As filed with the Securities and Exchange Commission on October 29, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-00582

NEUBERGER BERMAN EQUITY FUNDS

(Exact Name of Registrant as specified in charter)

c/o Neuberger Berman Management LLC

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

(Address of Principal Executive Offices – Zip Code)

Registrant's telephone number, including area code: (212) 476-8800

Robert Conti

Chief Executive Officer and President

Neuberger Berman Equity Funds

c/o Neuberger Berman Management LLC

605 Third Avenue, 2nd Floor

New York, New York 10158-0180

Arthur C. Delibert, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006-1600

(Names and Addresses of agents for service)

Date of fiscal year end: August 31

Date of reporting period: August 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”) (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

Following is a copy of the annual report transmitted to shareholders pursuant to Rule 30e-1 under the Act.

Neuberger Berman

Equity Funds

Investor Class Shares

Trust Class Shares

Advisor Class Shares

Institutional Class Shares

All Cap Core Fund

Emerging Markets Equity Fund

Equity Income Fund

Focus Fund

Genesis Fund

Global Equity Fund

Global Real Estate Fund

Greater China Equity Fund

Guardian Fund

International Equity Fund

International Select Fund

Class A Shares

Class C Shares

Class R3 Shares

Class R6 Shares

Intrinsic Value Fund

Large Cap Disciplined Growth Fund

Large Cap Value Fund

Mid Cap Growth Fund

Mid Cap Intrinsic Value Fund

Multi-Cap Opportunities Fund

Real Estate Fund

Small Cap Growth Fund

Socially Responsive Fund

Value Fund

World Equity Fund

Annual Report

August 31, 2015

Contents

THE FUNDS

President's Letter | | | 1 | | |

PORTFOLIO COMMENTARY | |

All Cap Core Fund | | | 2 | | |

Emerging Markets Equity Fund | | | 5 | | |

Equity Income Fund | | | 8 | | |

Focus Fund | | | 11 | | |

Genesis Fund | | | 14 | | |

Global Equity Fund | | | 17 | | |

Global Real Estate Fund | | | 20 | | |

Greater China Equity Fund | | | 23 | | |

Guardian Fund | | | 27 | | |

International Equity Fund | | | 30 | | |

International Select Fund | | | 33 | | |

Intrinsic Value Fund | | | 36 | | |

Large Cap Disciplined Growth Fund | | | 39 | | |

Large Cap Value Fund | | | 42 | | |

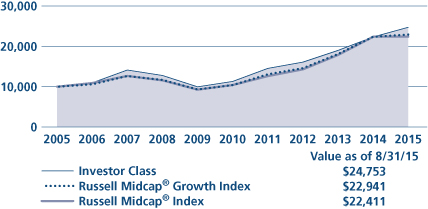

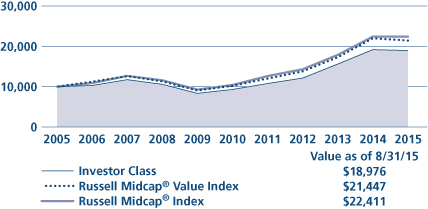

Mid Cap Growth Fund | | | 46 | | |

Mid Cap Intrinsic Value Fund | | | 49 | | |

Multi-Cap Opportunities Fund | | | 52 | | |

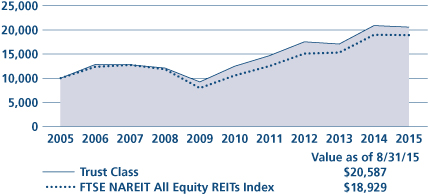

Real Estate Fund | | | 55 | | |

Small Cap Growth Fund | | | 58 | | |

Socially Responsive Fund | | | 61 | | |

Value Fund | | | 64 | | |

World Equity Fund | | | 67 | | |

FUND EXPENSE INFORMATION | | | 76 | | |

SCHEDULE OF INVESTMENTS/TOP TEN EQUITY HOLDINGS | |

All Cap Core Fund | | | 80 | | |

Emerging Markets Equity Fund | | | 81 | | |

Positions by Industry | | | 83 | | |

Equity Income Fund | | | 84 | | |

Focus Fund | | | 86 | | |

Genesis Fund | | | 87 | | |

Global Equity Fund | | | 90 | | |

Positions by Industry | | | 92 | | |

Global Real Estate Fund | | | 93 | | |

Positions by Sector | | | 95 | | |

Greater China Equity Fund | | | 96 | | |

Guardian Fund | | | 98 | | |

International Equity Fund | | | 99 | | |

Positions by Industry | | | 101 | | |

International Select Fund | | | 102 | | |

Positions by Industry | | | 104 | | |

Intrinsic Value Fund | | | 105 | | |

Large Cap Disciplined Growth Fund | | | 107 | | |

Large Cap Value Fund | | | 109 | | |

Mid Cap Growth Fund | | | 110 | | |

Mid Cap Intrinsic Value Fund | | | 112 | | |

Multi-Cap Opportunities Fund | | | 114 | | |

Real Estate Fund | | | 115 | | |

Small Cap Growth Fund | | | 116 | | |

Socially Responsive Fund | | | 118 | | |

Value Fund | | | 120 | | |

World Equity Fund | | | 121 | | |

Positions by Industry | | | 123 | | |

FINANCIAL STATEMENTS | | | 135 | | |

FINANCIAL HIGHLIGHTS (ALL CLASSES)/PER SHARE DATA | |

All Cap Core Fund | | | 203 | | |

Emerging Markets Equity Fund | | | 203 | | |

Equity Income Fund | | | 205 | | |

Focus Fund | | | 207 | | |

Genesis Fund | | | 209 | | |

Global Equity Fund | | | 211 | | |

Global Real Estate Fund | | | 213 | | |

Greater China Equity Fund | | | 213 | | |

Guardian Fund | | | 215 | | |

International Equity Fund | | | 217 | | |

International Select Fund | | | 219 | | |

Intrinsic Value Fund | | | 221 | | |

Large Cap Disciplined Growth Fund | | | 223 | | |

Large Cap Value Fund | | | 225 | | |

Mid Cap Growth Fund | | | 227 | | |

Mid Cap Intrinsic Value Fund | | | 231 | | |

Multi-Cap Opportunities Fund | | | 233 | | |

Real Estate Fund | | | 235 | | |

Small Cap Growth Fund | | | 237 | | |

Socially Responsive Fund | | | 239 | | |

Value Fund | | | 243 | | |

World Equity Fund | | | 243 | | |

| Reports of Independent Registered Public Accounting Firms | | | 250 | | |

Directory | | | 253 | | |

Trustees and Officers | | | 254 | | |

Proxy Voting Policies and Procedures | | | 262 | | |

Quarterly Portfolio Schedule | | | 262 | | |

Board Consideration of the Management and

Sub-Advisory Agreements | | | 263 | | |

Notice to Shareholders | | | 265 | | |

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC. "Neuberger Berman Management LLC" and the individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Management LLC. ©2015 Neuberger Berman Management LLC. All rights reserved.Dear Shareholder,

This report covers a period of contrasts between headlines and realities, at what in our view is likely the start of a return to more historically normal equity market conditions, both in terms of returns and investor behavior.

