Washington, D.C. 20549

Joseph V. Amato

Arthur C. Delibert, Esq.

1601 K Street, N.W.

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”) (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget

(“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

Following is a copy of the annual report transmitted to shareholders pursuant to Rule 30e-1 under the Act.

Neuberger Berman

Equity Funds

Investor Class Shares

Trust Class Shares

Advisor Class Shares

Institutional Class Shares

Dividend Growth Fund

Emerging Markets Equity Fund

Equity Income Fund

Focus Fund

Genesis Fund

Global Real Estate Fund

Greater China Equity Fund

Guardian Fund

Integrated Large Cap Fund

International Equity Fund

Class A Shares

Class C Shares

Class R3 Shares

Class R6 Shares

International Select Fund

International Small Cap Fund

Intrinsic Value Fund

Large Cap Value Fund

Mid Cap Growth Fund

Mid Cap Intrinsic Value Fund

Multi-Cap Opportunities Fund

Real Estate Fund

Small Cap Growth Fund

Sustainable Equity Fund

Annual Report

August 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund's website www.nb.com/fundliterature, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800.877.9700 or by sending an e-mail request to fundinfo@nb.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 800.877.9700 or send an email request to fundinfo@nb.com to inform the Fund that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Contents

THE FUNDS

President's Letter | | | 1 | | |

PORTFOLIO COMMENTARY | |

Dividend Growth Fund | | | 2 | | |

Emerging Markets Equity Fund | | | 6 | | |

Equity Income Fund | | | 10 | | |

Focus Fund | | | 14 | | |

Genesis Fund | | | 17 | | |

Global Real Estate Fund | | | 20 | | |

Greater China Equity Fund | | | 24 | | |

Guardian Fund | | | 28 | | |

Integrated Large Cap Fund | | | 32 | | |

International Equity Fund | | | 36 | | |

International Select Fund | | | 40 | | |

International Small Cap Fund | | | 44 | | |

Intrinsic Value Fund | | | 48 | | |

Large Cap Value Fund | | | 52 | | |

Mid Cap Growth Fund | | | 55 | | |

Mid Cap Intrinsic Value Fund | | | 58 | | |

Multi-Cap Opportunities Fund | | | 61 | | |

Real Estate Fund | | | 64 | | |

Small Cap Growth Fund | | | 67 | | |

Sustainable Equity Fund | | | 70 | | |

FUND EXPENSE INFORMATION | | | 80 | | |

LEGEND | | | 84 | | |

SCHEDULE OF INVESTMENTS | |

Dividend Growth Fund | | | 85 | | |

Positions by Country | | | 86 | | |

Emerging Markets Equity Fund | | | 87 | | |

Positions by Industry | | | 90 | | |

Equity Income Fund | | | 93 | | |

Positions by Country | | | 96 | | |

Focus Fund | | | 100 | | |

Positions by Country | | | 101 | | |

Genesis Fund | | | 104 | | |

Global Real Estate Fund | | | 107 | | |

Positions by Sector | | | 108 | | |

Greater China Equity Fund | | | 109 | | |

Guardian Fund | | | 111 | | |

Integrated Large Cap Fund | | | 117 | | |

International Equity Fund | | | 119 | | |

Positions by Industry | | | 121 | | |

International Select Fund | | | 123 | | |

Positions by Industry | | | 125 | | |

International Small Cap Fund | | | 127 | | |

Positions by Industry | | | 129 | | |

Intrinsic Value Fund | | | 131 | | |

Large Cap Value Fund | | | 134 | | |

Positions by Country | | | 136 | | |

Mid Cap Growth Fund | | | 137 | | |

Mid Cap Intrinsic Value Fund | | | 140 | | |

Multi-Cap Opportunities Fund | | | 142 | | |

Real Estate Fund | | | 144 | | |

Small Cap Growth Fund | | | 146 | | |

Sustainable Equity Fund | | | 149 | | |

Positions by Country | | | 150 | | |

FINANCIAL STATEMENTS | | | 153 | | |

FINANCIAL HIGHLIGHTS (ALL CLASSES)/PER SHARE DATA | |

Dividend Growth Fund | | | 213 | | |

Emerging Markets Equity Fund | | | 215 | | |

Equity Income Fund | | | 217 | | |

Focus Fund | | | 217 | | |

Genesis Fund | | | 221 | | |

Global Real Estate Fund | | | 223 | | |

Greater China Equity Fund | | | 223 | | |

Guardian Fund | | | 225 | | |

Integrated Large Cap Fund | | | 227 | | |

International Equity Fund | | | 229 | | |

International Select Fund | | | 231 | | |

International Small Cap Fund | | | 233 | | |

Intrinsic Value Fund | | | 235 | | |

Large Cap Value Fund | | | 237 | | |

Mid Cap Growth Fund | | | 241 | | |

Mid Cap Intrinsic Value Fund | | | 243 | | |

Multi-Cap Opportunities Fund | | | 247 | | |

Real Estate Fund | | | 247 | | |

Small Cap Growth Fund | | | 249 | | |

Sustainable Equity Fund | | | 253 | | |

Reports of Independent Registered Public Accounting Firms | | | 262 |

| |

Directory | | | 266 | | |

Trustees and Officers | | | 267 |

| |

Proxy Voting Policies and Procedures | | | 278 | | |

Quarterly Portfolio Schedule | | | 278 | | |

Liquidity Risk Management Program | | | 278 | | |

Notice to Shareholders | | | 279 | | |

The "Neuberger Berman" name and logo and "Neuberger Berman Investment Advisers LLC" name are registered service marks of Neuberger Berman Group LLC. The individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Investment Advisers LLC, an affiliate of Neuberger Berman BD LLC, distributor, member FINRA. ©2020 Neuberger Berman BD LLC, distributor. All rights reserved.

Dear Shareholder,

Global equity markets advanced this period, even after existing concerns about global growth rates, equity valuations and trade tensions were compounded by the economic dislocations—not to mention human toll—of the COVID-19 pandemic.

The World Bank estimates global GDP will decline by 5.2% in 2020, marking the worst recession since World War II. In the U.S., real GDP (gross domestic product, adjusted for inflation) declined 5% in first quarter, 31.7% in second, and by the Conference Board's estimates, which anticipate a significant improvement in third quarter, will close the year down 3.8%.

While that is an improvement over the first half, the Conference Board also reports consumer optimism about jobs, income and business conditions has declined from its June peak this year. Unemployment, at 3.6% in January, was at 8.4%—7.3% for white Americans and 13% for black Americans—as this period closed; high, but an improvement over earlier substantial job losses. Women, who were 47% of the workforce, have fared worse than men, comprising 54% of the unemployed.

Given numerous unknowns, economists' views about the length and curve shape of the economic recovery vary—from a bullish but unlikely V, to a U, L, or W, or even a K, where parts of the economy recover and others don't.

Since the sharp market correction in March, several key factors have supported investor sentiment (and thus equity prices) beyond the hope for a COVID-19 treatment or vaccine. Among the most important has been central bank policy.

