Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-7120

HARTE-HANKS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 74-1677284 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

9601 McAllister Freeway, Suite 610, San Antonio, Texas 78216

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code — 210-829-9000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act

Large accelerated filer ¨ | Accelerated filer x | |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price ($10.45) as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2010), was approximately $442,228,000.

The number of shares outstanding of each of the registrant’s classes of common stock as of January 31, 2011 was 63,678,809 shares of common stock, all of one class.

Documents incorporated by reference:

Portions of the Proxy Statement to be filed for the Company’s 2011 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

THIS ANNUAL REPORT ON FORM 10-K IS BEING DISTRIBUTED TO STOCKHOLDERS IN LIEU OF A SEPARATE ANNUAL REPORT PURSUANT TO RULE 14a-3(b) OF THE ACT AND SECTION 203.01 OF THE NEW YORK STOCK EXCHANGE LISTED COMPANY MANUAL.

Table of Contents

Harte-Hanks, Inc. and Subsidiaries

Form 10-K Report

December 31, 2010

2

Table of Contents

| ITEM 1. | BUSINESS |

INTRODUCTION

Harte-Hanks, Inc. (Harte-Hanks) is a worldwide direct and targeted marketing company that provides direct marketing services and shopper advertising opportunities to a wide range of local, regional, national and international consumer and business-to-business marketers. We manage our operations through two operating segments: Direct Marketing, which operates both nationally and internationally, and Shoppers, which operates in local and regional markets in California and Florida.

Marketing remains under intense focus in many organizations. Many businesses have a chief-level executive charged with marketing who is charged with combining data, technology, channels and resources to demonstrate a return on marketing investment. This has led many businesses to use direct and targeted marketing, which offer accountability and measurability of marketing programs, allowing customer insight to be leveraged to create and accelerate value. Direct Marketing, which represented 70% of our total revenues in 2010, is a leader in the movement toward highly targeted, multichannel marketing. Our Shoppers business applies geographic targeting principles.

Harte-Hanks® is the successor to a newspaper business which began in Texas in the early 1920s by Houston Harte and Bernard Hanks. In 1972, Harte-Hanks went public and was listed on the New York Stock Exchange (NYSE). We became private in a leveraged buyout initiated by management in 1984. In 1993, we again went public and listed our common stock on the NYSE. In 1997, we sold all of our remaining traditional media operations (consisting of newspapers, television and radio companies) in order to focus all of our efforts on two business segments - Direct Marketing and Shoppers. See segment financial information in Note OBusiness Segments in the Notes to Consolidated Financial Statements.

Harte-Hanks provides public access to all reports filed with the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934, as amended (the 1934 Act). These documents may be accessed free of charge on our website athttp://www.harte-hanks.com. These documents are provided as soon as practical after they are filed with the SEC and may also be found at the SEC’s website athttp://www.sec.gov. Additionally, we have adopted and posted on our website a code of ethics that applies to our principal executive officer, principal financial officer and principal accounting officer. Our website also includes our corporate governance guidelines and the charters for each of our audit, compensation, and nominating and corporate governance committees. We will provide a printed copy of any of the aforementioned documents to any requesting stockholder.

DIRECT MARKETING

General

Our Direct Marketing services offer a wide variety of integrated, multichannel, data-driven solutions for top brands around the globe. We help our customers gain insight into their customers’ behaviors from their data and use that insight to create innovative multichannel marketing programs to deliver a return on marketing investment. We believe our customer’s success is determined not only by how good their tools are, but how well we help them use the tools to gain insight and analyze their consumers. This results in a strong and enduring relationship between our clients and their customers.

We offer a full complement of capabilities and resources to provide a broad range of marketing services and data management software, in media from direct mail to e-mail.

| • | Agency & Creative Services. The Agency Inside Harte-Hanks® (The Agency) is a full-service, multichannel relationship marketing agency specializing in direct and digital communications. With |

3

Table of Contents

strategy, creative and implementation services, we help marketers within targeted industries understand, identify, and engage prospects and customers in their channel of choice. The Agency’s mission is to deploy world-class, data-driven, multichannel relationship marketing programs that address each client’s acquisition, cross-selling, retention and loyalty needs. |

| • | Database Marketing Solutions.We have successfully delivered marketing database solutions for over 35 years across various industries. Our solutions deliver on three pillars built around a centralized marketing database. The foundation consists of: insight and analytics; customer data integration; and marketing communications tools. Our solutions enable organizations to build and manage customer communication strategies that drive new customer acquisition and retention and maximize the value of existing customer relationships. Through insight, we help clients identify models of their most profitable customer relationships and then apply these models to increase the value of existing customers while also winning profitable new customers. Through customer data integration, data from multiple sources comes together to provide a single customer view of client prospects and customers. Then, utilizing our Allink® suite of customer communication and sales optimization tools, we help clients apply their data and insights to the entire customer lifecycle, to help clients sustain and grow their business, gain deeper customer insights, and continuously refine their customer resource management strategies and tactics. |

| • | Data Quality Software and Service Solutions with Trillium Software®. Our proprietary software has helped global customers more effectively analyze, enrich, cleanse and report on their product, financial and customer data as part of master data management, data governance, CRM, data warehousing and integration initiatives. With industry-leading Trillium Software System®, Global Locator™ geocoding product, and associated data governance services, business users can optimize data-based business processes and transactions, realize efficiencies, and enhance the accuracy of their master set of data-improving program results. |

| • | Digital Marketing and Social Networking Services. Our digital solutions integrate online services within the marketing mix and include: site development and design, social media marketing, e-mail marketing through our Postfuture® e-mail marketing solutions, e-commerce and interactive relationship management and a host of other services that support our core businesses. |

| • | Direct Mail and Supply Chain Management. As a full-service direct marketing provider and one of the largest mailing partners of the United States Postal Service (USPS®), our operational mandate is to ensure creativity and quality, provide an understanding of the options available in technologies and segmentation strategies and capitalize on economies of scale with our variety of execution options. Our services include advanced mail optimization, logistics and transportation optimization, tracking, commingling, shrink wrapping and specialized mailings. With facilities strategically placed nationwide, we are among the largest solo mailers in the country other than the U.S. government. |

| • | Fulfillment and Contact Centers. We deliver teleservices and fulfillment operations in both consumer and business-to-business markets. We operate teleservice workstations around the globe providing advanced contact center solutions such as: speech, chat, integrated voice response, e-mail, social cloud monitoring and web self-service. We also maintain fulfillment centers strategically located throughout the United States allowing our customers to distribute literature and other marketing materials, custom kitting services, print on demand, product recalls and obtain freight optimization. |

| • | Lead Generation. Our CI Technology Database™ tracks technology installations, business demographics and over 5 million key decision makers at more than 4.5 million business locations in twenty five countries in North America, Latin America, Europe and China. Our clients use the data to gain insight into their prospect’s and client’s technology buying cycles. Our Aberdeen Group is a provider of fact-based research to identify and educate technology buyers across numerous industries and product categories. Leading technology providers use Aberdeen’s proprietary research content for use in their demand creation programs, online marketing campaigns and Web-based sales and marketing tools. |

4

Table of Contents

Many of our client relationships start with an offering from the list above on an individual solution basis to the client or a combination of our offerings from across our portfolio of businesses. Multichannel marketing is communicating through different marketing solutions or channels in an integrated form to reach a consumer so it is easy for a consumer to buy in whatever manner the consumer chooses. During our client relationship we try to move our clients from marketing through multiple channels to multichannel marketing. Many of our new client relationships have started with a multichannel strategy as opposed to a single solution and management believes many of its clients will increase their multichannel strategy focus in the future.