The S&P 500® Index closed the 12 months ended August 31, 2015 up 0.48%. For most of the period, the market was range-bound with a volatile but positive trend; in August, sentiment shifted sharply and the market gave back most of its gains.

Although the S&P 500 has enjoyed multiple years of above-average returns since 2008's financial crisis, given the combination of a global debt overhang and memories of the crisis, investor sentiment has been unusually susceptible to headline news. This reporting period was no exception. From the Ebola crisis, to the possibility of a "Grexit" from the eurozone, to falling oil and commodities prices and a strengthening U.S. dollar, to the consensus around U.S. Federal Reserve action this year, to August's slower growth, market correction, and currency revaluation in China, investors had no shortage of macro distractions.

What did not make dramatic headlines was continuing healthy corporate and economic news, particularly in the U.S., but also in Europe and Japan. Corporate earnings, profits and cash flows were generally strong this period, outside of the headwinds facing energy- and materials-related companies as well as U.S.-based multinationals from commodity pricing and the strong dollar.

Looking at the U.S. economy, both residential and non-residential construction data have been healthy (the latter being especially significant given the contraction in energy-infrastructure spending amid plunging oil prices), labor markets have continued to tighten, and auto sales have set post-crisis records. Consumer confidence is elevated, and consumer spending has been steady—with real purchasing power likely in our view to improve as wages rise and American households benefit from lower gas prices. Several weeks ago, the U.S. Bureau of Economic Analysis updated its second quarter 2015 GDP growth estimate to 3.7%, from the first quarter's increase of 0.6%. Across Europe and in Japan, GDP growth is now solidly positive, although estimates for 2015 remain behind that of the U.S.

Looking ahead, while macro events still have the potential to shock the system—including China (though the official growth rate of the world's second largest economy remains around 7%), and Federal Reserve policy (which seems likely to remain supportive of economic growth even after its eventual rise)—we believe much of this risk may play out in index-type investments, where crowds move in unison. After a period in which unprecedented global policy stimulus created a macro-driven market, we now see evidence of what we believe is a shift back to a focus on fundamentals. We believe talented stock pickers have the advantage in a more typical market, where those able to identify unique opportunities via deep research and solid, tested disciplines, are positioned to outperform.

Thank you for your confidence in Neuberger Berman. We look forward to continuing to serve your investment needs.

Sincerely,

Robert Conti

President and CEO

Neuberger Berman Mutual Funds

All Cap Core Fund Commentary (Unaudited)

Neuberger Berman All Cap Core Fund Institutional Class generated a total return of –8.91% for the fiscal year ended August 31, 2015, trailing its benchmark, the S&P 500® Index, which returned 0.48% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Although macro headlines such as the Greek and Puerto Rican debt crises, and slowing growth and a currency devaluation in China roiled the markets as this fiscal period was closing, markets were mildly positive for most of the fiscal year. As investors weighed these issues along with expectations for economic growth, the likelihood of the Federal Reserve's first rate increase since the financial crisis, and the impacts of falling commodity prices and a strengthening dollar, sectors such as Energy and Materials saw negative results, while areas including Consumer Discretionary, Consumer Staples and Health Care stocks outperformed.

Early in the fiscal year, we made a conscious decision to reconfigure the composition of the portfolio. We reduced our exposure to the more cyclical, capital-intensive businesses such as Energy and Industrials, replacing them with select Information Technology, Health Care and Consumer Discretionary names. Our Energy holdings, overweight versus the benchmark at 13% of the portfolio as the period began, are now underweight at 7%. Industrials holdings were also reduced from 21% to an underweight. Health Care, at around 4% of the portfolio as the fiscal year began, was just at 9% as the period closed, Information Technology holdings moved from around 12% to around 26%, and Consumer Discretionary was reduced from 17.4% to 16.2%.

Even though we had reduced our exposure to Energy this period, our overweight in late 2014 played a large role in our relative underperformance for the full fiscal year, as oil's 50% price decline weighed heavily on energy-related stocks. Our Consumer Discretionary holdings also underperformed the benchmark. Information Technology was our strongest sector, with our holdings significantly outperforming. Our underweight to Materials, where oversupply has kept commodity prices low, was another relative benefit.

Anticipating the possibility of a period of heightened volatility this summer, we had increased the amount of cash equivalents in the portfolio—from a low of 5.5% at the end of May to roughly 16% today. Cash was a cushion in August when the market stumbled, and it also allowed us to use volatility to our advantage. We selectively added companies we believe will benefit from long-term secular trends, or that are undergoing significant changes we think are underappreciated by the market, at discounted valuations.

We continue to emphasize U.S.-centric positioning within the portfolio, based on our belief that growth in Europe is likely to be moderate at best, and possibly stagnant. Our exposure to China is also quite limited, given our awareness of the slowing that is happening there, and the opaqueness of the information about it.

While volatility may continue given the crowd behavior of passive funds, between the quality of the companies that comprise our repositioned portfolio and our focus on the U.S., where the economy appears to us to remain on a positive if subpar growth trend, we are confident that we are well positioned moving forward.

Sincerely,

Michael K. Kaminsky, Richard Werman, James Gartland and Mindy Schwartzapeel

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

All Cap Core Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NBEIX | |

Class A | | NBEAX | |

Class C | | NBECX | |

SECTOR ALLOCATION

(as a % of Total Investments) | |

Consumer Discretionary | | | 16.2 | % | |

Energy | | | 6.7 | | |

Financials | | | 14.5 | | |

Health Care | | | 9.0 | | |

Industrials | | | 6.5 | | |

Information Technology | | | 25.8 | | |

Utilities | | | 2.7 | | |

Other | | | 2.6 | | |

Short-Term Investments | | | 16.0 | | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS26

| | | | | Average Annual Total

Return Ended 08/31/2015 | |

| | | Inception

Date | | 1 Year | | 5 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 12/20/2007 | | | –8.91 | % | | | 11.88 | % | | | 4.70 | % | |

Class A | | 12/20/2007 | | | –9.26 | % | | | 11.39 | % | | | 4.31 | % | |

Class C | | 12/20/2007 | | | –9.97 | % | | | 10.55 | % | | | 3.53 | % | |

With Sales Charge | |

Class A | | | | | –14.51 | % | | | 10.08 | % | | | 3.51 | % | |

Class C | | | | | –10.72 | % | | | 10.55 | % | | | 3.53 | % | |

Index | |

| S&P 500® Index1,16 | | | | | 0.48 | % | | | 15.87 | % | | | 6.34 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 1.04%, 1.41% and 2.16% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.76%, 1.21% and 1.96% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

