| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| FORM N-CSR | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED | |

| MANAGEMENT INVESTMENT COMPANIES | |

| Investment Company Act file number 811- 2402 | |

| John Hancock Sovereign Bond Fund | |

| (Exact name of registrant as specified in charter) | |

| 601 Congress Street, Boston, Massachusetts 02210 | |

| (Address of principal executive offices) (Zip code) | |

| Michael J. Leary | |

| Treasurer | |

| 601 Congress Street | |

| Boston, Massachusetts 02210 | |

| (Name and address of agent for service) | |

| Registrant's telephone number, including area code: 617-663-4490 | |

| Date of fiscal year end: | May 31 |

| Date of reporting period: | May 31, 2009 |

ITEM 1. REPORT TO SHAREHOLDERS.

Discussion of Fund performance

By MFC Global Investment Management (U.S.), LLC

Despite tremendous market volatility and unprecedented turmoil in the economy and financial sector, U.S. bonds posted positive results for the 12 months ended May 31, 2009. Treasury bonds led the way in the first half of the period, as a deteriorating economic environment and a meltdown in the financial sector led to a flight to quality. Corporate bonds outperformed in the last six months, amid rising confidence in the government’s efforts to revive the economy and stabilize the financial sector.

“Despite tremendous market

volatility and unprecedented

turmoil in the economy and

financial sector, U.S. bonds posted

positive results for the 12 months

ended May 31, 2009.”

For the year ended May 31, 2009, John Hancock Bond Fund’s Class A shares posted a total return of –3.02% at net asset value. The Fund trailed the 4.47% return of its benchmark, the Barclays Capital Government/Credit Index, and the –0.44% average return of Morningstar, Inc.’s intermediate-term bond category.

The Fund’s underperformance of its benchmark index and Morningstar peer group average occurred entirely in the first half of the period and we believe was largely the result of our sector allocation. An overweight position in corporate bonds and very limited exposure to Treasury bonds contributed to substantial underperformance in the last half of 2008, when corporate bonds fell and Treasury securities rallied sharply. We took advantage of the decline in the corporate sector to increase our holdings of corporate bonds, particularly investment-grade securities, which tend to have lower default rates and typically recover first when the economy begins to improve. The expansion of our corporate holdings paid off. The resurgence of the corporate sector since the beginning of 2009 contributed to a double-digit gain for the Fund over the last six months of the period.

This commentary reflects the views of the portfolio managers through the end of the Fund’s period discussed in this report. The managers’ statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

The major factors in this Fund’s performance are interest rates and credit risk. When interest rates rise, bond prices usually fall. Generally, an increase in the Fund’s average maturity will make it more sensitive to interest-rate risk.

Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| 6 | Bond Fund | Annual report |

A look at performance

For the period ended May 31, 2009

| Average annual returns (%) | Cumulative total returns (%) | ||||||||||

| with maximum sales charge (POP) | with maximum sales charge (POP) | SEC 30- | |||||||||

| day yield | |||||||||||

| Inception | (%) as of | ||||||||||

| Class | date | 1-year | 5-year | 10-year | 1-year | 5-year | 10-year | 5-31-09 | |||

| A | 11-9-73 | –7.36 | 1.63 | 3.92 | –7.36 | 8.43 | 46.92 | 9.95 | |||

| B | 11-23-93 | –8.30 | 1.53 | 3.83 | –8.30 | 7.86 | 45.60 | 9.78 | |||

| C | 10-1-98 | –4.61 | 1.86 | 3.68 | –4.61 | 9.68 | 43.53 | 9.77 | |||

| I1,2 | 9-4-01 | –2.60 | 3.02 | 4.86 | –2.60 | 16.03 | 60.66 | 10.94 | |||

| R11,3 | 8-5-03 | –3.34 | 2.17 | 3.97 | –3.34 | 11.33 | 47.61 | 10.08 | |||

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charges on Class A shares of 4.5% and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class I and Class R1 shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. The net expenses equal the gross expenses and are as follows: Class A — 1.05%, Class B —1.76%, Class C — 1.75%, Class I — 0.62% and Class R1 — 1.34%. The Fund’s annual operating expenses will likely vary throughout the period and from year to year. Expenses for the current fiscal year may be higher than those shown in the “Annual operating expenses” table in the most recent publicly available prospectuses for one or more of the following reasons: (i) a significant decrease in average net assets may result in a higher advisory fee rate if advisory fee breakpoints are not achieved ; (ii) a significant decrease in average net assets may result in an increase in the expense ratio because certain fund expenses do not decrease as asset levels decrease; or (iii) the termination of voluntary expense cap reimbursements and/or fee waivers, as applicable.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For current to the most recent month-end performance data, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

The Fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

1 For certain types of investors as described in the Fund’s Class I and Class R1 share prospectuses.

2 November 9, 1973 is the inception date for the Class A shares. Class I shares were first offered on September 4, 2001; the returns prior to this date are those of Class A shares that have been recalculated to apply the fees and expenses of Class I shares.

3 November 9, 1973 is the inception date for Class A shares. Class R1 shares were first offered on August 5, 2003, the returns prior to this date are those of Class A shares that have been recalculated to apply the fees and expenses of Class R1 shares.

| Annual report | Bond Fund | 7 |

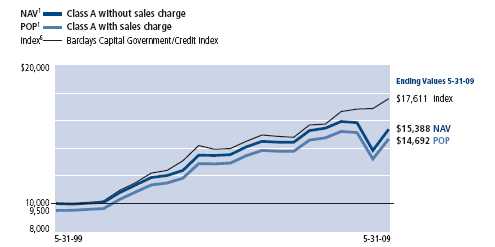

A look at performance

Growth of $10,000

This chart shows what happened to a hypothetical $10,000 investment in John Hancock Bond Fund Class A shares for the period indicated. For comparison, we’ve shown the same investment in the Barclays Capital Government/Credit Index.

| With maximum | ||||

| Class | Period beginning | Without sales charge | sales charge | Index |

| B2 | 5-31-99 | $14,560 | $14,560 | $17,611 |

| C2 | 5-31-99 | 14,353 | 14,353 | 17,611 |

| I3,4 | 5-31-99 | 16,066 | 16,066 | 17,611 |

| R13,5 | 5-31-99 | 14,761 | 14,761 | 17,611 |

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B, Class C, Class I and Class R1 shares, respectively, as of May 31, 2009. The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Barclays Capital Government/Credit Index is an unmanaged index that measures the performance of U.S. government bonds, U.S. corporate bonds and Yankee bonds.

It is not possible to invest directly in an index. Index figures do not reflect sales charges or direct expenses, which would have resulted in lower values if they did.

1 NAV represents net asset value and POP represents public offering price.

2 No contingent deferred sales charge applicable.

3 For certain types of investors as described in the Fund’s Class I and Class R1 share prospectuses.

4 November 9, 1973 is the inception date for the Class A shares. Class I shares were first offered on September 4, 2001; the returns prior to this date are those of Class A shares that have been recalculated to apply the fees and expenses of Class I shares.

5 November 9, 1973 is the inception date for Class A shares. Class R1 shares were first offered on August 5, 2003, the returns prior to this date are those of Class A shares that have been recalculated to apply the fees and expenses of Class R1 shares.

6 Formerly named Lehman Brothers Government Credit Index.

| 8 | Bond Fund | Annual report |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on December 1, 2008 with the same investment held until May 31, 2009.

| Account value | Ending value | Expenses paid during | |

| on 12-1-08 | on 5-31-09 | period ended 5-31-091 | |

| Class A | $1,000.00 | $1,110.60 | $6.63 |

| Class B | 1,000.00 | 1,105.90 | 10.29 |

| Class C | 1,000.00 | 1,106.80 | 10.30 |

| Class I | 1,000.00 | 1,113.00 | 4.00 |

| Class R1 | 1,000.00 | 1,109.00 | 8.41 |

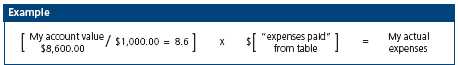

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at May 31, 2009, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| Annual report | Bond Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on December 1, 2008, with the same investment held until May 31, 2009. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Account value | Ending value | Expenses paid during | |

| on 12-1-08 | on 5-31-09 | period ended 5-31-091 | |

| Class A | $1,000.00 | $1,018.60 | $6.34 |

| Class B | 1,000.00 | 1,015.20 | 9.85 |

| Class C | 1,000.00 | 1,015.20 | 9.85 |

| Class I | 1,000.00 | 1,021.10 | 3.83 |

| Class R1 | 1,000.00 | 1,017.00 | 8.05 |

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.26%, 1.96%, 1.96%, 0.76% and 1.60% for Class A, Class B, Class C, Class I and Class R1 shares, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

| 10 | Bond Fund | Annual report |

Portfolio summary

| Portfolio diversification1 | ||||

| Bonds | 52% | Asset backed securities | 1% | |

| U.S. government & agency securities | 28% | Short-term investments & other | 3% | |

| Collateralized mortgage obligations | 16% | |||

| Sector composition1,2 | ||||

| U.S government & agencies | 28% | Materials | 5% | |

| Mortgage bonds | 17% | Consumer staples | 5% | |

| Financials | 16% | Industrials | 4% | |

| Consumer discretionary | 8% | Telecommunication services | 3% | |

| Utilities | 6% | Short-term investments & other | 3% | |

| Energy | 5% | |||

| Quality composition1 | ||||

| AAA | 38% | |||

| AA | 4% | |||

| A | 18% | |||

| BBB | 22% | |||

| BB | 7% | |||

| B | 5% | |||

| CCC | 3% | |||

| Short-term investments & other | 3% | |||

1 As a percentage of net assets on May 31, 2009.

2 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| Annual report | Bond Fund | 11 |

