Introducing Alcoa: Building Multi-Materials Leadership Together 1 March 9, 2015 Welcome to RTI International Metals Employees Exhibit 99.5 |

Important Information Forward-Looking Statements 2 Certain statements in this presentation, including statements regarding the proposed acquisition of RTI by Alcoa, the expected timing, closing and benefits of the transaction, the expected synergies, the expected contribution of RTI to Alcoa’s revenues and profitability, the expected acceleration of Alcoa’s portfolio transformation, the expected size, scope and growth of the combined company’s operations and the markets in which it will operate, including the aerospace market, the anticipated issuance of Alcoa common stock in exchange for RTI stock in the transaction, as well as Alcoa’s plans, objectives, strategy, and intentions, may contain words such as: “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,” “targets,” “will,” or other words of similar meaning that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on Alcoa’s current expectations, estimates, forecasts and projections about the proposed transaction and the operating environment, economies and markets in which Alcoa and RTI operate. In making these statements, Alcoa has made assumptions with respect to: the ability of Alcoa and RTI to achieve expected synergies and the timing of same; the ability of Alcoa and RTI to predict and adapt to changing customer requirements, demand, and preferences; future capital expenditures, including the amount and nature thereof; trends and developments in the aerospace, metals engineering (including aluminum and titanium), advanced manufacturing, and other sectors of the economy that are related to these sectors; business strategy and outlook; expansion and growth of business and operations; credit risks; future results being similar to historical results; expectations related to future general economic and market conditions; and other matters, many of which are beyond Alcoa’s control. Alcoa’s beliefs and assumptions are inherently subject to significant business, economic, competitive and other uncertainties and contingencies regarding future events and as such, are subject to change and may prove to be inaccurate. Actual results or events could differ materially from those contemplated in forward-looking statements as a result of numerous risks and uncertainties, including: (a) the risk that the businesses will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected, which could result in additional demands on Alcoa’s resources, systems, procedures and controls, disruption of its ongoing business and diversion of management’s attention from other business concerns; (b) the effect of an increased number of Alcoa shares outstanding as a result of the proposed transaction; (c) the possibility that certain assumptions with respect to RTI or the proposed transaction could prove to be inaccurate; (d) failure to receive the required votes of RTI’s shareholders to approve the transaction; (e) failure to receive, delays in the receipt of, or unacceptable or burdensome conditions imposed in connection with, all required regulatory approvals of the proposed transaction, or the failure to satisfy the other closing conditions to the proposed transaction; (f) the potential failure to retain key employees of Alcoa or RTI as a result of the proposed transaction or during integration of the businesses; (g) potential sales of Alcoa common stock issued in the acquisition; (h) the potential loss of customers, suppliers, and other business relationships of Alcoa or RTI as a result of the transaction; (i) consequences of investigations by governmental agencies or regulatory authorities; (j) the failure to capitalize on anticipated growth in the commercial aerospace market; and (k) the other risk factors summarized in Alcoa’s Form 10-K for the year ended December 31, 2014, and other reports filed with the Securities and Exchange Commission. Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks discussed above and other risks in the market. Nothing on Alcoa’s website is included or incorporated by reference herein. |

Important Information (continued) Additional Information and Where to Find It 3 Participants in the Solicitation This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The proposed business combination transaction between Alcoa and RTI will be submitted to the shareholders of RTI for their consideration. Alcoa will file with the Securities and Exchange Commission (SEC) a Registration Statement on Form S-4 that will include a proxy statement of RTI that also constitutes a prospectus of Alcoa. RTI will provide the proxy statement/prospectus to its shareholders. Alcoa and RTI also plan to file other documents with the SEC regarding the proposed transaction. This document is not a substitute for any prospectus, proxy statement or any other document which Alcoa or RTI may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF RTI ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from both Alcoa’s website (www.alcoa.com) and RTI ’s website (www.rtiintl.com). Alcoa, RTI, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from RTI shareholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of RTI shareholders in connection with the proposed transaction will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about Alcoa’s executive officers and directors in its definitive proxy statement filed with the SEC on March 18, 2014 and in its Annual Report on Form 10-K filed with the SEC on February 19, 2015. You can find information about RTI’s executive officers and directors in its definitive proxy statement filed with the SEC on March 28, 2014 and in its Annual Report on Form 10-K filed with the SEC on February 26, 2015. Additional information about Alcoa’s executive officers and directors and RTI’s executive officers and directors can be found in the above-referenced Registration Statement on Form S-4 when it becomes available. You can obtain free copies of these documents from Alcoa and RTI as described in the preceding paragraph. |