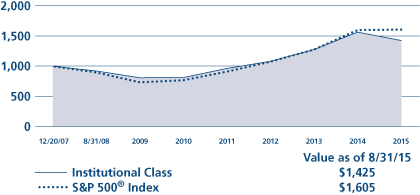

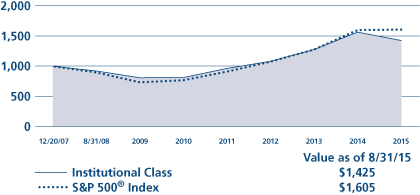

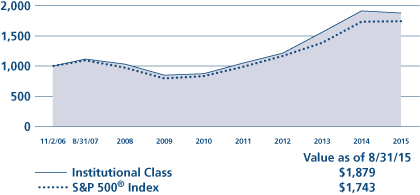

All Cap Core Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Emerging Markets Equity Fund Commentary (Unaudited)

Neuberger Berman Emerging Markets Equity Fund Institutional Class generated a –21.22% total return for the fiscal year ended August 31, 2015, outperforming its benchmark, the MSCI Emerging Markets Index, which posted a –22.67% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Several factors conspired to erode the performance of emerging markets equities this fiscal period. Pressures included falling commodities prices, currencies, increased risk aversion as investors considered likely tightening by the Federal Reserve, slower GDP growth rates in emerging economies including China, and in recent months, a correction in that country's domestic stock market and an unexpected currency devaluation, which we believe damaged the government's credibility.

Nine of 10 index sectors reported double-digit negative returns for the fiscal year, with Energy and Materials being the weakest. The most resilient sector was Health Care, which was down 2.3%. By country, Greece, Colombia and Brazil were the weakest index markets. Hungary outperformed, up 6.6%, followed by the Philippines and India, although both countries posted negative results.

The Fund's Institutional Class outperformed the index as a result of stock selection and an underweight versus the benchmark to Energy, and stock selection and an overweight to Industrials and Information Technology. By country, overweight allocations to India and China, and an underweight to Brazil were advantageous.

Our top contributors were three Indian holdings, Cummins India, Glenmark Pharmaceuticals and Yes Bank. Cummins India, the industrial engine manufacturer, saw growth in both domestic and export businesses, with the potential for more gains should domestic construction and mining activity continue to pick up. Glenmark's stock rose as the company enjoyed strong earnings and profit margins driven by a healthy pipeline of new drugs. Private-sector lender Yes Bank (sold prior to period end) announced better-than-expected earnings as loan growth accelerated and non-interest income was strong.

Although the Fund as a whole outperformed, stock selection within Financials, Materials and Consumer Discretionary (as well as an overweight to the latter underperforming sector), detracted from results relative to the benchmark. By country, South African and Russian holdings detracted, as did our underweight to the outperforming Taiwanese market.

Key individual detractors included Korea-based global automaker Hyundai Motor, which underperformed as domestic sales declined and on fears that a weakening Japanese yen could hurt its global cost competitiveness in the near term. MediaTek, a Taiwanese semiconductor name, corrected on concerns about a growth deceleration in its smart phone and tablet end markets. Brazilian bank Itau Unibanco was hurt by a weakening real and higher interest rates, which constricted loan demand.

With a longer-term view, we believe the recent indiscriminate selling offers attractive opportunities in domestically focused companies in a variety of geographies, both among our current holdings and potentially in new names. We remain broadly cautious about natural resource sectors, however, as we believe that even though their valuations are even cheaper, this speaks to the uncertainty in underlying commodity prices.

We continue to search for opportunities within what we believe are the more favorable markets, targeting the companies we believe are best positioned for growth, and seeking to use near-term volatility to our longer-term advantage.

Sincerely,

Conrad Saldanha

Portfolio Manager

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

Emerging Markets Equity Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NEMIX | |

Class A | | NEMAX | |

Class C | | NEMCX | |

Class R3 | | NEMRX | |

Class R6 | | NREMX | |

PERFORMANCE HIGHLIGHTS9

| | | | Average Annual Total

Return Ended 08/31/2015 | |

| | | Inception

Date | | 1 Year | | 5 Years | | Life of

Fund | |

At NAV | |

Institutional Class | | 10/08/2008 | | | –21.22 | % | | | –1.30 | % | | | 7.15 | % | |

Class A | | 10/08/2008 | | | –21.42 | % | | | –1.55 | % | | | 6.89 | % | |

Class C | | 10/08/2008 | | | –22.02 | % | | | –2.28 | % | | | 6.09 | % | |

| Class R310 | | 06/21/2010 | | | –21.70 | % | | | –1.96 | % | | | 6.61 | % | |

| Class R623 | | 03/15/2013 | | | –21.14 | % | | | –1.25 | % | | | 7.19 | % | |

With Sales Charge | |

Class A | | | | | –25.95 | % | | | –2.71 | % | | | 5.98 | % | |

Class C | | | | | –22.80 | % | | | –2.28 | % | | | 6.09 | % | |

Index | |

| MSCI Emerging Markets Index1,16 | | | | | –22.67 | % | | | –0.59 | % | | | 6.07 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 1.45%, 1.83%, 2.57%, 2.13% and 1.37% for Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.25%, 1.50%, 2.25%, 1.91% and 1.18% for Institutional Class, Class A, Class C, Class R3 and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

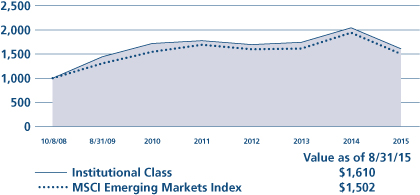

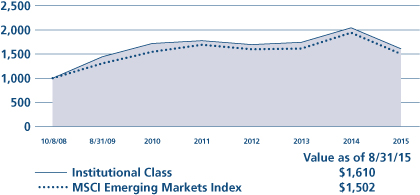

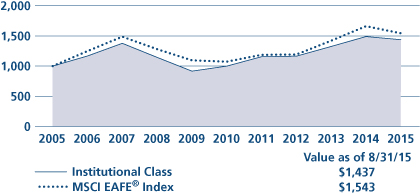

Emerging Markets Equity Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Equity Income Fund Commentary (Unaudited)

Neuberger Berman Equity Income Fund Institutional Class generated a -4.60% total return for the fiscal year ended August 31, 2015, compared to the 0.48% return of its benchmark, the S&P 500® Index. (Performance for all share classes is provided in the table immediately following this letter.)

Several factors contributed to the loss, including a severe dislocation in the Energy, Utilities and Materials sectors. In more normal markets and historically since the inception of the strategy, the Fund's defensive characteristics and its focus on both yield and growth have allowed it to provide equity-like returns with less volatility than the broader S&P 500 Index.

This period reflected investor uncertainty surrounding the direction of U.S. interest rates, the path of global economic growth, and the imbalance between supply and demand for oil. In the fall of 2014, the Federal Reserve (Fed) announced that the U.S. economy would no longer need further economic stimulus to maintain its upward trajectory, thus ending its quantitative easing program. At the same time, the European Central Bank (ECB) launched its fiscal stimulus program. The Chinese stock market intitially hit extreme highs only to tumble sharply downward as news pointed to the country's declining economic growth rate—and since China is tied to the success of so many commodity exporters, equity markets in Brazil, Australia and even Canada were dramatically affected. Weaker demand for oil, coupled with high oil production in the U.S., fueled a sharp price correction, with West Texas Intermediate crude oil tumbling 50% during this 12-month period.