F I N A N C I A L S T A T E M E N T S

Fund’s investments

Securities owned by the Fund on 5-31-09

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Bonds 52.23% | $396,726,656 | ||||

| (Cost $438,444,862) | |||||

| Aerospace & Defense 0.27% | 2,064,300 | ||||

| BE Aerospace, Inc., | |||||

| Sr Note | 8.500% | 07-01-18 | $1,150 | 1,086,750 | |

| Vought Aircraft Industries, Inc., | |||||

| Sr Note | 8.000 | 07-15-11 | 1,995 | 977,550 | |

| Agricultural Products 0.26% | 1,951,553 | ||||

| Bunge Ltd. Finance Corp., | |||||

| Gtd Sr Note | 5.350 | 04-15-14 | 2,100 | 1,951,553 | |

| Air Freight & Logistics 0.23% | 1,734,261 | ||||

| Fedex Corp., | |||||

| Sr Note | 7.375 | 01-15-14 | 1,600 | 1,734,261 | |

| Airlines 1.15% | 8,718,146 | ||||

| Continental Airlines, Inc., | |||||

| Ser 2000-2 Class B | 8.307 | 04-02-18 | 1,186 | 865,623 | |

| Ser 2001-1 Class C | 7.033 | 06-15-11 | 615 | 473,559 | |

| Ser 991A | 6.545 | 02-02-19 | 883 | 794,743 | |

| Delta Airlines, Inc., | |||||

| Ser 2002-1 Class G2 | 6.417 | 07-02-12 | 2,755 | 2,341,750 | |

| Ser 2007-1 Class A | 6.821 | 08-10-22 | 2,709 | 2,180,800 | |

| Northwest Airlines, Inc., | |||||

| Ser 2007-1 Class A | 7.027 | 11-01-19 | 1,655 | 1,191,458 | |

| US Airways Group, Inc., | |||||

| Note | 7.250 | 05-15-14 | 1,130 | 870,213 | |

| Aluminum 0.33% | 2,523,401 | ||||

| CII Carbon, LLC, | |||||

| Gtd Sr Sub Note (S) | 11.125 | 11-15-15 | 1,835 | 1,266,150 | |

| Rio Tinto Alcan, Inc., | |||||

| Sr Note | 6.125 | 12-15-33 | 1,725 | 1,257,251 | |

| Asset Management & Custody Banks 0.75% | 5,671,863 | ||||

| Northern Trust Co., | |||||

| Sr Note | 4.625 | 05-01-14 | 1,600 | 1,613,957 | |

| Sub Note | 6.500 | 08-15-18 | 920 | 974,056 | |

| Rabobank Capital Fund II, | |||||

| Perpetual Bond (5.260% To 12-31-13 | |||||

| then variable) (S) | 5.260 | 12-31-49 | 4,005 | 3,083,850 | |

See notes to financial statements

| 12 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Auto Parts & Equipment 0.66% | $4,986,000 | ||||

| Allison Transmission, Inc., | |||||

| Gtd Sr Note (S) | 11.000% | 11-01-15 | $2,500 | 1,950,000 | |

| Exide Technologies, | |||||

| Sr Sec Note Ser B | 10.500 | 03-15-13 | 1,945 | 1,633,800 | |

| Tenneco, Inc., | |||||

| Gtd Sr Sub Note | 8.625 | 11-15-14 | 2,280 | 1,402,200 | |

| Brewers 0.68% | 5,159,284 | ||||

| Anheuser-Busch InBev Worldwide, Inc., | |||||

| Gtd Sr Note (S) | 7.200 | 01-15-14 | 1,655 | 1,775,155 | |

| Miller Brewing Co., | |||||

| Gtd Note (S) | 5.500 | 08-15-13 | 1,580 | 1,574,015 | |

| SABmiller PLC, | |||||

| Note (S) | 6.500 | 07-15-18 | 1,850 | 1,810,114 | |

| Broadcasting & Cable TV 0.19% | 1,413,475 | ||||

| Intelsat Jackson Holdings, Ltd., | |||||

| Note (S) | 11.500 | 06-15-16 | 1,435 | 1,413,475 | |

| Cable & Satellite 2.08% | 15,784,008 | ||||

| Charter Communications Holdings | |||||

| II, LLC, | |||||

| Gtd Sr Note (H)(S) | 10.250 | 10-01-13 | 1,680 | 1,554,000 | |

| Comcast Cable Communications | |||||

| Holdings, Inc., | |||||

| Sr Note | 9.800 | 02-01-12 | 3,715 | 4,121,588 | |

| Comcast Corp., | |||||

| Gtd Note | 6.500 | 01-15-15 | 1,295 | 1,339,889 | |

| Gtd Note | 4.950 | 06-15-16 | 1,470 | 1,405,423 | |

| COX Communications, Inc., | |||||

| Bond (S) | 8.375 | 03-01-39 | 845 | 887,514 | |

| CSC Holdings, Inc., | |||||

| Sr Note | 7.875 | 02-15-18 | 1,690 | 1,592,825 | |

| Time Warner Cable, Inc., | |||||

| Gtd Note | 8.750 | 02-14-19 | 1,205 | 1,381,954 | |

| Gtd Sr Note | 6.750 | 07-01-18 | 1,995 | 2,060,815 | |

| XM Satellite Radio, Inc., | |||||

| Gtd Sr Note (S) | 13.000 | 08-01-13 | 2,000 | 1,440,000 | |

| Casinos & Gaming 1.56% | 11,835,133 | ||||

| Ameristar Casinos, Inc., | |||||

| Sr Note (S) | 9.250 | 06-01-14 | 1,750 | 1,750,000 | |

| Fontainebleau Las Vegas Holdings, LLC, | |||||

| Note (S) | 11.000 | 06-15-15 | 1,825 | 82,125 | |

| Greektown Holdings, LLC, | |||||

| Sr Note (H)(S) | 10.750 | 12-01-13 | 1,170 | 81,900 | |

| Jacobs Entertainment, Inc., | |||||

| Gtd Sr Note | 9.750 | 06-15-14 | 1,970 | 1,477,500 | |

| Little Traverse Bay Bands of | |||||

| Odawa Indians, | |||||

| Sr Note (S) | 10.250 | 02-15-14 | 2,210 | 955,825 | |

| Mashantucket Western Pequot Tribe, | |||||

| Bond Ser A (S) | 8.500 | 11-15-15 | 395 | 154,050 | |

| MGM Mirage, Inc., | |||||

| Sr Note (S) | 10.375 | 05-15-14 | 350 | 360,500 | |

See notes to financial statements

| Annual report | Bond Fund | 13 |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Casinos & Gaming (continued) | |||||

| Mohegan Tribal Gaming Authority, | |||||

| Sr Sub Note | 8.000% | 04-01-12 | $420 | $316,050 | |

| Sr Sub Note | 7.125 | 08-15-14 | 1,050 | 724,500 | |

| MTR Gaming Group, Inc., | |||||

| Gtd Sr Note Ser B | 9.750 | 04-01-10 | 1,365 | 1,228,500 | |

| Gtd Sr Sub Note Ser B | 9.000 | 06-01-12 | 1,090 | 675,800 | |

| Seminole Tribe of Florida, | |||||

| Bond (S) | 6.535 | 10-01-20 | 2,260 | 1,740,833 | |

| Turning Stone Resort Casino Enterprise, | |||||

| Sr Note (S) | 9.125 | 09-15-14 | 1,890 | 1,549,800 | |

| Waterford Gaming, LLC, | |||||

| Sr Note (S) | 8.625 | 09-15-14 | 1,135 | 737,750 | |

| Coal & Consumable Fuels 0.21% | 1,576,200 | ||||

| Drummond Co., Inc., | |||||

| Sr Note (S) | 7.375 | 02-15-16 | 2,130 | 1,576,200 | |

| Commodity Chemicals 0.17% | 1,298,163 | ||||

| Sterling Chemicals, Inc., | |||||

| Gtd Sr Sec Note | 10.250 | 04-01-15 | 1,490 | 1,298,163 | |

| Construction & Farm Machinery & Heavy Trucks 0.14% | 1,039,791 | ||||

| Terex Corp., | |||||

| Sr Note | 10.875 | 11-15-14 | 1,065 | 1,039,791 | |

| Construction Materials 0.24% | 1,806,866 | ||||

| CRH America, Inc., | |||||

| Gtd Note | 8.125 | 07-15-18 | 1,930 | 1,806,866 | |

| Consumer Finance 1.21% | 9,154,977 | ||||

| American Express Co., | |||||

| Sr Note | 7.000 | 03-19-18 | 1,995 | 1,905,387 | |

| American Express Credit Co., | |||||

| Sr Note Ser C | 7.300 | 08-20-13 | 2,700 | 2,733,202 | |

| American General Finance Corp., | |||||

| Note Ser J | 6.900 | 12-15-17 | 1,735 | 858,334 | |

| Capital One Financial Corp., | |||||

| Sr Note | 7.375 | 05-23-14 | 1,320 | 1,360,054 | |

| Nelnet, Inc., | |||||

| Note (7.400% to 9-1-11 then variable) | 7.400 | 09-29-36 | 2,595 | 1,167,750 | |

| SLM Corp., | |||||

| Sr Note Ser MTN | 8.450 | 06-15-18 | 1,650 | 1,130,250 | |

| Data Processing & Outsourced Services 0.19% | 1,456,205 | ||||

| Fiserv, Inc., | |||||

| Gtd Sr Note | 6.800 | 11-20-17 | 1,505 | 1,456,205 | |

| Department Stores 0.32% | 2,455,105 | ||||

| Macy’s Retail Holdings, Inc., | |||||

| Gtd Note | 8.875 | 07-15-15 | 1,540 | 1,483,759 | |

| Nordstrom, Inc., | |||||

| Sr Note | 6.750 | 06-01-14 | 965 | 971,346 | |

| Diversified Banks 1.43% | 10,869,932 | ||||

| Chuo Mitsui Trust & Banking Co. Ltd., | |||||

| Jr Sub Note (5.506% to 4-15-15 then | |||||

| variable) (S) | 5.506 | 12-15-49 | 2,530 | 1,720,400 | |

| Lloyds Banking Group, PLC, | |||||

| Note (P)(S) | 6.413 | 12-31-49 | 2,410 | 939,900 | |

See notes to financial statements

| 14 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Diversified Banks (continued) | |||||

