As filed with the Securities and Exchange Commission on November 2, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00582

NEUBERGER BERMAN EQUITY FUNDS

(Exact Name of Registrant as specified in charter)

c/o Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

(Address of Principal Executive Offices – Zip Code)

Joseph V. Amato

Chief Executive Officer and President

Neuberger Berman Equity Funds

c/o Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

Lori L. Schneider, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006-1600

(Names and Addresses of agents for service)

Registrant's telephone number, including area code: (212) 476-8800

Date of fiscal year end: August 31

Date of reporting period: August 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”) (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

| (a) | Following is a copy of the annual report transmitted to shareholders pursuant to Rule 30e-1 under the Act. |

Neuberger Berman

Equity Funds

| |

| |

| |

Institutional Class Shares | |

| |

|

Emerging Markets Equity Fund |

|

|

|

|

Greater China Equity Fund |

International Equity Fund |

International Select Fund |

International Small Cap Fund |

|

|

|

|

Mid Cap Intrinsic Value Fund |

Multi-Cap Opportunities Fund |

|

|

|

|

Annual Report

August 31, 2023

The "Neuberger Berman" name and logo and "Neuberger Berman Investment Advisers LLC" name are registered service marks of Neuberger Berman Group LLC. The individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Investment Advisers LLC, an affiliate of Neuberger Berman BD LLC, distributor, member FINRA. ©2023 Neuberger Berman BD LLC, distributor. All rights reserved.

President’s Letter

Dear Shareholder,

Over the 12-month period ended August 31, 2023 (the reporting period), as data began to suggest the pandemic’s long economic hangover could be stabilizing, investors returned to equities with a volatile version of optimism. Though sentiment remained headline-sensitive, the S&P 500® Index gained nearly 16% this reporting period, and the CBOE Volatility Index (VIX®), essentially a gauge of investors’ fears, declined 48%.

For central banks like the U.S. Federal Reserve Board (Fed), orchestrating a soft landing is difficult; and factors including slower growth in China (which suppressed emerging markets equities returns for the reporting period), war in Ukraine, the inverted yield curve, severe weather, strikes, and the ramping up of the U.S. election cycle could increase uncertainty. Still, much has improved since this reporting period began, and much of the recent recession forecasting has abated.

Even as elevated inflation and rising interest rates continue to weigh on markets, businesses and consumers, inflation appears to be slowing enough that economists believe the Fed, which raised the federal funds rate from nearly zero in early 2022 to 5.25% – 5.5%, may feel comfortable pausing soon.

During the second quarter of 2023, U.S. real GDP is estimated to have increased at 2.1% annualized, up from 2.0% in the first quarter. Corporate earnings have shown remarkable resilience, with 80% of the S&P 500’s constituents meeting or exceeding expectations in the second quarter.

Productivity is up, jobs continue to be added, and jobs now exceed pre-pandemic levels. The rate of job growth (and of wage growth) is slowing, however, and unemployment has ticked up slightly, from 3.5% to a still historically low 3.8%, as the Fed works to cool the economy to fight inflation.

Supply chain snags have unraveled to near pre-pandemic levels, work that began with the Biden Administration’s efforts to expand port capacity and continues with a pandemic-informed corporate emphasis on on-shoring and near-shoring.

Government spending, through programs in the Biden Administration’s Build Back Better plan, is also having a measurable positive impact. Infrastructure spending—on roads, railroads, bridges, broadband, the power grid and more—is one example. The CHIPS and Science Act, which has already attracted $200 billion in new private sector investment in U.S. tech manufacturing and materials facilities, is another.

Looking to the future, our managers are closely watching real-time data at both the macroeconomic and corporate level. This information could foreshadow changes to current expectations on either the upside or downside.

But for the most part, we’re business as usual: meticulous bottom-up management, hands-on independent research, using volatility to its advantage in buy and sell decisions, and executing against investment disciplines that have been tested over full market cycles.

We appreciate your trust and confidence in Neuberger Berman and look forward to continuing our work together.

Sincerely,

Joseph V. Amato

President and CEO

Neuberger Berman Equity Funds

Dividend Growth Fund Commentary (Unaudited)

Neuberger Berman Dividend Growth Fund Institutional Class generated a 12.89% total return for the fiscal year ended August 31, 2023 (the reporting period), underperforming its benchmark, the S&P 500® Index (the Index), which posted a 15.94% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The objective of the Fund is to generate capital appreciation and income from companies with attractive dividend per share growth. This investment discipline seeks to identify companies with strong business models generating cash to both grow their business, while also providing rising dividend distributions to shareholders. We focus on companies that we believe have strong balance sheets, solid management teams, attractive free cash flow yields and clear capital allocation strategies.

During the reporting period, the U.S. stock market, as measured by the Index, rose despite investors grappling with inflationary headwinds and tighter monetary policies. By early-2023, the U.S Federal Reserve Board’s (Fed) preferred inflation gauge, the Core Personal Consumption Expenditures index (PCE)1, which excludes food and energy costs, unexpectedly rose. In reaction, the central bank increased the Fed funds target rate by 3.00% during the reporting period as Fed Chair Jerome Powell emphasized price stability to tame inflation, bringing the Fed funds target rate range to 5.25% – 5.50%, while expressing higher for longer rates may be warranted.

The Fund’s top equity sector weights included approximately 27% Information Technology (IT), 14% Health Care, and 13% Financials at the end of the reporting period. Overall, the bulk of the Fund’s total returns were generated from stocks across IT, Health Care and Consumer Discretionary—while exposure to Communication Services, Utilities, and Real Estate dampened results.

Among our IT holdings, Applied Materials advanced by approximately 88%, as investors bid up the supplier of equipment, services, and software used to manufacture semiconductors. The company reported better than expected earnings results, hitting the high end of their revenue and earnings guidance range. The company’s CEO cited strategic investments in technologies to enhance the Internet of Things and artificial intelligence as key drivers. In addition, the company’s board of directors recently approved a 23% dividend per share increase. Such acceleration of free cash flow growth is a key component of the Fund’s investment philosophy.

Despite the broader Energy sector posting double-digit returns, Devon Energy, which is among our Energy holdings, experienced selling pressure, sliding by approximately -22%. Nonetheless, we remain constructive as the C-suite has articulated their commitment to balance sheet improvement while increasing shareholder returns through its formalized fixed plus variable dividend model. Through this lens, Devon Energy increased its quarterly dividend by 11% in 2023.

On a forward-looking basis, we remain focused on business fundamentals and portfolio construction. As always, we continue to favor what we believe are high-quality, cash-generative, dividend-paying stocks with managements focused on disciplined capital allocation. We believe this prudent approach can potentially provide outsized returns compounded over a full investment cycle.

We thank you for investing in our Fund.

Sincerely,

William D. Hunter and Shawn Trudeau

Portfolio Managers

1 Source: U.S. Bureau of Economic Analysis

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund’s portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

Dividend Growth Fund (Unaudited)

|

(as a % of Total Investments*) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Derivatives (other than options purchased), if

any, are excluded from this chart. |

| | |

| | Average Annual Total Return

Ended 08/31/2023 |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class’s returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund’s most recent prospectus, the total annual operating expense ratios for fiscal year 2022 were 1.05%, 1.48%, 2.17% and 1.25% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.70%, 1.06%, 1.81% and 0.60% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2023, can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

