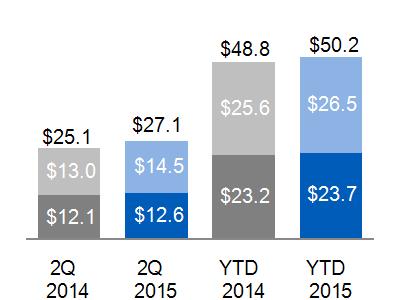

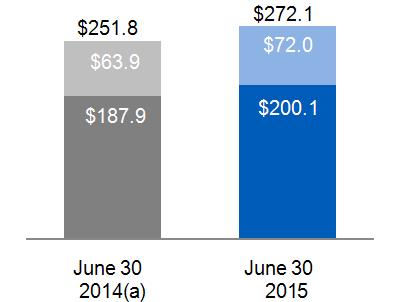

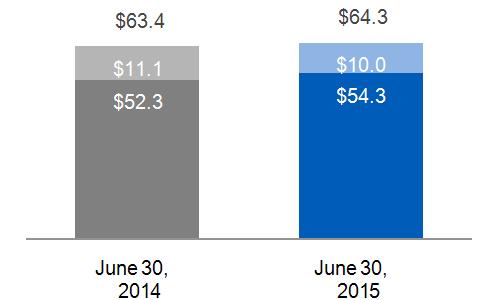

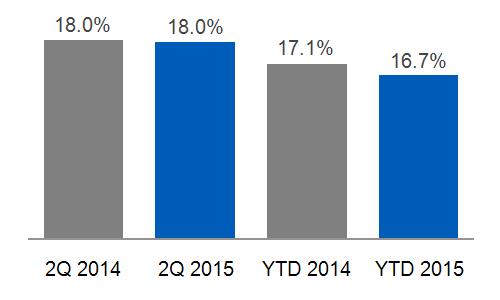

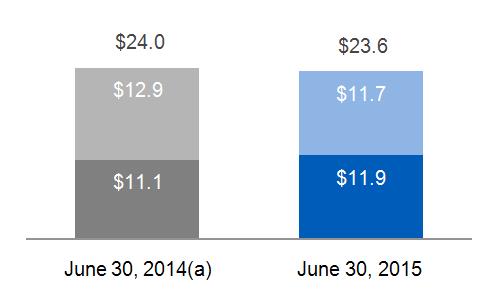

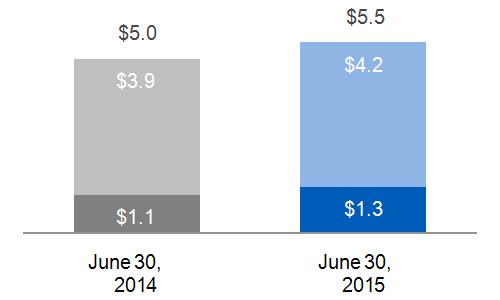

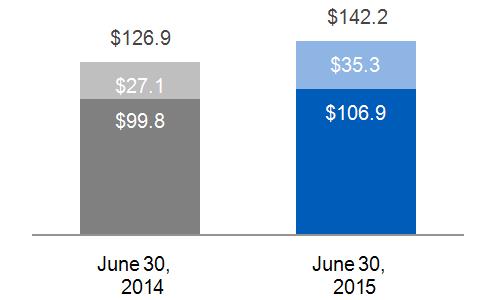

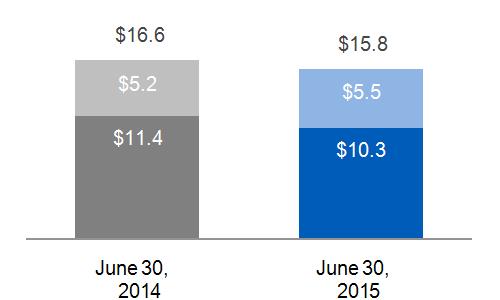

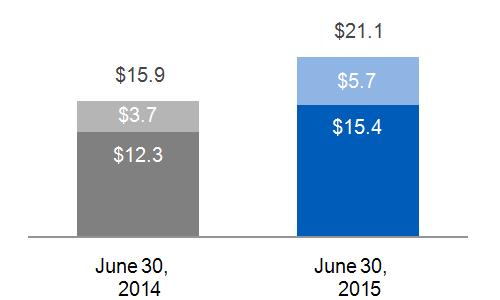

| ENDING NET INVESTMENT, EXCLUDING LIQUIDITY* | | TIER 1 COMMON RATIO ESTIMATE* | |

| | | |

| SIGNIFICANT TRENDS & DEVELOPMENTS |

| | The GE Capital Exit Plan - As previously discussed, on April 10, 2015, the Company announced its plan to reduce the size of the financial services businesses through the sale of most of the assets of GECC over the following 24 months. It is expected that as a result of the GE Capital Exit Plan, the GE Capital businesses that will remain with GE will account for about $90 billion in ending net investment (ENI), excluding liquidity, including about $40 billion in the U.S. ENI is a metric used to measure the total capital invested in the financial services businesses. GE Capital's ENI, excluding liquidity* was $179 billion at June 30, 2015. |

During the first half of 2015, GE signed agreements to sell approximately $68 billion of ENI, excluding liquidity (as originally reported at December 31, 2014) of which $32 billion and $23 billion related to the Real Estate and CLL businesses, respectively. Of these signed agreements, approximately $20 billion of Real Estate transactions have closed, including the majority of GECC's Real Estate debt and equity portfolio sold to funds managed by The Blackstone Group (which, in turn, sold a portion of this portfolio to Wells Fargo & Company). In connection with The Blackstone Group transactions, GECC will provide approximately $3.5 billion of seller financing to The Blackstone Group, which GECC intends to syndicate by 2016. The signed CLL transactions include approximately $11.2 billion related to