- HNI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

HNI (HNI) DEF 14ADefinitive proxy

Filed: 22 Mar 02, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

| Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

HON INDUSTRIES INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

HON INDUSTRIES Inc.

414 EAST THIRD STREET—P.O. BOX 1109

MUSCATINE, IA 52761-0071

563/264-7400

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The 2002 Annual Meeting of Shareholders of HON INDUSTRIES Inc. (the "Company") will be held at the Holiday Inn, Highways 61 and 38 North, Muscatine, Iowa, on Monday, May 6, 2002, beginning at 10:30 a.m. (local time), in order:

The holders of record as of the close of business on March 1, 2002 of the Company's Common Stock, par value $1.00 per share, are entitled to vote at the meeting.

You are encouraged to attend the meeting. We want to keep you informed of the Company's activities and progress.

By Order of the Board of Directors,

James I. Johnson

Vice President, General Counsel and Secretary

March 22, 2002

PLEASE MARK, SIGN, DATE, AND RETURN PROMPTLY THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE PREPAID ENVELOPE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

HON INDUSTRIES Inc.

414 East Third Street

Muscatine, Iowa 52761

March 22, 2002

PROXY STATEMENT

FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 6, 2002

This Proxy Statement is furnished by and on behalf of the Board of Directors of HON INDUSTRIES Inc. (the "Company" or "HON INDUSTRIES") in connection with the solicitation of proxies for use at the annual meeting of shareholders of the Company to be held on May 6, 2002 at the Holiday Inn in Muscatine, Iowa, and at any adjournment or postponement thereof (the "Annual Meeting").

There were 58,895,314 shares of the Company's common stock, par value $1.00 per share (the "Common Stock"), outstanding (the "Outstanding Shares") as of the close of business on March 1, 2002 ("Record Date"). Shareholders are entitled to cast one vote per share for election of Directors and one vote per share on all other matters.

This Proxy Statement and the enclosed proxy card will be first mailed on or about March 22, 2002 to the holders of shares on the Record Date (the "Shareholders" or, individually, a "Shareholder").

A Shareholder who gives a proxy may revoke it at any time prior to its exercise by filing with the Secretary a written revocation or a duly executed proxy bearing a later date. The proxy will be suspended if the Shareholder attends the meeting and elects to vote in person. Proxies that are signed but unmarked will be voted as recommended by the Board of Directors.

The Company will treat abstentions and broker non-votes as present at the Annual Meeting solely for purposes of determining whether or not a quorum exists. These non-votes will not be considered to be voting on the matters to which they pertain and, thus, will not be counted in determining whether the election of Directors or the adoption of the proposed 2002 Members' Stock Purchase Plan have been approved by the requisite vote of Shareholders.

Except as described below, the affirmative vote of the holders of two-thirds of the total Outstanding Shares entitled to vote is required to adopt any motion or resolution or to take any action at any meeting of shareholders. The affirmative vote of the holders of a majority of the total Outstanding Shares entitled to vote is required and will be sufficient to take any of the following actions submitted to a vote of shareholders: (1) any amendment to the Company's Articles of Incorporation that has been approved or recommended by the Board of Directors, other than certain amendments that would amend, limit or conflict with certain provisions governing shareholder voting requirements and the Company's Board of Directors (including removal and election); (2) the election of a class of Directors at any annual meeting of shareholders if (a) at the annual meeting of shareholders in the third preceding year, an election of such class was held but no Director of such class was elected because no candidate received the requisite two-thirds vote, and (b) the term of such class of Directors was extended for an additional term of three years; and (3) any other motion, resolution or action which has been approved or recommended by the Board of Directors of the Company (other than any such motion, resolution or action regarding (a) the election or removal of Directors, (b) amendment of certain portions of the Articles of Incorporation, (c) any Corporate Combination (as defined in the Company's Articles of Incorporation), (d) any partial or complete liquidation of the Company, (e) any liquidating dividend or distribution or (f) any dissolution of the Company).

PROPOSAL NO. 1—ELECTION OF DIRECTORS

At the Annual Meeting of Shareholders, one Director is to be elected to hold office for a term of two years and four Directors are to be elected to hold office each for a term of three years and until their successors are elected and shall qualify. The Board of Directors recommends the election of the five nominees listed below. The proxies named on the proxy card intend to vote for the election of the five nominees. If, at the time of the meeting, any of the nominees should be unable or decline to serve, the

1

discretionary authority provided in the proxy will be exercised to vote for a substitute or substitutes, unless otherwise directed. The Board of Directors has no reason to believe that any substitute nominee or nominees will be required.

Set forth below is certain information furnished to the Company by each nominee and each Director continuing in office after the Annual Meeting.

NOMINEES FOR ELECTION

TWO-YEAR TERM

| | | | | | Common Stock As of March 1, 2002 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nominee | Principal Occupation and Business Experience During the Past Five Years | Age | Director Since | Nominated For Term Expiring | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

| Robert L. Katz (1) | President since 1953, Robert L. Katz and Associates (consultants on corporate strategy); President since 1975, CalTex Investment Management Co. (venture capital firm). | 76 | 1995 | 2004 | 15,024(2 | ) | * | |||||

| | | | | | Common Stock As of March 1, 2002 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nominee | Principal Occupation and Business Experience During the Past Five Years | Age | Director Since | Nominated For Term Expiring | Amount and Nature of Beneficial Ownership | Percent of Class | |||||||

| Cheryl A. Francis(3) | Advisor/Consultant since 2000; Executive Vice President and Chief Financial Officer, 1995-2000, RR Donnelley & Sons Company (provider of printing and related services to the merchandising, magazine, book, directory and financial markets). | 48 | 1999 | 2005 | 4,684 | * | |||||||

| M. Farooq Kathwari | Chairman, President and Chief Executive Officer since 1988, Ethan Allen Interiors Inc. (manufacturer, marketer and distributor of quality home furnishings). | 57 | 2001 | 2005 | 824 | * | |||||||

2

| Richard H. Stanley(4) | Vice Chairman, Board of Directors since 1979, HON INDUSTRIES Inc.; Chairman since 1998, and President, 1986-1998, SC Companies, Inc. (private holding company with subsidiaries offering engineering, environmental, and design-build services); Chairman since 1984, Stanley Consultants, Inc. (international consultants engineering, architecture, planning and management). | 69 | 1964 | 2005 | 3,041,189(5 | )(6) | 5.16 | % | |||||

| Brian E. Stern(7) | President, Xerox Supplies Business Group since 2001, President, Xerox Technology Enterprises 1999-2001, Senior Vice President of Xerox Corporation 1996-1999, and President, Office Document Products Group, 1996-1999, Xerox Corporation (developer, marketer, manufacturer, financier and servicer of document processing products and services). | 54 | 1998 | 2005 | 10,085(5 | ) | * |

| | | | | | Common Stock As of March 1, 2002 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Continuing Directors | Principal Occupation and Business Experience During the Past Five Years | Age | Director Since | Term Expires | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

| Gary M. Christensen(8) | President and Chief Executive Officer since 1996, Pella Corporation (marketer and manufacturer of windows and doors). | 58 | 2000 | 2003 | 2,967(2 | ) | * | |||||

| Robert W. Cox(9) | Chairman Emeritus since 1999, Counsel 1994-1999, Baker & McKenzie (an international law firm). Director of various corporations. | 64 | 1994 | 2003 | 6,418(2 | ) | * | |||||

