QuickLinks -- Click here to rapidly navigate through this documentSecond Quarter 2002

Message from the Chairman of the Board and the President and Chief Executive Officer

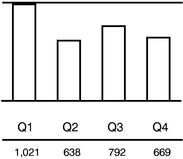

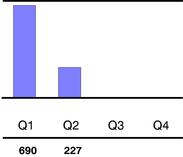

The first six months of 2002 ended with consolidated net income of $917 million. This compares favorably with net income at June 30, 2001, which totaled $665 million after restatement to comply with the new accounting standard on foreign currency translation. Without this restatement of the 2001 results, net income at June 30, 2002, would have been up approximately 13% over the previous year.

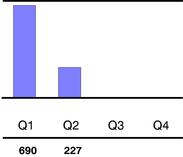

Consolidated net income of $227 million for the second quarter of 2002 also compares favorably with the results for the second quarter of 2001, which totaled $112 million after restatement. This improvement reflects the impact of increased domestic demand, a higher volume of short-term electricity sales on American markets, and the positive effects of sound, proactive debt management.

Consolidated results

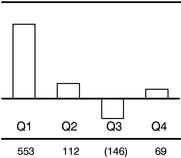

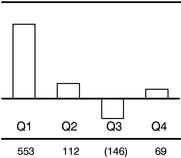

Total revenue amounted to $6,556 million in the first six months of 2002, compared with $6,746 million for the same period in 2001. This decrease of $190 million, or 2.8%, stems mainly from a decline in electricity and natural gas prices in northeastern North America relative to last year.

Expenditure totaled $4,059 million, for a decrease of $85 million or 2.1%. Electricity and fuel purchases totaled $1,749 million, down $108 million or 5.8%, as a result of the lower cost of electricity purchases made for purchase/resale transactions in the United States and the lower cost of natural gas purchases made through our holding in Noverco. Operating expenses rose $19 million, or 1.9%, to $1,033 million. Consequently, operating income fell $105 million, or 4.0%, to $2,497 million.

Financial expenses came to $1,561 million, down $358 million or 18.7% compared with the restated results for June 30, 2001. We have continued to reduce our financial expenses by carrying out long-term refinancing at more advantageous rates and maintaining a portion of our debt at variable rates to be able to take advantage of drops in interest rates on the markets. The $149-million cumulative restatement of the foreign exchange loss for the first six months of 2001, required by the new accounting standard for foreign currency translation, also contributed to this reduced figure.

Segmented results

Distribution

As at June 30, 2002, Hydro-Québec Distribution posted a net loss of $75 million, compared with $155 million in 2001. Total revenue rose $37 million to $4,192 million.

Revenue from electricity sales in Québec amounted to $4,130 million, an increase of $42 million or 1.0%. The volume of electricity sales in Québec was 80.5 TWh, up 0.9 TWh or 1.1% from the previous year. This increase is attributable to growth in demand totaling $78 million, or 1.4 TWh, resulting from the addition of major industrial customers in the third quarter of 2001. The colder temperatures in the second quarter of 2002, compared with the same period last year, were a factor in the $35-million improvement in sales revenue. However, because of the milder temperatures in the first quarter, total sales as at June 30, 2002, were down $38 million or 0.5 TWh compared with last year.

Transmission

As at June 30, 2002, net income for Hydro-Québec TransÉnergie reached $206 million, up $7 million or 3.5% over the first six months of last year. Sales totaled $1,483 million, compared with $1,511 million for the same period in 2001.

The Régie de l'énergie authorized the division to revise its transmission rates, retroactive to January 1, 2001. Until the transmission tariff receives final approval, which is expected in fall 2002, the current rates will remain as set by order-in-Council in March 1997.

Generation

Net income for Hydro-Québec Production amounted to $817 million as at June 30, 2002, compared with $786 million for the same period last year. Sales totaled $3,816 million, down $11 million or 0.3% from 2001. Revenue from electricity sales outside Québec declined, despite increased volume, owing to lower market prices. On the other hand, the division's electricity sales to Hydro-Québec Distribution were up $17 million or 0.9 TWh over June 30, 2001.

