Exhibit 99.3

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | |  | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| FIRST QUARTER 2013 |

| | | | | | | | | | | | | |

| FINANCIAL SUPPLEMENT |

ALLY FINANCIAL INC. FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION |  |

| | |

The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

This information is preliminary and based on company data available at the time of the presentation

In the presentation that follows and related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “seek,” “may,” “would, ” “could, ” “should, ” “believe, ” “potential, ” “continue,” , or the negative of these words, or similar expressions is intended to identify forward-looking statements. All statements herein and in related management comments, other than statements of historical fact, including without limitation, statements about future events and financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent Ally’s current judgment on what the future may hold, and Ally believes these judgments are reasonable, these statements are not guarantees of any events or financial results, and Ally’s actual results may differ materially due to numerous important factors that are described in the most recent reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or supplemented in subsequent reports filed with the SEC. Such factors include, among others, the following: maintaining the mutually beneficial relationship between Ally and General Motors (“GM”), and Ally and Chrysler Group LLC (“Chrysler”); the profitability and financial condition of GM and Chrysler; resolution of the Residential Capital, LLC and certain of its subsidiaries; our ability to realize the anticipated benefits associated with being a bank holding company, and the increased regulation and restrictions that we are now subject to; the potential for deterioration in the residual value of off-lease vehicles; disruptions in the market in which we fund our operations, with resulting negative impact on our liquidity; changes in our accounting assumptions that may require or that result from changes in the accounting rules or their application, which could result in an impact on earnings; changes in the credit ratings of Ally, Chrysler, or GM; changes in economic conditions, currency exchange rates or political stability in the markets in which we operate; and changes in the existing or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations (including as a result of the Dodd-Frank Act and Basel III).

Investors are cautioned not to place undue reliance on forward-looking statements. Ally undertakes no obligation to update publicly or otherwise revise any forward-looking statements except where expressly required by law. Reconciliation of non-GAAP financial measures included within this presentation are provided in this presentation.

Use of the term “loans” describes products associated with direct and indirect lending activities of Ally’s global operations. The specific products include retail installment sales contracts, loans, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase, acquisition or direct origination of various “loan” products.

| 1Q 2013 Preliminary Results | | 2 |

ALLY FINANCIAL INC. TABLE OF CONTENTS |  |

| | |

| | | | | | | | | Page(s) |

| Consolidated Results | | | | | | |

| Consolidated Financial Highlights | | | | | 4 |

| Consolidated Income Statement | | | | | | 5 |

| Consolidated Period-End Balance Sheet | | | | | 6 |

| Consolidated Average Balance Sheet | | | | | 7 |

| | | | | | | | | |

| Segment Detail | | | | | | | |

| Segment Highlights | | | | | | | 8 |

| Automotive Finance | | | | | | | 9-10 |

| Insurance | | | | | | | | 11 |

| Mortgage | | | | | | | | 12 |

| Corporate and Other | | | | | | | 13 |

| | | | | | | | | |

| Credit Related Information | | | | | | 14-16 |

| | | | | | | | | |

| Supplemental Detail | | | | | | |

| Capital | | | | | | | | 17 |

| Liquidity | | | | | | | | 18 |

| Deposits | | | | | | | | 19 |

| Ally Bank Consumer Mortgage HFI Portfolio | | | | | 20 |

| Discontinued Operations | | | | | | 21 |

| Ownership | | | | | | | 22 |

| | | | | | | | | |

| 1Q 2013 Preliminary Results | | 3 |

ALLY FINANCIAL INC. CONSOLIDATED FINANCIAL HIGHLIGHTS |  |

| | |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Selected Income Statement Data | | | 1Q 13 | | | | 4Q 12 | | | | 3Q 12 | | | | 2Q 12 | | | | 1Q 12 | | | | 4Q 12 | | | | 1Q 12 | |

| Net financing revenue (ex. OID) | | $ | 697 | | | $ | 667 | | | $ | 548 | | | $ | 553 | | | $ | 459 | | | $ | 30 | | | $ | 239 | |

| Total other revenue | | | 386 | | | | 480 | | | | 775 | | | | 714 | | | | 605 | | | | (94 | ) | | | (219 | ) |

| Total net revenue (ex. OID) | | | 1,083 | | | | 1,147 | | | | 1,323 | | | | 1,267 | | | | 1,064 | | | | (64 | ) | | | 20 | |

| Provision for loan losses | | | 131 | | | | 93 | | | | 105 | | | | 33 | | | | 98 | | | | 38 | | | | 33 | |

| Controllable expenses(1) | | | 578 | | | | 638 | | | | 552 | | | | 531 | | | | 578 | | | | (60 | ) | | | 0 | |

| Other noninterest expenses | | | 380 | | | | 313 | | | | 293 | | | | 440 | | | | 277 | | | | 67 | | | | 103 | |

| Core pre-tax (loss) income(2) | | $ | (6 | ) | | $ | 103 | | | $ | 373 | | | $ | 263 | | | $ | 111 | | | $ | (109 | ) | | $ | (116 | ) |

| Core OID amortization expense(3) | | | 57 | | | | 56 | | | | 76 | | | | 96 | | | | 108 | | | | 1 | | | | (50 | ) |

| Income tax (benefit) expense | | | (123 | ) | | | (887 | ) | | | 46 | | | | (16 | ) | | | 1 | | | | 764 | | | | (124 | ) |

| Income (loss) from discontinued operations | | | 1,033 | | | | 466 | | | | 133 | | | | (1,081 | ) | | | 308 | | | | 567 | | | | 725 | |

| Net income (loss) | | $ | 1,093 | | | $ | 1,400 | | | $ | 384 | | | $ | (898 | ) | | $ | 310 | | | $ | (307 | ) | | $ | 783 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Balance Sheet Data (Period-End) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 166,199 | | | $ | 182,347 | | | $ | 182,482 | | | $ | 178,560 | | | $ | 186,350 | | | $ | (16,148 | ) | | $ | (20,151 | ) |

| Consumer loans | | | 64,686 | | | | 63,536 | | | | 80,634 | | | | 77,959 | | | | 78,004 | | | | 1,150 | | | | (13,318 | ) |

| Commercial loans(4) | | | 34,437 | | | | 35,519 | | | | 40,625 | | | | 41,954 | | | | 41,814 | | | | (1,082 | ) | | | (7,377 | ) |

| Assets of discontinued operations held-for-sale | | | 19,063 | | | | 32,176 | | | | 375 | | | | 383 | | | | 1,008 | | | | (13,113 | ) | | | 18,055 | |

| Allowance for loan losses | | | (1,197 | ) | | | (1,170 | ) | | | (1,423 | ) | | | (1,427 | ) | | | (1,546 | ) | | | (27 | ) | | | 349 | |

| Deposits | | | 50,326 | | | | 47,915 | | | | 49,872 | | | | 47,992 | | | | 47,206 | | | | 2,411 | | | | 3,120 | |

| Common equity(5) | | | 13,534 | | | | 12,958 | | | | 11,734 | | | | 11,332 | | | | 12,636 | | | | 576 | | | | 898 | |

| Total equity | | | 20,474 | | | | 19,898 | | | | 18,674 | | | | 18,272 | | | | 19,576 | | | | 576 | | | | 898 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Select Financial Ratios | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest margin(6) | | | 2.1 | % | | | 1.9 | % | | | 1.6 | % | | | 1.7 | % | | | 1.5 | % | | | | | | | | |

| Return on average total equity (annualized) | | | 21.7 | % | | | 29.6 | % | | | 8.3 | % | | | -18.9 | % | | | 6.4 | % | | | | | | | | |

| Return on average assets (annualized) | | | 2.5 | % | | | 3.1 | % | | | 0.8 | % | | | -1.9 | % | | | 0.7 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Ratios | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tier 1 capital ratio | | | 14.6 | % | | | 13.1 | % | | | 13.6 | % | | | 13.6 | % | | | 13.4 | % | | | | | | | | |

| Tier 1 common capital ratio(7) | | | 7.9 | % | | | 7.0 | % | | | 7.3 | % | | | 7.2 | % | | | 7.5 | % | | | | | | | | |

| Total risk-based capital ratio | | | 15.6 | % | | | 14.1 | % | | | 14.6 | % | | | 14.6 | % | | | 14.5 | % | | | | | | | | |

| (1) | Includes employee related costs, consulting and legal fees, marketing, information technology, facility, portfolio servicing and restructuring expenses |

| (2) | Core pre-tax income (loss) is a non-GAAP financial measure. It is defined as income from continuing operations before taxes and primarily bond exchange original issue discount ("OID") amortization expense |

| (3) | Core OID excludes IO and 2010 issuances |

| (4) | Includes notes receivable from General Motors |

| (5) | Includes common stock and paid-in capital, accumulated deficit and accumulated other comprehensive income |

| (6) | Continuing operations only. Excludes OID amortization expense. |

| (7) | Tier 1 common capital ratio is a non-GAAP measurement. Refer to page 17 for additional details |

| 1Q 2013 Preliminary Results | | 4 |

ALLY FINANCIAL INC. CONSOLIDATED INCOME STATEMENT |  |

| | |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Financing revenue and other interest income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest and fees on finance receivables and loans(1) | | $ | 1,135 | | | $ | 1,165 | | | $ | 1,141 | | | $ | 1,140 | | | $ | 1,093 | | | $ | (30 | ) | | $ | 42 | |

| Interest on loans held-for-sale | | | 16 | | | | 24 | | | | 23 | | | | 20 | | | | 31 | | | | (8 | ) | | | (15 | ) |

| Interest on trading securities | | | - | | | | - | | | | - | | | | 1 | | | | 9 | | | | - | | | | (9 | ) |

| Interest and dividends on available-for-sale investment securities | | | 68 | | | | 77 | | | | 64 | | | | 77 | | | | 74 | | | | (9 | ) | | | (6 | ) |

| Interest-bearing cash | | | 3 | | | | 5 | | | | 8 | | | | 9 | | | | 2 | | | | (2 | ) | | | 1 | |

| Operating leases | | | 734 | | | | 680 | | | | 631 | | | | 561 | | | | 507 | | | | 54 | | | | 227 | |