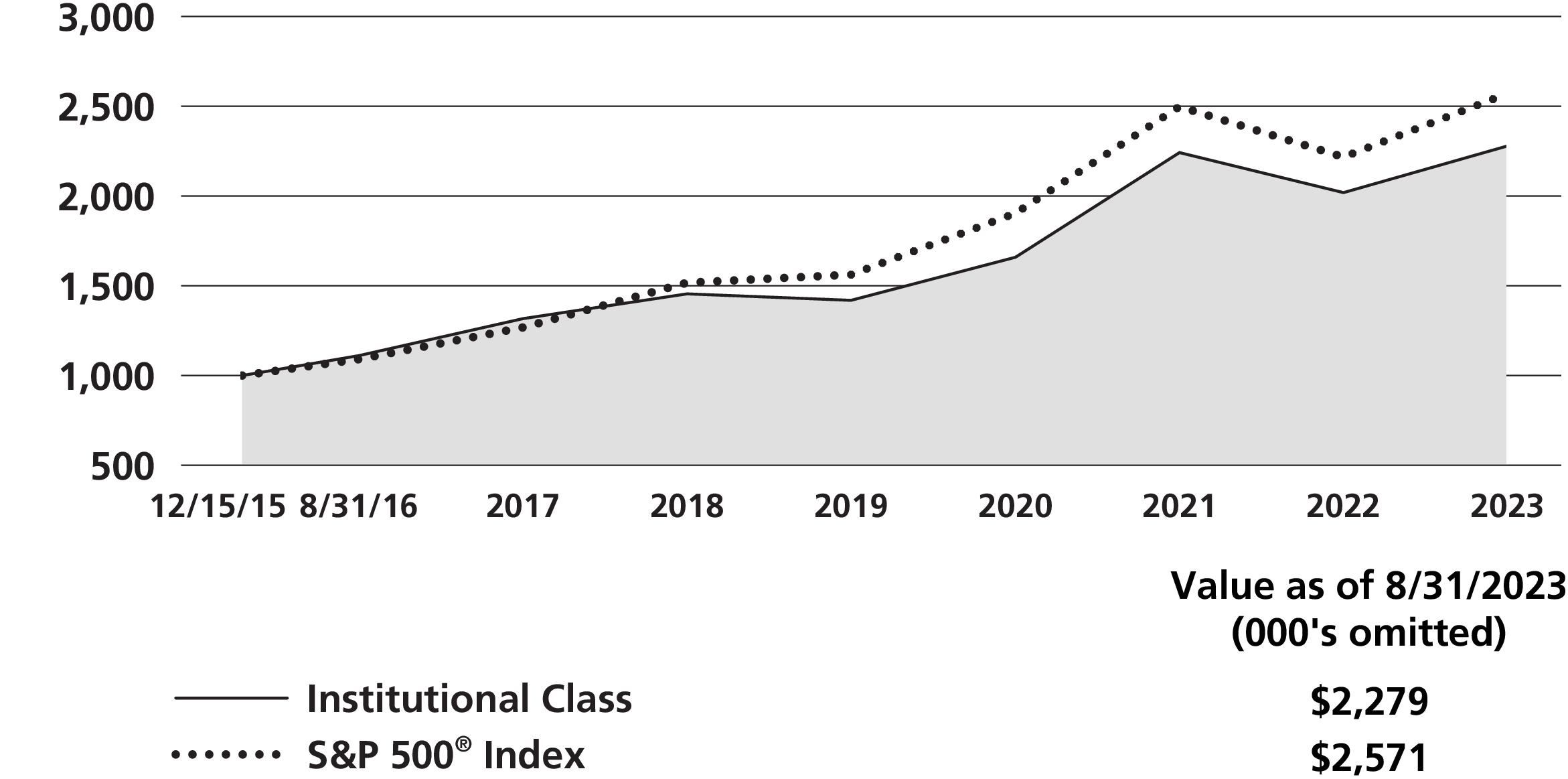

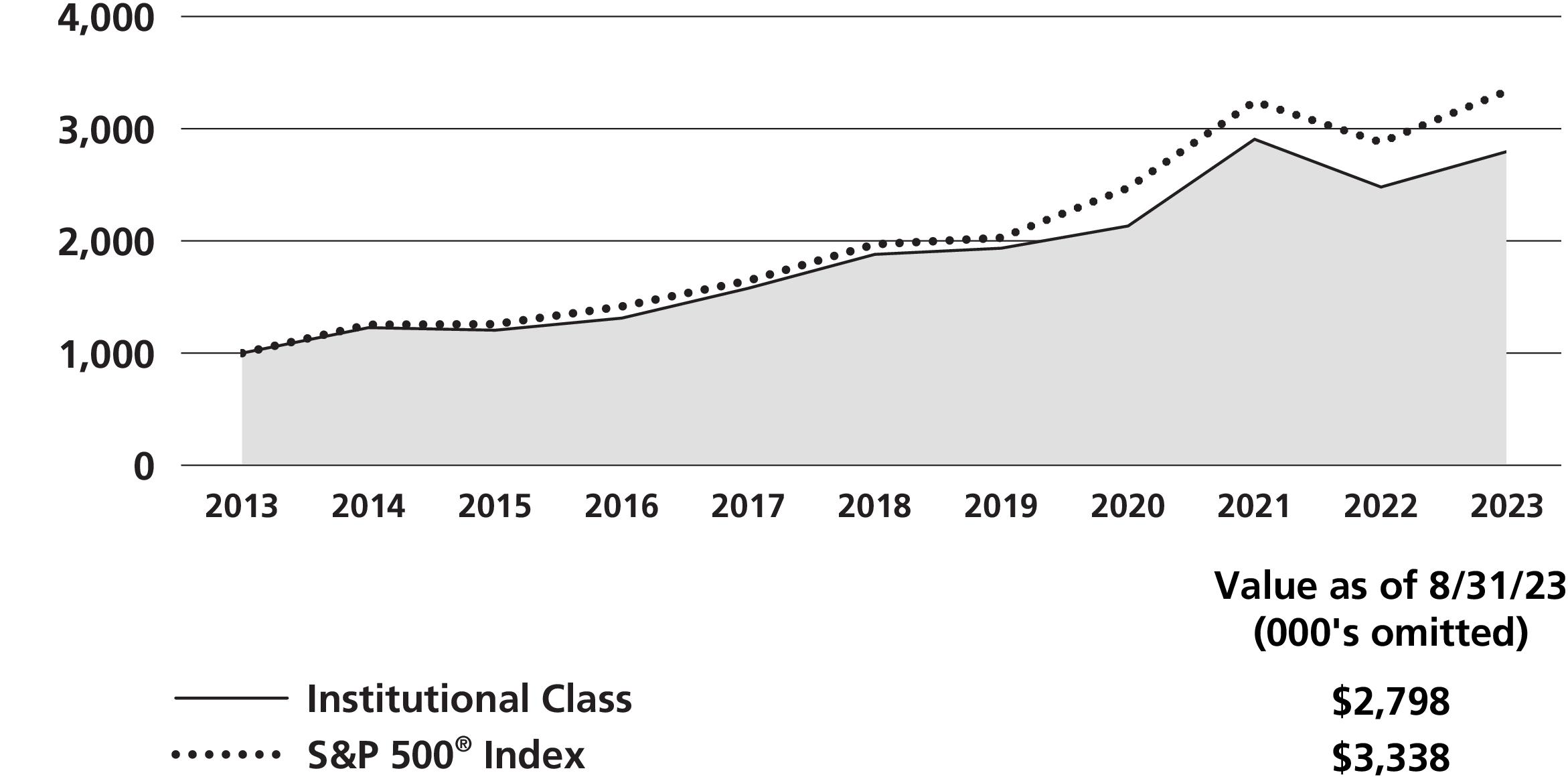

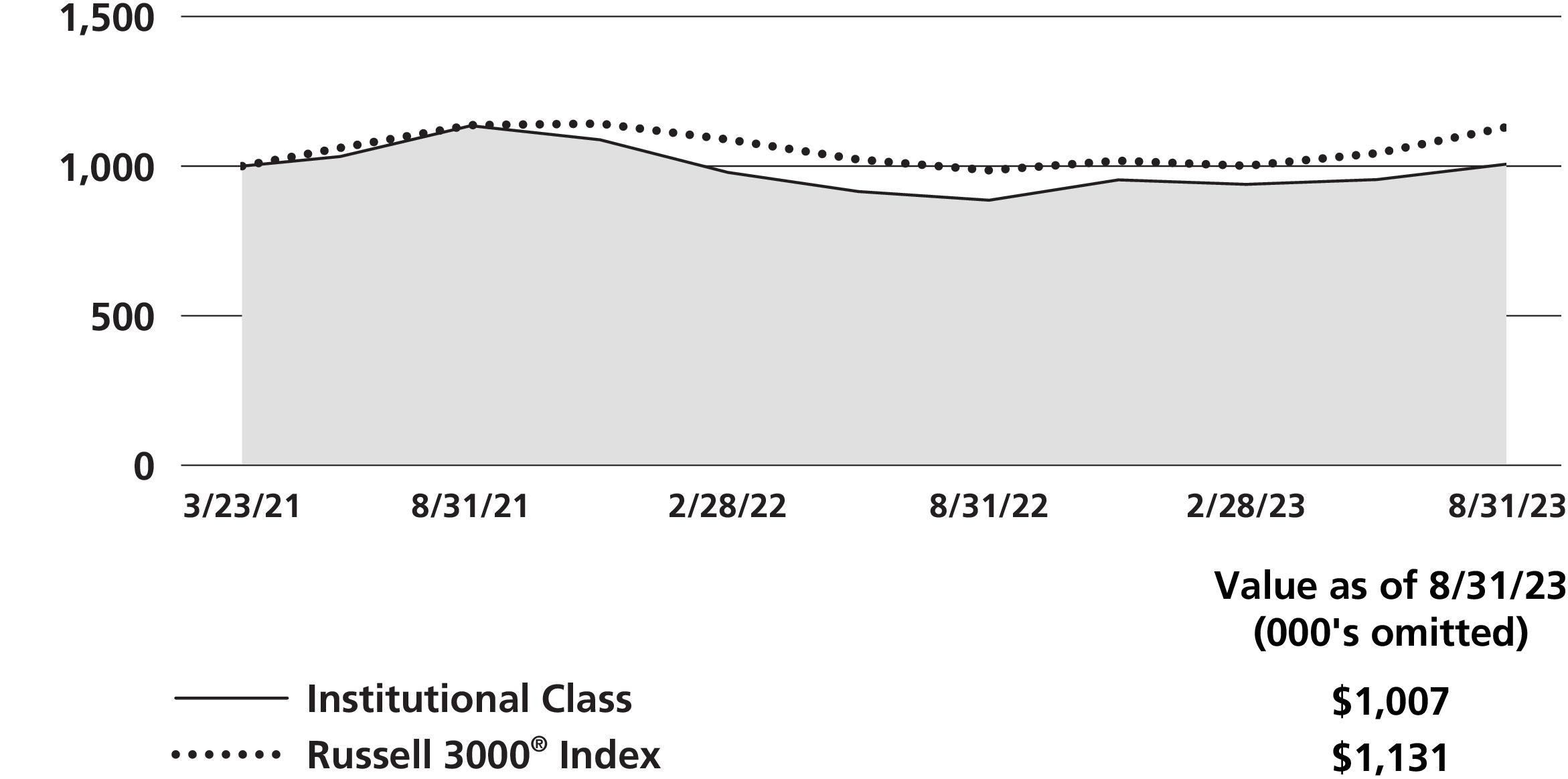

Dividend Growth Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund’s inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Emerging Markets Equity Fund Commentary (Unaudited)

Neuberger Berman Emerging Markets Equity Fund Institutional Class generated a total return of -2.69% for the fiscal year ended August 31, 2023 (the reporting period), trailing its benchmark, the MSCI Emerging Markets (EM) Index (Net) (the Index), which reported a total return of 1.25% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Optimism returned to global equity markets this reporting period, but EM equities, as measured by the Index, advanced only slightly, lagging the U.S. S&P 500® Index and developed markets, as measured by the MSCI EAFE® Index (Net). While EM investors cheered an improving outlook for U.S. interest rates as inflation slowed, sentiment was hampered by slower economic growth in China, which was under pressure as it emerged from COVID-19 lockdowns with issues in its property sector, high youth unemployment, and threats to consumer spending.

Results ranged widely by sector and by country. Information Technology (IT) and Energy led the Index for the reporting period as artificial intelligence (AI) hardware spending drove tech names to advance worldwide, and on rising energy commodity prices. Utilities, out of favor as investors sought higher growth potential, and Health Care declined the most. Greece, Turkey and Hungary outperformed significantly, each up 60% or higher. Qatar was weakest with a 21% decline, followed by smaller losses in Saudi Arabia and Kuwait.

The Fund’s performance shortfall resulted from stock selection, primarily in IT, Financials and Consumer Discretionary. By country, holdings based in India, China and Brazil, where the Fund was also underweight, were a headwind. Individual detractors included India’s API Holdings*, the largest Indian online digital healthcare platform, which declined in value on news that the firm may offer more equity at a lower price, and Chinese e-commerce names JD.com and Meituan, both of which were sold by the Fund during the reporting period. The team is closely monitoring the competitive dynamic in the Chinese e-commerce realm to determine how to position the Fund going forward.

Bottom-up driven sector positioning was an advantage during the reporting period, with an underweight versus the Index to falling Utilities and an overweight to rising IT the largest factors. Stock selection within Health Care, Energy and Consumer Staples also added relative value. By country, stock selection and an underweight to Saudi Arabia, stock selection in Korea, and an outside-Index exposure to a Colombian oil explorer domiciled in Canada helped most.

Korean electronics giant, Samsung, chipmaker, SK Hynix, and China’s Trip.com were among top contributors. Samsung and SK Hynix rallied on hopes that pricing for their semiconductor components had bottomed out and could improve going forward, while Trip.com benefited from increased travel post China’s economic reopening.

While we are cautious about and underweight the Chinese Real Estate sector and balance sheet-linked Financials, other segments of the Chinese economy appear to be still growing (e.g., Chinese tourism and global consumer product innovators), leading the Fund to be overweight select Consumer subsectors in that market.

Elsewhere, we believe artificial intelligence hype may be getting ahead of itself, but we have identified other niche opportunities across a variety of IT segments, which helped build back an overweight to that sector, at the expense of a previously larger overweight in Consumer Staples. At the end of the reporting period, the Fund remained underweight more cyclical segments such as metals and mining.

We believe these positioning decisions mean the Fund is poised to benefit from idiosyncratic opportunities, rather than a cyclical uplift, which feels appropriate given slower global growth.

Sincerely,

Conrad Saldanha

Portfolio Manager

*API Holdings is a private company. Investments in private companies involve greater risks than investments in securities of companies that have traded publicly on an exchange for extended periods of time. Investments in private companies are generally less liquid than investments in securities issued by public companies and may be difficult for the Fund to value.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund’s portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

Emerging Markets Equity Fund (Unaudited)

| | | |

| | Average Annual Total Return

Ended 08/31/2023 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class’s returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund’s most recent prospectus, the total annual operating expense ratios for fiscal year 2022 were 1.23%, 1.59%, 2.34%, 1.95% and 1.12% for Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.51%, 2.26% and 1.92% for Class A, Class C and Class R3 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2023, can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

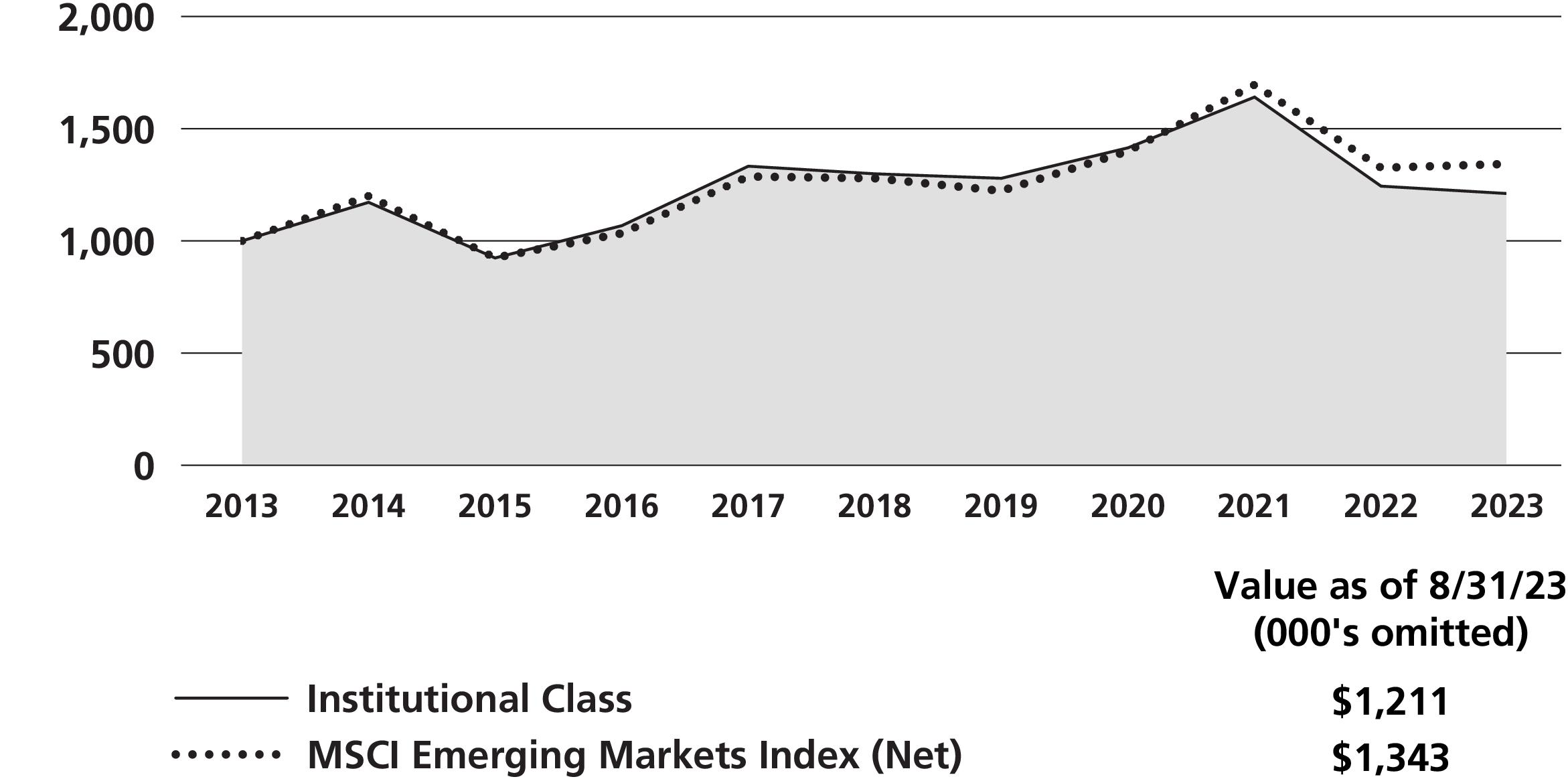

Emerging Markets Equity Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund’s inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Equity Income Fund Commentary (Unaudited)

Neuberger Berman Equity Income Fund Institutional Class generated a 2.46% total return for the fiscal year ended August 31, 2023 (the reporting period), underperforming its benchmark, the Russell 1000® Value Index (the Index), which posted an 8.59% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

This Fund is an objective-based strategy, targeting a total return profile between stocks and bonds compounded over a full investment cycle with limited volatility relative to the Index. Overall, the Fund is diversified among dividend-paying stocks selected through extensive analysis of cash flow prospects, that we believe have the ability to sustain and grow dividends.

During the reporting period, the U.S. stock market, as measured by the Index, rose despite investors grappling with inflationary headwinds and tighter monetary policies. By early-2023, the U.S Federal Reserve Board’s (Fed) preferred inflation gauge, the Core Personal Consumption Expenditures index (PCE)1, which excludes food and energy costs, unexpectedly rose. In reaction, the central bank increased the Fed funds target rate by 3.00% during the reporting period as Fed Chair Jerome Powell emphasized price stability to tame inflation, bringing the Fed funds target rate range to 5.25% – 5.50%, while expressing higher for longer rates may be warranted.