Engineering, procurement and construction

Sales posted by Hydro-Québec Ingénierie, approvisionnement et construction totaled $571 million for the first six months of 2002, a 21.2% increase over 2001, as a result of the increased volume of work carried out for Hydro-Québec Production.

Investment

Hydro-Québec's investment program for 2002 amounts to approximately $2.7 billion, up $0.8 billion over last year. Close to 65% of the program is allocated to ongoing operations, including $1 billion to ensure the long-term operability of assets and $300 million to respond to growth in domestic demand. In addition, $150 million will be invested to strengthen and improve the transmission and distribution systems, and over $500 million will go to technological and business development, with $220 million earmarked for the Toulnustouc project.

The most important projects of Hydro-Québec Production include the construction of new hydropower facilities at the Grand-Mère site and on the Toulnustouc River as well as the refurbishing of Beauharnois generating station. As well, remedial work is going on at Sainte-Marguerite-3 generating station, which is due to come on stream in the early months of 2003.

On June 26, the Québec government authorized the completion of the Montérégie reinforcement and loop project, enabling Hydro-Québec TransÉnergie to continue the work it began in the wake of the ice storm of January 1998.

At the end of the first six months, fixed-asset investments stood at $917 million, up $68 million from the same period in 2001.

Financing

The company's borrowing program for 2002 amounts to $1.5 billion. The proceeds of these loans will be used essentially to refinance debts that mature this year.

During the second quarter, the company undertook financing totaling $402 million: $332 million maturing in 2006 and $70 million borrowed for a period of close to 40 years. The securities were all issued under the program of medium-term Canadian notes.

2

Consolidated financing activities for the first six months generated $633 million, while debt maturities and early repayments totaled $1,589 million.

|  |

Jacques Laurent

Chairman of the Board |

André Caillé

President and Chief Executive Officer |

August 9, 2002

3

CONSOLIDATED STATEMENT OF OPERATIONS

(unaudited)

(in millions of dollars)

| | | | | Three months ended

June 30 | | Six months ended

June 30 |

| | | Notes | | 2002 | | 2001 | | 2002 | | 2001 |

| | | | | | | (restated) | | | | (restated) |

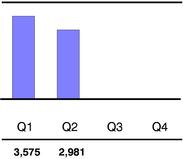

| Revenue | | | | 2,981 | | 2,909 | | 6,556 | | 6,746 |

Expenditure |

|

|

|

|

|

|

|

|

|

|

| | Operations | | | | 542 | | 545 | | 1,033 | | 1,014 |

| | Electricity and fuel purchased | | | | 777 | | 802 | | 1,749 | | 1,857 |

| | Depreciation, amortization and decommissioning | | | | 480 | | 486 | | 945 | | 943 |

| | Taxes | | | | 173 | | 174 | | 332 | | 330 |

| | | | |

| |

| |

| |

|

| | | | | 1,972 | | 2,007 | | 4,059 | | 4,144 |

Operating income |

|

|

|

1,009 |

|

902 |

|

2,497 |

|

2,602 |

| Financial expenses | | 2 and 3 | | 771 | | 779 | | 1,561 | | 1,919 |

| | (restated by a cumulative amount of $149 million in 2001) | | | | | | | | |

| | | | |

| |

| |

| |

|

| Income before non-controlling interest | | | | 238 | | 123 | | 936 | | 683 |

| Non-controlling interest | | | | 11 | | 11 | | 19 | | 18 |

| | | | |

| |

| |

| |

|

| Net income | | | | 227 | | 112 | | 917 | | 665 |

| | | | |

| |

| |

| |

|

CONSOLIDATED STATEMENT OF RETAINED EARNINGS

(unaudited)

(in millions of dollars)

| | | | | Three months ended

June 30 | | Six months ended

June 30 |

| | | Notes | | 2002 | | 2001 | | 2002 | | 2001 |

| | | | | | | (restated) | | | | (restated) |

| Balance at beginning, as previously reported | | | | 9,856 | | 9,690 | | 10,460 | | 9,906 |

