Neuberger Berman

Equity Funds

Investor Class Shares

Trust Class Shares

Advisor Class Shares

Institutional Class Shares

Dividend Growth Fund

Emerging Markets Equity Fund

Equity Income Fund

Focus Fund

Genesis Fund

Global Equity Fund

Global Real Estate Fund

Greater China Equity Fund

Guardian Fund

International Equity Fund

Class A Shares

Class C Shares

Class R3 Shares

Class R6 Shares

International Select Fund

International Small Cap Fund

Intrinsic Value Fund

Large Cap Value Fund

Mid Cap Growth Fund

Mid Cap Intrinsic Value Fund

Multi-Cap Opportunities Fund

Real Estate Fund

Small Cap Growth Fund

Socially Responsive Fund

Value Fund

Annual Report

August 31, 2017

Contents

THE FUNDS

President's Letter | | | 1 | | |

PORTFOLIO COMMENTARY | |

Dividend Growth Fund | | | 2 | | |

Emerging Markets Equity Fund | | | 5 | | |

Equity Income Fund | | | 9 | | |

Focus Fund | | | 12 | | |

Genesis Fund | | | 15 | | |

Global Equity Fund | | | 19 | | |

Global Real Estate Fund | | | 22 | | |

Greater China Equity Fund | | | 25 | | |

Guardian Fund | | | 29 | | |

International Equity Fund | | | 32 | | |

International Select Fund | | | 35 | | |

International Small Cap Fund | | | 38 | | |

Intrinsic Value Fund | | | 42 | | |

Large Cap Value Fund | | | 45 | | |

Mid Cap Growth Fund | | | 48 | | |

Mid Cap Intrinsic Value Fund | | | 51 | | |

Multi-Cap Opportunities Fund | | | 54 | | |

Real Estate Fund | | | 57 | | |

Small Cap Growth Fund | | | 60 | | |

Socially Responsive Fund | | | 63 | | |

Value Fund | | | 67 | | |

FUND EXPENSE INFORMATION | | | 77 | | |

SCHEDULE OF INVESTMENTS | |

Dividend Growth Fund | | | 81 | | |

Emerging Markets Equity Fund | | | 83 | | |

Positions by Industry | | | 85 | | |

Equity Income Fund | | | 87 | | |

Focus Fund | | | 91 | | |

Genesis Fund | | | 94 | | |

Global Equity Fund | | | 97 | | |

Positions by Industry | | | 99 | | |

Global Real Estate Fund | | | 101 | | |

Positions by Sector | | | 103 | | |

Greater China Equity Fund | | | 105 | | |

Guardian Fund | | | 107 | | |

International Equity Fund | | | 112 | | |

Positions by Industry | | | 114 | | |

International Select Fund | | | 116 | | |

Positions by Industry | | | 118 | | |

International Small Cap Fund | | | 120 | | |

Positions by Industry | | | 122 | | |

Intrinsic Value Fund | | | 124 | | |

Large Cap Value Fund | | | 127 | | |

Mid Cap Growth Fund | | | 130 | | |

Mid Cap Intrinsic Value Fund | | | 133 | | |

Multi-Cap Opportunities Fund | | | 136 | | |

Real Estate Fund | | | 138 | | |

Small Cap Growth Fund | | | 140 | | |

Socially Responsive Fund | | | 142 | | |

Value Fund | | | 144 | | |

FINANCIAL STATEMENTS | | | 147 | | |

FINANCIAL HIGHLIGHTS (ALL CLASSES)/PER SHARE DATA | |

Dividend Growth Fund | | | 211 | | |

Emerging Markets Equity Fund | | | 211 | | |

Equity Income Fund | | | 213 | | |

Focus Fund | | | 215 | | |

Genesis Fund | | | 217 | | |

Global Equity Fund | | | 219 | | |

Global Real Estate Fund | | | 221 | | |

Greater China Equity Fund | | | 221 | | |

Guardian Fund | | | 223 | | |

International Equity Fund | | | 225 | | |

International Select Fund | | | 229 | | |

International Small Cap Fund | | | 231 | | |

Intrinsic Value Fund | | | 231 | | |

Large Cap Value Fund | | | 233 | | |

Mid Cap Growth Fund | | | 235 | | |

Mid Cap Intrinsic Value Fund | | | 239 | | |

Multi-Cap Opportunities Fund | | | 241 | | |

Real Estate Fund | | | 241 | | |

Small Cap Growth Fund | | | 245 | | |

Socially Responsive Fund | | | 247 | | |

Value Fund | | | 249 | | |

Reports of Independent Registered Public Accounting Firms | | | 258 | | |

Directory | | | 261 | | |

Trustees and Officers | | | 262 | | |

Proxy Voting Policies and Procedures | | | 271 | | |

Quarterly Portfolio Schedule | | | 271 | | |

Board Consideration of the Management and

Sub-Advisory Agreement | | | 272 | | |

Notice to Shareholders | | | 274 | | |

The "Neuberger Berman" name and logo and "Neuberger Berman Investment Advisers LLC" name are registered service marks of Neuberger Berman Group LLC. The individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Investment Advisers LLC, an affiliate of Neuberger Berman BD LLC, distributor, member FINRA. ©2017 Neuberger Berman BD LLC, distributor. All rights reserved.

Dear Shareholder,

Stocks surged globally in the first eight months of 2017, as a period of volatility and limited returns driven by the 2016 U.S. election gave way to optimism around supportive economic data.

With global economic data remaining steady both in the U.S. and overseas, investors became more sanguine. Even given the period's weak start, the S&P 500® Index advanced over 16% for the fiscal year ended August 31, 2017, just below developed international markets' returns. Emerging markets (measured by the MSCI Emerging Markets Index) outperformed significantly, up nearly 25%, as risk appetite grew on positive economic and earnings news. Cyclical sectors outperformed their defensive counterparts as part of this trend.

Focusing on the U.S., markets set new records several times despite serious geopolitical tensions, rising interest rates, persistent upheaval at the White House, and gridlock in Washington, D.C., placing meaningful reforms in doubt.