| Mizuho Financial Group, Ltd., | |||||

| Gtd Sub Bond | 8.375% | 12-29-49 | $1,415 | $1,330,100 | |

| Natixis SA, | |||||

| Sub Bond (10.000% to 4-30-18 then | |||||

| variable) (S) | 10.000 | 04-29-49 | 1,575 | 866,597 | |

| Royal Bank of Scotland Group PLC, | |||||

| Jr Sub Bond Ser MTN (7.640% to | |||||

| 9-29-17 then variable) | 7.640 | 03-31-49 | 1,400 | 526,820 | |

| Silicon Valley Bank, | |||||

| Sub Note | 6.050 | 06-01-17 | 2,335 | 1,703,628 | |

| Sovereign Capital Trust VI, | |||||

| Gtd Note | 7.908 | 06-13-36 | 1,840 | 1,395,870 | |

| Wachovia Bank NA, | |||||

| Sub Note | 5.850 | 02-01-37 | 1,665 | 1,235,928 | |

| Sub Note Ser BKNT | 6.600 | 01-15-38 | 1,360 | 1,150,689 | |

| Diversified Chemicals 0.37% | 2,839,107 | ||||

| Dow Chemical Company, | |||||

| Sr Note | 8.550 | 05-15-19 | 1,350 | 1,349,868 | |

| EI Du Pont de Nemours & Co., | |||||

| Sr Note | 5.875 | 01-15-14 | 1,370 | 1,489,239 | |

| Diversified Financial Services 3.06% | 23,224,132 | ||||

| Beaver Valley Funding, | |||||

| Sec Lease Obligation Bond | 9.000 | 06-01-17 | 3,670 | 3,620,272 | |

| Citigroup, Inc., | |||||

| Jr Sub Bond (8.400% to 4-30-18 | |||||

| then variable) | 8.400 | 04-29-49 | 1,410 | 1,233,736 | |

| Sr Note | 6.125 | 11-21-17 | 2,925 | 2,621,786 | |

| Sr Note | 5.850 | 12-11-34 | 1,275 | 1,010,812 | |

| ERAC USA Finance Co., | |||||

| Gtd Sr Note (S) | 6.375 | 10-15-17 | 1,730 | 1,453,037 | |

| General Electric Capital Corp., | |||||

| Sr Note | 5.625 | 05-01-18 | 1,910 | 1,824,149 | |

| Sr Note Ser MTN | 5.875 | 01-14-38 | 2,330 | 1,886,347 | |

| JPMorgan Chase & Co., | |||||

| Jr Sub Note Ser 1 (7.900% to 4-30-18 | |||||

| then variable) | 7.900 | 04-26-49 | 2,470 | 2,062,524 | |

| Sr Note | 6.300 | 04-23-19 | 3,260 | 3,243,403 | |

| Sr Note | 4.650 | 06-01-14 | 2,575 | 2,557,665 | |

| SMFG Preferred Capital, | |||||

| Sub Bond (6.078% to 1-25-17 | |||||

| then variable) (S) | 6.078 | 01-01-49 | 2,215 | 1,710,401 | |

| Diversified Metals & Mining 0.72% | 5,497,776 | ||||

| Rio Tinto Finance USA, Ltd., | |||||

| Gtd Sr Note | 8.950 | 05-01-14 | 3,015 | 3,240,251 | |

| Teck Resources, Ltd., | |||||

| Sr Note (S) | 10.750 | 05-15-19 | 835 | 855,875 | |

| Vedanta Resources, PLC, | |||||

| Note (S) | 8.750 | 01-15-14 | 1,445 | 1,401,650 | |

See notes to financial statements

| Annual report | Bond Fund | 15 |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Drug Retail 0.53% | $4,014,836 | ||||

| CVS Caremark Corp., | |||||

| Jr Sub Bond (6.302% to 6-1-12 | |||||

| then variable) | 6.302% | 06-01-37 | $3,635 | 2,471,800 | |

| Sr Note | 5.750 | 06-01-17 | 1,545 | 1,543,036 | |

| Electric Utilities 3.58% | 27,186,683 | ||||

| BVPS II Funding Corp., | |||||

| Collateralized Lease Bond | 8.890 | 06-01-17 | 2,233 | 2,218,579 | |

| Commonwealth Edison Co., | |||||

| Sec Bond | 5.800 | 03-15-18 | 2,995 | 2,950,854 | |

| Delmarva Power & Light Co., | |||||

| 1st Mtg Bond | 6.400 | 12-01-13 | 1,475 | 1,552,479 | |

| Duke Energy Corp., | |||||

| Sr Note | 6.300 | 02-01-14 | 1,465 | 1,553,934 | |

| Indiantown Cogeneration LP, | |||||

| 1st Mtg Note Ser A–9 | 9.260 | 12-15-10 | 696 | 681,804 | |

| Israel Electric Corp., Ltd., | |||||

| Sec Note (S) | 7.250 | 01-15-19 | 2,395 | 2,416,639 | |

| ITC Holdings Corp., | |||||

| Sr Note (S) | 5.875 | 09-30-16 | 745 | 675,007 | |

| Midwest Generation LLC, | |||||

| Note Ser B | 8.560 | 01-02-16 | 2,484 | 2,409,025 | |

| Monongahela Power Co., | |||||

| Note (S) | 7.950 | 12-15-13 | 2,705 | 2,875,491 | |

| Nevada Power Co., | |||||

| Mtg Note Ser L | 5.875 | 01-15-15 | 1,540 | 1,504,560 | |

| Oncor Electric Delivery Co., | |||||

| Sr Sec Note | 6.375 | 05-01-12 | 3,470 | 3,566,570 | |

| PNPP II Funding Corp., | |||||

| Deb | 9.120 | 05-30-16 | 159 | 155,470 | |

| Southern Power Co., | |||||

| Sr Note Ser D | 4.875 | 07-15-15 | 1,150 | 1,083,542 | |

| Texas Competitive Electric Holdings | |||||

| Co. LLC, | |||||

| Gtd Sr Note Ser A | 10.250 | 11-01-15 | 2,505 | 1,484,212 | |

| Waterford 3 Funding Corp., | |||||

| Sec Lease Obligation Bond | 8.090 | 01-02-17 | 2,096 | 2,058,517 | |

| Electrical Components & Equipment 0.03% | 221,935 | ||||

| GrafTech Finance, Inc., | |||||

| Gtd Sr Note | 10.250 | 02-15-12 | 238 | 221,935 | |

| Electronic Manufacturing Services 0.34% | 2,609,920 | ||||

| Tyco Electronics Group SA, | |||||

| Gtd Note | 6.000 | 10-01-12 | 1,790 | 1,749,598 | |

| Gtd Sr Note | 6.550 | 10-01-17 | 970 | 860,322 | |

| Environmental & Facilities Services 0.06% | 436,500 | ||||

| Blaze Recycling & Metals LLC, | |||||

| Gtd Sr Sec Note (S) | 10.875 | 07-15-12 | 970 | 436,500 | |

| Fertilizers & Agricultural Chemicals 0.46% | 3,464,510 | ||||

| Mosiac Co., | |||||

| Sr Note (S) | 7.625 | 12-01-16 | 1,780 | 1,771,100 | |

| Potash Corp. of Saskatchewan, Inc., | |||||

| Sr Note | 5.250 | 05-15-14 | 1,640 | 1,693,410 | |

See notes to financial statements

| 16 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Gas Utilities 0.63% | $4,786,558 | ||||

| Atmos Energy Corp., | |||||

| Sr Note | 8.500% | 03-15-19 | $1,710 | 1,893,421 | |

| DCP Midstream LLC, | |||||

| Sr Note (S) | 9.750 | 03-15-19 | 1,705 | 1,779,041 | |

| EQT Corp., | |||||

| Note | 8.125 | 06-01-19 | 1,080 | 1,114,096 | |

| Gold 0.21% | 1,632,726 | ||||

| Barrick Gold Corp., | |||||

| Sr Note | 6.950 | 04-01-19 | 1,500 | 1,632,726 | |

| Health Care Equipment 0.23% | 1,740,073 | ||||

| Beckman Coulter, Inc., | |||||

| Note | 7.000 | 06-01-19 | 975 | 998,134 | |

| Hospira, Inc., | |||||

| Sr Note Series GMTN | 6.400 | 05-15-15 | 730 | 741,939 | |

| Health Care Facilities 0.17% | 1,310,094 | ||||

| Community Health Systems, Inc., | |||||

| Gtd Sr Sub Note | 8.875 | 07-15-15 | 1,325 | 1,310,094 | |

| Health Care Services 0.48% | 3,673,050 | ||||

| Medco Health Solutions, Inc., | |||||

| Sr Note | 7.250 | 08-15-13 | 3,615 | 3,673,050 | |

| Home Improvement Retail 0.15% | 1,110,899 | ||||

| Home Depot, Inc., | |||||

| Sr Note | 5.875 | 12-16-36 | 1,385 | 1,110,899 | |

| Hotels, Resorts & Cruise Lines 0.21% | 1,619,550 | ||||

| Starwood Hotels & Resorts | |||||

| Worldwide, Inc., | |||||

| Sr Note | 6.250 | 02-15-13 | 1,770 | 1,619,550 | |

| Household Appliances 0.39% | 2,943,197 | ||||

| Whirlpool Corp., | |||||

| Sr Note | 8.600 | 05-01-14 | 1,450 | 1,465,451 | |

| Sr Note | 8.000 | 05-01-12 | 1,450 | 1,477,746 | |

| Household Products 0.20% | 1,513,775 | ||||

| Yankee Acquisition Corp., | |||||

| Gtd Sr Sub Note | 8.500 | 02-15-15 | 2,005 | 1,513,775 | |

| Independent Power Producers & Energy Traders 0.61% | 4,622,789 | ||||

| AES Eastern Energy LP, | |||||

| Ser 1999-A | 9.000 | 01-02-17 | 3,236 | 3,009,764 | |

| IPALCO Enterprises, Inc., | |||||

| Sr Sec Note | 8.625 | 11-14-11 | 1,605 | 1,613,025 | |

| Industrial Machinery 0.27% | 2,046,714 | ||||

| Ingersoll-Rand Global Holding Co., Ltd., | |||||

| Gtd Note | 6.875 | 08-15-18 | 2,095 | 2,046,714 | |

| Industrial REIT’s 0.40% | 3,035,600 | ||||

| ProLogis, | |||||

| Sr Note | 6.625 | 05-15-18 | 2,285 | 1,786,194 | |

| Sr Note | 5.625 | 11-15-15 | 1,615 | 1,249,406 | |

| Integrated Oil & Gas 0.29% | 2,197,929 | ||||

| Marathon Oil Corp., | |||||

| Sr Note | 7.500 | 02-15-19 | 830 | 875,478 | |

See notes to financial statements

| Annual report | Bond Fund | 17 |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Integrated Oil & Gas (continued) | |||||