The Fund’s top equity sector holdings included approximately 20% Industrials, 12% Financials, and 11% Energy at the end of the reporting period. The bulk of the Fund’s total returns were generated from stocks across Industrials, Health Care, and Materials—while exposure to Real Estate, Financials, and Utilities dampened results.

The Fund’s overweight to Industrials versus the Index contributed the most to relative returns. The Fund maintains an overweight to Industrials as we believe the sector can benefit from infrastructure initiatives supported by recent legislation, including the Inflation Reduction Act of 2022. Eaton Corp. PLC proved to be our top performer in this sector, advancing by more than 70%. This core holding represents an intelligent power management business that we believe can capitalize on infrastructure modernization underpinned by electrification and digitalization trends.

While Materials exposure was accretive to total return, Canada’s Nutrien was an outlier, declining approximately 30% during the reporting period. This business represents one of the world’s largest providers of crop inputs, playing a critical role in the agricultural supply chain through its production and distribution of potash, phosphate, and nitrogen products. Despite the challenging environment, we remain constructive as we believe fertilizer imbalances could support profitability throughout 2023 and beyond.

The Fund’s use of written options contributed positively to performance during the reporting period.

Our analysis suggests stocks with dividend yields greater than 2.5% are priced close to their greatest discount relative to the broader equity market since the "Tech Boom" of the late 1990s. We believe investors can benefit from purchasing high quality dividend paying companies, which we believe are now at reasonable, even cheap, valuations. Given today’s setup we believe our unique approach to equity income provides an inflationary hedge, while providing attractive current income and capital appreciation potential for more risk-averse investors.

We thank you for investing in our Fund.

Sincerely,

Richard Levine and Sandy Pomeroy

Portfolio Managers

1 Source: U.S. Bureau of Economic Analysis

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund’s portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

Equity Income Fund (Unaudited)

|

(as a % of Total Investments*) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Derivatives (other than options purchased), if any, are excluded from this chart. |

| | | |

| | Average Annual Total Return

Ended 08/31/2023 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

Russell 1000® Value Index1,2 | | | | |

*The performance data for the life of Fund for each class includes the performance of the Fund’s oldest share class, Trust Class, from November 2, 2006 through June 9, 2008. The performance data for Class R3 also includes the performance of the Fund’s Institutional Class from June 9, 2008 through June 21, 2010. The performance data for Class E also includes the performance of the Fund's Institutional Class from June 9, 2008 through January 11, 2022. See endnote 5 for information about the effects of the different fees paid by each class.

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class’s returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund’s most recent prospectus, the total annual operating expense ratios for fiscal year 2022 were 0.71%, 1.07%, 1.82%, 1.38% and 0.57% for Institutional Class, Class A, Class C, Class R3 and Class E shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratio for fiscal year 2022 was 0.07% for Class E after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2023, can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

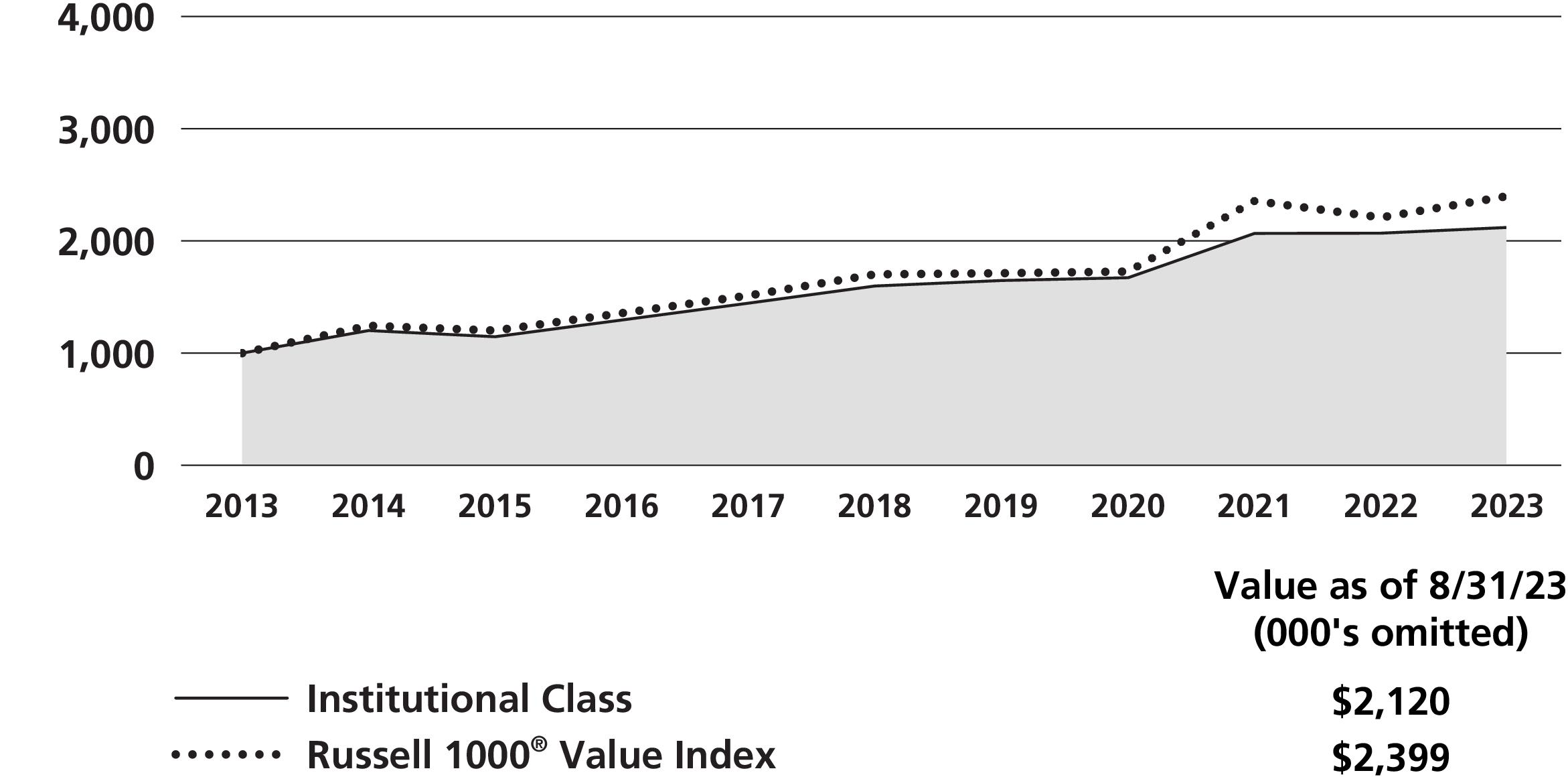

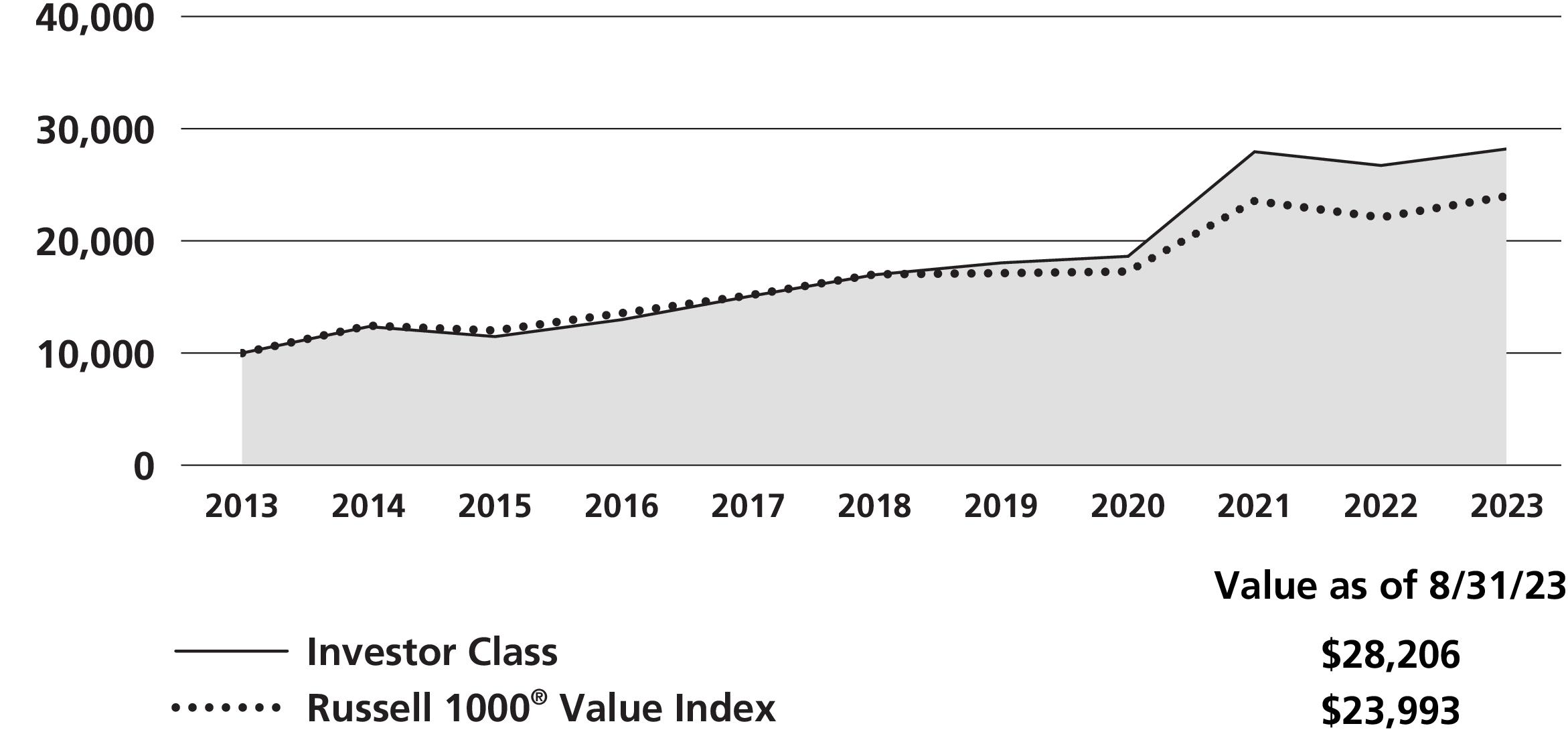

Equity Income Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund’s inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Focus Fund Commentary (Unaudited)

Neuberger Berman Focus Fund Investor Class generated a 11.82% total return for the fiscal year ended August 31, 2023 (the reporting period), underperforming the 13.95% total return of its benchmark, the MSCI All Country World Index (Net) (the Index), for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The global equity market, as measured by the Index, generated strong results during the reporting period. Investor sentiment was buoyed by the resilient economy, corporate earnings that often exceeded expectations, and moderating inflation. These factors offset concerns that interest rates may be "higher for longer," fears that central bank monetary tightening could push the global economy into a recession, and numerous geopolitical issues.

Sector allocation detracted from the Fund’s relative performance, whereas stock selection contributed to returns during the reporting period. In terms of sector allocation, a small cash position and an overweight to Consumer Discretionary versus the Index were the largest negatives for relative performance. On the upside, lack of exposure to Real Estate and an overweight to Industrials were the most additive to performance.

Looking at stock selection, positions in the Consumer Discretionary (led by Broadline Retail), Communication Services (led by Entertainment) and Materials (led by Chemicals) sectors were the largest contributors to relative performance. In terms of individual stocks, entertainment company Netflix, Inc., software firm Constellation Software Inc. and semiconductors & semiconductor equipment company NVIDIA Corp. were the most additive for total returns. On the downside, holdings in the Industrials (driven by Ground Transportation), Information Technology (IT) (driven by IT Services) and Utilities (driven by Electric Utilities) sectors were the largest detractors from performance. Individual stocks that negatively impacted total returns included online retail firm Amazon.com, Inc., IT services company Okta, Inc. and cloud-based data warehousing firm Snowflake, Inc. We eliminated our positions in Netflix, Inc., Okta, Inc. and Snowflake, Inc. during the reporting period.

Looking ahead, we see several interrelated reasons to be careful going forward, including the knock-on effects of sharply rising interest rates, persistent inflation, slowing corporate technology spending following the post-COVID-19 boom, continued geopolitical risks in Ukraine and Taiwan, the impact of rising corporate layoffs, and potentially slowing consumer discretionary spending. However, we believe it is important to be flexible in our thinking, and we continue to identify those companies that we believe will gain material market share whatever speed the global economy is growing.

