- AXP Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

American Express (AXP) DEF 14ADefinitive proxy

Filed: 18 Mar 22, 1:28pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

American Express Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

March 18, 2022 | ||||

Items of Business

To vote on the following proposals:

| Election of directors proposed by our Board of Directors for a term of one year, as set forth in this proxy statement

| |||

| Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2022

| |||

| Advisory resolution to approve executive compensation

| |||

| One shareholder proposal, if properly presented at the meeting

| |||

| Such other business that may properly come before the meeting

|

ADMISSION

We do not require tickets for admission to the meeting but do limit attendance to shareholders as of the record date or their proxy holders. Please bring proof of your common share ownership, such as a current brokerage statement, and photo identification.

If you are attending the meeting, you will be asked to comply with the special precautions we are taking in light of COVID-19, as described in this proxy statement. Detailed information regarding our 2022 Annual Meeting of Shareholders, including how to cast your vote, can be found in “Other Information” starting on page 84 of this proxy statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2022 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 3, 2022:

Our proxy statement and annual report are available online at http://ir.americanexpress.com*. We will mail to certain shareholders a notice of internet availability of proxy materials, which contains instructions on how to access these materials and vote online. We expect to mail this notice and to begin mailing our proxy materials on or about March 18, 2022.

Your vote is important to us. Please exercise your shareholder right to vote.

By Order of the Board of Directors,

Kristina V. Fink

Corporate Secretary and Chief Governance Officer

| * | Web links throughout this document are provided for convenience only. Information from the American Express website is not incorporated by reference into this proxy statement. |

WHEN

Tuesday, May 3, 2022

9:00 a.m. Eastern Time

WHERE

American Express Company

200 Vesey Street

New York, New York 10285

RECORD DATE

March 7, 2022

Cautionary Note Regarding Forward-Looking Statements

This proxy statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. You can identify forward-looking statements by words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” “estimate,” “predict,” “potential,” “continue” or other similar expressions. Actual results may differ from those set forth in the forward-looking statements due to a variety of factors, including those contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and the Company’s other filings with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements.

2022 PROXY STATEMENT i •

| 2022 PROXY STATEMENT | 1 | • |

Our Company’s Strategic Imperatives

American Express is a globally integrated payments company that provides customers with access to products, insights and experiences that enrich lives and build business success. Our integrated payments platform includes card-issuing, merchant-acquiring and card network businesses. We are a leader in providing payments products and services to a broad range of customers, including consumers, small businesses, mid-sized companies and large corporations around the world. Following an unprecedented year in 2020 with the onset of the COVID-19 pandemic, in 2021 we focused on rebuilding our growth momentum by investing in our customers, brand and talent and making progress against our four long-term strategic imperatives:

Business Performance

Our key focus in 2021 was to rebuild our growth momentum while continuing to invest in initiatives that advance our long-term strategic imperatives. Business performance highlights in 2021 include:

| ◾ | Maintained customer satisfaction scores and card retention rates above pre-pandemic (2019) levels; |

| ◾ | Added 9.7 million new proprietary cards; |

| ◾ | Grew worldwide network volumes(1) by 24% versus the prior year, surpassing 2019 levels, with growth driven by consumer and small and mid-sized business spending; |

| ◾ | Sustained virtual parity coverage in the U.S., with approximately 99% of credit-card accepting merchants able to accept American Express(2), and remained committed to growing coverage globally, adding over 7 million merchant locations outside of the U.S.; and |

| ◾ | Continued to invest in marketing, value propositions, technology, and colleagues, while retaining financial flexibility. |

| (1) | Represents the total of billed business on our proprietary cards and processed network volumes, including alternative payment solutions facilitated by AXP. |

| (2) | Source: AXP internal data and The Nilson Report, February 2022. |

Financial Results

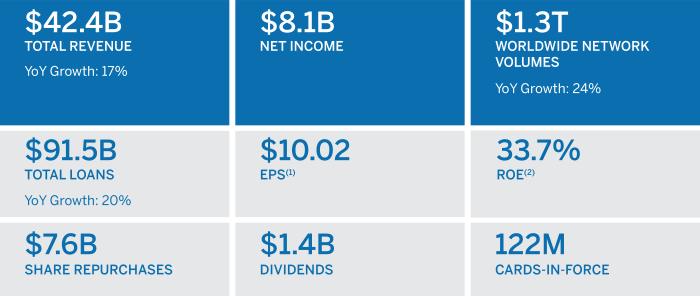

2021 financial highlights include:

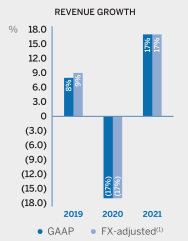

| ◾ | Delivered $42.4 billion in revenue; |

| ◾ | Total revenue for the year grew by 17% versus the prior year, reflecting momentum in Card Member spending and growth in card fees as Card Member acquisition increased and retention remained high; |

| ◾ | Credit metrics remained around historic lows throughout the year; |

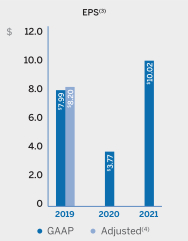

| ◾ | Diluted earnings per share (EPS) for the full year 2021 were $10.02, up from $3.77 the prior year, reflecting momentum in core business performance, credit reserve releases due to continued strong credit performance and an improving macroeconomic outlook, and sizeable net gains on equity investments; and |

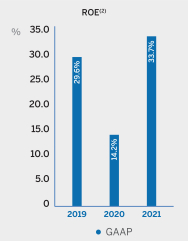

| ◾ | Return on equity (ROE) was 33.7% and we returned $9 billion of capital to our shareholders through both share repurchases and dividends. |

| 2022 PROXY STATEMENT | 2 | • |

Financial Performance Highlights

| (1) | Attributable to common shareholders. Represents net income less earnings allocated to participating share awards, dividends on preferred shares and other items. |

| (2) | Return on equity (ROE) is calculated by dividing the preceding twelve months of net income by the one-year monthly average of total shareholders’ equity. |

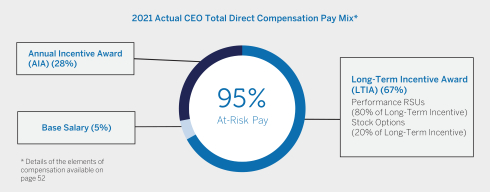

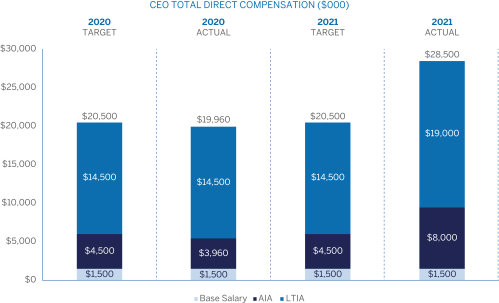

How Our Compensation Program Supports Our Business Strategy

Our executive compensation program is designed to support the longevity and stability of the Company by driving long-term business outcomes, promoting strong governance practices and encouraging responsible risk-taking. This is achieved by linking individual pay with the Company’s performance on a diverse set of measures as well as financial and strategic goals. All senior executives have a large portion of compensation that is variable and covers annual and multi-year performance periods. Long-Term Incentive Awards are designed to align executives with the Company’s long-term performance using performance-based equity awards in the form of Restricted Stock Units and Stock Options. Further, the Company Scorecard incentivizes performance and includes key objectives in four categories: Shareholder, Customer, Colleague and Strategic.