| Petro-Canada, | |||||

| Sr Note | 6.050% | 05-15-18 | $1,415 | $1,322,451 | |

| Integrated Telecommunication Services 1.63% | 12,397,332 | ||||

| Cincinnati Bell, Inc., | |||||

| Gtd Sr Sub Note | 8.375 | 01-15-14 | 1,825 | 1,726,906 | |

| Citizens Communications Co., | |||||

| Sr Note | 6.250 | 01-15-13 | 1,340 | 1,254,575 | |

| Qwest Corp., | |||||

| Sr Note | 7.875 | 09-01-11 | 1,620 | 1,613,925 | |

| Telecom Italia Capital, | |||||

| Gtd Sr Note | 7.721 | 06-04-38 | 2,550 | 2,406,950 | |

| Verizon Communications, Inc., | |||||

| Sr Bond | 6.900 | 04-15-38 | 1,430 | 1,454,739 | |

| Verizon Wireless Capital LLC, | |||||

| Sr Note (S) | 7.375 | 11-15-13 | 1,470 | 1,649,487 | |

| West Corp., | |||||

| Gtd Sr Sub Note | 11.000 | 10-15-16 | 2,695 | 2,290,750 | |

| Investment Banking & Brokerage 2.51% | 19,098,415 | ||||

| Bear Stearns Cos., Inc., | |||||

| Sr Note | 7.250 | 02-01-18 | 1,950 | 2,010,329 | |

| Goldman Sachs Group, Inc., | |||||

| Jr Sub Note | 6.750 | 10-01-37 | 1,830 | 1,534,135 | |

| Note | 7.500 | 02-15-19 | 2,030 | 2,136,068 | |

| Sr Note | 5.125 | 01-15-15 | 3,045 | 2,964,186 | |

| Jefferies Group, Inc., | |||||

| Sr Note | 6.450 | 06-08-27 | 1,115 | 704,875 | |

| Merrill Lynch & Co., Inc., | |||||

| Jr Sub Bond | 7.750 | 05-14-38 | 1,770 | 1,562,974 | |

| Sr Note Ser MTN | 6.875 | 04-25-18 | 3,095 | 2,872,343 | |

| Morgan Stanley, | |||||

| Sr Note | 7.300 | 05-13-19 | 2,070 | 2,120,388 | |

| Sr Note Ser F | 6.625 | 04-01-18 | 3,230 | 3,193,117 | |

| Leisure Facilities 0.33% | 2,512,406 | ||||

| AMC Entertainment, Inc., | |||||

| Sr Note (C)(S) | 8.750 | 06-01-19 | 525 | 509,906 | |

| Sr Sub Note | 8.000 | 03-01-14 | 2,225 | 2,002,500 | |

| Leisure Products 0.19% | 1,460,672 | ||||

| Hasbro, Inc., | |||||

| Sr Note | 6.125 | 05-15-14 | 1,450 | 1,460,672 | |

| Life & Health Insurance 0.87% | 6,626,585 | ||||

| Aflac, Inc., | |||||

| Sr Note | 8.500 | 05-15-19 | 1,455 | 1,506,811 | |

| Lincoln National Corp., | |||||

| Jr Sub Bond (6.050% to 4-20-17 | |||||

| then variable) | 6.050 | 04-20-67 | 915 | 512,400 | |

| Metlife, Inc., | |||||

| Sr Note | 6.750 | 06-01-16 | 1,445 | 1,470,429 | |

| Prudential Financial, Inc., | |||||

| Sr Note Ser D | 5.150 | 01-15-13 | 2,700 | 2,539,345 | |

| Symetra Financial Corp., | |||||

| Jr Sub Bond (8.300% to 10-1-17 | |||||

| then variable) (S) | 8.300 | 10-15-37 | 1,660 | 597,600 | |

See notes to financial statements

| 18 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Managed Health Care 0.28% | $2,116,393 | ||||

| Humana, Inc., | |||||

| Sr Note | 8.150% | 06-15-38 | $2,775 | 2,116,393 | |

| Marine 0.36% | 2,748,275 | ||||

| CMA CGM SA, | |||||

| Sr Note (S) | 7.250 | 02-01-13 | 2,690 | 1,237,400 | |

| Navios Maritime Holdings, Inc., | |||||

| Sr Note | 9.500 | 12-15-14 | 1,975 | 1,510,875 | |

| Metal & Glass Containers 0.18% | 1,388,263 | ||||

| BWAY Corp., | |||||

| Sr Sub Note (S) | 10.000 | 04-15-14 | 1,390 | 1,388,263 | |

| Movies & Entertainment 0.63% | 4,824,005 | ||||

| Cinemark, Inc., | |||||

| Sr Disc Note | 9.750 | 03-15-14 | 920 | 933,800 | |

| News America Holdings, Inc., | |||||

| Gtd Sr Deb | 8.250 | 08-10-18 | 2,085 | 2,115,641 | |

| Time Warner Entertainment Co., LP., | |||||

| Sr Deb | 8.375 | 03-15-23 | 1,705 | 1,774,564 | |

| Multi-Line Insurance 1.11% | 8,456,950 | ||||

| AXA SA, | |||||

| Sub Note (6.379% to 12-14-36 | |||||

| then variable) (S) | 6.379 | 12-14-49 | 1,170 | 725,435 | |

| Genworth Financial, Inc., | |||||

| Jr Sub Note (6.150% to 11-15-16 | |||||

| then variable) | 6.150 | 11-15-66 | 1,640 | 495,395 | |

| Horace Mann Educators Corp., | |||||

| Sr Note | 6.850 | 04-15-16 | 1,425 | 1,205,769 | |

| Liberty Mutual Group, Inc., | |||||

| Bond (S) | 7.500 | 08-15-36 | 3,070 | 1,967,965 | |

| Bond (S) | 7.300 | 06-15-14 | 2,330 | 1,829,924 | |

| Gtd Bond (S) | 7.800 | 03-15-37 | 2,635 | 1,291,150 | |

| Massachusetts Mutual Life | |||||

| Insurance Co., | |||||

| Note (S) | 8.875 | 06-01-39 | 895 | 941,312 | |

| Multi-Media 0.22% | 1,637,835 | ||||

| News America, Inc., | |||||

| Gtd Note (S) | 6.900 | 03-01-19 | 1,675 | 1,637,835 | |

| Multi-Utilities 1.55% | 11,810,381 | ||||

| DTE Energy Co., | |||||

| Sr Note | 7.625 | 05-15-14 | 1,310 | 1,353,162 | |

| Dynegy-Roseton Danskammer, | |||||

| Ser B | 7.670 | 11-08-16 | 1,990 | 1,681,550 | |

| PG&E Corp., | |||||

| Sr Note | 5.750 | 04-01-14 | 1,775 | 1,840,730 | |

| Salton Sea Funding Corp., | |||||

| Sr Sec Bond Ser F | 7.475 | 11-30-18 | 1,265 | 1,189,996 | |

| Sempra Energy, | |||||

| Sr Bond | 8.900 | 11-15-13 | 1,465 | 1,618,018 | |

| Sr Note | 6.500 | 06-01-16 | 1,745 | 1,780,380 | |

| Teco Finance Inc., | |||||

| Gtd Sr Note | 7.000 | 05-01-12 | 1,166 | 1,171,115 | |

| Gtd Sr Note | 6.572 | 11-01-17 | 1,304 | 1,175,430 | |

See notes to financial statements

| Annual report | Bond Fund | 19 |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Office Electronics 0.41% | $3,144,422 | ||||

| Xerox Corp., | |||||

| Sr Note | 8.250% | 05-15-14 | $1,160 | 1,177,352 | |

| Sr Note | 6.750 | 02-01-17 | 2,204 | 1,967,070 | |

| Office REIT’s 0.11% | 854,771 | ||||

| HRPT Properties Trust, | |||||

| Sr Note | 6.650 | 01-15-18 | 1,070 | 854,771 | |

| Oil & Gas Drilling 0.12% | 911,772 | ||||

| Delek & Avner Yam Tethys Ltd., | |||||

| Sr Sec Note (S) | 5.326 | 08-01-13 | 914 | 911,772 | |

| Oil & Gas Equipment & Services 0.09% | 685,800 | ||||

| Allis-Chalmers Energy, Inc., | |||||

| Sr Note | 8.500 | 03-01-17 | 1,270 | 685,800 | |

| Oil & Gas Exploration & Production 1.10% | 8,335,973 | ||||

| Devon Energy Corp., | |||||

| Sr Note | 5.625 | 01-15-14 | 2,620 | 2,747,046 | |

| EnCana Corp., | |||||

| Sr Note | 6.500 | 05-15-19 | 890 | 914,422 | |

| McMoRan Exploration Co., | |||||

| Gtd Sr Note | 11.875 | 11-15-14 | 1,230 | 953,250 | |

| Nexen, Inc., | |||||

| Sr Note | 5.875 | 03-10-35 | 1,500 | 1,190,538 | |

| XTO Energy, Inc., | |||||

| Sr Note | 5.900 | 08-01-12 | 2,420 | 2,530,717 | |

| Oil & Gas Storage & Transportation 3.66% | 27,790,265 | ||||

| Buckeye Partners LP, | |||||

| Sr Note | 5.125 | 07-01-17 | 1,260 | 1,036,242 | |

| Energy Transfer Partners LP, | |||||

| Sr Note | 9.700 | 03-15-19 | 1,445 | 1,680,428 | |

| Sr Note | 8.500 | 04-15-14 | 1,450 | 1,613,724 | |

| Enterprise Products Operating LLC, | |||||

| Gtd Sr Note Ser B | 5.600 | 10-15-14 | 2,760 | 2,712,807 | |

| Enterprise Products Operating LP, | |||||

| Gtd Jr Sub Note (7.034% to 1-15-18 | |||||

| then variable) | 7.034 | 01-15-68 | 2,130 | 1,491,000 | |

| Kinder Morgan Energy Partners LP, | |||||

| Sr Bond | 7.750 | 03-15-32 | 840 | 835,404 | |

| Sr Note | 9.000 | 02-01-19 | 2,190 | 2,469,827 | |

| Sr Note | 5.125 | 11-15-14 | 980 | 951,507 | |

| Markwest Energy Partners LP, | |||||

| Gtd Sr Note Ser B | 8.500 | 07-15-16 | 1,745 | 1,474,525 | |

| NGPL PipeCo LLC, | |||||

| Sr Note (S) | 7.119 | 12-15-17 | 2,150 | 2,184,473 | |

| ONEOK Partners LP, | |||||

| Gtd Sr Note | 6.150 | 10-01-16 | 3,020 | 2,879,902 | |

| Sr Note | 8.625 | 03-01-19 | 1,455 | 1,604,909 | |

| Plains All American Pipeline LP, | |||||

| Gtd Sr Note | 6.500 | 05-01-18 | 1,290 | 1,246,008 | |

| Regency Energy Partners LP, | |||||

| Sr Note (S) | 9.375 | 06-01-16 | 1,225 | 1,188,250 | |

| Southern Union Co., | |||||

| Jr Sub Note, Ser A (7.200% to 11-1-11 | |||||

| then variable) | 7.200 | 11-01-66 | 2,165 | 1,309,825 | |

See notes to financial statements

| 20 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Oil & Gas Storage & Transportation (continued) | |||||