| Total financing revenue and other interest income | | | 1,956 | | | | 1,951 | | | | 1,867 | | | | 1,808 | | | | 1,716 | | | | 5 | | | | 240 | |

| Interest expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest on deposits | | | 164 | | | | 164 | | | | 158 | | | | 160 | | | | 163 | | | | - | | | | 1 | |

| Interest on short-term borrowings | | | 16 | | | | 15 | | | | 20 | | | | 19 | | | | 17 | | | | 1 | | | | (1 | ) |

| Interest on long-term debt | | | 701 | | | | 768 | | | | 851 | | | | 837 | | | | 880 | | | | (67 | ) | | | (179 | ) |

| Total interest expense | | | 881 | | | | 947 | | | | 1,029 | | | | 1,016 | | | | 1,060 | | | | (66 | ) | | | (179 | ) |

| Depreciation expense on operating lease assets | | | 435 | | | | 393 | | | | 366 | | | | 335 | | | | 305 | | | | 42 | | | | 130 | |

| Net financing revenue | | | 640 | | | | 611 | | | | 472 | | | | 457 | | | | 351 | | | | 29 | | | | 289 | |

| Other revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Servicing fees | | | 82 | | | | 83 | | | | 91 | | | | 113 | | | | 122 | | | | (1 | ) | | | (40 | ) |

| Servicing asset valuation and hedge activities, net | | | (201 | ) | | | (78 | ) | | | 134 | | | | 46 | | | | (106 | ) | | | (123 | ) | | | (95 | ) |

| Total servicing income, net | | | (119 | ) | | | 5 | | | | 225 | | | | 159 | | | | 16 | | | | (124 | ) | | | (135 | ) |

| Insurance premiums and service revenue earned | | | 259 | | | | 262 | | | | 262 | | | | 261 | | | | 270 | | | | (3 | ) | | | (11 | ) |

| Gain on mortgage and automotive loans, net | | | 38 | | | | 131 | | | | 142 | | | | 86 | | | | 20 | | | | (93 | ) | | | 18 | |

| Loss on extinguishment of debt | | | - | | | | (148 | ) | | | - | | | | - | | | | - | | | | 148 | | | | - | |

| Other gain on investments, net | | | 51 | | | | 16 | | | | (23 | ) | | | 64 | | | | 89 | | | | 35 | | | | (38 | ) |

| Other income, net of losses | | | 157 | | | | 214 | | | | 169 | | | | 144 | | | | 210 | | | | (57 | ) | | | (53 | ) |

| Total other revenue | | | 386 | | | | 480 | | | | 775 | | | | 714 | | | | 605 | | | | (94 | ) | | | (219 | ) |

| Total net revenue | | | 1,026 | | | | 1,091 | | | | 1,247 | | | | 1,171 | | | | 956 | | | | (65 | ) | | | 70 | |

| Provision for loan losses | | | 131 | | | | 93 | | | | 105 | | | | 33 | | | | 98 | | | | 38 | | | | 33 | |

| Noninterest expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Compensation and benefits expense | | | 285 | | | | 276 | | | | 257 | | | | 270 | | | | 303 | | | | 9 | | | | (18 | ) |

| Insurance losses and loss adjustment expenses | | | 115 | | | | 117 | | | | 90 | | | | 149 | | | | 98 | | | | (2 | ) | | | 17 | |

| Other operating expenses | | | 558 | | | | 558 | | | | 498 | | | | 552 | | | | 454 | | | | - | | | | 104 | |

| Total noninterest expense | | | 958 | | | | 951 | | | | 845 | | | | 971 | | | | 855 | | | | 7 | | | | 103 | |

| (Loss) income from continuing operations before income tax expense | | | (63 | ) | | | 47 | | | | 297 | | | | 167 | | | | 3 | | | | (110 | ) | | | (66 | ) |

| Income tax (benefit) expense from continuing operations | | | (123 | ) | | | (887 | ) | | | 46 | | | | (16 | ) | | | 1 | | | | 764 | | | | (124 | ) |

| Net income (loss) from continuing operations | | | 60 | | | | 934 | | | | 251 | | | | 183 | | | | 2 | | | | (874 | ) | | | 58 | |

| Income (loss) from discontinued operations, net of tax | | | 1,033 | | | | 466 | | | | 133 | | | | (1,081 | ) | | | 308 | | | | 567 | | | | 725 | |

| Net income (loss) | | $ | 1,093 | | | $ | 1,400 | | | $ | 384 | | | $ | (898 | ) | | $ | 310 | | | $ | (307 | ) | | $ | 783 | |

| (1) Includes other interest income, net |

| 1Q 2013 Preliminary Results | | 5 |

ALLY FINANCIAL INC. CONSOLIDATED PERIOD-END BALANCE SHEET |  |

| | |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Assets | | 3/31/2013 | | | 12/31/2012 | | | 9/30/2012 | | | 6/30/2012 | | | 3/31/2012 | | | 12/31/2012 | | | 3/31/2012 | |

| Cash and cash equivalents | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest-bearing | | $ | 1,043 | | | $ | 1,073 | | | $ | 1,305 | | | $ | 2,106 | | | $ | 2,279 | | | $ | (30 | ) | | $ | (1,236 | ) |

| Interest-bearing | | | 6,394 | | | | 6,440 | | | | 15,852 | | | | 14,020 | | | | 10,800 | | | | (46 | ) | | | (4,406 | ) |

| Total cash and cash equivalents | | | 7,437 | | | | 7,513 | | | | 17,157 | | | | 16,126 | | | | 13,079 | | | | (76 | ) | | | (5,642 | ) |

| Trading assets | | | - | | | | - | | | | - | | | | - | | | | 895 | | | | - | | | | (895 | ) |

| Investment securities | | | 15,752 | | | | 14,178 | | | | 13,770 | | | | 13,366 | | | | 14,942 | | | | 1,574 | | | | 810 | |

| Loans held-for-sale, net | | | 718 | | | | 2,576 | | | | 1,937 | | | | 2,000 | | | | 6,670 | | | | (1,858 | ) | | | (5,952 | ) |

| Finance receivables and loans, net | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Finance receivables and loans, net | | | 99,123 | | | | 99,055 | | | | 121,259 | | | | 119,913 | | | | 119,818 | | | | 68 | | | | (20,695 | ) |

| Allowance for loan losses | | | (1,197 | ) | | | (1,170 | ) | | | (1,423 | ) | | | (1,427 | ) | | | (1,546 | ) | | | (27 | ) | | | 349 | |

| Total finance receivables and loans, net | | | 97,926 | | | | 97,885 | | | | 119,836 | | | | 118,486 | | | | 118,272 | | | | 41 | | | | (20,346 | ) |

| Investment in operating leases, net | | | 14,828 | | | | 13,550 | | | | 12,708 | | | | 11,197 | | | | 10,048 | | | | 1,278 | | | | 4,780 | |

| Mortgage servicing rights | | | 917 | | | | 952 | | | | 902 | | | | 1,105 | | | | 2,595 | | | | (35 | ) | | | (1,678 | ) |

| Premiums receivables and other insurance assets | | | 1,608 | | | | 1,609 | | | | 1,861 | | | | 1,887 | | | | 1,876 | | | | (1 | ) | | | (268 | ) |

| Other assets | | | 7,950 | | | | 11,908 | | | | 13,936 | | | | 14,010 | | | | 16,965 | | | | (3,958 | ) | | | (9,015 | ) |

| Assets of operations held-for-sale | | | 19,063 | | | | 32,176 | | | | 375 | | | | 383 | | | | 1,008 | | | | (13,113 | ) | | | 18,055 | |

| Total assets | | $ | 166,199 | | | $ | 182,347 | | | $ | 182,482 | | | $ | 178,560 | | | $ | 186,350 | | | $ | (16,148 | ) | | $ | (20,151 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposit liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest-bearing | | $ | 844 | | | $ | 1,977 | | | $ | 2,487 | | | $ | 2,411 | | | $ | 2,314 | | | $ | (1,133 | ) | | $ | (1,470 | ) |

| Interest-bearing | | | 49,482 | | | | 45,938 | | | | 47,385 | | | | 45,581 | | | | 44,892 | | | | 3,544 | | | | 4,590 | |

| Total deposit liabilities | | | 50,326 | | | | 47,915 | | | | 49,872 | | | | 47,992 | | | | 47,206 | | | | 2,411 | | | | 3,120 | |

| Short-term borrowings | | | 7,618 | | | | 7,461 | | | | 5,877 | | | | 6,010 | | | | 7,203 | | | | 157 | | | | 415 | |

| Long-term debt | | | 67,621 | | | | 74,561 | | | | 93,119 | | | | 91,187 | | | | 94,081 | | | | (6,940 | ) | | | (26,460 | ) |

| Interest payable | | | 972 | | | | 932 | | | | 1,590 | | | | 1,552 | | | | 1,675 | | | | 40 | | | | (703 | ) |

| Unearned insurance premiums and service revenue | | | 2,286 | | | | 2,296 | | | | 2,693 | | | | 2,631 | | | | 2,632 | | | | (10 | ) | | | (346 | ) |

| Accrued expense and other liabilities | | | 3,669 | | | | 6,585 | | | | 10,403 | | | | 10,675 | | | | 13,654 | | | | (2,916 | ) | | | (9,985 | ) |

| Liabilities of operations held-for-sale | | | 13,233 | | | | 22,699 | | | | 254 | | | | 241 | | | | 323 | | | | (9,466 | ) | | | 12,910 | |

| Total liabilities | | $ | 145,725 | | | $ | 162,449 | | | $ | 163,808 | | | $ | 160,288 | | | $ | 166,774 | | | $ | (16,724 | ) | | $ | (21,049 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock and paid-in capital | | $ | 19,668 | | | $ | 19,668 | | | $ | 19,668 | | | $ | 19,668 | | | $ | 19,668 | | | $ | 0 | | | $ | 0 | |

| Mandatorily convertible preferred stock held by U.S. Department of Treasury | | | 5,685 | | | | 5,685 | | | | 5,685 | | | | 5,685 | | | | 5,685 | | | | - | | | | - | |