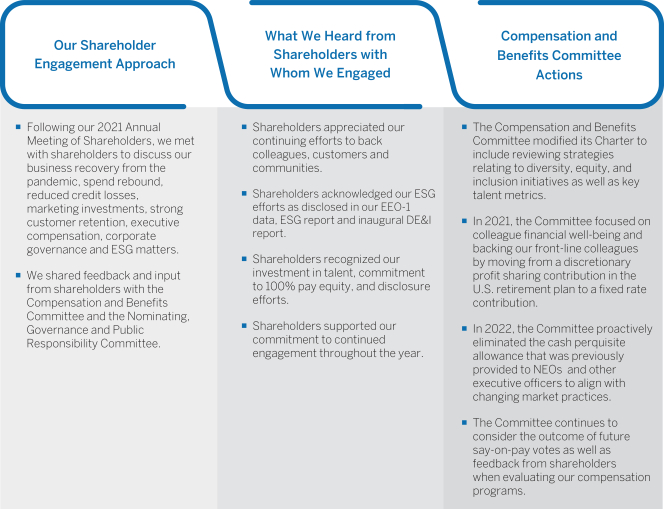

In 2021, the Compensation and Benefits Committee modified its charter to include reviewing strategies relating to diversity, equity, and inclusion initiatives as well as key talent metrics. In addition, executive compensation is also increasingly linked to our ESG goals. For example, in years past, the annual scorecard’s Colleague category included diversity representation, talent retention, culture and inclusion metrics as part of the calculation to determine incentive compensation for all eligible colleagues and in 2021, we also incorporated key ESG initiatives into our executive compensation program under the Strategic category of our Company Scorecard.

To support strong oversight, our Board’s Compensation and Benefits Committee approves performance goals across our categories and certifies performance outcomes.

Our executive compensation program, including compensation principles and strategy, is discussed in detail under the Compensation Discussion and Analysis section of this proxy statement.

| 2022 PROXY STATEMENT | 3 | • |

Our Board of Directors

The following provides current summary information about each director nominee. Our director nominees possess a range of diverse skills, backgrounds, experience and viewpoints that we believe are integral to an effective and well-functioning board. Detailed information about each nominee’s qualifications, experience, skills and expertise along with select professional and community contributions can be found starting on page 7.

Our Director Nominees

| Name | Position | Age | Director Since | AC | CB | NGPR | R | |||||||

Thomas J. Baltimore | Director | 58 | 2021 | ∎ |

|

|

| |||||||

Charlene Barshefsky | Director | 71 | 2001 |

|

|

| ∎ | |||||||

John J. Brennan | Lead Independent Director | 67 | 2017 | ∎ | ● |

|

| |||||||

Peter Chernin | Director | 70 | 2006 |

| ∎ | ● |

| |||||||

Ralph de la Vega | Director | 70 | 2016 | ● | ∎ |

|

| |||||||

Michael O. Leavitt | Director | 71 | 2015 | ∎ |

| ∎ |

| |||||||

Theodore J. Leonsis | Director | 66 | 2010 |

| ∎ | ∎ |

| |||||||

Karen L. Parkhill | Director | 56 | 2020 | ∎ |

|

| ● | |||||||

Charles E. Phillips | Director | 62 | 2020 |

|

|

| ∎ | |||||||

Lynn A. Pike | Director | 65 | 2020 |

| ∎ |

|

| |||||||

Stephen J. Squeri | CEO & Chairman | 63 | 2018 |

|

|

|

| |||||||

Daniel L. Vasella | Director | 68 | 2012 |

| ∎ | ∎ |

| |||||||

Lisa W. Wardell | Director | 52 | 2021 |

|

|

| ∎ | |||||||

Christopher D. Young | Director | 50 | 2018 |

|

| ∎ | ∎ | |||||||

∎ Member ● Chair

| AC | Audit and Compliance | CB | Compensation and Benefits | NGPR | Nominating, Governance and Public Responsibility | R | Risk |

| 2022 PROXY STATEMENT | 4 | • |

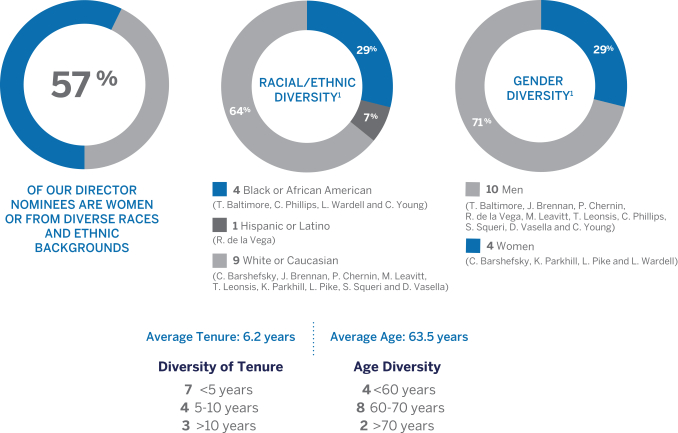

Director Nominee Demographics

| (1) | Based on self-identified characteristics. |

Director Experience Highlights

Our director nominees have a diversity of skills, viewpoints and expertise, including in the following areas:

| 2022 PROXY STATEMENT | 5 | • |

Corporate Governance Highlights

|

| BOARD STRUCTURE AND INDEPENDENCE |

◾ Engaged and autonomous Lead Independent Director with explicit duties and responsibilities

◾ All directors are independent

◾ Diverse and highly skilled Board that provides a range of viewpoints

| ◾ Annual Review of optimal Board leadership structure for the Company

◾ Executive sessions of the independent directors led by the Lead Independent Director at each regular in-person Board meeting without management present

| ◾ Executive sessions at committee meetings led by independent committee chairs without management present |  |

|

SHAREHOLDER RIGHTS | |

| ◾ Proxy access rights

◾ Annual election of all directors | ◾ Majority voting for directors | ◾ Shareholders representing at least 25% of outstanding shares are able to call special meetings

|

|

|

| BOARD OVERSIGHT | |

| ◾ Oversees the Company’s annual business plan and corporate strategy, succession planning and risk management

◾ Monitors the Company’s workplace culture, “tone at the top” and values

◾ Proactive, comprehensive and strategic Board and senior management succession planning

◾ Annual dedicated Board meeting focused on Company strategy

| ◾ Key management and rising talent reviewed at an annual talent review

◾ Director access to experts and advisors, both internal and external

◾ The Audit and Compliance Committee oversees the integrity of the Company’s financial statements and legal and regulatory compliance

◾ The Nominating, Governance and Public Responsibility Committee oversees Environmental, Social and Governance (ESG) matters

| ◾ The Compensation and Benefits Committee oversees the Company’s strategies relating to diversity, equity, and inclusion initiatives as well as key talent metrics

◾ Risk-aware culture overseen by the Risk Committee, which also oversees cybersecurity and ESG risks

|

|

|

| STRONG CORPORATE GOVERNANCE PRACTICES | |

| ◾ Prohibition of hedging and

◾ Sound policy on public company

◾ Responsive, active and ongoing shareholder engagement

◾ Strategic succession planning resulting in regular Board and committee refreshment with a range of tenures

| ◾ Robust Code of Business Conduct for

◾ Annual written Board and committee performance evaluations

◾ Comprehensive clawback policy for senior executives

◾ Robust annual risk assessment of executive compensation programs, policies and practices | ◾ Significant share ownership requirements for senior executives and directors

◾ Mandatory retirement age of 72

◾ Strong commitment to ESG, including net-zero carbon emissions by 2035

|

|

| |||||

◾ Wide-ranging and comprehensive director onboarding program along with robust continuing educational programs

| ||||||||||

For a detailed discussion of our corporate governance framework and our director nominees, please see “Corporate Governance at American Express” beginning on page 6.

| 2022 PROXY STATEMENT | 6 • |

Corporate Governance at American Express

Item 1: Election of Directors for a Term of One Year

Our Board currently has 15 members. Fourteen of our directors are standing for re-election to hold office until the next Annual Meeting of Shareholders or until their successors are duly elected and qualified. One of our current directors, Ronald A. Williams, is retiring and not standing for re-election. For more information, please see “Our Retiring Director” on page 14. Our Board has appointed Laureen E. Seeger, Richard Starr and Kristina V. Fink as proxies to vote your shares on your behalf. The proxies intend to vote for the election of each of the 14 candidates nominated by the Board unless you indicate otherwise on your proxy or voting instruction form or when you vote by telephone or online. Each candidate has consented to being named in this proxy statement and serving as a director, if elected. However, if any nominee is not able to serve, the Board can either nominate a different person or reduce the size of the Board. If the Board nominates another individual, the persons named as proxies may vote for that nominee.