| Spectra Energy Capital LLC, | |||||

| Gtd Sr Note | 6.200% | 04-15-18 | $1,440 | $1,385,434 | |

| TEPPCO Partners LP, | |||||

| Gtd Jr Sub Note (7.00% to 6-1-17 | |||||

| then variable) | 7.000 | 06-01-67 | 2,640 | 1,726,000 | |

| Packaged Foods & Meats 1.14% | 8,638,285 | ||||

| ASG Consolidated LLC/ASG | |||||

| Finance, Inc., | |||||

| Sr Disc Note | 11.500 | 11-01-11 | 1,860 | 1,664,700 | |

| General Mills, Inc., | |||||

| Sr Note | 5.200 | 03-17-15 | 665 | 691,414 | |

| Kraft Foods, Inc., | |||||

| Sr Note | 6.125 | 02-01-18 | 3,280 | 3,346,994 | |

| Sr Note | 6.000 | 02-11-13 | 2,760 | 2,935,177 | |

| Paper Packaging 0.05% | 344,850 | ||||

| U.S. Corrugated, Inc., | |||||

| Sr Sec Note | 10.000 | 06-12-13 | 605 | 344,850 | |

| Paper Products 0.57% | 4,312,868 | ||||

| International Paper Co., | |||||

| Sr Note | 9.375 | 05-15-19 | 1,650 | 1,660,878 | |

| Sr Note | 7.950 | 06-15-18 | 1,745 | 1,643,465 | |

| Verso Paper Holdings LLC, | |||||

| Gtd Sr Note Ser B | 9.125 | 08-01-14 | 1,695 | 1,008,525 | |

| Pharmaceuticals 0.13% | 985,669 | ||||

| Wyeth, | |||||

| Sr Sub Note | 5.500 | 03-15-13 | 925 | 985,669 | |

| Property & Casualty Insurance 0.49% | 3,724,145 | ||||

| Chubb Corp., | |||||

| Sr Note | 5.750 | 05-15-18 | 990 | 997,778 | |

| Progressive Corp., | |||||

| Jr Sub Debenture (6.700% to 6-1-17 | |||||

| then variable) | 6.700 | 06-15-37 | 1,225 | 820,423 | |

| QBE Insurance Group, Ltd., | |||||

| Sr Note (S) | 9.750 | 03-14-14 | 1,739 | 1,905,944 | |

| Publishing 0.02% | 182,700 | ||||

| R.H. Donnelley Corp., | |||||

| Sr Note Ser A–4 (H) | 8.875 | 10-15-17 | 2,610 | 182,700 | |

| Railroads 0.76% | 5,762,152 | ||||

| CSX Corp., | |||||

| Sr Note | 6.250 | 04-01-15 | 665 | 658,006 | |

| Sr Note | 5.500 | 08-01-13 | 2,590 | 2,599,329 | |

| Union Pacific Corp., | |||||

| Sr Bond | 5.450 | 01-31-13 | 2,465 | 2,504,817 | |

| Retail REIT’s 0.53% | 4,057,759 | ||||

| Simon Property Group LP, | |||||

| Sr Note | 10.350 | 04-01-19 | 1,495 | 1,683,823 | |

| Sr Note | 5.625 | 08-15-14 | 2,520 | 2,373,936 | |

| Soft Drinks 0.28% | 2,127,725 | ||||

| Dr Pepper Snapple Group, Inc., | |||||

| Gtd Sr Note | 6.820 | 05-01-18 | 1,215 | 1,222,949 | |

| Gtd Sr Note | 6.120 | 05-01-13 | 885 | 904,776 | |

See notes to financial statements

| Annual report | Bond Fund | 21 |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Specialized Consumer Services 0.18% | $1,348,013 | ||||

| Sotheby’s, | |||||

| Gtd Note | 7.750% | 06-15-15 | $1,745 | 1,348,013 | |

| Specialized Finance 1.89% | 14,372,411 | ||||

| American Honda Finance Corp., | |||||

| Note (S) | 7.625 | 10-01-18 | 2,750 | 2,629,946 | |

| Astoria Depositor Corp., | |||||

| Ser B (S) | 8.144 | 05-01-21 | 3,590 | 2,728,400 | |

| Bosphorous Financial Services, | |||||

| Sec Floating Rate Note (P)(S) | 2.683 | 02-15-12 | 1,829 | 1,584,939 | |

| CIT Group, Inc., | |||||

| Sr Note | 5.650 | 02-13-17 | 660 | 436,581 | |

| Sr Note | 5.000 | 02-13-14 | 445 | 299,867 | |

| Sr Note Ser MTN | 5.125 | 09-30-14 | 575 | 385,256 | |

| CME Group, Inc., | |||||

| Sr Note | 5.750 | 02-15-14 | 2,025 | 2,135,603 | |

| ESI Tractebel Acquisition Corp., | |||||

| Gtd Sec Bond Ser B | 7.990 | 12-30-11 | 2,664 | 2,580,569 | |

| HRP Myrtle Beach Operations, LLC, | |||||

| Sr Note (H)(S) | Zero | 04-01-12 | 1,075 | 10,750 | |

| USB Realty Corp., | |||||

| Perpetual Bond (6.091% to 1-15-12 | |||||

| then variable) (S) | 6.091 | 12-22-49 | 2,900 | 1,580,500 | |

| Specialized REIT’s 0.78% | 5,906,593 | ||||

| Health Care REIT, Inc., | |||||

| Sr Note | 6.200 | 06-01-16 | 1,835 | 1,518,802 | |

| Healthcare Realty Trust, Inc., | |||||

| Sr Note | 8.125 | 05-01-11 | 1,340 | 1,316,977 | |

| Nationwide Health Properties, Inc., | |||||

| Note | 6.500 | 07-15-11 | 1,745 | 1,600,001 | |

| Plum Creek Timberlands LP, | |||||

| Gtd Note | 5.875 | 11-15-15 | 1,740 | 1,470,813 | |

| Specialty Chemicals 0.55% | 4,209,009 | ||||

| American Pacific Corp., | |||||

| Gtd Sr Note | 9.000 | 02-01-15 | 2,160 | 1,884,600 | |

| Ecolab, Inc., | |||||

| Sr Note | 4.875 | 02-15-15 | 1,515 | 1,475,109 | |

| Momentive Performance, | |||||

| Gtd Sr Note | 9.750 | 12-01-14 | 2,235 | 849,300 | |

| Specialty Stores 0.27% | 2,061,914 | ||||

| Staples, Inc., | |||||

| Sr Note | 9.750 | 01-15-14 | 1,870 | 2,061,914 | |

| Steel 0.79% | 5,993,671 | ||||

| Allegheny Technologies, Inc., | |||||

| Sr Note | 9.375 | 06-01-19 | 1,205 | 1,223,075 | |

| Sr Note | 8.375 | 12-15-11 | 1,180 | 1,253,771 | |

| ArcelorMittal, | |||||

| Sr Note | 9.850 | 06-01-19 | 2,360 | 2,423,376 | |

| Commercial Metals Co., | |||||

| Sr Note | 7.350 | 08-15-18 | 1,295 | 1,093,449 | |

| Tires & Rubber 0.25% | 1,865,625 | ||||

| Goodyear Tire & Rubber Co., | |||||

| Sr Note | 10.500 | 05-15-16 | 1,875 | 1,865,625 | |

See notes to financial statements

| 22 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Tobacco 1.21% | $9,168,349 | ||||

| Alliance One International, Inc., | |||||

| Gtd Sr Note | 8.500% | 05-15-12 | $890 | 827,700 | |

| Altria Group, Inc., | |||||

| Gtd Sr Note | 8.500 | 11-10-13 | 3,405 | 3,830,547 | |

| Philip Morris International, Inc., | |||||

| Note | 5.650 | 05-16-18 | 2,905 | 2,972,489 | |

| Reynolds American, Inc., | |||||

| Sr Sec Note | 7.250 | 06-01-13 | 1,535 | 1,537,613 | |

| Trading Companies & Distributors 0.50% | 3,775,070 | ||||

| GATX Corp., | |||||

| Sr Note | 8.750 | 05-15-14 | 2,375 | 2,390,345 | |

| United Rentals North America, Inc., | |||||

| Gtd Sr Note | 7.750 | 11-15-13 | 485 | 395,275 | |

| Gtd Sr Note | 7.000 | 02-15-14 | 1,285 | 989,450 | |

| Wireless Telecommunication Services 1.03% | 7,862,317 | ||||

| America Movil SAB de CV, | |||||

| Sr Sec Note | 5.750 | 01-15-15 | 1,595 | 1,638,870 | |

| Digicel Group Ltd., | |||||

| Sr Note (S) | 8.875 | 01-15-15 | 2,115 | 1,692,000 | |

| Nextel Communications, Inc., | |||||

| Sr Gtd Note Ser E | 6.875 | 10-31-13 | 2,130 | 1,773,225 | |

| Rogers Cable, Inc., | |||||

| Sr Sec Note | 6.750 | 03-15-15 | 1,595 | 1,647,284 | |

| Sprint Capital Corp., | |||||

| Gtd Note | 7.625 | 01-30-11 | 1,125 | 1,110,938 | |

| Issuer, description | Shares | Value | |||

| Preferred stocks 0.66% | $5,030,708 | ||||

| (Cost $6,474,548) | |||||

| Agricultural Products 0.20% | 1,485,821 | ||||

| Ocean Spray Cranberries, Inc., | |||||

| 6.250%, Ser A (S) | 23,250 | 1,485,821 | |||

| Diversified Financial Services 0.25% | 1,932,177 | ||||

| Bank of America Corp., 8.625% | 100,425 | 1,932,177 | |||

| Wireless Telecommunication Services 0.21% | 1,612,710 | ||||

| Telephone & Data Systems, Inc., 7.600% | 81,000 | 1,612,710 | |||

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Convertible Bonds 0.07% | $558,438 | ||||

| (Cost $500,000) | |||||

| Auto Parts & Equipment 0.04% | 308,438 | ||||

| BorgWarner, Inc., | |||||

| Bond | 3.500% | 04-15-12 | $250 | 308,438 | |

| Construction & Farm Machinery & Heavy Trucks 0.03% | 250,000 | ||||

| Terex Corp., | |||||

| Bond | 4.000 | 06-01-15 | 250 | 250,000 | |

See notes to financial statements

| Annual report | Bond Fund | 23 |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Municipal bonds 0.28% | $2,096,945 | ||||

| (Cost $2,058,754) | |||||

| California 0.28% | 2,096,945 | ||||

| State of California, | |||||

| General Obligation (P) | 5.650% | 04-01-39 | $2,050 | 2,096,945 | |

| Interest | Maturity | Par value | |||

| Issuer, description, maturity date | rate | date | (000) | Value | |

| Tranche Loans 0.06% | $465,000 | ||||

| (Cost $767,250) | |||||

| Hotels, Resorts & Cruise Lines 0.06% | $465,000 | ||||

| East Valley Tourist | |||||

| Development Authority, | |||||

| Tranche EVTDA, 7.911%, 08-06-12 | 7.000% | 08-06-12 | $775 | 465,000 | |

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| U.S. Government & agency securities 27.51% | $208,975,249 | ||||