Sincerely,

Timothy Creedon and Hari Ramanan

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund’s portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

|

(as a % of Total Investments*) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Derivatives (other than options purchased), if any, are excluded from this chart. |

| | | |

| | Average Annual Total Return

Ended 08/31/2023 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class’s returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund’s most recent prospectus, the total annual operating expense ratios for fiscal year 2022 were 0.89%, 1.10%, 1.25%, 0.75%, 1.13%, and 1.91% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratio was 1.11% and 1.86% for Class A and Class C shares, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2023, can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

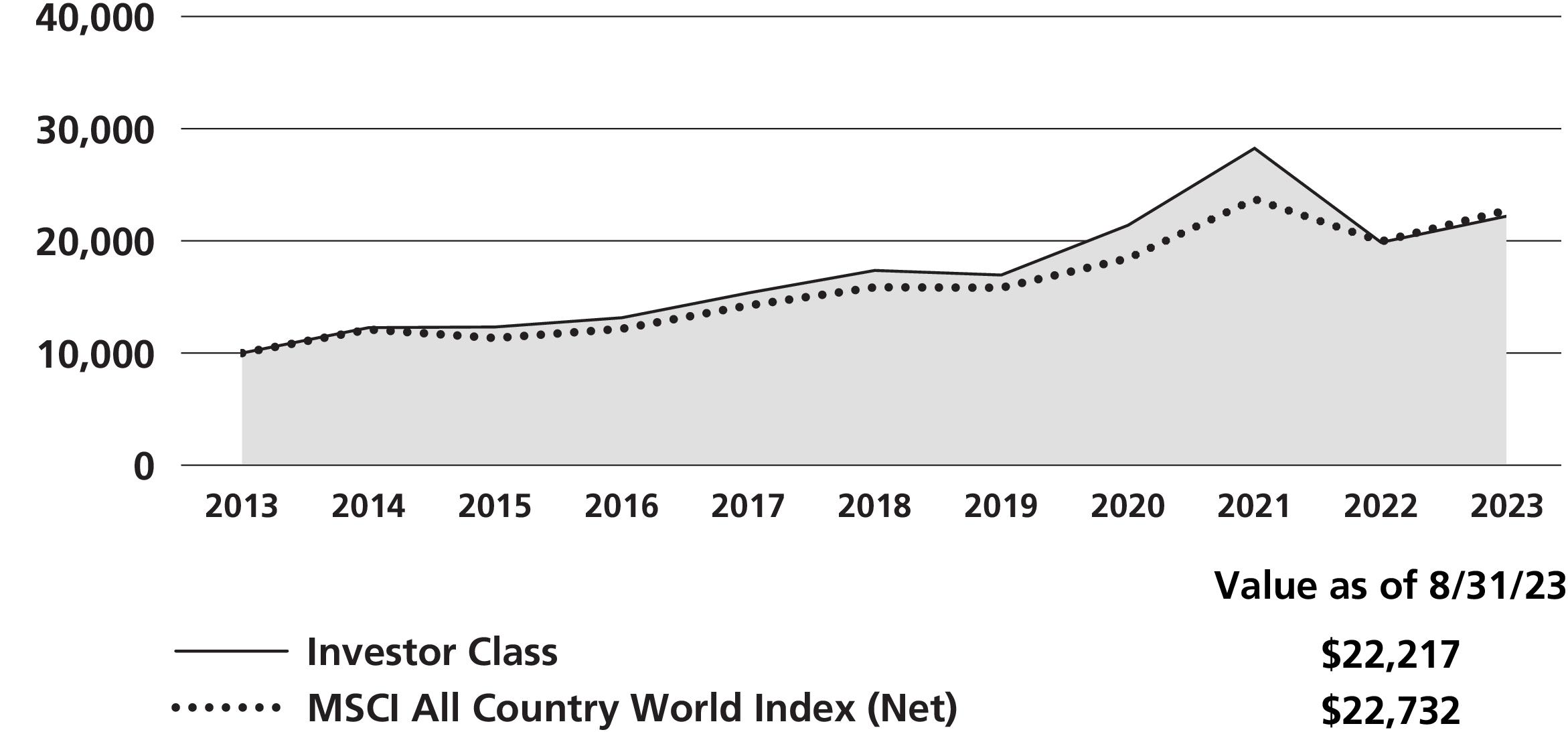

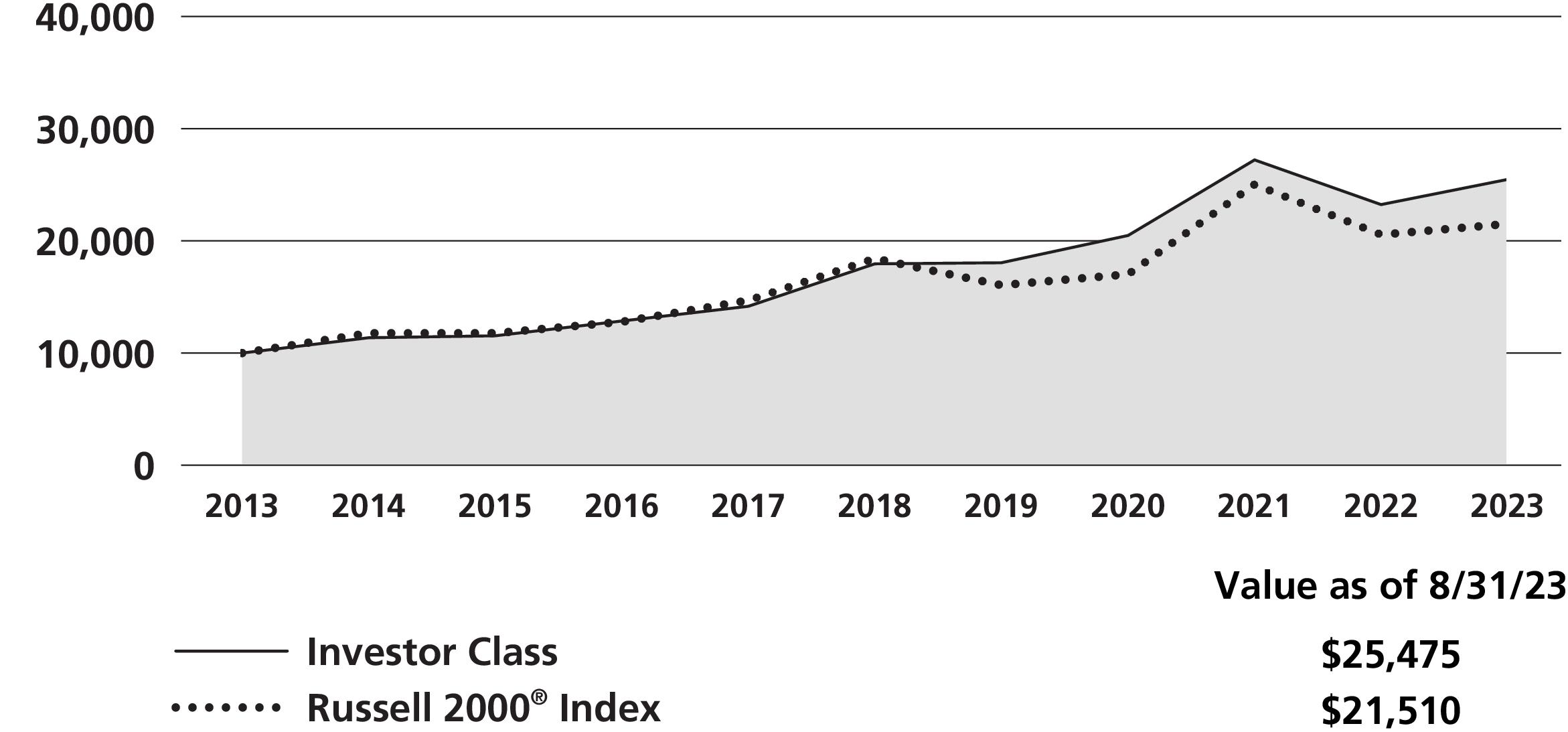

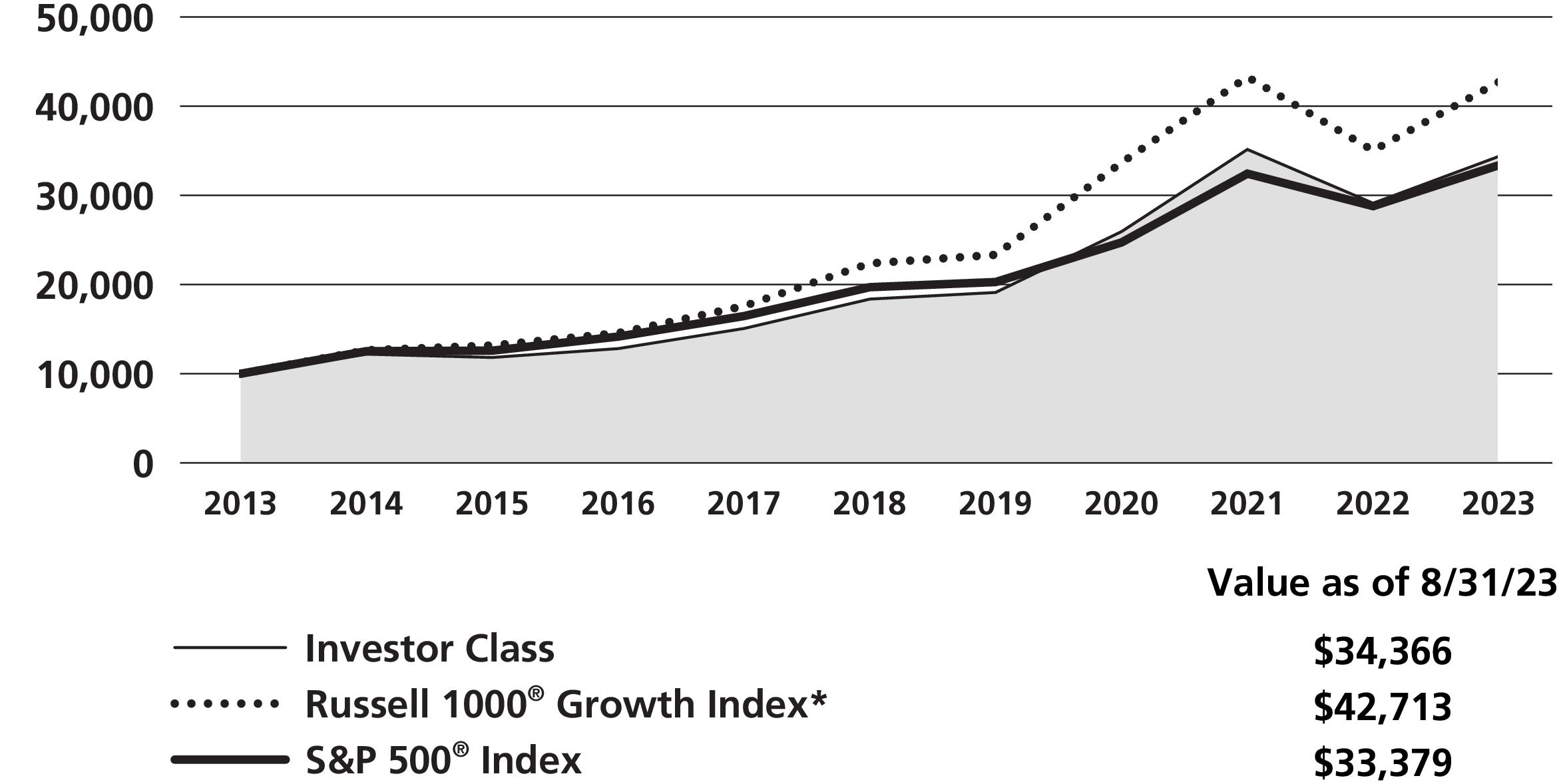

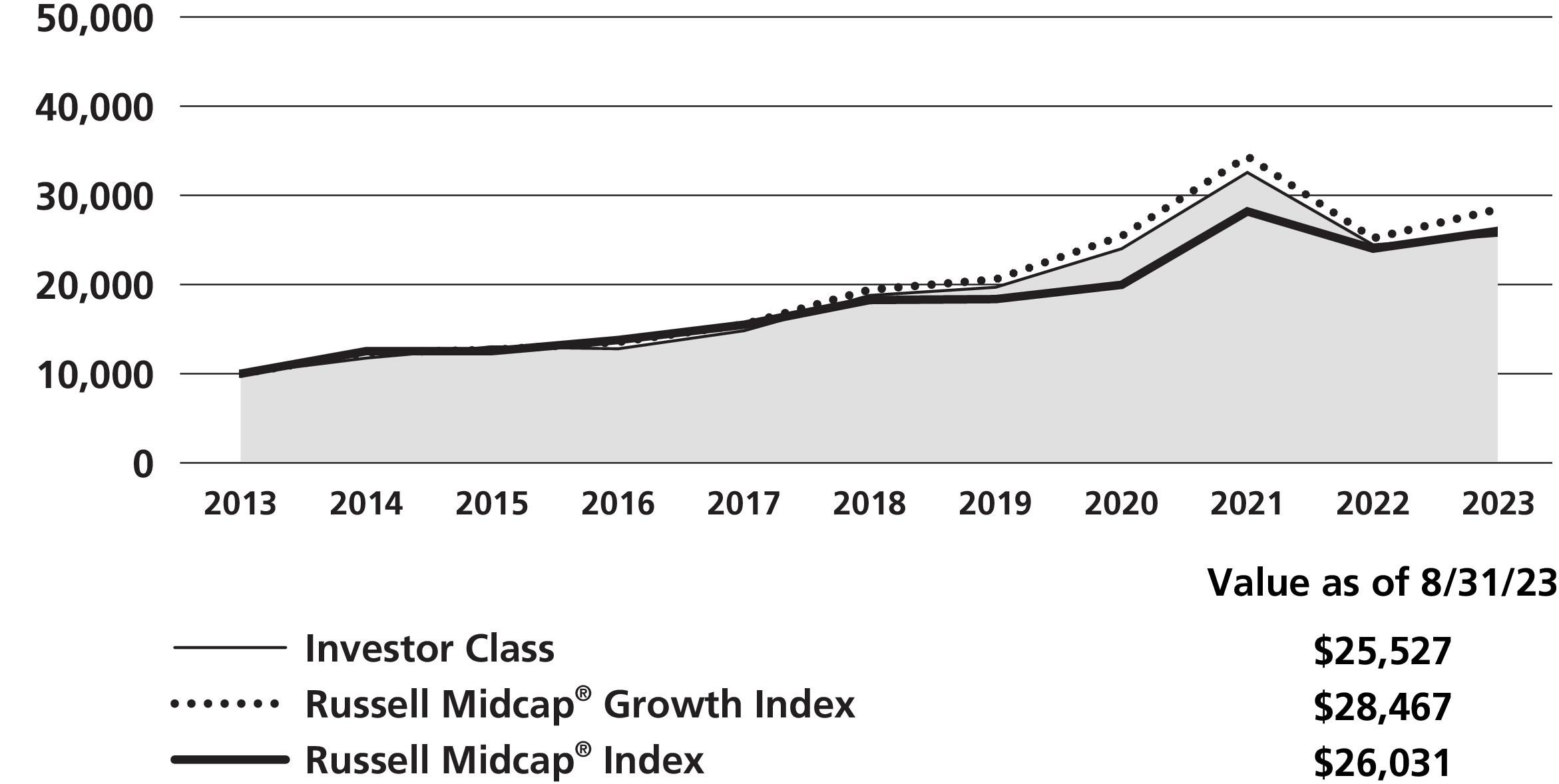

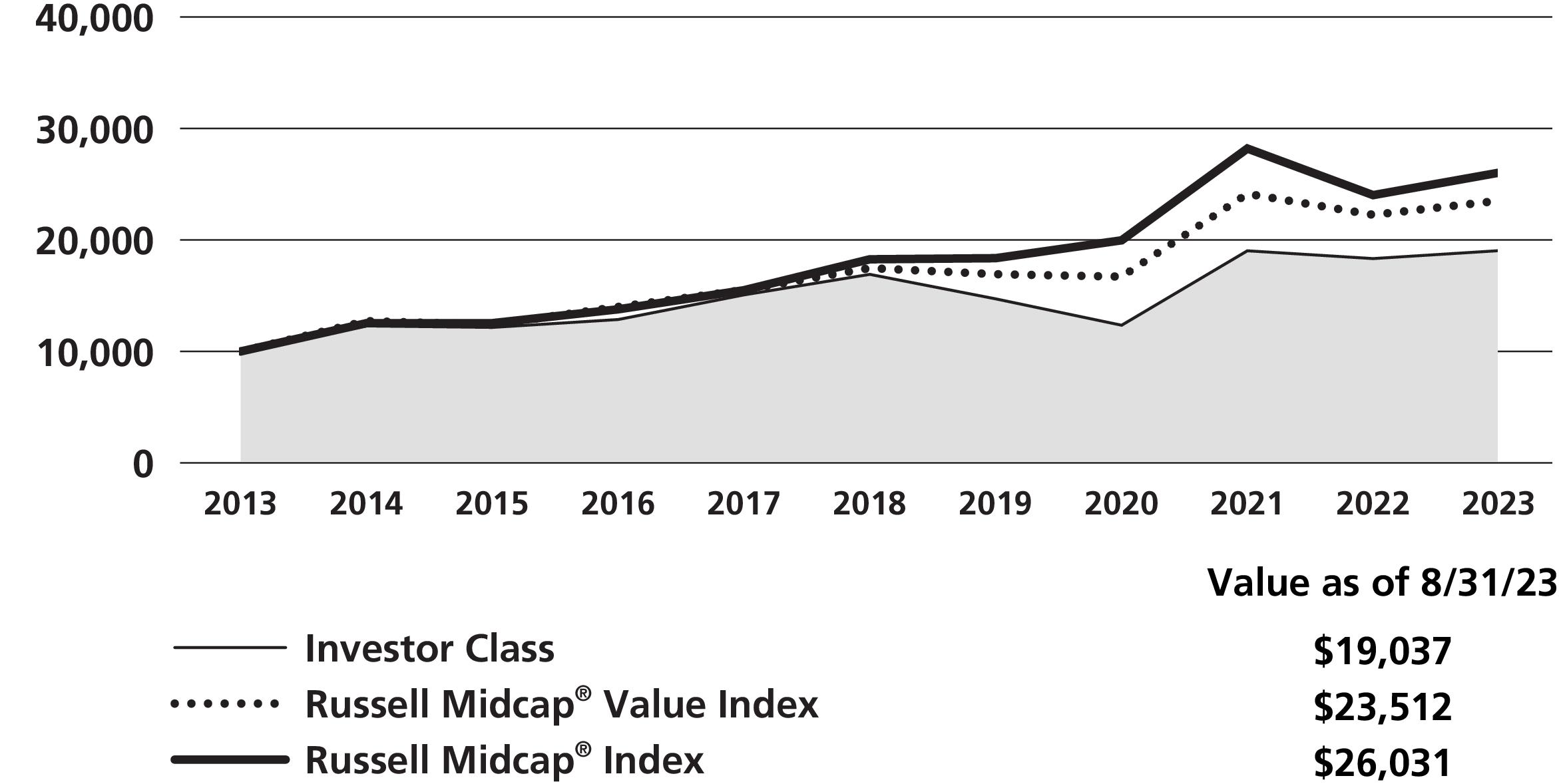

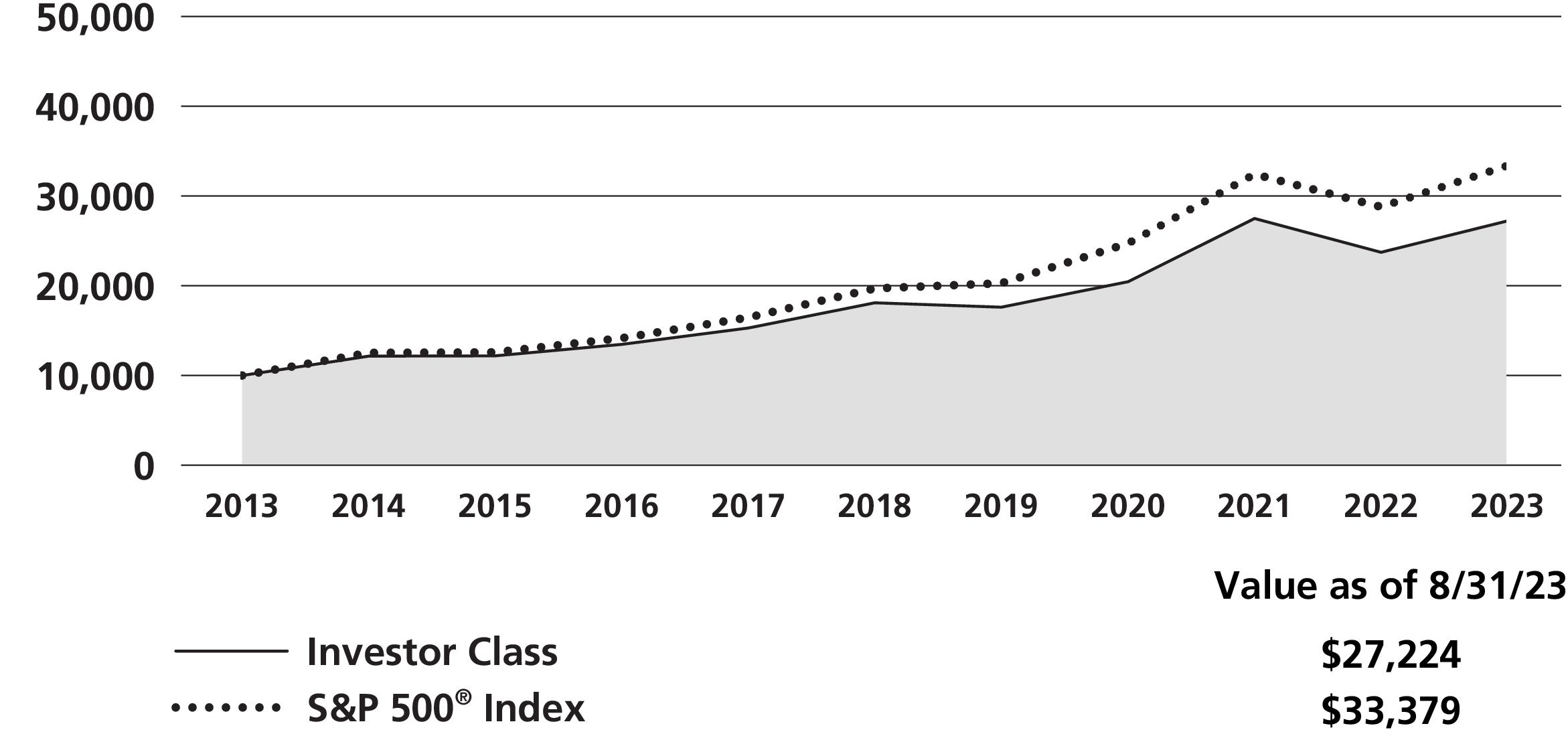

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund’s inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Genesis Fund Commentary (Unaudited)

Neuberger Berman Genesis Fund Investor Class generated a 9.64% total return for the fiscal year ended August 31, 2023 (the reporting period), outperforming the 4.65% total return of its benchmark, the Russell 2000® Index (the Index), for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The overall U.S. equity market, as measured by the S&P 500® Index, generated solid results during the reporting period. Investor sentiment was buoyed by the resilient economy, corporate earnings that often exceeded expectations, moderating inflation, and hopes that the U.S. Federal Reserve Board (Fed) was nearing the end of its rate hike cycle. These factors offset concerns that interest rates may be "higher for longer," fears that the Fed’s monetary tightening could push the economy into a recession, and numerous geopolitical issues. All told, the S&P 500 Index gained 15.94% during the reporting period. In contrast, small-cap stocks, as measured by the Index, returned 4.65% total return over the same period.

The Fund outperformed the Index on a relative basis due to strong sector allocation and stock selection. From a sector allocation perspective, overweights to the Information Technology (IT) and Industrials sectors versus the Index were the largest contributors to results. Within IT, the Fund’s overweight to Software was the most additive for returns. Within Industrials, our overweight to Machinery companies added the most value. Our minimal exposure to the underperforming Biotechnology industry also added to relative returns. Small-cap biotechnology companies generally do not meet our high-quality investment criteria, as they tend to be speculative, typically do not generate earnings, and require considerable capital market funding to operate. On the downside, an underweight to the Energy sector versus the Index was a meaningful detractor from performance.