Our director nominees hold and have held senior positions as leaders of various large, complex businesses and organizations and in government, demonstrating their ability to develop and execute significant policy and operational objectives at the highest levels. Our nominees include current and former chief executive officers, chief financial officers, chief operating officers and members of senior management of large, global businesses. Through these roles, our nominees have developed expertise in core business strategy, operations, finance, human capital management and leadership development, compliance, controls and risk management, as well as the skills to respond to rapidly evolving business environments and foster innovation and business transformation. Additionally, our nominees’ experience serving in government and on other public, private and non-profit boards bring valuable knowledge and expertise, including in the areas of public policy, ESG, succession planning, compensation, cybersecurity, financial reporting and regulatory compliance.

Detailed biographical information for each director nominee follows. We have included career highlights, other public directorships and select professional and community contributions along with the top qualifications, experience, skills and expertise that we believe each director brings to our Board. Our Board considered all of the aforementioned attributes and the results of our annual board evaluations when deciding to re-nominate the following directors.

| 2022 PROXY STATEMENT | 7 • |

| Thomas J. Baltimore

|

Director since 2021 | Independent | Age 58 Committee: Audit and Compliance | ||||

Career Highlights

◾ Chairman and CEO of Park Hotels & Resorts, Inc. (2016-present), an NYSE-listed lodging real estate investment trust (REIT) focused on upper-upscale and luxury hotel assets with 60 assets owned in the U.S.

◾ Former President, CEO and Director of RLJ Lodging Trust (2011-2016), an NYSE-listed lodging REIT focused on premium branded hotels in the U.S.

Specific Qualifications, Experience, ◾ Public company CEO ◾ Hospitality and real estate industry expert ◾ Core business, operations and management ◾ Financial accounting expertise ◾ Public company governance | Other Current Public Directorships ◾ Park Hotels & Resorts, Inc. ◾ Prudential Financial Inc.

Other Public Directorships in the Past Five Years ◾ AutoNation ◾ Duke Realty Corporation ◾ RLJ Lodging Trust

Select Professional and Community Contributions ◾ Executive Committee Member, American Hotel & Lodging Association ◾ Director, University of Virginia Investment Management Company ◾ Executive Board Member, National Association of Real Estate Investment Trusts ◾ Director, The Real Estate Roundtable |

| Charlene Barshefsky

|

Director since 2001 | Independent | Age 71 Committee: Risk | ||||

Career Highlights

◾ Former Senior International Partner at WilmerHale (2001-2021), where she advised U.S. and international companies on international business transactions, government relations, market access, and foreign government regulation of business and investments

◾ Former U.S. Trade Representative and member of President Clinton’s Cabinet, where she served as chief trade negotiator and principal trade policymaker for the United States, negotiating complex market access, regulatory and investment agreements with virtually every major country in the world | Specific Qualifications, Experience, ◾ High-level government service ◾ Expertise negotiating with foreign governments ◾ Advisor to firms on doing business in international markets ◾ Broad legal and public policy experience ◾ Public company governance

Other Current Public Directorships ◾ The Estée Lauder Companies Inc. ◾ Stagwell Inc. (fka MDC Partners Inc.)

Other Public Directorships in the Past Five Years ◾ Starwood Hotels & Resorts Worldwide, Inc. ◾ Intel Corporation

Select Professional and Community Contributions ◾ Trustee, Howard Hughes Medical Institute ◾ Member, Council on Foreign Relations |

| 2022 PROXY STATEMENT | 8 • |

| John J. Brennan

|

Director since 2017 | Lead Independent Director | Age 67 Committees: Audit and Compliance | Compensation and Benefits (Chair)

| ||||

Career Highlights

◾ Chairman Emeritus and Senior Advisor of The Vanguard Group, Inc. (2010-present), a global investment management company

◾ Former CEO, CFO and Chairman of the Board of The Vanguard Group, Inc.

◾ Former Chairman of the Board of Governors of The Financial Industry Regulatory Authority (FINRA), a U.S. financial services industry regulator

◾ Former Chairman of the Financial Accounting Foundation, an overseer of financial accounting and reporting standard-setting boards | Specific Qualifications, Experience, ◾ Core business, operations and management ◾ CFO and financial accounting expertise ◾ Risk and audit oversight ◾ Financial industry operations and regulation ◾ Institutional investor perspective

Other Current Public Directorships ◾ None

Other Public Directorships in the Past Five Years ◾ General Electric Company ◾ LPL Financial Holdings, Inc.

Select Professional and Community Contributions ◾ Chairman, Board of Trustees of the University of Notre Dame ◾ Chairman, Vanguard Charitable Endowment Program ◾ Founding Trustee, King Abdullah University of Science and Technology |

| Peter Chernin

|

Director since 2006 | Independent | Age 70 Committees: Compensation and Benefits | Nominating, Governance and Public Responsibility (Chair)

| ||||

Career Highlights

◾ Founder and CEO of Chernin Entertainment (2009-present), a film and television production company, and The Chernin Group, LLC, which focuses on strategic opportunities in media, technology and entertainment

◾ Co-Founder and Partner of TCG, a multi-stage investment firm dedicated to building consumer businesses

◾ Former President, Chief Operating Officer and director of News Corporation

◾ Former Chairman and CEO of the Fox Group, where he oversaw the global operations of the company’s film, television, satellite cable and digital media businesses | Specific Qualifications, Experience, ◾ Core business, operations and management ◾ Experience building global media businesses ◾ Digital business development ◾ Brand and marketing expertise ◾ Public company governance

Other Current Public Directorships ◾ None

Other Public Directorships in the Past ◾ Pandora Media, Inc. ◾ Twitter, Inc.

Select Professional and Community Contributions ◾ Co-Chairman and Co-Founder, Malaria No More ◾ Director and Co-chair, Board of Visitors of the University of California, Berkeley ◾ Former Director, Harvard AIDS Initiative |

| 2022 PROXY STATEMENT | 9 • |

| Ralph de la Vega

|

Director since 2016 | Independent | Age 70 Committees: Audit and Compliance (Chair) | Compensation and Benefits

| ||||

Career Highlights

◾ Chairman of the De la Vega Group (2018-present)

◾ Former Vice Chairman of AT&T Inc. and CEO of Business Solutions and International (2016), where he led AT&T’s Integrated Business Solutions group (both mobile and IP services), which served nearly all of the Fortune 1000 firms globally, AT&T’s Mexican wireless business and DIRECTV Latin America

◾ Former President and CEO of AT&T Mobile and Business Solutions (2014-2016)

◾ Former CEO of AT&T Mobility

◾ Former Chief Operating Officer of Cingular Wireless

Specific Qualifications, Experience, Skills ◾ Core business, operations and management ◾ Global business leader ◾ Extensive business experience in Latin America ◾ Digital and mobile technology expertise ◾ Financial accounting expertise | Other Current Public Directorships ◾ Amdocs Ltd.

Other Public Directorships in the Past ◾ None

Select Professional and Community ◾ Former Chairman and Current Director, Junior Achievement Worldwide ◾ Director, Latino Donor Collaborative ◾ Former Executive Board Member, Boy Scouts of America |

| Michael O. Leavitt

|

Director since 2015 | Independent | Age 71 Committees: Audit and Compliance | Nominating, Governance and Public Responsibility

| ||||

Career Highlights

◾ Founder and Chairman of Leavitt Partners, LLC (2009-present), a health care consulting firm, and Chairman of Leavitt Equity Partners, a private equity fund

◾ Former U.S. Secretary of Health and Human Services

◾ Former Administrator of the U.S. Environmental Protection Agency

◾ Former Governor of Utah

Specific Qualifications, Experience, Skills ◾ Extensive government experience ◾ Core business, operations and management ◾ Broad public policy experience ◾ Regulatory experience ◾ Public company governance | Other Current Public Directorships ◾ Royal Caribbean Cruises Ltd.

Other Public Directorships in the Past ◾ HealthEquity, Inc. ◾ Medtronic, Inc.

Select Professional and Community ◾ Board of Advisors, Center for Presidential Transition, Washington D.C. |

| 2022 PROXY STATEMENT | 10 • |

| Theodore J. Leonsis

|

Director since 2010 | Independent | Age 66 Committees: Compensation and Benefits | Nominating, Governance and Public Responsibility

| ||||

Career Highlights

◾ Founder, Chairman and CEO of Monumental Sports & Entertainment, LLC (2010-present), a sports, entertainment, media and technology company that owns the NBA’s Washington Wizards, NHL’s Washington Capitals, the WNBA’s Washington Mystics, the Capital City Go-Go, Wizards District Gaming, Caps Gaming and the Capital One Arena in Washington, D.C.