3

| Lorne R. Waxlax(10) | Executive Vice President, 1985-1993, The Gillette Company (marketer and manufacturer of personal care and use products). Director of various corporations. | 68 | 1994 | 2003 | 18,688(2 | ) | * | |||||

| Dennis J. Martin | Chairman, President and Chief Executive Officer since 2001, General Binding Corporation (manufacturer and marketer of binding and laminating office equipment); Executive Vice President, 1996-2001, Illinois Tool Works Inc. (developer and marketer of highly engineered products and systems); President, The Miller Group, 1994-2001, President, ITW Hobart Brothers Company, 1996-2001, (Illinois Tool Works Inc.). | 51 | 2000 | 2004 | 2,208(2 | ) | * | |||||

| Jack D. Michaels(11) | Chairman of the Board since 1996, Chief Executive Officer since 1991, President since 1990, HON INDUSTRIES Inc. | 64 | 1990 | 2004 | 242,202(12 | ) | * | |||||

| Abbie J. Smith(13) | Marvin Bower Fellow, September 2001-August 2002, Harvard Business School; Chaired Professor, Graduate School of Business since 1999, Full Professor, Graduate School of Business, 1989-1999, The University of Chicago (national leader in higher education and research). | 48 | 2000 | 2004 | 2,742(2 | ) | * |

Notes

4

5

Beneficial Owners of Common Stock

The following table sets forth information known as of March 1, 2002, with respect to any person who is known to the Company to be the beneficial owner of more than 5 percent of the Company's Common Stock. The table also includes any non-Director executive officers included in the Summary Compensation Table. For information regarding Director stock ownership, see "Election of Directors."

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | |||

|---|---|---|---|---|---|

| State Farm Insurance Companies One State Farm Plaza Bloomington, Illinois 61701 | 7,366,400 | 12.51 | % | ||

| Terrence L. and Loretta B. Mealy 301 East Second Street Muscatine, Iowa 52761 | 3,435,008 | 5.83 | % | ||

| David C. Burdakin | 10,936 | * | |||

| Phillip M. Martineau | 3,000 | * | |||

| Stanley A. Askren | 24,812 | * | |||

| Jerald K. Dittmer | 5,775 | * | |||

| All Directors and Officers as a Group(1) | 3,487,504 | 5.92 | % |

Notes

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's Directors and officers, and persons who own more than 10 percent of a registered class of the Company's equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of Common Stock, and to furnish the Company with copies of all such reports they file. To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other Forms 5 were required, during the fiscal year ended December 29, 2001, all Section 16(a) filing requirements applicable to its officers, Directors, and greater than 10 percent beneficial owners were complied with, except Mr. Stern inadvertently failed to report two transactions in Company securities on his Form 5 for 1999.

Board Meetings, Committees and Fees

The Board of Directors held four regular meetings during the last fiscal year. The Board has three standing committees that deal with audit matters, compensation and corporate governance, including nominations to the Board. Each Director has attended at least 75 percent of all committee and Board meetings during the last fiscal year.

The Audit Committee consists of Cheryl A. Francis, Dennis J. Martin and Abbie J. Smith. It met five times during the last fiscal year. The Committee recommends selection of the independent auditor and reviews the auditor's performance, fees and audit plans. The Committee also reviews the annual financial statements; the auditor's management letter with both the outside auditor and management; internal audit staffing, budget, plans and reports; nonaudit services provided by outside auditor; the Company's insurance coverage and any other financial matters as directed by the Board.

6

The Human Resources and Compensation Committee is comprised of Lorne R. Waxlax, Gary M. Christensen and Robert L. Katz. It met four times during the last fiscal year. The Committee reviews executive compensation, benefit programs for all employees, management's recommendations on election of officers and human resources development.

The Public Policy and Corporate Governance Committee is comprised of Richard H. Stanley, Robert W. Cox, M. Farooq Kathwari and Brian E. Stern. It met four times during the last fiscal year. The Committee monitors social accountability, recommends changes in Board size, oversees committee jurisdiction and assignments and proposes nominees for election to the Board of Directors. The Committee will consider candidates for Board membership recommended in writing by shareholders by the deadline for shareholder proposals. See "Deadline For Shareholder Proposals For 2003 Annual Meeting."

Each Non-employee Director receives an annual retainer of $22,000. Non-employee Directors are required to receive one-half of their annual retainer in the form of shares of Common Stock of the Company to be issued under the terms of the Amended and Restated 1997 Equity Plan for Non-Employee Directors of HON INDUSTRIES Inc. (the "Director Plan") or (to the extent the Director participates in the Directors Deferred Compensation Plan (the "Deferred Plan")) in the form of shares to be credited to the Director's Share Sub-Account under the Deferred Plan. However, this provision does not apply to any Director owning Common Stock with a market value of five times the annual retainer, or more. Non-employee Directors can also acquire Common Stock in several other ways. Under the Director Plan, Directors are entitled to receive up to 100 percent of their retainers and other fees in the form of shares of Common Stock. Under the Deferred Plan, each Director is provided with the opportunity to defer cash compensation earned as a Director, including retainer and committee fees, in accordance with the provisions of such plan. Deferred compensation may be deferred in cash or in the form of shares of Common Stock (determined by dividing the amount of the compensation deferred by the fair market value per share of Common Stock on the date such compensation would have otherwise been paid). In addition, each Non-employee Director is eligible to receive awards of options to purchase Common Stock of the Company, restricted stock or common stock grants, or any combination thereof, in such amounts as the Board of Directors may authorize under the Director Plan. In 2001, each Non-employee Director was issued 600 shares of Common Stock of the Company under the Director Plan. All shares of Common Stock issued in lieu of cash retainer amounts or other Director fees (as described below) have heretofore been issued pursuant to the Company's amended and restated 1995 Stock-Based Compensation Plan (the "Restated Stock-Based Compensation Plan") or the Director Plan. Each Director also receives $1,000 for each regular or special Board meeting, $1,000 for each special committee meeting, and $500 for each regular meeting of a committee of which the Director is a member. Directors also receive an additional $1,000 for each meeting attended if they are required to travel six hours or more on a round-trip basis. Each Director receives a $500 fee for each Board or committee meeting held by telephone conference or meetings attended at the request of the Chairman of the Board. Directors are also paid travel and related expenses for meetings attended. Directors who are employees of the Corporation do not receive compensation for service on the Board of Directors.

Audit Committee Report

The Company's Board of Directors has adopted a written charter for the Audit Committee. The Audit Committee Charter is set forth in Exhibit A to this Proxy Statement. The primary functions of the Audit Committee are set forth in its Charter and under "Board Meetings, Committees and Fees" on the preceding page.

All members of the Audit Committee are independent as defined in Sections 303.01 and 303.02 of the New York Stock Exchange Listed Company Manual.

The Audit Committee reviewed and discussed with management and Arthur Andersen LLP, the Company's independent auditor, the Company's audited financial statements for the year ended December 29, 2001. In addition, the independent auditor reviewed the Company's quarterly financial statements with the chair of the Audit Committee and management.

The Audit Committee also discussed with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended.

7

The Audit Committee received and reviewed the written disclosures and the letter from the independent auditor required by Independence Standard No. 1,Independence Discussions with Audit Committees, as amended, and discussed with the auditor the auditor's independence. The Audit Committee also considered whether the provision of tax assistance, ERISA audits of employee benefit and welfare plans, acquisition due diligence and accounting consultations are compatible with maintaining the independence of the Company's independent auditor.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 29, 2001, for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

Cheryl A. Francis, Chair

Dennis J. Martin

Abbie J. Smith

Certain Relationships and Related Transactions

On November 15, 1995, Robert L. Katz and Associates, of which Dr. Katz is President, entered into a one-year agreement with the Company to provide certain consulting services for $5,000 per month. The agreement also provides for reimbursement of travel expenses and other reasonable out-of-pocket costs incurred on the Company's behalf and is automatically renewed each year unless notice of cancellation is given no later than 90 days prior to the end of the one-year term. The agreement has been renewed for 2002. In 2001, the Company paid Robert L. Katz and Associates a total consulting fee of $60,000, plus $5,104 of expense reimbursement, for services rendered.

