- AXP Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

American Express (AXP) DEF 14ADefinitive proxy

Filed: 15 Mar 24, 12:01pm

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

March 15, 2024 | ||||

|

|

| ||||||||||||

| WHEN |

| WHERE |

| RECORD DATE | |||||||||

Monday, May 6, 2024 |

www.virtualshareholdermeeting.com/ |

March 8, 2024 | ||||||||||||

| 9:00 a.m. Eastern Time | AXP2024 | |||||||||||||

Items of Business

To vote on the following proposals:

| Election of directors proposed by our Board of Directors for a term of one year, as set forth in this Proxy Statement

| |||

| Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024

| |||

| Advisory resolution to approve executive compensation (Say-on-Pay) | |||

|

Approval of the Second Amended and Restated American Express Company 2016 Incentive Compensation Plan

| |||

| Three shareholder proposals, if properly presented at the meeting

| |||

| Such other business that may properly come before the meeting

|

ADMISSION

We have decided to hold our Annual Meeting of Shareholders virtually to enhance access for shareholders. Shareholders will be able to listen, vote and submit questions via the virtual meeting website at www.virtualshareholdermeeting.com/AXP2024 by using the 16-digit control number included on your notice, on your proxy card or in the voting instructions that accompanied your proxy materials. Shareholders with control numbers who attend the Annual Meeting of Shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting, including the ability to ask questions.

Please retain the 16-digit control number should you decide to attend the virtual Annual Meeting. Shareholders without a control number may attend the Annual Meeting of Shareholders as a guest but they will not have the ability to vote or submit questions during the meeting. Attendees may begin logging in to the virtual meeting website at 8:45 a.m. Eastern Time.

Detailed information regarding our 2024 Annual Meeting of Shareholders, including how to cast your vote and ask questions before and during the meeting, can be found in “Other Information” starting on page 114 of this Proxy Statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 6, 2024:

Our Proxy Statement and Annual Report are available online at http://ir.americanexpress.com.* We will mail to certain shareholders a notice of internet availability of proxy materials, which contains instructions on how to access these materials and vote online. We expect to mail this notice and to begin mailing our proxy materials on or about March 15, 2024.

Even if you do not plan to attend the meeting, your vote is important to us. Please review the materials and exercise your shareholder right to vote.

By Order of the Board of Directors,

Kristina V. Fink

Corporate Secretary and Chief Governance Officer

| * | Web links throughout this document are provided for convenience only. Information from the American Express website is not incorporated by reference into this Proxy Statement. |

Cautionary Note Regarding Forward-Looking Statements

This Proxy Statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. You can identify forward-looking statements by words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” “estimate,” “predict,” “potential,” “continue” or other similar expressions. Actual results may differ from those set forth in the forward-looking statements due to a variety of factors, including those contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and the Company’s other filings with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements.

2024 PROXY STATEMENT i •

Table of Contents

• ii 2024 PROXY STATEMENT

2024 PROXY STATEMENT 1 •

Proxy Summary

Our Company’s Strategic Imperatives

American Express Company (the Company) is a globally integrated payments company, providing customers with access to products, insights and experiences that enrich lives and build business success. Our integrated payments platform includes card-issuing, merchant-acquiring and card network businesses. We are a leader in providing credit and charge cards to a broad range of customers, including consumers, small businesses, mid-sized companies and large corporations around the world. We seek to grow by focusing on four strategic imperatives:

Business Performance

In 2023, we focused on continuing to execute our growth plan. Business performance highlights in 2023 include:

| ¾ | Grew total billed business by 9% versus the prior year, with growth driven by spending from our U.S. consumer Card Members and Card Members outside of the U.S.; |

| ¾ | Continued to drive strong customer engagement and demand for our premium products remained robust; |

| ¾ | Added 12.2 million new proprietary cards, bringing the total number of cards-in-force issued on our global network to over 140 million; |

| ¾ | Continued to drive generational relevance, with Millennial & Gen-Z customers representing over 60% of new consumer account acquisitions globally; |

| ¾ | Achieved strong, industry-leading credit performance, with net write-off and delinquency rates for Card Member loans and receivables below pre-pandemic levels; and |

| ¾ | Sustained virtual parity coverage in the U.S., with approximately 99% of credit-card accepting merchants able to accept American Express(1), and continued to grow international coverage. |

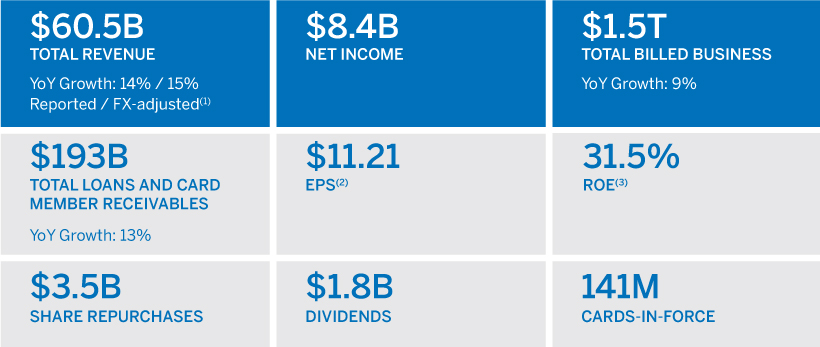

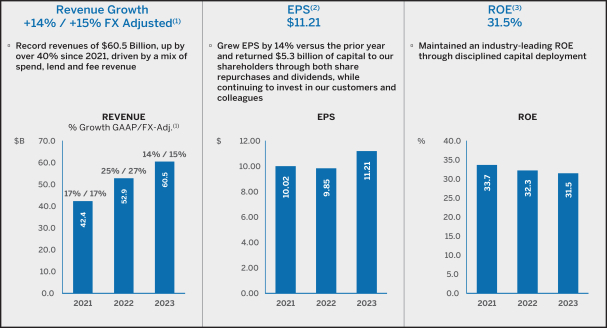

Financial Results

2023 financial highlights include:

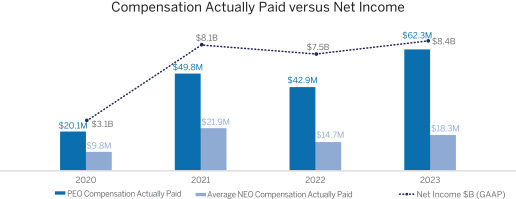

| ¾ | Total revenue reached an all-time high of $60.5 billion, up 14% versus the prior year, or 15% on an FX-adjusted basis(2); |

| ¾ | Revenue growth was broad-based, driven by a mix of spend, lend and fee revenue; |

| ¾ | Diluted earnings per share (EPS)(3) for the full year 2023 were $11.21; |

| ¾ | $5.3 billion of capital was returned to our shareholders in the form of share repurchases and dividends; and |

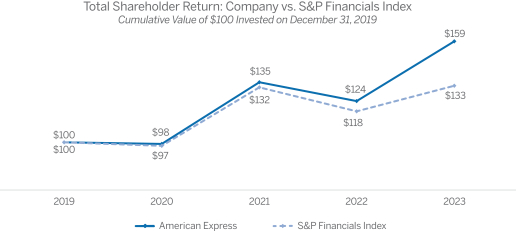

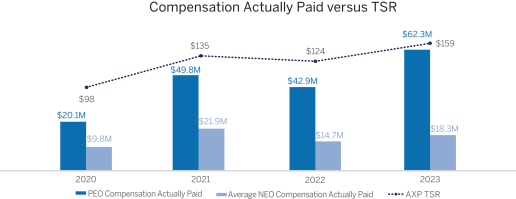

| ¾ | 1-year Total Shareholder Return of 29% outperformed the S&P Financials Index by 17 percentage points(4). |

| (1) | Source: Company internal data and The Nilson Report, February 2024. |

| (2) | FX-adjusted information assumes a constant exchange rate between the periods being compared for purposes of currency translation into U.S. dollars (i.e., assumes 2023 foreign exchange rates apply to 2022 results). Total revenues net of interest expense on an FX-adjusted basis is a non-GAAP measure. See Annex A for a reconciliation. Management believes the presentation of information on an FX-adjusted basis is helpful to investors by making it easier to compare the Company’s performance in one period to that of another period without the variability caused by fluctuations in currency exchange rates. |

| (3) | Attributable to common shareholders. Represents net income less earnings allocated to participating share awards, dividends on preferred shares and other items. |

| (4) | Total Shareholder Return (TSR) is the total return on common shares over a specified period, expressed as a percentage (calculated based on the change in stock price over the relevant measurement period and assuming reinvestment of dividends). Calculated as of December 31, 2023. |