Since March, the U.S. Federal Reserve Board (Fed) has provided an unprecedented level of support to fixed income markets, buying billions of dollars' worth of securities, lending directly to corporations, and reducing banking regulations; as well as committing to maintaining low interest rates. This has lessened existential worries for corporations and their shareholders. The European Central Bank has been similarly accommodative, and the European Union's grant and loan program is focused on supporting weaker states.

High frequency economic data, such as Purchasing Managers' Indexes, non-farm payrolls, and retail sales has also improved—but as stated above, much remains unknown.

As we look forward, we believe bottom-up stock picking skill and conscientious portfolio construction will remain paramount given the likelihood of ongoing volatility, heightened U.S. election rhetoric, any resurgence in COVID-19 infections, and any potential inflationary effects from the Fed's stimulus and supports. Pricing is also a concern in some sectors, where speculation has driven price-to-earnings ratios higher, so a focus on fundamental valuations remains key.

As always, our managers are both prudent and proactive, and focused on fundamental research, as they work to separate short-term speculation and dislocation from longer-term opportunities, using volatility to their advantage whenever possible.

Neuberger Berman continues to monitor the ongoing developments related to COVID-19 with a particular focus on two areas: the safety and health of its employees and clients, and the ability to continue to conduct effectively its investment and business operations, including all critical services. Neuberger Berman has a dedicated Business Continuity Management team staffed with full-time professionals, who partner with over 60 Business Continuity Coordinators covering all business functions across all geographies. Neuberger Berman currently has not experienced a significant impact on its operating model. Neuberger Berman will continue to watch the effectiveness of efforts to contain the spread of the COVID-19 virus and the potential long-term implications on global economies and will continue to monitor and adapt as necessary the firm's operations and processes to most effectively manage portfolios.

We appreciate your confidence in Neuberger Berman.

Sincerely,

JOSEPH V. AMATO

PRESIDENT AND CEO

NEUBERGER BERMAN EQUITY FUNDS

1

Dividend Growth Fund Commentary (Unaudited)

Neuberger Berman Dividend Growth Fund Institutional Class generated a 16.91% total return for the fiscal year ended August 31, 2020 (the reporting period), underperforming its benchmark, the S&P 500® Index (the Index), which posted a 21.94% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

It's worth highlighting that by far the largest part of the performance in the Index over the reporting period came in stocks not suitable for the Fund because they have limited, and in many cases, no dividend programs. Specifically, over the same timeframe the Russell 1000® Growth Index returned 4,350 bps more than the Russell 1000® Value Index.

The Fund seeks to provide gross current income in-line with the Index, while seeking capital appreciation driven by dividend per share growth. This approach seeks to identify companies with strong business models generating cash to grow their businesses while providing rising dividend distributions to shareholders. Overall, we focus on companies that we believe have strong balance sheets, solid management teams, attractive free cash flow yields, and clear capital allocation strategies.

By mid-February 2020, the expansion cycle officially became the longest in US history. Shortly thereafter, equities tumbled as mounting concerns from the impact of COVID-19 weighed on the global economy. However, by late August the Index had rallied over 50% from its March lows, driven in part by monetary and fiscal stimulus, a fifth COVID-19 relief bill, and vaccine optimism working in concert. On the macro front, investors looked past the worst economic downturn since the Great Depression, as the rally stood in contrast with high unemployment. Elsewhere, the U.S. Federal Reserve Board struck a dovish tone, keeping the door open for accommodative measures, while the dollar touched a two-year low, and the 10-year U.S. Treasury yield settled near 0.70%.

From a portfolio construction standpoint, top equity sector weights included 28% Information Technology (IT), 15% Health Care, and 14% Financials at the end of the reporting period. Overall, the bulk of returns were generated from stocks across IT, Materials, and Health Care—while exposure to Industrials, Communication Services, and Energy weighed on results.

Overall, Apple proved to be our biggest winner, as growth was underpinned by robust sales across several segments. When evaluating future growth prospects, we believe this IT name remains well positioned to benefit from new 5G smartphones that will likely be rolled out to consumers in the near future. Moreover, we believe management has the wherewithal to potentially increase its dividend policy as the tech giant currently has ~$100bn in cash on its balance sheet, making this an ideal holding given our mandate.

In contrast, stock selection across Communication Services weighed on results as the media giant ViacomCBS was among our losers. Recently, the iconic media company faced investor scrutiny amid increased competition in the era of streaming services. Given disappointing results, this holding was sold in April 2020.

In closing, the global capital markets are facing significant headwinds: a weak economy, political turmoil and novel central bank policies. Despite the challenging environment, we are encouraged by the potential for economic reopening—albeit at a measured pace—and remain optimistic as the medical community races towards a potential COVID-19 vaccine. The longer-term impact of central bank policies remain uncertain, and we feel dividend-paying stocks provide an attractive inflationary hedge relative to bonds.

We thank you for investing in our Fund.

Sincerely,

2

DAVID A. KIEFER AND WILLIAM D. HUNTER

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

3

Dividend Growth Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NDGIX | |

Class A | | NDGAX | |

Class C | | NDGCX | |

Class R6 | | NRDGX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Communication Services | | | 2.2 | % | |

Consumer Discretionary | | | 6.9 | | |

Consumer Staples | | | 6.2 | | |

Energy | | | 4.3 | | |

Financials | | | 14.0 | | |

Health Care | | | 15.1 | | |

Industrials | | | 6.2 | | |

Information Technology | | | 27.9 | | |

Materials | | | 6.2 | | |

Real Estate | | | 5.5 | | |

Utilities | | | 4.9 | | |

Short-Term Investments | | | 0.6 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS

| | | | | Average Annual Total Return

Ended 08/31/2020 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 12/15/2015 | | | 16.91 | % | | | 11.32 | % | |

Class A | | 12/15/2015 | | | 16.41 | % | | | 10.92 | % | |

Class C | | 12/15/2015 | | | 15.63 | % | | | 10.08 | % | |

Class R6 | | 12/15/2015 | | | 16.98 | % | | | 11.40 | % | |

With Sales Charge | |

Class A | | | | | 9.73 | % | | | 9.54 | % | |

Class C | | | | | 14.63 | % | | | 10.08 | % | |

Index | |

| S&P 500® Index1,15 | | | | | 21.94 | % | | | 14.63 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2019 were 1.21%, 1.65%, 2.32% and 1.16% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any, and after restatement for Class R6 shares). The expense ratios were 0.70%, 1.06%, 1.81% and 0.60% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers and/or restatement. The expense ratios for the annual period ended August 31, 2020 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

4

Dividend Growth Fund (Unaudited)