its U.S. Sponsor Finance business with Canada Pension Plan Investment Board, approximately $8.8 billion related to its Global Fleet Services business with Element Financial Corporation and Arval and approximately $2.5 billion related to its European Sponsor Finance business with Sumitomo Mitsui Banking Corporation

In the first and second quarters of 2015, GE recorded $16.1 billion and $4.6 billion, respectively, of after-tax charges related to the GE Capital Exit Plan. As a result of certain businesses meeting discontinued operations criteria, $6.7 billion of first quarter after-tax charges and $4.4 billion of second quarter after-tax charges (including $4.3 billion related to CLL) were reported in discontinued operations.

| | Budapest Bank – On June 29, 2015 we closed the sale of Budapest Bank to Hungary's government. |

* Non-GAAP Financial Measure

| | Australia and New Zealand (ANZ) Consumer Lending - During the first quarter of 2015, we signed an agreement to sell our consumer finance business in Australia and New Zealand to a consortium including KKR, Varde Partners and Deutsche Bank for approximately 6.0 billion Australian dollars and 1.4 billion New Zealand dollars, respectively. |

| | Milestone Aviation Group – On January 30, 2015, GECAS acquired Milestone Aviation Group, a helicopter leasing business, for approximately $1.8 billion. |

| | Synchrony Financial – In connection with Synchrony Financial's planned separation from GE, Synchrony Financial filed the related application to the Federal Reserve Board on April 30, 2015. For a further discussion of the Synchrony Financial transaction, see the Synchrony Financial annual report on Form 10-K for the year ended December 31, 2014 and the 2015 quarterly reports on Forms 10-Q. |

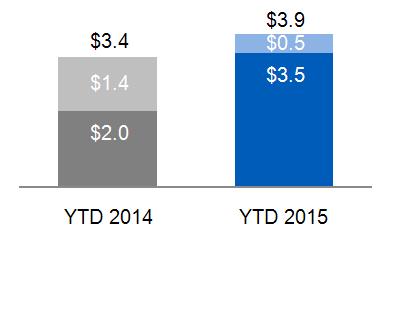

| | Dividends - GECC paid no quarterly dividends and $0.5 billion of quarterly dividends to GE in the three and six months ended June 30, 2015, respectively. |