| Preferred stock | | | 1,255 | | | | 1,255 | | | | 1,255 | | | | 1,255 | | | | 1,255 | | | | - | | | | - | |

| Accumulated deficit | | | (6,128 | ) | | | (7,021 | ) | | | (8,220 | ) | | | (8,404 | ) | | | (7,306 | ) | | | 893 | | | | 1,178 | |

| Accumulated other comprehensive income | | | (6 | ) | | | 311 | | | | 286 | | | | 68 | | | | 274 | | | | (317 | ) | | | (280 | ) |

| Total equity | | | 20,474 | | | | 19,898 | | | | 18,674 | | | | 18,272 | | | | 19,576 | | | | 576 | | | | 898 | |

| Total liabilities and equity | | $ | 166,199 | | | $ | 182,347 | | | $ | 182,482 | | | $ | 178,560 | | | $ | 186,350 | | | $ | (16,148 | ) | | $ | (20,151 | ) |

| 1Q 2013 Preliminary Results | | 6 |

ALLY FINANCIAL INC. CONSOLIDATED AVERAGE BALANCE SHEET(1)(2) |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Assets | | 3/31/2013 | | | 12/31/2012 | | | 9/30/2012 | | | 6/30/2012 | | | 3/31/2012 | | | 12/31/2012 | | | 3/31/2012 | |

| Interest-bearing cash and cash equivalents | | $ | 6,565 | | | $ | 8,970 | | | $ | 13,517 | | | $ | 11,130 | | | $ | 8,724 | | | $ | (2,405 | ) | | $ | (2,159 | ) |

| Trading assets | | | - | | | | - | | | | - | | | | 98 | | | | 958 | | | | - | | | | (958 | ) |

| Investment securities | | | 13,921 | | | | 13,051 | | | | 11,414 | | | | 12,124 | | | | 12,633 | | | | 870 | | | | 1,288 | |

| Loans held-for-sale, net | | | 2,027 | | | | 2,899 | | | | 2,731 | | | | 2,179 | | | | 3,463 | | | | (872 | ) | | | (1,436 | ) |

| Total finance receivables and loans, net(3) | | | 98,595 | | | | 98,029 | | | | 95,180 | | | | 95,423 | | | | 90,444 | | | | 566 | | | | 8,151 | |

| Investment in operating leases, net | | | 14,205 | | | | 13,125 | | | | 11,810 | | | | 10,422 | | | | 9,345 | | | | 1,080 | | | | 4,860 | |

| Total interest earning assets | | | 135,313 | | | | 136,074 | | | | 134,652 | | | | 131,376 | | | | 125,568 | | | | (761 | ) | | | 9,745 | |

| Noninterest-bearing cash and cash equivalents | | | 1,967 | | | | 1,623 | | | | 1,489 | | | | 2,337 | | | | 1,682 | | | | 344 | | | | 285 | |

| Other assets(4) | | | 38,257 | | | | 46,981 | | | | 47,498 | | | | 52,119 | | | | 58,516 | | | | (8,724 | ) | | | (20,259 | ) |

| Allowance for loan losses | | | (1,172 | ) | | | (1,189 | ) | | | (1,211 | ) | | | (1,250 | ) | | | (1,274 | ) | | | 17 | | | | 102 | |

| Total assets | | $ | 174,365 | | | $ | 183,490 | | | $ | 182,428 | | | $ | 184,582 | | | $ | 184,492 | | | $ | (9,125 | ) | | $ | (10,127 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposit liabilities | | $ | 47,985 | | | $ | 44,296 | | | $ | 42,470 | | | $ | 41,583 | | | $ | 41,128 | | | $ | 3,689 | | | $ | 6,857 | |

| Short-term borrowings | | | 4,585 | | | | 4,259 | | | | 3,390 | | | | 3,718 | | | | 3,436 | | | | 326 | | | | 1,149 | |

| Long-term debt(5) | | | 71,957 | | | | 78,202 | | | | 78,130 | | | | 78,053 | | | | 72,719 | | | | (6,245 | ) | | | (762 | ) |

| Total interest-bearing liabilities(5) | | | 124,527 | | | | 126,757 | | | | 123,990 | | | | 123,354 | | | | 117,283 | | | | (2,230 | ) | | | 7,244 | |

| Noninterest-bearing deposit liabilities | | | 1,579 | | | | 2,228 | | | | 2,503 | | | | 2,279 | | | | 2,142 | | | | (649 | ) | | | (563 | ) |

| Other liabilities(4) | | | 28,087 | | | | 35,567 | | | | 37,416 | | | | 39,991 | | | | 45,588 | | | | (7,480 | ) | | | (17,501 | ) |

| Total liabilities | | $ | 154,193 | | | $ | 164,552 | | | $ | 163,909 | | | $ | 165,624 | | | $ | 165,012 | | | $ | (10,359 | ) | | $ | (10,819 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total equity | | $ | 20,172 | | | $ | 18,937 | | | $ | 18,519 | | | $ | 18,958 | | | $ | 19,480 | | | $ | 1,235 | | | $ | 692 | |

| Total liabilities and equity | | $ | 174,365 | | | $ | 183,490 | | | $ | 182,428 | | | $ | 184,582 | | | $ | 184,492 | | | $ | (9,125 | ) | | $ | (10,127 | ) |

| (1) | Average balances are calculated using a combination of monthly and daily average methodologies |

| (2) | Prior periods exclude ResCap |

| (3) | Nonperforming finance receivables and loans are included in the average balances net of unearned income, unamortized premiums and discounts, and deferred fees and costs |

| (4) | Includes discontinued operations |

| (5) | QTD: Average balance includes $1,753 million and $2,062 million related to original issue discount at March 31, 2013 and 2012, respectively. Interest expense includes original issue discount amortization of $57 million and $108 million as of March 31, 2013 and 2012, respectively |

| | |

| 1Q 2013 Preliminary Results | | 7 |

ALLY FINANCIAL INC. SEGMENT HIGHLIGHTS |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | 1Q 13 | | | | 4Q 12 | | | | 3Q 12 | | | | 2Q 12 | | | | 1Q 12 | | | | 4Q 12 | | | | 1Q 12 | |

| Automotive Finance | | $ | 343 | | | $ | 371 | | | $ | 337 | | | $ | 440 | | | $ | 241 | | | $ | (28 | ) | | $ | 102 | |

| Insurance | | | 61 | | | | 27 | | | | 13 | | | | 20 | | | | 100 | | | | 34 | | | | (39 | ) |

| Dealer Financial Services | | | 404 | | | | 398 | | | | 350 | | | | 460 | | | | 341 | | | | 6 | | | | 63 | |

| Mortgage | | | (204 | ) | | | 99 | | | | 331 | | | | 102 | | | | 63 | | | | (303 | ) | | | (267 | ) |

| Corporate and Other (ex. OID)(1) | | | (206 | ) | | | (394 | ) | | | (308 | ) | | | (299 | ) | | | (293 | ) | | | 188 | | | | 88 | |

| Core pre-tax (loss) income(2) | | $ | (6 | ) | | $ | 103 | | | $ | 373 | | | $ | 263 | | | $ | 111 | | | $ | (109 | ) | | $ | (116 | ) |

| Core OID amortization expense | | | 57 | | | | 56 | | | | 76 | | | | 96 | | | | 108 | | | | 1 | | | | (50 | ) |

| Income tax (benefit) expense | | | (123 | ) | | | (887 | ) | | | 46 | | | | (16 | ) | | | 1 | | | | 764 | | | | (124 | ) |

| Income (loss) from discontinued operations | | | 1,033 | | | | 466 | | | | 133 | | | | (1,081 | ) | | | 308 | | | | 567 | | | | 725 | |

| Net income (loss) | | $ | 1,093 | | | $ | 1,400 | | | $ | 384 | | | $ | (898 | ) | | $ | 310 | | | $ | (307 | ) | | $ | 783 | |

| (1) | Corporate and Other primarily consists of Ally’s centralized treasury activities, the residual impacts of the company’s corporate funds transfer pricing and asset liability management activities, and the amortization of the discount associated with new debt issuances and bond exchanges. Corporate and Other also includes the Commercial Finance business, certain equity investments and reclassifications, eliminations between the reportable operating segments, and overhead previously allocated to operations that have since been sold or discontinued. |

| (2) | Core pre-tax (loss) income is a non-GAAP financial measure. It is defined as income from continuing operations before taxes and primarily bond exchange OID amortization expense |

| 1Q 2013 Preliminary Results | | 8 |

ALLY FINANCIAL INC. AUTOMOTIVE FINANCE - CONDENSED FINANCIAL STATEMENTS |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Income Statement | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Net financing revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer | | $ | 729 | | | $ | 739 | | | $ | 719 | | | $ | 708 | | | $ | 661 | | | $ | (10 | ) | | $ | 68 | |

| Commercial(1) | | | 281 | | | | 294 | | | | 283 | | | | 290 | | | | 285 | | | | (13 | ) | | | (4 | ) |

| Loans held-for-sale | | | - | | | | - | | | | 4 | | | | 6 | | | | 5 | | | | - | | | | (5 | ) |

| Operating leases | | | 734 | | | | 680 | | | | 631 | | | | 561 | | | | 507 | | | | 54 | | | | 227 | |

| Other interest income | | | 7 | | | | 10 | | | | 12 | | | | 15 | | | | 15 | | | | (3 | ) | | | (8 | ) |

| Total financing revenue and other interest income | | | 1,751 | | | | 1,723 | | | | 1,649 | | | | 1,580 | | | | 1,473 | | | | 28 | | | | 278 | |

| Interest expense | | | 543 | | | | 554 | | | | 555 | | | | 552 | | | | 538 | | | | (11 | ) | | | 5 | |

| Depreciation expense on operating lease assets | | | 435 | | | | 393 | | | | 366 | | | | 335 | | | | 305 | | | | 42 | | | | 130 | |

| Net financing revenue | | | 773 | | | | 776 | | | | 728 | | | | 693 | | | | 630 | | | | (3 | ) | | | 143 | |