On the positive side, higher interest rates and low oil prices have typically been favorable for companies in the Financials and Consumer sectors, as was the case this year. Among Financials, three of our top contributors were REITs. On the Consumer Discretionary front, Hasbro and Home Depot (sold prior to period end) were among our top contributors.

We believe that the ECB's monetary stimulus, designed to weaken the euro, should provide further tailwinds to certain European exporters, including Royal Philips, an Industrials company that underperformed during the period.

Weak energy prices impacted several of our oil producers and midstream company holdings. ONEOK, a gas gathering and pipeline company, was hurt by the drastic decline in natural gas liquids prices. Our outlook for natural gas prices is favorable due to what we anticipate will be normalized weather-related demand, the shutdown of coal-fired power plants and LNG export facilities coming on line. A visible decline in U.S. oil production this coming winter could provide support to companies levered to oil prices. The Fund holds an overweight to Energy, with an emphasis on producers with the strongest balance sheets and which we think will be able to maintain their dividends until a pricing recovery ensues.

Looking ahead, with many positive factors driving the U.S. economy in the near term, we do not believe that modest Fed rate increases would either slow momentum in housing or choke off continued growth. Dividend-paying equities can be more attractive than bonds during economic expansions and rising rate environments because earnings often grow, leading to higher dividend payouts for shareholders. We believe the Fund is favorably positioned to benefit from these trends in the months ahead.

Sincerely,

Richard Levine, Tony Gleason and Sandy Pomeroy

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

Equity Income Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NBHIX | |

Class A | | NBHAX | |

Class C | | NBHCX | |

Class R3 | | NBHRX | |

SECTOR ALLOCATION

(as a % of Total Investments) | |

Consumer Discretionary | | | 5.5 | % | |

Consumer Staples | | | 4.6 | | |

Energy | | | 8.5 | | |

Financials | | | 37.8 | | |

Health Care | | | 10.0 | | |

Industrials | | | 5.4 | | |

Information Technology | | | 3.8 | | |

Materials | | | 2.5 | | |

Telecommunication Services | | | 2.1 | | |

Utilities | | | 14.4 | | |

Other | | | 3.7 | | |

Short-Term Investments | | | 1.7 | | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS9

| | | | | Average Annual Total

Return Ended 08/31/2015 | |

| | | Inception

Date* | | 1 Year | | 5 Years | | Life of

Fund | |

At NAV | |

| Institutional Class14 | | 06/09/2008 | | | –4.60 | % | | | 8.92 | % | | | 6.70 | % | |

| Class A14 | | 06/09/2008 | | | –5.02 | % | | | 8.50 | % | | | 6.35 | % | |

| Class C14 | | 06/09/2008 | | | –5.65 | % | | | 7.71 | % | | | 5.73 | % | |

| Class R314 | | 06/21/2010 | | | –5.22 | % | | | 8.19 | % | | | 6.28 | % | |

With Sales Charge | |

| Class A14 | | | | | –10.47 | % | | | 7.22 | % | | | 5.64 | % | |

| Class C14 | | | | | –6.54 | % | | | 7.71 | % | | | 5.73 | % | |

Index | |

| S&P 500® Index1,16 | | | | | 0.48 | % | | | 15.87 | % | | | 6.49 | % | |

*The performance data for each class includes the performance of the Fund's oldest share class, Trust Class, from November 2, 2006 through June 9, 2008. The performance data for Class R3 also includes the performance of the Fund's Institutional Class from June 9, 2008 through June 21, 2010. See endnote 14 for information about the effects of the different fees paid by each class.

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 0.68%, 1.05%, 1.80% and 1.34% for Institutional Class, Class A, Class C and Class R3 shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratio for Class R3 includes the class's repayment of expenses previously reimbursed and/or fees previously waived by Management. The expense ratios for the annual period ended August 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

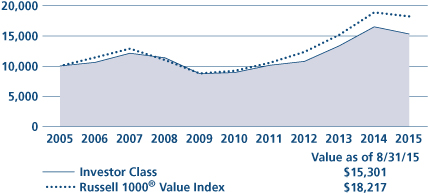

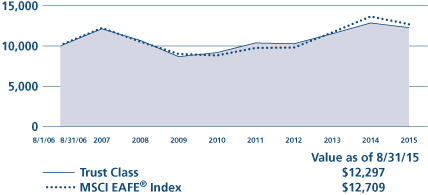

Equity Income Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT14

(000's Omitted)

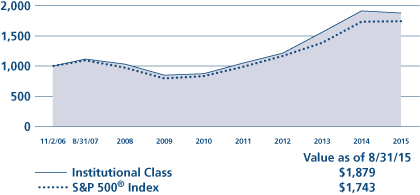

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Focus Fund Commentary (Unaudited)

Neuberger Berman Focus Fund Investor Class generated a 0.49% total return for the fiscal year ended August 31, 2015, compared to its benchmark, the S&P 500® Index, which provided a 0.48% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Over the 12-month reporting period, the equity market withstood some major macro challenges, yet as issues mounted, investor apprehension turned into panic and led to a steep market sell-off by period-end. In the earlier months, anxiety over the Federal Reserve's (Fed) interest rate tightening plan and a sharp decline in crude oil prices caused some tumult in the market. Greece's credit issues and possible exit from the eurozone also drove equities downward at times, as did signs of economic weakness in China and Japan. Still, the market remained resilient for much of the period as focus turned to the improving U.S. economy, signs of progress in Europe and various policy actions taken around the world to provide economic stimulus. But as the September U.S. Fed meeting neared, concerns began to grow about the health of our financial market in a rising rate environment. On top of this, economic data from China appeared to worsen; an unexpected move by the Chinese central bank to devalue the nation's currency sounded an alarm to investors that the global economy could be on shaky ground, which sent the equity market reeling in the final month of the period.

Performance within the S&P 500 Index varied greatly among sectors. Health Care and Consumer Discretionary generated double-digit positive returns, while the Energy sector suffered a decline of over 30% and Materials fell by over 12%. In calmer territory were Consumer Staples, Information Technology and Financials, which eked out modest rises during the fiscal year, and Industrials and Telecommunication Services, which experienced fairly minor losses. The greatest contribution to overall performance within the Fund came from Health Care. Strong stock selection in this segment gave a large boost to returns relative to the benchmark as well. This was mainly driven by our Pharmaceuticals holdings, including Eli Lilly (LLY), which soared over 30% during the year. LLY shares appreciated rather steadily amid many positive developments for the company such as the release of constructive data from its oncology drug trial as well as for trials relating to its diabetes and Alzheimer's treatments. In our view, LLY has a very promising drug pipeline that we believe creates a path of solid earnings and revenue growth for the company going forward. On the downside, our Energy sector holdings were the greatest drag on Fund performance, both in absolute terms and on a relative basis. The segment as a whole was weak during the period but we held a few names, including Antero Resources, that experienced outsized declines. We believe the near-term picture for oil will likely remain difficult for a while, as global supplies remain elevated and demand continues to wane with consumption from China and other emerging markets slowing in response to milder economic growth.

