Washington, D.C. 20549

Joseph V. Amato

Arthur C. Delibert, Esq.

1601 K Street, N.W.

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”) (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

Following is a copy of the annual report transmitted to shareholders pursuant to Rule 30e-1 under the Act.

Neuberger Berman

Equity Funds

Investor Class Shares

Trust Class Shares

Advisor Class Shares

Institutional Class Shares

Dividend Growth Fund

Emerging Markets Equity Fund

Equity Income Fund

Focus Fund

Genesis Fund

Global Equity Fund

Global Real Estate Fund

Greater China Equity Fund

Guardian Fund

International Equity Fund

Class A Shares

Class C Shares

Class R3 Shares

Class R6 Shares

International Select Fund

International Small Cap Fund

Intrinsic Value Fund

Large Cap Value Fund

Mid Cap Growth Fund

Mid Cap Intrinsic Value Fund

Multi-Cap Opportunities Fund

Real Estate Fund

Small Cap Growth Fund

Sustainable Equity Fund

(Formerly Socially Responsive Fund)

Value Fund

Annual Report

August 31, 2018

Contents

THE FUNDS

President's Letter | | | 1 | | |

PORTFOLIO COMMENTARY | |

Dividend Growth Fund | | | 2 | | |

Emerging Markets Equity Fund | | | 6 | | |

Equity Income Fund | | | 10 | | |

Focus Fund | | | 14 | | |

Genesis Fund | | | 17 | | |

Global Equity Fund | | | 20 | | |

Global Real Estate Fund | | | 24 | | |

Greater China Equity Fund | | | 27 | | |

Guardian Fund | | | 31 | | |

International Equity Fund | | | 34 | | |

International Select Fund | | | 37 | | |

International Small Cap Fund | | | 40 | | |

Intrinsic Value Fund | | | 44 | | |

Large Cap Value Fund | | | 47 | | |

Mid Cap Growth Fund | | | 50 | | |

Mid Cap Intrinsic Value Fund | | | 53 | | |

Multi-Cap Opportunities Fund | | | 57 | | |

Real Estate Fund | | | 60 | | |

Small Cap Growth Fund | | | 63 | | |

Sustainable Equity Fund | | | 66 | | |

Value Fund | | | 70 | | |

FUND EXPENSE INFORMATION | | | 80 | | |

SCHEDULE OF INVESTMENTS | |

Dividend Growth Fund | | | 84 | | |

Emerging Markets Equity Fund | | | 86 | | |

Positions by Industry | | | 89 | | |

Equity Income Fund | | | 92 | | |

Focus Fund | | | 96 | | |

Genesis Fund | | | 100 | | |

Global Equity Fund | | | 103 | | |

Positions by Industry | | | 105 | | |

Global Real Estate Fund | | | 107 | | |

Positions by Sector | | | 109 | | |

Greater China Equity Fund | | | 111 | | |

Guardian Fund | | | 113 | | |

International Equity Fund | | | 119 | | |

Positions by Industry | | | 121 | | |

International Select Fund | | | 123 | | |

Positions by Industry | | | 125 | | |

International Small Cap Fund | | | 127 | | |

Positions by Industry | | | 129 | | |

Intrinsic Value Fund | | | 131 | | |

Large Cap Value Fund | | | 134 | | |

Mid Cap Growth Fund | | | 137 | | |

Mid Cap Intrinsic Value Fund | | | 140 | | |

Multi-Cap Opportunities Fund | | | 143 | | |

Real Estate Fund | | | 145 | | |

Small Cap Growth Fund | | | 147 | | |

Sustainable Equity Fund | | | 149 | | |

Value Fund | | | 151 | | |

FINANCIAL STATEMENTS | | | 153 | | |

FINANCIAL HIGHLIGHTS (ALL CLASSES)/PER SHARE DATA | |

Dividend Growth Fund | | | 221 | | |

Emerging Markets Equity Fund | | | 221 | | |

Equity Income Fund | | | 223 | | |

Focus Fund | | | 225 | | |

Genesis Fund | | | 227 | | |

Global Equity Fund | | | 229 | | |

Global Real Estate Fund | | | 231 | | |

Greater China Equity Fund | | | 233 | | |

Guardian Fund | | | 233 | | |

International Equity Fund | | | 237 | | |

International Select Fund | | | 239 | | |

International Small Cap Fund | | | 241 | | |

Intrinsic Value Fund | | | 243 | | |

Large Cap Value Fund | | | 243 | | |

Mid Cap Growth Fund | | | 247 | | |

Mid Cap Intrinsic Value Fund | | | 249 | | |

Multi-Cap Opportunities Fund | | | 251 | | |

Real Estate Fund | | | 253 | | |

Small Cap Growth Fund | | | 255 | | |

Sustainable Equity Fund | | | 259 | | |

Value Fund | | | 261 | | |

| Reports of Independent Registered Public Accounting Firms | | | 268 | | |

Directory | | | 272 | | |

Trustees and Officers | | | 273 | | |

Proxy Voting Policies and Procedures | | | 284 | | |

Quarterly Portfolio Schedule | | | 284 | | |

Notice to Shareholders | | | 285 | | |

The "Neuberger Berman" name and logo and "Neuberger Berman Investment Advisers LLC" name are registered service marks of Neuberger Berman Group LLC. The individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Investment Advisers LLC, an affiliate of Neuberger Berman BD LLC, distributor, member FINRA. ©2018 Neuberger Berman BD LLC, distributor. All rights reserved.

Dear Shareholder,

During the 12-month reporting period ended August 31, 2018, we saw a significant shift in investor sentiment—from increasing confidence around global growth and trade trends through January—to concern through the end of the period; as inflation, oil prices, and potentially disruptive U.S. trade policy made headlines and increased volatility.

The U.S. equity market remained positive, though its momentum slowed. Developed international markets returned some of their early gains, and fortunes reversed for emerging markets, the beneficiaries of risk appetite in the first half of the period.

Ten years after the global financial crisis, global economic trends are, in fact, very healthy. U.S. household income has finally returned to 2007 levels. Unemployment has dropped in the U.S. and Eurozone, consumer confidence has improved, GDP growth rates have climbed across the developed and developing world, and corporate profits and balance sheets are strong.

However, investors are understandably concerned that tariffs and trade protectionism could disrupt these positive trends. Policy uncertainty causes business leaders to delay expansion plans, and draw down inventories. This is happening in Europe now, leading the European Central Bank to reduce growth forecasts this September. Trade wars also cost jobs, damaging income and spending. Further, tariffs increase the cost of goods, adding to inflationary pressures, and decreasing purchasing power. Unintended consequences are another factor—such as the losses U.S. farmers faced this year when China placed retaliatory tariffs on U.S. agricultural exports.

