UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01528

Bruce Fund, Inc.

(Exact name of registrant as specified in charter)

20 North Wacker Drive, Suite 2414 Chicago, IL 60606

(Address of principal executive offices) (Zip code)

R. Jeffrey Bruce

Bruce & Co.

20 North Wacker Drive, Suite 2414

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-236-9160

Date of fiscal year end: 6/30

Date of reporting period: 12/31/2024

Item 1. Reports to Stockholders.

Semi-Annual Shareholder Report - December 31, 2024

This semi-annual shareholder report contains important information about Bruce Fund for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at https://www.thebrucefund.com/document-library. You can also request this information by contacting us at (800) 872-7823. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Bruce Fund | $33 | 0.65% |

|---|

How did the Fund perform during the reporting period?

The Bruce Fund (the “Fund”) shares produced a gain of 4.00% for the six months ended December 31, 2024, compared to a gain of 8.44% for the S&P 500 Index for the same period. Stock markets marched to new highs during the period and the Fund again lagged.

The Fund’s large pharma stocks were overall relatively unchanged for the period, with some losses neutralizing the gains. Electric utilities produced gains despite higher interest rates. The smaller and specialty pharma stocks were dramatically mixed with some large gains offset with a few large losses. The volatility is high for the distressed and potential turn around stocks, and while we are still optimistic for most, the performance has been poor. Cash in the Fund has come down but remains elevated, with overall valuation levels at historical extremes.

Fiscal policies and proposals have encouraged activity and speculation, but with debt levels at extremes, caution is warranted. The markets have favored a narrow few and growth versus value or higher yielding stocks. That explains most of the Fund’s underperformance.

We continue to believe the markets are too confident or complacent with the total debt worldwide at dangerous levels. We feel growth will slow, corporate profit margins will deteriorate from all-time highs and earnings will ultimately disappoint. While we believe the world is overly leveraged and financially vulnerable, U.S. growth and optimism continues, and we will attempt to seek reasonable capital appreciation opportunities as they present themselves.

Management continues to screen investment opportunities for their long-term capital appreciation potential versus the risks that investment might present. The bonds as well as the stocks in the portfolio encompass significant investment risks, which are again outlined in the prospectus.

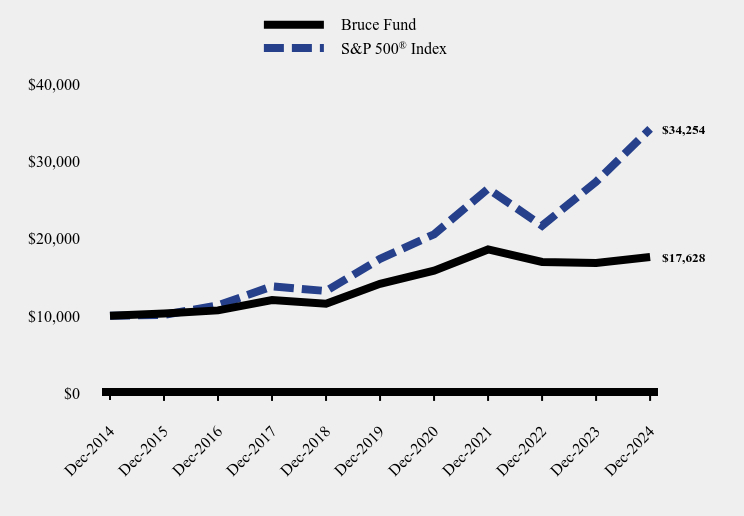

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Bruce Fund | S&P 500® Index |

|---|

| Dec-2014 | $10,000 | $10,000 |

|---|

| Dec-2015 | $10,290 | $10,138 |

|---|

| Dec-2016 | $10,708 | $11,351 |

|---|

| Dec-2017 | $12,042 | $13,829 |

|---|

| Dec-2018 | $11,565 | $13,223 |

|---|

| Dec-2019 | $14,158 | $17,386 |

|---|

| Dec-2020 | $15,857 | $20,585 |

|---|

| Dec-2021 | $18,617 | $26,494 |

|---|

| Dec-2022 | $16,986 | $21,696 |

|---|

| Dec-2023 | $16,859 | $27,399 |

|---|

| Dec-2024 | $17,628 | $34,254 |

|---|

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Bruce Fund | 4.56% | 4.48% | 5.83% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.10% |