| Other revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Servicing fees | | | 19 | | | | 23 | | | | 26 | | | | 30 | | | | 30 | | | | (4 | ) | | | (11 | ) |

| Gain on automotive loans, net | | | - | | | | - | | | | 2 | | | | 39 | | | | - | | | | - | | | | - | |

| Other income | | | 63 | | | | 35 | | | | 47 | | | | 43 | | | | 47 | | | | 28 | | | | 16 | |

| Total other revenue | | | 82 | | | | 58 | | | | 75 | | | | 112 | | | | 77 | | | | 24 | | | | 5 | |

| Total net revenue | | | 855 | | | | 834 | | | | 803 | | | | 805 | | | | 707 | | | | 21 | | | | 148 | |

| Provision for loan losses | | | 112 | | | | 59 | | | | 101 | | | | 15 | | | | 78 | | | | 53 | | | | 34 | |

| Noninterest expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Compensation and benefits | | | 113 | | | | 112 | | | | 99 | | | | 97 | | | | 108 | | | | 1 | | | | 5 | |

| Other operating expenses | | | 287 | | | | 292 | | | | 266 | | | | 253 | | | | 280 | | | | (5 | ) | | | 7 | |

| Total noninterest expense | | | 400 | | | | 404 | | | | 365 | | | | 350 | | | | 388 | | | | (4 | ) | | | 12 | |

| Income before income tax expense | | $ | 343 | | | $ | 371 | | | $ | 337 | | | $ | 440 | | | $ | 241 | | | $ | (28 | ) | | $ | 102 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet (Period-End) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash, trading and investment securities | | $ | 10 | | | $ | 10 | | | $ | 30 | | | $ | 22 | | | $ | 22 | | | $ | - | | | $ | (12 | ) |

| Loans held-for-sale | | | - | | | | - | | | | - | | | | 623 | | | | 623 | | | | - | | | | (623 | ) |

| Finance receivables and loans, net: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer loans | | | 55,014 | | | | 53,715 | | | | 70,847 | | | | 68,136 | | | | 67,214 | | | | 1,299 | | | | (12,200 | ) |

| Commercial loans(2) | | | 31,944 | | | | 32,894 | | | | 37,437 | | | | 38,424 | | | | 39,224 | | | | (950 | ) | | | (7,280 | ) |

| Allowance for loan losses | | | (698 | ) | | | (670 | ) | | | (929 | ) | | | (906 | ) | | | (976 | ) | | | (28 | ) | | | 278 | |

| Total finance receivables and loans, net | | $ | 86,260 | | | $ | 85,939 | | | $ | 107,355 | | | $ | 105,654 | | | $ | 105,462 | | | $ | 321 | | | $ | (19,202 | ) |

| Investment in operating leases, net | | | 14,828 | | | | 13,550 | | | | 12,708 | | | | 11,197 | | | | 10,048 | | | | 1,278 | | | | 4,780 | |

| Other assets | | | 1,165 | | | | 1,389 | | | | 3,079 | | | | 2,941 | | | | 2,839 | | | | (224 | ) | | | (1,674 | ) |

| Assets of operations held-for-sale | | | 16,619 | | | | 27,523 | | | | 80 | | | | 86 | | | | 87 | | | | (10,904 | ) | | | 16,532 | |

| Total assets | | $ | 118,882 | | | $ | 128,411 | | | $ | 123,252 | | | $ | 120,523 | | | $ | 119,081 | | | $ | (9,529 | ) | | $ | (199 | ) |

| (1) | Includes intercompany activity |

| (2) | Includes notes receivable from General Motors and intercompany |

| 1Q 2013 Preliminary Results | | 9 |

ALLY FINANCIAL INC. AUTOMOTIVE FINANCE - KEY STATISTICS |  |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| U.S. Market | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| SAAR (units in millions) | | | 15.3 | | | | 15.0 | | | | 14.5 | | | | 14.0 | | | | 14.5 | | | | 0.2 | | | | 0.8 | |

| Industry light vehicle sales(units in millions) | | | 3.7 | | | | 3.6 | | | | 3.6 | | | | 3.8 | | | | 3.5 | | | | 0.1 | | | | 0.2 | |

| GM market share | | | 18.1 | % | | | 17.6 | % | | | 18.0 | % | | | 18.7 | % | | | 17.6 | % | | | | | | | | |

| Chrysler market share | | | 11.7 | % | | | 11.2 | % | | | 11.5 | % | | | 11.5 | % | | | 11.5 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Consumer Originations(1)($ in billions) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GM new retail subvented | | $ | 1.3 | | | $ | 1.4 | | | $ | 0.9 | | | $ | 1.9 | | | $ | 1.7 | | | $ | (0.1 | ) | | $ | (0.5 | ) |

| GM new retail standard | | | 1.5 | | | | 1.5 | | | | 1.6 | | | | 1.5 | | | | 1.6 | | | | (0.0 | ) | | | (0.1 | ) |

| Chrysler new retail subvented | | | 0.2 | | | | 0.3 | | | | 0.5 | | | | 0.7 | | | | 0.5 | | | | (0.0 | ) | | | (0.3 | ) |

| Chrysler new retail standard | | | 1.0 | | | | 1.1 | | | | 1.1 | | | | 1.1 | | | | 1.1 | | | | (0.0 | ) | | | (0.0 | ) |

| Diversified new | | | 0.5 | | | | 0.5 | | | | 0.6 | | | | 0.6 | | | | 0.5 | | | | 0.1 | | | | (0.0 | ) |

| Lease | | | 2.7 | | | | 2.1 | | | | 2.6 | | | | 2.1 | | | | 1.6 | | | | 0.6 | | | | 1.1 | |

| Used | | | 2.5 | | | | 2.1 | | | | 2.3 | | | | 2.6 | | | | 2.6 | | | | 0.4 | | | | (0.2 | ) |

| Total originations | | $ | 9.7 | | | $ | 8.9 | | | $ | 9.6 | | | $ | 10.5 | | | $ | 9.7 | | | $ | 0.8 | | | $ | 0.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Consumer Penetration(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GM | | | 30.6 | % | | | 28.4 | % | | | 29.0 | % | | | 31.6 | % | | | 30.7 | % | | | | | | | | |

| Chrysler | | | 23.6 | % | | | 22.0 | % | | | 25.4 | % | | | 28.4 | % | | | 28.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Commercial Outstandings EOP($ in billions) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Floorplan outstandings | | $ | 28.5 | | | $ | 29.5 | | | $ | 26.8 | | | $ | 27.3 | | | $ | 27.5 | | | $ | (1.0 | ) | | $ | 1.0 | |

| Other dealer loans | | | 3.4 | | | | 3.3 | | | | 3.2 | | | | 3.1 | | | | 3.0 | | | | 0.1 | | | | 0.4 | |

| Total Commercial outstandings | | $ | 31.9 | | | $ | 32.8 | | | $ | 29.9 | | | $ | 30.4 | | | $ | 30.5 | | | $ | (0.9 | ) | | $ | 1.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Floorplan Penetration(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GM penetration | | | 68.6 | % | | | 69.2 | % | | | 70.3 | % | | | 71.2 | % | | | 72.2 | % | | | | | | | | |

| Chrysler penetration | | | 53.9 | % | | | 54.9 | % | | | 56.5 | % | | | 60.5 | % | | | 62.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Off-Lease Remarketing(3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales proceeds on scheduled lease terminations (36-month) per vehicle - On-balance sheet | | $ | 16,306 | | | $ | 17,122 | | | | NM | | | | NM | | | | NM | | | $ | (816 | ) | | | NM | |

| Off-lease vehicles terminated - On-balance sheet(# in units) | | | 31,924 | | | | 19,789 | | | | 15,502 | | | | 12,846 | | | | 15,180 | | | | 12,135 | | | | 16,744 | |

| (1) | Some standard rate loan originations contain manufacturer sponsored cash back rebate incentives. Some lease originations contain rate subvention. While Ally may jointly develop marketing programs for these originations, Ally does not have exclusive rights to such originations under operating agreements with manufacturers |

| (2) | Penetration rates are based on the trailing four month average |

| (3) | U.S. off-lease remarketing sales proceeds for 36 month leases are not meaningful (NM) in certain prior periods as originations of this lease type were immaterial in 1Q 09, 2Q 09, 3Q 09 & 4Q 09 |

| 1Q 2013 Preliminary Results | | 10 |

ALLY FINANCIAL INC. INSURANCE - CONDENSED FINANCIAL STATEMENTS AND KEY STATISTICS |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Income Statement | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Insurance premiums and other income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Insurance premiums and service revenue earned | | $ | 259 | | | $ | 262 | | | $ | 262 | | | $ | 261 | | | $ | 270 | | | $ | (3 | ) | | $ | (11 | ) |

| Investment income | | | 58 | | | | 34 | | | | (21 | ) | | | 38 | | | | 73 | | | | 24 | | | | (15 | ) |

| Other income | | | 3 | | | | 5 | | | | 6 | | | | 17 | | | | 7 | | | | (2 | ) | | | (4 | ) |

| Total insurance premiums and other income | | | 320 | | | | 301 | | | | 247 | | | | 316 | | | | 350 | | | | 19 | | | | (30 | ) |

| Expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Insurance losses and loss adjustment expenses | | | 115 | | | | 117 | | | | 90 | | | | 149 | | | | 98 | | | | (2 | ) | | | 17 | |

| Acquisition and underwriting expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Compensation and benefit expense | | | 15 | | | | 16 | | | | 13 | | | | 15 | | | | 17 | | | | (1 | ) | | | (2 | ) |

| Insurance commission expense | | | 92 | | | | 96 | | | | 93 | | | | 94 | | | | 99 | | | | (4 | ) | | | (7 | ) |

| Other expense | | | 37 | | | | 45 | | | | 38 | | | | 38 | | | | 36 | | | | (8 | ) | | | 1 | |

| Total acquisition and underwriting expense | | | 144 | | | | 157 | | | | 144 | | | | 147 | | | | 152 | | | | (13 | ) | | | (8 | ) |

| Total expense | | | 259 | | | | 274 | | | | 234 | | | | 296 | | | | 250 | | | | (15 | ) | | | 9 | |