Taking a look at the data, U.S. GDP growth continued on its slow path at an annualized 3.0% in second quarter 2017. Although business and consumer confidence have improved, this has not yet translated into a significant uptick in economic growth. However, there appear to be some clear positives. Strong consumer balance sheets and moderate wage inflation, coupled with lower energy prices, are likely to continue to support consumer spending. An increase in commodity prices off of their 2015 lows has meant an increase in hiring in the mining and energy fields. In addition, U.S. manufacturers with overseas customers have benefited as the U.S. dollar has weakened from 2016 levels (in part due to the gridlock in Washington, D.C.).

Economic data weakened as this period closed, likely in response to Hurricane Harvey, which hit Houston, America's fourth largest city, on August 25th. August data shows an unanticipated decline in retail sales, along with the year's first drop in industrial output—both at least in part due to the hurricane's impact. While longer-term impacts of Harvey (and other hurricanes in Florida and the Caribbean) remain unknown, there will be winners and losers, ranging from retail and insurance to auto and appliance replacement and construction. Oil prices have also increased since Harvey, both on demand and damage to oil refineries.

Looking ahead, while political concerns have taken a back seat for investors—not just in the U.S., but also in France and the UK—geopolitical instability remains high, with tensions between the West and Russia, and North Korea among the most alarming. Absent an unforeseen shock, however, our expectations are generally positive.

Given both uncertainties and low equity correlations, we anticipate the continuation of a market where fund performance will be driven by stock picking skill, research, and discipline. Our managers will continue to work to use any volatility to their advantage as they seek long-term opportunities to outperform.

As always, thank you for your confidence in Neuberger Berman.

Sincerely,

ROBERT CONTI

PRESIDENT AND CEO

NEUBERGER BERMAN MUTUAL FUNDS

1

Dividend Growth Fund Commentary (Unaudited)

Neuberger Berman Dividend Growth Fund Institutional Class generated an 18.54% total return for the fiscal year ended August 31, 2017, outperforming its benchmark, the S&P 500® Index (the "Index"), which rose 16.23% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The Fund seeks to provide capital appreciation and income in-line with its benchmark. We believe this approach identifies companies with strong business models generating cash both to grow their businesses, and provide growing dividend distributions to shareholders.

On the macro front, the U.S. economy was largely supported by strong labor statistics, while improving economic data prompted the Federal Reserve (Fed) to raise its benchmark interest rate three times since December. Furthermore, Fed Chair Janet Yellen set out details to unwind the central bank's massive $4.5 trillion balance sheet, signaling the strength of the world's largest economy.

During the twelve month timeframe, the market pushed further into record territory as "growth" stocks outperformed "value" by a wide margin. Overall, nine out of eleven sectors posted gains with Information Technology, Financials and Industrials benefitting the most.

The Fund generated the bulk of its returns from its approximately 21% Information Technology average allocation during the fiscal year. Stock selection within this space was positive. Apple was one of the Fund's top contributors, as investors bid-up the tech giant leading up to its highly anticipated iPhone X product launch. In contrast, telecom operator Frontier Communications experienced selling pressures and proved to be our greatest detractor. Ultimately, this security was sold after revisiting our initial investment thesis.

On the commodity front, our holdings delivered mixed results. Within Materials, stock selection was generally strong as Canada's Lundin Mining was our top overall contributor. This business enjoys an international footprint, producing copper, nickel and zinc. During the fiscal year, strong copper prices were a tailwind as the red metal reached its highest level in nearly three years, supported in-part by a weaker U.S. dollar, and improving Chinese economic data. Elsewhere, the Fund's Energy exposure hindered results as Devon Energy moved in lockstep with lower oil prices. As it stands, the Fund ended the fiscal year slightly overweight Energy and our diverse holdings remain well positioned in the event of an Energy rebound.

Elsewhere, banking stocks were also key contributors as Citizens Financial was among our top performers. This stock traded at 0.6x book value at the time of purchase, and still trades at a discount to most peers. As we enter the next phase of the business cycle, Financials remain a critical element to portfolio construction in what is likely a rising rate environment.

Overall, the Fund's exposure to Health Care detracted from relative returns. Israeli based Teva Pharmaceutical modestly dampened returns, and was ultimately sold in favor of opportunities elsewhere.

Looking ahead, we believe the Fund remains positioned for future interest rate hikes—despite muted expectations for further tightening. Elsewhere, political gridlock could test investor confidence in the months to come. However, we remain optimistic that elected officials can embrace a measured approach when addressing complex issues, including tax reforms. Under this scenario, we believe any headwinds on the policy front could support a rotation from "growth" to "value". In short, we remain steadfast in our commitment to focusing on businesses that have been exhibiting growing free cash flow and capital allocation policies prioritizing dividend increases. We feel stocks exhibiting these characteristics have the potential to provide a cushion in times of market stress for risk-adverse investors.

Sincerely,

DAVID A. KIEFER AND WILLIAM D. HUNTER

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

2

Dividend Growth Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NDGIX | |

Class A | | NDGAX | |

Class C | | NDGCX | |

Class R6 | | NRDGX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Consumer Discretionary | | | 12.8 | % | |

Consumer Staples | | | 6.7 | | |

Energy | | | 7.1 | | |

Financials | | | 14.8 | | |

Health Care | | | 7.4 | | |

Industrials | | | 10.5 | | |

Information Technology | | | 18.9 | | |

Materials | | | 8.6 | | |

Real Estate | | | 1.6 | | |

Utilities | | | 1.5 | | |

Short-Term Investment | | | 10.1 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS

| | | | | Average Annual

Total Return

Ended 08/31/2017 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 12/15/2015 | | | 18.54 | % | | | 17.42 | % | |

Class A | | 12/15/2015 | | | 18.10 | % | | | 17.04 | % | |

Class C | | 12/15/2015 | | | 17.47 | % | | | 16.12 | % | |

Class R6 | | 12/15/2015 | | | 18.60 | % | | | 17.45 | % | |

With Sales Charge | |

Class A | | | | | | | 11.28 | % | | | 13.07 | % | |

Class C | | | | | | | 16.47 | % | | | 16.12 | % | |

Index | |

| S&P 500® Index1,15 | | | | | | | 16.23 | % | | | 14.84 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 2.24%, 2.99%, 3.74% and 2.38% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.71%, 1.07%, 1.82% and 0.64% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for fiscal year 2016 have been restated to reflect actual expenses excluding organization expenses incurred during that period. The expense ratios for the annual period ended August 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

3

Dividend Growth Fund (Unaudited)