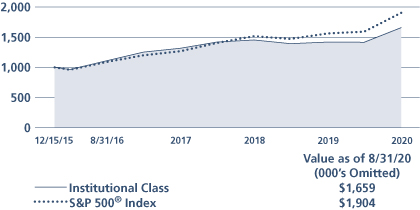

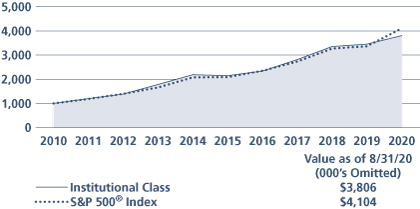

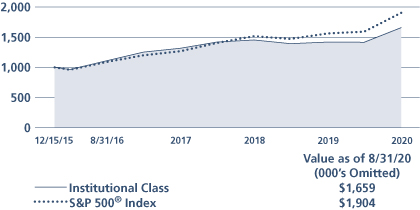

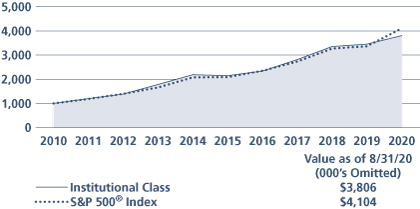

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

5

Emerging Markets Equity Fund Commentary (Unaudited)

Neuberger Berman Emerging Markets Equity Fund Institutional Class generated a total return of 10.59% for the fiscal year ended August 31, 2020 (the reporting period), trailing its benchmark, the MSCI Emerging Markets (EM) Index (Net) (the Index), which reported a total return of 14.49% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

EM equities recovered well from the strain of 2019's U.S./China trade tensions to end the calendar year strongly—with additional underpinning from monetary easing and a weak dollar. As 2020 began, however, COVID-19 began to dominate sentiment. With the outbreak initially centered in China, EM equities were particularly hard hit. As this reporting period progressed, however, optimism improved. Investors cheered re-opening plans in several major markets, and China evolved to the point of small, contained outbreaks. Aggressive central bank support in many markets, plus an uptick in manufacturing survey data and other high frequency economic indicators, also spurred investor enthusiasm, boosting equity markets globally.

Health Care, Consumer Discretionary (driven by internet-related names) and Information Technology (IT) stocks outperformed this reporting period, and on an individual market basis, Taiwan, China and Korea led the Index. By contrast, Utilities, Financials and Energy declined most during the reporting period. The countries within the Index with largest losses were Latin American commodity-linked markets of Colombia, Chile and Brazil.

Sector allocation benefited the Fund's relative performance this reporting period, primarily our overweight to IT versus the Index. Stock selection detracted, particularly within Consumer Discretionary, where our underweight to rallying Chinese internet retail names was a headwind, and in Health Care. Our Materials and Energy holdings outperformed.

By country, stock selection within Taiwan and Russia benefited returns, but stock selection and an underweight in China versus the Index, and stock selection in Mexico detracted.

Top contributors included Tencent, Taiwan Semiconductor and Alibaba. Tencent, the Chinese social media and gaming leader, beat earnings expectations as users remained loyal to the gaming and social-media platform during the COVID-19 economic downturn. Taiwan Semiconductor, the Taiwanese contract semiconductor manufacturer, saw investors grow more optimistic about its growth prospects as it continued to execute well, while competitors have struggled. Alibaba, the Chinese e-commerce giant, beat expectations driven by solid growth across all business units and good cost control. Despite U.S./China trade tensions, the fundamental drivers of the e-commerce business in China remain strong.

Detractors included Medy-Tox, PT Bank Mandiri and Energisa. Medy-Tox, the Korean Botox maker, disappointed investors with poor execution across a number of issues. We lost conviction in the name, and it was sold along with Indonesia's PT Bank Mandiri, where investors grew concerned with the impact of COVID-19 on the country. Energisa, the Brazilian electric power distributor, struggled to rebound since March's COVID-19 related market selloff due to growth concerns.

With U.S./China political tensions likely to remain in the headlines for the next few months, and the COVID-19 pandemic ongoing, we anticipate volatility, and shifts in direction driven by changes in sentiment ahead.

While we are cautiously optimistic given the fact that global economic indicators are improving, we also know that certain EM segments have rallied on hopes for specific policy changes. Rather than being distracted by names which may be driven by short-term speculation, we remain focused on identifying what we believe are sustainable quality businesses, and taking advantage of what we think are temporary price dislocations to add to our high conviction names, and to trade up in quality in specific geographies and sub-sectors.

6

Sincerely,

CONRAD SALDANHA

PORTFOLIO MANAGER

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

7

Emerging Markets Equity Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NEMIX | |

Class A | | NEMAX | |

Class C | | NEMCX | |

Class R3 | | NEMRX | |

Class R6 | | NREMX | |

PERFORMANCE HIGHLIGHTS

| | | | Average Annual Total Return

Ended 08/31/2020 | |

| | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

Institutional Class | | 10/08/2008 | | | 10.59 | % | | | 8.90 | % | | | 3.68 | % | | | 7.88 | % | |

Class A | | 10/08/2008 | | | 10.28 | % | | | 8.62 | % | | | 3.41 | % | | | 7.61 | % | |

Class C | | 10/08/2008 | | | 9.47 | % | | | 7.81 | % | | | 2.65 | % | | | 6.81 | % | |

| Class R310 | | 06/21/2010 | | | 9.85 | % | | | 8.18 | % | | | 2.99 | % | | | 7.26 | % | |

| Class R621 | | 03/15/2013 | | | 10.72 | % | | | 8.98 | % | | | 3.75 | % | | | 7.93 | % | |

With Sales Charge | |

Class A | | | | | 3.93 | % | | | 7.33 | % | | | 2.80 | % | | | 7.08 | % | |

Class C | | | | | 8.47 | % | | | 7.81 | % | | | 2.65 | % | | | 6.81 | % | |

Index | |

MSCI Emerging Markets

Index (Net)1,15 | | | | | | | 14.49 | % | | | 8.66 | % | | | 3.76 | % | | | 6.94 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2019 were 1.27%, 1.63%, 2.36%, 1.95% and 1.17% for Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any, and after restatement for Class R6 shares). The expense ratios were 1.52%, 2.27% and 1.93% for Class A, Class C and Class R3 shares, respectively, after expense reimbursements and/or fee waivers. The total annual operating expense ratio for each of Institutional Class and Class R6 includes each class's repayment of expenses previously reimbursed and/or fees previously waived by Management. The expense ratios for the annual period ended August 31, 2020 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

8

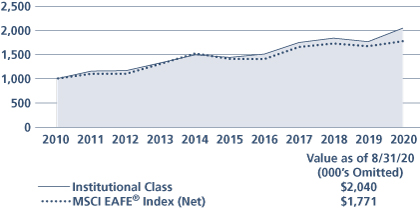

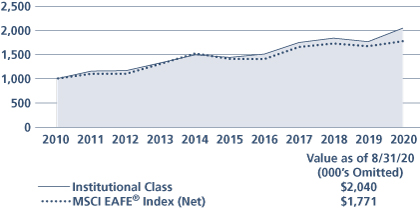

Emerging Markets Equity Fund (Unaudited)

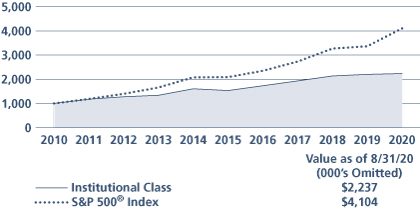

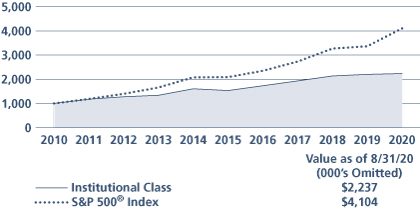

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

9

Equity Income Fund Commentary (Unaudited)

Neuberger Berman Equity Income Fund Institutional Class generated a 1.53% total return for the fiscal year ended August 31, 2020 (the reporting period), underperforming its benchmark, the S&P 500® Index (the Index), which posted a 21.94% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

It's worth highlighting that by far the largest part of the performance in the Index over the reporting period came in stocks not suitable for the Fund because they have limited, and in many cases, no dividend programs. Specifically, over the same timeframe the Russell 1000® Growth Index returned 4,350 bps more than the Russell 1000® Value Index .