• 2 2024 PROXY STATEMENT

Financial Performance Highlights

| (1) | Refer to footnote 2 under “Financial Results” on page 1 for details regarding FX-adjusted information. |

| (2) | Refer to footnote 3 under “Financial Results” on page 1 for details regarding EPS. |

| (3) | Return on average equity (ROE or Return on Equity) is calculated by dividing (i) net income for the period by (ii) average shareholders’ equity for the period. |

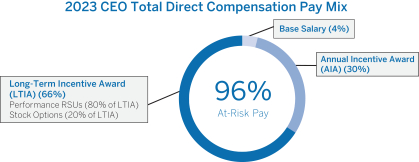

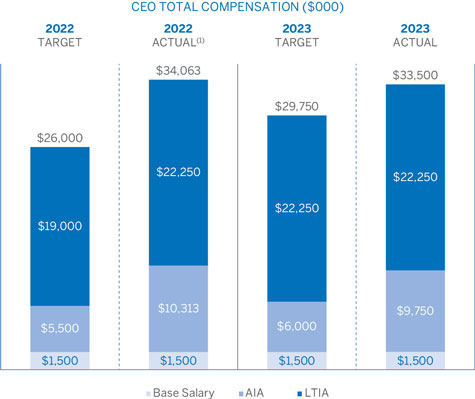

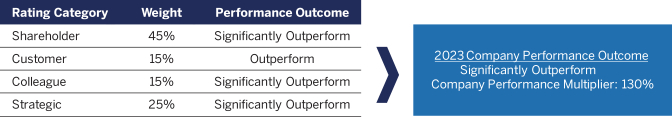

How Our Compensation Program Supports Our Business Strategy

Our executive compensation program is designed to support the longevity and stability of the Company by driving long-term business outcomes, promoting strong governance practices and encouraging responsible risk-taking. This is achieved by linking individual pay with the Company’s performance on a diverse set of measures as well as financial and strategic goals. All senior executives have a large portion of compensation that is variable and covers annual and multi-year performance periods. Long-Term Incentive Awards are designed to align executives with the Company’s long-term performance using performance-based equity awards in the form of Performance Restricted Stock Units and Stock Options. Further, the Company Scorecard incentivizes performance and includes key objectives in four categories: Shareholder, Customer, Colleague and Strategic.

To support strong oversight, our Compensation and Benefits Committee approves performance goals across our categories and certifies performance outcomes.

Our executive compensation program, including compensation principles and strategy, is discussed in detail under the “Compensation Discussion and Analysis” section of this Proxy Statement.

Shareholder Engagement and Responsiveness to 2023 Say-on-Pay Vote

At the 2023 Annual Meeting of Shareholders, approximately 54% of the votes cast were in favor of the advisory vote to approve executive compensation (Say-on-Pay). Following the vote, we sought specific feedback from our shareholders and other stakeholders regarding executive compensation-related matters. Management created a cross-functional group to review feedback received and identify recommendations for the Compensation and Benefits Committee to assess over the course of several months. As a result, we have committed that our Chairman and Chief Executive Officer (CEO), Stephen J. Squeri, will not receive any future special awards and enhanced our compensation disclosure. Our responsiveness to the vote is discussed in detail under “2023 Shareholder Engagement and Responsiveness to 2023 Say-on-Pay Vote” of the “Compensation Discussion and Analysis” section on page 53.

2024 PROXY STATEMENT 3 •

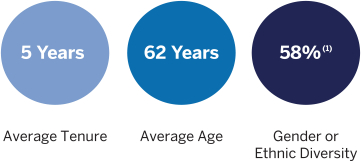

Our Board of Directors

The following provides current summary information about each director nominee. Our director nominees possess a range of diverse skills, backgrounds, experience and viewpoints that we believe are integral to an effective and well-functioning board. For more information about our director nominees, please see our “Board Experience and Diversity Matrix” on page 6. Detailed information about each director nominee’s qualifications, experience and expertise can be found in their biographies starting on page 7.

Our Director Nominees

Name | Position | Age | Director Since | AC | CB | NGPR | R | |||||||

Thomas J. Baltimore | Director | 60 | 2021 | ∎ | ||||||||||

John J. Brennan | Lead Independent Director | 69 | 2017 | ∎ | ● | |||||||||

Walter J. Clayton III | Director | 57 | 2022 | ● | ∎ | |||||||||

Theodore J. Leonsis | Director | 68 | 2010 | ∎ | ∎ | |||||||||

Deborah P. Majoras | Director | 60 | 2022 | ∎ | ∎ | |||||||||

Karen L. Parkhill | Director | 58 | 2020 | ∎ | ● | |||||||||

Charles E. Phillips | Director | 64 | 2020 | ∎ | ∎ | |||||||||

Lynn A. Pike | Director | 67 | 2020 | ∎ | ||||||||||

Stephen J. Squeri | CEO & Chairman | 65 | 2018 | |||||||||||

Daniel L. Vasella | Director | 70 | 2012 | ∎ | ∎ | |||||||||

Lisa W. Wardell | Director | 54 | 2021 | ∎ | ∎ | |||||||||

Christopher D. Young | Director | 52 | 2018 | ● | ∎ | |||||||||

∎ Member ● Chair

| AC | Audit and Compliance | CB | Compensation and Benefits | NGPR | Nominating, Governance and Public Responsibility | R | Risk |

| (1) | Based on self-identified characteristics. |

• 4 2024 PROXY STATEMENT

Corporate Governance Highlights

|

BOARD STRUCTURE AND INDEPENDENCE |

|

¾ Engaged and autonomous Lead

¾ All directors are independent except

¾ Diverse and highly skilled Board that

|

¾ Annual review of optimal Board

¾ Executive sessions of the independent

|

¾ Executive sessions at |

|

|

| SHAREHOLDER RIGHTS | ||

| ¾ Proxy access rights

¾ Annual election of all directors

¾ Annual advisory vote on executive

| ¾ Majority voting for directors (in

¾ Shareholder feedback regularly shared | ¾ Shareholders |

|

| BOARD OVERSIGHT | ||

| ¾ Oversight of the Company’s annual

¾ Monitors the Company’s workplace

¾ Proactive, comprehensive and

¾ Annual dedicated Board meeting

¾ Audit and Compliance Committee

| ¾ Key Management and rising talent

¾ Director access to experts and

¾ The Audit and Compliance Committee

¾ The Nominating, Governance and

| ¾ The Compensation and

¾ Risk-aware culture

|

|

| STRONG CORPORATE GOVERNANCE PRACTICES | ||

¾ Prohibition of hedging and pledging

¾ Sound policy on public company

¾ Responsive, active and ongoing

¾ Strategic succession planning

¾ Annual review of committee charters,

| ¾ Robust Code of Business Conduct for

¾ Annual written Board and committee

¾ Comprehensive clawback policies for

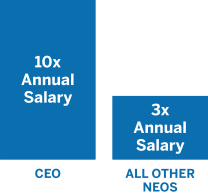

¾ Robust annual risk assessment of | ¾ Significant share

¾ Mandatory retirement

¾ Comprehensive ESG

|

|

| ||||||

¾ Wide-ranging and

|

For a detailed discussion of our corporate governance framework and our director nominees, please see “Corporate Governance at American Express” beginning on page 5.

2024 PROXY STATEMENT 5 •

Corporate Governance at American Express

Item 1: Election of Directors for a Term of One Year

The Board recommends a vote FOR each of the Director Nominees. |

Our Board currently has 14 members. Twelve of our directors are standing for re-election to hold office until the 2025 Annual Meeting of Shareholders or until their successors are duly elected and qualified. Two of our current directors, Peter Chernin and Ralph de la Vega, are retiring, having reached our mandatory retirement age, and are not standing for re-election. We thank them for their years of dedicated service and wish them continued success in the future. Our Board has appointed Laureen E. Seeger, Kristina V. Fink and David A. Kanarek as proxies to vote your shares on your behalf. The proxies intend to vote for the election of each of the 12 candidates nominated by the Board unless you indicate otherwise on your proxy or voting instruction form or when you vote by telephone or online. Each candidate has consented to being named in this Proxy Statement and serving as a director, if elected. However, if any nominee is not able to serve, the Board can either nominate a different person or reduce the size of the Board. If the Board nominates another individual, the persons named as proxies may vote for that nominee.