|---|

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $365,175,505 |

|---|

| Number of Portfolio Holdings | 42 |

|---|

| Advisory Fee | $986,005 |

|---|

| Portfolio Turnover | 8% |

|---|

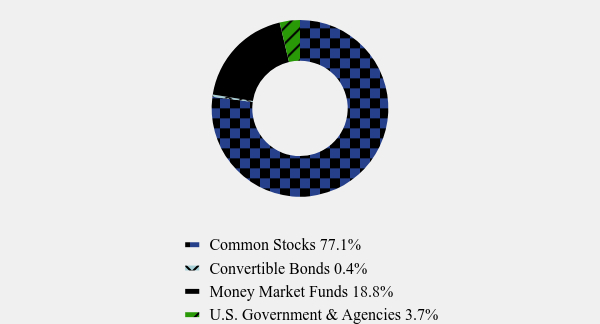

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 77.1% |

| Convertible Bonds | 0.4% |

| Money Market Funds | 18.8% |

| U.S. Government & Agencies | 3.7% |

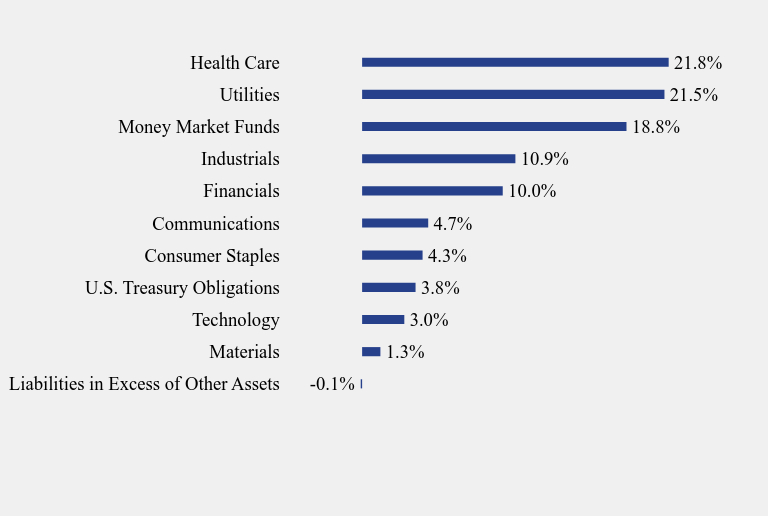

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.1% |

| Materials | 1.3% |

| Technology | 3.0% |

| U.S. Treasury Obligations | 3.8% |

| Consumer Staples | 4.3% |

| Communications | 4.7% |

| Financials | 10.0% |

| Industrials | 10.9% |

| Money Market Funds | 18.8% |

| Utilities | 21.5% |

| Health Care | 21.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Morgan Stanley Institutional Liquidity Government Portfolio, Institutional Class | 18.8% |

| U-Haul Holding Co., Class B | 7.0% |

| Allstate Corp. (The) | 6.1% |

| Duke Energy Corp. | 5.6% |

| Merck & Co., Inc. | 5.5% |

| AbbVie, Inc. | 5.3% |

| NextEra Energy, Inc. | 5.3% |

| CMS Energy Corp. | 5.1% |

| Abbott Laboratories | 4.5% |

| AT&T, Inc. | 4.4% |

Effective October 28, 2024, as approved by the Board, the Adviser changed the annual percentage fee by decreasing the breakpoint for assets over $100,000,000 from 0.50% to 0.30%.

Semi-Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.thebrucefund.com/document-library), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

Not Applicable – disclosed with annual report.

Item 3. Audit Committee Financial Expert.

Not Applicable - disclosed with annual report.

Item 4. Principal Accountant Fees and Services.

Not Applicable - disclosed with annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

2024

BRUCE FUND, INC.

SEMI-ANNUAL

FINANCIAL STATEMENTS AND

ADDITIONAL INFORMATION

Report to Shareholders

December 31, 2024

20 North Wacker Drive ● Suite 2414 ● Chicago, Illinois 60606 ● (312) 236-9160

Bruce Fund

Schedule of Investments (Unaudited)

December 31, 2024

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 77.2% | | | | | | | | |

| | | | | | | | | |

| Communications — 4.8% | | | | | | | | |

| AT&T, Inc. | | | 700,000 | | | $ | 15,939,000 | |

| Sirius XM Holdings, Inc. | | | 55,784 | | | | 1,271,875 | |

| | | | | | | | 17,210,875 | |

| Consumer Staples — 4.3% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 100,000 | | | | 5,052,000 | |

| Bunge Global SA | | | 80,000 | | | | 6,220,800 | |

| Darling Ingredients, Inc.(a) | | | 130,000 | | | | 4,379,700 | |

| | | | | | | | 15,652,500 | |

| Financials — 10.0% | | | | | | | | |

| AerCap Holdings N.V. (Ireland) | | | 150,000 | | | | 14,355,000 | |

| Allstate Corp. (The) | | | 115,000 | | | | 22,170,850 | |

| | | | | | | | 36,525,850 | |

| Health Care — 21.4% | | | | | | | | |

| 908 Devices, Inc.(a) | | | 68,286 | | | | 150,230 | |

| Abbott Laboratories | | | 144,500 | | | | 16,344,395 | |

| AbbVie, Inc. | | | 110,000 | | | | 19,547,000 | |

| Bausch Health Cos., Inc. (Canada)(a) | | | 70,000 | | | | 564,200 | |

| Caribou Biosciences, Inc.(a) | | | 250,000 | | | | 397,500 | |

| EDAP TMS SA - ADR (France)(a) | | | 529,794 | | | | 1,170,845 | |

| Eli Lilly & Co. | | | 2,000 | | | | 1,544,000 | |

| Fate Therapeutics, Inc.(a) | | | 350,000 | | | | 577,500 | |

| IGM Biosciences, Inc.(a) | | | 100,000 | | | | 611,000 | |

| Kodiak Sciences, Inc.(a) | | | 323,000 | | | | 3,213,850 | |

| LAVA Therapeutics N.V. (Netherlands)(a) | | | 771,874 | | | | 734,052 | |

| MannKind Corp.(a) | | | 195,073 | | | | 1,254,319 | |

| Merck & Co., Inc. | | | 200,000 | | | | 19,896,000 | |

| Organon & Co. | | | 30,000 | | | | 447,600 | |

| Personalis, Inc.(a) | | | 253,000 | | | | 1,462,340 | |

| Pfizer, Inc. | | | 250,000 | | | | 6,632,500 | |

| Supernus Pharmaceuticals, Inc.(a) | | | 82,105 | | | | 2,968,917 | |

| Viatris, Inc. | | | 55,835 | | | | 695,146 | |

| | | | | | | | 78,211,394 | |

| Industrials — 10.9% | | | | | | | | |

| Insteel Industries, Inc. | | | 343,423 | | | | 9,275,855 | |

| U-Haul Holding Co.(a) | | | 68,000 | | | | 4,698,120 | |

| U-Haul Holding Co., Class B | | | 400,000 | | | | 25,620,000 | |

| | | | | | | | 39,593,975 | |

Bruce Fund

Schedule of Investments (Unaudited) (continued)