◾ Former Vice Chairman Emeritus of AOL LLC, a leading global ad-supported web company

◾ Former Chairman of Revolution Money, Inc., acquired by American Express in January 2010

Specific Qualifications, Experience, Skills ◾ Successful innovator and entrepreneur ◾ Core business, operations and management ◾ Expertise in social media and digital trends ◾ Brand and marketing expertise ◾ Public company governance | Other Current Public Directorships ◾ Groupon, Inc.

Other Public Directorships in the Past ◾ None

Select Professional and Community ◾ Chairman, D.C. College Access Program, Inc. ◾ Co-Founder and Vice-Chair, Greater Washington Partnership ◾ Co-Founder and Co-Executive Chairman, aXiomatic Gaming ◾ Council Member, National Museum of African American History and Culture |

| Karen L. Parkhill

|

Director since 2020 | Independent | Age 56 Committees: Audit and Compliance | Risk (Chair)

| ||||

Career Highlights

◾ Executive Vice President and Chief Financial Officer of Medtronic, Inc. (2016-present), where she leads the global finance organization and key supporting functions including Treasury, Controller, Tax, Internal Audit, Investor Relations, Business Development, Information Technology and Enterprise Business Services

◾ Former Vice Chairman and Chief Financial Officer of Comerica Inc. (2011-2016), where she directly managed the Finance department overseeing Accounting, Business Finance, Corporate Planning and Development, Investor Relations, Treasury and Economics, with responsibility for all financial reporting

◾ Former Chief Financial Officer of the Commercial Banking business at JP Morgan Chase and Co.

Specific Qualifications, Experience, Skills ◾ Public company CFO ◾ Financial accounting expertise ◾ Banking industry expertise ◾ Core business, operations and management ◾ Risk and audit oversight | Other Current Public Directorships ◾None

Other Public Directorships in the Past ◾ Comerica Inc.

Select Professional and Community ◾ Former Member, International Women’s Forum ◾ Former National Trustee, Boys and Girls Clubs of America ◾ Former Director, Methodist Health System |

| 2022 PROXY STATEMENT | 11 • |

| Charles E. Phillips

|

Director since 2020 | Independent | Age 62 Committee: Risk | ||||

Career Highlights

◾ Managing Partner and Co-Founder of Recognize (2020-present), a technology private equity firm

◾ Former Chairman and CEO of Infor, Inc. (2010-2020), an enterprise software application provider

◾ Former President of Oracle Corporation

Specific Qualifications, Experience, Skills ◾ Technology industry expertise ◾ Core business, operations and management ◾ Financial services industry and investment expertise ◾ Risk oversight ◾ Regulatory experience | Other Current Public Directorships ◾ Paramount Global

Other Public Directorships in the Past ◾ BancoSantander SA

Select Professional and Community ◾ Former Director, Federal Reserve Bank of New York ◾ Director, Apollo Theater ◾ Director, Council on Foreign Relations

|

| Lynn A. Pike

|

Director since 2020 | Independent | Age 65 Committee: Compensation and Benefits | ||||

Career Highlights

◾ Former President of Capital One Bank (2007-2012) and a former member of the Capital One Executive Committee

◾ Former President of Business Banking at Bank of America, as well as the former President of California for that corporation

Specific Qualifications, Experience, Skills ◾ Unique perspective as Co-Chair of the Board of Directors of American Express National Bank ◾ Banking industry expertise ◾ Core business, operations and management ◾ Payments and network industry expertise ◾ Regulatory experience | Other Current Public Directorships ◾ Hiscox Ltd.

Other Public Directorships in the Past ◾ None

Select Professional and Community ◾ Co-Chair, Board of Directors of American Express National Bank ◾ Director, Hiscox USA (HICI) ◾ Director, BankWork$ ◾ Director, California State University Channel Islands Foundation

|

| 2022 PROXY STATEMENT | 12 • |

| Stephen J. Squeri

|

Director since 2018 | Chairman and CEO since 2018 | Age 63 Committees: None

| ||||

Career Highlights

◾ Chairman and CEO of American Express Company (2018 to present)

◾ Mr. Squeri has held many positions during his 36 years at American Express, including Vice Chairman, Group President of Global Corporate Services, Group President of Global Services and Executive Vice President and Chief Information Officer

Specific Qualifications, Experience, Skills ◾ Unique perspective as Company CEO ◾ Global business leader ◾ Core business, operations and management ◾ Payments and network industry expertise ◾ Expertise in digital and mobile innovation | Other Current Public Directorships ◾ None

Other Public Directorships in the Past ◾ None

Select Professional and Community ◾ Chair, Business Roundtable Corporate Governance Committee ◾ Trustee, Valerie Fund ◾ Trustee, Manhattan College ◾ Member, Board of Governors of Monsignor McClancy Memorial High School |

| Daniel L. Vasella

|

Director since 2012 | Independent | Age 68 Committees: Compensation and Benefits | Nominating, Governance and Public Responsibility

| ||||

Career Highlights

◾ Honorary Chairman and former Chairman and CEO of Novartis AG (1996-2013), a company that engages in the research, development, manufacture and marketing of health care products worldwide

◾ Former CEO and Former Chief Operating Officer, Senior Vice President, Head of Worldwide Development and Head of Corporate Marketing at Sandoz Pharma Ltd.

◾ Chairman, Numab Therapeutics AG

Specific Qualifications, Experience, Skills ◾ Core business, operations and management ◾ Finance, investment and M&A experience ◾ Global business leader ◾ Led a highly regulated business ◾ Public company governance | Other Current Public Directorships ◾ PepsiCo, Inc. ◾ SciClone Pharmaceuticals, Inc.

Other Public Directorships in the Past ◾ None

Select Professional and Community ◾ Foreign Honorary Member, American Academy of Arts and Sciences ◾ Former Trustee, Carnegie Endowment for International Peace ◾ Former Member, International Business Leaders Advisory Council for the Mayor of Shanghai

|

| 2022 PROXY STATEMENT | 13 • |

| Lisa W. Wardell

|

Director since 2021 | Age 52 Committee: Risk | ||||

Career Highlights

◾ Executive Chairman of Adtalem Global Education Inc. (2021-present), where she leads the board of directors and helps guide Adtalem’s mission and strategy, as well as representing Adtalem and interacting with key stakeholders to help advance Adtalem’s mission

◾ Former CEO and Chairman of Adtalem Global Education, Inc. (2016-2021), where she oversaw the strategic repositioning of Adtalem’s portfolio, successfully acquiring and integrating companies in Adtalem’s financial services vertical, and led turnarounds and divestitures of Adtalem’s non-core assets

◾ Former Executive Vice President and Chief Operating Officer for The RLJ Companies (2004-2016), where she was responsible for managing The RLJ Companies portfolio, including strategic partnerships, mergers and acquisitions, business strategy, operations and finance

| Specific Qualifications, Experience, ◾ Core business, operations and management ◾ Risk oversight ◾ Finance, investment and M&A experience ◾ Public company governance ◾ Experience building global education business

Other Current Public Directorships ◾ Adtalem Global Education Inc.

Other Public Directorships in the Past ◾ Christopher and Banks, Inc. ◾ Lowe’s Companies, Inc. ◾ THINK450

Select Professional and Community ◾ Member, The Business Council ◾ Member, The Executive Leadership Council ◾ Member, CEO Action for Diversity and Inclusion |

| Christopher D. Young

|

Director since 2018 | Independent | Age 50 Committees: Nominating, Governance and Public Responsibility | Risk

| ||||

Career Highlights

◾ Executive Vice President – Business Development, Strategy and Ventures of Microsoft Corp. (2020-present), responsible for developing Microsoft’s global business development strategies that drive growth across the company

◾ Former CEO of McAfee, LLC (2017-2020), one of the world’s leading independent cybersecurity companies

◾ Former Senior Vice President and General Manager at Intel Security Group (2014-2017), where he led the initiative to spin out McAfee

Specific Qualifications, Experience, Skills ◾ Cybersecurity expert ◾ Core business, operations and management ◾ Experience in national security and emergency preparedness ◾ Product development and marketing experience ◾ Risk oversight | Other Current Public Directorships ◾ None

Other Public Directorships in the Past ◾ Rapid7, Inc. ◾ Snap Inc.