Our Board’s Composition

Except for Mr. Squeri, our Board is comprised of independent directors. As illustrated by our Board Experience and Diversity Matrix and the director biographies starting on page 6, our Board is made up of a diverse group of leaders with substantial experience in their respective fields. Our Board believes that the combination of the various skills, qualifications and experiences of the director nominees contributes to an effective and well-functioning Board and that, individually and as a whole, the director nominees possess the necessary qualifications to provide effective oversight and insightful strategic guidance.

We continually review our Board’s composition to identify the skills needed for our Company both in the near term and into the future. Ongoing strategic board succession planning, along with our mandatory retirement age for directors, are designed to ensure that the Board continues to maintain an appropriate mix of objectivity, skills and experiences to provide fresh perspectives and effective oversight and guidance to Management, while leveraging the institutional knowledge and historical perspective of our longer-tenured directors. Over the next few years, certain of our current Board members will retire due to our mandatory retirement age. With this in mind, our Board has been actively engaged in succession planning and has added seven new members since 2020. We believe that having Board members with varying tenures allows for knowledge transfer and information sharing between our newer directors and our retiring directors and ensures an orderly and effective Board succession process over the next few years.

• 6 2024 PROXY STATEMENT

Our Board Experience and Diversity Matrix

12 Director Nominees |  |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||

| Experience and Skills | ||||||||||||||||||||||||||

| Brand and Marketing

|

|

|

| ●

|

|

|

| ●

| ●

| ●

|

| ●

| |||||||||||||

| Core Business Operations & Management (including Human Capital Management)

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| |||||||||||||

| Financial Services & Investment Experience

| ●

| ●

| ●

| ●

|

| ●

| ●

| ●

| ●

| ●

| ●

|

| |||||||||||||

| Global Business

|

| ●

|

| ●

| ●

| ●

| ●

|

| ●

| ●

| ●

| ●

| |||||||||||||

| Government, Legal / Regulatory

|

| ●

| ●

|

| ●

|

| ●

| ●

|

| ●

|

|

| |||||||||||||

| Public Company CEO Experience

| ●

|

|

|

|

|

|

|

| ●

| ●

| ●

|

| |||||||||||||

| Public Company Governance

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| |||||||||||||

| Risk and Audit Oversight

| ●

| ●

| ●

|

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| ●

| |||||||||||||

| Technology & Cybersecurity

|

|

| ●

| ●

| ●

| ●

| ●

|

| ●

|

|

| ●

| |||||||||||||

Demographics(1) | ||||||||||||||||||||||||||

Gender | ||||||||||||||||||||||||||

Male | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||

Female | ● | ● | ● | ● | ||||||||||||||||||||||

Race / Ethnicity | ||||||||||||||||||||||||||

Black or African American | ● | ● | ● | ● | ||||||||||||||||||||||

White or Caucasian | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||

| (1) | Based on self-identified characteristics. |

2024 PROXY STATEMENT 7 •

Our Director Nominees

As our Board Experience and Diversity Matrix illustrates, our director nominees have a variety of skills and experiences that help the Company execute its strategy. Specifically, our director nominees hold and have held senior positions as leaders of various large, complex businesses and organizations and in government, demonstrating their ability to develop and execute significant policy and operational objectives at the highest levels. Our nominees include current and former chief executive officers, chief financial officers, chief operating officers, senior regulators and members of senior management of large, global businesses. Through these roles, our nominees have developed expertise in core business strategy, operations, finance, human capital management and leadership development, compliance, controls and risk management, as well as the skills to respond to rapidly evolving business environments and foster innovation and business transformation. Additionally, our nominees’ experience serving in government and on other public, private and non-profit boards brings valuable knowledge and expertise, including in the areas of public policy, governance, succession planning, compensation, risk management, cybersecurity, financial reporting and regulatory compliance.

Detailed biographical information for each director nominee follows. We have included career highlights, other public directorships and select professional and community contributions along with the top qualifications, experience, skills and expertise that we believe each director brings to our Board. Our Board considered all of the aforementioned attributes and the results of our annual board evaluations when deciding to re-nominate the following directors.

| Thomas J. Baltimore |

| ||||||||

Age: 60 Independent

|

Committee: Audit and Compliance

| |||||||||

Skills:

| ||||||||||

Core Business Operations & Management

|

Financial Services & Investment

|

Public Company CEO Experience

|

Public Company Governance

|

Risk & Audit Oversight

| ||||||

Mr. Baltimore’s extensive hospitality and real estate experience coupled with his public company CEO position allows him to provide a valuable and diverse perspective to our Board.

Mr. Baltimore has been Chairman and CEO of Park Hotels & Resorts, Inc., a NYSE-listed lodging real estate investment trust, since 2016. From 2011 to 2016, Mr. Baltimore was President, CEO and Director of RLJ Lodging Trust, a NYSE-listed real estate investment company.

Mr. Baltimore currently serves as an Executive Committee member of the American Hotel & Lodging Association; a director of the University of Virginia Investment Management Company; a board member of the UVA McIntire School of Commerce Foundation; and a director of the Real Estate Roundtable. Mr. Baltimore is also a member of the board of directors of Park Hotels & Resorts, Inc. and Comcast Corporation. He is also a member of the audit committee of the board of directors of Comcast Corporation. Previously, he was a member of the board of directors of AutoNation, Inc. and Prudential Financial, Inc. Mr. Baltimore received his Bachelor of Science and his Master of Business Administration degrees from the University of Virginia.

• 8 2024 PROXY STATEMENT

| John J. Brennan |

| ||||||||||

Age: 69 Lead Independent Director |

Committees: Audit and Compliance Compensation and Benefits (Chair) | |||||||||||

Skills:

| ||||||||||||

Core Business Operations & Management

|

Financial Services & Investment

|

Global Business

|

Government, Legal / Regulatory

|

Public Company Governance

|

Risk & Audit Oversight

| |||||||

Mr. Brennan’s extensive career at The Vanguard Group, Inc. (Vanguard) provides him with the ability to understand our institutional investors’ perspectives and a deep knowledge of the financial industry’s operations and regulations, risk oversight and management and audit and reporting matters.

Mr. Brennan has been Chairman Emeritus and Senior Advisor at Vanguard, a global investment management company, since 2010. Mr. Brennan joined Vanguard in July 1982, was elected Chief Financial Officer (CFO) in 1985, President in 1989, CEO from 1996 to 2008 and Chairman of the Board from 1998 to 2009.

Mr. Brennan was Chairman of the Board of Governors of the Financial Industry Regulatory Authority; Chairman of the Board of Trustees of the University of Notre Dame; Chairman of the Vanguard Charitable Endowment Program; and Founding Trustee of the King Abdullah University of Science and Technology in Saudi Arabia. Mr. Brennan is a former Chairman of the Financial Accounting Foundation, an overseer of financial accounting and reporting standard-setting boards. Previously, he served as a member of the board of directors of General Electric Company and LPL Financial Holdings, Inc. Mr. Brennan received his Bachelor of Arts from Dartmouth College and his Master of Business Administration from Harvard University.

| Walter J. Clayton III |

| ||||||||||

Age: 57 Independent |

Committees: Audit and Compliance (Chair) Nominating, Governance and Public Responsibility

| |||||||||||

Skills: | ||||||||||||

Core Business Operations & Management

|

Financial Services & Investment

|

Government, Legal / Regulatory

|

Public Company Governance

|

Risk & Audit Oversight

|

Technology & Cybersecurity

| |||||||

Mr. Clayton’s breadth of legal and regulatory experience, as well as his deep knowledge and understanding of domestic and international financial markets, make him an asset to our Board.