December 31, 2024

| | | Shares | | | Fair Value | |

| COMMON STOCKS — (continued) | | | | | | | | |

| | | | | | | | | |

| Materials — 1.3% | | | | | | | | |

| Ashland, Inc. | | | 15,000 | | | $ | 1,071,900 | |

| Newmont Corp. | | | 100,000 | | | | 3,722,000 | |

| | | | | | | | 4,793,900 | |

| Technology — 3.0% | | | | | | | | |

| Apple, Inc. | | | 30,000 | | | | 7,512,600 | |

| Vicor Corp.(a) | | | 70,000 | | | | 3,382,400 | |

| | | | | | | | 10,895,000 | |

| Utilities — 21.5% | | | | | | | | |

| Avista Corp. | | | 200,000 | | | | 7,326,000 | |

| CMS Energy Corp. | | | 280,000 | | | | 18,662,000 | |

| Duke Energy Corp. | | | 190,000 | | | | 20,470,600 | |

| NextEra Energy, Inc. | | | 270,000 | | | | 19,356,300 | |

| Xcel Energy, Inc. | | | 190,000 | | | | 12,828,800 | |

| | | | | | | | 78,643,700 | |

| Total Common Stocks (Cost $157,171,237) | | | | | | | 281,527,194 | |

| | | Principal

Amount | | | | |

| U.S. GOVERNMENT BONDS — 3.7% | | | | | | | | |

| U.S. Treasury “Strips”, 0.00%, 2/15/2036 | | $ | 20,000,000 | | | | 12,279,359 | |

| U.S. Treasury “Strips”, 0.00%, 5/15/2053 | | | 5,000,000 | | | | 1,325,712 | |

| Total U.S. Government Bonds (Cost $13,326,669) | | | | | | | 13,605,071 | |

| | | | | | | | | |

| CONVERTIBLE CORPORATE BONDS — 0.4% | | | | | | | | |

| | | | | | | | | |

| Health Care — 0.4% | | | | | | | | |

| Accelerate Diagnostics, Inc., 5.00%, 12/15/2026(b) (c) | | | 3,292,574 | | | | 1,317,029 | |

| Acorda Therapeutics, Inc., 6.00%, 12/1/2024(b) (c) (d) | | | 5,000,000 | | | | 200,000 | |

| Total Convertible Corporate Bonds (Cost $5,387,852) | | | | | | | 1,517,029 | |

See accompanying notes which are an integral part of these financial statements.

Bruce Fund

Schedule of Investments (Unaudited) (continued)

December 31, 2024

| | | Shares | | | Fair Value | |

| MONEY MARKET FUNDS — 18.8% | | | | | | | | |

| Morgan Stanley Institutional Liquidity Government Portfolio, Institutional Class, 4.43%(e) | | | 68,715,616 | | | $ | 68,715,616 | |

| Total Money Market Funds (Cost $68,715,616) | | | | | | | 68,715,616 | |

| | | | | | | | | |

| Total Investments — 100.1% (Cost $244,601,374) | | | | | | | 365,364,910 | |

| Liabilities in Excess of Other Assets — (0.1)% | | | | | | | (189,405 | ) |

| NET ASSETS — 100.0% | | | | | | $ | 365,175,505 | |

| (a) | Non-income producing security. |

| (b) | Illiquid security. The total fair value of these securities as of December 31, 2024 was $1,517,029, representing 0.4% of net assets. |

| (c) | Security is currently being valued according to the fair value procedures approved by the Board of Directors. |

| (d) | In default. |

| (e) | Rate disclosed is the seven day effective yield as of December 31, 2024. |

ADR – American Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

Bruce Fund

Statement of Assets and Liabilities (Unaudited)

December 31, 2024

| Assets | | | | |

| Investments in securities, at market value (cost $244,601,374) | | $ | 365,364,910 | |

| Dividends and interest receivable | | | 589,905 | |

| Receivable for fund shares sold | | | 8,786 | |

| Prepaid expenses | | | 16,903 | |

| Total Assets | | | 365,980,504 | |

| Liabilities | | | | |

| Payable for fund shares redeemed | | | 576,229 | |

| Accrued investment advisory fees | | | 127,745 | |

| Payable to Administrator | | | 38,854 | |

| Payable to trustees | | | 8,179 | |

| Other accrued expenses | | | 53,992 | |

| Total Liabilities | | | 804,999 | |

| Net Assets | | $ | 365,175,505 | |

| Net Assets consist of | | | | |

| Capital stock (730,896 shares of $1 par value capital stock issued and outstanding) | | | 730,896 | |

| Paid-in capital | | | 240,029,286 | |

| Accumulated earnings | | | 124,415,323 | |

| Net Assets | | $ | 365,175,505 | |

| Shares outstanding: 2,000,000 shares authorized | | | 730,896 | |

| Net asset value, offering and redemption price per share | | $ | 499.63 | |

See accompanying notes which are an integral part of these financial statements.