Other trends impacting investor sentiment are the rise in oil price, which increases costs to both manufacturers and consumers; and rising interest rates, which the U.S. Federal Reserve suggests may increase two additional times in 2018 in response to signs of inflation. Debt is another concern. Student debt, for example, has doubled to $1.5 trillion since the financial crisis, and is now the second largest category of household debt behind mortgages. This stressor potentially delays major purchases and new household formation.

As markets measure optimistic data against various risk factors, we anticipate volatility will continue. The benefit of a strong team of managers with deep analyst bench strength is the ability to thoroughly investigate, and discriminate between investment opportunities, and to be ready to take advantage of pricing anomalies as they arise. Our teams work to identify the sectors of the economy that they believe can grow regardless of overarching pressures, and those companies best positioned within them; the parts of the economy best insulated from headline risk, and the companies with cash flows and reserves sufficient to survive and perhaps even benefit from economic dips; and companies with niche markets or undiscovered value.

As we wait for the cloud of policy uncertainty to diminish, our managers will continue to work to use volatility to investors' advantage, building portfolios of stocks they believe represent the most rewarding longer-term opportunities.

Thank you for your confidence in Neuberger Berman. We look forward to continuing to serve your investment needs.

Sincerely,

JOSEPH V. AMATO

PRESIDENT AND CEO

NEUBERGER BERMAN MUTUAL FUNDS

1

Dividend Growth Fund Commentary (Unaudited)

Neuberger Berman Dividend Growth Fund Institutional Class generated a 10.44% total return for the fiscal year ended August 31, 2018, underperforming its benchmark, the S&P 500® Index (the Index), which posted a 19.66 % total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

During the reporting period, the market (as measured by the Index) set a new all-time high, as the current expansion officially became the longest in U.S. history, driven by "growth" stocks with limited, and, in many cases, no dividend programs. Overall within the Index, all eleven sectors posted gains with Information Technology (IT), Consumer Discretionary, and Energy benefitting the most.

The Fund seeks long term capital appreciation and current income in line with its benchmark. We believe this approach identifies companies with strong business models generating cash to grow their businesses while providing dividend distributions to shareholders. We focus on companies that we judge to have strong balance sheets, solid management teams, attractive free cash flow yields, and clear capital allocation strategies.

The Fund generated the bulk of its returns from its average ~19% allocation to IT as Microsoft drove results. Under the leadership of CEO Satya Nadella, the tech giant has become a dominant player in cloud computing services, gaining market share from rivals. Positive momentum reinforced investor enthusiasm as the company's double-digit free cash flow growth has been used aggressively towards growing its dividend policy.

On the other end of the spectrum, the flash memory producer Western Digital was among our losers as waning demand weighed on performance. However, we believe this pullback could present a buying opportunity as this business remains, in our view, well positioned to benefit from reaccelerating demand for high capacity enterprise devices.

Within Industrials, stock selection was strong as CSX was our top overall performer. Shares of the rail operator rallied sharply as industry veteran Hunter Harrison took the helm as CEO in early 2017. During the reporting period, Mr. Harrison sadly passed away; however, during his tenure he successfully streamlined operations—unlocking significant value for shareholders. In our view, this freight holding remains well positioned to benefit from an uptick in consumer confidence and infrastructure projects, transporting consumer goods and raw materials.

On the commodity front, the portfolio's Energy exposure generated significant positive returns. Several holdings posted attractive results, moving higher with oil prices, as West Texas Intermediate crude oil was priced at approximately $70 at the end of the reporting period. Stock selection across our oil/gas holdings lifted results as Devon Energy was among our top performers. This upstream business rallied as management raised their output guidance driven by improving well productivity from the Delaware Basin. From a capital allocation perspective, management remains aligned with shareholders through stock buybacks and dividend increases, making this, in our view, an ideal investment given our mandate.

However, Materials detracted from absolute and relative performance. Stock performance was largely driven by the commodities these companies produce, including gold, cobalt and copper, which all declined in price, primarily in the final months of the period. We continue to believe the supply of these metals is likely to face challenges in coming years, while demand is likely to be driven, in the case of cobalt and copper, by the trend towards electric vehicles.

Lastly, Health Care exposure negatively impacted relative results versus the Index as Allergan preferred stock was among our laggards. This position was eliminated with proceeds used to fund opportunities elsewhere.

Directionally, we remain positive on the health of the economy. In our view, valuations across equities remain supported by robust corporate results as the market rally has been driven by the strongest profit growth witnessed in several years. Moreover, earnings season provided further insight into capital allocation plans whereby we anticipate greater dividend growth potential. However, looking ahead, we feel the effects from tax reforms likely represented a one time benefit, and feel volatility could be stoked by protectionist rhetoric. Under this scenario, equities could face headwinds, making a compelling case for dividend paying stocks as a defensive ballast. Given this backdrop, we remain focused on the search for high-quality cash-generative companies for risk-adverse investors.

2

We thank you for your investment in our Fund.

Sincerely,

DAVID A. KIEFER AND WILLIAM D. HUNTER

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

3

Dividend Growth Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NDGIX | |

Class A | | NDGAX | |

Class C | | NDGCX | |

Class R6 | | NRDGX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Consumer Discretionary | | | 11.4 | % | |

Consumer Staples | | | 6.9 | | |

Energy | | | 9.7 | | |

Financials | | | 12.6 | | |

Health Care | | | 13.5 | | |

Industrials | | | 15.1 | | |

Information Technology | | | 18.8 | | |

Materials | | | 6.4 | | |

Short-Term Investments | | | 5.6 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS

| | | | Average Annual

Total Return

Ended 08/31/2018 | |

| | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 12/15/2015 | | | 10.44 | % | | | 14.80 | % | |

Class A | | 12/15/2015 | | | 9.98 | % | | | 14.39 | % | |

Class C | | 12/15/2015 | | | 9.17 | % | | | 13.51 | % | |

Class R6 | | 12/15/2015 | | | 10.51 | % | | | 14.85 | % | |

With Sales Charge | |

Class A | | | | | 3.65 | % | | | 11.92 | % | |

Class C | | | | | 8.17 | % | | | 13.51 | % | |

Index | |

| S&P 500® Index1,15 | | | | | 19.66 | % | | | 16.60 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 1.70%, 2.16%, 2.82% and 1.67% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.70%, 1.06%, 1.81% and 0.64% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

4

Dividend Growth Fund (Unaudited)

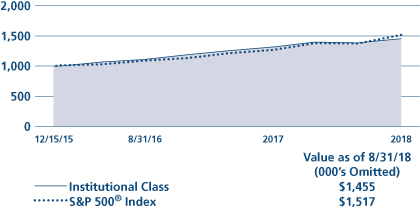

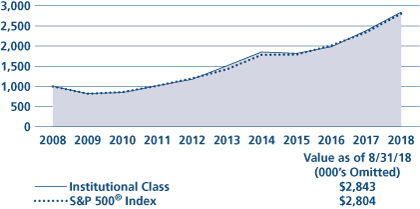

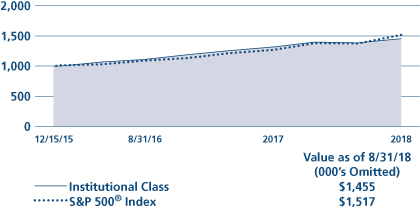

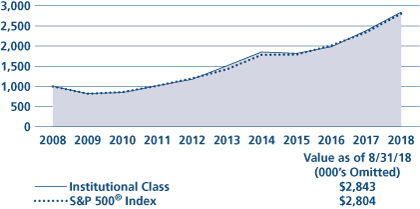

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

5

Emerging Markets Equity Fund Commentary (Unaudited)