| Income from cont. ops before income tax expense | | $ | 61 | | | $ | 27 | | | $ | 13 | | | $ | 20 | | | $ | 100 | | | $ | 34 | | | $ | (39 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet (Period-End) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash, trading and investment securities | | $ | 5,510 | | | $ | 5,144 | | | $ | 5,670 | | | $ | 5,489 | | | $ | 5,587 | | | $ | 366 | | | $ | (77 | ) |

| Finance receivables and loans, net | | | 5 | | | | 5 | | | | 5 | | | | 5 | | | | 5 | | | | - | | | | - | |

| Premiums receivable and other insurance assets | | | 1,617 | | | | 1,619 | | | | 2,004 | | | | 2,019 | | | | 2,010 | | | | (2 | ) | | | (393 | ) |

| Other assets | | | 240 | | | | 513 | | | | 462 | | | | 412 | | | | 433 | | | | (273 | ) | | | (193 | ) |

| Assets of operations held-for-sale | | | 959 | | | | 1,158 | | | | 320 | | | | 312 | | | | 359 | | | | (199 | ) | | | 600 | |

| Total assets | | $ | 8,331 | | | $ | 8,439 | | | $ | 8,461 | | | $ | 8,237 | | | $ | 8,394 | | | $ | (108 | ) | | $ | (63 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key Statistics (Continuing Operations) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Written Premiums | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dealer Products & Services | | $ | 233 | | | $ | 239 | | | $ | 285 | | | $ | 283 | | | $ | 250 | | | $ | (6 | ) | | $ | (17 | ) |

| Corporate | | | 1 | | | | 1 | | | | 1 | | | | 1 | | | | 1 | | | | (0 | ) | | | (0 | ) |

| Total written premiums and revenue | | $ | 234 | | | $ | 240 | | | $ | 286 | | | $ | 284 | | | $ | 251 | | | $ | (6 | ) | | $ | (17 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss ratio | | | 44.1 | % | | | 44.8 | % | | | 34.1 | % | | | 54.8 | % | | | 35.8 | % | | | | | | | | |

| Underwriting expense ratio | | | 55.5 | % | | | 59.3 | % | | | 54.6 | % | | | 54.2 | % | | | 55.6 | % | | | | | | | | |

| Combined ratio | | | 99.7 | % | | | 104.1 | % | | | 88.7 | % | | | 109.0 | % | | | 91.4 | % | | | | | | | | |

| 1Q 2013 Preliminary Results | | 11 |

ALLY FINANCIAL INC. MORTGAGE - CONDENSED FINANCIAL STATEMENTS AND KEY STATISTICS |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Income Statement | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Net financing revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total financing revenue and other interest income | | $ | 122 | | | $ | 146 | | | $ | 159 | | | $ | 146 | | | $ | 166 | | | $ | (24 | ) | | $ | (44 | ) |

| Interest expense | | | 88 | | | | 108 | | | | 114 | | | | 117 | | | | 129 | | | | (20 | ) | | | (41 | ) |

| Net financing revenue | | | 34 | | | | 38 | | | | 45 | | | | 29 | | | | 37 | | | | (4 | ) | | | (3 | ) |

| Servicing fees | | | 63 | | | | 60 | | | | 65 | | | | 83 | | | | 92 | | | | 3 | | | | (29 | ) |

| Servicing asset valuation and hedge activities, net | | | (201 | ) | | | (78 | ) | | | 134 | | | | 46 | | | | (106 | ) | | | (123 | ) | | | (95 | ) |

| Total servicing income, net | | | (138 | ) | | | (18 | ) | | | 199 | | | | 129 | | | | (14 | ) | | | (120 | ) | | | (124 | ) |

| Gain on mortgage loans, net | | | 38 | | | | 131 | | | | 140 | | | | 79 | | | | 25 | | | | (93 | ) | | | 13 | |

| Other income, net of losses | | | 81 | | | | 143 | | | | 107 | | | | 112 | | | | 126 | | | | (62 | ) | | | (45 | ) |

| Total other revenue | | | (19 | ) | | | 256 | | | | 446 | | | | 320 | | | | 137 | | | | (275 | ) | | | (156 | ) |

| Total net revenue | | | 15 | | | | 294 | | | | 491 | | | | 349 | | | | 174 | | | | (279 | ) | | | (159 | ) |

| Provision for loan losses | | | 20 | | | | 33 | | | | 5 | | | | 21 | | | | 27 | | | | (13 | ) | | | (7 | ) |

| Noninterest expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Compensation and benefits expense | | | 25 | | | | 29 | | | | 25 | | | | 23 | | | | 19 | | | | (4 | ) | | | 6 | |

| Representation and warranty expense | | | 83 | | | | (0 | ) | | | 30 | | | | 141 | | | | - | | | | 84 | | | | 83 | |

| Other operating expense | | | 91 | | | | 133 | | | | 100 | | | | 62 | | | | 65 | | | | (43 | ) | | | 26 | |

| Total noninterest expense | | | 199 | | | | 162 | | | | 155 | | | | 226 | | | | 84 | | | | 37 | | | | 115 | |

| Loss (income) from cont. ops before income tax expense | | $ | (204 | ) | | $ | 99 | | | $ | 331 | | | $ | 102 | | | $ | 63 | | | $ | (303 | ) | | $ | (267 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet (Period-End)(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash, trading and investment securities | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 685 | | | $ | - | | | $ | (685 | ) |

| Loans held-for-sale | | | 701 | | | | 2,490 | | | | 1,927 | | | | 1,377 | | | | 6,047 | | | | (1,789 | ) | | | (5,346 | ) |

| Finance receivables and loans, net: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer loans | | | 9,672 | | | | 9,821 | | | | 9,787 | | | | 9,823 | | | | 10,790 | | | | (149 | ) | | | (1,118 | ) |

| Commercial loans | | | - | | | | - | | | | 686 | | | | 1,146 | | | | 1,418 | | | | - | | | | (1,418 | ) |

| Allowance for loan losses | | | (451 | ) | | | (452 | ) | | | (447 | ) | | | (473 | ) | | | (518 | ) | | | 1 | | | | 67 | |

| Total finance receivables and loans, net | | $ | 9,221 | | | $ | 9,369 | | | $ | 10,026 | | | $ | 10,496 | | | $ | 11,690 | | | $ | (148 | ) | | $ | (2,469 | ) |

| Mortgage servicing rights | | | 917 | | | | 952 | | | | 902 | | | | 1,105 | | | | 2,595 | | | | (35 | ) | | | (1,678 | ) |

| Other assets(2) | | | 445 | | | | 1,933 | | | | 4,149 | | | | 4,168 | | | | 9,062 | | | | (1,488 | ) | | | (8,617 | ) |

| Total assets | | $ | 11,284 | | | $ | 14,744 | | | $ | 17,004 | | | $ | 17,146 | | | $ | 30,079 | | | $ | (3,460 | ) | | $ | (18,795 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key Statistics($ in billions) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mortgage loan production(3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Prime conforming | | $ | 5.6 | | | $ | 9.1 | | | $ | 7.3 | | | $ | 4.8 | | | $ | 6.5 | | | $ | (3.5 | ) | | $ | (1.0 | ) |

| Prime non-conforming | | | 0.5 | | | | 0.6 | | | | 0.5 | | | | 0.6 | | | | 0.5 | | | | (0.1 | ) | | | 0.0 | |

| Government | | | 0.0 | | | | 0.1 | | | | 0.3 | | | | 0.5 | | | | 1.5 | | | | (0.0 | ) | | | (1.4 | ) |

| Total mortgage loan production | | $ | 6.1 | | | $ | 9.8 | | | $ | 8.2 | | | $ | 5.9 | | | $ | 8.5 | | | $ | (3.6 | ) | | $ | (2.4 | ) |

| (1) | Mortgage balance sheet includes ResCap results prior to the May 14, 2012 deconsolidation |

| (2) | Includes derivative assets which are reflected on a gross basis on the balance sheet, assets of discontinued operations held-for-sale and other assets |

| (3) | Excludes ResCap |

| 1Q 2013 Preliminary Results | | 12 |

ALLY FINANCIAL INC. CORPORATE AND OTHER - CONDENSED FINANCIAL STATEMENTS |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| Includes CFG | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Income Statement | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Net financing loss | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total financing revenue and other interest income | | $ | 53 | | | $ | 42 | | | $ | 26 | | | $ | 45 | | | $ | 44 | | | $ | 11 | | | $ | 9 | |

| Interest expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Core original issue discount amortization | | | 57 | | | | 56 | | | | 76 | | | | 96 | | | | 108 | | | | 1 | | | | (50 | ) |

| Other interest expense | | | 175 | | | | 211 | | | | 265 | | | | 230 | | | | 264 | | | | (36 | ) | | | (90 | ) |

| Total interest expense | | | 232 | | | | 267 | | | | 341 | | | | 326 | | | | 372 | | | | (35 | ) | | | (140 | ) |

| Net financing loss | | | (179 | ) | | | (225 | ) | | | (315 | ) | | | (281 | ) | | | (328 | ) | | | 46 | | | | 149 | |

| Other revenue | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss on extinguishment of debt | | | - | | | | (148 | ) | | | - | | | | - | | | | - | | | | 148 | | | | - | |

| Other gain on investments, net | | | 3 | | | | 2 | | | | 7 | | | | 36 | | | | 24 | | | | 1 | | | | (21 | ) |

| Other income, net of losses (1) | | | 12 | | | | 33 | | | | 14 | | | | (54 | ) | | | 29 | | | | (21 | ) | | | (17 | ) |

| Total other revenue (expense) | | | 15 | | | | (113 | ) | | | 21 | | | | (18 | ) | | | 53 | | | | 128 | | | | (38 | ) |

| Total net expense | | | (164 | ) | | | (338 | ) | | | (294 | ) | | | (299 | ) | | | (275 | ) | | | 174 | | | | 111 | |

| Provision for loan losses | | | (1 | ) | | | 1 | | | | (1 | ) | | | (3 | ) | | | (7 | ) | | | (2 | ) | | | 6 | |