In 2010, 2009 and 2008, Harte-Hanks Direct Marketing had revenues of $601.3 million, $586.0 million, and $732.7 million, respectively, which accounted for approximately 70%, 68%, and 68% of our total revenues, respectively.

Customers

Direct marketing services are marketed to specific industries or markets with services and software products tailored to each industry or market. We believe that we are generally able to provide services to new industries and markets by modifying our existing services and applications. We currently provide direct marketing services to the retail, high-tech/telecom, financial services and pharmaceutical/healthcare vertical markets, in addition to a range of selected markets. The largest Direct Marketing client, measured in revenue, comprised 7% of total Direct Marketing revenues in 2010 and 5% of our total revenues in 2010. The largest 25 clients, measured in revenue, comprised 43% of total Direct Marketing revenues in 2010 and 30% of our total revenues in 2010.

Sales and Marketing

Our national direct marketing sales force is organized around the five verticals we service: retail, high-tech/telecom, financial services, pharmaceutical/healthcare, and a wide range of selected markets. We also maintain product-specific sales forces and sales groups in North America, Europe, Australia, South America and Asia. Our sales forces, with industry-specific knowledge and experience, emphasize the cross-selling of a full range of direct marketing services and are supported by employees in each sector. The overall sales focus is to position Harte-Hanks as a marketing partner offering various services and solutions (including end-to-end) as required to meet our client’s targeted marketing needs.

5

Table of Contents

Direct Marketing Facilities

Direct marketing services are provided at the following facilities, all of which are leased except as otherwise noted:

National Offices | Texarkana, Texas | |

Austin, Texas | Troy, Michigan | |

Baltimore, Maryland | Wilkes-Barre, Pennsylvania | |

Billerica, Massachusetts | Yardley, Pennsylvania | |

Boston, Massachusetts | ||

Cincinnati, Ohio | International Offices | |

Deerfield Beach, Florida | Bristol, United Kingdom | |

East Bridgewater, Massachusetts | Buckinghamshire, United Kingdom | |

Fort Worth, Texas | Hasselt, Belgium – owned site | |

Fullerton, California | Les Ulis, France | |

Grand Prairie, Texas | Madrid, Spain | |

Jacksonville, Florida | Manila, Philippines | |

Lake Mary, Florida | Melbourne, Australia | |

Langhorne, Pennsylvania | São Paulo, Brazil | |

Linthicum Heights, Maryland | Stuttgart, Germany | |

New York, New York | Sydney, Australia | |

Ontario, California | Theale, United Kingdom | |

San Diego, California | Uxbridge, United Kingdom | |

Shawnee, Kansas |

For more information please refer to Item 2, “ Properties”.

6

Table of Contents

Competition

Our Direct Marketing business faces competition in all of its offerings and within each of its vertical markets. Direct marketing is a dynamic business, subject to technological advancements, high turnover of client personnel who make buying decisions, client consolidations, changing client needs and preferences, continual development of competing products and services and an evolving competitive landscape. Our competition comes from numerous local, national and international direct marketing and advertising companies against whom we compete for individual projects, entire client relationships and marketing expenditures. Competitive factors in our industry include the quality and scope of services, technical and strategic expertise, the perceived value of the services provided, reputation and brand recognition. We also compete against print and electronic media and other forms of advertising for marketing and advertising dollars in general. Failure to continually improve our current processes, advance and upgrade our technology applications, and to develop new products and services in a timely and cost-effective manner, could result in the loss of our clients or prospective clients to current or future competitors. In addition, failure to gain market acceptance of new products and services could adversely affect our growth. Although we believe that our capabilities and breadth of services, combined with our national and worldwide production capability, industry focus and ability to offer a broad range of integrated services, enable us to compete effectively, our business results may be adversely impacted by competition. Please refer to Item 1A, “Risk Factors”, for additional information regarding risks related to competition.

Seasonality

Our Direct Marketing business is somewhat seasonal as revenues in the fourth quarter tend to be higher than revenues in other quarters during a given year. This increased revenue is a result of overall increased marketing activity prior to and during the holiday season, primarily related to our retail vertical.

SHOPPERS

General

Harte-Hanks Shoppers is North America’s largest owner, operator and distributor of shopper publications (based on weekly circulation and revenues). Shoppers are weekly advertising publications distributed free by mail to households and businesses in a particular geographic area. Shoppers offer advertisers a targeted, cost-effective local advertising system, with virtually 100% penetration in their areas of distribution. Shoppers are particularly effective in large markets with high media fragmentation in which major metropolitan newspapers generally have low penetration. Our Shoppers segment also provides search-engine marketing, as well as online advertising and other services through our websites,PennySaverUSA.com™ andTheFlyer.com™. These sites serve as advertising portals, bringing buyers and sellers together through our online offerings, including local classifieds, business listings, coupons, special offers and PowerSites®. PowerSites are templated web sites for our customers, optimized to help small and medium sized business owners establish a web presence and improve their lead generation through call tracking. At December 31, 2010, we are publishing approximately 6,000 PowerSites weekly.

As of December 31, 2010, Shoppers delivered approximately 11.2 million shopper packages in five major markets each week covering the greater Los Angeles market, the greater San Diego market, Northern California, South Florida and the greater Tampa market. Our California publications account for approximately 80% of Shoppers weekly circulation.

As of December 31, 2010, Harte-Hanks published approximately 950 individual shopper editions each week, distributed to zones with circulation of approximately 12,000 in each zone. This allows single-location, local advertisers to saturate a single relevant geographic zone, while enabling multiple-location advertisers to saturate multiple zones. This unique distribution system gives large and small advertisers alike a cost-effective way to reach their target markets. Our zoning capabilities and production technologies have enabled us to saturate and target areas in a number of ways, including geographic, demographic, lifestyle, behavioral and language, which we believe allows our advertisers to effectively target their customers.

7

Table of Contents

In 2010, 2009, and 2008, Harte-Hanks Shoppers had revenues of $259.2 million, $274.2 million, and $350.1 million, respectively, accounting for approximately 30%, 32%, and 32% of our total revenues, respectively.