Bruce Fund

Statement of Operations (Unaudited)

For the six months ended December 31, 2024

| Investment Income | | | | |

| Dividend income (net of foreign taxes withheld of $21,800) | | $ | 5,966,941 | |

| Interest income | | | 476,314 | |

| Total investment income | | | 6,443,255 | |

| Expenses | | | | |

| Investment advisory | | | 986,005 | |

| Administration | | | 112,527 | |

| Transfer agent | | | 57,691 | |

| Fund accounting | | | 42,534 | |

| Audit and tax preparation | | | 29,235 | |

| Registration | | | 19,669 | |

| Custodian | | | 18,633 | |

| Printing | | | 14,904 | |

| Postage | | | 8,422 | |

| Director | | | 8,179 | |

| Insurance | | | 773 | |

| Other | | | 1,741 | |

| Net operating expenses | | | 1,300,313 | |

| Net investment income | | | 5,142,942 | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain on investment securities | | | 4,224,321 | |

| Change in unrealized appreciation (depreciation) on investment securities | | | 7,191,001 | |

| Net realized and change in unrealized gain on investments | | | 11,415,322 | |

| Net increase in net assets resulting from operations | | $ | 16,558,264 | |

See accompanying notes which are an integral part of these financial statements.

Bruce Fund

Statements of Changes in Net Assets

| | | For the

Six Months Ended

December 31,

2024

(Unaudited) | | | For the

Year Ended

June 30,

2024 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 5,142,942 | | | $ | 13,269,730 | |

| Net realized gain on investment securities | | | 4,224,321 | | | | 6,476,872 | |

| Change in unrealized appreciation (depreciation) on investment securities | | | 7,191,001 | | | | (5,761,775 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 16,558,264 | | | | 13,984,827 | |

| Distributions to Shareholders from | | | | | | | | |

| Earnings | | | (17,721,482 | ) | | | (28,019,720 | ) |

| Total distributions | | | (17,721,482 | ) | | | (28,019,720 | ) |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 1,227,742 | | | | 1,991,540 | |

| Reinvestment of distributions | | | 16,195,759 | | | | 24,771,433 | |

| Amount paid for shares redeemed | | | (50,512,335 | ) | | | (106,618,920 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | (33,088,834 | ) | | | (79,855,947 | ) |

| Total Decrease in Net Assets | | | (34,252,052 | ) | | | (93,013,840 | ) |

| Net Assets | | | | | | | | |

| Beginning of period | | | 399,427,557 | | | | 493,318,397 | |

| End of period | | $ | 365,175,505 | | | $ | 399,427,557 | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 2,328 | | | | 3,910 | |

| Shares issued in reinvestment of distributions | | | 32,832 | | | | 50,183 | |

| Shares redeemed | | | (95,591 | ) | | | (210,271 | ) |

| Net increase (decrease) in shares outstanding | | | (60,431 | ) | | | (156,178 | ) |

See accompanying notes which are an integral part of these financial statements.

Bruce Fund

Financial Highlights

Selected data for each share of capital stock outstanding through each period is presented below

| | | For the

Six Months Ended

December 31,

2024 | | | For the Year Ended June 30, | |

| | | (Unaudited) | | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 504.76 | | | $ | 520.65 | | | $ | 595.73 | | | $ | 684.45 | | | $ | 559.92 | | | $ | 555.00 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 8.09 | | | | 16.57 | | | | 14.01 | | | | 10.16 | | | | 12.24 | | | | 13.36 | |

| Net realized and unrealized gain (loss) | | | 11.82 | | | | (0.01 | ) | | | (17.34 | ) | | | (36.91 | ) | | | 148.70 | | | | 3.58 | |

| Total from investment operations | | | 19.91 | | | | 16.56 | | | | (3.33 | ) | | | (26.75 | ) | | | 160.94 | | | | 16.94 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (14.82 | ) | | | (15.79 | ) | | | (13.09 | ) | | | (9.75 | ) | | | (13.58 | ) | | | (12.02 | ) |

| Net realized gains | | | (10.22 | ) | | | (16.66 | ) | | | (58.66 | ) | | | (52.22 | ) | | | (22.83 | ) | | | — | |

| Total distributions | | | (25.04 | ) | | | (32.45 | ) | | | (71.75 | ) | | | (61.97 | ) | | | (36.41 | ) | | | (12.02 | ) |

| Net asset value, end of period | | $ | 499.63 | | | $ | 504.76 | | | $ | 520.65 | | | $ | 595.73 | | | $ | 684.45 | | | $ | 559.92 | |

| Total Return(a) | | | 4.00 | %(b) | | | 3.32 | % | | | (0.86 | )% | | | (4.76 | )% | | | 29.42 | % | | | 2.96 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period ($ millions) | | $ | 365.18 | | | $ | 399.43 | | | $ | 493.32 | | | $ | 527.84 | | | $ | 590.14 | | | $ | 501.20 | |

| Ratio of expenses to average net assets | | | 0.65 | %(c) | | | 0.69 | % | | | 0.67 | % | | | 0.66 | % | | | 0.66 | % | | | 0.67 | % |

| Ratio of net investment income to average net assets | | | 2.58 | %(c) | | | 2.99 | % | | | 2.43 | % | | | 1.49 | % | | | 1.84 | % | | | 2.28 | % |

| Portfolio turnover rate | | | 8 | %(b) | | | 8 | % | | | 6 | % | | | 6 | % | | | 4 | % | | | 15 | % |

| (a) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

Bruce Fund

Notes to the Financial Statements (Unaudited)

December 31, 2024

NOTE A – ORGANIZATION

Bruce Fund, Inc. (the “Fund”) is a Maryland corporation incorporated on June 20, 1967. The Fund is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open end diversified management investment company and the Fund’s primary investment objective is long-term capital appreciation. The investment adviser to the Fund is Bruce & Co., Inc. (the “Adviser”).