Looking ahead, despite recent market movements, we believe the domestic stock market could recover alongside a steadily improving U.S. economy. Yet the possibility of a worse-than-expected economic slowdown in China and weakness in other emerging markets, combined with the unknown impact of rising interest rates in the U.S., keep us wary that we may see further volatility in equities. Nonetheless, we believe that our strategy of conducting in-depth research to find individual stocks with strong businesses and healthy fundamentals should enable the Fund to endure global macro risks and generate positive returns over an economic cycle.

Sincerely,

Timothy Creedon and David Levine

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

TICKER SYMBOLS

Investor Class | | NBSSX | |

Trust Class | | NBFCX | |

Advisor Class | | NBFAX | |

Institutional Class | | NFALX | |

Class A | | NFAAX | |

Class C | | NFACX | |

SECTOR ALLOCATION

(as a % of Total Investments) | |

Consumer Discretionary | | | 21.1 | % | |

Consumer Staples | | | 9.6 | | |

Energy | | | 9.5 | | |

Financials | | | 16.0 | | |

Health Care | | | 10.0 | | |

Industrials | | | 9.6 | | |

Information Technology | | | 20.4 | | |

Materials | | | 2.4 | | |

Short-Term Investments | | | 1.4 | | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS8

| | | | | Average Annual Total

Return Ended 08/31/2015 | |

| | | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

Investor Class | | 10/19/1955 | | | 0.49 | % | | | 15.98 | % | | | 5.93 | % | | | 10.45 | % | |

| Trust Class3 | | 08/30/1993 | | | 0.26 | % | | | 15.74 | % | | | 5.71 | % | | | 10.44 | % | |

| Advisor Class4 | | 09/03/1996 | | | 0.15 | % | | | 15.57 | % | | | 5.51 | % | | | 10.38 | % | |

| Institutional Class5 | | 06/21/2010 | | | 0.65 | % | | | 16.20 | % | | | 6.04 | % | | | 10.47 | % | |

| Class A20 | | 06/21/2010 | | | 0.24 | % | | | 15.77 | % | | | 5.83 | % | | | 10.44 | % | |

| Class C20 | | 06/21/2010 | | | –0.50 | % | | | 14.93 | % | | | 5.43 | % | | | 10.36 | % | |

With Sales Charge | |

| Class A20 | | | | | –5.52 | % | | | 14.40 | % | | | 5.21 | % | | | 10.33 | % | |

| Class C20 | | | | | –1.14 | % | | | 14.93 | % | | | 5.43 | % | | | 10.36 | % | |

Index | |

| S&P 500® Index1,16 | | | | | 0.48 | % | | | 15.87 | % | | | 7.15 | % | | | 10.04 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 0.91%, 1.11%, 1.27%, 0.76%, 1.14%, and 1.91% for Investor Class, Trust Class, Advisor Class, Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.75%, 1.11%, and 1.86% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

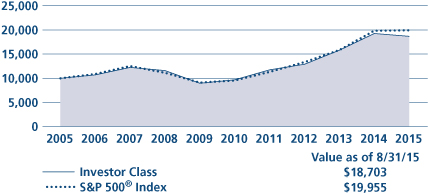

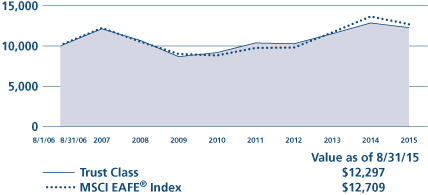

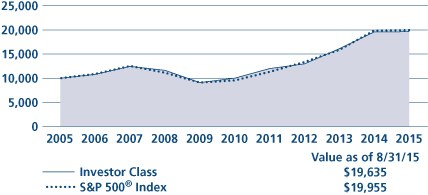

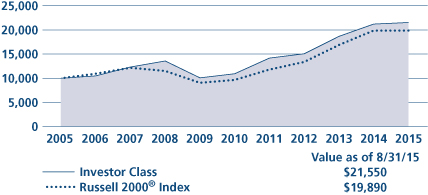

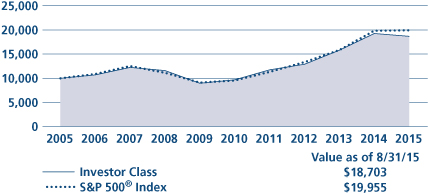

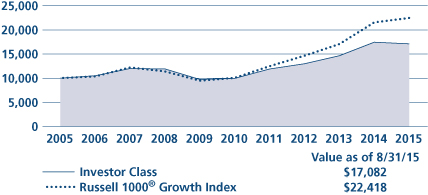

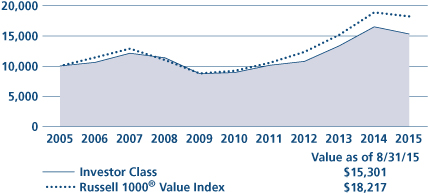

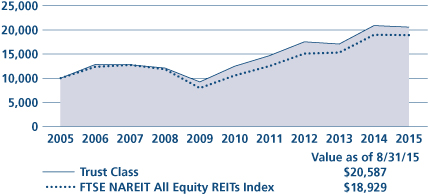

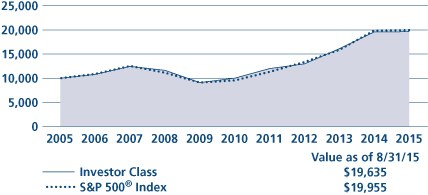

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Genesis Fund Commentary (Unaudited)

Neuberger Berman Genesis Fund Investor Class posted a 1.52% total return for the fiscal year ended August 31, 2015, outperforming its benchmark, the Russell 2000® Index, which provided a 0.03% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The U.S. stock market was volatile and generated a modest gain during the reporting period. The market was supported at times by signs of improving economic growth in the U.S. and solid demand. However, the market was periodically challenged—especially late in the period—by heightened investor risk aversion, some of which was triggered by geopolitical issues and signs of moderating growth in China. The overall U.S. stock market, as measured by the S&P 500® Index, gained 0.48% for the 12 months ended August 31, 2015. Small-cap stocks were also relatively flat, as the Russell 2000 Index returned 0.03% for the period. However, there was a significant dispersion between small-cap growth and value stocks, as the Russell 2000® Growth and Value Indexes returned 5.11% and –4.95%, respectively. This disparity was partially due to the strong performance from the biotechnology and technology industries, which make up a meaningful portion of the Russell 2000 Growth Index.

The Fund's outperformance during the reporting period was due to stock selection. In particular, the Fund's holdings in the Materials, Industrials and Information Technology sectors were the largest contributors to relative performance. In terms of individual holdings, Manhattan Associates and Constellation Software, added the most value. Manhattan Associates provides information technology solutions designed to enable efficient movement of goods through the supply chain. Constellation Software is a software holding company that acquires mission-critical vertical market software companies. On the downside, stock selection in the Financials sector was negative for performance. This was largely driven by the weak results from two mortgage service-related companies, Altisource Portfolio Solutions and Altisource Asset Management Corp. We eliminated our position on Altisource Portfolio Solutions and the Fund now has only a small allocation to Altisource Asset Management Corp.