Select Professional and Community ◾ Member, CISA Cybersecurity Advisory Committee ◾ Former Member, President’s National Security Telecommunications Advisory Committee ◾ Former Director, Cyber Threat Alliance ◾ Former Member, Board of Trustees of Princeton University

|

| 2022 PROXY STATEMENT | 14 • |

Ronald A. Williams is retiring from our Board at the end of his current term and, therefore, will not stand for reelection at our Annual Meeting of Shareholders. We thank Mr. Williams for his years of dedicated service and wish him continued success in the future.

As illustrated by the director biographies on the previous pages, our Board is made up of a diverse group of leaders with substantial experience in their respective fields. Our Board believes that the combination of the various skills, qualifications and experiences of the director nominees contributes to an effective and well-functioning Board and that, individually and as a whole, the director nominees possess the necessary qualifications to provide effective oversight and insightful strategic guidance.

We continually review our Board’s composition to identify the skills needed for our Company both in the near term and into the future. Ongoing strategic board succession planning, along with our mandatory retirement age for directors, ensures that the Board continues to maintain an appropriate mix of objectivity, skills and experiences to provide fresh perspectives and effective oversight and guidance to management, while leveraging the institutional knowledge and historical perspective of our longer-tenured directors. Over the next few years, several of our current Board members will retire due to our mandatory retirement age. With this in mind, our Board has been actively engaged in succession planning and added two new members in 2021. We believe that increasing the size of our Board in the short term to allow for knowledge transfer and information sharing between our newer directors and our retiring directors will help ensure an orderly and effective Board succession process over the next few years.

Ideal Director Nominee Attributes

The Nominating, Governance and Public Responsibility Committee assesses potential candidates based on their history of achievement, the breadth of their business experiences, whether they bring specific skills or expertise in areas that the committee has identified as desired and whether they possess personal attributes and experiences that will contribute to the sound functioning of our Board.

Diversity is also a key consideration in our nomination and succession planning processes. Our Corporate Governance Principles provide that the Board should be diverse, engaged and independent. When reviewing potential board nominees, the Nominating, Governance and Public Responsibility Committee considers the holistic diversity of the Board, including gender, race, ethnicity, age, sexual orientation and nationality, and does not discriminate on any basis. Specifically, we seek individuals who:

| ◾ | have established records of significant accomplishment in leading global businesses and large, complex organizations |

| ◾ | have achieved prominence in their fields and possess skills or significant experience in areas of importance to our business strategy and expected future business needs |

| ◾ | possess integrity, independence, energy, forthrightness, strong analytical skills and the commitment to devote the necessary time and attention to the Company’s affairs |

| ◾ | demonstrate they can constructively challenge and stimulate management and exercise sound judgment |

| ◾ | demonstrate a willingness to work as part of a team in an atmosphere of trust and candor and a commitment to represent the interests of all shareholders rather than those of a specific constituency |

| ◾ | will contribute to the diversity of skills, experience and backgrounds on our Board |

Process for Identifying and Adding New Directors

The Nominating, Governance and Public Responsibility Committee uses a professional search firm to help identify, evaluate and conduct due diligence on potential director candidates. Using a professional search firm supports the committee in conducting a broad search and looking at a diverse pool of potential candidates. The committee also maintains an ongoing list of potential candidates and considers recommendations made by the Board’s independent directors.

In addition, the Nominating, Governance and Public Responsibility Committee considers all shareholder recommendations for director candidates and applies the same standards in considering candidates submitted by shareholders as it does in evaluating all other candidates. Shareholders can recommend candidates by writing to the committee in care of the Company’s Corporate Secretary and Chief Governance Officer, whose contact information is on page 30. Shareholders who wish to submit nominees for election at an annual or special meeting of shareholders should follow the procedure described on page 87.

| 2022 PROXY STATEMENT | 15 • |

The Nominating, Governance and Public Responsibility Committee identifies and adds new directors using the following process:

1 | Collect Candidate Pool |

| Independent search firms |

| Independent director recommendations |

| Shareholder recommendations |

2 | Holistic Candidate Review |

Potential candidates are comprehensively reviewed and the subject of rigorous discussion during Nominating, Governance and Public Responsibility Committee meetings and Board meetings.

The candidates that emerge from this process are interviewed by members of the Nominating, Governance and Public Responsibility Committee and other Board members, including the Chairman and Lead Independent Director.

| During these meetings, directors assess candidates on the basis of their skills and experience, their personal attributes and their expected contribution to the diversity of skills, experiences and backgrounds on our Board. |

| Extensive due diligence is conducted by third parties, including soliciting feedback from other directors and applicable persons outside the Company. |

3 | Recommendation to the Board |

| The Nominating, Governance and Public Responsibility Committee presents qualified candidates to the Board for review and approval. |

| Seven New Independent Directors Added Since 2017

| ||

| Racial, ethnic and gender diversity

| |

| Current and former CEOs

Current and

| |

| Regulatory

| |

| Global business leaders

| |

| Investment and

| |

| Technology and cybersecurity expertise

| |

| Hospitality industry expertise

| |

| Financial services, banking and payments industry expertise | |

| 2022 PROXY STATEMENT | 16 • |

The Company maintains a comprehensive director onboarding program. In light of the COVID-19 pandemic, the Company’s director onboarding program was transitioned to a virtual experience to facilitate the seamless integration of new directors into their roles, all while maintaining consistency, integrity and efficiency within the Company’s existing onboarding process. The Company’s virtual director onboarding program includes all elements of the in-person experience and each onboarding session is individually tailored to take into account a director’s prior experience and background. New processes were developed for the virtual environment to introduce new directors and facilitate integration on the Board.

Our Board continually seeks to improve its performance. Our Lead Independent Director has regular one-on-one discussions with our Board members and conveys their feedback on an ongoing basis to our Chairman. Separately, our Chairman, Chief Legal Officer, and Corporate Secretary and Chief Governance Officer each routinely communicates with our Board members to obtain real-time feedback.

Our Nominating, Governance and Public Responsibility Committee oversees the formal annual evaluation process of the effectiveness of our Board and its standing committees. Conducting a robust annual evaluation process allows the Board to assess its performance and practices and identify areas for improvement. As part of the evaluation process, our Board analyzes and assesses the performance of both the Chairman and the Lead Independent Director, as well as the culture of the Board.

Our annual Board evaluations cover several areas, including the following:

| Board efficiency and overall effectiveness |

| Board and committee structure |

| Board and committee composition |

| Satisfaction with the performance of the Chairman |

| Satisfaction with the performance of the Lead Independent Director |

| Board member access to the Lead Independent Director, CEO and other members of senior management |

| Quality of Board discussions and balance between presentations and discussion |

| Quality and clarity of materials presented to directors |

| Board and committee information needs |

| Satisfaction with Board agendas and the frequency and format of meetings and time allocations |

| Areas where directors want to increase their focus |

| Board dynamics and culture |

| Board and committee access to experts and advisors |

| Satisfaction with the format of the evaluation |

Our Board plans to periodically engage an independent third-party evaluation firm as we have in the past to augment the Board’s annual evaluation process.

We believe that this continuous feedback cycle, along with our formal annual evaluation process, contributes to the overall functioning and ongoing effectiveness of our Board.

| 2022 PROXY STATEMENT | 17 • |

Below is a summary of our Board evaluation process: |

| 1 | ||||

Annual Board and Committee Evaluations

The process, including evaluation method, is reviewed annually by the Nominating, Governance and Public Responsibility Committee.

Written questionnaires are used for the Board and each standing committee and are updated and tailored each year to address the significant processes that drive Board effectiveness. Each director completes a written questionnaire on an unattributed basis for the Board and for each committee on which they serve. The questionnaires include open-ended questions and space for candid commentary. |

| 2 | ||||

Summary of the Written Evaluations

Reports are produced summarizing the written questionnaires, which include all responses and highlight year-over-year trends.

All comments are unattributed, included verbatim and shared with the full Board and each applicable committee. |

| 3 | ||||

Board and Committee Review

The Chair of the Nominating, Governance and Public Responsibility Committee leads a discussion of the written Board and committee evaluation results at the Board level. Separately, each committee chair leads a discussion of the applicable written committee evaluation at each committee meeting and reports on their discussions to the full Board.