FINANCIAL OVERVIEW - THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

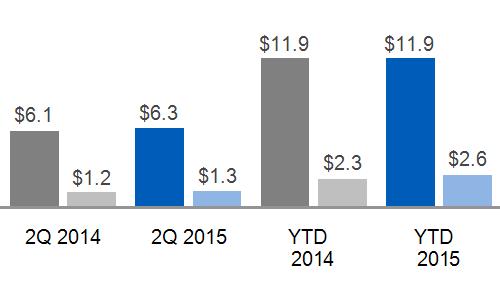

SEGMENT REVENUES & PROFIT (LOSS)(a) | | |

Revenue Profit (Loss) | ( a) Interest and other financial charges and income taxes are included in determining segment profit (loss) for the GE Capital segment. | |

| | | |

| COMMENTARY: 2015 - 2014 |

Segment revenues decreased 1% in the three months ended June 30, 2015 as a result of the effects of dispositions, the effects of currency exchange and organic revenue declines, partially offset by higher gains and the effects of acquisitions. Net earnings decreased 78% primarily due to core decreases, including charges associated with the GE Capital Exit Plan, partially offset by higher gains and the effects of dispositions.

Segment revenues decreased 13% and net earnings decreased significantly in the six months ended June 30, 2015, primarily due to the effects of the GE Capital Exit Plan.

COMMERCIAL LENDING AND LEASING

During the second quarter of 2015, the majority of CLL's business met held for sale criteria and was classified as discontinued operations. See Note 2 for additional information. The discussion below relates solely to the portion of CLL's business classified as continuing operations, which include Healthcare Equipment Finance and Working Capital Solutions.

CLL 2015 revenues increased 4% and net earnings increased 12% in the three months ended June 30, 2015. Revenues increased primarily as a result of organic revenue growth. Net earnings increased reflecting core increases.

CLL 2015 revenues increased 3% and net earnings increased 8% in the six months ended June 30, 2015. Revenues increased primarily as a result of organic revenue growth. Net earnings increased reflecting core increases.

CONSUMER

Consumer 2015 revenues decreased 2% and net earnings decreased 3% in the three months ended June 30, 2015. Revenues decreased as a result of the effects of dispositions ($0.2 billion) and the effects of currency exchange ($0.1 billion), partially offset by organic revenue growth ($0.2 billion) and higher gains ($0.1 billion). Net earnings decreased as a result of core decreases ($0.1 billion), partially offset by the effects of dispositions ($0.1 billion).

Consumer 2015 revenues decreased 22% and net earnings decreased unfavorably in the six months ended June 30, 2015. Revenues decreased as a result of higher impairments ($1.4 billion), the effects of dispositions ($0.3 billion) and the effects of currency exchange ($0.2 billion), partially offset by organic revenue growth ($0.2 billion) and higher gains ($0.1 billion). Net earnings decreased as a result of higher provisions for losses on financing receivables ($2.1 billion), higher impairments ($1.2 billion) and core decreases ($0.4 billion). These decreases are primarily related to the reclassification of assets within Consumer to financing receivables held-for-sale recorded at the lower of cost or fair value, less cost to sell, and asset impairments related to equity method investments in connection with the GE Capital Exit Plan.

ENERGY FINANCIAL SERVICES

Energy Financial Services 2015 revenues increased 29% and net earnings increased 43% in the three months ended June 30, 2015. Revenues increased as a result of higher gains ($0.2 billion), partially offset by organic revenue declines ($0.1 billion). Net earnings increased as a result of higher gains ($0.1 billion), partially offset by core decreases ($0.1 billion).

Energy Financial Services 2015 revenues decreased 12% and net earnings decreased 37% in the six months ended June 30, 2015. Revenues decreased as a result of organic revenue declines ($0.2 billion), partially offset by lower impairments ($0.1 billion). Net earnings decreased as a result of core decreases ($0.2 billion), partially offset by lower impairments ($0.1 billion).

GECAS 2015 revenues were flat and net earnings increased 5% in the three months ended June 30, 2015. Revenues reflected organic revenue declines ($0.1 billion), offset by the effects of acquisitions ($0.1 billion) and higher gains. Net earnings increased as a result of lower impairments, the effects of acquisitions and higher gains, partially offset by core decreases ($0.1 billion).