In terms of stock selection, the Fund’s strongest relative results were in the Health Care (led by Life Sciences Tools & Services and Health Care Equipment & Supplies), IT (led by Software and Semiconductors) and Materials (led by Chemicals) sectors. Conversely, stock selection in the Financials (driven by Banks), Industrials (driven by Construction & Engineering) and Communication Services (driven by Media) sectors were the largest drags on relative results.

Over the past eighteen months, the Fed has been squarely focused on restoring price stability with the goal of suppressing demand to bring inflation under control. Recent testimony from the Fed suggests it may be nearing the end of its tightening cycle. Overall economic activity remains stable, however, some economic indicators suggest an economic cooling, while some general macroeconomic data suggests continued resilience in the economy. Considering this backdrop, equity markets have remained highly sensitive to incoming inflation-related data points and economic indicators. Taking a step back, it is clear in our view that markets have entered a meaningfully different regime than the one present during the last decade. It appears risk aversion has returned, access to financing has become harder, and the cost of capital has risen materially. Furthermore, events in the banking sector might cause financial conditions to tighten further as lending standards become more stringent. The risk of recession both in the U.S. and globally has grown, but by no means is a certainty. With the macro trajectory clouded, we are striving to maintain balance in the Fund. We remain confident that our high-quality portfolio of businesses with attractive financial characteristics, differentiated and durable business models, and sustainable earnings growth is well positioned to weather these uncertain times and deliver above-average risk-adjusted returns.

Sincerely,

Judith M. Vale*, Robert W. D'Alelio, Brett S. Reiner and Gregory G. Spiegel

Portfolio Co-Managers

*As announced on July 18, 2023, Judith Vale intends to transition to a newly created Portfolio Strategist role starting in January 2024. In this role, she will focus on providing investment guidance and analysis to the portfolio managers and the broader investment team responsible for managing the Fund.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund’s portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

|

(as a % of Total Investments*) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Derivatives (other than options purchased), if any, are excluded from this chart. |

| | | |

| | Average Annual Total Return

Ended 08/31/2023 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class’s returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund’s most recent prospectus, the total annual operating expense ratios for fiscal year 2022 were 1.00%, 1.09%, 1.34%, 0.84%, 0.74% and 0.70% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class R6 and Class E shares, respectively, (before expense reimbursements and/or fee waivers, if any). The expense ratio for fiscal year 2022 was 0.04% for Class E after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2023, can be found in the Financial Highlights section of this report.