The Fund seeks total returns between stocks and bonds with lower volatility relative to the Index. The Fund is diversified among dividend-paying stocks and convertible securities, selected through extensive analysis of cash flow prospects, with the ability to sustain and grow dividends.

By mid-February 2020, the expansion cycle officially became the longest in U.S. history. Shortly thereafter equities tumbled as mounting concerns from the impact of COVID-19 weighed on the global economy. However, by late August the Index had rallied over 50% from its March-lows, driven in part by monetary and fiscal stimulus, a fifth COVID-19 relief bill, and vaccine optimism working in concert. On the macro front, investors looked past the worst economic downturn since the Great Depression, as the rally stood in contrast with high unemployment. Elsewhere, the U.S. Federal Reserve Board struck a dovish tone, keeping the door open for accommodative measures, while the dollar touched a two-year low, and the 10-year U.S. Treasury yield settled near 0.70%.

From a portfolio construction standpoint, top equity sector holdings included approximately 13% Real Estate, 12% Information Technology (IT), and 11% Utilities at the end of the reporting period. The Fund also had a roughly 11% allocation to convertible securities, which we believe provides a differentiated approach to an equity income portfolio. Additionally, the Fund's ability to own securities issued under Rule 144A, where retail investors often have limited exposure, allows broad exposure to the asset class.

Overall, this reporting period, the bulk of total returns were generated from our allocation across IT, Health Care, and Industrials—while exposure to Utilities, Financials, and Energy stocks weighed on results.

Exposure to Industrials was additive to results as our holdings outperformed the Index in this sector. Watsco proved to be our top overall performer as the distributor of air conditioning, heating and refrigeration equipment posted impressive results. During the reporting period, Watsco generated its highest level of cash flow in the company's history as the HVAC giant reported better than expected earnings and revenues, beating analyst estimates. Based on our analysis, we believe Watsco remains positioned to capitalize on home improvement trends as record-low mortgage rates have been a tailwind for housing market activity.

On the other end of the spectrum, stock selection within Financials was a headwind to relative returns, as Blackstone Mortgage Trust was among our biggest losers. After revisiting our assumptions, this position was sold during the reporting period with the proceeds allocated elsewhere. Within this space, we believe recent dislocations have created potential opportunities as our approach remains focused on balance sheet strength. Given this backdrop, the health of the financial system remains vital, and we believe valuations appear compelling for long-term investors.

Elsewhere, exposure to convertible securities was accretive to total returns over the reporting period, and dampened volatility. In retrospect, the prior year was a banner one for new deal flow as the Fund capitalized on an uptick of quality issuance. Historically, this sleeve has been among the most conservative aspects of the Fund as we favor convertibles trading at a discount to par value with attractive yields and reasonable conversion premiums.

The Fund's use of written options detracted from performance during the period.

10

In closing, the global capital markets are facing significant headwinds: a weak economy, political turmoil and novel central bank policies. Despite the challenging environment, we are encouraged by the potential for economic reopening—albeit at a measured pace—and remain optimistic as the medical community races towards a potential COVID-19 vaccine. The longer-term impact of central banks policies remains uncertain, and we feel dividend-paying stocks provide an attractive inflationary hedge relative to bonds.

We thank you for investing in our Fund.

Sincerely,

RICHARD LEVINE AND SANDY POMEROY

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

11

Equity Income Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NBHIX | |

Class A | | NBHAX | |

Class C | | NBHCX | |

Class R3 | | NBHRX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Communication Services | | | 3.9 | % | |

Consumer Discretionary | | | 5.8 | | |

Consumer Staples | | | 4.3 | | |

Energy | | | 3.3 | | |

Financials | | | 10.6 | | |

Health Care | | | 10.6 | | |

Industrials | | | 10.5 | | |

Information Technology | | | 11.9 | | |

Materials | | | 4.2 | | |

Real Estate | | | 13.3 | | |

Utilities | | | 10.6 | | |

Convertible Bonds | | | 10.5 | | |

Short-Term Investments | | | 0.5 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS

| | | | Average Annual Total Return

Ended 08/31/2020 | |

| | Inception

Date* | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

| Institutional Class13 | | 06/09/2008 | | | 1.53 | % | | | 7.85 | % | | | 8.38 | % | | | 7.11 | % | |

| Class A13 | | 06/09/2008 | | | 1.14 | % | | | 7.46 | % | | | 7.98 | % | | | 6.75 | % | |

| Class C13 | | 06/09/2008 | | | 0.38 | % | | | 6.65 | % | | | 7.18 | % | | | 6.06 | % | |

| Class R313 | | 06/21/2010 | | | 0.82 | % | | | 7.15 | % | | | 7.67 | % | | | 6.59 | % | |

With Sales Charge | |

| Class A13 | | | | | –4.69 | % | | | 6.20 | % | | | 7.34 | % | | | 6.29 | % | |

| Class C13 | | | | | –0.57 | % | | | 6.65 | % | | | 7.18 | % | | | 6.06 | % | |

Index | |

| S&P 500® Index1,15 | | | | | 21.94 | % | | | 14.46 | % | | | 15.16 | % | | | 9.30 | % | |

*The performance data for each class includes the performance of the Fund's oldest share class, Trust Class, from November 2, 2006 through June 9, 2008. The performance data for Class R3 also includes the performance of the Fund's Institutional Class from June 9, 2008 through June 21, 2010. See endnote 13 for information about the effects of the different fees paid by each class.

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2019 were 0.70%, 1.06%, 1.81% and 1.35% for Institutional Class, Class A, Class C and Class R3 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios for the annual period ended August 31, 2020 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

12

Equity Income Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

13

Focus Fund Commentary (Unaudited)

Neuberger Berman Focus Fund Investor Class generated a 26.17% total return for the fiscal year ended August 31, 2020 (the reporting period), outperforming the 16.52% total return of its benchmark, the MSCI All Country World Index (Net) (the Index) for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

On April 15, 2020, the Fund changed its principal investment strategy. Effective that date, it began comparing its performance to the Index, rather than the S&P 500® Index, to correspond with the Fund's revised principal investment strategy. From the close of April 15, 2020 (the effective date of the changes) through the end of the reporting period, the Fund's Investor Class returned 31.81%, outperforming the Index, which returned 26.00% for the same period. For the entire reporting period, the Fund's Investor Class returned 26.17%, outperforming the prior benchmark, which returned 21.94% for the same period.