Mr. Clayton has been Senior Policy Advisor and Of Counsel at Sullivan & Cromwell LLP since 2021. Prior to that, Mr. Clayton served as Chair of the U.S. Securities and Exchange Commission (SEC) from 2017 to 2020. During that time, in addition to chairing the SEC, he was a member of the President’s Working Group on Financial Markets, the Financial Stability Oversight Council and the Financial Stability Board. Mr. Clayton also participated on the Board of the International Organization of Securities Commissions. Prior to joining the SEC, Mr. Clayton was a partner at Sullivan & Cromwell LLP, where he was a member of the firm’s management committee and co-head of the firm’s corporate practice and cybersecurity group (2001-2017). From 2009 to 2017, Mr. Clayton was a Lecturer in Law and Adjunct Professor at the University of Pennsylvania Law School and, since 2021, has been an Adjunct Professor at both the Wharton School and the Carey Law School of the University of Pennsylvania.

Mr. Clayton is currently the independent chair, chair of the executive committee and a member of the nominating and corporate governance committee of Apollo Global Management. He is also a member of the Federal Deposit Insurance Corporation’s Systemic Resolution Advisory Committee. Mr. Clayton received his Bachelor of Science from the University of Pennsylvania, his Bachelor of Arts and Master of Arts from the University of Cambridge and his Juris Doctor from the University of Pennsylvania.

2024 PROXY STATEMENT 9 •

| Theodore J. Leonsis |

| ||||||||||

Age: 68 Independent |

Committees: Compensation and Benefits Nominating, Governance and Public Responsibility

| |||||||||||

Skills: | ||||||||||||

Brand and Marketing

|

Core Business Operations & Management

|

Financial Services & Investment Experience

|

Global Business

|

Public Company Governance

|

Technology & Cybersecurity

| |||||||

Mr. Leonsis’ success as an innovator and entrepreneur allows him to identify business opportunities and drive new strategies based on changing technologies, social media and digital trends.

Mr. Leonsis founded Monumental Sports & Entertainment, LLC, a sports, entertainment, media and technology company in 2010 and is currently the chairman and CEO. Mr. Leonsis was Chairman of Revolution Money, Inc., which American Express acquired in January 2010. From 1994 to 2006, Mr. Leonsis held several executive positions and was Vice Chairman Emeritus of AOL LLC, a leading global ad-supported internet company.

Mr. Leonsis serves as a board member for the Hellenic Initiative and for OxiWear. He is the Advisory Board Chair for Georgetown Entrepreneurship; the Chairman for D.C. College Access Program, Inc.; co-founder and Vice-Chair for the Greater Washington Partnership; and co-founder and co-Executive Chairman of aXiomatic Gaming. Mr. Leonsis is also a council member for the National Museum of African American History and Culture. Mr. Leonsis currently serves as chairman of the board of directors, chair of the nominating and governance committee, a member of the audit committee and a member of the executive committee of Groupon, Inc. He received his Bachelor of Arts from Georgetown University.

| Deborah P. Majoras |

| ||||||||||

Age: 60 Independent |

Committees: Nominating, Governance and Public Responsibility Risk

| |||||||||||

Skills: | ||||||||||||

Core Business Operations & Management

|

Global Business

|

Government, Legal / Regulatory

|

Public Company Governance

|

Risk and Audit Oversight

|

Technology & Cybersecurity

| |||||||

Ms. Majoras brings decades of legal, regulatory and public policy experience to our Board.

Ms. Majoras joined Procter & Gamble Co. in 2008 and was named Chief Legal Officer and Corporate Secretary in 2010, where she served in such capacity until 2022. She was previously Chair of the Federal Trade Commission from 2004 until 2008. Ms. Majoras served as Deputy Assistant Attorney General and later Principal Deputy of the U.S. Department of Justice’s Antitrust Division from 2001 to 2003. Earlier in her career, she was an associate and partner at the law firm Jones Day LLP.

Ms. Majoras previously served on the board of directors of the Leadership Council on Legal Diversity. She is currently a member of the executive committee of the United States Golf Association and serves on the boards of Westminster College and the First Tee Foundation. Ms. Majoras is a member of the board of directors, chair of the sustainability and public policy committee and a member of the nominating and corporate governance committee of Valero Energy Corporation. Ms. Majoras received her Bachelor of Arts from Westminster College and her Juris Doctor from the University of Virginia.

• 10 2024 PROXY STATEMENT

| Karen L. Parkhill |

| ||||||||||

Age: 58 Independent |

Committees: Audit and Compliance Risk (Chair)

| |||||||||||

Skills:

| ||||||||||||

Core Business Operations & Management

|

Financial Services & Investment

|

Global Business

|

Public Company Governance

|

Risk & Audit Oversight

|

Technology & Cybersecurity

| |||||||

Ms. Parkhill contributes her broad-ranging financial accounting expertise and banking experience to our Board.

Ms. Parkhill has been Executive Vice President and CFO of Medtronic, Inc. since 2016, where she serves on the operating and executive committees, is chair of the ESG committee and leads the global finance organization and other key supporting functions including Treasury, Controller, Tax, Internal Audit, Investor Relations, Strategy, Business Development and Information Technology. Previously, Ms. Parkhill was the Vice Chairman and CFO of Comerica Inc. from 2011 to 2016. Prior to Comerica Inc., she was the CFO of the Commercial Banking business at JP Morgan Chase and Co. from 2005 to 2011.

Ms. Parkhill previously served as a member of the International Women’s Forum, as a National Trustee for the Boys and Girls Club of America and on the board of directors of Methodist Health System. Ms. Parkhill received her Bachelor of Science from Southern Methodist University and her Master of Business Administration from the University of Chicago.

| Charles E. Phillips |

| ||||||||||||

Age: 64 Independent |

Committees: Compensation and Benefits Risk | |||||||||||||

Skills:

| ||||||||||||||

Core Business Operations & Management

|

Financial Services & Investment

|

Global Business

|

Government, Legal / Regulatory

|

Public Company Governance

|

Risk & Audit Oversight

|

Technology & Cybersecurity

| ||||||||

Mr. Phillips’ extensive career in the technology industry and financial services provides him with a valued perspective on our Board.

Mr. Phillips has been the Managing Partner and co-founder of Recognize, a technology private equity firm, since 2020. From 2010 to 2020, Mr. Phillips was the Chairman and CEO of Infor, Inc., an enterprise software application provider. Prior to that, he was President of Oracle Corporation and a Managing Director at Morgan Stanley. Mr. Phillips is a former director of the Federal Reserve Bank of New York.

Mr. Phillips currently serves as a director for Apollo Theater and the Council on Foreign Relations. Mr. Phillips also serves as a member of the board of directors of Paramount Global and Compass, Inc. He is currently a member of Paramount Global’s nominating and governance committee and Compass’ audit committee and nominating and corporate governance committee. Mr. Phillips also serves as Compass, Inc.’s lead independent director. Previously, Mr. Phillips served as a member of the board of directors of Oscar Health. Mr. Phillips received his Bachelor of Science from the United States Air Force Academy, his Master of Business Administration from Hampton University and his Juris Doctor from New York University.

2024 PROXY STATEMENT 11 •

| Lynn A. Pike |

| ||||||||||

Age: 67 Independent |

Committee: Compensation and Benefits | |||||||||||

Skills:

| ||||||||||||

Brand & Marketing

|

Core Business Operations & Management

|

Financial Services & Investment

|

Government, Legal / Regulatory

|

Public Company Governance

|

Risk & Audit Oversight

| |||||||

Ms. Pike brings extensive payments and financial industry experience to our Board and has served as the Chair of the Board of American Express National Bank, our U.S. banking subsidiary, since 2019, including as co-Chair with Stephen Squeri from 2021 to 2022. Ms. Pike joined the board of American Express National Bank in 2013 and is a member of American Express National Bank’s Audit Committee and Risk and Compliance Committee.

Ms. Pike is the former President of Capital One Bank and a former member of the Capital One Executive Committee from 2007 to 2012. Previously, Ms. Pike was former President of Business Banking at Bank of America (BOA), as well as the former President of California for BOA from 2004 to 2007. Prior to that, Ms. Pike was Managing Director of Consumer Banking at FleetBoston from 2002 to 2004, prior to FleetBank’s acquisition by BOA in 2004.