As a result of the difficult economic environments in California and Florida, we curtailed more than 1.4 million of circulation from July 2008 to February 2009. This consisted of approximately 850,000 of circulation in California and approximately 550,000 of circulation in Florida. We continue to evaluate our circulation performance and may make further circulation reductions in the future as part of our efforts to address local economic conditions in the California and Florida markets we serve.

Publications

The following table sets forth certain publication information with respect to Shoppers:

| December 31, 2010 | ||||||||||

Market | Publication Name | Weekly Circulation | Number of Zones | |||||||

Greater Los Angeles | PennySaverUSA.com | 5,120,900 | 458 | |||||||

Northern California | PennySaverUSA.com | 2,275,400 | 189 | |||||||

Greater San Diego | PennySaverUSA.com | 1,641,000 | 136 | |||||||

South Florida | TheFlyer.com | 1,150,900 | 93 | |||||||

Greater Tampa | TheFlyer.com | 1,026,400 | 72 | |||||||

Total | 11,214,600 | 948 | ||||||||

Our shopper publications contain classified and display advertising and are delivered by saturation mail. The typical shopper publication contains approximately 37 pages and is 7 by 10 inches in size. Each edition, or zone, is targeted around a natural neighborhood marketing pattern. Shoppers also serve as a distribution vehicle for multiple ads from national and regional advertisers, including “print and deliver” single-sheet inserts designed and printed by us, and coupon books, preprinted inserts, and four-color glossy flyers printed by third party printers. During 2010, we distributed approximately 4.9 billion insert pieces. In addition, our shoppers also provide advertising and other services online through our websites –PennySaverUSA.com andTheFlyer.com.

We have acquired, developed and applied innovative technology and customized equipment in the publication of our shoppers, contributing to our efficiency. A proprietary pagination system has made it possible for over a thousand weekly zoned editions to be designed, built and output direct-to-plate in a fully digital environment. Automating the production process saves on labor, newsprint, and overweight postage. This software also allows for better ad tracking, immediate checks on individual zone and ad status, and more on-time press starts with less manpower.

Customers

Shoppers serves both business and individual advertisers in a wide range of industries, including real estate, employment, automotive, retail, grocery, education, telecom, financial services, and a number of other industries. The largest client, measured in revenue, comprised 2% of Shoppers revenues in 2010 and 1% of our total revenues in 2010. The top 25 clients in terms of revenue comprised 22% of Shoppers revenues in 2010 and 7% of our total revenues in 2010.

8

Table of Contents

Sales and Marketing

We employ more than 400 commissioned sales representatives who develop both targeted and saturation advertising programs, both in print and online, for clients. The sales organization provides service to national, regional and local advertisers through its telemarketing departments and field sales representatives. Shoppers clients vary from individuals with a single item for sale to local neighborhood advertisers to large multi-location advertisers. The weekly number of ads is primarily driven by residential customers, whereas revenues are primarily driven by small and midsize businesses. We also focus our marketing efforts on larger national accounts by emphasizing our ability to deliver saturation advertising in defined zones, or even partial zones for inserts, in combination with advertising in the shopper publication.

Additional focus is placed on particular industries/categories through the use of sales specialists. These sales specialists are primarily used to target automotive, real estate and employment advertisers.

We utilize proprietary sales and marketing systems to enter client orders directly from the field, instantly checking space availability, ad costs and other pertinent information. These systems efficiently facilitate the placement of advertising into multiple-zoned editions and include built-in error-reducing safeguards that aid in minimizing costly sales adjustments. In addition to allowing advertising information to be entered for immediate publication, these systems feed a relational client database, enabling sales personnel to access client history by designated variables to facilitate the identification of similar potential clients and to assist with timely follow-up on existing clients.

Shoppers Facilities

Our shoppers are produced at owned or leased facilities in the markets they serve. At December 31, 2010, we had five production facilities – three in Southern California, one in Northern California, and one in Tampa, Florida – and approximately 13 sales offices.

For more information please refer to Item 2, “Properties”.

Competition

Our Shoppers business competes for advertising, as well as for readers, with other print and electronic media. Competition comes from local and regional newspapers, magazines, radio, broadcast, satellite and cable television, other shoppers, the internet, other communications media and other advertising printers that operate in our markets. The extent and nature of such competition are, in large part, determined by the location and demographics of the markets targeted by a particular advertiser and the number of media alternatives in those markets. Failure to continually improve our current processes, advance and upgrade our technology applications, and develop new products and services in a timely and cost-effective manner, could result in the loss of our clients to current or future competitors. In addition, failure to gain market acceptance of new products and services, and in geographic areas, could adversely affect our growth. We believe that our production systems and technology, which enable us to publish separate editions in narrowly targeted zones, our local ad content, and our integrated online offering allow us to compete effectively, particularly in large markets with high media fragmentation. However, our business results may be adversely impacted by competition. Please refer to Item 1A, “Risk Factors”, for additional information regarding risks related to competition.

Seasonality

Our Shoppers business has been somewhat seasonal in that revenues from the last two publication dates in December and the first two to three publication dates in January each year have been affected by a slowdown in advertising by businesses and individuals after the holidays. Historically, the second and third quarters have been the highest revenue quarters for our Shoppers business. As a result of the ongoing economic difficulties in California and Florida, our Shoppers revenues did not follow this general historical pattern in 2010, 2009 or 2008.

9

Table of Contents

U.S. AND FOREIGN GOVERNMENT REGULATIONS

As a company with business activities around the world, we are subject to a variety of domestic and international legal and regulatory requirements that impact our business, including, for example, regulations governing consumer protection and unfair business practices, contracts, e-commerce, intellectual property, labor and employment, securities, tax, and other laws that are generally applicable to commercial activities.

We are also subject to, or affected by, numerous domestic and foreign laws, regulations and industry standards that regulate direct marketing activities, including those that address privacy, data security and unsolicited marketing communications. Examples of some of these laws and regulations that may be applied to, or affect, our business or the businesses of our clients include the following:

| • | Federal and state laws governing the use of the internet and regulating telemarketing, including the U.S. Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003 (CAN-SPAM), which regulates commercial email and requires that commercial emails give recipients an opt-out method. The Canadian Fighting Internet and Wireless Spam Act will apply in a comparable manner for our activities in Canada. Telemarketing activities are regulated by, among other requirements, the Federal Trade Commission’s Telemarketing Sales Rule (TSR), the Federal Communications Commission’s Telephone Consumer Protection Act (TCPA) and various state do-not-call laws. |

| • | The U.S. Department of Commerce’s proposed Dynamic Privacy Framework, which is intended to address consumer privacy fears relating to the use of personal information. |

| • | A significant number of states in the U.S. have passed versions of security breach notification laws, which generally require timely notifications to affected persons in the event of data security breaches or other unauthorized access to certain types of protected personal data. |

| • | The Fair Credit Reporting Act (FCRA), which governs, among other things, the sharing of consumer report information, access to credit scores, and requirements for users of consumer report information. |