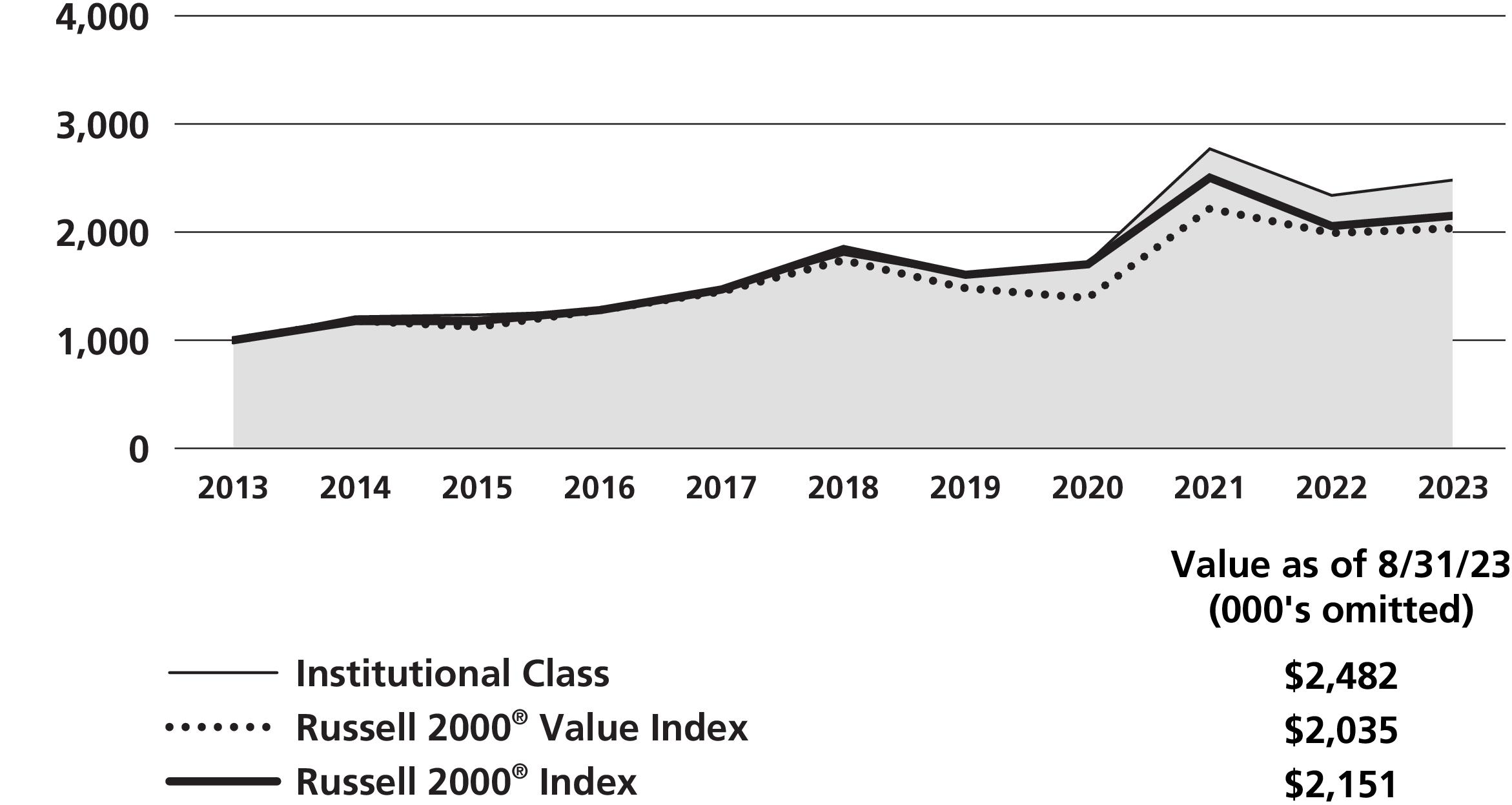

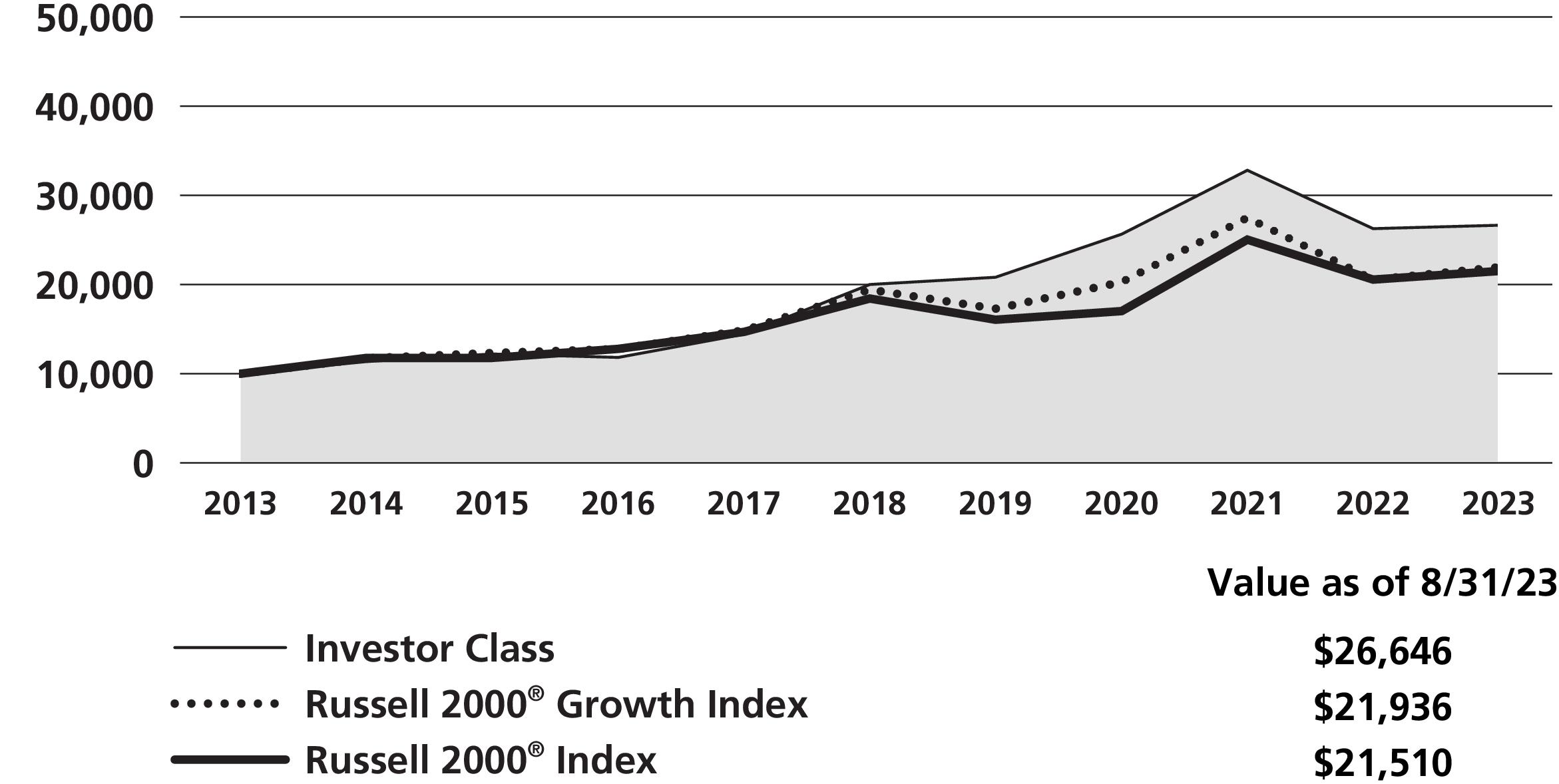

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund’s inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund’s share classes will differ primarily due to different class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Global Real Estate Fund* Commentary (Unaudited)

Neuberger Berman Global Real Estate Fund Institutional Class generated a -7.85% total return for the fiscal year ended August 31, 2023 (the reporting period), underperforming the -5.19% total return of its benchmark, the FTSE EPRA Nareit Developed Index (Net) (the Index), for the same period.

The global equity market, as measured by the MSCI All Country World Index (Net) generated a positive 13.95% total return. In most developed market economies inflation readings fell back, though core measures remained more persistent. Global bond yields moved higher at the short end of the curve, leading to deeper yield curve inversion for many developed markets. Credit performed well as spreads narrowed, with lower grade credits performing best as near-term recession risk receded. Comparatively, global real estate investment trusts (REITs), as measured by the Index, generated weaker results.

The Fund underperformed the Index on a relative basis during the reporting period. Stock selection and country positioning detracted from the Fund’s relative returns. From a sector selection perspective, an overweight in the Real Estate Holding and Development sector and underweights to Office REITs and Health Care REITs versus the Index were additive for relative returns. In terms of individual holdings, Prologis, Inc., Gecina SA, and Iron Mountain Inc. were the largest contributors to performance. On the downside, relative overweights to Infrastructure REITs, and underweights to Industrial REITs and Other Specialty REIT sectors were detractors. Individual holdings that detracted most from performance include Crown Castle, Inc., American Tower Corporation, and Extra Space Storage, Inc.

In terms of the Fund’s positioning from a country perspective, overweights in Spain and China and an underweight in Japan versus the Index were the most beneficial for relative returns. On the downside, an overweight in the U.K and lack of exposure to Switzerland were the largest detractors from relative performance.

We head into fall with continuing concerns related to an uncertain macro-economic backdrop, which is still weighed down by higher interest rates, slower economic growth and lack of liquidity in transaction markets and private investment vehicles. However, the banking sector stress, lower commodity prices and a slowing labor market could provide support for the view that inflation levels may have peaked. The broader commercial real estate sector has been viewed with caution as the failures of regional banks and subsequent tighter lending standards have increased concern that U.S. regional banks’ ability to lend to the sector is likely impaired. The effect on the listed REITs market is not expected to be pronounced as we believe such REITs own mainly high-quality assets, generally maintain strong balance sheets, and tend to use the larger banks. However, REITs continue to be weighed down by negative news headlines that suggest otherwise.

Within the UK, higher interest rates are beginning to bring inflation down but are also slowing economic activity and weighing on sentiment. On the European Continent, economic growth is expected to be relatively flat in 2023 and 2024. Real estate values are adjusting to the higher interest rate environment, but a lack of transactions makes ascertaining asset values challenging. However, many continental European real estate companies remain over leveraged. We maintain a preference for UK companies in sectors enjoying secular tailwinds with lower leverage levels. Asia is less impacted by the two important issues facing the global real estate sector, namely elevated office vacancies in the U.S. and excessive leverage in some European companies. We believe Japan is poised to emerge structurally from decades of deflation and subpar growth. We stay slightly cautious about Japanese REITs because of lower asset quality, richer valuations, and the possible sharp increase in Japanese bond yields as the Bank of Japan pursues a further pivot. Hong Kong experienced a healthy GDP rebound post China’s COVID-19 reopening but there are justifiable doubts about the medium-term outlook. Overall, we hold a constructive view for the strongest developers in Hong Kong, Singapore and Japan, which we believe could profit from opportunities made available in any forthcoming downturns, as well as the defensive incomes from grocery-anchored retail in Australia and logistics REITs in Japan.

While we believe the macro backdrop could continue to weigh on stocks, a near-term end to the U.S. Federal Reserve Board tightening cycle and attractive relative valuations versus the broader market could, in our view, support the REIT market later this year and into 2024.

Sincerely,

Steve Shigekawa, Brian C. Jones and Anton Kwang

Portfolio Managers

*Effective after the close of business on October 13, 2023, the Fund was reorganized into an exchange-traded fund. Please refer to Note H of the Notes to Financial Statements for additional important information. For more information, call us at 800-877-9700 or visit www.nb.com/ETF.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund’s portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

Global Real Estate Fund (Unaudited)

| | |

| | Average Annual Total Return

Ended 08/31/2023 |

| | | |

| | | | |

| | | | |

| | | | |

FTSE EPRA Nareit

Developed Index

| | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class’s returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund’s most recent prospectus, the total annual operating expense ratio for fiscal year 2022 was 7.96% (before expense reimbursements and/or fee waivers, if any). The expense ratio was 1.01% after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2023, can be found in the Financial Highlights section of this report.