Ms. Pike currently serves as a non-executive director, chair of the risk committee, member of the audit committee, member of the nominations and governance committee, member of the remuneration committee, and member of the investment committee for Hiscox Ltd. Ms. Pike is also a board member of BankWork$ and the California State University Channel Islands Foundation. Ms. Pike is a graduate of the Executive School of Marketing at the Fuqua School of Business at Duke University.

| Stephen J. Squeri |

| ||||||||||||||

Age: 65 Chairman and CEO since 2018 |

Committees: None | |||||||||||||||

Skills:

| ||||||||||||||||

Brand & Marketing

|

Core Business Operations & Management

|

Financial Services & Investment

|

Global Business

|

Public Company CEO Experience

|

Public Company Governance

|

Risk & Audit Oversight

|

Technology & Cybersecurity

| |||||||||

Mr. Squeri has been Chairman and CEO of American Express Company since 2018. As Chairman and CEO, Mr. Squeri has a unique perspective and has demonstrated leadership qualities and management capabilities to drive the long-term success of the Company.

Mr. Squeri has held many positions during his 38 years at American Express, including Vice Chairman of American Express Company, Group President of Global Corporate Services, Group President of Global Services and Executive Vice President and Chief Information Officer.

Mr. Squeri is chairman of the Board of Trustees for Manhattan College, a member of the Board of Governors for Monsignor McClancy Memorial High School, a Trustee for the Valerie Fund and a member of the Board of Overseers for the Memorial Sloan Kettering Cancer Center. He is a member of the Business Roundtable, where he chairs the corporate governance committee, as well as the Business Council and the American Society of Corporate Executives. Mr. Squeri received his Bachelor of Science and his Master of Business Administration from Manhattan College.

• 12 2024 PROXY STATEMENT

| Daniel L. Vasella |

| ||||||||||||||

Age: 70 Independent |

Committees: Compensation and Benefits Nominating, Governance and Public Responsibility

| |||||||||||||||

Skills:

| ||||||||||||||||

Brand & Marketing

|

Core Business Operations & Management

|

Financial Services & Investment

|

Global Business

|

Government, Legal / Regulatory

|

Public Company CEO Experience

|

Public Company Governance

|

Risk & Audit Oversight

| |||||||||

Dr. Vasella brings to the Board his deep experience leading a highly regulated global business as well as a global perspective.

Dr. Vasella has been an Honorary Chairman of Novartis AG since 2013. Prior to that, Dr. Vasella served as Chairman of Novartis from 1999 to 2013 and as CEO from 1996 to 2010. From 1992 to 1996, Dr. Vasella held the positions of CEO, Chief Operating Officer, Senior Vice President and Head of Worldwide Development and Head of Corporate Marketing at Sandoz Pharma Ltd.

Dr. Vasella is a foreign honorary member of the Academy of Arts and Sciences and a former trustee of the Carnegie Endowment for International Peace. Dr. Vasella is a director, chair of the nominating and corporate governance committee, and a member of the compensation committee at PepsiCo, Inc. He also serves as a director at SciClone Pharmaceuticals, Inc. Dr. Vasella received his Doctorate of Medicine from the University of Bern in Switzerland and attended Harvard University’s Program for Management Development.

| Lisa W. Wardell |

| ||||||||||

Age: 54 Independent |

Committees: Audit and Compliance Risk | |||||||||||

Skills:

| ||||||||||||

Core Business Operations & Management

|

Financial Services & Investment

|

Global Business

|

Public Company CEO Experience

|

Public Company Governance

|

Risk & Audit Oversight

| |||||||

Ms. Wardell brings her extensive senior leadership and global management experience to our Board.

Ms. Wardell is the former Executive Chairman of Adtalem Global Education, Inc., a position she held from 2021 to 2022. Prior to that Ms. Wardell was the Chairman and CEO of Adtalem Global Education, Inc. from 2016 to 2021. From 2004 to 2016, Ms. Wardell was Executive Vice President and Chief Operating Officer for The RLJ Companies.

Ms. Wardell serves as a member of the board of directors of Adtalem Global Education, Inc. Ms. Wardell is currently a member of the Business Council and the Executive Leadership Council. Previously, she served on the boards of Lowe’s Companies, G-lll Apparel Group, Ltd and Adtalem Global Education, Inc. Ms. Wardell received her Bachelor of Arts from Vassar College, her Juris Doctor from Stanford University and her Master of Business Administration from the University of Pennsylvania.

2024 PROXY STATEMENT 13 •

| Christopher D. Young |

| ||||||||||

Age: 52 Independent |

Committees: Nominating, Governance and Public Responsibility (Chair) | |||||||||||

Skills: | ||||||||||||

Brand & Marketing

|

Core Business Operations & Management

|

Global Business

|

Public Company Governance

|

Risk & Audit Oversight

|

Technology & Cybersecurity

| |||||||

Mr. Young has deep cybersecurity expertise and experience in national security and emergency preparedness.

Mr. Young has been the Executive Vice President – Business Development, Strategy and Ventures of Microsoft Corp., since 2020. From 2017 to 2020, he was the CEO of McAfee, LLC, one of the world’s leading independent cybersecurity companies. Prior to that, Mr. Young was a Senior Vice President and General Manager at Intel Security Group, where he led the initiative to spin out McAfee. Previously, he led cybersecurity efforts at Cisco, RSA (a division of Dell EMC) and AOL. Mr. Young also led end user computing at VMware and cofounded the company Cyveillance.

Mr. Young is a member of the Cybersecurity & Infrastructure Security Agency (CISA) Cybersecurity Advisory Committee and a former member of the President’s National Security Telecommunications Advisory Committee (NSTAC). He is a former director for the non-profit Cyber Threat Alliance and a former member of the Board of Trustees of Princeton University. Previously, Mr. Young served as a member of the board of directors of Snap Inc. Mr. Young received his Bachelor of Arts from Princeton University and his Master of Business Administration from Harvard University.

• 14 2024 PROXY STATEMENT

The Nominating, Governance and Public Responsibility Committee identifies and adds new directors using the following process:

| Independent search firms |

| Independent director recommendations |

| Shareholder recommendations |

Potential candidates are comprehensively reviewed and the subject of rigorous discussion during Nominating, Governance and Public Responsibility Committee meetings and Board meetings.

The candidates that emerge from this process are interviewed by members of the Nominating, Governance and Public Responsibility Committee and other Board members, including the Chairman and Lead Independent Director.

| During these meetings, directors assess candidates on the basis of their skills and experience, their personal attributes and their expected contribution to the diversity of skills, experiences and backgrounds on our Board. |

| Extensive due diligence is conducted by third parties, including soliciting feedback from other directors and applicable persons outside the Company. |

| The Nominating, Governance and Public Responsibility Committee presents qualified candidates to the Board for review and approval. |

Ideal Director Nominee Attributes

The Nominating, Governance and Public Responsibility Committee assesses potential candidates based on their history of achievement, the breadth of their business experiences, whether they bring specific skills or expertise in areas that the committee has identified as desired and whether they possess personal attributes and experiences that will contribute to the sound functioning of our Board.

Diversity is also a key consideration in our nomination and succession planning processes. Our Corporate Governance Principles provide that the Board should be diverse, engaged and independent. When reviewing potential director nominees, the Nominating, Governance and Public Responsibility Committee considers the holistic diversity of the Board, including gender, race, ethnicity, age, sexual orientation and nationality, and does not discriminate on any basis. Specifically, we seek individuals who:

| ¾ | have established records of significant accomplishment in leading global businesses and large, complex organizations; |

| ¾ | have achieved prominence in their fields and possess skills or significant experience in areas of importance to our business strategy and expected future business needs; |

| ¾ | possess integrity, independence, energy, forthrightness, strong analytical skills and the commitment to devote the necessary time and attention to the Company’s affairs; |

| ¾ | demonstrate they can constructively challenge and stimulate Management and exercise sound judgment; |

| ¾ | demonstrate a willingness to work as part of a team in an atmosphere of trust and candor and a commitment to represent the interests of all shareholders rather than those of a specific constituency; and |

| ¾ | will contribute to the diversity of skills, experience and backgrounds on our Board. |

Process for Identifying and Adding New Directors

The Nominating, Governance and Public Responsibility Committee uses a professional search firm to help identify, evaluate and conduct due diligence on potential director candidates. A professional search firm supports the committee in conducting a broad search and looking at a diverse pool of potential candidates. The committee also maintains an ongoing list of potential candidates and considers recommendations made by the Board’s independent directors.