Directors also deliver feedback to the Lead Independent Director and Chairman of the Board and suggest changes and areas for improvement. |

| 4 | ||||

Actions taken in response to the evaluation process over the years include:

◾ Streamlined Board committee structure and meeting cadence;

◾ Board meetings in international locations with Company site visits are under consideration when permitted by health and travel conditions;

◾ Director onboarding program was modified and enhanced;

◾ Management with varying degrees of seniority present to the Board and its committees;

◾ Information and materials regularly provided to directors continue to evolve to alleviate “information overload” and to enable directors to focus on the key data;

◾ Format of Board meetings has been altered to enable more time for director discussion with and without the CEO present;

◾ Number of informal meetings between directors and key executives has been increased;

◾ Increased time for informal director-only gatherings;

◾ Director education and presentations on emerging risk areas, corporate governance, industry disruptors and competitors; and

◾ Board members added with expertise in areas critical to the Company’s business strategy and operations. |

| 2022 PROXY STATEMENT | 18 • |

Our Board Leadership Structure

We believe that strong independent leadership is essential for our Board to effectively perform its primary oversight functions. We also believe it is critically important for our Board to retain flexibility to determine its leadership structure based on the particular composition of the Board, the individuals serving in leadership positions, the needs and opportunities of the Company as they change over time and considerations such as continuity of leadership, sound succession planning and the additional factors described below.

The Board believes that a combined Chairman and CEO role allows the Company to effectively convey its business strategy and core values to shareholders, customers, colleagues, regulators and the public in a single, consistent voice. The Board also recognizes the necessity of having a strong Lead Independent Director with a clearly defined role and set of responsibilities (as detailed below) where there is a combined Chairman and CEO or where the Chairman is not independent. Their leadership is supplemented by engaged and expert committee chairs along with independent-minded, skilled and committed directors.

The Board’s succession planning discussions surrounding the recent changes in the Lead Independent Director role included extensive discussions of the Board’s leadership structure. Further, our Board and Nominating, Governance and Public Responsibility Committee recently completed its annual review of the Board’s leadership structure and considered the insightful, effective and sound leadership provided by Mr. Brennan as well as the tangible benefits of having a Chairman and CEO with an operational focus and extensive company experience given the global and complex nature of our business. In addition, the review also considered how the Company’s robust corporate governance practices combined with the Board’s current leadership structure helps to ensure both clear, strategic alignment throughout the Company and independent oversight of management. Taking all of this into account, our Board continues to believe that our current structure, led by Messrs. Squeri and Brennan, allows the Board to focus on key strategic, policy and operational issues, provides critical and effective leadership (both internally and externally), and creates an environment in which the Board can work effectively and appropriately challenge management, all of which we believe will benefit the long-term interests of our shareholders.

Strong Lead Independent Director with Defined Role and Responsibilities

John J. Brennan was elected by the independent directors of our Board to serve as Lead Independent Director, effective September 26, 2021. Mr. Brennan succeeds Ronald A. Williams, who has reached our mandatory retirement age and will not stand for reelection at our annual meeting.

Mr. Brennan joined our Board in 2017. During his tenure as a Board member, Mr. Brennan has established strong and effective working relationships with his fellow directors and garnered their trust and respect. Furthermore, he has demonstrated strong leadership skills, independent thinking and a deep understanding of our business. In connection with his election to Lead Independent Director, Mr. Brennan rejoined our Compensation and Benefits Committee as Chair. He was the Chair of the Risk Committee up until his election and was succeeded in that role by Ms. Parkhill. He remains a member of the Audit and Compliance Committee.

Mr. Brennan was selected to serve as Lead Independent Director as a result of a vigorous vetting process led by the Nominating, Governance and Public Responsibility Committee, which included extensive discussions of potential candidates with all members of the Board to seek input and reach alignment. These robust discussions took into account independent director tenures and committee membership histories along with a potential candidate’s willingness and capacity to serve as Lead Independent Director, understanding that the position entails significant responsibility. The Board recognizes that in circumstances like ours where the positions of Chairman and CEO are combined, a strong Lead Independent Director with a clearly defined role and set of responsibilities is paramount for constructive and effective leadership. Therefore, the position of Lead Independent Director at American Express comes with a clear mandate and significant authority and responsibilities that are detailed as follows in our Board-approved Corporate Governance Principles:

| Preside at all meetings of the Board at which the Chairman is not present, including the executive sessions of the independent directors, and apprise the Chairman of the issues considered and decisions reached at those sessions; |

| Call additional meetings of the independent directors as needed; |

| Lead the Board in putting forth its expectations for “tone at the top”; |

| Meet regularly with the Chairman and serve as a liaison between the Chairman and the independent directors; |

| Facilitate effective and candid communication to optimize Board performance; |

| Serve as the Chair of the Compensation and Benefits Committee; |

| Coordinate with the Chair of the Nominating, Governance and Public Responsibility Committee (as needed) to recruit and interview qualified candidates for the Board; |

| Lead the annual evaluation of the Chairman and Chief Executive Officer, and together with the Chair of the Nominating, Governance and Public Responsibility Committee, the evaluation of the performance and effectiveness of the Board; |

| Advise the Chairman of the Board’s informational needs, participate in the setting of Board meeting agendas, including requesting the inclusion of additional agenda items at his or her discretion, and review and approve the types of information sent to the Board; |

| Review and approve the schedule of Board meetings to ensure there is sufficient time for discussion of all agenda items; |

| Monitor and coordinate with the Chairman on appropriate governance issues and developments; |

| Be available as appropriate for consultation and direct communication with major shareholders; |

| 2022 PROXY STATEMENT | 19 • |

| Advise and meet with the Chairs of each Committee of the Board as needed to assist with the fulfillment of each such Committee Chair’s responsibilities to the Board; and |

| Consult with the Chair of the Nominating, Governance and Public Responsibility Committee and the Board on succession planning and appointments for each Committee of the Board. |

In addition, all Board members are encouraged to propose the inclusion of additional Board agenda items that they deem necessary or appropriate in carrying out their duties. All Board members have direct access to the Chairman and to the Lead Independent Director.

Our Board’s Primary Role and Responsibilities, Structure and Processes

Our Board bears the responsibility for the oversight of management on behalf of our shareholders in order to ensure long-term value creation. In that regard, the primary responsibilities of our Board include, but are not limited to (i) oversight of the Company’s annual business plan and development of the Company’s strategy, including strategic objectives for the Company’s businesses, (ii) ongoing succession planning and talent management, including the review of the results of the Company’s Annual Colleague Experience Survey and (iii) risk management, including the oversight of the development of the Company’s risk appetite.

How our Board Oversees our Annual Business Plan and Corporate Strategy

Our Board is responsible for overseeing the development of the Company’s strategy, which articulates the Company’s strategic objectives for its businesses; helps establish and maintain an effective risk management structure and control function; and provides direction to senior management to determine which business opportunities to pursue. At the beginning of each year, our senior management presents our consolidated annual business plan to the Board, and the Board discusses the Company’s results relative to the plan periodically throughout the year. The Board holds senior management accountable for effectively implementing the Company’s strategy consistent with its risk appetite, while maintaining an effective risk management framework and system of internal controls. In 2021, in addition to continuing to analyze and oversee the impact of the COVID-19 pandemic on the Company’s strategy and performance throughout the year, our Board engaged in a virtual three-day meeting (in place of our in-person off-site meeting) to conduct a deep dive into the Company’s strategic goals, timeline to achieve these goals and execution plans.

| 2022 PROXY STATEMENT | 20 • |

How our Board Engages in Ongoing CEO and Key Executive Succession Planning

Our Board ensures that we have the right management talent to pursue our strategies successfully.

The entire Board is involved in the critical aspects of the CEO succession planning process, including establishing selection criteria that reflect our business strategies, identifying and evaluating potential internal candidates and making key management succession decisions. Succession and development plans are regularly discussed with the CEO as well as without the CEO present in executive sessions of the Board. The Board makes sure that it has adequate opportunities to meet with and assess development plans for potential CEO and senior management successors to address identified gaps in skills and attributes. This occurs through various means, including informal meetings, Board dinners, presentations to the Board and committees, attendance at Board meetings and the comprehensive annual talent review. In addition, the Board has developed an emergency CEO succession plan.