Adjustment for the retroactive application of

change in accounting policy | | 2 | | — | | — | | (1,294 | ) | (769) |

| | | | |

| |

| |

| |

|

| Balance at beginning, as restated | | | | 9,856 | | 9,690 | | 9,166 | | 9,137 |

| Net income | | | | 227 | | 112 | | 917 | | 665 |

| | | | |

| |

| |

| |

|

| Balance at end | | | | 10,083 | | 9,802 | | 10,083 | | 9,802 |

| | | | |

| |

| |

| |

|

4

CONSOLIDATED BALANCE SHEET

(in millions of dollars)

| | | Notes | | As at June 30, | | As at December 31, |

| | | | | 2002 | | 2001 |

| | | | | (unaudited)

| | (audited)

(restated) |

| ASSETS | | | | | | |

| Fixed assets | | | | 50,141 | | 50,044 |

Current assets |

|

|

|

|

|

|

| | Cash and cash equivalents | | | | 999 | | 251 |

| | Investments | | | | 39 | | 617 |

| | Accounts receivable | | | | 1,994 | | 1,766 |

| | Financial assets related to debt | | | | 13 | | 106 |

| | Materials, fuel and supplies | | | | 374 | | 427 |

| | | | |

| |

|

| | | | | 3,419 | | 3,167 |

| Other long-term assets | | | | | | |

| | Investments | | | | 850 | | 841 |

| | Deferred charges | | | | 2,582 | | 3,834 |

| | Financial assets related to debt | | | | 357 | | 299 |

| | Other assets | | 2 and 4 | | 485 | | 479 |

| | | | |

| |

|

| | | | | 4,274 | | 5,453 |

| | | | |

| |

|

| | | | | 57,834 | | 58,664 |

| | | | |

| |

|

| LIABILITIES AND EQUITY | | | | | | |

| Long-term debt | | | | 35,705 | | 37,269 |

Current liabilities |

|

|

|

|

|

|

| | Borrowings | | | | 1,131 | | 88 |

| | Dividends payable | | | | — | | 554 |

| | Accounts payable | | | | 1,181 | | 1,317 |

| | Accrued interest | | | | 1,049 | | 1,201 |

| | Current portion of long-term debt | | | | 2,663 | | 3,087 |

| | | | |

| |

|

| | | | | 6,024 | | 6,247 |

Other long-term liabilities |

|

|

|

768 |

|

762 |

| Perpetual debt | | | | 602 | | 637 |

| Non-controlling interest | | | | 186 | | 178 |

Shareholder's equity |

|

|

|

|

|

|

| | Share capital | | | | 4,374 | | 4,374 |

| | Retained earnings | | | | 10,083 | | 9,166 |

| | Translation gains | | | | 92 | | 31 |

| | | | |

| |

|

| | | | | 14,549 | | 13,571 |

| | | | |

| |

|

| | | | | 57,834 | | 58,664 |

| | | | |

| |

|

5

CONSOLIDATED STATEMENT OF CASH FLOWS

(unaudited)

(in millions of dollars)

| | | Three months ended

June 30 | | Six months ended

June 30 |

| | | 2002 | | 2001 | | 2002 | | 2001 |

| | | | | (restated | ) | | | (restated) |

| Operating activities | | | | | | | | |

| | Net income | | 227 | | 112 | | 917 | | 665 |

| | Depreciation of fixed assets | | 452 | | 454 | | 892 | | 871 |

| | Amortization of deferred charges | | 86 | | 54 | | 203 | | 469 |

| | Change in non-cash working capital items | | 444 | | 501 | | (476 | ) | (524) |

| | Other | | 30 | | 79 | | 19 | | 89 |

| | |

| |

| |

| |

|

| | | 1,239 | | 1,200 | | 1,555 | | 1,570 |

| Investing activities | | | | | | | | |

| | Fixed assets | | (504 | ) | (528 | ) | (917 | ) | (849) |

| | Long-term investments | | (9 | ) | (10 | ) | (20 | ) | 4 |

| | Net change in short-term investments | | 336 | | 185 | | 575 | | 510 |

| | Other | | 2 | | (43 | ) | 1 | | (49) |

| | |

| |

| |

| |

|

| | | (175 | ) | (396 | ) | (361 | ) | (384) |

| Financing activities | | | | | | | | |

| | Issue of long-term debt | | 416 | | 2,704 | | 633 | | 4,383 |

| | Maturity of long-term debt and sinking fund redemption | | (1,144 | ) | (1,171 | ) | (1,410 | ) | (2,059) |