| (Cost $206,284,937) | |||||

| U.S. Government 2.39% | 18,192,199 | ||||

| United States Treasury, | |||||

| Bond | 3.500% | 02-15-39 | $11,605 | 10,000,260 | |

| Note | 3.125 | 05-15-19 | 2,260 | 2,195,386 | |

| Note | 1.375 | 04-15-12 | 5,990 | 5,996,553 | |

| U.S. Government Agency 25.12% | 190,783,050 | ||||

| Federal Farm Credit Bank, | |||||

| Bond | 2.625 | 04-17-14 | 4,860 | 4,805,607 | |

| Federal Home Loan Mortgage Corp., | |||||

| 30 Yr Pass Thru Ctf | 11.250 | 01-01-16 | 26 | 29,615 | |

| 30 Yr Pass Thru Ctf | 5.000 | 07-01-35 | 7,959 | 8,165,813 | |

| 30 Yr Pass Thru Ctf | 5.000 | 09-01-35 | 927 | 951,482 | |

| 30 Yr Pass Thru Ctf | 4.500 | 03-01-39 | 25,189 | 25,380,366 | |

| Note | 1.750 | 06-15-12 | 8,625 | 8,621,831 | |

| Federal National Mortgage Assn., | |||||

| 30 Yr Pass Thru Ctf | 5.500 | 05-01-35 | 20,396 | 21,175,577 | |

| 30 Yr Pass Thru Ctf (P) | 5.339 | 12-01-38 | 2,831 | 2,956,832 | |

| 30 Yr Pass Thru Ctf (P) | 5.319 | 12-01-38 | 4,376 | 4,570,614 | |

| 30 Yr Pass Thru Ctf | 5.000 | 11-01-33 | 4,155 | 4,270,980 | |

| 30 Yr Pass Thru Ctf | 5.000 | 03-01-38 | 9,338 | 9,571,761 | |

| 30 Yr Pass Thru Ctf | 5.000 | 03-01-38 | 15,897 | 16,295,957 | |

| 30 Yr Pass Thru Ctf | 5.000 | 05-01-38 | 20,054 | 20,556,998 | |

| 30 Yr Pass Thru Ctf (P) | 4.908 | 12-01-38 | 3,574 | 3,712,232 | |

| STRIPS | Zero | 02-01-15 | 2,020 | 1,489,696 | |

| TBA (C) | 4.000 | TBA | 52,030 | 52,428,352 | |

| Government National Mortgage Assn., | |||||

| 30 Yr Pass Thru Ctf | 10.500 | 01-15-16 | 10 | 11,272 | |

| 30 Yr Pass Thru Ctf | 10.000 | 06-15-20 | 24 | 27,664 | |

| 30 Yr Pass Thru Ctf | 10.000 | 11-15-20 | 10 | 11,880 | |

| 30 Yr Pass Thru Ctf | 4.500 | 03-15-39 | 2,189 | 2,213,081 | |

| SBA CMBS Trust, | |||||

| Sub Bond Ser 2005-1A Class D (S) | 6.219 | 11-15-35 | 850 | 816,000 | |

| Sub Bond Ser 2005-1A Class E (S) | 6.706 | 11-15-35 | 795 | 763,200 | |

| Sub Bond Ser 2006-1A Class H (S) | 7.389 | 11-15-36 | 1,373 | 1,208,240 | |

| Sub Bond Ser 2006-1A Class J (S) | 7.825 | 11-15-36 | 850 | 748,000 | |

See notes to financial statements

| 24 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Collateralized Mortgage Obligations 16.16% | $122,710,037 | ||||

| (Cost $176,954,994) | |||||

| Collateralized Mortgage Obligations 16.16% | 122,710,037 | ||||

| American Home Mortgage Assets, | |||||

| Ser 2006-6 Class A1A (P) | 0.499% | 12-25-46 | $2,692 | 1,041,801 | |

| Ser 2006-6 Class XP IO | 3.084 | 12-25-46 | 37,235 | 907,611 | |

| Ser 2007-5 Class XP IO | 3.927 | 06-25-47 | 36,286 | 1,587,512 | |

| American Home Mortgage | |||||

| Investment Trust, | |||||

| Ser 2007-1 Class GIOP IO | 2.078 | 05-25-47 | 29,451 | 1,306,874 | |

| American Tower Trust, | |||||

| Ser 2007-1A Class D (S) | 5.957 | 04-15-37 | 3,175 | 2,619,375 | |

| Banc of America Commercial | |||||

| Mortgage, Inc., | |||||

| Ser 2005-6 Class A4 (P) | 5.179 | 09-10-47 | 2,965 | 2,623,239 | |

| Ser 2006-2 Class A3 (P) | 5.711 | 05-10-45 | 5,400 | 4,687,106 | |

| Ser 2006-3 Class A4 (P) | 5.889 | 07-10-44 | 5,260 | 4,040,363 | |

| Ser 2006-4 Class A3A | 5.600 | 07-10-46 | 4,245 | 3,624,015 | |

| Banc of America Funding Corp., | |||||

| Ser 2006-B Class 6A1 (P) | 5.881 | 03-20-36 | 2,953 | 1,971,769 | |

| Ser 2007-E Class 4A1 (P) | 5.811 | 07-20-47 | 1,892 | 1,049,503 | |

| Bear Stearns Alt-A Trust, | |||||

| Ser 2005-3 Class B2 (P) | 5.246 | 04-25-35 | 1,164 | 194,841 | |

| Bear Stearns Commercial Mortgage | |||||

| Securities, Inc., | |||||

| Ser 2006-PW14 Class D (S) | 5.412 | 12-11-38 | 2,480 | 481,256 | |

| Bear Stearns Mortgage Funding Trust, | |||||

| Ser 2006-AR1 2A1 (P) | 0.529 | 08-25-36 | 1,830 | 666,147 | |

| Chaseflex Trust, | |||||

| Ser 2005-2 Class 4A1 | 5.000 | 05-25-20 | 2,371 | 2,095,968 | |

| Citigroup Commercial Mortgage Trust, | |||||

| Ser 2006-C4 Class A3 (P) | 5.726 | 03-15-49 | 3,350 | 2,810,163 | |

| Citigroup Mortgage Loan Trust, Inc., | |||||

| Ser 2005-10 Class 1A5A (P) | 5.827 | 12-25-35 | 2,487 | 1,569,465 | |

| Ser 2005-5 Class 2A3 | 5.000 | 08-25-35 | 1,440 | 1,201,056 | |

| Citigroup/Deutsche Bank Commercial | |||||

| Mortgage Trust, | |||||

| Ser 2005-CD1 Class C (P) | 5.225 | 07-15-44 | 1,030 | 468,365 | |

| ContiMortgage Home Equity Loan Trust, | |||||

| Ser 1995-2 Class A–5 | 8.100 | 08-15-25 | 258 | 225,369 | |

| Countrywide Alternative Loan Trust, | |||||

| Ser 2005-59 Class 2X IO | 3.351 | 11-20-35 | 30,272 | 865,603 | |

| Ser 2006-0A12 Class X IO | 3.776 | 09-20-46 | 42,298 | 1,295,381 | |

| Ser 2006-0A3 Class X IO | 2.911 | 05-25-36 | 14,923 | 496,666 | |

| Ser 2006-11CB Class 3A1 | 6.500 | 05-25-36 | 3,331 | 1,640,580 | |

| Ser 2007-25 1A2 | 6.500 | 11-25-37 | 5,117 | 3,148,325 | |

| Crown Castle Towers LLC, | |||||

| Ser 2006-1A Class F (S) | 6.650 | 11-15-36 | 5,065 | 4,761,100 | |

| Ser 2006-1A Class E (S) | 6.065 | 11-15-36 | 2,900 | 2,726,000 | |

| Sub Bond Ser 2005-1A Class D (S) | 5.612 | 06-15-35 | 3,455 | 3,351,350 | |

| DSLA Mortgage Loan Trust, | |||||

| Ser 2005-AR5 Class X2 IO | 3.427 | 08-19-45 | 29,830 | 522,023 | |

See notes to financial statements

| Annual report | Bond Fund | 25 |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Collateralized Mortgage Obligations (continued) | |||||