Alcoa and RTI: Advancing the Next Generation of Metal Solutions 4 This transaction is a great fit of resources, capabilities and strategy that will benefit both companies’ shareholders, customers and employees worldwide Alcoa’s offer confirms the value RTI has worked so hard to create With Alcoa, RTI will take its innovative technologies to the next level and deliver even more value-added titanium and specialty metals solutions to meet customer needs We look forward to joining Alcoa’s team to advance the next generation of metals solutions |

…and today, a Global Leader in innovating Lightweight Metals You may be wondering: Who is Alcoa? Multi-Material Solutions 5 Aluminum Applications & Globalization Invented Aluminum We pioneered the Aluminum Industry more than 125 years ago… |

We are a lightweight, high-performance metals innovation leader EPS: Engineered Products and Solutions; GRP: Global Rolled Products Downstream: Engineered Products & Solutions 2014 Revenue: $23.9B | Locations: Operations in 30 countries | 2014 Employees: 59,000 Midstream: Global Rolled Products 21.9% EBITDA Margin $6.0B Revenue $767M ATOI $339 EBITDA/MT $7.4B Revenue $312M ATOI $55 EBITDA/MT $3.5B Revenue $370M ATOI $422 EBITDA/MT $6.8B Revenue $594M ATOI Upstream: Global Primary Products - Alumina Upstream: Global Primary Products - Aluminum 6 ATOI: After-tax operating income; See appendix for EBITDA reconciliations |

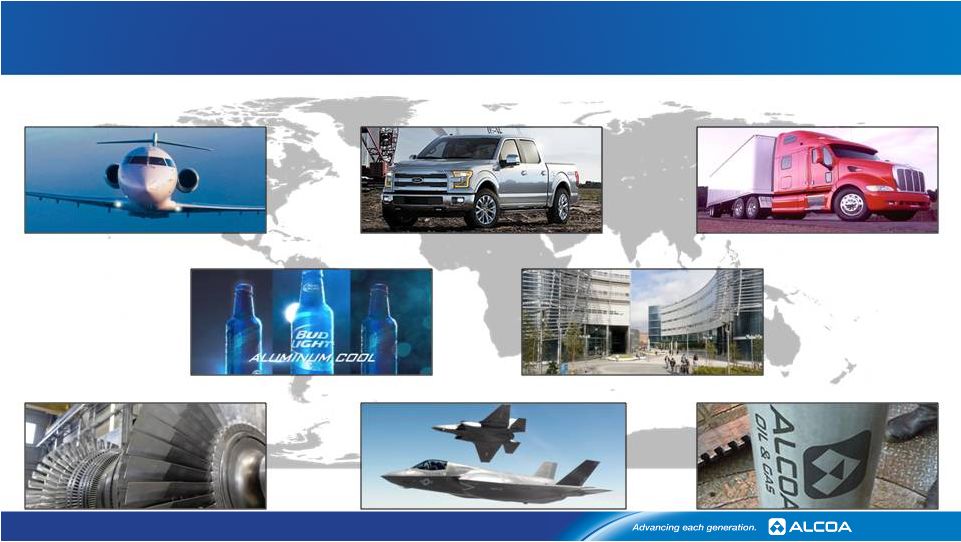

Alcoa caters to eight major end markets 7 Alcoa End Markets Aerospace Commercial Transportation Automotive Industrial Gas Turbines Defense Oil & Gas Beverage Packaging Building & Construction |

Our Values guide everything we do 8 |

We attract, develop, and engage the best talent globally 9 #1 Fortune Most Admired – 4 years running Metals Company Engagement: 32,000 employees shared improvement ideas valued at $2.2B; 58% volunteer in community programs Development: : In past 12 months, new assignments for 31% of top talent Recognition: Around the world, honored for the way we operate Winner of prestigious Catalyst award honoring advancement of women People: Our Only Sustainable Advantage |