Sector allocation, overall, detracted from performance during the reporting period. In particular, a lack of exposure to biotechnology companies detracted from results. We do not typically own these companies as they do not meet our investment criteria given their speculative nature, a general lack of earnings and their need to access the capital markets. Overweights relative to the index in the Materials and Industrials sectors were also drags on results. In contrast, overweights to the Consumer Staples and Information Technology sectors were modestly positive for performance.

Looking ahead, we have a cautiously optimistic outlook for the Fund. In a world rife with geopolitical issues and the anticipation of future Fed interest rate hikes, we feel that investors' interest in less risky/higher quality stocks could increase. This portion of the small-cap market has lagged lower quality stocks. However, in our view, the tide may turn as lower quality/higher leverage companies experience higher borrowing costs, some of which is already occurring in the marketplace. We believe this environment aligns with our investment approach. To be sure, valuations across the equity market appear to be full given where we currently are in the interest rate cycle. In addition, periods of continued heightened volatility cannot be ruled out. Regardless, we maintain our focus on stock-specific analysis and a long-term perspective, which have always been the foundation of our investment process. Furthermore, we believe the portfolio is favorably positioned given the relatively benign economic environment in the U.S.

Sincerely,

Judith M. Vale and Robert D'Alelio

Portfolio Co-Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

TICKER SYMBOLS

Investor Class | | NBGNX | |

Trust Class | | NBGEX | |

Advisor Class | | NBGAX | |

Institutional Class | | NBGIX | |

Class R6 | | NRGSX | |

SECTOR ALLOCATION

(as a % of Total Investments) | |

Consumer Discretionary | | | 13.0 | % | |

Consumer Staples | | | 6.1 | | |

Energy | | | 2.8 | | |

Financials | | | 11.0 | | |

Health Care | | | 15.6 | | |

Industrials | | | 20.6 | | |

Information Technology | | | 19.4 | | |

Materials | | | 9.6 | | |

Short-Term Investments | | | 1.9 | | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS

| | | | | Average Annual Total

Return Ended 08/31/2015 | |

| | | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

Investor Class | | 09/27/1988 | | | 1.52 | % | | | 14.53 | % | | | 7.98 | % | | | 12.20 | % | |

| Trust Class3 | | 08/26/1993 | | | 1.41 | % | | | 14.43 | % | | | 7.91 | % | | | 12.18 | % | |

| Advisor Class4 | | 04/02/1997 | | | 1.11 | % | | | 14.11 | % | | | 7.62 | % | | | 11.97 | % | |

| Institutional Class5 | | 07/01/1999 | | | 1.68 | % | | | 14.72 | % | | | 8.19 | % | | | 12.35 | % | |

| Class R624 | | 03/15/2013 | | | 1.75 | % | | | 14.66 | % | | | 8.04 | % | | | 12.22 | % | |

Index | |

| Russell 2000® Index1,16 | | | | | 0.03 | % | | | 15.55 | % | | | 7.12 | % | | | 9.54 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 1.01%, 1.10%, 1.37%, 0.85% and 0.78% for Investor Class, Trust Class, Advisor Class, Institutional Class and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratio for each of Institutional Class and Class R6 includes the class's repayment of expenses previously reimbursed and/or fees previously waived by Management. The expense ratios for the annual period ended August 31, 2015 can be found in the Financial Highlights section of this report.

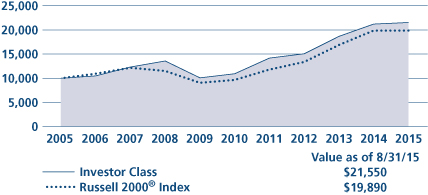

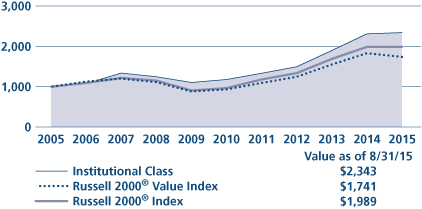

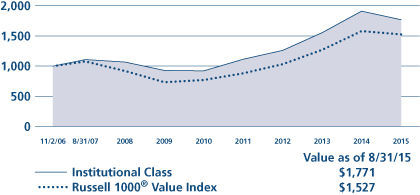

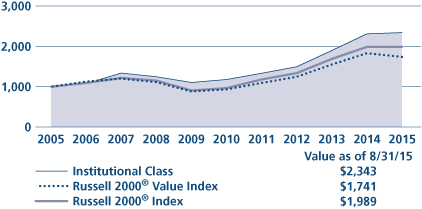

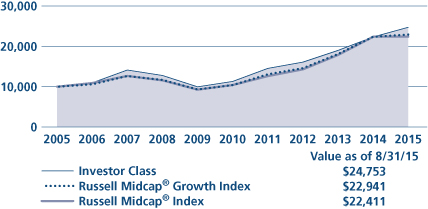

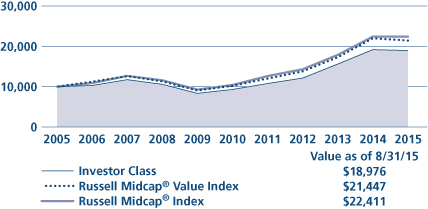

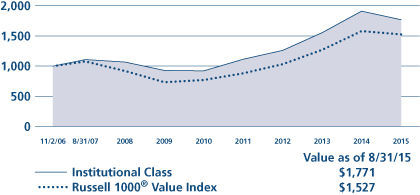

COMPARISON OF A $10,000 INVESTMENT

This graph shows the change in value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Investor Class shares only; the performance of the Fund's share classes will differ primarily due to different class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Global Equity Fund Commentary (Unaudited)

Neuberger Berman Global Equity Fund Institutional Class generated a –3.16% total return for the fiscal year ended August 31, 2015, outperforming the –5.79% return of its benchmark, the MSCI All Country World Index, for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The U.S. stock market (as represented by the S&P 500® Index), while volatile, closed this period relatively flat, outperforming developed international and emerging markets equities (represented by the MSCI EAFE® and MSCI Emerging Markets indices, respectively). Outside of multinationals, hurt by dollar strength, and energy-related companies, hurt by falling oil prices, U.S. companies saw positive earnings within a generally positive environment. However, this was overshadowed by concerns that troubled international markets. Globally, markets struggled with central bank policy uncertainty, commodity prices, economic weakness, geopolitical issues, and risk aversion—especially toward the end of this period, as focus shifted from Greece's debt crisis to China's slowdown, correction and currency revaluation.

By sector, within the index, Energy and Materials reported large losses, as oil and commodities prices declined. Health Care performed best, followed by Consumer Discretionary and Consumer Staples stocks—the only sectors reporting positive results. By country, Greece, Colombia and Brazil were weakest, while Israel, Ireland and Denmark led the index.