The overall equity market, as measured by the Index, experienced periods of heightened volatility, but ultimately generated a strong return over the reporting period. After a positive start, beginning in mid-February 2020 the repercussions from the COVID-19 pandemic triggered a rapid and severe downturn, with the market posting its fastest fall on record from an all-time high to a bear market. However, the market then had an equally dramatic rally over the last five months of the reporting period. This turnaround was triggered by several factors, including unprecedented monetary policy accommodation by the U.S. Federal Reserve Board, a $2 trillion fiscal stimulus package, phased economic re-openings, and hopes for a COVID-19 vaccine. All told, the Index gained 16.52% over the period.

Both stock selection and sector allocation contributed to relative performance during the reporting period. In terms of stock selection, holdings in the Financials, Communication Services and Industrials sectors added the most value. Looking at individual stocks, e-commerce giant Amazon.com, Inc., Information Technology (IT) leader Microsoft Corp., and semiconductor company ASML Holding were the most beneficial for returns. From a sector allocation perspective, an overweight to IT and an underweight to Energy versus the Index were the largest contributors to relative results.

While the Fund's positioning in IT was positive overall, certain holdings within the sector were headwinds for relative results. Stock selection in the Energy sector was also negative for relative returns. Looking at individual stocks, aerospace and defense company Safran SA, IT service management firm WEX, Inc., and Indian multinational banking and financial services company ICICI Ltd. were the largest detractors from results. All three positions were sold during the reporting period. In terms of sector allocation, underweights to Health Care and Communication Services versus the Index were the largest negatives for performance.

Although we do not plan for long-term interest rates to remain low, we believe this environment is supportive of resilient businesses with attractive cash flow growth characteristics. We remain steadfast in our focus on owning what we believe to be quality businesses as our fundamental, data-science and Environmental, Social and Governance (ESG) process has been honed over time to be sensitive to inflections and resilience in the earnings-power of such companies.

Sincerely,

TIMOTHY CREEDON AND HARI RAMANAN

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

14

TICKER SYMBOLS

Investor Class | | NBSSX | |

Trust Class | | NBFCX | |

Advisor Class | | NBFAX | |

Institutional Class | | NFALX | |

Class A | | NFAAX | |

Class C | | NFACX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Communication Services | | | 2.5 | % | |

Consumer Discretionary | | | 21.2 | | |

Consumer Staples | | | 10.0 | | |

Financials | | | 2.2 | | |

Health Care | | | 3.0 | | |

Industrials | | | 9.9 | | |

Information Technology | | | 41.7 | | |

Materials | | | 5.1 | | |

Real Estate | | | 3.7 | | |

Short-Term Investments | | | 0.7 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS8

| | | | Average Annual Total Return

Ended 08/31/2020 | |

| | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

Investor Class | | 10/19/1955 | | | 26.17 | % | | | 11.66 | % | | | 13.80 | % | | | 10.54 | % | |

| Trust Class3 | | 08/30/1993 | | | 25.90 | % | | | 11.46 | % | | | 13.58 | % | | | 10.52 | % | |

| Advisor Class4 | | 09/03/1996 | | | 25.70 | % | | | 11.28 | % | | | 13.40 | % | | | 10.45 | % | |

| Institutional Class5 | | 06/21/2010 | | | 26.32 | % | | | 11.84 | % | | | 14.00 | % | | | 10.57 | % | |

| Class A19 | | 06/21/2010 | | | 25.90 | % | | | 11.45 | % | | | 13.59 | % | | | 10.51 | % | |

| Class C19 | | 06/21/2010 | | | 24.96 | % | | | 10.62 | % | | | 12.75 | % | | | 10.38 | % | |

With Sales Charge | |

| Class A19 | | | | | 18.65 | % | | | 10.14 | % | | | 12.91 | % | | | 10.41 | % | |

| Class C19 | | | | | 23.96 | % | | | 10.62 | % | | | 12.75 | % | | | 10.38 | % | |

Index | |

| MSCI All Country World Index (Net)1,15 * | |

| | | 16.52 | % | | | 10.21 | % | | | 9.90 | % | | | N/A | | |

| S&P 500® Index1,15 | | | | | 21.94 | % | | | 14.46 | % | | | 15.16 | % | | | 10.37 | % | |

*On April 15, 2020, the Fund changed its principal investment strategy. Effective that date, it began comparing its performance to the MSCI All Country World Index (Net) rather than the S&P 500® Index to correspond with the Fund's revised principal investment strategy.

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2019 were 0.92%, 1.10%, 1.27%, 0.76%, 1.12%, and 1.88% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.76%, 1.12% and 1.87% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2020 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

15

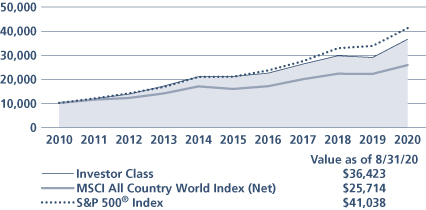

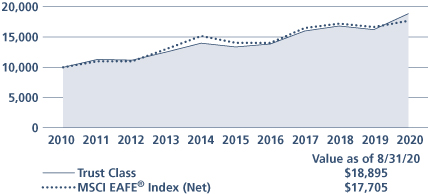

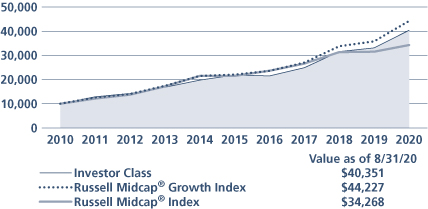

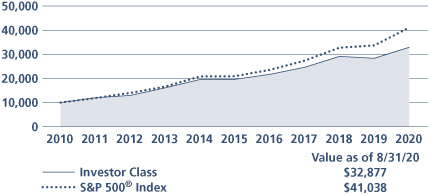

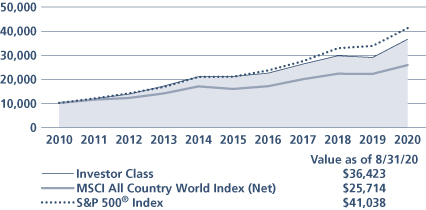

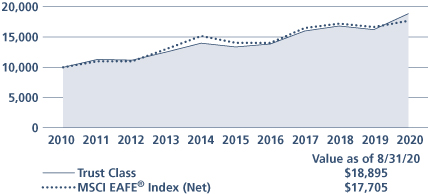

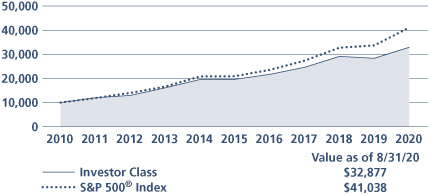

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

16

Genesis Fund Commentary (Unaudited)

Neuberger Berman Genesis Fund Investor Class generated a 13.48% total return for the fiscal year ended August 31, 2020 (the reporting period), outperforming the 6.02% total return of its benchmark, the Russell 2000® Index (the Index), for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The overall equity market experienced periods of heightened volatility, but ultimately generated a strong return over the reporting period. After a positive start, beginning in mid-February 2020 the repercussions from the COVID-19 pandemic triggered a rapid and severe downturn, with the market posting its fastest fall on record from an all-time high to a bear market. However, the market then had an equally dramatic rally over the last five months of the reporting period. This turnaround was triggered by several factors, including unprecedented monetary policy accommodation by the U.S. Federal Reserve Board, a $2 trillion fiscal stimulus package, phased economic re-openings, and hopes for a COVID-19 vaccine. All told, the S&P 500® Index gained 21.94% during the reporting period. Small-cap stocks posted less robust results, as the Index returned 6.02%.