GECAS 2015 revenues decreased 2% and net earnings decreased 4% in the six months ended June 30, 2015. Revenues decreased as a result of organic revenue declines ($0.2 billion), partially offset by the effects of acquisitions ($0.1 billion) and higher gains. Net earnings decreased as a result of core decreases ($0.2 billion), partially offset by lower impairments ($0.1 billion) and the effects of acquisitions.

| CORPORATE ITEMS AND ELIMINATIONS | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| REVENUES AND OPERATING PROFIT (COST) | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Three months ended June 30 | | Six months ended June 30 |

| (In millions) | | 2015 | | | 2014 | | | 2015 | | | 2014 |

| | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | |

| | Gains on disposed or held for sale businesses | $ | 49 | | $ | 91 | | $ | 49 | | $ | 91 |

| | NBCU settlement | | 450 | | | - | | | 450 | | | - |

| | Eliminations and other | | (838) | | | (1,014) | | | (1,824) | | | (1,899) |

| Total Corporate Items and Eliminations | $ | (339) | | $ | (923) | | $ | (1,325) | | $ | (1,808) |

| | | | | | | | | | | | | |

| Operating profit (cost) | | | | | | | | | | | |

| | Gains on disposed or held for sale businesses | $ | 49 | | $ | 91 | | $ | 49 | | $ | 91 |

| | NBCU settlement | | 450 | | | - | | | 450 | | | - |

| | Principal retirement plans(a) | | (673) | | | (582) | | | (1,461) | | $ | (1,163) |

| | Restructuring and other charges | | (399) | | | (407) | | | (821) | | | (783) |

| | Eliminations and other | | (613) | | | (576) | | | (1,095) | | | (1,161) |

| Total Corporate Items and Eliminations | $ | (1,186) | | $ | (1,474) | | $ | (2,878) | | $ | (3,016) |

| | | | | | | | | | | | | |

| CORPORATE COSTS | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Three months ended June 30 | | Six months ended June 30 |

| (In millions) | | 2015 | | 2014 | | | 2015 | | 2014 |

| | | | | | | | | | | | | |

| Total Corporate Items and Eliminations | $ | (1,186) | | $ | (1,474) | | $ | (2,878) | | $ | (3,016) |

| Less non-operating pension cost | | (689) | | | (529) | | | (1,384) | | | (1,055) |

Total Corporate costs (operating)* | $ | (497) | | $ | (945) | | $ | (1,494) | | $ | (1,961) |

| Less restructuring and other charges, gains and settlement | | 100 | | | (316) | | | (322) | | | (692) |

| Adjusted total corporate costs (operating)* | $ | (597) | | $ | (629) | | $ | (1,172) | | $ | (1,269) |

| | | | | | | | | | | | | |

| (a) | Included non-operating pension cost* of $0.7 billion and $0.5 billion in the three months ended June 30, 2015 and 2014, respectively, and $1.4 billion and $1.1 billion in the six months ended June 30, 2015 and 2014, respectively, which includes expected return on plan assets, interest costs and non-cash amortization of actuarial gains and losses. |

2015 – 2014 COMMENTARY: THREE MONTHS ENDED JUNE 30

Revenues and other income increased $0.6 billion, primarily a result of:

| | $0.5 billion higher other income from a settlement related to the NBCU transaction, and |

| | $0.1 billion of lower inter-segment eliminations. |

Operating costs decreased $0.3 billion, primarily as a result of:

| | $0.5 billion higher income from a settlement related to the NBCU transaction, partially offset by $0.1 billion higher costs associated with our principal retirement plans including the effects of lower discount rates and updated mortality assumptions. |

2015 – 2014 COMMENTARY: SIX MONTHS ENDED JUNE 30

Revenues and other income increased $0.5 billion, primarily a result of:

| | $0.5 billion higher other income from a settlement related to the NBCU transaction. |

Operating costs decreased $0.1 billion, primarily as a result of:

| | $0.5 billion higher income from the NBCU transaction, partially offset by $0.3 billion higher costs associated with our principal retirement plans including the effects of lower discount rates and updated mortality assumptions. |

*Non-GAAP Financial Measure

COSTS NOT INCLUDED IN SEGMENT RESULTS

Certain amounts are not included in industrial operating segment results because they are excluded from measurement of their operating performance for internal and external purposes. These amounts are included in GE Corporate Items & Eliminations and may include matters such as charges for restructuring; rationalization and other similar expenses; acquisition costs and related charges; technology and product development cost; certain gains and losses from acquisitions or dispositions; and litigation settlements or other charges, for which responsibility preceded the current management team. The amount of costs and gains not included in segment results follows.