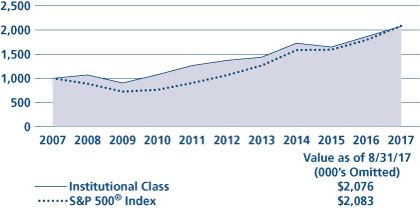

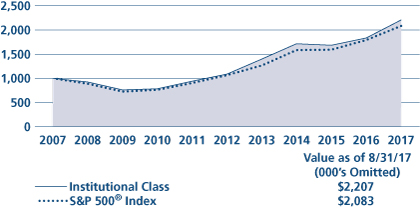

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

4

Emerging Markets Equity Fund Commentary (Unaudited)

Neuberger Berman Emerging Markets Equity Fund Institutional Class generated a total return of 24.76% for the fiscal year ended August 31, 2017, outperforming its benchmark, the MSCI Emerging Markets (EM) Index (Net) (the "Index"), which reported returns of 24.53% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Emerging markets equities solidly outperformed both developed international and U.S. equities this period. Negative sentiment in late 2016, driven by apprehension about the U.S. election (including anti-China and trade protectionism talk) caused EM equities to sell off briefly. However, as 2017 began, they rebounded decisively as an upsurge in EM earnings expectations and positive GDP revisions, inflows from investors with an appetite for higher risk/reward assets, and positive global growth trends overshadowed any concerns about rising U.S. interest rates.

Compared to the Index as a whole, the Information Technology (IT), Materials, and Financials sectors outperformed with the rotation to more cyclical areas. Defensive segments, such as Health Care, Utilities, and Consumer Staples, lagged. By country, Poland, Hungary, and Greece were top performers. At the other end of the spectrum, Pakistan (which was reclassified as an EM by MSCI at the end of May and added to the Index), Egypt and Qatar posted losses.

The Fund's outperformance was driven primarily by stock selection, with IT, Financials, Consumer Discretionary and Consumer Staples holdings most significant. By country, holdings from within China, Korea, and Taiwan strongly benefited Fund performance.

Top contributors included Tencent, the Chinese Internet consumer services giant, which continued to post strong top-line growth; Chinese electronics and lens company, Sunny Optical, which previewed new 3-D camera technologies; and Samsung, the Korean consumer electronics and semiconductor giant, on strong earnings and a perception of improving corporate governance.

On average, overweight positions in both Consumer Staples and Health Care, and stock selection within Telecommunication Services limited relative results. Our Philippines, UK-based and Indonesian holdings were weakest by country.

Individual detractors included PT Matahari, the Indonesian retailer, which disappointed on sales growth, but continues to invest in their properties; Ulker, the Turkish confectioner, which sold off on fears about weak Turkish consumer sentiment and subdued international demand; and Hikma Pharmaceuticals, the UK-listed Jordanian firm, which announced a delay in a key generic drug launch. We continue to own the names, believing they offer opportunity over the longer term.

While EM equities maintained their upward trajectory as investor flows continued to buoy markets and companies enjoyed earning upgrades, we are vigilant regarding several areas. First, the ongoing bribery scandal in Brazil potentially puts current reform initiatives at risk. We have not made any major trades but are closely monitoring the situation. Our second concern is the high level of debt permeating the Chinese economy, although we believe rising profitability for large corporates could aid their ability to service the debts investors are worried about.

Looking to the remainder of the year, we continue to prefer sectors tied to local market demand over global cyclically driven segments of the market. By sector, the largest portfolio overweights versus the Index are in Consumer Staples and IT. We believe both provide diverse opportunity sets. This overweight has been at the expense of the Financials and Energy sectors, which are the two largest underweights versus the Index. China remains the portfolio's largest underweight, in favor of a variety of smaller markets such as Mexico, where we have found attractive opportunities.

5

We are pleased with the quality and positioning of the current portfolio, as well as with the performance of our holdings this period. We anticipate that stock picking skills and research should continue to be advantageous as the year progresses.

Sincerely,

CONRAD SALDANHA

PORTFOLIO MANAGER

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

6

Emerging Markets Equity Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NEMIX | |

Class A | | NEMAX | |

Class C | | NEMCX | |

Class R3 | | NEMRX | |

Class R6 | | NREMX | |

PERFORMANCE HIGHLIGHTS9

| | | | | Average Annual Total Return

Ended 08/31/2017 | |

| | | Inception

Date | | 1 Year | | 5 Years | | Life of

Fund | |

AT NAV | |

Institutional Class | | 10/08/2008 | | | 24.76 | % | | | 6.49 | % | | | 9.93 | % | |

Class A | | 10/08/2008 | | | 24.51 | % | | | 6.24 | % | | | 9.67 | % | |

Class C | | 10/08/2008 | | | 23.57 | % | | | 5.43 | % | | | 8.85 | % | |

| Class R310 | | 06/21/2010 | | | 23.94 | % | | | 5.79 | % | | | 9.34 | % | |

| Class R622 | | 03/15/2013 | | | 24.90 | % | | | 6.57 | % | | | 9.98 | % | |

With Sales Charge | |

Class A | | | | | 17.36 | % | | | 4.99 | % | | | 8.94 | % | |

Class C | | | | | 22.57 | % | | | 5.43 | % | | | 8.85 | % | |

Index | | | | | | | | | |

| MSCI Emerging Markets Index (Net)1,15 | | | | | 24.53 | % | | | 5.30 | % | | | 8.36 | % | |

| MSCI Emerging Markets Index1,15 | | | | | 24.99 | % | | | 5.67 | % | | | 8.73 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 1.44%, 1.82%, 2.51%, 2.06% and 1.33% for Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.26%, 1.51%, 2.26%, 1.92% and 1.19% for Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

7

Emerging Markets Equity Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

8

Equity Income Fund Commentary (Unaudited)

Neuberger Berman Equity Income Fund Institutional Class generated an 11.56% total return for the fiscal year ended August 31, 2017, underperforming its benchmark, the S&P 500® Index (the "Index"), which posted a 16.23% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The Fund strives to deliver a total return between stocks and bonds with limited volatility. This portfolio is diversified among dividend-paying stocks and convertible bonds, selected through extensive analysis of cash flow prospects, with the ability to sustain and grow dividends.

On the macro front, the U.S. economy was largely supported by strong labor statistics; while improving economic data prompted the Federal Reserve (Fed) to raise its benchmark interest rate three times since December. Furthermore, Fed Chair, Janet Yellen set out details to unwind the central bank's massive $4.5 trillion balance sheet, signaling the strength of the world's largest economy.