The Fund outperformed the Index during the reporting period. As we have seen in the past, the Fund tends to outperform in periods of slower economic growth, or in periods characterized by investor fear and uncertainty. During those times, our high quality bias has provided a strong tailwind to the Fund's relative results. This can be largely attributed to investors' preference for less speculative/less cyclical companies with stronger balance sheets. However, the Fund tends to underperform in significant up markets, where lower quality non-earners, less profitable, and highly cyclical companies have tended to outperform. For the full year, the Fund's outperformance was due to a combination of strong stock selection and sector allocation. Stock selection was particularly strong in the Financials, Consumer Discretionary and Communication Services sectors. In the Financials sector, our Banks and Capital Markets positions were positive for relative returns. Within Consumer Discretionary, our pool supplier holding added the most value. In the Communication Services sector, our Media holdings were the largest contributors to results. Conversely, holdings in the Health Care, Consumer Staples and Materials sectors were the largest detractors from excess returns. Within Health Care, Health Care Provider & Services names negatively impacted results. Within the Consumer Staples sector, our Food and Household Product names were a headwind for performance. Within Materials, our Containers & Packaging positions negatively impacted results.

Sector allocation was also a large contributor to performance, largely driven by an overweight to the Information Technology sector and not holding positions in either mortgage or equity real estate investment trusts. On the downside, a significant underweight to traditional Biotechnology companies was a meaningful drag on relative performance.

While recent economic data has improved, the duration and severity of the economic impact COVID-19 will have on the global economy remain key unknowns regarding the timing and scale of the recovery. Despite this uncertainty, fiscal and monetary support has been meaningful, and likely to remain in place during these uncertain times. This has helped fuel the market's rally from its March low, although it has more recently started to correct. Some type of bipartisan cooperation will likely be necessary, along with improved treatment and progress on a COVID-19 vaccine, to support economic conditions and market sentiment going forward. We remain steadfast that a diversified portfolio of financially strong companies, with durable and highly differentiated business models, will weather the storm.

Sincerely,

JUDITH M. VALE, ROBERT W. D'ALELIO, BRETT S. REINER AND GREGORY G. SPIEGEL

PORTFOLIO CO-MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

17

TICKER SYMBOLS

Investor Class | | NBGNX | |

Trust Class | | NBGEX | |

Advisor Class | | NBGAX | |

Institutional Class | | NBGIX | |

Class R6 | | NRGSX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Communication Services | | | 3.4 | % | |

Consumer Discretionary | | | 12.9 | | |

Consumer Staples | | | 4.5 | | |

Energy | | | 0.2 | | |

Financials | | | 13.4 | | |

Health Care | | | 17.0 | | |

Industrials | | | 16.5 | | |

Information Technology | | | 26.2 | | |

Materials | | | 3.8 | | |

Real Estate | | | 1.3 | | |

Short-Term Investments | | | 0.8 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS

| | | | Average Annual Total Return

Ended 08/31/2020 | |

| | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

Investor Class | | 09/27/1988 | | | 13.48 | % | | | 12.16 | % | | | 13.34 | % | | | 12.19 | % | |

| Trust Class3 | | 08/26/1993 | | | 13.38 | % | | | 12.07 | % | | | 13.25 | % | | | 12.16 | % | |

| Advisor Class4 | | 04/02/1997 | | | 13.10 | % | | | 11.78 | % | | | 12.94 | % | | | 11.94 | % | |

| Institutional Class5 | | 07/01/1999 | | | 13.65 | % | | | 12.35 | % | | | 13.53 | % | | | 12.34 | % | |

| Class R622 | | 03/15/2013 | | | 13.74 | % | | | 12.44 | % | | | 13.55 | % | | | 12.26 | % | |

Index | |

| Russell 2000® Index1,15 | | | | | 6.02 | % | | | 7.65 | % | | | 11.53 | % | | | 9.24 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2019 were 1.02%, 1.10%, 1.35%, 0.85% and 0.75% for Investor Class, Trust Class, Advisor Class, Institutional Class and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any, and after restatement for Class R6 shares). The expense ratios for the annual period ended August 31, 2020 can be found in the Financial Highlights section of this report.

18

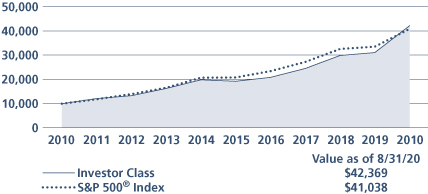

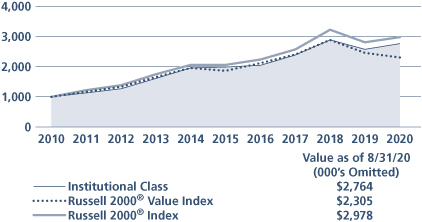

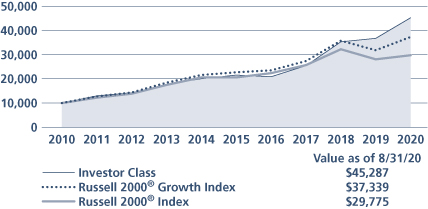

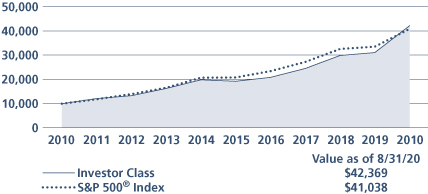

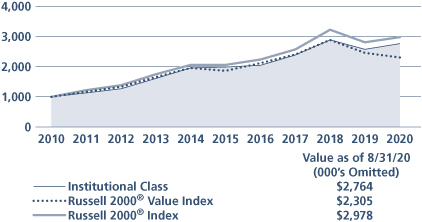

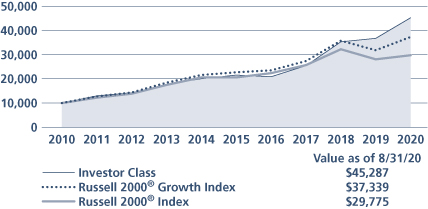

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

19

Global Real Estate Fund Commentary (Unaudited)

Neuberger Berman Global Real Estate Fund Institutional Class generated a –3.48% total return for the fiscal year ended August 31, 2020 (the reporting period), outperforming the –13.68% total return of its benchmark, the FTSE EPRA/Nareit Developed Index (Net) (the Index), for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Global equity markets experienced periods of heighted volatility, but ultimately generated a positive return over the reporting period. After a positive start, beginning in mid-February 2020 the repercussions from the COVID-19 pandemic triggered a rapid and severe downturn. However, the market then had an equally dramatic rally over the last five months of the reporting period. This turnaround was triggered by several factors, including aggressive global monetary policy accommodation, phased economic re-openings, and hopes for a COVID-19 vaccine. All told, the MSCI All Country World Index (Net) returned 16.52% for the reporting period. Comparatively, global real estate investment trusts (REITs) generated significantly weaker results.