| • | The Financial Services Modernization Act of 1999, or Gramm-Leach-Bliley Act (GLB), which, among other things, regulates the use for marketing purposes of non-public personal financial information of consumers that is held by financial institutions. Although Harte-Hanks is not considered a financial institution, many of our clients are subject to the GLB. The GLB also includes rules relating to the physical, administrative and technological protection of non-public personal financial information. |

| • | The Health Insurance Portability and Accountability Act of 1996 (HIPAA), which regulates the use of personal health information for marketing purposes and requires reasonable safeguards designed to prevent intentional or unintentional use or disclosure of protected health information. |

| • | The Fair and Accurate Credit Transactions Act of 2003 (FACT Act), which amended the FCRA and requires, among other things, consumer credit report notice requirements for creditors that use consumer credit report information in connection with risk-based credit pricing actions and also prohibits a business that receives consumer information from an affiliate from using that information for marketing purposes unless the consumer is first provided a notice and an opportunity to direct the business not to use the information for such marketing purposes, subject to certain exceptions. |

| • | The European Union (EU) data protection laws, including the comprehensive EU Directive on Data Protection (1995), which imposes a number of obligations with respect to use of personal data, and includes a prohibition on the transfer of personal information from the EU to other countries that do not |

10

Table of Contents

provide consumers with an “adequate” level of privacy or security. The EU standard for adequacy is generally stricter and more comprehensive than that of the U.S. and most other countries. |

There are additional consumer protection, privacy and data security regulations domestically and in other countries in which we or our clients do business. These laws regulate the collection, use, disclosure and retention of personal data and may require consent from consumers and grant consumers other rights, such as the ability to access their personal data and to correct information in the possession of data controllers. We and many of our clients also belong to trade associations that impose guidelines that regulate direct marketing activities, such as the Direct Marketing Association’s Commitment to Consumer Choice.

As a result of increasing public awareness and interest in individual privacy rights, data security and environmental and other concerns regarding unsolicited marketing communications, federal, state and foreign governmental and industry organizations continue to consider new legislative and regulatory proposals that would impose additional restrictions on direct marketing services and products. Examples include data encryption standards, data breach notification requirements, consumer choice and consent restrictions and increased penalties against offending parties, among others. We anticipate that additional proposals will continue to be introduced in the future, some of which may be adopted. In addition, our business may be affected by the impact of these restrictions on our clients and their marketing activities. These additional regulations could increase compliance requirements and restrict or prevent the collection, management, aggregation, transfer, use or dissemination of information or data that is currently legally available. Additional regulations may also restrict or prevent current practices regarding unsolicited marketing communications. For example, many states have considered implementing do-not-mail legislation that could impact our Direct Marketing and Shoppers businesses and the businesses of our clients and customers. In addition, continued public interest in individual privacy rights and data security may result in the adoption of further voluntary industry guidelines that could impact our direct marketing activities and business practices.

We cannot predict the scope of any new legislation, regulations or industry guidelines or how courts may interpret existing and new laws. Additionally, enforcement priorities by governmental authorities may change and also impact our business either directly or through requiring our customers to alter their practices. Compliance with regulations is costly and time-consuming for us and our clients, and we may encounter difficulties, delays or significant expenses in connection with our compliance. We may also be exposed to significant penalties, liabilities, reputational harm and loss of business in the event that we fail to comply with applicable regulations. There could be a material adverse impact on our business due to the enactment or enforcement of legislation or industry regulations, the issuance of judicial or governmental interpretations, enforcement priorities of governmental agencies or a change in customs arising from public concern over consumer privacy and data security issues.

INTELLECTUAL PROPERTY RIGHTS

Our intellectual property assets include, for example, trademarks and service marks that identify our company and our products and services, software and other technology that we develop, our proprietary collections of data and intellectual property licensed from third parties, such as prospect list providers. We generally seek to protect our intellectual property through a combination of license agreements and trademark, service mark, copyright, patent and trade secret laws, and domain name registrations and enforcement procedures. We also enter into confidentiality agreements with many of our employees, vendors and clients and seek to limit access to and distribution of intellectual property and other proprietary information. We pursue the protection of our trademarks and other intellectual property in the United States and internationally.

Despite our efforts to protect our intellectual property, unauthorized parties may attempt to copy or otherwise obtain and use our proprietary information and technology. Monitoring unauthorized use of our intellectual property is difficult, and unauthorized use of our intellectual property may occur. We cannot be certain that patents or trademark registrations will be issued, nor can we be certain that any issued patents or trademark

11

Table of Contents

registrations will give us adequate protection from competing products. For example, issued patents may be circumvented or challenged and declared invalid or unenforceable. In addition, others may develop competing technologies or databases on their own. Moreover, there is no assurance that our confidentiality agreements with our employees or third parties will be sufficient to protect our intellectual property and proprietary information.

We may also be subject to infringement claims against us by third parties and may incur substantial costs and devote significant management resources in responding to such claims. We are obligated under some agreements to indemnify our clients as a result of claims that we infringe on the proprietary rights of third parties. These costs and diversions could cause our business to suffer. If any party asserts an infringement claim, we may need to obtain licenses to the disputed intellectual property. We cannot assure you, however, that we will be able to obtain these licenses on commercially reasonable terms or that we will be able to obtain any licenses at all. The failure to obtain necessary licenses or other rights may have an adverse affect on our ability to provide our products and services.

EMPLOYEES

As of December 31, 2010, Harte-Hanks employed approximately 4,850 full-time employees and 300 part-time employees. Approximately 3,450 full-time and 75 part-time employees were in the Direct Marketing segment and 1,400 full-time and 225 part-time employees were in the Shoppers segment. A portion of our workforce is provided to us through staffing companies. None of the workforce is represented by labor unions. We consider our relations with our employees to be good.

| ITEM 1A. | RISK FACTORS |

Cautionary Note Regarding Forward-Looking Statements

This report, including the Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A), contains “forward-looking statements” within the meaning of the federal securities laws. All such statements are qualified by this cautionary note, which is provided pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 (1933 Act) and Section 21E of the Securities Exchange Act of 1934 (1934 Act). Forward-looking statements may also be included in our other public filings, press releases, our website and oral and written presentations by management. Statements other than historical facts are forward-looking and may be identified by words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “seeks,” “could,” “intends,” or words of similar meaning. Examples include statements regarding (1) our strategies and initiatives, (2) adjustments to our cost structure and other actions designed to respond to market conditions and improve our performance, and the anticipated effectiveness and expenses associated with these actions, (3) our financial outlook for revenues, earnings per share, operating income, expense related to equity-based compensation, capital resources and other financial items, (4) expectations for our businesses and for the industries in which we operate, including with regard to the negative performance trends in our Shoppers business and the adverse impact of the ongoing economic downturn in the United States and other economies on the marketing expenditures and activities of our Direct Marketing clients and prospects, (5) competitive factors, (6) acquisition and development plans, (7) our stock repurchase program, (8) expectations regarding legal proceedings and other contingent liabilities, and (9) other statements regarding future events, conditions or outcomes.