The Fund operates as a single operating segment. The Fund’s income, expenses, assets, and performance are regularly monitored and assessed as a whole by the Adviser, who is responsible for the oversight functions of the Fund, using the information presented in the financial statements and financial highlights.

NOTE B – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation – The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with the generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities Valuation – All investments in securities are recorded at their fair value as described in Note C.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the six months ended December 31, 2024, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the Fund did not incur any interest or penalties.

Bruce Fund

Notes to the Financial Statements (Unaudited) (continued)

December 31, 2024

Security Transactions and Related Income – Investment transactions are accounted for no later than the first calculation of the Net Asset Value (“NAV”) on the business day following the trade date. For financial reporting purposes, however, security transactions are accounted for on the trade date on the last business day of the reporting period. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method. Withholding taxes on foreign dividends has been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political development in the relevant specific country or region.

Distributions – Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The Fund intends to distribute substantially all of its net investment income as dividends and distributions to its shareholders on at least an annual basis. The Fund intends to distribute its net realized long-term capital gains and its net realized short-term capital gains at least once a year. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expenses or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

NOTE C – SUMMARY OF SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

In accordance with Accounting Standards Codification 820, “Fair Value Measurements and Disclosures” (“ASC 820”), fair value is defined as the price that the Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. ASC 820 established a three-tier hierarchy to maximize the use of the observable market data and minimize the use of unobservable inputs and to establish classification of the fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value such as pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability, developed based on market data obtained from sources independent of

Bruce Fund

Notes to the Financial Statements (Unaudited) (continued)

December 31, 2024

the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability, developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad levels listed below:

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/ or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, convertible preferred stocks, and American Depositary Receipts (ADR’s), are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Adviser believes such prices more accurately reflect the fair value of such securities. Securities that are traded on any stock exchange are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued by the pricing service at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing service at the NASDAQ Official Closing Price. When using market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security will be classified as a Level 2 security.

When market quotations are not readily available or when the Adviser determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, such securities are valued as determined by the Adviser, in conformity with guidelines adopted by and subject to review by the Board of Directors (the “Board”). These securities are generally categorized as Level 3 securities.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the service agent of the funds. These securities will be categorized as Level 1 securities.

Bruce Fund

Notes to the Financial Statements (Unaudited) (continued)

December 31, 2024

Fixed income securities, including corporate bonds, convertible corporate bonds, U.S. government bonds, and U.S. municipal bonds are generally categorized as Level 2 securities and valued on the basis of prices furnished by a pricing service. A pricing service uses various inputs and techniques, which include broker-dealer quotations, live trading levels, recently executed transactions in securities of the issuer or comparable issuers, and option adjusted spread models that include base curve and spread curve inputs. Adjustments to individual bonds can be applied to recognize trading differences compared to other bonds issued by the same issuer. The broker-dealer quotations received are supported by credit analysis of the issuer that takes into consideration credit quality assessments, daily trading activity, and the activity of the underlying equities, listed bonds and sector-specific trends. To the extent that these inputs are observable, the fixed income securities are categorized as Level 2 securities. If the Adviser decides that a price provided by the pricing service does not accurately reflect the fair value of the securities or when prices are not readily available from a pricing service, securities are valued at fair value as determined in good faith by the Adviser, in conformity with guidelines adopted by and subject to review of the Board. These securities are generally categorized as Level 3 securities.

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2024, based on the three levels defined previously:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Communications | | $ | 17,210,875 | | | $ | — | | | $ | — | | | $ | 17,210,875 | |

| Consumer Staples | | | 15,652,500 | | | | — | | | | — | | | | 15,652,500 | |

| Financials | | | 36,525,850 | | | | — | | | | — | | | | 36,525,850 | |

| Health Care | | | 78,211,394 | | | | — | | | | — | | | | 78,211,394 | |

| Industrials | | | 39,593,975 | | | | — | | | | — | | | | 39,593,975 | |

| Materials | | | 4,793,900 | | | | — | | | | — | | | | 4,793,900 | |

| Technology | | | 10,895,000 | | | | — | | | | — | | | | 10,895,000 | |

| Utilities | | | 78,643,700 | | | | — | | | | — | | | | 78,643,700 | |

| U.S. Government Bonds | | | | | | | | | | | | | | | | |

| U.S. Treasury Strips | | | — | | | | 13,605,071 | | | | — | | | | 13,605,071 | |

| Convertible Corporate Bonds | | | | | | | | | | | | | | | | |

| Health Care | | | — | | | | — | | | | 1,517,029 | | | | 1,517,029 | |

| Money Market Funds | | | 68,715,616 | | | | — | | | | — | | | | 68,715,616 | |

| Total | | $ | 350,242,810 | | | $ | 13,605,071 | | | $ | 1,517,029 | | | $ | 365,364,910 | |

In the absence of a listed price quote, or in the case of a supplied price quote which is deemed to be unrepresentative of the actual market price, the Adviser shall use any or all of the following criteria to value Level 3 securities:

| ● | Price given by pricing service |

Bruce Fund

Notes to the Financial Statements (Unaudited) (continued)

December 31, 2024

| ● | Last quoted bid & asked price |

| ● | Third party bid & asked price |

| ● | Estimated remaining distributions |

| ● | Estimated possible recoveries |

The significant unobservable inputs that may be used in the fair value measurement of the Fund’s investments in common stock, corporate bonds and convertible corporate bonds for which market quotations are not readily available include: broker quotes, discounts from the most recent trade or “stale price” and estimates from trustees (in bankruptcies) on disbursements. A change in the assumption used for each of the inputs listed above may indicate a directionally similar change in the fair value of the investment.