| Noninterest expense | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Compensation and benefits expense | | | 132 | | | | 119 | | | | 120 | | | | 135 | | | | 159 | | | | 13 | | | | (27 | ) |

| Other operating expense(2) | | | (32 | ) | | | (8 | ) | | | (29 | ) | | | (36 | ) | | | (26 | ) | | | (24 | ) | | | (6 | ) |

| Total noninterest expense | | | 100 | | | | 111 | | | | 91 | | | | 99 | | | | 133 | | | | (11 | ) | | | (33 | ) |

| Loss from cont. ops before income tax expense | | $ | (263 | ) | | $ | (450 | ) | | $ | (384 | ) | | $ | (395 | ) | | $ | (401 | ) | | $ | 187 | | | $ | 138 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet (Period-End) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash, trading and investment securities | | $ | 17,669 | | | $ | 16,537 | | | $ | 25,227 | | | $ | 23,981 | | | $ | 22,622 | | | $ | 1,132 | | | $ | (4,953 | ) |

| Loans held-for-sale | | | 17 | | | | 86 | | | | 10 | | | | - | | | | - | | | | (69 | ) | | | 17 | |

| Finance receivables and loans, net | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer loans | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Commercial loans(3) | | | 2,488 | | | | 2,620 | | | | 2,497 | | | | 2,379 | | | | 1,167 | | | | (132 | ) | | | 1,321 | |

| Allowance for loan losses | | | (48 | ) | | | (48 | ) | | | (47 | ) | | | (48 | ) | | | (52 | ) | | | - | | | | 4 | |

| Total finance receivables and loans, net | | | 2,440 | | | | 2,572 | | | | 2,450 | | | | 2,331 | | | | 1,115 | | | | (132 | ) | | | 1,325 | |

| Other assets | | | 6,091 | | | | 8,063 | | | | 6,103 | | | | 6,357 | | | | 5,060 | | | | (1,972 | ) | | | 1,031 | |

| Assets of operations held-for-sale | | | 1,485 | | | | 3,495 | | | | (25 | ) | | | (15 | ) | | | (1 | ) | | | (2,010 | ) | | | 1,486 | |

| Total assets | | $ | 27,702 | | | $ | 30,753 | | | $ | 33,765 | | | $ | 32,654 | | | $ | 28,796 | | | $ | (3,051 | ) | | $ | (1,094 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| OID Amortization Schedule (4) | | | | | | | 2013 | | | | 2014 | | | | 2015 and After | | | | | | | | | | | | | |

| Remaining Core OID Amortization (as of 3/31/2013) | | | | | | $ | 192 | | | $ | 176 | | | | Avg = $52/yr | | | | | | | | | | | | | |

| (1) | Includes gain/(loss) on mortgage and automotive loans |

| (2) | Includes reductions of $193 million for March 31, 2013, $210 million for December 31, 2012, $202 million for September 30, 2012, $195 million for June 30, 2012 and $207 million for March 31, 2012 related to the allocation of corporate overhead expenses to other segments. The receiving segments record their allocation of corporate overhead expense within other operating expense. 2Q12 other operating expense includes the $1,192 million charge taken for ResCap actions |

| (3) | Includes Intercompany |

| (4) | Primarily represents bond exchange OID amortization expense used for calculating core pre-tax income |

| | |

| 1Q 2013 Preliminary Results | | 13 |

ALLY FINANCIAL INC. CREDIT RELATED INFORMATION |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Asset Quality - Consolidated(1) | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Ending loan balance(2) | | $ | 99,123 | | | $ | 99,055 | | | $ | 121,259 | | | $ | 119,913 | | | $ | 118,986 | | | $ | 67 | | | $ | (19,864 | ) |

| 30+ Accruing DPD | | $ | 930 | | | $ | 1,145 | | | $ | 1,051 | | | $ | 932 | | | $ | 802 | | | $ | (215 | ) | | $ | 128 | |

| 30+ Accruing DPD % | | | 0.9 | % | | | 1.2 | % | | | 0.9 | % | | | 0.8 | % | | | 0.7 | % | | | | | | | | |

| Non-performing loans (NPLs) | | $ | 938 | | | $ | 858 | | | $ | 1,130 | | | $ | 995 | | | $ | 845 | | | $ | 80 | | | $ | 93 | |

| Net charge-offs (NCOs) | | $ | 114 | | | $ | 154 | | | $ | 125 | | | $ | 88 | | | $ | 107 | | | $ | (40 | ) | | $ | 7 | |

| Net charge-off rate(3) | | | 0.5 | % | | | 0.5 | % | | | 0.4 | % | | | 0.3 | % | | | 0.4 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Provision for loan losses | | $ | 131 | | | $ | 93 | | | $ | 105 | | | $ | 33 | | | $ | 98 | | | $ | 38 | | | $ | 33 | |

| Allowance for loan losses (ALLL) | | $ | 1,197 | | | $ | 1,170 | | | $ | 1,423 | | | $ | 1,427 | | | $ | 1,546 | | | $ | 26 | | | $ | (349 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ALLL as % of Loans(4) | | | 1.2 | % | | | 1.2 | % | | | 1.2 | % | | | 1.2 | % | | | 1.3 | % | | | | | | | | |

| ALLL as % of NPLs(4) | | | 127.6 | % | | | 136.3 | % | | | 125.9 | % | | | 143.4 | % | | | 182.9 | % | | | | | | | | |

| ALLL as % of NCOs(4) | | | 263.2 | % | | | 190.0 | % | | | 285.3 | % | | | 405.2 | % | | | 361.2 | % | | | | | | | | |

| (1) | Loans within this table are classified as held-for-investment recorded at historical cost as these loans are included in our allowance for loan losses |

| (2) | 1Q 12 ending loan balance excludes FAS 159 and FAS 140 |

| (3) | Net charge-off ratios are calculated as annualized net charge-offs divided by average outstanding finance receivables and loans excluding loans measured at fair value and loans held-for-sale |

| (4) | ALLL coverage ratios are based on the allowance for loan losses related to loans held-for-investment excluding those loans held at fair value as a percentage of the unpaid principal balance, net of premiums and discounts |

| 1Q 2013 Preliminary Results | | 14 |

ALLY FINANCIAL INC. CREDIT RELATED INFORMATION, CONTINUED |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | |

| CONTINUING OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Automotive Finance(1) | | QUARTERLY TRENDS | | | CHANGE VS. | |

| Consumer | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Allowance for loan losses | | $ | 598 | | | $ | 575 | | | $ | 618 | | | $ | 589 | | | $ | 628 | | | $ | 23 | | | $ | (29 | ) |

| Total consumer loans | | $ | 55,013 | | | $ | 53,713 | | | $ | 52,434 | | | $ | 50,697 | | | $ | 49,444 | | | $ | 1,299 | | | $ | 5,569 | |

| Coverage ratio | | | 1.1 | % | | | 1.1 | % | | | 1.2 | % | | | 1.2 | % | | | 1.3 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for loan losses | | $ | 99 | | | $ | 95 | | | $ | 95 | | | $ | 94 | | | $ | 95 | | | $ | 5 | | | $ | 4 | |

| Total commercial loans | | $ | 31,875 | | | $ | 32,822 | | | $ | 29,935 | | | $ | 30,413 | | | $ | 30,534 | | | $ | (947 | ) | | $ | 1,341 | |

| Coverage ratio | | | 0.3 | % | | | 0.3 | % | | | 0.3 | % | | | 0.3 | % | | | 0.3 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mortgage(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consumer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for loan losses | | $ | 451 | | | $ | 452 | | | $ | 447 | | | $ | 472 | | | $ | 489 | | | $ | (0 | ) | | $ | (38 | ) |

| Total consumer loans | | $ | 9,672 | | | $ | 9,821 | | | $ | 9,787 | | | $ | 9,823 | | | $ | 9,794 | | | $ | (148 | ) | | $ | (121 | ) |

| Coverage ratio | | | 4.7 | % | | | 4.6 | % | | | 4.6 | % | | | 4.8 | % | | | 5.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate and Other (1)(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for loan losses | | $ | 48 | | | $ | 48 | | | $ | 47 | | | $ | 48 | | | $ | 52 | | | $ | (1 | ) | | $ | (5 | ) |

| Total commercial loans | | $ | 2,562 | | | $ | 2,697 | | | $ | 2,591 | | | $ | 2,470 | | | $ | 1,294 | | | $ | (135 | ) | | $ | 1,268 | |

| Coverage ratio | | | 1.9 | % | | | 1.8 | % | | | 1.8 | % | | | 1.9 | % | | | 4.0 | % | | | | | | | | |

| (1) | ALLL coverage ratios are based on the allowance for loan losses related to loans held-for-investment excluding those loans held at fair value as a percentage of the unpaid principal balance, net of premiums and discounts. Represents domestic allowance for loan losses only |

| (2) | Includes Insurance |

| 1Q 2013 Preliminary Results | | 15 |

ALLY FINANCIAL INC. CREDIT RELATED INFORMATION, CONTINUED |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| U.S. Auto Delinquencies - HFI Retail Contract Amount(1) | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Delinquent contract $ | | $ | 843 | | | $ | 1,073 | | | $ | 836 | | | $ | 689 | | | $ | 543 | | | $ | (230 | ) | | $ | 301 | |

| % of retail contract $ outstanding | | | 1.53 | % | | | 2.00 | % | | | 1.59 | % | | | 1.36 | % | | | 1.10 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Auto Annualized Credit Losses - HFI Retail Contract Amount | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Credit losses | | $ | 93 | | | $ | 100 | | | $ | 70 | | | $ | 43 | | | $ | 54 | | | $ | (7 | ) | | $ | 40 | |

| % of avg. HFI assets | | | 0.69 | % | | | 0.76 | % | | | 0.54 | % | | | 0.34 | % | | | 0.45 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Automotive Finance | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Repossessions as a % of average number of managed retail contracts outstanding | | | 1.64 | % | | | 1.55 | % | | | 1.39 | % | | | 1.14 | % | | | 1.43 | % | | | | | | | | |