During the twelve month timeframe, the market pushed further into record territory as "growth" stocks outperformed "value" by a wide margin. Overall, nine out of eleven sectors posted gains with Information Technology (IT), Financials and Industrials benefitting the most.

Overall, the IT sector made the largest contribution to the Fund's absolute returns. The Fund's approximately 11% allocation to IT represents mature businesses with reduced cyclicality and attractive valuations. Within this space, flash memory producer Western Digital proved to be our top performer, with results driven by supply/demand imbalances. In our view, strong free cash flow metrics will likely be a tailwind for dividend growth potential. In contrast, QUALCOMM detracted from results as ongoing legal claims weighed on the chipmaker.

On the consumer front, Best Buy was among our top contributors. While e-commerce has gained market share from brick and mortar outlets—Best Buy has effectively bucked this trend becoming the destination of choice for big ticket items such as TVs and home appliances. Management has mitigated headwinds from online retailers via its price match guarantee and during the period its shares surged to an all-time high. In reaction, the Fund reduced exposure as Best Buy reached our price target.

Elsewhere, the Fund's approximately 12% allocation to Financials remains a critical element to portfolio construction, acting as a counterbalance to stocks with inverse correlations to interest rates. JPMorgan Chase, the largest U.S. bank by assets, rose to the top as investors supported its shares in the wake of the presidential election. As we enter the next phase of the business cycle, we feel several of our asset sensitive banks can benefit from an improving economic landscape whereby rising interest rates and potential regulatory reforms work in concert for this sector.

Within Energy, Ensco Plc. and Occidental Petroleum dampened returns, moving in lockstep with lower oil prices. They were both ultimately sold with the proceeds recycled elsewhere. As it stands, we believe the Fund with its diverse holdings is well positioned in the event of a rebound across the energy complex.

The Fund's use of written options contributed positively to performance during the period.

Looking ahead, we believe the Fund remains positioned for future interest rate hikes—despite muted expectations for further tightening. Elsewhere, political gridlock could test investor confidence in the months to come. However, we remain optimistic that elected officials can embrace a measured approach when addressing complex issues, including tax reforms. Under this scenario, we believe any headwinds on the policy front could support a rotation from "growth" to "value". In short, we remain steadfast in our commitment, focusing on businesses that have been exhibiting healthy free cash flow growth funding attractive dividend yields. We feel stocks with these characteristics have the potential to provide a cushion in times of market stress for risk-adverse investors.

Sincerely,

RICHARD LEVINE AND SANDY POMEROY

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

9

Equity Income Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NBHIX | |

Class A | | NBHAX | |

Class C | | NBHCX | |

Class R3 | | NBHRX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Consumer Discretionary | | | 2.5 | % | |

Consumer Staples | | | 5.5 | | |

Energy | | | 6.6 | | |

Financials | | | 11.5 | | |

Health Care | | | 8.1 | | |

Industrials | | | 7.7 | | |

Information Technology | | | 10.6 | | |

Materials | | | 5.8 | | |

Real Estate | | | 19.2 | | |

Utilities | | | 14.2 | | |

Convertible Bonds | | | 4.4 | | |

Short-Term Investment | | | 3.9 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS9

| | | | | Average Annual Total Return

Ended 08/31/2017 | |

| | | Inception

Date* | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

| Institutional Class13 | | 06/09/2008 | | | 11.56 | % | | | 8.65 | % | | | 7.58 | % | | | 7.71 | % | |

| Class A13 | | 06/09/2008 | | | 11.17 | % | | | 8.24 | % | | | 7.19 | % | | | 7.35 | % | |

| Class C13 | | 06/09/2008 | | | 10.34 | % | | | 7.44 | % | | | 6.48 | % | | | 6.69 | % | |

| Class R313 | | 06/21/2010 | | | 10.88 | % | | | 7.93 | % | | | 7.06 | % | | | 7.23 | % | |

With Sales Charge | |

| Class A13 | | | | | | | 4.75 | % | | | 6.97 | % | | | 6.56 | % | | | 6.77 | % | |

| Class C13 | | | | | | | 9.34 | % | | | 7.44 | % | | | 6.48 | % | | | 6.69 | % | |

Index | |

| S&P 500® Index1,15 | | | | | | | 16.23 | % | | | 14.34 | % | | | 7.61 | % | | | 7.90 | % | |

*The performance data for each class includes the performance of the Fund's oldest share class, Trust Class, from November 2, 2006 through June 9, 2008. The performance data for Class R3 also includes the performance of the Fund's Institutional Class from June 9, 2008 through June 21, 2010. See endnote 13 for information about the effects of the different fees paid by each class.

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 0.70%, 1.08%, 1.82% and 1.34% for Institutional Class, Class A, Class C and Class R3 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios for the annual period ended August 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

10

Equity Income Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT13

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

11

Focus Fund Commentary (Unaudited)

Neuberger Berman Focus Fund Investor Class generated a 16.81% total return for the fiscal year ended August 31, 2017, outperforming its benchmark, the S&P 500® Index (the "Index"), which provided a 16.23% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The bull market in U.S. equities persisted over the fiscal year with indexes breaking record levels throughout the period. The initial run-up in stocks occurred in the wake of President Trump's election victory, as investors grew increasingly hopeful that a new pro-business regime was forming in Washington, D.C. The stock market also benefited during the earlier months from a rise in oil prices after OPEC reached an agreement to curb production activity. Yet over the course of the year, the election afterglow faded for equities as news reports described turmoil within the new administration and policy changes faced legislative gridlock. Various geopolitical issues also surfaced and caused occasional pullbacks in the market. Overall, however, investor optimism remained steadfast in light of the more stable global economy and strong corporate earnings, and the U.S. Federal Reserve reaffirmed this sentiment as it continued to gradually increase interest rates in light of the healthier macro picture.

The best performing areas of the S&P 500 during the period were the Information Technology (IT) and Financials sectors, both of which benefited from the economic recovery and other macro factors. Energy was the weakest area of the market during the period due to a fall in oil prices, and the Telecommunication Services, Real Estate and Consumer Staples segments also underperformed as investors sought higher returns in more cyclical areas of the market.