| | Repayment in advance of long-term debt | | — | | — | | (170 | ) | — |

| | Net change in short-term borrowings | | 5 | | (995 | ) | 1,044 | | (1,149) |

| | Dividends paid | | — | | (539 | ) | (554 | ) | (539) |

| | Other | | 13 | | 181 | | 11 | | 178 |

| | |

| |

| |

| |

|

| | | (710 | ) | 180 | | (446 | ) | 814 |

Net change in cash and cash equivalents |

|

354 |

|

984 |

|

748 |

|

2,000 |

| Cash and cash equivalents at beginning of period | | 645 | | 1,128 | | 251 | | 112 |

| | |

| |

| |

| |

|

| Cash and cash equivalents at end of period | | 999 | | 2,112 | | 999 | | 2,112 |

| | |

| |

| |

| |

|

Cash and cash equivalents comprise cash and liquid short-term investments with maturities generally less than or equal to three months from the date of acquisition.

6

Complementary notes

(unaudited except where indicated) (in millions of dollars)

Note 1 — Accounting policies

The consolidated financial statements have been prepared in accordance with Canadian generally accepted accounting principles and take into account generally accepted accounting methods and practices recognized by regulatory bodies. The regulatory accounting practices adopted by the Corporation, which differ from the accounting practices applied in unregulated enterprises, relate specifically to certain deferred charges, such as those concerning canceled major projects and personnel reduction and renewal measures, and the depreciation of fixed assets that are disposed of.

The consolidated financial statements for the quarter and the present Notes should be read in conjunction with the Consolidated Financial Statements and accompanying Notes in Hydro-Québec's 2001 Annual Report.

The accounting policies used to prepare the quarterly consolidated financial statements conform to those described in Hydro-Québec's 2001 Annual Report, except for the changes in accounting policies described in Note 2.

Some figures for the previous year were reclassified in order to respect the presentation adopted in the current year.

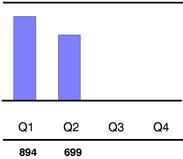

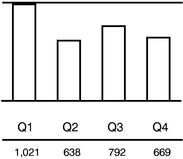

As can be seen from the charts in the Consolidated Financial Highlights, seasonal temperature fluctuations affect the quarterly financial results.

Note 2 — Changes in accounting policies

Foreign currency translation

The Canadian Institute of Chartered Accountants (CICA) has revised Chapter 1650 of the CICA Handbook, entitled "Foreign Currency Translation," effective January 1, 2002. All unrealized exchange gains and losses related to monetary items denominated in foreign currencies must henceforth be charged to income for the year, including gains and losses on long-term monetary assets and liabilities, which were formerly deferred and amortized on a straight-line basis over the remaining term of the asset or liability. In accordance with the standard, Hydro-Québec has applied these changes retroactively and the figures for the prior period have been restated.

The retroactive application of this standard reduced retained earnings as at January 1, 2002, by $1,294 million. The amount attributable to the second quarter of 2001 corresponds to an exchange gain of $53 million, while the cumulative impact for the first half of 2001 is a $149-million loss on exchange. To reduce the volatility resulting from the prohibition on amortizing unrealized gains and losses, the Corporation adapted its foreign exchange risk management strategy for 2002.

Goodwill and other intangible assets

On January 1, 2002, Hydro-Québec also adopted the recommendations of Chapter 3062 of the CICA Handbook, entitled "Goodwill and Other Intangible Assets." Thus, goodwill and intangible assets with an indefinite useful life are no longer amortized and are subject to an annual impairment test.

The fact that we no longer record amortization expense for goodwill and intangible assets with an indefinite useful life pushed income up by $6 million for the second quarter ended June 30, 2002, and by $10 million for the first half of the year, compared with the same periods last year.

The transitional impairment tests will be completed during the current fiscal year. Any resulting loss in value will be reported, if applicable, as a consequence of a change in accounting policy and deducted from retained earnings as at January 1, 2002. This standard has been applied prospectively.