The Board also oversees management’s succession planning for other key executive positions. Our Board calendar includes at least one meeting each year at which the Board conducts a detailed talent review, which includes a review of the Company’s talent strategies, leadership pipeline and succession plans for key executive positions.

Additionally, the detailed results of the Company’s Annual Colleague Experience Survey are reviewed each year with the Board. Our Annual Colleague Experience Survey provides insights into employee satisfaction, leadership efficacy, learning opportunities, and career development. The insights provided by the survey help improve the American Express colleague experience, workplace culture and business results. We believe that maintaining our strong workplace culture, adhering to our Blue Box Values and ensuring that our people feel included, valued, recognized and backed will help us attract, retain and develop the right talent to lead the Company and successfully execute our corporate strategy. Please see page 39 for additional information about our workplace culture.

| 2022 PROXY STATEMENT | 21 • |

How our Board Oversees Risk Management

Board of Directors

We are committed to Board-level risk management. Our Board monitors our “tone at the top” and risk culture and oversees emerging strategic risks. Risk management is overseen by our Board through three Board committees: Risk, Audit and Compliance and Compensation and Benefits. Each committee consists entirely of independent directors and provides regular reports to the Board regarding matters reviewed at their committee. The committees meet regularly in executive sessions with our Chief Financial Officer, Chief Legal Officer, Chief Risk Officer, Chief Compliance & Ethics Officer, Chief Audit Executive and other members of senior management with regard to our risk management processes, controls, talent and capabilities

Risk Committee

| Provides oversight of our enterprise risk management framework, processes and methodologies. Approves our Enterprise Risk Management policy, which covers risk governance, risk oversight and risk appetite, including credit risk, market risk, liquidity risk, operational risk, reputational risk, country risk, model risk, asset-liability management risk and strategic, business risk and ESG risk, including, but not limited to, climate change risk. Our Enterprise Risk Management policy: |

| ◾ | Defines the authorized risk limits to control exposures within our risk capacity and risk tolerance, including stressed forward-looking scenarios |

| ◾ | Establishes principles for risk taking in the aggregate and for each risk type, and is supported by a comprehensive system for monitoring limits, escalation triggers and assessing control programs |

| Reviews and concurs in the appointment, replacement, performance and compensation of our Chief Risk Officer |

| Receives regular updates from the Chief Risk Officer on key risks, transactions and exposures |

| Receives reports on cybersecurity and related risks at least twice a year |

| Reviews our risk profile against the tolerances specified in the Risk Appetite Framework, including significant risk exposures, risk trends in our portfolios and major risk concentrations |

| Provides oversight of management’s execution of capital management, liquidity planning and resolution planning |

| Monitors the quality and effectiveness of the Company’s technology security, data privacy and disaster recovery capabilities |

Audit and Compliance Committee

| Assists the Board in its oversight responsibilities relating to the integrity of our annual and quarterly consolidated financial statements and financial reporting process, internal and external auditing, including the qualifications and independence of the Company’s independent registered public accounting firm and the performance of our internal audit services function, and the integrity of our systems of internal control over financial reporting and legal and regulatory compliance |

| Provides oversight of our Internal Audit Department |

| Periodically reviews and discusses with management and the Company’s independent registered public accounting firm the Company’s accounting policies, critical accounting estimates and critical auditing matters |

| Reviews and concurs in the appointment, replacement, performance and compensation of our Chief Audit Executive and approves Internal Audit’s annual audit plan, charter, policies, budget and overall risk assessment methodology |

| Receives regular updates on the status of the audit plan and results including significant reports issued by Internal Audit and the status of our corrective actions |

| Reviews and approves our compliance policies, which include our Compliance Risk Tolerance Statement |

| Reviews the effectiveness of our Corporate-wide Compliance Risk Management Program |

| Appoints, replaces, reviews and evaluates the qualifications of the Company’s independent registered public accounting firm |

Compensation and Benefits Committee

| Works with the Chief Colleague Experience Officer and the Chief Risk Officer to ensure our overall compensation programs, as well as those covering our business units and risk-taking employees, appropriately balance risk with business incentives and that business performance is achieved without taking imprudent or excessive risk |

| ◾ | Our Chief Risk Officer is actively involved in setting goals, including for our business units |

| ◾ | Our Chief Risk Officer also reviews the current and forward-looking risk profiles of each business unit and provides input into performance evaluations |

| ◾ | Our Chief Risk Officer meets with the committee and attests as to whether performance goals and results have been achieved without taking imprudent risks |

| Uses a risk-balanced incentive compensation framework to decide on our bonus pools and the compensation of senior executives |

| 2022 PROXY STATEMENT | 22 • |

Board Oversight of Cybersecurity

We are a global financial services company and understand the substantial operational risks for companies in our industry as well as the importance of preserving the trust of our customers and protecting personal information. To that end, we have an extensive cybersecurity governance framework in place. Our Board receives reports on cybersecurity at least once a year and our Risk Committee receives reports on cybersecurity at least twice a year, including in at least one joint meeting with the Audit and Compliance Committee, and all receive ad hoc updates as needed. In addition, the Risk Committee annually approves the Company’s Information Security Program.

Our cybersecurity program is designed to protect the confidentiality, integrity and availability of information and information systems from unauthorized access, use, disclosure, disruption, modification or destruction. The program is built upon a foundation of advanced security technology, a well-staffed and highly trained team of experts, and robust operations based on the National Institute of Standards and Technology Cybersecurity Framework. This consists of controls designed to identify, protect, detect, respond to and recover from information and cybersecurity incidents. The framework defines risks and associated controls which are embedded in our processes and technology. Those controls are measured and monitored by a combination of subject matter experts and a security operations center with our integrated cyber detection, response and recovery capabilities.

Program Highlights

| We have a robust Cyber Crisis Response Plan in place that provides a documented framework for handling high-severity security incidents and facilitates coordination across multiple parts of the Company. |

| We deploy a defense-in-depth strategy with multiple layers of controls, including embedding security into our technology investments. |

| We invest in threat intelligence and are active participants in industry and government forums to improve sector cybersecurity defense. |

| We collaborate with our peers in the areas of threat intelligence, vulnerability management and response and drills. |

| We routinely perform simulations and drills at both a technical and management level. |

| We incorporate external expertise and reviews in all aspects of our program. |

| All colleagues receive annual cybersecurity awareness training. |

We continuously assess the risks and changes in the cyber environment and dynamically adjust our program and investments as appropriate.

How our Management Oversees Risk

We use our comprehensive Enterprise Risk Management program to identify, aggregate, monitor and manage risks. The program also defines our risk appetite, governance, culture and capabilities. The implementation and execution of the Enterprise Risk Management program is headed by our Chief Risk Officer.

There are several internal management committees, including the Enterprise Risk Management Committee (ERMC), chaired by our Chief Risk Officer. The ERMC is the highest-level management committee to oversee all firm-wide risks and is responsible for risk governance, risk oversight and risk appetite. It maintains the enterprise risk appetite framework and monitors compliance with limits and escalations defined in it. The ERMC oversees implementation of certain risk policies Company-wide. The ERMC reviews key risk exposures, trends and concentrations, and significant compliance matters, and provides guidance on the steps to monitor, control and report major risks.