Neuberger Berman Emerging Markets Equity Fund Institutional Class generated a total return of –2.49% for the fiscal year ended August 31, 2018, lagging its benchmark, the MSCI Emerging Markets Index (Net) (the Index), which reported a total return of –0.68% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Although Emerging Market (EM) equities performed extremely well during the first half of this period—as risk appetite, positive GDP growth revisions, and global growth trends attracted investors—the market reversed course in February 2018. Volatility and negative sentiment prevailed for the remainder of the period on fears of the global repercussions of U.S.-China trade tensions. U.S. policy toward other trading partners, a stronger U.S. dollar, rising U.S. interest rates, and rising oil prices compounded pressures through the end of the period.

Within the Index, the defensive Health Care sector and commodity price driven Energy sector were standout performers. Each posted double-digit positive returns for the period. Information Technology (IT) and Materials stocks also outperformed the Index overall. The interest rate sensitive Telecommunication Services and Real Estate sectors, and economically sensitive Industrials, declined significantly. Among individual markets, Qatar, Thailand, and Czech Republic were top performers. Turkey saw the sharpest losses, followed by Greece and Pakistan.

The portfolio lagged the Index most within the Consumer Discretionary and Consumer Staples sectors, and also due to a relative underweight to Energy. Relative returns were positive within Financials, due both to strong stock selection and our underweight on average during the period. Stock selection was advantageous within Health Care, and IT as well. By country, holdings based in China, South Africa, and Korea outperformed while those based in India, Russia, and Taiwan lagged.

Top contributors included China's Sinopharm, which demonstrated strong cost containment, enabling investors to focus on the robust growth prospects within its strong drug pipeline. Despite concerns over peak smartphone sales, Taiwan Semiconductor continues to benefit from demand for high-end semiconductor chips used in other application such as artificial intelligence and 5G communications. Ping An Insurance, a leading private property and casualty insurer, delivered better-than-expected earnings, aided by its financial technology products, which have been increasingly adopted by other Chinese financial institutions.

Detractors included X5 Retail, a Russian food retailer that retreated along with other Russian domestic names, as investors grew concerned about the impact of sanctions on the Russian economy. Elite Material, the Taiwanese eco-friendly printed circuit board supplier, fell as recent quarterly margins disappointed investors due to recently lost contracts; however, we believe the firm could potentially gain market share. China Everbright declined following a surprise rights issue and poor communication from the management team.

Looking ahead, while the recent selloff has left EM equities cheaper on a price to earnings basis, we would distinguish between market segments that are cheap for a reason, such as commodities (which suffer from underlying price volatility), and areas where we believe earnings can be sustained, such as smaller cap stocks. As such, part of our current emphasis is identifying small cap names with sufficient liquidity that were sold off based on sentiment rather than fundamentals.

Although we anticipate ongoing equity market volatility, the EM earnings growth forecast*, for both 2018 and 2019, remains in double-digit growth territory despite the U.S. dollar's strength, which speaks to the fundamental strength of EM companies. As the year progresses, we will continue to seek individual companies where we believe growth can be sustained regardless of tougher market conditions.

6

Sincerely,

CONRAD SALDANHA

PORTFOLIO MANAGER

* Source: Bank of America Merrill Lynch as of September 2018

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

7

Emerging Markets Equity Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NEMIX | |

Class A | | NEMAX | |

Class C | | NEMCX | |

Class R3 | | NEMRX | |

Class R6 | | NREMX | |

PERFORMANCE HIGHLIGHTS9

| | | | Average Annual Total Return

Ended 08/31/2018 | |

| | Inception

Date | | 1 Year | | 5 Years | | Life of

Fund | |

At NAV | |

Institutional Class | | 10/08/2008 | | | –2.49 | % | | | 5.38 | % | | | 8.61 | % | |

Class A | | 10/08/2008 | | | –2.78 | % | | | 5.11 | % | | | 8.34 | % | |

Class C | | 10/08/2008 | | | –3.51 | % | | | 4.31 | % | | | 7.53 | % | |

| Class R310 | | 06/21/2010 | | | –3.16 | % | | | 4.68 | % | | | 8.01 | % | |

| Class R622 | | 03/15/2013 | | | –2.46 | % | | | 5.45 | % | | | 8.65 | % | |

With Sales Charge | |

Class A | | | | | –8.35 | % | | | 3.88 | % | | | 7.70 | % | |

Class C | | | | | –4.47 | % | | | 4.31 | % | | | 7.53 | % | |

Index | |

| MSCI Emerging Markets Index (Net)1,15 | | –0.68 | % | | | 5.04 | % | | | 7.41 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 1.37%, 1.74%, 2.46%, 2.02% and 1.27% for Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.26%, 1.51%, 2.26%, 1.92% and 1.19% for Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

8

Emerging Markets Equity Fund (Unaudited)

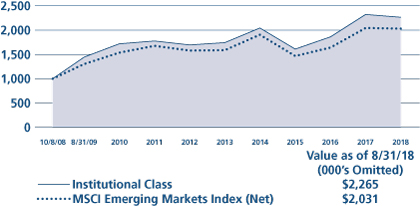

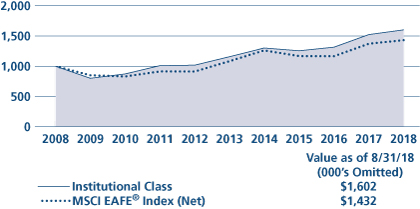

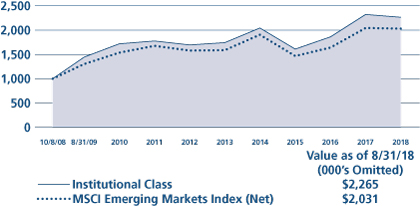

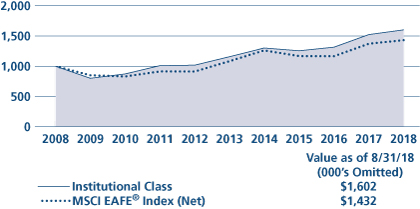

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

9

Equity Income Fund Commentary (Unaudited)

Neuberger Berman Equity Income Fund Institutional Class generated a 10.58% total return for the fiscal year ended August 31, 2018, trailing its benchmark, the S&P 500® Index (the Index) which posted a 19.66% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

During this timeframe, the market (as measured by the Index) set a new all-time high, as the current expansion officially became the longest in U.S. history driven by "growth" stocks with lower, and, in many cases, no dividend programs. In fact, stocks with dividend yields below the S&P's aggregate yield of 1.8% contributed about 60% of the market return over that period.