The Company has agreed to purchase a residence located in Muscatine, Iowa from Mr. and Mrs. Richard H. Stanley. Mr. Stanley is a Director of the Company. The Stanleys have owned the property for many years. The purchase price of approximately $200,000 was determined by taking the average of three appraisals conducted by independent, real estate appraisal firms. The Company intends to use the property as housing for visiting executives or for resale to new executives.

Required Vote

Approval of the election of the above nominees as Directors requires the affirmative vote of the holders of two-thirds of the total Outstanding Shares entitled to vote at the Annual Meeting.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS A VOTE FOR THE ELECTION OF THE ABOVE NOMINEES AS DIRECTORS. PROXIES RECEIVED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS SHAREHOLDERS SPECIFY A CONTRARY CHOICE IN THEIR PROXIES.

8

The following table sets forth the compensation awarded to, earned by, or paid to the Company's Chief Executive Officer and the other four most highly compensated executive officers of the Company (determined by reference to fiscal year 2001) for the years indicated:

| | | Annual Compensation | Long-Term Compensation | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | Awards | Vested Benefits | | |||||||||

| Name and Principal Position | Fiscal Year | Salary(1) ($) | Bonus(2) ($) | Other Annual Compen- sation(3) ($) | Restricted Stock Awards(4) ($) | Securities Underlying Options/ SARs(5) (#) | LTIP Vested(6) ($) | All Other Compen- sation(7) ($) | ||||||||

| Jack D. Michaels Chairman, President and Chief Executive Officer | 2001 2000 1999 | 685,000 593,333 527,500 | 267,150 525,943 483,834 | 10,494 11,968 16,241 | 431,000 | 85,000 240,000 75,000 | 259,479 | 260,752 223,394 191,301 | ||||||||

David C. Burdakin Executive Vice President, HON INDUSTRIES Inc.; President, The HON Company | 2001 2000 1999 | 211,000 182,484 149,219 | 129,417 156,668 108,585 | 9,966 8,725 8,144 | 13,000 25,000 15,000 | 42,580 31,030 22,862 | ||||||||||

Phillip M. Martineau Executive Vice President, HON INDUSTRIES Inc.; President, Wood Furniture Group | 2001 2000 1999 | 237,083 78,333 | 68,640 67,471 | 1,008 | 14,000 20,000 | 2,060 46 | ||||||||||

Stanley A. Askren Executive Vice President, HON INDUSTRIES Inc.; President, Allsteel Inc. | 2001 2000 1999 | 211,000 194,593 177,141 | 53,805 221,550 112,120 | 7,819 8,948 11,814 | 13,000 25,000 15,000 | 378,871 237,398 | 45,940 33,420 28,589 | |||||||||

Jerald K. Dittmer Vice President and Chief Financial Officer | 2001 2000 1999 | 195,417 187,655 140,707 | 56,700 95,338 64,751 | 10,056 9,383 7,938 | 6,000 15,000 11,250 | 32,206 24,349 20,922 | ||||||||||

Notes

9

| the year. Merit reviews in 2001 for all participants in the Company's Executive Bonus Plan program were delayed 90 days as a cost savings measure. The executives affected included the executives named in this table. Messrs. Michaels, Askren and Burdakin did not receive a merit increase in 2001 due to this delay. The higher base salaries reflected for these individuals in 2001 compared to 2000 reflect merit increases that were effective November 2000. |

10

Common Stock equal in value to benefits they would have received under certain Company ERISA plans and the Company's Cash Profit-Sharing Plan but for a $170,000 earnings cap for 2001. The number of shares of Company Common Stock to be paid is determined by dividing the value of such benefits by the average of the closing prices of a share of the Company's Common Stock for each trading day of the last calendar quarter of the most recent calendar year immediately preceding the date of payment, with cash payable in lieu of any fractional share. The amount included in this column as compensation under the ESRP is equal to the closing price of the shares on the date they are paid. The shares for 2001 were issued as of February 22, 2002. The Common Stock is issued under the Company's Restated Stock-Based Compensation Plan and may not be transferred while the recipient remains employed by the Company.

Stock Options

The following table contains information concerning the grant of stock options under the Company's Restated Stock-Based Compensation Plan to the Named Executive Officers for the year ended December 29, 2001, all of which are reflected in the Company's Summary Compensation Table.

Option/SAR Grants in Last Fiscal Year

| | Individual Grants | | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Percent of Total Options/ SARs Granted to Employees in Fiscal Year | | | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation For Option Term(3) | ||||||||||

| | Number of Securities Underlying Option/SARs Granted(1)(#) | | | ||||||||||||

| Name | Exercise or Base Price ($/Share)(2) | Expiration Date | 5% ($) | 10% ($) | |||||||||||

| Jack D. Michaels | 85,000 | 31.9 | % | $ | 23.32 | February 14, 2011 | $ | 1,246,595 | $ | 3,159,116 | |||||

| David C. Burdakin | 13,000 | 4.9 | % | $ | 23.32 | February 14, 2011 | $ | 190,656 | $ | 483,159 | |||||

| Phillip M. Martineau | 14,000 | 5.3 | % | $ | 23.32 | February 14, 2011 | $ | 205,322 | $ | 520,325 | |||||

| Stanley A. Askren | 13,000 | 4.9 | % | $ | 23.32 | February 14, 2011 | $ | 190,656 | $ | 483,159 | |||||

| Jerald K. Dittmer | 6,000 | 2.3 | % | $ | 23.32 | February 14, 2011 | $ | 87,995 | $ | 222,996 | |||||

Notes

11

until the earlier of the expiration date of the option or the second anniversary of the date of disability. The representative of participants whose employment is terminated due to death may exercise options, which shall become fully vested as of the date of death, until the earlier of the expiration date of the option or the second anniversary of the date of death. Those participants who terminate employment due to retirement may exercise options, which shall become fully vested as of the date of retirement, until the earlier of the expiration of the option, or, the third anniversary of the date of retirement. Those participants who terminate employment for any other reason (except termination "for cause" in which case no additional exercise period is provided) may exercise options which are vested as the date of termination until the earlier of the expiration of the option or the end of the 30th day following the date of termination. Except as set forth above, all options terminate upon termination of employment.

Option Exercises and Holdings

The following table sets forth information with respect to the Named Executive Officers concerning the exercise of options and the unexercised options held as of December 29, 2001. None of the Named Executive Officers exercised any stock options.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option/SAR Values

| | Number of Securities Underlying Unexercised Options/SARs At Fiscal Year-End(1) (#) | | | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | Value of Unexercised In-The-Money Options/SARs At Fiscal Year-End ($) | |||||||||

| Name | ||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||

| Jack D. Michaels | 45,000 | 400,000 | $ | 166,500 | $ | 2,305,150 | ||||

| David C. Burdakin | -0- | 63,000 | N/A | $ | 381,640 | |||||

| Phillip M. Martineau | -0- | 34,000 | N/A | $ | 163,520 | |||||

| Stanley A. Askren | 7,000 | 56,000 | $ | 25,900 | $ | 381,640 | ||||

| Jerald K. Dittmer | -0- | 39,250 | N/A | $ | 230,843 | |||||

Notes

Long-Term Performance Plan

The awards made in 2001 under the Company's Long-Term Performance Plan ("Performance Plan") are designed to focus executives on both growth of earnings and return on invested capital. This focus is created by requiring minimum standards for compound average annual increases in earnings and minimum average returns on capital for the particular business units during the three-year performance period before a benefit is paid to the executives managing that business unit. The performance period runs from the beginning of the Company's 2001 fiscal year to the end of the 2003 fiscal year.