The greatest contribution to Fund performance relative to the S&P 500 came from the Telecommunication Services sector. Specifically, our investment in T-Mobile yielded strong returns as the company gained market share, leading to robust earnings and revenue growth. IT also provided a significant lift to relative performance due in large part to our exposure to data storage provider Western Digital (WDC). We believe the future for WDC looks bright as it continues to grow its footprint in the ever-expanding flash memory industry through strategic acquisitions and internal initiatives. The largest detraction from relative performance stemmed from negative stock selection in Health Care. This was mainly due to Teva Pharmaceuticals (TEVA), which declined in the first half of the year alongside industry peers due to mounting pressure from a Federal investigation into possible illegal drug pricing practices. We exited our position in TEVA during the period. Financials was another area of relative loss for the Fund, as our holdings did not fare quite as well as those in that sector of the Index. Our lack of exposure to the capital markets industry had an adverse impact, and we were hurt within the insurance area as we owned Willis Tower Watson (which was sold during the period) and built up our position in American International Group.

The Fund's aggregate use of purchased and written options contributed positively to performance during the period.

We expect the domestic economy to continue progressing steadily while inflation remains subdued, which we believe is an auspicious environment for continued strength in corporate profits and further appreciation in stocks. However, as equities continue to climb, valuations are stretching, which could leave the market vulnerable to a sell-off if earnings fall short of expectations. The economic impact of tightening monetary policy also remains uncertain and could throw the stock market off course. We believe that our bottom-up investment strategy is the best way to navigate the current environment. We therefore conduct extensive fundamental research on individual stocks to create a portfolio that we believe can generate positive returns over an economic cycle.

Sincerely,

TIMOTHY CREEDON AND DAVID LEVINE

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

12

TICKER SYMBOLS

Investor Class | | NBSSX | |

Trust Class | | NBFCX | |

Advisor Class | | NBFAX | |

Institutional Class | | NFALX | |

Class A | | NFAAX | |

Class C | | NFACX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Consumer Discretionary | | | 13.2 | % | |

Consumer Staples | | | 8.0 | | |

Energy | | | 5.9 | | |

Financials | | | 17.7 | | |

Health Care | | | 14.9 | | |

Industrials | | | 11.1 | | |

Information Technology | | | 17.7 | | |

Materials | | | 3.4 | | |

Telecommunication Services | | | 4.4 | | |

Utilities | | | 2.6 | | |

Short-Term Investment | | | 1.1 | | |

Options Purchased | | | 0.0 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS8

| | | | | Average Annual Total Return

Ended 08/31/2017 | |

| | | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

Investor Class | | 10/19/1955 | | | 16.81 | % | | | 13.88 | % | | | 6.47 | % | | | 10.49 | % | |

| Trust Class3 | | 08/30/1993 | | | 16.61 | % | | | 13.66 | % | | | 6.25 | % | | | 10.47 | % | |

| Advisor Class4 | | 09/03/1996 | | | 16.51 | % | | | 13.50 | % | | | 6.07 | % | | | 10.41 | % | |

| Institutional Class5 | | 06/21/2010 | | | 17.04 | % | | | 14.07 | % | | | 6.61 | % | | | 10.51 | % | |

| Class A19 | | 06/21/2010 | | | 16.58 | % | | | 13.65 | % | | | 6.33 | % | | | 10.47 | % | |

| Class C19 | | 06/21/2010 | | | 15.76 | % | | | 12.84 | % | | | 5.78 | % | | | 10.37 | % | |

With Sales Charge | |

| Class A19 | | | | | 9.84 | % | | | 12.31 | % | | | 5.71 | % | | | 10.36 | % | |

| Class C19 | | | | | 14.95 | % | | | 12.84 | % | | | 5.78 | % | | | 10.37 | % | |

Index | |

| S&P 500® Index1,15 | | | | | 16.23 | % | | | 14.34 | % | | | 7.61 | % | | | 10.17 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 0.94%, 1.11%, 1.26%, 0.76%, 1.15%, and 1.90% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.75%, 1.11%, and 1.86% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

13

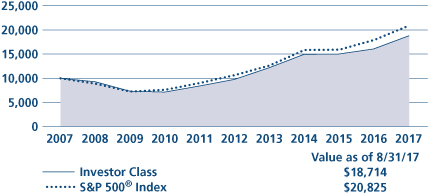

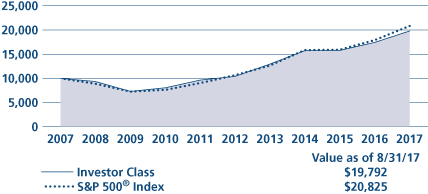

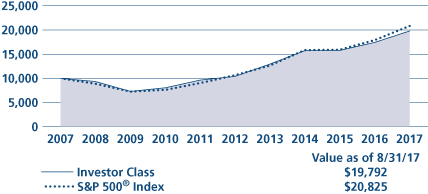

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

14

Genesis Fund Commentary (Unaudited)

Neuberger Berman Genesis Fund Investor Class generated a 10.19% total return for the fiscal year ended August 31, 2017, underperforming its benchmark, the Russell 2000® Index (the "Index"), which provided a 14.91% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

After some initial weakness, the U.S. stock market moved sharply higher over the last 10 months of the reporting period. This turnaround was partially driven by corporate profits that were generally better than expected and hopes for improving growth and less regulation under the Trump administration. The overall U.S. stock market, as measured by the S&P 500® Index, rose 16.23% for the 12-month period. Small-cap stocks also produced strong results, as the Russell 2000 Index gained 14.91%.

The Fund generated a positive absolute return during the reporting period but lagged the benchmark, driven by stock selection. The largest detractor was our holdings in the Financials sector. In particular, our more growth-oriented bank holdings underperformed, reflecting concerns around sustainability of growth and/or credit risk. Stock selection in the Materials sector was also a headwind for results as more cyclical, lower quality companies outperformed "Steady Eddie" type companies that we favor. Elsewhere, holdings in the Health Care sector were negative for relative results. The relatively strong performance of our investments in the sector was overshadowed by the outstanding performance of the benchmark's biotechnology names. Turning to individual stocks owned by the Fund, Tractor Supply Co., RLI Corp., and Manhattan Associates, Inc. performed poorly. Tractor Supply operates retail stores focused on supplying the lifestyle needs of recreational farmers and ranchers. The stock underperformed as the company delivered disappointing results due to weakness in energy-related markets and deflationary pressures. RLI Corp. is a specialty property and casualty insurer focused on hard-to-write niche products. The stock underperformed due to lingering adverse development in its transportation segment. Manhattan Associates provides software solutions that enable the efficient movement of goods through the supply chain. The company reported decent results, but this was overshadowed by guidance that implied a slowdown in its business.