The Fund has an objective-based strategy, targeting a total return between stocks and bonds with lower volatility relative to the broader equity market. This portfolio is diversified among dividend-paying stocks and convertible bonds, selected through extensive analysis of cash flow prospects, which we believe have the ability to sustain and grow dividends.

The Fund's largest contribution to total returns came from its average ~12% allocation to the Information Technology sector. The passage of tax reform and the resulting clarity around cash repatriation helped to drive sector earnings expectations and shares higher. Microsoft was a key contributor to the Fund's performance during the period. This company has become a dominant player in cloud computing services, leading to double-digit free cash flow growth, rising dividends, and share repurchases. On the other end of the spectrum, the flash memory producer Western Digital was among our losers as pricing of its key products remains a market concern.

On the commodity front, the Fund's stock selection across our oil/gas holdings lifted absolute and relative results. We believe several commodities have attractive supply-demand fundamentals, and the Fund's holdings in this sector can provide a potential hedge against inflation.

Elsewhere, our underweight to Consumer Discretionary holdings weighed on performance, as the sector was lifted by constituents with limited free cash flow and dividends. Within this space, L Brands dampened results of the Fund, as sales within its Pink brand faced mounting challenges, offset partially by improving sales at the company's Bath & Body Works segment.

Financials, and in particular Banks, continued to be a key component of the Fund. Over the period, stock selection contributed positively to performance. The sector has exhibited high correlation with 10-year U.S. Treasury note yields, which helps to offset the interest rate sensitivity inherent in the Fund.

The Fund increased its exposure to convertible bonds over the course of the year. Rising yields in the high yield market have led issuers to consider convertible bonds. We believe this trend is likely to continue, and have found attractive risk-reward opportunities in this eclectic asset class.

The Fund's use of written options contributed positively to performance during the period.

Directionally, we remain positive on the health of the economy. In our view, valuations across equities remain supported by robust corporate results as the market rally has been driven by the strongest profit growth witnessed in several years. Capital allocation plans for our companies continue to include dividends and importantly growth in dividends as a key component. However, we feel the effects from tax reforms likely represented a one time benefit, and feel volatility could be stoked by protectionist rhetoric. Under this scenario, equities could face headwinds, making a compelling case for dividend paying stocks as a defensive ballast. In our opinion, companies with growing free cash flow, strong balance sheets, and capital allocation strategies that benefit shareholders with current yield, while re-investing for the future, will deliver attractive returns in the future.

10

We thank you for your investment in our Fund.

Sincerely,

RICHARD LEVINE AND SANDY POMEROY

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

11

Equity Income Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NBHIX | |

Class A | | NBHAX | |

Class C | | NBHCX | |

Class R3 | | NBHRX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Consumer Discretionary | | | 6.4 | % | |

Consumer Staples | | | 3.5 | | |

Energy | | | 8.6 | | |

Financials | | | 12.0 | | |

Health Care | | | 6.6 | | |

Industrials | | | 16.5 | | |

Information Technology | | | 11.5 | | |

Materials | | | 5.2 | | |

Telecommunication Services | | | 1.7 | | |

Utilities | | | 13.2 | | |

Convertible Bonds | | | 11.1 | | |

Short-Term Investments | | | 3.7 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS9

| | | | Average Annual Total Return

Ended 08/31/2018 | |

| | Inception

Date* | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

| Institutional Class13 | | 06/09/2008 | | | 10.58 | % | | | 9.83 | % | | | 7.93 | % | | | 7.95 | % | |

| Class A13 | | 06/09/2008 | | | 10.21 | % | | | 9.43 | % | | | 7.51 | % | | | 7.59 | % | |

| Class C13 | | 06/09/2008 | | | 9.36 | % | | | 8.61 | % | | | 6.73 | % | | | 6.92 | % | |

| Class R313 | | 06/21/2010 | | | 9.93 | % | | | 9.15 | % | | | 7.35 | % | | | 7.46 | % | |

With Sales Charge | |

| Class A13 | | | | | 3.84 | % | | | 8.15 | % | | | 6.88 | % | | | 7.05 | % | |

| Class C13 | | | | | 8.36 | % | | | 8.61 | % | | | 6.73 | % | | | 6.92 | % | |

Index | |

| S&P 500® Index1,15 | | 19.66 | % | | | 14.52 | % | | | 10.86 | % | | | 8.85 | % | |

*The performance data for each class includes the performance of the Fund's oldest share class, Trust Class, from November 2, 2006 through June 9, 2008. The performance data for Class R3 also includes the performance of the Fund's Institutional Class from June 9, 2008 through June 21, 2010. See endnote 13 for information about the effects of the different fees paid by each class.

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 0.69%, 1.06%, 1.80% and 1.34% for Institutional Class, Class A, Class C and Class R3 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios for the annual period ended August 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

12

Equity Income Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT13

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

13

Focus Fund Commentary (Unaudited)

Neuberger Berman Focus Fund Investor Class generated a 13.05% total return for the fiscal year ended August 31, 2018, underperforming its benchmark, the S&P 500® Index (the Index), which provided a 19.66% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The U.S. stock market generated strong results during the reporting period. After rising over the first five months of the period, the overall stock market fell sharply in February and March 2018. This occurred given concerns that the U.S. Federal Reserve may raise interest rates at a faster pace than previously expected. However, this was a short-term setback, as the market then rallied over the last five months of the period and reached several new all-time highs in August 2018. This rally was driven by a number of factors, including overall strong corporate profits and accelerating growth in the U.S.—both of which overshadowed concerns over a global trade war. All told, the Index gained 19.66% for the 12-month period.

Within the Index, Information Technology (IT), Consumer Discretionary and Energy led sector performance. These areas benefited from the solid U.S. economy, which bolstered consumers and enhanced operating conditions for many businesses. Defensive areas such as Utilities, Consumer Staples, and Telecommunication Services were the weakest segments of the Index over the period.

The greatest detractors from relative performance stemmed from IT, where our holdings generated softer returns than their counterparts in the Index. A notable shortfall was in the Software industry, where we owned cybersecurity firm Symantec Corp. Its shares fell sharply as the company released disappointing fiscal results and weaker than expected guidance. Symantec Corp. was sold during the period. Consumer Discretionary was also a source of relative weakness for the Fund. The greatest loss stemmed from the Household Durables industry, as shares of Whirlpool Corp. declined in the wake of disappointing earnings and concerns over potential trade issues.

Consumer Staples provided the largest lift to relative performance for the Fund owing to better overall stock selection. In particular, the Fund's holding in the Food Products industry added the most value. A standout performer was packaged foods company Conagra Brands, Inc. Its shares rallied sharply as the company released strong operational results. Stock selection in the Industrials sector was also beneficial, led by the Fund's positions in the Road & Rail industry. A top performer in this segment was CSX Corp. The company reported robust earnings that exceeded expectations.