In addition, the Nominating, Governance and Public Responsibility Committee considers shareholder recommendations for director candidates and applies the same standards in considering candidates submitted by shareholders as it does in evaluating all other candidates. Shareholders can recommend candidates by writing to the Nominating, Governance and Public Responsibility Committee in care of the Company’s Corporate Secretary and Chief Governance Officer, whose contact information is on page 32. Shareholders who wish to submit nominees for election at an annual or special meeting of shareholders should follow the procedure described on pages 118.

2024 PROXY STATEMENT 15 •

Director Onboarding

The Company maintains a comprehensive director onboarding program. The Company’s director onboarding program is individually tailored to take into account a director’s prior experience and background and includes one-on-one meetings with several members of our senior Management. Our onboarding process is regularly updated and focuses on introducing new directors to our business and senior Management, as well as facilitating integration on the Board.

Our Board Evaluation Process

Our Board continually seeks to improve its performance. Our Lead Independent Director has regular one-on-one discussions with our Board members and conveys their feedback on an ongoing basis to our Chairman. Separately, our Chairman, Chief Legal Officer, and Corporate Secretary and Chief Governance Officer each routinely communicates with our Board members to obtain real-time feedback.

Our Nominating, Governance and Public Responsibility Committee oversees the formal annual evaluation process of the effectiveness of our Board and its standing committees. Conducting a robust annual evaluation process allows the Board to assess its performance and practices and identify areas for improvement. As part of the evaluation process, our Board analyzes and assesses the performance of both the Chairman and the Lead Independent Director, as well as the culture of the Board.

Our Board plans to periodically engage an independent third-party evaluation firm as it has in the past to augment the Board’s annual evaluation process.

We believe that this continuous feedback cycle, along with the formal annual evaluation process, contributes to the overall functioning and ongoing effectiveness of our Board.

• 16 2024 PROXY STATEMENT

Below is a summary of our Board evaluation process:

The process, including the evaluation method, is reviewed annually by the Nominating, Governance and Public Responsibility Committee.

Written questionnaires are used for the Board and each standing committee and are updated and tailored each year to address the significant processes that drive Board effectiveness. Each director completes a written questionnaire on an unattributed basis for the Board and for each committee on which they serve. The questionnaires include open-ended questions and space for candid commentary.

Reports are produced summarizing the written questionnaires, which include all responses and highlight year-over-year trends.

All comments are unattributed, included verbatim and shared with the full Board and each applicable committee.

The Chair of the Nominating, Governance and Public Responsibility Committee leads a discussion of the written Board and committee evaluation results at the Board level. Separately, each committee chair leads a discussion of the applicable written committee evaluation at each committee meeting and reports on their discussions to the full Board.

Directors also deliver feedback to the Lead Independent Director and Chairman of the Board and suggest changes and areas for improvement.

| ¾ | Streamlined Board committee structure and meeting cadence; |

| ¾ | Scheduled offsite Board meetings in conjunction with Company site visits; |

| ¾ | Director onboarding program was modified and enhanced; |

| ¾ | Management with varying degrees of seniority presents to the Board and its committees; |

| ¾ | Information and materials regularly provided to directors continue to evolve to alleviate “information overload” and to enable directors to focus on the key data and relevant issues; |

| ¾ | Format of Board meetings has been updated to enable more time for director discussion with and without the CEO present; |

| ¾ | Number of informal meetings between directors and key executives has been increased; |

| ¾ | Increased time for director-only gatherings; |

| ¾ | Director education and presentations on emerging risk areas, compliance, corporate governance, industry disruptors and competitors from outside advisors and experts, including outside counsel, leading investment banks, external auditors, independent compensation consultants, regulators and investors; |

| ¾ | Board members added with expertise in areas critical to the Company’s business strategy and operations; and |

| ¾ | Added topics to Board agendas as suggested by directors. |

Our annual Board evaluations

cover several areas, including the

following:

| Board efficiency and overall effectiveness |

| Board and committee structure |

| Board and committee composition |

| Satisfaction with the performance of the Chairman |

| Satisfaction with the performance of the Lead Independent Director |

| Board member access to the Lead Independent Director, CEO and other members of senior Management |

| Quality of Board discussions and balance between presentations and discussion |

| Quality and clarity of materials presented to directors |

| Board and committee information needs |

| Satisfaction with Board agendas and the frequency and format of meetings and time allocations |

| Areas where directors want to increase their focus |

| Board dynamics and culture |

| Board and committee access to experts and advisors |

| Satisfaction with the format of the evaluation |

| Satisfaction with the flow of information from Management |

| Satisfaction with the reports on committee activities to ensure committees are properly fulfilling their responsibilities |

| Providing the necessary information, training, resources and tools needed to ensure effective oversight |

| Identifying topics and areas that should receive more attention or focus |

2024 PROXY STATEMENT 17 •

Our Board Leadership Structure

Our Board is led by Mr. Brennan, our Lead Independent Director, and Mr. Squeri, our Chairman and CEO. We believe that strong independent leadership is essential for our Board to effectively perform its primary oversight functions and constructively challenge Management. We also believe it is critically important for our Board to retain flexibility to determine its leadership structure based on the particular composition of the Board, the individuals serving in leadership positions, the needs and opportunities of the Company as they change over time and considerations such as continuity of leadership, sound succession planning and the additional factors described below.

The Board believes that a combined Chairman and CEO role allows the Company to effectively convey its business strategy and core values to shareholders, customers, colleagues, regulators and the public in a single, consistent voice. The Board also recognizes the necessity of having a strong Lead Independent Director with a clearly defined role and set of responsibilities (as detailed below) where there is a combined Chairman and CEO or where the Chairman is not independent. Their leadership is supplemented by engaged and expert committee chairs along with independent-minded, skilled and committed directors.

Our Board and Nominating, Governance and Public Responsibility Committee recently completed their annual review of the Board’s leadership structure, and the independent directors re-elected Mr. Brennan as Lead Independent Director, a position he has held since September 2021. The annual Board leadership review considered how Mr. Brennan’s past experience enable him to perform the duties set forth below as Lead Independent Director as well as the insightful, effective and sound leadership provided by Mr. Brennan. The annual Board leadership review also considers the tangible benefits to the Company of having a Chairman and CEO with an operational focus and extensive Company experience given the global and complex nature of our business. In addition, the review also considered how the Company’s robust corporate governance practices combined with the Board’s current leadership structure helps to ensure both clear, strategic alignment throughout the Company and independent oversight of Management. Taking all of this into account, our Board continues to believe that our current structure, led by Messrs. Brennan and Squeri, allows the Board to focus on key strategic, policy and operational issues, provides critical and effective leadership (both internally and externally), and creates an environment in which the Board can work effectively and appropriately challenge Management, all of which we believe will benefit the long-term interests of our shareholders.

Strong Lead Independent Director with Defined Role and Responsibilities

As noted above, the Board recognizes that in circumstances like ours where the positions of Chairman and CEO are combined, a strong Lead Independent Director with a clearly defined role and set of responsibilities is paramount for constructive and effective leadership. Our Lead Independent Director facilitates Board discussions on key issues and concerns outside of Board meetings, including risk oversight and management, financial performance and strategic initiatives. Additionally, our Lead Independent Director seeks to ensure the independent directors effectively challenge Management, including with respect to overseeing risk, maintaining an effective internal controls framework and effectively implementing the Company’s strategy consistent with its risk appetite.

Mr. Brennan, the Board’s Lead Independent Director, has been a member of the Board since 2017. During his tenure as a Board member, Mr. Brennan has established strong and effective working relationships with his fellow directors and garnered their trust and respect. Furthermore, he has demonstrated strong leadership skills, independent thinking and a deep understanding of our business. Mr. Brennan chairs the Compensation and Benefits Committee and is a member of the Audit and Compliance Committee. He was the Chair of the Risk Committee up until his election as Lead Independent Director in September 2021 and regularly attends Risk Committee and Nominating, Governance and Public Responsibility Committee meetings as an observer.