7

Transitional information

The following table presents the impact of the application of the new accounting standards:

| | | Three months ended June 30 | | Six months ended June 30 |

| | | 2002 | | 2001 | | 2002 | | 2001 |

| Net income, as reported | | 227 | | 54 | | 917 | | 809 |

| Restatements | | — | | 58 | | — | | (144) |

| | |

| |

| |

| |

|

| Net income, as restated | | 227 | | 112 | | 917 | | 665 |

| | |

| |

| |

| |

|

| Amortization of goodwill and intangible assets | | | | | | | | |

| | with an indefinite useful life | | — | | 6 | | — | | 10 |

| | |

| |

| |

| |

|

| Net income, as adjusted | | 227 | | 118 | | 917 | | 675 |

| | |

| |

| |

| |

|

Note 3 — Financial expenses

| | | Three months ended June 30 | | Six months ended June 30 |

| | | 2002 | | 2001 | | 2002 | | 2001 |

| | | | | (restated) | | | | (restated) |

| Interest | | | | | | | | |

| | Interest on debt securities | | 719 | | 788 | | 1,460 | | 1,610 |

| | Amortization of borrowing discount and expenses | | 8 | | 15 | | 20 | | 27 |

| | |

| |

| |

| |

|

| | | 727 | | 803 | | 1,480 | | 1,637 |

| | |

| |

| |

| |

|

| Less | | | | | | | | |

| | Capitalized borrowing costs | | 69 | | 65 | | 134 | | 125 |

| | Net investment income | | 11 | | 25 | | 21 | | 35 |

| | |

| |

| |

| |

|

| | | 80 | | 90 | | 155 | | 160 |

| | |

| |

| |

| |

|

| Exchange loss (restated by a cumulative amount of $149 million in 2001) | | 78 | | 20 | | 142 | | 350 |

| Loan guarantee fees | | 46 | | 46 | | 94 | | 92 |

| | |

| |

| |

| |

|

| | | 771 | | 779 | | 1,561 | | 1,919 |

| | |

| |

| |

| |

|

Note 4 — Other assets

| | | As at June 30 | | As at December 31 |

| | | 2002 | | 2001 |

| | | | | (audited)

(restated) |

| Goodwill | | 303 | | 297 |

| Government reimbursement for the 1998 ice storm | | 182 | | 182 |

| | |

| |

|

| | | 485 | | 479 |

| | |

| |

|

8

Note 5 — Segmented information

Six months ended June 30, 2002

|

| | Distribution

| | Transmission

| | Generation

| | EPC(a)

|

| | Other

| |

| | Intersegment(b)

| | Total

|

|---|

| Revenue | | | | | | | | | | | | | | | | | |

| | External customers | | 4,175 | | 147 | | 1,655 | | 11 | | | 575 | | | | (7 | ) | 6,556 |

| | Intersegment | | 17 | | 1,336 | | 2,161 | | 560 | (c) | | 97 | | | | (4,171 | ) | — |

| Net income (loss) | | (75 | ) | 206 | | 817 | | 8 | | | (39 | ) | | | — | | 917 |

| Total assets | | 9,557 | | 18,417 | | 24,452 | | 536 | | | 2,290 | | | | 2,582 | | 57,834 |

Six months ended June 30, 2001

(restated)

|

| | Distribution

| | Transmission

| | Generation

| | EPC(a)

| |

| | Other

| |

| | Intersegment(b)

| | Total

|

|---|

| Revenue | | | | | | | | | | | | | | | | | | |

| | External customers | | 4,142 | | 143 | | 1,684 | | 7 | | | | 777 | | | | (7 | ) | 6,746 |

| | Intersegment | | 13 | | 1,368 | | 2,143 | | 464 | | (c) | | 100 | | | | (4,088 | ) | — |

| Net income (loss) | | (155 | ) | 199 | | 786 | | (9 | ) | | | (156 | ) | (d) | | — | | 665 |

| Total assets | | 9,524 | | 18,147 | | 24,282 | | 565 | | | | 2,378 | | | | 4,505 | | 59,401 |