The Fund's use of purchased and written options detracted from performance during the period.

Looking ahead, we believe the U.S. economy has the necessary momentum to continue expanding. While growth will likely moderate from the second quarter's robust rate, in our view it will still grow at a solid pace as the year progresses. This, in turn, would likely further bolster equity fundamentals and could continue to drive the stock market upward in our view. That being said, there are areas of uncertainty that could lead to periods of volatility. For example, the levying of additional tariffs and restrictions on key U.S. trade partners could backfire if it escalates into a trade war that results in rising prices for U.S. consumers. The geopolitical backdrop is also a source of apprehension with the rise of nationalist fervor in Europe. While the general equity market has at times been swayed by external macro conditions, we believe that our bottom-up investment strategy has the potential to mitigate these broader uncertainties. We therefore conduct extensive fundamental research on individual stocks to create a portfolio that we believe can generate positive returns over an economic cycle.

Sincerely,

TIMOTHY CREEDON AND DAVID LEVINE

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

14

TICKER SYMBOLS

Investor Class | | NBSSX | |

Trust Class | | NBFCX | |

Advisor Class | | NBFAX | |

Institutional Class | | NFALX | |

Class A | | NFAAX | |

Class C | | NFACX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Consumer Discretionary | | | 16.5 | % | |

Consumer Staples | | | 6.4 | | |

Energy | | | 6.8 | | |

Financials | | | 15.3 | | |

Health Care | | | 14.7 | | |

Industrials | | | 8.6 | | |

Information Technology | | | 20.4 | | |

Materials | | | 3.0 | | |

Telecommunication Services | | | 4.4 | | |

Utilities | | | 2.7 | | |

Short-Term Investments | | | 1.2 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS8

| | | | Average Annual Total Return

Ended 08/31/2018 | |

| | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

Investor Class | | 10/19/1955 | | | 13.05 | % | | | 11.67 | % | | | 8.59 | % | | | 10.53 | % | |

| Trust Class3 | | 08/30/1993 | | | 12.88 | % | | | 11.46 | % | | | 8.37 | % | | | 10.51 | % | |

| Advisor Class4 | | 09/03/1996 | | | 12.62 | % | | | 11.30 | % | | | 8.18 | % | | | 10.44 | % | |

| Institutional Class5 | | 06/21/2010 | | | 13.20 | % | | | 11.85 | % | | | 8.75 | % | | | 10.56 | % | |

| Class A19 | | 06/21/2010 | | | 12.80 | % | | | 11.44 | % | | | 8.43 | % | | | 10.50 | % | |

| Class C19 | | 06/21/2010 | | | 11.92 | % | | | 10.62 | % | | | 7.77 | % | | | 10.40 | % | |

With Sales Charge | |

| Class A19 | | | | | 6.34 | % | | | 10.13 | % | | | 7.79 | % | | | 10.40 | % | |

| Class C19 | | | | | 11.18 | % | | | 10.62 | % | | | 7.77 | % | | | 10.40 | % | |

Index | |

| S&P 500® Index1,15 | | 19.66 | % | | | 14.52 | % | | | 10.86 | % | | | 10.32 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 0.93%, 1.11%, 1.27%, 0.76%, 1.14%, and 1.88% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.76%, 1.12%, and 1.87% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

15

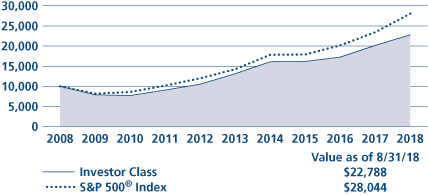

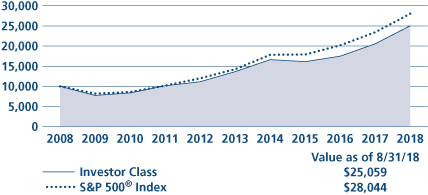

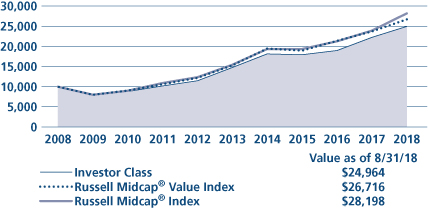

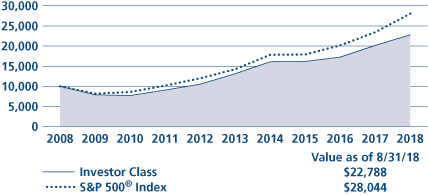

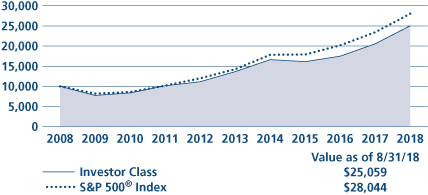

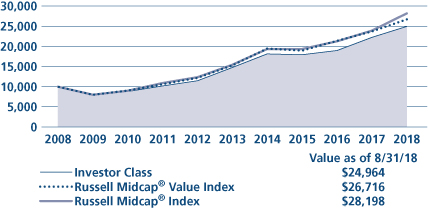

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

16

Genesis Fund Commentary (Unaudited)

Neuberger Berman Genesis Fund Investor Class generated a 26.73% total return for the fiscal year ended August 31, 2018, outperforming its benchmark, the Russell 2000® Index (the Index), which provided a 25.45% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Despite weakness in early calendar year 2018, the U.S. stock market generated strong results during the reporting period. After rising over the first five months of the period, the overall stock market declined in February and March 2018. This turnaround occurred given concerns that the U.S. Federal Reserve may raise interest rates at a faster pace than previously expected. However, this proved to be a temporary setback, as the market then rallied during the last five months of the period and reached several new all-time highs in August 2018. This was driven by a number of factors, including corporate profits that often exceeded expectations and accelerating growth in the U.S.—both of which overshadowed concerns over a global trade war. All told, the S&P 500® Index gained 19.66% for the 12-month period. Small-cap stocks also produced even stronger results, as the Russell 2000 Index gained 25.45%.

The Fund outperformed the benchmark during the reporting period, as both sector allocation and stock selection were positive for results. From a sector allocation perspective, having no exposure to real estate investment trusts (REITs) was the most additive for results. We do not typically own REITs, as they do not meet our investment criteria. In addition, REITs are often viewed as bond-proxies and they underperformed given rising interest rates. Elsewhere, having no allocation to Utilities, another bond-proxy, was beneficial. Within the Information Technology (IT) sector, an overweight to higher quality Software companies was a meaningful contributor to performance. Conversely, within the IT sector, an underweight to the lower quality, more speculative Internet Software & Services industry was the largest detractor from results. Finally, an underweight to Biotechnology companies and a modest allocation to cash were headwinds to performance.