The position of Lead Independent Director at American Express comes with a clear mandate and significant authority and responsibilities that are detailed below and can be found in our Board-approved Corporate Governance Principles. Mr. Brennan fulfills these responsibilities in his role as Lead Independent Director.

| Preside at all meetings of the Board at which the Chairman is not present, including the executive sessions of the independent directors, and apprise the Chairman of the issues considered and decisions reached at those sessions; |

| Call additional meetings of the independent directors as needed; |

| Lead the Board in putting forth its expectations for “tone at the top;” |

| Meet regularly with the Chairman and serve as a liaison between the Chairman and the independent directors; |

| Facilitate effective and candid communication to optimize Board performance; |

| Serve as the Chair of the Compensation and Benefits Committee; |

| Coordinate with the Chair of the Nominating, Governance and Public Responsibility Committee (as needed) to recruit and interview qualified candidates for the Board; |

• 18 2024 PROXY STATEMENT

| Lead the annual evaluation of the Chairman and CEO, and together with the Chair of the Nominating, Governance and Public Responsibility Committee, the evaluation of the performance and effectiveness of the Board; |

| Advise the Chairman of the Board’s informational needs, participate in the setting of Board meeting agendas, including requesting the inclusion of additional agenda items at his or her discretion, and review and approve the types of information sent to the Board; |

| Review and approve the schedule of Board meetings to ensure that the appropriate items are being discussed and that there is sufficient time for discussion of all agenda items; |

| Monitor and coordinate with the Chairman on appropriate governance issues and developments; |

| Be available as appropriate for consultation and direct communication with major shareholders; |

| Advise and meet with the Chairs of each committee of the Board as needed to assist with the fulfillment of each such committee Chair’s responsibilities to the Board; and |

| Consult with the Chair of the Nominating, Governance and Public Responsibility Committee and the Board on succession planning and appointments for each committee of the Board. |

Our Lead Independent Director may identify risk-related issues for the Board to consider and discuss, in consultation with the CEO, as appropriate. In addition, all Board members are encouraged to propose the inclusion of additional Board agenda items that they deem necessary or appropriate in carrying out their duties. All Board members have direct access to the Chairman and to the Lead Independent Director.

Our Board’s Primary Role and Responsibilities, Structure and Processes

Our Board bears the responsibility for the oversight of Management on behalf of our shareholders in order to ensure long-term value creation. The Board, as a whole, is responsible for risk oversight at the Company and fulfills this responsibility through its committees and its oversight of Management. The approach allows the Board to draw upon the experience and judgment of all directors in understanding and overseeing the Company’s risks. In that regard, the primary responsibilities of our Board include, but are not limited to (i) oversight of the Company’s annual business plan and development of the Company’s strategy, including strategic objectives for the Company’s businesses, (ii) ongoing succession planning and talent management, including the review of the results of the Company’s Annual Colleague Experience Survey and (iii) oversight of risk management, including overseeing the development of the Company’s risk appetite.

2024 PROXY STATEMENT 19 •

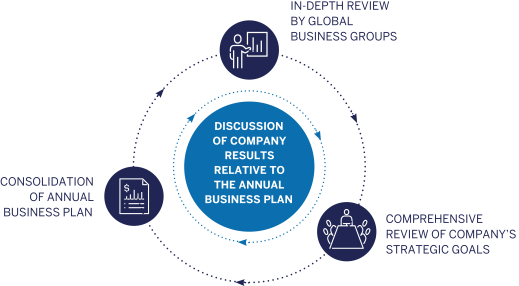

How Our Board Oversees Our Annual Business Plan and Corporate Strategy

Our Board is responsible for overseeing the development of the Company’s strategy, which articulates the Company’s strategic objectives for its businesses; helps establish and maintain an effective risk management structure and control function; and provides direction to senior Management to determine which business opportunities to pursue. At the beginning of each year, our senior Management presents our consolidated annual business plan to the Board, and the Board discusses the Company’s results relative to the plan periodically throughout the year. The Board holds senior Management accountable for effectively implementing the Company’s strategy consistent with its risk appetite, while maintaining an effective risk management framework and system of internal controls. Each year the Board holds an offsite strategy meeting to conduct a deep dive into the Company’s strategic goals, timeline to achieve these goals and execution plans.

How Our Board Engages in Ongoing CEO and Key Executive Succession Planning

Our Board ensures that we have the right Management talent to pursue our strategies successfully.

The entire Board is involved in the critical aspects of the CEO succession planning process, including establishing selection criteria that reflect our business strategies, identifying and evaluating potential internal candidates and making key Management succession decisions. Succession and development plans are regularly discussed with the CEO as well as without the CEO present in executive sessions of the Board. The Board makes sure that it has adequate opportunities to meet with and assess development plans for potential CEO and senior Management successors to address identified gaps in skills and attributes. This occurs through various means, including informal meetings, Board dinners, presentations to the Board and committees, attendance at Board meetings and the comprehensive annual talent review. In addition, the Board has developed and approved an emergency CEO succession plan.

The Board also oversees Management’s succession planning for other key executive positions. Our Board calendar includes at least one meeting each year at which the Board conducts a detailed talent review, which includes a review of the Company’s talent strategies, leadership pipeline and succession plans for key executive positions.

Additionally, we believe that maintaining our strong workplace culture, adhering to our Blue Box Values and ensuring that our people feel included, valued, recognized and backed will help us attract, retain and develop the right talent to lead the Company and successfully execute our corporate strategy. The Board reviews several colleague development, compensation, wellness and culture programs each year, in addition to the detailed results of the Company’s Annual Colleague Experience Survey. Our Annual Colleague Experience Survey provides insights into employee satisfaction, leadership efficacy, learning opportunities and career development. The insights provided by the survey help improve the American Express colleague experience, workplace culture and business results. Please see page 41 for additional information about our workplace culture.

• 20 2024 PROXY STATEMENT

How Our Board Oversees Risk Management

Board of Directors

We are committed to Board-level oversight of risk management. Our Board monitors our “tone at the top” and risk culture and is responsible for overseeing emerging and strategic risks. Our CEO and other members of senior Management regularly report to the Board and its committees to discuss short-term, intermediate-term, and long-term risks, including credit risk, market risk, funding and liquidity risk, compliance risk, operational risk (including, but not limited to, conduct risk), reputational risk, country risk, model risk, strategic and business risk, and emerging risks (e.g., climate risk). These reports assist in the Board’s oversight of risk management and the ongoing evaluation of management controls. Risk management is primarily overseen by our Board through three Board committees: Risk, Audit and Compliance, and Compensation and Benefits. Each committee consists entirely of independent directors and provides regular reports to the Board regarding matters reviewed at their committee. The committees meet regularly in executive sessions with our CFO, Chief Legal Officer, Chief Risk Officer, Chief Compliance Officer (who reports to our Chief Risk Officer), Chief Audit Executive, and other members of senior Management with regard to our risk management processes, controls, talent and capabilities. The Board believes that these meetings help promote an effective ongoing risk dialogue between the Board and Management. Additionally, from time to time, the Board and Management engage with outside advisors and experts to provide insights with regard to proper oversight over the risk management process and for external perspectives on trends and risks facing the Company.

Mr. Brennan, the Lead Independent Director, brings his extensive experience to bear in connection with the Board’s role in risk oversight. Mr. Brennan chairs the Compensation and Benefits Committee and is a member of the Audit and Compliance Committee. He was the Chair of the Risk Committee up until his election as Lead Independent Director in September 2021 and regularly attends Risk Committee and Nominating, Governance and Public Responsibility Committee meetings as an observer. As a Bank Holding Company with greater than $100 billion in total assets, the Company is required under the Federal Reserve’s “Enhanced Prudential Standards” to have a stand-alone Risk Committee, which must include at least one member with “experience in identifying, assessing and managing risk exposures of large, complex financial firms.” Mr. Brennan met this requirement when he was a member of the Risk Committee based on his experience with a variety of diverse financial companies, including, without limitation, his current and prior experience on the Company’s Board, including serving as the former chair of the Risk Committee and his prior professional experience as former Chairman, CEO and CFO of Vanguard. Vanguard is one of the largest investment companies in the world focused on consumer-oriented products and services, and Mr. Brennan’s leadership roles at Vanguard further demonstrate his experience in identifying, assessing and managing the risk exposures of a large, complex financial firm in a highly regulated sector. Specifically, Mr. Brennan was the Chairman and CEO of Vanguard for over a decade and spent another five years, prior to being appointed CEO, as the CFO of Vanguard. As CEO of Vanguard, Mr. Brennan was involved in, and was ultimately responsible for, risk management with respect to many of the same categories of risks faced by the Company, including credit risk, interest rate risk, liquidity risk, technology risk, operational risk, reputational risk and compliance and legal risk. Moreover, during his time at Vanguard and as part of its substantial expansion under his leadership, many of Vanguard’s risk management processes were necessarily enhanced over time. In addition, the Board believes that Mr. Brennan’s current and prior board service for external companies also support his risk management qualifications, including through his prior roles as Lead Governor and then Chairman of the FINRA. The Risk Committee is now chaired by Ms. Parkhill, who succeeded Mr. Brennan in September 2021. Ms. Parkhill brings a wealth of experience as a public company CFO in a highly regulated industry, responsible for leading a global finance organization within Medtronic, Inc. and key supporting functions, which include supporting Medtronic, Inc.’s risk management functions.