On the upside, stock selection in the Energy sector was positive for performance. Within energy services, we believe our holdings possess differentiated technologies, leading market positions, and strong competitive barriers. Within oil and gas production, we believe our holdings are among the most efficient producers in the industry. Elsewhere, stock selection in the Information Technology and Consumer Staples sectors were additive for results. A number of the Fund's individual holdings also performed well, including Cognex Corp., Rollins, Inc., and Rogers Corp. Cognex Corp. is a global leader in machine vision systems and software that enable high-precision and high-speed manufacturing. The stock rallied as the company delivered stronger-than-expected earnings results and provided a constructive outlook. Rollins, Inc. is a leading provider of pest and termite control. The stock performed well as the company reported revenue and earnings growth that exceeded expectations. Rogers Corp. manufactures and markets specialty materials and components for applications in the communications, computer, imaging and transportation markets. The company reported excellent results and provided guidance that implied continued strong demand for its products.

Sector allocation, overall, modestly contributed to relative performance during the period. In particular, having no exposure to real estate investment trusts (REITs) was beneficial. We do not typically own REITs, as they do not meet our investment criteria. In addition, REITs are often viewed as bond-proxies and they underperformed given rising interest rates and investors' preference for more cyclical companies. Conversely, having no exposure to biotechnology stocks was the largest detractor from performance. We do not typically own biotechnology companies as they do not meet our investment criteria given their speculative nature, a general lack of earnings, and their need to often access the capital markets.

Looking ahead, recent hurricane activity will clearly pose a challenge in gauging near term economic trends. We also feel that a number of uncertainties could impact the market and possibly lead to increased volatility. As discussed in previous commentaries, the Trump pro-growth economic agenda has largely stalled. Against this backdrop, economic growth might remain muted for the foreseeable future. As of now, it is unclear how the recent Federal Reserve's (Fed) interest rate increases will impact financial conditions, loan demand, and overall economic growth. In addition, the Fed's

15

attempts to shrink its balance sheet could introduce another layer of uncertainty. Geopolitical risks also seem to be increasing, with North Korea being a major wildcard. Lastly, numerous unresolved issues remain outside the U.S., including continued challenges in the European banking sector. Based on our views, we believe that the stocks that we own in the portfolio represent high quality businesses that should perform relatively well. We will continue to maintain a diversified portfolio that emphasizes companies that have consistently generated solid free cash flow and high returns on capital.

Sincerely,

JUDITH M. VALE AND ROBERT W. D'ALELIO

PORTFOLIO CO-MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

16

TICKER SYMBOLS

Investor Class | | NBGNX | |

Trust Class | | NBGEX | |

Advisor Class | | NBGAX | |

Institutional Class | | NBGIX | |

Class R6 | | NRGSX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Consumer Discretionary | | | 12.0 | % | |

Consumer Staples | | | 6.5 | | |

Energy | | | 2.2 | | |

Financials | | | 16.8 | | |

Health Care | | | 12.9 | | |

Industrials | | | 21.0 | | |

Information Technology | | | 19.9 | | |

Materials | | | 7.3 | | |

Real Estate | | | 0.4 | | |

Short-Term Investments | | | 1.0 | | |

Total | | | 100.0 | % | |

* Derivatives (other than options purchased), if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS

| | | | | Average Annual Total Return

Ended 08/31/2017 | |

| | | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

Investor Class | | 09/27/1988 | | | 10.19 | % | | | 11.91 | % | | | 7.94 | % | | | 12.10 | % | |

| Trust Class3 | | 08/26/1993 | | | 10.11 | % | | | 11.82 | % | | | 7.87 | % | | | 12.08 | % | |

| Advisor Class4 | | 04/02/1997 | | | 9.81 | % | | | 11.51 | % | | | 7.58 | % | | | 11.86 | % | |

| Institutional Class5 | | 07/01/1999 | | | 10.40 | % | | | 12.10 | % | | | 8.15 | % | | | 12.25 | % | |

| Class R623 | | 03/15/2013 | | | 10.47 | % | | | 12.15 | % | | | 8.05 | % | | | 12.14 | % | |

Index | |

| Russell 2000® Index1,15 | | | | | 14.91 | % | | | 13.15 | % | | | 7.38 | % | | | 9.68 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 1.03%, 1.10%, 1.38%, 0.85% and 0.78% for Investor Class, Trust Class, Advisor Class, Institutional Class and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratio for each of Institutional Class and Class R6 includes the class's repayment of expenses previously reimbursed and/or fees previously waived by Management. The expense ratios for the annual period ended August 31, 2017 can be found in the Financial Highlights section of this report.

17

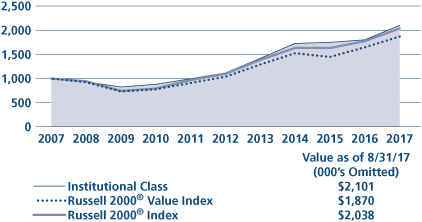

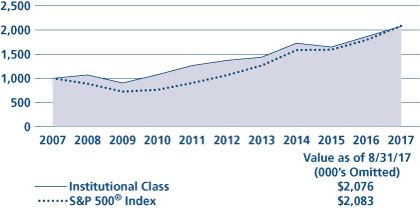

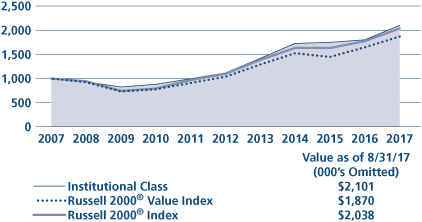

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

18

Global Equity Fund Commentary (Unaudited)

Neuberger Berman Global Equity Fund Institutional Class generated a total return of 15.13% for the fiscal year ended August 31, 2017, underperforming the 17.11% return of its benchmark, the MSCI All Country World Index (Net) (the "Index") for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Global equity markets fared well this fiscal year, as the volatility that limited results in 2016 gave way to a period of rapidly rising returns. As 2017 began, investors' concerns about the U.S. election—including what trade protectionism and nationalism rhetoric might mean for global economic growth—began to lessen. Instead, the focus thus far in 2017 has been on steady to positive economic data from the U.S., Eurozone, UK, Japan, and emerging markets, as well as strong corporate earnings.