Our Board’s current standing committee membership information is listed on the following pages. Effective March 9, 2022, our Board approved revisions to the membership of our standing committees (see page 3 for our Board’s current committee membership). The Compensation and Benefits Committee Chair and Risk Committee Chair reflected below assumed those positions in connection with the election of our new Lead Independent Director on September 26, 2021. Each current member of our standing committees and each member in 2021 was independent and fulfilled the requirements applicable to each committee on which he or she served.

| 2022 PROXY STATEMENT | 23 • |

Board Committee Responsibilities

Audit and Compliance Committee

| ||||||||

COMMITTEE HIGHLIGHTS

| 9 Meetings in 2021 | 2021 Members Thomas J. Baltimore John J. Brennan Ralph de la Vega (Chair) Michael O. Leavitt Karen L. Parkhill | Independence Each member of the committee is independent and financially literate. | Audit Committee Each of Mr. Brennan, Mr. de la Vega and Ms. Parkhill meet the | ||||

Role and Responsibilities ◾ Assists the Board in its oversight of the integrity of our consolidated financial statements and related financial reporting processes, and internal and external auditing, including the qualifications and the independence of the independent registered public accounting firm, the performance of the Company’s Internal Audit services function, the integrity of our systems of internal control over financial reporting, and legal and regulatory compliance. See page 45 under Report of the Audit and Compliance Committee for additional information regarding the duties of the committee with respect to oversight of our financial reporting process ◾ Appoints, replaces, reviews and evaluates the qualifications of the Company’s independent registered public accounting firm ◾ Oversees the process for the receipt, retention and treatment, on a confidential basis, of complaints we receive regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters ◾ Reviews and discusses reports from management regarding significant reported ethics violations under our Code of Conduct and other corporate governance policies ◾ Meets regularly in executive session with management, including with the Company’s Chief Financial Officer, Chief Legal Officer, Chief Compliance & Ethics Officer and Chief Audit Executive, and also with the Lead Engagement Partner from the Company’s independent registered public accounting firm

| ||||||||

Compensation and Benefits Committee

| ||||||||

COMMITTEE HIGHLIGHTS

| 6 Meetings in 2021 | 2021 Members John J. Brennan (Chair) Peter Chernin Ralph de la Vega Theodore J. Leonsis Lynn A. Pike Daniel L. Vasella Ronald A. Williams | Independence Each member of the committee is independent. | |||||

Role and Responsibilities ◾ Oversees the compensation of our executive officers and designated key employees, considering the results of the Company’s most recent Say on Pay vote ◾ Oversees our employee compensation plans and arrangements and employee benefit plans ◾ Approves an overall compensation philosophy and strategy for the Company and its executive officers, including the selection of performance measures that appropriately balance risk with business objectives, and the review of our compensation practices so business performance is achieved without taking imprudent or excessive risk, with appropriate input from the Company’s Chief Risk Officer ◾ Evaluates potential conflicts of interest with respect to its advisors ◾ The committee may delegate certain of its responsibilities to one or more of its members or to executive officers or designated senior executives, to the extent permissible under its charter, the Company’s bylaws, the terms of the applicable plans, laws, rules, regulations and listing standards, and subject to any limitations imposed by our Board from time to time ◾ Reviews strategies relating to diversity, equity, and inclusion as well as key talent metrics, and such other matters as the committee deems appropriate from time to time

Compensation and Benefits Committee Interlocks and Insider Participation ◾ Neither any current member of the committee nor any person who served as a member of the committee during the last fiscal year is a former or current officer or employee of the Company or any of its subsidiaries. Neither any current member of the committee nor any person who served as a member of the committee during the last fiscal year has any relationship required to be disclosed under this caption under the rules of the SEC.

| ||||||||

| 2022 PROXY STATEMENT | 24 • |

Nominating, Governance and Public Responsibility Committee

| ||||||||

COMMITTEE HIGHLIGHTS

| 5 Meetings in 2021 | 2021 Members Peter Chernin (Chair) Michael O. Leavitt Theodore J. Leonsis Daniel L. Vasella Ronald A. Williams Christopher D. Young | Independence Each member of the committee is independent. | |||||

Role and Responsibilities ◾ Considers and recommends candidates for election to the Board, consistent with criteria approved by the Board ◾ Provides oversight of and advice with respect to corporate governance matters at the Company consistent with the long-term best interests of the Company and its shareholders ◾ Advises the Board on director compensation ◾ Oversees the annual performance evaluation process for the Board and Board committees, including establishing criteria for evaluating their performance ◾ Advises the Board on Board leadership ◾ Considers feedback from shareholders regarding governance practices ◾ Administers the Related Person Transaction Policy ◾ Supports the Board with respect to CEO and management succession planning ◾ Reviews legislation, regulations and policies affecting us and the communities we serve, as well as our philanthropic programs, our political action committee, our corporate political contributions and our government relations activities ◾ Reviews the Company’s practices, positions, strategy, formal reporting, policies and programs on ESG matters, including those related to sustainability, climate change, human rights, social impact and philanthropy, and the impact those matters have on the Company’s business and key stakeholders

Political Engagement Activities We communicate with policymakers on public policy issues important to the Company. In addition to our advocacy efforts, we participate in the political process through the American Express Political Action Committee (AXP PAC) and through corporate political contributions in those jurisdictions where it is permissible. AXP PAC is funded solely by voluntary employee contributions and does not contribute to presidential campaigns. We maintain comprehensive compliance procedures to ensure that our activities are conducted in accordance with all relevant laws, and management regularly reports to the committee regarding its engagement in the public policy arena and its political contributions. Information regarding our Company’s political activities, including U.S. political contributions, may be found at | ||||||||

Risk Committee

| ||||||||

COMMITTEE HIGHLIGHTS

| 7 Meetings in 2021 | 2021 Members Charlene Barshefsky Karen L. Parkhill (Chair) Charles E. Phillips Lisa W. Wardell Christopher D. Young | Independence Each member of the committee is independent. | |||||

Role and Responsibilities ◾ Assists the Board in its oversight of the Company’s Enterprise Risk Management framework and roles and responsibilities of the three lines of defense, and other risk management policies and procedures established by management to identify, assess, measure and manage key risks facing the Company ◾ Assists the Board in its oversight of management’s execution of capital management, liquidity planning and resolution planning ◾ Monitors the quality and effectiveness of the Company’s information technology security ◾ Meets regularly in executive session with the Company’s Chief Risk Officer

Please see How our Board Oversees Risk Management on page 21 for additional information regarding the activities of the committee.

| ||||||||

| 2022 PROXY STATEMENT | 25 • |

Our Corporate Governance Framework

We have adopted Corporate Governance Principles that, together with the charters of the four standing committees of the Board (Audit and Compliance, Compensation and Benefits, Nominating, Governance and Public Responsibility and Risk), our Code of Conduct (which constitutes our code of ethics for colleagues) and the Code of Business Conduct for Members of the Board of Directors, provide our governance framework. Key governance policies and processes also include our Whistleblower Policy, our comprehensive Enterprise Risk Management Program, our commitment to transparent financial reporting and our systems of internal checks and balances. Comprehensive management policies, many of which are approved at the Board committee level, guide the Company’s operations.

Our Board, along with management, regularly reviews our Corporate Governance Principles and practices to ensure that they are appropriate and reflect our high standards and Blue Box Values. In reviewing our Corporate Governance Principles and making recommendations, the Nominating, Governance and Public Responsibility Committee considers the views of shareholders expressed to us in engagement meetings, as well as publicly available discourse on governance.

You may view the following documents by clicking on the “Corporate Governance” link found on our Investor Relations webpage at http://ir.americanexpress.com and then selecting “Governance Framework.” You may also access our Investor Relations webpage through our main website at www.americanexpress.com by clicking on the “About American Express” link, which is located at the bottom of the Company’s homepage. You may also obtain free copies of the following materials by writing to our Company’s Corporate Secretary and Chief Governance Officer:

| ◾ | Corporate Governance Principles |

| ◾ | Charters for each of the four standing Board committees |

| ◾ | Code of Conduct (which constitutes our code of ethics for colleagues) |

| ◾ | Code of Business Conduct for Members of the Board of Directors |

Majority Voting Standard for Director Elections

In a non-contested election, directors are elected by a majority of “for” votes cast by shareholders. A non-contested election is an election where the number of nominees is the same as the number of directors to be elected. If a director receives a greater number of votes “against” than votes “for” his or her election, the director is required to immediately submit his or her resignation to the Board. The Board, excluding such individual, will decide whether or not to accept such resignation and will promptly disclose and explain its decision in a Form 8-K filed with the SEC.

In a contested election, the director nominees who receive the plurality of votes cast are elected as directors. Under the plurality standard, the number of persons equal to the number of vacancies to be filled who receive more votes than other nominees are elected to the Board, regardless of whether they receive a majority of votes cast. An election is considered contested under our Certificate of Incorporation if there are more nominees than positions on the Board to be filled at the meeting of shareholders as of the fourteenth day prior to the date on which we file our definitive proxy statement with the SEC.

Our Policy on Director Outside Board Commitments