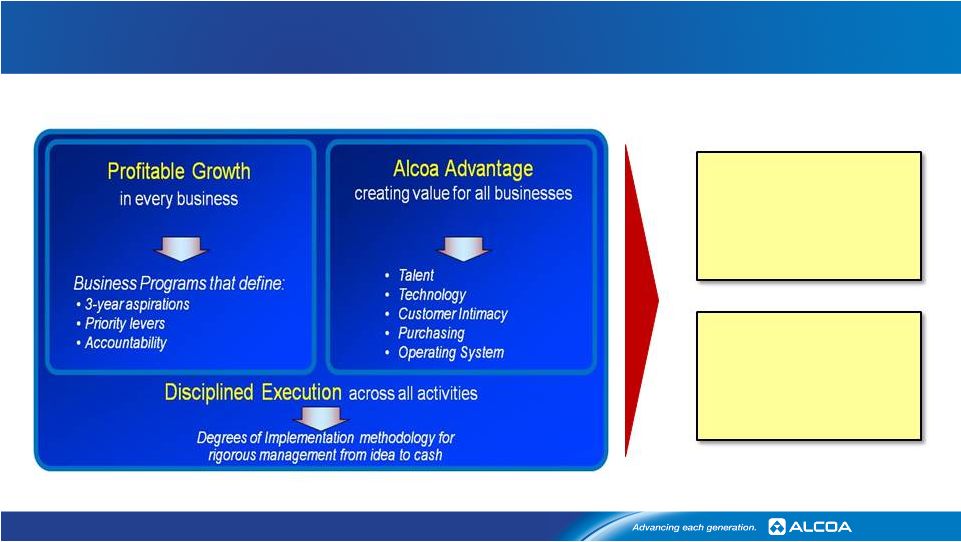

The “Alcoa Advantage” adds value to each business we own Maximizing the value of our collective businesses 10 Drive commercial advantage through customer intimacy Optimize performance across Alcoa Leveraging global spend and best-in- class strategies Recruit, develop and retain the best talent Develop innovative solutions through technical expertise |

Acquisition aligned with strategic priorities, furthers transformation EPS: Engineered Products and Solutions; GRP: Global Rolled Products; GPP: Global Primary Products 11 Globally competitive commodity business Alcoa Strategic Priorities and Transformation Levers Lightweight multi-material innovation powerhouse |

Grows Aerospace Revenue 13% to $5.6B in 2014 High Performance Engine Castings Specialized Rings and Forgings Global leader in jet engine airfoils 100% nickel super alloys Global leader in seamless rings Full range of global engine forgings ~60% nickel alloys ~25% titanium ~15% steel and aluminum Innovative Fastening Systems Aluminum sheet, plate and extrusions Aluminum ~90% and titanium forgings ~10% Structural castings ~50% titanium ~30% aluminum and ~20% nickel alloys Advanced Aerospace Structures 2014 Pro forma Aerospace Revenue: $5.6B Global leader in aerospace fastening systems Both airframe and engine applications ~40% titanium, ~25% steel and ~35% nickel alloys 35% $2.0B 18% $1.0B 23% $1.3B 13% $0.7B Full Service Ti Mill and Fabricated Products Strong position in melting, conversion 1 and machining Complete range of Ti melting, billetizing and rolling capabilities Multi-material high-velocity machining, subassemblies 11% $0.6B 12 1) Conversion refers to forging, extruding and investment casting , , ; |

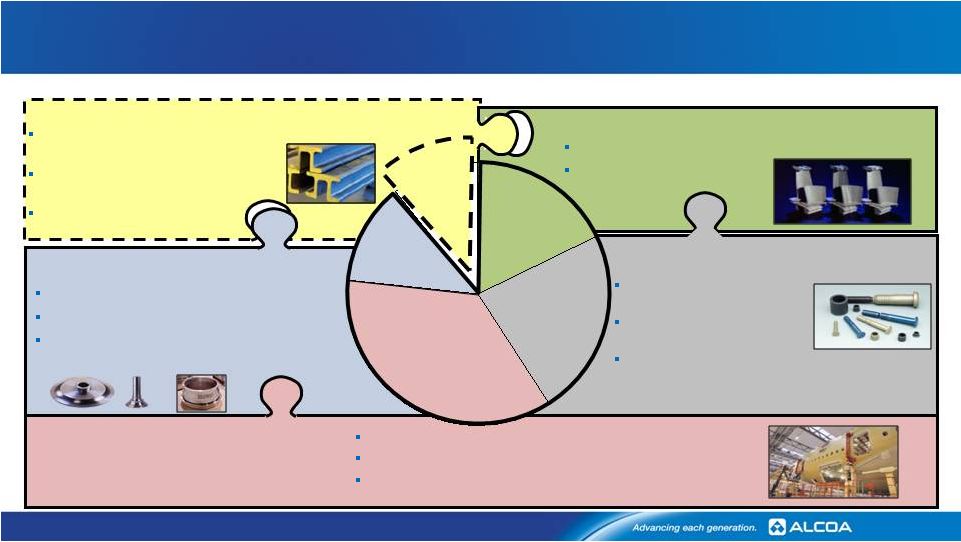

Expanding Range of Titanium Midstream and Downstream Offerings 13 Enables Fully Integrated Scrap Loop Midstream and downstream supply chain combining Alcoa and RTI capabilities Melting (Ingot, Cast Slab) Billetizing, Rolling (Mill Products) Machining, Subassemblies Midstream Downstream Conversion (Closed-Die Forging, Extruding, Investment Casting) 1) Representative of mid and downstream capabilities; not intended to reflect a market position Capabilities¹ None Limited Moderate Significant Full |