In terms of stock selection, our holding in the IT sector was the largest contributor to relative returns, partially driven by our Software and Electronic Equipment, Instruments & Components names. Within the Consumer Staples sector, several Food Products and Household Products holdings benefited relative performance. Looking at the Health Care sector, our Life Science Tools & Software names were the most additive for returns. On the downside, stock selection in the Industrials (mostly Machinery), Consumer Discretionary (mostly Specialty Retail and Hotels, Restaurants & Leisure) and Health Care (mostly Health Care Equipment & Supplies) sectors were the largest detractors from relative performance.

While the labor market in the U.S. has tightened amidst a vibrant domestic economy, economic activity outside the U.S. appears to be decelerating. We believe this is most likely due to increased uncertainty around trade disputes and a stronger U.S. dollar. The latter acts to increase the burden of dollar-based loans, particularly in many emerging markets. Domestically-oriented small-caps benefited from their perceived insulation from global trade wars. We will have to wait and see if trade rhetoric turns out to be part of a negotiating process or something more serious. Either way, companies with superior business models and strong balance sheets, as well as those with high returns defended by competitive moats that grow earnings and free cash flow faster than the market overall, in our view, will outperform in the long term. We began to see evidence of this in the tail end of the reporting period. Whether or not this is sustainable will depend on the direction of interest rates, whether there is a spillover effect from moderating growth overseas and other factors that could impact investor sentiment.

Sincerely,

JUDITH M. VALE AND ROBERT W. D'ALELIO

PORTFOLIO CO-MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

17

TICKER SYMBOLS

Investor Class | | NBGNX | |

Trust Class | | NBGEX | |

Advisor Class | | NBGAX | |

Institutional Class | | NBGIX | |

Class R6 | | NRGSX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Consumer Discretionary | | | 12.8 | % | |

Consumer Staples | | | 5.0 | | |

Energy | | | 4.9 | | |

Financials | | | 15.7 | | |

Health Care | | | 13.5 | | |

Industrials | | | 18.4 | | |

Information Technology | | | 21.8 | | |

Materials | | | 6.3 | | |

Real Estate | | | 0.6 | | |

Short-Term Investments | | | 1.0 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS

| | | | | Average Annual Total Return

Ended 08/31/2018 | |

| | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

Investor Class | | 09/27/1988 | | | 26.73 | % | | | 12.42 | % | | | 9.46 | % | | | 12.56 | % | |

| Trust Class3 | | 08/26/1993 | | | 26.64 | % | | | 12.33 | % | | | 9.38 | % | | | 12.54 | % | |

| Advisor Class4 | | 04/02/1997 | | | 26.31 | % | | | 12.02 | % | | | 9.09 | % | | | 12.31 | % | |

| Institutional Class5 | | 07/01/1999 | | | 26.96 | % | | | 12.61 | % | | | 9.66 | % | | | 12.71 | % | |

| Class R623 | | 03/15/2013 | | | 27.07 | % | | | 12.69 | % | | | 9.61 | % | | | 12.61 | % | |

Index | |

| Russell 2000® Index1,15 | | 25.45 | % | | | 13.00 | % | | | 10.46 | % | | | 10.18 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 1.02%, 1.09%, 1.36%, 0.85% and 0.77% for Investor Class, Trust Class, Advisor Class, Institutional Class and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratio was 0.75% for Class R6 shares after expense reimbursements and/or fee waivers. The total annual operating expense ratio for each of Institutional Class and Class R6 includes the class's repayment of expenses previously reimbursed and/or fees previously waived by Management. The expense ratios for the annual period ended August 31, 2018 can be found in the Financial Highlights section of this report.

18

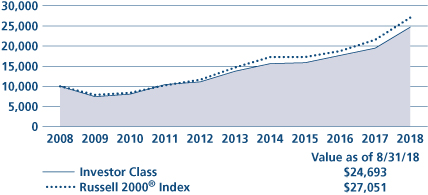

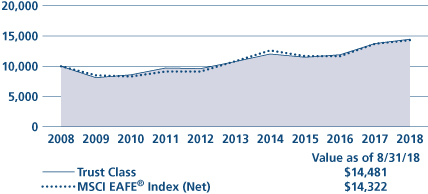

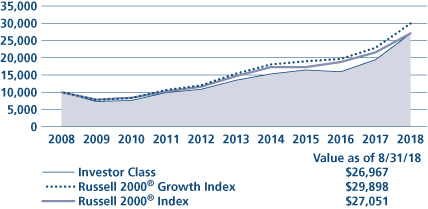

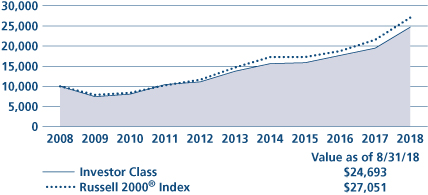

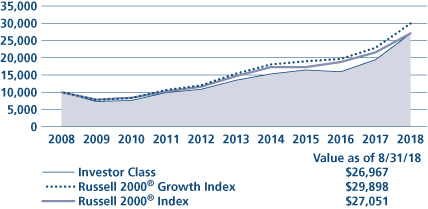

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

19

Global Equity Fund Commentary (Unaudited)

Neuberger Berman Global Equity Fund Institutional Class generated a total return of 14.53% for the fiscal year ended August 31, 2018, outperforming the 11.41% total return of its benchmark, the MSCI All Country World Index (Net) (the Index) for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

During the first half of this period, global equity markets climbed steadily on positive and improving economic data, healthy global trade, strong corporate earnings, and low interest rates. By February 2018, emerging markets and U.S. equities were up approximately 16 percent from the beginning of the period, with developed international markets not far behind. Since February, volatility increased sharply. Protectionist U.S. trade policy, higher oil prices, and early signs of inflation—suggesting higher interest rates—gave investors pause. This slowed U.S. equity momentum, damaged international developed market returns and pushed emerging markets into negative territory.

Within the Index, the Information Technology (IT), Energy, and Consumer Discretionary sectors outperformed, with cyclical sectors benefiting from generally positive economic data, and Energy from higher oil prices. Interest rate sensitive areas including Utilities and Telecommunication Services lagged, as did Consumer Staples. By country, Israel, Qatar, and the U.S. led the Index this period, while Turkey, Greece, and Pakistan were among markets posting losses.

Both stock selection and sector allocation benefited the portfolio's relative performance this period. Stock selection within Consumer Staples, Financials, and Industrials had the largest positive effect. By country, holdings from the U.S., UK, and Netherlands added to relative performance.

Individual contributors included Amazon.com, ASML, and Centene. Amazon, the e-commerce giant, posted better than expected results and guided targets higher, driven by revenue acceleration in the web services division. Dutch semiconductor specialist ASML benefited from solid earnings announcements, and managed care provider Centene's second quarter results beat analyst expectations.

Portfolio holdings lagged the benchmark in the IT, Health Care, and Energy sectors. By country, holdings based in Israel, France and Germany underperformed.