The following provides quantitative information about the Fund’s significant Level 3 fair value measurements as of December 31, 2024:

| Quantitative Information about Significant Level 3 Fair Value Measurements |

| Asset Category | | Fair Value at

December 31,

2024 | | | Valuation

Techniques | | Unobservable Input(s) | | Range |

| Convertible Corporate Bonds | | $ | 1,317,029 | | | Indicated Opening Range | | Discount for Lack of Marketability | | 20%-40% |

| | | | | | | Last Sales Price | | Discount for Lack of Marketability | | |

| | | | 200,000 | | | Asset Liquidation Analysis | | Liquidation Proceeds | | N/A |

Bruce Fund

Notes to the Financial Statements (Unaudited) (continued)

December 31, 2024

The significant unobservable inputs used in the fair value measurement of the convertible corporate bonds are discount for lack of marketability. Significant increases (decreases) in those inputs in isolation would have resulted in a significantly lower (higher) fair value measurement. Following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value for the Fund:

| | | Balance as of

June 30,

2024 | | | Realized gain

(loss) | | | Amortization/

Accretion | | | Change in

unrealized

appreciation

(depreciation) | | | Purchases | |

| Convertible Corporate Bonds | | $ | 4,785,057 | | | $ | — | | | $ | 9,438 | | | $ | (536,239 | ) | | $ | 80,306 | |

| Total | | $ | 4,785,057 | | | $ | — | | | $ | 9,438 | | | $ | (536,239 | ) | | $ | 80,306 | |

| | | | | | Sales | | | Transfer in

Level 3* (a) | | | Transfer out

Level 3* (b) | | | Balance as of

December 31,

2024 | |

| Convertible Corporate Bonds | | | | | | $ | (2,821,533 | ) | | $ | — | | | $ | — | | | $ | 1,517,029 | |

| Total | | | | | | $ | (2,821,533 | ) | | $ | — | | | $ | — | | | $ | 1,517,029 | |

| * | The amount of transfers in and/or out are reflected at the reporting period end. |

| (a) | Transfers in relate primarily to securities for which observable inputs became unavailable during the period. Therefore, the securities were valued at fair value by the Adviser, in conformity with guidelines adopted by and subject to review by the Board and are categorized as Level 3 inputs as of December 31, 2024. |

| (b) | Transfers out relate primarily to securities for which observable inputs became available during the period, and as of December 31, 2024, the Fund was able to obtain quotes from its pricing service. These quotes represent Level 2 inputs, which is the level of the fair value hierarchy in which these securities are included as of December 31, 2024. |

The total change in unrealized appreciation included in the Statement of Operations attributable to Level 3 investments still held at December 31, 2024 was as follows:

| | | Total Change in

Unrealized Appreciation

(Depreciation) | |

| Convertible Corporate Bonds | | $ | (536,239 | ) |

| Total | | $ | (536,239 | ) |

Bruce Fund

Notes to the Financial Statements (Unaudited) (continued)

December 31, 2024

NOTE D – PURCHASES AND SALES OF SECURITIES

For the six months ended December 31, 2024, cost of purchases and proceeds from maturities and sales of securities, other than short-term investments and short-term U.S. Government obligations were as follows:

| | | Other | | | U.S. Government

Obligations | |

| Purchases | | $ | 23,574,939 | | | $ | — | |

| Sales | | $ | 23,444,399 | | | $ | — | |

NOTE E – RELATED PARTIES

Bruce & Co., Inc., an Illinois corporation, is the investment adviser of the Fund and furnishes investment advice. In addition, it provides office space and facilities and pays the cost of all prospectuses and financial reports (other than those mailed to current shareholders). Effective October 28, 2024, as approved by the Board, the Adviser changed the annual percentage fee by decreasing the breakpoint for assets over $100,000,000 from 0.50% to 0.30%. Expenses incurred are reflected on the Statement of Operations as “Investment Advisory” fees. Compensation to the Adviser for its services under the Investment Advisory Contract is paid monthly based on the following:

| Annual Percentage Fee | Applied to Average Net Assets of Fund |

| 1.00% | Up to $20,000,000; plus |

| 0.60% | $20,000,000 to $100,000,000; plus |

| 0.30% | over $100,000,000 |

At December 31, 2024, R. Jeffrey Bruce was the beneficial owner of 47,644 Fund shares, Robert DeBartolo was the beneficial owner of 36 Fund shares, and W. Martin Johnson was the beneficial owner of 7 Fund shares. R. Jeffrey Bruce, Robert DeBartolo, and W. Martin Johnson are directors of the Fund; R. Jeffrey Bruce is an officer of the Fund and the Adviser. The Fund pays two Independent Directors $8,000 per year.

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies and certain costs related to the pricing of the Fund’s portfolio securities. Expenses incurred are reflected on the Statement of Operations.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as the principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Bruce Fund

Notes to the Financial Statements (Unaudited) (continued)

December 31, 2024

NOTE F – FEDERAL INCOME TAXES

At December 31, 2024, the breakdown of net unrealized appreciation and tax cost of investments for federal income tax purpose is as follows:

| Gross Unrealized Appreciation | | $ | 132,640,606 | |

| Gross Unrealized Depreciation | | | (11,877,070 | ) |

| Net Unrealized Appreciation on Investments | | $ | 120,763,536 | |

| Tax Cost | | $ | 244,601,374 | |

The difference between book basis and tax basis of unrealized appreciation (depreciation) is primarily attributable to differences due to wash sales and investment in passive foreign investment companies.