The Fund's outperformance versus the benchmark was due to a combination of strong stock selection and advantageous sector positioning, particularly within Financials, Materials and Industrials. By country, UK and U.S. holdings outperformed. An overweight to Israel was another benefit.

Top contributors included U.S. stocks Pall Corp. (sold before period end), Sealed Air and Amazon.com. Pall, a filtration and purification specialist, accepted a takeover approach by Danaher. Sealed Air, a global leader in food safety and security, saw strong results despite the strong dollar. Amazon.com outperformed on positive news including growth in Prime subscriptions and growing profitability at Amazon Web Services.

By sector, the portfolio underperformed versus the benchmark within Health Care, Consumer Discretionary and Information Technology. By country, Switzerland, China and an underweight to Japan limited relative performance.

Detractors included SanDisk, ShawCor and Haier Electronics. U.S.-based SanDisk, the leading supplier of NAND flash technologies, struggled to set short-term earnings expectations as it transitions from a commodity supplier to a higher-margin tech solutions provider. ShawCor, the Canada-based pipeline services firm, fell on fears that lower oil prices would continue to hurt pipeline development, and was sold. Haier, the Chinese white-goods distributor, disappointed investors with lighter-than-expected earnings and committed to additional investments that hurt near-term margins.

As we look ahead, we do not believe the downward revaluation of the Chinese currency has addressed the underlying challenges China is perceived to face: excessive debt, high manufacturing costs relative to its emerging markets competitors, and muted private-sector spending. While China and emerging markets have outpaced the developed world in recent years, we believe this outperformance has come to an end and remain focused on companies with underlying exposure to Europe and North America. In Europe, earnings are improving and economies appear to have troughed. We are seeing opportunities to add to Japanese exporters—which has long been our preferred segment of this market—as we believe the yen will likely continue its slide. We remain slightly underweight U.S. stocks, with holdings concentrated among domestically oriented companies with scale in their operating niches.

We continue to believe that the cash-generative businesses with the stable demand profiles we favor offer the most value in the current environment, with a lower downside risk profile in the event of sharp market declines.

Sincerely,

Benjamin Segal and Saurin D. Shah

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

Global Equity Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NGQIX | |

Class A | | NGQAX | |

Class C | | NGQCX | |

PERFORMANCE HIGHLIGHTS9

| | |

| | Average Annual Total

Return Ended 08/31/2015 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 06/30/2011 | | | –3.16 | % | | | 4.68 | % | |

Class A | | 06/30/2011 | | | –3.47 | % | | | 4.30 | % | |

Class C | | 06/30/2011 | | | –4.21 | % | | | 3.54 | % | |

With Sales Charge | |

Class A | | | | | | | –9.02 | % | | | 2.83 | % | |

Class C | | | | | | | –4.76 | % | | | 3.54 | % | |

Index | |

| MSCI All Country World Index1,16 | | | | | | | –5.79 | % | | | 6.75 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 6.65%, 7.01% and 7.76% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.15%, 1.51% and 2.26% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended August 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

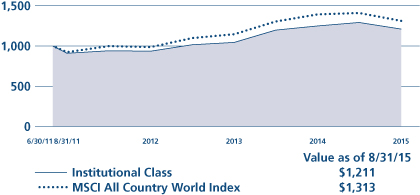

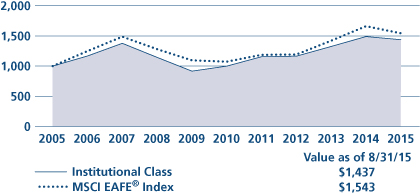

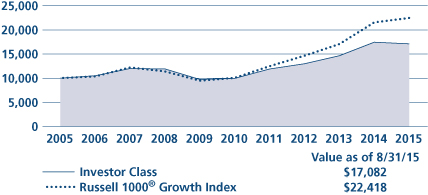

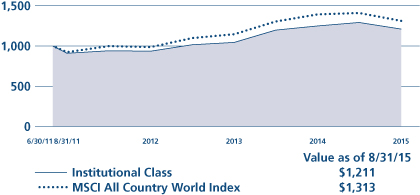

Global Equity Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Global Real Estate Fund Commentary (Unaudited)

Neuberger Berman Global Real Estate Fund Institutional Class generated a –5.92% total return for the period from its inception on December 30, 2014 through August 31, 2015, outperforming its benchmark, the FTSE EPRA/NAREIT Developed Index, which generated a –6.41% total return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The global stock market was volatile and generated a negative return during the period since the Fund's launch. The market was supported at times by signs of improving economic growth in the U.S. and the eurozone and solid demand. However, the market was periodically challenged—especially late in the period—by heightened investor risk aversion, some of which was triggered by geopolitical issues and signs of moderating growth in China. Global real estate investment trusts (REITs) posted weak results during the reporting period, partially due to concerns over rising interest rates.

While it produced a negative absolute return, as noted the Fund's Institutional Class outperformed the benchmark during the reporting period. From a regional perspective, an overweight to Europe relative to the benchmark was the most beneficial for results, whereas an overweight to Japan was a small negative for relative performance. Country allocation, overall, was also positive for performance, largely driven by an overweight to the UK. In contrast, our lack of exposure to Switzerland and Spain was a drag on results. Stock selection was beneficial to the Fund's performance as well. In particular, our holdings in the Industrial & Office, Real Estate Holding & Development and Retail sectors were the most additive to results. These positives were partially offset by stock selection in the Hotel & Lodging and Specialty sectors. Finally, sector allocation, overall, was additive for performance. The Fund's cash position, along with an overweight to Real Estate Holding & Development, were the largest contributors to results. Conversely, underweights to the Retail and Residential sectors were the largest negatives for performance.

Looking ahead, economic activity in the U.S. has continued to expand at a moderate pace and in our view the Federal Reserve (Fed) is likely to continue moving toward policy normalization. We believe these two factors, an improving economy and a less accommodative Fed, should they occur, will be important drivers for real estate values over the next 12-24 months. While higher interest rates could be a headwind for REITs in the near term, we believe the benefits of a sustainable improvement in the economy and job market on real estate demand trends could outweigh this concern in the longer term. In the European real estate markets, we believe the key theme will continue to be interest rate movements. In particular, we will closely monitor how the listed real estate markets react to what we anticipate will be a rising rate environment in the UK and continued monetary easing on the Continent. Elsewhere, it is projected that Asia-Pacific countries such as Australia and China will continue to aggressively loosen monetary policies and Japan will remain committed to recreate an inflationary mindset. While such lowering of interest rates continue to lend support to real estate markets, we believe the anticipated normalization of U.S. interest rates may undermine this support during the second half of 2015 and cause the compressed cap rates to expand, particularly in Hong Kong and Singapore.