| COSTS | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Three months ended June 30 | | Six months ended June 30 |

| (In billions) | | 2015 | | | 2014 | | | 2015 | | | 2014 |

| | | | | | | | | | | | |

| Power & Water | $ | 0.1 | | $ | 0.2 | | $ | 0.2 | | $ | 0.3 |

| Oil & Gas | | 0.2 | | | 0.1 | | | 0.3 | | | 0.1 |

| Energy Management | | - | | | 0.1 | | | 0.1 | | | 0.1 |

| Aviation | | - | | | 0.1 | | | - | | | 0.1 |

| Healthcare | | 0.1 | | | 0.1 | | | 0.1 | | | 0.2 |

| Transportation | | - | | | - | | | - | | | - |

| Appliances & Lighting | | - | | | - | | | - | | | - |

| Total | $ | 0.4 | | $ | 0.5 | | $ | 0.7 | | $ | 0.9 |

| | | | | | | | | | | | |

| GAINS | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Three months ended June 30 | | Six months ended June 30 |

| (In billions) | | 2015 | | | 2014 | | | 2015 | | | 2014 |

| | | | | | | | | | | | |

| Power & Water | $ | - | | $ | - | | $ | - | | $ | - |

| Oil & Gas(a) | | - | | | 0.1 | | | - | | | 0.1 |

| Energy Management | | - | | | - | | | - | | | - |

| Aviation | | - | | | - | | | - | | | - |

| Healthcare | | - | | | - | | | - | | | - |

| Transportation | | - | | | - | | | - | | | - |

| Appliances & Lighting | | - | | | - | | | - | | | - |

| Total | $ | - | | $ | 0.1 | | $ | - | | $ | 0.1 |

| | | | | | | | | | | | |

(a) Related to a fuel dispenser business disposition in 2014. DISCONTINUED OPERATIONS

Discontinued operations primarily included most of our CLL business, our Real Estate business and our U.S. mortgage business (WMC). All of these operations were previously reported in the GE Capital segment.

Results of operations, financial position and cash flows for these businesses are separately reported as discontinued operations for all periods presented.

| FINANCIAL INFORMATION FOR DISCONTINUED OPERATIONS |

| | | | | | | | | | | | |

| | Three months ended June 30 | | Six months ended June 30 |

| (In millions) | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | | | | | |

| Earnings (loss) from discontinued operations, net of taxes | $ | (3,750) | | $ | 661 | | $ | (9,989) | | $ | 1,359 |

| | | | | | | | | | | | |

2015 – 2014 COMMENTARY: THREE MONTHS ENDED JUNE 30

The second quarter 2015 loss from discontinued operations, net of taxes, primarily reflected the following:

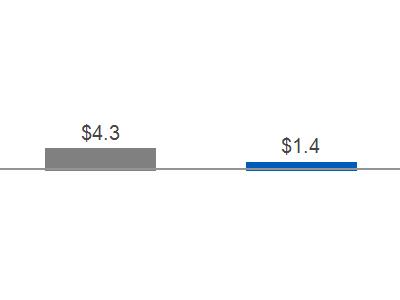

| | $3.7 billion after-tax loss at our CLL business (including a $4.3 billion loss on the planned disposal). |

The second quarter 2014 earnings from discontinued operations, net of taxes, primarily reflected the following:

| | $0.4 billion of earnings from operations at our CLL business and |

| | $0.3 billion of earnings from operations at our Real Estate business. |

2015 – 2014 COMMENTARY: SIX MONTHS ENDED JUNE 30

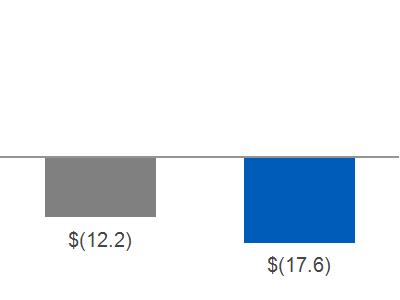

The 2015 loss from discontinued operations, net of taxes, primarily reflected the following:

| | $7.7 billion after-tax loss at our CLL business (including a $7.2 billion loss on the planned disposal) and |

| | $2.3 billion after-tax loss at our Real Estate business (including a $2.4 billion loss on the planned disposal). |

The 2014 earnings from discontinued operations, net of taxes, primarily reflected the following:

| | $0.9 billion of earnings from operations at our CLL business and |

| | $0.5 billion of earnings from operations at our Real Estate business. |

For additional information related to discontinued operations, see Note 2 to the consolidated financial statements.