At June 30, 2024, the Fund’s most recent fiscal year end, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Undistributed Ordinary Income | | $ | 5,648,233 | |

| Undistributed Long-Term Capital Gains | | | 4,476,787 | |

| Unrealized Appreciation | | | 113,453,521 | |

| Total | | $ | 125,578,541 | |

The tax character of distributions paid during the fiscal year ended June 30, 2024 was as follows:

| | | 2024 | |

| Distributions paid from: | | | | |

| Ordinary Income | | $ | 13,632,410 | |

| Long-Term Capital Gain | | | 14,387,310 | |

| Total | | $ | 28,019,720 | |

NOTE G – RESTRICTED SECURITIES

The Fund has acquired securities, the sale of which is restricted, through private placement. 100% of the restricted securities are valued according to fair value procedures approved by the Board. It is possible that the estimated value may differ significantly from the amount that might ultimately be realized in the near term, and the difference could be material. At December 31, 2024, the Fund held no restricted securities.

NOTE H – INDEMNIFICATIONS

The Fund indemnifies its officers and Board for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties

Bruce Fund

Notes to the Financial Statements (Unaudited) (continued)

December 31, 2024

which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

NOTE I – SUBSEQUENT EVENTS

In accordance with GAAP, management has evaluated subsequent events through the date these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

Additional Information (Unaudited)

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the period covered by this report.

Proxy Disclosures

Not applicable

Remuneration Paid to Directors, Officers and Others

Refer to the financial statements included herein.

Statement Regarding Basis for Approval of Investment Advisory Agreement

The Board of Directors (the “Board”), including the Directors who are not “interested persons” (as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) (the “Independent Directors”) voting separately, reviewed and approved the investment advisory agreement between the Fund and Bruce & Company, Inc. (the “Advisory Agreement”). The approval took place at a meeting held on September 26, 2024 (the “September Meeting”) at which all the Independent Directors were present.

At the September Meeting, counsel to the Fund and the Independent Directors (“Counsel”) explained the Board’s duties and legal standards applicable to the consideration and renewal of the Advisory Agreement. Counsel discussed with the Directors the types of information and factors that should be considered by the Board in order to make an informed decision regarding the approval of the Advisory Agreement in accordance with Section 15 of the 1940 Act, including the following with respect to the Fund: (1) the nature, extent, and quality of the services to be provided by Bruce with respect to the Fund; (2) the Fund’s historical performance as managed by Bruce; (3) the costs of the services to be provided by Bruce and the profits to be realized by Bruce from services rendered to the Fund; (4) comparative fee and expense data for the Fund and other investment companies with similar investment objectives; (5) the extent to which economies of scale may be realized as the Fund grows, and whether the advisory fee for the Fund reflects such economies of scale for the Fund’s benefit; and (6) other benefits to Bruce resulting from its relationship with the Fund.

Prior to the September Meeting, the Board requested from and received and reviewed a substantial amount of information provided by the Adviser (the “Renewal Support Materials”. The Renewal Support Materials included, among other things, information regarding 1) the Adviser’s personnel and proposed services to the Fund; 2) the fees to be paid by the Fund to the Adviser for services rendered under the Advisory Agreement; 3) the Adviser’s profitability on services to be rendered to the Fund and related economies of scale; and 4) a report from an independent third-party (Broadridge) that presents comparative performance and fees of a peer group.

Additional Information (Unaudited) (continued)

In determining whether to approve the Advisory Agreement and reaching its conclusion to renew the Advisory Agreement, the Board reviewed and analyzed the following factors and made the following conclusions with respect to the Fund:

Nature, Extent and Quality of Services. Counsel noted that, except for a proposed reduction in fees, the Advisory Agreement’s substantive terms were identical to the previous advisory agreement in place, as approved last year by the Board and approved by Shareholders on November 15, 2023.

With respect to the nature, extent and quality of services that the Adviser renders, the Directors considered the scope of services provided under the Agreement, which includes, but is not limited to, the following: (1) providing a continuous investment program for the Fund, adhering to the Fund’s investment restrictions, complying with the Fund’s policies and procedures, and voting proxies on behalf of the Fund. The Directors considered the qualifications and experience of the Fund’s portfolio manager who is responsible for the day-to-day management of the Fund’s portfolio, as well as the qualifications and experience of other resources utilized by Bruce to provide services to the Fund. The Directors concluded that they were satisfied with the nature, extent, and quality of investment management services provided by Bruce to the Fund and that the fees for the services provided seem reasonable and appropriate for the services especially in comparison to what other funds pay, especially given the reduction in fees from 0.50%to 0.30% for the last breakpoint. The Directors also considered the long-term investment philosophy and the significant industry experience of the Adviser’s portfolio manager in servicing the Fund, noting his high quality. In addition, The Directors concluded that they were satisfied with the nature, extent and quality of services provided by the Adviser pursuant to the Agreement.

Performance of the Fund. The Board also reviewed the Fund’s performance and observed that the Fund had outperformed its peers in its Morningstar category of Hybrid Funds for the long-term categories (15 and 20 years). The Directors noted that the Fund has performed better in difficult market conditions and that a longer-term assessment is appropriate in light of the Fund’s long-term view. Director DeBartolo commented on the long-term success of the Fund’s performance, and the steady and consistent approach of the Adviser in the face of uncertain markets. He specifically pointed to the 15-year performance of the Fund that he observed was exceptional. He also commented on the Adviser’s consistent strategy as a long-term player, and noted that it has always been so. In his view the relevant time frame is the long term - not some short-term view. Based upon the foregoing, the Directors concluded the Fund’s performance is acceptable.