Target awards are made in units at the beginning of the performance period. The number of units awarded is determined by the Board based upon the estimated future value of the units, the participant's compensation level, position in the Company to influence the Company's performance and industry survey data provided by Towers Perrin. The number of units actually earned by an executive at the end of the performance period is based upon actual financial results during the performance period

12

compared to the standards set for the executive's business unit. The number of units earned can range from zero to 200% of the initial target award.

The value of the units is determined at the end of the performance period for each executive based on the increase or decrease from the beginning of the performance period in the valuation of the business unit in which the executive serves. The beginning valuation of the business unit is five times year-end earnings before interest and taxes (EBIT) for that business unit for the year preceding the first year of the performance period. The valuation at the end of the performance period is five times EBIT for the last year of the performance period, plus free cash flows (after-tax operating income minus the change in capital) generated by that business unit during the performance period. The value of a unit at the end of the performance period is equal to the result of dividing the ending valuation of the applicable business unit by the beginning valuation.

The benefit under the plan will be paid shortly after the end of the performance period. The benefit is equal to the result of multiplying the value of the units at the end of the performance period for the business unit in which the executive serves times the number of units earned. One-half of the benefit will be paid in cash and one-half in unrestricted, Common Stock of the Company.

The table below sets forth information with respect to awards granted under the Company's Performance Plan to the Named Executive Officers in 2001.

Long-Term Incentive Plans—Awards In Last Fiscal Year

| | | | Estimated Future Payouts Under Non-Stock, Price-Based Plans | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name | Number of Shares, Units or Other Rights (#) (Units) | Performance or Other Period Until Maturation or Payout(1) | Threshold (#) (Units) | Target (#) (Units) | Maximum (#) (Units) | |||||

| Jack D. Michaels | 342,500 | 2001-2003 | -0- | 342,500 | 685,000 | |||||

| David C. Burdakin | 158,250 | 2001-2003 | -0- | 158,250 | 316,500 | |||||

| Phillip M. Martineau | 176,250 | 2001-2003 | -0- | 176,250 | 352,500 | |||||

| Stanley A. Askren | 158,250 | 2001-2003 | -0- | 158,250 | 316,500 | |||||

| Jerald K. Dittmer | 69,375 | 2001-2003 | -0- | 69,375 | 138,750 | |||||

Notes

13

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the preceding Audit Committee Report and the following Performance Graph and the Report of the Human Resources and Compensation Committee of the Board of Directors of the Company on Executive Compensation shall not be incorporated by reference into any such filings.

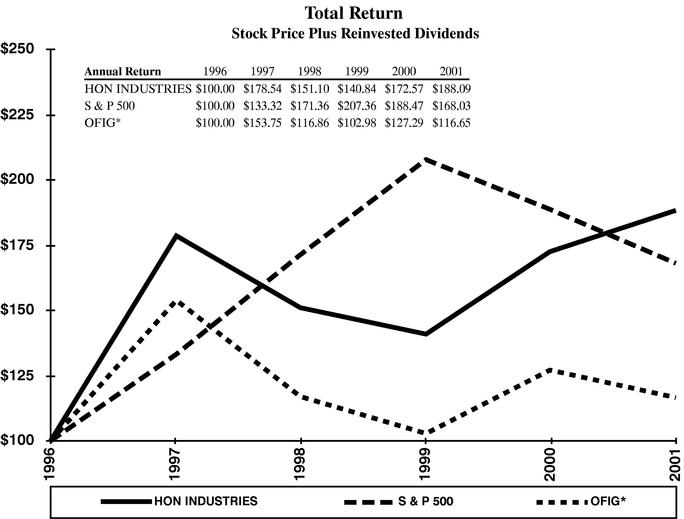

Performance Graph

Comparison of Five Year Cumulative Total Return Among

S & P 500 Index, Office Furniture Industry Group, and the Company

The total return assumes $100.00 invested in each of the Company's Common Stock, the S & P 500 Index, and the Office Furniture Industry Group Stocks on December 29, 1996. It includes reinvestment of dividends and is based on the closing stock price on the last trading day of the Company's fiscal quarter. Information for Steelcase Inc. is not available prior to its Initial Public Offering on February 18, 1998, and returns for the Office Furniture Industry Group do not include Steelcase Inc. prior to the second quarter of 1998. Information for Teknion Corporation is not available prior to its Initial Public Offering on July 17, 1998, and returns for the Office Furniture Industry Group do not include Teknion Corporation prior to the fourth quarter of 1998.

The comparative performance of the Company's Common Stock against the indexes as depicted in this graph is dependent on the price of stock at a particular measurement point in time. Since individual stocks are more volatile than broader stock indexes, the perceived comparative performance of the Company's Common Stock may vary based on the strength or weakness of the stock price at the new measurement point used in each future proxy statement graph. For this reason, the Company does not believe that this graph should be considered as the sole indicator of Company performance.

14

Report of the Human Resources and Compensation Committee

of the Board of Directors of the Company

on Executive Compensation

Overall Policy. The Company's executive compensation program is designed to be linked to Company performance. To this end, the Company has developed an overall compensation strategy and specific compensation plans that tie executive compensation to the Company's success in meeting its business goals and objectives.

The executive compensation strategy is designed to: (i) ensure the total program will assist the Company to attract, motivate, and retain executives of the highest quality; (ii) relate total compensation to individual executive performance and the performance of the business unit he or she manages; and (iii) provide incentives for high levels of performance that reward strong Company performance and recognize individual initiative and achievement.

The Company also believes executive compensation should be subject to independent review. Relative matters pertaining to executive compensation are submitted to the non-employee Directors of the Board for approval following review and recommendation by the Human Resources and Compensation Committee (the "Committee"). The Committee is comprised of three non-employee Directors and met four times during fiscal year 2001.

Operating within the framework of a statement of duties and responsibilities established by the Board of Directors, the Committee's role is to assure the Company's: (1) compensation strategy is aligned with the long-term interest of the shareholders and members; (2) compensation structure is fair and reasonable; and (3) compensation reflects both Company and individual performance. In discharging its responsibilities, the Committee utilizes broad-based, comparative compensation surveys developed by independent professional organizations.

Approximately every three to five years, the Board of Directors requests a more extensive competitive assessment of the Company's executive compensation programs. During fiscal year 2000, the Company retained Towers Perrin, a national compensation consulting firm, to conduct this executive compensation review under the oversight of the Committee.

The federal corporate income tax law (IRS Code Section 162(m)) limits the ability of public companies to deduct compensation in excess of $1 million paid annually to the chief executive officer or the other four most highly compensated executive officers. There are exceptions to this limit, including exceptions for compensation that qualifies as "performance based." The Company has structured the performance-based portion of the compensation of its executive officers in a manner that complies with the exception to Section 162(m) to permit the Company to deduct the related expenses.

Executive Compensation Program. The Company's executive compensation program consists of the following components:

Base Salary. Base salaries are determined by evaluating the duties and level of responsibilities of a position, the experience of a candidate, prior compensation, compensation for positions having similar scope and accountability within the Company, and market survey data. In general, the Company uses as a guide, for setting base salary levels, 90% of the mid-point of base salary ranges from compensation surveys. The Company participates annually in the Towers Perrin Compensation Survey, which is widely used and gives relevant compensation information on executive positions. While some of the companies in the peer group chosen for comparison of shareholder returns in the Performance Graph on page 14 may be included in the surveys considered by the Committee in setting executives' salaries, there is no set peer group against which those salaries are measured. Base salaries are determined for executive officers by considering an executive's individual performance and level of experience, changes in responsibilities and by reference to salary surveys for comparably situated executives with companies of similar size.