OTHER CONSOLIDATED INFORMATION

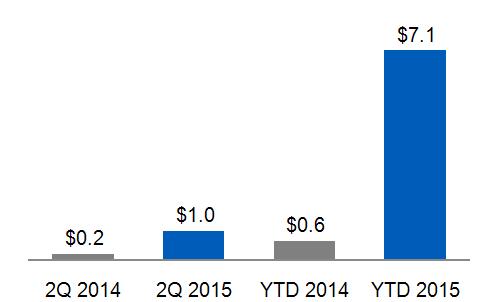

INCOME TAXES

Income taxes have a significant effect on our net earnings. As a global commercial enterprise, our tax rates are affected by many factors, including our global mix of earnings, the extent to which those global earnings are indefinitely reinvested outside the United States, legislation, acquisitions, dispositions and tax characteristics of our income. Our tax rates are also affected by tax incentives introduced in the U.S. and other countries in furtherance of policies to encourage and support certain types of activity. Our tax returns are routinely audited and settlements of issues raised in these audits sometimes affect our tax provisions.

GE and GECC file a consolidated U.S. federal income tax return. This enables GE to use GECC tax deductions and credits to reduce the tax that otherwise would have been payable by GE. The GECC effective tax rate for each period reflects the benefit of these tax reductions in the consolidated return. GE makes cash payments to GECC for these tax reductions at the time GE's tax payments are due.

CONSOLIDATED – THREE AND SIX MONTHS ENDED JUNE 30

(Dollars in billions)

| PROVISION FOR INCOME TAXES | | |

| |

2015 – 2014 COMMENTARY: THREE MONTHS ENDED JUNE 30

| | The consolidated income tax provision increased due to additional tax expense associated with the GE Capital Exit Plan, a smaller benefit from the adjustment to the projected full-year effective tax rate and an increase in pre-tax income taxed at above the average tax rate. |

| | The consolidated tax provision includes $0.4 billion and $0.6 billion for GE (excluding GECC) for the second quarters of 2014 and 2015, respectively. The increase related primarily to higher pre-tax income taxed at above the average tax rate. |

2015 – 2014 COMMENTARY: SIX MONTHS ENDED JUNE 30

| | The consolidated income tax rate for the six months ended June 30, 2015 was greater than 100% as the positive tax expense of $7.1 billion exceeded pre-tax income of $2.3 billion due to charges associated with GE Capital Exit Plan. |

| | As discussed in Note 10 to the consolidated financial statements, during the first six months ended June 30, 2015 in conjunction with the GE Capital Exit Plan, we incurred tax expense of $6.3 billion related to expected repatriation of foreign earnings and write-off of deferred tax assets. |

| | The increase in the income tax expense is primarily due to the tax expense incurred as part of the GE Capital Exit Plan. |

| | The consolidated tax provision includes $0.7 billion and $0.9 billion for GE (excluding GECC) for the first six months of 2014 and 2015, respectively. The increase is related primarily to higher pre-tax income taxed at above the average tax rate. |

BENEFITS FROM GLOBAL OPERATIONS

Absent the effects of the GE Capital Exit Plan, our consolidated income tax rate is lower than the U.S. statutory rate primarily because of benefits from lower-taxed global operations, including the use of global funding structures. There is a benefit from global operations as non-U.S. income is subject to local country tax rates that are significantly below the 35% U.S. statutory rate. These non-U.S. earnings have been indefinitely reinvested outside the U.S. and are not subject to current U.S. income tax. The rate of tax on our indefinitely reinvested non-U.S. earnings is below the 35% U.S. statutory rate because we have significant business operations subject to tax in countries where the tax on that income is lower than the U.S. statutory rate and because GE funds certain of its non-U.S. operations through foreign companies that are subject to low foreign taxes.