| Severity of loss per unit serviced - Retail | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| New | | $ | 7,378 | | | $ | 6,986 | | | $ | 6,357 | | | $ | 5,314 | | | $ | 5,341 | | | $ | 392 | | | $ | 2,037 | |

| Used | | $ | 6,100 | | | $ | 6,459 | | | $ | 5,709 | | | $ | 4,683 | | | $ | 4,834 | | | $ | (360 | ) | | $ | 1,265 | |

| (1) $ Amount of accruing contracts greater than 30 days past due |

| 1Q 2013 Preliminary Results | | 16 |

ALLY FINANCIAL INC. CAPITAL |  |

| ($ in billions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Cost of Funds | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Ally Financial's cost of borrowing (incl. OID) | | | 2.8 | % | | | 2.9 | % | | | 3.2 | % | | | 3.3 | % | | | 3.6 | % | | | | | | | | |

| Ally Financial's cost of borrowing (excl. OID) | | | 2.6 | % | | | 2.7 | % | | | 3.0 | % | | | 2.9 | % | | | 3.2 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Risk-weighted assets | | $ | 141.6 | | | $ | 154.0 | | | $ | 150.3 | | | $ | 147.9 | | | $ | 158.5 | | | $ | (12.4 | ) | | $ | (16.9 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tier 1 capital ratio | | | 14.6 | % | | | 13.1 | % | | | 13.6 | % | | | 13.6 | % | | | 13.4 | % | | | | | | | | |

| Tier 1 common capital ratio | | | 7.9 | % | | | 7.0 | % | | | 7.3 | % | | | 7.2 | % | | | 7.5 | % | | | | | | | | |

| Total risk-based capital ratio | | | 15.6 | % | | | 14.1 | % | | | 14.6 | % | | | 14.6 | % | | | 14.5 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tangible common equity / Tangible assets | | | 7.9 | % | | | 6.9 | % | | | 6.2 | % | | | 6.1 | % | | | 6.5 | % | | | | | | | | |

| Tangible common equity / Risk-weighted assets | | | 9.2 | % | | | 8.1 | % | | | 7.5 | % | | | 7.3 | % | | | 7.7 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders’ equity | | $ | 20.5 | | | $ | 19.9 | | | $ | 18.7 | | | $ | 18.3 | | | $ | 19.6 | | | $ | 0.6 | | | $ | 0.9 | |

| less: Goodwill and certain other intangibles | | | (0.5 | ) | | | (0.5 | ) | | | (0.5 | ) | | | (0.5 | ) | | | (0.5 | ) | | | - | | | | - | |

| Unrealized (gains) losses and other adjustments | | | (1.9 | ) | | | (1.7 | ) | | | (0.3 | ) | | | (0.2 | ) | | | (0.3 | ) | | | (0.2 | ) | | | (1.6 | ) |

| add: Trust preferred securities | | | 2.5 | | | | 2.5 | | | | 2.5 | | | | 2.5 | | | | 2.5 | | | | - | | | | - | |

| Tier 1 capital | | $ | 20.7 | | | $ | 20.2 | | | $ | 20.4 | | | $ | 20.1 | | | $ | 21.3 | | | $ | 0.5 | | | $ | (0.6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tier 1 capital | | $ | 20.7 | | | $ | 20.2 | | | $ | 20.4 | | | $ | 20.1 | | | $ | 21.3 | | | $ | 0.5 | | | $ | (0.6 | ) |

| less: Preferred equity | | | (6.9 | ) | | | (6.9 | ) | | | (6.9 | ) | | | (6.9 | ) | | | (6.9 | ) | | | - | | | | - | |

| Trust preferred securities | | | (2.5 | ) | | | (2.5 | ) | | | (2.5 | ) | | | (2.5 | ) | | | (2.5 | ) | | | - | | | | - | |

| Tier 1 common capital(1) | | $ | 11.2 | | | $ | 10.7 | | | $ | 10.9 | | | $ | 10.7 | | | $ | 11.8 | | | $ | 0.5 | | | $ | (0.6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tier 1 capital | | $ | 20.7 | | | $ | 20.2 | | | $ | 20.4 | | | $ | 20.1 | | | $ | 21.3 | | | $ | 0.5 | | | $ | (0.6 | ) |

| add: Qualifying subordinated debt and redeemable preferred stock | | | 0.3 | | | | 0.3 | | | | 0.2 | | | | 0.2 | | | | 0.2 | | | | - | | | | 0.1 | |

| Allowance for loan and lease losses includible in Tier 2 capital and other adjustments | | | 1.2 | | | | 1.2 | | | | 1.2 | | | | 1.3 | | | | 1.4 | | | | - | | | | (0.2 | ) |

| Total risk-based capital | | $ | 22.1 | | | $ | 21.7 | | | $ | 21.9 | | | $ | 21.6 | | | $ | 22.9 | | | $ | 0.4 | | | $ | (0.8 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total shareholders' equity | | $ | 20.5 | | | $ | 19.9 | | | $ | 18.7 | | | $ | 18.3 | | | $ | 19.6 | | | $ | 0.6 | | | $ | 0.9 | |

| less: Preferred equity | | | (6.9 | ) | | | (6.9 | ) | | | (6.9 | ) | | | (6.9 | ) | | | (6.9 | ) | | | - | | | | - | |

| Goodwill and intangible assets | | | (0.5 | ) | | | (0.5 | ) | | | (0.5 | ) | | | (0.5 | ) | | | (0.5 | ) | | | - | | | | - | |

| Tangible common equity(2) | | $ | 13.0 | | | $ | 12.5 | | | $ | 11.3 | | | $ | 10.8 | | | $ | 12.1 | | | $ | 0.5 | | | $ | 0.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 166.2 | | | $ | 182.3 | | | $ | 182.5 | | | $ | 178.6 | | | $ | 186.4 | | | $ | (16.1 | ) | | $ | (20.2 | ) |

| less: Goodwill and intangible assets | | | (0.5 | ) | | | (0.5 | ) | | | (0.5 | ) | | | (0.5 | ) | | | (0.5 | ) | | | - | | | | - | |

| Tangible assets | | $ | 165.7 | | | $ | 181.9 | | | $ | 182.0 | | | $ | 178.1 | | | $ | 185.9 | | | $ | (16.2 | ) | | $ | (20.2 | ) |

Note: Numbers may not foot due to rounding

| (1) | We define Tier 1 common as Tier 1 capital less noncommon elements including qualified perpetual preferred stock, qualifying minority interest in subsidiaries, and qualifying trust preferred securities. Ally considers various measures when evaluating capital utilization and adequacy, including the Tier 1 common equity ratio, in addition to capital ratios defined by banking regulators. This calculation is intended to complement the capital ratios defined by banking regulators for both absolute and comparative purposes. Because GAAP does not include capital ratio measures, Ally believes there are no comparable GAAP financial measures to these ratios. Tier 1 common equity is not formally defined by GAAP or codified in the federal banking regulations and, therefore, is considered to be a non-GAAP financial measure. Ally believes the Tier 1 common equity ratio is important because we believe analysts and banking regulators may assess our capital adequacy using this ratio. Additionally, presentation of this measure allows readers to compare certain aspects of our capital adequacy on the same basis to other companies in the industry. |

| (2) | We define tangible common equity as common stockholders’ equity less goodwill and identifiable intangible assets (other than mortgage servicing rights), net of deferred tax liabilities. Ally considers various measures when evaluating capital adequacy, including tangible common equity. Tangible common equity is not formally defined by GAAP or codified in the federal banking regulations and, therefore, is considered to be a non-GAAP financial measure. Ally believes that tangible common equity is important because we believe analysts and banking regulators may assess our capital adequacy using this measure. Additionally, presentation of this measure allows readers to compare certain aspects of our capital adequacy on the same basis to other companies in the industry. |

| | |

| 1Q 2013 Preliminary Results | | 17 |

ALLY FINANCIAL INC. LIQUIDITY |  |

| ($ in billions) | | | | | | | | | | | | | | | | | | |

| | | 3/31/2013 | | | 12/31/2012 | | | 3/31/2012 | |

| Available Liquidity | | Parent(1) | | | Ally Bank | | | Parent(1) | | | Ally Bank | | | Parent(1) | | | Ally Bank | |

| Cash and cash equivalents | | $3.5 | | | $3.1 | | | $4.2 | | | $2.7 | | | $6.8 | | | $4.4 | |

| Highly liquid securities(2) | | | 0.9 | | | | 6.2 | | | | 0.9 | | | | 5.9 | | | | 0.2 | | | | 5.4 | |

| Current committed unused capacity(3) | | | 11.3 | | | | 3.3 | | | | 7.2 | | | | 6.2 | | | | 12.0 | | | | 6.7 | |

| Subtotal | | $ | 15.7 | | | $ | 12.6 | | | $ | 12.3 | | | $ | 14.8 | | | $ | 19.0 | | | $ | 16.5 | |

| Ally Bank intercompany loan(4) | | | 2.2 | | | | (2.2 | ) | | | 1.6 | | | | (1.6 | ) | | | 3.0 | | | | (3.0 | ) |

| Total Current Available Liquidity | | $ | 17.9 | | | $ | 10.4 | | | $ | 13.9 | | | $ | 13.2 | | | $ | 22.0 | | | $ | 13.5 | |

| Forward commited unused capacity (5) | | | 1.6 | | | | - | | | | 1.7 | | | | - | | | | 2.5 | | | | - | |

| Total Available Liquidity | | $ | 19.5 | | | $ | 10.4 | | | $ | 15.6 | | | $ | 13.2 | | | $ | 24.5 | | | $ | 13.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Unsecured Long-Term Debt Maturity Profile | | | 2013 | | | | 2014 | | | | 2015 | | | | 2016 | | | | 2017 | | | | 2018 and