Executive Bonus Plan. The purpose of the Company's Executive Bonus Plan ("Bonus Plan") is to motivate and reward executive management to achieve specific financial and non-financial objectives. These objectives include, for example, achievement of annual profitability and return on asset goals by operating units and meeting personal achievement objectives established for each participant based upon the participant's position and responsibilities. A target bonus level, stated as a percent of annual base salary, is established for each participant and approved by the Committee and the Board annually. For the Chairman, President and Chief Executive Officer, the Committee determines the annual bonus opportunity and performance objectives. The annual target bonus percentage for the Chairman, President and Chief Executive Officer is equal to 100% of base salary. The other named executives in the Summary Compensation Table have annual target bonus percentages that range from 50% to 85% of their

15

base salary. The Bonus Plan objectives are reviewed and approved annually by the Chairman, President and Chief Executive Officer, the Committee and the Board. Bonuses are normally awarded annually based upon achievement of predetermined financial performance targets and personal objectives, measured over the Company's fiscal year. The bonus awards for each fiscal year are approved by the Committee and the Board of Directors.

Executive Long-Term Incentive Compensation Plan. The purpose of the Executive Long-Term Incentive Compensation Plan (the "LTIP") is to focus the attention of senior executives on the long-term financial performance of the Company and to strengthen the ability of the Company to attract, motivate and retain senior executives of high caliber.

Awards made under the LTIP are in the form of rights to the appreciation, over a five-year period (unless otherwise designated by the Board of Directors), in the value of units of permanent capital of the Company and/or one of its operating companies. Appreciation is measured on a net cumulative basis over the award period. Under the LTIP, permanent capital may be defined by the Board of Directors and generally means total assets less current liabilities (excluding current portions of long-term debt and capital lease obligations). Appreciation is defined as after-tax net income exclusive of non-operating items such as gains and losses from sales of assets and sales, transfers, or redemption of permanent capital, and certain other extraordinary and non-operating items. Each unit of permanent capital is equal to one dollar. The size of an award is dependent upon the impact the participant has on the long-term realization of Company or business unit, or both, sales and profits. Maximum amounts are not specified, but are dependent upon the net cumulative appreciation or net growth in the permanent capital of the relevant business unit during the period, which is itself based on such business unit's financial and business performance and is governed by such practical limitations as the size of the market, the rigors of competition and the business unit's manufacturing capacity. The ultimate value of an award payment, which is equal to the net cumulative appreciation, if any, on units of permanent capital, is dependent on the financial performance of the Company or the applicable business unit, or both.

Rights to award payments become vested, unless the participant's employment has been terminated previously, at the end of the award period or on death, disability, retirement at age 62 or change in corporate control. Award payments are made in cash in three equal installments over three fiscal years unless the Board of Directors approves a different payment schedule. In lieu of payments, participants may elect to receive shares of the Company's Common Stock pursuant to the terms of the Restated Stock-Based Compensation Plan.

No LTIP awards were made in fiscal year 2001.

Long-Term Performance Plan. In fiscal year 2000, the Board approved the addition of the Performance Plan. The purpose of this Performance Plan is to promote the attainment of the Company's performance goals. The Performance Plan is designed to reward increasing long-term shareholder value and is tied to an individual business unit's three-year strategic plan. The Performance Plan provides target awards of performance "units" to each participant at the beginning of a three-year performance period. Actual performance units earned are based upon growth in profitability and average return on capital. Performance unit valuation, in turn, is based upon business unit valuation determined by profitability, use of capital and free cash flow.

Restated Stock-Based Compensation Plan. The Restated Stock-Based Compensation Plan authorizes, among other things, the grant of stock options and SARs to participants, including the Company's executives. The grant of stock options and SARs is intended to further the growth, development, and financial success of the Company by providing additional incentives to key employees and assist them to become owners of Common Stock of the Company. As owners, they will benefit directly from its growth, development and financial success of the Company with other shareholders. Stock option grants will also enable the Company to attract and retain the services of executives considered essential to the long-range success of the Company by providing them with a competitive compensation package and an opportunity to become owners of Common Stock of the Company.

Awards were based on Towers Perrin market survey data of long-term incentive compensation for executives in similar positions and individual performance of each participant. Stock option grants are generally made to those individuals who have the ability through their leadership, strategic planning and actions to impact the long-term performance of the Company and, consequently, its stock price.

Executive Stock Ownership Policy. The Company has adopted an Executive Stock Ownership Policy based upon the belief that key executives who can impact shareholder value through their achievements should own significant amounts of the Company

16

Common Stock. Under this Policy, guidelines are provided for participants to acquire and hold a recommended amount of Common Stock of the Company based on their position and compensation level. Such Common Stock ownership will align the interests of key executives with shareholder interests and provide a personal benefit for the success of the Company. Vested stock options provide one of several means by which key executives can satisfy this Policy.

Chief Executive Officer Compensation. In determining Jack D. Michaels' compensation, the Committee and the Board of Directors consider, in a manner consistent with the base salary guidelines applied to executive officers of the Company as described above, the Company's success in implementing strategies for long-term growth, profitability and shareholder value creation. The primary measures of the Chief Executive Officer's performance used by the Committee include the Company's performance in the areas of revenue, profitability, return on equity, return on capital, growth, financial soundness, member relations, corporate citizenship and achievement of long-term initiatives related to strategic business objectives. The Committee also considers the compensation levels of chief executive officers as shown by Towers Perrin survey data and other reputable independent surveys for organizations of similar size.

Mr. Michaels was paid a base salary of $685,000 with respect to fiscal year 2001. His last merit increase to base salary occurred in November 2000. Because merit increases for all executives were delayed 90 days in 2001, Mr. Michaels' scheduled 2001 merit review for base pay was delayed from November 2001 until February 2002 (see Note 1 in the Summary Compensation Table). In setting Mr. Michaels' base salary, the Committee reviews survey data for comparable positions within the manufacturing industry and considers recommendations from Towers Perrin as part of an overall executive competitive compensation assessment performed in fiscal year 2000 at the direction of the Committee. The Committee also considers performance against certain financial goals. In the 2001 fiscal year, the Company's net sales were $1.80 billion, compared to $2.05 billion in 2000. Net income and earnings per share in 2001, excluding a one-time charge for plant closings of $15.4 million after tax or $0.26 per share, were $89.8 million and $1.52 per share, respectively, compared to $106.2 million and $1.77 in 2000. The Company's return on average shareholders' equity was 15.4% in fiscal year 2001.

Under the Bonus Plan, Mr. Michaels received an award of $267,150 in respect of fiscal year 2001 compared to an award of $525,943 for fiscal year 2000. This award reflected the performance of the Company against goals established by the Committee under the Bonus Plan and the Committee's judgment regarding the level of achievement by Mr. Michaels of non-financial, personal goals established for him by the Board for fiscal year 2001. No bonus award was made to Mr. Michaels with respect to 2001 financial goals.

Mr. Michaels received a grant of 85,000 stock options in fiscal year 2001 (see Note 5 in the Summary Compensation Table).

HUMAN RESOURCES AND

COMPENSATION COMMITTEE

Lorne R. Waxlax, Chair

Gary M. Christensen

Robert L. Katz

Compensation Committee Interlocks and Insider Participation

During fiscal year 2001, the Human Resources and Compensation Committee was comprised of Messrs. Waxlax and Christensen and Dr. Katz, none of whom is a current or former officer of the Company. There are no interlocking board memberships between officers of the Company and any member of the Committee.