Historically, the most significant portion of these benefits depends on the provision of U.S. law deferring the tax on active financial services income, which, as discussed below, is subject to expiration. A substantial portion of the remaining benefit related to business operations subject to tax in countries where the tax on that income is lower than the U.S. statutory rate is derived from our GECAS aircraft leasing operations located in Ireland. No other operation in any one country accounts for a material portion of the remaining balance of the benefit.

We expect our ability to benefit from non-U.S. income taxed at less than the U.S. rate to continue, subject to changes in our earnings profile due to the GE Capital Exit Plan and changes in U.S. or foreign law, including the expiration of the U.S. tax law provision deferring tax on active financial services income. In addition, since this benefit depends on management's intention to indefinitely reinvest amounts outside the U.S., our tax provision will increase to the extent we no longer intend to indefinitely reinvest foreign earnings.

STATEMENT OF FINANCIAL POSITION

Because GE and GECC share certain significant elements of their Statements of Financial Position, the following discussion addresses significant captions in the consolidated statement. Within the following discussions, however, we distinguish between GE and GECC activities in order to permit meaningful analysis of each individual consolidating statement.

MAJOR CHANGES IN OUR FINANCIAL POSITION FOR THE SIX MONTHS ENDED JUNE 30, 2015

| | GECC Financing receivables-net decreased $41.4 billion. See the following GECC Financing Receivables section for additional information. |

| | GECC Financing receivables held for sale increased $27.2 billion. See the following GECC Financing Receivables Held for Sale section for additional information. |

| | Assets of discontinued operations decreased $32.1 billion, primarily due to Real Estate of $19.3 billion and the CLL businesses of $12.6 billion. See Note 2 for additional information. |

| | Borrowings decreased $19.1 billion, primarily due to net repayments on GECC borrowings of $16.0 billion, along with a $6.2 billion reduction in the balances driven by the strengthening of the U.S. dollar against all major currencies, partially offset by new debt issuances by GE of $3.5 billion. |

| | Deferred income taxes increased $5.4 billion primarily due to deferred tax asset write-offs resulting from the GE Capital Exit Plan, along with the remeasurement of postretirement benefit plans. |

GECC FINANCING RECEIVABLES

Financing receivables held for investment are those that we have the intent and ability to hold for the foreseeable future and are measured at the principal amount outstanding, net of the allowance for losses, write-offs, unamortized discounts and premiums, and net deferred loan fees or costs.

At June 30, 2015, our financing receivables portfolio primarily relates to GECAS, Energy Financial Services, Healthcare Equipment Finance (that directly relate to GE's core industrial businesses), Working Capital Solutions, which purchases GE customer receivables, and Synchrony Financial, our U.S. consumer business. The portfolios in our GECAS and Energy Financial Services businesses are collateralized by commercial aircraft and operating assets in the global energy and water industries, respectively. Our Healthcare Equipment Finance portfolio is collateralized by equipment used in the healthcare industry and the Working Capital Solutions portfolio is substantially recourse to GE or insured. Both the Healthcare Equipment Finance and Working Capital Solutions portfolios are reported in the CLL segment. Substantially all of the Synchrony Financial portfolio consists of U.S. consumer credit card and sales finance receivables and are reported in the Consumer segment.

For purposes of the discussion that follows, "delinquent" receivables are those that are 30 days or more past due based on their contractual terms. Loans purchased at a discount are initially recorded at fair value and accrete interest income over their estimated lives based on reasonably estimable cash flows even if the underlying loans are contractually delinquent at acquisition. "Nonaccrual" financing receivables are those on which we have stopped accruing interest. We stop accruing interest at the earlier of the time at which collection of an account becomes doubtful or the account becomes 90 days past due, with the exception of consumer credit card accounts, for which we continue to accrue interest until the accounts are written off in the period that the account becomes 180 days past due. Recently restructured financing receivables are not considered delinquent when payments are brought current according to the restructured terms, but may remain classified as nonaccrual until there has been a period of satisfactory payment performance by the borrower and future payments are reasonably assured of collection.