Mix Changes Drive Titanium: Fastest Growing Aerospace Metal Source: ICF International 1) Buy weight value for billet, bloom, plate, sheet, bar; 2) Includes Large Commercial Jets and Regional Jets 14 Commercial jet titanium mill products growth 2014-2019 and titanium growth content in next generation aircraft Aircraft mix changes 5.3X B787 B767 A330 4.5X A350 B777 B777X 2.4X Drives Growth in Titanium 2019E 2014 +4.9% CAGR Titanium Mill Products Spend 1 for Commercial Jets 2 ($B) 170 406 43 226 46 208 2.7 2.1 Platform Titanium Buy Weights (000 lbs) for Select Aircraft |

Direct access to RTI TiAl ingot for Alcoa’s investment casting and forging technology Technically advanced TiAl LPT blades; 50% lighter than Ni-based alloy Employed on highest-volume next-generation engine programs (LEAP X &GEnX) Long-term agreement with Snecma in place for LEAP X engine Advanced Technologies Drive Further Growth Opportunities Highly Complementary: Ti-Aluminide (TiAl) 15 Ti Aluminide and Additive Manufacturing capabilities Additive Manufacturing: Multi-Material 3-D Printing Provides intellectual property in multi-material 3-D printing (Ti, Ni, Steel and Al) Access to operational, commercial expertise in additive manufactured part production Enables faster, multi-material proto-typing, tooling and production across aerospace and medical Advanced speed to market; reduces new part cycle time > 50% LPT = Low Pressure Turbine Direct Metal Laser Deposition Sample Jet Engine Low Pressure Turbine Blades |

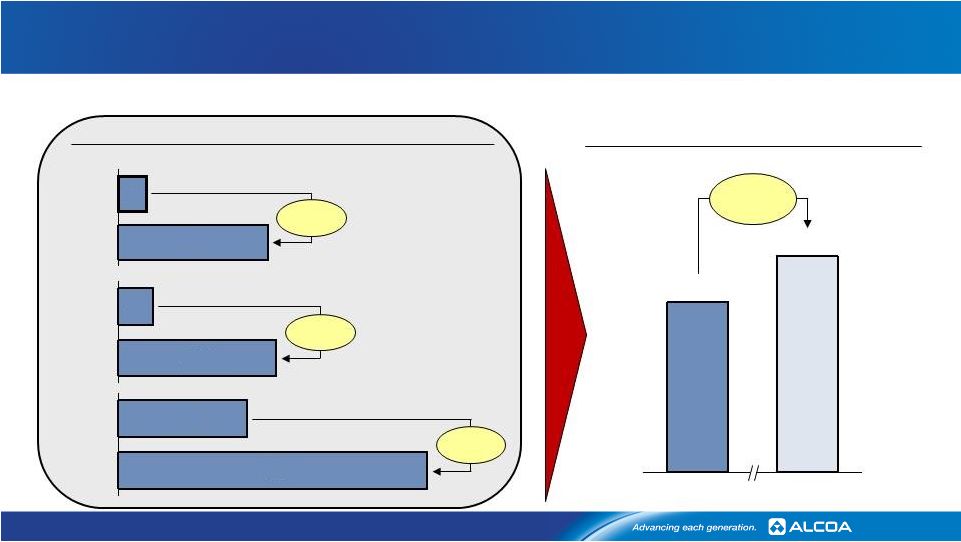

Improves Alcoa overall value position and competitiveness in the Aerospace supply chain Delivers significant value creation; net realized synergies of $100M in 2019 In sum, RTI is highly complementary to Alcoa’s EPS segment Opportunity to combine Midstream and Downstream of Both Companies to Rival Leading Industry Players RTI Provides… Alcoa EPS Brings… 16 Alcoa Confidential Stable and cost competitive supply of Titanium Ingot / Slab Cutting-edge Titanium billetizing and rolling capabilities Access to high-quality downstream assets Specialized long-bed multi spindle machining Advanced forming and part assembly / kitting Expansion of Alcoa’s high technology aerospace portfolio (Titanium Aluminide, powder metallurgy, and additive mfg.) A closed Ti scrap loop with processing capabilities VAR furnaces to close EPS North American nickel revert loop Global leadership in jet engine and airframe components Accelerated growth in aerospace and non-aero sectors Optimized closed scrap loops and maximized metal internal supply R&D-depth that is unique in the metallic materials sector World-class talent development system Disciplined execution and multi-billion dollar procurement spend |

What’s on your mind? Ask a question or share a comment: Press *1 to ask your question via phone Chat electronically by clicking on the “Ask a Question” box at the bottom of your screen 17 17 |

We look forward to getting to know you Created a website for you and your families to get to know us Learn more about Alcoa Ask questions Go to: www.alcoa.com/RTIemployees Access code: XXXXX 18 18 |

|