Change in Control Employment Agreements

The Company has entered into change in control employment agreements with corporate officers and certain other key employees. According to the agreements, a change in control occurs when a third person or entity becomes the beneficial owner of 20 percent or more of the Company's Common Stock or more than one-third of the Company's Board of Directors is composed of persons not recommended by at least three-fourths of the incumbent Board of Directors, or upon the occurrence of certain business combinations involving the Company. Upon a change in control, a two-year employment contract between the Company and each

17

such executive becomes effective, and all his or her benefits become vested under Company plans. In addition, the executive becomes entitled to certain benefits if, at any time within two years of the change in control, any of the following occurs: (i) employment is terminated by the Company for any reason other than cause or disability of the executive, or (ii) employment is terminated by the executive for good reason, as such terms are defined in the agreement. In such circumstances, the executive is entitled to receive his or her annual salary through the date of termination, a bonus equal to the average of the executive's annual bonuses for the prior two years prorated based on the length of employment during the year in which termination occurs, and a severance payment equal to two times the sum of (i) the executive's annual base salary and (ii) the average of the executive's annual bonuses for the prior two years. The executive will also be entitled to a continuation of certain employee benefits for two years, or longer if comparable benefits are not otherwise available to the executive. The executive will be entitled to receive reimbursement for any legal fees and expenses, plus interest thereon, that may be incurred in enforcing or defending his or her employment agreement. All of the executive officers named in the Summary Compensation Table have executed such agreements.

PROPOSAL NO. 2—ADOPTION OF THE HON INDUSTRIES INC. 2002 MEMBERS' STOCK PURCHASE PLAN

On February 13, 2002, the Board of Directors of the Company adopted, subject to shareholder approval, the HON INDUSTRIES Inc. 2002 Members' Stock Purchase Plan (the "Plan"), which authorizes the granting of rights to purchase up to 800,000 shares of Common Stock to the Company's members. The Plan will replace the Company's 1994 Members' Stock Purchase Plan as currently in effect (the "1994 Purchase Plan"). If the Shareholders approve the Plan, the Company will not issue shares under the 1994 Purchase Plan after June 30, 2002.

The following is a summary of the principal provisions of the Plan, but it is not intended to be a complete description of all of the terms and provisions of the Plan. The capitalized terms used herein are as defined in the Plan. A copy of the Plan is set forth in Exhibit B to this Proxy Statement.

Description of the Plan.

Purpose. The Company has maintained member stock purchase plans since 1961 to allow its members to purchase the Company's Common Stock. The proposed current Plan is intended to advance the interests of the Company and its Shareholders by strengthening the Company's ability to attract and retain members who have the training, experience, and ability to enhance the profitability of the Company. It is also intended to align the interests of members with the interests of shareholders by rewarding members of the Company and its subsidiaries, upon whose judgment, initiative, and effort the success of the Company largely depends.

Administration. The Board of Directors will appoint a committee of not less than three members (the "Committee") to administer the Plan. The Committee will have authority, among other things, to make adjustments in the exercise price and the number and kind of shares as may be equitably required as a result of stock splits or other changes affecting the Common Stock. The interpretation and construction by the Committee of any provision of the Plan will be final.

Eligibility. Any person (i) who has been employed by the Company or a subsidiary for at least one year, (ii) who works 20 or more hours a week and (iii) who customarily works more than 5 months in any calendar year, is eligible to participate in the Plan. Currently, approximately 8,341 members of the Company would be eligible to participate in the Plan.

Terms of Options and Acceptance. On the first business day of each fiscal quarter during which the Plan is in effect (the "Grant Date"), each eligible member will be granted the right to purchase shares of Common Stock. A member who desires to purchase Common Stock will execute a Subscription and Authorization Form providing for the purchase of any dollar amount of Common Stock not to exceed 20 percent of the member's gross earnings. Gross earnings are determined by a member's W-2 form for the calendar year prior to the Grant Date. If the amount included on the member's W-2 form covers less than 12 calendar months, such amount will be adjusted to an annual rate. Payment of the purchase price will be accomplished through payroll deductions (subject to certain minimum amounts). Notwithstanding the foregoing, a member may not be granted a right to purchase stock under the Plan if, assuming the member purchased all the shares he or she has the right to purchase, such member would own 5 percent or more of the total combined voting power or value of all classes of stock of the Company. In addition, no member shall be given the right to purchase shares of Common Stock having a fair market value as of the relevant Grant Dates in excess of $25,000 in any calendar year.

18

Once a member agrees to purchase stock under the Plan, the member automatically will continue to participate in the Plan unless he or she withdraws from the Plan in the manner described below. After a member sets the rate of payroll deductions, he or she may increase or decrease the rate by submitting appropriate forms to the Company at least ten days prior to the Grant Date of the next fiscal quarter.

Purchase of Stock. The purchase of the shares of Common Stock takes place automatically on the last business day of each fiscal quarter during which the Plan is in effect (the "Exercise Date"). Shares of Common Stock issued pursuant to the Plan shall be authorized but unissued or reacquired shares. The number of shares purchased by each participant is determined by dividing the amount credited to his or her account by the purchase price per share determined as described below. If the number of shares which may be purchased on any Exercise Date exceeds the number of shares eligible for issuance under the Plan, the shares eligible for issuance will be made available for purchase on a pro rata basis.

Purchase Price. The purchase price of shares purchased on any Exercise Date shall be 85 percent of the closing sale price of the Common Stock on the applicable Exercise Date, as reported on the New York Stock Exchange. As of March 1, 2002, the closing price of the Common Stock was $27.26.

Cancellation and Withdrawal. A participant in the Plan may not withdraw from the Plan for a fiscal quarter after the date that is ten days before the Exercise Date for the preceding fiscal quarter. A member may withdraw from the Plan for a future fiscal quarter by giving written notice to the Company at least ten days before any Exercise Date. If written notice is provided less than ten days prior to an Exercise Date, the withdrawal is effective the first day of the next fiscal quarter after the Exercise Date.

Termination of Employment. If a participant in the Plan ceases to be employed by the Company or a subsidiary for any reason, the total unused payments credited to his or her account will be used to purchase stock on the next Exercise Date at the purchase price required by the Plan, and he or she will have no further rights under the Plan.

Leaves of Absence. A member who commences a leave of absence during any fiscal quarter may continue to make payments only if the member is receiving pay through the regular payroll system of the Company or a subsidiary in an amount sufficient to cover the payments under the Plan. Such payments shall be equal to the rate of payroll deduction made prior to commencement of the leave and continue until the earlier of (i) the first Exercise Date following the commencement of such leave, or (ii) the member's termination of employment with the Company or a subsidiary. If, at any time during the leave of absence, the member is not receiving pay from the Company or a subsidiary in an amount sufficient to cover the payments under the Plan, the total unused payments credited to his or her account will be used to purchase stock on the next Exercise Date at the purchase price required by the Plan.

Adjustment. The Committee may adjust the price and the number and kind of shares of Common Stock or other securities that are covered by outstanding grants to prevent dilution or enlargement of purchase rights which would result from any stock dividend, stock split, or other changes in the capital structure of the Company, any merger, reorganization or other corporate transaction having a similar effect.