Detractors included Western Digital, Tower Semiconductor, and Valeo. Western Digital, the U.S. memory chip maker, declined on concerns that memory chip prices will fall. We believe these fears to be overdone, and added to the position. Tower Semiconductor, the Israeli headquartered semiconductor foundry, announced solid fourth quarter results but revised guidance downwards based on weaker first quarter demand, particularly in smartphones; and Valeo, the French auto parts supplier, was caught up in the selloff due to rising global trade tensions.

While a trade dispute between the U.S. and China is unhelpful for market sentiment in the near term, we anticipate that cooler heads will prevail and a major trade-driven global slowdown will be avoided. Still, the economic effects are uncertain until negotiations conclude.

Our focus generally remains on what we believe are the most innovative businesses in the healthier countries. We believe this helps insulate the portfolio from political uncertainty and helped reduce volatility and drive relative performance this period. We endeavor to avoid firms exposed to markets characterized by low economic growth, significant debt and limited appetite for reform.

Continued volatility should afford us opportunities to add or trim positions in core names. Our focus remains on quality businesses that we anticipate will benefit from secular growth, niche business models and/or defensive end-markets, which, historically, have typically helped our portfolios experience lower volatility than the market.

20

Sincerely,

BENJAMIN SEGAL

PORTFOLIO MANAGER

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

21

Global Equity Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NGQIX | |

Class A | | NGQAX | |

Class C | | NGQCX | |

PERFORMANCE HIGHLIGHTS9

| | | | Average Annual Total

Return Ended 08/31/2018 | |

| | Inception

Date | | 1 Year | | 5 Years | | Life of

Fund | |

At NAV | |

Institutional Class | | 06/30/2011 | | | 14.53 | % | | | 10.08 | % | | | 7.57 | % | |

Class A | | 06/30/2011 | | | 14.17 | % | | | 9.73 | % | | | 7.21 | % | |

Class C | | 06/30/2011 | | | 13.22 | % | | | 8.88 | % | | | 6.40 | % | |

With Sales Charge | |

Class A | | | | | 7.55 | % | | | 8.43 | % | | | 6.33 | % | |

Class C | | | | | 12.22 | % | | | 8.88 | % | | | 6.40 | % | |

Index | |

| MSCI All Country World Index (Net)1,15 | | 11.41 | % | | | 9.67 | % | | | 8.51 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 7.12%, 7.54% and 8.27% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.75%, 1.11% and 1.86% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

22

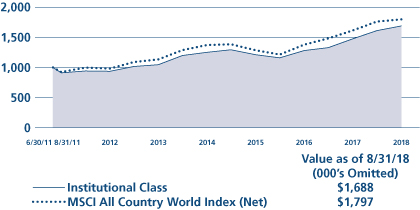

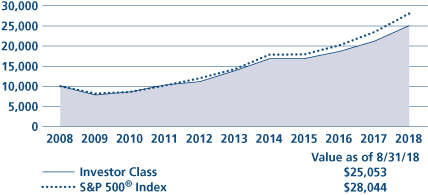

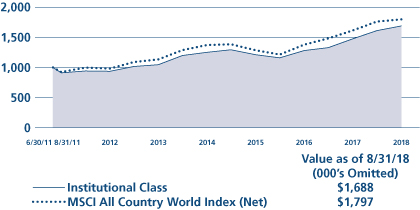

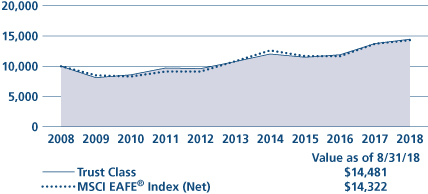

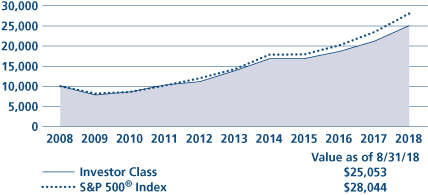

Global Equity Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

23

Global Real Estate Fund Commentary (Unaudited)

Neuberger Berman Global Real Estate Fund Institutional Class generated a 4.98% total return for the fiscal year ended August 31, 2018, underperforming its benchmark, the FTSE EPRA/NAREIT Developed Index (Net) (the Index), which generated a 5.49% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Despite periods of weakness, the global stock market, as measured by the MSCI All Country World Index (Net), generated strong results during the reporting period. After rising over the first five months of the period, the global stock market declined in February and March 2018. This turnaround occurred given concerns that the U.S. Federal Reserve (Fed) may raise interest rates at a faster pace than previously expected. This proved to be a temporary setback in the U.S, as its market then rallied during the last five months of the period and reached several new all-time highs in August 2018. This was driven by a number of factors, including corporate profits that often exceeded expectations and accelerating growth in the U.S. In contrast, equities outside the U.S. remained largely challenged, partially due to signs of moderating growth and concerns over a global trade war. Comparatively, global real estate investment trusts (REITs) posted less robust results during the period.

The Fund underperformed the benchmark during the reporting period. The Fund's positioning from a regional/country perspective relative to the Index detracted from results. In particular, an overweight to the Netherlands on average during the period, along with underweights to the U.S and Austria, were the largest detractors from relative performance. On the upside, overweights to Spain and Canada, coupled with an underweight to Singapore, were additive for results.

On the upside, stock selection contributed to the Fund's results. Our holdings in the Industrial & Office REITs, Residential REITs, and Retail REITs sectors were the most additive for returns. The largest detractors from performance were the Fund's holdings in the Real Estate Holding & Development, and Specialty REITs sectors.

We anticipate seeing solid economic growth for the U.S. as the year progresses, and for the Fed to take a measured approach in terms of further rate hikes. While interest rate movements could be a near-term headwind, we believe the drivers of this change, namely solid economic and job growth, combined with modest inflation, should be positive for real estate fundamentals. The tax cuts signed into law in late 2017 have had a positive impact on corporate profitability, while also increasing disposable income for most consumers. Improved consumer confidence, accelerating non-residential fixed investment and modest inflation, if they continue, should benefit tenant demand for real estate space. We are monitoring the potential impact from proposed trade tariffs, government deregulation and infrastructure that may affect the real estate sector. Overseas, we continue to see a positive economic environment for most of Europe in 2018. In our view, continued growth in assets under management on the direct property side will put pressure on investors to deploy capital. That being said, the prospect of higher long-term interest rates may start to pose a challenge to pricing. Among the Asia-Pacific markets, the solid labor market and rising inflation continues to bolster the case, in our minds, for Japan real estate stocks in 2018, especially with loose monetary policy and greater focus on shareholder returns. We anticipate that Hong Kong will come under moderate pressure due to the rising interbank rates and the threat of the U.S./China trade war. We believe the fundamental outlook for Australia and Singapore remains quite solid and the two markets will likely prove more defensive in the near term.