These forward-looking statements are based on current information, expectations and estimates and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to vary materially from what is expressed in or indicated by the forward-looking statements. In that event, our business, financial condition, results of operations or liquidity could be materially adversely affected, and investors in our securities could lose part or all of their investments. Some of these risks, uncertainties, assumptions and other factors can be found in our filings with the SEC, including the factors discussed below in this Item 1A, “Risk Factors”, and any updates thereto in our Forms 10-Q. The forward-looking statements included in this report and those included in our other public filings, press releases, our website and oral and

12

Table of Contents

written presentations by management are made only as of the respective dates thereof, and we undertake no obligation to update publicly any forward-looking statement in this report or in other documents, our website or oral statements for any reason, even if new information becomes available or other events occur in the future.

In addition to the information set forth elsewhere in this report, including in the MD&A section, the factors described below should be considered carefully in making any investment decisions with respect to our securities. The risks described below are not the only ones we face or may face in the future. Additional risks and uncertainties that are not presently anticipated or that we may currently believe are immaterial could also impair our business operations and financial performance.

We face significant competition for individual projects, entire client relationships and advertising dollars in general.

Our Direct Marketing business faces significant competition in all of its offerings and within each of its vertical markets. Direct marketing is a dynamic business, subject to technological advancements, high turnover of client personnel who make buying decisions, client consolidations, changing client needs and preferences, continual development of competing products and services and an evolving competitive landscape. This competition comes from numerous local, national and international direct marketing and advertising companies against whom we compete for individual projects, entire client relationships and marketing expenditures by clients and prospective clients. We also compete against print and electronic media and other forms of advertising for marketing and advertising dollars in general. In addition, our ability to attract new clients and to retain existing clients may, in some cases, be limited by clients’ policies on or perceptions of conflicts of interest. These policies can prevent us from performing similar services for competing products or companies. Our Shoppers business competes for advertising, as well as for readers, with other print and electronic media. Competition comes from local and regional newspapers, magazines, radio, broadcast, satellite and cable television, other shoppers, the internet, other communications media and other advertising printers that operate in our markets. The extent and nature of such competition are, in large part, determined by the location and demographics of the markets targeted by a particular advertiser and the number of media alternatives in those markets. Our failure to improve our current processes or to develop new products and services could result in the loss of our clients to current or future competitors. In addition, failure to gain market acceptance of new products and services could adversely affect our growth.

Current and future competitors may have significantly greater financial and other resources than we do, and they may sell competing products and services at lower prices or at lower profit margins, resulting in pressures on our prices and margins.

The sizes of our competitors vary across market segments. Therefore, some of our competitors may have significantly greater financial, technical, marketing or other resources than we do in one or more of our market segments, or overall. As a result, our competitors may be in a position to respond more quickly than we can to new or emerging technologies and changes in customer requirements, or may devote greater resources than we can to the development, promotion, sale and support of products and services. Moreover, new competitors or alliances among our competitors may emerge and potentially reduce our market share, revenue or margins. Some of our competitors also may choose to sell products or services competitive to ours at lower prices by accepting lower margins and profitability, or may be able to sell products or services competitive to ours at lower prices given proprietary ownership of data, technical superiority or economies of scale. Price reductions or pricing pressure by our competitors could negatively impact our margins and results of operations, and could also harm our ability to obtain new customers on favorable terms. Competitive pricing pressures tend to increase in difficult economic environments, such as the current environments in the United States and other economies, due to reduced marketing expenditures of many of our clients and prospects and the resulting impact on the competitive business environment for marketing service providers such as our company.

We must maintain technological competitiveness, continually improve our processes and develop and introduce new products and services in a timely and cost-effective manner.

13

Table of Contents

We believe that our success depends on, among other things, maintaining technological competitiveness in our Direct Marketing and Shoppers products, processing functionality and software systems and services. Technology changes rapidly and there are continuous improvements in computer hardware, network operating systems, programming tools, programming languages, operating systems, database technology and the use of the Internet. Advances in information technology may result in changing client preferences for products and product delivery formats in our industry. We must continually improve our current processes and develop and introduce new products and services in order to match our competitors’ technological developments and other improvements in competing product and service offerings and the increasingly sophisticated requirements of our clients. We may be unable to successfully identify, develop and bring new and enhanced services and products to market in a timely and cost-effective manner, such services and products may not be commercially successful, and services, products and technologies developed by others may render our services and products noncompetitive or obsolete.

Our success depends on our ability to consistently and effectively deliver our products and services to our clients.

Our success depends on our ability to effectively and consistently staff and execute client engagements within the agreed upon timeframe and budget. Depending on the needs of our clients, our Direct Marketing engagements may require customization, integration and coordination of a number of complex product and service offerings and execution across many of our facilities worldwide. Moreover, in some of our engagements, we rely on subcontractors and other third parties to provide a portion of our overall services, and we cannot guarantee that these third parties will effectively deliver their services or that we will have adequate recourse against these third parties in the event they fail to effectively deliver their services. Other contingencies and events outside of our control may also impact our ability to provide our products and services. Our failure to effectively and timely staff, coordinate and execute our client engagements may adversely impact existing client relationships, the amount or timing of payments from our clients, our reputation in the marketplace and ability to secure additional business and our resulting financial performance. In addition, our contractual arrangements with our Direct Marketing clients and other customers may not provide us with sufficient protections against claims for lost profits or other claims for damages.

If we lose key management or are unable to attract and retain the talent required for our business, our operating results could suffer.

Our prospects depend in large part upon our ability to attract, train and retain experienced technical, client services, sales, consulting, research and development, marketing, administrative and management personnel. While the demand for personnel is dependent on employment levels, competitive factors and general economic conditions, qualified personnel historically have been in great demand. The loss or prolonged absence of the services of these individuals could have a material adverse effect on our business, financial position or operating results.

We have recently experienced, and may experience in the future, reduced demand for our products and services and increased bad debt expense because of general economic conditions, the financial conditions and marketing budgets of our clients and other factors that may impact the industry verticals that we serve.

Economic downturns and turmoil severely affect the marketing services industry. Throughout this recent recession, and in other previous economic downturns, our customers have responded, and may respond in the future, to weak economic conditions by reducing their marketing budgets, which are generally discretionary in nature and easier to reduce in the short-term than other expenses. In addition, revenues from our Shoppers business are largely dependent on local advertising expenditures in the markets in which they operate. Such expenditures are substantially affected by the strength of the local economies in those markets. Direct Marketing revenues are dependent on national, regional and international economies and business conditions. A lasting economic recession or anemic recovery in the United States economy and the other markets in which we operate, such as the recent recession and recovery, could have material adverse effects on our business, financial position or operating results. Similarly, there may be industry or company-specific factors that negatively impact our clients and prospective clients or their industries and result in reduced demand for our products and services, client bankruptcies or other collection

14

Table of Contents

difficulties and bankruptcy preference actions to recover certain amounts previously paid to us by our clients. We may also experience reduced demand as a result of consolidation of clients and prospective clients in the industry verticals that we serve. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-K for additional information about the adverse impact on our financial performance of the ongoing difficult economic environment in the United States and other economies.