Amendment or Termination. The Committee may at any time amend or terminate the Plan. Except for the adjustments described above, no amendment may be made without the approval of the shareholders of the Company if the amendment: (i) may increase the total number of shares available for issuance under the Plan, (ii) materially modify the requirements as to eligibility for participation in the Plan, (iii) cause the Plan to fail to meet the requirements applicable to "employee stock purchase plans" as defined in Section 423 of the Internal Revenue Code (the "Code"), or (iv) cause the transactions under the Plan to cease to qualify as exempt transactions under Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). In addition, any amendment that must be approved by shareholders of the Company in order to comply with the rules of the New York Stock Exchange or any other principal exchange on which the Common Stock is then trading, shall not be effective unless and until shareholder approval has been obtained.

Other Provisions. No shares may be purchased under the Plan after June 30, 2012. Rights under the Plan are not transferable by a participant except by will or the laws of descent and distribution. Only the member may purchase Common Stock under the Plan during the member's lifetime except that in the event of his or her incapacity, his or her guardian or legal representative acting in a fiduciary capacity on behalf of the member under state law and court supervision, may purchase Common Stock under the Plan.

19

Federal Income Tax Consequences

The following is a brief summary of the tax consequences of purchasing shares under the Plan for United States citizens under current United States federal income tax laws.

The Plan is intended to qualify as an "employee stock purchase plan" within the meaning of Section 423 of the Code. Assuming the Plan qualifies under Section 423 of the Code, participants will not recognize income for federal income tax purposes either upon enrollment in the Plan or upon purchase of shares thereunder. All tax consequences of purchasing shares under the Plan are deferred until the participant sells or otherwise disposes of the shares, or after the participant dies.

If the shares are held more than two years from the applicable Grant Date and more than one year from the applicable Exercise Date, the participant will be taxed on the sale of such shares at long-term capital gains rates, except to the extent that the participant realizes ordinary income. Under Section 423(c) of the Code, a participant realizes ordinary income in an amount equal to the lesser of (i) 15 percent of the fair market value of the shares on the Grant Date or (ii) the amount by which the fair market value of the shares at the time of the sale exceeds the purchase price.

If the shares are not held for the minimum period described in the preceding paragraph, the participant will have ordinary income in the amount by which the fair market value of the shares on the Exercise Date exceeded the purchase price paid by the member. This ordinary income is not limited to the gain from the sale of the stock. The participant's basis in the stock is increased by the amount of the ordinary income. The difference between the increased basis and the selling price of the stock is a capital gain or loss—long-term or short-term—depending on the holding period.

If a participant should die owning shares acquired under the Plan, he or she will be deemed to have disposed of his or her shares on the date of death and will realize ordinary income to the extent of the ordinary income component described in the preceding paragraphs, as applicable, but no capital gain will result until the time of a subsequent sale, when the amount of gain will typically be equal to the excess of the selling price over the fair market value of the shares on the date of death or the alternative valuation date for federal estate tax purposes.

To the extent that a member of the Company or any subsidiary realizes ordinary income because he or she did not hold the stock more than two years from the applicable Grant Date, the Company or its subsidiary will be entitled to a corresponding deduction in the year in which the disposition occurs, provided, among other things, that such income meets the test of reasonableness, is an ordinary and necessary business expense, and that any applicable withholding requirements are satisfied. Otherwise, no deduction is allowable to the Company with respect to shares acquired under the Plan.

2002 Purchase Plan Activity

Participation in the Plan is voluntary and is dependent upon each eligible member's election to participate and his or her determination as to the level of payments or payroll deductions. Accordingly, purchases under the Plan are not determinable. The table below sets forth certain information regarding potential benefits in fiscal 2002 under the Plan. The following table assumes that participation in the Plan will be identical to participation in the 1994 Purchase Plan in fiscal 2001.

20

Potential Plan Benefits During Fiscal Year 2002

| Name and Position | Purchase Price | Number of Shares Purchased | ||||

|---|---|---|---|---|---|---|

| Jack D. Michaels | $ | 20.687 | 1,048 | |||

| David C. Burdakin | $ | 20.687 | 888 | |||

| Phillip M. Martineau | $ | 20.687 | -0- | (1) | ||

| Stanley A. Askren | $ | 20.687 | 880 | |||

| Jerald K. Dittmer | $ | 20.687 | 468 | |||

| All Current Executive Officers as a Group | $ | 20.687 | 5,088 | |||

| All Current Directors who are not Executive Officers as a Group | — | — | ||||

| All Members, including all Current Officers, who are not Executive Officers, as a Group | $ | 20.687 | 80,089 | |||

Notes

The foregoing information is not necessarily indicative of the number of shares that will be purchased under the Plan by any person or group listed in the foregoing table.

Required Vote

Approval of the adoption of the 2002 Purchase Plan requires the affirmative vote of the holders of a majority of the total Outstanding Shares entitled to vote at the Annual Meeting.

Recommendation by the Board of Directors

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS A VOTE FOR THE PROPOSAL TO APPROVE THE HON INDUSTRIES INC. 2002 MEMBERS' STOCK PURCHASE PLAN. PROXIES RECEIVED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS SHAREHOLDERS SPECIFY IN THEIR PROXIES A CONTRARY CHOICE.

Independent Auditor

Representatives of Arthur Andersen LLP, the Company's independent auditor, are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Audit Fees

The aggregate fees billed by the Company's independent auditor for professional services rendered in connection with the audit of the Company's financial statements included in the Company's Annual Report on Form 10-K for fiscal year 2001, as well as for the review of the Company's financial statements included in the Company's Quarterly Reports on Form 10-Q during the 2001 fiscal year, totaled $462,700.

21

Financial Information Systems Design and Implementation Fees

The Company's independent auditor did not provide any financial information systems design or implementation services in fiscal year 2001.

All Other Fees

The aggregate fees billed by the Company's independent auditor for professional services during fiscal year 2001, other than those described above, totaled $890,305, including $284,310 of audit-related fees and other fees of $605,995. Audit-related fees include statutory audits of subsidiaries, benefit plan audits, acquisition due diligence and accounting consultations. Other fees are primarily tax services.

DEADLINE FOR SHAREHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

Proposals by shareholders intended to be presented at the 2003 Annual Meeting must be received at the Company's executive offices no later than November 28, 2002 to be included in the proxy statement and proxy form. All shareholder notice of proposals submitted outside the processes of Rule 14a-8 of the General Rules and Regulations under the Securities Exchange Act of 1934, as amended, must be received by March 7, 2003 to be considered for presentation at the Annual Meeting of Shareholders in 2003. In addition, any shareholder proposals must comply with the informational requirements contained in the Company's By-laws in order to be presented at the 2003 Annual Meeting.

The Board of Directors knows of no other matters that will be brought before the Annual Meeting, but, if other matters properly come before the meeting, it is intended that the persons named in the proxy will vote the proxy according to their best judgment.

The entire cost of soliciting proxies for the Annual Meeting is paid by the Company. No solicitation other than by mail is contemplated.

On written request to the undersigned at 414 East Third Street, P.O. Box 1109, Muscatine, IA 52761-0071, the Company will provide, without charge to any shareholder, a copy of its Annual Report on Form 10-K, including financial statements and schedules, filed with the Securities and Exchange Commission for the Company's most recent fiscal year.

Information set forth in this proxy statement is as of March 1, 2002, unless otherwise noted.

James I. Johnson

Vice President, General Counsel and Secretary

March 22, 2002

The Annual Report to Shareholders of the Company for the fiscal year ended December 29, 2001, which includes financial statements, is being mailed to Shareholders of the Company together with this Proxy Statement. The Annual Report does not form any part of the material for the solicitation of proxies.

22

HON INDUSTRIES Inc.