Sincerely,

Steve S. Shigekawa, Brian Jones, Gillian Tiltman and Anton Kwang

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

Global Real Estate Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NGRIX | |

Class A | | NGRAX | |

Class C | | NGRCX | |

PERFORMANCE HIGHLIGHTS9

| | |

Inception Date | | Cumulative Total Return

Ended 08/31/2015

Life of Fund | |

At NAV | |

Institutional Class | | 12/30/2014 | | | –5.92 | % | |

Class A | | 12/30/2014 | | | –6.19 | % | |

Class C | | 12/30/2014 | | | –6.64 | % | |

With Sales Charge | |

Class A | | | | | | | –11.58 | % | |

Class C | | | | | | | –7.57 | % | |

Index | |

| FTSE EPRA/NAREIT Developed Index1,16 | | | | | | | –6.41 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during the period shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the estimated total annual operating expense ratios for fiscal year 2015 are 1.45%, 1.81% and 2.56% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.00%, 1.36% and 2.11% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the period from December 30, 2014 through August 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

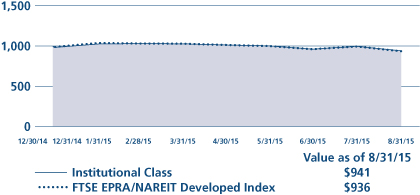

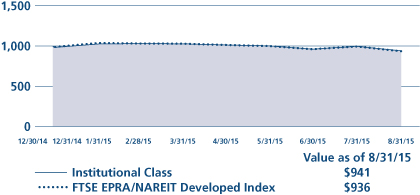

Global Real Estate Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's Omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

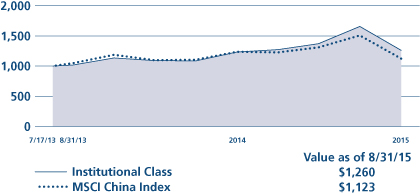

Greater China Equity Fund Commentary (Unaudited)

Neuberger Berman Greater China Equity Fund Institutional Class generated a 2.15% total return for the fiscal year ended August 31, 2015, outperforming its benchmark, the MSCI China Index, which provided a –9.15% total return over the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The China equity markets experienced high volatility over the past 12 months. Following a weak month in September 2014, affected by the protests in Hong Kong, China equity markets entered into a seven-month rally. Going into the fourth quarter of last year, markets outperformed primarily due to stabilizing earnings and positive investor sentiment tied to expectations of further policy easing. The Shanghai-Hong Kong Stock Connect program launched in November, coupled with the People's Bank of China (PBoC) unexpectedly cutting interest rates for the first time in close to three years, supported both the onshore China A-shares market and the offshore Hong Kong market. In January, positive momentum continued as expectations of the easing of monetary policy and home purchase restrictions continued to boost investor sentiment. At the beginning of February, the PBoC lowered the reserve requirement ratio by 50 basis points, and investors looked to the government's announcement of supportive policies at the National People's Congress (NPC) and Chinese People's Political Consultative Conference in March.

Despite the Chinese government setting its lowest GDP growth target in 15 years at the NPC, the China equity markets expanded trading volume on the back of a further 25-basis-point benchmark interest rate cut, Premier Li's positive comments on monetary policy easing, the PBoC's extension of its RMB 500 billion mid-term lending facility, and the announcement of "One Belt, One Road" and "Made in China 2025" plans. Going into April, markets maintained strong momentum as the PBoC unexpectedly cut the reserve requirement ratio by 1% and state-owned enterprise and resource tax reform developments led to a broad based rally and significant expansion in turnover. In May, the offshore Hong Kong market experienced a correction due to liquidity concerns resulting from initial public offerings, although the domestic market was supported by another 25-basis-point interest rate cut, the State Council's unveiling of the "China Manufacturing 2025" plan and the announcement of the China-Hong Kong Mutual Recognition of Funds program. Markets corrected sharply in June, primarily due to tightening of margin financing and Greece's debt situation. Heavy deleveraging, voluntary suspension of trading for a large number of domestic listed companies, and uncertainty regarding the U.S. Federal Reserve's potential interest rate hike contributed to negative investor sentiment, which led the China equity markets to further decline in July. The devaluation of the renminbi resulted in significant volatility across global asset classes in August. Toward the end of the month, a further market correction and capital outflow pressure prompted the PBoC to cut the reserve requirement ratio by 50 basis points and benchmark interest rates by 25 basis points, which stabilized the markets and pared losses at month-end.

For the 12-month period, the Fund's overweight versus the benchmark in Utilities and underweight in Energy contributed to performance. In contrast, the Fund's overweight position in Consumer Discretionary detracted from relative returns. Stock selection had a positive impact in Financials and Utilities and a negative impact in Information Technology and Telecommunication Services relative to the benchmark.

The Fund continues to focus on companies that appear to have sustainable top- and bottom-line growth by looking at the companies' operating cash flow from their recurring core businesses. As of August 31, 2015, the Fund's largest sector overweight relative to the benchmark was Consumer Discretionary, and the largest sector underweight was Financials. The Fund also held overweight positions in Utilities and Health Care, and underweight positions in Telecommunication Services and Energy. The Fund's top 10 positions comprised almost 48% of total portfolio assets at the end of August.

Looking ahead, we anticipate that the markets could remain volatile over the short to medium-term as China continues to press ahead with its economic rebalancing, resulting in potential growth headwinds. At the same time, equity valuations have come off the high levels observed earlier in the year, potentially indicating that some of these growth concerns have been discounted in markets. Longer-term, we think the growth outlook should stabilize towards a more sustainable, quality trajectory if various economic reforms come to fruition.

Sincerely,

Lihui Tang and Frank Yao

Portfolio Managers

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

Greater China Equity Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NCEIX | |

Class A | | NCEAX | |

Class C | | NCECX | |

SECTOR ALLOCATION

(as a % of Total Investments) | |

Consumer Discretionary | | | 14.0 | % | |

Consumer Staples | | | 5.4 | | |

Energy | | | 1.2 | | |

Financials | | | 20.0 | | |

Health Care | | | 9.6 | | |

Industrials | | | 10.3 | | |

Information Technology | | | 18.1 | | |

Telecommunication Services | | | 3.8 | | |

Utilities | | | 13.6 | | |

Short-Term Investments | | | 4.0 | | |

Total | | | 100.0 | % | |

EXCHANGE ALLOCATION

(as a % of Long Term Investments) | |

Mainland China | | | 19.5 | % | |

Hong Kong | | | 65.1 | | |

United States | | | 15.4 | | |

Total | | | 100.0 | % | |

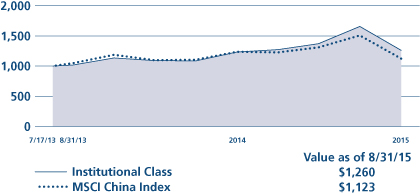

PERFORMANCE HIGHLIGHTS

| | |

| | Average Annual Total

Return Ended 08/31/2015 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 07/17/2013 | | | 2.15 | % | | | 11.46 | % | |

Class A | | 07/17/2013 | | | 1.68 | % | | | 11.10 | % | |

Class C | | 07/17/2013 | | | 0.93 | % | | | 10.24 | % | |

With Sales Charge | |

Class A | | | | | | | –4.16 | % | | | 8.05 | % | |

Class C | | | | | | | –0.02 | % | | | 10.24 | % | |

Index | |

| MSCI China Index1,16 | | | | | | | –9.15 | % | | | 5.59 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.