Three months ended June 30, 2002

|

| | Distribution

| | Transmission

| | Generation

| | EPC(a)

|

| | Other

| |

| | Intersegment(b)

| | Total

|

|---|

| Revenue | | | | | | | | | | | | | | | | | |

| | External customers | | 1,826 | | 75 | | 761 | | 9 | | | 317 | | | | (7 | ) | 2,981 |

| | Intersegment | | 8 | | 671 | | 951 | | 307 | | | 51 | | | | (1,988 | ) | — |

| Net income (loss) | | (183 | ) | 99 | | 318 | | 11 | | | (18 | ) | | | — | | 227 |

| Total assets | | (328 | ) | (41 | ) | 4 | | 26 | | | (34 | ) | | | (1,257 | ) | (1,630) |

Three months ended June 30, 2001

(restated)

|

| | Distribution

| | Transmission

| | Generation

| | EPC(a)

| |

| | Other

|

| | Intersegment(b)

| | Total

|

|---|

| Revenue | | | | | | | | | | | | | | | | | |

| | External customers | | 1,725 | | 132 | | 632 | | 5 | | | | 429 | | | (14 | ) | 2,909 |

| | Intersegment | | 8 | | 683 | | 901 | | 237 | | | | 52 | | | (1,881 | ) | — |

| Net income (loss) | | (254 | ) | 126 | | 178 | | (2 | ) | | | 64 | | | — | | 112 |

| Total assets | | (500 | ) | (1 | ) | (208 | ) | (49 | ) | | | 158 | | | (222 | ) | (822) |

- (a)

- Engineering, Procurement and Construction.

- (b)

- Includes assets related to long-term financing that have not been allocated to the operating segments.

- (c)

- Intersegment revenue generated by the EPC segment includes a cumulative amount of $317 million ($222 million in 2001) that corresponds to capital works carried out for the client segments.

- (d)

- This amount includes a cumulative $149-million restatement of the exchange loss resulting from the retroactive application of the new accounting standard related to foreign currency translation effective January 1, 2002.

9

CONSOLIDATED FINANCIAL HIGHLIGHTS

| Operations in Brief ($M) | | Three months ended June 30 | | Six months ended June 30 |

|

| | | 2002 | | 2001 | | Change (% | ) | | | 2002 | | 2001 | | Change (% | ) | |

|

Revenue |

|

2,981 |

|

2,909 |

|

2.5 |

|

UP |

|

6,556 |

|

6,746 |

|

2.8 |

|

DOWN |

| Expenditure | | 1,972 | | 2,007 | | 1.7 | | DOWN | | 4,059 | | 4,144 | | 2.1 | | DOWN |

| Financial expenses | | 771 | | 779 | | 1.0 | | DOWN | | 1,561 | | 1,919 | | 18.7 | | DOWN |

| Non-controlling interest | | 11 | | 11 | | — | | | | 19 | | 18 | | 5.6 | | UP |

| Net income | | 227 | | 112 | | 102.7 | | UP | | 917 | | 665 | | 37.9 | | UP |

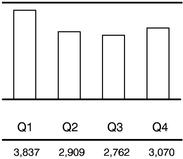

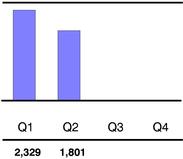

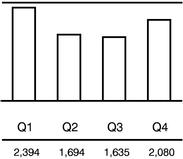

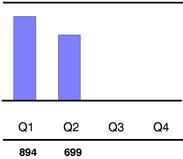

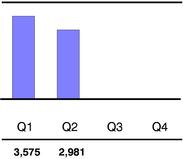

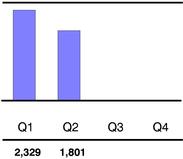

Net Income (Net Loss) ($M)

|

|

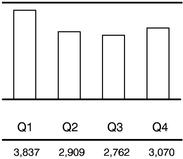

Revenue ($M)

|

|---|

2002

| | 2001(a)

| | 2002

| | 2001

|

|---|

| |  | |  | |  |

Revenue from Electricity Sales in Québec ($M)

|

|

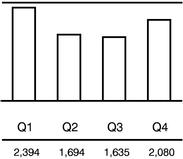

Revenue from Electricity Sales Outside Québec ($M)

|

|---|

2002

| | 2001

| | 2002

| | 2001

|

|---|

| |  | |  | |  |

$M: millions of dollars

- (a)

- The results for 2001 include restatements related to the retroactive application of the new accounting standard concerning foreign currency translation, effective January 1, 2002.