Our Shoppers business is geographically concentrated and is subject to the California and Florida economies.

Our Shoppers business is concentrated geographically in California and Florida. An economic downturn in these states, such as the current downturn, or a large disaster, such as a flood, hurricane, earthquake or other disaster or condition that disables our facilities, immobilizes the USPS or causes a significant negative change in the economies of these regions, could have a material adverse effect on our business, financial position or operating results.

Our business plan requires us to effectively manage our costs. If we do not achieve our cost management objectives, our financial results could be adversely affected.

Our business plan and expectations for the future require that we effectively manage our cost structure, including our operating expenses and capital expenditures across our operations. To the extent that we do not effectively manage our costs, our financial results may be adversely affected in any economic climate and even more so during a prolonged recession, such as the ongoing economic downturn in the United States and other economies.

Privacy, security and other direct marketing regulatory requirements may prevent or impair our ability to offer our products and services.

We are subject to, or affected by, numerous laws, regulations and industry standards that regulate direct marketing activities, including those that address privacy, data security and unsolicited marketing communications. Please refer to the section above entitled “U.S. and Foreign Government Regulations” for additional information regarding some of these regulations.

As a result of increasing public awareness and interest in individual privacy rights, data security and environmental and other concerns regarding unsolicited marketing communications, federal, state and foreign governmental and industry organizations continue to consider new legislative and regulatory proposals that would impose additional restrictions on direct marketing services and products. Examples include data encryption standards, data breach notification requirements, registration requirements, consumer choice and consent restrictions and increased penalties against offending parties, among others. We anticipate that additional proposals will continue to be introduced in the future, some of which may be adopted. In addition, our business may be affected by the impact of these restrictions on our clients and their marketing activities. These additional regulations could increase compliance requirements and restrict or prevent the collection, management, aggregation, transfer, use or dissemination of information or data that is currently legally available. Additional regulations may also restrict or prevent current practices regarding unsolicited marketing communications. For example, many states have considered implementing do not contact legislation that could impact our Direct Marketing and Shoppers businesses and the businesses of our clients and customers. In addition, continued public interest in individual privacy rights and data security may result in the adoption of further voluntary industry guidelines that could impact our direct marketing activities and business practices.

We cannot predict the scope of any new legislation, regulations or industry guidelines or how courts may interpret existing and new laws. Additionally, enforcement priorities by governmental authorities may change and also impact our business. Compliance with regulations is costly and time-consuming, and we may encounter difficulties, delays or significant expenses in connection with our compliance, and we may be exposed to significant penalties, liabilities, reputational harm and loss of business in the event that we fail to comply. There could be a material adverse impact on our business due to the enactment or enforcement of legislation or industry regulations, the issuance of judicial or governmental interpretations, enforcement

15

Table of Contents

priorities of governmental agencies or a change in customs arising from public concern over consumer privacy and data security issues.

We could fail to adequately protect our intellectual property rights and may face claims for intellectual property infringement.

Our ability to compete effectively depends in part on the protection of our technology, products, services and brands through intellectual property right protections, including patents, copyrights, database rights, trade secrets, trademarks and domain name registrations and enforcement procedures. The extent to which such rights can be protected and enforced varies in different jurisdictions. There is also a risk of litigation relating to our use or future use of intellectual property rights of third parties. Third-party infringement claims and any related litigation against us could subject us to liability for damages, restrict us from using and providing our technologies, products or services or operating our business generally, or require changes to be made to our technologies, products and services. Please refer to the section above entitled “Intellectual Property Rights” for additional information regarding our intellectual property and associated risks.

Consumer perceptions regarding the privacy and security of their data may prevent or impair our ability to offer our products and services.

Pursuant to various federal, state, foreign and industry regulations, consumers have control as to how certain data regarding them is collected, used and shared for marketing purposes. If, due to privacy or security concerns, consumers exercise their ability to prevent such data collection, use or sharing, this may impair our ability to provide direct marketing to those consumers and limit our clients’ requirements for our services. Additionally, privacy and security concerns may limit consumers’ willingness to voluntarily provide data to our customers or marketing companies. Some of our services depend on voluntarily provided data and may be impaired without such data.

Our reputation and business results may be adversely impacted if we, or subcontractors upon whom we rely, do not effectively protect sensitive personal information of our clients and our clients’ customers.

Current privacy and data security laws and industry standards impact the manner in which we capture, handle, analyze and disseminate customer and prospect data as part of our client engagements. In many instances, client contracts also mandate privacy and security practices. If we fail to effectively protect and control sensitive personal information (such as personal health information, social security numbers or credit card numbers) of our clients and their customers or prospects in accordance with these requirements, we may incur significant expenses, suffer reputational harm and loss of business, and, in certain cases, be subjected to regulatory or governmental sanctions or litigation. These risks may be increased due to our reliance on subcontractors and other third parties in providing a portion of our overall services in certain engagements. We cannot guarantee that these third parties will effectively protect and handle sensitive personal information or other confidential information, or that we will have adequate recourse against these third parties in that event.

We may not be able to adequately protect our information systems.

Our ability to protect our information systems against damage from a data loss, security breach, computer virus, fire, power loss, telecommunications failure or other disaster is critical to our future success. Some of these systems may be outsourced to third-party providers from time to time. Any damage to our information systems that causes interruptions in our operations or a loss of data could affect our ability to meet our clients’ requirements, which could have a material adverse effect on our business, financial position or operating results. While we take precautions to protect our information systems, such measures may not be effective, and existing measures may become inadequate because of changes in future conditions.

Breaches of security, or the perception that e-commerce is not secure, could harm our business and reputation.

Business-to-business and business-to-consumer electronic commerce, including that which is Internet-based, requires the secure transmission of confidential information over public networks. Some of our products and services are accessed through the Internet. Security breaches in connection with the delivery of our products

16

Table of Contents

and services, or well-publicized security breaches that may affect us or our industry, such as database intrusion, could be detrimental to our business, operating results and financial condition. We cannot be certain that advances in criminal capabilities, new discoveries in the field of cryptography or other developments will not compromise or breach the technology protecting the information systems that access our products, services and proprietary database information.

Data suppliers could withdraw data that we rely on for our products and services.

We purchase or license much of the data we use.There could be a material adverse impact on our Direct Marketing business if owners of the data we use were to withdraw or cease to allow access to the data or materially restrict the authorized uses of their data. Data providers could withdraw their data if there is a competitive reason to do so, if there is pressure from the consumer community or if additional legislation is passed restricting the use of the data. We also rely upon data from other external sources to maintain our proprietary and non-proprietary databases, including data received from customers and various government and public record sources. If a substantial number of data providers or other key data sources were to withdraw or restrict their data, if we were to lose access to data due to government regulation, or if the collection of data becomes uneconomical, our ability to provide products and services to our clients could be materially adversely affected, which could result in decreased revenues, net income and earnings per share.