The Fund meaningfully outperformed the Index during the reporting period. Stock selection, overall, was the largest contributor to the Fund's relative results. In particular, holdings in the Specialty REITs, Industrial & Office REITs and Residential REITs sectors were the most additive for returns. In terms of individual holdings, Equinix, Inc., Segro plc., Prologis, Inc., Goodman Group and Mitsui Fudosan Logistics Park, Inc. were the largest contributors to performance. The sectors that detracted from results from a stock selection perspective were Real Estate Holding & Development, Diversified REITs and Retail REITs. Several individual holdings were also negative for results, including Equity Residential, National Retail Properties, Inc., Dexus, Mitsui Fudosan Co., Ltd. and CK Asset Holdings Limited. Dexus and CK Asset Holdings Limited were both sold during the reporting period.

The Fund's positioning from a country perspective also contributed to relative results. In particular versus the Index, overweights to the UK and Belgium, along with an underweight to the U.S., were the most additive for results. On the downside, underweights in Germany, Singapore and Sweden were the largest detractors from relative performance.

A likely extended global economic slowdown triggered by the COVID-19 outbreak, the coming U.S. election, and growing tensions between the world's two largest economies (U.S. and China), has us redoubling our efforts to position the Fund to better withstand these headwinds. We believe massive global stimulus, if it continues, could help ease the impact on markets. In addition, with worldwide quarantines, we are seeing the increased importance of technology infrastructure, logistics and e-commerce. We continue to focus on companies with secular demand drivers that we believe will result in above average cash flow and dividend growth. We remain focused on companies with strong, flexible balance sheets that we believe can better withstand increased market volatility.

Overseas, in the UK and Europe, equity markets are facing pressure from disruptions from COVID-19. To position for these challenging times, we continue to focus on businesses where we see a structural growth angle and a strong rental growth profile. Our preferred strategy is still to concentrate on owning those companies investing in sectors with robust fundamentals, with business models that can handle both near term disruption and potential longer-term structural changes that could emerge. For Asia, the economic disruptions caused by COVID-19 added to existing concerns posed by growth deceleration, Hong Kong's uncertain political situation and the elevated office supply outlook in Australia and Singapore. Stocks have been trading at significant discounts to underlying real estate values, but a clear catalyst is lacking until the pandemic is brought under control. We retain our bias for high quality companies that appear to be more resilient to a macro downturn and not overvalued.

20

Sincerely,

STEVE SHIGEKAWA, BRIAN C. JONES, GILLIAN TILTMAN AND ANTON KWANG

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

21

Global Real Estate Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NGRIX | |

Class A | | NGRAX | |

Class C | | NGRCX | |

PERFORMANCE HIGHLIGHTS9

| | | | | Average Annual Total Return

Ended 08/31/2020 | |

| | | Inception

Date | | 1 Year5 YearsLife of

Fund | |

At NAV | |

Institutional Class | | 12/30/2014 | | | – | 3.48% | | | 6.96 | % | | | 4.97 | % | |

Class A | | 12/30/2014 | | | – | 3.93% | | | 6.55 | % | | | 4.57 | % | |

Class C | | 12/30/2014 | | | – | 4.65% | | | 5.76 | % | | | 3.79 | % | |

With Sales Charge | |

Class A | | | | | –9.47 | % | | | 5.29 | % | | | 3.48 | % | |

Class C | | | | | –5.57 | % | | | 5.76 | % | | | 3.79 | % | |

Index | |

FTSE EPRA/Nareit

Developed Index

(Net)1,15 | | | | | –13.68% | | | | 2.91% | | | | 1.27% | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2019 were 9.11%, 9.72% and 10.43% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.01%, 1.37% and 2.12% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2020 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

22

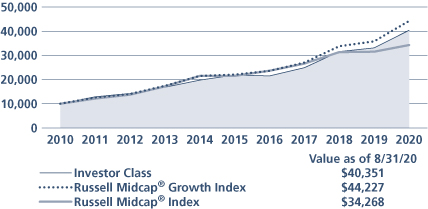

Global Real Estate Fund (Unaudited)

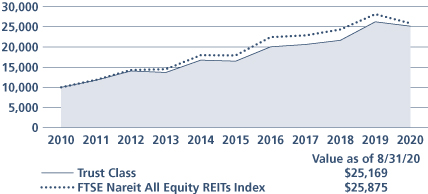

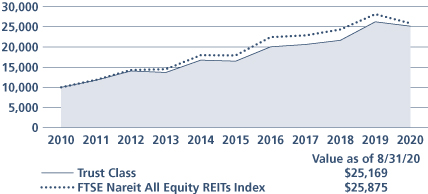

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

23

Greater China Equity Fund Commentary (Unaudited)

Neuberger Berman Greater China Equity Fund Institutional Class generated a 24.93% total return for the fiscal year ended August 31, 2020 (the reporting period), underperforming its benchmark, the MSCI China Index (Net) (the Index), which returned 37.30% over the same period. (Performance for all share classes is provided in the table immediately following this letter.)

During the Fund's reporting period, the China equity markets continued to experience volatility. In September, the China equity markets rebounded as Sino-U.S. trade talks resumed. The State Council signaled targeted reserve requirement ratio (RRR) cuts and the State Administration of Foreign Exchange announced the removal of quotas on certain foreign investors, but most of the gains reversed ahead of the China National Day holidays amid ongoing trade tensions, policy easing and continued social unrest in Hong Kong. After the Golden Week holidays in October 2019, both offshore and onshore markets rallied strongly because of solid 3Q earnings results, and investors awaited guidance from the 4th Plenary Session of the 19th Central Committee of the Communist Party of China. Markets extended gains into November as China and the U.S. both stated plans to lift tariffs as part of a phase one trade deal, but corrected sharply later in the month after the U.S. passed a bill in support of the Hong Kong protest movement. In December, Chinese equities rallied strongly as China and the U.S. reached a phase one trade deal which prevented additional U.S. tariffs on $160 billion worth of Chinese imports from coming into effect, and both countries agreed to scale back existing tariffs. Encouraging China macroeconomic data and expectations of additional fiscal and monetary stimulus from Beijing, further lifted investor sentiment which led markets to end calendar year 2019 on a strong note. Going into 2020, China equity markets extended gains as the government announced a broad-based 50 bps RRR cut and trade tensions eased after China and the U.S. signed the trade deal, but markets took a downturn later in January ahead of the Lunar New Year holidays as investors assessed the impact of the COVID-19 outbreak to the global economy. Throughout February, investors were focused on the COVID-19 pandemic and Chinese equities were sold off after resuming trading from the extended New Year holidays. Global markets also declined as the outbreak spread to more countries and the spike in number of infections heightened concerns over disruptions to global supply chains.