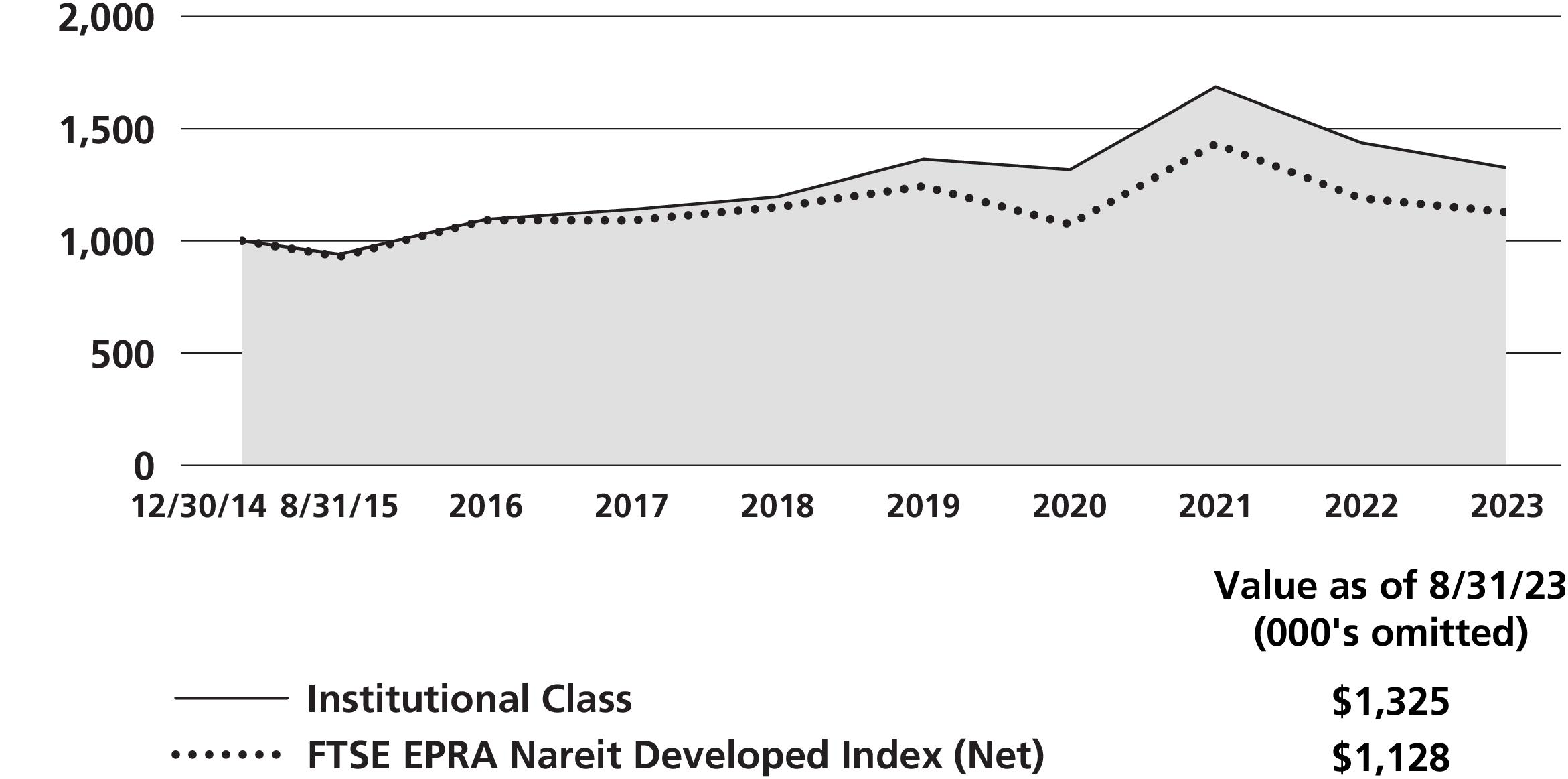

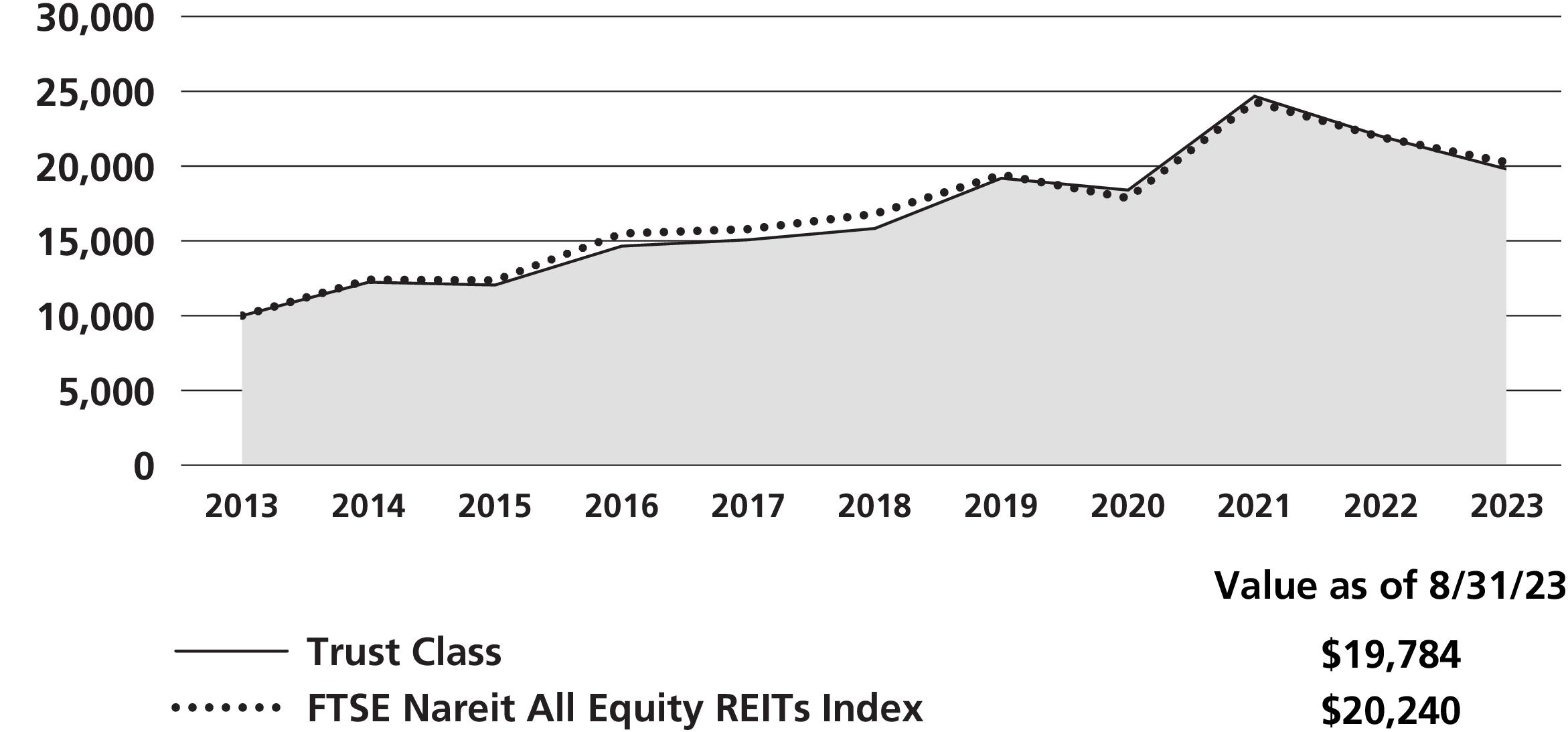

Global Real Estate Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund’s inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Greater China Equity Fund* Commentary (Unaudited)

Neuberger Berman Greater China Equity Fund Institutional Class generated a -16.10% total return for the fiscal year ended August 31, 2023 (the reporting period), underperforming its benchmark, the MSCI China All Shares Index (Net) (the Index), which returned -9.75% over the same period.

Over the reporting period, contributors to performance relative to the Index included Health Care (stock selection in Biotechnology), Real Estate (stock selection) and Utilities (no exposure). Detractors from performance relative to the Index included Materials (significant overweight and stock selection in Construction Materials), Consumer Staples (stock selection in Food Products and Beverages) and Communication Services (significant underweight).

During the reporting period, China equity markets remained volatile. In September and October 2022, China equity markets underwent severe turbulence given China’s ongoing "zero-COVID policy" which posed significant challenges to domestic economic conditions. Investors were also concerned about the weak housing market, geopolitical tensions and implications of upcoming leadership changes following the 20th Party Congress. China equity markets subsequently rebounded in November as China accelerated its reopening process and rolled out supportive measures for property developers. Policymakers also took a concerted approach to promote growth and boost consumption. The market rally was carried into January 2023 as data showed a faster than expected recovery in China and macro indicators came in above expectations. However, China equity markets corrected in February 2023 as investors took profits following the strong rebound from November.

At a high level, domestic growth conditions were improving after China’s reopening although not necessarily at a pace anticipated by the market. Specifically, consumption and services-related sectors have been holding up well although manufacturing capital expenditures and private sector confidence remained relatively weak. During the National People’s Congress in March 2023, the government was also being intentionally conservative in setting a 5.0% growth target (versus consensus expectations of 5.5%) which was largely driven by its concerns around potential weaker external demand and its potential impact on exports. Collectively, year-to-date economic data and forward guidance by policymakers weighed on investor confidence.

While policymakers have become much more pro-business and announced substantive policy easing measures to revive the confidence of businesses and consumers at the July Politburo meeting, market observers remained concerned about the ailing housing market and its potential contagion to the broader economy. To provide further support for the economy, policymakers announced more stimulus measures in the last week of August including a reduction in stamp duty on stock transactions to help activate the A-shares stock market and measures to speed up special local government bond issuances. The People’s Bank of China also announced the first nationwide mortgage easing measures in eight years for both first and second homes, providing a strong signal that policymakers remain focused on providing support for the economy and restoring confidence from homebuyers and consumers.

We continue to identify what we believe are high quality companies with good earnings visibility. Across the Fund’s core holdings, most have been successful in capturing additional market share amidst the economic challenges in 2022, which we believe puts them in a better position to benefit from a prospective recovery that we anticipate later in 2023.

Sincerely,

Ning Meng**

Portfolio Manager

*Effective after the close of business on October 13, 2023, the Fund was reorganized into an exchange-traded fund. Please refer to Note H of the Notes to Financial Statements for additional important information. For more information, call us at 800-877-9700 or visit www.nb.com/ETF.

** Effective August 21, 2023, Green Court Capital Management Limited ceased its services as subadviser to the Fund. At that time, Portfolio Manager, Ning Meng and Associate Portfolio Manager, Yi Shi, began managing the Fund.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund’s portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

Greater China Equity Fund (Unaudited)

|

(as a % of Total Investments*) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Derivatives (other than options purchased), if any, are excluded from this chart. |

|

(as a % of Long Term Investments) |

| |

| |

| |

| | | |

| | Average Annual Total Return

Ended 08/31/2023 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

MSCI China All Shares Index

| | | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class’s returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund’s most recent prospectus, the total annual operating expense ratio for fiscal year 2022 was 1.91% (before expense reimbursements and/or fee waivers, if any). The expense ratio was 1.51% after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2023, can be found in the Financial Highlights section of this report.

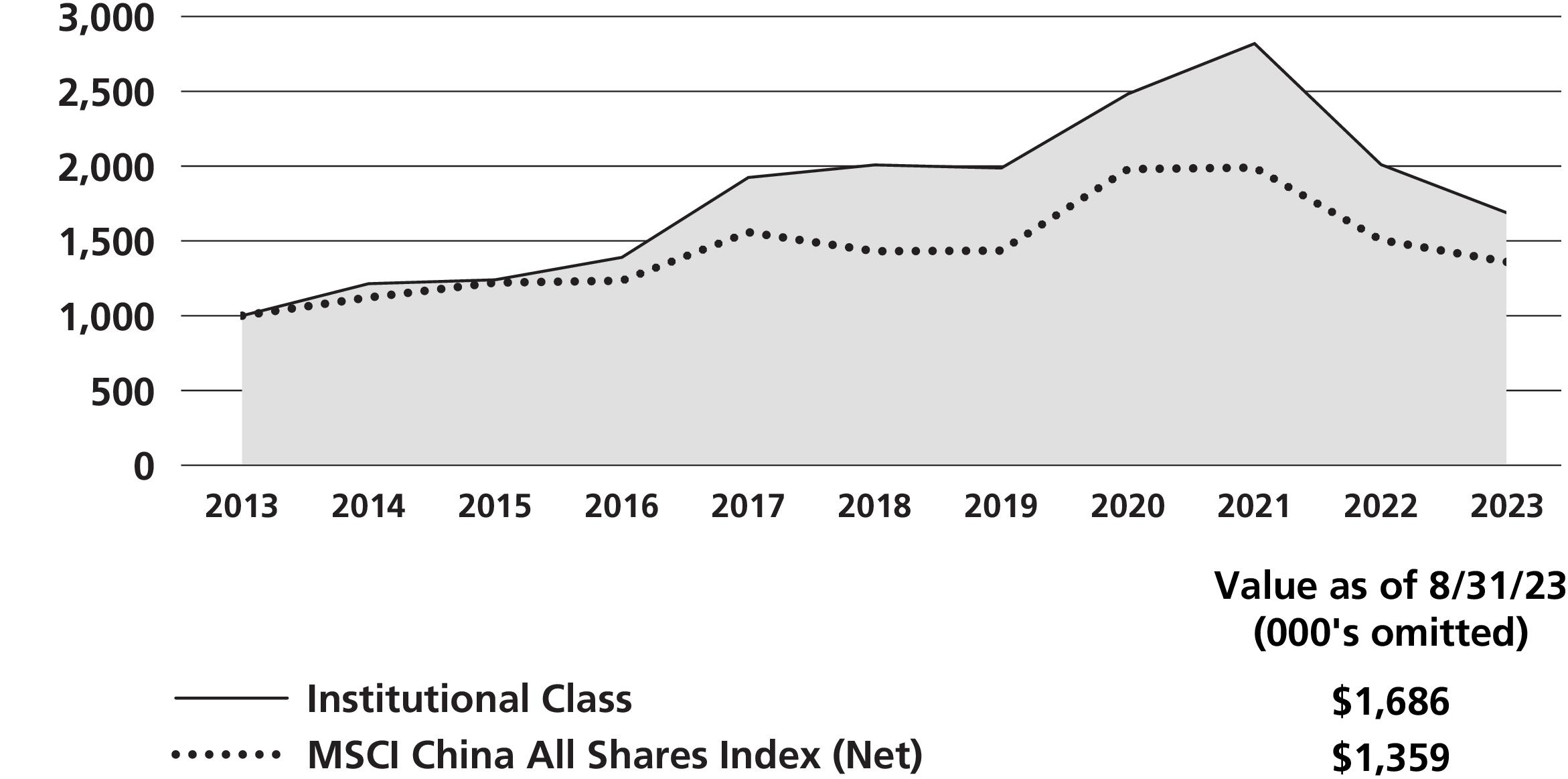

Greater China Equity Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund’s inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

International Equity Fund Commentary (Unaudited)

Neuberger Berman International Equity Fund Institutional Class generated a total return of 15.09% for the fiscal year ended August 31, 2023 (the reporting period), trailing its benchmark, the MSCI EAFE® Index (Net) (the Index), which posted a 17.92% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

As measured by the Index, developed international equities outperformed both the U.S. S&P 500® and MSCI Emerging Markets (Net) indices this reporting period. Investors favored value over growth stocks as rates rose sharply during the reporting period, and core inflation remained sticky, benefitting many "real economy" segments of the global markets that have been out of favor during the low rate era. As the reporting period progressed, evidence suggesting headline inflation was slowing faster than expected was welcomed by investors and corporate management teams hoping for relief from rising global interest rates.

On the cautionary side, a slowdown in China, with ripple effects from the meltdown of its real estate market and high unemployment among the nation’s young, loomed large within an interconnected global economy, adding to uncertainty. Toward the end of this reporting period, the Chinese government had begun aiming policy at resolving issues, but results remain unclear.

By country, Italy, Denmark and Ireland led the Index this reporting period, while Israel, Hong Kong and Norway declined most. From a sector perspective for the Index, Information Technology, Industrials and Consumer Discretionary outperformed, advancing over 20%. Real Estate declined, and Communication Services and Consumer Staples lagged.

The Fund’s underperformance relative to the Index resulted from stock selection. Our longer-term Quality at a Reasonable Price discipline means that the Fund can lag somewhat within markets where investors are willing to overpay, in our view, for growth. Accordingly, our holdings within the three "hottest" sectors—Industrials, Financials, and Consumer Discretionary—lagged. Stock selection within Italy and France, and lack of exposure to Denmark also limited relative returns.