We believe that our current Board leadership structure and risk management committee structure facilitates effective oversight and management over key risk areas. The following graphic illustrates our risk management committee governance structure, as further detailed below.

2024 PROXY STATEMENT 21 •

Risk Committee

| Provides oversight of our enterprise risk management framework, processes and methodologies. Approves our Enterprise Risk Management policy, which covers risk governance, risk oversight and risk appetite, including credit risk (both individual and institutional), operational risk (e.g., operations and process, legal, conduct, third-party, information technology, information security, data management, privacy and people risks), compliance risk, reputational risk, market risk, funding and liquidity risk, model risk, strategic and business risk, country risk and emerging risks (e.g., climate risk). Our Enterprise Risk Management policy: |

| ¾ | Defines the authorized risk limits to control exposures within our risk capacity and risk tolerance, including stressed forward-looking scenarios |

| ¾ | Establishes principles for risk-taking in the aggregate and for each risk type, and is supported by a comprehensive system for monitoring performance (including limits and escalation triggers) and assessing control programs |

| Reviews and concurs with the appointment, replacement, performance and compensation of our Chief Risk Officer |

| Receives regular updates from the Chief Risk Officer on key risks and exposures |

| Receives reports on cybersecurity and related risks at least twice a year |

| Reviews our risk profile against the tolerances specified in the Risk Appetite Framework, including significant risk exposures, risk trends in our portfolios, and major risk concentrations |

| Provides oversight of Management’s compliance with regulatory capital and liquidity standards, and our Internal Capital Adequacy Assessment process, including the Comprehensive Capital Analysis and Review (CCAR) submissions |

| Monitors the quality and effectiveness of the Company’s technology security, data privacy and disaster recovery capabilities |

Audit and Compliance Committee

| Assists the Board in its oversight responsibilities relating to the integrity of our annual and quarterly consolidated financial statements and financial reporting process, internal and external auditing, including the qualifications and independence of the Company’s independent registered public accounting firm and the performance of our internal audit services function, and the integrity of our systems of internal control over financial reporting and legal and regulatory compliance |

| Provides oversight of our Internal Audit Group |

| Periodically reviews and discusses with Management and the Company’s independent registered public accounting firm the Company’s accounting policies, critical accounting estimates and critical auditing matters |

| Periodically reviews with Management the Company’s disclosure controls and procedures and Management’s conclusions about the efficacy of such disclosure controls and procedures |

| Reviews and concurs in the appointment, replacement, performance and compensation of our Chief Audit Executive and approves our Internal Audit Group’s annual audit plan, charter, policies, budget and overall risk assessment methodology |

| Receives regular updates on the status of the audit plan and results including significant reports issued by our Internal Audit Group and the status of our corrective actions |

| Receives regular updates from the Chief Compliance Officer and reviews and approves our compliance policies, which include our Compliance Risk Tolerance Statement |

| Reviews the effectiveness of our Corporate-wide Compliance Risk Management Program |

| Appoints, replaces, reviews and evaluates the qualifications of the Company’s independent registered public accounting firm |

| Establishes procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters |

| Receives and discusses whistleblower claims, fraud situations and reports from Management regarding significant ethics violations under the Company’s Code of Conduct and other corporate governance policies |

| Receives and discusses reports from Management concerning significant operating and control issues identified in internal audit reports, Management letters and significant regulatory authorities’ examination reports pertaining to the Company and Management responses, and regarding the status of any significant special investigations concerning operating and control issues |

• 22 2024 PROXY STATEMENT

Compensation and Benefits Committee

| Works with the Chief Colleague Experience Officer and the Chief Risk Officer to ensure our overall compensation programs, as well as those covering our business units and risk-taking employees, appropriately balance risk with business incentives and that business performance is achieved without taking imprudent or excessive risk |

| ¾ | Our Chief Risk Officer is actively involved in setting risk goals, including for our business units |

| ¾ | Our Chief Risk Officer also reviews the current and forward-looking risk profiles of each business unit and provides input into performance evaluations |

| ¾ | Our Chief Risk Officer meets with the committee and attests as to whether performance goals and results have been achieved without taking imprudent risks |

| Uses a risk-balanced incentive compensation framework to decide on our bonus pools and the compensation of senior executives |

| Approves the charter of, and receives reports from, Management’s Risk Performance & Incentive Review Committee that reviews whether certain risk outcomes warrant downward adjustment to incentive compensation |

Cybersecurity Oversight and Risk Management

We maintain an information security and cybersecurity program and a cybersecurity governance framework that are designed to protect our information systems against cybersecurity risks. Information security and cybersecurity risk is an operational risk that is measured and managed as part of our operational risk framework. Operational risk is incorporated into our comprehensive Enterprise Risk Management (ERM) program, which we use to identify, aggregate, monitor, report and manage risks. Our Board receives an update on cybersecurity at least once a year and our Risk Committee receives reports on cybersecurity at least twice a year, including in at least one joint meeting with the Audit and Compliance Committee, and our Board and these committees all receive ad hoc updates as needed. In addition, the Risk Committee annually approves the Company’s Technology Risk and Information Security (TRIS) program described below.

Our TRIS program, which is our enterprise information security and cybersecurity program incorporated in our ERM program and led by our Chief Information Security Officer (CISO), is designed to (i) ensure the security, confidentiality, integrity and availability of our information and information systems; (ii) protect against any anticipated threats or hazards to the security, confidentiality, integrity or availability of such information and information systems; and (iii) protect against unauthorized access to or use of such information or information systems that could result in substantial harm or inconvenience to us, our colleagues or our customers. The TRIS program is built upon a foundation of advanced security technology, employs a highly trained team of experts and is designed to operate in alignment with global regulatory requirements. The program deploys multiple layers of controls, including embedding security into our technology investments, designed to identify, protect, detect, respond to and recover from information security and cybersecurity incidents. Those controls are measured and monitored by a combination of subject matter experts and a security operations center with integrated cyber detection, response and recovery capabilities. Cybersecurity risks related to third parties are managed as part of our Third Party Management Policy, which sets forth the procurement, risk management and contracting framework for managing third-party relationships commensurate with their risk and complexity.

TRIS Program Highlights

| We have a Cyber Crisis Response Plan in place that provides a documented framework for handling high-severity security incidents and facilitates coordination across multiple parts of the Company |

| We invest in threat intelligence and are active participants in industry and government forums |

| We collaborate with our peers in the areas of threat intelligence, vulnerability management and incident response and drills |

| We routinely perform simulations and drills at both a technical and management level |

| We incorporate external expertise and reviews in our program |

| Colleagues receive annual cybersecurity awareness training |

We continuously assess the risks and changes in the cyber environment and adjust our program and investments as appropriate. For more information on our cybersecurity risk management, strategy and governance, see “Item 1C. Cybersecurity” of our 2023 Annual Report on Form 10-K.

2024 PROXY STATEMENT 23 •

Management Oversight of Risk

While our Board is responsible for risk oversight, Management is responsible for assessing and managing the Company’s risks, as well as providing appropriate risk reporting and information to the Board. We use our comprehensive ERM program to identify, aggregate, monitor, measure, report and manage risks. The program also defines our risk appetite, governance, culture and capabilities. The implementation and execution of the ERM program is headed by our Chief Risk Officer.