In March, China's containment of the outbreak outside Hubei was largely effective and factory production gradually resumed, but the number of cases accelerated outside China and the eruption of an oil price war between Russia and Saudi Arabia triggered a heavy sell-off in all asset classes. Towards calendar quarter-end, markets stabilized as government stimulus and easing measures such as targeted RRR cuts by the People's Bank of China (PBoC) and two aggressive rate cuts by the U.S. Federal Reserve Board (Fed) helped investors gain some risk appetite. In April, despite a historic collapse in U.S. West Texas Intermediate crude oil prices which settled negative for the first time, Chinese equities traded higher because March Manufacturing and Non-Manufacturing Purchasing Managers Indices (PMIs) rebounded, the additional government stimulus, optimism over corporate earnings and the reopening of global economies. The China equity markets corrected in May, primarily due to tensions between China and the U.S. resurfacing after President Trump expressed doubts over phase one of the trade agreement and the proposal of the Hong Kong national security legislation, and the "Two Sessions" meeting in Beijing fell short of markets' expectations as the government did not set a 2020 GDP growth target. Markets rallied in June as solid macroeconomic data released for May fueled optimism of a sustainable global economic recovery and better than expected Exports and Industrial Profits data. In July, the market rally continued due to ongoing economic recovery indicated by solid PMI data, rebounding 2Q GDP growth and accelerated Industrial Profit growth, and risk appetite resumed following positive news of vaccine trials and anticipation of further fiscal stimulus and policy support from central banks and governments. Strong market returns extended into August despite increasing China-U.S. tensions and concerns over high borrowing cost and a wave of new share listings. The positive returns were primarily because of better than expected corporate interim results, solid performance of the ChiNext Board after new initial public offering listing and trading rules, and accommodative monetary policy from the Fed supported risk appetite globally.

For the reporting period, contributors to performance relative to the Index included Materials (stock selection within the Construction Materials industry), Communication Services (stock selection within Interactive Media & Services and

24

Entertainment) and Utilities (an underweight versus the Index). Detractors from performance relative to the Index included Consumer Discretionary (stock selection, primarily from Internet & Direct Marketing Retail, Automobiles, Diversified Consumer Services and Household Durables), Information Technology (IT) (an underweight versus the Index and stock selection within Electronic Equipment Instruments & Components) and Health Care (stock selection within Biotechnology and Pharmaceuticals).

The Fund continues to focus on companies that have sustainable top and bottom line growth by looking at the companies' operating cash flow from their recurring core businesses. As of August 31, 2020, the Fund's largest sector overweight relative to the Index was Consumer Staples, followed by Materials and Real Estate. The largest sector underweight was Communication Services, followed by Consumer Discretionary and IT. The Fund's top 10 positions comprised more than 55% of total portfolio assets at the end of August.

Economic growth in China likely continued to recover in 2Q 2020. Median estimates put GDP growth for the quarter at 2.5% year over year and the trajectory points comfortably towards a path to recovery. In particular, Manufacturing PMI unexpectedly picked-up in June, led by large- and medium-sized enterprises. On the other hand, PMI for small-sized enterprises contracted, indicating that additional policy stimulus for this segment may be necessary. Other bright spots include improving property sales in China's 30 major cities, strong fixed asset investment and the resumption of construction activities. Meanwhile, there are signs that domestic consumption in China is recovering as contraction in retail sales started to plateau in June. In view of the need for more balance in recovery, the PBoC announced on July 1 that it has reduced both the re-discount and re-lending rates by 25 bps, a targeted measure meant to provide credit support to the small and medium enterprises space (SME). The State Council has also approved the use of local government special bonds to shore up the capital base of small and medium-sized banks, thereby cushioning the finances of SMEs, which is expected to have indirect flow-through effects to support employment.

Looking ahead, we anticipate the policy environment to continue to be accommodative and future policy stimulus to be led by further loosening of fiscal policy, particularly in the form of ongoing local government special bond issuance to ensure robust credit growth in the second half of 2020. On the back of improving economic conditions and improved earnings visibility, China equity market returns have exhibited strength over the last three months of the reporting period. Domestic investor sentiment has also been positive as evidenced by an uptick of new mutual fund launches in China and acceleration in the opening of brokerage accounts, both of which have been in conjunction with ongoing capital market reforms. Taken together, these are anticipated to provide ongoing liquidity support for China A-shares. Despite this optimism, we continue to be in an uncertain environment. In recent periods, the emergence of a string of new COVID-19 cases that led to a partial lockdown in Beijing is a stark reminder of the potential downside risks associated with COVID-19. Moreover, escalating geopolitical tensions between the U.S. and China continue to be a source of risk, which may be further complicated by the upcoming U.S. presidential election. With this in mind, we continue to focus on identifying and owning what we believe to be high quality companies with good earnings visibility capable of weathering the cloudy outlook in the horizon.

Sincerely,

LIHUI TANG AND FRANK YAO

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

25

Greater China Equity Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NCEIX | |

Class A | | NCEAX | |

Class C | | NCECX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Communication Services | | | 9.7 | % | |

Consumer Discretionary | | | 29.7 | | |

Consumer Staples | | | 14.9 | | |

Energy | | | 1.7 | | |

Financials | | | 12.4 | | |

Health Care | | | 5.9 | | |

Industrials | | | 8.0 | | |

Information Technology | | | 1.1 | | |

Materials | | | 8.6 | | |

Real Estate | | | 7.9 | | |

Short-Term Investments | | | 0.1 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

EXCHANGE ALLOCATION

(as a % of Long Term Investments) | |

Mainland China | | | 19.7 | % | |

Hong Kong | | | 78.8 | | |

United States | | | 1.5 | | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS

| | | | Average Annual Total Return

Ended 08/31/2020 | |

| | Inception

Date | | 1 Year | | 5 Years | | Life of

Fund | |

At NAV | | | | | | | |

| |

Institutional Class | | 07/17/2013 | | | 24.93 | % | | | 14.90 | % | | | 13.85 | % | |

Class A | | 07/17/2013 | | | 24.51 | % | | | 14.59 | % | | | 13.53 | % | |

Class C | | 07/17/2013 | | | 23.62 | % | | | 13.66 | % | | | 12.62 | % | |

With Sales Charge | | | | | | | |

| |

Class A | | | | | 17.37 | % | | | 13.24 | % | | | 12.59 | % | |

Class C | | | | | 22.62 | % | | | 13.66 | % | | | 12.62 | % | |