| First Horizon Alternative | |||||

| Mortgage Securities, | |||||

| Ser 2004-AA5 Class B1 (P) | 5.215% | 12-25-34 | $1,175 | $146,568 | |

| Ser 2006-RE1 Class A1 | 5.500 | 05-25-35 | 3,235 | 1,887,704 | |

| Global Signal Trust, | |||||

| Ser 2004-2A Class D (S) | 5.093 | 12-15-14 | 1,115 | 1,103,850 | |

| Global Tower Partners Acquisition | |||||

| Partners LLC, | |||||

| Ser 2007-1A Class F (S) | 7.050 | 05-15-37 | 780 | 611,276 | |

| GMAC Commercial Mortgage | |||||

| Securities, Inc., | |||||

| Ser 2003-C2 Class B (P) | 5.501 | 05-10-40 | 7,495 | 6,304,280 | |

| GMAC Mortgage Corp. Loan Trust, | |||||

| Ser 2006-AR1 Class 2A1 (P) | 5.632 | 04-19-36 | 2,156 | 1,589,027 | |

| Greenpoint Mortgage Funding Trust, | |||||

| Ser 2005-AR1 Class A3 (P) | 0.589 | 06-25-45 | 607 | 155,577 | |

| Ser 2005-AR4 Class 4A2 (P) | 0.669 | 10-25-45 | 2,682 | 848,898 | |

| Ser 2006-AR1 Class A2A (P) | 0.679 | 02-25-36 | 4,330 | 1,557,095 | |

| Greenwich Capital Commercial | |||||

| Funding Corp., | |||||

| Ser 2007-GG9 Class C (P) | 5.554 | 03-10-39 | 1,810 | 475,002 | |

| Ser 2007-GG9 Class F (P) | 5.633 | 03-10-39 | 995 | 141,916 | |

| GSR Mortgage Loan Trust, | |||||

| Ser 2004-9 Class B1 (P) | 4.570 | 08-25-34 | 1,670 | 487,418 | |

| Ser 2006-AR1 Class 3A1 (P) | 5.352 | 01-25-36 | 4,794 | 3,169,914 | |

| Harborview Mortgage Loan Trust, | |||||

| Ser 2005-16 Class 2A1B (P) | 0.658 | 01-19-36 | 1,555 | 457,971 | |

| Ser 2005-16 Class X3 IO | 3.349 | 01-19-36 | 63,326 | 1,662,320 | |

| Ser 2005-8 Class 1X IO | 3.201 | 09-19-35 | 25,437 | 254,369 | |

| Ser 2006-SB1 Class A1A (P) | 2.289 | 12-19-36 | 3,192 | 1,120,838 | |

| Ser 2007-3 Class ES IO | 0.350 | 05-19-47 | 63,188 | 296,193 | |

| Ser 2007-4 Class ES IO | 0.350 | 07-19-47 | 65,185 | 325,925 | |

| Ser 2007-6 Class ES IO (S) | 0.342 | 08-19-37 | 46,500 | 217,969 | |

| Indymac Index Mortgage Loan Trust, | |||||

| Ser 2004-AR13 Class B1 | 5.296 | 01-25-35 | 1,166 | 234,893 | |

| Ser 2005-AR18 Class 1X IO | 3.233 | 10-25-36 | 41,774 | 626,611 | |

| Ser 2005-AR18 Class 2X IO | 2.969 | 10-25-36 | 73,040 | 869,174 | |

| Ser 2005-AR5 Class B1 (P) | 4.559 | 05-25-35 | 1,641 | 90,650 | |

| JPMorgan Chase Commercial Mortgage | |||||

| Security, Corp., | |||||

| Ser 2005-LDP3 Class A4B (P) | 4.996 | 08-15-42 | 3,635 | 2,787,759 | |

| Ser 2005-LDP4 Class B (P) | 5.129 | 10-15-42 | 1,646 | 579,256 | |

| Ser 2006-LDP7 Class A4 (P) | 5.875 | 04-15-45 | 3,345 | 2,792,670 | |

| JPMorgan Mortgage Trust, | |||||

| Ser 2005-S2 Class 2A16 | 6.500 | 09-25-35 | 2,211 | 1,691,828 | |

| Ser 2005-S3 Class 2A2 | 5.500 | 01-25-21 | 2,769 | 2,473,648 | |

| Ser 2006-A7 Class 2A5 (P) | 5.790 | 01-25-37 | 3,950 | 1,070,092 | |

| LB–UBS Commercial Mortgage Trust, | |||||

| Ser 2006-C4 Class A4 (P) | 5.882 | 06-15-38 | 3,950 | 3,321,591 | |

| Master Adjustable Rate Mortgages Trust, | |||||

| Ser 2006-2 Class 4A1 (P) | 4.986 | 02-25-36 | 3,482 | 2,684,084 | |

| Merrill Lynch/Countrywide Commercial | |||||

| Mortgage Trust, | |||||

| Ser 2006-2 Class A4 (P) | 5.909 | 06-12-46 | 4,535 | 3,902,533 | |

See notes to financial statements

| 26 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Collateralized Mortgage Obligations (continued) | |||||

| MLCC Mortgage Investors, Inc., | |||||

| Ser 2007-3 Class M1 (P) | 5.925% | 09-25-37 | $1,565 | $372,489 | |

| Ser 2007-3 Class M2 (P) | 5.925 | 09-25-37 | 585 | 44,632 | |

| Ser 2007-3 Class M3 (P) | 5.925 | 09-25-37 | 375 | 20,960 | |

| Morgan Stanley Capital I, | |||||

| Ser 2005-HQ7 Class A4 (P) | 5.208 | 11-14-42 | 3,065 | 2,751,497 | |

| Ser 2005-IQ10 Class A4A (P) | 5.230 | 09-15-42 | 2,680 | 2,420,748 | |

| Ser 2006-IQ12 Class E (P) | 5.538 | 12-15-43 | 2,430 | 461,532 | |

| Provident Funding Mortgage Loan Trust, | |||||

| Ser 2005-1 Class B1 (P) | 4.407 | 05-25-35 | 1,574 | 302,945 | |

| Residential Accredit Loans, Inc., | |||||

| Ser 2005-Q04 Class X IO | 3.391 | 12-25-45 | 50,520 | 1,262,994 | |

| Ser 2005-QA12 Class NB5 (P) | 5.952 | 12-25-35 | 2,300 | 1,119,260 | |

| Ser 2007-QS10 Class A1 | 6.500 | 09-25-37 | 3,295 | 1,862,768 | |

| Ser 2007-QS11 Class A1 | 7.000 | 10-25-37 | 2,748 | 1,463,990 | |

| Residential Asset Securitization Trust, | |||||

| Ser 2006-A7CB Class 2A1 | 6.500 | 07-25-36 | 3,734 | 2,110,969 | |

| Structured Asset Securities Corp., | |||||

| Ser 2003-6A Class B1 (P) | 4.935 | 03-25-33 | 2,357 | 681,590 | |

| Washington Mutual, Inc., | |||||

| Ser 2005-6 Class 1CB | 6.500 | 08-25-35 | 1,414 | 870,173 | |

| Ser 2005-AR13 Class B1 (P) | 0.909 | 10-25-45 | 4,057 | 507,128 | |

| Ser 2005-AR13 Class X IO | 2.516 | 10-25-45 | 152,742 | 2,100,206 | |

| Ser 2005-AR19 Class A1B3 (P) | 0.659 | 12-25-45 | 1,107 | 295,829 | |

| Ser 2005-AR19 Class B1 (P) | 1.009 | 12-25-45 | 2,363 | 295,415 | |

| Ser 2005-AR4 Class 1A1B (P) | 2.379 | 05-25-46 | 2,827 | 480,568 | |

| Ser 2005-AR6 Class B1 (P) | 0.909 | 04-25-45 | 4,553 | 341,481 | |

| Ser 2007-0A4 Class XPPP IO | 0.942 | 04-25-47 | 65,430 | 368,043 | |

| Ser 2007-0A5 Class 1XPP IO | 1.008 | 06-25-47 | 158,712 | 1,190,338 | |

| Ser 2007-0A6 Class 1XPP IO | 0.950 | 07-25-47 | 91,675 | 572,971 | |

| Wells Fargo Mortgage Backed | |||||

| Securities Trust, | |||||

| Ser 2006-AR15 Class A3 (P) | 5.658 | 10-25-36 | 4,297 | 893,786 | |

| Interest | Maturity | Par value | |||

| Issuer, description | rate | date | (000) | Value | |

| Asset Backed Securities 1.34% | $10,187,032 | ||||

| (Cost $20,373,685) | |||||

| Asset Backed Securities 1.34% | $10,187,032 | ||||

| DB Master Finance LLC, | |||||

| Ser 2006-1 Class A2 (S) | 5.779% | 06-20-31 | $4,605 | 3,340,835 | |

| Ser 2006-1 Class M1 (S) | 8.285 | 06-20-31 | 1,065 | 697,298 | |

| Dominos Pizza Master Issuer LLC, | |||||

| Ser 2007-1 Class M1 (S) | 7.629 | 04-25-37 | 3,215 | 1,414,600 | |

| Lehman XS Trust, | |||||

| Ser 2005-5N Class 3A2 (P) | 0.669 | 11-25-35 | 3,143 | 831,218 | |

| Ser 2005-7N Class 1A1B (P) | 0.609 | 12-25-35 | 2,206 | 466,655 | |

| Ser 2006-2N Class 1A2 (P) | 0.649 | 02-25-46 | 6,902 | 1,470,349 | |

| Renaissance Home Equity Loan Trust, | |||||

| Ser 2005-2 Class AF3 | 4.499 | 08-25-35 | 989 | 901,380 | |

| Ser 2005-2 Class AF4 | 4.934 | 08-25-35 | 2,365 | 1,064,697 | |

See notes to financial statements

| Annual report | Bond Fund | 27 |

F I N A N C I A L S T A T E M E N T S

| Issuer | Shares | Value |

| Warrants 0.00% | $8,421 | |

| (Cost $0) | ||

| Gold 0.00% | 8,421 | |

| New Gold, Inc. (I) | 21 | 8,421 |

| Total investments (Cost $851,859,030)† 98.31% | $746,758,486 | |

| Other assets and liabilities, net 1.69% | $12,820,182 | |

| Total net assets 100.00% | $759,578,668 | |

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

BKNT Bank Note

GMTN Global Medium-Term Note

Gtd Guaranteed

IO Interest Only

MTN Medium-Term Note

REIT Real Estate Investment Trust

SBA Small Business Administration

TBA To Be Announced

(C) Purchased on a forward commitment.

(H) Issuer has filed for protection under the Federal Bankruptcy Code or is in default of interest payment.

(I) Non-income producing security.

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration. Rule 144A securities amounted to $101,184,315 or 13.32% of the net assets of the Fund as of May 31, 2009.

† At May 31, 2009, the aggregate cost of investment securities for federal income tax purposes was $852,902,798. Net unrealized depreciation aggregated $106,144,312, of which $22,067,594 related to appreciated investment securities and $128,211,906 related to depreciated investment securities.

See notes to financial statements

28 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 5-31-09

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| Assets | |

| Investments, at value (Cost $851,859,030) | $746,758,486 |

| Total investments, at value (Cost $851,859,030) | 746,758,486 |

| Foreign currency, at value (Cost $68,253) | 62,858 |

| Cash collateral at broker for futures contracts | 674,999 |

| Receivable for investments sold | 12,399,425 |

| Receivable for delayed delivery securities sold | 53,931,295 |

| Receivable for fund shares sold | 576,160 |

| Interest receivable | 12,192,272 |

| Receivable for futures variation margin | 265,625 |

| Other receivables and prepaid assets | 135,073 |

| Total assets | 826,996,193 |

| Liabilities | |

| Due to custodian | 650,366 |

| Payable for investments purchased | 11,302,569 |

| Payable for delayed delivery securities purchased | 53,191,924 |

| Payable for fund shares repurchased | 653,246 |

| Unrealized depreciation of swap contracts (Note 3) | 594,762 |

| Distributions payable | 54,169 |

| Payable to affiliates | |

| Accounting and legal services fees | 44,822 |

| Transfer agent fees | 122,633 |

| Distribution and service fees | 213,586 |

| Trustees’ fees | 97,697 |

| Management fees | 308,163 |

| Other liabilities and accrued expenses | 183,588 |

| Total liabilities | 67,417,525 |

| Net assets | |

| Capital paid-in | $900,359,640 |

| Undistributed net investment income | 930,912 |

| Accumulated net realized loss on investments, futures contracts, options | |

| written, foreign currency transactions and swap agreements | (35,660,868) |

| Net unrealized appreciation (depreciation) on investments, futures contracts, | |

| translation of assets and liabilities in foreign currencies and swap agreements | (106,051,016) |

| Net assets | $759,578,668 |

| Net asset value per share | |

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($685,559,290 ÷ 52,916,560 shares) | $12.96 |

| Class B ($27,937,053 ÷ 2,156,628 shares)1 | $12.95 |

| Class C ($26,332,252 ÷ 2,032,313 shares)1 | $12.96 |

| Class I ($18,928,970 ÷ 1,460,779 shares) | $12.96 |

| Class R1 ($821,103 ÷ 63,369 shares) | $12.96 |

| Maximum offering price per share | |

| Class A (net asset value per share ÷ 95.5%)2 | $13.57 |

1 Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $100,000. On sales of $100,000 or more and on group sales the offering price is reduced.