10

QUARTER HIGHLIGHTS

Corporate Affairs

Electricity transmission rate

On April 30, 2002, the Régie de l'énergie rendered its decision on Hydro-Québec TransÉnergie's revised application to amend its transmission rates. The division originally applied to the Régie for a rate amendment on May 1, 1998.

In its decision, the Régie ruled on various points including transmission activities, pricing policies, capital needs and forecasts, expenditure required, rate base, rate of return, rate structure and discount policies. The Régie approved a presumed capital structure made up of 70% loan capital and 30% shareholder's equity. It authorized a 9.72% rate of return on the transmission provider's rate base, in view of a 9.66% rate of return on shareholder's equity.

Electricity rate amendment

On July 8, Hydro-Québec Distribution filed an application (phase 1) with the Régie de l'énergie to establish the Distributor's cost of service and amend its electricity rates.

In a related matter, the Régie turned down the division's application to repeal Rate BT. This rate is offered to business customers with dual-energy systems for which a contract was in effect on May 1, 1996.

Call for tenders for power purchases

Hydro-Québec Distribution received 19 bids, totaling 4,625 MW, in response to its call for tenders issued on February 21, 2002 for the purchase of 1,200 MW of firm capacity. The division will analyze the bids in the coming months and will announce its selections in early fall.

Online billing

To meet the expectations of residential customers who receive and pay their bills via the Internet, the company has signed a partnership agreement with epost, a new service that delivers mail online. Hydro-Québec joins some 55 Canadian companies already using epost services, which provide an ideal solution for customers who wish to receive, pay and manage all their bills online in one central location. Hydro-Québec will nonetheless continue to offer online billing and payment on its own Web site.

Undergrounding of distribution systems

As part of its program for burying overhead distribution lines in heritage, cultural and tourist sites, the Québec government announced a $5.8-million initiative to improve the urban landscape in three municipalities in the Mauricie region: Trois-Rivières, Yamachiche and Champlain. It also approved projects proposed by the municipalities of Saint-Laurent-de-l'Île-d'Orléans and Sainte-Famille. Hydro-Québec was placed in charge of guiding the municipalities throughout the project implementation process as well as coordinating technical studies.

Fortuna, a quality investment

In 1999, Hydro-Québec International and the Solidarity Fund (affiliated with the Québec Federation of Labor), in partnership with El Paso Corporation, acquired a 49% stake in the 300-MW Fortuna generating station in Panama. By contract, the consortium Americas Generation Corporation holds a controlling interest in the new company formed, called Empresa de Generación Eléctrica Fortuna S.A. (or Fortuna).

11

Since the acquisition agreement calls for repayment of the company's debts, which are guaranteed by the government of Panama, Fortuna's finance committee, composed of experts from Hydro-Québec and El Paso, launched its refinancing campaign in September 2001. Despite difficult market conditions, this initial bond issue was a success, and nonrecourse refinancing was secured on very attractive terms. Of the US$170 million required, US$99 million was raised on the American market, US$55 million on the Panamanian market, and US$16 million on the Canadian market. In addition, the Fitch rating agency assigned Fortuna a credit rating of BBB-, a sign of a quality investment. This is a higher rating than that of the government of Panama.

Social Role and Community Involvement

Science and business

Hydro-Québec renewed its partnership with the Québec Chamber of Commerce for the 22nd edition of the Mercuriades competition, in which it was honorary sponsor for the Client Orientation category. This competition is considered the ultimate recognition in the Québec business world.

The company also reiterated its commitment to promoting science and technology among young people by renewing its partnership with the Conseil de développement du loisir scientifique. Through science fairs across the province, as well as the Énergie Hydro-Québec awards and the Rencontres d'avenir events, it fosters young Quebecers' interest in science and technology careers and helps demystify science. Hydro-Québec sees this partnership as a key to developing the next generation in the high-tech field, an area in which it offers a great many jobs.