We must successfully evaluate acquisition targets and integrate acquisitions.

We frequently evaluate acquisition opportunities to expand our product and service offerings and geographic locations, including potential international acquisitions. Acquisition activities, even if not consummated, require substantial amounts of management time and can distract from normal operations. In addition, we may be unable to achieve the profitability goals, synergies and other objectives initially sought in acquisitions, and any acquired assets, data or businesses may not be successfully integrated into our operations. Acquisitions may result in the impairment of relationships with employees and customers. Moreover, although we review and analyze assets or companies we acquire, such reviews are subject to uncertainties and may not reveal all potential risks, and we may incur unanticipated liabilities and expenses as a result of our acquisition activities. The failure to identify appropriate candidates, to negotiate favorable terms, or to successfully integrate future acquisitions into existing operations could result in not achieving planned revenue growth and could negatively impact our net income and earnings per share.

We are vulnerable to increases in paper prices.

Newsprint prices have fluctuated in recent years. We maintain, on average, less than 45 days of paper inventory and do not purchase our paper pursuant to long-term paper contracts. Because we have a limited ability to protect ourselves from fluctuations in the price of paper or to pass increased costs along to our clients, these fluctuations could materially affect the results of our operations.

We are vulnerable to increases in postal rates and disruptions in postal services.

Our Shoppers and Direct Marketing services depend on the USPS to deliver products. Our shoppers are delivered by Standard Mail, and postage is the second largest expense, behind labor, in our Shoppers business. Standard postage rates have increased in recent years, most recently in May 2009, and rates remain subject to further increases. For example, in July 2010, the U.S. Postal Service proposed an exigent price increase to go into effect in January 2011 by an average of 5.6%. (The Postal Regulatory Commission denied the proposal in its entirety.) Under the Postal Accountability and Enhancement Act of 2006, the USPS can file for a rate increase in February of each year, and any increase will take effect the following April. Any such rate increase is capped at the average of the consumer price index from the previous December. At this point we believe the next postal rate increase will likely occur in April 2011 and will be less than 1%. Overall Shoppers postage costs will be affected by any future increases in postage rates. Postage rates also influence the demand for our Direct Marketing services even though the cost of mailings is typically borne by our clients and is not directly reflected in our revenues or expenses. Accordingly, future postal increases or disruptions in the operations of the USPS may have an adverse impact on us.

17

Table of Contents

Our financial results could be negatively impacted by impairments of goodwill or other intangible assets with indefinite useful lives.

As of December 31, 2010, the net book value of our goodwill and other intangibles, represented approximately $581.4 million out of our total assets of $926.9 million. We test goodwill and other intangible assets with indefinite useful lives for impairment as of November 30 of each year and on an interim date should factors or indicators become apparent that would require an interim test. A downward revision in the fair value of either of our reporting units or any of the other intangible assets could result in impairments and non-cash charges. Any such impairment charges could have a significant negative effect on our reported net income.

Scheduled debt maturities and liquidity

All of our $193.0 million outstanding debt is scheduled to mature over the next fifteen months. As of December 31, 2010 we had $86.0 million in cash and had $58.2 million of unused borrowing capacity under our 2010 Revolving Credit Facility. Depending on our ability to generate sufficient cash flow from operations, our overall liquidity and ability to make payments on our indebtedness may be adversely impacted, and we may be required to seek one or more alternatives, such as refinancing or restructuring our indebtedness, selling material assets or operations, or seeking to raise debt or equity capital. We cannot assure you that any of these actions could be effected on a timely basis or on satisfactory terms, if at all. In addition, our existing debt agreements contain restrictive covenants that may prohibit us from adopting one or more of these alternatives.

Our indebtedness may adversely impact our ability to react to changes in our business or changes in general economic conditions.

The amount of our indebtedness and the terms under which we have borrowed money under our credit facilities or other agreements could have important consequences for our business. Our debt covenants require that we maintain certain financial measures and ratios. As a result of these covenants and ratios, we may be limited in the manner in which we can conduct our business, and we may be unable to engage in favorable business activities or finance future operations or capital needs. A failure to comply with these restrictions or to maintain the financial measures and ratios contained in the debt agreements could lead to an event of default that could result in an acceleration of outstanding indebtedness. In addition, the amount and terms of our indebtedness could:

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate, including limiting our ability to invest in our strategic initiatives, and, consequently, place us at a competitive disadvantage; |

| • | reduce the availability of our cash flows that would otherwise be available to fund working capital, capital expenditures, acquisitions and other general corporate purposes; and |

| • | result in higher interest expense in the event of increases in interest rates, as discussed below under “Interest rate increases could affect our results of operations, cash flows and financial position.” |

We may incur additional indebtedness in the future and, if new debt is added to our current debt levels, the above risks could be increased.

Interest rate increases could affect our results of operations, cash flows and financial position.

Interest rate movements in Europe and the United States can affect the amount of interest we pay related to our debt and the amount we earn on cash equivalents. Our primary interest rate exposure is to interest rate fluctuations in Europe, specifically Eurodollar rates, due to their impact on interest related to our credit facilities. As of December 31, 2010, we had $193.0 million of debt outstanding, all of which was at variable interest rates. Our results of operations, cash flows and financial position could be materially adversely affected by significant increases in interest rates. We also have exposure to interest rate fluctuations in the United States, specifically money market, commercial paper and overnight time deposit rates, as these affect our earnings on excess cash. Even with the offsetting increase in earnings on excess cash in the event of an

18

Table of Contents

interest rate increase, we cannot be assured that future interest rate increases will not have a material adverse impact on our business, financial position or operating results.

Our international operations subject us to risks associated with operations outside the U.S.

Harte-Hanks Direct Marketing conducts business outside of the United States. During 2010, approximately 15.4% of Harte-Hanks Direct Marketing’s revenues and 10.7% of Harte-Hanks total revenues were derived from businesses outside the United States, primarily Europe, Asia and South America. We may expand our international operations in the future as part of our growth strategy. Accordingly, our future operating results could be negatively affected by a variety of factors, some of which are beyond our control, including:

| • | social, economic and political instability; |

| • | changes in U.S. and foreign governmental legal requirements or policies resulting in burdensome government controls, tariffs, restrictions, embargoes or export license requirements; |

| • | inflation; |

| • | the potential for nationalization of enterprises; |

| • | less favorable labor laws that may increase employment costs and decrease work force flexibility; |

| • | potentially adverse tax treatment; |

| • | less favorable foreign intellectual property laws that would make it more difficult to protect our intellectual properties from appropriation by competitors; |

| • | more onerous or differing data privacy and security requirements or other marketing regulations; |

| • | longer payment cycles for sales in foreign countries; and |

| • | the costs and difficulties of managing international operations. |

In addition, exchange rate movements may have an impact on our future costs or on future cash flows from foreign investments. We have not entered into any foreign currency forward exchange contracts or other derivative instruments to hedge the effects of adverse fluctuations in foreign currency exchange rates. The various risks that are inherent in doing business in the United States are also generally applicable to doing business outside of the United States, and may be exaggerated by the difficulty of doing business in numerous sovereign jurisdictions due to differences in culture, laws and regulations.