Audit Committee Charter

(Revised February 12, 2002)

Role of the Audit Committee

The Audit Committee is appointed by the Board of Directors to assist it in fulfilling the Board's oversight responsibilities relating to (1) the Company's financial reporting and accounting processes for the Company's financial position and results of operations, and (2) the independence of the Company's independent auditor.

The independent auditor for the Company is ultimately accountable to the Board of Directors and Audit Committee of the Company. The Board of Directors and Audit Committee have the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the independent auditor (or to nominate the independent auditor to be proposed for shareholder approval in any proxy statement).

The Audit Committee shall have the authority to retain special legal, accounting or other consultants to advise the Committee. The Audit Committee shall have the authority to conduct any investigation appropriate to fulfill its responsibilities.

The Committee shall meet at least four times per year or more frequently as circumstances require. The Audit Committee shall have the authority to retain special legal, accounting or other consultants to advise the Committee. The Audit Committee may request any officer or employee of the Company or the Company's outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee.

While the Audit Committee has the responsibilities and powers set forth in the Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate or are in accordance with generally accepted accounting principles. This is the responsibility of management. Nor is it the duty of the Audit Committee to conduct investigations, to resolve disagreements, if any, between management and the independent auditor or to assure compliance with laws and regulations and the Company's Code of Conduct. This is the responsibility of management.

The Audit Committee shall make regular reports to the Board.

Composition/Expertise Requirement of Audit Committee Members

The Audit Committee shall consist of at least three Directors, all of whom have no relationship to the Company that may interfere with the exercise of their independence from management and the Company.

In determining independence, the Board will observe the requirements of Rules 303.01 and 303.02 of the NYSE Listed Company Manual.

The members of the Audit Committee shall be appointed by the Board on the recommendation of the Public Policy and Corporate Governance Committee.

Each Audit Committee member shall be financially literate, as the Company's Board interprets such qualifications in its business judgment, or attain such status within a reasonable period after appointment. At least one Audit Committee member shall have accounting or related financial management expertise, as the Company's Board interprets such qualifications in its business judgment.

A-1

Responsibilities of the Audit Committee

A-2

A-3

EXHIBIT B

HON INDUSTRIES INC.

2002 MEMBERS' STOCK PURCHASE PLAN

Section 1. PURPOSE.

The HON INDUSTRIES Inc. 2002 Members' Stock Purchase Plan (the "Plan") is intended to advance the interests of HON INDUSTRIES Inc. (the "Company") and its stockholders by strengthening the Company's ability to attract and retain members who have the training, experience and ability to enhance the profitability of the Company. It is also intended to align the interests of members with the interests of shareholders by rewarding members of the Company and its subsidiaries, upon whose judgment, initiative and effort the success of the Company largely depends. It is further intended that options issued pursuant to this Plan shall constitute options issued pursuant to an "employee stock purchase plan" within the meaning of Section 423 of the Internal Revenue Code of 1986, as amended (the "Code").

Section 2. ADMINISTRATION.

The Plan shall be administered by a committee consisting of not less than three members appointed by the Board of Directors (the "Committee"). The majority of the Committee shall constitute a quorum, and the acts of a majority of the members of the Committee present at any meeting at which a quorum is present, or actions unanimously approved in writing, shall be the acts of the Committee.

The interpretation and construction by the Committee of any provision of the Plan or of any option granted under it shall be final. The Committee may establish any policies or procedures which in the discretion of the Committee are relevant to the operation and administration of the Plan and may adopt rules for the administration of the Plan. No member of the Committee shall be liable for any action or determination made in good faith with respect to the Plan or any option granted under it.

Section 3. ELIGIBILITY.

Each Member (as defined below) of the Company or of any Subsidiary (as defined below) of the Company who has been employed by the Company or by a Subsidiary of the Company for one year or more on any Grant Date (as defined below) shall be offered options under the Plan to purchase the Company's common stock, par value $1.00 per share ("Common Stock"). However, no Member shall be granted an option under the Plan if, immediately after the option was granted, such member would own stock possessing 5 percent or more of the total combined voting power or value of all classes of stock of the Company or of any Subsidiary of the Company. For purposes of this paragraph, stock ownership of an individual shall be determined under the rules of Section 424(d) of the Code, and stock that the Member may purchase under outstanding options shall be treated as owned by the Member.

For purposes of the Plan, the term "Member" shall include a person employed as a common law employee on the payroll of the Company or any of its Subsidiaries, but does not include (a) a member whose customary employment is less than 20 hours per week or (b) a member whose customary employment is for not more than 5 months in any calendar year.

For purposes of the Plan, the term "Subsidiary" means any wholly owned subsidiary either of the Company or of any wholly owned subsidiary of the Company. The term "Grant Date" means the first business day of each fiscal quarter of the Company during which this Plan is effective. The first Grant Date under this Plan will be July 1, 2002.

Section 4. PARTICIPATION.

(a) An eligible Member shall evidence his or her acceptance of the option by completing a written agreement (the "Subscription and Authorization Form") provided by the Committee and filing it as directed by the Committee at least ten days before the applicable Grant Date. Once a Member provides the Committee with the Subscription and Authorization Form, he or she continues to participate in the Plan for a full fiscal quarter or a series of full fiscal quarters until he or she withdraws

B-1

from the Plan. A Member's withdrawal from the Plan is effective the first day of the next fiscal quarter after the Member provides written notice to the Company at least ten days before any Exercise Date (as defined in Section 6(c) of the Plan). If written notice is provided less than ten days prior to an Exercise Date, the withdrawal is effective the first day of the second fiscal quarter after the Exercise Date.

(b) In the Subscription and Authorization Form, an eligible Member may subscribe for any dollar amount of Common Stock which does not exceed 20 percent of the Member's Compensation (as defined below) reduced by amounts withheld from the Member's pay pursuant to this Plan for earlier quarters of the same calendar year.

For purposes of this Plan, the term "Compensation" means the gross earnings includible in the box that is designated for "Wages, tips and other compensation" on IRS Form W-2 for the calendar year prior to the Grant Date. The amount includible on Form W-2 shall be adjusted to an annual rate if the Form W-2 for the calendar year preceding the Grant Date covers less than 12 calendar months. Compensation does not include any deferred compensation even if it would otherwise be counted as "wages, tips and other compensation" on Form W-2.

Section 5. STOCK.

The stock subject to the options granted under the Plan shall be shares of authorized but unissued or reacquired Common Stock. Subject to the provisions of Section 6(h), the aggregate number of shares that may be purchased under the Plan shall not exceed 800,000 shares of Common Stock. In the event that the number of shares subject to options to be granted pursuant to any offering under the Plan exceeds the number of shares available to be purchased under the Plan, the shares available to be purchased shall be allocated on a pro rata basis among the options to be granted.

Section 6. TERMS AND CONDITIONS OF OPTIONS.

Options granted pursuant to the Plan shall be evidenced by a Subscription and Authorization Form in such form as the Committee shall from time to time approve, provided that all Members granted such options shall have the same rights and privileges (except as otherwise provided in subparagraphs (c) and (d) below), and provided further that such options shall comply with and be subject to the following terms and conditions:

(a) Option Price. The option price shall be an amount equal to 85 percent of the Closing Price Per Share on the Exercise Date (as defined in Section 6(c) of the Plan). "Closing Price Per Share" means, as of any particular date, (i) the closing sale price of the Common Stock as reported on the New York Stock Exchange, or any other principal exchange on which shares of the Common Stock are then trading, if any, on the relevant date, or if there are no sales on such day, on the next preceding trading day during which a sale occurred, or (ii) if Section 6(a)(i) does not apply, the fair market value of the Common Stock as determined by the Committee. Subject to the foregoing, the Committee shall have full authority and discretion in fixing the option price.