At the Bell Super Science Fair held in Sherbrooke in April, the company presented its Énergie Hydro-Québec award to two students from Collège Jean-de-la-Mennais, in Montérégie, for a project that involved using bacteria to generate electricity. Five other young people received Hydro-Québec participation awards and will go to the International Science Fair in Moscow in 2003.

The Québec vocational and technical training Olympiad was held in May at the ExpoCité exhibition complex in Québec City. Some 235 young people, working in a multidisciplinary industrial facility, competed in the 30 different trades represented. By providing financial support for this competition to promote achievement and excellence, Hydro-Québec contributes to developing a skilled and eager work force.

Under its awards of excellence program, Hydro-Québec will contribute $100,000 to the Université du Québec foundation to encourage new talent in the science and technology fields. Five scholarships will be awarded to college students going on to civil or mechanical engineering or business administration studies in the Université du Québec system.

Sports

Hydro-Québec was the presenting sponsor of the 19th Défi sportif games for athletes with disabilities. This annual event brought together more than 2,000 athletes from nearly a dozen countries to compete in 16 adapted disciplines. The company has supported the games for more than 10 years because it believes in the importance of contributing to the development of amateur sports as well as the integration of people living with a hearing, visual, mental or physical impairment.

Environment

Hydro-Québec donated two of its properties to the Québec branch of the Nature Conservancy of Canada. One property consists of some of the islands in the Lachine Rapids and the other is a 15-kilometre section of the Richelieu River bed. These gifts will make possible the creation and management of two important conservation areas and wildlife preserves. They promote the long-term protection of Québec's ecological heritage and express the company's commitment to sustainable development and biodiversity.

In addition, Hydro-Québec's foundation for the environment contributed financially to a number of projects: preservation of Papineau Wood, in Laval, rebuilding of the salmon trapping system in the Mitis River, protection of the Mont Sutton massif in Montérégie, restoration and improvement of the peregrine falcon nesting habitat at Mont Saint-Hilaire, and enhancement of other areas in Johnville (Eaton municipality) and Kingsbury.

12

Culture

For several years, Hydro-Québec has sponsored two of the prizes awarded by the society to promote French song (SACEF) as part of the competition Ma première Place des Arts. In May, it presented the Singing the Song award, for best performance, to singer Catherine Gauthier; the Song of the Year award went to singer/songwriter Dominique Godin.

Hydro-Québec also sponsored the 25th season of the Festival international de Lanaudière. It plays an important role in the success of this internationally acclaimed event, to which it has made a three-year commitment as presenting sponsor.

Distinctions

In its FP500 supplement of June 2002, listing the 500 largest Canadian companies according to revenues, the Financial Post ranked Hydro-Québec first in the Canadian Crown Corporations category and first in the Energy Sector (electrical and gas utilities).

In April, the company received the prestigious Hydro Achievement Award for Recreational Stewardship from the National Hydropower Association, a trade association representing the hydropower industry in the United States and a number of companies in Canada. The award, which Hydro-Québec won for the first time, recognizes the company's efforts in facilitating access to the St. Maurice River through a variety of recreational projects, as well as in refurbishing four generating stations and building a new facility at Grand-Mère. It underlines the outstanding work done to reconcile corporate activities and the interests of residents of the Mauricie region.

Hydro-Québec, 75, boul. René-Lévesque Ouest, Montréal (Québec) H2Z 1A4

Ce document est également publié en français

www.hydroquebec.com

ISSN 0848-5836

2002G001-2A

13

QuickLinks

CONSOLIDATED STATEMENT OF OPERATIONS (unaudited) (in millions of dollars)CONSOLIDATED STATEMENT OF RETAINED EARNINGS (unaudited) (in millions of dollars)CONSOLIDATED BALANCE SHEET (in millions of dollars)CONSOLIDATED STATEMENT OF CASH FLOWS (unaudited) (in millions of dollars)Complementary notes (unaudited except where indicated) (in millions of dollars)CONSOLIDATED FINANCIAL HIGHLIGHTSQUARTER HIGHLIGHTS