Cost of Advisory Services and Profitability. The Directors considered and discussed with the Adviser the profitability of the Adviser. The Directors also considered a profitability analysis presented by Bruce, which showed that Bruce is earning a profit. The Directors noted Bruce’s representation that it does not enter into soft-dollar transactions on behalf of the Fund. The Directors also considered that the Adviser bears a substantial portion of all the operational costs. They noted that the Adviser has been diligent in ensuring that the Fund has provided no undue compensation or benefits to the Adviser or anyone else.

Additional Information (Unaudited) (continued)

The Board considered the Adviser’s suggestion of a lower last breakpoint. The proposed advisory fee payable by the Fund to Bruce is a percentage applied to the average net assets of the Fund as follows:

| Annual Percentage Fee | | Applied to Average Net Assets of Fund |

| 1.0% | | Up to $20,000,000; plus |

| 0.6% | | $20,000,000 through $100,000,000; plus |

| 0.30% (currently 0.50%) | | over $100,000,000 |

Economies of Scale. In determining the reasonableness of the management fee, the Directors also considered the extent to which Bruce will realize economies of scale as the Fund grows. The Directors noted that the management fee is currently subject to breakpoints and that such breakpoints are reasonable. The Directors then discussed the proposal that the last breakpoint be reduced, commenting that this would further benefit the Fund for economies of scale.

Comparative Fee and Expense Data. The Directors discussed the Fund’s Fee Rate and Profitability. The Directors reviewed a fee and expense comparison for the Fund from Broadridge. The Directors noted that the advisory fee of the Fund is below the average and median of the Fund’s Morningstar category and the Fund’s peer group. The Directors also noted that the expense ratio of the Fund is below the average and median of the Fund’s Morningstar category and the Fund’s peer group.

Other Benefits. The Directors noted that the Adviser has been diligent to ensure that the Fund has provided no undue compensation or benefits to the Adviser or anyone else.

Based upon the Adviser’s presentation and the information contained in the Adviser’s Section 15(c) Response, as well as other information gleaned from the Fund’s quarterly Board meetings throughout the year and past information, the Board concluded that the overall arrangements between the Fund and the Adviser as set forth in the Advisory Agreement are fair and reasonable in light of the services to be performed, fees to be paid and such other matters as the Directors considered relevant in the exercise of their reasonable judgment. In their deliberations, the Directors did not identify any particular factor that was all-important or controlling.

The Board found the Adviser to be reasonable, comprehensive, and solid ethically, and then he is very supportive of their process and results. In his view, the Adviser remains strong in terms of its forward and current thinking and he is fully supportive of the approval of the new investment advisory contract. The Board noted the Adviser’s consistent solid performance over the long run and that the Adviser’s approach is and has always been a long-term play not subject to the vagaries of short-term effects and the focus on “long and strong” should be embraced as the data confirms that the Adviser’s strategy has been valid.

Additional Information (Unaudited) (continued)

The Directors then discussed in detail the proposed lower last breakpoint on the renewed agreement. The Directors appreciated that the Adviser is willing to pass along its lower expenses. He also stated that the fact that the Fund holds a large cash potion also justifies a lower fee structure. The Directors noted that the Adviser can still be profitable with a lowered fee and that its efficiency can be passed along to the shareholders.

Based on all of the information presented to and considered by the Board and the conclusions that it reached, the Board approved the renewal of the Advisory Agreement for the Fund on the basis that its terms and conditions are fair and reasonable and in the best interests of the Fund and its shareholders. The renewal is to be effective upon the execution of the new agreement by the Adviser and the Fund.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (800) 872-7823 and (2) in Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

BRUCE FUND

OFFICERS AND DIRECTORS

R. Jeffrey Bruce

President, Treasurer, Director, Chief Compliance Officer and Secretary

Robert DeBartolo

Director

W. Martin Johnson

Director

Investment Adviser

Bruce & Co., Inc.

Chicago, Illinois

Custodian

Huntington National Bank

Columbus, Ohio

Administrator, Transfer Agent and Fund Accountant

Ultimus Fund Solutions, LLC

Cincinnati, Ohio

Distributor

Ultimus Fund Distributors, LLC

Cincinnati, Ohio

Counsel

Klevatt & Associates

Chicago, Illinois

Independent Registered Public Accounting Firm

Grant Thornton LLP

Chicago, Illinois

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fees and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Included under Item 7.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Included under Item 7.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 15. Submission of Matters to a Vote of Security Holders.

None.

Item 16. Controls and Procedures

| (a) | The registrant’s Principal Executive Officer and Principal Financial Officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act) are effective in design and operation and are sufficient to form the basis of the certifications required by Rule 30a-(2) under the Act, based on their evaluation of these disclosure controls and procedures as of a date within 90 days of this report on Form N-CSR. |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 18. Recovery of Erroneously Awarded Compensation.

Item 19. Exhibits.

| (a)(1) | | Not applicable – disclosed with annual report. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| By | /s/ R. Jeffrey Bruce | |

| | R. Jeffery Bruce, Principal Accounting Officer | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ R. Jeffrey Bruce | |

| | R. Jeffery Bruce, Principal Accounting Officer | |

| By | /s/ R. Jeffrey Bruce | |

| | R. Jeffery Bruce, Principal Accounting Officer | |