See notes to financial statements

| Annual report | Bond Fund | 29 |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the year ended 5-31-09

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| Investment income | |

| Interest | $61,564,787 |

| Dividends | 524,560 |

| Income from affiliated issuers | 119,618 |

| Securities lending | 65,514 |

| Less foreign taxes withheld | (1,542) |

| Total investment income | 62,272,937 |

| Expenses | |

| Investment management fees (Note 6) | 3,955,448 |

| Distribution and service fees (Note 6) | 2,723,607 |

| Transfer agent fees (Note 6) | 1,703,154 |

| Accounting and legal services fees (Note 6) | 132,991 |

| Trustees’ fees (Note 6) | 44,196 |

| Printing and postage fees | 117,438 |

| Professional fees | 140,818 |

| Custodian fees | 323,596 |

| State registration fees | 76,660 |

| Proxy fees | 230,855 |

| Miscellaneous | 46,023 |

| Total expenses | 9,494,786 |

| Less expense reductions (Note 6) | (588) |

| Net expenses | 9,494,198 |

| Net investment income | 52,778,739 |

| Realized and unrealized gain (loss) | |

| Net realized gain (loss) on | |

| Investments | (15,494,724) |

| Futures contracts | 861,464 |

| Options | 92,895 |

| Swap contracts | 148,011 |

| Foreign currency transactions | 318 |

| (14,392,036) | |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | (71,283,237) |

| Futures contracts | (285,551) |

| Swap contracts | (289,145) |

| Translation of assets and liabilities in foreign currencies | 19,173 |

| (71,838,760) | |

| Net realized and unrealized loss | (86,230,796) |

| Decrease in net assets from operations | ($33,452,057) |

See notes to financial statements

30 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| Year | Year | |

| ended | ended | |

| 5-31-09 | 5-31-08 | |

| Increase (decrease) in net assets | ||

| From operations | ||

| Net investment income | $52,778,739 | $51,718,418 |

| Net realized gain (loss) | (14,392,036) | 5,424,574 |

| Change in net unrealized appreciation (depreciation) | (71,838,760) | (33,550,312) |

| Increase (decrease) in net assets resulting from operations | (33,452,057) | 23,592,680 |

| Distributions to shareholders | ||

| From net investment income | ||

| Class A | (48,395,953) | (47,507,427) |

| Class B | (1,985,117) | (2,418,760) |

| Class C | (1,498,050) | (1,363,427) |

| Class I | (1,353,495) | (728,380) |

| Class R1 | (61,014) | (58,466) |

| Total distributions | (53,293,629) | (52,076,460) |

| From Fund share transactions (Note 7) | (71,142,760) | (12,435,902) |

| Total decrease | (157,888,446) | (40,919,682) |

| Net assets | ||

| Beginning of year | 917,467,114 | 958,386,796 |

| End of year | $759,578,668 | $917,467,114 |

| Undistributed net investment income | $930,912 | $471,849 |

See notes to financial statements

| Annual report | Bond Fund | 31 |

F I N A N C I A L S T A T E M E N T S

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| CLASS A SHARES Period ended | 5-31-09 | 5-31-08 | 5-31-07 | 5-31-06 | 5-31-05 |

| Per share operating performance | |||||

| Net asset value, beginning of year | $14.31 | $14.75 | $14.51 | $15.30 | $14.98 |

| Net investment income1 | 0.87 | 0.81 | 0.75 | 0.68 | 0.67 |

| Net realized and unrealized gain (loss) on | |||||

| investments | (1.34) | (0.43) | 0.26 | (0.74) | 0.38 |

| Total from investment operations | (0.47) | 0.38 | 1.01 | (0.06) | 1.05 |

| Less distributions | |||||

| From net investment income | (0.88) | (0.82) | (0.77) | (0.72) | (0.73) |

| Return of capital | — | — | — | (0.01) | — |

| Total distributions | (0.88) | (0.82) | (0.77) | (0.73) | (0.73) |

| Net asset value, end of year | $12.96 | $14.31 | $14.75 | $14.51 | $15.30 |

| Total return (%)2 | (3.02) | 2.57 | 7.08 | (0.45)3 | 7.113 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in millions) | $686 | $824 | $870 | $899 | $1,012 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.164 | 1.05 | 1.05 | 1.08 | 1.06 |

| Expenses net of fee waivers | 1.164 | 1.05 | 1.05 | 1.07 | 1.05 |

| Expenses net of all fee waivers and credits | 1.164 | 1.05 | 1.05 | 1.07 | 1.05 |

| Net investment income | 6.71 | 5.54 | 5.11 | 4.56 | 4.41 |

| Portfolio turnover (%) | 90 | 90 | 106 | 135 | 139 |

| 1 Based on the average of the shares outstanding. | |||||

| 2 Assumes dividend reinvestment and does not reflect the effect of sales charges. | |||||

| 3 Total returns would have been lower had certain expenses not been reduced during the periods shown. | |||||

| 4 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.03%. | |||||

| CLASS B SHARES Period ended | 5-31-09 | 5-31-08 | 5-31-07 | 5-31-06 | 5-31-05 |

| Per share operating performance | |||||

| Net asset value, beginning of year | $14.31 | $14.75 | $14.51 | $15.30 | $14.98 |

| Net investment income1 | 0.77 | 0.71 | 0.65 | 0.58 | 0.57 |

| Net realized and unrealized gain (loss) on | |||||

| investments | (1.34) | (0.43) | 0.26 | (0.74) | 0.37 |

| Total from investment operations | (0.57) | 0.28 | 0.91 | (0.16) | 0.94 |

| Less distributions | |||||

| From net investment income | (0.79) | (0.72) | (0.67) | (0.62) | (0.62) |

| Return of capital | — | — | — | (0.01) | — |

| Total distributions | (0.79) | (0.72) | (0.67) | (0.63) | (0.62) |

| Net asset value, end of year | $12.95 | $14.31 | $14.75 | $14.51 | $15.30 |

| Total return (%)2 | (3.77) | 1.863 | 6.33 | (1.14)3 | 6.373 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in millions) | $28 | $42 | $59 | $87 | $128 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.864 | 1.76 | 1.75 | 1.78 | 1.76 |

| Expenses net of fee waivers | 1.864 | 1.76 | 1.75 | 1.77 | 1.75 |

| Expenses net of all fee waivers and credits | 1.864 | 1.75 | 1.75 | 1.77 | 1.75 |

| Net investment income | 5.96 | 4.82 | 4.40 | 3.84 | 3.70 |

| Portfolio turnover (%) | 90 | 90 | 106 | 135 | 139 |

1 Based on the average of the shares outstanding.

2 Assumes dividend reinvestment and does not reflect the effect of sales charges.

3 Total returns would have been lower had certain expenses not been reduced during the periods shown.

4 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.03%.

See notes to financial statements

| 32 | Bond Fund | Annual report |

F I N A N C I A L S T A T E M E N T S

| CLASS C SHARES Period ended | 5-31-09 | 5-31-08 | 5-31-07 | 5-31-06 | 5-31-05 |

| Per share operating performance | |||||

| Net asset value, beginning of year | $14.31 | $14.75 | $14.51 | $15.30 | $14.98 |

| Net investment income1 | 0.78 | 0.71 | 0.65 | 0.58 | 0.57 |

| Net realized and unrealized gain (loss) on | |||||

| investments | (1.34) | (0.43) | 0.26 | (0.74) | 0.37 |

| Total from investment operations | (0.56) | 0.28 | 0.91 | (0.16) | 0.94 |

| Less distributions | |||||

| From net investment income | (0.79) | (0.72) | (0.67) | (0.62) | (0.62) |

| Return of capital | — | — | — | (0.01) | — |

| Total distributions | (0.79) | (0.72) | (0.67) | (0.63) | (0.62) |

| Net asset value, beginning of year | $12.96 | $14.31 | $14.75 | $14.51 | $15.30 |

| Total return (%)2 | (3.70) | 1.86 | 6.33 | (1.14)3 | 6.373 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in millions) | $26 | $29 | $23 | $24 | $28 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.864 | 1.75 | 1.75 | 1.78 | 1.76 |

| Expenses net of fee waivers | 1.864 | 1.75 | 1.75 | 1.77 | 1.75 |

| Expenses net of all fee waivers and credits | 1.864 | 1.75 | 1.75 | 1.77 | 1.75 |

| Net investment income | 6.02 | 4.86 | 4.41 | 3.86 | 3.71 |

| Portfolio turnover (%) | 90 | 90 | 106 | 135 | 139 |

| 1 Based on the average of the shares outstanding. | |||||

| 2 Assumes dividend reinvestment and does not reflect the effect of sales charges. | |||||

| 3 Total returns would have been lower had certain expenses not been reduced during the periods shown. | |||||

| 4 Includes proxy fees. The impact of this expense to gross and net expense ratios was 0.03%. | |||||

| CLASS I SHARES Period ended | 5-31-09 | 5-31-08 | 5-31-07 | 5-31-06 | 5-31-05 |

| Per share operating performance | |||||

| Net asset value, beginning of year | $14.31 | $14.74 | $14.51 | $15.30 | $14.98 |

| Net investment income1 | 0.93 | 0.88 | 0.81 | 0.75 | 0.73 |

| Net realized and unrealized gain (loss) on | |||||

| investments | (1.35) | (0.43) | 0.25 | (0.74) | 0.38 |

| Total from investment operations | (0.42) | 0.45 | 1.06 | 0.01 | 1.11 |

| Less distributions | |||||

| From net investment income | (0.93) | (0.88) | (0.83) | (0.79) | (0.79) |

| Return of capital | — | — | — | (0.01) | — |

| Total distributions | (0.93) | (0.88) | (0.83) | (0.80) | (0.79) |

| Net asset value, end of year | $12.96 | $14.31 | $14.74 | $14.51 | $15.30 |

| Total return (%)2 | (2.60) | 3.01 | 7.53 | (0.01) | 7.55 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in millions) | $19 | $22 | $5 | $5 | $5 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 0.703 | 0.62 | 0.62 | 0.64 | 0.65 |

| Expenses net of fee waivers | 0.703 | 0.62 | 0.62 | 0.64 | 0.65 |

| Expenses net of all fee waivers and credits | 0.703 | 0.62 | 0.62 | 0.64 | 0.65 |

| Net investment income | 7.22 | 6.08 | 5.54 | 4.99 | 4.82 |

| Portfolio turnover (%) | 90 | 90 | 106 | 135 | 139 |

1 Based on the average of the shares outstanding.

2 Assumes dividend reinvestment and does not reflect the effect of sales charges.

3 Includes proxy fees. The impact of this expense to gross and net expense ratios was 0.03%.

See notes to financial statements

| Annual report | Bond Fund | 33 |

F I N A N C I A L S T A T E M E N T S

| CLASS R1 SHARES Period ended | 5-31-09 | 5-31-08 | 5-31-07 | 5-31-06 | 5-31-05 |

| Per share operating performance | |||||

| Net asset value, beginning of year | $14.38 | $14.74 | $14.51 | $15.30 | $14.98 |

| Net investment income1 | 0.82 | 0.77 | 0.65 | 0.59 | 0.67 |

| Net realized and unrealized gain (loss) on | |||||

| investments | (1.34) | (0.42) | 0.26 | (0.75) | 0.36 |

| Total from investment operations | (0.52) | 0.35 | 0.91 | (0.16) | 1.03 |