Compared to the Index as a whole, Information Technology (IT), Financials, and Materials outperformed, benefiting from a shift in favor of more cyclical areas given economic data. All sectors posted positive returns, but Energy—on weak commodity pricing—and defensive areas such as Telecommunication Services and Consumer Staples underperformed. By country, Austria, Poland and Hungary led the Index; Pakistan (which was reclassified as an emerging market by MSCI at the end of May and added to the Index), Israel, and Egypt were weakest, with each posting losses for the period.

The Fund's underperformance this period resulted from stock selection, particularly within Materials, Energy, and Health Care. By country, holdings from France, Canada and the U.S. underperformed.

Individual detractors included Nielsen, the Netherlands-based TV and consumer ratings service, which announced weak results in retail measurement; Israeli-based Teva, which fell on news that three of its Copaxone patents had been invalidated; and Range Resources, which underperformed with the weak Energy sector. Teva and Range Resources were sold.

Sector allocation, especially our overweight to IT and underweight to Real Estate, along with strong stock selection within IT and Consumer Discretionary was a benefit to relative performance. By country, companies domiciled in China, the Netherlands and Hong Kong had the largest relative benefit.

Top individual contributors for the period included Apple, the U.S. computer/smartphone marketer, which announced better-than-expected earnings from the iPhone 7 launch; Alibaba, the Chinese e-commerce giant, which raised future revenue expectations; and Dutch semiconductor specialist ASML, which benefited from solid earnings announcements.

Global equity markets have been strong calendar year-to-date through the end of August, with the MSCI EAFE® Index and MSCI Emerging Markets Index outperforming U.S. equities by 5.12% and 16.36%, respectively. We think political risk is subsiding in the Eurozone and the European economic recovery is gathering momentum. Equity markets have reacted very positively. While valuations do not look particularly cheap in Europe, we believe they do look reasonable relative to U.S. peers. After several years of lackluster earnings, we are beginning to see the signs of what we think will be a significant rebound in European profits. While profit margins in Europe are still well below their mid 2000's peak, we believe that if the earnings recovery can be sustained, markets could yet move higher.

Given our efforts to achieve a lower risk profile of the Fund relative to the benchmark, it is gratifying that our stock selection is being rewarded and the portfolio is currently outpacing a fast-rising market year-to-date. We continue to look for opportunities across countries, sectors and the market cap spectrum. Given higher overall valuations, particularly in the U.S., we need to retain discipline around the prices we are paying for stocks. However, we continue to find companies that have had attractive secular growth drivers, stable demand and profit profiles, and proven management teams that appear underappreciated and, we believe, offer investors attractive risk/return characteristics.

Sincerely,

BENJAMIN SEGAL AND SAURIN D. SHAH

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

19

Global Equity Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NGQIX | |

Class A | | NGQAX | |

Class C | | NGQCX | |

PERFORMANCE HIGHLIGHTS9

| | | | | Average Annual Total

Return Ended 08/31/2017 | |

| | | Inception

Date | | 1 Year | | 5 Years | | Life of

Fund | |

At NAV | |

Institutional Class | | 06/30/2011 | | | 15.13 | % | | | 9.52 | % | | | 6.48 | % | |

Class A | | 06/30/2011 | | | 14.85 | % | | | 9.15 | % | | | 6.13 | % | |

Class C | | 06/30/2011 | | | 13.89 | % | | | 8.33 | % | | | 5.33 | % | |

With Sales Charge | |

Class A | | | | | | | 8.26 | % | | | 7.86 | % | | | 5.11 | % | |

Class C | | | | | | | 12.89 | % | | | 8.33 | % | | | 5.33 | % | |

Index | |

| MSCI All Country World Index (Net)1,15 | | | | | | | 17.11 | % | | | 10.46 | % | | | 8.05 | % | |

| MSCI All Country World Index1,15 | | | | | | | 17.75 | % | | | 11.06 | % | | | 8.64 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 8.47%, 8.92% and 9.60% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.75%, 1.11% and 1.86% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

20

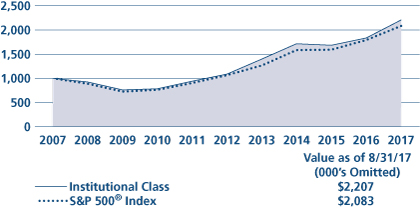

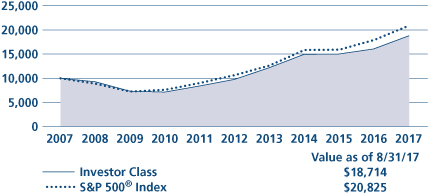

Global Equity Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

21

Global Real Estate Fund Commentary (Unaudited)

Neuberger Berman Global Real Estate Fund Institutional Class generated a 4.01% total return for the fiscal year ended August 31, 2017, outperforming its benchmark, the FTSE EPRA/NAREIT Developed Index (Net) (the "Index"), which generated a –0.10% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

After a poor start, the global stock market rallied sharply and generated strong results during the reporting period. This turnaround was partially driven by corporate profits that were generally better than expected, strengthening global growth and hopes for improving growth and less regulation under the Trump administration. However, expectations for significant shifts in U.S. fiscal policy have been delayed, or the probability of success has been reduced. Comparatively, global real estate investment trusts (REITs) posted weak results during the period.

The Fund outperformed the benchmark during the reporting period. Stock selection was the primary driver of the Fund's results. On the upside, our holdings in the Specialty REITs, Hotel & Lodging REITs and Real Estate Holding & Development sectors were the most additive for returns. The largest detractors from relative performance were the Fund's holdings in the Industrial & Office REITs and Retail REITs sectors and lack of exposure to the Real Estate Services sector. The Fund's positioning from the regional/country perspective was relatively flat for results. From a regional perspective, an overweight to Asia Pacific ex-Japan was the most additive for results. In terms of country positioning, overweights to Hong Kong and Canada were rewarded, whereas an overweight to France and an underweight to Singapore detracted from performance.