Individual detractors included Teleperformance and DSM-Firmenich. Teleperformance, a French customer service solutions business, reported soft earnings, which was compounded by a surprise acquisition and concerns over artificial intelligence-related disruption. DSM-Firmenich, a newly merged, Dutch listed, flavors and fragrances specialist, issued a profit warning during the reporting period as customers worked through existing inventories.

Our holdings outperformed within Communication Services, Energy and Materials, and our sector allocation that resulted from bottom-up decision-making was another advantage. By country, a zero weighting to companies domiciled in Australia, a non-Index allocation to the U.S., and an overweight to Ireland versus the Index had the largest relative positive impacts.

Key contributors included Novartis and SAP. Novartis, the Swiss pharmaceutical giant, reported strong results and reiterated guidance. Strong earnings at SAP, a German software firm, demonstrated the resiliency of its cloud business despite a tougher macroeconomic backdrop.

As longer-term investors, we remain committed to our proven investment discipline. As such, we hold steady through short-term market swings whether they benefit or hinder relative performance. The Fund in our view is well diversified, and within an economic backdrop that remains somewhat uncertain, is built around what we believe to be quality businesses with resilient earnings streams.

We continue to develop and test new ideas that we believe can benefit in a period of higher inflation, higher interest rates, and higher nominal growth driven by increased capital investment aimed at the underinvestment of the recent past.

In our view, the current key challenge is striking a balance between what we believe to be quality defensive holdings, secular growth opportunities, and companies with business models that benefit from higher inflation

and increased capital expenditure, while avoiding cyclical companies with excessive leverage. We believe the Fund remains well positioned for both the risks and opportunities we foresee ahead.

Sincerely,

Elias Cohen and Thomas Hogan

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund’s portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

International Equity Fund (Unaudited)

| | | |

| | Average Annual Total Return

Ended 08/31/2023 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

MSCI EAFE® Index (Net)1,2 | | | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class’s returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund’s most recent prospectus, the total annual operating expense ratios for fiscal year 2022 were 1.19%, 1.26%, 1.00%, 1.37%, 2.12%, 0.90% and 0.86% for Investor Class, Trust Class, Institutional Class, Class A, Class C, Class R6 and Class E shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.87%, 1.23%, 1.98%, 0.77% and 0.07% for Institutional Class, Class A, Class C, Class R6 and Class E shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2023, can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

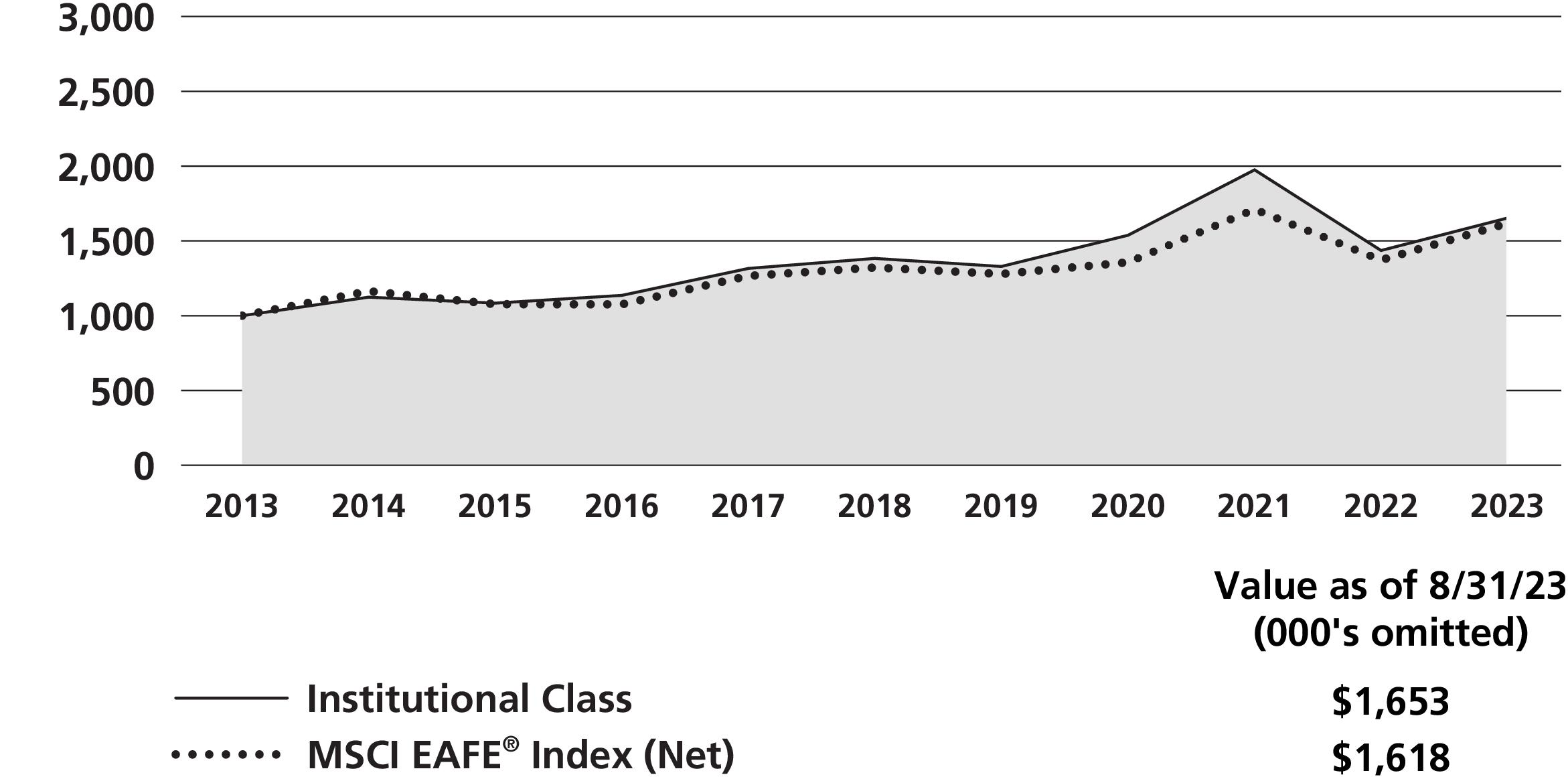

International Equity Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund’s inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

International Select Fund Commentary (Unaudited)

Neuberger Berman International Select Fund Trust Class generated a total return of 14.41% for the fiscal year ended August 31, 2023 (the reporting period), trailing its benchmark, the MSCI EAFE® Index (Net) (the Index), which posted a 17.92% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

As measured by the Index, developed international equities outperformed both the U.S. S&P 500® and MSCI Emerging Markets (Net) indices this reporting period. Investors favored value over growth stocks as rates rose sharply during the reporting period, and core inflation remained sticky, benefitting many "real economy" segments of the global markets that have been out of favor during the low rate era. As the reporting period progressed, evidence suggesting headline inflation was slowing faster than expected was welcomed by investors and corporate management teams hoping for relief from rising global interest rates.

On the cautionary side, a slowdown in China, with ripple effects from the meltdown of its real estate market and high unemployment among the nation’s young, loomed large within an interconnected global economy, adding to uncertainty. Toward the end of this reporting period, the Chinese government had begun aiming policy at resolving issues, but results remain unclear.

By country, Italy, Denmark and Ireland led the Index this reporting period, while Israel, Hong Kong and Norway declined most. From a sector perspective for the Index, Information Technology (IT), Industrials and Consumer Discretionary outperformed, advancing over 20%. Real Estate declined, and Communication Services and Consumer Staples lagged.

The Fund’s underperformance relative to the Index resulted from stock selection. Our longer-term Quality at a Reasonable Price discipline means that the Fund can lag somewhat within markets where investors are willing to overpay, in our view, for growth. Accordingly, our holdings within the three "hottest" sectors—Industrials, Financials, and Consumer Discretionary—lagged. Stock selection within Italy and France, and lack of exposure to Denmark also limited relative returns.

Individual detractors included Teleperformance and DSM-Firmenich. Teleperformance, a French customer service solutions business, reported soft earnings, which was compounded by a surprise acquisition and concerns over artificial intelligence-related disruption. DSM-Firmenich, a newly merged, Dutch listed, flavors and fragrances specialist, issued a profit warning during the reporting period as customers worked through existing inventories.

Our holdings outperformed within Communication Services, IT and Energy, and our sector allocation that resulted from bottom-up decision-making was another advantage. By country, a zero weighting to companies domiciled in Australia, a non-Index allocation to the U.S., and an overweight to Ireland versus the Index had the largest positive impacts.

Key contributors included Schlumberger and Novartis. Schlumberger, a U.S. listed global oil services specialist, reported strong results, exceeding analysts’ expectations. Novartis, the Swiss pharmaceutical giant, reported strong results and reiterated guidance.

As longer-term investors, we remain committed to our proven investment discipline. As such, we hold steady through short-term market swings whether they benefit or hinder relative performance. The Fund in our view is well diversified, and within an economic backdrop that remains somewhat uncertain, is built around what we believe to be quality businesses with resilient earnings streams.

We continue to develop and test new ideas that we believe can benefit in a period of higher inflation, higher interest rates, and higher nominal growth driven by increased capital investment aimed at the underinvestment of the recent past.

In our view, the current key challenge is striking a balance between what we believe to be quality defensive holdings, secular growth opportunities, and companies with business models that benefit from higher inflation

and increased capital expenditure, while avoiding cyclical companies with excessive leverage. We believe the Fund remains well positioned for both the risks and opportunities we foresee ahead.

Sincerely,

Elias Cohen and Thomas Hogan

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund’s portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

International Select Fund (Unaudited)

| | | |

| | Average Annual Total Return

Ended 08/31/2023 |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class’s returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund’s most recent prospectus, the total annual operating expense ratios for fiscal year 2022 were 1.42%, 1.00%, 1.37%, 2.15%, 1.64% and 0.91% for Trust Class, Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.20%, 0.85%, 1.20%, 1.95%, 1.46% and 0.74% for Trust Class, Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2023, can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

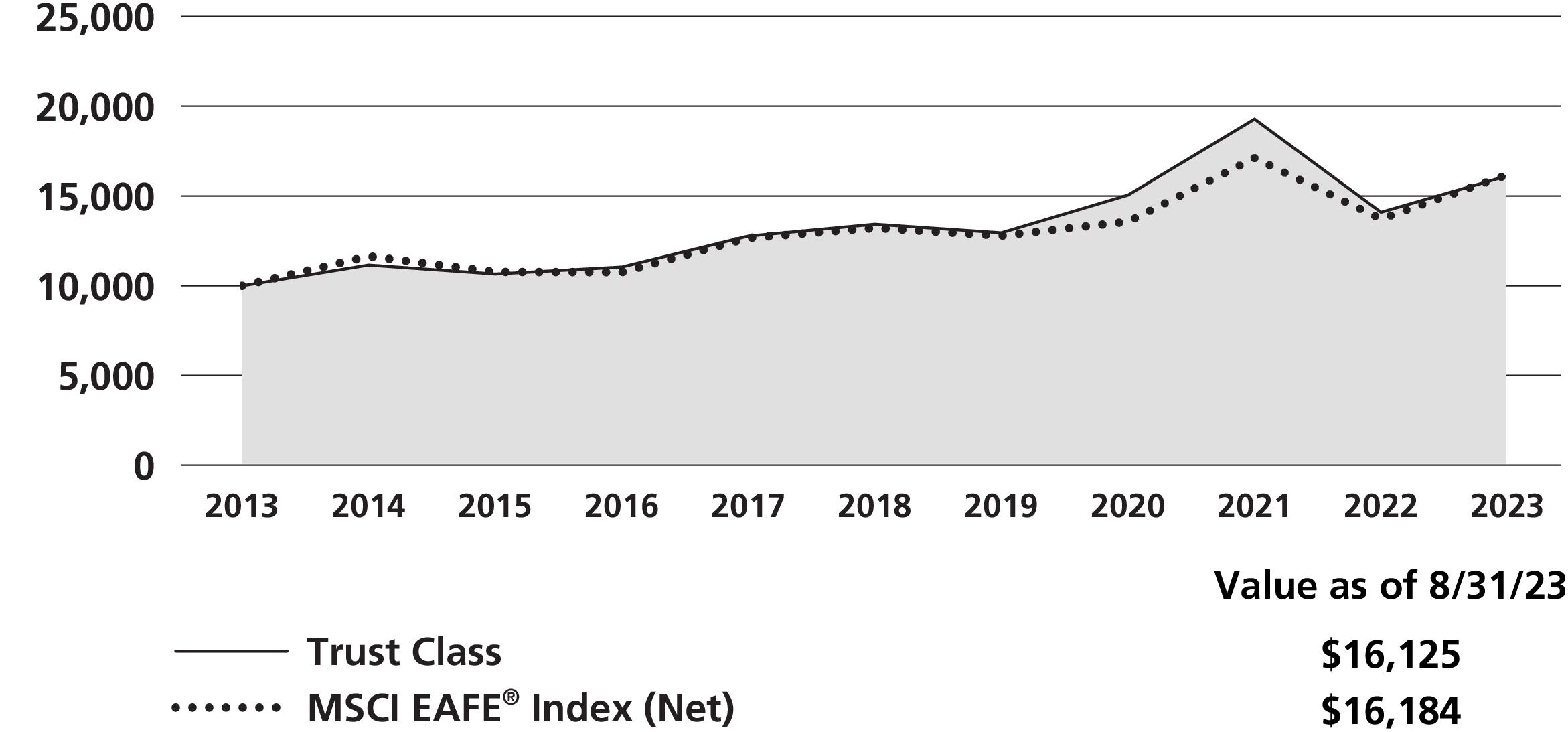

International Select Fund (Unaudited)

COMPARISON OF A $10,000 INVESTMENT