After | |

| Consolidated remaining maturities(6) | | $ | 1.0 | | | $ | 5.6 | | | $ | 5.1 | | | $ | 2.0 | | | $ | 3.7 | | | $ | 16.7 | |

| (1) | Parent company liquidity is defined as our consolidated operations less Ally Bank and the subsidiaries of Ally Insurance Holding Company |

| (2) | Includes UST, Agency debt and Agency MBS |

| (3) | Includes equal allocation of shared unused capacity totaling $3.0 billion in 1Q13, $3.0 billion in 4Q12 and $3.8 billion in 1Q12, which can be used by Ally Bank or the Parent |

| (4) | To optimize use of cash and secured facility capacity between entities, Ally Financial lends cash to Ally Bank from time to time under an intercompany loan agreement. Amounts outstanding on this loan are repayable to Ally Financial at any time, subject to a 5 days notice |

| (5) | Represents capacity from certain forward purchase commitments and committed secured facilities that are generally reliant upon the origination of future automotive receivables over the next 12 months |

| (6) | Excludes OID amortization |

| 1Q 2013 Preliminary Results | | 18 |

ALLY FINANCIAL INC. DEPOSITS |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | | | | QUARTERLY TRENDS | | | CHANGE VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Key Statistics | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Average retail CD maturity (months) | | | 29.9 | | | | 29.5 | | | | 29.1 | | | | 28.8 | | | | 28.2 | | | | 0.4 | | | | 1.7 | |

| Average retail deposit rate | | | 1.29 | % | | | 1.34 | % | | | 1.36 | % | | | 1.41 | % | | | 1.46 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CD balances up for renewal | | $ | 3,105 | | | $ | 2,595 | | | $ | 2,495 | | | $ | 3,345 | | | $ | 2,911 | | | $ | 510 | | | $ | 194 | |

| CD balances retained(1) | | | 2,873 | | | | 2,405 | | | | 2,282 | | | | 3,010 | | | | 2,647 | | | | 468 | | | | 226 | |

| Retention rate | | | 93 | % | | | 93 | % | | | 91 | % | | | 90 | % | | | 91 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ally Financial Deposits Levels | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ally Bank retail | | $ | 38,770 | | | $ | 35,042 | | | $ | 32,139 | | | $ | 30,404 | | | $ | 29,323 | | | $ | 3,729 | | | $ | 9,447 | |

| Ally Bank brokered | | | 9,876 | | | | 9,914 | | | | 9,882 | | | | 9,905 | | | | 9,884 | | | | (37 | ) | | | (8 | ) |

| ResMor(2) | | | - | | | | - | | | | 3,753 | | | | 3,491 | | | | 3,519 | | | | - | | | | (3,519 | ) |

| Other | | | 1,679 | | | | 2,960 | | | | 4,098 | | | | 4,192 | | | | 4,480 | | | | (1,280 | ) | | | (2,801 | ) |

| Total deposits | | $ | 50,326 | | | $ | 47,915 | | | $ | 49,872 | | | $ | 47,992 | | | $ | 47,206 | | | $ | 2,411 | | | $ | 3,120 | |

| (1) | Retention includes balances retained in any Ally Bank product |

| (2) | ResMor moved to discontinued operations in 4Q12 and sold in 1Q13 |

| 1Q 2013 Preliminary Results | | 19 |

ALLY FINANCIAL INC. ALLY BANK CONSUMER MORTGAGE HFI PORTFOLIO (PERIOD-END) |  |

| ($ in billions) | | | | | | | | | | | | | | | |

| | | HISTORICAL QUARTERLY TRENDS | |

| | | | | | | | | | | | | | | | |

| Loan Value | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | |

| Gross carry value | | $ | 9.7 | | | $ | 9.8 | | | $ | 9.7 | | | $ | 9.8 | | | $ | 9.7 | |

| Net carry value | | $ | 9.2 | | | $ | 9.3 | | | $ | 9.3 | | | $ | 9.3 | | | $ | 9.3 | |

| | | | | | | | | | | | | | | | | | | | | |

| Estimated Pool Characteristics | | | | | | | | | | | | | | | | | | | | |

| % Prime jumbo (> 1/1/2009) | | | 40.2 | % | | | 38.9 | % | | | 36.6 | % | | | 34.5 | % | | | 31.2 | % |

| % Second lien | | | 11.3 | % | | | 11.7 | % | | | 12.3 | % | | | 12.8 | % | | | 13.4 | % |

| % Interest only | | | 19.5 | % | | | 21.2 | % | | | 23.3 | % | | | 25.9 | % | | | 29.1 | % |

| % 30+ Day delinquent | | | 3.0 | % | | | 3.0 | % | | | 3.2 | % | | | 3.2 | % | | | 3.3 | % |

| % Low/No documentation | | | 13.7 | % | | | 14.0 | % | | | 14.5 | % | | | 14.9 | % | | | 15.6 | % |

| % Non-primary residence | | | 3.6 | % | | | 3.7 | % | | | 3.8 | % | | | 3.9 | % | | | 3.9 | % |

| Refreshed FICO | | | 730 | | | | 730 | | | | 730 | | | | 730 | | | | 728 | |

| Wtd. Avg. LTV/CLTV(1) | | | 85.3 | % | | | 88.9 | % | | | 89.8 | % | | | 90.4 | % | | | 91.8 | % |

| Higher risk geographies (2) | | | 40.8 | % | | | 40.3 | % | | | 39.6 | % | | | 39.2 | % | | | 38.6 | % |

| (1) | Updated home values derived using a combination of appraisals, BPOs, AVMs and MSA level house price indices |

| (2) | Includes CA, FL, MI and AZ |

| 1Q 2013 Preliminary Results | | 20 |

ALLY FINANCIAL INC. DISCONTINUED OPERATIONS, NET OF TAX |  |

| ($ in millions) | | | | | | | | | | | | | | | | | | | | | |

| | | QUARTERLY TRENDS | | | INC / (DEC) VS. | |

| | | | | | | | | | | | | | | | | | | | | | |

| Impact of Discontinued Operations(1) | | 1Q 13 | | | 4Q 12 | | | 3Q 12 | | | 2Q 12 | | | 1Q 12 | | | 4Q 12 | | | 1Q 12 | |

| Canada | | $ | 908 | | | $ | 25 | | | $ | 34 | | | $ | 51 | | | $ | 62 | | | $ | 883 | | | $ | 846 | |

| International Auto | | | 129 | | | | 86 | | | | 91 | | | | 113 | | | | 75 | | | | 42 | | | | 54 | |

| Insurance | | | 28 | | | | 38 | | | | 13 | | | | (3 | ) | | | 38 | | | | (9 | ) | | | (10 | ) |

| Dealer Financial Services | | | 1,065 | | | | 150 | | | | 138 | | | | 160 | | | | 175 | | | | 916 | | | | 890 | |

| Mortgage Operations | | | 0 | | | | 0 | | | | (0 | ) | | | (84 | ) | | | 164 | | | | 0 | | | | (164 | ) |

| Corporate and Other | | | (16 | ) | | | 26 | | | | 32 | | | | (1,121 | ) | | | 33 | | | | (42 | ) | | | (49 | ) |

| Consolidated pretax income | | $ | 1,049 | | | $ | 175 | | | $ | 170 | | | $ | (1,044 | ) | | $ | 373 | | | $ | 874 | | | $ | 677 | |

| Tax expense (benefit) | | | 17 | | | | (291 | ) | | | 38 | | | | 36 | | | | 65 | | | | 307 | | | | (48 | ) |

| Consolidated net income | | $ | 1,033 | | | $ | 466 | | | $ | 133 | | | $ | (1,081 | ) | | $ | 308 | | | $ | 567 | | | $ | 725 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Assets of discontinued operations held-for-sale | | $ | 19,063 | | | $ | 32,176 | | | $ | 375 | | | $ | 383 | | | $ | 1,008 | | | $ | (13,113 | ) | | $ | 18,055 | |

| Businesses classified as discontinued operations above |

| Automotive Finance |

| Canada |

| Europe, Latin America and China (J.V.) |

| Insurance |

| ABA Seguros |

| U.K.-based operations that provide vehicle service contracts and insurance products in Europe and Latin America |

| Mortgage |

| ResCap |

| (1) | Included are operations that have been wound down or sold in addition to those held for sale |

Note: The sales of Canada and Europe (ex. France), Mexico, Colombia and Chile were completed 1Q13. The sales of France, Brazil and the China (J.V.) as well as the Mexican Insurance business are expected to occur throughout 2013.

| 1Q 2013 Preliminary Results | | 21 |

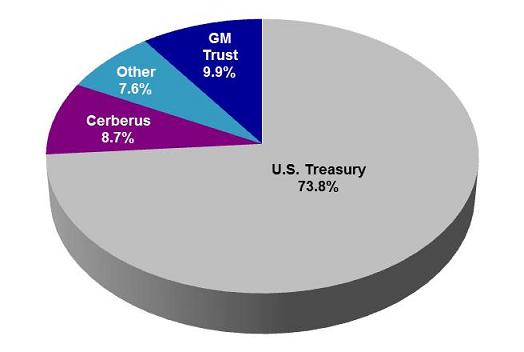

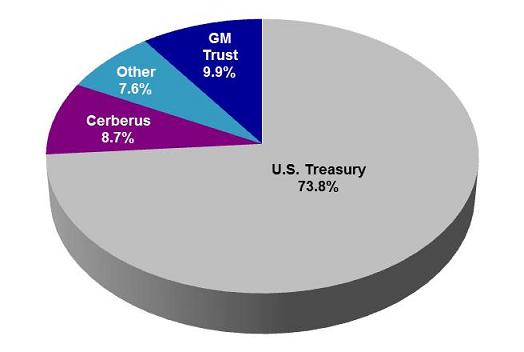

ALLY FINANCIAL INC. OWNERSHIP |  |

| Common Ownership as of 1Q 13 |

| Other Tier 1 Capital as of 1Q 13 |

| | | | | Liquidation | | | Book | |

| Series | | Owner | | Preference | | | Value | |

| Trust Preferred Securities(1) | | Investors | | $ | 2,667 | | | $ | 2,543 | |

| Series F-2 Mandatory Convertible Preferred (1) | | U.S. Treasury | | $ | 5,938 | | | $ | 5,685 | |

| Series G Perpetual Preferred | | Investors | | $ | 2,577 | | | $ | 234 | |

| Series A Perpetual Preferred | | Investors | | $ | 1,022 | | | $ | 1,021 | |

| (1) Includes exercised warrants |

| 1Q 2013 Preliminary Results | | 22 |