Sincerely,

STEVE SHIGEKAWA, BRIAN C. JONES, GILLIAN TILTMAN AND ANTON KWANG

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

24

Global Real Estate Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NGRIX | |

Class A | | NGRAX | |

Class C | | NGRCX | |

PERFORMANCE HIGHLIGHTS9

| | | | Average Annual Total

Return Ended 08/31/2018 | |

| | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 12/30/2014 | | | 4.98 | % | | | 5.01 | % | |

Class A | | 12/30/2014 | | | 4.47 | % | | | 4.61 | % | |

Class C | | 12/30/2014 | | | 3.81 | % | | | 3.85 | % | |

With Sales Charge | |

Class A | | | | | –1.54 | % | | | 2.94 | % | |

Class C | | | | | 2.81 | % | | | 3.85 | % | |

Index | |

| FTSE EPRA/NAREIT Developed Index (Net)1,15 | | 5.49 | % | | | 3.90 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 10.97%, 11.23% and 12.10% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.01%, 1.37% and 2.12% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

25

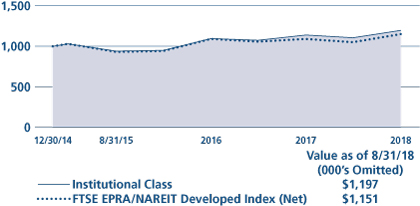

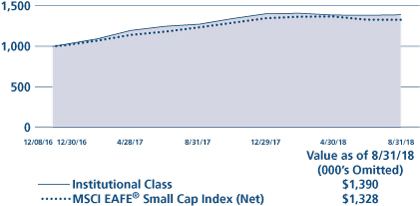

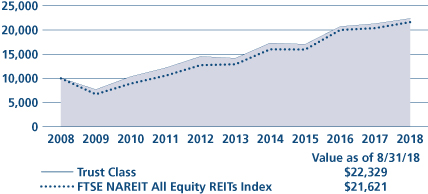

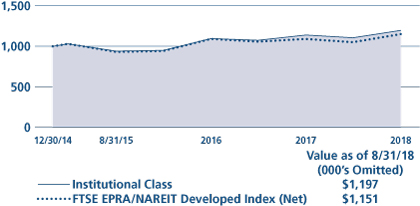

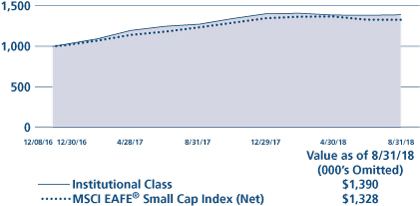

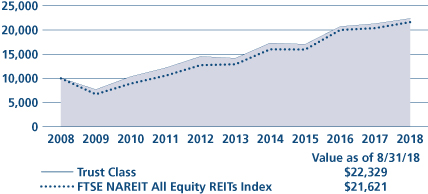

Global Real Estate Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

26

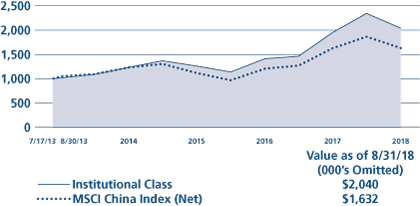

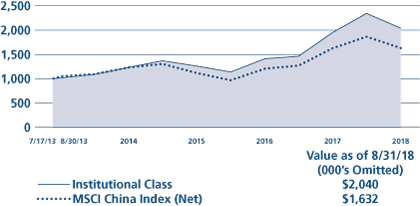

Greater China Equity Fund Commentary25 (Unaudited)

Neuberger Berman Greater China Equity Fund Institutional Class generated a 4.37% total return for the fiscal year ended August 31, 2018, outperforming its benchmark, the MSCI China Index (Net) (the Index), which returned 0.22% over the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Over the past 12 months, the China equity markets were quite volatile. In September 2017, profit taking led to markets consolidating, and investor sentiment was weighed down by Standard & Poor's downgrading China and Hong Kong's sovereign credit ratings, tighter restrictions on the sale of certain real property and escalating geopolitical risks. However, continued supply side reforms and the People's Bank of China (PBoC) eliminating foreign exchange derivative sales reserve requirements supported markets by month-end. Positive momentum continued into October due to policy support expectations from the 19th National Congress of the Communist Party of China, the State Council's supportive decision to cut reserve requirement ratio (RRR) aimed at small and medium enterprises financing, the PBoC's announcement of RRR reduction for certain banks and solid corporate earnings in the third quarter of 2017. News that the State Council is planning a pilot program for full convertibility of domestic shares to H-shares and announcements of significant business deals concluded with the U.S. after President Trump's visit to China led markets to trade higher in November, but they corrected sharply later as sentiment was impacted by purging of online microlenders, reduction of import tariffs, and property tightening policies. Towards year-end, despite concerns over liquidity, the PBoC raising rates for certain instruments and the U.S. Federal Reserve's third rate hike, China equity markets ended the year on a high note primarily due to the removal of uncertainty regarding U.S. tax reforms and bond yields surging after hawkish comments from European Central Bank policymakers. In January, both the domestic China A-shares market and offshore Hong Kong market rallied as macroeconomic indicators continued to reflect stable growth, most notably GDP growth of 6.9% for 2017. China equity markets corrected in February due to profit taking following January's markets rallying, options hedging and liquidity concerns. Macroeconomic data indicated mixed signals, and investors remained cautious ahead of earnings season and China's "Two Sessions" to be held in March.

Market performance continued to decline in March despite the State Council's approval of the China Securities Regulatory Commission's China depository receipts mechanism plans, and upcoming initial public offerings (IPOs) by Chinese tech unicorns as investors were concerned over trade war tensions between China and the U.S. Sentiment continued to weaken in April, as markets succumbed to pressure due to the U.S. ban on ZTE and investigations of Huawei. Towards month-end, the PBoC cut RRR for certain banks, but investors were cautious amid the ongoing earnings season. In May, investors took a risk-off position due to China-U.S. trade talks, U.S.-North Korea Summit developments, concerns over liquidity from heavy IPO pipeline in Hong Kong and the Eurozone geopolitical issues, but both the onshore and offshore markets pared some losses later in the month as the focus shifted towards A-shares inclusion into the MSCI Emerging Market Index ("MSCI"). Markets declined sharply in June primarily due to escalating trade war tensions. Despite A-shares having been effectively included in the MSCI and the PBoC continuing to cut RRR, sentiment was further weighed down by the continued depreciation of the Chinese Yuan (CNY), concerns over liquidity tightening, a hawkish Federal Open Market Committee, and weaker China economic data. China equity markets further consolidated in July from escalating Sino-U.S. trade tensions, CNY depreciation, weaker than expected Purchasing Managers Index and trade data, ongoing deleveraging, and tightening property policies. Later in the month, markets rebounded to pare some losses after the government announced a range of targeted measures to support the economy, including a shift to fiscal stimulus and credit easing. Weak performance of the markets extended into August despite positive company earnings results and a stabilizing CNY, but both onshore and offshore markets corrected towards month-end as trade tensions and emerging markets currency risks escalated once again.