We anticipate seeing modest economic growth in the U.S. for the year as a whole. The U.S. Federal Reserve (Fed), as expected, raised interest rates for a second time in calendar year 2017 at its meeting that concluded on June 14. Looking forward, we believe the Fed will likely take a measured approach in terms of further interest rate hikes. After moving higher following the U.S. presidential election, longer-term interest rates have declined thus far in 2017, balancing expectations for improved economic growth, with some level of political uncertainty. However, we believe real estate fundamentals, not interest rates, will be the long-term driver of performance in the REIT market. We think improved business and consumer confidence, potential fiscal stimulus, and modest inflation should be supportive for the U.S. commercial property market. We believe real estate companies with sustainable cash flow and dividend growth have the potential to perform well. Overseas, the UK continues to face uncertainty after the recent general election and as it becomes clear how Brexit will unfold. As a result, we are positive on structural change stories in the UK, but remain very wary of businesses exposed to the London office sector. We remain positive on residential properties in France and Germany, as well as mixed use properties in Sweden. Among the Asia-Pacific markets, we believe positive sentiment on Hong Kong and Singapore real estate stocks show no sign of abating. Meanwhile, the sharp rise in the bond yields of Australia and Japan have dented the performance of local real estate stocks. Long term, we still favor Australia for sector fundamentals that look to us to be healthy as well as Hong Kong for stock valuations that appear to us to be inexpensive.

Sincerely,

STEVE SHIGEKAWA, BRIAN C. JONES, GILLIAN TILTMAN AND ANTON KWANG

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

22

Global Real Estate Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NGRIX | |

Class A | | NGRAX | |

Class C | | NGRCX | |

PERFORMANCE HIGHLIGHTS9

| | | | | Average Annual Total

Return Ended 08/31/2017 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 12/30/2014 | | | 4.01 | % | | | 5.02 | % | |

Class A | | 12/30/2014 | | | 3.71 | % | | | 4.66 | % | |

Class C | | 12/30/2014 | | | 2.96 | % | | | 3.87 | % | |

With Sales Charge | |

Class A | | | | | –2.28 | % | | | 2.37 | % | |

Class C | | | | | 1.96 | % | | | 3.87 | % | |

Index | |

| FTSE EPRA/NAREIT Developed Index (Net)1,15 | | | | | –0.10 | % | | | 3.31 | % | |

| FTSE EPRA/NAREIT Developed Index1,15 | | | | | 0.84 | % | | | 4.22 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 10.93%, 11.32% and 12.04% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.01%, 1.37% and 2.12% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

23

Global Real Estate Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

24

Greater China Equity Fund Commentary25 (Unaudited)

Neuberger Berman Greater China Equity Fund Institutional Class generated a 38.46% total return for the fiscal year ended August 31, 2017, outperforming its benchmark, the MSCI China Index (Net) (the "Index"), which returned 35.00% over the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Over the past 12 months, the China equity markets performed relatively well. In September, profit taking prompted markets to consolidate after first-half interim results season concluded, and the offshore Hong Kong market outperformed the domestic China A-shares market primarily due to southbound flows (flows from mainland China to Hong Kong market using the Stock Connect program) following the China Insurance Regulatory Commission announcement allowing onshore insurers to invest via the Stock Connect program. After the China National Day holidays, China's State Council released guidelines for its debt-to-equity swap program, and the National Development and Reform Commission (NDRC) proposed mixed ownership reform for six state-owned enterprises (SOE). Furthermore, macroeconomic data such as September 2016's Purchasing Managers Index (PMI) and 3Q 2016 Gross Domestic Product (GDP) growth pointed towards a stabilizing economy. In November, the China A-shares market advanced as investors anticipated the Shenzhen-Hong Kong Stock Connect program and the NDRC accelerating infrastructure projects, while the offshore Hong Kong market was impacted by Donald Trump's victory in the U.S. presidential elections that led to uncertainty surrounding foreign policies. Towards calendar year-end 2016, concerns over liquidity and regulators imposing tighter leverage controls, continued renminbi depreciation leading to capital outflow and bond defaults resulted in a significant market correction. China equity markets rallied in January on the back of solid December macroeconomic data, better than expected 4Q 2016 GDP growth and improved investor sentiment due to the government tightening capital controls to alleviate capital outflow pressures. Despite the People's Bank of China (PBoC) raising interbank interest rates in early February, markets continued their upward trend because of January's PMI and trade data, additional supply side reforms, and policy expectations from the upcoming "two sessions" in March.

Market performance remained positive in March despite the U.S. Federal Reserve and PBoC tightening monetary policy, but the offshore Hong Kong market outperformed as company earnings and SOE dividend policies came into focus. In April, the announcement to create the Xiong'an special economic zone in Hebei province led the China equity markets to rally, but the onshore China A-shares market experienced a correction towards month-end despite strong 1Q 2017 GDP growth. In May, investor sentiment improved after China's agreement with the U.S. on trade deals, conclusion of the Belt and Road Forum, and approval of the Hong Kong-China Bond Connect program. Both markets traded higher in June after the China Securities Regulatory Commission tightened regulations on stock selling by major shareholders, MSCI's inclusion of A-shares into their regional and country indices (to be effective in June 2018) and the government's capital markets reforms to streamline mergers & acquisitions approval processes. Strong 2Q 2017 GDP growth and better than expected June macroeconomic indicators led to strong performance of large cap names in July, and the offshore Hong Kong market outperformed due to an increase in southbound volumes. China equity markets corrected briefly in August amid escalating geopolitical tensions in the Korean Peninsula, but rallied later in the month after strong corporate earnings announced for the first half of 2017 and ongoing SOE and supply side reforms lifted investor sentiment.

For the 12-month fiscal period, the Fund's average overweight to Consumer Discretionary and underweight to Telecommunication Services and Energy contributed to performance relative to the Index. In contrast, the Fund's underweight to Information Technology and overweight to Industrials and Real Estate detracted from relative returns. Stock selection had a positive impact in Consumer Discretionary, Consumer Staples and Financials, whereas stock selection had a negative impact in Real Estate.

The Fund continues to focus on companies that have sustainable top and bottom line growth by looking at companies' operating cash flows from their recurring core businesses. As of August 31, 2017, the Fund's largest sector overweight relative to the Index was Financials, followed by Health Care and Industrials. The largest sector underweight was Information Technology, followed by Energy and Telecommunication Services. The Fund's top ten positions comprised more than 55% of total portfolio assets at the end of August.

25