We must maintain effective internal controls.

In designing and evaluating our internal controls over financial reporting, we recognize that any internal control or procedure, no matter how well designed and operated, can provide only reasonable assurance of achieving desired control objectives and that no system of internal controls can be designed to provide absolute assurance of effectiveness. If we fail to maintain a system of effective internal controls, it could have a material adverse effect on our business, financial position or operating results. Additionally, adverse publicity related to a failure in our internal controls over financial reporting could have a negative impact on our reputation and business.

Fluctuation in our revenue and operating results and other factors may impact the volatility of our stock price.

The price at which our common stock has traded in recent years has fluctuated greatly and has declined significantly over that period of time. The price may continue to be volatile due to a number of factors including the following, some of which are beyond our control:

| • | the impact and duration of the ongoing economic downturn, overall strength of the United States and other economies and general market volatility; |

| • | variations in our operating results from period to period and variations between our actual operating results and the expectations of securities analysts, investors and the financial community; |

| • | unanticipated developments with client engagements or client demand, such as variations in the size, budget, or progress toward the completion of engagements, variability in the market demand for our services, client consolidations and the unanticipated termination of several major client engagements; |

| • | announcements of developments affecting our businesses; |

| • | competition and the operating results of our competitors; and |

19

Table of Contents

| • | other factors discussed elsewhere in this Item 1A, “Risk Factors”. |

As a result of these and other factors, investors in our common stock may not be able to resell their shares at or above their original purchase price.

War or terrorism could affect our business.

War and/or terrorism or the threat of war and/or terrorism involving the United States could have a significant impact on our business, financial position or operating results. War or the threat of war could substantially affect the levels of advertising expenditures by clients in each of our businesses. In addition, each of our businesses could be affected by operation disruptions and a shortage of supplies and labor related to such a war or threat of war.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

Our headquarters are located in San Antonio, Texas, and we occupy approximately 8,000 square feet of leased premises at that location. Our business is conducted in facilities worldwide containing aggregate space of approximately 3.2 million square feet. Approximately 3.0 million square feet are held under leases, which expire at dates through 2020. The balance of the properties, used in our Southern California Shoppers operations and Hasselt, Belgium Direct Marketing operations, are owned.

| ITEM 3. | LEGAL PROCEEDINGS |

Information regarding legal proceedings is set forth in Note K,Commitments and Contingencies, of the “Notes to Consolidated Financial Statements” and is incorporated herein by reference.

| ITEM 4. | RESERVED |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Common Stock

Our common stock is listed on the NYSE (symbol: HHS). The reported high and low quarterly sales price ranges for 2010 and 2009 were as follows:

| 2010 | 2009 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

First Quarter | 13.30 | 10.25 | 7.98 | 4.50 | ||||||||||||

Second Quarter | 15.84 | 10.37 | 10.14 | 5.21 | ||||||||||||

Third Quarter | 11.90 | 9.60 | 14.22 | 8.31 | ||||||||||||

Fourth Quarter | 13.65 | 11.14 | 14.48 | 9.25 | ||||||||||||

In 2010 and 2009, quarterly dividends were paid at the rate of 7.5 cents per share.

We currently plan to pay a quarterly dividend of 8.0 cents per common share in each of the quarters in 2011, although any actual dividend declaration can be made only upon approval of our Board of Directors, based on its business judgment.

20

Table of Contents

As of January 31, 2011, there are approximately 2,300 holders of record.

Issuer Purchases of Equity Securities

The following table contains information about our purchases of equity securities during the fourth quarter of 2010:

Period | Total Number of Shares Purchased(2) | Average Price Paid per Share | Total Number of Shares Purchased as Part of a Publicly Announced Plan(1) | Maximum Number of Shares that May Yet Be Purchased Under the Plan | ||||||||||||

October 1 – 31, 2010 | – | $ | – | – | 10,475,491 | |||||||||||

November 1 – 30, 2010 | – | $ | – | – | 10,475,491 | |||||||||||

December 1 – 31, 2010 | 2,298 | $ | 12.72 | – | 10,475,491 | |||||||||||

Total | 2,298 | $ | 12.72 | – | ||||||||||||

| (1) | During the fourth quarter of 2010, we did not purchase any shares of our stock through our stock repurchase program that was publicly announced in January 1997. Under this program, from which shares can be purchased in the open market or through privately negotiated transactions, our Board of Directors has authorized the repurchase of up to 74,400,000 shares of our outstanding common stock. As of December 31, 2010, we had repurchased a total of 63,924,509 shares at an average price of $18.83 per share under this program. |

| (2) | Total number of shares purchased includes shares, if any, purchased as part of our publicly announced stock repurchase program, plus shares withheld to pay applicable withholding taxes and the exercise price related to stock options, and shares withheld to pay applicable withholding taxes related to the vesting of nonvested shares, pursuant to the Harte-Hanks, Inc. 2005 Omnibus Incentive Plan. |

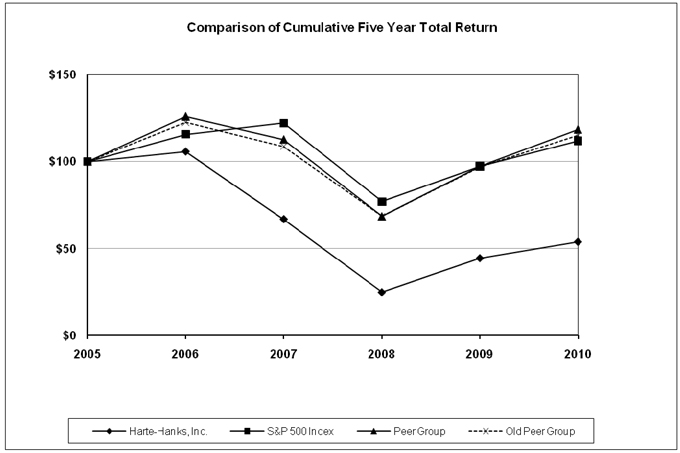

Comparison of Stockholder Returns

The material under this heading is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing under the 1933 Act or the 1934 Act, whether made before or after the date hereof and irrespective of any general incorporation language in such filing.

The following graph compares the cumulative total return of our common stock during the period December 31, 2005 to December 31, 2010 with the Standard & Poor’s 500 Stock Index (S&P 500 Index) and with two peer groups. We made modifications to our peer group in this 2010 Annual Report on Form 10-K compared to our previous peer group in order to be consistent with the modified 2011 peer group used by our Compensation Committee in evaluating management compensation.