Further information on the determination of the allowance for losses on financing receivables and the credit quality and categorization of our financing receivables is provided in Notes 5 and 18 to the consolidated financial statements.

| GECC FINANCING RECEIVABLES AND ALLOWANCE FOR LOSSES(a) |

| | | | | | | |

| (Dollars in millions) | June 30, 2015 | | December 31, 2014 |

| | | | | | | |

| Financing receivables | $ | 84,476 | | $ | 126,561 | |

| Nonaccrual receivables | | 368 | (b) | | 1,996 | |

| Allowance for losses | | 3,393 | | | 4,104 | |

| | | | | | | |

| Nonaccrual financing receivables as a percent of financing receivables | | 0.4 | % | | 1.6 | % |

| Allowance for losses as a percent of nonaccrual financing receivables | | (c) | | | 205.6 | |

| Allowance for losses as a percent of total financing receivables | | 4.0 | | | 3.2 | |

| | | | | | | |

| (a) | For additional information related to the portfolio of financing receivables, refer to the GECC quarterly report on Form 10-Q for the period ended June 30, 2015. |

| (b) | Substantially all of our $0.4 billion of nonaccrual loans at June 30, 2015, are currently paying in accordance with the contractual terms. We continue to accrue interest on consumer credit cards until the accounts are written off in the period the account becomes 180 days past due. |

Financing receivables, before allowance for losses, decreased $42.1 billion from December 31, 2014, primarily as a result of reclassifications to financing receivables held for sale or assets of businesses held for sale (primarily Consumer) ($33.7 billion), write-offs ($4.8 billion) and the stronger U.S. dollar ($4.0 billion), partially offset by originations exceeding collections (which includes sales) ($0.9 billion).

Nonaccrual receivables decreased $1.6 billion from December 31, 2014, primarily due to reclassifications to financing receivables held for sale (including write-offs) or assets of businesses held for sale (primarily Consumer).

Allowance for losses decreased $0.7 billion from December 31, 2014, primarily as a result of write-offs on financing receivables reclassified to financing receivables held for sale and the transfer of that portion of the allowance for losses related to financing receivables reclassified to assets of businesses held for sale (primarily Consumer). The allowance for losses as a percent of total financing receivables increased from 3.2% at December 31, 2014 to 4.0% at June 30, 2015 reflecting decreases in both the allowance for losses and the overall financing receivables balance related to the financing receivables reclassified to financing receivables held for sale and assets of businesses held for sale as part of the GE Capital Exit Plan.

GECC FINANCING RECEIVABLES HELD FOR SALE

Financing receivables held for sale are recorded at the lower of cost or fair value, less cost to sell, and represent those financing receivables that management does not intend to hold for the foreseeable future. Subsequent declines in fair value are recognized in the period in which they occur. Valuations are primarily performed on a portfolio basis, except for commercial financing receivables, which may be performed on an individual financing receivable basis. Interest income on financing receivables held for sale is accrued and subject to the nonaccrual policies described above. Because financing receivables held for sale are recognized at the lower of cost or fair value, less cost to sell, the allowance for losses and write-off policies do not apply to these financing receivables.

During the first quarter of 2015, we transferred all of our non-U.S. Consumer financing receivables to financing receivables held for sale or assets of businesses held for sale as a result of the GE Capital Exit Plan and the signing of an agreement to sell our consumer finance business in Australia and New Zealand.

The transfer of financing receivables to financing receivables held for sale and assets of businesses held for sale in the six months ended June 30, 2015, totaled $28.2 billion and $5.5 billion, respectively. Prior to transferring the financing receivables to financing receivables held for sale we recognized a pre-tax provision for losses on financing receivables of $2.4 billion ($2.2 billion after-tax) to reduce the carrying value of the financing receivables to the lower of cost or fair value, less cost to sell, and wrote-off the associated balance of the allowance for losses of $2.9 billion to establish a new cost basis of the financing receivables held for sale at June 30, 2015.

For businesses held for sale, financing receivable balances of $5.5 billion and the related allowance for loan losses of $0.2 billion were reclassified to assets of businesses held for sale. The businesses held for sale were recorded at the lower of cost or fair value, less cost to sell, at June 30, 2015.